OMB APPROVAL

OMB Number: 3235-0570

Expires: August 31, 2011

Estimated average burden hours per response: 18.9

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05773

ING Balanced Portfolio, Inc.

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

The Corporation Trust Incorporated, 300 E. Lombard Street, Baltimore, MD 21201

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | December 31 |

| |

Date of reporting period: | January 1, 2009 to December 31, 2009 |

ITEM 1. REPORTS TO STOCKHOLDERS.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Annual Report

December 31, 2009

Classes ADV, I, S and S2

ING Variable Product Funds

Domestic Equity and Income Portfolios

n ING Balanced Portfolio

n ING Growth and Income Portfolio

Domestic Equity Growth Portfolio

n ING Small Company Portfolio

Domestic Equity Value Portfolio

n ING Opportunistic LargeCap Portfolio

Fixed-Income Portfolios

n ING Intermediate Bond Portfolio

n ING Money Market Portfolio

Global Equity Portfolio

n ING BlackRock Science and Technology Opportunities Portfolio

E-Delivery Sign-up – details inside

E-Delivery Sign-up – details inside

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

MUTUAL FUNDS

TABLE OF CONTENTS

| President's Letter | | | 1 | | |

|

| Market Perspective | | | 2 | | |

|

| Portfolio Managers' Reports | | | 4 | | |

|

| Shareholder Expense Examples | | | 17 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 19 | | |

|

| Statements of Assets and Liabilities | | | 20 | | |

|

| Statements of Operations | | | 24 | | |

|

| Statements of Changes in Net Assets | | | 26 | | |

|

| Financial Highlights | | | 30 | | |

|

| Notes to Financial Statements | | | 34 | | |

|

| Portfolios of Investments | | | 54 | | |

|

| Tax Information | | | 107 | | |

|

| Director/Trustee and Officer Information | | | 108 | | |

|

| Advisory Contract Approval Discussion | | | 112 | | |

|

Go Paperless with E-Delivery!

Go Paperless with E-Delivery!

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs.

Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll.

You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail.

PROXY VOTING INFORMATION

A description of the policies and procedures that the Portfolios use to determine how to vote proxies related to portfolio securities is available: (1) without charge, upon request, by calling Shareholder Services toll-free at (800) 992-0180; (2) on the ING Funds' website at www.ingfunds.com; and (3) on the U.S. Securities and Exchange Commission's (the "SEC") website at www.sec.gov. Information regarding how the Portfolios voted proxies related to portfolio securities during the most recent 12-month period ended June 30 is available without charge on the ING Funds' website at www.ingfunds.com and on the SEC's website at www.sec.gov.

QUARTERLY PORTFOLIO HOLDINGS

The Portfolios file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Portfolios' Forms N-Q are available on the SEC's website at www.sec.gov. The Portfolios' Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC, and information on the operation of the Public Reference Room may be obtained by calling (800) SEC-0330; and is available upon request from the Portfolios by calling Shareholder Services toll-free at (800) 992-0180.

PRESIDENT'S LETTER

Dear Shareholder,

It would be hard to find fault with the returns of securities markets over the past year, but we have been through a tumultuous period, and recent events raise new questions. By most measures (with the confounding exception of employment) the global recession is abating and economies are growing again, especially in the developing countries of Asia. Every silver lining has a cloud, though, and the improved but fragile outlook carries within it the same risks that got us into this crisis: disengaged monetary policies, unpredictable asset bubbles, enfeebled regulation and wilting political will.

Against the backdrop of the Davos World Economic Forum and President Obama's first State of the Union address, Ben Bernanke, Chairman of the Federal Reserve, was confirmed by the Senate for a second four-year term, adding some element of certainty to the concerns of investors about the future. He and other policymakers still face economic problems, such as our growing long-term budget deficit, which will influence markets going forward.

How can this information help you with your investment plans? The outlook for corporate profits and market valuations is driven, at least in part, by reactions of government officials to economic and political events. The federal budget deficit casts overtones of uncertainty around expectations for inflation, for example, which could affect the value of all assets in U.S. markets. As a result, it could make sense to broaden one's investment horizons to include additional exposure to non-U.S. investments.

The strong returns of the stock markets last year should not obscure the fact that keeping a well-diversified asset mix is likely to serve your financial needs. Before you make any changes to your portfolio, discuss them thoroughly with your investment advisor to ensure they appropriately reflect your situation.

Thank you for your continued confidence in ING Funds. We look forward to serving your investment needs in the future.

Sincerely,

Shaun Mathews

President & Chief Executive Officer

ING Funds

January 28, 2010

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaim any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice. Consider the fund's investment objectives, risks, and charges and expenses carefully before investing. The prospectus contains this information and other information about the fund.

International investing poses special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

1

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2009

In our semi-annual report we described how markets in risky assets, depressed by the financial crisis and recession, had abruptly recovered after early March to register gains through June 30, 2009. This was maintained in the second half of the fiscal year and global equities in the form of the MSCI World IndexSM(1) measured in local currencies, including net reinvested dividends ("MSCI" for regions discussed below), added 20.00%, for a return of 25.70% for the fiscal year ended December 31, 2009. (The MSCI World IndexSM returned 29.99 % for the fiscal year ended December 31, 2009, measured in U.S. dollars). From the March 9, 2009 low point, the return was 60.90%. In currencies, the U.S. dollar was mixed for the year, losing 1.60% to the euro and 9.10% to the pound, but gaining 2.10% on the yen.

The rally had been credited to "green shoots", a metaphor for signs, perhaps frail and erratic, that the worst of the financial crisis and resulting recession was over. Governments intervened massively to recapitalize companies considered systemically important, or at least to make practically unlimited amounts of liquidity available to them at low cost. These were mainly banks and other financial institutions, but in the U.S. also included major auto makers. Some financial giants in the U.S. and U.K., once thought impregnable, now sit meekly under government control. Interest rates have been reduced to record low levels to encourage these institutions to lend and generally to support demand. Bank lending has continued to stagnate, however (except in China, where banks tend to follow government directions). Corporations have instead issued bonds, which have been eagerly taken up by yield hungry investors.

"Cash-for-Clunkers" programs were successfully introduced in a number of countries, under which governments subsidized the trade-in of old vehicles for newer models. In the U.S., the government offered an $8,000 tax credit to first-time home buyers and extended jobless benefits. In Europe, to reduce the number of workers being laid off, corporations were subsidized to keep them on part time. The UK reduced Value Added Tax.

Government budget deficits have soared to modern-day records: in the U.S. alone, the deficit equaled $1.42 trillion for the fiscal year ending September 30, 2009. To keep interest rates down, the Federal Reserve Board and the Bank of England have been buying Treasury bonds in a strategy known as quantitative easing.

What will happen when large-scale government intervention ends is probably the greatest concern for investors. But China's rate of gross domestic product ("GDP") growth is approaching 10% again and by the end of the year some key areas of the domestic economy were clearly looking better.

House prices are rising again. The Standard & Poor's ("S&P")/Case-Shiller National U.S. Home Price Index(2) of house prices in 20 cities was reported in December to have risen for five consecutive months, although it was still down 7.30% from a year earlier. Sales of existing homes in November rose to the highest levels since February 2007.

On the employment front, just 11,000 jobs were lost in November and by year end the number of new unemployment claims was the lowest since July 2008. Yet the unemployment rate rose to 10.00%, having peaked at 10.20% even as thousands of workers left the labor force. Wage growth continued to decelerate and the average working week still hovered near lowest recorded levels. Broad, sustainable recovery will require a much more vigorous improvement in the labor market.

The economy, after four consecutive quarterly declines, has at least started to expand again. In the third quarter of 2009, GDP in the U.S. rose by 2.20% at an annual rate.

In U.S. fixed income markets, the Barclays Capital U.S. Aggregate Bond Index(3) of investment grade bonds returned 5.93% for the fiscal year ended December 31, 2009. But improving risk appetite, combined with concern over the large volumes of issuance and fears of longer term inflation, meant that the Barclays Capital U.S. Treasury Index(4) component returned (3.57)% while the Barclays Capital Corporate Investment Grade Bond Index(5) returned 18.68%. High yield bonds, represented by the Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index(6), did even better, gaining a remarkable 58.76%. The annual yield on the 90-day U.S. Treasury Bills started the year at 12 basis points and ended it at just 5 basis points.

U.S. equities, represented by the S&P 500® Composite Stock Price ("S&P 500®") Index(7) including dividends, returned 26.46% for the fiscal year ended December 31, 2009, led by the technology and materials sectors, with telecoms and utilities lagging, albeit with positive returns. It was far from a smooth ride, and sentiment would periodically become fixated on the rather shaky foundation of the rally. Profits for S&P 500® companies suffered their ninth straight

2

MARKET PERSPECTIVE: YEAR ENDED DECEMBER 31, 2009

quarter of annual decline in the third quarter. But this must surely change in the fourth quarter since in the corresponding period in 2008, S&P 500® earnings were actually negative.

In international markets, the MSCI Japan® Index(8) rose 9.10% for the fiscal year, all of it in the first half. By the second quarter, GDP was rising again but it was due to net exports and government stimulus. Domestic demand was still in the doldrums, with wages down for 18 straight months and deflation again the norm. The MSCI Europe ex UK® Index(9) surged 27.70%. As in the U.S., the region's economy returned to growth in the third quarter of 2009. Prices stopped falling in November and by year end purchasing managers' indices were in expansion mode. Against this, unemployment was still on the rise to 9.80%. The MSCI UK® Index(10) jumped 27.60%, despite the disappointment that, alone among the world's largest economies, a rebound in GDP had not been reported by year end. Still, by November house prices were rising on an annual basis for the first time since early 2008, unemployment stabilized and, as in Continental Europe, purchasing managers' indices pointed firmly to expansion.

(1) The MSCI World IndexSM is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The S&P/Case-Shiller National U.S. Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single family home price indices for the nine U.S. Census divisions and is calculated quarterly.

(3) The Barclays Capital U.S. Aggregate Bond Index is an unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(4) The Barclays Capital U.S. Treasury Index is an unmanaged index that includes public obligations of the U.S. Treasury. Treasury bills, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS and STRIPS, are excluded.

(5) The Barclays Capital Corporate Investment Grade Bond Index is the corporate component of the Barclays Capital U.S. Credit Index. The U.S. Credit Index includes publicly-issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. The index includes both corporate and non-corporate sectors. The corporate sectors are industrial, utility and finance, which includes both U.S. and non-U.S. corporations.

(6) The Barclays Capital High Yield Bond — 2% Issuer Constrained Composite Index is an unmanaged index that includes all fixed income securities having a maximum quality rating of Ba1, a minimum amount outstanding of $150 million, and at least one year to maturity.

(7) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization companies whose securities are traded on major U.S. stock markets.

(8) The MSCI Japan® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(9) The MSCI Europe ex UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(10) The MSCI UK® Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

Parentheses denote a negative number.

All indices are unmanaged and investors cannot invest directly in an index. Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Portfolios' performance is subject to change since the period's end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING's Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

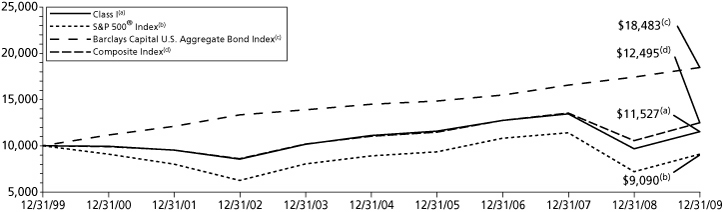

ING BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Balanced Portfolio (the "Portfolio") seeks to maximize investment return consistent with reasonable safety of principal, by investing in a diversified portfolio of one or more of the following asset classes: stocks, bonds and cash equivalents, based on the judgment of the Portfolio's management, of which of those sectors or mix thereof offers the best investment prospects. The Portfolio is managed by Vincent Costa, Christine Hurtsellers, Michael Hyman and Paul Zemsky, Portfolio Managers, of ING Investment Management Co. — the Sub-Adviser.*

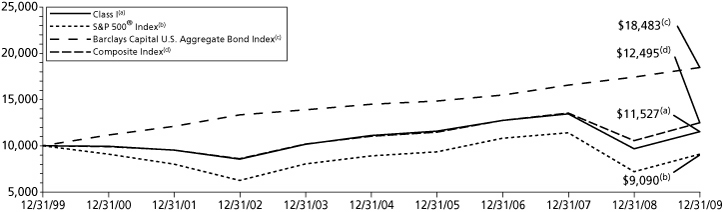

Performance: For the year ended December 31, 2009, the Portfolio's Class I shares provided a total return of 19.23% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index"), the Barclays Capital U.S. Aggregate Bond Index(2) and the Composite Index(3) (60% S&P 500® Index/40% Barclays Capital U.S. Aggregate Bond Index), which returned 26.46%, 5.93% and 18.40%, respectively, for the same period.

Portfolio Specifics: As the reporting period began, the financial world was on the brink of collapse after the failure of Lehman Brothers. Credit markets froze and the housing market cratered; global bond and stock markets suffered some of the worst performance since the crash of 1987. Bank failures escalated and central banks across the world provided unprecedented policy action in the form of massive fiscal and monetary stimulus. This gloomy picture brightened in March, however, when Citibank announced a return to profitability. A rally ensued; equity markets rewarded investors with positive performance, and the year finished on a strong note.

Throughout the period, the Portfolio was either neutral or overweight equities. Our most recent equity overweight was from August through November. We believed that the U.S. recession had reached an end, and expected a recovery in the United States and globally that would be stronger than consensus forecasts. The Portfolio ended the year in a neutral stance. We remained constructive on prospects for a U.S. and global economic recovery, and in particular on a continued recovery in earnings. Nevertheless, the recent equity rally brought stocks close to or even above fair value on some measures. Collectively, the Portfolio's asset allocation decisions added value.

The bond portion of the Portfolio represented a significant contribution to relative performance. The Portfolio's bond sleeve significantly outperformed its sub-benchmark, the Barclays Capital U.S. Aggregate Bond Index. The sleeve rebounded smartly on the heels of non-agency residential mortgage-backed securities, an overweight to investment grade credit, and allocations to emerging market debt and high yield. Allocations to lower-rated investment grade corporate, especially financials, were also helpful. On the equity side, our larger-cap stock selection detracted from performance, more than offsetting our positive stock picks and overweight in mid-cap. The Portfolio's cash position also acted as a slight drag.

Allocations between equities and fixed income are dependent on our quantitative asset allocation model, which uses the factors mentioned and not on a qualitative evaluation of the bond versus the equity markets. The Portfolio is actively managed and may deviate from its strategic weights.

Current Strategy and Outlook: As we close the chapter on another year, we are pleased with the progress and amazed at the stark differences in the overall environment compared with a mere 12 months ago. We believe economic depression worries have abated, stock markets around the world have rallied and signs of an early upswing are plentiful.

We remain cautiously optimistic, however, particularly regarding the outlook for the developed world as we forecast past mid-year. As growth from the inventory cycle and government stimulus fades, we will continue to confront issues that will ultimately shape the direction and magnitude of the recovery. Unemployment is the key driver of a sustained recovery; additionally, credit creation must provide the fuel for growth.

Top Ten Holdings*

as of December 31, 2009

(as a percent of net assets)

| U.S. Treasury Note, 0.750%, due 11/30/11 | | | 3.7 | % | |

| U.S. Treasury Note, 4.500%, due 08/15/39 | | | 1.4 | % | |

| Microsoft Corp. | | | 1.3 | % | |

| Procter & Gamble Co. | | | 1.2 | % | |

| AT&T, Inc. | | | 1.2 | % | |

| International Business Machines Corp. | | | 1.2 | % | |

| Pfizer, Inc. | | | 1.1 | % | |

| ExxonMobil Corp. | | | 1.1 | % | |

| Government National Mortgage Association, | | | | | |

| 4.500%, due 01/15/40 | | | 1.1 | % | |

| JPMorgan Chase & Co. | | | 1.1 | % | |

* Excludes short-term investments related to ING Institutional Prime Money Market Fund — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

* Effective January 13, 2009, Omar Aguilar, Ph.D. and James Kauffmann were replaced by Vincent Costa, Michael Hyman and Christine Hurtsellers as portfolio managers to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

4

ING BALANCED PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2009 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 29, 2006 | | Since Inception

of Class S

May 29, 2003 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 20.08 | % | | | — | | | | — | | | | (3.51 | )% | | | — | | | | — | | |

| Class I | | | 19.23 | % | | | 0.74 | % | | | 1.43 | % | | | — | | | | — | | | | — | | |

| Class S | | | 18.94 | % | | | 0.48 | % | | | — | | | | — | | | | 3.24 | % | | | — | | |

| Class S2 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 35.82 | % | |

| S&P 500® Index(1) | | | 26.46 | % | | | 0.42 | % | | | (0.95 | )% | | | (5.63 | )%(4) | | | 4.31 | %(5) | | | 54.56 | %(6) | |

Barclays Capital Aggregate

Bond Index(2) | | | 5.93 | % | | | 4.97 | % | | | 6.33 | % | | | 6.04 | %(4) | | | 4.42 | %(5) | | | 7.28 | %(6) | |

| Composite Index(3) | | | 18.40 | % | | | 2.52 | % | | | 2.25 | % | | | (0.67 | )%(4) | | | 4.63 | %(5) | | | 33.93 | %(6) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Balanced Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the U.S.

(2) The Barclays Capital Aggregate U.S. Bond Index is an unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The Composite Index consists of 60% of the return of (securities included in) the S&P 500® Index and 40% of the return of (securities included in) the Barclays Capital Aggregate U.S. Bond Index.

(4) Since inception performance for the indices is shown from January 1, 2007.

(5) Since inception performance for the indices is shown from June 1, 2003.

(6) Since inception performance for the indices is shown from March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

5

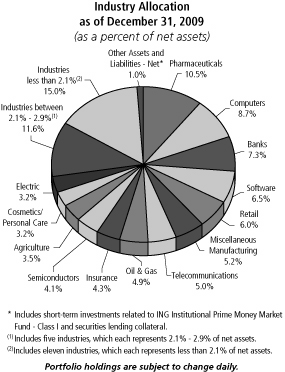

ING GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Growth and Income Portfolio (the "Portfolio") seeks to maximize total return through investments in a diversified portfolio of common stocks and securities convertible into common stock. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by Christopher F. Corapi and Michael Pytosh, Portfolio Managers of ING Investment Management Co. — the Sub-Adviser.

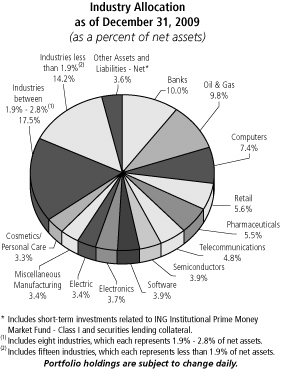

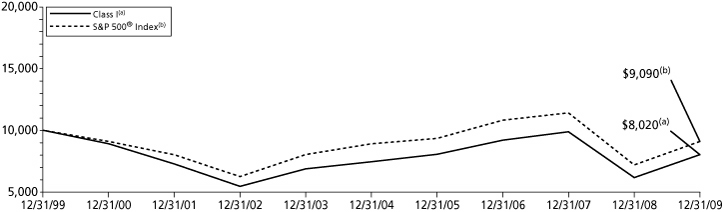

Performance: For the year ended December 31, 2009, the Portfolio's Class I shares provided a total return of 30.24% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index"), which returned 26.46% for the same period.

Portfolio Specifics: Outperformance was due to strong stock selection, which was favorable in eight out of 10 sectors. In particular, stock picks in consumer discretionary and telecommunications were the largest contributors to the Portfolio's results.

Liberty Media Corp. ("Liberty") was one of the Portfolio's strongest performers in consumer discretionary. Strong results from DirecTV Group, Inc. ("DirecTV"), Liberty's largest holding, was largely driven by better-than-expected subscriber growth in the United States. DirecTV has also executed very well in a tough macro environment and its sticky sports packages and high-definition offerings continue to be competitive differentiators. In telecommunications, our investment in Sprint Nextel Corp. ("Sprint") aided results. We purchased this stock last year after it had significantly underperformed the telecommunication sector as well as its peers and was trading at depressed levels. Our thesis, that Sprint's turnaround efforts — including cost cutting and improved customer service — would lead to better-than-expected results, came to fruition in the first half of this year. We sold the Portfolio's position at that time.

In contrast, the Portfolio was hurt by a handful of securities including Wells Fargo & Co. ("Wells Fargo") and ExxonMobil Corp ("ExxonMobil"). Wells Fargo's stock price declined significantly in the first nine weeks of the year due to concerns over its capital levels and larger-than-expected losses related to its acquisition of banking firm Wachovia Bank NA ("Wachovia"). Through the rest of the year, the stock was able to recover most of the losses incurred during that period, but it failed to recover as quickly as its peers did. The Portfolio still owns Wells Fargo, as it is a premier banking franchise with a consistent record of effective execution. We expect Wells Fargo's acquisition of Wachovia to lead to positive synergies and allow its banking franchise to achieve national scale. Owning ExxonMobil detracted from the Portfolio's relative results as the stock price, along with other integrated oil and gas companies, lagged the energy sector — investors preferred early cycle securities with high sensitivity to commodity prices.

Current Strategy and Outlook: The Portfolio is positioned in companies that we believe have strong or improving competitive positions, robust end markets or attractive capital allocation opportunities. We believe each stock possesses an attractive valuation and a clear catalyst to improve it. Top holdings include Wal-Mart Stores, Inc. ("Wal-Mart"), Apple, Inc. ("Apple") and Cisco Systems, Inc ("Cisco"). Wal-Mart is in the early phase of a project to improve its shopping experience. We believe this effort, along with overseas growth opportunities, will lead to better results going forward. Within technology, we like Apple and Cisco due to their long-term growth potential and the ability to sustain earnings in the near term.

Top Ten Holdings*

as of December 31, 2009

(as a percent of net assets)

| ExxonMobil Corp. | | | 4.4 | % | |

| Apple, Inc. | | | 4.0 | % | |

| Procter & Gamble Co. | | | 3.3 | % | |

| Cisco Systems, Inc. | | | 3.1 | % | |

| Wal-Mart Stores, Inc. | | | 3.0 | % | |

| JPMorgan Chase & Co. | | | 2.9 | % | |

| Pfizer, Inc. | | | 2.6 | % | |

| General Electric Co. | | | 2.4 | % | |

| Oracle Corp. | | | 2.4 | % | |

| PepsiCo, Inc. | | | 2.2 | % | |

* Excludes short-term investments related to ING Institutional Prime Money Market Fund — Class I.

Portfolio holdings are subject to change daily.

* Effective May 1, 2009, Mr. Pytosh was added as a portfolio manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

6

ING GROWTH AND INCOME PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2009 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 20, 2006 | | Since Inception

of Class S

June 11, 2003 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 29.69 | % | | | — | | | | — | | | | (4.98 | )% | | | — | | | | — | | |

| Class I | | | 30.24 | % | | | 1.50 | % | | | (2.18 | )% | | | — | | | | — | | | | — | | |

| Class S | | | 30.03 | % | | | 1.24 | % | | | — | | | | — | | | | 3.91 | % | | | — | | |

| Class S2 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 52.46 | % | |

| S&P 500® Index(1) | | | 26.46 | % | | | 0.42 | % | | | (0.95 | )% | | | (5.63 | )%(2) | | | 4.31 | %(3) | | | 54.56 | %(4) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Growth and Income Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the U.S.

(2) Since inception performance for the index is shown from January 1, 2007.

(3) Since inception performance for the index is shown from June 1, 2003.

(4) Since inception performance for the index is shown from March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

7

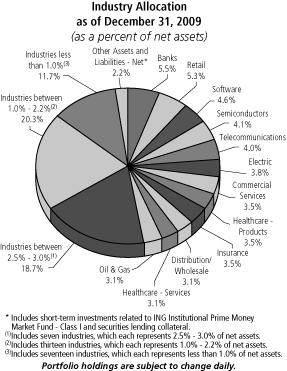

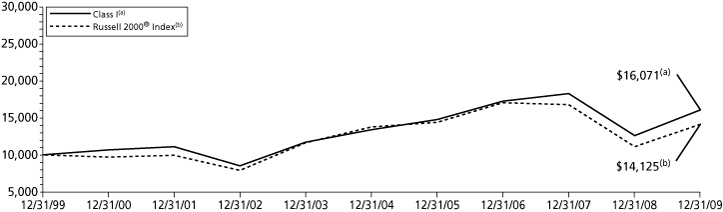

ING SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Small Company Portfolio (the "Portfolio") seeks growth of capital primarily through investment in a diversified portfolio of common stocks of companies with smaller market capitalizations. The Portfolio is managed by Joseph Basset, CFA, and Steve Salopek, Portfolio Managers of ING Investment Management Co. — the Sub Adviser.

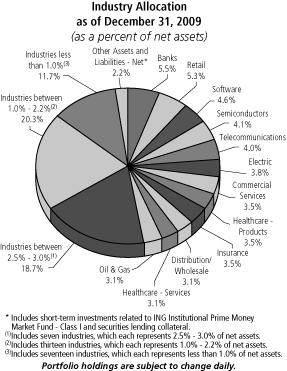

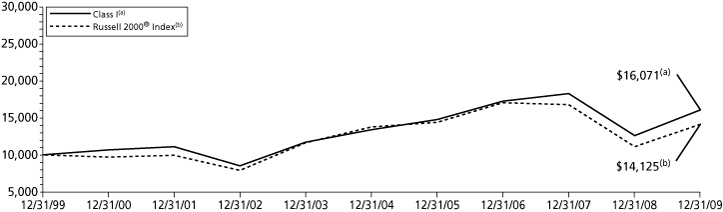

Performance: For the year ended December 31, 2009, the Portfolio's Class I shares provided a total return of 27.56% compared to the Russell 2000® Index(1), which returned 27.17% for the same period.

Portfolio Specifics: Although the Russell 2000® Index lagged both large- and mid-caps for the year, it had one of its best recoveries on record, being down more than 31% on March 9 and subsequently rebounding more than 82%. In our opinion, lower quality, lower market capitalization stocks led the rally of 2009. The fourth quarter marked a shift as stocks, which in our view represent higher quality, higher-market capitalization companies, outperformed. We believe this shift reflected a focus on companies' fundamentals as market prices for many of these stocks already reflected expectations of a strong recovery.

Both sector allocation and stock selection benefited performance. Underweight positions in financials and healthcare helped, while an underweight position in consumer discretionary acted as a drag.

Stock selection in financials, energy, industrials and utilities benefited the Portfolio. Notable outperformance in financials was due to selection in commercial banks and capital markets. Energy benefited from selection in energy equipment and services. Selection in machinery, airfreight and logistics and airlines also helped most among industrials.

In contrast, stock selection in information technology, consumer staples, telecommunication services and consumer discretionary detracted from performance. In consumer discretionary, stock selection in household durables and specialty retail held back returns. In consumer staples, stock selection in food and staples retailing detracted from returns. Underperformance in telecommunication services was attributable to stock selection among wireless and diversified telecommunication services.

Cooper Tire and Rubber Co. ("Cooper Tire and Rubber") and Dril-Quip, Inc. ("Dril-Quip") contributed significantly to performance over the period. Cooper Tire and Rubber, which manufactures replacement tires, benefited from a significant improvement in company fundamentals, lower commodity input prices, pricing power and a favorable restructuring. The U.S. government imposed a tariff on imports of Chinese tires in the fall, which benefited U.S. tire manufacturers. A position in Dril-Quip, which manufactures offshore oil drilling and production equipment for use in deep water and harsh environments, also benefited results. Despite a weak start to the year for the oil services industry, the company benefited from an increase in drilling activity after mid-year. In particular, there was renewed interest in deep water drilling and Dril-Quip is one of the few providers of subsea equipment.

In contrast, ArvinMeritor, Inc. ("ArvinMeritor") and Spartan Stores, Inc. ("Spartan Stores") were two of the largest detractors from performance over the period. ArvinMeritor supplies a range of integrated systems for commercial trucks and light vehicles. We initiated a position earlier in the year. Unfortunately, the unfavorable economic environment hurt the stock, as bankruptcy concerns increased. We sold the stock before it rebounded later in the period. Spartan Stores operates as a grocery distributor and retailer, predominantly in Michigan and Indiana. Spartan's geographic exposure hurt it, as Michigan suffered a spike in unemployment brought on by the decline in the auto industry. Later, despite signs that the economy was stabilizing, the stock did not experience the same rebound that other retailers realized. The Portfolio continues to hold the stock, as we believe that the company will benefit as the auto industry recovers and unempl oyment in Michigan declines. In addition, the stock's valuation is reasonable and we believe management has led the business well against a challenging economic backdrop.

Current Strategy and Outlook: We believe that the economy will continue to recover slowly, and we remain focused on companies with strong balance sheets and good cash flow generation capabilities. The majority of stocks that have performed well since the low on March 9 have been lower quality, more cyclical companies, in our view. We believe that many of these stocks have become relatively expensive, as investors already have priced in expectations of rapid and strong earnings recovery. Now we are focusing on companies that we believe are less cyclical and more attractively valued, with a greater emphasis on earnings achievability. We continue to take advantage of market volatility to acquire what we believe are attractively valued companies.

Top Ten Holdings*

as of December 31, 2009

(as a percent of net assets)

| iShares Russell 2000 Index Fund | | | 1.5 | % | |

| Cleco Corp. | | | 1.2 | % | |

| Bally Technologies, Inc. | | | 1.2 | % | |

| Solera Holdings, Inc. | | | 1.1 | % | |

| Healthsouth Corp. | | | 1.1 | % | |

| SVB Financial Group | | | 1.1 | % | |

| Polycom, Inc. | | | 1.1 | % | |

| Fossil, Inc. | | | 1.1 | % | |

| Stifel Financial Corp. | | | 1.1 | % | |

| Wolverine World Wide, Inc. | | | 1.0 | % | |

* Excludes short-term investments related to ING Institutional Prime Money Market Fund — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

8

ING SMALL COMPANY PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2009 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 16, 2008 | | Since Inception

of Class S

November 1, 2001 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 26.96 | % | | | — | | | | — | | | | 30.65 | % | | | — | | | | — | | |

| Class I | | | 27.56 | % | | | 3.70 | % | | | 4.86 | % | | | — | | | | — | | | | | | |

| Class S | | | 27.33 | % | | | 3.38 | % | | | — | | | | — | | | | 5.71 | % | | | — | | |

| Class S2 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 58.73 | % | |

| Russell 2000® Index(1) | | | 27.17 | % | | | 0.51 | % | | | 3.51 | % | | | 27.17 | %(2) | | | 6.13 | % | | | 62.88 | %(3) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Small Company Portfolio against the index indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Russell 3000 Index is an unmanaged index that measures the performance of 3,000 U.S. companies based on total market capitalization.

(2) Since inception performance for the index is January 1, 2009.

(3) Since inception performance for the index is March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

9

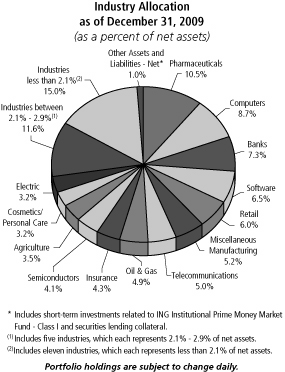

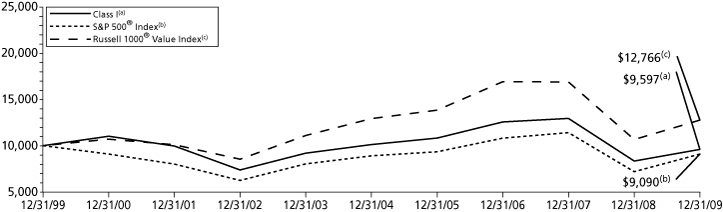

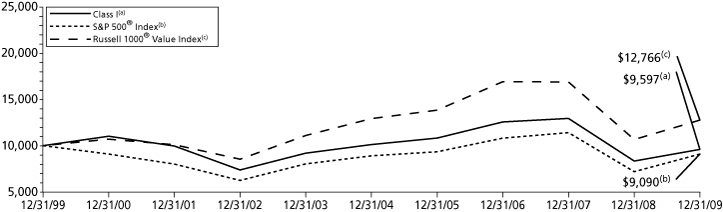

ING OPPORTUNISTIC LARGE CAP PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Opportunistic LargeCap Portfolio* (the "Portfolio") seeks growth of capital primarily through investment in a diversified portfolio of common stocks and securities convertible into common stocks. The Portfolio is managed by Vincent Costa, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.**

Performance: For the year ended December 31, 2009, the Portfolio's Class I shares provided a total return of 15.10% compared to the Standard and Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index") and the Russell 1000® Value Index(2), which returned 26.46% and 19.69%, respectively, for the same period.

Portfolio specifics: The Portfolio began 2009 with an overweight in valuation factors, which worked until the middle of January and then reversed performance for the rest of the quarter, hurting returns.

Underperformance in market recognition factors, such as price momentum and analyst estimate revisions, was the main driver of underperformance. This underperformance was most severe in March and April and again in July and August. Quality factors also detracted from performance during the first three quarters of 2009, particularly factors like return on equity and return on assets. Free cash flow to net income was an exception within the quality buckets as it performed well. Within valuation, our model was overweight in high quality, value factors such as free cash flow to price, rather than deep value factors such as book to price and cash to price, which saw the steepest recoveries. Therefore, although the Portfolio was overweight valuation, our stress on high quality meant that the Portfolio did not reap the entire benefit of the valuation bounce-back.

During the first four months of the year, the Portfolio was benchmarked to the Russell 1000 Value Index. In that period, security selection in the energy, utilities and healthcare sectors was unfavorable. Selection in the industrials and consumer staples sectors benefited returns. An underweight position in the materials sector and an overweight position in the consumer staples sector detracted from returns, which was partially offset by an overweight allocation in utilities and an underweight in financials.

For the rest of the year, the Portfolio was benchmarked to the S&P 500 Index. In this period, security selection in the consumer discretionary and financials sectors was the primary detractor from returns. Sector allocation added to returns during the period, through underweight positions in energy and consumer staples.

The top detractors during the year included overweight positions Capital One Financial Corp., Regions Financial Corp. and Sprint Nextel Corp. The top contributors for the period included overweight positions in Wells Fargo & Co., General Electric Co. and Gap, Inc.

Current Strategy and Outlook: The Portfolio's quantitatively driven large-cap strategy applies a proprietary ranking process to detect unrecognized value in stocks of companies that we expect to outperform the market averages, because of what we believe are their strong business fundamentals. Our analysis positions the Portfolio to capitalize on what we believe are high-quality companies with superior business momentum, strong earnings and attractive valuations.

At the end of the period, the Portfolio was overweight information technology and industrials, and underweight consumer staples and energy.

Top Ten Holdings

as of December 31, 2009

(as a percent of net assets)

| International Business Machines Corp. | | | 3.6 | % | |

| AT&T, Inc. | | | 3.5 | % | |

| Procter & Gamble Co. | | | 3.2 | % | |

| Pfizer, Inc. | | | 3.2 | % | |

| Microsoft Corp. | | | 3.2 | % | |

| General Electric Co. | | | 2.7 | % | |

| JPMorgan Chase & Co. | | | 2.6 | % | |

| EMC Corp. | | | 2.3 | % | |

| Oracle Corp. | | | 2.2 | % | |

| Marvell Technology Group Ltd. | | | 2.1 | % | |

Portfolio holdings are subject to change daily.

* Effective May 1, 2009, the Portfolio changed its name and principal investment strategy.

** Effective January 13, 2009, Omar Aguilar is no longer a portfolio manager to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

10

ING OPPORTUNISTIC LARGECAP PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2009 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 29, 2006 | | Since Inception

of Class S

July 16, 2001 | |

| Class ADV | | | 14.74 | % | | | — | | | | — | | | | (9.07 | )% | | | — | | |

| Class I | | | 15.10 | % | | | (1.06 | )% | | | (0.41 | )% | | | — | | | | — | | |

| Class S | | | 14.83 | % | | | (1.30 | )% | | | — | | | | — | | | | (1.74 | )% | |

| S&P 500® Index(1) | | | 26.46 | % | | | 0.42 | % | | | (0.95 | )% | | | (5.63 | )%(3) | | | 0.95 | %(4) | |

| Russell 1000® Value Index(2) | | | 19.69 | % | | | (0.25 | )% | | | 2.47 | % | | | (8.96 | )%(3) | | | 2.25 | %(4) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Opportunistic LargeCap Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in the indices. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio manager, only through the end of the period as stated on the cover. The portfolio manager's views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The S&P 500® Index is an unmanaged index that measures the performance of the securities of approximately 500 of the largest companies in the U.S.

(2) The Russell 1000® Value Index is an unmanaged index that measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values, which more closely tracks the types of securities in which the Portfolio invests than the S&P 500® Composite Stock Price Index.

(3) Since inception performance for the indices is shown from January 1, 2007.

(4) Since inception performance for the indices is shown from August 1, 2001.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

11

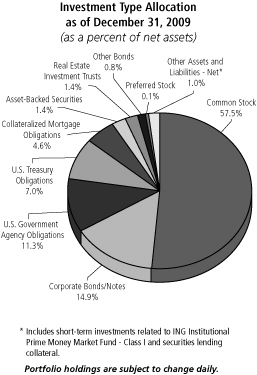

ING INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Intermediate Bond Portfolio (the "Portfolio") seeks to maximize total return consistent with reasonable risk. The Portfolio seeks its objective through investments in a diversified portfolio consisting primarily of debt securities. It is anticipated that capital appreciation and investment income will both be major factors in achieving total return. The Portfolio is managed by Christine Hurtsellers, Michael Hyman, Peter Guan and Christopher Diaz, Portfolio Managers of ING Investment Management Co. — the Sub-Adviser.*

Performance: For the year ended December 31, 2009, the Portfolio's Class I shares provided a total return of 11.57% compared to the Barclays Capital U.S. Aggregate Bond Index(1), which returned 5.93% for the same period.

Portfolio Specifics: In what was a very strong year for returns of risk-based bonds, despite a weak first quarter, corporate bonds posted excess returns of 22.76%, with utilities leading industrials and financials. Securitized assets also performed well on a relative basis. Commercial mortgage-backed securities ("CMBS") posted excess returns of 29.60%, while asset-backed securities ("ABS") returned 24.96%. Fixed-rate agency residential mortgage-backed securities ("RMBS") rose 4.82%.

It is difficult to gauge the excess returns of the non-agency RMBS bonds since they are not in the major indices; however, we estimate that excess returns may have reached 40% with prime and Alt-A RMBS outperforming home equity loans. The high beta, or non-investment grade, sectors fared extraordinarily well. Global high yield (HY) posted 59.62% of excess returns and emerging market debt ("EMD") returned 37.34%.

After a challenging first quarter, the Portfolio outperformed its benchmark due to significant sector overweights to credit, CMBS, ABS, and non-agency RMBS. Within corporate bonds, its combined overweight to financials (especially insurance companies and banks) and lower-rated bonds also proved beneficial, especially in the context of security selection. In addition, the broader themes of moving from consumer non-cyclicals to cyclicals and commodity-rally themed securities proved beneficial for most of the year.

The strategy was underweight U.S. Treasuries, agency debentures and agency RMBS and overweight riskier sectors as mentioned previously. Indeed, this call was intrinsically correct and we were very happy to underweight two modestly outperforming sectors in order to increase the strategy's overweight to even stronger performing sectors. Duration positioning, which varied over the year, was largely beneficial.

An overweight to high yield was a source of outperformance versus the benchmark while currency allocations to Brazil, Australia, India, Indonesia, and the euro were also beneficial in a period of generally weakening U.S. dollar.

Current Outlook and Strategy: Our key themes for 2010 are for, in our opinion, range-bound U.S. Treasury rates and little likelihood of Federal Reserve tightening in the first half of the year, due to expected high continuing unemployment and significant slack in the domestic economy. Although concerns about inflation may resurface intermittently, we believe that it will not be a problem for the near-term, especially given the decline in owner's equivalent rent and little wage pressure resulting from poor job growth. Given the expansion of domestic and global economies of late, market participants are paying greater attention to the need for an "exit strategy" from quantitative easing and the (near) zero interest rate policy which may well precede actual increases in the fed funds rate.

The Portfolio maintains an overweight to investment grade credit and non-agency RMBS, but we are trimming non-agency RMBS exposure. Additionally, we are overweight CMBS and ABS. We are underweight agency RMBS but may look to add floating rate paper given the opportunity. Our overweight to spread sectors leaves us with an underweight to U.S. Treasuries and agency debentures. We will tactically trade duration with a bias to staying short in the opening days of 2010 as recent economic data has been surprising markets by their strength versus market consensus.

Our new EMD model target is zero pending a better entry point while the high yield target has increased to 10% as we reduce our non-agency RMBS exposures. As 2010 evolves, we may revisit some of our winning trades from 2009 including reinitiating EMD exposures especially in economies that benefit from commodities, have high savings rates, may benefit from rising internal consumption, and a rebound in exports. We re-entered a long Brazilian real trade late in December while maintaining small currency exposures to India and Indonesia.

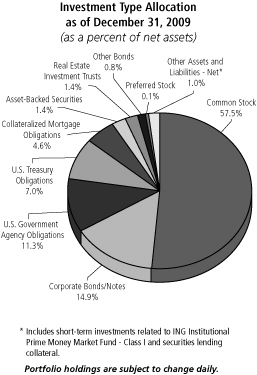

Investment Type Allocation

as of December 31, 2009

(as a percent of net assets)

| Corporate Bonds/Notes | | | 40.2 | % | |

| U.S. Government Agency Obligations | | | 29.6 | % | |

| U.S. Treasury Obligations | | | 18.7 | % | |

| Collateralized Mortgage Obligations | | | 12.3 | % | |

| Asset-Backed Securities | | | 3.5 | % | |

| Other Bonds | | | 2.4 | % | |

| Preferred Stock | | | 0.2 | % | |

| Other Assets and Liabilities — Net | | | (6.9 | )% | |

| Net Assets | | | 100.0 | % | |

* Includes short-term investments related to commercial paper, ING Institutional Prime Money Market Fund — Class I and securities lending collateral.

Portfolio holdings are subject to change daily.

Top Ten Holdings*

as of December 31, 2009

(as a percent of net assets)

| U.S. Treasury Note, 0.750%, due 11/30/11 | | | 6.3 | % | |

| U.S. Treasury Note, 4.500%, due 08/15/39 | | | 4.3 | % | |

| U.S. Treasury Note, 1.125%, due 12/15/12 | | | 3.4 | % | |

| Federal National Mortgage Association, | | | | | |

| 6.000%, due 01/15/33 | | | 2.7 | % | |

| Brazil Notas do Tesouro Nacional Series F, | | | | | |

| 10.000%, due 01/01/11 | | | 2.4 | % | |

| U.S. Treasury Note, 3.375%, due 11/15/19 | | | 2.0 | % | |

| Federal National Mortgage Association, | | | | | |

| 5.500%, due 01/25/39 | | | 1.6 | % | |

| Federal National Mortgage Association, | | | | | |

| 4.500%, due 01/25/39 | | | 1.5 | % | |

| Federal Home Loan Mortgage Corporation, | | | | | |

| 5.000%, due 01/15/39 | | | 1.4 | % | |

| Government National Mortgage Association, | | | | | |

| 4.500%, due 01/15/40 | | | 1.3 | % | |

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

* Effective January 13, 2009, James Kauffmann was replaced by Christopher Diaz, Peter Guan, Michael Hyman and Christine Hurtsellers as portfolio co-managers to the Portfolio.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

12

ING INTERMEDIATE BOND PORTFOLIO

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended December 31, 2009 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class ADV

December 20, 2006 | | Since Inception

of Class S

May 3, 2002 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 11.08 | % | | | — | | | | — | | | | 2.01 | % | | | — | | | | — | | |

| Class I | | | 11.57 | % | | | 3.05 | % | | | 5.28 | % | | | — | | | | — | | | | — | | |

| Class S | | | 11.38 | % | | | 2.79 | % | | | — | | | | — | | | | 4.17 | % | | | — | | |

| Class S2 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 14.59 | % | |

Barclays Capital Aggregate

Bond Index(1) | | | 5.93 | % | | | 4.97 | % | | | 6.33 | % | | | 6.04 | %(2) | | | 5.39 | %(3) | | | 7.28 | %(4) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Intermediate Bond Portfolio against the index indicated. An index has has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) The Barclays Capital Aggregate U.S. Bond Index is an unmanaged index publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(2) Since inception performance for the the index is shown from January 1, 2007.

(3) Since inception performance for the index is shown from May 1, 2002.

(4) Since inception performance for the index is shown from March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser and ING Investment Management Co., the former investment adviser, began serving as sub-adviser to the Portfolio.

13

ING MONEY MARKET PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING Money Market Portfolio (the "Portfolio") seeks to provide high current return, consistent with preservation of capital and liquidity, through investment in high-quality money market instruments, while maintaining a stable share price of $1.00 per share. The Portfolio is managed by David S. Yealy, Portfolio Manager of ING Investment Management Co. — the Sub-Adviser.

Performance*: For the year ended December 31, 2009, the Portfolio's shares provided a total return of 0.33% compared to the iMoneyNet First Tier Retail Index(1), which returned 0.16% for the same period.

Portfolio Specifics: For money market investors, 2009 was a year characterized by a low interest rate environment, continued government support in the U.S. and globally, with both struggling in the first half of the year followed by stabilization and modest recovery in the second half of the period.

The Portfolio's focus this past year has not been on maximizing yield and returns but on preserving capital, limiting credit risk and keeping an excess liquidity cushion due to elevated risks. The Portfolio did take on interest rate risk throughout the year, maintaining a weighted average maturity ("WAM") at the longer end of its maturity range by buying longer-term Treasury and agency securities. The Portfolio finished the year with a 73 day WAM. We avoided additional credit risk but gave up some incremental yield by not buying higher yielding debt of more marginal issuers and structured securities not covered by the government programs during the first half of the year. We started to add longer credit exposure only marginally during the third quarter as the economy and markets stabilized.

Current Strategy and Outlook: It is our expectation that the economy will recover slowly in 2010 due to continuing high unemployment and significant domestic slack. We believe the lack of a sustained and significant housing recovery will remain a drag. We expect the Federal Open Market Committee ("FOMC") will keep the federal funds rate in the 0.00–0.25% range for most if not all of 2010. An increase in short-term rates will be predicated on how soon and quickly the Federal Reserve Board (the "Fed') can remove its quantitative easing measures, and the strength and speed of the economic recovery and future inflation expectations.

Our current strategy continues to focus on maintaining an extended WAM posture with a view that the markets have built in an expectation for a strong economic rebound and the Fed raising short-term rates much earlier in 2010 than we currently expect.

We believe short-term markets are still highly dependent on central bank liquidity programs and have a long way to go before returning to what we would consider normal. The Fed and U.S. Treasury have already terminated some programs they put in place following the Lehman Brothers bankruptcy, and have announced that others will expire in early 2010. Preservation of capital and liquidity remain our top objectives. We plan to maintain the Portfolio's above-average excess daily liquidity and short-term liquidity as well as reduced credit exposure until we see how the short-term markets react to the terminations of those programs and the unwinding of quantitative easing.

Investment Type Allocation

as of December 31, 2009

(as a percent of net assets)

| Commercial Paper | | | 64.0 | % | |

| Repurchase Agreement | | | 13.8 | % | |

| Corporate Bonds/Notes | | | 7.3 | % | |

| Certificates of Deposit | | | 6.4 | % | |

| U.S. Government Agency Obligations | | | 5.5 | % | |

| U.S. Treasury Obligations | | | 3.6 | % | |

| Securities Lending Collateral | | | 2.3 | % | |

| Other Assets and Liabilities — Net | | | (2.9 | )% | |

| Net Assets | | | 100.0 | % | |

Portfolio holdings are subject to change daily.

* Please see Note 5 for more information regarding the contractual waiver in place to reimburse certain expenses of the Portfolio to the extent necessary to assist the Portfolio in maintaining a yield of not less than zero.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

14

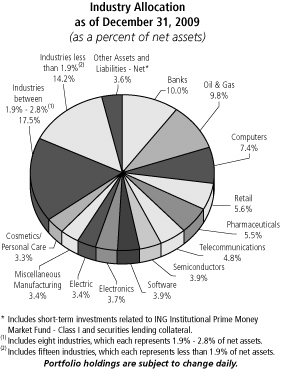

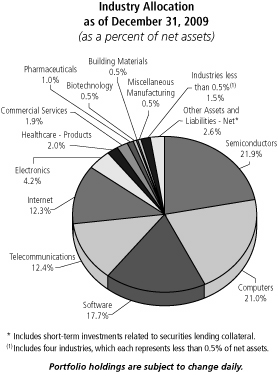

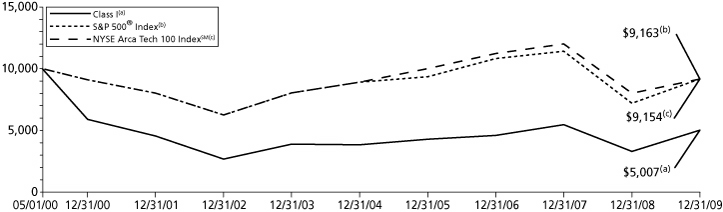

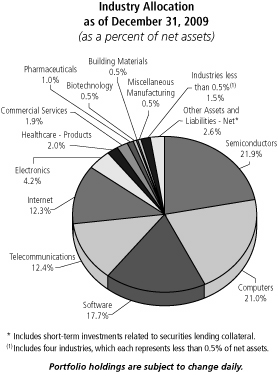

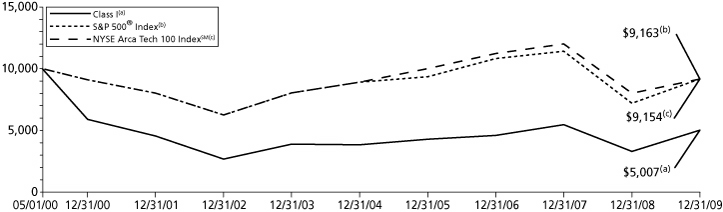

ING BLACKROCK GLOBAL SCIENCE AND TECHNOLOGY OPPORTUNITIES PORTFOLIO

PORTFOLIO MANAGERS' REPORT

ING BlackRock Science and Technology Opportunities Portfolio (the "Portfolio") seeks long-term capital appreciation. The Portfolio is managed by Thomas P. Callan, CFA, Managing Director and Senior Portfolio Manager, Erin Xie, PhD, Managing Director and Portfolio Manager and Jean M. Rosenbaum, CFA, Managing Director and Portfolio Manager of BlackRock Advisors, LLC — the Sub-Adviser.

Performance: For the year ended December 31, 2009, the Portfolio's Class I shares provided a total return of 52.74% compared to the Standard & Poor's 500® Composite Stock Price Index(1) ("S&P 500® Index") and the NYSE Arca Tech 100 IndexSM(2), which returned 26.46% and 44.35%, respectively, for the same period.

Portfolio Specifics: Looking back, the first two months of 2009 saw equity markets continuing the previous year's declines on fears of economic depression and widespread bank nationalization. By March 2009, stimulus packages and central bank interventions helped stabilize the financial system and sparked a sharp upward re-rating of stocks and other risk assets from deeply oversold levels. As the year closed, investors were focusing on whether private sector demand will be sufficient to fuel growth and create jobs in the quarters to come. At the same time, there are questions around how central banks plan to unwind massive policy responses now that financial markets have normalized considerably and concerns about inflation are beginning to surface.

The Portfolio outperformed the NYSE Arca Tech 100 IndexSM for the year. Stock selection and allocation effects were both positive contributors to these results. Within information technology ("IT"), strong selection came from semiconductors and internet software & services, and, to a lesser extent, from semiconductor equipment and systems software holdings. From an individual holdings perspective, Marvel Technology Group Ltd., Micron Technology, Inc. and Atheros Communications, Inc. within the semiconductor sub-industry more than doubled during their holding periods. Additionally, exposure to Baidu and Google, Inc. helped boost returns relative to the benchmark in the Portfolio's internet software & services group. Conversely, relative performance across technology hardware & equipment was hurt by selection in the computer storage & peripherals, computer hardware and electronic components sub-industries.

Overall allocation effects were positive. Maintaining underweights in the healthcare and industrials sectors relative to the benchmark were the primary contributors as each underperformed IT returns significantly. Additionally, the Portfolio's underweight in biotechnology was a notable source of strength as it was one of the few sub-industries to generate a negative total return in the benchmark in 2009. Allocation effects were also aided by an overweight in the semiconductors & semiconductor equipment industry, and an underweight in aerospace & defense companies within industrials.

Current Strategy and Outlook: The IT supply chain is continuing to stabilize following the freezing of credit experienced at the end of 2008 and early 2009. With signs of economic recovery underway, a rebound in corporate IT spending may follow, as it has historically been highly correlated with economic activity. Inventory remains at below normal levels for many products in the supply chain, so continued growth is expected. In the near term, however, some parts have better availability than others, possibly causing some variability in earnings results in the coming months. We believe investors should maintain portfolios that are diversified, have carefully calibrated risk exposures, and have an emphasis on valuation in stock selection.

At year-end, the Portfolio was invested as follows: 87% in IT, 4% in healthcare, 3% in telecommunication services, with the remainder in industrials and consumer discretionary. Within IT, the Portfolio's primary overweights were in semiconductors, semiconductor equipment, internet software & services and systems software; significant underweights were in communication equipment, data processing & outsourced services and computer hardware. We remain underweight across healthcare, with the exception of a small exposure to healthcare supplies, which is not represented in the benchmark.

Top Ten Holdings

as of December 31, 2009

(as a percent of net assets)

| Apple, Inc. | | | 5.8 | % | |

| Microsoft Corp. | | | 3.4 | % | |

| Google, Inc. — Class A | | | 3.4 | % | |

| Hewlett-Packard Co. | | | 3.3 | % | |

| International Business Machines Corp. | | | 2.9 | % | |

| Cisco Systems, Inc. | | | 2.6 | % | |

| Intel Corp. | | | 2.4 | % | |

| Oracle Corp. | | | 2.2 | % | |

| Texas Instruments, Inc. | | | 2.1 | % | |

| Qualcomm, Inc. | | | 2.0 | % | |

Portfolio holdings are subject to change daily.

Portfolio holdings and characteristics are subject to change and may not be representative of current holdings and characteristics. The outlook for this Portfolio may differ from that presented for other ING Funds. Performance for the different classes of shares will vary based on differences in fees associated with each class.

15

ING BLACKROCK GLOBAL SCIENCE AND TECHNOLOGY OPPORTUNITIES PORTFOLIO

PORTFOLIO MANAGERS' REPORT

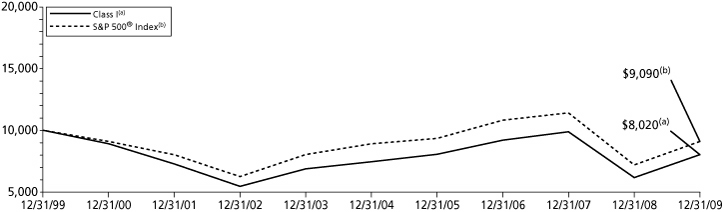

| Average Annual Total Returns for the Periods Ended December 31, 2009 | |

| | | 1 Year | | 5 Year | | Since Inception

of Class I

May 1, 2000 | | Since Inception

of Class S

November 1, 2001 | | Since Inception

of Class ADV

December 16, 2008 | | Since Inception

of Class S2

February 27, 2009 | |

| Class ADV | | | 52.00 | % | | | — | | | | — | | | | — | | | | 47.76 | % | | | — | | |

| Class I | | | 52.74 | % | | | 5.57 | % | | | (6.90 | )% | | | — | | | | — | | | | — | | |

| Class S(1) | | | 52.62 | % | | | 5.33 | % | | | — | | | | (4.69 | )% | | | — | | | | — | | |

| Class S2 | | | — | | | | — | | | | — | | | | — | | | | — | | | | 64.45 | % | |

| S&P 500® Index(2) | | | 26.46 | % | | | 0.42 | % | | | (1.81 | )% | | | 2.60 | % | | | 26.46 | %(4) | | | 54.56 | %(5) | |

| NYSE Arca Tech 100 IndexSM(3) | | | 44.35 | % | | | 2.94 | % | | | (0.91 | )% | | | 5.24 | % | | | 44.35 | %(4) | | | 56.95 | %(5 | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING BlackRock Global Science and Technology Portfolio against the indices indicated. An index has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Portfolio's performance is shown without the imposition of any expenses or charges which are, or may be, imposed under your annuity contract. Total returns would have been lower if such expenses or charges were included.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on portfolio distributions or the redemption of portfolio shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

The performance update illustrates performance for a variable investment option available through a variable annuity contract. The performance shown indicates past performance and is not a projection or prediction of future results. Actual investment returns and principal value will fluctuate so that shares and/or units, at redemption, may be worth more or less than their original cost. Please call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Portfolio holdings are subject to change daily.

(1) On December 16, 2003, all outstanding shares of Class S were fully redeemed. On July 20, 2005, Class S recommenced operations. The returns for Class S include the performance for Class I, adjusted to reflect the higher expenses of Class S, for the period December 17, 2003 to July 19, 2005.

(2) The S&P 500® Index is an unmanaged index that measures the performance of the securities of approximately 500 of the largest companies in the U.S.

(3) The NYSE Arca Tech 100 IndexSM is a multi-industry technology index measuring the performance of companies using technology innovation across a broad spectrum of industries. It is comprised of 100 listed and over-the-counter stocks from 14 different subsectors including computer hardware, software, semiconductors, telecommunications, data storage and processing, electronics and biotechnology.

(4) Since inception performance for the indices is shown from January 1, 2009.

(5) Since inception performance for the indices is shown from March 1, 2009.

Effective March 1, 2002, ING Investments, LLC began serving as investment adviser. Formerly, ING Investment Management Co. served as the investment adviser. Prior to January 1, 2004, the Portfolio was sub-advised by a different sub-adviser.

16

SHAREHOLDER EXPENSE EXAMPLES (UNAUDITED)

As a shareholder of a Portfolio, you incur two types of costs: (1) transaction costs, including redemption fees and exchange fees; and (2) ongoing costs, including management fees, distribution and/or service (12b-1) fees, and other Portfolio expenses. These Examples are intended to help you understand your ongoing costs (in dollars) of investing in a Portfolio and to compare these costs with the ongoing costs of investing in other mutual funds.

The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2009 to December 31, 2009. The Portfolios' expenses are shown without the imposition of any charges which are, or may be, imposed under your annuity contract. Expenses would have been higher if such charges were included.

Actual Expenses

The first section of the table shown below, "Actual Portfolio Return," provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes