Board of Directors’ Consideration of Investment Advisory Agreement

The Investment Company Act of 1940, as amended (the “1940 Act”) and the terms of the investment advisory agreement (the “Advisory Agreement”) between the abrdn Emerging Markets Equity Income Fund, Inc. (the “Fund”) and abrdn Investments Limited (the “Adviser” or “aIL”) require that the Advisory Agreement be approved annually at an in-person meeting by the Board of Directors (the “Board” or “Directors”), all of whom have no direct or indirect interest in the Advisory Agreement and are not “interested persons” of the Fund, as defined in the 1940 Act (the “Independent Directors”).

At a regularly scheduled quarterly meeting held on June 13, 2023 (the “Quarterly Meeting”), the Board voted unanimously to renew the Advisory Agreement between the Fund and the Adviser for an additional one-year period. In considering whether to approve the continuation of the Fund’s Advisory Agreement, the Board members received and considered a variety of information provided by the Adviser relating to the Fund, the Advisory Agreement and the Adviser, including information regarding the nature, extent and quality of services provided by the Adviser under the Advisory Agreement, comparative investment performance, fee and expense information of a peer group of funds (the “Peer Group”) selected by Institutional Shareholder Services Inc. (“ISS”), an independent third-party provider of investment company data and other performance information for relevant benchmark indices. In addition, the Directors of the Fund held a separate telephonic meeting on June 6, 2023 and a separate in-person meeting with their independent legal counsel on June 12, 2023 (together with the Quarterly Meeting held on June 13, 2023, the “Meetings”) to review the materials provided and the relevant legal considerations.

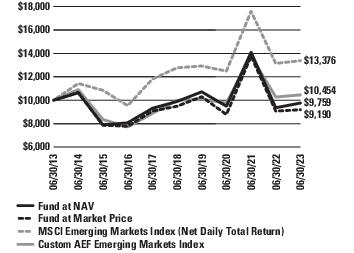

The materials provided to the Board generally included, among other items: (i) information regarding the Fund’s expenses and advisory fees, including information comparing the Fund’s expenses to the Peer Group and information about applicable fee “breakpoints” and expense limitations; (ii) information regarding the profitability of the Advisory Agreement to the Adviser; (iii) information on the investment performance of the Fund and the performance of the Peer Group and the Fund’s performance benchmark, including, with respect to the Fund’s performance and accounting predecessor (the “Predecessor Fund”), information for the Predecessor Fund for periods prior to the reorganization of seven closed-end funds with and into the Fund (the “Reorganization”) and the renaming of the Fund that took effect on April 30, 2018; (iv) a report prepared by the Adviser in response to a request submitted by the Independent Directors’ independent legal counsel on behalf of the Independent Directors; and (v) a memorandum from the Independent Directors’ independent legal counsel on the responsibilities of the Board in considering the approval of the investment advisory arrangement under the 1940 Act and Maryland law.

The Board also considered other matters such as: (i) the Adviser’s investment personnel and operations, (ii) the Adviser’s financial condition and stability, (iii) the resources devoted by the Adviser to the Fund, (iv) the Fund’s investment objective and strategy, (v) the Adviser’s record of compliance with the Fund’s investment policies and restrictions, policies on personal securities transactions and other compliance policies, (vi) possible conflicts of interest, and (vii) the allocation of the Fund’s brokerage, and the use, if any, of “soft” commission dollars to pay the Fund’s expenses and to pay for research and other similar services. Throughout the process, the Board members had and availed themselves of the opportunity to ask questions of and request additional information from the Adviser.

The Board also noted that in addition to the materials provided by the Adviser in connection with the Board’s consideration of the renewal of the Advisory Agreement at the Meetings, the Board received and reviewed materials in advance of each regular quarterly meeting that contained information about the Fund’s investment performance and information relating to the services provided by the Adviser.

The Independent Directors were advised by separate independent legal counsel throughout the process and also consulted in executive sessions with their counsel regarding consideration of the renewal of the Advisory Agreement. In determining whether to approve the continuation of the Advisory Agreement, the Board did not identify any single factor as determinative. Individual Directors may have evaluated the information presented differently from one another and given different weights to various factors. Matters considered by the Board in connection with its approval of the continuation of the Advisory Agreement include the factors listed below.

The costs of the services provided and profits realized by the Adviser and its affiliates from their relationships with the Fund. The Board reviewed with management the effective annual management fee rate paid by the Fund to the Adviser for investment management services. The Board considered the management fee structure, including that management fees for the Fund were based on the Fund’s average weekly net assets