Abatix Corp.

8201 Eastpoint Drive, Suite 500

Dallas, Texas 75227

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO STOCKHOLDERS OF ABATIX CORP.:

The 2004 Annual Meeting of the Stockholders of Abatix Corp., a Delaware corporation, will be held at the Company’s corporate offices at 8201 Eastpoint Drive, Suite 500, Dallas, Texas 75227 on Thursday, May 6, 2004 at 9:00 A.M. Central Time, or at any and all adjournments thereof, for the following purposes:

- To elect five directors to the Board of Directors;

- To ratify of the appointment of independent auditors; and

- To transact such other business as may properly come before the meeting or any adjournment thereof.

The foregoing items are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors set April 6, 2004 as the record date for the meeting. Only record owners of the Company’s common stock at the close of business on that date are entitled to notice of, and to vote, at the meeting and at any adjournment or postponement thereof.

We urge each stockholder to promptly to date, sign and return the enclosed proxy card.

BY ORDER OF THE BOARD OF DIRECTORS,

Gary L. Cox,Secretary

Dallas, Texas

April 19, 2004

Abatix Corp.

8201 Eastpoint Drive, Suite 500

Dallas, Texas 75227

PROXY STATEMENT

We are furnishing this Proxy Statement to our stockholders in connection with the solicitation of proxies by and on behalf of the Board of Directors of Abatix Corp., a Delaware corporation (the “Company”) for use at the 2004 Annual Meeting of Stockholders (“Annual Meeting”) to be held at the Company’s corporate offices at 8201 Eastpoint Drive, Suite 500, Dallas, Texas 75227 on Thursday, May 6, 2004 at 9:00 A.M., Central Time, or at any and all adjournments thereof.

The cost of this solicitation will be borne by the Company. Directors, officers and employees of the Company may solicit proxies by telephone, telegraph or personal interview.

The Annual Report of the Company for the fiscal year ended December 31, 2003 is being mailed together with this Proxy Statement and form of Proxy. The approximate date of mailing of this Proxy Statement and form of Proxy is April 19, 2004.

Voting Procedures

Only holders of record of the Company’s common stock, $.001 par value per share (“Common Stock”), at the close of business on April 6, 2004, are entitled to notice of and to vote at the Annual Meeting. On April 6, 2004, we had 1,711,148 shares of Common Stock issued and outstanding, each of which is entitled to one vote.

The holders of a majority of the shares of Common Stock issued and outstanding, present in person or represented by proxy, will constitute a quorum at the Annual Meeting. If a quorum is present, (1) directors will be elected by a plurality vote; and (2) the ratification of the retention of the independent auditors will require the affirmative vote of the holders of a majority of the shares of Common Stock present in person or by proxy at the Annual Meeting.

We are not aware of any items, other than those referred to in the accompanying Notice of Annual Meeting of Stockholders, which may properly come before the Annual Meeting or other matters incident to the conduct of the Annual Meeting. If, however, any other matters properly come before the Annual Meeting, the persons named as proxies on the enclosed form of proxy intend to vote in accordance with their judgment on the matters presented.

Abstentions will be treated as present both for purposes of determining a quorum and with respect to each proposal other than the election of directors. If brokers do not receive instructions from beneficial owners as to the granting or withholding of proxies, and may not or do not exercise discretionary power to grant a proxy with respect to such shares (“broker non-vote”), then shares not voted on such proposal, other than the election of directors, will be counted as not present and not cast with respect to such proposal. Accordingly, abstentions will have no effect on the election of directors, but will have the effect of a vote against the ratification of the independent auditors, and broker non-votes will have no effect on the election of directors or the ratification of the independent auditors.

If you come to the Annual Meeting, you can, of course, vote in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Annual Meeting, you must obtain from the record holder a proxy issued in your name. If you do not come to the Annual Meeting, your shares can be voted only if you have returned a properly executed proxy. If you hold your shares through a bank, broker, or other nominee, you must provide voting instructions to the bank, broker, or nominee; obtain a proxy issued in your name from such record holder; or if your bank, broker or nominee makes telephone or Internet voting available, follow the instructions the bank, broker or nominee will enclose with the proxy statement. If you execute and return your proxy, but do not give voting instructions, the shares represented by that proxy will be voted as recommended by the Board of Directors. You can revoke your authorization at any time before the shares are voted at the Annual Meeting by filing with the Secretary of the Company a written revocation or duly executed proxy bearing a later date. The proxy will also be deemed revoked with respect to any matter on which you vote in person at the Annual Meeting. Attendance at the Annual Meeting will not in and of itself constitute a revocation of a proxy. Unless otherwise marked, properly executed proxies in the form of the accompanying proxy card will be voted in favor of the election of each of the nominees for director and the ratification of the independent auditors.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of Common Stock as of March 31, 2004, by (i) each stockholder known to the Company to be the beneficial owner of more than 5% of the outstanding Common Stock, (ii) each director, nominee for director and executive officer of the Company and (iii) all directors and executive officers of the Company as a group. This information as to beneficial ownership was furnished to the Company by or on behalf of the persons named. Unless otherwise indicated, the business address of each person listed is 8201 Eastpoint Drive, Suite 500, Dallas, Texas 75227.

| | | Shares | | |

|---|

| | | Beneficially | | Percent of |

|---|

| Name | | Owned (1) | | Class (2) |

|---|

| Terry W. Shaver (3) | | 532,000 | | 31.1% |

| Gary L. Cox (4) | | 299,403 | | 17.5% |

| Frank J. Cinatl (5) | | 18,500 | | 1.1% |

| Donald N. Black (6) | | 5,100 | | 0.3% |

| Eric A. Young (6) | | 3,000 | | 0.2% |

| A. David Cook (6) | | - | | 0.0% |

| All executive officers and directors | | | | |

| as a group (5 persons) | | 858,003 | | 50.1% |

| MicroCapital LLC, et al. (7) | | 291,418 | | 17.0% |

- Unless otherwise provided, amount represents shares for which the beneficial owner has sole voting and investment power and includes options currently exercisable or exercisable within sixty (60) days.

- The percentage of class is calculated assuming that the beneficial owner has exercised any options or other rights to subscribe which are currently exercisable within sixty (60) days and that no other options or rights or warrants to subscribe have been exercised by anyone else.

- Mr. Shaver is President, Chief Executive Officer and Chairman of the Board of Directors of the Company.

- Mr. Cox is Executive Vice President, Chief Operating Officer, Secretary and a Director of the Company. Mr. Cox's wife, who was an employee of the Company until June 2003, owns approximately 1,400 shares in the Company's 401k Profit Sharing Plan. These shares are included above.

- Mr. Cinatl is Vice President, Chief Financial Officer and a Director of the Company. Mr. Cinatl's shares beneficially owned include approximately 4,500 shares held in the Company's 401k Profit Sharing Plan. These shares are included above.

- Mr. Black and Mr. Young are Directors of the Company. Mr. Cook is a Director nominee.

- These shares are owned by MicroCapital LLC, MicroCapital Fund LP and MicroCapital Fund Ltd. The business address for MicroCapital LLC and MicroCapital Fund LP is 201 Post Street, Suite 1001, San Francisco, California 94108. The business address for MicroCapital Fund Ltd. is c/o Citco Fund Services (Curacao), N.V., Kaya Flamboyan 9, Curacao, Netherland, Antilles. The information included in this table is derived from a report on Form 13G filed by the group with the Securities and Exchange Commission on February 25, 2004.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

The December 2003 Form 4 for Gary L. Cox was inadvertently filed 18 days late on January 8, 2004 instead of December 21, 2003.

ELECTION OF DIRECTORS

(Proposal 1)

General

The Company’s By-laws, as amended, provide that the size of the Board shall be fixed from time to time by resolution of the Board. Currently, the number of directors is fixed at five.

Effective January 26, 2004, Mr. Daniel M. Birnley, a member of the audit and compensation committees, resigned from the Board of Directors to pursue other business interests. The Board of Directors has selected Mr. A. David Cook to stand for election at this Stockholders’ Meeting. If elected, Mr. Cook will be appointed to the audit, compensation and nominating corporate governance committees.

As part of the corporate governance reforms for Nasdaq, the majority of directors of a Nasdaq listed company must be independent. To accommodate this rule within the required time period, Mr. Frank J. Cinatl, who is currently part of management of the Company and also a director is not standing for re-election at the Annual Meeting.

Each Director is elected for a period of one year at the Company’s annual meeting of stockholders. Executive officers are appointed annually and, except to the extent governed by employment contracts, serve at the discretion of the Board of Directors.

Section 145 of the General Corporation Law of Delaware permits the indemnification of directors, officers, employees and agents of Delaware corporations. The Company’s Certificate of Incorporation and By-Laws provide that the Company shall indemnify its Directors and Officers to the full extent permitted by the General Corporation Law of the State of Delaware.

The Board of Directors is responsible for the overall affairs of the Company. The names of the nominees, their principal occupations and the year in which they became Directors, are set forth.

Nominees for Election

TERRY W. SHAVER, Director since 1988, Age 46

Mr. Shaver has served as President, Chief Executive Officer and Chairman of the Board and a director of the Company since its incorporation in December 1988 and of its predecessor, T&T Supply Company, Inc., since its organization in 1983.

GARY L. COX, Director since 1988, Age 50

Mr. Cox has been Executive Vice President, Chief Operating Officer and a director of the Company since its organization. Mr. Cox was a director of its predecessor company, T&T Supply Company, Inc., since its organization in 1983 and a vice president since 1985.

DONALD N. BLACK, Director since 1998, Age 52

Mr. Black was appointed a Director of the Company in February 1998, and was elected a Director at the 1998 annual meeting. Currently, Mr. Black is a partner and President of Turnkey Concepts, a health and beauty aid product development company. Between 1979 and 1996, Mr. Black was employed by and owned Gena Laboratories Inc., a manufacturer and distributor of professional beauty products.

Mr. Black is the Chairman of the Audit Committee, a member of the Compensation Committee and will be a member of the Nominating and Corporate Governance Committee.

ERIC A. YOUNG, Director since 2001, Age 46

Mr. Young was elected a Director of the Company in May 2001. Since 2000, Mr. Young has been the Vice President-Sales & Marketing at QuietFlex Manufacturing Co., LP in Houston, Texas. From 1990 until 2000 he was President of Comfort Supply, Inc., a Houston based distribution company and a subsidiary of Watsco, Inc. where he was also a Group Vice President.

Mr. Young is the Chairman of the Compensation Committee, a member of the Audit Committee and will be a member of the Nominating and Corporate Governance Committee.

A. DAVID COOK, Nominee, Age 48

Mr. Cook is nominated to stand for election at the Annual Meeting. Since 2001, Mr. Cook has been Vice President of Sales and Marketing for SCP Pool Corporation. In 1997, he was promoted to Vice President with general manager duties of the company's largest operating division, as well as directing the entire company's sales efforts. Between 1988 and 1997, Mr. Cook developed new locations and directed the sales efforts for SCP Pool.

Mr. Cook will appointed to the Audit, Compensation and Nominating and Corporate Governance Committees.

Other Information about the Board of Directors and its Committees

The Board of Directors met five times during 2003. During the last full fiscal year, each director attended 75% or more of the total number of meetings of the Board, and 75% or more of the total number of meetings held by all committees of the Board on which he served. The Board has determined that each member of the Board or Board nominee, other than Messrs. Shaver and Cox, meets the definition of “independent director” as defined by Rule 4200(a)(15) of the National Association of Securities Dealers, Inc. (“NASD”). Mr. Black has been designated by the Board as its lead independent director and as such, Mr. Black will preside at any meetings of the Board’s independent directors and perform such other functions as the Board may direct, including recommending agenda items for Board meetings. There are no family relationships among the Company’s Executive Officers and Directors.

In 2003, each non-employee director was paid an annual fee of $7,500. Directors are also reimbursed for reasonable expenses incurred in connection with their attendance at Board and committee meetings.

Stockholders may communicate with members of the Company’s Board by mail addressed to the full Board, a specific member of the Board or to a particular committee of the Board at 8201 Eastpoint Drive, Suite 500, Dallas, Texas 75227.

The Company has adopted a Code of Business Conduct and Ethics that applies to the Company’s employees, officers (including the Company’s principal executive officer and principal financial officer) and directors. The Code of Business Conduct and Ethics is posted on the Company’s website at www.abatix.com and can also be obtained free of charge by sending a request to the Company’s Corporate Secretary at 8201 Eastpoint Drive, Suite 500, Dallas, Texas 75227.

The Board presently has an Audit Committee and a Compensation Committee. The Nominating and Corporate Governance Committee will be formed at the next regularly scheduled meeting of the Board of Directors. A description of those committees follows:

Audit Committee. The Audit Committee’s duties include the selection and recommendation of independent auditors subject to the approval of the stockholders, review of the scope and results of the annual audit, and review of the adequacy and effectiveness of the Company’s internal control structure. The Audit Committee met four times during 2003. The Board of Directors has determined that all members of the Audit Committee are independent, and that Mr. Young meets the requirements of a financial expert, as required and defined by the standards of the National Association of Securities Dealers and the rules of the Securities and Exchange Commission. A copy of the audit committee charter is attached as an exhibit to the Proxy Statement.

Compensation Committee. The Compensation Committee makes recommendations to the Board regarding the compensation of officers of the Company, the awards under the Company’s compensations and benefits plans and the Company’s compensation policies and practices. The Compensation Committee’s specific responsibilities are set forth in its written charter, a copy of which is included as an exhibit to the Proxy Statement. The Board of Directors has determined that each member of the Compensation Committee is independent. The Compensation Committee met one time during 2003.

Nominating and Corporate Governance Committee. The Nominating Committee’s primary purpose is to provide oversight on a broad range of issues surrounding the composition of the Board, including identifying individuals qualified to become Board members, recommending to the Board director nominees for the next annual meeting of stockholders, and assisting the Board in the areas of committee member selection, evaluation of the overall effectiveness of the Board and committees of the Board, and review and consideration of corporate governance practices. The Nominating and Corporate Governance Committee has the authority to recommend to the Board candidates for Board membership. Stockholders may also make recommendations for director nominations by sending a letter to the Nominating and Corporate Governance Committee, or may make a nomination by complying with the notice procedures set forth in the Company’s By-laws, as amended. The specific responsibilities of the Nominating and Corporate Governance Committee are set forth in its written charter, a copy of which is included as an exhibit to the Proxy Statement. The Board of Directors has determined that each member of the Nominating and Corporate Governance Committee is independent. This committee will be formed at the next meeting of the Board of Directors.

When identifying, evaluating and considering potential candidates for membership on the Company’s Board, including those recommended or nominated by stockholders, the Nominating and Corporate Governance Committee considers relevant educational, business and industry experience and demonstrated character and judgment.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF NOMINEES FOR DIRECTORS SET FORTH ABOVE.

EXECUTIVE COMPENSATION

Compensation Committee Report

The compensation program for Abatix is administered in a manner that promotes the attainment of reasonable profits on a consistent basis in order to preserve job protection and job security; that promotes and rewards productivity and dedication to the success of Abatix; that accomplishes internal equity among its people; and that responds to the influence of external market forces.

The above principles are applied to all employees, including executive officers. The Compensation Committee of the Board of Directors reviews the compensation of Abatix’s executive officers on an annual basis. They consider the total compensation (both salary and incentives), as well as the recommendation of the Company’s President, in establishing each element of compensation.

At current cash compensation levels, the Compensation Committee does not expect Internal Revenue Service regulations regarding maximum deductibility of executive compensation to have any application to the Company.

The principal elements of compensation for Abatix’s executive officers are the following:

Base Salary. As a rule, base salary for the executive officers of Abatix is comparable to the salaries for comparable positions in comparably sized companies. The Compensation Committee bases this determination on information obtained for similarly situated businesses; its impression of the prevailing business climate; and the advice of the Company’s President. Annual salary increases, if any, for executive officers as a group are not more, on a percentage basis, than those received by other employees.

Annual Incentive Bonus. The Compensation Committee determines the amount of each bonus for executive officers at the end of each year.

In fixing the salary and bonus amounts for 2003, the Compensation Committee considered the performance of each individual, his or her level of responsibility within the Company, the Company’s profitability, the longevity in office of each officer, and each officer’s performance as a team member. However, no mathematical weighing formulae were applied with respect to any of these factors. In evaluating an individual’s performance, the Compensation Committee relied on the recommendation of the President, whose recommendation is based on his own perception of such officer’s performance.

The Company does not use defined performance targets in establishing compensation, nor does it employ minimum, targeted or maximum amounts of bonuses or total compensation levels for the executive officers and the final determination of compensation is subjective.

Automobiles. Each executive officer of the Company is supplied with a vehicle owned and maintained by the Company.

Stock Options. In an effort to provide a long-term incentive for future performance that aligns officers’ interests with shareholders in general, the Company has granted stock options to executive officers and other key employees in the past or may in the future. Currently, there are no options outstanding, nor are there any options available for grant.

Executive officers, including the President, participate in the Abatix 401(K) Profit Sharing Plan, which is available to all Abatix employees on the same basis.

COMPENSATION COMMITTEE

Eric A. Young, Chairman

Donald N. Black

All of the Company’s Executive Officers are full-time employees. Total cash compensation paid to all Executive Officers as a group for services provided to the Company in all capacities during the fiscal year ended in December 31, 2003 aggregated to $685,400. Set forth below is a summary compensation table in the tabular format specified in the applicable rules of the Securities and Exchange Commission with respect to all Executive Officers of the Company or any of its subsidiaries who received total salary and bonus that exceeded $100,000 during the periods reflected.

Summary Compensation Table

| | | | | Annual Compensation

| | Long Term Compensation

| | |

|---|

| | | | | | | | | | | | | Securities | | | | |

|---|

| Name and principal | | | | | | | | | | Restricted | | underlying | | | | |

|---|

| position | | | | | | | | Other annual | | stock | | Options/ | | LTIP | | All other |

|---|

| | Year

| | Salary

| | Bonus

| | compensationa

| | award(s)

| | SARs (#)

| | payouts

| | compensation

|

|---|

| Terry W. Shaver, | | 2003 | | $216,000 | | $45,000b | | $12,000 | | - | | - | | - | | - |

| President and CEO | | 2002 | | $206,400 | | $40,000b | | $12,000 | | - | | - | | - | | - |

| | | 2001 | | $195,000 | | $ -b | | $12,000 | | - | | - | | - | | - |

| |

| Gary L. Cox, | | 2003 | | $216,000 | | $45,000c | | $12,000 | | - | | - | | - | | - |

| Exec. V.P. and COO | | 2002 | | $206,400 | | $40,000c | | $12,000 | | - | | - | | - | | - |

| | | 2001 | | $195,000 | | $20,000c | | $12,000 | | - | | - | | - | | - |

| |

| Frank J. Cinatl, | | 2003 | | $134,400 | | $29,000d | | $ 8,000 | | - | | - | | - | | - |

| V.P. and CFOe | | 2002 | | $128,400 | | $25,000d | | $ 8,000 | | - | | - | | - | | - |

| | | 2001 | | $122,140 | | $ -d | | $ 8,000 | | - | | - | | - | | - |

- Amounts represent the estimated annual value of vehicles and related maintenance benefits provided to such Executive Officers.

- Mr. Shaver elected to defer the payment of his 2001 bonus of $40,000 until January 2002 and his 2002 bonus of $45,000 until January 2003. Mr. Shaver did not receive a bonus for 2003.

- Mr. Cox elected to defer the payment of his 2000 bonus of $20,000 until January 2001, his 2001 bonus of $40,000 until January 2002 and his 2002 bonus of $45,000 until January 2003. Mr. Cox did not receive a bonus for 2003.

- Mr. Cinatl elected to defer the payment of his 2001 bonus of $25,000 until January 2002, his 2002 bonus of $29,000 until January 2003 and his 2003 bonus of $5,000 until January 2004.

- Mr. Cinatl has been Vice President and Chief Financial Officer of the Company since 1994 and was a director of the Company from 1999 until 2004.

There are currently no stock options, stock appreciation rights or long-term compensation plans for any employees, including the executives, of the Company.

Employment Agreements

Messrs. Shaver and Cox are parties to employment agreements with the Company expiring December 31, 2004. These agreements provide for minimum annual compensation of $216,000 each. Such employment agreements preclude each individual from competing with the Company for a period of twelve months following termination of his employment for cause or by reason of his voluntarily leaving the employ of the Company. The employment agreements also require them to maintain the confidentiality of proprietary data relating to the Company and its activities and services. The employment agreements also provide for certain executive benefits such as the use of an automobile, reimbursement of business expenses, health insurance and related benefits.

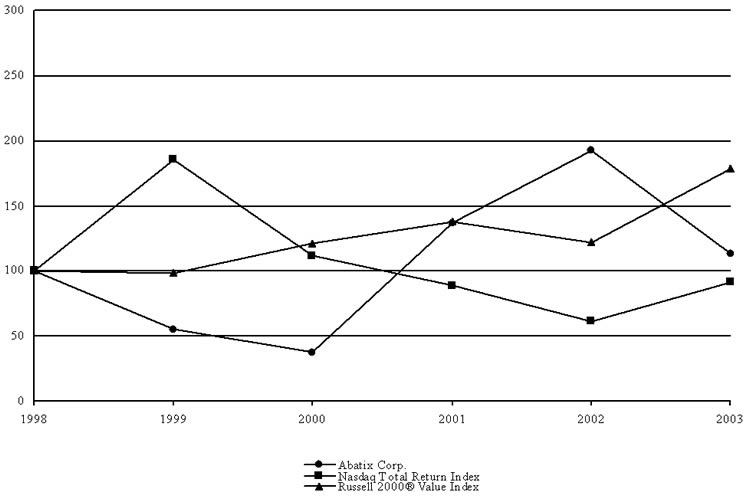

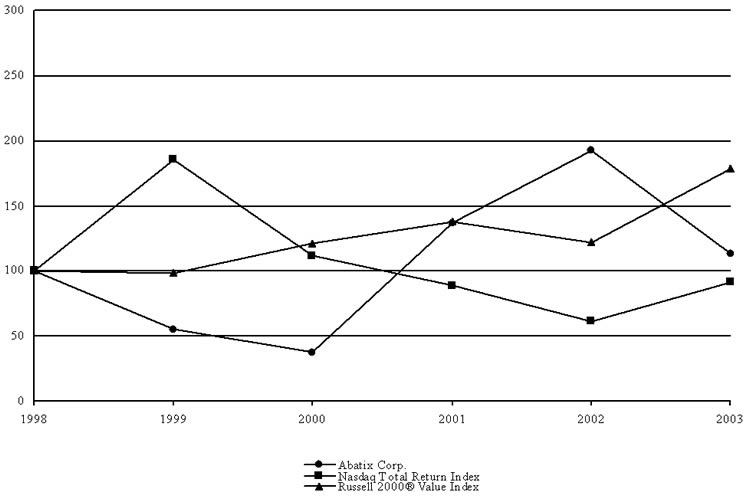

Performance Graph

The following graph compares total stockholder returns for the Company over the last five years to the CRSP Total Return Index for The NASDAQ Stock Market and for the Russell 2000® Value Index assuming a $100 investment made on December 31, 1998. The stock performance shown on the graph below is not necessarily indicative of future price performance. The closing price is used to compute the return for Abatix Corp.

| | | 1998

| | 1999

| | 2000

| | 2001

| | 2002

| | 2003

| |

|---|

| Abatix Corp. | | 100.00 | | 55.17 | | 37.93 | | 137.38 | | 193.10 | | 113.10 |

| Nasdaq Total Return Index | | 100.00 | | 185.43 | | 111.83 | | 88.76 | | 61.37 | | 91.75 | |

| Russell 2000® Value Index | | 100.00 | | 98.51 | | 121.00 | | 137.97 | | 122.20 | | 178.45 | |

| |

Retirement Plans

The Company has a 401(K) Plan, pursuant to which the Company contributed $115,262, $115,617, and $50,046 during 2003, 2002 and 2001, respectively. At this time, Terry W. Shaver, Gary L. Cox, Frank J. Cinatl and 89 other employees are eligible to participate in the 401(K) Plan, which requires all employees to have performed services to the Company for at least one year. Contributions by an employee in any one year may not exceed the Internal Revenue Service specified limits. The Company currently contributes 50% of the employees’ contributions up to 5% of their salary on an ongoing basis, but the Board of Directors may approve an increase or a decrease in the matching portion at any time in the future.

APPOINTMENT OF THE COMPANY’S AUDITORS

(Proposal 2)

Audit Committee Report

In accordance with its written charter adopted by the Board of Directors, the Audit Committee of the Board assists the Board in fulfilling its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company.

In discharging its oversight responsibility for the audit process, the Audit Committee discussed with the independent auditors all relationships between the auditors and the Company that might bear on the auditors’ independence consistent with Independence Standards Board Standard No. 1, “Independence Discussions with Audit Committees,” discussed with the independent auditors any other relationships that may impact their objectivity and independence and satisfied itself as to the auditors’ independence. The Audit Committee also discussed with management and the independent auditors, the quality and adequacy of the Company’s internal controls. The Audit Committee reviewed with the independent auditors their audit plans, audit scope and identification of audit risks.

The Audit Committee discussed and reviewed with the independent auditors all communications required by generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended, “Communication with Audit Committees” and, with and without management present, discussed and reviewed the results of the independent auditors’ examination of the financial statements.

The Audit Committee reviewed the audited financial statements of the Company as of and for the fiscal year ending December 31, 2003, with management and the independent auditors. Management has the responsibility for the preparation of the Company’s financial statements and the independent auditors have the responsibility for the examination of those statements.

Based on the above-mentioned review and discussions with management and the independent auditors, the Audit Committee recommended to the Board that the Company’s audited financial statements be included in its Annual Report on Form 10-K for the fiscal year ending December 31, 2003, for filing with the Securities and Exchange Commission. The Audit Committee also recommended the reappointment, subject to stockholder approval, of the independent auditors and the Board concurred in such recommendation.

AUDIT COMMITTEE

Donald N. Black, Chairman

Eric A. Young

Principal Accounting Firm Fees

Aggregate fees billed to the Company for the fiscal years ending December 31, 2003 and 2002, by the Company’s principal accounting firm, KPMG LLP, were as follows:

| | | 2003

| | 2002

|

| Audit fees | | $ 61,800 | | $ 56,000 |

| Financial information systems design and implementation fees | | - | | - |

| All other fees | | - | | - |

The appointment of KPMG LLP as independent auditors of the Company for the fiscal year ended December 31, 2004 will be ratified.

Although the Board of Directors of the Company is submitting the appointment of KPMG LLP for stockholder approval, it reserves the right to change the selection of KPMG LLP as auditors, at any time during the fiscal year, if it deems such change to be in the best interest of the Company, even after stockholder approval.

Representatives of KPMG LLP are expected to be present at the Annual Meeting with the opportunity to make a statement if they so desire, and will be available to respond to appropriate questions.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPOINTMENT OF THE COMPANY’S AUDITORS.

INTEREST OF CERTAIN PERSONS IN

OPPOSITION TO MATTERS TO BE ACTED UPON

The Company is not aware of any substantial interest, direct or indirect, by securities holdings or otherwise of any officer, director or associate of the foregoing persons in any matter to be acted on, as described herein, other than elections to offices.

STOCKHOLDER’S PROPOSALS TO BE PRESENTED AT

THE COMPANY’S NEXT ANNUAL MEETING OF

STOCKHOLDERS

Stockholder proposals intended to be presented at the 2005 Annual Meeting of Stockholders of the Company must be received by the Company, at its principal executive offices no later than February 28, 2005, for inclusion in the Proxy Statement and Proxy relating to the 2005 Annual Meeting of Stockholders.

AVAILABILITY OF FORM 10-K ANNUAL REPORT

Printed copies of the Company’s Annual Report on Form 10-K for the year ended December 31, 2003, as filed with the Securities and Exchange Commission, are available without charge to stockholders upon request to Mr. Frank J. Cinatl, Vice President and Chief Financial Officer, Abatix Corp., 8201 Eastpoint Drive, Suite 500, Dallas, Texas 75227. On-line copies are also available at the Company’s website, www.abatix.com/investor/.

BY ORDER OF THE BOARD OF DIRECTORS

Gary L. Cox, Secretary

Dallas, Texas

April 19, 2004

APPENDIX A

ABATIX CORP.

Charter of the Audit Committee of the Board of Directors

I. Purpose

- The Audit Committee is appointed to assist the Board in fulfilling its oversight responsibilities. The Audit Committee's role is one of oversight, whereas the Company's management is responsible for preparing the Company's financial statements and the independent auditors are responsible for auditing those financial statements. The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as anyone in the organization. The Audit Committee has the ability to retain, at the Company's expense, special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties. The Audit Committee shall prepare the report required by the rules of the Security and Exchange Commission ("SEC") to be included in the Company's annual proxy statement.

- The Audit Committee's primary duties and responsibilities are to:

- Monitor the integrity of the Company's financial reporting process and systems of internal controls regarding finance, accounting, and legal compliance.

- Appoint, compensate, retain and oversee the work of the independent auditors and resolve any disagreements between management and the independent auditors regarding financial reporting.

- Provide an avenue of communication among the independent auditors, management, and the Board of Directors.

- Assess the adequacy of the Company's financial disclosures

- Monitor the Company's compliance with legal and regulatory requirements

II. Composition and Meetings

- Audit Committee members shall be appointed by the Board of Directors upon the recommendation of a majority of the independent directors. If an audit committee Chair is not designated or present, the members of the Committee may designate a Chair by majority vote of the Committee membership.

- The Audit Committee shall be comprised of three or more directors, each of whom shall be independent nonexecutive directors, free from any relationship that would interfere with the exercise of his or her independent judgment. For the purposes hereof, the term "independent" shall mean a director who meets The Nasdaq Stock Market, Inc. standards of "independence," as determined by the Board. Each member of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements, and at least one member of the Committee shall have accounting or related financial management expertise, being an "audit committee financial expert" as defined by the SEC.

- No member of the Audit Committee may have participated in the preparation of financial statements of the Company for the past three years.

- The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Audit Committee Chair shall prepare and/or approve an agenda in advance of each meeting. The Committee should meet privately in executive session at least annually with management, the independent auditors, and as a committee to discuss any matters that the Committee or each of these groups believes should be discussed. In addition, the Committee, or at least its Chair, should communicate with management and the independent auditors' quarterly to review the Company's financial statements and significant findings based upon the auditors limited review procedures.

III. Responsibilities and Duties

- Review Procedures

- Review and reassess the adequacy of this Charter at least annually. Submit the charter to the Board of Directors for approval and have the document published at least every three years in accordance with SEC regulations.

- Review the Company's annual audited financial statements prior to filing or distribution. Review should include discussion with management and independent auditors of significant issues regarding accounting principles, practices, and judgments.

- In consultation with the management and the independent auditors, consider the integrity of the Company's financial reporting process and controls. Discuss significant financial risk exposures and the steps management has taken to monitor, control, and report such exposures. Review significant findings prepared by the independent auditors together with management's responses.

- Review with financial management and the independent auditors the company's quarterly financial results prior to the release of earnings and/or the company's quarterly financial statements prior to filing or distribution. Discuss any significant changes to the Company's accounting principles and any items required to be communicated by the independent auditors in accordance with SAS 61 (see item 9). The Chair of the Committee may represent the entire Audit Committee for purposes of this review.

- Independent Auditors

- The independent auditors are ultimately accountable to the Audit Committee and the Board of Directors. The Audit Committee shall review the independence and performance of the auditors and shall have sole authority to appoint and retain, subject to ratification by the Company's stockholders, the independent auditors or approve any discharge of auditors when circumstances warrant.

- Approve the fees and other significant compensation to be paid to the independent auditors, including the responsibility to approve in advance, except as otherwise permitted by law, all services, including non-audit services, performed by the independent auditor for the Company.

- On an annual basis, the Committee should review and discuss with the independent auditors all significant relationships they have with the Company that could impair the auditors' independence by obtaining a formal written statement delineating all relationships and all non-audit services and fees.

- Review the independent auditors audit plan - discuss scope, staffing, locations, and reliance upon management.

- Prior to releasing the year-end earnings, discuss the results of the audit with the independent auditors. Discuss certain matters required to be communicated to audit committees in accordance with AICPA SAS 61.

- Consider the independent auditors' judgements about the quality and appropriateness of the Company's accounting principles as applied in its financial reporting.

- Legal Compliance

- On at least an annual basis, review with the Company's counsel, any legal matters that could have a significant impact on the organization's financial statements, the Company's compliance with applicable laws and regulations, and inquiries received from regulators or government agencies.

- Ethics and Business Conduct

- Provide oversight to the business ethics and compliance program.

- Require management to report on procedures that provide assurance that the corporation's mission, values, and code of conduct are properly communicated to all employees on an annual basis.

- Review the corporation's code of conduct annually and direct management to establish a system reasonably designed to assure compliance with the code.

- Review the programs and policies of the company designed by management to assure compliance with applicable laws and regulations and monitor the results of the compliance efforts.

- Other Audit Committee Responsibilities

- Review all related party transactions for conflicts of interest, with the authority to approve all related party transactions.

- Annually prepare a report to shareholders as required by the Securities and Exchange Commission disclosing that the committee reviewed and discussed the audited financial statements with management and discussed certain other matters with the independent auditor. The report should be included in the Company's annual proxy statement.

- Perform any other activities consistent with this Charter, the Company's by-laws, and governing law, as the Committee or the Board deems necessary or appropriate.

- Maintain minutes of meetings and periodically report to the Board of Directors on significant results of the foregoing activities.

- Conduct an annual performance evaluation of the Committee and discuss those results with the Board of Directors.

APPENDIX B

ABATIX CORP.

Charter of the Compensation Committee of the Board of Directors

Purpose

The Compensation Committee (the “Committee”) of the Board of Director reviews and makes recommendations to the Board regarding compensations and benefits of executive officers and key employees of the Company. The Committee shall prepare an annual report on executive compensation for inclusion in the Company’s Proxy statement, in accordance with applicable rules and regulations of the Securities and Exchange Commission (“SEC”).

Composition

The Committee shall be composed of not less than three independent Directors. Each member shall be an outside director, independent of management, consistent with applicable rules and regulations of the SEC. The Members of the Committee shall be elected annually at the meeting of the Board of Directors, immediately following the shareholders meeting or as necessary to fill vacancies in the interim. The Chairman is elected by the Board or by the majority vote of the members.

Specific Duties and Responsibilities

The general responsibilities of the Committee are oversight of executive compensation for the President, and the Executive Officers and other key employees, communications with the full board, and communications with shareholders through the proxy statement.

Director Compensation and Equity-based Plans

The Committee shall make recommendations to the Board with respect to the compensation of directors and incentive-compensation plans and equity-based plans for all employees.

Stock Plan Administration

The Committee shall have full and final authority in connection with the administration of all plans of the Company under which common shares or other equity securities of the Company may be issued. In furtherance of the foregoing, the Committee shall, in its sole discretion, grant options and make awards of shares under the Company’s stock plans.

Chief Executive Officer ("CEO") Compensation and Goals

The Committee shall annually review and approve corporate goals and objectives relevant to CEO compensation, evaluate the CEO’s performance in light of those goals and objectives, and set the CEO’s compensation levels based on this evaluation. In determining the long-term incentive component of CEO compensation, the Committee will consider the Company’s performance and relative shareholder return, the value of similar incentive awards to CEO’s at comparable companies, and the awards given to the CEO in past years.

Approval of CEO and Executive Officer Compensation

The Committee shall annually review and approve for the CEO and the executive officers of the Company: (a) the annual base salary level, (b) the annual incentive opportunity level, (c) the long-term incentive opportunity level, (d) employment agreements, severance arrangements, and change in control agreement/provisions, in each case as, when and if appropriate, and (e) any special or supplemental benefits.

Delegation

The Compensation Committee may form and delegate authority to subcommittees when appropriate, provided any action taken by a subcommittee is subsequently reported to the Committee and ratified. The Committee may also delegate to the CEO the authority to grant options and make awards of shares under the Company’s stock plans under conditions established by the Committee.

Engaging Consultants

The Committee shall have the sole authority to retain and terminate any compensation consultant to be used to assist in the evaluation of director, CEO or executive officer compensation and shall have the sole authority to approve the consultant’s fees and other retention terms. The Committee shall also have authority to obtain advice and assistance from internal or external legal, accounting or other advisors.

Miscellaneous

All other duties as delegated by the Board of Directors.

Charter

The Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval.

Meetings

The Committee shall have at least one (1) regularly scheduled meeting but will meet as often as necessary to carry out its responsibilities. Meetings may be called by the Chairman of the Committee and/or the CEO of the Company. The Corporate Secretary will maintain one set of all Committee minutes and presentations to be filed as Corporate record and will be provided a set of all Committee correspondence. All meetings of the Committee shall be held pursuant to the By-laws of the Company with regard to notice and waiver thereof, and written minutes of each meeting shall be duly filed in the Company records. Reports of meetings of the Committee shall be made to the Board of Directors at its next regularly scheduled meeting following the Committee meeting accompanied by any recommendations to the Board of Directors approved by the Committee.

APPENDIX C

ABATIX CORP.

Charter of the Nominating and Corporate Governance Committee of the

Board of Directors

Organization and Member Qualifications

The nominating and corporate governance committee shall be comprised of at least three directors appointed by the Board, each of whom shall comply with the independence and other member qualification requirements of the Nasdaq Stock Market, Inc. and all legal requirements.

Committee Purpose and Authority

The nominating and corporate governance committee’s primary purpose is to provide oversight on the broad range of issues surrounding the composition and operation of the Board of Directors, including identifying individuals qualified to become Board members, recommending to the Board director nominees for the next annual meeting of shareholders and recommending to the Board a set of corporate governance principles applicable to the Company. The committee shall recruit, screen, interview and select prospective candidates for Board membership as necessary to fill vacancies or to meet the needs of the Board. The committee also provides assistance to the Board in the areas of committee member selection, evaluation of the overall effectiveness of the Board and committees of the Board, and review and consideration of corporate governance practices.

The committee shall have the sole authority to recommend to the Board candidates for Board membership, unless such authority belongs to a third party under the terms of the Company’s Articles of Incorporation, By-laws or any shareholder agreement that allocates the right to nominate directors to a third party.

Responsibilities

In meeting its responsibilities, the nominating committee will:

Nomination of Directors

- Evaluate and identify:

- nominees to fill vacancies on the Board that occur in between meetings of the shareholders; and

- prior to each annual meeting of shareholders, a slate of nominees to be presented for shareholder approval at the annual meeting.

- Consider nominees recommended by shareholders of record who comply with the shareholder nomination procedures established in the By-laws.

- Evaluate the qualifications and performance of each incumbent director prior to the end of his or her term and determine whether to nominate him or her for re-election to the Board.

- Review the Board’s committee structure no less than annually and recommend to the Board for its approval the directors to serve as members of each Board committee, keeping in mind the committee independence requirements of the Nasdaq Stock Market, Inc. and all legal requirements.

- Evaluate no less than annually the appropriateness of the composition and size of the Board of Directors. In carrying out this responsibility, the committee shall consider:

- the director independence requirements of the Nasdaq Stock Market, Inc. and all legal requirements;

- the collective educational and business experience of the members of the Board;

- the long-term interests of the Company's shareholders; and

- any other criteria deemed relevant by the committee.

- Determine whether at least one member of the Company’s audit committee is a “financial expert,” as that term is defined by the SEC in rulemaking under Section 407 of the Sarbanes-Oxley Act of 2002 and the Nasdaq Stock Market, Inc. If no member of the audit committee meets the “financial-expert” qualifications, the committee should identify one or more candidates for nomination who meet the qualifications, no later than may be required by such rulemaking.

Evaluations of the Board of Directors and Committees of the Board

- Evaluate and make recommendations to the full Board regarding the number and accountability of committees of the Board.

- No less than annually, solicit input from the full Board and conduct a review of the effectiveness of the operation of the Board and Board committees.

Corporate Governance

- Develop and recommend to the full Board for its approval a set of corporate governance principles. Review the principles no less than annually for the purposes of:

- determining whether the principles are being effectively adhered to and implemented;

- ensuring that the principles are appropriate for the Company and comply with applicable laws, regulations, and Nasdaq listing standards; and

- recommending any desirable changes in the principles to the full Board.

Director Orientation and Continuing Education

- Develop (i) an orientation program for new directors, including meetings with senior management and visits to Company facilities and (ii) a director continuing education program that complies with the director education requirements of the Nasdaq Stock Market, Inc. and all legal requirements.

- Monitor the continuing education needs of directors with respect to the Company’s business, financial statements, corporate governance policies and other appropriate subjects and recommend action to the Board, individual directors and management when appropriate.

Regulatory and Other Requirements

- Monitor services unrelated to Board membership provided by non-employee directors to the Company and its subsidiaries.

- Prior to publication, review and approve the “election of directors” section of the Company’s proxy statement.

- Review the committee’s charter annually and recommend proposed changes to the Board if necessary or advisable.

- Carry out such other duties and responsibilities as may be assigned to the committee from time to time by the Board and/or the Chairman of the Board.

Process

The nominating and corporate governance committee shall meet at least once annually and more frequently if the committee deems it to be appropriate. The committee shall make regular reports of its activities to the Board. When discussing candidates for nomination, the committee shall meet in executive session.

The committee may delegate authority to one or more members when appropriate, provided that decisions made pursuant to such delegated authority shall be presented to the full committee at its next scheduled meeting.

The committee shall be empowered to retain independent legal counsel, accountants or other advisors, and the Company shall provide for appropriate funding for such advisors. The committee shall have the sole authority to retain and terminate any consulting firm used to identify director candidates.

[FRONT]

This Proxy Is Solicited By And On Behalf Of The Board of Directors of ABATIX CORP.

Proxy - Annual Meeting of Stockholders - May 6, 2004

The undersigned, revoking all previous proxies, hereby appoints(s) Terry W. Shaver and Gary L. Cox, or any one of them, Proxies, with full power of substitution to represent and to vote all Common Stock of Abatix Corp. owned by the undersigned at the Annual Meeting of Stockholders to be held in Dallas, Texas on Thursday, May 6, 2004, including any original or subsequent adjournment thereof, with respect to the proposals set forth in the Notice of Annual Meeting and Proxy Statement. No business other than matters described below is expected to come before the meeting, but should any other matter requiring a vote of stockholders arise, the persons named herein will vote thereon in accordance with their best judgment. All powers may be exercised by both of said proxies or substitutes voting or acting or, if only one votes or acts, then by that one. Receipt of the Notice of Annual Meeting and Proxy Statement is hereby acknowledged.The Board of Directors Recommends a Vote FOR Each of the Following.

1. Election of Directors. Nominees: Terry W. Shaver Gary L. Cox A. David Cook Donald N. Black Eric A. Young

FOR ALL NOMINESS LISTED OR WITHHOLDING AUTHORITY to

(Except as specified here: vote for all nominees listed above.

)

2. Proposal to Ratify the Appointment of Independent Auditors. FOR AGAINST ABSTAIN

[REVERSE]

The shares represented by this proxy will be voted as directed. IF NO SPECIFIC DIRECTION IS GIVEN, THE SHARES REPRESENTED BY THIS PROXY WILL BE VOTED FOR THE NOMINEES NAMES IN PROPOSAL 1 AND FOR PROPOSAL 2.

| | Dated , 2004 |

| | |

| | (Signature) |

| | |

| | (Signature) |

| |

| | Where there is more than one owner, each should sign. When signing as an attorney, administrator, executor, guardian or trustee, please add your full title as such. If executed by a corporation or partnership, the proxy should be signed in the corporate or partnership name by a duly authorized officer or other duly authorized person, indicating such officer’s or person’s title. |

PLEASE SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE.