UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to§240.14a-12 |

The China Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

THE CHINA FUND, INC.

c/o State Street Bank and Trust Company

P.O. Box 5049, One Lincoln Street

Boston, Massachusetts 02206-5049

February 5, 2018

Dear Stockholders:

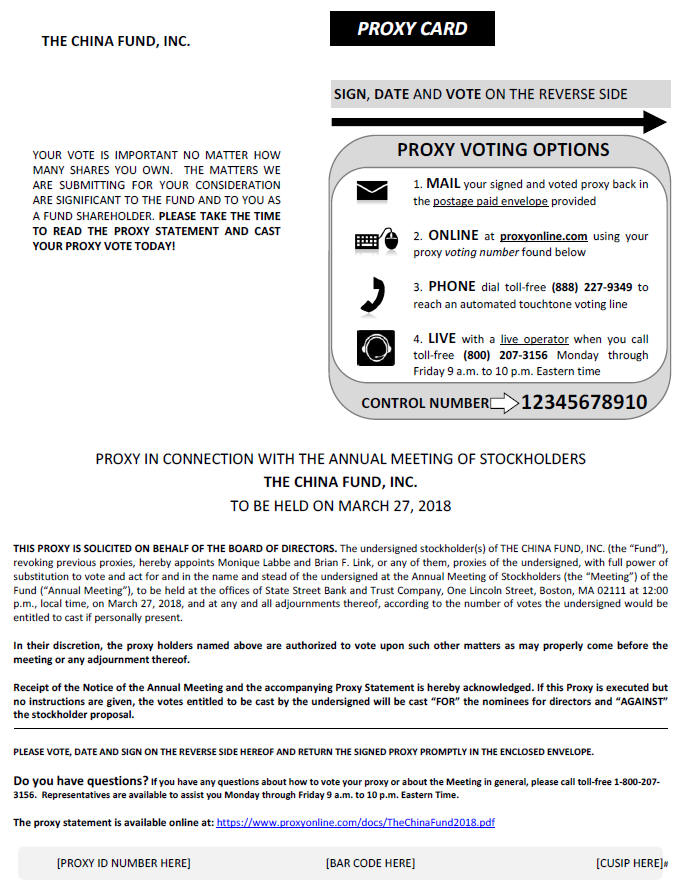

The Annual Meeting of Stockholders (the “Meeting”) of The China Fund, Inc. (the “Fund”) will be held at 12:00 P.M., Eastern Time, on Tuesday, March 27, 2018, at the offices of State Street Bank and Trust Company, One Lincoln Street, Boston, MA 02111. A Notice and Proxy Statement regarding the Meeting, proxy card for your vote, and postage prepaid envelope in which to return your proxy card are enclosed.

The matters on which you, as a stockholder of the Fund, are being asked to vote are: 1) the election of two Fund directors; and 2) if properly presented at the Meeting, the consideration of a stockholder proposal to terminate all investment advisory and management agreements between the Fund and Allianz Global Investors U.S. LLC (“Allianz”) (the “Termination Proposal”).

Emerging Markets Country Fund (“EMC”), a stockholder of the Fund, has notified the Board that at the Meeting it intends to propose two nominees (the “EMC Nominees”) for election to the Fund’s Board of Directors. The Board of Directors believes EMC’s Director nominations and the Termination Proposal together are part of a plan to force the Fund to cease operations and liquidate. City of London Investment Management Company Limited (“City of London”), which is the sponsor of the Termination Proposal, is EMC’s investment adviser and has described its preference for liquidation of the Fund in an SEC filing. The Board strongly believes that a forced liquidation would be inconsistent with the best interests of the Fund and its stockholders – particularly since in 2017 the Fund delivered a return to the stockholders of over 37%. The Board also believes that its Director nominees are better qualified than the EMC Nominees and will serve the interests of all the Fund’s stockholders better than the EMC Nominees.

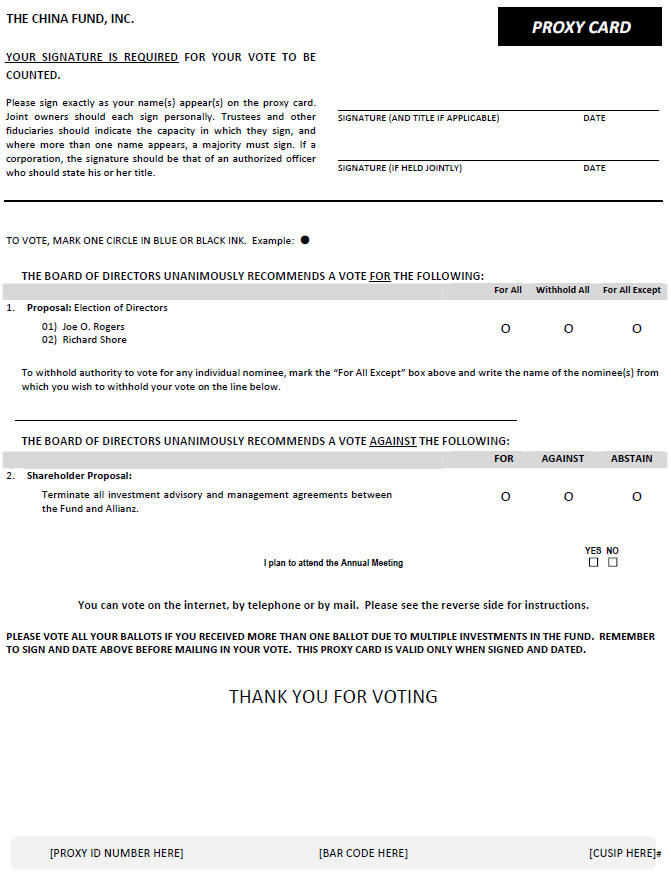

The Board of Directors recommends that on the enclosed WHITE proxy card you vote “FOR” the election of the Fund directors named on the WHITE proxy card and “AGAINST” the Termination Proposal. If EMC, City of London or their affiliates present a proposal to elect the EMC Nominees at the Meeting, the Board of Directors recommends that you vote “AGAINST” that proposal.

You may receive proxy solicitation materials from EMC, City of London or any of their affiliates, including an opposition proxy statement and proxy card. The Board of Directors recommends that you NOT return any proxy card furnished by or on behalf of EMC, City of London or any of their affiliates. If you have previously signed a proxy card furnished by EMC, City of London or any of their affiliates, you can revoke that proxy and vote for the Board of Directors’ nominees and on any other matter to be properly considered at the Meeting by signing, dating and returning the WHITE proxy card in the enclosed postagepre-paid envelope, or by authorizing your proxy electronically via the Internet using the Internet address on the WHITE proxy card or by telephone using the toll-free number on the WHITE proxy card.

| Respectfully, | ||

| Brian F. Link | ||

| Secretary | ||

YOU ARE STRONGLY URGED TO VOTE. YOU MAY DO SO BY TELEPHONE; BY INTERNET; OR BY COMPLETING, DATING AND SIGNING THE ENCLOSED WHITE PROXY CARD, AND MAILING IT IN THE ENVELOPE PROVIDED FOR THAT PURPOSE. THIS SOLICITATION IS BEING MADE BY THE BOARD OF DIRECTORS OF THE FUND.

THE CHINA FUND, INC.

NOTICE OF THE ANNUAL MEETING OF STOCKHOLDERS

March 27, 2018

To the Stockholders of

The China Fund, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of The China Fund, Inc. (the “Fund”) will be held at the offices of State Street Bank and Trust Company, One Lincoln Street, Boston, MA 02111, on Tuesday, March 27, 2018, at 12:00 P.M., Eastern Time, for the following purposes:

| 1. | To elect two Class I directors, to serve for a term expiring on the date on which the annual meeting of stockholders is held in 2021; |

| 2. | If properly presented at the Meeting, to consider a stockholder proposal to terminate all investment advisory and management agreements between the Fund and Allianz Global Investors U.S. LLC (“Allianz”) (the “Termination Proposal”); and |

| 3. | To transact such other business as may properly come before the Meeting or any adjournments thereof. |

The Board of Directors recommends that you vote “FOR” the election of the Fund directors named on the WHITE proxy card and “AGAINST” the Termination Proposal.

The Board of Directors has fixed the close of business on February 2, 2018 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting or any adjournments thereof.

You are cordially invited to attend the Meeting. If you are a stockholder entitled to vote and you do not expect to attend the Meeting in person, you can vote by telephone or by Internet or by completing, dating and signing the enclosed form of WHITE proxy card and returning it promptly in the envelope provided for that purpose. If you vote in that manner but then attend the Meeting, you can vote in person at the Meeting. This solicitation is being made by the Board of Directors of the Fund.

Emerging Markets Country Fund (“EMC”) has notified the Board that at the Meeting it intends to propose two nominees (the “EMC Nominees”) for election to the Fund’s Board of Directors. The Board of Directors believes EMC’s Director nominations and the Termination Proposal together are part of a plan to force the Fund to cease operations and liquidate. City of London Investment Management Company Limited (“City of London”), which is the sponsor of the Termination Proposal, is EMC’s investment adviser and has described its preference for liquidation of the Fund in an SEC filing. The Board strongly believes that a forced liquidation would be inconsistent with the best interests of the Fund and its stockholders – particularly since in 2017 the Fund delivered a return to the stockholders of over 37%. The Board also believes that its Director nominees are better qualified than the EMC Nominees and will serve the interests of all the Fund’s stockholders better than the EMC Nominees.

You may receive proxy solicitation materials from EMC, City of London or any of their affiliates, including an opposition proxy statement and proxy card. The Board of Directors recommends that you NOT return any proxy card furnished by or on behalf of EMC, City of London or any of their affiliates. If you have previously signed a proxy card furnished by EMC, City of London or any of their affiliates, you can revoke that proxy and vote for the Board of Directors’ nominees and on any other matter to be properly considered at the Meeting by signing, dating and returning the WHITE proxy card in the enclosed postagepre-paid envelope, or by authorizing your proxy electronically via the Internet using the Internet address on the WHITE proxy card or by telephone using the toll-free number on the WHITE proxy card.

YOU ARE STRONGLY URGED TO VOTE. YOU MAY DO SO BY TELEPHONE; BY INTERNET; OR BY COMPLETING, DATING AND SIGNING THE ENCLOSED WHITE PROXY CARD, AND MAILING IT IN THE ENVELOPE PROVIDED FOR THAT PURPOSE. THIS SOLICITATION IS BEING MADE BY THE BOARD OF DIRECTORS OF THE FUND.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING ON MARCH 27, 2018: This Notice, Proxy Statement and Form of WHITE proxy card are available on the Internet athttps://www.proxyonline.com/docs/TheChinaFund2018.pdf.

| By order of the Board of Directors, | ||

| Brian F. Link | ||

| Secretary | ||

February 5, 2018

THE CHINA FUND, INC.

c/o State Street Bank and Trust Company

P.O. Box 5049, One Lincoln Street

Boston, Massachusetts 02206-5049

PROXY STATEMENT

PROXY SUMMARY

This Proxy Statement addresses the two Proposals we expect will be considered at the 2018 Annual Meeting of Stockholders (the “Meeting”) of The China Fund, Inc. (the “Fund”). The two Proposals are (1) a proposal to elect two directors and (2) a proposal to terminate all the Fund’s investment advisory and management agreements with Allianz Global Investors U.S. LLC (“Allianz”) (the “Termination Proposal”).

The Fund’s Board of Directors (the “Board”) has nominated Joe Rogers and Richard Shore forre-election as directors. Emerging Markets Country Fund (“EMC”), a stockholder of the Fund, has notified the Fund that it intends to propose two different nominees (the “EMC Nominees”) at the Meeting, for election to the Fund’s Board. You are being asked to choose between these two sets of nominees.

City of London Investment Management Company Limited (“City of London”), which is EMC’s investment adviser, is the sponsor of the Termination Proposal. In filings with the Securities and Exchange Commission (the “SEC”), EMC and City of London have confirmed they are acting in concert and that their two proposals are related, and form part of a plan to alter the Fund’s strategic direction. In its Termination Proposal, City of London is not proposing to replace Allianz, only to remove it. As a result, if the Termination Proposal were adopted, the Fund would have no investment manager and in practical terms would be unable to manage its investment portfolio.

The Board believes EMC and City of London are seeking through their two proposals (to elect the EMC Nominees and adopt the Termination Proposal) to place the Fund in a seriously weakened position in which the Fund would have no choice but to submit to whatever further proposals EMC and City of London might then make. EMC and City of London have indicated these further proposals (to be made after the Meeting) might include liquidation of the Fund, or some type of business combination transaction involving the Fund and other investment vehicles. Presumably, EMC and City of London also could propose something else that has not yet been identified. Any business combination proposal that EMC and City of London might propose may involve conflicts of interest affecting them. The Board believes that, for example, merging the Fund with one or more smaller funds in which City of London has substantial positions might be beneficial for City of London but not for other stockholders of the Fund.

The Board believes this approach on the part of EMC and City of London is unfair to the Fund’s other stockholders and is inconsistent with the best interests of the Fund. The Board believes that if EMC and City of London have a specific proposal to make (such as liquidation, or a merger with one or more other funds), they should describe the proposal in detail and present it to the Fund’s stockholders in circumstances in which the stockholders are free to vote no. If the Termination Proposal were adopted, the Board believes that the Fund’s stockholders likely wouldnot feel free to vote no on a proposal presented by City of London or EMC, because the stockholders probably would believe the alternative of having the Fund continue its operations without an investment adviser is not viable.

The Board OPPOSES this attempt by EMC and City of London to place the Fund in a vulnerable position in which EMC and City of London could be able to pressure the Fund’s stockholders to approve actions the stockholders would not otherwise endorse. The Board strongly recommends that you protect your interests by voting FOR the Board’s nominees for director, Joe Rogers and Richard Shore, and AGAINST the Termination

1

Proposal. The Board believes Joe Rogers and Richard Shore will provide a safe pair of hands capable of helping protect the interests of all the Fund’s stockholders, and that your rejection of the Termination Proposal will put a stop to what the Board believes is City of London’s bullying.

Your vote is important. It will determine the future of the Fund. Please carefully consider the following points:

No Disclosed Plan For The Future of The Fund

EMC and City of London have not said specifically what they would seek to have the Fund do if the Fund’s stockholders were to approve the Termination Proposal and elect the EMC Nominees. In their proxy statement, City of London and EMC say only that the EMC Nominees, if elected, would consider reinstating the Fund’s share buyback program, liquidating the Fund, or seeking the consolidation of the Fund with one or more otherclosed-end funds focused on the emerging markets.

The Board believes this lack of a clear, specific plan is especially troubling because once the Fund’s relationship with Allianz ended (which would be 60 days after the vote on the Termination Proposal), the Fund would be incapable of operating. In that situation, rapid action would be needed to protect the value of the stockholders’ investments in the Fund. If City of London and EMC do not know for sure what they would seek to have the Fund do after firing Allianz, that is troubling. If City of London and EMC do know and are not saying, that is worse.

No Explanation of How the Fund Would Operate Without an Investment Adviser

The Fund exists to own and manage an investment portfolio. The Fund has no employees and instead (like other similar funds) relies entirely on an investment adviser (presently Allianz). If the Fund is going to continue to operate it needs an investment adviser. In their proxy statement, City of London and EMC say they seek to “ensure that the Fund is managed properly in the future,” but give no explanation of how the Fund could be “managed properly” if the Termination Proposal were approved and as a result the Fund had no access to management resources. If the Termination Proposal were approved by stockholders, it is unlikely that the Fund would be able to engage another investment adviser (and obtain the required stockholder approval to do so) without City of London’s support. The Board believes there is no reason to believe City of London would vote for the appointment of a replacement adviser, because if City of London wanted to replace (rather than simply fire) Allianz it presumably would have made a proposal to that effect.

If City of London and EMC intend to force a liquidation of the Fund, they should say so and should submit a liquidation proposal to the stockholders that explains the likely risks, costs and consequences. If City of London and EMC wish to force a merger of the Fund with one or more other funds, they should say so and should identify the prospective merger partners and the terms of the merger they wish to pursue. If City of London and EMC wish to force a replacement of the Fund’s investment adviser, they should say so and should identify their preferred replacement. If City of London and EMC have some other plan for the Fund, they should reveal it. Without this information, stockholders cannot know what the implications would be of electing the EMC Nominees and approving the Termination Proposal.

To protect your investment in the Fund against the uncertainty and potential loss of value that could follow election of the EMC Nominees and adoption of the Termination Proposal, you should vote FOR the Board’s director nominees and AGAINST the Termination Proposal

2

The Termination Proposal is an Attempt by City of London to Punish the Board For a Proposal That Received a Majority of Votes Cast

In an SEC filing, City of London has tied the Termination Proposal to its opposition to the Board’s proposal to engage Open Door Investment Management, Ltd. (“Open Door”) as the Fund’s investment adviser. The Open Door proposal was approved by a substantial majority of the shares voted on the proposal (nearly 60%), but the proposal narrowly missed obtaining the necessary vote for approval, because of City of London’s opposition. Incongruously, City of London faults the Board for retaining Allianz as the Fund’s investment adviser, after City of London prevented the Fund from replacing Allianz with a new investment adviser.

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of the Fund for use at the Meeting, to be held at the offices of State Street Bank and Trust Company, One Lincoln Street, Boston, MA 02111, on Tuesday, March 27, 2018, at 12:00 P.M., Eastern Time, and at any adjournments thereof.

This Proxy Statement and a WHITE proxy card are being mailed to stockholders on or about February 5, 2018. Any stockholder giving a proxy has the power to revoke it by giving a superseding proxy by phone, Internet or mail, in each case following the applicable procedure described on the WHITE proxy card, or by submitting a notice of revocation to the Fund prior to the date of the Meeting or in person at the Meeting. All properly executed WHITE proxy cards received in time for the Meeting will be voted as specified or, if no specification is made, will have no effect on the election of the directors and will have the effect of a vote against the Termination Proposal. If your shares are held by a broker and you do not instruct your broker how you want your shares to be voted and EMC, City of London or any of their affiliates delivers a competing set of proxy materials to brokers, your shares will not be voted on the election of directors, and that will have no effect on the election of directors, and your shares will not be voted on the Termination Proposal, and that will have the same effect as a vote against that proposal.

The presence at the Meeting, in person or by proxy, of stockholders entitled to cast a majority of the votes eligible to be cast at the Meeting will constitute a quorum. For purposes of determining the presence of a quorum for transacting business at the Meeting, shares represented by executed proxies that are returned without voting instructions will be treated as shares that are present for quorum purposes. Abstentions are included in the determination of the number of shares present at the Meeting for purposes of determining the presence of a quorum.

If a quorum is not present at the Meeting, or in the event that a quorum is present at the Meeting but sufficient votes to approve Proposal 1 are not received, the chairman of the Meeting or the stockholders present at the Meeting may adjourn the Meeting from time to time to a date not more than 120 days after the original record date without notice other than announcement at the Meeting. At any such adjourned Meeting at which a quorum is present, any business may be transacted which might have been transacted at the Meeting as originally notified. The Fund may set a subsequent record date and give notice of it to stockholders, in which case the meeting may be held not more than 120 days beyond the subsequent record date. The Fund may postpone or cancel the Meeting by making a public announcement of such postponement or cancellation before the Meeting. Notice of the date, time, and place to which the Meeting is postponed is required to be given not less than ten days prior to such date and otherwise in the manner set forth in the Fund’sBy-Laws.

The Board of Directors has fixed the close of business on February 2, 2018 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting and at any adjournments thereof. Stockholders on the record date will be entitled to one vote for each share held, with no shares having cumulative voting rights. As of the record date, the Fund had 15,722,675 shares of common stock outstanding.

3

EMC has notified the Board that at the Meeting it intends to propose the EMC Nominees for election to the Fund’s Board of Directors. The Board of Directors believes EMC’s Director nominations and the Termination Proposal together are part of a plan to force the Fund to cease operations and liquidate. City of London, which is the sponsor of the Termination Proposal, is EMC’s investment adviser and has described its preference for liquidation of the Fund in an SEC filing. The Board strongly believes that a forced liquidation would be inconsistent with the best interests of the Fund and its stockholders – particularly since in 2017 the Fund delivered a return to the stockholders of over 37%. The Board also believes that its Director nominees are better qualified than the EMC Nominees and will serve the interests of all the Fund’s stockholders better than the EMC Nominees.

You may receive proxy solicitation materials from EMC, City of London or any of their affiliates, including an opposition proxy statement and proxy card. The Board of Directors recommends that you NOT return any proxy card furnished by or on behalf of EMC, City of London or any of their affiliates. If you have previously signed a proxy card furnished by EMC, City of London or any of their affiliates, you can revoke that proxy and vote for the Board of Directors’ nominees and on any other matter to be properly considered at the Meeting by signing, dating and returning the WHITE proxy card in the enclosed postagepre-paid envelope, or by authorizing your proxy electronically via the Internet using the Internet address on the WHITE proxy card or by telephone using the toll-free number on the WHITE proxy card.

Management of the Fund knows of no items of business, other than the election of directors and, if properly presented, the Termination Proposal, that will be presented for consideration at the Meeting. If any other matters are properly presented, it is the intention of the persons named in the enclosed WHITE proxy card to vote in accordance with their best judgment.

The Fund will furnish, without charge, a copy of its annual report for its fiscal year ended October 31, 2017 to any stockholder requesting the report. Requests for the annual report should be made to The China Fund, Inc., c/o Computershare Fund Services, P.O. Box 505000, Louisville, KY 40233, by accessing the Fund’s website at www.chinafundinc.com or by calling (866)209-2870.

IMPORTANT INFORMATION

The proxy statement discusses important matters affecting the Fund. Please take the time to read the proxy statement, and then cast your vote.You may obtain additional copies of the Notice of Meeting, Proxy Statement and form of WHITE proxy card by calling (866)209-2870 or by accessinghttps://www.proxyonline.com/docs/TheChinaFund2018.pdf.

There are multiple ways to vote. Choose the method that is most convenient for you. To vote by telephone or Internet, follow the instructions provided on the WHITE proxy card. To vote by mail simply fill out the WHITE proxy card and return it in the enclosed postage-paid reply envelope.Please do not return your WHITE proxy card if you vote by telephone or Internet.To vote in person, attend the Meeting and cast your vote. The Meeting will be held at the offices of State Street Bank and Trust Company, One Lincoln Street, Boston, MA 02111.

PROPOSAL 1

ELECTION OF DIRECTORS

The Fund’sBy-Laws provide that the Board of Directors is to be divided into three classes: Class I, Class II and Class III. The terms of office of the present directors (each a “Director”) in each class expire at the Annual Meeting of Stockholders in the year indicated or thereafter in each case when their respective successors are elected and qualified: Class I, 2018; Class II, 2019; and Class III, 2020. At each subsequent annual election, Directors chosen to succeed those whose terms are expiring will be identified as being in the same class and will be elected for a three-year term. The effect of these staggered terms is to limit the ability of other entities or persons to acquire control of the Fund by delaying the replacement of a majority of the Board of Directors.

4

The term of Messrs. Joe O. Rogers and Richard Shore will expire at the 2018 Annual Meeting of Stockholders. At a meeting held on December 5, 2017, the Board of Directors nominated each of Messrs. Joe O. Rogers and Richard Shore to serve as Class I Directors of the Fund until the Fund’s 2021 Annual Meeting of Stockholders or until each of their successors is duly elected and qualified.

The persons named in the accompanying form of WHITE proxy card intend, in the absence of contrary instructions, to vote all proxies for the elections of Messrs. Joe O. Rogers and Richard Shore to serve for a term expiring on the date on which the Annual Meeting of Stockholders is held in 2021, or until their successors are elected and qualified. Mr. Rogers and Mr. Shore each have indicated they will serve if elected. If either of them should be unable to serve, an event not now anticipated, the proxies will be voted for such person, if any, as is designated by the Board of Directors to replace the applicable nominee. The election of a Director will require the affirmative vote of a majority of the votes cast on the election of directors at the Meeting. For this purpose, abstentions and brokernon-votes will have no effect on the outcome of the election.If you hold your shares in the Fund through a broker and EMC, City of London or any of their affiliates delivers proxy materials to brokers soliciting proxies for the election of directors, your shares will not be voted unless you provide instructions to your broker. Also in that case, shares covered by executed proxies that are furnished by brokers without instructions on the election of directors will not be voted. To ensure your vote for theelection of Mr. Rogers and Mr. Shore is counted, you must either provide voting instructions in the manner indicated on the WHITE proxy card if you do not hold your shares through a broker or instruct your broker to vote your shares for Mr. Rogers and Mr. Shore.

As noted in the Proxy Summary,EMC has notified the Fund that it intends to propose the EMC Nominees at the Meeting, for election to the Board and, together with City of London, has filed a proxy statement seeking approval of the EMC Nominees. The Board believes that its nominees, Mr. Rogers and Mr. Shore, would better serve the interests of the Fund’s stockholders. In this connection, the Board believes it important that stockholders consider the following:

The EMC Nominees Serve on a Fund Board That Exhibited Many of The Same Supposed “Faults” Attributed by City of London and EMC to the Fund’s Board

The EMC Nominees serve as directors (and one of them as Chairman) of the Korea Fund, Inc. (the “Korea Fund”), an emerging marketclosed-end country fund similar in many respects to the Fund. In their proxy statement, City of London and EMC fault the Board for: the overall level of fees paid to the Board, the fact the Board’s members hold only modest amounts of the Fund’s shares, and the Board’s authorization of an additional retainer fee paid to the Chairman of the Fund’s Audit Committee. But the average fees paid to members of the Board are roughly the same as the fees paid to the Korea Fund board; the share ownership levels of the Korea Fund by the EMC Nominees are comparable to those of the Board’s nominees for director; and the Korea Fund pays the Chairman of its Audit Committee the same additional annual retainer as the Fund pays its Audit Committee Chairman. City of London and EMC also criticize the investment performance (overseen by Allianz as the Fund’s investment adviser) for being below its benchmark, but the investment performance of the Korea Fund, whose investment adviser also happens to be Allianz, also has been below its benchmark. Finally, City of London and EMC criticize the discount below net asset value (“NAV”) at which the Fund’s shares trade, but the Korea Fund’s shares currently trade at a greater discount than the Fund’s shares trade (and shares of closed end funds generally trade at a discount to NAV).

In view of the foregoing, there appears to be little basis to conclude that electing the EMC Nominees would address any of the criticisms leveled by City of London and EMC at the Board. The Board believes based on this record that while the EMC Nominees would have a fiduciary duty to all stockholders and not just City of London and EMC, EMC probably nominated the EMC Nominees because it believes they would be more likely to support initiatives proposed by City of London and EMC than the Board’s nominees (who have demonstrated a willingness to stand up to City of London and EMC, including for example in continuing to pursue last year’s

5

Open Door nomination in the face of severe criticism from City of London). The Board believes the Fund and its stockholders will be better served by the Board’s nominees for election of directors, both because of their willingness to stand up to City of London and EMC when they deem it appropriate and because the Board’s nominees have experience dealing with the various issues that are specific to the Fund, and the EMC nominees do not.

The Open Door Proposal Was in The Best Interest of The Fund

As noted in the Proxy Summary, City of London’s Termination Proposal was prompted by the Board’s seeking in 2017 to engage Open Door as the Fund’s investment adviser. The Board’s decision to recommend replacing Allianz with Open Door was primarily based on two factors: (1) during theten-year period that the two principals of Open Door managed the Fund while associated with another investment adviser, the Fund achieved its best sustained investment performance relative to its benchmark since the Fund’s inception, substantially outperforming the Fund’s benchmark; and (2) Open Door would provide the Fund with a Greater China investment strategy that focuses more on smaller-capitalization and entrepreneurial companies, listed primarily in Shanghai, Shenzhen, Hong Kong and Taipei, than do most other investment funds investing in the Greater China markets. The Board also noted that Open Door believes that this strategy would differentiate the Fund from otherclosed-end funds and ETFs, which generally have index-anchored, large-capitalization approaches to investing in Greater China. While Allianz, with the Board’s encouragement, had been seeking to invest a greater portion of the Fund’s assets in smaller capitalization issuers, including issuers not represented in the Fund’s benchmark, the Board felt that Open Door had a better approach to achieve success with a somewhat similar strategy.

The Board was aware when it recommended replacing Allianz with Open Door that one of the principals of Open Door had been sanctioned by the SEC with regard to transactions in direct investments while the principal was the portfolio manager of the Fund and this was disclosed in the Fund’s proxy statement seeking approval of Open Door. The Board gained comfort in proposing to engage Open Door from the facts that the other principal of Open Door, and not the sanctioned principal, would manage the Fund and that the Fund has no present intention to make direct investments (i.e., private equity-type investments).As importantly,the Board was advised that the Fund’s Chief Compliance Officer (“CCO”) and Counsel had conducted a review of Open Door’s compliance program and compliance capabilities, including meeting with Open Door’s compliance personnel at Open Door’s San Francisco office. The CCO noted for the Board that he considered Open Door’s engagement of an outsourced chief compliance officer to supplement its internal compliance staff. He explained that this chief compliance officer and the compliance company he is engaged by provides independent oversight of Open Door’s compliance program. He also noted that Open Door has an experienced, Mandarin speaking compliance manager that managesday-to-day compliance matters and works closely with management at Open Door as well as the chief compliance officer and that personnel of the compliance company regularly meet with the compliance manager. Lastly, the CCO noted that Open Door has engaged independent legal counsel to advise it as necessary on any compliance related matters. Based on this review, the Fund’s CCO advised the Board that Open Door’s compliance program appeared to be reasonably designed to prevent violations of the Federal securities laws, with Open Door appearing to have compliance personnel capable of implementing the program effectively.

Also, in their proxy statement City of London and EMC state the Fund and its stockholders would have been left “holding the bag” on the losses suffered by the Fund “if it were not for the SEC’s enforcement proceeding and subsequent settlement with Mr. Ruffle.” This misleadingly implies the reimbursement of the losses was a term of the settlement Mr. Ruffle reached with the SEC, in turn suggesting the Fund’s board was not independently proactive. That is not what happened. The Fund’s board itself identified the issue giving rise to the losses; and brought it to the attention of the Fund’s adviser. The adviser in turn notified the SEC, which eventually led to the enforcement proceeding against Mr. Ruffle. In the meantime, the Fund entered into an agreement with its former adviser and the adviser’s insurers for recovery of the losses in December 2010, independently of the outcome of the enforcement proceeding (and long before the settlement with Mr. Ruffle was finalized in June 2014).

6

Continued Retention of Allianz Was Also in the Best Interest of the Fund

In their proxy statement, City of London and EMC criticize the Board’s decision to continue the Fund’s investment advisory and management agreements with Allianz, noting that the Fund has underperformed it benchmark, performance the Board characterized as “adequate.” In making this decision, the Board noted that the recentsub-par performance relative to the benchmark largely reflects Allianz’s overweighting, relative to the Fund’s benchmark Index (MSCI Golden Dragon), of small- andmid-capitalization stocks in the Fund’s portfolio. The Board supports an investing approach that seeks to outperform its benchmark by taking positions that may not closely conform to the benchmark and believes the Fund’s stockholders generally support this approach. In addition, the Board understands that the Fund’s recent underperformance may be largely a matter of temporary technical factors, such as heavy flows from foreign investors concentrated on larger capitalization stocks.

City of London and EMC also criticize the Board for apparent inconsistency in approving the continuation of the investment advisory and management agreements with Allianz after proposing to replace Allianz with Open Door as the Fund’s investment adviser. This criticism is disingenuous. The Board thought Open Door could do a better job, and recommended that the stockholders vote to approve that replacement. Because of City of London’s opposition, that proposal failed (narrowly) to garner sufficient support even though a majority of shares voted were in favor of the recommendation. After the stockholders failed to approve the Open Door proposal by a sufficient margin, the Board had no choice but to make the best of the Fund’s existing relationship with Allianz. While the Board hoped the Open Door proposal would be approved by stockholders for the reasons discussed above, the Board was also comfortable that Allianz was employing an investment strategy that the Board supported and believed would be to the Fund’s benefit in the long run. Unlike City of London and EMC, the Board is unwilling to place the Fund in jeopardy by firing Allianz without a replacement being immediately available.

Failure to Accurately Describe The Background of The Accrued Liability For Chinese Taxes

In their Proxy Statement, City of London and EMC state, in suggesting that the Fund mishandled an accrual for Chinese taxes, “Chinese tax authorities had provided guidance regarding the accrual of capital gains earlier that year.” The Chinese authorities did not provide guidance on accruing liabilities. The guidance they provided addressed whether taxes would be imposed on capital gains realized by foreign investors on certain Chinese securities over a number of previous years. Since the Fund did not hold these securities but instead held derivatives giving it exposure to the securities, whether the Fund had exposure to liability for capital gains taxes depended on whether the issuers of the derivatives would assert their contractual rights to be reimbursed for any taxes imposed on the issuers with respect to the securities. This was not a foregone conclusion, because it appeared that the issuers could reduce or eliminate the taxes under tax treaties with China or offset gains with losses. It was not until close to the end of the Fund’s fiscal year that the Fund received from one of the issuers a demand for reimbursement. The Fund then accrued the liability after confirming the issuer’s detailing of the transactions giving rise to the liability.

7

INFORMATION RELATING TO PROPOSAL 1

Information Concerning the Nominees and Members of the Board of Directors

The following table provides information concerning the nominees and other members of the Board of Directors of the Fund each of whom is not an “interested person” of the Fund, as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), and therefore is deemed to be “independent.”

Name (Age) and Address of Directors or Nominees for Director | Position(s) Held with Fund | Director Since (Term Ends) | Principal Occupation(s) or | Number of Funds in the Complex(1) Overseen by the Director or Nominee | Other Directorships Held by Director or | |||||

CLASS I | ||||||||||

Joe O. Rogers (69)* 2477 Foxwood Drive Chapel Hill, NC 27514 | Chairman of the Board and Director | 1992 (2018) | President, Rogers International LLC (investment consultation) (2010-Present); Visiting Professor, Fudan University School of Management(2010-2012). | 1 | None. | |||||

Richard Shore (56)* 1100 New York Avenue, NW Suite 700 Washington, D.C. 20005 | Director | 2014 (2018) | Partner, Gilbert LLP (law firm) (2001-Present); Director, Reneo Consulting LLC (strategic consulting firm)(2014-Present). | 1 | None. | |||||

CLASS II | ||||||||||

Michael F. Holland (73) 375 Park Avenue New York, New York 10152 | Director | 1992 (2019) | Chairman, Holland & Company LLC. (investment adviser) (1995-Present). | 1 | Director, The Holland Balanced Fund, Inc., Reaves Utility Income Fund and Blackstone Funds;Co-Chairman and Trustee, State Street Master Funds and State Street Institutional Funds and Trustee, SSgA Funds. | |||||

Li Jin (47) 204 Moss Hill Rd Boston, MA 02130 | Director | 2013 (2019) | Professor, Oxford University (2012-Present); Chair Professor, Peking University (2012-Present); Assistant and Associate Professor, Harvard University (2001-2012). | 1 | None. | |||||

Gary L. French (66) 1307 61st Street NW Bradenton, FL 34209 | Director | 2013 (2019) | Real estate investor; Manager Member, Warners Bayou Investments I, LLC and Palma Sola Investments I, LLC (2011-Present); Senior Consultant, Regulatory Fundamentals Group (development and distribution of software and related consulting services) (2011-2017). | 1 | Independent Trustee, J.P. Morgan Exchange— Traded Fund Trust (2014-present). | |||||

8

Name (Age) and Address of Directors or Nominees for Director | Position(s) Held with Fund | Director Since (Term Ends) | Principal Occupation(s) or | Number of Funds in the Complex(1) Overseen by the Director or Nominee | Other Directorships Held by Director or | |||||

CLASS III | ||||||||||

William C. Kirby (67) Harvard University CGIS South Building 1730 Cambridge Street Cambridge, MA 02138 | Director | 2007 (2020) | T.M Chang Professor of China Studies (2006-Present); Spangler Family Professor of Business Administration (2006-Present); Chairman, Harvard China Fund (2006-Present); Harvard University Distinguished Service Professor (2006-Present); Director, John K. Fairbank Center for Chinese Studies, Harvard University (2006-2014); Dean of the Faculty of Arts and Sciences Harvard University (2002-2006). | 1 | Chairman, The Taiwan Fund, Inc. (2016-present); Director, Cabot Corporation. | |||||

Linda C. Coughlin (65) 10 Delia Drive Holderness, NH 03245 | Director | 2015 (2020) | Founder and CEO, Great Circle Associates, LLC (management consultation) (2008-present). | 1 | None. | |||||

| * | Nominee |

| (1) | The term “Fund Complex” means two or more registered investment companies that share the same investment adviser or principal underwriter or hold themselves out to investors as related companies for the purposes of investment and investor services. |

Leadership Structure and Board of Directors

The Board of Directors has general oversight responsibility with respect to the business and affairs of the Fund. The Board of Directors is responsible for overseeing the operations of the Fund in accordance with the provisions of the 1940 Act, other applicable laws and the Fund’s Articles of Incorporation. The Board is composed of seven Independent Directors and one of the Independent Directors serves as Chairman of the Board of Directors. Generally, the Board acts by majority vote of all of the Directors, including a majority vote of the Independent Directors if required by applicable law. The Fund’sday-to-day operations are managed by Allianz Global Investors U.S. LLC, the Fund’s Investment Manager, and other service providers who have been approved by the Board of Directors. The Board of Directors meets periodically throughout the year to oversee the Fund’s activities, review contractual arrangements with service providers, oversee compliance with regulatory requirements and review performance. The Board has determined that its leadership structure is appropriate given the size of the Board of Directors, the fact that all of the Directors are not interested persons, and the nature of the Fund.

The Directors were selected to serve and continue on the Board of Directors based upon their skills, experience, judgment, analytical ability, diligence, ability to work effectively with other Directors and a commitment to the interests of stockholders and a demonstrated willingness to take an independent and questioning view of management. Each Director also has considerable familiarity with the Fund and the Administrator, and their operations, as well as the special regulatory requirements governing regulated investment companies and the special responsibilities of investment company directors as a result of his substantial prior service as a Director or officer of the Fund and, in several cases, as a director or executive of other investment companies. In addition to those qualifications, the following is a brief summary of the specific experience, qualifications or skills that led to the conclusion, as of the date of this proxy statement, that each person identified below should serve as a Director for the Fund. References to the qualifications, attributes and skills of the Directors are pursuant to requirements of the SEC, and do not constitute a holding out of the Board of Directors or any Director as having any special expertise and should not be considered to impose any greater

9

responsibility or liability on any such person or on the Board of Directors by reason thereof than the normal responsibility and liability of an investment company board member or board. As required by rules the SEC has adopted under the 1940 Act, the Fund’s Independent Directors select and nominate all candidates for Independent Director positions.

Joe O. Rogers: Mr. Rogers has served as a Director of the Fund since the Fund’s inception in 1992. He has provided business and investment consulting services for over 30 years. Mr. Roger’s experience includes service as the president, vice president or partner in business and investment consulting firms including Rogers International LLC, PHH Asia Corporation and PHH Fantus Consulting. He served as the U.S. Ambassador to the Asian Development Bank under President Ronald Reagan. Mr. Rogers also served the U.S. House of Representatives in various capacities including Executive Director and International Relations Counselor of the Republican Conference and served as the chief economist and budget advisor to Senator William Armstrong. He has lectured on economics and finance at various U.S. based and internationally based universities and served as a Visiting Professor of Finance at Fudan University in Shanghai from 2010 to 2012.

Richard Shore: Mr. Shore has served as a Director of the Fund since 2014. He is a founding director of Reneo Consulting LLC, a strategic consulting firm, and a founding partner of Gilbert LLP, a boutique law firm. He is a recognized authority on complex insurance and liability matters. His work involves strategic advice, litigation, alternative dispute resolution and complex, multi-party settlement negotiations. Mr. Shore is also a frequent writer and speaker on insurance coverage and dispute resolution topics.

Michael F. Holland: Mr. Holland has served as a Director of the Fund since the Fund’s inception in 1992. He has worked in the investment management industry for over 40 years. Mr. Holland’s experience includes service as the Chairman of Holland & Company LLC, which he founded in 1995, and as the chief executive officer, chairman or vice chairman of major U.S. asset management firms including Salomon Brothers Asset Management, First Boston Asset Management and Oppenheimer & Co., Inc. He is a regular guest on several financial television programs and is regularly quoted in leading financial publications. Mr. Holland also serves on the boards of other charitable and listed companies.

Li Jin: Mr. Li Jin has served as a Director of the Fund since 2013. He currently serves as Chair Professor of Finance at Guanghua School of Management in Peking University and Professor of Finance at Oxford University Said Business School. He also acts as an Assistant Dean to the Guanghua School of Management and theCo-Chair of the Finance Department at the school. Before he joined Oxford and Peking Universities, Mr. Li Jin taught in the finance department at the Harvard Business School from 2001 to 2012.

Gary L. French: Mr. French has served as a Director of the Fund since 2013. Currently, Mr. French is primarily a private investor focusing on residential real estate acquisition, refurbishment and sales as well as commercial real estate financing. He served as a Senior Consultant with Regulatory Fundamentals Group, providing development, distribution of software and related consulting services from 2011 to 2017. He served as a Senior Vice President and Business Head of Fund Administration Division at State Street Bank and Trust Company from 2002 to 2010. He brings over 30 years of investment management industry experience to the Board of Directors. Mr. French also serves on the board of another listed company.

William C. Kirby: Mr. Kirby has served as a Director of the Fund since 2007. He is T. M. Chang Professor of China Studies at Harvard University and Spangler Family Professor of Business Administration at Harvard Business School. Mr. Kirby is a historian of modern China, whose work examines China’s business, economic and political development in an international context. He has served the academic community for over 30 years. Mr. Kirby joined Harvard University in 1992, where he currently serves various positions including Chairman of the Harvard China Fund. He has also served as the Director of the John K. Fairbank Center for Chinese Studies, Dean of the Faculty of Arts and Sciences, Chair of the Council on East Asian Studies and the Director of the National Resource Center for East Asia for Harvard University. Prior to joining Harvard University, Mr. Kirby served as the Dean of University College, Director of Asian Studies and Director of International Affairs at Washington University. Mr. Kirby has published numerous books and articles related to Chinese business and history.

10

Linda C. Coughlin: Ms. Coughlin has served as a Director of the Fund since 2015. She is the Founder and CEO of Great Circle Associates, LLC, a management consulting firm that specializes in business, organization and communication strategy and implementation and executive coaching. She has also served as chair of the boards of three families of funds and President of the Americas Mutual Funds Group at Scudder Investments, responsible for four North American based retail businesses including three families of open and closed end mutual funds, the Americas offshore mutual funds group and the firm’s defined contribution business.

The Fund’s Board of Directors has an Audit Committee, which is responsible for reviewing financial and accounting matters. The Fund’s Audit Committee is comprised of all of the Directors, all of whom are not interested persons of the Fund (as defined in Section 2(a)(19) of the 1940 Act), and its actions are governed by the Fund’s written Audit Committee Charter. The current members of the Audit Committee are Ms. Coughlin and Messrs. French, Holland, Kirby, Li Jin, Rogers and Shore. All members of the Audit Committee are independent as independence is defined in the New York Stock Exchange’s listing standards, as may be modified or supplemented. The Audit Committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “1934 Act”). The Audit Committee met five times during the fiscal year ended October 31, 2017. The Audit Committee has a charter which is available on the Fund’s website (www.chinafundinc.com).

The Fund’s Board of Directors has a Nominating and Compensation Committee, comprised of the current members of the Audit Committee, which is responsible for nominating candidates to fill any vacancies on the Board of Directors. All of the members of the Nominating and Compensation Committee are independent as independence is defined in the New York Stock Exchange’s listing standards, as may be modified or supplemented and are not interested persons of the Fund. Currently, the Nominating and Compensation Committee does not have a policy to consider nominees recommended by stockholders. The Nominating and Compensation Committee believes that it is not necessary to have such a policy because the Board of Directors consists entirely of Directors who are not interested persons of the Fund (as defined in Section 2(a)(19) of the 1940 Act). The Nominating and Compensation Committee evaluates a candidate’s qualifications for Board of Directors membership and the candidate’s independence from the Fund’s Investment Manager and other principal service providers. The Nominating and Compensation Committee does not have specific minimum qualifications that must be met by candidates recommended by the Nominating and Compensation Committee and there is not a specific process for identifying such candidates. In nominating candidates, the Nominating and Compensation Committee takes into consideration such factors as it deems appropriate. These factors may include judgment, skill, diversity, experience with businesses or other organizations of comparable size, the interplay of the candidate’s experience with the experience of other Board of Directors members, requirements of the New York Stock Exchange and the SEC to maintain a minimum number of independent ornon-interested directors, requirements of the SEC as to disclosure regarding persons with financial expertise on the Fund’s audit committee and the extent to which the candidate generally would be a desirable addition to the Board of Directors and any committees of the Board of Directors. The Nominating and Compensation Committee believes the Board of Directors generally benefits from diversity of background, experience and views among its members, and considers this a factor in evaluating the composition of the Board of Directors, but has not adopted any specific policy in this regard. The Nominating and Compensation Committee met one time during the fiscal year ended October 31, 2017. The Nominating and Compensation Committee has a charter which is available on the Fund’s website (www.chinafundinc.com).

The Fund does not have a specified process for stockholders to send communications to the Board of Directors because stockholders are able to communicate directly with the Board of Directors at the Annual Meeting of Stockholders and the Fund’s reports to stockholders disclose contact information which may be used to direct communications to the Board of Directors.

The Fund does not have a policy regarding Board of Directors member’s attendance at the Annual Meeting of Stockholders. However, six Directors attended the 2017 Annual Meeting of Stockholders.

11

The Fund’s Board of Directors held four regular meetings and five special meetings during the fiscal year ended October 31, 2017. Each Director attended at least seventy-five percent of the aggregate number of meetings of the Board of Directors and of any committee on which he or she served.

Risk Oversight

Theday-to-day operations of the Fund, including the management of risk, is performed by third party service providers, such as the Fund’s Investment Manager (Allianz Global Investors U.S. LLC) and Administrator (State Street Bank and Trust Company). The Directors are responsible for overseeing the Fund’s service providers and thus have oversight responsibilities with respect to risk management performed by those service providers. Risk management seeks to identify and address risks, i.e., events or circumstances that could have material adverse effects on the business, operations, stockholder services, investment performance or reputation of the Fund. The Fund and its service providers employ a variety of processes, procedures and controls to identify certain of those possible events or circumstances, to lessen the probability of their occurrence and/or to mitigate the effects of such events or circumstances if they do occur.

Not all risks that may affect the Fund can be identified nor can controls be developed to eliminate or mitigate their occurrence or effects. It may not be practical or cost effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the reasonable control of the Fund or the Investment Manager or other service providers. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve the Fund’s goals. As a result of the foregoing and other factors, the Fund’s ability to manage risk is subject to substantial limitations.

Risk oversight forms part of the Board of Directors’ general oversight of the Fund and is addressed as part of various Board of Directors and Committee activities. As part of its regular oversight of the Fund, the Board of Directors, directly or through a Committee, interacts with and reviews reports from, among others, the Investment Manager, the Fund’s Chief Compliance Officer and the Fund’s independent registered public accounting firm, as appropriate, regarding risks faced by the Fund. The Board of Directors is responsible for overseeing the nature, extent and quality of the services provided to the Fund by the Investment Manager and receives information about those services at its regular meetings. In addition, on an annual basis, in connection with its consideration of whether to renew the Fund’s Advisory Agreements, the Board of Directors meets with the Investment Manager to review the services provided. Among other things, the Board of Directors regularly considers the Investment Manager’s adherence to the Fund’s investment restrictions and compliance with various Fund policies and procedures and with applicable securities regulations. The Board of Directors has appointed a Chief Compliance Officer who oversees the implementation and testing of the Fund’s compliance program and reports to the Board of Directors regarding compliance matters for the Fund and its service providers. The Board of Directors, with the assistance of the Investment Manager, reviews investment policies and risks in connection with its review of the Fund’s performance. In addition, as part of the Board of Directors’ oversight of the Fund’s Investment Manager and other service provider agreements, the Board of Directors may periodically consider risk management aspects of their operations and the functions for which they are responsible.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act requires the Fund’s officers and Directors, and beneficial owners of more than ten percent of a registered class of the Fund’s equity securities, to file reports of ownership and changes in ownership with the SEC and the New York Stock Exchange. Section 30(h) of the 1940 Act extends the reporting requirements under Section 16(a) of the 1934 Act to the investment adviser or manager of the Fund and the officers and directors of such investment adviser or manager. The Fund believes that its officers and Directors and the officers of the Investment Manager have complied with all applicable filing requirements for the fiscal year ended October 31, 2017.

12

Officers of the Fund

The following table provides information concerning each of the officers of the Fund.

Name (Age) and Address of Officers | Position(s) Held with Fund | Officer Since | Principal Occupation(s) or Employment During Past Five Years | |||

Joseph Quirk (49) Allianz Global Investors U.S. LLC 1633 Broadway New York, NY 10019 | President | 2014 | Managing Director and Head of Fund Operations for Allianz Global Investors (2008-Present). | |||

Patrick Keniston (54) Foreside Fund Officer Services, LLC Three Canal Plaza, Suite 100 Portland, ME 04101 | Chief Compliance Officer | 2011 | Managing Director, Foreside Fund Officer Services, LLC (2008-Present). | |||

Monique Labbe (44) Foreside Fund Officer Services, LLC 10 High Street #302 Boston, MA 02210 | Treasurer | 2015 | Fund Principal Financial Officer, Foreside Fund Officer Services, LLC (2014-present); Principal/Assistant Vice President, State Street Global Advisers (2012-2014); Director/Assistant Vice President, State Street Corporation (2005-2012). | |||

Brian Link (45) 100 Summer Street, SUM0703 Boston, MA 02111 | Secretary | 2014 | Vice President and Managing Counsel, State Street Bank and Trust Company (2007-Present). | |||

Ownership of Securities

The following table sets forth information regarding the ownership of securities in the Fund by Directors and Nominees for Director as of December 31, 2017.

Name of Director or Nominee | Dollar Range of Equity Securities in the Fund | Aggregate Dollar Range of Equity Securities in all Funds Overseen or to be Overseen by Director or Nominee in the Fund Complex(1) | ||

Joe O. Rogers | $50,001 - $100,000 | $50,001 - $100,000 | ||

Richard Shore | None | None | ||

Michael F. Holland | $50,001 - $100,000 | $50,001 - $100,000 | ||

Li Jin | None | None | ||

Gary L. French | $10,001 - $50,000 | $10,001 - $50,000 | ||

William C. Kirby | $10,001 - $50,000 | $10,001 - $50,000 | ||

Linda C. Coughlin | None | None |

| (1) | The term “Fund Complex” means two or more registered investment companies that share the same investment adviser or principal underwriter or hold themselves out to investors as related companies for the purposes of investment and investor services. The Fund is the only fund in the Fund Complex overseen by the Directors. |

Transactions with and Remuneration of Officers and Directors

The aggregate remuneration for Directors was $468,000 during the year ended October 31, 2017 and, for that period, the aggregate amount of expenses reimbursed by the Fund for Directors’ attendance at directors’ meetings was $139,247. Each Director currently receives fees, paid by the Fund, of $3,000 for each directors’ meeting and committee meeting attended and an annual fee of either $35,000 (for the Chairman of the Fund), $30,000 (for the Chairman of the Audit Committee), or $20,000 (for the other Directors).

13

The following table sets forth the aggregate compensation from the Fund paid to each Director during the fiscal year ended October 31, 2017. The Fund does not compensate the officers of the Fund.

Name of Director | Aggregate Compensation From Fund(1) | Pension or Retirement Benefits Accrued As Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation From Fund and Fund Complex Paid To Directors(2) | ||||||||||||

Joe O. Rogers | $ | 80,000 | — | — | $ | 80,000 | ||||||||||

Richard Shore | $ | 59,000 | — | — | $ | 59,000 | ||||||||||

Michael F. Holland | $ | 62,000 | — | — | $ | 62,000 | ||||||||||

Li Jin | $ | 71,000 | — | — | $ | 71,000 | ||||||||||

Gary L. French | $ | 75,000 | — | — | $ | 75,000 | ||||||||||

William C. Kirby | $ | 65,000 | — | — | $ | 65,000 | ||||||||||

Linda C. Coughlin | $ | 56,000 | — | — | $ | 56,000 | ||||||||||

| (1) | Includes compensation paid to Directors by the Fund. The Fund’s Directors did not receive any pension or retirement benefits as compensation for their service as Directors of the Fund. |

| (2) | There is one fund in the Fund Complex overseen by the Directors. |

Stockholder Approval

The election of the Board’s nominees (Mr. Rogers and Mr. Shore) as Directors will require the affirmative vote of the holders of a majority of the shares of common stock of the Fund cast on the election of directors at the Meeting. Pursuant to the Fund’sBy-laws, if the EMC Nominees are not nominated any Director who is nominated by the Board of Directors forre-election at the Meeting and is notre-elected at the Meeting will be deemed to have tendered to the Board of Directors his resignation as a Director, with such resignation to take effect 30 days after the date of the Meeting unless the Board of Directors unanimously decides to reject that Director’s tender of resignation, in which case the Director will continue in office until his or her death, resignation or removal or until his or her successor shall have been elected and shall have been qualified. In deciding whether to reject a Director’s tender of resignation, the Board of Directors must consider what is in the best interests of the Fund and its stockholders. Among the considerations that affect this decision are the potential adverse consequences of accepting the resignation, including the failure to comply with any applicable rule or regulation (including applicable stock exchange rules or federal securities laws).

THE BOARD OF DIRECTORS OF THE FUND RECOMMENDS (1) THAT YOU VOTE “FOR” THE PROPOSAL TORE-ELECT JOE ROGERS AND RICHARD SHORE, AND (2) THAT YOUDO NOT VOTE FOR THE EMC NOMINEES ANDDO NOT SIGN ANY PROXY CARD THAT MAY BE PROVIDED BY OR ON BEHALF OF EMC, CITY OF LONDON OR THEIR AFFILIATES.

PROPOSAL 2

APPROVAL OF PROPOSED TERMINATION OF ALL INVESTMENT ADVISORY AND MANAGEMENT AGREEMENTS BETWEEN THE FUND AND ALLIANZ

The Termination Proposal is a proposal to terminate all the investment advisory and management agreements between the Fund and Allianz (“Advisory Agreements”). The Termination Proposal calls for the removal, but not the replacement, of Allianz as the Fund’s investment adviser. The Termination Proposal will be voted on only if it is properly presented at the Meeting. To be considered properly presented, either the Proponent or a representative of the Proponent who is qualified under state law must be present in person at the Meeting. In addition, the Proponent or a representative of the Proponent must follow the proper state law procedures for attending the meeting and/or presenting the Termination Proposal.

City of London submitted the Termination Proposal for inclusion in this Proxy Statement on September 11, 2017. The text furnished by City of London for inclusion in this Proxy Statement is set forth later in this section.

14

City of London has provided evidence to the Fund that it beneficially owns shares of the Fund with a market value over $2,000.1

Statement of the Board of Directors in Opposition to The Termination Proposal:

The Fund’s Board, all of whom are Independent Directors, has carefully considered Proposal 2 and, for the reasons set forth below, strongly opposes the termination of the Fund’s Advisory Agreements with Allianz and unanimously recommends a vote “AGAINST” Proposal 2.

The Board bases its recommendation on the fact that the Proposed Termination would be inconsistent with the best interests of the Fund and its stockholders, the Fund’s performance has been adequate and has improved over the pastone-year period and that terminating the Adviser would likely lead to liquidation of the Fund and in any case would be disruptive and expensive to Fund stockholders.

The Board believes that stockholders strongly benefit from the services, experiences and resources of the current investment adviser, Allianz, and there is an important continuing service to be provided to stockholders by maintaining Allianz as the Fund’s investment adviser, subject to continued 1940 Act annual reviews.

The Board believes that comparing the Fund to its benchmark index, the MSCI Golden Dragon Index (the “Index”), should not be the sole judgment for the performance of the Fund. For example, over the last several years, the performance of the Fund has suffered from an overweighting of the Fund’s portfolio in small andmid-capitalization stocks while the performance of the Index was being driven by the flow of investments into large capitalization stocks by exchange traded funds and other foreign investors. The Board supports an investment approach that seeks to outperform the Index by taking positions that may not closely conform to the Index. Also important to the Board in evaluating Allianz is how it has positioned the Fund to capture the growing investment opportunity represented by the domestic Chinese economy and longer term structural trends in the region. The idiosyncrasies of the Index on the other hand mean that its performance can be driven by short and medium term cyclicality and liquidity flows. This may not truly reflect the underlying value or longer term investment opportunities in the region. The Board continues to have confidence in the Adviser’s investment management of the Fund.

The Board believes that the Proponent’s proposal to terminate the Advisory Agreements would have a significant adverse impact on theday-to-day operations of the Fund and could result in loss of share value for Fund stockholders. We hope that you will support Allianz’s continued management of the Fund by voting “AGAINST” the Proposed Termination.

Termination Would Likely Lead to Liquidation of the Fund

The Board believes that it is clear from the Proponent’s correspondence with the Fund that the purpose of the Proponent’s proposal is to force liquidation of the Fund. If Proposal 2 is approved the Fund would be required to provide 60 days’ notice of termination to the Adviser. The Board would then need to put in place new investment advisory agreements with the Adviser or another investment adviser. Under the 1940 Act, any new advisory agreements could continue in effect for only 150 days without stockholder approval. Any such approval would require a favorable vote by a majority of the Fund’s outstanding voting securities (as defined in the 1940 Act). For these purposes, as required by the 1940 Act, the vote of a “majority” of the Fund’s outstanding voting securities means the affirmative vote of (a) 67% or more of the shares of the Fund’s common stock present at a meeting, if the holders of more than 50% of the outstanding shares are present or represented by proxy or

| 1 | Additional information regarding City of London’s status as a stockholder, including the number of shares it owns, is available from the Fund upon oral or written request. |

15

(b) more than 50% of the outstanding shares of the Fund, whichever is less. The Board believes it highly unlikely that such a vote could be obtained, particularly in the face of opposition by the Proponent and other stockholders that support the Proponent’s proposal.

Other Impacts of Proposed Termination

The termination of the Advisory Agreements could lead to the loss of access to all administrative personnel and services currently provided by the Adviser, which would cause substantial disruption to the Fund’s business and operations. The Adviser and its affiliates currently provide the Fund with certain administrative services and officers and other personnel that are necessary for the operations of the Fund.

The Board believes that it would be very difficult and time-consuming to replace the Adviser and the services it currently provides for the Fund with an investment adviser of similar quality that would provide such services at a comparable price. Moreover, the Fund could be subject to additional costs of a transition to a new investment adviser, such as trading costs associated with adjusting the Fund’s portfolio. In any event, there is no assurance that future investment performance would be comparable to or better than the returns achieved under the existing Advisory Agreements.

For these reasons, the Board believes that the termination of the Advisory Agreements would cause significant distraction to the management of the Fund, is likely to disrupt the business and operations of the Fund and could be detrimental to the value of the Fund’s shares. If the Advisory Agreements with the Adviser are terminated, the Board intends to carefully evaluate the situation at the time and take all appropriate actions to act in the best interests of the Fund and its stockholders under the circumstances. If the Fund is unable to secure the services of a suitable investment adviser or cannot obtain stockholder approval of new investment advisory agreements, it may become in the best interests of the Fund’s stockholders to liquidate the Fund. Under Maryland law, liquidation of the Fund requires stockholder approval by the affirmative vote oftwo-thirds of all the votes entitled to be cast. If it becomes in the best interests of the Fund’s stockholders to liquidate the Fund, there could be a protracted period of time before the Fund obtains either the requisite affirmative stockholder vote to liquidate or a resolution as to the appropriate outcome under state law in the Maryland courts.

* * *

After taking the foregoing considerations into account, the Board of Directors, including all of the Independent Directors, believes that the Termination Proposal is contrary to the best interests of the Fund and its stockholders. In addition, when considering the joint arrangement between City of London and EMC to propose the EMC Nominees the Board of Directors believes that the Proponent only has its self-interests in mind and not those of long term stockholders.

The text provided by City of London for inclusion in this Proxy Statement is as follows:

The matter proposed by City of London to be brought before the Meeting:

RESOLVED: All investment advisory and management agreements between The China Fund, Inc. (“the Fund”) and Allianz Global Investors U.S. LLC (“Allianz”) shall be terminated by the Fund, pursuant to the right of stockholders as embodied in Section 15(a)(3) of the Investment Company Act of 1940 and as required to be included in such agreements, at the earliest date the Fund is legally permitted to do so.

The Proponent’s statement in support of the matter:

“The investment results achieved by Allianz, the Fund’s investment manager, did not keep pace with the benchmark index over an extended period. As such, Allianz, in its capacity as Manager, delivered

16

unsatisfactory net asset value (“NAV”) investment performance. Therefore, all investment advisory and management agreements between the Fund and Allianz should be terminated by the Fund.

As outlined in the Fund’s “Semi-Annual Report to Stockholders – April 30, 2017”, the Board considered the renewal of the investment management and portfolio management agreements. The Manager’s affiliate assumed its responsibilities effective April 6, 2012, and thus had crossed the five-year threshold at the date of the Semi-Annual Report.

According to the section of the Semi-Annual Report entitled “Board Deliberations Regarding Approval of Investment Advisory Agreements,” the Board determined that “the Fund underperformed the MSCI Golden Dragon Index for theone-, three- and five-year periods ended December 31, 2016 and outperformed the Index for the10-year period ended December 31, 2016.” The section went on the state that “The Directors concluded that, despite this general underperformance when compared to the Fund’s benchmark, the performance of the Fund was adequate.”

The facts are that the NAV performance delivered by Allianz for the rolling periods ending June 30, 2017, according to the Fund’s own published investment results, lagged the benchmark index by 4.79% for the1-year period and 2.62% annualized for the3-year period, equating to a cumulative underperformance of approximately 7.5%. This is weak investment performance.

The Board deemed Allianz’s performance to be “adequate” on March 28, 2017, but later that same day the Board resolved to select Open Door Investment Management Ltd. as successor to Allianz. Clearly, the Board’s actions and its words on that day stand in opposition to each other.

For the reasons outlined above, we urge stockholders to exercise their right pursuant to Section 15(a)(3) of the Investment Company Act to vote to terminate all investment advisory and management agreements with Allianz Global Investors U.S. LLC.”

Stockholder Approval

Approval of the Termination Proposal would require the affirmative vote of a majority of the Fund’s outstanding shares of common stock. As defined in the 1940 Act, a “majority of the outstanding shares” means the lesser of 67% of the voting securities present at the Annual Meeting of Stockholders, if a quorum is present, or 50% of the outstanding securities. For this purpose, abstentions and brokernon-votes will have the effect of a vote against the Proposed Termination.

THE BOARD OF DIRECTORS OF THE FUND UNANIMOUSLY RECOMMENDS THAT YOU VOTE “AGAINST” THE TERMINATION PROPOSAL.

MANNER OF VOTING PROXIES

Votes cast by proxy or in person at the Meeting will be tabulated by the inspectors of election appointed for the Meeting. The inspectors of election will determine whether or not a quorum is present at the Meeting. The inspectors of election will treat withheld votes and “brokernon-votes,” if any, as present for purposes of determining a quorum. Brokernon-votes occur when shares are held by brokers or nominees, typically in “street name,” for which proxies have been returned but (a) voting instructions have not been received from the beneficial owners or persons entitled to vote, (b) the broker or nominee does not have discretionary voting power or elects not to exercise discretion on a particular matter and (c) the shares are present at the Meeting.

Voting by direct holders of Fund shares.

If you hold your shares directly (not through a broker-dealer, bank or other financial institution) and if you return a signed and dated WHITE proxy card that does not specify how you wish to vote on a proposal, your shares will be voted “FOR” the election of Fund Directors in Proposal 1 and “AGAINST” the Proposed Termination in Proposal 2.

17

Voting of shares held through brokers.

Before the Meeting, broker-dealer firms holding Fund shares in “street name” for the benefit of their customers and clients will request instructions from those customers and clients on how to vote their beneficially-owned shares at the Meeting. The Fund understands that, under the rules of the New York Stock Exchange, such broker-dealer firms may for certain “routine” matters, without instructions from their customers and clients, grant discretionary authority to the proxies designated by the Board of Directors to vote if no instructions have been received prior to the date specified in the broker-dealer firm’s request for voting instructions. If EMC, City of London or any of their affiliates delivers a competing set of proxy materials to brokers, the New YorkStock Exchange rules governing brokers’ discretionary authority will not permit such brokers to exercise discretionary authority regarding any of the proposals to be voted at the Meeting, whether “routine” ornot.In that situation, if you hold your shares through a broker,to ensure your vote for the election of Mr. Rogers and Mr. Shore is counted, you must provide voting instructions to your broker.