UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | | Preliminary Proxy Statement |

| ¨ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to §240.14a-12 |

PLUM CREEK TIMBER COMPANY, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| ¨ | | Fee paid previously with preliminary materials. |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | | | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

Notice of

2009 Annual Meeting

of Stockholders

and Proxy Statement

PRELIMINARY PROXY MATERIAL - SUBJECT TO COMPLETION

PLUM CREEK TIMBER COMPANY, INC.

Dear Stockholder:

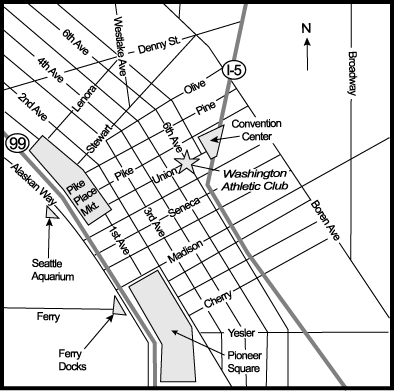

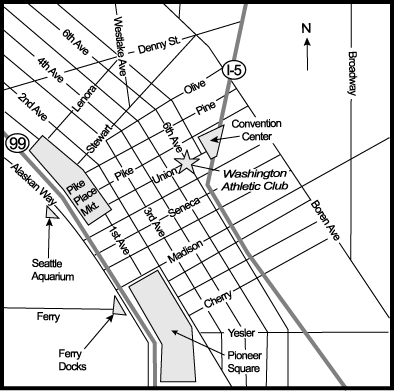

It is a pleasure to invite you to Plum Creek’s Annual Meeting of Stockholders on Wednesday, May 6, 2009, beginning at 9:00 a.m. local time, at the Washington Athletic Club in Seattle, Washington. Driving instructions to the Washington Athletic Club can be found at the back of this document.

Your vote is very important. Whether or not you plan to attend the Annual Meeting in person, I urge you to vote your proxy as soon as possible. You can vote over the internet, by telephone or by mailing back a proxy card. Voting in any of these ways will ensure your representation at the Annual Meeting if you do not attend in person. Please review the instructions on the proxy card regarding each of these options. If you do attend the meeting in person, you will have the opportunity, if you desire, to change your vote at the meeting.

The agenda for the Annual Meeting includes:

| | – | The election of eight (8) directors to serve until the 2010 Annual Meeting |

| | – | A proposal to amend Plum Creek’s Restated Certificate of Incorporation to eliminate the requirement of a plurality vote in director elections |

| | – | A proposal to amend Plum Creek’s Restated Certificate of Incorporation to increase the share ownership limitation from 5% to 9.8% per holder |

| | – | A proposal to ratify the appointment of Ernst & Young as Plum Creek’s independent auditors |

| | – | A stockholder proposal (if properly presented at the meeting) |

The Board of Directors recommends that you vote“FOR”each of the director nominees,“FOR”the amendment proposal to eliminate plurality voting in director elections,“FOR”the amendment proposal to increase the share ownership limitation,“FOR”ratifying the appointment of Ernst & Young as Plum Creek’s independent auditors and“AGAINST”the stockholder proposal. In addition to these specific matters, there will be a report on Plum Creek’s business following the business portion of the meeting, and you will have an opportunity to ask questions.

If you have any questions concerning the Annual Meeting or any of the proposals, please contact our Investor Relations Department at (800) 858-5347 (within the United States and Canada) or (206) 467-3600 (outside the United States and Canada, call collect).

I look forward to seeing you on May 6th in Seattle.

|

| Sincerely yours, |

|

|

Rick R. Holley President and Chief Executive Officer |

|

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

PRELIMINARY PROXY MATERIAL - SUBJECT TO COMPLETION

PLUM CREEK TIMBER COMPANY, INC.

999 Third Avenue, Suite 4300

Seattle, Washington 98104-4096

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON WEDNESDAY, MAY 6, 2009

NOTICE is hereby given of the Annual Meeting of Stockholders of Plum Creek Timber Company, Inc., a Delaware corporation (the “Company”).

| | |

| MEETING DATE, TIME AND LOCATION | | The Annual Meeting of Stockholders will take place on Wednesday, May 6, 2009, at 9:00 a.m. local time, in the Noble Room at the Washington Athletic Club located at 1325 Sixth Avenue, Seattle, Washington. Please refer to the map and the driving instructions located at the back of this document for the location of the Washington Athletic Club. |

| |

| MEETING AGENDA | | The purposes of the Annual Meeting of Stockholders are: |

| | 1. To elect eight (8) persons to serve on the Company’s Board of Directors for one-year terms expiring at the Annual Meeting of Stockholders to be held in 2010 and until their successors are duly elected and qualified; |

| | 2. To consider and act upon a proposal to amend Plum Creek’s Restated Certificate of Incorporation to eliminate the requirement of a plurality vote in director elections; |

| | 3. To consider and act upon a proposal to amend Plum Creek’s Restated Certificate of Incorporation to increase the share ownership limitation from 5% to 9.8% per holder; |

| | 4. To consider and act upon a proposal to ratify the appointment of Ernst & Young LLP as the Company’s independent auditors for 2009; |

| | 5. To consider and act upon a stockholder proposal, if it is properly presented at the meeting, regarding an annual stockholder advisory vote on the compensation of the executive officers named in the summary compensation tables and narrative disclosure; and |

| | 6. To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

| |

| RECORD DATE | | You are entitled to vote on the matters presented at the Annual Meeting of Stockholders if you were a stockholder of record at the close of business on March 10, 2009. |

| |

| VOTING | | Please submit your proxy as soon as possible so that your shares can be voted at the meeting. Properly executing and submitting the enclosed proxy card will appoint Rick R. Holley, David W. Lambert and James A. Kraft as your proxies.You may submit your proxy and vote your shares (1) by internet, (2) by telephone or (3) by mail. For instructions on how to vote, please refer to the enclosed proxy card. |

| | If your shares are held in “street name” by a broker, bank or other registered holder of record, you are not the registered holder of record of the stock (and your name is not on the Company’s list of registered stockholders), but you are considered the beneficial owner of the stock, and these proxy materials are being forwarded to you by your broker, bank or other registered holder of record of the stock. If you hold your stock in street name and would like to vote in person at the meeting, you must bring with you a proxy, executed in your favor, from your broker, bank or other registered holder of record. |

| |

| ELECTRONIC ACCESS OF PROXY MATERIALS | | Under new Securities and Exchange Commission rules, we are providing access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of the Company’s proxy statement and Annual Report on Form 10-K for the year ended December 31, 2008 (including the 10-K wrap) on our website athttp://proxy.plumcreek.com, which does not employ the use of “cookies” or other tracking technologies that identify visitors to the site. The proxy statement and the Annual Report are also available atwww.proxyvote.com, where stockholders may vote their proxies over the internet. |

|

| By Order of the Board of Directors, |

|

|

James A. Kraft Senior Vice President, General Counsel and Secretary

March , 2009 |

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

TABLE OF CONTENTS

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | i

ii | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

PRELIMINARY PROXY MATERIAL - SUBJECT TO COMPLETION

PLUM CREEK TIMBER COMPANY, INC.

999 THIRD AVENUE, SUITE 4300

SEATTLE, WASHINGTON 98104-4096

PROXY STATEMENT FOR THE 2009 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 6, 2009

The Date of this Proxy Statement is March , 2009.

PROXIES IN THE FORM ENCLOSED ARE SOLICITED BY THE BOARD OF DIRECTORS OF PLUM CREEK TIMBER COMPANY, INC., TO BE VOTED AT THE ANNUAL MEETING OF STOCKHOLDERS ON MAY 6, 2009, AT 9:00 A.M. LOCAL TIME, AND AT ANY ADJOURNMENT OR POSTPONEMENT THEREOF, FOR THE PURPOSES SET FORTH IN THE ATTACHED NOTICE OF ANNUAL MEETING OF STOCKHOLDERS. STOCKHOLDERS OF RECORD AT THE CLOSE OF BUSINESS ON MARCH 10, 2009, ARE ENTITLED TO VOTE AT THE ANNUAL MEETING. THE COMPANY ANTICIPATES THAT THE ATTACHED NOTICE, THIS PROXY STATEMENT AND THE ENCLOSED PROXY CARD WILL FIRST BE SENT TO STOCKHOLDERS ON OR ABOUT MARCH , 2009.

SOLICITATION AND REVOCABILITY OF PROXY

This Proxy Statement is furnished to stockholders of Plum Creek Timber Company, Inc., a Delaware corporation (“Plum Creek” or the “Company”), in connection with the solicitation by the Company’s Board of Directors (the “Board”) of proxies to be voted at the Company’s Annual Meeting of Stockholders on May 6, 2009, or any adjournment or postponement thereof (the “Annual Meeting”). Proxy cards that are properly executed and returned to the Company or voted by telephone or internet, and not later revoked, will be voted at the Annual Meeting in accordance with the instructions specified on the enclosed proxy card. Proxies received without specific voting instructions, unless revoked before exercised, will be voted:

| • | | “For” each of the nominees for director listed in these materials and on the enclosed proxy card; |

| • | | “For” the proposal to amend Plum Creek’s Restated Certificate of Incorporation to eliminate the requirement of a plurality vote in director elections; |

| • | | “For” the proposal to amend Plum Creek’s Restated Certificate of Incorporation to increase the share ownership limitation from 5% to 9.8% per holder; |

| • | | “For”ratifying the appointment of Ernst & Young LLP as the Company’s independent auditors for 2009; and |

| • | | “Against”the stockholder proposal relating to submission of an annual stockholder advisory vote on the compensation of the executive officers named in the summary compensation tables and narrative disclosure. |

Proxies will be voted on such other matters as may properly come before the meeting, or any adjournment or postponement thereof, in the discretion of the appointed proxy holders.

Any person giving a proxy may revoke it at any time prior to its exercise. A proxy may be revoked either by: (1) filing an instrument of revocation with the Company’s Corporate Secretary at 999 Third Avenue, Suite 4300, Seattle, Washington 98104-4096; (2) voting by telephone at a later date, (3) voting by internet at a later date; or (4) signing and submitting another proxy card with a later date. A proxy may also be revoked by voting in person at the meeting. If your shares of Plum Creek common stock are held in street name (in the name of a broker, bank or other registered holder of record), you must obtain a proxy, executed in your favor, from the registered holder of record of the stock to be able to vote in person at the Annual Meeting.

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 1

The Company will bear the entire cost of solicitation, including the preparation, assembly, printing and mailing of this Proxy Statement, the enclosed proxy card, and any additional material that may be furnished to stockholders. In accordance with the regulations of the Securities and Exchange Commission (“SEC”) and the New York Stock Exchange (“NYSE”), the Company will also reimburse brokerage firms, banks and other registered holders for their expenses incurred in sending proxies and proxy materials to the beneficial owners of shares of Plum Creek common stock. In addition to solicitation by mail, directors, officers or other employees of the Company, without extra compensation, may solicit proxies in person or by telephone or facsimile. Georgeson, Inc. will assist the Company in the solicitation of proxies for a fixed fee of $8,000 and reasonable out-of-pocket expenses, to be paid by the Company.

CERTAIN MATTERS RELATING TO PROXY MATERIALS AND ANNUAL REPORTS

Each year in connection with the annual meeting of stockholders, the Company is required to send to each registered stockholder of record a proxy statement and annual report and to arrange for a proxy statement and annual report to be sent to each beneficial stockholder whose shares are held by or in the name of a broker, bank, trust or other registered holder of record. Because many stockholders hold shares of our common stock in multiple accounts or share an address with other stockholders, this process results in duplicate mailings of proxy statements and annual reports. Stockholders may avoid receiving duplicate mailings and save the Company the cost of producing and mailing duplicate documents as follows.

Stockholders of Record. If your shares are registered in your own name and you are interested in consenting to the delivery of a single proxy statement or annual report, you may contact Investor Relations by mail at 999 Third Avenue, Suite 4300, Seattle, Washington, 98104-4096; or by telephone at (800) 858-5347 if calling within the United States and Canada, or at (206) 467-3600 if calling outside the United States and Canada (call collect).

Beneficial Stockholders. If your shares are not registered in your own name, your broker, bank, trust or other registered holder of record that holds your shares may have asked you to consent to the delivery of a single proxy statement or annual report if there are other Plum Creek stockholders who share an address with you. If you currently receive more than one proxy statement or annual report at your household and would like to receive only one copy of each in the future, you should contact a representative of your broker, bank, trust or other holder of record.

Right to Request Separate Copies. If you consent to the delivery of a single proxy statement and annual report but later decide that you would prefer to receive a separate copy of the proxy statement or annual report for each stockholder sharing your address, then please notify the Company or your broker, bank, trust or other holder of record, and additional proxy statements or annual reports will be delivered to you. If you wish to receive a separate copy of the proxy statement or annual report for each stockholder sharing your address in the future, you may also contact Investor Relations using the contact information provided above.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 6, 2009. This Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2008 (including the 10-K Wrap) are available on Plum Creek’s web site athttp://proxy.plumcreek.com, which does not employ the use of “cookies” or other tracking technologies that identify visitors to the site. These materials are also available atwww.proxyvote.com, where stockholders may vote their shares over the internet (seeVoting Options below). Directions to the location of the Annual Meeting are also available on Plum Creek’s web site athttp://proxy.plumcreek.com.

VOTING OPTIONS

Your vote is important.Whether or not you expect to attend the Annual Meeting in person, we urge you to vote your shares via the internet, by phone or by signing, dating and returning the enclosed proxy card at your earliest convenience. This will ensure the presence of a quorum at the meeting. Promptly voting your shares will save the

2 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

Company the expense and extra work of additional solicitation. Submitting your proxy now will not prevent you from voting your shares at the meeting if you want to do so, because your vote by proxy is revocable at your option. Voting byinternet ortelephone is fast and convenient, and your vote is immediately confirmed and tabulated. Most important, by using the internet or telephone, you help the Company reduce postage and proxy tabulation costs. Or, if you prefer, you can vote by mail by returning the enclosed proxy card in the addressed, prepaid envelope provided.

Vote by Internet. You can vote your shares over the internet atwww.proxyvote.comuntil 11:59 P.M. Eastern Time on May 5, 2009, the day before the meeting date. Have the enclosed proxy card in hand when you access the web site and follow the instructions to cast your vote on the five matters discussed in this Proxy Statement.

Vote by Telephone.You can vote your shares over the telephone by calling1-800-690-6903 until 11:59 P.M. Eastern Time on May 5, 2009, the day before the meeting date. Have the enclosed proxy card in hand when you call and follow the instructions to cast your vote on the five matters discussed in this Proxy Statement.

Vote by Mail.You can vote your shares by mail by signing, dating and completing the enclosed proxy card and mailing it in the enclosed postage paid envelopeor you can return it toPlum Creek Timber Company, Inc., c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717.

VOTE REQUIRED AND METHOD OF COUNTING VOTES

Under the Delaware General Corporation Law (“Delaware Law”) and the Company’s Amended and Restated Bylaws, as amended (the “Company Bylaws”), the presence at the Annual Meeting, in person or by duly authorized proxy, of the holders of a majority of the outstanding shares of stock entitled to vote at the Annual Meeting constitutes a quorum for the transaction of business. Each share of Plum Creek common stock entitles the holder to one vote on each of the five (5) proposals to be presented at the Annual Meeting. Abstentions and broker non-votes are counted toward determining a quorum.

Broker Non-Votes

A broker non-vote occurs when a registered holder of stock votes on behalf of the beneficial owner of that stock (e.g., a broker or bank holding stock on behalf of its client) on at least one proposal, but not on another, because the registered holder does not have discretionary voting authority with respect to that item of business and has not received instructions from the beneficial owner. We have been advised by the NYSE that the election of directors, the proposals to amend Plum Creek’s Restated Certificate of Incorporation (the “Certificate of Incorporation”) and the ratification of the appointment of our independent auditors are considered “discretionary” items. This means that brokerage firms and other registered holders of stock may vote in their discretion on these matters on behalf of their clients who have not otherwise furnished voting instructions before the meeting. In contrast, the stockholder proposal is a “non-discretionary” item. This means that brokerage firms that have not received voting instructions from their clients on this proposal may not vote on the proposal.

Voting Standard for Director Elections

The Company’s Certificate of Incorporation currently provides that directors shall be elected by a plurality of the votes of the shares present, in person or by proxy, at an annual meeting and entitled to vote on the election of directors. As described in Proposal 2 below, the Board is proposing and recommending an amendment to the Certificate of Incorporation to eliminate such plurality voting requirement. The Board previously approved an amendment to the Company Bylaws to provide for majority voting in the election of directors by requiring that a nominee for director shall be elected if the votes cast for such nominee’s election exceed the votes cast against such nominee’s election in uncontested elections. The Company Bylaws also provide that in a contested election (a situation in which the number of director nominees exceeds the number of directors to be elected), the standard for election of directors will be a plurality of the shares represented in person or by proxy at any such meeting and entitled to vote on the election of directors.

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 3

If Proposal 2 is approved by stockholders, directors will be elected under the majority voting standard. If Proposal 2 is not approved by stockholders, directors will be elected under the plurality voting standard. Under the majority voting standard, Company policy governs whether current directors who are not re-elected continue to serve until their successors are elected. Under Delaware Law, any director who is currently serving on the Board and who is not re-elected at the end of his or her term of office nonetheless continues to serve on the Board as a “holdover director” until his or her successor has been elected. To address this situation, the Board has adopted a Corporate Governance Policy on Majority Voting, which can be found in the Company’s Corporate Governance Guidelines. Under the policy, any director who does not receive the required number of votes for re-election under the majority voting standard, must tender his or her resignation to the Chairman of the Board. The Board will consider the tendered resignation and, within 90 days of the stockholder meeting at which the election occurred, decide whether to accept or reject the tendered resignation, and will publicly disclose its decision and the process involved in the consideration. Absent a compelling reason to reject the resignation, the Board shall accept the resignation. The director who tenders his or her resignation will not participate in the Board’s decision. Only persons who are currently serving as directors and seeking re-election can become a “holdover director” under Delaware Law. Therefore, the Corporate Governance Policy on Majority Voting would not apply to any person who was not then serving as a director at the time he or she sought, and failed to obtain, election to the Board. For 2009, all nominees for the election of directors are currently serving on the Board. The complete Corporate Governance Policy on Majority Voting is available on the Company’s website atwww.plumcreek.com by clicking on “Investors,” then “Corporate Governance” and finally “Governance Guidelines.”

Vote Required for Each Item of Business

Proposal 1. For Proposal 1, if the majority voting standard applies in the election of directors, a nominee will be elected to the Board only if the votes cast “for” such nominee’s election exceed the votes cast “against” such nominee’s election. If the plurality voting standard applies in the election of directors, the eight (8) nominees who receive the greatest number of votes cast will be elected to the Board and “against” or “abstain” votes will have the same effect as a vote to withhold authority. In either case, abstentions and broker non-votes, if any, will have no effect on the outcome of the election.

Proposal 2 and Proposal 3. For Proposal 2 (amending the Certificate of Incorporation to eliminate the plurality voting requirement in director elections), the affirmative vote of at least 66-2/3% of the outstanding shares entitled to vote is required for approval. For Proposal 3 (amending the Certificate of Incorporation to increase the share ownership limitation from 5% to 9.8% per holder), the affirmative vote of at least a majority of the outstanding shares entitled to vote is required for approval. Abstentions and broker non-votes, if any, will have the same effect as a vote against Proposal 2 and Proposal 3.

Proposal 4 and Proposal 5. For Proposal 4 (ratifying the appointment of Ernst & Young) and Proposal 5 (stockholder proposal regarding advisory vote on executive compensation), the affirmative vote of the majority of shares present in person or by proxy and entitled to vote at the Annual Meeting is required. Therefore, abstentions and broker non-votes, if any, will have the same effect as a vote against Proposal 4 and Proposal 5.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Role of the Board of Directors

Pursuant to Delaware Law and the Company Bylaws, the business, property and affairs of the Company are managed under the direction of the Board. The current members of the Board are Rick R. Holley, Ian B. Davidson, Robin Josephs, John G. McDonald, Robert B. McLeod, John F. Morgan, Sr., John H. Scully, Stephen C. Tobias and Martin A. White. Members of the Board are kept informed of the Company’s business through discussions with Plum Creek’s officers, by reviewing materials provided to them and by participating in meetings of the Board and its committees. The Board held four regularly scheduled meetings and one special meeting during 2008.

4 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

Director Independence

The Board’s governance principles require that at least two-thirds of the Board be comprised of independent directors and that each of the Board’s three committees are comprised solely of independent directors. No director is considered independent unless the Board has determined that he or she has no material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that has a material relationship with the Company. To evaluate the materiality of any such relationship, the Board has adopted categorical independence standards consistent with NYSE listing standards for director independence. A copy of these standards can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link.

With the assistance of its legal counsel, the Corporate Governance and Nominating Committee reviewed written responses to annually submitted questionnaires completed by each member of the Board against the Board’s and the NYSE’s director independence standards, along with NYSE and SEC independence standards specifically applicable to Board members who serve on the Audit Committee. On the basis of this review, the Corporate Governance and Nominating Committee advised the full Board of its conclusions regarding director independence. After considering the Committee’s recommendation, the Board affirmatively determined that each of Ms. Josephs and Messrs. Davidson, McDonald, McLeod, Morgan, Scully, Tobias and White is independent under the Board’s and the NYSE’s independence standards. In addition, the Board determined that each member of the Audit Committee is independent under the NYSE’s and SEC’s independence standards for directors who serve on audit committees.

Board Committees

The Board has a standing Compensation Committee, Corporate Governance and Nominating Committee and Audit Committee.

Compensation Committee.During 2008, the Compensation Committee met five times. The Compensation Committee acts pursuant to a written charter adopted in January 2003, which can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link. The Committee is responsible for developing and modifying over time the Company’s compensation policies and plans, including the compensation policies and plans for the Company’s executive officers and directors. It is also responsible for making recommendations to the Board concerning amendments to the Company’s compensation plans and, in certain instances, making amendments to such plans. The Committee also oversees the annual performance evaluation of the Company’s President and Chief Executive Officer and is responsible for producing a report on executive compensation for inclusion in the Company’s proxy materials. The current members of the Compensation Committee are Ms. Josephs and Messrs. McLeod, Tobias and White (Chairman).

The Compensation Committee reviews executive compensation each year. To assist it in doing its job, the Compensation Committee has retained the firm of Towers Perrin, a nationally recognized compensation consulting firm. Towers Perrin is engaged by and reports directly to the Compensation Committee and interacts with management as necessary to fulfill its responsibilities. Representatives of Towers Perrin participate in most regularly scheduled meetings of the Compensation Committee.

For 2008, the Compensation Committee instructed Towers Perrin to obtain and present relevant competitive data to assist the Committee in determining total direct compensation and perquisites. The Compensation Committee also instructed Towers Perrin to keep the Compensation Committee apprised of current and developing trends in executive compensation.

Corporate Governance and Nominating Committee.The Corporate Governance and Nominating Committee met two times during 2008. The Committee acts pursuant to a written charter adopted in January 2003, which can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link. The Committee is responsible for overseeing and coordinating the Company’s corporate governance practices. The Committee advises the Board with respect to matters of Board composition and procedures and is responsible for

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 5

developing and recommending to the Board the Company’s corporate governance principles. The Committee also oversees the annual performance evaluation of the Board and its committees. The current members of the Corporate Governance and Nominating Committee are Messrs. Davidson, McDonald, Scully (Chairman) and Tobias.

Audit Committee. The Board of Directors has a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). During 2008, the Audit Committee met nine times. The Audit Committee acts pursuant to a written charter, which was originally adopted by the Board during 2000, and was last revised in May of 2008. The Audit Committee charter can be found on the Company’s website atwww.plumcreek.com by clicking on the “Investors” link and then the “Corporate Governance” link. Among other things, this Committee has the responsibility to appoint, terminate, replace, compensate and oversee the Company’s independent auditors, to review and approve the scope of the annual audit; to interview the independent auditors for review and analysis of the Company’s financial systems and controls; and to review the independence of, and pre-approve any audit or non-audit services provided by, the independent auditors.

Current members of the Audit Committee are Mr. Davidson, Ms. Josephs and Messrs. McDonald, (Chairman) and Morgan. The Board of Directors has determined that each of the current members of the Audit Committee is independent in accordance with both NYSE listing standards applicable to audit committee members and Rule 10A-3(b)(1) under the Exchange Act. In addition, the Board has designated each of Mr. Davidson and Ms. Josephs as an “audit committee financial expert,” as that term is defined in Item 407(d)(5)(ii) of Regulation S-K promulgated by the SEC.

Report of the Audit Committee

In connection with the Audit Committee’s review of the Company’s financial statements for the year ended December 31, 2008:

| 1. | The Audit Committee has reviewed and discussed the audited financial statements with management of the Company; |

| 2. | The Audit Committee has discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T; |

| 3. | The Audit Committee has received the written disclosures and the letter from the independent accountant required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees), as adopted by the Public Company Accounting Oversight Board in Rule 3600T, and has discussed with the independent accountant the independent accountant’s independence; and |

| 4. | Based on the review and discussions of the above three items, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the last fiscal year for filing with the Securities and Exchange Commission. |

Ian B. Davidson, Robin Josephs, John G. McDonald (Chairman) and John F. Morgan, Sr.

Selection of Nominees to the Board of Directors

Stockholder Nominations. The Corporate Governance and Nominating Committee will consider director nominee recommendations from stockholders. Stockholder recommendations must be in writing and addressed to the Chairman of the Corporate Governance and Nominating Committee, c/o Corporate Secretary, Plum Creek Timber Company, Inc., 999 Third Avenue, Suite 4300, Seattle, Washington, 98104-4096. If a stockholder intends to make a

6 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

nomination at any annual stockholder meeting, the Company Bylaws require that the stockholder deliver written notice to the Company not more than 90 days or less than 60 days prior to the anniversary date of the Company’s previous year’s annual meeting of stockholders. The notice must comply with the Company Bylaws and set forth, among other things: (1) the name and address of the stockholder who intends to make the nomination; (2) the name, age, address and principal occupation of the proposed director nominee or nominees; (3) a representation that the stockholder is entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; (4) the consent of each proposed director nominee to serve as a director of the Company if so elected; and (5) the number of shares of common stock of the Company owned by the notifying stockholder and by the proposed director nominee or nominees. These Company Bylaw provisions afford the Board the opportunity to consider the qualifications of the proposed nominees and, to the extent deemed necessary or desirable by the Board, to inform stockholders about such qualifications.

Director Qualifications. The Corporate Governance and Nominating Committee believes that the minimum qualification for serving as a director of the Company is that a director nominee demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board’s oversight of the business and affairs of the Company. A director nominee must also have an impeccable record and reputation for honest and ethical conduct in his or her professional and personal activities. In addition, the Committee examines a candidate’s specific experiences and skills, time availability in light of other commitments, potential conflicts of interest and independence from management and the Company. The Committee also seeks to have the Board represent a diversity of backgrounds and experience.

Selection Process for Director Nominees. The Corporate Governance and Nominating Committee identifies potential director nominees by asking current directors and executive officers to notify the Committee if they become aware of persons meeting the criteria described above. From time to time, the Committee engages firms that specialize in identifying director candidates. As described above, the Committee will also consider candidates recommended by stockholders.

Once a person has been identified as a potential candidate by the Corporate Governance and Nominating Committee, the Committee may collect and review publicly available information regarding the person to assess whether the person should be considered further. If the Committee determines that the candidate warrants further consideration, the Chairman of the Committee or another member of the Committee contacts the candidate. Generally, if the candidate expresses a willingness to be considered and to serve on the Board, the Committee requests information from the candidate, reviews his or her accomplishments and qualifications in light of any other candidates that the Committee might be considering, and conducts one or more interviews with the candidate. In certain instances, Committee members may contact one or more references provided by the candidate or may contact other members of the business community or other persons that may have greater first-hand knowledge of the candidate’s accomplishments. The Committee’s evaluation process does not vary based on whether or not a candidate is recommended by a stockholder.

Executive Sessions of the Board of Directors

In accordance with the Company’s Corporate Governance Guidelines, the Board’s independent directors meet in executive session at least four (4) times each year. The Chairman of the Board, who must be an independent director under the Corporate Governance Guidelines, presides at, and sets the agenda for, each executive session of the independent directors. If the Board has not selected a Chairman, then the Corporate Governance Guidelines require that the chair of the Audit Committee, the Corporate Governance and Nominating Committee and the Compensation Committee each preside over the meetings of the independent directors in rotating order as decided by the other independent directors. Mr. Davidson served as Chairman of the Board during 2008 and presided over all executive sessions of the independent members of the Board.

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 7

Communicating with the Board

Anyone who wishes to notify or communicate with the entire Board of Directors, any individual director or the independent directors as a group, may do so. Communications should be delivered to the following address, marked “confidential”, care of Corporate Secretary, Plum Creek Timber Company, Inc., 999 Third Avenue, Suite 4300, Seattle, Washington 98104-4096. The Corporate Secretary reviews all such correspondence and will forward to the Chairman of the Board of Directors, or other individual director or group of directors, as the case may be, a copy of such correspondence that, in the opinion of the Corporate Secretary, relates to the functions of the Board or its committees, or that the Corporate Secretary otherwise determines requires their attention. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Company’s internal audit department and handled in accordance with procedures established by the Audit Committee with respect to such matters. These stockholder communication procedures were approved by the Board of Directors.

Board Member Attendance at Board and Committee Meetings During 2008

The table below summarizes Board member attendance at both regularly scheduled and special meetings of the Board of Directors and each committee on which he or she serves. In 2008, there were five (5) meetings of the Board of Directors, nine (9) meetings of the Audit Committee, two (2) meetings of the Corporate Governance and Nominating Committee and five (5) meetings of the Compensation Committee. As the Company’s President and Chief Executive Officer, Mr. Holley periodically attended meetings of the Board’s committees at their invitation. Mr. Holley’s attendance at those meetings is not reported in the table below because Mr. Holley is not a member of any Board committee.

| | | | | | | | |

| Name | | Board

Meetings

Attended

by

Director | | Audit

Committee

Meetings

Attended

by

Director | | Corporate

Governance

and

Nominating

Committee

Meetings

Attended by

Director | | Compensation

Committee

Meetings

Attended by Director |

Ian B. Davidson | | 5 | | 9 | | 2 | | n/a |

Rick R. Holley | | 5 | | n/a | | n/a | | n/a |

Robin Josephs | | 5 | | 8 | | n/a | | 5 |

John G. McDonald | | 5 | | 9 | | 2 | | n/a |

Robert B. McLeod | | 5 | | n/a | | n/a | | 5 |

John F. Morgan, Sr. | | 5 | | 9 | | n/a | | n/a |

John H. Scully | | 5 | | n/a | | 2 | | n/a |

Stephen C. Tobias | | 5 | | n/a | | 1 | | 5 |

Martin A. White | | 5 | | n/a | | n/a | | 5 |

| |

Board Member Attendance at Annual Meetings

While members of the Board are always welcome to attend each annual meeting of stockholders, the Board has no formal policy requiring their attendance. Two of the Company’s directors, Messrs. Holley and Davidson, attended the 2008 annual meeting of stockholders held on May 7, 2008.

Code of Ethics and Other Corporate Governance Information

The Company maintains a code of ethics, entitled thePlum Creek Code of Conduct, which applies to each director and to the principal executive officer, the principal financial officer and the principal accounting officer as well as to all other employees of the Company. ThePlum Creek Code of Conduct, along with the governing charters of each of the Board’s committees and the Company’s Corporate Governance Guidelines, can be found in the “Corporate

8 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

Governance” section of the Company’s website accessible to the public atwww.plumcreek.com. To find this section of the website, click on the “Investors” link and then the “Corporate Governance” link. The Company will post any amendments to, or waivers from, its Code of Conduct (to the extent applicable to any director or any of the Company’s executive officers, including the principal executive officer, principal financial officer or principal accounting officer) at this location on its website. In addition to these documents, the Company’s proxy statements and annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and reports concerning transactions in the Company’s stock by directors and certain officers of the Company, and any amendments to those reports, can also be found on the Company’s website by first clicking the “Investors” link, then the “Financial Publications” link and finally the “SEC Filings” link. Copies of any of these documents may be obtained from our website or free of charge by contacting the Company’s Investor Relations Department at 999 Third Avenue, Suite 4300, Seattle, Washington 98104-4096 or by calling (206) 467-3600.

On May 13, 2008, Rick R. Holley, as President and Chief Executive Officer of the Company, submitted an unqualified certification to the NYSE stating that, as of that date, he was not aware of any violation by the Company of the NYSE Corporate Governance Listing Standards. Additionally, the Company has filed with the SEC the Chief Executive Officer and Chief Financial Officer certifications required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, as amended.

Director Compensation

The Compensation Committee periodically reviews director compensation and engages Towers Perrin to advise it on market data, trends and recommendations for this review. Based upon this review and advice, the Compensation Committee then makes recommendations to the full Board regarding the compensation for the outside directors.

2008 Director Compensation

Our non-employee directors receive the following compensation for their service on the Board:

| • | | $40,000 annual cash retainer |

| • | | $2,000 meeting fee for each meeting of the Board (one-half of this amount is paid for participation in any telephonic meeting unless otherwise determined by the Chairman of the Board) |

| • | | 2,000 shares of the Company’s common stock that carry a six-month restriction on transfer. |

The Chairman of the Board receives an additional annual retainer of $30,000, and members of Board committees may receive the following amounts, depending upon their involvement with each committee of the Board:

| • | | Audit Committee—$10,000 annual cash retainer for the Chairperson of the Committee; $5,000 annual cash retainer for other Committee members. All members of the Committee receive a $2,000 fee for each meeting of the Committee (one-half of this amount is paid for participation in any telephonic meeting unless otherwise determined by the Committee Chairperson). |

| • | | Compensation, Corporate Governance and Nominating Committees—$5,000 annual cash retainer for the Chairperson of each committee. Members of each committee receive a $1,500 fee for each committee meeting (one-half of this amount is paid for participation in any telephonic meeting unless otherwise determined by the Committee Chairperson). |

Directors have the choice to elect to take all or a portion of their Board fees in common stock of the Company and may defer all or part of their fee compensation. Directors are reimbursed for expenses incurred in connection with attending Board and committee meetings.

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 9

The table below summarizes compensation received by non-employee directors of the Board during 2008.

| | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid

in Cash ($)(A) | | Stock

Awards ($)(B) | | Option

Awards ($)(C) | | Non-Equity

Incentive Plan

Compensation ($) | | Change in

Pension Value and

Nonqualified

Deferred

Compensation

Earnings ($) | | All Other

Compensation ($) | | Total ($) |

Ian B. Davidson | | $ | 99,500 | | $ | 85,960 | | – | | – | | – | | – | | $ | 185,460 |

Robin Josephs | | $ | 73,750 | | $ | 85,960 | | – | | – | | – | | – | | $ | 159,710 |

John G. McDonald | | $ | 74,500 | | $ | 85,960 | | – | | – | | – | | – | | $ | 160,460 |

Robert B. McLeod | | $ | 55,750 | | $ | 85,960 | | – | | – | | – | | – | | $ | 141,710 |

John F. Morgan, Sr. | | $ | 68,000 | | $ | 85,960 | | – | | – | | – | | – | | $ | 153,960 |

John H. Scully | | $ | 54,500 | | $ | 85,960 | | – | | – | | – | | – | | $ | 140,460 |

Stephen C. Tobias | | $ | 56,500 | | $ | 85,960 | | – | | – | | – | | – | | $ | 142,460 |

Martin A. White | | $ | 60,750 | | $ | 85,960 | | – | | – | | – | | – | | $ | 146,710 |

| |

| (A) | Fees earned or paid in cash—includes cash retainers and meeting fees earned in 2008. Under the terms of the Plum Creek Director Stock Ownership Plan, directors may also elect to receive shares of the Company’s common stock in lieu of cash fees based on the closing price of the stock on the date such cash fees are payable to the director. Mr. White elected to receive 100% of his cash fees in common stock under the plan, and Mr. Tobias elected to receive 50% of his cash fees in stock under the plan. For cash fees earned in 2008, Mr. White was paid 1,513 shares of common stock, and Mr. Tobias was paid 704 shares of common stock, which he deferred under the terms of the Plum Creek Deferral Plan. |

| (B) | Stock awards—represents the 2008 FAS 123(R) expense recognized for grants of restricted stock awards made to non-employee directors of the Board. The grant date fair value for the 2008 award of restricted stock was $42.98 per share. For more information regarding the cost recognized for these awards, refer to the Company’s disclosure in its Annual Report on Form 10-K for the year ended December 31, 2008, as filed with the SEC on February 27, 2009, Part II, Item 8 Notes to Consolidated Financial Statements—Note 14 Share-Based Compensation Plans. |

| (C) | From 2002 through 2004, directors were granted stock options under the Stock Incentive Plan on an annual basis. Each stock option carries an exercise price equal to the fair market value of the Company’s common stock on the date of grant, expires 10 years from the date of grant, and is fully vested and exercisable. Ms. Josephs currently holds 9,000 stock options. Each of Messrs. Davidson, McDonald, Scully and Tobias currently hold 12,000 stock options. |

PROPOSAL 1

Election of Directors

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE“FOR”EACH OF THE DIRECTOR NOMINEES.

The Board is authorized under the Company Bylaws to set, by resolution, the number of directors who comprise the Board. The directors whose terms expire in 2009 and have been nominated for election to one-year terms of office expiring at the 2010 Annual Meeting of Stockholders, or until their successors are elected and qualified, are Rick R. Holley, Robin Josephs, John G. McDonald, Robert B. McLeod, John F. Morgan, Sr., John H. Scully, Stephen C. Tobias and Martin A. White. Mr. Davidson, whose term of office expires at the Annual Meeting, has informed the Company that he is retiring from the Board and, therefore, is not standing for re-election. For this reason, he has not been nominated for re-election. In connection with Mr. Davidson’s retirement, the Board has passed a resolution reducing the authorized number of directors from nine to eight, effective immediately upon the election of directors at the Annual Meeting.

10 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

In the absence of instructions to the contrary, the proxy holders will vote the proxies received by them for the election of Ms. Josephs and Messrs. Holley, McDonald, McLeod, Morgan, Scully, Tobias and White. Discretionary authority is reserved to cast votes for the election of a substitute should any of the nominees be unable or unwilling to serve as a director.

Each of the nominees has agreed to serve as a director if elected, and the Company believes that each of them will be available to serve. The names and ages of the nominees and their principal occupations or employment during the past five years are set forth below.

Nominees for Election to One-Year Terms Expiring at the 2010 Annual Stockholder Meeting:

| | | | |

| Name | | Age | | Background |

Rick R. Holley | | 57 | | Mr. Holley was elected to the Board of Directors of the Company and appointed as its President and Chief Executive Officer on July 1, 1999, the date of our conversion from a master limited partnership to a real estate investment trust, or REIT. From 1994 through the date of our REIT conversion, Mr. Holley served as a director and president and chief executive officer of the general partner of the former master limited partnership. |

| | |

Robin Josephs | | 49 | | Ms. Josephs was appointed to the Board of Directors of the Company in July 2003. From 2005 to 2007, Ms. Josephs was a managing director of Starwood Capital Group, a private equity firm specializing in real estate investments. Ms. Josephs was previously employed as a senior executive with Goldman Sachs from 1986 to 1996, where she served in various capacities. Prior to working at Goldman Sachs, Ms. Josephs served as an analyst for Booz Allen & Hamilton, Inc., in New York from 1982 to 1984. Ms. Josephs also serves on the board of directors of iStar Financial, Inc. |

| | |

John G. McDonald | | 71 | | Professor McDonald was elected to the Board of Directors of the Company on July 1, 1999. Professor McDonald is a Professor of Finance at the Graduate School of Business at Stanford University, where he has been a faculty member since 1968 and where he holds the Stanford Investors Chair. Professor McDonald also serves as a director of Varian, Inc.; Scholastic Corp.; iStar Financial, Inc.; and eight mutual funds managed by Capital Research and Management Company. |

| | |

Robert B. McLeod | | 67 | | Mr. McLeod was appointed to the Board of Directors of the Company in June 2004. Since 1999, Mr. McLeod has served as the chairman of the board of directors and chief executive officer of Newland Communities, a national developer of master planned communities. |

| | |

John F. Morgan, Sr. | | 62 | | Mr. Morgan was appointed to the Board of Directors of the Company in October 2006. Since 2001, Mr. Morgan has owned and managed Morgan Timber, LLC, a private timberland and real estate management and development company. Mr. Morgan previously held positions in general banking and public securities investment management at First Orlando Corporation (Sun Trust) from 1969 to 1972 and Citizens & Southern Corporation (Bank of America) from 1973 to 1978, and later helped found INVESCO Capital Management, a global money management firm, where he served from 1979 to 2000. |

| | |

John H. Scully | | 64 | | Mr. Scully served as a director of the general partner of the former master limited partnership from November 1992 through July 1999 and was elected to the Board of Directors of the Company on July 1, 1999. He is a founder, and is the managing director, of SPO Partners & Co., a private investment firm, where he has served since 1969. Mr. Scully also serves as chairman of the board of directors for Advent Software, Inc. |

| | |

Stephen C. Tobias | | 64 | | Mr. Tobias was appointed to the Board of Directors of the Company in October 2001. Mr. Tobias has served as the vice chairman and chief operating officer of Norfolk Southern Corporation, a rail transportation company, since 1998, and as the vice president of Norfolk Southern Railway Company, a subsidiary of Norfolk Southern Corporation, since 2000. He previously served as executive vice president-operations of Norfolk Southern Corporation and vice president and chief operating officer of Norfolk Southern Railway Company. Mr. Tobias also serves as a director of Norfolk Southern Railway Company. |

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 11

| | | | |

| Name | | Age | | Background |

Martin A. White | | 67 | | Mr. White was appointed to the Board of Directors of the Company in July 2006. From 1998 to 2006, Mr. White served as chairman and chief executive officer of MDU Resources Group, Inc., a diversified natural resource company that provides energy, natural resource products and related services to both U.S. and international markets. Mr. White has also served as a Senior Advisor to the Tharaldson School of Business and Technology at the University of Mary since 2007. He is currently the chairman of the board of trustees at the University of Mary, and a director of First Interstate BancSystem, Inc. |

| | | | | |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE“FOR”EACH OF THE NOMINEES ON THE ENCLOSED PROXY CARD. UNLESS INDICATED OTHERWISE, THE SHARES WILL BE VOTED“FOR”EACH OF THE NOMINEES TO BE ELECTED TO THE BOARD OF DIRECTORS.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth the beneficial ownership of the Company’s common stock as of March 10, 2009 for each director, each Named Executive Officer, and the directors and executive officers as a group. Amounts shown do not include restricted stock units held by executive officers. There is no person or entity known to the Company to beneficially own more than 5% of the Company’s common stock. Unless otherwise indicated, the address of each person is c/o Plum Creek Timber Company, Inc., 999 Third Avenue, Suite 4300, Seattle, Washington, 98104-4096.

| | | | |

| Name of Individual | | Number of Shares Beneficially Owned | | Percent of Class |

Directors | | | | |

Ian B. Davidson | | 59,038(A) | | * |

Rick R. Holley | | 612,570(B) | | * |

Robin Josephs | | 25,200(C) | | * |

John G. McDonald | | 34,000(D) | | * |

Robert B. McLeod | | 13,000 | | * |

John F. Morgan, Sr. | | 6,220 | | * |

John H. Scully | | 72,000(E) | | * |

Stephen C. Tobias | | 22,000(F) | | * |

Martin A. White | | 10,546 | | * |

| | |

Named Executive Officers | | | | |

Thomas M. Lindquist | | 130,389(G) | | * |

David W. Lambert | | 72,449(H) | | * |

James A. Kilberg | | 52,193(I) | | * |

Larry D. Neilson | | 60,824(J) | | * |

| | |

Directors & Executive Officers as a Group (24 persons, including those named above) | | 1,733,733 | | 1.06% |

| | | | | |

| * | Represents less than 1.0% of the outstanding shares of common stock, based on 162,804,208 shares of common stock outstanding as of March 10, 2009. |

| (A) | Includes 300 shares of common stock owned by Mr. Davidson’s wife. Also includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

| (B) | Includes 28,042 shares of common stock held by a Company benefits trust over which Mr. Holley, on behalf of the Company, has voting power. Mr. Holley disclaims beneficial ownership of these shares. Also includes 447,500 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

12 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

| (C) | Includes 200 shares of common stock held in trust for the benefit of Ms. Josephs’ children and 3,000 shares of common stock held in a trust over which Ms. Josephs has voting and dispositive power. Also includes 9,000 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

| (D) | Includes 20,000 shares held in a family trust over which Mr. McDonald has voting and dispositive power, and 2,000 shares held in an individual retirement account. Also includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

| (E) | Includes 45,000 shares of common stock held in a trust over which Mr. Scully has voting and dispositive power. Also includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

| (F) | Includes 12,000 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. Amount shown does not include 5,584 shares of common stock deferred under the Plum Creek Deferral Plan and held by a Company benefits trust. Mr. Tobias does not have voting or dispositive power over these shares under the terms of the plan, but he does maintain an economic and pecuniary interest in the shares. |

| (G) | Includes 93,750 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

| (H) | Includes 60,750 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

| (I) | Includes 41,750 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

| (J) | Includes 48,250 shares of common stock issuable under stock options exercisable within sixty days of March 10, 2009. |

EXECUTIVE COMPENSATION

This section contains information relating to compensation of the Company’s named executive officers. The named executive officers are determined in accordance with SEC disclosure rules and include the Company’s Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), and the three most highly compensated executive officers other than the CEO and CFO who were serving as executive officers at the end of 2008 (collectively, the “Named Executive Officers” or “NEOs”).

Overview

The following provides a brief overview of the more detailed disclosures as covered in the “Compensation Discussion & Analysis” as outlined below:

| • | | The objectives of our compensation program are to attract, retain, and motivate talented and experienced executives; |

| • | | We provide our NEOs with a balanced compensation program including base salary, short and long-term incentives, health and welfare, retirement benefits and a limited number of perquisites; |

| • | | Short-term incentives support our “pay-for-performance” philosophy; |

| • | | Long-term incentives also support our “pay-for-performance” philosophy and are designed to focus our executives on long-range strategic goals to maximize shareholder value, as well as serving as a retention award; |

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 13

• | | We target total compensation at the 50th percentile of the market and at the 75th percentile for superior performance |

| • | | We use equity-based awards to align the interests of our executives with those of our stockholders; and |

| • | | Our executives do not have employment or change-in-control agreements (except as provided in the long-term incentive plans). |

Compensation Discussion and Analysis

With respect to the compensation of the Company’s NEOs, this section summarizes:

| • | | Our executive compensation program objectives; |

| • | | Our executive compensation programs; and |

| • | | Recent decisions regarding 2008 compensation. |

Objectives of our Executive Compensation Program

Our executive compensation programs are organized around the following objectives:

| • | | Attracting talented and experienced executives; |

| • | | Retaining the executive management required to lead the Company; and |

| • | | Motivating executive management to deliver superior Company performance. |

These objectives reflect our belief that programs which support the attraction and retention of a highly qualified executive management team—coupled with appropriate incentive programs—serve the long-term interests of our stockholders.

With these objectives in mind, the following principles help guide our decisions regarding executive compensation:

• | | NEO compensation opportunities should be competitive with market practices.In order to attract and retain executives with the experience and skills necessary to lead the Company and deliver strong performance to our stockholders, we are committed to providing total annual compensation opportunities that are competitive. We target our base salaries to the middle (50th percentile) of the market. We review market data provided by Towers Perrin, our independent consultant. While the 50th percentile is provided as a single data point, we consider the market at these levels to be represented by a range of pay that is plus or minus 10 percent of the market rate. We also target our total cash compensation (i.e., base salary plus target annual incentives) and total direct compensation (i.e., total cash compensation plus the expected value of long-term incentives) to the middle (50th percentile) of the market for achieving our business plan. Similar to information on market base salaries, Towers Perrin provides us with market data for total cash and total direct compensation. Total cash and total direct compensation earned by the executives may vary from the 50th percentile based on actual performance relative to our plan. For superior Company performance, we target the 75th percentile for total cash and total direct compensation. Our 2008 decisions resulted in compensation that was within 10 percent of the middle of the appropriate market, for both total cash compensation and the expected value of long-term incentive compensation. The actual value of the long-term incentive compensation of each NEO as compared to market is dependent upon the Company’s future performance. |

| | | In 2008, we considered compensation levels and practices among a peer group of forest products companies and general industry (i.e., S&P 500 Peer Group). Both of these peer groups are also used in determining our performance under our long-term incentive plans. However, when benchmarking executive compensation, we use a subset of the peer companies that are similar in size to Plum Creek from a revenue and market-capitalization perspective. Additionally, the National Association of Real Estate Investment Trusts (“NAREIT”) |

14 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

| | salary survey was used to benchmark compensation for our Senior Vice President, Real Estate, a position held by James Kilberg. |

The tables below summarizes the peer companies we use to evaluate Company performance under our long-term incentive plans and the subset we use to benchmark executive compensation:

Peer Groups for Measuring Performance Under Our Long-Term Incentive Plans

| | | | |

| Forest Products Peer Group | | Real Estate Companies Peer Group | | S&P 500 Peer Group |

| | |

AbitibiBowater | | A total of 96 companies that | | A total of 500 companies that |

Deltic Timber | | comprise the Morgan Stanley | | comprise the S&P 500 Index |

International Paper | | REIT Index | | |

Louisiana-Pacific | | | | |

MeadWestvaco | | | | |

Potlatch | | | | |

Rayonier | | | | |

St. Joe | | | | |

TimberWest | | | | |

Universal Forest Products | | | | |

Weyerhaeuser | | | | |

| | | | | |

|

| Subset of the above Companies for Benchmarking Compensation |

| | |

| Forest Products Peer Group | | Real Estate Companies Peer Group | | S&P 500 Peer Group |

| | |

AbitibiBowater | | NAREIT Salary Survey | | A total of 152 companies with |

Louisiana-Pacific | | | | revenues between $1 to $5 billion |

MeadWestvaco | | | | included in the S&P 500 Index |

Potlatch | | | | (seeAppendix A of this Proxy Statement |

Rayonier | | | | for a listing of the 152 companies we |

St. Joe | | | | use to benchmark compensation) |

Universal Forest Products | | | | |

| | | | | |

| • | | Other compensation considerations. When making compensation decisions, we consider each NEO’s experience; transferability of skills; the relevance of the NEO’s experience to other potential employers, and the NEO’s readiness to assume a more significant role either within the Company or with another organization. |

| | | Along with these considerations, the Compensation Committee reviewed compensation data provided by Towers Perrin from the peer groups previously described. For the CEO, Chief Operating Officer, CFO, and Senior Vice President of Business Development, the Committee considers the entire peer group, but places increased emphasis on the general industry data (i.e., S&P 500 Peer Group), recognizing that we compete for talent with the companies in this peer group. For our Senior Vice President, Real Estate, the Committee also considered data from the NAREIT Salary Survey since this position would also be marketable to the companies that comprise NAREIT’s membership. |

| | | In addition to base salary and incentives, we also offer competitive benefit programs including health and welfare benefits, a 401(k) savings program and a defined benefit pension plan. We offer our NEOs a small |

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 15

| | number of perquisites. These programs are described in more detail below underOur Executive Compensation Programs. |

| • | | A substantial portion of NEO compensation should be performance-based.Our executive compensation program emphasizes pay-for-performance. This means that shareholder returns along with corporate performance, both short- and long-term, determine the largest portion of executive pay. For our NEOs, over 70% of total direct compensation is performance-based. |

| | | The compensation package for our NEOs and other members of management includes a number of components that are designed to align individual compensation with the short-term and long-term performance of the Company: |

| | – | | Annual incentive awards are earned based on achievement of a financial target: funds from operations (“FFO”) generally defined as net income plus non-cash charges equal to depletion, depreciation and amortization, and the cost basis for lands sold. |

| | – | | There are three components of our long-term incentive program: stock options, restricted stock units and value management awards. Compensation from all three components is tied to either growth in our stock price or total return to stockholders. Long-term incentive plan awards to the NEOs are determined by the Compensation Committee. These components are further described below inOur Executive Compensation Programs. |

| • | | Our NEOs’ interests should be aligned with those of our stockholders. Approximately half the value of our long-term incentive compensation is delivered in the form of equity—stock options and restricted stock units that are settled in shares of stock, the value of which is dependent upon the performance of our stock price. The remaining portion of our long-term incentives—our value management awards—provide cash and/or stock awards based on our total shareholder return performance relative to return performance earned by the forest products, REIT and S&P 500 industry groups described earlier. |

| | | In addition, we have share ownership guidelines for our NEOs. These guidelines ensure that our executives hold a meaningful amount of Company stock so that the impact of changes in our stock performance affects our executives as it affects our stockholders. Our executives must hold a multiple of their base pay in stock as shown below. All our NEOs have met or exceeded the guidelines. |

| | |

| Named Executive Officers | | Stock Ownership Target

as a Multiple of Salary |

Rick R. Holley | | Five (5) x Base Salary |

| |

Thomas M. Lindquist | | Three (3) x Base Salary |

| |

David W. Lambert | | Two (2) x Base Salary |

| |

James A. Kilberg | | Two (2) x Base Salary |

| |

Larry D. Neilson | | Two (2) x Base Salary |

| | | |

| • | | NEO compensation should be perceived as fair and equitable.We strive to create a compensation program that will be perceived as fair and equitable, both internally and externally. We conduct analyses of market pay levels and consider each NEO’s experience and impact on the organization. Ultimately, the Compensation Committee exercises its judgment in determining the relative value and equity amongst the NEOs. |

16 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

Our Executive Compensation Programs

Overall, our executive compensation programs are designed to be consistent with the objectives and principles set forth above. The basic elements of our 2008 executive compensation program are summarized in the table below, followed by a more detailed discussion of those programs.

| | | | |

| Element | | Characteristics | | Purpose |

| | |

Base salary | | Fixed element of compensation. All employees are eligible for periodic increases in base salary. | | Intended to support market-competitiveness of pay package and is commensurate with each position’s role and responsibilities. |

| | |

Annual incentive plan awards | | Performance-based cash incentive. Compensation Committee retains discretion to adjust actual award. Amount earned depends on Company performance. | | Amount earned for achievement of target levels of performance intended to support market-competitiveness of pay package. Potential for lesser or greater amounts intended to motivate participants to achieve superior financial performance for the Company. |

| | |

Long-term incentive plan awards: | | Performance-based incentive. Compensation Committee retains discretion to adjust size of grants. Amounts earned/realized depend upon changes in stock price and total stockholder return relative to peer groups. | | Size of grant intended to reward individuals’ prior contributions to the performance of the Company, and future expectations, and to recognize the value of the individual to the organization. |

| | |

• Stock option awards | | | | • Service-based vesting conditions intended to retain executives. Amount realized from exercise of stock options rewards absolute stock price appreciation. |

| | |

• Restricted stock unit awards | | | | • Service-based vesting conditions intended to retain executives. Amount realized upon vesting dependent upon stock price performance. |

| | |

• Value management awards | | | | • Performance-based vesting conditions intended to reward superior total stockholder return relative to each of the peer groups. |

| | |

Retirement income benefits | | Retirement income is a function of base salary, earned annual incentive awards and years of service with the Company. | | Intended to support market-competitiveness of pay package. Benefit is affected by years of service and cash compensation (base salary plus annual bonus). Encourages retention and superior performance. |

| | |

Executive benefits & perquisites | | Executives have been eligible for perquisites, including an allowance for a leased vehicle, an annual physical, tax and financial planning advice, and certain executives are eligible for a club membership. The Compensation Committee has decided to discontinue the leased vehicle and club membership perquisites. For more information, seeOther Pay Decisions on page 24 of this Proxy Statement. | | These benefits are provided as part of a competitive benefit and compensation package. These perquisites are generally provided by the companies from which we recruit and are, therefore, provided to attract and retain members of management. |

| | |

Change in Control | | Under the terms of the long-term incentive plan, if a plan participant were terminated by the Company within one year following a change-in-control of the Company for any reason other than cause, all benefits under the long-term incentive plan would become vested. | | The change-in-control provision in the long-term incentive plan is provided to promote stability and continuity of the management team and is consistent with market practice. |

| | | | | |

PLUM CREEK 2009 NOTICE AND PROXY STATEMENT | 17

Total Direct Compensation

Based on the principle that NEO compensation opportunities should be competitive with market practices, the specific mix of compensation among base salary, annual incentives and long-term incentives is a function of market pay practices.

| • | | Base Salary. We provide base salaries for each NEO commensurate with the services each provides to the Company because we believe a portion of total direct compensation should be provided in a form that is fixed and liquid. Based on prevailing market practices, base salary represents approximately 20% of total direct compensation (base salary plus annual incentive plus the value of long-term incentives at grant). In establishing base salary levels of the NEOs and other members of the management team, as previously described, we consider market median pay levels among individuals in comparable positions within the forest products and general industries, and in the case of our Senior Vice President of Real Estate, the real estate industry. We also consider individual experience, contributions and responsibilities. We believe calibrating base salary at these levels is necessary to attract and retain the executive management required to lead the Company. |

Determinations regarding base salary adjustments (as well as other elements of compensation) are made in connection with the annual performance reviews of the NEOs and other members of the management team. The CEO reviews each NEO’s annual performance and makes salary recommendations based on merit to the Compensation Committee. The Committee reviews and approves these recommendations.

To determine the compensation for the CEO, the Compensation Committee reviews the annual performance evaluations completed by each member of the Board of Directors. Using these evaluation forms and the competitive data provided by Towers Perrin, the Committee exercises its judgment and determines the appropriate level of remuneration.

| • | | Annual Incentive Plan Awards. NEOs and other employees of the Company are eligible to receive a cash bonus based upon the financial performance of the Company. The Compensation Committee believes this element of compensation is important to focus management efforts and provide rewards for annual financial results that are aligned with creating value for our stockholders. |

With the assistance of Towers Perrin, cash compensation (base salary plus annual bonus) is targeted at approximately the 25th percentile of the market for threshold bonuses (80% of target performance goal) and approximately at the 75th percentile of the market for maximum bonuses (120% of target performance goal). The table below shows the threshold, target and maximum bonus opportunities represented as a percentage of base salary effective as of the end of the year under the 2008 Annual Incentive Plan at corresponding levels of actual financial performance results versus target performance goal.

| | | | | | | | |

| Named Executive Officer | | < 80% of financial

goal achieved | | 80% of financial

goal achieved | | 100% of financial

goal achieved | | 120% of financial

goal achieved |

| | | | |

Rick R. Holley | | No bonus paid | | 55% of salary | | 110% of salary | | 165% of salary |

| | | | |

Thomas M. Lindquist | | No bonus paid | | 45% of salary | | 90% of salary | | 135% of salary |

| | | | |

David W. Lambert | | No bonus paid | | 40% of salary | | 80% of salary | | 120% of salary |

| | | | |

James A. Kilberg | | No bonus paid | | 40% of salary | | 80% of salary | | 120% of salary |

| | | | |

Larry D. Neilson | | No bonus paid | | 40% of salary | | 80% of salary | | 120% of salary |

| |

Earned annual bonuses are determined at year-end based on the Company’s performance against the target performance goal of budgeted funds from operations, or FFO, which is net income plus non-cash charges equal

18 | PLUM CREEK 2009 NOTICE AND PROXY STATEMENT

to depletion, depreciation and amortization, and the cost basis of land sales. Budgeted FFO is presented to the Company’s Board of Directors and is approved at the first Board of Directors meeting in late January or early February.