UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

PLUM CREEK TIMBER COMPANY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Notice of

2007 Annual Meeting

of Stockholders

and Proxy Statement

PLUM CREEK TIMBER COMPANY, INC.

Dear Stockholder:

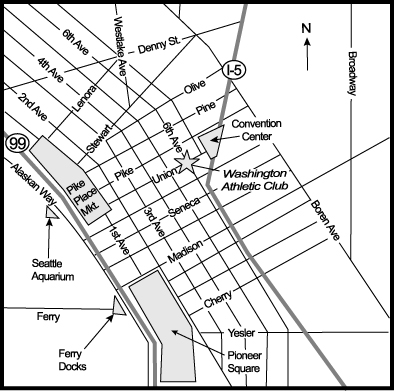

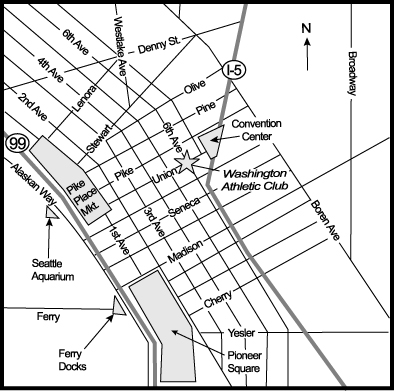

It is a pleasure to invite you to Plum Creek’s Annual Meeting of Stockholders on Wednesday, May 2, 2007, beginning at 9:00 a.m. local time, at the Washington Athletic Club in Seattle, Washington. Driving instructions to the Washington Athletic Club can be found at the back of this document.

Your vote is very important. Whether or not you plan to attend the Annual Meeting in person, I urge you to vote your proxy as soon as possible. You can vote over the Internet, by telephone or by mailing back a proxy card. Voting in any of these ways will ensure your representation at the Annual Meeting if you do not attend in person. Please review the instructions on the proxy card regarding each of these options. If you do attend the meeting in person, you will have the opportunity, if you desire, to change your vote at the meeting.

The agenda for the Annual Meeting includes the election of ten (10) directors to serve until the 2008 Annual Meeting, consideration of a proposal to ratify the appointment of Ernst & Young as Plum Creek’s independent auditors, consideration of two stockholder proposals (if properly presented at the meeting), and such other business as may properly come before the meeting. The Board of Directors recommends that you vote“FOR” each of the director nominees,“FOR” ratifying the appointment of Ernst & Young as Plum Creek’s independent auditors and“AGAINST” each of the stockholder proposals. In addition to these specific matters, there will be a report on Plum Creek’s business, and you will have an opportunity to ask questions.

If you have any questions concerning the Annual Meeting or any of the proposals, please contact our Investor Relations Department at (800) 858-5347 (within the United States and Canada) or (206) 467-3600 (outside the United States and Canada, call collect).

I look forward to seeing you on May 2nd in Seattle.

|

| Sincerely yours, |

|

|

Rick R. Holley President and Chief Executive Officer |

PLUM CREEK TIMBER COMPANY, INC.

999 Third Avenue, Suite 4300

Seattle, Washington 98104-4096

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, MAY 2, 2007

NOTICE is hereby given of the Annual Meeting of Stockholders of Plum Creek Timber Company, Inc., a Delaware corporation (the “Company”).

| | |

| MEETING DATE, TIME AND LOCATION | | The Annual Meeting of Stockholders will take place on Wednesday, May 2, 2007, at 9:00 a.m. local time, in the Noble Room at the Washington Athletic Club located at 1325 Sixth Avenue, Seattle, Washington. Please refer to the map and the driving instructions located at the back of this document for the location of the Washington Athletic Club. |

| |

| MEETING AGENDA | | The purposes of the Annual Meeting of Stockholders are: |

| |

| | 1. To elect ten (10) persons to serve on the Company’s Board of Directors for one-year terms expiring at the Annual Meeting of Stockholders to be held in 2008; |

| |

| | 2. To consider and act upon a proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for 2007; |

| |

| | 3. To consider and act upon a stockholder proposal, if it is properly presented at the meeting, relating to disclosure of the Company’s political contribution policies and certain of its political contribution activities; |

| |

| | 4. To consider and act upon a stockholder proposal, if it is properly presented at the meeting, relating to the Company’s long-term incentive and annual incentive compensation; and |

| |

| | 5. To transact such other business as may properly come before the Annual Meeting or any adjournment thereof. |

| |

| RECORD DATE | | You are entitled to vote on the matters presented at the Annual Meeting of Stockholders if you were a stockholder of record at the close of business onMarch 9, 2007. |

| |

| VOTING | | Please submit your proxy as soon as possible so that your shares can be voted at the meeting. Properly executing and submitting the enclosed proxy card will appoint Rick R. Holley, David W. Lambert and James A. Kraft as your proxies. You may submit your proxy and vote your shares (1) by Internet, (2) by telephone, or (3) by mail. For instructions, please refer to the enclosed proxy card. |

| |

| | If your shares are held in “street name” by a broker, bank or other registered holder of record, you are not theregistered holder of record of the stock (and your name is not on the Company’s list of registered stockholders), but you are considered thebeneficial owner of the stock, and these proxy materials are being forwarded to you by your broker, bank or other registered holder of record of the stock . If you hold your stock in street name and would like to vote in person at the meeting, you must bring with you a proxy, executed in your favor, from your broker, bank or other registered holder of record. |

|

| By Order of the Board of Directors, |

|

|

James A. Kraft Senior Vice President, General Counsel and Secretary March 26, 2007 |

TABLE OF CONTENTS

i

ii

PLUM CREEK TIMBER COMPANY, INC.

999 Third Avenue, Suite 4300

Seattle, Washington 98104-4096

PROXY STATEMENT FOR THE 2007 ANNUAL MEETING OF

STOCKHOLDERS

To Be Held on May 2, 2007

The Date of this Proxy Statement is March 26, 2007.

PROXIES IN THE FORM ENCLOSED ARE SOLICITED BY THE BOARD OF DIRECTORS OF PLUM CREEK TIMBER COMPANY, INC., TO BE VOTED AT THE ANNUAL MEETING OF STOCKHOLDERS ON MAY 2, 2007, AT 9:00 A.M. LOCAL TIME, AND AT ANY ADJOURNMENT THEREOF, FOR THE PURPOSES SET FORTH IN THE ATTACHED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS. STOCKHOLDERS OF RECORD AT THE CLOSE OF BUSINESS ON MARCH 9, 2007, ARE ENTITLED TO VOTE AT THE ANNUAL MEETING. THE COMPANY ANTICIPATES THAT THE ATTACHED NOTICE, THIS PROXY STATEMENT AND THE ENCLOSED PROXY CARD WILL FIRST BE SENT TO STOCKHOLDERS ON OR ABOUT MARCH 27, 2007.

SOLICITATION AND REVOCABILITY OF PROXY

This Proxy Statement is furnished to stockholders of Plum Creek Timber Company, Inc., a Delaware corporation (“Plum Creek” or the “Company”), in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies to be voted at the Company’s Annual Meeting of Stockholders on May 2, 2007, or any adjournment thereof (the “Annual Meeting”). Proxy cards that are properly executed and returned to the Company or voted by telephone or Internet, and not later revoked, will be voted at the Annual Meeting in accordance with the instructions specified on the enclosed proxy card. Proxies received without specific voting instructions, unless revoked before exercised, will be voted:

| | • | | “For” each of the nominees for director listed in these materials and on the enclosed proxy card; |

| | • | | “For” ratifying the appointment of Ernst & Young LLP as the Company’s independent auditors for 2007; |

| | • | | “Against” the stockholder proposal relating to disclosure of the Company’s political contribution policies and certain of its political contribution activities; and |

| | • | | “Against” the stockholder proposal relating to the Company’s long-term incentive and annual incentive compensation. |

Proxies will be voted on such other matters as may properly come before the meeting, or any adjournment thereof, in the discretion of the appointed proxy holders.

Any person giving a proxy may revoke it at any time prior to its exercise. A proxy may be revoked either by: (1) filing an instrument of revocation with the Company’s Corporate Secretary at 999 Third Avenue, Suite 4300, Seattle, Washington 98104-4096; (2) voting by telephone or by Internet at a later date; or (3) signing and submitting another proxy card with a later date. A proxy may also be revoked by voting in person at the meeting. If your shares of Plum Creek common stock are held in street name (in the name of a broker, bank or other registered holder of record), you must obtain a proxy, executed in your favor, from the registered holder of record of the stock to be able to vote in person at the Annual Meeting.

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the enclosed proxy card, and any additional material that may be furnished to

1

stockholders. In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”), the Company will also reimburse brokerage firms, banks and other registered holders for their expenses incurred in sending proxies and proxy materials to the beneficial owners of shares of Plum Creek common stock. In addition to solicitation by mail, directors, officers or other employees of the Company, without extra compensation, may solicit proxies in person or by telephone or facsimile. Georgeson Shareholder Communications, Inc., will assist the Company in the solicitation of proxies for a fixed fee of $8,000 and reasonable out-of-pocket expenses, to be paid by the Company.

CERTAIN MATTERS RELATING TO PROXY MATERIALS AND ANNUAL REPORTS

Each year in connection with the annual meeting of stockholders, the Company is required to send to each registered stockholder of record a proxy statement and annual report and to arrange for a proxy statement and annual report to be sent to each beneficial stockholder whose shares are held by or in the name of a broker, bank, trust or other registered holder of record. Because many stockholders hold shares of our common stock in multiple accounts or share an address with other stockholders, this process results in duplicate mailings of proxy statements and annual reports. Stockholders may avoid receiving duplicate mailings and save the Company the cost of producing and mailing duplicate documents as follows.

Stockholders of Record. If your shares are registered in your own name and you are interested in consenting to the delivery of a single proxy statement or annual report, you may contact Investor Relations by mail at 999 Third Avenue, Suite 4300, Seattle, Washington, 98104-4096; or by telephone at (800) 858-5347 if calling within the United States and Canada, or at (206) 467-3600 if calling outside the United States and Canada (call collect).

Beneficial Stockholders. If your shares are not registered in your own name, your broker, bank, trust or other registered holder of record that holds your shares may have asked you to consent to the delivery of a single proxy statement or annual report if there are other Plum Creek stockholders who share an address with you. If you currently receive more than one proxy statement or annual report at your household and would like to receive only one copy of each in the future, you should contact a representative of your broker, bank, trust or other holder of record.

Right to Request Separate Copies. If you consent to the delivery of a single proxy statement and annual report but later decide that you would prefer to receive a separate copy of the proxy statement or annual report for each stockholder sharing your address, then please notify the Company or your broker, bank, trust or other holder of record, and additional proxy statements or annual reports will be delivered to you. If you wish to receive a separate copy of the proxy statement or annual report for each stockholder sharing your address in the future, you may also contact Investor Relations using the contact information provided above.

VOTE REQUIRED AND METHOD OF COUNTING VOTES

Under the Delaware General Corporation Law (“Delaware Law”) and the Company’s Amended and Restated Bylaws, as amended (the “Company Bylaws”), the presence at the Annual Meeting, in person or by duly authorized proxy, of the holders of a majority of the outstanding shares of stock entitled to vote at the Annual Meeting constitutes a quorum for the transaction of business. Each share of Plum Creek common stock entitles the holder to one vote on each of the four (4) proposals to be presented at the Annual Meeting. Abstentions and broker non-votes are counted toward determining a quorum.

Broker Non-Votes

A broker non-vote occurs when a registered holder of stock votes on behalf of the beneficial owner of that stock (e.g., a broker or bank holding stock on behalf of its client) on at least one proposal, but not on another, because the registered holder does not have discretionary voting authority with respect to that item of business

2

and has not received instructions from the beneficial owner. For example, under NYSE Rules, proposals to elect directors and to ratify the appointment of independent auditors are considered “discretionary” items. This means that brokerage firms and other registered holders of stock may vote in their discretion on these matters on behalf of their clients who have not otherwise furnished voting instructions at least 15 days before the date of the meeting. In contrast, stockholder proposals are “non-discretionary” items. This means that brokerage firms that have not received voting instructions from their clients on these proposals may not vote on them.

Adoption of Majority Vote Standard for Director Elections

In February 2007, the Board approved an amendment to the Company Bylaws to require that a nominee for director shall be elected if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election in uncontested elections. In a contested election (a situation in which the number of director nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors.

If a director nominee who is then serving as a director is not re-elected at the end of his or her term of office, then, under Delaware Law, the director would continue to serve on the Board as a “holdover director.” Under the Company’s Corporate Governance Policy on Majority Voting, a director who fails to receive the required number of votes for re-election must tender his or her resignation to the Chairman of the Board. The Board will consider the tendered resignation and, within 90 days of the stockholder meeting at which the election occurred, decide whether to accept or reject the tendered resignation and will publicly disclose its decision and the process involved in the consideration. Absent a compelling reason to reject the resignation, the Board shall accept the resignation. The director who tenders his or her resignation will not participate in the Board’s decision. If a director nominee who was not already serving as a director is not elected at any annual meeting, then, under Delaware law, that director nominee would not become a director and would not serve on the Board as a “holdover director.” For 2007, all nominees for the election of directors are currently serving on the Board. The complete Corporate Governance Policy on Majority Voting is available on the Company’s website atwww.plumcreek.com by clicking on “Investors,” then “Corporate Governance” and finally “Governance Guidelines.”

Required Vote For Each Item of Business

Proposal 1. For Proposal 1, the election of directors, stockholders may vote for or against each of the director nominees. As described above, a director nominee will be elected to the Board only if the votes cast “for” such director nominee’s election exceed the votes cast “against” his or her election. Abstentions and broker non-votes, if any, will have no effect on the election of directors.

Proposal 2, Proposal 3 and Proposal 4. For Proposal 2 (ratifying the appointment of Ernst & Young), Proposal 3 (stockholder proposal regarding political contribution disclosure) and Proposal 4 (stockholder proposal regarding executive compensation), the affirmative vote of the majority of shares present in person or by proxy and entitled to vote at the Annual Meeting is required. Abstentions and broker non-votes, therefore, will have the same effect as a voteagainst Proposal 2, Proposal 3 and Proposal 4.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Role of the Board of Directors

Pursuant to Delaware Law and the Company Bylaws, the business, property and affairs of the Company are managed under the direction of the Board. The current members of the Board are Rick R. Holley, Ian B. Davidson, Robin Josephs, John G. McDonald, Robert B. McLeod, John F. Morgan, Sr., John H. Scully, Stephen C. Tobias, Carl B. Webb and Martin A. White. Members of the Board are kept informed of the Company’s business through discussions with Plum Creek’s officers, by reviewing materials provided to them and

3

by participating in meetings of the Board and its committees. The Board held four regularly scheduled meetings and two special meetings during 2006.

Director Independence

The Board’s governance principles require that at least two-thirds of the Board be composed of independent directors and that each of the Board’s three committees be composed solely of independent directors. No director is considered independent unless the Board has determined that he or she has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a material relationship with the Company. To evaluate the materiality of any such relationship, the Board has adopted categorical independence standards consistent with NYSE listing standards for director independence. A copy of these standards can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link.

With the assistance of its legal counsel, the Corporate Governance and Nominating Committee reviewed written responses to annually submitted questionnaires completed by each member of the Board against the Board’s and the NYSE’s director independence standards, along with NYSE and SEC independence standards applicable to Board members who serve on the Audit Committee. On the basis of this review, the Corporate Governance and Nominating Committee advised the full Board of its conclusions regarding director independence. After considering the Committee’s recommendation, the Board affirmatively determined that each of Ms. Josephs and Messrs. Davidson, McDonald, McLeod, Morgan, Scully, Tobias, Webb and White is independent under the Board’s and the NYSE’s independence standards. In addition, the Board determined that each member of the Audit Committee is independent under the NYSE’s and SEC’s independence standards for directors who serve on audit committees.

Mr. Hamid R. Moghadam and Ms. Deanna W. Oppenheimer, each of whom served on the Board during part of 2006, were also determined by the Board to be independent.

Board Committees

The Board has a standing Audit Committee, Corporate Governance and Nominating Committee and Compensation Committee.

Compensation Committee. During 2006, the Compensation Committee met seven times. The Compensation Committee acts pursuant to a written charter adopted in January 2003, which can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link. The Committee is responsible for developing and modifying over time the Company’s compensation policies and plans, including the compensation policies and plans for the Company’s executive officers and directors. It is also responsible for making recommendations to the Board concerning amendments to the Company’s compensation plans and, in certain instances, making amendments to such plans. The Committee also oversees the annual performance evaluation of the Company’s President and Chief Executive Officer and is responsible for producing a report on executive compensation for inclusion in the Company’s proxy materials.

The Compensation Committee has retained the firm of Towers Perrin, a nationally recognized compensation consulting firm, as its advisor to assist the Committee in discharging its responsibilities. Towers Perrin is engaged by and reports directly to the Compensation Committee and interacts with management as necessary to fulfill its responsibilities. Towers Perrin representatives participate in most regularly scheduled meetings of the Committee. The current members of the Compensation Committee are Ms. Josephs and Messrs. McLeod, Webb (Chairman) and White.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee met once during 2006. The Committee acts pursuant to a written charter adopted in January 2003,

4

which can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link. The Committee is responsible for overseeing and coordinating many of the Company’s corporate governance practices. The Committee advises the Board with respect to matters of Board composition and procedures and is responsible for developing and recommending to the Board the Company’s corporate governance principles. The Committee also oversees the annual performance evaluation of the Board and its committees. The current members of the Corporate Governance and Nominating Committee are Messrs. Davidson, McDonald, Scully (Chairman) and Tobias.

Audit Committee. The Board of Directors has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). During 2006, the Audit Committee met nine times. The Audit Committee acts pursuant to a written charter, which was originally adopted by the Board during 2000, and was last revised in February of 2004. The Audit Committee charter can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link. Among other things, this Committee has the responsibility to appoint, terminate, replace, compensate and oversee the Company’s independent auditors, to review and approve the scope of the annual audit; to interview the independent auditors for review and analysis of the Company’s financial systems and controls; and to review the independence of, and pre-approve any audit or non-audit services provided by, the independent auditors.

Current members of the Audit Committee are Mr. Davidson, Ms. Josephs and Messrs. McDonald, (Chairman), Morgan and Webb. The Board of Directors has determined that each of the current members of the Audit Committee is independent in accordance with both NYSE listing standards applicable to audit committee members and Rule 10A-3(b)(1) under the Exchange Act. In addition, the Board has designated each of Mr. Davidson and Ms. Josephs as an “audit committee financial expert,” as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC.

Report of the Audit Committee

In connection with the Audit Committee’s review of the Company’s financial statements for the year ended December 31, 2006:

| | 1. | The Audit Committee has reviewed and discussed the audited financial statements with management of the Company; |

| | 2. | The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; |

| | 3. | The Audit Committee has received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with the independent accountant the independent accountant’s independence; and |

| | 4. | Based on the review and discussions of the above three items, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission. |

Ian B. Davidson, Robin Josephs, John G. McDonald (Chairman), John F. Morgan, Sr. and Carl B. Webb

Selection of Nominees to the Board of Directors

Stockholder Nominations. The Corporate Governance and Nominating Committee will consider director nominee recommendations from stockholders. Stockholder recommendations must be in writing and addressed to the Chairman of the Corporate Governance and Nominating Committee, c/o Corporate Secretary,

5

Plum Creek Timber Company, Inc., 999 Third Avenue, Suite 4300, Seattle, Washington, 98104-4096. If a stockholder intends to make a nomination at any annual stockholder meeting, the Company Bylaws require that the stockholder deliver written notice to the Company not more than 90 days or less than 60 days prior to the anniversary date of the Company’s previous year’s annual meeting of stockholders. The notice must set forth, among other things: (1) the name and address of the stockholder who intends to make the nomination; (2) the name, age, address and principal occupation of the proposed director nominee or nominees; (3) a representation that the stockholder is entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (4) the consent of each proposed director nominee to serve as a director of the Company if so elected; and (5) the number of shares of common stock of the Company owned by the notifying stockholder and by the proposed director nominee or nominees. These Company Bylaw provisions afford the Board the opportunity to consider the qualifications of the proposed nominees and, to the extent deemed necessary or desirable by the Board, to inform stockholders about such qualifications.

Director Qualifications. The Corporate Governance and Nominating Committee believes that the minimum qualifications for serving as a director of the Company are that a director nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company and have an impeccable record and reputation for honest and ethical conduct in both his or her professional and personal activities. In addition, the Committee examines a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company. The Committee also seeks to have the Board represent a diversity of backgrounds and experience.

Selection Process for Director Nominees. The Corporate Governance and Nominating Committee identifies potential director nominees by asking current directors and executive officers to notify the Committee if they become aware of persons meeting the criteria described above. From time to time, the Committee engages firms that specialize in identifying director candidates. As described above, the Committee will also consider candidates recommended by stockholders.

Once a person has been identified as a potential candidate by the Corporate Governance and Nominating Committee, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Committee determines that the candidate warrants further consideration, the Chairman of the Committee or another member of the Committee contacts the candidate. Generally, if the candidate expresses a willingness to be considered and to serve on the Board, the Committee requests information from the candidate, reviews his or her accomplishments and qualifications in light of any other candidates that the Committee might be considering, and conducts one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder.

Mr. White, who was appointed to the Board in July of 2006, was recommended to the Committee for consideration by a non-management member of the Board. Mr. Morgan, who was appointed to the Board in October of 2006, was recommended to the Committee for consideration by an executive officer of the Company.

Executive Session of the Board of Directors

In accordance with the Company’s Corporate Governance Guidelines, the Board’s independent directors meet in executive session at least four (4) times each year. The Chairman of the Board, who must be an independent director under the Corporate Governance Guidelines, presides at, and sets the agenda for, each executive session of the independent directors. If the Board has not selected a Chairman, then the Corporate Governance Guidelines require that the chair of the Audit Committee, the Corporate Governance and Nominating Committee and the Compensation Committee each preside over the meetings of the independent

6

directors in rotating order as decided by the other independent directors. Mr. Davidson served as Chairman of the Board during 2006 and presided over all executive sessions of the independent members of the Board.

Communicating With the Board

Anyone who wishes to notify or communicate with the entire Board, any individual director, or the independent directors as a group may do so. Communications should be delivered to the following address, marked “confidential”, care of Corporate Secretary, Plum Creek Timber Company, Inc., 999 Third Avenue, Suite 4300, Seattle, Washington 98104-4096. The Corporate Secretary reviews all such correspondence and will forward to the Chairman of the Board or other individual director or group of directors, as the case may be, a copy of such correspondence that, in the opinion of the Corporate Secretary, relates to the functions of the Board or its committees, or that the Corporate Secretary otherwise determines requires their attention. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Company’s internal audit department and handled in accordance with procedures established by the Audit Committee with respect to such matters. These stockholder communication procedures were approved by the Board of Directors.

Board Member Attendance at Annual Meetings

While members of the Board are always welcome to attend each annual meeting of stockholders, the Board has no formal policy requiring their attendance. Two of the Company’s directors, Messrs. Holley and Davidson, attended the 2006 annual meeting of stockholders held on May 3, 2006.

Code of Ethics and Other Corporate Governance Information

The Company maintains a code of ethics, entitled thePlum Creek Code of Conduct, which applies to each director and to the principal executive officer, the principal financial officer and the principal accounting officer as well as to all other employees of the Company. ThePlum Creek Code of Conduct, along with the governing charters of each of the Board’s committees and the Company’s Corporate Governance Guidelines, can be found in the “Corporate Governance” section of the Company’s website accessible to the public atwww.plumcreek.com.To find this section of the website, click on the “Investors” link and then the “Corporate Governance” link. The Company will post any amendments to, or waivers from, itsCode of Conduct (to the extent applicable to any director or any of the Company’s executive officers, including the chief executive officer, principal financial officer or principal accounting officer) at this location on its website. In addition to these documents, the Company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and reports concerning transactions in the Company’s stock by directors and certain officers of the Company, and any amendments to those reports, can also be found on the Company’s website by first clicking the “Investors” link, then the “Earnings/Financial Publications” link and finally the “SEC Filings” link. Copies of any of these documents may be obtained from our website or free of charge by contacting the Company’s Investor Relations Department at 999 Third Avenue, Suite 4300, Seattle, Washington 98104-4096 or by calling (206) 467-3600.

On May 12, 2006, Rick R. Holley, as President and Chief Executive Officer of the Company, submitted an unqualified certification to the NYSE stating that, as of that date, he was not aware of any violation by the Company of the NYSE Corporate Governance Listing Standards. Additionally, the Company has filed with the SEC the Chief Executive Officer and Chief Financial Officer certifications required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, as amended.

Director Compensation

The Compensation Committee periodically reviews director compensation and engages Towers Perrin to advise it on market data, trends and recommendations for this review. The Committee establishes the compensation for the outside directors based upon this review and advice.

7

2006 Director Compensation

Our non-employee directors receive the following compensation for their service on the Board:

| | • | | $40,000 annual cash retainer |

| | • | | $2,000 meeting fee for each meeting of the Board (one-half of this amount is paid for participation in any telephonic meeting unless otherwise determined by the Chairman of the Board) |

| | • | | 2,000 shares of the Company’s common stock that carry a six-month restriction on transfer. |

The Chairman of the Board receives an additional annual retainer of $30,000, and members of Board committees may receive the following amounts, depending upon their involvement with each committee of the Board:

| | • | | Audit Committee—$10,000 annual cash retainer for the Chairperson of the Committee; $5,000 annual cash retainer for other Committee members. All members of the Committee receive a $2,000 fee for each meeting of the Committee (one-half of this amount is paid for participation in any telephonic meeting unless otherwise determined by the Committee Chair). |

| | • | | Compensation, Corporate Governance and Nominating Committees—$5,000 annual cash retainer for the chairperson of each committee. Members of each committee receive a $1,500 fee for each committee meeting (one-half of this amount is paid for participation in any telephonic meeting unless otherwise determined by the committee chair). |

Directors have the choice to elect to take all or a portion of their Board fees in common stock of the Company and may defer all or part of their fee compensation. Directors are reimbursed for expenses incurred in connection with attending Board and committee meetings.

The table below summarizes compensation received by non-employee directors of the Board during 2006.

| | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid

in Cash ($) (a) | | Stock

Awards ($) (b) | | Option

Awards ($) (c) | | Non-Equity

Incentive Plan

Compensation ($) | | Change in

Pension

Value and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation ($) | | Total ($) |

| |

| | | | | | | | | | | | | | | |

Ian B. Davidson | | $ | 99,500 | | $ | 71,340 | | — | | — | | — | | — | | $ | 170,840 |

Robin Josephs | | $ | 71,250 | | $ | 71,340 | | — | | — | | — | | — | | $ | 142,590 |

John G. McDonald | | $ | 74,500 | | $ | 71,340 | | — | | — | | — | | — | | $ | 145,840 |

Robert B. McLeod | | $ | 54,500 | | $ | 71,340 | | — | | — | | — | | — | | $ | 125,840 |

John F. Morgan, Sr. | | $ | 11,000 | | | — | | — | | — | | — | | — | | $ | 11,000 |

John H. Scully | | $ | 56,500 | | $ | 71,340 | | — | | — | | — | | — | | $ | 127,840 |

Stephen C. Tobias | | $ | 50,680 | | $ | 71,340 | | — | | — | | — | | — | | $ | 122,020 |

Carl B. Webb | | $ | 77,319 | | $ | 71,340 | | — | | — | | — | | — | | $ | 148,659 |

Martin A. White | | $ | 28,000 | | $ | 35,600 | | — | | — | | — | | — | | $ | 63,600 |

Hamid R. Moghadam (d) | | $ | 19,016 | | | — | | — | | — | | — | | — | | $ | 19,016 |

Deanna W. Oppenheimer(d) | | $ | 0 | | | — | | — | | — | | — | | — | | $ | 0 |

| |

| (a) | Fees earned or paid in cash—includes cash retainers and meeting fees earned in 2006. |

| (b) | Stock awards—represents the 2006 SFAS No. 123(R) expense recognized for restricted stock grants made to non-employee directors of the Board. These amounts include expense recognized for grants made during 2006. For more information regarding the cost recognized for these awards, refer to the Company’s disclosure in its Annual Report on Form 10-K for the year ended December 31, 2006, as filed with the SEC on February 27, 2007, Part II, Item 8Notes to Consolidated Financial Statements—Note 11 Share-Based Compensation Plans. |

8

| (c) | From 2002 through 2004, directors were granted stock options under the Stock Incentive Plan on an annual basis. Each stock option carries an exercise price equal to the fair market value of the Company’s common stock on the date of grant, expires 10 years from the date of grant, and is fully vested and exercisable. Ms. Josephs currently holds 9,000 stock options, and Mr. Webb currently holds 7,500 stock options. Each of Messrs. Davidson, McDonald, Moghadam, Scully and Tobias currently hold 12,000 stock options. |

| (d) | Mr. Moghadam resigned from the Board at the end of his term on May 3, 2006, and Ms. Oppenheimer resigned from the Board on January 12, 2006. Amounts shown represent director fees earned for the year 2006 through the end of their respective terms. |

PROPOSAL 1

Election of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE“FOR”EACH OF THE DIRECTOR NOMINEES.

The Board is authorized under the Company Bylaws to set, by resolution, the number of directors who comprise the Board. The directors whose terms expire in 2007 and have been nominated for election to one-year terms of office expiring at the 2008 Annual Meeting of Stockholders, or until their successors are elected, are Rick R. Holley, Ian B. Davidson, Robin Josephs, John G. McDonald, Robert B. McLeod, John F. Morgan, Sr., John H. Scully, Stephen C. Tobias, Carl B. Webb and Martin A. White.

In the absence of instructions to the contrary, the proxy holders will vote the proxies received by them for the election of Ms. Josephs and Messrs. Holley, Davidson, McDonald, McLeod, Morgan, Scully, Tobias, Webb and White. Discretionary authority is reserved to cast votes for the election of a substitute should any of the nominees be unable or unwilling to serve as a director.

Each of the nominees has agreed to serve as a director if elected, and the Company believes that each of them will be available to serve. The names and ages of the nominees and their principal occupations or employment during the past five years are set forth below.

Nominees for Election to One-Year Terms Expiring at the 2008 Annual Stockholder Meeting:

| | | | |

| Name | | Age | | Background |

| |

Rick R. Holley | | 55 | | Mr. Holley was elected to the Board of Directors of the Company and appointed as its President and Chief Executive Officer on July 1, 1999, the date of our conversion from a master limited partnership to a real estate investment trust, or REIT. From 1994 through the date of our REIT conversion, Mr. Holley served as a director and President and Chief Executive Officer of the general partner of the former master limited partnership. |

| | |

Ian B. Davidson | | 75 | | Mr. Davidson was elected to the Board of Directors of the Company on July 1, 1999, and from December 1992 through July 1999, he served as a director of the general partner of the former master limited partnership. Mr. Davidson is the chairman of the board of directors of Davidson Companies, a leading regional financial services holding company and the parent company of DA Davidson & Co., a full-service investment firm based in the Northwest. |

9

| | | | |

| Name | | Age | | Background |

| |

Robin Josephs | | 47 | | Ms. Josephs was appointed to the Board of Directors of the Company in July 2003. From 2005 to 2007, Ms. Josephs was a managing director of Starwood Capital Group, a private equity firm specializing in real estate investments. She is also the founder and managing director of Ropasada, LLC, a private investment and consulting firm. Ms. Josephs was previously employed by Goldman Sachs, where she served as a senior officer in their Real Estate Investment Banking Division and Equity Capital Markets Group, and prior to that served as an analyst for Booz Allen & Hamilton, Inc., in New York. Ms. Josephs also serves on the board of directors of iStar Financial, Inc. |

| | |

John G. McDonald | | 69 | | Professor McDonald was elected to the Board of Directors of the Company on July 1, 1999. Professor McDonald is a Professor of Finance at the Graduate School of Business at Stanford University, where he has been a faculty member since 1968 and where he holds the Stanford Investors Chair. Professor McDonald also serves as a director of Varian, Inc.; Scholastic Corp.; iStar Financial, Inc.; and eight mutual funds managed by Capital Research and Management Company. |

| | |

Robert B. McLeod | | 64 | | Mr. McLeod was appointed to the Board of Directors of the Company in June 2004. Mr. McLeod is the chairman of the board of directors and chief executive officer of Newland Communities, a national developer of master planned communities. |

| | |

John F. Morgan, Sr. | | 60 | | Mr. Morgan was appointed to the Board of Directors of the Company in October 2006. Mr. Morgan is the owner and manager of Morgan Timber, LLC, a private timberland and real estate management and development company. Mr. Morgan previously held positions in general banking and public securities investment management at First Orlando Corporation (Sun Trust) and Citizens & Southern Corporation (Bank of America), and later helped found INVESCO Capital Management, a global money management firm. |

| | |

John H. Scully | | 62 | | Mr. Scully served as a director of the general partner of the former master limited partnership from November 1992 through July 1999 and was elected to the Board of Directors of the Company on July 1, 1999. He is the managing director of SPO Partners & Co., a private investment firm. Mr. Scully also serves as chairman of the board for Advent Software, Inc. |

| | |

Stephen C. Tobias | | 62 | | Mr. Tobias was appointed to the Board of Directors of the Company in October 2001. Mr. Tobias has served as the vice chairman and chief operating officer of Norfolk Southern Corporation since July 1998 and as the vice president of Norfolk Southern Railway Company since May 2000, having served previously as executive vice president-operations of Norfolk Southern Corporation and vice president and chief operating officer of Norfolk Southern Railway Company. Mr. Tobias also serves as a director of Norfolk Southern Railway Company. |

10

| | | | |

| Name | | Age | | Background |

| |

Carl B. Webb | | 57 | | Mr. Webb was appointed to the Board of Directors of the Company in October 2003. From 1994 to 2002, Mr. Webb served as president and chief operating officer and director of Golden State Bancorp, Inc., and its wholly owned subsidiary California Federal Bank, one of the nation’s largest thrift banks before merging with Citigroup Inc. in 2002. Prior to working at Golden State Bancorp and California Federal Bank, he was employed by First Madison Bank as president and chief executive officer. Mr. Webb currently serves as a director of Affordable Residential Communities, Inc., and M&F Worldwide Corp. |

| | |

Martin A. White | | 66 | | Mr. White was appointed to the Board of Directors of the Company in July 2006. From 1998 to 2006, Mr. White served as chairman and chief executive officer of MDU Resources Group, Inc., a diversified natural resource company that provides energy, natural resource products and related services to both U.S. and international markets. Mr. White also serves as a director of First Interstate BancSystem. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE“FOR”EACH OF THE NOMINEES ON THE ENCLOSED PROXY CARD. UNLESS INDICATED OTHERWISE, THE SHARES WILL BE VOTED“FOR” EACH OF THE NOMINEES TO BE ELECTED TO THE BOARD OF DIRECTORS.

11

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of the Company’s common stock as of March 9, 2007, for each director, each named executive officer, the directors and executive officers as a group and any person or entity known to the Company to beneficially own more than 5% of the Company’s common stock. Unless otherwise indicated, the address of each person is c/o Plum Creek Timber Company, Inc., 999 Third Avenue, Suite 4300, Seattle, Washington, 98104-4096.

| | | | | | |

| Name of Individual or Identity of Group | | Number of Shares Beneficially Owned | | | Percent of Class | |

| | |

| | |

Beneficial Owners of More Than 5% | | | | | | |

| | |

Barclay’s Global Investors, NA 45 Fremont Street San Francisco, CA 94105 | | 9,558,584 | | | 5.39 | % |

| | |

Directors | | | | | | |

Ian B. Davidson | | 47,208 | (A) | | * | |

Rick R. Holley | | 623,452 | (B) | | * | |

Robin Josephs | | 21,200 | (C) | | * | |

John G. McDonald | | 20,000 | (D) | | * | |

Robert B. McLeod | | 9,000 | | | * | |

John H. Scully | | 211,230 | (E) | | * | |

Stephen C. Tobias | | 22,268 | (F) | | * | |

Carl B. Webb | | 19,285 | (G) | | * | |

John F. Morgan, Sr. | | 2,000 | | | * | |

Martin A. White | | 3,757 | | | * | |

| | |

Named Executive Officers | | | | | | |

Thomas M. Lindquist | | 154,636 | (H) | | * | |

James A. Kilberg | | 28,919 | (I) | | * | |

David W. Lambert | | 36,550 | (J) | | * | |

Leonard A. Kosar | | 0 | (K) | | * | |

William R. Brown | | 0 | (K) | | * | |

Directors & Executive Officers as a Group (26 persons, including those named above) | | 1,655,714 | | | * | |

| | | | | | |

|

| | |

| * | Represents less than 1.0% of the outstanding shares of common stock, based on 177,258,167 shares of common stock outstanding as of March 9, 2007. |

| (A) | Includes 300 shares of common stock owned by Mr. Davidson’s wife. Also includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (B) | Includes 445,000 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (C) | Includes 200 shares of common stock held in trust for the benefit of Ms. Josephs’ children and 3,000 shares of common stock held in a trust over which Ms. Josephs has power to vote and dispose. Also includes 9,000 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (D) | Includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (E) | Includes 188,230 shares of common stock held in a trust over which Mr. Scully has voting and dispositive power. Also includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

12

| (F) | Includes 4,268 shares of common stock held in trust over which Mr. Tobias has voting and dispositive power. Also includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (G) | Includes 7,500 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (H) | Includes 122,500 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (I) | Includes 18,750 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (J) | Includes 29,500 shares of common stock issuable under stock options exercisable within sixty days of March 9, 2007. |

| (K) | Messrs. Kosar and Brown have terminated employment with the Company, but are included herein because each is a named executive officer for 2006. |

13

EXECUTIVE COMPENSATION

This section contains information relating to compensation of the Company’s named executive officers. The named executive officers are determined in accordance with SEC disclosure rules and include the Company’s Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), anyone who served as CFO during 2006 and the three most highly compensated executive officers other than the CEO and CFO who were serving as executive officers at the end of 2006 (collectively, the “Named Executive Officers” or “NEOs”). Therefore, the information that follows includes information relating to 2006 compensation for William R. Brown, the Company’s former CFO, and Leonard A. Kosar, the Company’s former Executive Vice President.

Compensation Discussion and Analysis

With respect to the compensation of the Company’s Named Executive Officers, this section summarizes:

| | • | | Our executive compensation program objectives; |

| | • | | Our executive compensation programs; and |

| | • | | Recent decisions by the Company regarding 2006 compensation. |

Objectives of our Executive Compensation Program

Our executive compensation programs are organized around the following, sometimes competing, objectives:

| | • | | Attracting talented and experienced executives |

| | • | | Retaining the executive management required to lead the Company |

| | • | | Motivating executive management to deliver superior Company performance |

These objectives reflect our belief that programs which support the attraction and retention of a highly qualified executive management team—coupled with appropriate incentive programs—serve the long-term interests of our investors.

With these objectives in mind, the following principles help guide our decisions regarding executive compensation:

| | • | | NEO compensation opportunities should be competitive with market practices.In order to attract and retain the executives with the experience and skills necessary to lead the Company and deliver strong performance to our shareholders, we are committed to providing total annual compensation opportunities that are competitive. We target our base salary to the middle (50th percentile) of the market. We also target our total cash compensation (i.e., base salary plus target annual incentives) and total direct compensation (i.e., total cash compensation plus the expected value of long-term incentives) to the middle (50th percentile) of the market for achieving our business plan. Total cash and total direct compensation earned by the executives may vary from the 50th percentile (below or above) based on actual performance relative to our plan. For superior performance, we target the 75th percentile for total cash and total direct compensation. |

In 2006, we considered compensation levels and practices among forest products companies, real estate companies and general industrials—the same industries against which shareholder return of the Company is assessed under our long-term incentive awards. However, to account for differences in size, we use a subset of companies from these industries, similar in size to Plum Creek from a revenue and market-capitalization perspective:

| | – | | Forest products companies: Bowater, Louisiana-Pacific, MeadWestvaco, Potlatch, Rayonier, St. Joe Company and Universal Forest Products |

14

| | – | | Real Estate companies: Largest 15 real estate investment trusts (“REITs”) within the Morgan Stanley REIT Index |

| | – | | General industry: S&P Index companies with $1 billion—$5 billion in revenues |

For each NEO, we consider the relevance of data for each comparator group, considering (i) the transferability of managerial skills, (ii) the relevance of the NEOs’ experience to other potential employers, and (iii) the readiness of the NEOs to assume a different or more significant role either within the Company or with another organization. Consistent with this view, the Compensation Committee of the Board of Directors (“the Committee”) has articulated an increased emphasis on the forest products and general industry data for most of the NEOs, referencing real estate industry data for the NEO positions for whom real estate activities are their primary function.

We also offer a competitive benefits program including health and welfare benefits, a 401(k) savings program and a defined benefit pension plan. We offer our NEOs a small number of perquisites. These programs are described in more detail below underOur Executive Compensation Programs.

| | • | | A substantial portion of NEO compensation should be performance-based.Our executive compensation program emphasizes pay for performance. This means that shareholder returns, along with corporate, business unit and individual performance, both short- and long-term, determine the largest portion of executive pay. For our NEOs, over 70% of total direct compensation is performance-based. |

The compensation package for our NEOs and other members of management includes a number of components that are designed to align individual compensation with the short-term and long-term performance of the Company:

| | – | | Annual incentive awards are earned based on performance metrics that are set at the beginning of the year: |

| | ¨ | Achievement of a financial target: funds from operations (“FFO,” generally defined as net income plus non-cash charges equal to depletion, depreciation and amortization, and the cost basis for lands sold) |

| | ¨ | Achievement of measurable strategic objectives for the Company |

| | ¨ | Individual performance goals |

| | – | | There are three components of our long-term incentive program: stock options, restricted stock units and value management awards. Compensation from all three components is tied to either growth in our stock price or total return to shareholders. Long-term incentive plan awards to the NEOs are determined by the Committee. These components are further described below inOur Executive Compensation Programs. |

| | • | | Our NEOs’ interests should be aligned with those of our shareholders. Approximately half the value of our long-term incentive compensation is delivered in the form of equity—stock options and restricted stock units that are settled in shares of stock, the value of which is dependent upon the performance of our stock price. The remaining portion of our long-term incentives—our value management awards—provide cash and/or stock awards based on our total shareholder return performance relative to return performance earned by forest products, REIT and S&P 500 industry groups. |

In addition, we have share ownership guidelines for our NEOs. These guidelines ensure that our executives hold a meaningful amount of Company stock so that the impact of changes in our stock performance affects our executives as it affects our shareholders. Our executives must hold a multiple of their base pay in stock as shown below. All our NEOs, with the exception of our CFO, who was recently promoted into the position, have met or exceeded the guidelines. Executives receive up to 50% of the long-term incentive award payouts in stock until the guideline levels are met.

15

| | |

| Executive Level | | Stock Ownership Target

as Multiple of Salary |

|

| |

| CEO | | 5 x base salary |

| |

| EVPs | | 3 x salary |

| |

| SVPs | | 2 x salary |

| |

| VPs & GMs | | 1 x salary |

| | • | | NEO compensation should be perceived as fair and equitable.We strive to create a compensation program that will be perceived as fair and equitable, both internally and externally. In addition to conducting analyses of market pay levels, we consider the pay of the NEOs relative to one another and relative to other members of the management team. |

Our Executive Compensation Programs

Overall, our executive compensation programs are designed to be consistent with the objectives and principles set forth above. The basic elements of our 2006 executive compensation program are summarized in the table below, followed by a more detailed discussion of those programs.

| | | | |

| Element | | Characteristics | | Purpose |

|

| |

| Base salary | | Fixed element of compensation; all employees are eligible for periodic increases in base salary. | | Intended to support market-competitiveness of pay package. |

| | |

| Annual incentive plan awards | | Performance-based cash incentive; amount earned depends on Company, business unit and individual performance relative to budget or expectations. | | Amount earned for achievement of target levels of performance intended to support market-competitiveness of pay package; potential for lesser or greater amounts intended to motivate participants to achieve superior financial performance. |

| | |

| Long-term incentive plan awards: | | Performance-based long-term incentive; amounts earned/realized depend upon changes in stock price and total shareholder return relative to comparator groups. | | Size of grant intended to reward prior contributions to the performance of the Company, and future expectations and to recognize the value of the position to the organization. |

| | |

• Stock option awards | | | | • Service-based vesting conditions intended to support retention; amount realized from exercise of stock options rewards absolute stock price appreciation. |

| | |

• Restricted stock unit awards | | | | • Service-based vesting conditions intended to support retention; amount realized upon vesting dependent upon stock price performance. |

16

| | | | |

| Element | | Characteristics | | Purpose |

|

| |

• Value management awards | | | | • Performance-based vesting conditions intended to reward superior total shareholder return relative to each of the comparator groups. |

| | |

| Retirement income benefits | | Retirement income is a function of base salary, earned annual incentive awards and years of service with the Company. | | Intended to support market-competitiveness of pay package; benefit is affected by years of service, in support of retention; benefit is affected by continued and sustained performance (as reflected in the annual incentive plan awards earned by the individual), intended to motivate participants to achieve superior financial performance. |

| | |

| Executive benefits & perquisites | | Executives are eligible for perquisites, including an allowance for a leased vehicle, an annual physical, tax and financial planning advice, and certain executives are eligible for a club membership. Executive officers also have access to a leased aircraft. Personal use of the aircraft, however, is limited. Income for any such personal use is imputed to the executive and is disclosed pursuant to SEC rules. | | These benefits are provided as part of a competitive benefit and compensation package. These perquisites are generally provided by the companies from which we recruit and are, therefore, provided to attract and retain members of management. |

| | |

| Severance benefits | | Broad-based severance providing up to 10 weeks’ pay. In certain circumstances, expanded benefits have been provided for up to one year, depending on years of service. According to the terms of the long-term incentive plan, if a plan participant were terminated by the Company within one year following a change-in-control of the Company for any reason other than cause, all benefits under the long-term incentive plan would become vested. | | Severance benefits are provided to bridge the gap to re-employment. The change-in-control provision in the long-term incentive plan is provided to promote stability and continuity of the management team. |

Total Direct Compensation

Based on the principle that NEO compensation opportunities should be competitive with market practices, the specific mix of compensation among base salary, annual incentives and long-term incentives is a function of market pay practices.

| | • | | Base Salary. We provide base salaries for each NEO commensurate with the services each provides to the Company because we believe a portion of total direct compensation should be provided in a form that is fixed and liquid. Based on prevailing market practices, base salary represents approximately 20% of total direct compensation (base salary plus annual incentive plus the value of long-term incentives at |

17

| | grant). In establishing base salary levels of the NEOs and other members of the management team, we consider market median pay levels among individuals in comparable positions within the forest products and real estate industries and general industry as described above. We also consider individual experience and contributions, responsibilities and other factors, including internal equity. We believe calibrating base salary at these levels is necessary to attract and retain the executive management required to lead the Company. |

Determinations regarding base salary adjustments (as well as other elements of compensation) are made in connection with the annual performance reviews of the NEOs and other members of the management team. The CEO reviews each NEO’s performance and makes salary recommendations to the Committee. The Committee reviews and approves these recommendations, with modifications, as it deems appropriate. It also annually determines the salary for the CEO.

| | • | | Annual Incentive Plan Awards. NEOs and other employees of the Company are eligible to receive cash bonus awards under the Company’s Annual Incentive Plan (“AIP”) based upon the financial performance of the Company and other factors, including individual performance. The Committee believes this element of compensation is important to focus management efforts on and provide rewards for annual financial and strategic results that are aligned with creating value for our shareholders. |

In 2005, the Committee, with the help of its outside consultant, reviewed the structure and design of the Annual Incentive Plan and approved a new plan with payout opportunities at threshold, target and maximum levels that are calibrated with corresponding levels of our financial performance versus budget. The Committee believes that this structure better aligns executives’ potential bonus awards with levels of performance results. For example, if performance is at the threshold level (80% of budget), bonuses are paid that position cash compensation at approximately the 25th percentile of the market, and if maximum performance is achieved (120% of budget), bonuses are paid that position cash compensation at approximately the 75th percentile of the market.

The table below shows the threshold, target and maximum bonus opportunities represented as a percentage of base salary effective as of the end of the year under the 2006 Annual Incentive Plan at corresponding levels of financial performance results versus plan.

| | | | | | | | |

| Named Executive Officer | | < 80% of financial

goal achieved | | 80% of financial

goal achieved | | 100% of financial

goal achieved | | 120% of financial

goal achieved |

|

| |

Rick R. Holley | | No bonus paid | | 55% of salary | | 110% of salary | | 165% of salary |

Thomas M. Lindquist | | No bonus paid | | 45% of salary | | 90% of salary | | 135% of salary |

Leonard A. Kosar | | No bonus paid | | 45% of salary | | 90% of salary | | 135% of salary |

David W. Lambert | | No bonus paid | | 40% of salary | | 80% of salary | | 120% of salary |

James A. Kilberg | | No bonus paid | | 40% of salary | | 80% of salary | | 120% of salary |

|

| |

Financial and strategic objectives are established each year based on a business plan developed by management. For 2006, the business plan objectives included budgeted FFO and strategic objectives of the Company. The business plan is presented to the Company’s Board of Directors and subject to their review, modification and approval. Individual goals are also established for each NEO. Such goals include meeting personal and/or business unit financial goals. Performance against these goals is assessed at the end of the year and serves as input into individual bonus award determinations.

Earned Annual Incentive Plan awards are determined at year-end based on the Company’s performance against the Board-approved business plan (including both financial and strategic objectives). The Committee reviews award levels recommended by the CEO and exercises discretion, adjusting awards based on its consideration of each NEO’s individual performance.

18

| | • | | Long-Term Incentive Plan Awards. As described above, the Committee believes that a substantial portion of each NEO’s compensation should be in performance-based pay. Long-term incentive potential represents approximately 50% of our NEOs’ total direct compensation. |

Long-term incentive awards are made pursuant to our 2004 Amended and Restated Stock Incentive Plan (the “Stock Incentive Plan”). The Compensation Committee specifies which NEOs are to receive awards and determines the amounts of each award to be granted.

NEOs and other employees of the Company currently receive annual grants of stock options, restricted stock units and value management award units. The mix between these forms of awards is designed to be approximately 50% of the total value delivered in value management awards, 25% in stock options and 25% in restricted stock units. We believe this mix represents a balance among vehicles, rewarding for stock price appreciation and relative shareholder return while supporting both the retention and motivation of our NEOs.

Individual determinations are made with respect to the type and amount of each long-term incentive vehicle granted by the Company. In making these determinations, we consider the performance of the Company relative to the financial and strategic objectives set forth in the annual business plan (and considered by the Committee in determining final annual incentive awards of the NEOs) and the individual performance of each NEO. Adjustments to targeted long-term incentive award levels are not determined using a formulaic or other method—rather, the Committee subjectively considers these factors when determining the individual awards for each NEO and for other executives.

As with other elements of our executive compensation program, long-term incentive award grant opportunities are calibrated to market. With the assistance of the outside consultant, long-term incentive grant ranges are established which result in total direct compensation levels ranging from the 25th to the 75th percentile of market pay levels (also depending on performance in the prior year and the impact on bonus payments).

| | – | | Stock Option Awards.Stock option awards provide recipients the right to purchase shares of common stock at a fixed exercise price for a period of up to 10 years. The exercise price of each stock option is based on the fair market value of the common stock on the grant date. Stock options are earned on the basis of continued service to the Company and vest in four equal annual installments, beginning one year after the date of grant. For more information regarding these awards and the cost recognized for these awards, refer to the Company’s disclosure in its Annual Report on Form 10-K for the year ended December 31, 2006, as filed with the SEC on February 27, 2007, Part II, Item 8Notes to Consolidated Financial Statements—Note 11 Share-Based Compensation. |

| | – | | Practices Regarding the Grant of Options and Other Stock-Based Awards.The Committee has followed a practice of making all option grants to its eligible employees on a single date each year. The Committee has granted annual awards at its regularly scheduled meeting in late January or early February since the approval of the Stock Incentive Plan in 2000. In 2006, restricted stock unit awards were also made at the February meeting. This meeting has historically occurred within two weeks following the issuance of the release of our annual earnings report. The Committee believes it is appropriate that annual awards are made at a time when material information regarding our performance for the preceding year has been disclosed. |

While the vast majority of our awards to NEOs have been made pursuant to our annual grant program, the Committee retains discretion to make awards to NEOs at other times in connection with the hiring of a new executive, for retention purposes or in other situations.

All option awards made to eligible employees (including our NEOs) are made under the Stock Incentive Plan. As described above, all stock options are granted with an exercise price equal to the fair market value of our common stock on the date of grant. Fair market value is defined to be the closing market price of a share of our common stock on the date of grant. We do not have any

19

program, plan or practice of awarding stock options and setting the exercise price based on a date or price other than the closing market price on the grant date. All grants to NEOs are made by the Committee and not pursuant to delegated authority.

Option repricing is expressly prohibited by the terms of the Stock Incentive Plan.

| | – | | Restricted Stock Unit Awards. RSUs provide recipients with shares of common stock upon lapse of the award restrictions. RSUs are earned on the basis of continued service to the Company and vest 25% per year, beginning one year after the date of grant. RSUs are entitled to receive a cash amount equal to any dividends declared and paid on the Company’s common stock. |

In 2006, the Committee approved grants of restricted stock units in conjunction with grants of stock options and value management awards to replace the dividend equivalent rights program described below. In making the decision, the Committee viewed the addition of restricted stock units as increasing the retention value of the overall program and making it more straightforward and, therefore, more meaningful to the participants. In addition, they considered that restricted stock units are an increasingly common feature of peer companies’ long-term incentive programs and, therefore, the component would assist in attracting and retaining key executives. For more information regarding these awards and the cost recognized for these awards, refer to the Company’s disclosure in its Annual Report on Form 10-K for the year ended December 31, 2006, as filed with the SEC on February 27, 2007, Part II, Item 8Notes to Consolidated Financial Statements—Note 11 Share-Based Compensation.

| | – | | Value Management Awards.Value management awards are performance-based awards that result in cash and/or stock payments to participants based on the Company’s three-year total shareholder return relative to that of three comparator groups: (1) a group of 12 forest products companies (including Bowater, Deltic, International Paper, Longview Fiber, Louisiana-Pacific, MeadWestvaco, Potlatch, Rayonier, St. Joe, Timberwest, Universal Forest Products and Weyerhaeuser); (2) the S&P 500 Index; and (3) the Morgan Stanley REIT Index. The Company’s performance is measured against each peer group as follows: 50% forest product companies, 25% S&P 500 Index and 25% Morgan Stanley REIT Index, respectively. The value of each unit is zero if relative total shareholder return is below the 50th percentile for each of the peer groups and has a maximum value of $200 if the Company’s relative total shareholder return is at or above the 75th percentile for each of the peer groups. |

For 2007, the Compensation Committee decided to reduce the Peer Group weighting for the value management award plan from 50% to 25% for the Forest Products companies, and to increase the S&P 500 weighting from 25% to 50% in consideration of consolidation of the forest products industry and resulting smaller peer group. The Morgan Stanley REIT Index will maintain its 25% weighting. Prior awards will maintain the peer group weighting in effect at the time of the grant. For more information regarding these awards and the cost recognized for these awards, refer to the Company’s disclosure in its Annual Report on Form 10-K for the year ended December 31, 2006, as filed with the SEC on February 27, 2007, Part II, Item 8Notes to Consolidated Financial Statements—Note 11 Share-Based Compensation.

| | – | | Dividend Equivalent Rights.Prior to 2006, our long-term incentive program included awards of dividend equivalent rights. Dividend equivalent rights were granted in tandem with each stock option awarded to executives and provided the opportunity to receive cash payments equal to the per-share dividend paid by the Company based on performance. |

Dividend equivalent rights were earned on the basis of relative total shareholder return of the Company relative to that of three comparator groups: (1) a group of 12 forest products companies (including all the companies listed above and reviewed for market comparison purposes); (2) the S&P 500 Index; and (3) the Morgan Stanley REIT Index with the Company’s performance against each peer group weighted 50%, 25% and 25%, respectively. In addition, the Company was required to have a minimum total shareholder return on an annualized basis of at least 5.5% per year (considering both stock price appreciation plus dividends paid). Based on satisfaction of these performance requirements, up to 100% of the per-share dividends could be earned by participants over a five-year period.

20

Prior to 2004, dividend equivalent right awards were earned based on the Company achieving total shareholder returns of 13% on an annualized basis. The performance period for the 2003 dividend equivalent right award ends December 31, 2007, and any awards earned under that plan will be paid in 2008.

With primary consideration to the complexity of the plan design, the Committee decided to discontinue the dividend equivalent right plan beginning in 2006. All NEOs hired prior to January 2006 hold outstanding dividend equivalent right awards, which could earn additional amounts each year through 2009 if performance goals are met. For more information regarding these awards and the cost recognized for these awards, refer to the Company’s disclosure in its Annual Report on Form 10-K for the year ended December 31, 2006, as filed with the SEC on February 27, 2007, Part II, Item 8Notes to Consolidated Financial Statements—Note 11 Share-Based Compensation.

Other Compensation

| | • | | Perquisites. Our NEOs receive a small number of perquisites provided by or paid by us. The allowance for these perquisites differs depending on position and includes an allowance for a leased automobile, financial tax preparation, annual fee for home security system (President & CEO only), an annual physical and annual membership for a business or social club. The total value of these benefits is disclosed on page 24 in theAll Other Compensation column of theSummary Compensation Table. We provide these perquisites because they are provided by many companies from which we attract talent and it is, therefore, beneficial for recruitment and retention purposes. |