OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2011

Estimated average burden hours per response: 18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05773

ING VP Balanced Portfolio, Inc.

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ |

| 85258 |

(Address of principal executive offices) |

| (Zip code) |

The Corporation Trust Incorporated, 300 E. Lombard Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | December 31 |

|

|

Date of reporting period: | January 1, 2008 to December 31, 2008 |

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2008

Classes ADV, I and S

ING Variable Product Funds

Domestic Equity and Income Portfolios

n ING VP Balanced Portfolio

n ING VP Growth and Income Portfolio

Domestic Equity Growth Portfolios

n ING Opportunistic LargeCap Growth Portfolio (formerly, ING VP Growth Portfolio)

n ING VP Small Company Portfolio

Domestic Equity Value Portfolio

n ING Opportunistic LargeCap Value Portfolio (formerly, ING VP Value Opportunity Portfolio)

Fixed-Income Portfolios

n ING VP Intermediate Bond Portfolio

n ING VP Money Market Portfolio

Global Equity Portfolio

n ING BlackRock Global Science and Technology Portfolio (formerly, ING VP Global Science and Technology Portfolio)

E-Delivery Sign-up – details inside

E-Delivery Sign-up – details inside

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS

TABLE OF CONTENTS

| President's Letter | 1 | ||||||

| Market Perspective | 2 | ||||||

| Portfolio Managers' Reports | 4 | ||||||

| Shareholder Expense Examples | 19 | ||||||

| Report of Independent Registered Public Accounting Firm | 21 | ||||||

| Statements of Assets and Liabilities | 22 | ||||||

| Statements of Operations | 26 | ||||||

| Statements of Changes in Net Assets | 28 | ||||||

| Financial Highlights | 32 | ||||||

| Notes to Financial Statements | 35 | ||||||

| Portfolios of Investments | 54 | ||||||

| Tax Information | 113 | ||||||

| Director/Trustee and Officer Information | 114 | ||||||

| Advisory Contract Approval Discussion | 119 | ||||||

Go Paperless with E-Delivery!

Go Paperless with E-Delivery!

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs.

Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll.

You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail.

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds' website at www.ingfunds.com; and (3) on the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds' website at www.ingfunds.com and on the SEC's website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Portfolios' Forms N-Q are available on the SEC's website at www.sec.gov. The Portfolios' Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330; and is available upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

(THIS PAGE INTENTIONALLY LEFT BLANK)

PRESIDENT'S LETTER

Dear Shareholders,

We are in the midst of one of the most challenging periods ever faced by investors, and we at ING Funds are aware of the anxiety that you may be feeling at this time.

I want to assure you that we are actively engaged in monitoring the situation and are committed to keeping you fully informed of how the rapidly unfolding events around us may impact your investments with our company.

We recognize that the confidence of many investors is being tested, perhaps as never before. It is understandable that some of you may be second guessing your investment strategy due to these recent events. We encourage you to work with your investment professional and seek out their advice about your portfolio in light of the current conditions. But we also urge investors not to make rash decisions. ING Funds still believes that a well-diversified, globally allocated portfolio remains the most effective investment strategy of all. We ask that investors not lose sight of their commitment to the long-term.

We thank you for your support and confidence and we look forward to continuing to do business with you in the future.

Sincerely,

Shaun Mathews

President & Chief Executive Officer

ING Funds

January 23, 2009

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice. Consider the fund's investment objectives, risks, and charges and expenses carefully before investing. The prospectus contains this information and other information about the fund.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2008

In our semi-annual report, we described a failed second quarter rally that fizzled when investors realized that borderline recessionary conditions and a credit crunch had not gone away. By year-end, governments were committing previously unimaginable sums of taxpayer money to prevent systemic collapse. Global equities in the form of the MSCI World® Index(1) measured in local currencies, including net reinvested dividends ("MSCI" for regions discussed below) plunged 29.70% in the six months ended December 31, 2008 (down 38.70% for the entire fiscal year). (The MSCI World® Index plunged 40.71% for the entire fiscal year, measured in U.S. dollars.) In currencies, the dollar at first drifted near record lows against the euro. But the tide turned in mid-July and for the six months ended December 31, 2008, the dollar strengthened by 12.10% (4.50% for the entire fiscal year). The dollar also soared 37.80% against the pound for the six months ended December 31, 2008 (37.90% for the entire fiscal year). But the yen advanced as carry trades (essentially short yen positions) were unwound and the dollar fell 14.90% for the six months ended December 31, 2008 (down 19.60% for the entire fiscal year).

Even more dramatic was the price of oil which marched to an all-time high of around $147 per barrel in mid-July, only to lose more than two thirds of that price by December 31, 2008.

The economic statistics remained bleak. By the end of October, the Standard & Poor's ("S&P")/Case-Shiller National U.S. Home Price Index(2) of house prices had fallen a record 18% over the year. New home sales were at 1991 levels. Some 45% of existing home sales were distressed.

Payrolls declined in every month of 2008, as the number of people claiming unemployment reached 4.1 million, a 26-year high. Gross domestic product ("GDP") fell at an annualized rate of 0.50% in the third quarter, and the National Bureau of Economic Research announced that the recession had actually started in December 2007.

Yet these were side-shows to the fireworks display in the financial sector, where major institutions — hanging by a thread through problems rooted in unwise mortgage borrowing, lending and investment — met different fates in September 2008 at the hands of the U.S. government.

The Federal National Mortgage Association ("Fannie Mae") and the Federal Home Loan Mortgage Corporation ("Freddie Mac") were taken into "conservatorship." Merrill Lynch was acquired by the Bank of America with a wink from the authorities. AIG received an $85 billion loan from a reluctant government, which also took a 79.90% equity stake in AIG. But Lehman Brothers having sought capital, then a buyer, found neither and was left to file for Chapter 11 bankruptcy protection.

The U.S. government was now in the position of choosing winners and losers among financial institutions: none too successfully, for it quickly became obvious that by pointedly leaving Lehman Brothers to go under, a credit crisis had become a credit market collapse. Lending all but seized up.

Policy response was huge but at least initially muddled. A Troubled Asset Relief Plan ("TARP") would set up a $700 billion fund to buy illiquid mortgage securities from financial institutions. But on November 12, 2008 with half of the money already used to recapitalize banks, Treasury Secretary Paulson announced that the rest of the funds would not be used to buy illiquid mortgage securities after all. This merely renewed the pressure on the holders of such securities like Citigroup, which within two weeks received guarantees from the government against losses and another $20 billion in capital.

Other programs were of more practical use, like support for the commercial paper market and a guarantee facility for money market funds. Arguably the most effective measure was the announced intention to buy vast quantities of agency mortgage-backed securities and debentures. This had the effect of driving down rates on the 30-year mortgage towards 5.00%, a record low. In the meantime, the newly-elected president promised a stimulus package worth approximately $1 trillion. And by year end, the Federal Open Market Committee ("FOMC") reduced interest rates to a range of between 0% and 0.25%.

2008 ended with much gloom and bad news still to come, but the platform for recovery was perhaps taking shape.

In U.S. fixed-income markets, yields on the 90-day Treasury Bills briefly turned negative in December 2008, while the yield on the ten-year Treasury Note fell below 2.50%, something we had not seen in 50 years. The Barclays Capital U.S. Aggregate Bond Index(3), formerly known as the Lehman Brothers U.S. Aggregate Bond Index, of investment grade bonds returned 4.10% for the six months ended December 31, 2008, (5.20% for the

2

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2008

entire fiscal year). By contrast, high yield bonds, represented by the Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index(4), formerly known as the Lehman Brothers High Yield Bond — 2% Issuer Constrained Composite Index, behaved more like a stock index and returned (25.10)% for the six months ended December 31, 2008 (down 25.90% for the entire fiscal year).

U.S. equities, represented by the S&P 500® Composite Stock Price ("S&P 500®") Index(5), including dividends, returned (28.50)% for the six months ended December 31, 2008, (down 37.00% for the entire fiscal year), increasingly unimpressed by sharply falling oil prices. Profits for S&P 500® Index companies suffered their fifth straight quarter of decline, led again by the financials sector, although taxpayer money was also potentially committed to save the big three auto make rs from bankruptcy. On November 20, 2008, the S&P 500® Index plumbed a level not seen since April 1997, before a December recovery.

In international markets, plainly entering recession, the MSCI Japan® Index(6) slumped 35.90% for the six months ended December 31, 2008, (down 42.60% for the entire fiscal year). The strengthening yen hit exports in an export-dependent economy even as global demand slowed for other reasons. The MSCI Europe ex UK® Index(7) sagged 29.40% for the six months ended December 31, 2008 (down 43.20% for the entir e fiscal year), beset by sharply falling economic activity and a European Central Bank in denial that inflation was falling fast. Finally, rates were reduced by an unprecedented 175 basis points (or 1.75%) in two months near the end of the year while governments, one after the other, proposed large stimulus packages. In the UK, the MSCI UK® Index(8) fell 19.40% for the six months ended December 31, 2008 (down 28.50% for the entire fiscal year). The UK had allowed a bigger housing bubble than the United States and deeper personal indebtedness in an economy more dependent on the financial sector. Rates were reduced to 1951 levels as venerable banks ceased to exist as independent entities.

(1) The MSCI World® Index is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The S&P/Case-Shiller National U.S. Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated quarterly.

(3) The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(4) The Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index is an unmanaged index that measures the performance of non-investment grade fixed-income securities.

(5) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the United States.

(6) The MSCI Japan® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(7) The MSCI Europe ex UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(8) The MSCI UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios' performance is subject to change since the period's end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING's Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

ING VP BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Balanced Portfolio (the "Portfolio") seeks to maximize investment return consistent with reasonable safety of principal, by investing in a diversified portfolio of one or more of the following asset classes: stocks, bonds and cash equivalents, based on the judgment of the Portfolio's management, of which of those sectors or mix thereof offers the best investment prospects. The Portfolio is managed by Omar Aguilar, Ph.D., James Kauffmann and Paul Zemsky, Portfolio Managers*, of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2008, the Portfolio's Class I shares provided a total return of (28.10)% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index"), the Barclays Capital U.S. Aggregate Bond Index**(2) and the Composite Index(3) (60% S&P 500® Index/40% Barclays Capital U.S. Aggregate Bond Index), which returned (37.00)%, 5.24% and (22.06)%, respectively, for the same period.

Portfolio Specifics: Asset allocation results had a modest positive impact on performance of the Portfolio during 2008, mainly due to our defensive cash positioning.

The performance of the domestic equity portion of the Portfolio was in line with the S&P 500® Index. Stock selection in the larger-cap stocks proved most successful during the year. Selection in the smallest-cap stocks added value, whereas both an average overweight position and stock selection within the mid-cap names detracted from performance. Both Amgen, Inc. and BB&T Corp. were strong performers during the year, as well as Bristol-Myers Squibb Co. and AutoZone, Inc.

The year 2008 turned out to be a painful one for investors. Negative absolute returns in all equity classes were the result of a year underscored by a litany of issues: an escalating financial crisis; global recession fears; geopolitics; collapses of storied financial firms; unparalleled levels of market volatility; threat of deflation; and a credit crunch that dried up liquidity in the bond markets. The housing market continues to weaken, industrial production has slowed and unemployment has risen. Intervention from the Federal Reserve Board (the "Fed") and the U.S. Department of the Treasury appears to have slowed down the pace of negative news, but has not, as yet, halted it.

The fixed income portion of the Portfolio underperformed the Barclays Capital U.S. Aggregate Bond Index, in a very difficult year. A large source of underperformance was the Portfolio's underweight in Treasuries, which hurt when investors fled to their relative safety. The Portfolio was also overweight many of the sectors hit hardest by this risk aversion, including financials, corporate bonds and off-benchmark holdings in non-agency residential mortgage-backed securities. The yield curve, duration and currency exposures of the Portfolio were beneficial for the year, but not by a large enough margin to overcome the negative selection effect.

Current Strategy and Outlook: Looking forward, we believe the recession will continue for the next two quarters, with growth resuming in the second half of 2009. We expect headline inflation to decline, and perhaps turn negative, but we don't believe we are in the midst of a deflationary spiral. Finally, we believe a large fiscal stimulus program will be enacted by Congress early in 2009. We ended the year overweight in equity versus fixed income, but would be looking to pare back our equity position until the effects of the fiscal stimulus are more evident.

Allocations between equities and fixed income are dependent on our quantitative asset allocation model, which uses the factors mentioned above and not on a qualitative evaluation of the bond versus the equity markets.

* Effective January 13, 2009, Omar Aguilar, Ph.D. and James Kauffmann are replaced by Vincent Costa, Michael Hyman and Christine Hurtsellers as co-portfolio managers to the Portfolio.

** Formerly known as the Lehman Brothers U.S. Aggregate Bond Index. As of October 31, 2008, all Lehman Brothers indices were renamed: the words "Lehman Brothers" changed to "Barclays Capital."

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Investment Type Allocation

as of December 31, 2008

(as a percent of net assets)

| Common Stock | 61.4 | % | |||||

| U.S. Government Agency Obligations | 12.9 | % | |||||

| Collateralized Mortgage Obligations | 9.8 | % | |||||

| Corporate Bonds/Notes | 9.8 | % | |||||

| U.S. Treasury Obligations | 4.7 | % | |||||

| Real Estate Investment Trusts | 1.4 | % | |||||

| Asset-Backed Securities | 1.2 | % | |||||

| Municipal Bonds | 0.5 | % | |||||

| Preferred Stock | 0.3 | % | |||||

| Other Assets and Liabilities — Net* | (2.0 | )% | |||||

| Net Assets | 100.0 | % | |||||

* Includes short-term investments related to commercial paper, ING Institutional Prime Money Market Fund — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2008

(as a percent of net assets)

| Federal Home Loan Mortgage Corporation, | |||||||

| 5.500%, due 02/12/37 | 3.7 | % | |||||

| ExxonMobil Corp. | 3.1 | % | |||||

| Federal National Mortgage Association, | |||||||

| 5.000%, due 01/12/36 | 2.1 | % | |||||

| U.S. Treasury Note, 1.250%, due 11/30/10 | 1.9 | % | |||||

| Federal National Mortgage Association, | |||||||

| 6.000%, due 02/12/37 | 1.2 | % | |||||

| Hewlett-Packard Co. | 1.1 | % | |||||

| U.S. Treasury Bond, 4.375%, due 02/15/38 | 1.1 | % | |||||

| International Business Machines Corp. | 1.0 | % | |||||

| Wal-Mart Stores, Inc. | 1.0 | % | |||||

| Federal Home Loan Mortgage Corporation, | |||||||

| 6.000%, due 01/15/29 | 1.0 | % | |||||

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

4

ING VP BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

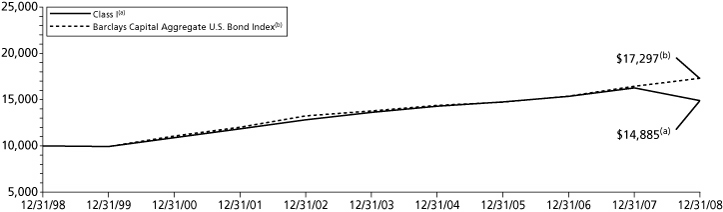

| Average Annual Total Returns for the Periods Ended December 31, 2008 | |||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception of Class ADV December 29, 2006 | Since Inception of Class S May 29, 2003 | |||||||||||||||||||

| Class ADV | (28.62 | )% | — | — | (13.46 | )% | — | ||||||||||||||||

| Class I | (28.10 | )% | (0.97 | )% | 0.94 | % | — | — | |||||||||||||||

| Class S | (28.28 | )% | (1.25 | )% | — | — | 0.66 | % | |||||||||||||||

| S&P 500® Index(1) | (37.00 | )% | (2.19 | )% | (1.38 | )% | (18.47 | )%(4) | 0.77 | %(5) | |||||||||||||

| Barclays Capital Aggregate U.S. Bond Index(2) | 5.24 | % | 4.65 | % | 5.63 | % | 6.10 | %(4) | 4.15 | %(5) | |||||||||||||

| Composite Index(3) | (22.06 | )% | 0.71 | % | 1.69 | % | (9.01 | )%(4) | 2.33 | %(5) | |||||||||||||

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Balanced Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the U.S.

(2) The Barclays Capital Aggregate U.S. Bond Index is an unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The Composite Index consists of 60% of return of (securities included in) the S&P 500® Index and 40% of the return of (securities included in) the Barclays Capital Aggregate U.S. Bond Index.

(4) Since inception performance for the indices is shown from January 1, 2007.

(5) Since inception performance for the indices is shown from June 1, 2003.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

5

ING VP GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Growth and Income Portfolio (the "Portfolio") seeks to maximize total return through investments in a diversified portfolio of common stocks and securities convertible into common stock. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by Christopher F. Corapi, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2008, the Portfolio's Class I shares provided a total return of (37.63)% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index"), which returned (37.00)% for the same period.

Portfolio Specifics: During this period, the Portfolio was hurt by weak stock selection within the industrials and telecom sectors. Within industrials, our underweight position in United Parcel Service, Inc. ("UPS") detracted from results. UPS held up better than its peers due to its defensive characteristics and attractive dividend yield. Also, Quanta Services, Inc. ("Quanta") declined significantly after a disappointing fourth quarter due to delays in telecom spending. Although some of the projects were pushed out as a result of typical permitting and bureaucratic delays rather than credit-related issues, investors took this as a sign of weakness in the transmission cycle. We continue to believe that the transmission cycle is still alive and believe that Quanta offers a less-cyclical, multi-year growth story at a reasonable price.

Within telecom, the Portfolio's position in Sprint Nextel Corp. ("Sprint") detracted from results during the period. The stock was punished in the fourth quarter due to liquidity concerns. We believe that these concerns were overblown and expect Sprint to be able to stabilize its market share through its continued efforts to improve customer service and reduce costs.

The Portfolio benefited from strong stock selection in the financials, utilities and healthcare sectors. Avoiding or underweighting some of the worst performing financial names, including AIG, the Government-Sponsored Entities ("GSEs") like Fannie Mae and Freddie Mac, and Merrill Lynch, helped relative performance during this period. Our emphasis on companies with lower credit and capital markets exposures, such as life and property/casualty insurers, also contributed to results. Within utilities, investments in NSTAR and Pacific Gas & Electric Co ("PG&E"). held up well due to their defensive characteristics and low exposure to fluctuations in commodity prices.

Abbott Laboratories ("Abbott") and Teva Pharmaceutical Industries Ltd. ("Teva") were two health-care names that aided relative returns. Abbott's diversified business mix and multiple product approvals and launches helped it withstand a pretty brutal market and outperform its peers. Within healthcare, generics were one of the safest places to be this year given limited scrutiny from Washington and limited risk to earnings versus other healthcare names. Teva, a premier generic manufacturer, benefited from having one of the broadest and deepest pipelines for upcoming patent losses on branded drugs.

Current Strategy and Outlook: Currently, the Portfolio is positioned in companies that we believe have strong or improving competitive positions, robust end markets or superior capital allocation opportunities. We believe each stock possesses an attractive valuation and a clear catalyst to improve it. Top holdings include Exxon-Mobil Corp. ("ExxonMobil"), Royal Dutch Shell PLC ("Royal Dutch Shell"), PG&E and Wells Fargo & Co ("Wells Fargo"). Within energy, we continue to favor integrated oil companies such as Exxon-Mobil and Royal Dutch Shell that have strong balance sheets, high dividend yields and good management teams.

We continue to like PG&E as a defensive play within the utility sector. The company is currently trading at an attractive valuation versus its peers and has a good balance sheet, a high dividend yield and no exposure to commodity or customer usage risk. Finally, we believe Wells Fargo's recent acquisition of Wachovia was an extremely favorable deal, which will lead to synergies and will allow its premier banking franchise to achieve national scale.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings

as of December 31, 2008

(as a percent of net assets)

| ExxonMobil Corp. | 6.3 | % | |||||

| Procter & Gamble Co. | 3.2 | % | |||||

| Wells Fargo & Co. | 2.9 | % | |||||

| JPMorgan Chase & Co. | 2.7 | % | |||||

| AT&T, Inc. | 2.1 | % | |||||

| Philip Morris International, Inc. | 1.9 | % | |||||

| General Electric Co. | 1.9 | % | |||||

| Gilead Sciences, Inc. | 1.8 | % | |||||

| Wal-Mart Stores, Inc. | 1.8 | % | |||||

| Google, Inc. — Class A | 1.8 | % | |||||

Portfolio holdings are subject to change daily.

6

ING VP GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2008 | |||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception of Class ADV December 20, 2006 | Since Inception of Class S June 11, 2003 | |||||||||||||||||||

| Class ADV | (37.94 | )% | — | — | (18.46 | )% | — | ||||||||||||||||

| Class I | (37.63 | )% | (2.16 | )% | (3.18 | )% | — | — | |||||||||||||||

| Class S | (37.82 | )% | (2.43 | )% | — | — | (0.19 | )% | |||||||||||||||

| S&P 500® Index(1) | (37.00 | )% | (2.19 | )% | (1.38 | )% | (18.47 | )%(2) | 0.77 | %(3) | |||||||||||||

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Growth and Income Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the U.S.

(2) Since inception performance for the index is shown from January 1, 2007.

(3) Since inception performance for the index is shown from June 1, 2003.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

7

ING OPPORTUNISTIC LARGE CAP GROWTH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Opportunistic Large Cap Growth Portfolio (the "Portfolio") seeks growth of capital through investment in a diversified portfolio consisting primarily of common stock and securities convertible into common stocks believed to offer growth potential. The Portfolio is managed by Omar Aguilar, Ph.D. and Vincent Costa, CFA, Portfolio Managers* of ING Investment Management Co. ("INGIM")— the Sub-Adviser.

Performance: For the year ended December 31, 2008, the Portfolio's Class I shares provided a total return of (44.06)% compared to the Russell 1000® Growth Index(1), which returned (38.44)% for the same period.

Portfolio Specifics: The Portfolio had a challenging year, underperforming its benchmark for the period.

Equity markets started the year with a turbulent first quarter as volatility spiked, in part, due to the relatively quick changes between the growth and value regimes. This period was particularly difficult for quantitative strategies as the performance of the factors was volatile through the period, making it difficult to sustain a positive model performance.

During the first quarter, we saw a brief change in market leadership from growth to value in January, which was accompanied by a spike in volatility. In February, valuation factors ended their brief comeback while price momentum drove returns. Valuation factors continued their underperformance in March, with factors like free cash flow to price causing the worst underperformance in the healthcare sector.

In the second quarter, security selection in the healthcare and information technology sectors hurt performance. The healthcare sector suffered as some pharmaceutical companies cut their earnings forecasts, with names like Forest Laboratories, Inc. and Perrigo Co. hurting the most. In the technology sector securities in the semiconductor and hardware industries hurt performance. Stocks such as MEMC Electronic Materials, Inc. and Arrow Electronics, Inc. slipped due to lower than expected earnings. In the energy sector our models were unable to keep up with momentum and the Portfolio got hurt by underweight positions in Schlumberger Ltd. and Halliburton Co., which were sharply higher due to a steep increase in crude oil prices.

In the second half of the year our dynamic factor model began pointing more towards valuation and quality factors, resulting in a slight overweight of these factors. This helped performance slightly in the third quarter as valuation factors bounced back; however, they turned negative in September wiping out all the gains from July and August. Market recognition factors, which were in favor for most of the year, turned sharply negative during the period.

Valuation factors continued to perform well in the fourth quarter with factors like forward and trailing earnings to price as well as price to free cash flow doing well in November and December. However, market recognition factors such as analyst estimate revisions and earnings trends that worked well early in the quarter underperformed toward the end of the year hurting returns.

Overall, security selection detracted from performance with selection in the healthcare, industrials, consumer discretionary and information technology sectors hurting returns. These losses were partially offset by security selection in the energy and financials sectors.

Current Strategy and Outlook: Our research builds a structured portfolio of stocks with fundamental characteristics that we believe will translate into a performance advantage over the benchmark. The evaluation includes every stock in the index.

At the close of the reporting period, the Portfolio was overweight in the consumer discretionary and healthcare sectors and underweight in the information technology and utilities sectors.

* Effective January 13, 2009, Mr. Aguilar is no longer a portfolio manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings

as of December 31, 2008

(as a percent of net assets)

| Apple, Inc. | 3.9 | % | |||||

| Procter & Gamble Co. | 3.7 | % | |||||

| Lockheed Martin Corp. | 3.5 | % | |||||

| TJX Cos., Inc. | 2.9 | % | |||||

| Xilinx, Inc. | 2.8 | % | |||||

| Altera Corp. | 2.7 | % | |||||

| Cooper Industries Ltd. | 2.5 | % | |||||

| CA, Inc. | 2.5 | % | |||||

| Sunoco, Inc. | 2.5 | % | |||||

| Fluor Corp. | 2.5 | % | |||||

Portfolio holdings are subject to change daily.

8

ING OPPORTUNISTIC LARGECAP GROWTH PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2008 | |||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception of Class ADV December 29, 2006 | Since Inception of Class S November 1, 2001 | |||||||||||||||||||

| Class ADV | (44.38 | )% | — | — | (19.19 | )% | — | ||||||||||||||||

| Class I | (44.06 | )% | (4.51 | )% | (4.40 | )% | — | — | |||||||||||||||

| Class S | (44.21 | )% | (4.76 | )% | — | — | (3.78 | )% | |||||||||||||||

| Russell 1000® Growth Index(1) | (38.44 | )% | (3.42 | )% | (4.27 | )% | (17.03 | )%(2) | (2.08 | )% | |||||||||||||

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Opportunistic LargeCap Growth Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 1000® Growth Index measures the performance of the 1,000 largest companies in the Russell 3000 Index with higher price-to-book ratios and higher forecasted growth. The Russell 3000 Index is an unmanaged index that measures the performance of 3,000 U.S. companies based on total market capitalization.

(2) Since inception performance for the index is shown from January 1, 2007.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

9

ING VP SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Small Company Portfolio (the "Portfolio") seeks growth of capital primarily through investment in a diversified portfolio of common stocks of companies with smaller market capitalizations. The Portfolio is managed by Joseph Basset, CFA, and Steve Salopek, Portfolio Managers of ING Investment Management Co. — the Sub Adviser.

Performance: For the year ended December 31, 2008, the Portfolio's Class I shares provided a total return of (31.05)% compared to the Russell 2000® Index(1), which returned (33.79)% for the same period.

Portfolio Specifics: Despite the recent rally of nearly 30% for the Russell 2000® Index, the index was down over 33% for the year. This past year was the worst year since 1973 for small-cap stocks and there were few places to hide. Returns were negative across all sectors — fewer than one in five stocks of the index turned in positive results. However, small-caps did outperform both large-caps and mid-caps due to better performance by financials. Energy was down almost 50% for the year due to the significant decline in the price of oil and the fact that the current economic environment is unfavorable for energy.

Stock selection within industrials, financials, utilities and materials benefited the Portfolio during the period. Our underweight in consumer discretionary also added to performance, as the sector was down over 47% for the year. Notable outperformance within industrials was due to strong stock selection within aerospace and defense, commercial services and supplies and professional services. Financials benefited from stock selection within thrifts and mortgage finance and real estate investment trusts ("REITs").

Stock selection within the energy, technology and healthcare sectors detracted most from performance. In energy, returns were held back by our slight overweight position and stock selection within energy equipment and services and oil, gas and consumable fuels. Within technology, stock selection within communications equipment and electronic equipment instruments and components detracted from performance. Underperformance in healthcare is attributable to stock selection among pharmaceuticals.

Greatbatch, Inc. ("Greatbatch") and First Niagara Financial Group, Inc. ("First Niagara") contributed significantly to performance over the period. First Niagara provides retail and commercial banking and financial services. The stock's outperformance was mainly driven by the bank's overall capital strength, disciplined underwriting and lack of exposure to the troubled loan segments, e.g., sub-prime mortgages, construction lending and speculative development. While the company has not been immune to the problems facing the banking sector throughout 2008, the strength of its balance sheet has allowed it to outperform relative to its peers.

Greatbatch is a leading developer and manufacturer of critical components used in medical devices for the cardiac rhythm management, neurostimulation, vascular and interventional radiology markets. The company executed well on its acquisition strategy, which helped it diversify from its cardiac rhythm management franchise and provide greater stability/visibility to its operating earnings. Also, the street was initially skeptical of the company's ability to diversify and execute on the diversification strategy. As each quarter passed, the company's execution proved to be flawless and the firm gained substantial momentum as evidenced by increasing earnings and expanded margins.

Global Industries Ltd. ("Global Industries") and Arbitron, Inc. ("Arbitron") were two of the largest detractors from performance over the period. Global Industries provides construction and support services to the offshore oil and gas industry. The company had a difficult second quarter due to execution issues, which resulted in investors losing confidence in management, and due to a poor macro environment for energy. We no longer hold a position in this company.

Arbitron, which measures the listening audience for radio and provides this data to both radio stations and advertisers, recently lost market share to a competitor. We continue to hold this name, as the company remains the market leader, expectations have been reset and we believe the valuation is reasonable.

Current Strategy and Outlook: We continue to focus on companies with strong balance sheets and cash flow generation capabilities. We are conscious of the difficulties in the current economic environment. We believe, however, that the economy will begin to improve in 2009 due to the massive amount of monetary stimulus being pumped into the system globally.

Accordingly, we have begun to increase our exposure to more early cyclical companies. Within financials, we continue to mitigate risk through diversification and are invested across the financial sector, in banks, diversified financials, insurance companies and real estate investments trusts ("REITS"). The banks that we own are typically over-capitalized and have higher reserves than industry averages. We continue to take advantage of the volatility in the market to acquire attractively valued companies whose share prices we believe are not trading on fundamentals.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings*

as of December 31, 2008

(as a percent of net assets)

| iShares Russell 2000 Index Fund | 3.0 | % | |||||

| Watson Wyatt Worldwide, Inc. | 1.2 | % | |||||

| Cleco Corp. | 1.1 | % | |||||

| CACI International, Inc. | 1.1 | % | |||||

| Portland General Electric Co. | 1.1 | % | |||||

| Moog, Inc. | 1.1 | % | |||||

| Solera Holdings, Inc. | 1.0 | % | |||||

| Waste Connections, Inc. | 1.0 | % | |||||

| Regal-Beloit Corp. | 1.0 | % | |||||

| Silgan Holdings, Inc. | 1.0 | % | |||||

* Excludes short-term investments related to ING Institutional Prime Money Market Fund — Class I, repurchase agreement and securities lending collateral.

Portfolio holdings are subject to change daily.

10

ING VP SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

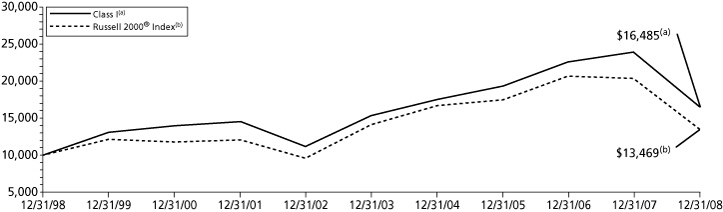

| Average Annual Total Returns for the Periods Ended December 31, 2008 | |||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception of Class ADV December 16, 2008 | Since Inception of Class S November 1, 2001 | |||||||||||||||||||

| Class ADV | — | — | — | 4.04 | % | — | |||||||||||||||||

| Class I | (31.05 | )% | 1.47 | % | 5.12 | % | — | — | |||||||||||||||

| Class S | (31.28 | )% | 1.14 | % | — | — | 3.00 | % | |||||||||||||||

| Russell 2000® Index(1) | (33.79 | )% | (0.93 | )% | 3.02 | % | N/A(2) | 3.49 | % | ||||||||||||||

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Small Company Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index that measures the performance of 3,000 U.S. companies based on total market capitalization.

(2) Since inception performance for the index is not shown.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

11

ING OPPORTUNISTIC LARGE CAP VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Opportunistic Large Cap Value Portfolio (the "Portfolio") seeks growth of capital primarily through investment in a diversified portfolio of common stocks. The Portfolio is managed by Omar Aguilar, Ph.D. and Vincent Costa — Portfolio Managers* of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2008, the Portfolio's Class I shares provided a total return of (35.61)% compared to the Russell 1000® Value Index(1) and the Russell 1000® Index(2), which returned (36.85)% and (37.60)%, respecti vely, for the same period.

Portfolio Specifics: Security selection drove performance for the period, with selection in the financials, energy and consumer discretionary sectors benefiting returns. These gains were partially offset by security selection in the industrials and health care sectors. Underweight positions in the financials and materials sectors as well as an overweight position in the consumer staples sector also benefited results for the period.

2008 began with a spike in volatility, but during the rest of the first half of the year market recognition factors such as sales growth and analyst estimate revisions re-asserted themselves and drove performance. Quality and valuation factors such as book to price, dividend yield and capital expenditure to sales did not work well. Sectors such as banks and utilities benefited from the good performance of market recognition factors. In contrast, market recognition factors in the energy, health care, industrials and financials services sectors could not offset the severe underperformance of the valuation factors.

After a challenging first quarter our quantitative strategies stabilized in the second quarter as the markets began to return to company fundamentals. The Portfolio rebounded and offset much of its loss from the first quarter. Our dynamic factor weighting model helped us tilt the Portfolio's weights away from deep value factors like book to price, steering it to an underweight position in the financials sector, which fell sharply during the second quarter. The tilt also helped security selection within the consumer staples sector, particularly in food and staples retailing names such as Kroger Co.

In the second half of the year the Portfolio's dynamic factor model began pointing more towards valuation and quality factors, resulting in a slight overweight of these factors. Regrettably, after a promising start in July and August, these factors turned negative in September and wiped out all their previous gains. Market recognition factors also turned sharply negative and detracted from performance. Quality factors that were flat for the year performed well during the third quarter.

The shift to value and quality paid off in the fourth quarter, as factors like forward and trailing earnings to price and price to free cash flow performed extremely well. Quality factors such as capital expenditures to deprecation also helped returns during the fourth quarter. Finally, market recognition factors such as analyst estimate revisions and earnings trends worked well early in the quarter but faded toward the end of the year.

Current Strategy and Outlook: Our research builds a structured portfolio of stocks with fundamental characteristics that we believe will translate into a performance advantage over the benchmark. The evaluation includes every stock in the index.

At the close of the reporting period, portfolio overweightings included the energy and information technology sectors and underweightings included the financials sectors and materials sectors.

* Effective January 13, 2009, Mr. Aguilar is no longer a portfolio manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Top Ten Holdings*

as of December 31, 2008

(as a percent of net assets)

| ExxonMobil Corp. | 8.2 | % | |||||

| Pfizer, Inc. | 4.5 | % | |||||

| AT&T, Inc. | 4.5 | % | |||||

| ConocoPhillips | 4.1 | % | |||||

| Forest Laboratories, Inc. | 2.9 | % | |||||

| Chevron Corp. | 2.7 | % | |||||

| Gap, Inc. | 2.7 | % | |||||

| Kroger Co. | 2.7 | % | |||||

| Time Warner, Inc. | 2.6 | % | |||||

| Valero Energy Corp. | 2.4 | % | |||||

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

12

ING OPPORTUNISTIC LARGECAP VALUE PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2008 | |||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception of Class ADV December 29, 2006 | Since Inception of Class S July 16, 2001 | |||||||||||||||||||

| Class ADV | (36.01 | )% | — | — | (19.01 | )% | — | ||||||||||||||||

| Class I | (35.61 | )% | (1.93 | )% | (0.03 | )% | — | — | |||||||||||||||

| Class S | (35.80 | )% | (2.17 | )% | — | — | (3.78 | )% | |||||||||||||||

| Russell 1000® Value Index(1) | (36.85 | )% | (0.79 | )% | 1.36 | % | (20.60 | )%(3) | 0.16 | %(4) | |||||||||||||

| Russell 1000® Index(2) | (37.60 | )% | (2.04 | )% | (1.09 | )% | (18.76 | )%(3) | (1.76 | )%(4) | |||||||||||||

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Opportunistic LargeCap Value Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in the indices. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 1000® Value Index is an unmanaged index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values, which more closely tracks the types of securities in which the Portfolio invests than the S&P 500® Composite Stock Price Index.

(2) The Russell 1000® Index is a comprehensive large-cap index measuring the performance of the largest 1,000 U.S. incorporated companies.

(3) Since inception performance for the indices is shown from January 1, 2007.

(4) Since inception performance for the indices is shown from August 1, 2001.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

13

ING VP INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Intermediate Bond Portfolio (the "Portfolio") seeks to maximize total return consistent with reasonable risk. The Portfolio seeks its objective through investments in a diversified portfolio consisting primarily of debt securities. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by James Kauffmann, Portfolio Manager* of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2008, the Portfolio's Class I shares provided a total return of (8.41)% compared to the Barclays Capital U.S. Aggregate Bond Index**(1), which returned 5.24% for the same period.

Portfolio Specifics: Most pundits agree that 2008 was a record-breaking annus horribilis. Global de-leveraging worsened volatility across asset classes, and fixed income was not immune. In December, the National Bureau of Economic Research officially declared that the United States had been in recession for a year.

Home prices declined precipitously across major metro areas, foreclosures sky-rocketed and investors largely abandoned the residential mortgage-backed securities ("RMBS") market. Yields on U.S. Treasuries reached historic lows as investment grade corporate debt spreads widened to a level implying an expected default rate of 30%, which tops the experience of the Great Depression, when corporate defaults totaled about 20%.

Central banks around the globe frantically reduced short-term rates in the face of rapidly deteriorating economic conditions. Fiscal stimulus programs were initiated in most major economies. Here in the U.S., the Federal Open Market Committee reduced the federal funds rate at each meeting, eventually settling at 0.25% by year-end. The Federal Reserve Board (the "Fed") also indicated it would purchase large quantities of agency debt and mortgage-backed securities to support the mortgage and housing market. As a result, the markets calmed down a bit in the waning days of 2008.

The Portfolio was underweight Treasuries for most of the year, which hurt performance. The Portfolio was overweight many of the sectors hit hardest by risk aversion, including non-agency residential mortgage-backed securities ("RMBS"), financials and corporate bonds. Given that non-agency RMBS are not in the benchmark, our positions led to significant underperformance versus the benchmark. Additionally, we were too early in adding corporate risk back into the Portfolio following the rescue of Bear Stearns in March; this renewed focus detracted from results when Lehman Brothers went bankrupt in September.

Our investment process focuses on security selection, which was clearly out of favor in 2008. We tend to focus on unique corporate bonds, which are often lower in the capital structure and may trade at a discount to their intrinsic value. Unfortunately, the bond market cared little about important distinctions between bonds and witnessed an unprecedented flight to quality.

We did, however, avoid the underperformance of high yield and emerging market debt by being largely absent those sectors. Although yield curve, duration and currency exposures changed throughout a highly volatile year, the decisions made in this risk area were largely beneficial.

Current Outlook and Strategy: We believe the government will continue to deploy significant amounts of capital in an effort to combat liquidity constraints, which will lead to larger deficits but also a possibility of better economic growth in the future. But since we also believe the Fed will not be raising rates anytime soon, we think that Treasury rates will continue to be range-bound; therefore, we believe a relative neutral duration and curve exposure, with small tactical moves, is warranted at this time.

In an economy where cash flow is scarce and both individuals and corporations want to de-lever we believe it is prudent to be in the higher end of the capital structure where debt holders are the beneficiaries of limited cash flows to the detriment of equity holders. In our opinion, U.S. investment grade bonds offer attractive value.

We believe that in a market where the government is controlling a majority of the outcomes we should invest along with the government. Therefore, some of the companies we own either will have some sort of government support, or their ratings will allow them to sell commercial paper directly to the Fed. Other criteria are that they belong to an extremely important sector for the economy, such as utilities or telecommunications and that they have strong cash flows and balance sheets.

The Portfolio remains overweight securitized assets and RMBS in particular. We still believe there are good investments with the potential for solid, long-term returns in some of these securities. The areas where we believe value exists include certain securities backed by prime jumbo loans with good borrower profiles, and even some ALT-A backed bonds that have a conforming balance and may be refinanced at a lower rate.

* Effective January 13, 2009, James Kauffmann was replaced by Chris Diaz, Peter Guan, Michael Hyman and Christine Hurtsellers as co-portfolio managers to the Portfolio.

** Formerly known as the Lehman Brothers U.S. Aggregate Bond Index. As of October 31, 2008, all Lehman Brothers indices were renamed: the words "Lehman Brothers" changed to "Barclays Capital."

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

Investment Type Allocation

as of December 31, 2008

(as a percent of net assets)

| U.S. Government Agency Obligations | 39.0 | % | |||||

| Corporate Bonds/Notes | 27.7 | % | |||||

| Collateralized Mortgage Obligations | 19.6 | % | |||||

| U.S. Treasury Obligations | 15.9 | % | |||||

| Asset-Backed Securities | 2.1 | % | |||||

| Municipal Bonds | 1.0 | % | |||||

| Preferred Stock | 0.5 | % | |||||

| Other Assets and Liabilities — Net* | (5.8 | )% | |||||

| Net Assets | 100.0 | % | |||||

* Includes short-term investments related to certificates of deposit, commercial paper, ING Institutional Prime Money Market Fund — Class I, securities lending collateral and U.S. Treasury Bills.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2008

(as a percent of net assets)

| Federal Home Loan Mortgage Corporation, | |||||||

| 5.500%, due 02/12/37 | 10.3 | % | |||||

| Federal National Mortgage Association, | |||||||

| 5.000%, due 01/12/36 | 7.6 | % | |||||

| U.S. Treasury Note, 2.000%, due 11/30/13 | 3.7 | % | |||||

| U.S. Treasury Bond, 3.750%, due 11/15/18 | 3.6 | % | |||||

| U.S. Treasury Bond, 4.375%, due 02/15/38 | 2.7 | % | |||||

| Government National Mortgage Association, | |||||||

| 6.000%, due 02/15/34 | 2.7 | % | |||||

| U.S. Treasury Note, 1.125%, due 12/15/11 | 2.2 | % | |||||

| Federal National Mortgage Association, | |||||||

| 6.500%, due 02/12/37 | 1.7 | % | |||||

| Federal National Mortgage Association, | |||||||

| 6.000%, due 02/12/37 | 1.7 | % | |||||

| Government National Mortgage Association, | |||||||

| 5.500%, due 02/15/35 | 1.6 | % | |||||

* Excludes short-term investments related to commercial paper, ING Institutional Prime Money Market Fund — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

14

ING VP INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2008 | |||||||||||||||||||||||

| 1 Year | 5 Year | 10 Year | Since Inception of Class ADV December 20, 2006 | Since Inception of Class S May 3, 2002 | |||||||||||||||||||

| Class ADV | (9.16 | )% | — | — | (2.17 | )% | — | ||||||||||||||||

| Class I | (8.41 | )% | 1.78 | % | 4.06 | % | — | — | |||||||||||||||

| Class S | (8.73 | )% | 1.51 | % | — | — | 3.13 | % | |||||||||||||||

| Barclays Capital Aggregate U.S. Bond Index(1) | 5.24 | % | 4.65 | % | 5.63 | % | 6.10 | %(2) | 5.31 | %(3) | |||||||||||||

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING VP Intermediate Bond Portfolio against the index indicated. An index has has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Barclays Capital Aggregate U.S. Bond Index is an unmanaged index publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(2) Since inception performance for the the index is shown from January 1, 2007.

(3) Since inception performance for the index is shown from May 1, 2002.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

15

ING VP MONEY MARKET PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING VP Money Market Portfolio (the "Portfolio") seeks to provide high current return, consistent with preservation of capital and liquidity, through investment in high-quality money market instruments, while maintaining a stable share price of $1.00 per share*. The Portfolio is managed by David S. Yealy, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended December 31, 2008, the Portfolio's shares provided a total return of 2.67% compared to the iMoneyNet First Tier Retail Index(1), which returned 2.13% for the same period.

Portfolio Specifics: Calendar-year 2008 was one of the most difficult and challenging periods in history for money market funds. The first quarter was highlighted by near collapse of Bear Stearns and the subsequent buyout by JPMorgan. The Federal Reserve Board (the "Fed") aggressively cut interest rates a combined 2% during the quarter. This was one of many steps taken by the U.S. central bank along with the other central banks globally to address the illiquidity and credit stress in the market.

The second quarter was one of transition, from concern over lower economic growth leading to lower short-term rates to concern over inflation and the possibility of significant interest rate increases. The Fed lowered the federal funds rate in April 2008. Liquidity remained an issue but central bank actions prevented further market deterioration, and we saw modest improvement in conditions.

The third quarter was marked by the seizing up of the credit markets and loss of confidence as the government took over Fannie Mae and Freddie Mac, Lehman Brothers went bankrupt and market bellwethers such as General Electric, AIG and Wachovia faltered. The systemic risk and capital market panic that ensued resulted in a worldwide multi-sector collapse of virtually all risk-based asset prices.

The markets for short-term funding, such as money market funds, threatened to stop functioning. The Fed made an emergency inter-meeting cut of the federal funds rate from 2.00% to 1.50% on October 8, 2008. This was followed by another 0.50% cut at the October 29, 2008 meeting and an unprecedented step at the December 15–16, 2008 meeting where the Fed set a Fed funds target rate range of 0% to 0.25%. The Fed initiated a variety of innovative confidence building tactics, such as providing relief for the commercial paper markets and money market funds.

Our focus during the period was not on maximizing yield and return but on preservation of capital, reducing risk and increasing liquidity due to extreme risks in the market. The Portfolio was able to outperform its benchmark despite our risk reduction strategy.

The Portfolio did take on interest rate risk, primarily during the second half of the year, extending its weighted average maturity ("WAM") by buying longer term Treasury and agency securities. The Portfolio finished the year with a 78-day WAM, which is at the long end of its range. We avoided additional credit risk but gave up some incremental yield by not buying higher yielding debt of more marginal issues and structured securities not covered by the government programs. This strategy cushioned the impact of the rate cuts and declining yields, and we believe it should continue to do so in the current low rate environment going forward.

Current Strategy and Outlook: Going into the new year, we continue to emphasize reducing credit risk and maintaining excess liquidity. The Portfolio is targeting three times the normal 7% position in repurchase agreements. The Portfolio is targeting additional liquid positions that mature in fewer than seven days, as well as 35–45% exposure in asset backed commercial paper ("ABCP"), which is eligible to be sold to the Fed at amortized cost under one of its liquidity support programs. We have been extending ABCP maturities into March and April 2009, seeking to lock in the higher yields offered there relative to maturities in January 2009.

The Portfolio continues to reduce exposure to issuers that have not received direct central bank support or guarantees or are not covered by one of the various Fed/Treasury programs. Without these supports, such securities carry more risk and could be illiquid if we had to sell them prior to maturity. We continue to reduce the Portfolio's floating rate exposure through maturities and secondarily via outright sales, as this sector is expected to underperform in a low interest rate environment.

Principal Risk Factors: Please see the "Notes to Financial Statements" section for information regarding the Capital Support Agreement that the Portfolio has entered into.

Although the Portfolio seeks to preserve the value of your investment at $1.00 per share, it is possible to lose money by investing in the Portfolio.

* Effective October 7, 2008, the Portfolio's investment objective was revised to state that it will seek to maintain a stable share price of $1.00 per share.

(1) The iMoneyNet First Tier Retail Index is an unmanaged index that includes the most broadly based money market funds. This index is intended to be the comparative index for the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

| Investment Type Allocation as of December 31, 2008 (as a percent of net assets) | |||||||

| Commercial Paper | 43.0 | % | |||||

| U.S. Government Agency Obligations | 17.0 | % | |||||

| Corporate Bonds/Notes | 13.1 | % | |||||

| Repurchase Agreement | 12.9 | % | |||||

| Certificates of Deposit | 2.8 | % | |||||

| U.S. Treasury Notes | 1.2 | % | |||||

| Securities Lending Collateral | 0.0 | % | |||||

| Other Assets and Liabilities — Net | 10.0 | % | |||||

| Net Assets | 100.0 | % | |||||

Portfolio holdings are subject to change daily.

16

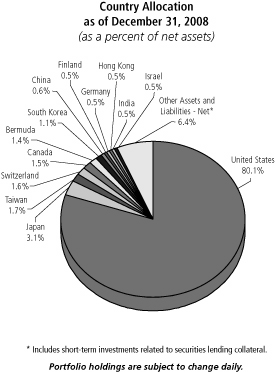

ING BLACKROCK GLOBAL SCIENCE AND TECHNOLOGY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING BlackRock Global Science and Technology Portfolio (the "Portfolio") seeks long-term capital appreciation. The Portfolio is managed by Thomas P. Callan, CFA, Managing Director and Senior Portfolio Manager, Erin Xie, PhD, Managing Director and Portfolio Manager and Jean M. Rosenbaum, CFA, Managing Director and Portfolio Manager of BlackRock Advisors, LLC — the Sub-Adviser.

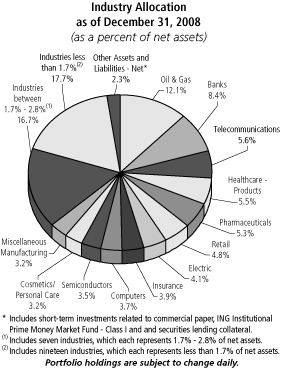

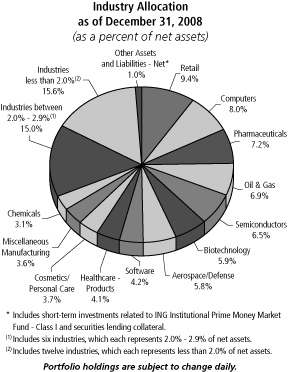

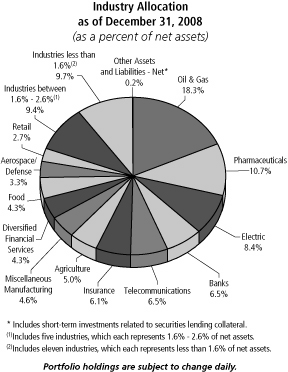

Performance: For the year ended December 31, 2008, the Portfolio's Class I shares provided a total return of (39.82)% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index") and the NYSE Arca Tech 100 IndexSM(2),which returned (37.00)% and (34.50)%, respectively, for the same period.