UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934 (Amendment No.)

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

The China Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing: | |||

| (1) | Amount previously paid:

| |||

| (2) | Form, Schedule or Registration Statement No:

| |||

| (3) | Filing party:

| |||

| (4) | Date Filed:

| |||

THE CHINA FUND, INC.

c/o State Street Bank and Trust Company

P.O. Box 5049, One Lincoln Street

Boston, Massachusetts 02206-5049

[ ], 2018

Dear Stockholders:

A Special Meeting of Stockholders (the “Meeting”) of The China Fund, Inc. (the “Fund”) will be held at 9:00 AM, Eastern Time, on Friday, December 7, 2018, at the offices of Clifford Chance US LLP, 31 West 52nd Street, New York, New York 10019. A Notice and Proxy Statement regarding the Meeting, proxy card for your vote, and postage prepaid envelope in which to return your proxy card, are enclosed.

The matter on which you, as a stockholder of the Fund, are being asked to vote is the approval of the proposed Investment Advisory and Management Agreement (the “Proposed Agreement”) between the Fund and Matthews International Capital Management, LLC.

The Board of Directors recommends that you approve the Proposed Agreement.

| Respectfully, |

| Brian F. Link |

| Secretary |

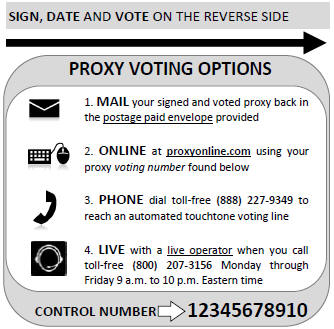

STOCKHOLDERS ARE STRONGLY URGED TO VOTE BY TELEPHONE, BY INTERNET OR BY SIGNING AND MAILING THE ENCLOSED PROXY CARD IN THE ENVELOPE PROVIDED FOR THAT PURPOSE TO ENSURE A QUORUM AT THE MEETING.

THE CHINA FUND, INC.

NOTICE OF A SPECIAL MEETING OF STOCKHOLDERS

[ ], 2018

To the Stockholders of

The China Fund, Inc.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (the “Meeting”) of The China Fund, Inc. (the “Fund”) will be held at the offices of Clifford Chance US LLP, 31 West 52nd Street, New York, New York 10019, on Friday, December 7, 2018, at 9:00 AM, Eastern Time, for the following purposes:

| 1. | To approve the proposed Investment Advisory and Management Agreement (the “Proposed Agreement”) between the Fund and Matthews International Capital Management, LLC; and |

| 2. | To transact such other business as may properly come before the Meeting or any adjournments thereof. |

The Board of Directors has fixed the close of business on October 29, 2018 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting or any adjournments thereof.

You are cordially invited to attend the Meeting. Stockholders who do not expect to attend the Meeting in person are requested to vote by telephone, by Internet or by completing, dating and signing the enclosed form of proxy card and returning it promptly in the envelope provided for that purpose. You may nevertheless vote in person at the Meeting if you choose to attend. The enclosed proxy is being solicited by the Board of Directors of the Fund.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING ON DECEMBER 7, 2018: This Notice and the Proxy Statement are available on the Internet at https://www.proxyonline.com/docs/[ ].

By order of the Board of Directors, |

Brian F. Link |

Secretary |

[ ], 2018

2

THE CHINA FUND, INC.

c/o State Street Bank and Trust Company

P.O. Box 5049, One Lincoln Street

Boston, Massachusetts 02206-5049

PROXY STATEMENT

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of The China Fund, Inc. (the “Fund”) for use at a Special Meeting of Stockholders (the “Meeting”), to be held at the offices of Clifford Chance US LLP, 31 West 52nd Street, New York, New York, on Friday, December 7, 2018, at 9:00 AM, Eastern Time, and at any adjournments thereof.

This Proxy Statement and the form of proxy card are being mailed to stockholders on or about[ ], 2018. Any stockholder giving a proxy has the power to revoke it by executing a superseding proxy by phone, Internet or mail following the process described on the proxy card or by submitting a notice of revocation to the Fund prior to the date of the Meeting or in person at the Meeting. All properly executed proxies received in time for the Meeting will be voted as specified in the proxy or, if no specification is made, for the approval of the Proposed Agreement as described in Proposal 1 of this Proxy Statement.

For purposes of determining the presence of a quorum for transacting business at the Meeting, executed proxies returned without marking a vote on Proposal 1 will be treated as shares that are present for quorum purposes. Abstentions are included in the determination of the number of shares present at the Meeting for purposes of determining the presence of a quorum.If a stockholder is present in person or by proxy at the Meeting but does not cast a vote, the stockholder’s shares will count towards a quorum but will have the effect of a vote against Proposal 1.In the event a quorum is not present at the Meeting, or in the event that a quorum is present at the Meeting but sufficient votes to approve Proposal 1 are not received, holders of a majority of the stock present in person or by proxy have the power to adjourn the meeting. In addition, the chairman of the Meeting may adjourn any meeting of stockholders from time to time (a) to a date not more than 120 days after the original record date without notice other than announcement at the meeting or (b) provided that a new notice is given and a new record date is set, to a date more than 120 days after the original record date. At such adjourned meeting at which a quorum is present, any business may be transacted which might have been transacted at the Meeting as originally notified. The Fund may set a subsequent record date and give notice of it to stockholders, in which case the meeting may be held not more than 120 days beyond the subsequent record date. The Fund may postpone or cancel a meeting of stockholders by making a public announcement of such postponement or cancellation prior to the meeting. Notice of the date, time, and place to which the meeting is postponed is required to be given not less than ten days prior to such date and otherwise in the manner set forth in the Fund’sBy-Laws.

The Board of Directors has fixed the close of business on October 29, 2018 as the record date for the determination of stockholders entitled to notice of and to vote at the Meeting and at any adjournments thereof. Stockholders on the record date will be entitled to one vote for each share held, with no shares having cumulative voting rights. As of the record date, the Fund had outstanding [ ] shares of common stock.

Management of the Fund knows of no item of business other than that mentioned in Proposal 1 of the Notice of Meeting that will be presented for consideration at the Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

The Fund will furnish, without charge, a copy of its annual report for its fiscal year ended October 31, 2017 and a copy of its semi-annual report for the period ended April 30, 2018 to any stockholder requesting such reports. Requests for the annual report or the semi-annual report should be made to The China Fund, Inc., c/o Computershare Fund Services, 280 Oser Avenue, Hauppauge, New York 11788, by accessing the Fund’s website at www.chinafundinc.com or by calling (866)209-2870.

3

IMPORTANT INFORMATION

The proxy statement discusses important matters affecting the Fund. Please take the time to read the proxy statement, and then cast your vote.You may obtain additional copies of the Notice of Meeting, Proxy Statement and form of proxy card by calling [ ] or by accessing https://www.proxyonline.com/docs/[ ].There are multiple ways to vote. Choose the method that is most convenient for you. To vote by telephone or Internet, follow the instructions provided on the proxy card. To vote by mail simply fill out the proxy card and return it in the enclosed postage-paid reply envelope.Please do not return your proxy card if you vote by telephone or Internet.To vote in person, attend the Meeting and cast your vote. The Meeting will be held at the offices of Clifford Chance US LLP, 31 West 52nd Street, New York, New York 10019.

PROPOSAL 1

APPROVAL OF PROPOSED INVESTMENT ADVISORY AND MANAGEMENT AGREEMENT

On April 6, 2012, stockholders approved the Investment Advisory and Management Agreement, dated as of April 7, 2012, between the Fund and RCM Asia Pacific Limited (“RCM AP”) and the Direct Investment Management Agreement, dated as of April 7, 2012, between the Fund and RCM AP (the “Agreements”). RCM AP and Allianz Global Investors U.S. LLC (“Allianz”) are affiliates. As part of a global initiative by the Allianz organization to operate as “one company” with distinctive investment capabilities and a global brand, and at the request of Allianz, the Board approved Allianz assuming the role of investment adviser to the Fund from RCM AP and the Agreements were restated to reflect Allianz as the legal entity serving as the Fund’s investment adviser. These new arrangements are reflected in the Amended and Restated Investment Advisory and Management Agreement (the “Current Management Agreement”) and the Amended and Restated Direct Investment Management Agreement (the “Current Direct Management Agreement” together, the “Current Agreements”), each dated, April 1, 2014, between the Fund and Allianz. On July 25, 2018, the Fund provided Allianz with Notice of Termination of the Current Agreements. The termination of the Current Agreements is scheduled to occur on the earlier of December 31, 2018 and a date which is not less than 20 business days after the date of a further notice that the Fund provides to Allianz. The Fund intends to provide the further notice upon approval of the proposed Investment Advisory and Management Agreement between the Fund and Matthews International Capital Management, LLC (the “Proposed Agreement”).

On October 11, 2018, the Board of Directors, all of whom are Independent Directors, voted to approve and recommend to stockholders the approval of the Proposed Agreement. At that same meeting, the Board of Directors chose not to approve a new Direct Investment Management Agreement because the Board of Directors does not intend for the Fund to make direct investments. A discussion of the reasons the Board of Directors recommended a change in investment adviser can be found below under “Approval Process and the Factors Considered by the Board of Directors in Approving the Proposed Agreement.”If approved by the stockholders of the Fund, the Proposed Agreement will replace the Current Management Agreement. This Special Meeting is being held to permit stockholders to consider approval of the Proposed Agreement.

The Proposed Agreement requires that Matthews International Capital Management, LLC (“Matthews Asia”) undertake to provide substantially the same investment advisory and management services as provided under the Current Management Agreement. Matthews Asia’s duties under the Proposed Agreement include making investment decisions, supervising the acquisition and disposition of investments and supervising the selection of brokers or dealers to execute these transactions in accordance with the Fund’s investment objective and policies and within the guidelines and directions established by the Board.

Under the Proposed Agreement, Matthews Asia will bear all expenses arising out of its duties under the Proposed Agreement but will not be responsible for any expenses of the Fund other than those specifically allocated to Matthews Asia in the Proposed Agreement. In particular, the Fund bears expenses for legal fees and expenses of counsel to the Fund; fees for directors and officers other than those employed by Matthews Asia; auditing and accounting expenses; taxes and governmental fees; New York Stock Exchange listing fees; dues and expenses incurred in connection with membership in investment company organizations; fees and expenses of the Fund’s custodian,sub-custodian, transfer agents, registrars and other service providers; fees and expenses with respect to

4

administration (except as may be expressly provided otherwise); expenses for portfolio pricing services by a pricing agent, if any; expenses of preparing share certificates and other expenses in connection with the issuance, offering and underwriting of shares issued by the Fund; interest charges and other expenses on any borrowings or transactions that may be considered to involve leverage; insurance premiums on property or personnel of the Fund which inure primarily to the Fund’s benefit, including liability and fidelity bond insurance; third-party expenses relating to the development, hosting and maintenance of the Fund’s website; third-party expenses relating to investor and public relations and marketing; expenses of registering or qualifying securities of the Fund for public sale; freight, insurance and other charges in connection with the shipment of the Fund’s portfolio securities; brokerage commissions or other costs of acquiring or disposing of any portfolio holding of the Fund; expenses of preparation and distribution of reports, notices and dividends to stockholders; expenses of the Fund’s dividend reinvestment and cash purchase plan; costs related to licenses for the Fund to use, distribute and/or publish data for any indexes used by the Fund; costs of stationery; any litigation expenses; costs of stockholders’ and other meetings; and all other charges and costs of the Fund’s operation plus any extraordinary andnon-recurring expenses, except as herein otherwise prescribed. To the extent Matthews Asia incurs any costs by assuming expenses which are an obligation of the Fund as set forth herein, the Fund shall promptly reimburse Matthews Asia for such costs and expenses, except to the extent Matthews Asia has otherwise agreed to bear such expenses. To the extent the services for which the Fund is obligated to pay are performed by Matthews Asia, Matthews Asia shall be entitled to recover from the Fund to the extent of Matthews Asia’s actual costs for providing such services.

Under the Proposed Agreement, as is the case under the Current Management Agreement, Matthews Asia will pay the salaries and expenses of such of the Fund’s officers and directors who are directors, officers or employees of Matthews Asia,provided,however, that the Fund, and not Matthews Asia, will bear travel expenses or an appropriate fraction thereof of (i) directors and officers of the Fund who are directors, officers or employees of Matthews Asia and (ii) the portfolio manager of Matthews Asia who is primarily responsible for Fund (or any other member of the investment team attending in lieu of that portfolio manager or, if at the invitation of the Board of Directors, in addition to the portfolio manager) to the extent that such expenses relate to attendance at meetings of the Board or any committee thereof, andprovided,further, that such expenses are incurred in accordance with the Fund’s travel policy.

Under the Proposed Agreement, neither Matthews Asia nor its affiliates, directors, employees, or agents will be subject to any liability for any act or omission, error of judgment or mistake of law, or for any loss suffered by the Fund in the course of, connected with or arising out of any services to be rendered thereunder, except by reason of Matthews Asia’s willful misfeasance, bad faith or gross negligence in the performance of its duties or by reason of Matthews Asia’s reckless disregard of its obligations and duties under the Proposed Agreement.

The Proposed Agreement may be terminated at any time, without payment of penalty, by Matthews Asia, or by the Fund acting pursuant to a vote of the Board of Directors or by a vote of a majority of the Fund’s outstanding securities (as defined in the 1940 Act) upon sixty days’ written notice, and will terminate automatically in the event of its assignment (as defined in the 1940 Act) by Matthews Asia.

If approved by stockholders, the Proposed Agreement would remain in effect for an initial period of two years from the date it becomes effective. Thereafter, the Proposed Agreement would continue in effect from year to year if its continuance is specifically approved at least annually by (i) a vote of a majority of the Independent Directors, cast in person at a meeting called for the purpose of voting on such approval, and (ii) either a vote of a majority of the Board of Directors as a whole or a majority of the Fund’s outstanding shares of common stock as defined in the 1940 Act.

Stockholders do not have dissenter’s rights of appraisal in connection with the matter to be voted on by stockholders.

Fee Provisions

Under the terms of the proposed Investment Advisory and Management Agreement, Matthews Asia would be entitled to receive fees for its services, computed based on the actual number of days of that month and payable monthly within five (5) business days after the end of each calendar month in US dollars, at the annual rate of 0.70% of the Fund’s average daily net assets if the Fund’s average daily net assets exceed $150,000,000 and 0.80% of the Fund’s average daily net assets if the Fund’s average daily net

5

assets consisting of assets do not exceed $150,000,000. Under the structure of this fee, the fee rate and the amounts paid to Matthews Asia would increase discontinuously (and not just on marginal assets) if the Fund’s average daily net assets decline to $150,000,000 or lower. Under the Current Management Agreement, Allianz receives a fee, computed weekly and payable monthly in US dollars, at the following annual rates: 0.70% of the first US$315 million of the Fund’s average weekly net assets; and 0.50% of the Fund’s average weekly net assets in excess of US$315 million.

The Fund’s total net assets as of[ ], 2018 were $[ ].

For the fiscal year ended October 31, 2018, the aggregate amount of advisory fees paid by the Fund was $[__]. Had the Proposed Agreement been in place for the fiscal year ended October 31, 2019, the advisory fees paid by the Fund would have been $[__].

Approval Process and the Factors Considered by the Board of Directors in Approving the Proposed Agreement

At a special Board meeting held on July 19, 2018, the Board determined that it would be appropriate for the Board to consider another investment manager for the Fund. Among the considerations that led to the Board’s determination to consider another investment manager of the Fund was the investment performance of Allianz in managing the Fund. The Board noted that the Fund had generally underperformed its benchmark index for theone-month, three-month and three-year periods and from the date the current portfolio managers began managing the Fund through April 30, 2018. The Board then retained a consultant to assist it in identifying potential investment adviser candidates and providing initial evaluations of those candidates. After considering those evaluations the Board determined that the consultant should invite a number of those candidates to respond to a request for proposal prepared by the consultant. Separately, the Board also sent its own request for proposal to several candidates it had identified. After receiving the responses to the requests for proposal as well as further evaluation by the consultant, the Board requested that five of these potential investment adviser candidates provide additional information relative to providing investment advisory services to the Fund. Each of the candidates provided information, and each was requested to make a presentation to the Board at a meeting on October 10, 2018 and October 11, 2018.

Following those presentations and considering a final evaluation by the consultant, the Board approved the selection of Matthews Asia as the investment adviser for the Fund and agreed to submit the Proposed Agreement for approval by the Fund’s stockholders at a special stockholders meeting. The Proposed Agreement would replace the Current Management Agreement. Because the Fund has no current intention to enter into direct investments, the Fund is not proposing to enter into a Direct Management Agreement.

In making this selection the Board noted that Matthews Asia has a singular focus on Asia and employs a fundamental,bottom-up investment process that seeks to identify companies with sustainable long-term growth prospects, strong business models, quality management teams and reasonable valuations. The Board noted that Matthews Asia’s intent is to manage the Fund using an all capitalization universe that includes approximately 5,000 companies. The Board noted that to better reflect the all capitalization universe of this strategy, as well as its focus on China rather than Greater China, the Fund’s benchmark index would change from the MSCI Golden Dragon Index to the MSCI China All Shares Index upon the commencement of Matthews Asia managing the Fund.

The Board also considered Matthews Asia’s attention to risk management, which focuses on governance matters, including franchise and management issues, security risk, which includes valuation and liquidity considerations, and macro factors including geopolitical and regulatory issues. The Board noted that Matthews Asia employs an independent risk committee that conducts an autonomous assessment of risk utilizingvalue-at-risk modeling, liquidity metrics, country and currency exposure and company specific testing for all holdings.

The Board also noted that the advisory fee agreed to by Matthews Asia was generally the same as under the Current Management Agreement at current asset levels although the Current Management Agreement has a tiered fee of 0.50% of the Fund’s average weekly net assets in excess of US$315 million that the Proposed Agreement does not have. The Board also noted that the advisory fee agreed to by Matthews Asia compared favorably with fees charged by advisers of other U.S. registeredclosed-end funds that invest in the Greater China region.

The Board also considered the terms and conditions of the Proposed Agreement. The Board noted that the Current Management Agreement and the Proposed Agreement are substantially similar, with one exception. The Proposed Agreement has a tiered advisory fee of 0.70% if assets exceed $150,000,000 and 0.80% if assets do not exceed 150,000,000 and the Current Management Agreement has a tiered advisory fee of 0.70% of the first

6

US$315 million of the Fund’s average weekly net assets and 0.50% of the Fund’s average weekly net assets in excess of US$315 million. At the current and anticipated asset levels of the Fund, the difference in advisory fees rates between the Proposed Agreement and the Current Management Agreement is expected to be immaterial.

The Board also based its decision on the following considerations, among others, although the Board did not identify any consideration that was all important or controlling, and each Director may have attributed different weights to the various factors.

Nature, Extent and Quality of the Services provided by the Investment Adviser.The Board reviewed and considered the nature and extent of the investment management services to be provided by Matthews Asia under the Proposed Agreement. The Board noted the following:

Matthews Asia, with offices in San Francisco, CA, is a US registered investment adviser. Upon Matthews Asia’s engagement by the Fund, Andrew Mattock, CFA, of Matthews Asia, will become the Fund’s Portfolio Manager. Mr. Mattock is U.S. based and has over 19 years of experience investing in the Greater China markets and 23 years of industry experience.

Matthews Asia has not managed a U.S.closed-end registered fund previously. Matthews Asia does, however, manage U.S.open-end registered funds. The Board considered Matthews Asia’s compliance program and compliance capabilities as well as the portfolio manager’s previous experience and concluded that Matthews Asia has a compliance program that appeared to be reasonably designed to prevent violations of the Federal securities laws.

The Board determined that Matthews Asia appeared to be capable of providing the Fund with investment management services of above average quality.

Performance, Fees and Expenses of the Fund.The Board noted that, at the time of Matthews Asia’s selection by the Board, Matthews Asia had not been providing services to the Fund; therefore, there were limitations on the Board’s ability to evaluate the performance of Matthews Asia in managing the Fund. Based however on Matthews Asia’s performance in managing other portfolios containing Chinese equity securities, the Board concluded that there was reason to believe that Matthews Asia could achieve competitive performance over the long term in managing the Fund. The Board also noted that other expenses of the Fund were not expected to increase materially as a result of the retention of Matthews Asia.

Economies of Scale. The Board considered the potential benefits from economies of scale that the Fund’s stockholders could be afforded. The Board noted that, while the management fee rate under the Proposed Agreement does not decline as the Fund’s assets grow, fixed operating costs are spread over a larger asset base, resulting in a lower per share allocation of such costs. The Board also considered Matthews Asia’s history of reinvesting its profits in additional resources for providing services to its clients.

Other Benefits of the Relationship. The Board considered whether there were other benefits that Matthews Asia and its affiliates may derive from its relationship with the Fund and concluded that any such benefits were likely to be minimal.

Resources of the Proposed Investment Adviser. The Board considered whether Matthews Asia is financially sound and has the resources necessary to perform its obligations under the Proposed Agreement. The Board noted that Matthews Asia appears to have sufficient financial resources necessary to fulfill its obligations under the Proposed Agreement.

General Conclusions.After considering and weighing all of the above factors, the Board concluded that it would be in the best interest of the Fund and its stockholders to approve the Proposed Agreement. In reaching this conclusion, the Board did not give particular weight to any single factor referenced above.

7

Information About the Proposed Adviser

Matthews Asia currently manages 41 investment vehicles with collective assets of $32.5 billion (as of September 30, 2018). Matthews Asia manages the Matthews China Fund that could be deemed to have an investment objective similar to the Fund. That fund has assets of $818.1 million and pays a management fee of 0.66% (as of September 30, 2018).

Principal Executive Officer and Directors of Matthews Asia

The following table sets forth certain information concerning the principal executive officer, chief investment officer and the directors of Matthews Asia.

Name/Address | Position Held | Since | Principal Occupation or | |||||||

| William J. Hackett | Chief Executive Officer | 2009 | Chief Executive Officer, Matthews Asia; President of Matthews International Funds | |||||||

| Robert J. Horrocks | Chief Investment Officer | 2009 | Chief Investment Officer and Portfolio Manager, Matthews Asia; Vice President of Matthews International Funds | |||||||

| G. Paul Matthews | Director | 1996 | Director, Matthews Asia | |||||||

| Mark Headley | Chairman and Director | [ ] | Chairman and Director, Matthews Asia | |||||||

| Bill Sappington | Director | 2018 | Executive Vice President and Head of Private Banking and Wealth Management of City National Bank | |||||||

| Jeffrey D. Lovell | Director | [ ] | Co-Founder andCo-Chairman of the Board of Lovell Minnick Partners LLC | |||||||

| Katsunobu Motohashi | Director | [ ] | Head of Asset Management at Mizuho Bank, Ltd. | |||||||

The following table sets forth certain information concerning the individual who is anticipated to serve as portfolio manager for the Fund:

Name/Address | Position Held with | | Since | Principal Occupation or Employment | ||||||

| Andrew Mattock | Portfolio Manager | 2015 | Portfolio Manager, Asia (2015-present); Fund Manager, Janus Henderson Global Investors (2000-2015) |

Required Vote

The 1940 Act requires that an investment advisory contract between an investment company and an investment adviser be in writing, that such contract specify, among other things, the compensation payable to the adviser pursuant thereto and that such contract be approved by the holders of a majority of the investment company’s outstanding shares of common stock as defined in the 1940 Act and discussed below.

Approval of the Proposed Agreement will require the affirmative vote of a majority of the Fund’s outstanding shares of common stock. As defined in the 1940 Act, a “majority of the outstanding shares” means the lesser of 67% of the voting securities present at a Special Meeting of Stockholders, if a quorum is present, or 50% of the outstanding securities. For this purpose, abstentions will have the effect of a vote against the Proposed Agreement. If this proposal is not approved by stockholders, the Fund will continue under the Current Agreements until December 31, 2018, while the Board of Directors considers other steps.

A Form of the Proposed Agreement is attached as Appendix A.

THE BOARD RECOMMENDS THAT THE STOCKHOLDERS VOTE “FOR” THE PROPOSAL TO APPROVE THE PROPOSED AGREEMENT BETWEEN THE FUND AND MATTHEWS INTERNATIONAL CAPITAL MANAGEMENT, LLC.

8

GENERAL INFORMATION

Investment Manager

Allianz currently acts as the Investment Manager to the Fund pursuant to the Current Agreements. The principal business address of the Investment Manager is 1633 Broadway, 43rd Floor, New York, New York 10019.

Fund Administration

State Street Bank and Trust Company (the “Administrator”) currently acts as Administrator to the Fund pursuant to an Administration Agreement between the Administrator and the Fund. The principal business address of the Administrator is State Street Financial Center, One Lincoln Street, Boston, Massachusetts 02111.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Set forth below is information with respect to persons who are registered or beneficial owners of more than 5% of the Fund’s outstanding shares as of October 29, 2018.

Title Of Class | Name and Address | Shares | Percent of Class | |||||||||

| Common Stock | CEDE & CO Bowling Green STN P. O. Box 20 New York, NY 10274-0020 | [ ] | [ | ]% | ||||||||

The shares held by Cede & Co. include the accounts set forth below. The information below is based on publicly available information such as Schedule 13D and 13G disclosures filed with the SEC or other similar regulatory filings from foreign jurisdictions.

Title Of Class | Name and Address | Shares | Percent of Class | |||||||||

| Common Stock | City of London Investment Management Co. Ltd. 77 Gracechurch Street London EC3V 0AS England | [ ] | [ | ]% | ||||||||

| Common Stock | Lazard Asset Management 30 Rockefeller Plaza New York, NY 10112 | [ ] | [ | ]% | ||||||||

MISCELLANEOUS

Proxies will be solicited by mail and may be solicited in person or by telephone or facsimile or other electronic means, by officers of the Fund or personnel of the Administrator. The Fund has retained D.F. King & Co. to assist in the proxy solicitation. The total cost of proxy solicitation services, including legal and printing fees, is estimated at [$26,000], plusout-of-pocket expenses. The expenses connected with the solicitation of proxies including proxies solicited by the Fund’s officers or agents in person, by telephone or by facsimile or other electronic means will be borne by the Fund. The Fund will reimburse banks, brokers, and other persons holding the Fund’s shares registered in their names or in the names of their nominees for their expenses incurred in sending proxy material to and obtaining proxies from the beneficial owners of such shares.

In the event that sufficient votes in favor of Proposal 1 are not received by December 7, 2018, the persons named as attorneys in the enclosed proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. In addition, the chairman of the Meeting may adjourn any meeting of stockholders from time to time (a) to a date not more than 120 days after the original record date without notice other than announcement at

9

the meeting or (b) provided that a new notice is given and a new record date is set, to a date more than 120 days after the original record date. At such adjourned meeting at which a quorum is present, any business may be transacted which might have been transacted at the Meeting as originally notified. The Fund may set a subsequent record date and give notice of it to stockholders, in which case the meeting may be held not more than 120 days beyond the subsequent record date.

STOCKHOLDER PROPOSALS

In order to submit a stockholder proposal to be considered for inclusion in the Fund’s proxy statement for the Fund’s 2019 Annual Meeting of Stockholders, stockholder proposals had to be received by the Fund (addressed to The China Fund, Inc., c/o Secretary of the Fund/State Street Bank and Trust Company, P.O. Box 5049, One Lincoln Street, Boston, Massachusetts 02206-5409) not later than October 5, 2018. Any stockholder who desires to bring a proposal at the Fund’s 2019 Annual Meeting of Stockholders without including such proposal in the Fund’s Proxy Statement, must deliver written notice thereof to the Secretary of the Fund (addressed to The China Fund, Inc., c/o Secretary of the Fund / State Street Bank and Trust Company, P.O. Box 5049, One Lincoln Street, Boston, Massachusetts 02206-5049), not before December 27, 2018 and not later than January 26, 2019.

By order of the Board of Directors, |

Brian F. Link |

Secretary |

The China Fund, Inc. c/o State Street Bank and Trust Company |

P.O. Box 5049 |

One Lincoln Street |

Boston, Massachusetts 02206-5409 |

[ ], 2018

10

APPENDIX A

INVESTMENT ADVISORY AND MANAGEMENT AGREEMENT

Advisory Agreement, dated as of December —, 2018 (New York time) (the “Agreement”) between THE CHINA FUND, INC., a Maryland corporation (the “Fund”) and Matthews International Capital Management, LLC, a limited liability company organized and existing under the laws of the State of Delaware and registered as an investment adviser with the U.S. Securities and Exchange Commission (the “Investment Manager”).

WHEREAS, the Fund is aclosed-end,non-diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), shares of common stock of which are registered under the Securities Act of 1933, as amended; and

WHEREAS, the Fund’s investment objective is long-term capital appreciation which it seeks to achieve by investing primarily in equity securities of China companies (as that term is defined in the Prospectus, dated June 27, 2005 (the “Prospectus”) contained in the Fund’s Registration Statement on FormN-2 (FileNo. 333-124392) (the “Registration Statement”));

WHEREAS, the Fund desires to retain the Investment Manager to render investment management services to the Fund and the Investment Manager is willing to render such services;

NOW, THEREFORE, in consideration of the mutual covenants hereafter contained, it is hereby agreed by and between the parties hereto as follows:

1. Appointment of Investment Manager.

(a) The Fund hereby employs the Investment Manager for the period and on the terms and conditions set forth herein, subject at all times to the supervision of the Board of Directors of the Fund, to:

i. Other than with respect to the portion of the Fund’s assets invested in “direct investments” (assets of the Fund that are invested in securities that at the time of such investment are not (or approved for listing) on a securities exchange), make all investment decisions for the assets of the Fund (the “Assets”) and to manage the investment and reinvestment of the Assets in accordance with the investment objective and policies of the Fund set forth in the Fund’s Prospectus, and as such investment objective and policies are amended from time to time by the Fund’s Board of Directors, and subject always to the restrictions of the Fund’s Articles of Incorporation andBy-Laws, as amended or restated from time to time, and the provisions of the 1940 Act. Should the Board of Directors for the Fund at any time make any definite determination as to investment policy and notify the Investment Manager thereof, the Investment Manager shall be bound by such determination for the period, if any, specified in such notice or until similarly notified that such determination has been revoked. The Investment Manager shall vote the Fund’s proxies in connection with its Assets in accordance with the Investment Manager’s proxy voting policy as may be amended from time to time, provided that the Board of Directors of the Fund receives at least ten days advance notice of any such material amendment. The Investment Manager shall make such reports to the Board concerning such proxy voting as the Board may deem necessary or advisable. It is understood and acknowledged that no assurance has been or can be provided that the investment objective of the Fund can or will be achieved. The Investment Manager shall take, on behalf of the Fund, all actions which it deems necessary to implement the investment policies of the Fund applicable to the Fund’s Assets and, with respect to the Fund’s Assets, to place all orders for the purchase or sale of portfolio securities for the Fund with brokers or dealers selected by the Investment Manager, and in connection therewith, the Investment Manager is authorized as agent of the Fund to give instructions to the custodians from time to time of the Fund’s Assets as to deliveries of securities and payments of cash for the account of the Fund. In connection with the selection of such brokers or dealers and the placing of such orders, the Investment Manager is directed at all times to seek to use its reasonable efforts to obtain for the Fund the most favorable net results available (“best

11

execution”). In using its reasonable efforts to obtain for the Fund best execution, the Investment Manager shall consider all factors it deems relevant, including, by way of illustration, price, the size of the transaction, the nature of the market security, the amount of the commission, the timing of the transaction taking into account market prices and trends, the reputation, experience and financial stability of the broker or dealer involved and the quality of service rendered by the broker or dealer in other transaction. Subject to such policies as the Fund may communicate to the Investment Manager in writing, the Investment Manager shall not be deemed to have acted unlawfully or to have breached any duty created by this Agreement solely by reason of its having caused the Fund to pay a broker or dealer that provides brokerage and research services to the Investment Manager or its affiliates an amount of commission for effecting a portfolio investment transaction in excess of the amount of commission another broker or dealer would have charged for effecting that transaction, if the Investment Manager determines in good faith that such amount of commission was reasonable. Subject to these requirements and the provision of the 1940 Act, the U.S. Securities Exchange Act of 1934 and any other applicable provisions of law, nothing shall prohibit the Investment Manager from selecting brokers or dealers with which it or the Fund is affiliated.

It is also understood that it is desirable for the Fund that the Investment Manager have access to investment and market research and securities and economic analyses provided by brokers and others. It is also understood that brokers providing such services may execute brokerage transactions at a higher cost to the Fund than might result from the allocation of brokerage to other brokers on the basis of seeking the most favorable price and efficient execution. Therefore, the purchase and sale of securities for the Fund may be made with brokers who provide such research and analysis, subject to review by the Fund’s Board of Directors from time to time with respect to the extent and continuation of this practice to determine whether the Fund benefits, directly or indirectly, from such practice. It is understood by both parties that the Investment Manager may select broker-dealers for the execution of the Fund’s portfolio transactions who provide research and analysis as the Investment Manager may lawfully and appropriately use in its investment management and advisory capacities, whether or not such research and analysis may also be useful to the Investment Manager in connection with its services to other clients.

On occasions when the Investment Manager deems the purchase or sale of a security to be in the best interest of the Fund as well as of other clients, the Investment Manager, to the extent permitted by applicable laws and regulations, may aggregate the securities to be so purchased or sold in order to obtain the most favorable price or lower brokerage commissions and the most efficient execution. In such event, allocation of the securities so purchased or sold, as well as the expenses incurred in the transaction, will be made by the Investment Manager in the manner it considers to be the most equitable and consistent with its fiduciary obligations to the Fund and to such other clients;

ii. Prepare and make available to the Fund as reasonably requested by the Board of Directors pertinent research and statistical data; and

iii. Maintain or cause to be maintained for the Fund all books and records required under the 1940 Act, to the extent that such books and records are not maintained or furnished by administrators, custodians or other agents of the Fund.

(b) The Investment Manager accepts such appointment and agrees during the term of this Agreement (i) to render such services, (ii) to permit one of its or its affiliate’s directors, officers or employees to serve without compensation as an officer of the Fund if elected to such positions and to assume the obligations herein for the compensation herein provided, (iii) to manage the hosting and updating of the Fund’s website, (iv) to produce the Fund’s monthly investor update, (v) to assist the Fund’s marketing efforts, (vi) to assist the Fund’s Treasurer in identifying passive foreign investment companies (PFICs) in the Fund’s portfolio, (vii) to providesub-certifications regarding the Investment Manager to support certifications made by officers of the Fund in

12

documents filed by the Fund with the SEC, (viii) to identify securities in the Fund’s portfolio that constitute holdings of 5% or more voting shares of a portfolio company, (ix) to assist in identifying securities that are restricted or illiquid securities, (x) to provide the Fund with information on brokerage commissions incurred by the Fund, and (xi) to provide such other services as may be agreed between the Fund and the Investment Manager from time to time. The Investment Manager shall for all purposes herein provided be deemed to be an independent contractor, and unless otherwise expressly provided or authorized, shall have no authority to act for or represent the Fund in any way or otherwise be deemed an agent of the Fund.

(c) The Investment Manager hereby acknowledges the Fund has informed it that the Fund may allocate a portion of its assets to “direct investments” (assets of the Fund that are invested in securities that at the time of such investment are not listed (or approved for listing) on a securities exchange). The portion, if any, of the Fund’s Assets is actually invested in direct investments shall be managed by such entity as may be appointed by the Fund to manage the assets of the Fund other than the Assets (the “Direct Investment Manager”) in accordance with the terms of a separate investment management and advisory services agreement entered into by and between the Fund and the Direct Investment Manager (the “Direct Investment Management Agreement”). Whenever the Direct Investment Manager shall recommend the investment of Fund assets in a direct investment, the Fund shall instruct the Investment Manager in writing as to the amount of Fund assets sought to be invested in such direct investment, and the Investment Manager shall, within ten business days thereafter (or such other period of time as the Fund may direct in writing, but such period may not be less than 10 business days), liquidate sufficient portfolio securities to realize such amount and make the net proceeds thereof available for investment in such direct investment. Upon the sale of a direct investment, the Direct Investment Manager shall make the net proceeds thereof available as soon as reasonably practicable for investment pursuant to this Agreement by the Investment Manager.

(d) As of the date of this Agreement, the Fund has no intention to make any direct investment for the foreseeable future. The Fund hereby agrees that the Investment Manager shall be entitled to delegate all or any of its functions, powers, discretions, duties and obligations, to any person or persons, including one or more investment advisers or participating affiliates that control, are controlled by or are under common control with the Investment Manager, and any such delegation may be on such terms and conditions as the Investment Manager thinks fit provided that any such delegation shall not relieve the Investment Manager of its obligations under this Agreement; provided, however, that no delegation of investment management powers and functions may occur unless approved in advance by the Board of Directors of the Fund and, if required by the 1940 Act, by the Fund’s stockholders; and provided further that no delegation of any other powers or functions may occur unless the Investment Manager has given the Board of Directors of the Fund at least 30 days prior notice of such delegation.

2. Compensation. For the services and facilities described in Section 1, the Fund agrees to pay in United States dollars to the Investment Manager, a fee in accordance with the schedule set forth as Exhibit A hereto. For the month and year in which this Agreement becomes effective or terminates, there shall be an appropriate proration on the basis of the number of days that this Agreement is in effect during such month and year, respectively. For the avoidance of doubt, the amounts paid as compensation under this Section 2 are separate from, and in addition to, any amounts paid by the Fund as expenses or otherwise under Section 6 of this Agreement.

3. Investment in Fund Stock. The Investment Manager agrees that it will not make a short sale of any capital stock of the Fund, or purchase any share of the capital stock of the Fund.

4. Non-Exclusivity of Services. Nothing herein shall be construed as prohibiting the Investment Manager or any of its affiliates from providing investment advisory services to, or entering into investment advisory agreements with, any other clients (including other registered investment companies), including clients which may invest in Chinese equity securities, so long as the Investment Manager’s services to the Fund pursuant to this Agreement are not materially impaired thereby. The Investment Manager is not obligated to purchase or sell for the Fund any security which the Investment Manager or its affiliates may purchase or sell for their own accounts or other clients.

5. Standard of Care; Indemnification. The Investment Manager may rely on information reasonably believed by it to be accurate and reliable. Neither the Investment Manager nor its officers, directors, employees, agents or controlling persons (as defined in the 1940 Act) shall be subject to any liability for any act or

13

omission, error of judgment or mistake of law, or for any loss suffered by the Fund, in the course of, connected with or arising out of any services to be rendered hereunder, except by reason of willful misfeasance, bad faith or gross negligence on the part of the Investment Manager in the performance of its duties or by reason of reckless disregard on the part of the Investment Manager of its obligations and duties under this Agreement. Any person, even though also employed by the Investment Manager, who may be or become an employee of the Fund shall be deemed, when acting within the scope of his employment by the Fund, to be acting in such employment solely for the Fund and not as an employee or agent of the Investment Manager. In no event will the Investment Manager have any responsibility for any portion of the Fund other than the Assets or for the acts or omissions of any Direct Investment Manager or any other adviser of the Fund. In particular, the Investment Manager shall have no responsibility for the Fund’s being in violation of any applicable law or regulation or investment policy or restriction or instruction applicable to the Fund as a whole or for the Fund’s failing to qualify as a regulated investment company under the Internal Revenue Code of 1986, as amended (the “Code”), if the Fund’s holding of the Assets is such that the Assets would not be in such violation or if the Fund would not fail to qualify if the Assets were deemed a separate series of the Fund or a separate “regulated investment company” under the Code.

The Fund agrees to indemnify and hold harmless the Investment Manager, its officers, directors, employees, agents, shareholders, controlling persons or other affiliates (each an “Indemnified Party”), for any losses, taxes, costs, charges assessments, claims and liabilities (including, without limitation, liabilities arising under the Securities Act of 1933, as amended (“1933 Act”), the Securities and Exchange Act of 1934, as amended (the “1934 Act”), the 1940 Act, and any state and foreign securities laws, all as amended from time to time) and expenses, including (without limitation) reasonable attorneys’ fees and disbursements incurred or suffered by any Indemnified Party arising from any action, proceeding or claims which may be brought against such Indemnified Party in connection with the performance ornon-performance in good faith of its functions under this Agreement, including taking or omitting to take any action at the request or on the direction of or in reliance on the advice of the Fund, except to the extent resulting from willful misfeasance, bad faith or gross negligence in the performance of such Indemnified Party’s duties or from reckless disregard on the part of such Indemnified Party of such Indemnified Party’s obligations and duties under this Agreement.

6. Allocation of Charges and Expenses.

(a) The Investment Manager shall assume and pay for maintaining its staff and personnel, and shall at its own expense provide the equipment, office space and facilities, necessary to perform its obligations hereunder. The Investment Manager shall pay the salaries and expenses of such officer of the Fund and any fees and expenses of such Directors of the Fund who, as contemplated by Section 1(b) hereof, is a director, officer or employee of the Investment Manager or any of its affiliates, provided, however, that the Fund, and not the Investment Manager, shall bear travel expenses or an appropriate fraction thereof of (i) any Director and/or officer of the Fund who is a director, officer or employee of the Investment Manager and (ii) the portfolio manager at the Investment Manager who is primarily responsible for Fund (or any other member of the investment team attending in lieu of that portfolio manager or, if at the invitation of the Board of Directors, in addition to the portfolio manager) to the extent that such expenses relate to attendance at meetings of the Board of Directors of the Fund or any committee thereof and provided, further, that such expenses are incurred in accordance with the Fund’s travel policy.

(b) In addition to the fee of the Investment Manager, the Fund shall assume and pay the following expenses: fees of any Direct Investment Manager; legal fees and expenses of counsel to the Fund; auditing and accounting expenses; taxes and governmental fees; New York Stock Exchange listing fees; dues and expenses incurred in connection with membership in investment company organizations; fees and expenses of the Fund’s custodian,sub-custodian, transfer agents, registrars and other service providers; fees and expenses with respect to administration, except as may be herein expressly provided otherwise; expenses for portfolio pricing services by a pricing agent, if any; expenses of preparing share certificates and other expenses in connection with the issuance, offering and underwriting of shares issued by the Fund; interest charges and other expenses on any borrowings or transactions that may be considered to involve leverage; insurance premiums on property or personnel of the Fund which inure primarily to the Fund’s benefit, including liability and fidelity bond insurance; third-party expenses relating to the development, hosting and maintenance of the Fund’s website; third-party expenses relating to investor and public relations and marketing; expenses of registering or qualifying securities of the Fund for public sale; freight, insurance and other charges in connection with the shipment of the Fund’s portfolio securities; brokerage

14

commissions or other costs of acquiring or disposing of any portfolio holding of the Fund; expenses of preparation and distribution of reports, notices and dividends to stockholders; expenses of the Fund’s dividend reinvestment and cash purchase plan; costs related to licenses for the Fund to use, distribution and/or publish data for any indexes used by the Fund; costs of stationery; any litigation expenses; costs of stockholder’s and other meetings; and all other charges and costs of the Fund’s operation plus any extraordinary andnon-recurring expenses, except as herein otherwise prescribed.

(c) To the extent the Investment Manager incurs any costs by assuming expenses which are an obligation of the Fund as set forth herein, the Fund shall promptly reimburse the Investment Manager for such costs and expenses, except to the extent the Investment Manager has otherwise agreed to bear such expenses. To the extent the services, other than those services set forth in Section 1(b) hereof, for which the Fund is obligated to pay are performed by the Investment Manager, the Investment Manager shall be entitled to recover from the Fund to the extent of the Investment Manager’s actual costs for providing such services.

7. Potential Conflicts of Interest

(a) Subject to applicable statutes and regulations, it is understood that directors, officers or agents of the Fund are or may be interested in the Investment Manager as directors, officers, employees, agents, shareholders or otherwise, and that the directors, officers, employees, agents or shareholders of the Investment Manager may be interested in the Fund as a director, officer, agent or otherwise.

(b) If the Investment Manager considers the purchase or sale of securities for the Fund and other advisory clients of the Investment Manager at or about the same time, transactions in such securities will be made for the Fund and such other clients in accordance with the Investment Manager’s trade allocation procedures, as may be amended from time to time, provided that the Board of Directors of the Fund receives at least ten days advance notice of any such amendment.

8. Duration and Termination.

(a) This Agreement shall be effective for a period of two years from the date of this Agreement and will continue in effect from year to year thereafter, provided that such continuance is specifically approved at least annually by (i) a majority of the members of the Fund’s Board of Directors who are neither parties to this Agreement nor interested persons of the Fund or of the Investment Manager or of any entity regularly furnishing investment advisory services with respect to the Fund pursuant to an agreement with the Investment Manager, cast in person at a meeting called for the purpose of voting on such approval, and (ii) separately by the Fund’s Board of Directors (all Directors voting) or by vote of a majority of the Fund’s outstanding voting securities.

(b) This Agreement may nevertheless be terminated at any time, without payment of penalty, by the Investment Manager or by the Fund acting pursuant to a vote of its Board of Directors or by vote of a majority of the Fund’s outstanding securities upon sixty (60) days’ written notice. This Agreement shall automatically be terminated in the event of its assignment, provided, however, that a transaction which does not, in accordance with the 1940 Act, result in a change of actual control or management of the Investment Manager’s business shall not be deemed to be an assignment for the purposes of this Agreement. This agreement shall also be automatically terminated if the Investment Manager ceases to be registered as an investment adviser with the U.S. Securities and Exchange Commission.

(c) Termination of this Agreement shall not (i) affect the right of the Investment Manager to receive payments of any unpaid balance of the compensation described in Section 2 earned prior to such termination, or (ii) extinguish the Investment Manager’s right of indemnification under Section 5. As used herein, the terms “interested person,” “assignment,” and “vote of a majority of the outstanding voting securities” shall have the meanings set forth in the 1940 Act.

9. Amendment. This Agreement may be amended by mutual agreement if required by the 1940 Act or other applicable law, provided, that, any such amendment shall only become effective after the affirmative vote of (i) the holders of a majority of the outstanding voting securities of the Fund, and (ii) a majority of the members of the Fund’s Board of Directors who are not interested persons of the Fund or of the Investment Manager, cast in person at a meeting called for the purpose of voting on such approval.

15

10. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of New York, provided, however, that nothing herein shall be construed in a manner inconsistent with the 1940 Act.

11. Notices. Any communication hereunder must be in writing and must be made by letter, telex or facsimile. Any communication or document to be made or delivered by one person to another pursuant to this Agreement shall (unless that other person has by fifteen (15) days’ notice to the other specified another address) be made or delivered to that other person at the following relevant address:

If to the Investment Manager:

Matthews International Capital Management, LLC

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

Attention: Global Head of Distribution

Telephone No:415-954-4552

With copies to:

Matthews International Capital Management, LLC

Four Embarcadero Center, Suite 550

San Francisco, CA 94111

Attention: General Counsel

Telephone No:415-954-4555

If to the Fund:

The China Fund, Inc.

c/o State Street Bank and Trust Company

100 Summer Street,

Mail Stop: SUM0703

Boston, MA 02110

Attention: Brian F. Link

Telephone No.: 617-662-1504

With copies to:

Clifford Chance US LLP

31 West 52nd Street

New York, New York 10019-6131

Attention; Leonard Mackey, Esq.

Telephone No.:212-878-8000

Facsimile No.:212-878-8375

and shall, if made by letter, be deemed to have been received when delivered by hand or if sent by mail within two days if the letter is sent by prepaid airmail, and shall if made by telex be deemed to have been received when acknowledged by the addressee’s correct answer back code, and shall, if sent by facsimile, be deemed to have been received upon production of a transmission report by the machine from which the facsimile was sent which indicates that the facsimile was sent in its entirety to the facsimile number of the recipient, and shall, if sent by email or similar means of electronic transmission, shall be deemed received upon transmission to the email address specified above; and provided that a hard copy of the notice so served by telex, facsimile or email was posted that same day as the notice was served by electronic means.

16

12. Jurisdiction. Each party hereto irrevocably agrees that any suit, action or proceeding against either of the Investment Manager or the Fund arising out of or relating to this Agreement shall be subjectnon-exclusively to the jurisdiction of the United States District Court for the Southern District of New York or the Supreme Court of the State of New York, New York County, and each party hereto irrevocably submitsnon-exclusively to the jurisdiction of each such court in connection with any such suit, action or proceeding. Each party hereto waives any objection to the laying of venue of any such suit, action or proceeding in either such court, and waives any claim that such suit, action or proceeding has been brought in an inconvenient forum. Each party hereto irrevocably consents to service of process in connection with any such suit, action or proceeding by mailing a copy thereof in English by registered or certified mail, postage prepaid, to their respective addresses as set forth in the Agreement.

13. Representations and Warranties of the Investment Manager. The Investment Manager represents and warrants that it is duly registered as an investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and that it will use its reasonable efforts to maintain effective such registration during the term of this Agreement.

14. Representation and Warranty of the Fund. The Fund represents and warrants that it has full legal right to enter into this Agreement and to perform the obligations hereunder and that it has obtained all necessary consents and approvals to enter into this Agreement.

15. Provision of Certain Information by the Fund. The Fund shall furnish the Investment Manager with copies of the Fund’s Articles of Incorporation,By-laws and Registration Statement on FormN-2, as amended or restated from time to time, any press releases made by the Fund and any reports made by the Fund to its stockholders, as soon as practicable after such documents become available. The Investment Manager shall not be bound by the terms of these documents until delivered to the Investment Manager in accordance with Section 11 herein. The Fund shall furnish the Investment Manager with any further documents, materials or information that the Investment Manager may reasonably request to enable it to perform its duties pursuant to this Agreement.

16. Press Releases, Reports, Other Disclosures. Any reports, press releases or other disclosures made by the Fund which contain statements about the management of assets by the Investment Manager shall be subject to the prior approval of the Investment Manager. Any disclosure of Fund holdings and information derived therefrom, such as Fund holdings characteristics, must comply with the Investment Manager’s disclosure policy and procedures, as amended from time to time and informed to the Board of Directors of the Fund.

17. Name of Investment Manager. The parties agree that the Investment Manager has a proprietary interest in the name “Matthews.” The Fund shall not use the name “Matthews” in the name of the Fund unless and only to the extent the Investment Manager provides prior, written approval specifically referencing this Article 17 of this Agreement. Thereafter, the Fund agrees to promptly take such action as may be necessary to delete from the name of the Fund any reference to the name of the Investment Manager or the name “Matthews,” promptly after receipt from the Investment Manager of a written request therefor.

18. Severability. If any provision of the Agreement is determined by a court of competent jurisdiction to be invalid or unenforceable, such finding shall not affect the validity or enforceability of the remaining portions of this Agreement.

19. Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

20. Captions. The captions in this Agreement are included for convenience of reference only and in no way define any of the provisions hereof or otherwise affect their construction or effect.

17

IN WITNESS WHEREOF, the parties have executed this Agreement by their officers thereunto duly authorized as of the day and year first written above.

| THE CHINA FUND, INC. | ||

| By: |

|

| Name: | ||

| Title: | ||

| MATTHEWS INTERNATIONAL CAPITAL MANAGEMENT, LLC | ||

| By: |

|

| Name: | ||

| Title: |

18

EXHIBIT A

The Investment Manager shall receive a fee for its services under the Agreement, computed based on the actual number of days of that month and payable monthly within five (5) business days after the end of each calendar month, at the annual rates as set forth below:

0.70% of the Fund’s average daily net assets if the Fund’s average daily net assets exceed $150,000,000; and

0.80% of the Fund’s average daily net assets if the Fund’s average daily net assets do not exceed $150,000,000.

The net asset value of the Assets shall be determined in the manner provided in the Fund’s Registration Statement on FormN-2.

19

THE CHINA FUND, INC.

PROXY CARD

|

YOUR VOTE IS IMPORTANT NO MATTER HOW MANY SHARES YOU OWN.THE MATTERS WE ARE SUBMITTING FOR YOUR CONSIDERATION ARE SIGNIFICANT TO THE FUND AND TO YOU AS A FUND SHAREHOLDER. PLEASE TAKE THE TIME TO READ THE PROXY STATEMENT AND CAST YOUR PROXY VOTE TODAY! |

|

PROXY IN CONNECTION WITH THE SPECIAL MEETING OF STOCKHOLDERS

THE CHINA FUND, INC.

TO BE HELD ON DECEMBER 7, 2018

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. The undersigned stockholder(s) of THE CHINA FUND, INC. (the “Fund”), revoking previous proxies, hereby appoints Monique Labbe and Brian F. Link, or any of them, proxies of the undersigned, with full power of substitution to vote and act for and in the name and stead of the undersigned at the Special Meeting of Stockholders (the “Meeting”) of the Fund (“Special Meeting”), to be held at the offices of Clifford Chance US LLP, 31 West 52nd Street, New York, New York 10019 at 9:00 a.m., local time, on December 7, 2018, and at any and all adjournments thereof, according to the number of votes the undersigned would be entitled to cast if personally present.

In their discretion, the proxy holders named above are authorized to vote upon such other matters as may properly come before the Meeting or any adjournment thereof.

Receipt of the Notice of the Special Meeting and the accompanying Proxy Statement is hereby acknowledged. If this Proxy is executed but no instructions are given, the votes entitled to be cast by the undersigned will be cast “FOR” the Proposed Agreement.

PLEASE VOTE, DATE AND SIGN ON THE REVERSE SIDE HEREOF AND RETURN THE SIGNED PROXY PROMPTLY IN THE ENCLOSED ENVELOPE.

Do you have questions? If you have any questions about how to vote your proxy or about the Meeting in general, please call toll-free1-800-207-3156. Representatives are available to assist you Monday through Friday 9 a.m. to 10 p.m. Eastern Time.

The proxy statement is available online at:https://www.proxyonline.com/docs/[ ]

[PROXY ID NUMBER HERE]

| [BAR CODE HERE] | [CUSIP HERE]# | ||

THE CHINA FUND, INC.

PROXY CARD

|

YOUR SIGNATURE IS REQUIRED FOR YOUR VOTE TO BE COUNTED.

Please sign exactly as your name(s) appear(s) on the proxy card. Joint owners should each sign personally. Trustees and other fiduciaries should indicate the capacity in which they sign, and where more than one name appears, a majority must sign. If a corporation, the signature should be that of an authorized officer who should state his or her title.

| SIGNATURE (AND TITLE IF APPLICABLE) | DATE |

| SIGNATURE (IF HELD JOINTLY) | DATE |

TO VOTE, MARK ONE CIRCLE IN BLUE OR BLACK INK. Example: ●

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTEFOR THE FOLLOWING:

| 1. | Proposal: | FOR | AGAINST | ABSTAIN | ||||

To approve the proposed Investment Advisory and Management Agreement between the Fund and Matthews International Capital Management, LLC. | ☐ | ☐ | ☐ | |||||

| YES | NO | |||||||

| I plan to attend the Special Meeting | ☐ | ☐ |

You can vote on the internet, by telephone or by mail. Please see the reverse side for instructions.

PLEASE VOTE ALL YOUR BALLOTS IF YOU RECEIVED MORE THAN ONE BALLOT DUE TO MULTIPLE INVESTMENTS IN THE FUND. REMEMBER TO SIGN AND DATE ABOVE BEFORE MAILING IN YOUR VOTE. THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED.

THANK YOU FOR VOTING

[PROXY ID NUMBER HERE]

| [BAR CODE HERE]

| [CUSIP HERE]#

| ||