|  |  |  |

| Underwritten Replacement Reserves |  |  | S-108 |

| Unrestricted Servicer Reports |  |  | S-185 |

| Voting Rights |  |  | S-188 |

| WA |  |  | S-108 |

| Wachovia |  |  | S-82, S-111 |

| Wachovia Mortgage Loans |  |  | S-122 |

| Wachovia Securities |  |  | S-206 |

| Weighted Average Net Mortgage Rate |  |  | S-161 |

| Wells Fargo Bank |  |  | S-189 |

| Whole Loan |  |  | S-91 |

| Whole Loans |  |  | S-91 |

| Workout Fee |  |  | S-146 |

| Workout-Delayed Reimbursement Amount |  |  | S-179 |

| Year Built |  |  | S-108 |

| Yield Maintenance Charges |  |  | S-173 |

|

S-216

WACHOVIA BANK COMMERCIAL MORTGAGE TRUST SERIES 2006-C29

ANNEX A-1

CERTAIN CHARACTERISTICS OF THE MORTGAGE LOANS AND MORTGAGED PROPERTIES

LOAN

MORTGAGE LOAN GROUP

NUMBER NUMBER PROPERTY NAME ADDRESS

- ------------------------------------------------------------------------------------------------------------------------------------

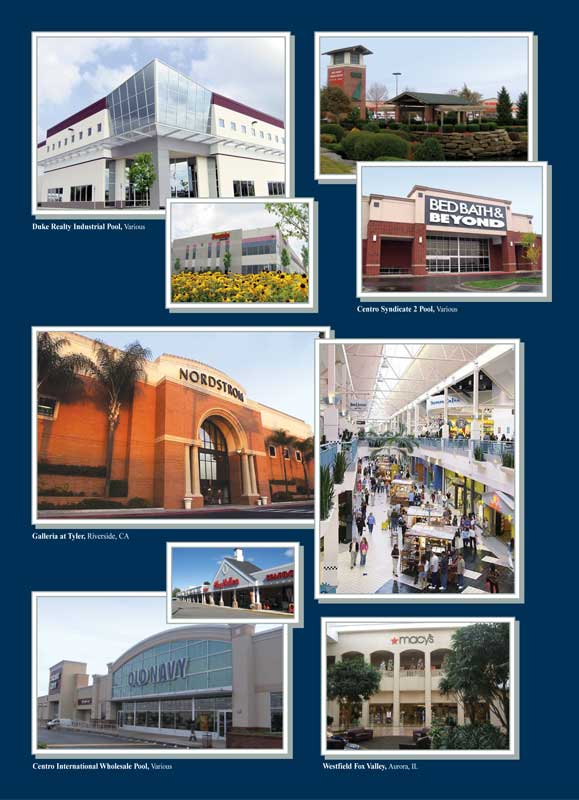

1 1 Duke Realty Industrial Pool Various

1.01 400 South Enterprise Boulevard 400 South Enterprise Boulevard

1.02 2425 East Hadley Road(1) 2425 East Hadley Road

1.03 250 Declaration Drive 250 Declaration Drive

1.04 2209-2233 Stafford Road 2209-2233 Stafford Road

1.05 500-520 South Enterprise Boulevard 500-520 South Enterprise Boulevard

1.06 163 Portside Court 163 Portside Court

1.07 3201 Centre Parkway 3201 Centre Parkway

1.08 1581 South Perry Road 1581 South Perry Road

1.09 1551 South Perry Road 1551 South Perry Road

1.10 185 North Mount Zion Road 185 North Mount Zion Road

1.11 1390 South Perry Road 1390 South Perry Road

1.12 322 South Enterprise Boulevard 322 South Enterprise Boulevard

1.13 4200 North Commerce Drive 4200 North Commerce Drive

1.14 6655 Sugarloaf Parkway 6655 Sugarloaf Parkway

1.15 420 East Enterprise Boulevard 420 East Enterprise Boulevard

1.16 3079 Premiere Parkway 3079 Premiere Parkway

1.17 175 Alcovy Industrial Boulevard 175 Alcovy Industrial Boulevard

1.18 2850 Premiere Parkway 2850 Premiere Parkway

1.19 3800 Centre Parkway - Building 1400 3800 Centre Parkway, Building 1400

1.20 2855 Premiere Parkway 2855 Premiere Parkway

1.21 3900 North Commerce Drive 3900 North Commerce Drive

1.22 2775 Premiere Parkway 2775 Premiere Parkway

1.23 198 Gulfstream Road 198 Gulfstream Road

1.24 3800 Centre Parkway - Building 1800 3800 Centre Parkway, Building 1800

1.25 3800 Centre Parkway - Building 2400 3800 Centre Parkway, Building 2400

1.26 3800 Centre Parkway - Building 2600 3800 Centre Parkway, Building 2600

1.27 3800 Centre Parkway - Building 2000 3800 Centre Parkway, Building 2000

2 1 Centro Syndicate 2 Pool Various

2.01 College Plaza Middle Country Road and Boyle Road

2.02 Oakwood Commons 4642-4724 Lebanon Pike

2.03 Parkway Plaza 217 Glen Cove Road

2.04 Rutland Plaza 1 Ruthland Plaza

2.05 Spradlin Farm Retail Center 110 Conston Avenue

2.06 Torrington Plaza 1 South Main Street

2.07 Tri-City Plaza Tri-City Road and High Street

2.08 Watson Glen 209 South Royal Oaks Boulevard

2.09 Westgate Plaza 231 East Main Street

2.10 Dalewood Shopping Center 353-425 N. Central Avenue

2.11 Grand Traverse Crossing 2522 - 2664 Crossing Circle

2.12 Lehigh Shopping Center West Union Boulevard at Pennsylvania Avenue

2.13 Northern Hills 95 and 105 Buckland Hills Drive

2.14 Southport Centre I-VI 15050-15300 Cedar Avenue

2.15 Trinity Commons South Hulen Street & Bellaire Drive

2.16 Wendover Place 1210 Bridford Parkway

3 1 Galleria at Tyler(1) 1299 Galleria at Tyler

4 1 Centro International Wholesale Pool Various

4.01 Falcaro's Plaza 294 Burnside Avenue

4.02 Hale Road 169-179 Hale Road

4.03 Innes Street Market 343 Faith Road

4.04 Kings Park Shopping Center 38-66 Indian Head Road

4.05 Lynn Marketplace 43 State Street

4.06 Morris Hills Shopping Center Parsippany Boulevard (Route 202) and Bloomfield Avenue (Route 46)

4.07 New Centre Market 4711 New Centre Drive

4.08 Rockville Centre 150-156 North Village Avenue

4.09 Suffolk Plaza 4042-4088 Nesconset Highway

4.10 Three Village Shopping Center Route 25A & Ridgeway Avenue

4.11 Venetian Isles 3700 North Federal Highway

4.12 Berkshire Crossing 555 Hubbard Avenue

4.13 County Line Plaza 1053 East County Line Road

5 1 Westfield Fox Valley 195 Fox Valley Center Drive

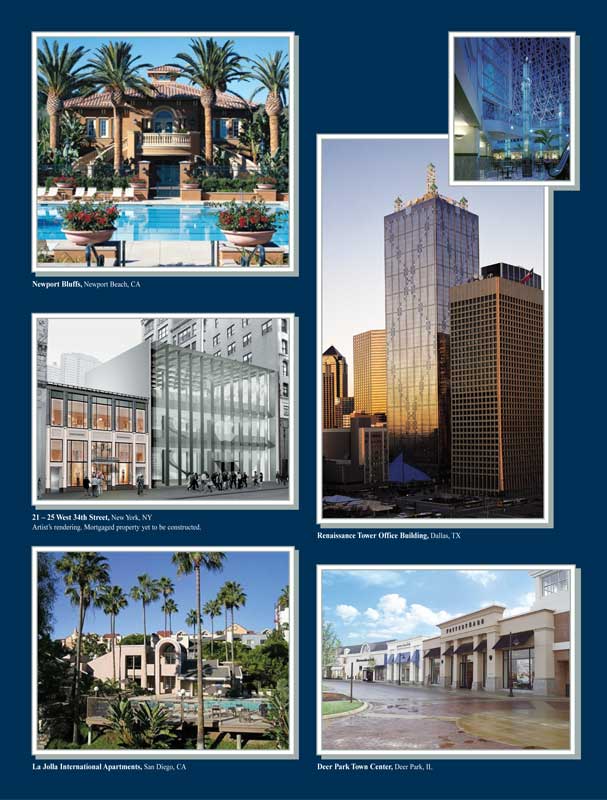

6 1 Newport Bluffs(2) 100 Vilaggio

7 1 Renaissance Tower Office Building 1201 Elm Street

8 1 21-25 West 34th Street(1)(3) 21-25 West 34th Street

9 2 La Jolla International Apartments 3415, 3425, 3435, 3445, 3455 and 3465 Lebon Drive

10 1 Deer Park Town Center(4) 20530 North Rand Road

11 1 Dakota Square Mall(1) 2400 10th Street SW

12 2 La Scala Apartments 3833, 3845, 3855 & 3899 Nobel Drive

13 2 Pennwood Crossing MHP 1201 Adler Drive

14 1 Alhambra Towers 121 Alhambra Plaza

15 2 AMLI at Riverbend 8850 Riverbend Parkway

16 1 Hilton - Providence, RI(1) 21 Atwells Avenue

17 1 New Market Pool Various

17.01 New Market 2161 2161 Newmarket Parkway

17.02 New Market 2211 2211 New Market Parkway

17.03 New Market 2221 2221 New Market Parkway

17.04 New Market 2121 2121 Newmarket Parkway

17.05 New Market 2250 2250 New Market Parkway

17.06 New Market 2110 2110 New Market Parkway

18 1 Crossroads Technology Park 3200 & 3280 Whipple Road

19 1 Gateway Chula Vista II(1)(5) 333 H Street

20 2 Village on University Apartments 1655 East University Drive

21 1 Shoppes of Wellington Green 10500 Forest Hill Boulevard

22 2 The Fairways Apartments(1) 777 West Chandler Boulevard

23 1 Barry Woods Crossings Shopping Center 8121-8341 N.W. Roanridge Road

24 1 Weston One 1001 Winstead Drive

25 1 Lakeland Commons Shopping Center 200-250 Ridge Way

26 1 Las Colinas Corporate Center II 6363 North State Highway 161

27 2 Raveneaux Apartments(6) 14500 Cutten Road

28 2 Gramercy Apartments 9054 Gramercy Drive

29 2 Rancho Solana Apartments 2400-2444 Alvarado Street

30 1 Concourse Office Plaza I & II 4709 - 4711 Golf Road

31 2 Napa Valley Apartments 1349 West Horizon Ridge Parkway

32 1 SanTan Village Phase III(1)(5) 2716, 2720, 2756 and 2810 South Market Street; 2711, 2721 and

2757 South SanTan Village Parkway

33 2 Pinnacle Grove Apartments(1) 701 West Grove Parkway

34 1 Boulder Crossing Shopping Center 5500 Boulder Way

35 1 Sono Corporate Center 50 Washington Street

36 1 Reads Way 11, 13, & 15 Reads Way

37 1 Professional Center at Pembroke Lakes Mall 400-700 North Hiatus Road

38 1 Chestnut Run 4250 Lancaster Pike

39 2 Melody Lakes Country Club Estates 1045 North West End Boulevard

40 2 Treybrooke Apartments 701 Treybrooke Circle

41 2 Smoky Crossing I Apartments 11647 Chapman Highway

42 1 Cost Plus Plaza 2552 Taylor Street

43 1 Las Colinas Corporate Center I 6333 North State Highway 161

44 1 The Forum at Ashley Park, Phase I 100 Newnan Crossing Bypass

45 1 Warner Crossings 8260 & 8312 South Hardy Drive

46 1 Professional Centre at Gardens Mall 11601-11641 Kew Gardens Avenue

47 1 Driftwood Village Shopping Center 2238-2252 South Euclid Avenue

48 1 Embassy Suites Tucson-Broadway 5335 East Broadway Boulevard

49 2 Heritage Lake at Westland Apartments 1105 Lake Heritage Way

50 1 Aetna Building - Fresno, CA 1333-1385 East SHaw Avenue

51 1 345 Inverness Building(5) 345 Inverness Drive South

52 2 Andorra Apartments 81-720 Avenue 46

53 1 West Sahara Promenade 8145 West Sahara Avenue

54 2 Eagle Pointe Apartments 8608 Eagle Pointe Drive

55 1 Twelve Oaks 5500 Abercorn Street

56 1 Northdale Executive Center I & II 3810 & 3820 Northdale Boulevard

57 1 Arcadia Gateway Center - Office SWC Huntington Drive & 5th Avenue

58 2 Silver Lakes Heights Apartments 2020 Lake Heights Drive

59 2 The Place at Greenway Apartments 3333 Cummins Street

60 1 The Crescent at Ballantyne 15110 John J. Delaney Drive

61 2 River Ranch Apartments 6152 West Oakland Street

62 1 Cambridge Center 38777 West Six Mile Road

63 2 M Street Towers 1112 M Street NW

64 1 Time Warner Call Center 3140 West Arrowood Road

65 1 Attic Self Storage Pool Various

65.01 Attic Storage of Olathe 11675 South Strang Line Road

65.02 Attic Storage of Belton 715 North Scott Avenue

65.03 Attic Storage of Platte City 2700 N.W. Prairie View Road

65.04 Attic Storage of Kansas City 2806 South 44th Street

65.05 Attic Storage of Knobtown 13824 Blue Parkway

65.06 407Attic Storage of Needmore 1702 East Kansas City Road

66 1 Arcadia Gateway Center - Retail SWC Huntington Drive & 5th Avenue

67 2 Tudor Heights Apartments 10505 Evans Plaza

68 1 Avenues North 9357 and 9365 Philips Highway

69 2 Belleau Woods 4000, 4002, 4004, 4006, 4008, 4010, 4014, 4016, 4018, 4020, 4022

& 4024 Northwest Avenue

70 1 Riveredge Pool Various

70.01 Riveredge II 42 Lukens Drive

70.02 Riveredge III 59 Lukens Drive

70.03 Riveredge IV 19 Lukens Drive

71 1 Academy Square Retail 1600 North Main Street

72 1 100 Carillon Parkway 100 Carillon Parkway

73 1 PNC Bank Plaza 200 West Vine Street

74 2 Avalon Park Apartments 17000 SW Pacific Highway

75 1 T-Mobile - Nashville, TN 695 Grassmere Park

76 2 Arbors at Fairview Apartments 1000 Arbor Keats Drive

77 1 Residence Inn - Virginia Beach, VA 3217 Atlantic Avenue

78 1 Arcadia Gateway Center - Medical Office SWC Huntington Drive & 5th Avenue

79 1 Southtowne Plaza 3100 Oakland Avenue

80 1 FBI - Albany, NY 200 McCarty Avenue

81 2 Forest Ridge I Apartments 9706 Smoky Ridge Way

82 1 MAC I and MAC II 828 and 801 Royal Parkway

83 1 Lowe's - Auburn, NY 299 Grant Avenue

84 1 SHPS Building 9305 East Via de Ventura

85 2 The Grove at White Oak Apartments 1710 West TC Jester Boulevard

86 1 Dick's Sporting Goods - Sterling, VA 21070 Dulles Town Center

87 2 Beechwood Apartments 2700 Cottage Place

88 1 Llanerch Shopping Center 365-403 West Chester Pike (PA Route 3)

89 1 Best Western - Everett, WA(5) 10210 Evergreen Way

90 1 Heritage Place 227 French Landing Drive

91 1 Atrium Crest 18333 Egret Bay Boulevard

92 1 Woodberry Square Shopping Center 7065 Allentown Road

93 1 Camp Creek Center 8120 Camp Creek Boulevard

94 1 Shops at Volente 11416 RR 620 North

95 1 Big Dog Distribution Facility 519 Lincoln County Parkway Extension

96 2 Jefferson Trace Apartments 2506 Atwell Drive

97 2 The Venterra at Waters Edge Apartments 12330 Metric Boulevard

98 1 Davis and Oak(1) 1100-1118 Davis Street

99 1 Landmark Village 2301 North Collins Street

100 2 Village at Baker Creek(5) 3820, 3844, 3832, 3856, 3868, 3924, 3936, 3948, 3960 & 3972

Primrose Lane

101 1 Holiday Inn - Bangor, ME 404 Odlin Road

102 1 Summit Square 8410-8472 Federal Boulevard

103 1 Parker Crossroads 10831 & 10841 South Crossroads Drive

104 2 Park Manor Apartments 22 Forest Circle

105 1 43-45 Crossways Park Drive 43-45 Crossways Park Drive

106 2 Cougar Court Apartments 697 Trejo Street

107 1 St. Pete Post Office 3135 1st Avenue

108 1 Center Building 7825 Baymeadows Way

109 1 First Commons Industrial Buildings 4625 & 4635 West McDowell Road

110 1 Abbotts Bridge Office 10700 Abbotts Bridge Road

111 1 543 - 561 Lincoln Avenue(1) 543 - 561 Lincoln Avenue; 743-749 Elm Street

112 1 1900 West New Hampshire Street 1900 West New Hampshire Street

113 1 Rodeo Park Plaza 1659 & 1661 South Val Vista Drive 1663 East Ray Road

114 2 The Hamilton 1025 Hancock Street

115 2 Hinton Hollow Apartments 2812 Bakertown Road

116 1 1 Derby Street 1 Derby Street

117 1 Armitage and California 2820 West Armitage Avenue & 2020 North California Avenue

118 2 Taylor Apartments 1660 & 1670 North 21st Road

119 1 Courthouse Square 2124, 2126 and 2128 Jefferson Davis Highway

120 1 4349 Duke Street 4349 Duke Street

121 1 Wingate Inn - Birmingham, AL(5) 800 Corporate Ridge Drive

122 1 Walgreens - Edgewater, MD 3106 Solomons Island Road

123 1 501 - 507 Chestnut Court(1) 501-507 Chestnut Court

124 1 715-729 Elm Street(1) 715 - 729 Elm Street

125 2 Chelsea Court Apartments(5) 7206 & 7208 NE 182nd Street

126 2 Autumn Woods Apartments 9801 Autumnwood Circle

127 1 Staples - Miami, FL 9801 South Dixie Highway

128 1 Liberty Mutual 9489 Interline Avenue

129 2 Dempster and Judson(1) 1243-1249 Judson Avenue

130 1 Care Free Mini Storage Pool Various

130.01 Care Free Mini Storage North 1264 Hadleyview Court NE

130.02 Care Free Mini Storage South 2907 South Broadway

131 1 Fox Mill Centre Outparcels 2B and 5 6822-6826 Walton Lane; 6709-6723 Walton Lane

132 1 CVS - San Antonio, TX 9838 Potranco Road

133 1 President Plaza 13310 - 13334 Ramona Boulevard

134 2 Southern Woods Apartments 9100 Jenny Cook Circle

135 1 788 Fairview 788 Fairview Drive

136 1 Grand Oaks Plaza 6310 20th Street

137 1 874-878 Green Bay(1) 874 - 878 Green Bay Road

138 1 Dollar General - Livingston, TN 118 Tom Davis Road

139 1 Walgreens - Houston, TX 3900 Reveille Street

140 1 25 West Anapamu Street 25 West Anapamu Street

141 1 Family Dollar Pool Various

141.01 Catalina Springs Shopping Center 9955-9975 Fuqua Street

141.02 Family Dollar - Houston, TX 5005 East Crosstimbers

142 1 Advance Auto Grand Forks, ND 3805 Gateway Drive

MORTGAGE LOAN CROSS COLLATERALIZED AND CROSS LOAN MORTGAGE

NUMBER CITY STATE ZIP CODE DEFAULTED LOAN FLAG PURPOSE LOAN SELLER

- ---------------------------------------------------------------------------------------------------------------------------------

1 Various Various Various Refinance Wachovia

1.01 Lebanon IN 46052

1.02 Plainfield IN 46168

1.03 McDonough GA 30253

1.04 Plainfield IN 46168

1.05 Lebanon IN 46052

1.06 Savannah GA 31407

1.07 East Point GA 30344

1.08 Plainfield IN 46168

1.09 Plainfield IN 46168

1.10 Lebanon IN 46052

1.11 Plainfield IN 46168

1.12 Lebanon IN 46052

1.13 East Point GA 30344

1.14 Duluth GA 30097

1.15 Lebanon IN 46052

1.16 Duluth GA 30097

1.17 Dacula GA 30019

1.18 Duluth GA 30097

1.19 Atlanta GA 30331

1.20 Duluth GA 30097

1.21 Atlanta GA 30344

1.22 Duluth GA 30097

1.23 Savannah GA 31408

1.24 Atlanta GA 30331

1.25 Atlanta GA 30331

1.26 Atlanta GA 30331

1.27 Atlanta GA 30331

2 Various Various Various Acquisition Wachovia

2.01 Selden NY 11784

2.02 Hermitage TN 37076

2.03 Carle Place NY 11514

2.04 Rutland VT 05701

2.05 Christiansburg VA 24073

2.06 Torrington CT 06790

2.07 Somersworth NH 03878

2.08 Franklin TN 37064

2.09 Westfield MA 01085

2.10 Hartsdale NY 10530

2.11 Traverse City MI 49684

2.12 Bethlehem PA 18018

2.13 South Windsor CT 06074

2.14 Apple Valley MN 55124

2.15 Fort Worth TX 76109

2.16 Greensboro NC 27409

3 Riverside CA 92503 Refinance Wachovia

4 Various Various Various Acquisition Wachovia

4.01 Lawrence NY 11559

4.02 Manchester CT 06042

4.03 Salisbury NC 28146

4.04 Kings Park NY 11754

4.05 Lynn MA 01901

4.06 Parsippany NJ 07054

4.07 Wilmington NC 28405

4.08 Rockville Centre NY 11570

4.09 East Setauket NY 11733

4.10 East Setauket NY 11733

4.11 Lighthouse Point FL 33064

4.12 Pittsfield MA 01201

4.13 Jackson MS 39211

5 Aurora IL 60504 Refinance Wachovia

6 Newport Beach CA 92660 Refinance Wachovia

7 Dallas TX 75270 Acquisition Wachovia

8 New York NY 10001 Refinance Wachovia

9 San Diego CA 92122 Refinance Artesia

10 Deer Park IL 60010 Refinance Wachovia

11 Minot ND 58701 Refinance Wachovia

12 San Diego CA 92122 Refinance Artesia

13 Morrisville PA 19067 Acquisition Wachovia

14 Coral Gables FL 33134 Refinance Wachovia

15 Indianapolis IN 46250 Acquisition Wachovia

16 Providence RI 02903 Refinance Wachovia

17 Marietta GA 30067 Refinance Wachovia

17.01 Marietta GA 30067

17.02 Marietta GA 30067

17.03 Marietta GA 30067

17.04 Marietta GA 30067

17.05 Marietta GA 30067

17.06 Marietta GA 30067

18 Union City CA 94587 Refinance Wachovia

19 Chula Vista CA 91910 Refinance Artesia

20 Tempe AZ 85281 Acquisition Wachovia

21 Wellington FL 33414 Refinance Wachovia

22 Chandler AZ 85225 Acquisition Wachovia

23 Kansas City MO 64155 Acquisition Wachovia

24 Cary NC 27513 Acquisition Wachovia

25 Flowood MS 39232 Acquisition Wachovia

26 Irving TX 75038 Las Colinas Portfolio Refinance Wachovia

27 Houston TX 77069 Acquisition Wachovia

28 San Diego CA 92123 Refinance Wachovia

29 Oxnard CA 93036 Refinance Wachovia

30 Skokie IL 60076 Acquisition Wachovia

31 Henderson NV 89012 Acquisition Wachovia

32 Gilbert AZ 85296 Refinance Artesia

33 Tempe AZ 85283 Acquisition Wachovia

34 Las Vegas NV 89122 Refinance Wachovia

35 Norwalk CT 06854 Refinance Wachovia

36 New Castle DE 19720 Refinance Wachovia

37 Pembroke Pines FL 33026 Refinance Wachovia

38 Wilmington DE 19720 Refinance Wachovia

39 Quakertown PA 18951 Refinance Wachovia

40 Greenville NC 27834 Refinance Wachovia

41 Seymour TN 37865 Refinance Wachovia

42 San Francisco CA 94133 Acquisition Wachovia

43 Irving TX 75038 Las Colinas Portfolio Refinance Wachovia

44 Newnan GA 30265 Refinance Wachovia

45 Tempe AZ 85284 Acquisition Artesia

46 Palm Beach Gardens FL 33410 Refinance Wachovia

47 Ontario CA 91762 Acquisition Wachovia

48 Tucson AZ 85711 Refinance Wachovia

49 Knoxville TN 37922 Acquisition Wachovia

50 Fresno CA 93710 Acquisition Wachovia

51 Englewood CO 80112 Refinance Artesia

52 Indio CA 92201 Acquisition Wachovia

53 Las Vegas NV 89117 Refinance Wachovia

54 Knoxville TN 37931 Refinance Wachovia

55 Savannah GA 31405 Refinance Wachovia

56 Tampa FL 33624 Acquisition Wachovia

57 Arcadia CA 91006 Arcadia Gateway Center Portfolio Refinance Wachovia

58 Everett WA 98208 Acquisition Wachovia

59 Houston TX 77036 Acquisition Wachovia

60 Charlotte NC 28277 Refinance Wachovia

61 Chandler AZ 85226 Acquisition Wachovia

62 Livonia MI 48152 Refinance Wachovia

63 Washington DC 20005 Refinance Wachovia

64 Charlotte NC 28273 Acquisition Wachovia

65 Various Various Various Acquisition Wachovia

65.01 Olathe KS 66062

65.02 Belton MO 64012

65.03 Platte City MO 64079

65.04 Kansas City KS 66106

65.05 Kansas City MO 64139

65.06 Olathe KS 66061

66 Arcadia CA 91006 Arcadia Gateway Center Portfolio Refinance Wachovia

67 Omaha NE 68134 Acquisition Wachovia

68 Jacksonville FL 32256 Acquisition Artesia

69 Bellingham WA 98226 Refinance Artesia

70 New Castle DE 19720 Refinance Wachovia

70.01 New Castle DE 19720

70.02 New Castle DE 19720

70.03 New Castle DE 19720

71 Logan UT 84341 Refinance Artesia

72 Saint Petersburg FL 33716 Acquisition Wachovia

73 Lexington KY 40507 Refinance Wachovia

74 Tigard OR 97224 Acquisition Wachovia

75 Nashville TN 37211 Acquisition Wachovia

76 Simpsonville SC 29680 Acquisition Wachovia

77 Virginia Beach VA 23451 Refinance Wachovia

78 Arcadia CA 91006 Arcadia Gateway Center Portfolio Refinance Wachovia

79 Indiana PA 15701 Refinance Wachovia

80 Albany NY 14202 Acquisition Wachovia

81 Knoxville TN 37931 Refinance Wachovia

82 Nashville TN 37214 Acquisition Wachovia

83 Auburn NY 13021 Acquisition Artesia

84 Scottsdale AZ 85258 Acquisition Artesia

85 Houston TX 77008 Acquisition Wachovia

86 Sterling VA 20166 Refinance Wachovia

87 Greensboro NC 27455 Acquisition Wachovia

88 Haverford Township PA 19083 Refinance Wachovia

89 Everett WA 98204 Refinance Artesia

90 Nashville TN 37228 Acquisition Wachovia

91 Houston TX 77058 Acquisition Wachovia

92 Temple Hills MD 20748 Refinance Wachovia

93 Olive Branch MS 38654 Acquisition Wachovia

94 Austin TX 78726 Refinance Wachovia

95 Lincolnton NC 28093 Refinance Wachovia

96 Richmond VA 23234 Refinance Wachovia

97 Austin TX 78758 Refinance Wachovia

98 Evanston IL 60201 Refinance Wachovia

99 Arlington TX 76011 Acquisition Artesia

100 Bellingham WA 98226 Refinance Artesia

101 Bangor ME 04401 Refinance Wachovia

102 Westminster CO 80031 Acquisition Wachovia

103 Parker CO 80134 Refinance Wachovia

104 Newnan GA 30265 Acquisition Wachovia

105 Woodbury NY 11797 Refinance Artesia

106 Rexburg ID 83440 Refinance Artesia

107 Saint Petersburg FL 33730 Refinance Wachovia

108 Jacksonville FL 32256 Refinance Wachovia

109 Phoenix AZ 85035 Refinance Wachovia

110 Duluth GA 30097 Acquisition Artesia

111 Winnetka IL 60093 Refinance Wachovia

112 Orlando FL 32804 Acquisition Wachovia

113 Gilbert AZ 85296 Refinance Artesia

114 Quincy MA 02169 Refinance Wachovia

115 Knoxville TN 37931 Autumnwood/Hinton Hollow/Southern Woods Portfolio Refinance Wachovia

116 Hingham MA 02043 Refinance Wachovia

117 Chicago IL 60647 Refinance Wachovia

118 Arlington VA 22209 Refinance Wachovia

119 Stafford VA 22554 Refinance Wachovia

120 Alexandria VA 22304 Refinance Wachovia

121 Birmingham AL 35242 Refinance Artesia

122 Edgewater MD 21037 Acquisition Wachovia

123 Winnetka IL 60093 Refinance Wachovia

124 Winnetka IL 60093 Refinance Wachovia

125 Kenmore WA 98028 Refinance Artesia

126 Knoxville TN 37932 Autumnwood/Hinton Hollow/Southern Woods Portfolio Refinance Wachovia

127 Miami FL 33156 Acquisition Wachovia

128 Baton Rouge LA 70809 Acquisition Artesia

129 Evanston IL 60201 Refinance Wachovia

130 Rochester MN Various Acquisition Artesia

130.01 Rochester MN 55906

130.02 Rochester MN 55904

131 Gloucester VA 23061 Refinance Wachovia

132 San Antonio TX 78251 Acquisition Wachovia

133 Baldwin Park CA 91706 Refinance Artesia

134 Knoxville TN 37923 Autumnwood/Hinton Hollow/Southern Woods Portfolio Refinance Wachovia

135 Carson City NV 89701 Acquisition Artesia

136 Vero Beach FL 32966 Acquisition Wachovia

137 Winnetka IL 60093 Refinance Wachovia

138 Livingston TN 38570 Acquisition Wachovia

139 Houston TX 77087 Acquisition Artesia

140 Santa Barbara CA 93101 Refinance Artesia

141 Houston TX Various Refinance Artesia

141.01 Houston TX 77075

141.02 Houston TX 77016

142 Grand Forks ND 58203 Acquisition Wachovia

% OF AGGREGATE % OF AGGREGATE

MORTGAGE LOAN GENERAL SPECIFIC ORIGINAL LOAN CUT-OFF DATE CUT-OFF DATE CUT-OFF DATE

NUMBER PROPERTY TYPE PROPERTY TYPE BALANCE ($) LOAN BALANCE ($) BALANCE GROUP 1 BALANCE

- -----------------------------------------------------------------------------------------------------------------------------

1 Industrial Various 318,976,000.00 318,976,000.00 9.46% 11.94%

1.01 Industrial Distribution/Warehouse 25,840,000.00

1.02 Industrial Distribution/Warehouse 22,960,000.00

1.03 Industrial Distribution/Warehouse 20,800,000.00

1.04 Industrial Distribution/Warehouse 20,080,000.00

1.05 Industrial Distribution/Warehouse 19,360,000.00

1.06 Industrial Distribution/Warehouse 18,696,000.00

1.07 Industrial Distribution/Warehouse 18,600,000.00

1.08 Industrial Distribution/Warehouse 17,760,000.00

1.09 Industrial Distribution/Warehouse 16,080,000.00

1.10 Industrial Distribution/Warehouse 15,120,000.00

1.11 Industrial Distribution/Warehouse 14,160,000.00

1.12 Industrial Distribution/Warehouse 12,800,000.00

1.13 Industrial Distribution/Warehouse 10,400,000.00

1.14 Industrial Distribution 9,740,000.00

1.15 Industrial Distribution/Warehouse 9,120,000.00

1.16 Industrial Distribution 9,000,000.00

1.17 Industrial Distribution/Warehouse 8,520,000.00

1.18 Industrial Distribution 7,680,000.00

1.19 Industrial Distribution 6,240,000.00

1.20 Industrial Distribution 6,100,000.00

1.21 Industrial Distribution/Warehouse 5,720,000.00

1.22 Industrial Distribution 5,240,000.00

1.23 Industrial Distribution/Warehouse 4,280,000.00

1.24 Industrial Distribution 4,240,000.00

1.25 Industrial Distribution 3,520,000.00

1.26 Industrial Distribution 3,520,000.00

1.27 Industrial Distribution 3,400,000.00

2 Retail Various 233,977,430.00 233,977,430.00 6.94% 8.76%

2.01 Retail Anchored 10,932,308.44

2.02 Retail Anchored 14,316,118.20

2.03 Retail Anchored 14,055,825.14

2.04 Retail Anchored 14,003,766.53

2.05 Retail Anchored 16,919,048.78

2.06 Retail Anchored 8,902,022.59

2.07 Retail Anchored 7,652,615.91

2.08 Retail Anchored 12,103,627.21

2.09 Retail Anchored 5,674,388.67

2.10 Retail Anchored 31,755,753.10

2.11 Retail Anchored 17,960,221.01

2.12 Retail Anchored 15,981,993.77

2.13 Retail Unanchored 2,811,165.03

2.14 Retail Anchored 13,014,652.91

2.15 Retail Anchored 15,617,583.49

2.16 Retail Anchored 32,276,339.21

3 Retail Anchored 205,000,000.00 205,000,000.00 6.08% 7.67%

4 Retail Anchored 161,039,673.00 161,039,673.00 4.78% 6.03%

4.01 Retail Anchored 7,577,082.03

4.02 Retail Anchored 10,671,946.52

4.03 Retail Anchored 24,011,879.67

4.04 Retail Anchored 7,683,801.50

4.05 Retail Anchored 5,229,253.80

4.06 Retail Anchored 17,341,913.10

4.07 Retail Anchored 11,899,220.37

4.08 Retail Anchored 5,335,973.26

4.09 Retail Anchored 6,509,887.38

4.10 Retail Anchored 10,405,147.86

4.11 Retail Anchored 13,873,530.48

4.12 Retail Anchored 19,156,144.00

4.13 Retail Anchored 21,343,893.04

5 Retail Anchored 150,000,000.00 150,000,000.00 4.45% 5.61%

6 Multifamily Conventional 132,000,000.00 132,000,000.00 3.92% 4.94%

7 Office CBD 129,000,000.00 129,000,000.00 3.83% 4.83%

8 Retail Single Tenant 100,000,000.00 100,000,000.00 2.97% 3.74%

9 Multifamily Conventional 65,050,000.00 65,050,000.00 1.93%

10 Retail Anchored 60,000,000.00 60,000,000.00 1.78% 2.25%

11 Retail Anchored 58,000,000.00 58,000,000.00 1.72% 2.17%

12 Multifamily Conventional 57,150,000.00 57,150,000.00 1.70%

13 Mobile Home Park Mobile Home Park 56,800,000.00 56,800,000.00 1.68%

14 Office Suburban 52,000,000.00 52,000,000.00 1.54% 1.95%

15 Multifamily Conventional 50,000,000.00 50,000,000.00 1.48%

16 Hospitality Full Service 49,000,000.00 49,000,000.00 1.45% 1.83%

17 Office Suburban 37,000,000.00 37,000,000.00 1.10% 1.38%

17.01 Office Suburban 9,860,000.00

17.02 Office Suburban 9,150,000.00

17.03 Office Suburban 5,770,000.00

17.04 Office Suburban 4,800,000.00

17.05 Office Suburban 4,190,000.00

17.06 Office Suburban 3,230,000.00

18 Industrial Light Industrial 35,000,000.00 35,000,000.00 1.04% 1.31%

19 Office Suburban 33,300,000.00 33,300,000.00 0.99% 1.25%

20 Multifamily Student Housing 33,150,000.00 33,150,000.00 0.98%

21 Retail Anchored 30,750,000.00 30,750,000.00 0.91% 1.15%

22 Multifamily Conventional 30,315,000.00 30,315,000.00 0.90%

23 Retail Anchored 28,275,000.00 28,275,000.00 0.84% 1.06%

24 Office Suburban 28,200,000.00 28,200,000.00 0.84% 1.06%

25 Retail Shadow Anchored 25,600,000.00 25,600,000.00 0.76% 0.96%

26 Office Suburban 25,025,000.00 25,025,000.00 0.74% 0.94%

27 Multifamily Conventional 24,475,000.00 24,475,000.00 0.73%

28 Multifamily Conventional 23,000,000.00 23,000,000.00 0.68%

29 Multifamily Conventional 23,000,000.00 23,000,000.00 0.68%

30 Office Suburban 22,600,000.00 22,600,000.00 0.67% 0.85%

31 Multifamily Conventional 22,400,000.00 22,400,000.00 0.66%

32 Retail Shadow Anchored 22,400,000.00 22,400,000.00 0.66% 0.84%

33 Multifamily Conventional 22,100,000.00 22,100,000.00 0.66%

34 Retail Anchored 21,000,000.00 21,000,000.00 0.62% 0.79%

35 Office Suburban 20,000,000.00 20,000,000.00 0.59% 0.75%

36 Office Suburban 18,800,000.00 18,800,000.00 0.56% 0.70%

37 Office Suburban 18,750,000.00 18,750,000.00 0.56% 0.70%

38 Office Suburban 18,400,000.00 18,400,000.00 0.55% 0.69%

39 Mobile Home Park Mobile Home Park 18,080,000.00 18,080,000.00 0.54%

40 Multifamily Conventional 18,000,000.00 18,000,000.00 0.53%

41 Multifamily Conventional 17,600,000.00 17,600,000.00 0.52%

42 Mixed Use Retail/Office 17,500,000.00 17,500,000.00 0.52% 0.65%

43 Office Suburban 17,500,000.00 17,500,000.00 0.52% 0.65%

44 Retail Anchored 17,500,000.00 17,500,000.00 0.52% 0.65%

45 Office Suburban 17,300,000.00 17,300,000.00 0.51% 0.65%

46 Office Suburban 17,250,000.00 17,250,000.00 0.51% 0.65%

47 Retail Anchored 17,000,000.00 17,000,000.00 0.50% 0.64%

48 Hospitality Limited Service 17,000,000.00 17,000,000.00 0.50% 0.64%

49 Multifamily Conventional 16,185,000.00 16,185,000.00 0.48%

50 Office Suburban 16,043,000.00 16,043,000.00 0.48% 0.60%

51 Office Suburban 15,500,000.00 15,500,000.00 0.46% 0.58%

52 Multifamily Conventional 15,500,000.00 15,500,000.00 0.46%

53 Retail Anchored 15,500,000.00 15,500,000.00 0.46% 0.58%

54 Multifamily Conventional 15,200,000.00 15,200,000.00 0.45%

55 Retail Anchored 15,120,000.00 15,120,000.00 0.45% 0.57%

56 Office Suburban 14,950,000.00 14,950,000.00 0.44% 0.56%

57 Office Suburban 14,880,000.00 14,880,000.00 0.44% 0.56%

58 Multifamily Conventional 14,700,000.00 14,700,000.00 0.44%

59 Multifamily Conventional 14,700,000.00 14,700,000.00 0.44%

60 Office Medical 14,450,000.00 14,450,000.00 0.43% 0.54%

61 Multifamily Conventional 14,050,000.00 14,050,000.00 0.42%

62 Office Suburban 13,375,000.00 13,375,000.00 0.40% 0.50%

63 Multifamily Conventional 13,300,000.00 13,300,000.00 0.39%

64 Office Suburban 13,025,000.00 13,025,000.00 0.39% 0.49%

65 Self Storage Self Storage 13,000,000.00 13,000,000.00 0.39% 0.49%

65.01 Self Storage Self Storage 3,563,000.00

65.02 Self Storage Self Storage 2,312,000.00

65.03 Self Storage Self Storage 2,160,000.00

65.04 Self Storage Self Storage 2,085,000.00

65.05 Self Storage Self Storage 1,781,000.00

65.06 Self Storage Self Storage 1,099,000.00

66 Retail Unanchored 12,820,000.00 12,820,000.00 0.38% 0.48%

67 Multifamily Conventional 12,500,000.00 12,500,000.00 0.37%

68 Retail Unanchored 12,300,000.00 12,300,000.00 0.36% 0.46%

69 Multifamily Conventional 12,200,000.00 12,200,000.00 0.36%

70 Industrial Warehouse/Distribution 12,160,000.00 12,160,000.00 0.36% 0.46%

70.01 Industrial Warehouse/Distribution 6,000,000.00

70.02 Industrial Warehouse/Distribution 3,120,000.00

70.03 Industrial Warehouse/Distribution 3,040,000.00

71 Retail Anchored 12,000,000.00 12,000,000.00 0.36% 0.45%

72 Office Suburban 11,500,000.00 11,500,000.00 0.34% 0.43%

73 Office CBD 11,350,000.00 11,350,000.00 0.34% 0.42%

74 Multifamily Conventional 11,000,000.00 11,000,000.00 0.33%

75 Office Suburban 10,885,000.00 10,885,000.00 0.32% 0.41%

76 Multifamily Conventional 10,500,000.00 10,500,000.00 0.31%

77 Hospitality Extended Stay 10,500,000.00 10,500,000.00 0.31% 0.39%

78 Office Medical 10,300,000.00 10,300,000.00 0.31% 0.39%

79 Retail Anchored 10,200,000.00 10,200,000.00 0.30% 0.38%

80 Office Suburban 10,137,000.00 10,137,000.00 0.30% 0.38%

81 Multifamily Conventional 9,800,000.00 9,800,000.00 0.29%

82 Office Suburban 9,800,000.00 9,800,000.00 0.29% 0.37%

83 Retail Single Tenant 9,500,000.00 9,500,000.00 0.28% 0.36%

84 Office Suburban 9,400,000.00 9,400,000.00 0.28% 0.35%

85 Multifamily Conventional 9,000,000.00 9,000,000.00 0.27%

86 Retail Single Tenant 9,000,000.00 8,982,796.47 0.27% 0.34%

87 Multifamily Conventional 8,625,000.00 8,625,000.00 0.26%

88 Retail Anchored 8,450,000.00 8,450,000.00 0.25% 0.32%

89 Hospitality Limited Service 8,400,000.00 8,400,000.00 0.25% 0.31%

90 Office Suburban 8,240,000.00 8,240,000.00 0.24% 0.31%

91 Office Suburban 8,150,000.00 8,150,000.00 0.24% 0.30%

92 Retail Unanchored 8,000,000.00 8,000,000.00 0.24% 0.30%

93 Retail Unanchored 7,800,000.00 7,800,000.00 0.23% 0.29%

94 Retail Unanchored 7,680,600.00 7,680,600.00 0.23% 0.29%

95 Industrial Distribution 7,630,000.00 7,630,000.00 0.23% 0.29%

96 Multifamily Conventional 7,250,000.00 7,250,000.00 0.22%

97 Multifamily Conventional 7,100,000.00 7,100,000.00 0.21%

98 Multifamily Conventional 7,030,000.00 7,030,000.00 0.21% 0.26%

99 Retail Unanchored 7,000,000.00 7,000,000.00 0.21% 0.26%

100 Multifamily Conventional 7,000,000.00 7,000,000.00 0.21%

101 Hospitality Full Service 6,700,000.00 6,700,000.00 0.20% 0.25%

102 Retail Anchored 6,700,000.00 6,700,000.00 0.20% 0.25%

103 Mixed Use Retail/Office 6,650,000.00 6,650,000.00 0.20% 0.25%

104 Multifamily Conventional 6,500,000.00 6,500,000.00 0.19%

105 Office Suburban 6,400,000.00 6,400,000.00 0.19% 0.24%

106 Multifamily Student Housing 6,250,000.00 6,250,000.00 0.19%

107 Industrial Distribution 6,250,000.00 6,250,000.00 0.19% 0.23%

108 Office Suburban 6,200,000.00 6,200,000.00 0.18% 0.23%

109 Industrial Flex 6,200,000.00 6,200,000.00 0.18% 0.23%

110 Office Suburban 5,671,000.00 5,671,000.00 0.17% 0.21%

111 Mixed Use Retail/Office/Multifamily 5,640,000.00 5,640,000.00 0.17% 0.21%

112 Industrial Flex 5,400,000.00 5,400,000.00 0.16% 0.20%

113 Retail Unanchored 5,000,000.00 5,000,000.00 0.15% 0.19%

114 Multifamily Conventional 5,000,000.00 5,000,000.00 0.15%

115 Multifamily Conventional 4,840,000.00 4,840,000.00 0.14%

116 Mixed Use Office/Retail 4,750,000.00 4,750,000.00 0.14% 0.18%

117 Retail Unanchored 4,750,000.00 4,750,000.00 0.14% 0.18%

118 Multifamily Conventional 4,600,000.00 4,600,000.00 0.14%

119 Office Suburban 4,400,000.00 4,400,000.00 0.13% 0.16%

120 Retail Unanchored 4,150,000.00 4,150,000.00 0.12% 0.16%

121 Hospitality Limited Service 4,000,000.00 4,000,000.00 0.12% 0.15%

122 Retail Single Tenant 3,800,000.00 3,795,971.97 0.11% 0.14%

123 Mixed Use Retail/Multifamily 3,620,000.00 3,620,000.00 0.11% 0.14%

124 Mixed Use Retail/Multifamily/Office 3,590,000.00 3,590,000.00 0.11% 0.13%

125 Multifamily Conventional 3,500,000.00 3,496,468.82 0.10%

126 Multifamily Conventional 3,220,000.00 3,220,000.00 0.10%

127 Retail Single Tenant 3,200,000.00 3,196,721.89 0.09% 0.12%

128 Office Suburban 3,040,000.00 3,040,000.00 0.09% 0.11%

129 Multifamily Conventional 2,915,000.00 2,915,000.00 0.09%

130 Self Storage Self Storage 2,900,000.00 2,900,000.00 0.09% 0.11%

130.01 Self Storage Self Storage

130.02 Self Storage Self Storage

131 Retail Shadow Anchored 2,800,000.00 2,800,000.00 0.08% 0.10%

132 Retail Single Tenant 2,690,000.00 2,690,000.00 0.08% 0.10%

133 Retail Unanchored 2,500,000.00 2,497,511.24 0.07% 0.09%

134 Multifamily Conventional 2,460,000.00 2,460,000.00 0.07%

135 Office Suburban 2,300,000.00 2,300,000.00 0.07% 0.09%

136 Retail Unanchored 2,142,000.00 2,142,000.00 0.06% 0.08%

137 Mixed Use Office/Retail 2,100,000.00 2,100,000.00 0.06% 0.08%

138 Retail Single Tenant 1,856,000.00 1,856,000.00 0.06% 0.07%

139 Retail Single Tenant 1,732,000.00 1,732,000.00 0.05% 0.06%

140 Office CBD 1,600,000.00 1,600,000.00 0.05% 0.06%

141 Retail Various 1,500,000.00 1,500,000.00 0.04% 0.06%

141.01 Retail Unanchored 1,032,258.00

141.02 Retail Single Tenant 467,742.00

142 Retail Single Tenant 840,000.00 840,000.00 0.02% 0.03%

INTEREST

% OF AGGREGATE MATURITY LOAN INTEREST ACCRUAL

MORTGAGE LOAN CUT-OFF DATE ORIGINATION DATE ADMINISTRATIVE ACCRUAL METHOD

NUMBER GROUP 2 BALANCE DATE FIRST PAY DATE OR ARD MORTGAGE RATE COST RATE METHOD DURING IO

- ----------------------------------------------------------------------------------------------------------------------------

1 11/07/06 12/11/06 11/11/16 5.9140% 0.02062% 30/360 30/360

1.01

1.02

1.03

1.04

1.05

1.06

1.07

1.08

1.09

1.10

1.11

1.12

1.13

1.14

1.15

1.16

1.17

1.18

1.19

1.20

1.21

1.22

1.23

1.24

1.25

1.26

1.27

2 12/01/06 01/09/07 12/09/16 5.4400% 0.02062% Actual/360 Actual/360

2.01

2.02

2.03

2.04

2.05

2.06

2.07

2.08

2.09

2.10

2.11

2.12

2.13

2.14

2.15

2.16

3 09/29/06 11/11/06 10/11/11 5.3050% 0.02062% Actual/360 Actual/360

4 12/01/06 01/09/07 12/09/13 5.4200% 0.02062% Actual/360 Actual/360

4.01

4.02

4.03

4.04

4.05

4.06

4.07

4.08

4.09

4.10

4.11

4.12

4.13

5 11/10/06 12/11/06 11/11/16 5.3700% 0.02062% Actual/360 Actual/360

6 10/05/06 11/11/06 10/11/16 6.1040% 0.02062% 30/360 30/360

7 11/09/06 12/11/06 11/11/16 5.8500% 0.02062% Actual/360 Actual/360

8 11/21/06 01/11/07 12/11/16 5.7600% 0.02062% Actual/360 Actual/360

9 9.31% 11/30/06 01/11/07 12/11/16 5.4900% 0.02062% Actual/360 Actual/360

10 09/29/06 11/11/06 10/11/11 5.5900% 0.02062% 30/360 30/360

11 11/09/06 12/11/06 11/11/16 5.889093% 0.02062% Actual/360 Actual/360

12 8.18% 11/30/06 01/11/07 12/11/16 5.4900% 0.02062% Actual/360 Actual/360

13 8.13% 11/08/06 12/11/06 11/11/16 5.7900% 0.02062% Actual/360 Actual/360

14 11/10/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

15 7.15% 09/28/06 11/11/06 10/11/16 5.7000% 0.02062% Actual/360 Actual/360

16 12/04/06 01/11/07 12/11/16 6.2000% 0.03562% Actual/360 Actual/360

17 10/24/06 12/11/06 11/11/16 6.1200% 0.02062% Actual/360 Actual/360

17.01

17.02

17.03

17.04

17.05

17.06

18 11/01/06 12/11/06 11/11/16 5.6600% 0.03062% Actual/360 Actual/360

19 10/13/06 12/11/06 11/11/16 6.0200% 0.02062% Actual/360 Actual/360

20 4.74% 12/05/06 01/11/07 12/11/16 5.9200% 0.02062% Actual/360 Actual/360

21 11/21/06 01/11/07 12/11/16 5.5700% 0.02062% Actual/360 Actual/360

22 4.34% 11/14/06 01/11/07 12/11/11 6.0500% 0.02062% Actual/360 Actual/360

23 06/08/06 07/11/06 06/11/16 5.3800% 0.02062% Actual/360 Actual/360

24 10/06/06 11/11/06 10/11/16 5.4850% 0.02062% Actual/360 Actual/360

25 11/10/06 12/11/06 11/11/16 5.7800% 0.05062% Actual/360 Actual/360

26 10/02/06 11/11/06 10/11/16 5.7000% 0.02062% Actual/360 Actual/360

27 3.50% 08/23/06 10/11/06 09/11/16 6.2850% 0.02062% Actual/360 Actual/360

28 3.29% 10/11/06 11/11/06 10/11/16 5.7600% 0.02062% Actual/360 Actual/360

29 3.29% 10/31/06 12/11/06 11/11/16 5.8500% 0.02062% Actual/360 Actual/360

30 11/01/06 12/11/06 11/11/16 5.5300% 0.05062% Actual/360 Actual/360

31 3.20% 11/21/06 01/11/07 12/11/11 5.5800% 0.02062% Actual/360 Actual/360

32 10/30/06 01/01/07 12/01/16 6.1025% 0.02062% Actual/360 Actual/360

33 3.16% 11/15/06 01/11/07 12/11/11 6.0900% 0.02062% Actual/360 Actual/360

34 11/08/06 12/11/06 11/11/16 5.7900% 0.02062% Actual/360 Actual/360

35 11/03/06 12/11/06 11/11/16 6.1600% 0.02062% Actual/360 Actual/360

36 11/02/06 12/11/06 11/11/16 5.6100% 0.02062% Actual/360 Actual/360

37 11/16/06 01/11/07 12/11/16 5.8400% 0.02062% Actual/360 Actual/360

38 11/02/06 12/11/06 11/11/16 5.6100% 0.02062% Actual/360 Actual/360

39 2.59% 11/08/06 12/11/06 11/11/16 5.7900% 0.02062% Actual/360 Actual/360

40 2.58% 11/01/06 12/11/06 11/11/16 5.7600% 0.02062% Actual/360 Actual/360

41 2.52% 09/29/06 11/11/06 10/11/16 6.0200% 0.02062% Actual/360 Actual/360

42 10/11/06 11/11/06 10/11/16 5.6500% 0.02062% Actual/360 Actual/360

43 10/02/06 11/11/06 10/11/16 5.7000% 0.02062% Actual/360 Actual/360

44 10/10/06 11/11/06 10/11/16 5.6400% 0.02062% Actual/360 Actual/360

45 11/20/06 01/11/07 12/11/11 5.7000% 0.02062% Actual/360 Actual/360

46 11/16/06 01/11/07 12/11/16 5.8400% 0.02062% Actual/360 Actual/360

47 11/09/06 12/11/06 11/11/16 5.7900% 0.05062% Actual/360 Actual/360

48 12/01/06 01/11/07 12/11/16 5.9700% 0.02062% Actual/360

49 2.32% 11/21/06 01/11/07 12/11/16 5.2600% 0.02062% Actual/360 Actual/360

50 11/13/06 01/11/07 12/11/16 5.6300% 0.02062% Actual/360 Actual/360

51 11/15/06 01/11/07 12/11/16 5.8500% 0.02062% Actual/360 Actual/360

52 2.22% 08/24/06 10/11/06 09/11/11 6.5050% 0.02062% Actual/360 Actual/360

53 11/15/06 01/11/07 12/11/16 5.8000% 0.02062% Actual/360 Actual/360

54 2.17% 09/29/06 11/11/06 10/11/16 6.0200% 0.02062% Actual/360 Actual/360

55 12/05/06 01/11/07 12/11/16 5.6300% 0.02062% Actual/360 Actual/360

56 11/22/06 01/11/07 12/11/16 5.6200% 0.02062% Actual/360 Actual/360

57 11/09/06 12/11/06 11/11/16 6.0700% 0.02062% Actual/360 Actual/360

58 2.10% 10/30/06 12/11/06 11/11/11 5.8000% 0.02062% Actual/360 Actual/360

59 2.10% 11/30/06 01/11/07 12/11/11 5.6100% 0.06062% Actual/360 Actual/360

60 10/19/06 12/11/06 11/11/16 5.7600% 0.02062% Actual/360 Actual/360

61 2.01% 12/01/06 01/11/07 12/11/11 6.4200% 0.02062% Actual/360 Actual/360

62 11/01/06 12/11/06 11/11/16 5.7300% 0.02062% Actual/360 Actual/360

63 1.90% 11/15/06 01/11/07 12/11/16 5.6200% 0.02062% Actual/360 Actual/360

64 11/03/06 12/11/06 11/11/16 5.5700% 0.02062% Actual/360 Actual/360

65 10/30/06 12/11/06 11/11/16 5.9100% 0.02062% Actual/360 Actual/360

65.01

65.02

65.03

65.04

65.05

65.06

66 11/09/06 12/11/06 11/11/16 6.0700% 0.02062% Actual/360 Actual/360

67 1.79% 11/03/06 12/11/06 11/11/16 5.7200% 0.02062% Actual/360 Actual/360

68 08/14/06 10/11/06 09/11/16 6.2900% 0.02062% Actual/360 Actual/360

69 1.75% 11/13/06 01/11/07 12/11/16 5.7500% 0.02062% Actual/360

70 11/03/06 12/11/06 11/11/16 5.6100% 0.02062% Actual/360 Actual/360

70.01

70.02

70.03

71 11/17/06 01/11/07 12/11/16 5.4500% 0.02062% Actual/360 Actual/360

72 11/02/06 12/11/06 11/11/16 5.9000% 0.02062% Actual/360 Actual/360

73 11/21/06 01/11/07 12/11/16 5.6700% 0.02062% Actual/360 Actual/360

74 1.57% 11/15/06 01/11/07 12/11/16 5.8900% 0.02062% Actual/360 Actual/360

75 11/20/06 01/11/07 12/11/16 5.5900% 0.02062% Actual/360 Actual/360

76 1.50% 10/12/06 12/11/06 11/11/16 5.7140% 0.02062% Actual/360 Actual/360

77 10/26/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

78 11/09/06 12/11/06 11/11/16 6.0700% 0.02062% Actual/360 Actual/360

79 12/08/06 01/11/07 12/11/16 5.7200% 0.02062% Actual/360

80 10/25/06 12/11/06 11/11/16 5.5000% 0.02062% Actual/360 Actual/360

81 1.40% 09/29/06 11/11/06 10/11/16 6.0200% 0.02062% Actual/360 Actual/360

82 11/21/06 01/11/07 12/11/16 5.6800% 0.02062% Actual/360 Actual/360

83 11/01/06 12/11/06 11/11/16 5.6000% 0.02062% Actual/360 Actual/360

84 11/10/06 01/11/07 12/11/16 5.9500% 0.02062% Actual/360

85 1.29% 09/28/06 11/11/06 10/11/16 5.3400% 0.02062% Actual/360 Actual/360

86 10/06/06 11/11/06 10/11/16 5.8000% 0.02062% Actual/360

87 1.23% 11/17/06 01/11/07 12/11/16 5.5500% 0.02062% Actual/360 Actual/360

88 10/06/06 11/11/06 10/11/16 5.9100% 0.02062% Actual/360 Actual/360

89 11/01/06 12/11/06 11/11/16 6.0500% 0.02062% Actual/360 Actual/360

90 11/16/06 01/11/07 12/11/16 5.6800% 0.02062% Actual/360 Actual/360

91 11/01/06 12/11/06 11/11/16 5.7000% 0.06062% Actual/360 Actual/360

92 11/15/06 01/11/07 12/11/16 5.9200% 0.02062% Actual/360 Actual/360

93 10/30/06 12/11/06 11/11/16 5.7500% 0.02062% Actual/360 Actual/360

94 08/07/06 09/11/06 08/11/16 6.1300% 0.07062% Actual/360 Actual/360

95 11/22/06 01/11/07 12/11/11 6.4000% 0.02062% Actual/360

96 1.04% 11/29/06 01/11/07 12/11/16 5.4800% 0.02062% Actual/360 Actual/360

97 1.02% 09/29/06 11/11/06 10/11/11 5.8200% 0.06062% Actual/360 Actual/360

98 10/26/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

99 10/25/06 12/11/06 11/11/16 5.8800% 0.07062% Actual/360 Actual/360

100 1.00% 11/13/06 01/11/07 12/11/26 5.8300% 0.02062% Actual/360

101 11/30/06 01/11/07 12/11/16 5.8000% 0.02062% Actual/360

102 10/11/06 11/11/06 10/11/16 5.8500% 0.02062% Actual/360 Actual/360

103 11/21/06 01/11/07 12/11/16 5.6000% 0.07062% Actual/360 Actual/360

104 0.93% 10/25/06 12/11/06 11/11/16 5.7500% 0.06062% Actual/360 Actual/360

105 10/10/06 11/11/06 10/11/16 6.1900% 0.02062% Actual/360 Actual/360

106 0.89% 11/06/06 12/11/06 11/11/16 5.7500% 0.02062% Actual/360 Actual/360

107 11/13/06 01/11/07 12/11/16 5.8000% 0.02062% Actual/360

108 11/08/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

109 10/30/06 12/11/06 11/11/16 5.8100% 0.07062% Actual/360 Actual/360

110 08/14/06 10/11/06 09/11/16 6.4500% 0.02062% Actual/360 Actual/360

111 10/30/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

112 10/03/06 11/11/06 10/11/16 5.7100% 0.02062% Actual/360 Actual/360

113 11/09/06 01/11/07 12/11/16 5.6900% 0.02062% Actual/360 Actual/360

114 0.72% 11/28/06 01/11/07 12/11/16 5.6700% 0.02062% Actual/360 Actual/360

115 0.69% 09/29/06 11/11/06 10/11/16 6.0200% 0.02062% Actual/360 Actual/360

116 11/17/06 01/11/07 12/11/16 5.9900% 0.02062% Actual/360

117 11/21/06 01/11/07 12/11/16 5.7500% 0.02062% Actual/360 Actual/360

118 0.66% 11/01/06 12/11/06 11/11/16 5.6900% 0.02062% Actual/360 Actual/360

119 11/03/06 12/11/06 11/11/16 5.8300% 0.02062% Actual/360 Actual/360

120 12/04/06 01/11/07 12/11/16 5.8300% 0.02062% Actual/360 Actual/360

121 11/13/06 01/11/07 12/11/16 6.1400% 0.09062% Actual/360

122 11/03/06 12/11/06 11/11/16 5.6700% 0.02062% Actual/360

123 10/30/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

124 10/30/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

125 0.50% 10/16/06 12/11/06 11/11/16 5.9300% 0.02062% Actual/360

126 0.46% 09/29/06 11/11/06 10/11/16 6.0200% 0.02062% Actual/360 Actual/360

127 10/31/06 12/11/06 11/11/16 5.8500% 0.02062% Actual/360

128 10/26/06 12/11/06 11/11/16 5.9300% 0.02062% Actual/360 Actual/360

129 0.42% 10/26/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

130 11/10/06 01/11/07 12/11/16 5.9700% 0.02062% Actual/360

130.01

130.02

131 11/29/06 01/11/07 12/11/16 5.6800% 0.02062% Actual/360

132 08/02/06 09/11/06 08/11/16 5.2800% 0.02062% Actual/360 Actual/360

133 10/17/06 12/11/06 11/11/16 6.0000% 0.02062% Actual/360

134 0.35% 09/29/06 11/11/06 10/11/16 6.0200% 0.02062% Actual/360 Actual/360

135 10/20/06 12/11/06 11/11/16 5.9200% 0.02062% Actual/360 Actual/360

136 11/30/06 01/11/07 12/11/16 5.7200% 0.02062% Actual/360 Actual/360

137 10/30/06 12/11/06 11/11/16 5.8800% 0.02062% Actual/360 Actual/360

138 06/12/06 08/11/06 07/11/16 5.7900% 0.02062% Actual/360 Actual/360

139 11/28/06 01/11/07 12/11/16 6.0400% 0.02062% Actual/360

140 10/25/06 01/11/07 12/11/16 5.9800% 0.02062% Actual/360 Actual/360

141 11/28/06 01/11/07 12/11/16 6.0400% 0.02062% Actual/360

141.01

141.02

142 08/15/06 10/11/06 09/11/16 5.8700% 0.02062% Actual/360 Actual/360

ORIGINAL REMAINING

TERM TO TERM TO MATURITY DATE OR

MORTGAGE LOAN MATURITY OR MATURITY OR REMAINING IO ORIGINAL AMORT REMAINING AMORT MONTHLY P&I ARD BALLOON

NUMBER ARD (MOS.) ARD (MOS.) PERIOD (MOS.) TERM (MOS.) TERM (MOS.) PAYMENTS ($) BALANCE ($) ARD LOAN

- ---------------------------------------------------------------------------------------------------------------------------------

1 120 119 119 IO IO IO 318,976,000.00 N

1.01

1.02

1.03

1.04

1.05

1.06

1.07

1.08

1.09

1.10

1.11

1.12

1.13

1.14

1.15

1.16

1.17

1.18

1.19

1.20

1.21

1.22

1.23

1.24

1.25

1.26

1.27

2 120 120 120 IO IO IO 233,977,430.00 N

2.01

2.02

2.03

2.04

2.05

2.06

2.07

2.08

2.09

2.10

2.11

2.12

2.13

2.14

2.15

2.16

3 60 58 58 IO IO IO 205,000,000.00 N

4 84 84 84 IO IO IO 161,039,673.00 N

4.01

4.02

4.03

4.04

4.05

4.06

4.07

4.08

4.09

4.10

4.11

4.12

4.13

5 120 119 119 IO IO IO 150,000,000.00 N

6 120 118 118 IO IO IO 132,000,000.00 N

7 120 119 59 360 360 761,023.81 120,447,303.01 N

8 120 120 120 IO IO IO 100,000,000.00 N

9 120 120 120 IO IO IO 65,050,000.00 N

10 60 58 58 IO IO IO 60,000,000.00 N

11 120 119 23 360 360 343,614.49 51,266,667.28 N

12 120 120 120 IO IO IO 57,150,000.00 N

13 120 119 119 IO IO IO 56,800,000.00 N

14 120 119 119 IO IO IO 52,000,000.00 N

15 120 118 58 360 360 290,200.21 46,590,577.09 N

16 120 120 36 360 360 300,109.80 44,450,487.92 N

17 120 119 59 360 360 224,696.28 34,671,985.41 N

17.01

17.02

17.03

17.04

17.05

17.06

18 120 119 119 IO IO IO 35,000,000.00 N

19 120 119 59 420 420 190,320.64 31,846,310.12 N

20 120 120 120 IO IO IO 33,150,000.00 Y

21 120 120 120 IO IO IO 30,750,000.00 N

22 60 60 60 IO IO IO 30,315,000.00 N

23 120 114 114 IO IO IO 28,275,000.00 Y

24 120 118 118 IO IO IO 28,200,000.00 N

25 120 119 59 360 360 149,882.89 23,879,844.63 N

26 120 118 118 IO IO IO 25,025,000.00 N

27 120 117 81 360 360 151,254.36 23,636,816.63 N

28 120 118 118 IO IO IO 23,000,000.00 N

29 120 119 119 IO IO IO 23,000,000.00 N

30 120 119 119 IO IO IO 22,600,000.00 N

31 60 60 60 IO IO IO 22,400,000.00 N

32 120 120 48 360 360 135,779.01 20,645,345.21 N

33 60 60 60 IO IO IO 22,100,000.00 N

34 120 119 119 IO IO IO 21,000,000.00 N

35 120 119 59 360 360 121,975.15 18,751,453.42 N

36 120 119 35 360 360 108,045.43 16,857,261.61 N

37 120 120 120 IO IO IO 18,750,000.00 N

38 120 119 35 360 360 105,746.59 16,498,596.48 N

39 120 119 119 IO IO IO 18,080,000.00 N

40 120 119 119 IO IO IO 18,000,000.00 N

41 120 118 118 IO IO IO 17,600,000.00 N

42 120 118 118 IO IO IO 17,500,000.00 N

43 120 118 118 IO IO IO 17,500,000.00 N

44 120 118 118 IO IO IO 17,500,000.00 N

45 60 60 60 IO IO IO 17,300,000.00 N

46 120 120 120 IO IO IO 17,250,000.00 N

47 120 119 119 IO IO IO 17,000,000.00 N

48 120 120 360 360 101,595.93 14,405,820.95 N

49 120 120 120 IO IO IO 16,185,000.00 N

50 120 120 120 IO IO IO 16,043,000.00 N

51 120 120 36 360 360 91,440.84 13,965,928.06 N

52 60 57 57 IO IO IO 15,500,000.00 N

53 120 120 120 IO IO IO 15,500,000.00 N

54 120 118 118 IO IO IO 15,200,000.00 N

55 120 120 120 IO IO IO 15,120,000.00 N

56 120 120 120 IO IO IO 14,950,000.00 N

57 120 119 119 IO IO IO 14,880,000.00 N

58 60 59 59 IO IO IO 14,700,000.00 N

59 60 60 60 IO IO IO 14,700,000.00 N

60 120 119 59 360 360 84,418.10 13,475,344.82 Y

61 60 60 60 IO IO IO 14,050,000.00 N

62 120 119 59 360 360 77,883.02 12,467,690.84 N

63 120 120 60 360 360 76,520.32 12,379,175.01 N

64 120 119 119 IO IO IO 13,025,000.00 N

65 120 119 119 IO IO IO 13,000,000.00 N

65.01

65.02

65.03

65.04

65.05

65.06

66 120 119 119 IO IO IO 12,820,000.00 N

67 120 119 59 360 360 72,708.56 11,650,435.49 N

68 120 117 69 360 360 76,053.49 11,719,287.03 N

69 120 120 360 360 71,195.89 10,270,508.83 N

70 120 119 35 360 360 69,884.70 10,903,420.28 N

70.01

70.02

70.03

71 120 120 120 IO IO IO 12,000,000.00 N

72 120 119 35 360 360 68,210.70 10,371,523.68 Y

73 120 120 36 360 360 65,659.83 10,189,959.09 N

74 120 120 120 IO IO IO 11,000,000.00 N

75 120 120 36 360 360 62,419.88 9,756,640.24 N

76 120 119 47 360 360 61,035.23 9,615,220.09 N

77 120 119 23 300 300 66,883.53 8,697,836.80 N

78 120 119 119 IO IO IO 10,300,000.00 N

79 120 120 300 300 63,984.07 7,824,363.56 N

80 120 119 119 IO IO IO 10,137,000.00 Y

81 120 118 118 IO IO IO 9,800,000.00 N

82 120 120 60 360 360 56,755.10 9,129,149.76 N

83 120 119 119 IO IO IO 9,500,000.00 N

84 120 120 420 420 53,282.57 8,416,303.00 N

85 120 118 58 360 360 50,201.21 8,343,513.37 N

86 120 118 360 358 52,807.77 7,588,209.57 Y

87 120 120 48 360 360 49,242.72 7,876,411.65 N

88 120 118 22 360 360 50,174.12 7,473,164.00 N

89 120 119 11 300 300 54,378.35 6,760,913.15 N

90 120 120 60 360 360 47,720.61 7,675,938.17 N

91 120 119 59 360 360 47,302.63 7,593,978.31 N

92 120 120 36 360 360 47,553.35 7,218,158.18 N

93 120 119 119 IO IO IO 7,800,000.00 N

94 120 116 20 360 360 46,692.97 6,826,643.21 N

95 60 60 360 360 47,726.10 7,174,619.19 Y

96 120 120 60 360 360 41,073.77 6,734,688.52 N

97 60 58 58 IO IO IO 7,100,000.00 N

98 120 119 119 IO IO IO 7,030,000.00 N

99 120 119 47 360 360 41,430.02 6,427,980.50 N

100 240 240 240 240 49,807.44 0.00 N

101 120 120 120 120 73,712.60 46,107.30 N

102 120 118 34 360 360 39,526.04 6,036,967.96 N

103 120 120 120 IO IO IO 6,650,000.00 N

104 120 119 119 IO IO IO 6,500,000.00 N

105 120 118 58 360 360 39,156.49 6,003,077.55 N

106 120 119 23 360 360 36,473.30 5,506,729.84 N

107 120 120 240 240 44,058.81 4,066,391.07 Y

108 120 119 59 360 360 36,695.16 5,791,301.11 N

109 120 119 119 IO IO IO 6,200,000.00 N

110 120 117 57 360 360 35,658.30 5,336,866.17 N

111 120 119 119 IO IO IO 5,640,000.00 N

112 120 118 34 360 360 31,375.85 4,852,057.58 N

113 120 120 120 IO IO IO 5,000,000.00 N

114 120 120 60 360 360 28,925.04 4,657,080.58 N

115 120 118 118 IO IO IO 4,840,000.00 N

116 120 120 360 360 28,448.12 4,027,533.39 N

117 120 120 60 360 360 27,719.71 4,429,138.77 N

118 120 119 59 360 360 26,669.28 4,285,576.57 N

119 120 119 23 360 360 25,901.25 3,883,922.05 N

120 120 120 120 IO IO IO 4,150,000.00 N

121 120 120 300 300 26,115.45 3,112,427.01 N

122 120 119 360 359 21,983.03 3,191,001.88 Y

123 120 119 119 IO IO IO 3,620,000.00 N

124 120 119 119 IO IO IO 3,590,000.00 N

125 120 119 360 359 20,827.01 2,962,146.31 N

126 120 118 118 IO IO IO 3,220,000.00 N

127 120 119 360 359 18,878.11 2,701,802.46 N

128 120 119 35 360 360 18,089.75 2,743,301.95 N

129 120 119 119 IO IO IO 2,915,000.00 N

130 120 120 360 360 17,331.07 2,457,463.75 N

130.01

130.02

131 120 120 360 360 16,215.74 2,352,162.32 N

132 120 116 116 IO IO IO 2,690,000.00 Y

133 120 119 360 359 14,988.76 2,120,199.91 N

134 120 118 118 IO IO IO 2,460,000.00 N

135 120 119 35 360 360 13,671.59 2,075,118.18 N

136 120 120 60 360 360 12,459.34 1,996,480.13 N

137 120 119 119 IO IO IO 2,100,000.00 N

138 120 115 115 IO IO IO 1,856,000.00 Y

139 120 120 360 360 10,428.80 1,470,727.58 N

140 120 120 24 360 360 9,572.24 1,417,268.02 N

141 120 120 360 360 9,031.87 1,273,724.87 N

141.01

141.02

142 120 117 117 IO IO IO 840,000.00 Y

MORTGAGE LOAN

NUMBER PREPAYMENT PROVISIONS APPRAISED VALUE ($)

- ----------------------------------------------------------------------------------------------------------------------------------

1 GRTR1%orYM(113),O(7) 398,720,000

1.01 32,300,000

1.02 28,700,000

1.03 26,000,000

1.04 25,100,000

1.05 24,200,000

1.06 23,370,000

1.07 23,250,000

1.08 22,200,000

1.09 20,100,000

1.10 18,900,000

1.11 17,700,000

1.12 16,000,000

1.13 13,000,000

1.14 12,175,000

1.15 11,400,000

1.16 11,250,000

1.17 10,650,000

1.18 9,600,000

1.19 7,800,000

1.20 7,625,000

1.21 7,150,000

1.22 6,550,000

1.23 5,350,000

1.24 5,300,000

1.25 4,400,000

1.26 4,400,000

1.27 4,250,000

2 L(24),D(92),O(4) 449,450,000

2.01 21,000,000

2.02 27,500,000

2.03 27,000,000

2.04 26,900,000

2.05 32,500,000

2.06 17,100,000

2.07 14,700,000

2.08 23,250,000

2.09 10,900,000

2.10 61,000,000

2.11 34,500,000

2.12 30,700,000

2.13 5,400,000

2.14 25,000,000

2.15 30,000,000

2.16 62,000,000

3 L(26),D(21),O(13) 457,000,000

4 L(24),D(56),O(4) 301,800,000

4.01 14,200,000

4.02 20,000,000

4.03 45,000,000

4.04 14,400,000

4.05 9,800,000

4.06 32,500,000

4.07 22,300,000

4.08 10,000,000

4.09 12,200,000

4.10 19,500,000

4.11 26,000,000

4.12 35,900,000

4.13 40,000,000

5 L(25),D(88)orGRTR1%orYM(88),O(7) 259,000,000

6 L(26),D(90),O(4) or GRTR1%orYM(116),O(4) 371,900,000

7 GRTR2%orYM(116),O(4) 161,355,000

8 L(24),D(93),O(3) 125,000,000

9 L(36),GRTR1%orYM(81),O(3) or L(24),D(93),O(3) 92,000,000

10 L(26),D(27),O(7) or GRTR1%orYM(53),O(7) 129,000,000

11 L(25),D(91),O(4) 72,500,000

12 L(36),GRTR1%orYM(81),O(3) or L(24),D(93),O(3) 81,500,000

13 L(25),D(92),O(3) 71,000,000

14 L(25),D(90),O(5) or GRTR1%orYM(115),O(5) 65,000,000

15 L(26),D(90),O(4) 69,550,000

16 L(7),GRTR1%orYM(110),O(3) 67,000,000

17 L(25),D(92),O(3) 47,210,000

17.01 11,600,000

17.02 11,000,000

17.03 6,790,000

17.04 7,950,000

17.05 6,070,000

17.06 3,800,000

18 L(25),D(90),O(5) 58,400,000

19 L(36),D(81),O(3) 43,500,000

20 L(24),GRTR1%orYM(93),O(3) 51,450,000

21 L(24),D(93),O(3) 38,900,000

22 L(24),GRTR1%orYM(32),O(4) 43,700,000

23 L(48),D(68),O(4) 45,100,000

24 L(37),GRTR1%orYM(76),O(7) 41,000,000

25 L(25),D(92),O(3) 35,200,000

26 GRTR1%orYM(116),O(4) 36,500,000

27 L(27),D(89),O(4) 36,100,000

28 L(26),D(90),O(4) 33,600,000

29 GRTR1%orYM1%(117),O(3) 28,800,000

30 L(25),D(92),O(3) 40,000,000

31 GRTR1%orYM(56),O(4) 32,800,000

32 L(36),D(81),O(3) 34,500,000

33 GRTR1%orYM(35),O(25) 28,200,000

34 GRTR1%orYM(116),O(4) 26,700,000

35 L(25),D(92),O(3) 32,800,000

36 L(25),D(91),O(4) 23,500,000

37 L(24),D(93),O(3) 23,700,000

38 L(25),D(91),O(4) 23,000,000

39 L(25),D(92),O(3) 22,600,000

40 L(25),D(92),O(3) 27,900,000

41 L(24),GRTR1%orYM(93),O(3) 22,000,000

42 L(26),D(90),O(4) 29,200,000

43 GRTR1%orYM(116),O(4) 25,000,000

44 L(23),GRTR1%orYM(36),LSR5%orYM(12),LSR4%orYM(12),LSR3%orYM(12),LSR2%orYM(12),LSR1%orYM(7),O(6) 25,450,000

45 L(36),GRTR1%orYM(21),O(3) 23,000,000

46 L(24),D(93),O(3) 22,700,000

47 L(25),D(92),O(3) 21,250,000

48 L(48),D(69),O(3) 23,060,000

49 L(24),D(93),O(3) 25,000,000

50 L(24),D(93),O(3) 25,200,000

51 L(24),D(93),O(3) 20,700,000

52 GRTR1%orYM(36),O(24) 19,400,000

53 GRTR1%orYM(116),O(4) 19,400,000

54 L(24),GRTR1%orYM(93),O(3) 19,000,000

55 L(24),D(93),O(3) 18,900,000

56 L(24),D(93),O(3) 20,500,000

57 L(25),D(91),O(4) 18,600,000

58 L(25),D(31),O(4) 21,500,000

59 L(24),D(33),O(3) 19,625,000

60 L(49),GRTR1%orYM(68),O(3) 20,400,000

61 L(24),GRTR1%orYM(32),O(4) 17,600,000

62 L(25),D(92),O(3) 17,000,000

63 L(36),GRTR2%orYM(71),YM(10),O(3) 18,300,000

64 L(25),D(92),O(3) 18,350,000

65 L(25),D(92),O(3) 17,150,000

65.01 4,700,000

65.02 3,050,000

65.03 2,850,000

65.04 2,750,000

65.05 2,350,000

65.06 1,450,000

66 L(25),D(91),O(4) 17,500,000

67 L(25),D(92),O(3) 15,650,000

68 L(27),D(89),O(4) 20,000,000

69 L(24),D(93),O(3) 21,900,000

70 L(25),D(91),O(4) 15,200,000

70.01 7,500,000

70.02 3,900,000

70.03 3,800,000

71 L(24),D(93),O(3) 17,300,000

72 L(25),D(92),O(3) 16,300,000

73 L(48),D(69),O(3) 15,600,000

74 GRTR1%orYM(116),O(4) 15,300,000

75 L(24),D(93),O(3) 15,550,000

76 L(25),D(91),O(4) 14,100,000

77 L(25),D(92),O(3) 14,100,000

78 L(25),D(91),O(4) 13,200,000

79 L(24),D(92),O(4) 24,700,000

80 L(25),D(92),O(3) 16,600,000

81 L(24),GRTR1%orYM(93),O(3) 12,250,000

82 L(24),D(93),O(3) 12,400,000

83 L(25),D(92),O(3) 14,000,000

84 L(24),D(93),O(3) 12,420,000

85 L(48),D(69),O(3) 11,300,000

86 L(26),D(91),O(3) 11,900,000

87 L(24),D(92),O(4) 11,500,000

88 L(26),D(90),O(4) 11,850,000

89 L(36),GRTR1%orYM(81),O(3) 12,400,000

90 L(24),D(93),O(3) 10,600,000

91 L(25),D(92),O(3) 10,200,000

92 GRTR1%orYM(116),O(4) 11,400,000

93 L(25),D(92),O(3) 9,750,000

94 L(28),D(89),O(3) 9,620,000

95 L(24),D(33),O(3) 10,300,000

96 L(24),D(93),O(3) 9,100,000

97 L(26),D(31),O(3) 9,075,000

98 L(25),D(92),O(3) 10,650,000

99 L(25),D(92),O(3) 8,700,000

100 L(24),D(213),O(3) 12,500,000

101 L(24),D(93),O(3) 14,000,000

102 L(26),D(90),O(4) 8,500,000

103 L(24),D(93),O(3) 9,150,000

104 L(25),D(92),O(3) 8,500,000

105 L(26),D(89),O(5) 8,200,000

106 L(25),D(92),O(3) 8,000,000

107 L(24),D(93),O(3) 11,200,000

108 L(25),D(90),O(5) or GRTR1%orYM(115),O(5) 11,000,000

109 L(25),D(92),O(3) 8,500,000

110 L(27),D(89),O(4) 8,400,000

111 L(25),D(92),O(3) 8,100,000

112 L(26),D(91),O(3) 7,400,000

113 L(24),D(93),O(3) 7,100,000

114 L(36),GRTR1%orYM(77),O(7) 7,100,000

115 L(24),GRTR1%orYM(93),O(3) 6,050,000

116 L(24),D(93),O(3) 6,100,000

117 L(24),D(92),O(4) 6,100,000

118 GRTR2%orYM(117),O(3) 6,300,000

119 L(25),D(92),O(3) 6,150,000

120 L(24),D(93),O(3) 6,500,000

121 L(24),D(93),O(3) 5,850,000

122 L(25),D(91),O(4) 4,800,000

123 L(25),D(92),O(3) 5,310,000

124 L(25),D(92),O(3) 5,120,000

125 L(25),D(92),O(3) 5,540,000

126 L(24),GRTR1%orYM(93),O(3) 4,025,000

127 L(25),D(92),O(3) 4,150,000

128 L(25),D(92),O(3) 4,000,000

129 L(25),D(92),O(3) 4,630,000

130 L(24),D(93),O(3) 3,830,000

130.01 1,940,000

130.02 1,890,000

131 L(24),D(93),O(3) 4,400,000

132 L(48),D(68),O(4) 4,200,000

133 L(25),D(92),O(3) 4,100,000

134 L(24),GRTR1%orYM(93),O(3) 3,075,000

135 L(25),D(92),O(3) 3,800,000

136 L(24),D(93),O(3) 2,700,000

137 L(25),D(92),O(3) 3,140,000

138 L(48),D(68),O(4) 2,830,000

139 L(24),D(93),O(3) 2,330,000

140 L(60),GRTR1%orYM(57),O(3) 3,950,000

141 L(24),D(93),O(3) 2,700,000

141.01 1,830,000

141.02 870,000

142 L(48),D(68),O(4) 1,400,000

MORTGAGE LOAN CUT-OFF DATE LTV RATIO AT YEAR UNIT OF

NUMBER APPRAISAL DATE DSCR (X) LTV RATIO MATURITY OR ARD BUILT YEAR RENOVATED NUMBER OF UNITS MEASURE

- -------------------------------------------------------------------------------------------------------------------------

1 Various 1.39 80.00% 80.00% Various 8,324,477 Sq. Ft.

1.01 08/23/06 2002 842,000 Sq. Ft.

1.02 06/01/07 2006 650,760 Sq. Ft.

1.03 08/29/06 2001 759,300 Sq. Ft.

1.04 08/23/06 2002 600,576 Sq. Ft.

1.05 08/23/06 2004 689,009 Sq. Ft.

1.06 08/25/06 2004 200,000 Sq. Ft.

1.07 08/29/06 2003 607,650 Sq. Ft.

1.08 08/23/06 2000 481,874 Sq. Ft.

1.09 08/23/06 2000 450,000 Sq. Ft.

1.10 08/23/06 2000 418,400 Sq. Ft.

1.11 08/23/06 2004 426,326 Sq. Ft.

1.12 08/23/06 1999 395,679 Sq. Ft.

1.13 08/29/06 2005 301,200 Sq. Ft.

1.14 08/25/06 1998 250,000 Sq. Ft.

1.15 08/23/06 2003 250,000 Sq. Ft.

1.16 08/25/06 1998 101,600 Sq. Ft.

1.17 08/25/06 2004 108,400 Sq. Ft.

1.18 08/25/06 1997 86,000 Sq. Ft.

1.19 08/25/06 1988 60,177 Sq. Ft.

1.20 08/25/06 1999 89,636 Sq. Ft.

1.21 08/29/06 2005 129,842 Sq. Ft.

1.22 08/25/06 1997 79,110 Sq. Ft.

1.23 08/25/06 1997 150,000 Sq. Ft.

1.24 08/25/06 1990 44,306 Sq. Ft.

1.25 08/25/06 1988 61,318 Sq. Ft.

1.26 08/25/06 1990 57,168 Sq. Ft.

1.27 08/25/06 1990 34,146 Sq. Ft.

2 Various 2.39 52.06% 52.06% Various Various 3,281,027 Sq. Ft.

2.01 09/01/06 1977 1994 175,086 Sq. Ft.

2.02 09/01/06 1988 278,017 Sq. Ft.

2.03 09/01/06 1973 89,704 Sq. Ft.

2.04 09/01/06 1960 1996 224,514 Sq. Ft.

2.05 09/01/06 2000 181,055 Sq. Ft.

2.06 09/01/06 1975 125,710 Sq. Ft.

2.07 09/01/06 1968 1992 146,947 Sq. Ft.

2.08 09/01/06 1988 264,360 Sq. Ft.

2.09 09/01/06 1969 1996 103,903 Sq. Ft.

2.10 09/01/06 1970 2005 191,085 Sq. Ft.

2.11 07/31/06 1996 387,273 Sq. Ft.

2.12 09/01/06 1962 2003 372,243 Sq. Ft.

2.13 09/01/06 2002 12,000 Sq. Ft.

2.14 07/31/06 1992 124,937 Sq. Ft.

2.15 07/31/06 1998 197,424 Sq. Ft.

2.16 09/01/06 1997 406,769 Sq. Ft.

3 03/01/08 1.97 44.86% 44.86% 1970 1991 564,247 Sq. Ft.

4 Various 2.31 53.36% 53.36% Various Various 1,777,884 Sq. Ft.

4.01 09/01/06 1968 61,295 Sq. Ft.

4.02 09/01/06 2001 103,931 Sq. Ft.

4.03 09/01/06 1999 349,433 Sq. Ft.

4.04 09/01/06 1963 1988 71,940 Sq. Ft.

4.05 09/01/06 1962 1993 78,092 Sq. Ft.

4.06 09/01/06 1959 1990 159,454 Sq. Ft.

4.07 09/01/06 1998 143,763 Sq. Ft.

4.08 09/01/06 1975 44,131 Sq. Ft.

4.09 09/01/06 1967 1998 84,480 Sq. Ft.

4.10 09/01/06 1964 1988 77,458 Sq. Ft.

4.11 09/01/06 1959 1992 183,867 Sq. Ft.

4.12 09/01/06 1996 198,473 Sq. Ft.

4.13 07/31/06 1997 2000 221,567 Sq. Ft.

5 09/20/06 2.15 57.92% 57.92% 1975 1998 552,388 Sq. Ft.

6 07/26/06 1.35 70.99% 70.99% 1999 1,052 Units

7 10/19/06 1.34 79.95% 74.65% 1974 1991 1,729,294 Sq. Ft.

8 01/01/08 1.04 80.00% 80.00% 2008 27,900 Sq. Ft.

9 11/14/06 1.22 70.71% 70.71% 1986 400 Units

10 09/01/06 2.44 46.51% 46.51% 2000 340,369 Sq. Ft.

11 10/01/07 1.30 80.00% 70.71% 1979 2004 593,626 Sq. Ft.

12 11/14/06 1.23 70.12% 70.12% 1989 354 Units

13 10/03/06 1.33 80.00% 80.00% 1971 1,079 Pads

14 09/08/06 1.21 80.00% 80.00% 2002 174,310 Sq. Ft.

15 08/24/06 1.20 71.89% 66.99% 1983 2001 996 Units

16 01/01/08 1.33 73.13% 66.34% 1969 2006 274 Rooms

17 08/11/06 1.25 78.37% 73.44% Various 469,667 Sq. Ft.

17.01 08/11/06 1984 109,837 Sq. Ft.

17.02 08/11/06 1985 108,004 Sq. Ft.

17.03 08/11/06 1985 68,991 Sq. Ft.

17.04 08/11/06 1981 86,006 Sq. Ft.

17.05 08/11/06 1986 57,903 Sq. Ft.

17.06 08/11/06 1981 38,926 Sq. Ft.

18 09/20/06 2.17 59.93% 59.93% 2000 322,318 Sq. Ft.

19 07/26/06 1.21 76.55% 73.21% 2005 129,315 Sq. Ft.

20 08/28/06 1.57 64.43% 64.43% 1998 288 Units

21 10/14/06 1.41 79.05% 79.05% 2002 130,838 Sq. Ft.

22 10/17/07 1.40 69.37% 69.37% 1985 1996 352 Units

23 03/15/06 1.74 62.69% 62.69% 1997 245,590 Sq. Ft.

24 09/07/06 1.58 68.78% 68.78% 1987 212,267 Sq. Ft.

25 09/21/06 1.30 72.73% 67.84% 2005 211,749 Sq. Ft.

26 09/12/06 1.68 68.56% 68.56% 1998 226,904 Sq. Ft.

27 06/28/06 1.25 67.80% 65.48% 1999 382 Units

28 09/22/06 1.34 68.45% 68.45% 1979 184 Units

29 09/29/06 1.21 79.86% 79.86% 1973 2003 168 Units

30 09/28/06 1.36 56.50% 56.50% 1972 2003 293,643 Sq. Ft.

31 10/19/06 1.29 68.29% 68.29% 1998 2006 240 Units

32 04/01/07 1.19 64.93% 59.84% 2006 102,777 Sq. Ft.

33 12/01/08 1.39 78.37% 78.37% 1987 247 Units

34 09/02/06 1.43 78.65% 78.65% 2000 107,705 Sq. Ft.

35 08/17/06 1.40 60.98% 57.17% 1970 1999 185,532 Sq. Ft.

36 10/09/06 1.23 80.00% 71.73% 1997 126,935 Sq. Ft.

37 10/06/06 1.47 79.11% 79.11% 2001 91,845 Sq. Ft.

38 10/09/06 1.31 80.00% 71.73% 2002 98,500 Sq. Ft.

39 10/03/06 1.36 80.00% 80.00% 1965 356 Pads

40 09/15/06 1.59 64.52% 64.52% 1987 457 Units

41 08/31/06 1.32 80.00% 80.00% 1997 222 Units

42 09/12/06 1.38 59.93% 59.93% 1986 1997 88,338 Sq. Ft.

43 09/12/06 1.53 70.00% 70.00% 1997 159,212 Sq. Ft.

44 09/25/06 1.55 68.76% 68.76% 2006 110,178 Sq. Ft.

45 10/19/06 1.31 75.22% 75.22% 1999 137,484 Sq. Ft.

46 10/04/06 1.48 75.99% 75.99% 2000 85,022 Sq. Ft.

47 10/01/06 1.22 80.00% 80.00% 1982 2004 95,420 Sq. Ft.

48 10/17/06 1.30 73.72% 62.47% 1975 2004 142 Rooms

49 10/20/06 1.94 64.74% 64.74% 2001 262 Units

50 12/01/06 1.62 63.66% 63.66% 1968 1999 122,605 Sq. Ft.

51 10/04/06 1.28 74.88% 67.47% 2001 175,213 Sq. Ft.

52 07/05/06 1.25 79.90% 79.90% 1987 2003 186 Units

53 09/02/06 1.47 79.90% 79.90% 1999 88,455 Sq. Ft.

54 08/31/06 1.34 80.00% 80.00% 1987 226 Units

55 09/19/06 1.25 80.00% 80.00% 1985 1995 105,084 Sq. Ft.

56 09/28/06 1.45 72.93% 72.93% 1986 1997 138,772 Sq. Ft.

57 09/11/06 1.20 80.00% 80.00% 1988 64,828 Sq. Ft.

58 10/11/06 1.35 68.37% 68.37% 1989 1999 200 Units

59 09/20/06 1.46 74.90% 74.90% 1968 1997 219 Units

60 09/22/06 1.28 70.83% 66.06% 2006 59,472 Sq. Ft.

61 07/25/06 1.29 79.83% 79.83% 1986 186 Units

62 09/27/06 1.35 78.68% 73.34% 1986 116,339 Sq. Ft.

63 10/03/06 1.23 72.68% 67.65% 1965 2000 124 Units

64 10/06/06 1.67 70.98% 70.98% 2001 113,600 Sq. Ft.

65 Various 1.35 75.80% 75.80% Various Various 533,653 Sq. Ft.

65.01 09/11/06 2000 117,725 Sq. Ft.

65.02 09/12/06 1964 2003 123,733 Sq. Ft.

65.03 09/11/06 2001 2003 73,600 Sq. Ft.

65.04 09/13/06 2002 71,085 Sq. Ft.

65.05 09/12/06 2003 111,010 Sq. Ft.

65.06 09/11/06 1997 36,500 Sq. Ft.

66 09/11/06 1.20 73.26% 73.26% 1988 43,456 Sq. Ft.

67 09/26/06 1.25 79.87% 74.44% 1972 418 Units

68 05/22/06 1.38 61.50% 58.60% 2004 98,749 Sq. Ft.

69 10/13/06 1.26 55.71% 46.90% 2003 234 Units

70 10/09/06 1.37 80.00% 71.73% Various 244,158 Sq. Ft.

70.01 10/09/06 1987 120,300 Sq. Ft.

70.02 10/09/06 1989 62,000 Sq. Ft.

70.03 10/09/06 1989 61,858 Sq. Ft.

71 10/17/06 1.85 69.36% 69.36% 2006 124,900 Sq. Ft.

72 09/28/06 1.38 70.55% 63.63% 1987 2005 79,660 Sq. Ft.

73 09/13/06 1.23 72.76% 65.32% 1972 92,815 Sq. Ft.

74 10/10/06 1.33 71.90% 71.90% 1990 192 Units

75 11/10/06 1.41 70.00% 62.74% 2002 69,287 Sq. Ft.

76 09/08/06 1.20 74.47% 68.19% 2002 168 Units

77 09/19/06 1.30 74.47% 61.69% 2005 72 Rooms

78 09/11/06 1.24 78.03% 78.03% 1988 48,455 Sq. Ft.

79 10/10/06 1.90 41.30% 31.68% 1995 236,345 Sq. Ft.

80 10/06/06 1.75 61.07% 61.07% 1998 95,500 Sq. Ft.

81 08/31/06 1.37 80.00% 80.00% 1996 140 Units

82 10/17/06 1.30 79.03% 73.62% 1996 125,290 Sq. Ft.

83 10/05/06 1.70 67.86% 67.86% 1997 130,316 Sq. Ft.

84 09/20/06 1.22 75.68% 67.76% 2005 64,835 Sq. Ft.

85 09/13/06 1.29 79.65% 73.84% 1985 2005 156 Units

86 09/12/06 1.32 75.49% 63.77% 2005 75,000 Sq. Ft.

87 10/13/06 1.32 75.00% 68.49% 1985 208 Units

88 09/15/06 1.29 71.31% 63.06% 1960 1999 41,151 Sq. Ft.

89 09/13/06 1.68 67.74% 54.52% 1999 2006 103 Rooms

90 10/17/06 1.21 77.74% 72.41% 1984 2005 107,782 Sq. Ft.

91 09/05/06 1.31 79.90% 74.45% 1984 2004 106,320 Sq. Ft.

92 09/21/06 1.21 70.18% 63.32% 1988 2001 53,110 Sq. Ft.

93 09/08/06 1.50 80.00% 80.00% 2002 56,004 Sq. Ft.

94 06/20/06 1.15 79.84% 70.96% 2005 30,868 Sq. Ft.

95 09/28/06 1.22 74.08% 69.66% 2006 229,000 Sq. Ft.

96 09/18/06 1.22 79.67% 74.01% 1947 2005 224 Units

97 09/18/06 1.26 78.24% 78.24% 1985 184 Units

98 04/01/07 1.41 66.01% 66.01% 1918 2001 52 Units

99 09/25/06 1.35 80.46% 73.88% 1984 72,112 Sq. Ft.

100 10/13/06 1.17 56.00% 0.00% 2000 134 Units

101 07/01/06 1.76 47.86% 0.33% 1969 1999 207 Rooms

102 09/18/06 1.21 78.82% 71.02% 1979 2003 96,153 Sq. Ft.

103 10/09/06 1.71 72.68% 72.68% 1984 2004 52,328 Sq. Ft.

104 09/18/06 1.59 76.47% 76.47% 2001 114 Units

105 07/11/06 1.21 78.05% 73.21% 1966 1997 35,011 Sq. Ft.

106 10/04/06 1.24 78.13% 68.83% 2003 149 Units

107 07/10/06 1.28 55.80% 36.31% 1956 159,494 Sq. Ft.

108 09/07/06 1.52 56.36% 52.65% 1976 1994 95,739 Sq. Ft.

109 10/02/06 1.30 72.94% 72.94% 2002 99,436 Sq. Ft.

110 02/19/06 1.21 67.51% 63.53% 2001 68,888 Sq. Ft.

111 04/01/07 1.43 69.63% 69.63% 1926 24,650 Sq. Ft.

112 09/05/06 1.29 72.97% 65.57% 1962 144,889 Sq. Ft.

113 10/03/06 1.60 70.42% 70.42% 2001 24,503 Sq. Ft.

114 09/19/06 1.21 70.42% 65.59% 1964 2004 48 Units

115 08/31/06 1.36 80.00% 80.00% 1991 76 Units

116 09/06/06 1.23 77.87% 66.03% 2006 16,206 Sq. Ft.

117 09/28/06 1.20 77.87% 72.61% 2005 18,275 Sq. Ft.

118 10/04/06 1.25 73.02% 68.03% 1953 1998 28 Units

119 08/29/06 1.41 71.54% 63.15% 1989 26,783 Sq. Ft.

120 09/22/06 1.51 63.85% 63.85% 1960 1987 21,578 Sq. Ft.

121 01/01/07 1.64 68.38% 53.20% 1997 100 Rooms

122 03/31/06 1.22 79.08% 66.48% 2006 14,820 Sq. Ft.

123 04/01/07 1.41 68.17% 68.17% 1929 20,700 Sq. Ft.

124 04/01/07 1.37 70.12% 70.12% 1933 20,475 Sq. Ft.

125 09/27/06 1.21 63.11% 53.47% 2006 41 Units

126 08/31/06 1.33 80.00% 80.00% 1985 60 Units

127 09/28/06 1.47 77.03% 65.10% 1994 16,827 Sq. Ft.

128 08/14/06 1.28 76.00% 68.58% 1986 2006 24,000 Sq. Ft.

129 04/01/07 1.40 62.96% 62.96% 1910 2001 19 Units

130 09/29/06 1.29 75.72% 64.16% Various 72,213 Sq. Ft.

130.01 09/29/06 1994 30,713 Sq. Ft.

130.02 09/29/06 1998 41,500 Sq. Ft.

131 08/11/06 1.50 63.64% 53.46% 2006 14,990 Sq. Ft.

132 06/17/06 1.98 64.05% 64.05% 2004 13,813 Sq. Ft.

133 09/17/06 1.43 60.91% 51.71% 1989 24,621 Sq. Ft.

134 08/31/06 1.38 80.00% 80.00% 1987 41 Units

135 10/03/06 1.21 60.53% 54.61% 1982 1999 30,000 Sq. Ft.

136 09/20/06 1.20 79.33% 73.94% 2006 7,200 Sq. Ft.

137 04/01/07 1.26 66.88% 66.88% 1930 12,900 Sq. Ft.

138 04/25/06 1.91 65.58% 65.58% 2006 24,341 Sq. Ft.

139 10/10/06 1.20 74.33% 63.12% 1993 12,915 Sq. Ft.

140 09/29/06 1.34 40.51% 35.88% 1922 1995 10,548 Sq. Ft.

141 Various 1.44 55.56% 47.17% 2005 24,748 Sq. Ft.

141.01 09/27/06 2005 15,568 Sq. Ft.

141.02 10/14/06 2005 9,180 Sq. Ft.

142 06/12/06 2.01 60.00% 60.00% 2005 7,000 Sq. Ft.

CUT-OFF DATE OCCUPANCY MOST MOST

MORTGAGE LOAN LOAN AMOUNT OCCUPANCY "AS OF" MOST RECENT MOST RECENT RECENT RECENT

NUMBER PER (UNIT) ($) RATE(7) DATE MOST RECENT PERIOD REVENUES ($) EXPENSES ($) NOI ($) NCF ($)

- -----------------------------------------------------------------------------------------------------------------------------------

1 38.32 95.53% 11/01/06

1.01 100.00% 11/01/06

1.02 61.50% 11/01/06

1.03 90.04% 11/01/06

1.04 100.00% 11/01/06

1.05 96.37% 11/01/06

1.06 100.00% 11/01/06

1.07 100.00% 11/01/06

1.08 100.00% 11/01/06

1.09 100.00% 11/01/06

1.10 100.00% 11/01/06

1.11 100.00% 11/01/06

1.12 100.00% 11/01/06

1.13 100.00% 11/01/06

1.14 100.00% 11/01/06

1.15 100.00% 11/01/06

1.16 100.00% 11/01/06

1.17 100.00% 11/01/06

1.18 100.00% 11/01/06

1.19 100.00% 11/01/06

1.20 100.00% 11/01/06

1.21 100.00% 11/01/06

1.22 80.63% 11/01/06

1.23 100.00% 11/01/06

1.24 100.00% 11/01/06

1.25 90.77% 11/01/06

1.26 100.00% 11/01/06

1.27 100.00% 11/01/06

2 71.31 97.45% Various TTM June 2006 44,817,910 12,831,740 31,986,170 31,329,965

2.01 97.12% 08/01/06 TTM June 2006 2,290,565 826,671 1,463,894 1,428,877

2.02 97.96% 08/01/06 TTM June 2006 2,956,146 979,838 1,976,308 1,920,705

2.03 93.96% 08/01/06 TTM June 2006 2,954,023 1,134,820 1,819,203 1,801,262

2.04 97.77% 08/01/06 TTM June 2006 2,768,399 820,820 1,947,579 1,902,676

2.05 100.00% 08/01/06 TTM June 2006 2,565,142 295,101 2,270,041 2,233,830

2.06 96.01% 08/01/06 TTM June 2006 1,706,822 376,114 1,330,708 1,305,566

2.07 97.96% 08/01/06 TTM June 2006 1,451,419 337,887 1,113,532 1,084,143

2.08 100.00% 08/01/06 TTM June 2006 2,349,638 480,116 1,869,522 1,816,650

2.09 88.34% 08/01/06 TTM June 2006 1,319,013 396,334 922,679 901,898

2.10 98.43% 10/30/06 TTM June 2006 5,975,921 2,071,864 3,904,057 3,865,840

2.11 97.86% 08/01/06 TTM June 2006 3,294,075 671,556 2,622,519 2,545,064

2.12 95.10% 08/01/06 TTM June 2006 2,644,366 679,280 1,965,086 1,890,637

2.13 100.00% 08/01/06 TTM June 2006 338,323 64,164 274,159 271,759

2.14 97.84% 08/01/06 TTM June 2006 2,499,845 686,350 1,813,495 1,788,508

2.15 94.87% 08/01/06 TTM June 2006 4,588,316 2,152,269 2,436,047 2,396,562

2.16 100.00% 08/01/06 TTM June 2006 5,115,897 858,556 4,257,341 4,175,987

3 363.32 90.71% 08/11/06 TTM 7/06 27,275,603 8,721,829 18,553,774 18,440,925

4 90.58 98.93% 08/01/06 TTM June 2006 29,134,103 6,841,377 22,292,726 21,937,149

4.01 100.00% 08/01/06 TTM June 2006 1,578,604 557,504 1,021,100 1,008,841

4.02 100.00% 08/01/06 TTM June 2006 1,395,754 303,279 1,092,475 1,071,689