| | |

| UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| | |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | |

| Investment Company Act file number: | (811-05740) |

| | |

| Exact name of registrant as specified in charter: | Putnam Managed Municipal Income Trust |

| | |

| Address of principal executive offices: | 100 Federal Street, Boston, Massachusetts 02110 |

| | |

| Name and address of agent for service: | Robert T. Burns, Vice President

100 Federal Street

Boston, Massachusetts 02110 |

| | |

| Copy to: | Bryan Chegwidden, Esq.

Ropes & Gray LLP

1211 Avenue of the Americas

New York, New York 10036 |

| | |

| Registrant's telephone number, including area code: | (617) 292-1000 |

| | |

| Date of fiscal year end: | October 31, 2019 |

| | |

| Date of reporting period: | November 1, 2018 — April 30, 2019 |

| | |

|

Item 1. Report to Stockholders: | |

| | |

| The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Investment Company Act of 1940: | |

Putnam

Managed Municipal

Income Trust

Semiannual report

4|30|19

IMPORTANT NOTICE: Delivery of paper fund reports

In accordance with regulations adopted by the Securities and Exchange Commission, beginning on January 1, 2021, reports like this one will no longer be sent by mail unless you specifically request it. Instead, they will be on Putnam’s website, and you will be notified by mail whenever a new one is available, and provided with a website link to access the report.

If you wish to stop receiving paper reports sooner, or if you wish to continue to receive paper reports free of charge after January 1, 2021, please see the back cover or insert for instructions. If you invest through a bank or broker, your choice will apply to all funds held in your account. If you invest directly with Putnam, your choice will apply to all Putnam funds in your account.

If you already receive these reports electronically, no action is required.

Message from the Trustees

June 10, 2019

Dear Fellow Shareholder:

If there is any lesson to be learned from constantly changing financial markets, it is the importance of positioning your investment portfolio for your long-term goals. We believe that one strategy is to diversify across different asset classes and investment approaches.

We also believe your mutual fund investment offers a number of advantages, including constant monitoring by experienced investment professionals who maintain a long-term perspective. Putnam’s portfolio managers and analysts take a research-intensive approach that includes risk management strategies designed to serve you through changing conditions.

Another key strategy, in our view, is seeking the counsel of a financial advisor. For over 80 years, Putnam has recognized the importance of professional investment advice. Your financial advisor can help in many ways, including defining and planning for goals such as retirement, evaluating the level of risk appropriate for you, and reviewing your investments on a regular basis and making adjustments as necessary.

As always, your fund’s Board of Trustees remains committed to protecting the interests of Putnam shareholders like you, and we thank you for investing with Putnam.

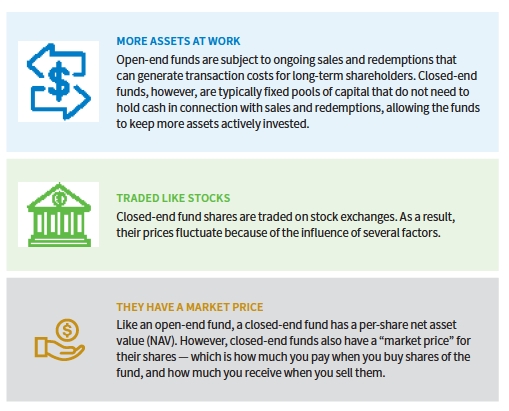

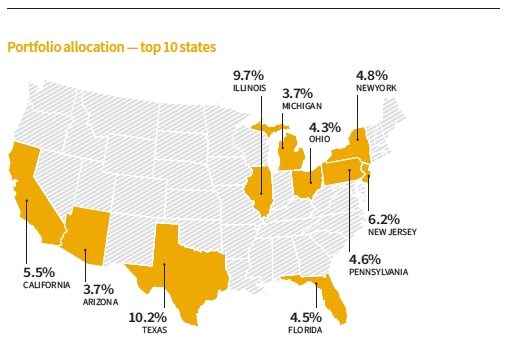

Putnam Managed Municipal Income Trust has the flexibility to invest in municipal bonds issued by any state in the country or U.S. territory. As a closed-end fund, it shares some common characteristics with open-end mutual funds, but there are some key differences that investors should understand as they consider their portfolio.

|

| 2 Managed Municipal Income Trust |

Looking at a closed-end fund’s performance

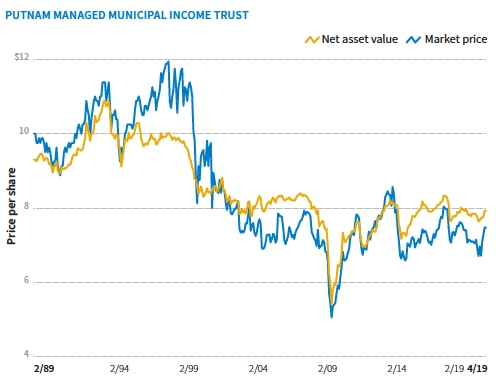

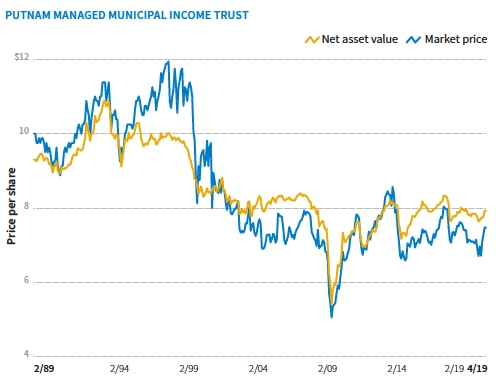

You will usually see that the NAV and the market price differ. The market price can be influenced by several factors that cause it to vary from the NAV, including fund distributions, changes in supply and demand for the fund’s shares, changing market conditions, and investor perceptions of the fund or its investment manager.

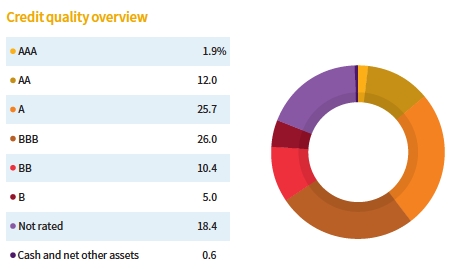

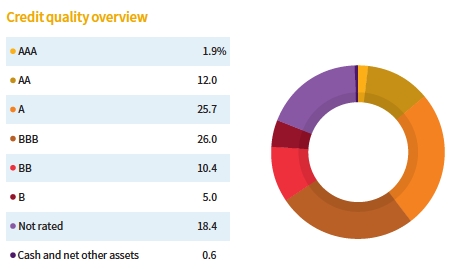

A mix of credit qualities

In addition to its flexible geographical focus, Putnam Managed Municipal Income Trust combines bonds of differing credit quality. The fund invests in high-quality bonds, but also includes an allocation to lower-rated bonds, which may offer higher income in return for more risk.

|

| Managed Municipal Income Trust 3 |

Data are historical. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return and net asset value will fluctuate, and you may have a gain or a loss when you sell your shares. Performance assumes reinvestment of distributions and does not account for taxes. Fund returns in the bar chart are at NAV. See below and pages 10–11 for additional performance information, including fund returns at market price. Index and Lipper results should be compared with fund performance at NAV. Fund results reflect the use of leverage, while index results are unleveraged and Lipper results reflect varying use of, and methods for, leverage.

*Returns for the six-month period are not annualized, but cumulative.

This comparison shows your fund’s performance in the context of broad market indexes for the six months ended 4/30/19. See above and pages 10–11 for additional fund performance information. Index descriptions can be found on page 13.

| |

| 4 Managed Municipal Income Trust |

How was the market for municipal bonds during the period?

Municipal bonds performed well on both an absolute basis and relative to other asset classes for the period, with much of the momentum coming in the second half of the period. During the first three months of the period, which coincided with the fourth quarter of 2018, markets were rattled by several concerns, including rising interest rates, the partial U.S. government shutdown, slowing global growth, and geopolitical tensions. Investors responded by selling higher-risk equity and fixed-income investments and buying more conservative fixed-income investments.

With the prevailing macroeconomic and geopolitical winds presenting some uncertainty about the pace of global growth, the Federal Reserve became quite dovish in its outlook for future interest-rate hikes during the first quarter of 2019. The shift in the Fed’s monetary policy, combined with the end of the federal government shutdown in January 2019 and optimism over a U.S.–China trade agreement, rallied investor sentiment and increased demand for higher-risk assets.

|

| Managed Municipal Income Trust 5 |

Credit qualities are shown as a percentage of the fund’s net assets (common and preferred shares) as of 4/30/19.A bond rated BBB or higher (SP-3 or higher, for short-term debt) is considered investment grade. This chart reflects the highest security rating provided by one or more of Standard & Poor’s, Moody’s, and Fitch. Ratings may vary over time.

Cash and net other assets, if any, represent the market value weights of cash, derivatives, and short-term securities in the portfolio. The fund itself has not been rated by an independent rating agency.

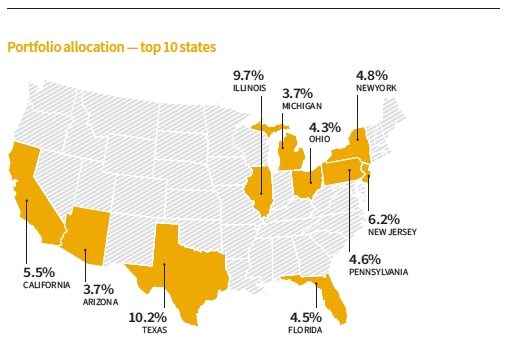

Top ten state allocations are shown as a percentage of the fund’s net assets (common and preferred shares) as of 4/30/19. Investments in Puerto Rico represented 0.2% of the fund’s net assets. Summary information may differ from the portfolio schedule included in the financial statements due to the differing treatment of interest accruals, the floating rate portion of tender option bonds, derivative securities, if any, the timing of matured security transactions, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

| |

| 6 Managed Municipal Income Trust |

Technicals, or supply and demand dynamics, were favorable during the period. With the Tax Cuts and Jobs Act of 2017 capping the deductibility of state and local taxes at $10,000 a year, many Americans faced higher taxes for 2018. As a result, tax-exempt bond funds saw heightened demand and record inflows, which supported prices.

Given their favorable technicals, tax-exempt municipal bonds enjoyed solid returns that outperformed Treasuries and the fixed-income markets for the period.

How did the fund perform during the reporting period?

For the six months ended April 30, 2019, the fund outperformed the Bloomberg Barclays Municipal Bond Index [the municipal benchmark] but underperformed the average return of its Lipper peer group, High Yield Municipal Debt Funds.

What was your investment approach?

We favored an overweight position in bonds with longer intermediate maturities while underweighting shorter intermediate and long maturity holdings as compared with the fund’s municipal benchmark. Consequently, the fund’s yield-curve positioning had more of a bulleted portfolio structure focused on the intermediate portion of the curve at period-end, which resulted in an average maturity of approximately 18 years. Additionally, we used market weakness in October and November 2018 to adjust duration in the portfolio to capture positive seasonal conditions in December and early January. [Duration is a measure of the portfolio’s sensitivity to interest rates.] Consequently, the fund’s duration positioning moved to a generally neutral stance relative to its Lipper peers during the period.

The fund held an overweight exposure to higher-quality bonds rated A and BBB relative to the fund’s Lipper peer group. We continued to look for what we view as attractively priced opportunities to movehigher up the credit-quality spectrum. From a sector positioning perspective, we favored essential service utilities, continuing-care retirement community, and higher-education bonds relative to the fund’s Lipper group. The fund continued to be weighted more toward essential service revenue bonds than toward local general obligation bonds [GOs], which typically rely on the taxing power of state and local governments.

Geographically, the fund held an overweight position in Illinois GOs relative to its benchmark. We believe that the state’s financial profile continues to stabilize, and this is not currently reflected by market spreads. As such, the Illinois GO holdings look attractive from a fundamental and relative value standpoint, in our view.

In February 2019, Puerto Rico reached an important milestone in its financial recovery. Federal bankruptcy Judge Laura Taylor Swain formally approved a major debt restructuring plan for Puerto Rico’s sales tax bonds known as “COFINA.” The agreement swapped out more than $17 billion in COFINA sales tax revenue bonds, including a senior and subordinate lien, for new bonds in a debt exchange. Senior lien bonds recovered roughly 93 cents on the dollar. Subordinate lien bonds recovered roughly 56 cents on the dollar. The restructured bonds were downsized — to about $12 billion — into one new single lien security.

The compromise agreement may help Puerto Rico save more than $400 million annually, which could be available for public services such as health, education, and pension payments. While the ruling brings clarity, and we believe the bond restructuring is a positive

|

| Managed Municipal Income Trust 7 |

step to help resolve Puerto Rico’s debt crisis, the uncertainty of the island’s road to economic recovery causes us to remain cautious.

The fund remained significantly underweight in exposure to Puerto Rico municipal bonds during the period compared with the fund’s Lipper peer group.

Can you discuss changes in the fund’s dividend rate during the reporting period?

In November 2018, the Trustees of the Putnam Funds approved an amendment to the dividend policy for the Putnam closed-end funds to establish targeted distribution rates for common shares, effective with the December 2018 distribution. Under the policy, the fund currently expects to make monthly distributions to common shareholders at a distribution rate of $0.0320 per share, up from $0.0289 per share. The fund’s targeted distribution rate may change from time to time or be discontinued, based on market conditions, among other factors.

What is your outlook for interest rates and the municipal bond market?

We believe slower growth and the absence of inflationary pressures may keep any interest-rate increases by the data-dependent Fed on hold in 2019. This bodes well for municipal bond prices for the foreseeable future, in our view.

Although unfunded pension liabilities remain a concern for some municipalities, defaults for investment-grade municipal bonds have been rare and remain relatively low for non-investment-grade municipal bonds. The asset class also has demonstrated a low correlation to equities in recent years, suggesting that they could help play a defensive role in a diversified investment portfolio during periods of equity market volatility, in our view.

With their competitive tax-adjusted returns and stable credit fundamentals, municipals could perform relatively well in 2019, in our view. We’ll continue to monitor the market on a daily basis to capture opportunities that arise from supply and/or demand imbalances. We’ll also continue

This chart shows how the fund’s top weightings have changed over the past six months. Allocations are shown as a percentage of the fund’s net assets (common and preferred shares). Current period summary information may differ from the information in the portfolio schedule notes included in the financial statements due to the inclusion of derivative securities, any interest accruals, the timing of matured security transactions, the use of different classifications of securities for presentation purposes, and rounding. Holdings and allocations may vary over time.

| |

| 8 Managed Municipal Income Trust |

to adjust the portfolio’s interest-rate sensitivity accordingly as our views change.

Thank you, Paul, for your time and insights today.

The views expressed in this report are exclusively those of Putnam Management and are subject to change. They are not meant as investment advice.

Please note that the holdings discussed in this report may not have been held by the fund for the entire period. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk. Statements in the Q&A concerning the fund’s performance or portfolio composition relative to those of the fund’s Lipper peer group may reference information produced by Lipper Inc. or through a third party.

|

| Managed Municipal Income Trust 9 |

Your fund’s performance

This section shows your fund’s performance, price, and distribution information for periods ended April 30, 2019, the end of the first half of its current fiscal year. In accordance with regulatory requirements for mutual funds, we also include performance as of the most recent calendar quarter-end. Performance should always be considered in light of a fund’s investment strategy. Data represent past performance. Past performance does not guarantee future results. More recent returns may be less or more than those shown. Investment return, net asset value, and market price will fluctuate, and you may have a gain or a loss when you sell your shares.

Fund performanceTotal return and comparative index results for periods ended 4/30/19

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | | | | | | | |

| | Life of | | | | | | | | |

| | fund (since | | Annual | | Annual | | Annual | | |

| | 2/24/89) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

| NAV | 6.46% | 133.73% | 8.86% | 34.28% | 6.07% | 12.77% | 4.09% | 6.82% | 6.35% |

| Market price | 6.10 | 142.22 | 9.25 | 38.28 | 6.70 | 12.69 | 4.06 | 10.89 | 14.25 |

| Bloomberg Barclays | | | | | | | | | |

| Municipal Bond Index | 5.81 | 56.03 | 4.55 | 19.14 | 3.56 | 7.97 | 2.59 | 6.16 | 5.68 |

| Lipper High Yield | | | | | | | | | |

| Municipal Debt | | | | | | | | | |

| Funds (closed-end) | 5.80 | 143.05 | 9.22 | 32.55 | 5.79 | 11.97 | 3.84 | 6.63 | 6.98 |

| category average* | | | | | | | | | |

Performance assumes reinvestment of distributions and does not account for taxes.

Index and Lipper results should be compared with fund performance at net asset value. Fund results reflect the use of leverage, while index results are unleveraged and Lipper results reflect varying use of, and methods for, leverage.

*Over the 6-month, 1-year, 3-year, 5-year, 10-year, and life-of-fund periods ended 4/30/19, there were 12, 11, 11, 11, 11, and 6 funds, respectively, in this Lipper category.

Performance includes the deduction of management fees and administrative expenses.

| |

| 10 Managed Municipal Income Trust |

Fund price and distribution informationFor the six-month period ended 4/30/19

| | | |

| Distributions | | | |

| Number | | 6 | |

| Income1 | | $0.1889 | |

| Capital gains2 | | — | |

| Total | | $0.1889 | |

| | Series A | | Series C |

| Distributions — preferred shares | (240 shares) | | (1,507 shares) |

| Income1 | $1,664.03 | | $643.11 |

| Capital gains2 | — | | — |

| Total | $1,664.03 | | $643.11 |

| Share value | NAV | | Market price |

| 10/31/18 | $7.64 | | $6.71 |

| 4/30/19 | 7.93 | | 7.47 |

| Current dividend rate (end of period) | NAV | | Market price |

| Current dividend rate3 | 4.84% | | 5.14% |

| Taxable equivalent4 | 8.18 | | 8.68 |

The classification of distributions, if any, is an estimate. Final distribution information will appear on your year-end tax forms.

1For some investors, investment income may be subject to the federal alternative minimum tax. Income from federally exempt funds may be subject to state and local taxes.

2Capital gains, if any, are taxable for federal and, in most cases, state purposes.

3Most recent distribution, including any return of capital and excluding capital gains, annualized and divided by NAV or market price at end of period.

4Assumes maximum 40.80% federal tax rate for 2019. Results for investors subject to lower tax rates would not be as advantageous.

Fund performance as of most recent calendar quarterTotal return for periods ended 3/31/19

| | | | | | | | | |

| | Annual | | | | | | | | |

| | average | | | | | | | | |

| | Life of | | | | | | | | |

| | fund (since | | Annual | | Annual | | Annual | | |

| | 2/24/89) | 10 years | average | 5 years | average | 3 years | average | 1 year | 6 months |

| NAV | 6.46% | 141.76% | 9.23% | 36.20% | 6.37% | 13.37% | 4.27% | 6.14% | 4.67% |

| Market price | 6.11 | 154.68 | 9.80 | 42.21 | 7.30 | 14.66 | 4.67 | 10.28 | 10.94 |

See the discussion following the fund performance table on page 10 for information about the calculation of fund performance.

|

| Managed Municipal Income Trust 11 |

Consider these risks before investing

Lower-rated bonds may offer higher yields in return for more risk. Bond investments are subject to interest-rate risk (the risk of bond prices falling if interest rates rise) and credit risk (the risk of an issuer defaulting on interest or principal payments). Interest-rate risk is generally greater for longer-term bonds, and credit risk is generally greater for below-investment-grade bonds. Unlike bonds, funds that invest in bonds have fees and expenses. The value of investments in the fund’s portfolio may fall or fail to rise over extended periods of time for a variety of reasons, including general economic, political or financial market conditions, investor sentiment and market perceptions, government actions, geopolitical events or changes, and factors related to a specific issuer, geography, industry or sector. These and other factors may lead to increased volatility and reduced liquidity in the fund’s portfolio holdings. You can lose money by investing in the fund. The fund’s shares trade on a stock exchange at market prices, which may be lower than the fund’s net asset value.

| |

| 12 Managed Municipal Income Trust |

Terms and definitions

Important terms

Total returnshows how the value of the fund’s shares changed over time, assuming you held the shares through the entire period and reinvested all distributions in the fund.

Net asset value (NAV)is the value of all your fund’s assets, minus any liabilities, divided by the number of outstanding shares.

Market priceis the current trading price of one share of the fund. Market prices are set by transactions between buyers and sellers on exchanges such as the New York Stock Exchange.

Fixed-income terms

Current rateis the annual rate of return earned from dividends or interest of an investment. Current rate is expressed as a percentage of the price of a security, fund share, or principal investment.

Yield curveis a graph that plots the yields of bonds with equal credit quality against their differing maturity dates, ranging from shortest to longest. It is used as a benchmark for other debt, such as mortgage or bank lending rates.

Comparative indexes

Bloomberg Barclays Municipal Bond Indexis an unmanaged index of long-term fixed-rate investment-grade tax-exempt bonds.

Bloomberg Barclays U.S. Aggregate Bond Indexis an unmanaged index of U.S. investment-grade fixed-income securities.

ICE BofAML (Intercontinental Exchange Bank of America Merrill Lynch) U.S. 3-Month Treasury Bill Indexis an unmanaged index that seeks to measure the performance of U.S.Treasury bills available in the marketplace.

S&P 500 Indexis an unmanaged index of common stock performance.

Indexes assume reinvestment of all distributions and do not account for fees. Securities and performance of a fund and an index will differ. You cannot invest directly in an index.

ICE Data Indices, LLC (“ICE BofAML”), used with permission. ICE BofAML permits use of the ICE BofAML indices and related data on an “as is” basis; makes no warranties regarding same; does not guarantee the suitability, quality, accuracy, timeliness, and/or completeness of the ICE BofAML indices or any data included in, related to, or derived therefrom; assumes no liability in connection with the use of the foregoing; and does not sponsor, endorse, or recommend Putnam Investments, or any of its products or services.

Lipperis a third-party industry-ranking entity that ranks mutual funds. Its rankings do not reflect sales charges. Lipper rankings are based on total return at net asset value relative to other funds that have similar current investment styles or objectives as determined by Lipper. Lipper may change a fund’s category assignment at its discretion. Lipper category averages reflect performance trends for funds within a category.

|

| Managed Municipal Income Trust 13 |

Other information for shareholders

Important notice regarding share repurchase program

In September 2018, the Trustees of your fund approved the renewal of a share repurchase program that had been in effect since 2005. This renewal allows your fund to repurchase, in the 12 months beginning October 10, 2018, up to 10% of the fund’s common shares outstanding as of October 9, 2018.

Important notice regarding delivery of shareholder documents

In accordance with Securities and Exchange Commission (SEC) regulations, Putnam sends a single copy of annual and semiannual shareholder reports, prospectuses, and proxy statements to Putnam shareholders who share the same address, unless a shareholder requests otherwise. If you prefer to receive your own copy of these documents, please call Putnam at 1-800-225-1581, and Putnam will begin sending individual copies within 30 days.

Proxy voting

Putnam is committed to managing our mutual funds in the best interests of our shareholders. The Putnam funds’ proxy voting guidelines and procedures, as well as information regarding how your fund voted proxies relating to portfolio securities during the 12-month period ended June 30, 2018, are available in the Individual Investors section of putnam.com and on the SEC’s website, www.sec.gov. Ifyou have questions about finding forms on the SEC’s website, you may call the SEC at 1-800-SEC-0330. You may also obtain the Putnam funds’ proxy voting guidelines and procedures at no charge by calling Putnam’s Shareholder Services at 1-800-225-1581.

Fund portfolio holdings

The fund will file a complete schedule of its portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT within 60 days of the end of such fiscal quarter. Shareholders may obtain the fund’s Form N-PORT on the SEC’s website at www.sec.gov.

Prior to its use of Form N-PORT, the fund filed its complete schedule of its portfolio holdings with the SEC on Form N-Q, which is available online at www.sec.gov.

Trustee and employee fund ownership

Putnam employees and members of the Board of Trustees place their faith, confidence, and, most importantly, investment dollars in Putnam mutual funds. As of April 30, 2019, Putnam employees had approximately $507,000,000 and the Trustees had approximately $71,000,000 invested in Putnam mutual funds. These amounts include investments by the Trustees’ and employees’ immediate family members as well as investments through retirement and deferred compensation plans.

| |

| 14 Managed Municipal Income Trust |

Summary of Putnam Closed-End Funds’ Amended and Restated Dividend Reinvestment Plans

Putnam Managed Municipal Income Trust, Putnam Master Intermediate Income Trust, Putnam Municipal Opportunities Trust and Putnam Premier Income Trust (each, a “Fund” and collectively, the “Funds”) each offer adividend reinvestment plan(each, a “Plan” and collectively, the “Plans”). If you participate in a Plan, all income dividends and capital gain distributions areautomatically reinvestedin Fund shares by the Fund’s agent, Putnam Investor Services, Inc. (the “Agent”). If you are not participating in a Plan, every month you will receive all dividends and other distributions in cash, paid by check and mailed directly to you.

Upon a purchase (or, where applicable, upon registration of transfer on the shareholder records of a Fund) of shares of a Fund by a registered shareholder, each such shareholderwill be deemed to have elected to participatein that Fund’s Plan. Each such shareholder will have all distributions by a Fund automatically reinvested in additional shares, unless such shareholder elects to terminate participation in a Plan by instructing the Agent to pay future distributions in cash. Shareholders who were not participants in a Plan as of January 31, 2010, will continue to receive distributions in cash but may enroll in a Plan at any time by contacting the Agent.

If you participate in a Fund’s Plan, the Agent will automatically reinvest subsequent distributions, and the Agent will send you a confirmation in the mail telling you how many additional shares were issued to your account.

To change your enrollment status or to request additional information about the Plans, you may contact the Agent either in writing, at P.O. Box 8383, Boston, MA 02266-8383, or by telephone at 1-800-225-1581 during normal East Coast business hours.

How you acquire additional shares through a PlanIf the market price per share for your Fund’s shares (plus estimated brokeragecommissions) is greater than or equal to their net asset value per share on the payment date for a distribution, you will be issued shares of the Fund at a value equal to the higher of the net asset value per share on that date or 95% of the market price per share on that date.

If the market price per share for your Fund’s shares (plus estimated brokerage commissions) is less than their net asset value per share on the payment date for a distribution, the Agent will buy Fund shares for participating accounts in the open market. The Agent will aggregate open-market purchases on behalf of all participants, and the average price (including brokerage commissions) of all shares purchased by the Agent will be the price per share allocable to each participant. The Agent will generally complete these open-market purchases within five business days following the payment date. If, before the Agent has completed open-market purchases, the market price per share (plus estimated brokerage commissions) rises to exceed the net asset value per share on the payment date, then the purchase price may exceed the net asset value per share, potentially resulting in the acquisition of fewer shares than if the distribution had been paid in newly issued shares.

How to withdraw from a PlanParticipants may withdraw from a Fund’s Plan at any time by notifying the Agent, either in writing or by telephone. Such withdrawal will be effective immediately if notice is received by the Agent with sufficient time prior to any distribution record date; otherwise, such withdrawal will be effective with respect to any subsequent distribution following notice of withdrawal. There is no penalty for withdrawing from or not participating in a Plan.

Plan administrationThe Agent will credit all shares acquired for a participant under a Plan to the account in which the participant’s common shares are held. Each participant will

|

| Managed Municipal Income Trust 15 |

be sent reasonably promptly a confirmation by the Agent of each acquisition made for his or her account.

About brokerage feesEach participant pays a proportionate share of any brokerage commissions incurred if the Agent purchases additional shares on the open market, in accordance with the Plans. There are no brokerage charges applied to shares issued directly by the Funds under the Plans.

About taxes and Plan amendments

Reinvesting dividend and capital gain distributions in shares of the Funds does not relieve you of tax obligations, which are the same as if you had received cash distributions. The Agent supplies tax information to you and to the IRS annually. Each Fund reserves the right to amend or terminate its Plan upon 30 days’ written notice. However, the Agent may assign its rights, and delegate its duties, to a successor agent with the priorconsent of a Fund and without prior notice to Plan participants.

If your shares are held in a broker or nominee nameIf your shares are held in the name of a broker or nominee offering a dividend reinvestment service, consult your broker or nominee to ensure that an appropriate election is made on your behalf. If the broker or nominee holding your shares does not provide a reinvestment service, you may need to register your shares in your own name in order to participate in a Plan.

In the case of record shareholders such as banks, brokers or nominees that hold shares for others who are the beneficial owners of such shares, the Agent will administer the Plan on the basis of the number of shares certified by the record shareholder as representing the total amount registered in such shareholder’s name and held for the account of beneficial owners who are to participate in the Plan.

| |

| 16 Managed Municipal Income Trust |

Financial statements

These sections of the report, as well as the accompanying Notes, constitute the fund’s financial statements.

The fund’s portfoliolists all the fund’s investments and their values as of the last day of the reporting period. Holdings are organized by asset type and industry sector, country, or state to show areas of concentration and diversification.

Statement of assets and liabilitiesshows how the fund’s net assets and share price are determined. All investment and non-investment assets are added together. Any unpaid expenses and other liabilities are subtracted from this total. The result is divided by the number of shares to determine the net asset value per share. (For funds with preferred shares, the amount subtracted from total assets includes the liquidation preference of preferred shares.)

Statement of operationsshows the fund’s net investment gain or loss. This is done by first adding up all the fund’s earnings — from dividends and interest income — and subtracting its operating expenses to determine net investment income (or loss). Then, any net gain or loss the fund realized on the sales of its holdings — as well as any unrealized gains or losses over the period — is added toor subtracted from the net investment result to determine the fund’s net gain or loss for the fiscal period.

Statement of changes in net assetsshows how the fund’s net assets were affected by the fund’s net investment gain or loss, by distributions to shareholders, and by changes in the number of the fund’s shares. It lists distributions and their sources (net investment income or realized capital gains) over the current reporting period and the most recent fiscal year-end. The distributions listed here may not match the sources listed in the Statement of operations because the distributions are determined on a tax basis and may be paid in a different period from the one in which they were earned. Dividend sources are estimated at the time of declaration. Actual results may vary. Any non-taxable return of capital cannot be determined until final tax calculations are completed after the end of the fund’s fiscal year.

Financial highlightsprovide an overview of the fund’s investment results, per-share distributions, expense ratios, net investment income ratios, and portfolio turnover in one summary table, reflecting the five most recent reporting periods. In a semiannual report, the highlights table also includes the current reporting period.

|

| Managed Municipal Income Trust 17 |

The fund’s portfolio4/30/19 (Unaudited)

Key to holding’s abbreviations

| |

| ABAGAssociation Of Bay Area Governments | VRDNVariable Rate Demand Notes, which are floating- |

| AGMAssured Guaranty Municipal Corporation | rate securities with long-term maturities that carry |

| AMBACAMBAC Indemnity Corporation | coupons that reset and are payable upon demand |

| COPCertificatesof Participation | either daily, weekly or monthly. The rate shown is the |

| G.O. BondsGeneral Obligation Bonds | current interest rate at the close of the reporting |

| NATLNational Public Finance Guarantee Corp. | period. Rates are set by remarketing agents and may |

| PSFGPermanent School Fund Guaranteed | take into consideration market supply and demand, |

| U.S. Govt. Coll.U.S. Government Collateralized | credit quality and the current SIFMA Municipal Swap |

| Index rate, which was 2.30% as of the close of the |

| reporting period. |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)* | Rating** | Principal amount | Value |

| Alabama (1.8%) | | | |

| Jefferson Cnty., Swr. Rev. Bonds | | | |

| Ser. D, 6.50%, 10/1/53 | BBB | $500,000 | $592,630 |

| zero %, 10/1/46 | BBB | 3,950,000 | 3,654,422 |

| Jefferson, Cnty. Rev. Bonds, (Warrants) | | | |

| 5.00%, 9/15/34 | AA | 2,075,000 | 2,407,062 |

| 5.00%, 9/15/33 | AA | 275,000 | 319,913 |

| | | | 6,974,027 |

| Alaska (1.6%) | | | |

| Northern Tobacco Securitization Corp. Rev. Bonds, | | | |

| Ser. A, 5.00%, 6/1/46 | B3 | 6,370,000 | 6,234,701 |

| | | | 6,234,701 |

| Arizona (4.5%) | | | |

| AZ State Indl. Dev. Auth. Ed. 144A Rev. Bonds, | | | |

| (BASIS Schools, Inc.), Ser. G, 5.00%, 7/1/37 | BB | 500,000 | 534,145 |

| Casa Grande, Indl. Dev. Auth. Rev. Bonds, | | | |

| (Casa Grande Regl. Med. Ctr.) | | | |

| Ser. A, 7.625%, 12/1/29 (escrow) F | D/P | 1,800,000 | 5,380 |

| 7.25%, 12/1/19 (escrow) F | D/P | 1,000,000 | 2,989 |

| La Paz Cnty., Indl. Dev. Auth. Ed. Fac. Rev. Bonds, | | | |

| (Harmony Pub. Schools), Ser. A | | | |

| 5.00%, 2/15/48 | BBB | 2,330,000 | 2,533,805 |

| 5.00%, 2/15/38 | BBB | 500,000 | 548,220 |

| Maricopa Cnty., Indl. Dev. Auth. Ed. Rev. Bonds, | | | |

| (Horizon Cmnty. Learning Ctr.), 5.00%, 7/1/35 | BB+ | 500,000 | 522,295 |

| Phoenix, Indl. Dev. Auth. Ed. Rev. Bonds | | | |

| (Great Hearts Academies), 6.00%, 7/1/32 | | | |

| (Prerefunded 7/1/21) | AAA/P | 200,000 | 218,414 |

| (Choice Academies, Inc.), 5.625%, 9/1/42 | BB | 315,000 | 326,614 |

| (Great Hearts Academies), 5.00%, 7/1/44 | BBB– | 1,700,000 | 1,807,865 |

| (Choice Academies, Inc.), 4.875%, 9/1/22 | BB | 555,000 | 569,119 |

| Phoenix, Indl. Dev. Auth. Ed. 144A Rev. Bonds, | | | |

| (BASIS Schools, Inc.) | | | |

| Ser. A, 5.00%, 7/1/46 | BB | 250,000 | 260,198 |

| 5.00%, 7/1/35 | BB | 900,000 | 952,722 |

| Ser. A, 5.00%, 7/1/35 | BB | 600,000 | 635,148 |

| Pinal Cnty., Indl. Dev. Auth. Env. Fac. 144A Rev. | | | |

| Bonds, (Green Bond), 7.25%, 10/1/33 | BB–/P | 1,000,000 | 1,037,160 |

| |

| 18 Managed Municipal Income Trust |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Arizonacont. | | | |

| Salt Verde, Fin. Corp. Gas Rev. Bonds | | | |

| 5.50%, 12/1/29 | A3 | $2,000,000 | $2,516,940 |

| 5.00%, 12/1/37 | A3 | 2,000,000 | 2,522,040 |

| 5.00%, 12/1/32 | A3 | 570,000 | 704,383 |

| Yavapai Cnty., Indl. Dev. Auth. Hosp. Fac. Rev. Bonds | | | |

| (Yavapai Regl. Med.), 5.00%, 8/1/36 | A3 | 200,000 | 226,472 |

| (Yavapai Regl. Med. Ctr.), 5.00%, 8/1/34 | A3 | 200,000 | 227,526 |

| Yavapai Cnty., Indl. Dev. Ed. Auth. Rev. Bonds, | | | |

| (Agribusiness & Equine Ctr.), 5.00%, 3/1/32 | BB+ | 1,000,000 | 1,037,790 |

| Yavapai Cnty., Indl. Dev. Ed. Auth. 144A Rev. Bonds, | | | |

| Ser. A, 5.00%, 9/1/34 | BB+ | 500,000 | 529,210 |

| | | | 17,718,435 |

| California (8.0%) | | | |

| ABAG Fin. Auth. for Nonprofit Corps. Rev. Bonds, | | | |

| (Episcopal Sr. Cmntys.), 6.00%, 7/1/31 | A–/F | 660,000 | 713,255 |

| CA School Fin. Auth. Rev. Bonds, (2023 Union, LLC), | | | |

| Ser. A, 6.00%, 7/1/33 | BBB | 465,000 | 523,585 |

| CA State Muni. Fin. Auth. Charter School Rev. Bonds, | | | |

| (Partnerships Uplift Cmnty.), Ser. A, 5.00%, 8/1/32 | BB | 665,000 | 689,126 |

| CA State Poll. Control Fin. Auth. Rev. Bonds | | | |

| (Wtr. Furnishing), 5.00%, 11/21/45 | Baa3 | 1,000,000 | 1,054,640 |

| (San Jose Wtr. Co.), 4.75%, 11/1/46 | A | 1,100,000 | 1,215,984 |

| CA Statewide Cmnty. Dev. Auth. Rev. Bonds | | | |

| (Terraces at San Joaquin Gardens), Ser. A, | | | |

| 6.00%, 10/1/47 | BB/P | 1,345,000 | 1,436,191 |

| (American Baptist Homes West), 5.75%, 10/1/25 | BBB+/F | 3,000,000 | 3,049,410 |

| (U. CA Irvine E. Campus Apts. Phase 1), | | | |

| 5.375%, 5/15/38 | Baa1 | 1,000,000 | 1,067,990 |

| (899 Charleston, LLC), Ser. A, 5.25%, 11/1/44 | BB/P | 450,000 | 482,558 |

| (U. CA Irvine E. Campus Apts. Phase 1), | | | |

| 5.125%, 5/15/31 | Baa1 | 2,250,000 | 2,404,733 |

| Golden State Tobacco Securitization Corp. Rev. | | | |

| Bonds, Ser. A-2, 5.00%, 6/1/47 | BB/P | 5,000,000 | 4,908,000 |

| La Verne, COP, (Brethren Hillcrest Homes), | | | |

| 5.00%, 5/15/36 | BBB–/F | 325,000 | 338,978 |

| Los Angeles, CA Dept. Wtr & Pwr Rev Bonds Ser | | | |

| C 5.00% 7/1/42 T | Aa2 | 6,460,000 | 7,669,384 |

| Los Angeles, Regl. Arpt. Impt. Corp. Lease Rev. | | | |

| Bonds, (Laxfuel Corp.), 4.50%, 1/1/27 | A | 400,000 | 420,004 |

| Morongo Band of Mission Indians 144A Rev. Bonds, | | | |

| Ser. B, 5.00%, 10/1/42 | BBB–/F | 2,350,000 | 2,559,714 |

| Rancho Cordova, Cmnty. Fac. Dist. Special Tax | | | |

| Bonds, (Sunridge Anatolia), Ser. 03-1, 5.00%, 9/1/37 | BBB–/P | 350,000 | 373,275 |

| San Francisco City & Cnty., Redev. Agcy. Cmnty. | | | |

| Successor Special Tax Bonds, (No. 6 Mission Bay | | | |

| Pub. Impts.), Ser. C | | | |

| zero %, 8/1/43 | BBB/P | 2,000,000 | 539,580 |

| zero %, 8/1/38 | BBB/P | 2,000,000 | 728,800 |

|

| Managed Municipal Income Trust 19 |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Californiacont. | | | |

| Sunnyvale, Special Tax Bonds, (Cmnty. Fac. Dist. | | | |

| No. 1), 7.75%, 8/1/32 | B+/P | $835,000 | $837,346 |

| Yucaipa Special Tax Bonds, (Cmnty. Fac. Dist. | | | |

| No. 98-1 Chapman Heights), 5.375%, 9/1/30 | A | 375,000 | 401,224 |

| | | | 31,413,777 |

| Colorado (3.0%) | | | |

| Broadway Station Metro. Dist. No. 2 Co. G.O. Bonds, | | | |

| Ser. A, 5.125%, 12/1/48 | B/P | 500,000 | 505,750 |

| Central Platte Valley, Metro. Dist. G.O. Bonds, | | | |

| 5.00%, 12/1/43 | BB+ | 400,000 | 422,924 |

| CO Pub. Hwy. Auth. Rev. Bonds, (E-470), Ser. C, | | | |

| 5.375%, 9/1/26 | A2 | 500,000 | 521,065 |

| CO State Educ. & Cultural Fac. Auth. Rev. Bonds, | | | |

| (Skyview Academy), 5.125%, 7/1/34 | BB | 755,000 | 787,790 |

| CO State Hlth. Fac. Auth. Rev. Bonds | | | |

| (Christian Living Cmnty.), 6.375%, 1/1/41 | BB/P | 810,000 | 870,620 |

| (Total Longterm Care National), Ser. A, 6.25%, | | | |

| 11/15/40 (Prerefunded 11/15/20) | AAA/P | 300,000 | 320,607 |

| (Evangelical Lutheran Good Samaritan Society | | | |

| Oblig. Group (The)), 5.625%, 6/1/43 | BBB | 250,000 | 275,650 |

| (Evangelical Lutheran Good Samaritan Society | | | |

| Oblig. Group (The)), 5.00%, 12/1/33 | BBB | 1,100,000 | 1,172,171 |

| CO State Hlth. Fac. Auth. Hosp. Rev. Bonds | | | |

| (Frasier Meadows Retirement Cmnty.), Ser. B, | | | |

| 5.00%, 5/15/48 | BB+/F | 1,500,000 | 1,562,760 |

| (Christian Living Neighborhood), 5.00%, 1/1/37 | BB/P | 1,250,000 | 1,338,363 |

| (Christian Living Neighborhood), 5.00%, 1/1/31 | BB/P | 500,000 | 543,890 |

| Eaton, Area Park & Recreation Dist. G.O. Bonds, | | | |

| 5.25%, 12/1/34 | BB/P | 220,000 | 231,103 |

| Park Creek, Metro. Dist. Tax Allocation Bonds, | | | |

| (Sr. Ltd. Property Tax Supported), Ser. A, | | | |

| 5.00%, 12/1/45 | A/F | 225,000 | 247,757 |

| Plaza, Tax Alloc. Bonds, (Metro. Dist. No. 1), | | | |

| 5.00%, 12/1/40 | BB–/P | 1,650,000 | 1,711,166 |

| Regl. Trans. Dist. Rev. Bonds, (Denver Trans. | | | |

| Partners), 6.00%, 1/15/41 | Baa3 | 750,000 | 778,515 |

| Southlands, Metro. Dist. No. 1 G.O. Bonds, Ser. A-1, | | | |

| 5.00%, 12/1/37 | Ba1 | 500,000 | 539,765 |

| | | | 11,829,896 |

| Connecticut (0.4%) | | | |

| Harbor Point Infrastructure Impt. Dist. 144A Tax | | | |

| Alloc. Bonds, (Harbor Point Ltd.), 5.00%, 4/1/39 | BB/P | 1,500,000 | 1,607,160 |

| | | | 1,607,160 |

| Delaware (2.5%) | | | |

| DE State Econ. Dev. Auth. Rev. Bonds | | | |

| (Delmarva Pwr.), 5.40%, 2/1/31 | A– | 500,000 | 520,585 |

| (Indian River Pwr.), 5.375%, 10/1/45 | Baa3 | 2,600,000 | 2,695,784 |

| (ASPIRA of Delaware Charter Operations, Inc.), | | | |

| Ser. A, 5.00%, 6/1/51 | BB+ | 1,035,000 | 1,085,208 |

| (ASPIRA Charter School), Ser. A, 5.00%, 6/1/36 | BB+ | 705,000 | 752,989 |

|

| 20 Managed Municipal Income Trust |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Delawarecont. | | | |

| DE State Hlth. Fac. Auth. VRDN, (Christiana Care), | | | |

| Ser. A, 2.30%, 10/1/38 | VMIG 1 | $3,000,000 | $3,000,000 |

| Millsboro Special Oblig. 144A Tax Alloc. Bonds, | | | |

| (Plantation Lakes Special Dev. Dist.), 5.125%, 7/1/38 | BB–/P | 1,490,000 | 1,559,211 |

| | | | 9,613,777 |

| District of Columbia (1.5%) | | | |

| DC Rev. Bonds, (Howard U.), Ser. A | | | |

| 6.50%, 10/1/41 | BBB– | 395,000 | 413,225 |

| 6.25%, 10/1/32 | BBB– | 525,000 | 550,289 |

| DC Tobacco Settlement Fin. Corp. Rev. Bonds, | | | |

| Ser. A, zero %, 6/15/46 | CCC/P | 7,500,000 | 1,157,625 |

| DC, Rev. Bonds, (Methodist Home of The DC (The)), | | | |

| Ser. A, 5.25%, 1/1/39 | BB–/P | 250,000 | 245,770 |

| DC, Wtr. & Swr. Auth. Pub. Util. Rev. Bonds, Ser. C, | | | |

| 5.00%, 10/1/39 | AA+ | 3,000,000 | 3,385,170 |

| | | | 5,752,079 |

| Florida (5.5%) | | | |

| Cap. Trust Agcy. Senior Living 144A Rev. Bonds, | | | |

| (H-Bay Ministries, Inc.-Superior Residencies), Ser. C, | | | |

| 7.50%, 7/1/53 | B–/P | 250,000 | 248,438 |

| Celebration Pointe Cmnty. Dev. Dist. No. 1 144A | | | |

| Special Assessment Bonds, (Alachua Cnty.), | | | |

| 5.00%, 5/1/48 | B/P | 250,000 | 256,460 |

| Double Branch Cmnty. Dev. Dist. Special Assmt. | | | |

| Bonds, (Sr. Lien), Ser. A-1, 4.125%, 5/1/31 | A– | 500,000 | 521,750 |

| Fishhawk, CCD IV Special Assmt. Bonds, | | | |

| 7.25%, 5/1/43 | B/P | 380,000 | 413,786 |

| Greater Orlando Aviation Auth. Rev. Bonds, | | | |

| (JetBlue Airways Corp.), 5.00%, 11/15/36 | B/P | 1,000,000 | 1,050,550 |

| Halifax Hosp. Med. Ctr. Rev. Bonds, 5.00%, 6/1/36 | A– | 1,300,000 | 1,443,819 |

| Lakeland, Retirement Cmnty. 144A Rev. Bonds, | | | |

| (1st Mtge. — Carpenters), 6.375%, 1/1/43 | BBB–/F | 840,000 | 841,714 |

| Lakewood Ranch, Stewardship Dist. Special | | | |

| Assessment Bonds, (Village of Lakewood Ranch | | | |

| South), 5.125%, 5/1/46 | B+/P | 905,000 | 928,503 |

| Lakewood Ranch, Stewardship Dist. Special Assmt. | | | |

| Bonds, 4.875%, 5/1/35 | BB–/P | 485,000 | 495,491 |

| Martin Cnty., Rev. Bonds, (Indiantown | | | |

| Cogeneration), 4.20%, 12/15/25 | BBB+ | 1,500,000 | 1,528,950 |

| Miami Beach, Hlth. Fac. Auth. Hosp. Rev. Bonds, | | | |

| (Mount Sinai Med. Ctr.), 5.00%, 11/15/29 | Baa1 | 1,000,000 | 1,094,950 |

| Miami-Dade Cnty., Rev. Bonds, (Tran. Syst. Sales | | | |

| Surtax), 5.00%, 7/1/42 | AA | 2,000,000 | 2,163,200 |

| Miami-Dade Cnty., Indl. Dev. Auth. Rev. Bonds, | | | |

| (Pinecrest Academy, Inc.), 5.00%, 9/15/34 | BBB | 1,240,000 | 1,328,635 |

| Midtown Miami Cmnty. Dev. Dist. Special Assmt. | | | |

| Bonds, (Garage), Ser. A, 5.00%, 5/1/29 | BB–/P | 570,000 | 599,247 |

| Sarasota Cnty., Hlth. Fac. Auth. Rev. Bonds, | | | |

| (Village on the Isle), Ser. A, 5.00%, 1/1/37 | BBB–/F | 1,000,000 | 1,068,800 |

| Sarasota Cnty., Pub. Hosp. Dist. Rev. Bonds, | | | |

| (Sarasota Memorial Hosp.), 4.00%, 7/1/48 | A1 | 1,500,000 | 1,554,360 |

|

| Managed Municipal Income Trust 21 |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Floridacont. | | | |

| South Lake Hosp. Dist. Rev. Bonds, (South Lake | | | |

| Hosp.), Ser. A, 6.00%, 4/1/29 | Baa1 | $1,000,000 | $1,002,740 |

| Southeast Overtown Park West Cmnty. Redev. Agcy. | | | |

| 144A Tax Alloc. Bonds, Ser. A-1, 5.00%, 3/1/30 | BBB+ | 480,000 | 532,848 |

| Tallahassee, Hlth. Fac. Rev. Bonds, (Tallahassee | | | |

| Memorial HealthCare, Inc.), Ser. A, 5.00%, 12/1/55 | Baa1 | 1,000,000 | 1,089,950 |

| Tolomato, Cmnty. Dev. Dist. Special Assmt. Bonds, | | | |

| 5.40%, 5/1/37 | B+/P | 600,000 | 600,696 |

| Verandah, West Cmnty. Dev. Dist. Special Assmt. | | | |

| Bonds, (Cap. Impt.), 5.00%, 5/1/33 | B+/P | 465,000 | 474,272 |

| Village Cmnty. Dev. Dist. No. 10 Special Assmt. | | | |

| Bonds, 5.75%, 5/1/31 | BB/P | 735,000 | 820,458 |

| Village Cmnty. Dev. Dist. No. 12 144A Special | | | |

| Assessment Bonds, 4.00%, 5/1/33 | BB–/P | 750,000 | 771,135 |

| Village Cmnty. Dev. Dist. No. 8 Special Assmt. Bonds, | | | |

| (Phase II), 6.125%, 5/1/39 | BBB–/P | 370,000 | 384,245 |

| Village Cmnty. Dev. Dist. No. 9 Special Assmt. Bonds, | | | |

| 5.00%, 5/1/22 | BBB–/P | 205,000 | 212,378 |

| | | | 21,427,375 |

| Georgia (4.2%) | | | |

| Clayton Cnty., Dev. Auth. Special Fac. Rev. Bonds, | | | |

| (Delta Airlines), Ser. A, 8.75%, 6/1/29 | Baa3 | 3,000,000 | 3,214,920 |

| Cobb Cnty., Dev. Auth. Student Hsg. Rev. Bonds, | | | |

| (Kennesaw State U. Real Estate Oblig. Group), Ser. C, | | | |

| 5.00%, 7/15/38 | Baa2 | 750,000 | 804,075 |

| GA State Private College & U. Auth. Rev. Bonds, | | | |

| (Mercer U.) | | | |

| Ser. C, 5.25%, 10/1/30 | Baa1 | 750,000 | 811,628 |

| Ser. A, 5.25%, 10/1/27 | Baa1 | 1,000,000 | 1,071,820 |

| Ser. A, 5.00%, 10/1/32 | Baa1 | 1,000,000 | 1,047,600 |

| Gainesville & Hall Cnty., Dev. Auth. Edl. Fac. Rev. | | | |

| Bonds, (Riverside Military Academy) | | | |

| 5.00%, 3/1/47 | BBB–/F | 1,000,000 | 1,077,060 |

| 5.00%, 3/1/37 | BBB–/F | 1,450,000 | 1,582,211 |

| Gainesville & Hall Cnty., Devauth Retirement Cmnty. | | | |

| Rev. Bonds, (Acts Retirement-Life Cmnty.), Ser. A-2, | | | |

| 6.375%, 11/15/29 (Prerefunded 11/15/19) | A–/F | 700,000 | 717,535 |

| Main St. Natural Gas, Inc. Gas Supply Rev. Bonds, | | | |

| Ser. A, 5.00%, 5/15/34 | A3 | 3,345,000 | 3,904,217 |

| Muni. Election Auth. of GA Rev. Bonds, (Plant Voltage | | | |

| Units 3 & 4), Ser. A, 5.50%, 7/1/60 | A | 2,000,000 | 2,137,720 |

| | | | 16,368,786 |

| Guam (0.1%) | | | |

| Territory of GU, Pwr. Auth. Rev. Bonds, Ser. A, | | | |

| 5.00%, 10/1/34 | Baa2 | 200,000 | 212,028 |

| | | | 212,028 |

| Hawaii (1.0%) | | | |

| HI State Dept. Budget & Fin. Rev. Bonds | | | |

| (Craigside), Ser. A, 9.00%, 11/15/44 | | | |

| (Prerefunded 11/15/19) | B/P | 400,000 | 415,448 |

| (Hawaiian Elec. Co. — Subsidiary), 6.50%, 7/1/39 | Baa2 | 3,000,000 | 3,028,470 |

| (Kahala Nui), 5.125%, 11/15/32 | A–/F | 400,000 | 439,924 |

| | | | 3,883,842 |

| |

| 22 Managed Municipal Income Trust |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Idaho (0.5%) | | | |

| ID State Hlth. Fac. Auth. Rev. Bonds, (St. Luke’s Hlth. | | | |

| Sys. Oblig. Group), Ser. A, 4.00%, 3/1/38 | A3 | $2,000,000 | $2,073,340 |

| | | | 2,073,340 |

| Illinois (12.0%) | | | |

| Chicago, G.O. Bonds, Ser. A | | | |

| 6.00%, 1/1/38 | BBB+ | 2,560,000 | 2,920,858 |

| 5.50%, 1/1/49 | BBB+ | 1,000,000 | 1,104,840 |

| 5.00%, 1/1/40 | BBB+ | 2,000,000 | 2,135,740 |

| Chicago, Special Assmt. Bonds, (Lake Shore East), | | | |

| 6.75%, 12/1/32 | BB/P | 1,572,000 | 1,580,835 |

| Chicago, Board of Ed. G.O. Bonds | | | |

| Ser. C, 5.25%, 12/1/39 | B+ | 1,500,000 | 1,579,560 |

| Ser. H, 5.00%, 12/1/36 | B+ | 2,100,000 | 2,245,509 |

| Chicago, Motor Fuel Tax Rev. Bonds, 5.00%, 1/1/29 | Ba1 | 500,000 | 528,635 |

| Chicago, O’Hare Intl. Arpt. Rev. Bonds | | | |

| Ser. A, 5.00%, 1/1/38 | A | 700,000 | 816,753 |

| Ser. C, 5.00%, 1/1/26 | A2 | 2,595,000 | 2,860,079 |

| Chicago, Waste Wtr. Transmission Rev. Bonds, | | | |

| (2nd Lien), 5.00%, 1/1/39 | A | 1,360,000 | 1,456,478 |

| Chicago, Wtr. Wks Rev. Bonds | | | |

| 5.00%, 11/1/39 | A | 875,000 | 959,770 |

| 5.00%, 11/1/30 | A | 1,000,000 | 1,142,030 |

| Cicero, G.O. Bonds, Ser. A, AGM, 5.00%, 1/1/20 | AA | 1,250,000 | 1,275,075 |

| Cook Cnty., G.O. Bonds, 5.00%, 11/15/35 | AA– | 500,000 | 556,650 |

| Du Page Cnty., Special Svc. Area No. 31 Special Tax | | | |

| Bonds, (Monarch Landing), 5.625%, 3/1/36 | B/P | 319,000 | 319,632 |

| IL Fin. Auth. Rev. Bonds | | | |

| (Silver Cross Hosp. & Med. Ctr.), 7.00%, 8/15/44 | | | |

| (Prerefunded 8/15/19) | AAA/P | 2,000,000 | 2,030,280 |

| (Navistar Intl. Recvy. Zone), 6.75%, 10/15/40 | BB– | 500,000 | 521,435 |

| (American Wtr. Cap. Corp.), 5.25%, 10/1/39 | A | 1,575,000 | 1,589,144 |

| IL State G.O. Bonds | | | |

| 5.25%, 2/1/30 | Baa3 | 1,000,000 | 1,068,940 |

| 5.00%, 11/1/41 | Baa3 | 1,250,000 | 1,318,838 |

| 5.00%, 1/1/41 | Baa3 | 700,000 | 735,490 |

| 5.00%, 2/1/39 | Baa3 | 200,000 | 207,712 |

| Ser. A, 5.00%, 5/1/38 | Baa3 | 1,000,000 | 1,070,970 |

| 5.00%, 11/1/34 | Baa3 | 500,000 | 534,410 |

| Ser. B, 5.00%, 10/1/31 | Baa3 | 1,000,000 | 1,094,680 |

| Ser. C, 5.00%, 11/1/29 | Baa3 | 1,200,000 | 1,316,484 |

| 5.00%, 1/1/29 | Baa3 | 1,095,000 | 1,186,016 |

| Ser. A, 5.00%, 12/1/28 | Baa3 | 1,760,000 | 1,946,085 |

| Ser. D, 5.00%, 11/1/28 | Baa3 | 1,000,000 | 1,105,420 |

| IL State Fin. Auth. Rev. Bonds | | | |

| (Three Crowns Park), 5.25%, 2/15/47 | BB–/P | 540,000 | 572,503 |

| (Plymouth Place), 5.25%, 5/15/45 | BB+/F | 1,000,000 | 1,045,150 |

| (Three Crowns Park), 5.25%, 2/15/37 | BB–/P | 305,000 | 325,435 |

| (Southern IL Healthcare Enterprises, Inc.), | | | |

| 5.00%, 3/1/33 | A+ | 700,000 | 800,212 |

| (Windy City Portfolio), Ser. A-1, 4.375%, 12/1/42 | BB | 1,000,000 | 755,180 |

| (Riverside Hlth. Syst.), 4.00%, 11/15/35 | A+ | 500,000 | 522,015 |

|

| Managed Municipal Income Trust 23 |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Illinoiscont. | | | |

| IL State Fin. Auth. Student Hsg. & Academic Fac. Rev. | | | |

| Bonds, (U. of IL-CHF-Chicago, LLC), Ser. A | | | |

| 5.00%, 2/15/47 | Baa3 | $500,000 | $546,740 |

| 5.00%, 2/15/37 | Baa3 | 500,000 | 555,415 |

| Metro. Pier & Exposition Auth. Rev. | | | |

| Bonds, (McCormick Place Expansion), | | | |

| Ser. B, stepped-coupon zero % (4.950%, 6/15/31), | | | |

| 12/15/47 †† | BBB | 1,500,000 | 894,945 |

| Metro. Wtr. Reclamation Dist. of Greater Chicago | | | |

| G.O. Bonds, Ser. A, 5.00%, 12/1/31 | AA+ | 1,000,000 | 1,166,190 |

| Sales Tax Securitization Corp. Rev. Bonds, Ser. C, | | | |

| 5.50%, 1/1/36 | AA– | 2,000,000 | 2,379,700 |

| | | | 46,771,833 |

| Indiana (0.5%) | | | |

| IN State Fin. Auth. Edl. Fac. Rev. Bonds, (Butler U.), | | | |

| Ser. B, 5.00%, 2/1/29 | A– | 500,000 | 538,180 |

| Valparaiso, Exempt Facs. Rev. Bonds, (Pratt Paper, | | | |

| LLC), 6.75%, 1/1/34 | B+/P | 1,125,000 | 1,298,981 |

| | | | 1,837,161 |

| Iowa (0.2%) | | | |

| IA State Fin. Auth. Midwestern Disaster Rev. Bonds, | | | |

| (IA Fertilizer Co., LLC), 5.25%, 12/1/25 | B+ | 750,000 | 808,703 |

| | | | 808,703 |

| Kansas (0.4%) | | | |

| Lenexa, Hlth. Care Fac. Rev. Bonds, (LakeView | | | |

| Village), 7.125%, 5/15/29 (Prerefunded 5/15/19) | BB/P | 500,000 | 500,970 |

| Wichita, Hlth. Care Fac. Rev. Bonds, (Presbyterian | | | |

| Manors), Ser. I, 5.00%, 5/15/33 | BB–/P | 500,000 | 532,135 |

| Wyandotte, Cnty./Kansas City, Unified Govt. 144A | | | |

| Rev. Bonds, (Legends Apt. Garage & West Lawn), | | | |

| 4.50%, 6/1/40 | AA | 500,000 | 508,335 |

| | | | 1,541,440 |

| Kentucky (2.5%) | | | |

| KY Econ. Dev. Fin. Auth. Rev. Bonds, (Masonic Home | | | |

| Indpt. Living), 5.00%, 5/15/46 | BB/P | 1,000,000 | 1,029,240 |

| KY Pub. Trans. Infrastructure Auth. Rev. Bonds, | | | |

| (1st Tier Downtown Crossing), Ser. A, 6.00%, 7/1/53 | Baa3 | 1,100,000 | 1,206,524 |

| KY State Econ. Dev. Fin. Auth. Rev. Bonds, | | | |

| (Owensboro Hlth.), Ser. A, 5.25%, 6/1/41 | Baa3 | 125,000 | 139,348 |

| KY State Econ. Dev. Fin. Auth. Hlth. Care Rev. Bonds, | | | |

| (Masonic Homes of KY), 5.375%, 11/15/42 | BB–/P | 900,000 | 934,695 |

| KY State Pub. Energy Auth. Gas Supply Mandatory | | | |

| Put Bonds (6/1/25), Ser. C-1, 4.00%, 12/1/49 | A3 | 2,100,000 | 2,290,470 |

| Louisville & Jefferson Cnty., Metro. Govt. Hlth. Syst. | | | |

| Rev. Bonds, (Norton Healthcare Oblig. Group), | | | |

| 5.50%, 10/1/33 | A– | 3,000,000 | 3,377,280 |

| Owen Cnty., Wtr. Wks. Syst. Rev. Bonds, (American | | | |

| Wtr. Co.), Ser. A, 6.25%, 6/1/39 | A | 700,000 | 702,310 |

| | | | 9,679,867 |

| |

| 24 Managed Municipal Income Trust |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Louisiana (0.6%) | | | |

| LA State Pub. Fac. Solid Waste Disp. Auth. Rev. | | | |

| Bonds, (LA Pellets, Inc.), Ser. A, 8.375%, 7/1/39 | | | |

| (In default) † | D/P | $500,000 | $5 |

| Pub. Fac. Auth. Rev. Bonds, (Tulane U.), Ser. A, | | | |

| 4.00%, 12/15/50 | A2 | 750,000 | 779,648 |

| Pub. Fac. Auth. Dock & Wharf 144A Rev. Bonds, | | | |

| (Impala Warehousing, LLC), 6.50%, 7/1/36 | B+/P | 1,000,000 | 1,094,950 |

| St. Tammany, Public Trust Fin. Auth. Rev. Bonds, | | | |

| (Christwood), 5.25%, 11/15/37 | BB/P | 385,000 | 408,681 |

| | | | 2,283,284 |

| Maine (0.7%) | | | |

| ME Hlth. & Higher Edl. Fac. Auth. Rev. Bonds | | | |

| (ME Gen. Med. Ctr.), 7.50%, 7/1/32 | Ba3 | 1,000,000 | 1,106,400 |

| (MaineGeneral Health Oblig. Group), 6.95%, 7/1/41 | Ba3 | 1,000,000 | 1,086,240 |

| ME State Fin. Auth. Solid Waste Disp. 144A | | | |

| Mandatory Put Bonds (8/1/25), (Casella Waste Syst.), | | | |

| 5.125%, 8/1/35 | B | 500,000 | 525,150 |

| | | | 2,717,790 |

| Maryland (1.4%) | | | |

| Frederick Cnty., Edl. Fac. 144A Rev. Bonds, | | | |

| (Mount St. Mary’s U.), Ser. A, 5.00%, 9/1/37 | BB+ | 500,000 | 539,140 |

| MD Econ. Dev. Corp. Poll. Control Rev. Bonds, | | | |

| (Potomac Electric Power Co.), 6.20%, 9/1/22 | A2 | 550,000 | 560,445 |

| Prince Georges Cnty., Rev. Bonds, (Collington | | | |

| Episcopal Life Care Cmnty., Inc.), 5.25%, 4/1/37 | BB/P | 1,200,000 | 1,281,552 |

| Prince Georges Cnty., Special Oblig. 144A Tax Alloc. | | | |

| Bonds, (Westphalia Town Ctr.), 5.125%, 7/1/39 | B/P | 1,000,000 | 1,047,750 |

| Westminster, Rev. Bonds | | | |

| (Lutheran Village at Miller’s Grant, Inc. (The)), | | | |

| Ser. A, 6.00%, 7/1/34 | B–/P | 250,000 | 266,498 |

| (Carroll Lutheran Village, Inc.), 5.125%, 7/1/34 | BB/P | 1,500,000 | 1,595,205 |

| | | | 5,290,590 |

| Massachusetts (2.0%) | | | |

| MA State Dev. Fin. Agcy. Rev. Bonds | | | |

| (Suffolk U.), Ser. A, 6.25%, 7/1/30 | Baa2 | 360,000 | 362,711 |

| (Loomis Communities), Ser. A, 6.00%, 1/1/33 | BBB/P | 100,000 | 111,026 |

| (Loomis Communities), Ser. A, U.S. Govt. Coll., | | | |

| 6.00%, 1/1/33 (Prerefunded 1/1/23) | AAA/P | 100,000 | 116,686 |

| (Suffolk U.), Ser. A, 5.75%, 7/1/39 | Baa2 | 320,000 | 322,150 |

| (Linden Ponds, Inc.), Ser. B, zero %, 11/15/56 | B–/P | 439,022 | 117,232 |

| MA State Dev. Fin. Agcy. 144A Rev. Bonds, | | | |

| (Linden Ponds, Inc. Fac.) | | | |

| 5.125%, 11/15/46 | BB/F | 1,000,000 | 1,044,070 |

| 5.00%, 11/15/38 | BB/F | 500,000 | 523,150 |

| MA State Dev. Fin. Agcy. Hlth. Care Fac. 144A Rev. | | | |

| Bonds, (Adventcare), Ser. A, 6.65%, 10/15/28 | B/P | 995,000 | 995,259 |

| MA State Port Auth. Rev. Bonds, Ser. A, 5.00%, 7/1/40 | Aa2 | 2,795,000 | 3,327,168 |

| MA State Port Auth. Special Fac. Rev. Bonds, | | | |

| (Conrac), Ser. A, 5.125%, 7/1/41 | A | 750,000 | 796,395 |

| | | | 7,715,847 |

|

| Managed Municipal Income Trust 25 |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Michigan (6.0%) | | | |

| Detroit, G.O. Bonds, 5.00%, 4/1/37 | Ba3 | $750,000 | $802,260 |

| Detroit, Wtr. Supply Syst. Rev. Bonds, Ser. B, AGM, | | | |

| 6.25%, 7/1/36 | AA | 5,000 | 5,035 |

| Flint, Hosp. Bldg. Auth. Rev. Bonds, Ser. A, | | | |

| 5.25%, 7/1/39 | Ba1 | 750,000 | 782,948 |

| Great Lakes, Wtr. Auth. Swr. Rev. Bonds, (Brazos | | | |

| Presbyterian Homes, Inc.), Ser. C, 5.00%, 7/1/36 | A | 2,000,000 | 2,293,140 |

| Kentwood, Economic Dev. Rev. Bonds, | | | |

| (Holland Home), 5.625%, 11/15/32 | BBB–/F | 2,195,000 | 2,355,059 |

| MI State Fin. Auth. Rev. Bonds | | | |

| (Local Govt. Loan Program — Detroit Wtr. & Swr. | | | |

| Dept. (DWSD)), Ser. D-2, 5.00%, 7/1/34 | A+ | 400,000 | 456,828 |

| (Detroit Wtr. & Swr.), Ser. C-6, 5.00%, 7/1/33 | A+ | 600,000 | 673,338 |

| MI State Fin. Auth. Ltd. Oblig. Rev. Bonds | | | |

| (Lawrence Technological U.), 5.00%, 2/1/47 | BB+ | 2,150,000 | 2,303,725 |

| (Kalamazoo College), 4.00%, 12/1/47 | A1 | 1,000,000 | 1,050,770 |

| MI State Hosp. Fin. Auth. Rev. Bonds, (Trinity Hlth. | | | |

| Credit Group), Ser. A, 5.00%, 12/1/47 T | Aa3 | 8,500,000 | 9,186,653 |

| MI State Strategic Fund Ltd. Rev. Bonds, | | | |

| (Worthington Armstrong Venture), 5.75%, 10/1/22 | | | |

| (Escrowed to maturity) | AAA/P | 1,350,000 | 1,517,184 |

| Wayne Cnty., Arpt. Auth. Rev. Bonds, Ser. A, | | | |

| 5.00%, 12/1/21 | A2 | 2,000,000 | 2,154,420 |

| | | | 23,581,360 |

| Minnesota (1.3%) | | | |

| Baytown Twp., Lease Rev. Bonds, Ser. A, | | | |

| 4.00%, 8/1/41 | BB+ | 380,000 | 368,528 |

| Ham Lake, Charter School Lease Rev. Bonds, | | | |

| (DaVinci Academy of Arts & Science), Ser. A, | | | |

| 5.00%, 7/1/47 | BB–/P | 500,000 | 512,670 |

| Rochester, Hlth. Care Fac. Rev. Bonds, | | | |

| (Olmsted Med. Ctr.), 5.875%, 7/1/30 | A/F | 1,000,000 | 1,043,690 |

| Sartell, Hlth. Care & Hsg. Facs. Rev. Bonds, | | | |

| (Country Manor Campus, LLC) | | | |

| 5.25%, 9/1/30 | B–/P | 500,000 | 535,055 |

| 5.25%, 9/1/27 | B–/P | 750,000 | 810,998 |

| St. Paul, Hsg. & Redev. Auth. Charter School Lease | | | |

| Rev. Bonds, (Nova Classical Academy), Ser. A | | | |

| 6.625%, 9/1/42 (Prerefunded 9/1/21) | BBB– | 250,000 | 277,948 |

| 6.375%, 9/1/31 | BBB– | 250,000 | 269,370 |

| St. Paul, Port Auth. Lease Rev. Bonds, | | | |

| (Regions Hosp. Pkg. Ramp), Ser. 1, 5.00%, 8/1/36 | A–/P | 1,125,000 | 1,126,991 |

| | | | 4,945,250 |

| Mississippi (1.4%) | | | |

| MS State Bus. Fin. Corp. Rev. Bonds, (System Energy | | | |

| Resources, Inc.), 2.50%, 4/1/22 | BBB+ | 5,600,000 | 5,619,768 |

| | | | 5,619,768 |

| |

| 26 Managed Municipal Income Trust |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Missouri (1.4%) | | | |

| MO State Hlth. & Edl. Fac. Auth. VRDN, (WA U. (The)), | | | |

| Ser. D, 2.20%, 9/1/30 | VMIG 1 | $1,000,000 | $1,000,000 |

| Saint Louis, Indl. Dev. Auth. Fin. Rev. Bonds, | | | |

| (Ballpark Village Dev.), Ser. A, 4.75%, 11/15/47 | BB–/P | 875,000 | 905,231 |

| St. Louis Arpt. Rev. Bonds, (Lambert-St. Louis Intl.), | | | |

| Ser. A-1, 6.625%, 7/1/34 | A2 | 1,000,000 | 1,007,750 |

| St. Louis Cnty., Indl. Dev. Auth. Sr. Living Fac. Rev. | | | |

| Bonds, (Friendship Village Oblig. Group), Ser. A, | | | |

| 5.00%, 9/1/38 | BB+/F | 2,500,000 | 2,701,050 |

| | | | 5,614,031 |

| Nebraska (1.5%) | | | |

| Central Plains, Energy Mandatory Put Bonds | | | |

| (1/1/24), (No. 4), 5.00%, 3/1/50 | A3 | 4,500,000 | 4,998,690 |

| Lancaster Cnty., Hosp. Auth. Rev. Bonds, | | | |

| (Immanuel Oblig. Group), 5.50%, 1/1/30 | AA/F | 1,000,000 | 1,022,600 |

| | | | 6,021,290 |

| Nevada (1.7%) | | | |

| Clark Cnty., Arpt. Rev. Bonds, Ser. A-2, 5.00%, 7/1/33 | Aa3 | 1,050,000 | 1,184,211 |

| Clark Cnty., Impt. Dist. Special Assmt. Bonds, | | | |

| (Mountains Edge Local No. 142), 5.00%, 8/1/21 | A | 465,000 | 490,487 |

| Clark Cnty., Impt. Dist. No. 159 Special Assessment | | | |

| Bonds, (Summerlin Village 16A), 5.00%, 8/1/32 | B+/P | 480,000 | 500,880 |

| Las Vegas, Special Assmt. Bonds | | | |

| 5.00%, 6/1/31 | B+/P | 410,000 | 422,394 |

| (Dist. No. 607 Local Impt.), 5.00%, 6/1/23 | BBB–/P | 340,000 | 362,960 |

| Las Vegas, Impt. Dist. No. 812 Special Assessment | | | |

| Bonds, (Summerlin Village 24), 5.00%, 12/1/35 | B/P | 250,000 | 256,613 |

| North Las Vegas, G.O. Bonds, AGM, 4.00%, 6/1/33 | AA | 3,095,000 | 3,323,999 |

| | | | 6,541,544 |

| New Hampshire (3.3%) | | | |

| National Fin. Auth. 144A Rev. Bonds, (Covanta | | | |

| Holding Corp.), Ser. C, 4.875%, 11/1/42 | B1 | 1,275,000 | 1,301,635 |

| NH State Bus. Fin. Auth. Solid Waste Disp. 144A | | | |

| Mandatory Put Bonds (10/1/19), (Casella Waste | | | |

| Syst., Inc.), 4.00%, 4/1/29 | B | 350,000 | 351,733 |

| NH State Hlth. & Ed. Fac. Auth. Rev. Bonds | | | |

| (Rivermead), Ser. A, 6.875%, 7/1/41 | BB+/P | 2,000,000 | 2,122,180 |

| (Rivermead), Ser. A, 6.625%, 7/1/31 | BB+/P | 1,320,000 | 1,404,031 |

| (Catholic Med. Ctr.), 5.00%, 7/1/44 | A– | 1,000,000 | 1,120,970 |

| (Concord Hosp. Trust), 5.00%, 10/1/42 | A2 | 3,250,000 | 3,693,398 |

| (Kendel at Hanover), 5.00%, 10/1/40 | BBB+/F | 585,000 | 630,911 |

| (Elliot Hosp.), 5.00%, 10/1/38 | A– | 250,000 | 283,630 |

| (Southern NH Med. Ctr.), 5.00%, 10/1/37 | A– | 1,000,000 | 1,134,210 |

| NH State Hlth. & Ed. Fac. Auth. 144A Rev. Bonds, | | | |

| (Hillside Village), Ser. A, 6.25%, 7/1/42 | B–/P | 750,000 | 803,325 |

| | | | 12,846,023 |

| New Jersey (7.7%) | | | |

| Atlantic City, G.O. Bonds, (Tax Appeal), Ser. B, AGM, | | | |

| 4.00%, 3/1/42 | AA | 1,250,000 | 1,316,550 |

| Burlington Cnty., Bridge Comm. Econ. Dev. Rev. | | | |

| Bonds, (The Evergreens), 5.625%, 1/1/38 | BB+/P | 1,500,000 | 1,499,850 |

|

| Managed Municipal Income Trust 27 |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| New Jerseycont. | | | |

| NJ State Econ. Dev. Auth. Rev. Bonds | | | |

| (Ashland School, Inc.), 6.00%, 10/1/33 | BBB | $1,000,000 | $1,120,260 |

| (NYNJ Link Borrower, LLC), 5.375%, 1/1/43 | BBB– | 1,000,000 | 1,104,900 |

| Ser. EEE, 5.00%, 6/15/48 | Baa1 | 3,000,000 | 3,287,010 |

| (North Star Academy Charter School of Newark, | | | |

| Inc.), 5.00%, 7/15/47 | BBB– | 1,000,000 | 1,089,720 |

| Ser. AAA, 5.00%, 6/15/36 | Baa1 | 350,000 | 383,593 |

| (United Methodist Homes), Ser. A, 5.00%, 7/1/29 | BBB–/F | 500,000 | 530,760 |

| Ser. B, 5.00%, 11/1/26 | Baa1 | 3,000,000 | 3,446,940 |

| 5.00%, 6/15/26 | Baa1 | 500,000 | 535,865 |

| NJ State Econ. Dev. Auth. Fac. Rev. Bonds, | | | |

| (Continental Airlines, Inc.), 5.625%, 11/15/30 | BB | 1,500,000 | 1,707,795 |

| NJ State Econ. Dev. Auth. Special Fac. Rev. Bonds, | | | |

| (Port Newark Container Term., LLC), 5.00%, 10/1/37 | Ba1 | 1,500,000 | 1,644,450 |

| NJ State Econ. Dev. Auth. Wtr. Fac. Rev. Bonds, | | | |

| (NJ American Wtr. Co.) | | | |

| Ser. A, 5.70%, 10/1/39 | A1 | 2,600,000 | 2,639,390 |

| Ser. D, 4.875%, 11/1/29 | A1 | 700,000 | 725,431 |

| NJ State Hlth. Care Fac. Fin. Auth. Rev. Bonds, | | | |

| (St. Peter’s U. Hosp.), 6.25%, 7/1/35 | Ba1 | 2,000,000 | 2,133,020 |

| NJ State Trans. Trust Fund Auth. Rev. Bonds, | | | |

| (Federal Hwy. Reimbursement Notes), | | | |

| 5.00%, 6/15/28 | A+ | 600,000 | 691,740 |

| North Hudson, Swr. Auth. Rev. Bonds, Ser. A | | | |

| 5.00%, 6/1/42 | A+ | 945,000 | 1,017,264 |

| 5.00%, 6/1/42 (Prerefunded 6/1/22) | AAA/P | 55,000 | 60,633 |

| Tobacco Settlement Fin. Corp. Rev. Bonds, Ser. B, | | | |

| 5.00%, 6/1/46 | BBB | 3,300,000 | 3,446,784 |

| Union Cnty., Util. Auth. Resource Recvy. Fac. Lease | | | |

| Rev. Bonds, (Covanta Union), Ser. A, 5.25%, 12/1/31 | AA+ | 1,450,000 | 1,566,841 |

| | | | 29,948,796 |

| New Mexico (0.7%) | | | |

| Farmington, Poll. Control Rev. Bonds | | | |

| (Public Service Co. of San Juan, NM), Ser. D, | | | |

| 5.90%, 6/1/40 | BBB+ | 500,000 | 519,855 |

| (AZ Pub. Svc. Co.), Ser. B, 4.70%, 9/1/24 | A2 | 2,000,000 | 2,077,160 |

| | | | 2,597,015 |

| New York (8.0%) | | | |

| Glen Cove, Local Econ. Assistance Corp. Rev. Bonds, | | | |

| (Garvies Point Pub. Impt.), Ser. C, stepped-coupon | | | |

| zero% (5.625%, 1/1/24), 1/1/55 †† | B/P | 300,000 | 266,316 |

| Metro. Trans. Auth. Rev. Bonds, (Green Bonds), | | | |

| Ser. C-1, 4.00%, 11/15/32 | A1 | 3,500,000 | 3,857,665 |

| Metro. Trans. Auth. Dedicated Tax Mandatory Put | | | |

| Bonds (6/1/22), Ser. A-2A, 2.75%, 11/1/26 | AA | 2,910,000 | 2,894,257 |

| NY City, VRDN Ser. I, 2.29%, 4/1/36 | VMIG 1 | 3,000,000 | 3,000,000 |

| NY Counties, Tobacco Trust VI Rev. Bonds, (Tobacco | | | |

| Settlement Pass Through), Ser. A-2B, 5.00%, 6/1/51 | BBB | 1,700,000 | 1,734,459 |

| NY State Convention Ctr. Dev. Corp. Rev. Bonds, | | | |

| (Hotel Unit Fee), zero %, 11/15/50 | Aa3 | 2,500,000 | 785,850 |

| |

| 28 Managed Municipal Income Trust |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| New Yorkcont. | | | |

| NY State Dorm. Auth. Non-State Supported Debt | | | |

| Rev. Bonds, (NYU Hosp. Ctr.), 5.00%, 7/1/34 | A3 | $500,000 | $562,875 |

| NY State Dorm. Auth. Rev. Bonds, Ser. A, Group C , | | | |

| 5.00% 3/15/42 T | Aa1 | 10,845,000 | 12,637,798 |

| NY State Env. Fac. Corp. Solid Waste Disp. 144A | | | |

| Mandatory Put Bonds (12/2/19), (Casella Waste | | | |

| Syst., Inc.), 3.75%, 12/1/44 | B | 1,000,000 | 1,005,850 |

| NY State Liberty Dev. Corp. 144A Rev. Bonds | | | |

| (World Trade Ctr.), Class 2, 5.375%, 11/15/40 | BB–/P | 750,000 | 824,475 |

| (3 World Trade Ctr., LLC), Class 1-3, | | | |

| 5.00%, 11/15/44 | BB–/P | 2,350,000 | 2,530,880 |

| Port Auth. of NY & NJ Special Oblig. Rev. Bonds, | | | |

| (KIAC Partners Special Project — 5th Installment), | | | |

| 6.75%, 10/1/19 | BBB–/P | 100,000 | 102,260 |

| Port Auth. of NY & NJ Special Oblig. Rev. Bonds, | | | |

| (John F. Kennedy Intl. Air Term.), 6.00%, 12/1/42 | Baa1 | 1,000,000 | 1,058,480 |

| | | | 31,261,165 |

| North Carolina (1.4%) | | | |

| NC State Med. Care Comm. Hlth. Fac. Rev. Bonds, | | | |

| (Presbyterian Homes), Ser. C, 5.00%, 10/1/31 | A–/F | 800,000 | 910,528 |

| NC State Med. Care Comm. Retirement | | | |

| Fac. Rev. Bonds | | | |

| (Salemtowne), 5.375%, 10/1/45 | BB/P | 1,615,000 | 1,721,606 |

| (Aldersgate United Methodist Retirement Cmnty., | | | |

| Inc.), Ser. A, 5.00%, 7/1/47 | BB/P | 400,000 | 419,644 |

| (Aldersgate United Methodist Church), | | | |

| 5.00%, 7/1/45 | BB/P | 825,000 | 857,744 |

| (Southminister, Inc.), 5.00%, 10/1/37 | BB/P | 965,000 | 1,026,992 |

| (United Church Homes & Svcs. Oblig. Group), | | | |

| Ser. A, 5.00%, 9/1/37 | BB/P | 500,000 | 527,445 |

| | | | 5,463,959 |

| Ohio (5.2%) | | | |

| Buckeye, Tobacco Settlement Fin. Auth. Rev. Bonds | | | |

| Ser. A-2, 6.50%, 6/1/47 | B3 | 4,000,000 | 3,990,480 |

| Ser. A-3, 6.25%, 6/1/37 | B– | 5,850,000 | 5,774,873 |

| Ser. A-2, 6.00%, 6/1/42 | B3 | 4,000,000 | 3,942,000 |

| Ser. B, zero %, 6/1/47 | CCC+/P | 10,000,000 | 572,500 |

| Franklin Cnty., Hlth. Care Fac. Rev. Bonds, | | | |

| (OH Presbyterian Retirement Svcs. (OPRS) Cmntys. | | | |

| Oblig. Group), Ser. A, 5.625%, 7/1/26 | BBB/F | 1,250,000 | 1,287,200 |

| Lake Cnty., Hosp. Fac. Rev. Bonds, (Lake Hosp. Syst., | | | |

| Inc.), Ser. C, 5.625%, 8/15/29 | Baa1 | 245,000 | 245,784 |

| OH State Air Quality Dev. Auth. Exempt Fac. 144A | | | |

| Rev. Bonds, (Pratt Paper, LLC), 4.50%, 1/15/48 | BB+/P | 1,200,000 | 1,253,544 |

| OH State Higher Edl. Fac. Comm. Rev. Bonds, | | | |

| (Kenyon College) | | | |

| 5.00%, 7/1/44 | A | 525,000 | 542,378 |

| U.S. Govt. Coll., 5.00%, 7/1/44 | | | |

| (Prerefunded 7/1/20) | AAA/P | 275,000 | 285,571 |

| OH State Private Activity Rev. Bonds, (Portsmouth | | | |

| Bypass), AGM, 5.00%, 12/31/35 | AA | 750,000 | 841,410 |

|

| Managed Municipal Income Trust 29 |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Ohiocont. | | | |

| Southeastern OH Port Auth. Hosp. Fac. Rev. Bonds | | | |

| 5.75%, 12/1/32 | BB–/F | $900,000 | $971,064 |

| (Memorial Hlth. Syst. Oblig. Group), | | | |

| 5.00%, 12/1/43 | BB–/F | 150,000 | 154,539 |

| Toledo-Lucas Cnty., Port Auth. Rev. Bonds, | | | |

| (CSX Transn, Inc.), 6.45%, 12/15/21 | A3 | 500,000 | 551,515 |

| | | | 20,412,858 |

| Oklahoma (0.7%) | | | |

| Tulsa Cnty., Indl. Auth. Rev. Bonds, (Sr. Living | | | |

| Cmnty. Montereau, Inc.), Ser. A, 7.125%, 11/1/30 | | | |

| (Prerefunded 5/1/20) | BB–/P | 1,250,000 | 1,315,625 |

| Tulsa, Muni. Arpt. Trust Rev. Bonds, (American | | | |

| Airlines, Inc.), Ser. B, 5.50%, 12/1/35 | B+/P | 1,250,000 | 1,351,363 |

| | | | 2,666,988 |

| Oregon (0.4%) | | | |

| Multnomah Cnty., Hosp. Fac. Auth. Rev. Bonds, | | | |

| (Terwilliger Plaza, Inc.), 5.00%, 12/1/29 | BBB/F | 350,000 | 373,856 |

| Warm Springs Reservation, Confederated Tribes | | | |

| 144A Rev. Bonds, (Pelton Round Butte Tribal), Ser. B, | | | |

| 6.375%, 11/1/33 | A3 | 700,000 | 711,116 |

| Yamhill Cnty., Hosp. Auth. Rev. Bonds, (Friendsview | | | |

| Retirement Cmnty.), Ser. A, 5.00%, 11/15/36 | BB/P | 325,000 | 349,749 |

| | | | 1,434,721 |

| Pennsylvania (5.7%) | | | |

| Allegheny Cnty., Higher Ed. Bldg. Auth. Rev. Bonds | | | |

| (Robert Morris U.), Ser. A, 5.50%, 10/15/30 | Baa3 | 1,000,000 | 1,038,890 |

| (Robert Morris U.-UPMC Events Ctr.), | | | |

| 5.00%, 10/15/47 | Baa3 | 1,820,000 | 1,961,596 |

| Allegheny Cnty., Hosp. Dev. Auth. Rev. Bonds, | | | |

| (Allegheny Hlth. Network Oblig. Group), Ser. A | | | |

| 5.00%, 4/1/35 | A | 1,200,000 | 1,392,852 |

| 5.00%, 4/1/32 | A | 1,425,000 | 1,672,052 |

| Cap. Region Wtr. Rev. Bonds, 5.00%, 7/15/30 | A+ | 1,500,000 | 1,809,975 |

| Chester Cnty., Hlth. & Ed. Fac. Auth. Rev. Bonds, | | | |

| (Immaculata U.), 5.00%, 11/1/46 | BB/F | 500,000 | 517,850 |

| Chester Cnty., Indl. Dev. Auth. Rev. Bonds | | | |

| (Collegium Charter School), Ser. A, | | | |

| 5.125%, 10/15/37 | BB+ | 750,000 | 792,323 |

| (Renaissance Academy Charter School), | | | |

| 5.00%, 10/1/34 | BBB– | 350,000 | 376,929 |

| Chester Cnty., Indl. Dev. Auth. Student Hsg. Rev. | | | |

| Bonds, (West Chester U. Student Hsg., LLC), Ser. A, | | | |

| 5.00%, 8/1/45 | Baa3 | 1,000,000 | 1,043,810 |

| Cmnwlth. Fin. Auth. Rev. Bonds, (Tobacco Master | | | |

| Settlement Payment), 5.00%, 6/1/35 | A1 | 1,000,000 | 1,171,430 |

| Dallas, Area Muni. Auth. U. Rev. Bonds, (Misericordia | | | |

| U.), 5.00%, 5/1/48 | Baa3 | 500,000 | 540,870 |

| Lycoming Cnty., Auth. Hlth. Syst. Rev. Bonds, | | | |

| (Susquehanna Hlth. Syst.), Ser. A, 5.75%, 7/1/39 | A+ | 3,000,000 | 3,017,700 |

| Montgomery Cnty., Indl. Auth. Rev. Bonds, | | | |

| (Whitemarsh Continuing Care Retirement Cmnty.), | | | |

| Ser. A, 5.25%, 1/1/48 | BB–/P | 500,000 | 510,395 |

| |

| 30 Managed Municipal Income Trust |

| | | |

| MUNICIPAL BONDS AND NOTES (131.6%)*cont. | Rating** | Principal amount | Value |

| Pennsylvaniacont. | | | |

| Moon, Indl. Dev. Auth. Rev. Bonds, (Baptist Homes | | | |

| Society Oblig. Group), 5.75%, 7/1/35 | B+/P | $1,500,000 | $1,589,085 |

| PA State Higher Edl. Fac. Auth. Rev. Bonds | | | |

| (Shippensburg U.), 6.25%, 10/1/43 | | | |

| (Prerefunded 10/1/21) | BBB– | 500,000 | 554,200 |

| (Gwynedd Mercy College), Ser. KK1, | | | |

| 5.375%, 5/1/42 | BBB | 785,000 | 818,857 |

| PA State Tpk. Comm. Rev. Bonds | | | |

| Ser. B-1, 5.00%, 6/1/42 | A3 | 900,000 | 1,015,983 |

| Ser. A, 5.00%, 12/1/38 | A1 | 500,000 | 560,275 |

| Philadelphia, Auth. for Indl. Dev. Rev. Bonds, | | | |

| (Master Charter School), 6.00%, 8/1/35 | | | |

| (Prerefunded 8/1/20) | BBB– | 1,055,000 | 1,110,039 |

| West Shore Area Auth. Rev. Bonds, (Lifeways | | | |

| at Messiah Village), Ser. A, 5.00%, 7/1/35 | BBB–/F | 785,000 | 830,546 |

| | | | 22,325,657 |

| Puerto Rico (0.3%) | | | |

| Cmnwlth. of PR, G.O. Bonds, (Pub. Impt.), Ser. A, | | | |

| NATL, 5.50%, 7/1/20 | Baa2 | 1,000,000 | 1,024,750 |

| | | | 1,024,750 |

| Rhode Island (0.4%) | | | |

| RI Hlth. & Edl. Bldg. Corp. Rev. Bonds, (Lifespan | | | |

| Oblig. Group-Hosp. Fin.), 5.00%, 5/15/25 | BBB+ | 1,500,000 | 1,722,480 |

| | | | 1,722,480 |

| South Carolina (3.6%) | | | |

| SC State Jobs Econ. Dev. Auth. Edl. Fac. 144A Rev. | | | |

| Bonds, (High Point Academy), Ser. A | | | |

| 5.75%, 6/15/49 | Ba1 | 1,000,000 | 1,091,270 |

| 5.75%, 6/15/39 | Ba1 | 500,000 | 551,435 |

| SC State Jobs-Econ. Dev. Auth. Hosp. Rev. Bonds, | | | |

| (Prisma Hlth. Oblig. Group), Ser. A, 5.00%, 5/1/43 | A2 | 4,500,000 | 5,130,045 |

| SC State Pub. Svcs. Auth. Rev. Bonds | | | |

| Ser. A, 5.50%, 12/1/54 | A+ | 2,000,000 | 2,221,960 |

| Ser. C, 5.00%, 12/1/46 | A+ | 2,500,000 | 2,753,675 |

| (Santee Cooper), Ser. D, 5.00%, 12/1/43 | A+ | 1,000,000 | 1,059,250 |

| Ser. A, 5.00%, 12/1/36 | A+ | 1,000,000 | 1,138,090 |

| | | | 13,945,725 |

| Tennessee (0.3%) | | | |

| Tennergy Corp., Gas Mandatory Put Bonds | | | |

| (10/1/24), Ser. A, 5.00%, 2/1/50 | Aa2 | 1,000,000 | 1,143,810 |

| | | | 1,143,810 |

| Texas (14.1%) | | | |

| Arlington, Higher Ed. Fin. Corp. Rev. Bonds, | | | |

| (Uplift Ed.), Ser. A, PSFG, 4.00%, 12/1/42 | AAA | 1,000,000 | 1,056,310 |

| Central TX Regl. Mobility Auth. Rev. Bonds, (Sr. Lien), | | | |

| Ser. A, 5.00%, 1/1/33 | A– | 525,000 | 571,195 |

| Clifton, Higher Ed. Fin. Corp. Rev. Bonds | | | |