The Mortgage Loans included in the Trust Fund provide that, in the event of a partial prepayment of such Mortgage Loan due to the receipt of insurance proceeds or a condemnation award in connection with a casualty or condemnation, the monthly debt service payment of such Mortgage Loan will remain unchanged. See ‘‘RISK FACTORS—The Offered Certificates—Prepayments Will Affect Your Yield’’ in this prospectus supplement.

Certain of the Mortgage Loans provide for a recast of the amortization schedule and an adjustment of the scheduled debt service payments of the related Mortgage Loan upon certain applications of insurance proceeds or condemnation awards to the related unpaid principal balance of such Mortgage Loan.

See ‘‘YIELD AND MATURITY CONSIDERATIONS—Yield Considerations’’ and the modeling assumptions described in ‘‘YIELD AND MATURITY CONSIDERATIONS—Weighted Average Life’’ in this prospectus supplement.

Generally, neither the Master Servicer nor the Special Servicer is permitted to waive or modify the terms of any Mortgage Loan prohibiting voluntary prepayments during a Lockout Period or requiring the

Table of Contentspayment of a Prepayment Premium or Yield Maintenance Charge except under the circumstances described in ‘‘SERVICING OF THE MORTGAGE LOANS—Modifications, Waivers and Amendments’’ in this prospectus supplement.

Other Financing. With limited exceptions, all of the Mortgage Loans prohibit the related borrower from encumbering the Mortgaged Property with additional secured debt without the mortgagee’s prior consent and, also with limited exceptions, prohibit the entities with a controlling interest in the related borrower from pledging their interests in such borrower as security for mezzanine debt.

With respect to 7 Mortgage Loans (loan numbers 1, 8, 22, 27, 28, 55 and 131), representing 13.0% of the Cut-Off Date Pool Balance (3 Mortgage Loans in Loan Group 1 or 12.5% of the Cut-Off Date Group 1 Balance and 4 Mortgage Loans in Loan Group 2 or 15.5% of the Cut-Off Date Group 2 Balance), the ownership interests of the direct or indirect owners of the related borrower have been pledged as security for mezzanine debt subject to the terms of an intercreditor agreement entered into in favor of the mortgagee.

With respect to 4 Mortgage Loans (loan numbers 7, 42, 47 and 162), representing approximately 4.6% of the Cut-Off Date Pool Balance (2 Mortgage Loans in Loan Group 1 or 1.0% of the Cut-Off Date Group 1 Balance and 2 Mortgage Loans in Loan Group 2 or 23.8% of Cut-Off Date Group 2 Balance), the related borrower has incurred subordinate debt secured by a second mortgage of $25,000, $5,150,000, $3,850,000 and $320,000, respectively, encumbering the related Mortgaged Property, which is subject to a subordination and standstill agreement.

With respect to 30 Mortgage Loans (loan numbers 1, 2, 3, 5, 6, 7, 8, 11, 12, 14, 17, 25, 26, 28, 36, 40, 51, 61, 62, 81, 84, 93, 114, 117, 122, 130, 138, 141, 156 and 160), representing 51.2% of the Cut-Off Date Pool Balance (25 Mortgage Loans in Loan Group 1 or 54.7% of the Cut-Off Date Group 1 Balance and 5 Mortgage Loans in Loan Group 2 or 32.5% of the Cut-Off Date Group 2 Balance), the related Mortgage Loan documents provide that, under certain circumstances (which may include satisfaction of DSCR and LTV tests, the consent of the mortgagee and/or written confirmation from the rating agencies that any ratings of the certificates will not, as a result of the proposed debt, be downgraded, qualified or withdrawn), ownership interests in the related borrowers may be pledged as security for mezzanine debt in the future, subject to the terms of a subordination and standstill agreement or intercreditor agreement to be entered into in favor of the mortgagee.

With respect to 1 Mortgage Loan listed above (loan number 1), representing approximately 7.9% of the Cut-Off Date Pool Balance (9.4% of the Cut-Off Date Group 1 Balance), the owners of the borrower are permitted to obtain additional or replacement financing, which may be subordinate debt or mezzanine debt, after the existing junior mezzanine debt in the original principal amount of $200,000,000 has been paid in full; provided that (a) the amount of such additional junior indebtedness is either (i) reasonably acceptable to lender or (ii) with respect to mezzanine debt, in an amount such that when added to the then outstanding principal balance of the Mortgage Loan and the outstanding balance of the related senior mezzanine loan, if applicable, results in a loan-to-value ratio not in excess of 89%, based on a new appra isal; and (b) the lender must have received written confirmation from the applicable rating agencies that the incurrence of such indebtedness will not result in the downgrade, qualification or withdrawal of the ratings then assigned to the Certificates or any commercial mortgage pass-through certificates backed by a related pari passu companion loan.

With respect to 1 Mortgage Loan listed above (loan number 3), representing approximately 7.4% of the Cut-Off Date Pool Balance (8.7% of the Cut-Off Date Group 1 Balance), the related Mortgage Loan documents permit one of the equity owners of the related borrower to pledge its direct or indirect interest in the related borrower to an institutional lender meeting the requirements set forth in the related Mortgage Loan documents to secure debt other than mortgage indebtedness secured by the related mortgaged property. Such institutional lender may have the right to foreclosure or other realization upon such pledge in certain circumstances.

With respect to 1 Mortgage Loan listed above (loan number 5), representing approximately 5.6% of the Cut-Off Date Pool Balance (6.6% of the Cut-Off Date Group 1 Balance), the related Mortgage Loan documents permit a direct or indirect owner of the related borrower to pledge the interests it owns in the

S-94

Table of Contentsrelated borrower as security for a corporate or parent level credit facility from one or more financial institutions (a) that have total assets (in name or under management) in excess of $600,000,000 and (except with respect to a pension advisory firm or similar fiduciary) capital/statutory surplus or shareholder’s equity of $250,000,000 and (b) that are regularly engaged in the business of making or owning commercial real estate loans or operating commercial mortgage properties, in connection with a corporate or parent level credit facility.

With respect to 1 Mortgage Loan (loan number 152), representing approximately 0.1% of the Cut-Off Pool Balance (0.1% of the Cut-Off Date Group 1 Balance), the related Mortgage Loan documents provide that the related borrower may incur additional debt (a) secured by the Mortgaged Property or (b) secured by ownership interests in the related borrower pledged as security for such loan.

With respect to 1 Mortgage Loan (loan number 58), representing 0.4% of the Cut-Off Date Pool Balance (0.4% of the Cut-Off Date Group 1 Balance), the related Mortgage Loan documents provide that, under certain circumstances, the related borrowers may incur additional unsecured debt (in addition to unsecured trade payables in customary amounts incurred in the ordinary course of business).

With respect to 3 Mortgage Loans (loan numbers 69, 154 and 164), representing approximately 0.4% of the Cut-Off Date Pool Balance (1 Mortgage Loan or 0.3% of the Cut-Off Date Group 1 Balance and 2 Mortgage Loans or 0.6% of the Cut-Off Date Group 2 Balance), the related Mortgage Loan documents provide that, under certain circumstances, the related borrowers may incur additional unsecured debt in favor of affiliates, subject to the terms of a subordination and standstill agreement to be entered into in favor of the mortgagee.

With respect to 1 Mortgage Loan (loan number 82), representing approximately 0.2% of the Cut-Off Date Pool Balance (0.3% of the Cut-Off Date Group 1 Balance), the related Mortgage Loan documents provide that the related borrowers may incur additional debt secured by the Mortgaged Property.

Further, certain of the Mortgage Loans included in the Trust Fund do not prohibit limited partners or other owners of non-controlling interests in the related borrower from pledging their interests in the borrower as security for mezzanine debt. See ‘‘RISK FACTORS—The Mortgage Loans—Additional Debt on Some Mortgage Loans Creates Additional Risks’’ in this prospectus supplement.

In addition, with respect to the Whole Loans, the related Mortgaged Property also secures one or more Companion Loans. See ‘‘Co-Lender Loans’’ in this prospectus supplement.

Nonrecourse Obligations. The Mortgage Loans are generally nonrecourse obligations of the related borrowers and, upon any such borrower’s default in the payment of any amount due under the related Mortgage Loan, the holder thereof may look only to the related Mortgaged Property for satisfaction of the borrower’s obligations. In addition, in those cases where recourse to a borrower or guarantor is purportedly permitted, the Depositor has not undertaken an evaluation of the financial condition of any such person, and prospective investors should therefore consider all of the Mortgage Loans to be nonrecourse.

Due-On-Sale and Due-On-Encumbrance Provisions. Substantially all of the Mortgages contain ‘‘due-on-sale’’ and ‘‘due-on-encumbrance’’ clauses that, in general, permit the holder of the Mortgage to accelerate the maturity of the related Mortgage Loan if the borrower sells or otherwise transfers or encumbers the related Mortgaged Property or prohibit the borrower from doing so without the consent of the holder of the Mortgage. However, certain of the Mortgage Loans may permit one or more transfers of the related Mortgaged Property or the transfer of a controlling interest in the related borrower to pre-approved transferees or pursuant to pre-approved conditions (including without limitation, as and to the extent permitted under the related Mortgage Loan documents, transfers to or between borrower affiliates, family members, partners and other co-owners and their affiliates, estate planning transfers and transfers upon death or disability, and transfers to transferees meeting criteria set forth in the related Mortgage Loan documents) without the approval of the mortgagee, and certain Mortgage Loans may not prohibit transfers of limited partnership interests or non-managing member interests in the related borrowers. For example , the terms of 8 Mortgage Loans (loan numbers 25, 33, 36, 74, 102, 118, 124 and 165) representing 2.4% of the Cut-Off Date Pool Balance (6 Mortgage Loans in Loan Group 1 or 2.2% of the Cut-Off Date Group 1 Balance and 2 Mortgage Loans in Loan Group 2 or 3.8% of the Cut-Off Date

S-95

Table of ContentsGroup 2 Balance), permit the borrowers to transfer tenant-in-common interests to certain transferees as specified in the related Mortgage Loan documents, or to investors that qualify as ‘‘accredited investors’’ under the Securities Act. In the case of certain Mortgage Loans, the related borrower is required under the terms of the related loan documents to transfer the Mortgaged Property to an affiliate in the future that will assume the related Mortgage Loan. As provided in, and subject to, the Pooling and Servicing Agreement, the Master Servicer or the Special Servicer will determine, in a manner consistent with the servicing standard described under ‘‘SERVICING OF THE MORTGAGE LOANS—General’’ in this prospectus supplement whether to exercise any right the mortgagee may have under any such clause to accelerate payment of the related Mortgage Loan upon, or to withhold its consent to, any transfer or further encumbrance of the related Mortgaged Proper ty.

Cross-Default and Cross-Collateralization of Certain Mortgage Loans; Certain Multi-Property Mortgage Loans. Six (6) groups of Mortgage Loans are groups of Mortgage Loans that are cross-collateralized and/or cross-defaulted with each of the other Mortgage Loans in their respective groups, as indicated in Annex A-5 to this prospectus supplement. Although the Mortgage Loans within each group of cross-collateralized and/or cross-defa ulted Mortgage Loans are generally cross-collateralized and/or cross-defaulted with the other Mortgage Loans in such group, the Mortgage Loans in one group are not cross-collateralized or cross-defaulted with the Mortgage Loans in any other group. As of the Closing Date, no Mortgage Loan, except the Whole Loans, will be cross-collateralized or cross-defaulted with any loan that is not included in the Mortgage Pool. See ‘‘RISK FACTORS—The Mortgage Loans—Limitations on the Benefits of Cross-Collateralized and Cross-Defaulted Properties’’ in this prospectus supplement. The Master Servicer or the Special Servicer, as the case may be, will determine whether to enforce the cross-default and cross-collateralization rights upon a mortgage loan default with respect to any of these Mortgage Loans. The Certificateholders will not have any right to participate in or control any such determination. No other Mortgage Loans are subject to cross-collateralization or cross-defaul t provisions.

Partial Releases. Certain of the Mortgage Loans permit a partial release of a portion of the related Mortgaged Property not material to the underwriting of the Mortgage Loan at the time of origination, without any prepayment or defeasance of the Mortgage Loan.

For example, with respect to 1 Mortgage Loan (loan number 5), representing approximately 5.6% of the Cut-Off Date Pool Balance 6.6% of the Cut-Off Date Group 1 Balance), the related Mortgage Loan documents permit the related borrower to obtain the release of the air rights above the improvements on the Mortgaged Property to a third party in connection with the development of a condominium or vertical space subdivision of improvements to be constructed by such third party or sold in the air space from the lien of the Mortgage upon satisfaction of certain conditions, including but not limited to: delivery by the related mortgage borrower to the mortgagee of (i) a site plan showing the proposed air space development, (ii) legal description for the air rights, (iii) ALTA survey showing the air rights area, (iv) any air space development documentation submitted to a governmental authority, (v) an endorsement to the mortgage lender’s title policy for the remaini ng property, (vi) zoning approvals and (vii) other documentation set forth in the related loan agreement.

Additionally, with respect to 2 Mortgage Loans (loan numbers 3 and 5), representing approximately 12.9% of the Cut-Off Date Pool Balance (15.3% of the Cut-Off Date Group 1 Balance), the related Mortgage Loan documents permit the related borrower, without consent of the mortgagee, provided no event of default occurs and is continuing, to (i) make transfers of immaterial or non-income producing portions of the Mortgaged Property to any federal, state or local government or any political subdivision thereof in connection with takings or condemnations of any portion of the Mortgaged Property for dedication or public use and (ii) make transfers of non-income producing portions of the Mortgaged Property (by sale, ground lease, sublease or other conveyance of any interest) to third parties, including, without limitation, owners of out parcels and department store pads, pads for office buildings, hotels or other properties for the purpose of erecting and operating addit ional structures or parking facilities whose use is integrated and consistent with the use of the Mortgaged Property; provided, however, it is a condition to any of the transfers or encumbrances in (ii) above that no transfer, conveyance or other encumbrance shall result in a Material Adverse Effect. A ‘‘Material Adverse Effect’’ shall mean any event or condition that has a material adverse effect on (a) the value of the Mortgaged Property, (b) the business

S-96

Table of Contentsoperations or financial condition of the related mortgage borrower, (c) the ability of the related Borrower to repay the Mortgage Loan and (d) in the case of the Independence Center Mortgage Loan, the compliance of the Mortgaged Property with any legal requirements.

One (1) Mortgage Loan (loan number 1), representing 7.9% of the Cut-Off Date Pool Balance (9.4% of the Cut-Off Date Group 1 Balance), permits the related borrower to obtain the release of the parcels known as the parking garage and the non-Fifth Avenue retail space at the Mortgaged Property after the later to occur of the date on which the Mortgaged Property’s conversion to a condominium is complete and the expiration of the defeasance lockout period at a release price equal to $8,550,000 with respect to the parking garage space and $95,000,000 with respect to the non-Fifth Avenue retail space if, among other things, (a) the senior mezzanine borrower has prepaid (or is simultaneously prepaying) the senior mezzanine loan in full, (b) the junior mezzanine borrower has prepaid (or is simultaneously prepaying) the junior mezzanine loan in an amount equal to all remaining net sales proceeds and (c) after giving effect to such release, the DSCR is at least equal to the DSCR for the property (including the release parcel) for the 12 months immediately preceding the release. In addition, the related borrower is permitted to obtain the release of the portion of the Mortgaged Property consisting of the Fifth Avenue retail space without prepayment of the Mortgage Loan on or after the date on which the Mortgaged Property’s conversion to a condominium is complete, if, among other things, (a) the junior mezzanine debt has not been paid in full, (b) in the event that such release occurs prior to July 1, 2008, the borrower has deposited an amount equal to $105,000,000, less $2,500,000 for every full calendar month, if any, that the release occurs prior to July 1, 2008, to be held and disbursed in accordance with the Mortgage Loan documents, (c) the senior mezzanine borrower has prepaid (or is simultaneously prepaying) the senior mezzanine loan in full, (d) the junior mezzanine borrower has prepaid (or is simultaneously prepaying) (i) in connect ion with a sale of the Fifth Avenue retail space to a third party, the junior mezzanine loan in an amount equal to all remaining net sales proceeds or (ii) in connection with a refinancing of the Fifth Avenue retail space, the entire balance of the junior mezzanine loan and (e) with respect to the remaining Mortgaged Property (not including the released portion of the Mortgaged Property), the loan-to-value ratio (including the remaining junior mezzanine debt and/or junior indebtedness, if applicable) is not more than 89%.

Eight (8) of the Mortgage Loans (loan numbers 2, 4, 7, 9, 11, 13, 26 and 68), representing 25.8% of the Cut-Off Date Pool Balance (7 Mortgage Loans in Loan Group 1 or 26.3% of the Cut-Off Date Group 1 Balance and 1 Mortgage Loan in Loan Group 2 or 23.6% of the Cut-Off Date Group 2 Balance), permit a partial release of a portion or portions of the related Mortgaged Property or one or more entire Mortgaged Property(ies) in the case of a multi-property loan; provided that among other things, (i) prior to the release of the portion or portions of the related Mortgaged Property or one or more entire Mortgaged Properties in the case of a multi-property loan, a specified percentage (generally between 100% and 120%) of the allocated loan amount for such released Mortgaged Property(ies) or p ortion(s) of a Mortgaged Property may be prepaid or partially defeased, or alternatively, partial defeasance of an amount specified in the related Mortgage Loan documents and (ii) certain DSC Ratio and LTV tests are satisfied at the time of the partial release with respect to the remaining portion of the related Mortgaged Property after the partial release. See ‘‘Three Borough Pool’’, ‘‘84 Lumber Industrial Pool’’, ‘‘ING Hospitality Pool’’, ‘‘Ashford Hospitality Pool 6’’, ‘‘Central/Eastern Industrial’’ and ‘‘Nordic Cold Storage Pool’’ in Annex D to this prospectus supplement.

With respect to 1 Mortgage Loan (loan number 157), representing 0.1% of the Cut-Off Date Pool Balance (0.3% of the Cut-Off Date Group 2 Balance), the related Mortgage Loan documents permit the related borrower to obtain the partial release of an unimproved portion of the related Mortgaged Property for no consideration; provided that, among other things, (i) there shall be no event of default and (ii) the conditions set forth in the related Mortgage Loan documents shall be satisfied.

Substitutions. Twelve (12) mortgage loans (loan numbers 11, 13, 23, 31, 34, 40, 54, 114, 121, 122, 156 and 160), representing 6.8% of the Cut-off Date Pool Balance (8.0% of the Cut-Off Date Group 1 Balance), permit the related borrowers to substitute Mortgaged Properties of like kind and quality for the properties securing the related Mortgage Loans, subject to certain conditions, including LTV tests and DSC tests, and, in certain cases, the related Mortgage Loan documents also provide for the delivery of an opinion of counsel that the proposed substitution will not adversely affect the REMIC status of the Trust

S-97

Table of ContentsFund and written confirmation from the Rating Agencies that any ratings of the Certificates will not, as a result of the proposed substitution, be downgraded, qualified or withdrawn. See ‘‘RISK FACTORS —The Mortgage Loans—Substitution of Mortgaged Properties May Lead to Increased Risks’’ in this prospectus supplement.

Certain State-Specific Considerations

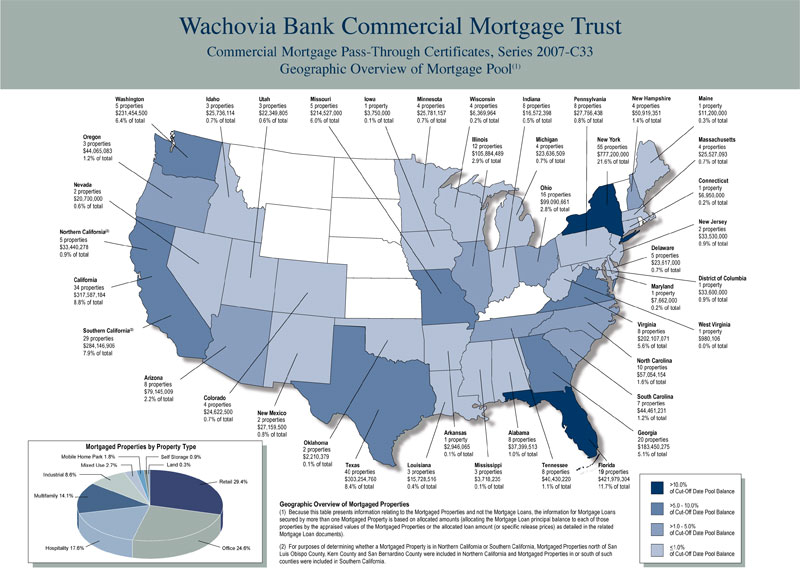

Fifty-five (55) of the Mortgaged Properties, representing, by allocated loan amount, 21.6% of the Cut-Off Date Pool Balance (11 Mortgaged Properties in Loan Group 1 or 17.9% of the Cut-Off Date Group 1 Balance and 44 Mortgaged Properties in Loan Group 2 or 41.2% of the Cut-off Date Group 2 Balance) are located in the State of New York. As a result of this concentration, any adverse economic impact on the New York area may have a more pronounced effect on certificateholders as compared with a similar economic impact on other geographical areas.

In addition, laws related to foreclosure may be more or less favorable to lenders depending on the state. New York law requires a mortgagee to elect either a foreclosure action or a personal action against the borrower, and to exhaust the security under the mortgage, or exhaust its personal remedies against the borrower, before it may bring the other such action. The practical effect of the election requirement is that mortgagees will usually proceed first against the security rather than bringing personal action against the borrower. Other statutory provisions limit any deficiency judgment against the former borrower following a judicial sale to the excess of the outstanding debt over the fair market value of the property at the time of the public sale. The purpose of these statutes is generally to prevent a mortgagee from obtaining a large deficiency judgment against the former borrower as a result of low bids or the absence of bids at the judicial sale.

Nineteen (19) of the Mortgaged Properties, representing, by allocated loan amount, 11.7% of the Cut-Off Date Pool Balance (16 Mortgaged Properties in Loan Group 1 or 12.8% of the Cut-Off Date Group 1 Balance and 3 Mortgaged Properties in Loan Group 2 or 5.9% of the Cut-Off Date Group 2 Balance), are located in the State of Florida. Mortgage loans involving real property in Florida are secured by mortgages and foreclosures are accomplished by judicial foreclosure. There is no power of sale in Florida. After an action for foreclosure is commenced and the lender secures a judgment, the final judgment will provide that the property be sold at a public sale at the courthouse if the full amount of the judgment is not paid prior to the scheduled sale. Generally, the foreclosure sale must occur no earlier than 20 (but not more than 35) days after the judgment is entered. During this period, a notice of sale must be published twice in the county in which the property is located. There is no right of redemption after the foreclosure sale. Florida does not have a ‘‘one action rule’’ or ‘‘anti-deficiency legislation.’’ Subsequent to a foreclosure sale, however, a lender may be required to prove the value of the property sold as of the date of foreclosure in order to recover a deficiency. Further, other statutory provisions in Florida limit any deficiency judgment (if otherwise permitted) against a borrower following a judicial sale to the excess of the outstanding debt over the value of the property at the time of the judicial sale. In certain circumstances, the lender may have a receiver appointed.

Assessments of Property Condition

Property Inspections. Generally, the Mortgaged Properties were inspected by or on behalf of the Mortgage Loan Sellers in connection with the origination or acquisition of the related Mortgage Loans to assess their general condition. No inspection revealed any patent structural deficiency or any deferred maintenance considered material and adverse to the value of the Mortgaged Property as security for the related Mortgage Loan, except in such cases where adequate reserves have been established.

Appraisals. All of the Mortgaged Properties were appraised by a state-certified appraiser or an appraiser belonging to the Appraisal Institute in accordance with the Federal Institutions Reform, Recovery and Enforcement Act of 1989. The primary purpose of each appraisal was to provide an opinion as to the market value of the related Mortgaged Property. There can be no assurance that another appraiser would have arrived at the same opinion of market value. In addition, with respect to 54 Mortgaged Properties securing 9 Mortgage Loans (loan numbers 2, 37, 60, 67, 71, 82, 95, 134 and 137), representing, by allocated loan amount, 9.9% of the Cut-Off Date Pool Balance (8 Mortgage Loans in

S-98

Table of ContentsLoan Group 1 or 11.5% of the Cut-Off Date Group 1 Balance and 1 Mortgage Loan in Loan Group 2 or 1.1% of the Cut-Off Date Group 2 Balance), the appraised value represented is the ‘‘as-stabilized’’ value. See also ‘‘RISK FACTORS—The Mortgage Loans—Inspections and Appraisals May Not Accurately Reflect Value or Condition of Mortgaged Property’’ and ‘‘DESCRIPTION OF THE MORTGAGE POOL—Additional Mortgage Loan Information’’ in this prospectus supplement.

Environmental Assessments. A ‘‘Phase I’’ environmental site assessment was performed by independent environmental consultants with respect to each Mortgaged Property in connection with the origination of the related Mortgage Loans. ‘‘Phase I’’ environmental site assessments generally do not include environmental testing. In certain cases, environmental testing, including in some cases a ‘‘Phase II’’ environmental site assessment as recommended by such ‘‘Phase I’’ assessment, was performed. Generally, in each case where environmental assessments recommended corrective action, the originator of the Mortgage Loan determined that the necessary corrective action had been undertaken in a satisfactory manner, was being undertaken in a satisfactory manner or that such corrective action would be adequately addressed post-closing. In some instances, the originator required that reserves be established to cover the estimated cost of such remediation or an environmental insurance policy was obtained from a third-party. See also ‘‘RISK FACTORS—The Mortgage Loans—Environmental Laws May Adversely Affect the Value of and Cash Flow from a Mortgaged Property’’ in this prospectus supplement.

Engineering Assessments. In connection with the origination of all of the Mortgage Loans, a licensed engineer or architect inspected the related Mortgaged Property to assess the condition of the structure, exterior walls, roofing, interior structure and mechanical and electrical systems. The resulting reports indicated deferred maintenance items and/or recommended capital improvements on the Mortgaged Properties. Generally, with respect to a majority of Mortgaged Properties, the related borrowers were required to deposit with the mortgagee an amount equal to at least 100% of the licensed engineer’s estimated cost of the recommended repairs, corrections or replacements to assure their completion; provided, however, the mortgagee may waive such required deposits under certain circumstances.

Earthquake Analyses. An architectural and/or engineering consultant performed an analysis on certain Mortgaged Properties located in areas considered to be an earthquake risk, which includes California, in order to evaluate the structural and seismic condition of the property and to assess, based primarily on statistical information, the maximum probable loss for the property in an earthquake scenario. The resulting reports concluded that, in the event of an earthquake, 7 Mortgaged Properties (loan numbers 2.02, 2.05, 2.08, 2.09, 12, 76 and 135) representing, by allocated loan amount, 3.4% of the Cut-Off Date Pool Balance (4.0% of the Cut-Off Date Group 1 Balance) is likely to suffer a probable maximum loss equal to or in excess of 20% of the amount of the estimated replacement cost of the improvements located on the related Mortgag ed Property. The related Mortgage Loan Seller required the related borrower to obtain earthquake insurance to protect against these risks.

Co-Lender Loans

General

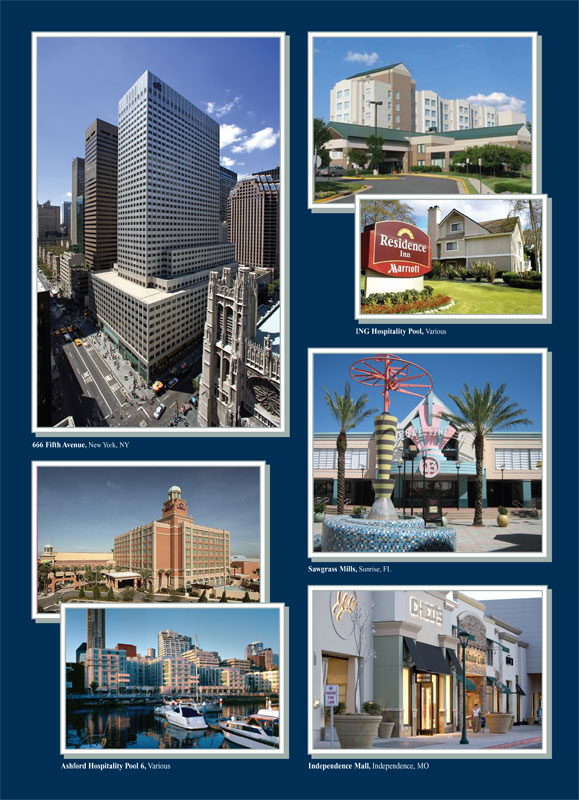

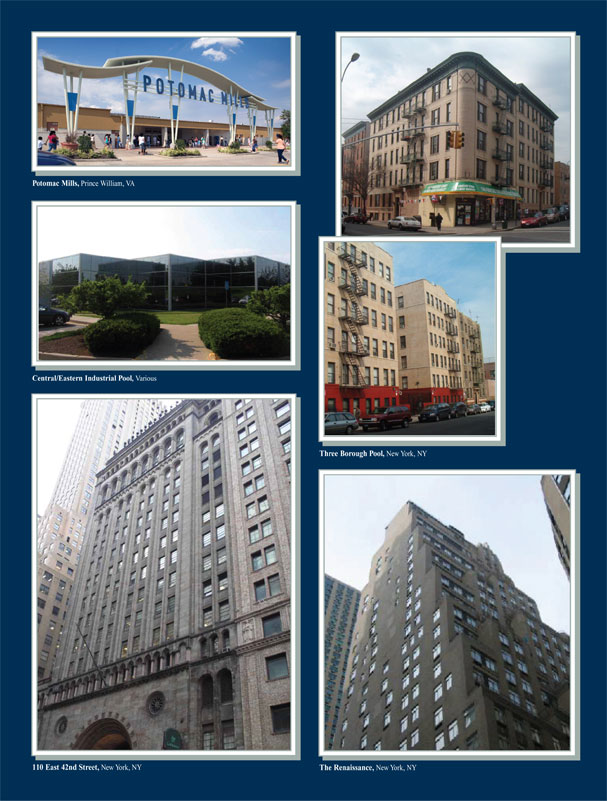

Eleven (11) Mortgage Loans (loan number 1, the ‘‘666 Fifth Avenue Loan’’, loan number 2, the ‘‘ING Hospitality Pool Loan’’, loan number 3, the ‘‘Sawgrass Mills Loan’’, loan number 6, the ‘‘Potomac Mills Loan’’ loan number 9, the ‘‘Central/Eastern Industrial Pool Loan’’, loan number 10, ‘‘The Renaissance Loan’’, loan number 11, the ‘‘84 Lumber Industrial Pool Loan’’, loan number 13, the ‘‘Nordic Cold Storage Pool Loan’’, loan number 20, the ‘‘4929 Wilshire Loan’’, loan number 49, the ‘‘Deerwood MHP I Loan’’ and loan number 50, the ‘‘Deerwood MHP II Loan’’ (each, a ‘‘Whole Loan’’ and collectively, the ‘‘Whole Loans’’)), are each evidenced by one (or in the case of the 666 Fifth Avenue Loan, two) of two or more notes each secured by a single mortgage and a single assignment of leases and rents. In addition to the Whole Loans, certain other mortgage loans have additional debt. See ‘‘RISK FACTORS—The Mortgage Loans—Additional Debt on Some Mortgage Loans Creates Additional Risks’’ in this prospectus supplement.

S-99

Table of ContentsThe 666 Fifth Avenue Loan is part of a split loan structure, which consists of 8 pari passu Mortgage Loans. Two of these Mortgage Loans are included in the trust fund. The remaining six Mortgage Loans are not included in the trust fund (the ‘‘666 Fifth Avenue Pari Passu Companion Loans’’). The 666 Fifth Avenue Companion Loans and the 666 Fifth Avenue Loan are herein collectively referred to as the ‘‘666 Fifth Avenue Whole Loan’’. The 666 Fifth Avenue Loan has a Cut-Off Date Balance of $285,500,000, representing 7.9% of the Cut-Off Date Pool Balance (9.4% of the Cut-Off Date Group 1 Balance). Two of the 666 Fifth Avenue Pari Passu Companion Loans are include d in the trust fund created in connection with the GECMC 2007-C1 transaction (the ‘‘GECMC 2007-C1 Transaction’’ and the related trust fund, the ‘‘GECMC 2007-C1 Trust Fund’’). Two of the other 666 Fifth Avenue Pari Passu Companion Loans are included in the trust fund created in connection with the Wachovia Bank 2007-C31 transaction and two of the other 666 Fifth Avenue Pari Passu Companion Loans in the aggregate principal amount of $285,500,000 are currently owned by UBS Real Estate Securities, Inc. The 666 Fifth Avenue Pari Passu Companion Loans will not be included in the Trust Fund. See ‘‘666 Fifth Avenue Loan’’ in Annex D to this prospectus supplement.

The ING Hospitality Pool Loan is part of a split loan structure, which has a companion loan (the ‘‘ING Hospitality Pool Pari Passu Companion Loan’’), in which the ING Hospitality Pool Pari Passu Companion Loans are pari passu in right of entitlement to payment with the ING Hospitality Pool Loan. The ING Hospitality Pool Pari Passu Companion Loans and the ING Hospitality Pool Loan are referred to collectively herein as the ‘‘ING Hospitality Pool Whole Loan’’. The ING Hospitality Pool Pari Passu Companion Loans were included in the trust fund cre ated in connection with the Wachovia Bank 2007-C32 transaction. The ING Hospitality Pool Loan has a Cut-Off Date Balance of $283,850,000, representing 7.9% of the Cut-Off Date Pool Balance (9.3% of the Cut-Off Date Group 1 Balance). None of the ING Hospitality Pool Pari Passu Companion Loans will be included in the Trust Fund. See ‘‘ING Hospitality Pool’’ in Annex D to this prospectus supplement.

The Sawgrass Mills Loan is part of a split loan structure, which has multiple pari passu companion loans (collectively, the ‘‘Sawgrass Mills Pari Passu Companion Loans’’), with respect to which the Sawgrass Mills Pari Passu Companion Loan is pari passu in right of entitlement to payment with the Sawgrass Mills Loan, and has multiple subordinate companion loans (collectively, the ‘‘Sawgrass Mills Subordinate Companion Loans’’), with respect to which the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans are senior in right of entitlement to payment. The Sawgrass Mills Pari Passu Companion Loans, the Sawgrass Mills Loan and the Sawgrass Mills Subordinate Companion Loans are referred to collectively herein as the ‘‘Sawgrass Mills Whole Loan’’. One of the Sawgrass Mills Pari Passu Companion Loans is expected to be included in the trust fund created in connection with the J.P. Morgan 2007-LDP12 transaction. The Sawgrass Mills Loan has a Cut-Off Date Balance of $265,294,118, representing 7.4% of the Cut-Off Date Pool Balance (8.7% of the Cut-Off Date Group 1 Balance). None of the Sawgrass Mills Pari Passu Companion Loans or Sawgrass Mills Subordinate Companion Loans will be included in the Trust Fund. See ‘‘Sawgrass Mills’’ in An nex D to this prospectus supplement.

The Potomac Mills Loan is part of a split loan structure, which has a companion loan (the ‘‘Potomac Mills Pari Passu Companion Loan’’), in which the Potomac Mills Pari Passu Companion Loan is pari passu in right of entitlement to payment with the Potomac Mills Loan. The Potomac Mills Pari Passu Companion Loan and the Potomac Mills Loan are referred to collectively herein as the ‘‘Potomac Mills Whole Loan’’. The Potomac Mills Loan has a Cut-Off Date Balance of $164,000,000, representing 4.6% of the Cut-Off Date Pool Balance (5.4% of the Cut-Off Date Group 1 Balance). None of the Potomac Mills Pari Passu Companion Loans will be included in the Trust Fund. See ‘‘Potomac Mills’’ in Annex D to this prospectus supplement.

The 84 Lumber Industrial Pool Loan is part of a split loan structure, which has a companion loan (the ‘‘84 Lumber Industrial Pool Pari Passu Companion Loan’’), in which the 84 Lumber Industrial Pool Pari Passu Companion Loan is pari passu in right of entitlement to payment with the 84 Lumber Industrial Pool Loan. The 84 Lumber Industrial Pool Pari Passu Companion Loan and the 84 Lumber Industrial Pool Loan are referred to collectively herein as the ‘‘84 Lumber Industrial Pool Whole Loan’’. The 84 Lumber Industrial Pool Loan has a Cut-Off Date B alance of $75,008,971, representing 2.1% of the Cut-Off Date Pool Balance (2.5% of the Cut-Off Date Group 1 Balance). The 84 Lumber Industrial Pool

S-100

Table of ContentsPari Passu Companion Loan will not be included in the Trust Fund. See ‘‘84 Lumber Industrial Pool’’ in Annex D to this prospectus supplement.

The Nordic Cold Storage Pool Loan, which has 1 companion loan (the ‘‘Nordic Cold Storage Pool Subordinate Companion Loan’’), is part of a split loan structure in which the Nordic Cold Storage Pool Subordinate Companion Loan is subordinate in its right of entitlement to payment to the Nordic Cold Storage Pool Loan. The Nordic Cold Storage Pool Loan has a Cut-Off Date Balance of $55,500,000, representing 1.5% of the Cut-Off Date Pool Balance (1.8% of the Cut-Off Date Group 1 Balance). The Nordic Cold Storage Pool Subordinate Companion Loan will not be included in the Trust Fund. See ‘‘Nordic Cold Storage Pool’’ in Annex D to this prospectus supplement.

The Deerwood MHP I Loan, which has 1 companion loan (the ‘‘Deerwood MHP I Subordinate Companion Loan’’) is part of a split loan structure in which the Deerwood MHP I Subordinate Companion Loan is subordinate in its right of entitlement to payment to the Deerwood MHP I Loan. The Deerwood MHP I Loan has a Cut-Off Date Pool Balance of $14,413,500, representing 0.4% of the Cut-Off Date Pool Balance (2.6% of the Cut-Off Date Group 2 Balance). The Deerwood MHP I Subordinate Companion Loan will not be included in the Trust Fund.

The Deerwood MHP II Loan, which has 1 companion loan (the ‘‘Deerwood MHP II Subordinate Companion Loan’’) is part of a split loan structure in which the Deerwood MHP II Subordinate Companion Loan is subordinate in its right of entitlement to payment to the Deerwood MHP II Loan. The Deerwood MHP II Loan has a Cut-Off Date Pool Balance of $14,413,500, representing 0.4% of the Cut-Off Date Pool Balance (2.6% of the Cut-Off Date Group 2 Balance). The Deerwood MHP II Subordinate Companion Loan will not be included in the Trust Fund.

The Renaissance Loan, which has 1 companion loan (the ‘‘Renaissance Subordinate Companion Loan’’), is part of a split loan structure in which the Renaissance Subordinate Companion Loan is subordinate in its right of entitlement to payment to the Renaissance Loan. The Renaissance Loan has a Cut-Off Date Balance of $84,000,000, representing 2.3% of the Cut-Off Date Pool Balance (14.9% of the Cut-Off Date Group 2 Balance). The Renaissance Subordinate Companion Loan will not be included in the Trust Fund. See ‘‘The Renaissance’’ in Annex D to this prospectus supplement.

The Central/Eastern Industrial Pool Loan, which has 1 companion loan (the ‘‘Central/Eastern Industrial Pool Subordinate Companion Loan’’), is part of a split loan structure in which the Central/Eastern Industrial Pool Subordinate Companion Loan is subordinate in its right of entitlement to payment to the Central/Eastern Industrial Pool Loan. The Central/Eastern Industrial Pool Loan has a Cut-Off Date Balance of $89,000,000, representing 2.5% of the Cut-Off Date Pool Balance (2.9% of the Cut-Off Date Group 1 Balance). The Central/Eastern Industrial Pool Subordinate Companion Loan will not be included in the Trust Fund. See ‘‘Central/Eastern Industrial Pool’’ in Annex D to this prospectus supplement.

The 4929 Wilshire Loan, which has 1 companion loan (the ‘‘4929 Wilshire Subordinate Companion Loan’’), is part of a split loan structure in which the 4929 Wilshire Subordinate Companion Loan is subordinate in its right of entitlement to payment to the 4929 Wilshire Loan. The 4929 Wilshire Loan has a Cut-Off Date Balance of $31,316,000, representing 0.9% of the Cut-Off Date Pool Balance (1.0% of the Cut-Off Date Group 1 Balance). The 4929 Wilshire Subordinate Companion Loan will not be included in the Trust Fund. See ‘‘4929 Wilshire’’ in Annex D to this prospectus supplement.

The 666 Fifth Avenue Pari Passu Companion Loans, the ING Hospitality Pool Pari Passu Companion Loans, the Potomac Mills Pari Passu Companion Loan, Sawgrass Mills Pari Passu Companion Loans, the Sawgrass Mills Subordinate Companion Loans, the 84 Lumber Industrial Pool Pari Passu Companion Loan, The Renaissance Subordinate Companion Loan, the Central/Eastern Industrial Pool Subordinate Companion Loan, the 4929 Wilshire Subordinate Companion Loan and the Nordic Cold Storage Pool Subordinate Companion Loan are referred to herein as the ‘‘Companion Loans’’. None of the Companion Loans are included in the Trust Fund.

The 666 Fifth Avenue Pari Passu Companion Loans, the ING Hospitality Pool Pari Passu Companion Loans, the Potomac Mills Pari Passu Companion Loan, the Sawgrass Mills Pari Passu Companion Loans and the 84 Lumber Industrial Pool Pari Passu Companion Loan, are referred to herein as the ‘‘Pari Passu

S-101

Table of ContentsCompanion Loans’’ and the 666 Fifth Avenue Loan, the ING Hospitality Pool Loan, the Potomac Mills Loan, the Sawgrass Mills Loan and the 84 Lumber Industrial Pool Loan are referred to as the ‘‘Pari Passu Loans’’. The Companion Loans, other than the Pari Passu Companion Loans, are collectively referred to herein as the ‘‘Subordinate Companion Loans’’. The Renaissance Loan, the Central/Eastern Industrial Pool Loan, the 4929 Wilshire Loan and the Nordic Cold Storage Loan are referred to as the ‘‘A/B Loans’’.

With respect to the 666 Fifth Avenue Loan, the terms of the related intercreditor agreement (the ‘‘666 Fifth Avenue Pari Passu Intercreditor Agreement’’), provide that the 666 Fifth Avenue Loan and the 666 Fifth Avenue Pari Passu Companion Loans are generally of equal priority with each other and no portion of either of the loans will have priority or preference over the other.

With respect to the ING Hospitality Pool Loan, the terms of the related intercreditor agreement (the ‘‘ING Hospitality Pool Pari Passu Intercreditor Agreement’’), provide that the ING Hospitality Pool Loan and the ING Hospitality Pool Pari Passu Companion Loans are generally of equal priority with each other and no portion of either of the loans will have priority or preference over the other.

With respect to the Potomac Mills Loan, the terms of the related intercreditor agreement (the ‘‘Potomac Mills Pari Passu Intercreditor Agreement’’), provide that the Potomac Mills Loan and the Potomac Mills Pari Passu Companion Loan are of equal priority with each other and no portion of either of the loans will have priority or preference over the other.

With respect to the Sawgrass Mills Loan, the terms of the related intercreditor agreement (the ‘‘Sawgrass Mills Intercreditor Agreement’’), provides that the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans are of equal priority with each other and no portion of either of the loans will have priority or preference over the other.

Further, with respect to the Sawgrass Mills Subordinate Companion Loans, the terms of the Sawgrass Mills Intercreditor Agreement provides that the Sawgrass Mills Subordinate Companion Loans are subordinate in certain respects to the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans.

With respect to the 84 Lumber Industrial Pool Loan, the terms of the related intercreditor agreement (the ‘‘84 Lumber Industrial Pool Pari Passu Intercreditor Agreement’’), provide that the 84 Lumber Industrial Pool Loan and the 84 Lumber Industrial Pool Pari Passu Companion Loan are of equal priority with each other and no portion of either of the loans will have priority or preference over the other.

With respect to The Renaissance Loan, the terms of the related intercreditor agreement (the ‘‘Renaissance Intercreditor Agreement’’) provide that the related The Renaissance Subordinate Companion Loan is subordinate in certain respects to The Renaissance Loan.

With respect to the Central/Eastern Industrial Pool Loan, the terms of the related intercreditor agreement (the ‘‘Central/Eastern Industrial Pool Intercreditor Agreement’’) provide that the related Central/Eastern Industrial Pool Subordinate Companion Loan is subordinate in certain respects to the Central/Eastern Industrial Pool Loan.

With respect to the 4929 Wilshire Loan, the terms of the related intercreditor agreement (the ‘‘4929 Wilshire Intercreditor Agreement’’) provide that the related 4929 Wilshire Subordinate Companion Loan is subordinate in certain respects to the 4929 Wilshire Loan.

With respect to the Nordic Cold Storage Pool Loan, the terms of the related intercreditor agreement (the ‘‘Nordic Cold Storage Pool Intercreditor Agreement’’) provide that the related Nordic Cold Storage Pool Subordinate Companion Loan is subordinate in certain respects to the Nordic Cold Storage Pool Loan.

With respect to the Deerwood MHP I Loan, the terms of the related intercreditor agreement (the ‘‘Deerwood MHP I Intercreditor Agreement’’) provide that the related Deerwood MHP I Subordinate Companion Loan is subordinate in certain respects to the related Deerwood MHP I Loan.

With respect to the Deerwood MHP II Loan, the terms of the related intercreditor agreement (the ‘‘Deerwood MHP II Intercreditor Agreement’’) provide that the related Deerwood MHP II Subordinate Companion Loan is subordinate in certain respects to the related Deerwood MHP II Loan.

S-102

Table of ContentsThe 666 Fifth Avenue Pari Passu Intercreditor Agreement, the ING Hospitality Pool Pari Passu Intercreditor Agreement, the Potomac Mills Pari Passu Intercreditor Agreement, the Sawgrass Mills Pari Passu Intercreditor Agreement, the 84 Lumber Industrial Pool Pari Passu Intercreditor Agreement, the Renaissance Intercreditor Agreement, the Central/Eastern Industrial Pool Intercreditor Agreement, the 4929 Wilshire Intercreditor Agreement and the Nordic Cold Storage Pool Intercreditor Agreement are individually referred to in this prospectus supplement as an ‘‘Intercreditor Agreement’’ and, collectively, as the ‘‘Intercreditor Agreements’’.

The Renaissance Intercreditor Agreement, the Central/Eastern Industrial Pool Intercreditor Agreement, the 4929 Wilshire Intercreditor Agreement and the Nordic Cold Storage Pool Intercreditor Agreement are individually referred to in this prospectus supplement as an ‘‘A/B Loan Intercreditor Agreement’’ and, collectively, as the ‘‘A/B Loan Intercreditor Agreements’’.

The following table presents certain information with respect to the Whole Loans:

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

Mortgage

Loan |  |  | Cut-Off

Date Principal

Balance of

Trust Mortgage

Asset |  |  | Cut-Off

Date Principal

Balance of

Senior Mortgage

Loans |  |  | Cut-Off

Date Principal

Balance of

Whole Loan |  |  | Whole Loan

Underwritten

DSCR(1) |  |  | Whole Loan

Cut-Off

Date LTV

Ratio(1) |

| 666 Fifth Avenue |  |  |  | $ | 285,500,000 |  |  |  |  | $ | 1,215,000,000 |  |  |  |  | $ | 1,215,000,000 |  |  |  |  |  | 1.46x |  |  |  |  |  | 60.8 | % |

| ING Hospitality Pool |  |  |  | $ | 283,850,000 |  |  |  |  | $ | 567,700,000 |  |  |  |  | $ | 567,700,000 |  |  |  |  |  | 2.14x |  |  |  |  |  | 63.8 | % |

| Sawgrass Mills |  |  |  | $ | 265,294,118 |  |  |  |  | $ | 820,000,000 |  |  |  |  | $ | 850,000,000 |  |  |  |  |  | 1.16x |  |  |  |  |  | 82.9 | % |

| Potomac Mills |  |  |  | $ | 164,000,000 |  |  |  |  | $ | 410,000,000 |  |  |  |  | $ | 410,000,000 |  |  |  |  |  | 1.17x |  |  |  |  |  | 78.8 | % |

| Central/Eastern Industrial Pool |  |  |  | $ | 89,000,000 |  |  |  |  | $ | 89,000,000 |  |  |  |  | $ | 108,000,000 |  |  |  |  |  | 1.01x |  |  |  |  |  | 88.9 | % |

| The Renaissance |  |  |  | $ | 84,000,000 |  |  |  |  | $ | 84,000,000 |  |  |  |  | $ | 93,000,000 |  |  |  |  |  | 1.22x |  |  |  |  |  | 78.8 | % |

| 84 Lumber Industrial Pool |  |  |  | $ | 75,008,971 |  |  |  |  | $ | 150,017,942 |  |  |  |  | $ | 150,017,942 |  |  |  |  |  | 1.57x |  |  |  |  |  | 68.5 | % |

| Nordic Cold Storage Pool |  |  |  | $ | 55,500,000 |  |  |  |  | $ | 55,500,000 |  |  |  |  | $ | 65,500,000 |  |  |  |  |  | 1.23x |  |  |  |  |  | 74.2 | % |

| 4929 Wilshire |  |  |  | $ | 31,316,000 |  |  |  |  | $ | 31,316,000 |  |  |  |  | $ | 35,316,000 |  |  |  |  |  | 1.00x |  |  |  |  |  | 73.9 | % |

| Deerwood MHP I |  |  |  | $ | 14,413,500 |  |  |  |  | $ | 14,413,500 |  |  |  |  | $ | 16,015,000 |  |  |  |  |  | 1.13x |  |  |  |  |  | 77.6 | % |

| Deerwood MHP II |  |  |  | $ | 14,413,500 |  |  |  |  | $ | 14,413,500 |  |  |  |  | $ | 16,015,000 |  |  |  |  |  | 1.13x |  |  |  |  |  | 77.6 | % |

| (1) | Certain of the Mortgage Loans reflect LTV Ratios that have been calculated on an ‘‘as-stabilized’’ basis, or that have LTV Ratios or DSC Ratios that have been adjusted to take into account certain cash reserves, holdback amounts or letters of credit or were calculated based on assumptions regarding the future financial performance of the related Mortgaged Property. See ‘‘Additional Mortgage Loan Information’’ herein. Also, see ‘‘DESCRIPTION OF THE MORTGAGE POOL—Additional Mortgage Loan Information’’ and ‘‘RISK FACTORS—The Mortgage Loans—Risks Relating to Net Cash Flow’’ and ‘‘—Inspections and Appraisals May Not Accurately Reflect Value & Condition of Mortgaged Property’’ in this prospectus supplement and ‘‘666 Fifth Avenue’’ in Annex D to this prospectus supplement. |

Certain Information Relating to The Renaissance Loan, the Central/Eastern Industrial Pool Loan and the 4929 Wilshire Loan

The discussion under this ‘‘Certain Information Relating to the Renaissance Loan, the Central/Eastern Industrial Pool Loan and the 4929 Wilshire Loan’’ subsection relates solely to the Co-Lender Loans identified as The Renaissance Loan, the Central/Eastern Industrial Pool Loan and the 4929 Wilshire Loan and their related Subordinate Companion Loans.

General. Pursuant to the terms of the related A/B Loan Intercreditor Agreements, the A/B Loans will be serviced and administered pursuant to the terms of the Pooling and Servicing Agreement by the Master Servicer and Special Servicer, as applicable, on behalf of the holders of the various notes (as a collective whole). The A/B Loan Intercreditor Agreements generally provide that expenses, losses and shortfalls relating to the A/B Loans will be allocated first, to the holder of the Subordinate Companion Loans and thereafter to the A/B Loans. Prior to a default under the related mortgage loan documents or, in some cases, prior to when the A/B Loan becomes a specially serviced loan as a result of an event of default under the related Mortgage Loan documents, payments received by or on behalf of the related Borrower are generally applied pro rata between the A/B Loan and the related Subordinate Companion Loan(s). During the continuance of an event of default or, in some cases, during the time that an A/B Loan is specially serviced as a result of an event of default under the related Mortgage Loan documents, such payments will be applied first in respect of interest and principal to the A/B Loan until paid in full and then in respect of interest and principal to each related Subordinate Companion Loan until paid in

S-103

Table of Contentsfull, and then in respect of certain prepayment fees, extension fees, exit fees and default interest among the A/B Loan and Subordinate Companion Loan, all in accordance with the terms of the related A/B Loan Intercreditor Agreement.

With respect to the A/B Loans, the Master Servicer and Special Servicer will service and administer each of the A/B Loans and the Subordinate Companion Loans pursuant to the Pooling and Servicing Agreement and the A/B Loan Intercreditor Agreements for so long as each A/B Loan is part of the Trust Fund. The holders of the most subordinate Subordinate Companion Loan will be entitled to advise and direct the Master Servicer and/or Special Servicer with respect to certain matters, including, among other things, foreclosure or material modifications of the A/B Loans at such times as such Subordinate Companion Loans are not the subject of an A/B Loan Control Appraisal Period (as defined below).

Control Appraisals. While certain A/B Loans may provide for certain variations, an ‘‘A/B Loan Control Appraisal Period’’ will generally be deemed to have occurred if and so long as (a) the principal balance of a Subordinate Companion Loan minus an amount equal to the excess (if any) of (i)(A) the outstanding principal balance of the related A/B Loan, plus (B) to the extent not previously advanced by the Master Servicer or the Trustee, all accrued and unpaid interest on the related A/B Loan at a per annum rate equal to its mortgage interest rate (exclu sive, in most cases, of any default interest), plus (C) all unreimbursed Advances and unpaid interest thereon and any unpaid interest on any principal and interest advances with respect to the related A/B Loan, plus (D) all currently due and unpaid real estate taxes and assessments, insurance premiums and, if applicable, ground rents relating to the Mortgaged Property (less, in certain cases, any amounts held in escrow for such items) over (ii) an amount equal to ninety percent (90%) of the value thereof as determined by the most recent appraisal of the Mortgaged Property as required by the related A/B Loan Intercreditor Agreement (net of any liens senior to the lien of the related A/B Loan), is less than or equal to (b) twenty five percent (25%) of the principal balance of such Subordinate Companion Loan. No advice or direction of the holder of a Subordinate Companion Loan may require or cause the Master Servicer or the Special Servicer to violate any provision of the Pooling and Se rvicing Agreement, including the Master Servicer’s and the Special Servicer’s obligation to act in accordance with the Servicing Standard. See ‘‘SERVICING OF THE MORTGAGE LOANS—The Controlling Class Representative’’ in this prospectus supplement.

Cure and Purchase Rights. In the event of certain defaults under an A/B Loan, the holder of the related Subordinate Companion Loan that is most subordinate will generally be entitled to (i) cure such monetary default within a certain specified time frame, generally between 3 and 7 Business Days of receipt of the cure notice; (ii) cure such non-monetary default within a certain specified time frame, generally between 20 and 30 days of receipt of the cure notice; (iii) purchase such A/B Loan (together with any Subordinate Companion Loan that is senior to it) from the Trust Fund after the expiration of the cure period and/or, (iv) post additional collateral, subject to the conditions contained in the applicable A/B Loan Intercreditor Agreement; provided, further, however, the holder of the related Subordinate Companion Loan is limited with respect to the amount and duration of cures as more particularly described in the applicable A/B Loan Intercreditor Agreement, but that are generally between 3 and 30 days. While certain A/B Loans may provide for certain limited variations, the purchase price will generally equal the unpaid aggregate principal balance of the A/B Loan, together with all unpaid interest thereon at the related mortgage interest rate (including default interest) and any unreimbursed servicing expenses, advances and interest on advances for which the borrower under the A/B Loan is res ponsible and any other Additional Trust Fund Expenses in respect of the A/B Loan actually paid or incurred by the Trust Fund; provided, however, that the purchase price shall typically not be reduced by any outstanding P&I Advance. No prepayment consideration will typically be payable in connection with such a purchase of an A/B Loan. The holder of the most subordinate Subordinate Companion Loan has the right, at any time and from time to time, to replace the Special Servicer then acting with respect to the related A/B Loan with or without cause and appoint a replacement Special Servicer solely with respect to such A/B Loan.

Consent and Consultation Rights of the Holders of the Subordinate Companion Loans. Prior to a Control Appraisal Period with respect to the Subordinate Companion Loans, the holder of the related Subordinate Companion Loan that is most subordinate is entitled to advise the Special Servicer with respect to the following actions of the Special Servicer, and the Special Servicer is generally not permitted

S-104

Table of Contentsto take any of the following actions as to which the Controlling Class Representative has objected in writing within a certain period of time, generally between 10 to 20 Business Days of being notified thereof (provided that if such written objection has not been received by the Special Servicer within that time frame, then the approval will be deemed to have been given):

(i) any actual or proposed foreclosure upon or comparable conversion (which may include acquisitions of an REO Property) of the ownership of properties securing such of the Specially Serviced Mortgage Loans as come into and continue in default;

(ii) any modification or waiver of any term of the related Mortgage Loan documents of a Mortgage Loan that relates to the maturity date, Mortgage Rate, principal balance, amortization term, payment frequency or any provision requiring the payment of a Prepayment Premium or Yield Maintenance Charge (other than a modification consisting of the extension of the maturity date of a Mortgage Loan for one year or less) or a material non-monetary term;

(iii) any actual or proposed sale of an REO Property (other than in connection with the termination of the Trust Fund as described under ‘‘DESCRIPTION OF THE CERTIFICATES— Termination’’ in this prospectus supplement or pursuant to a Purchase Option as described below under ‘‘—Defaulted Mortgage Loans; REO Properties; Purchase Option’’);

(iv) any determination to bring an REO Property into compliance with applicable environmental laws or to otherwise address hazardous materials located at an REO Property;

(v) any acceptance of substitute or additional collateral or release of material collateral for a Mortgage Loan unless required by the underlying Mortgage Loan documents;

(vi) any waiver of a ‘‘due-on-sale’’ or ‘‘due-on-encumbrance’’ clause;

(vii) any release of any performance or ‘‘earn-out’’ reserves, escrows or letters of credit;

(viii) any acceptance of an assumption agreement releasing a borrower from liability under a Mortgage Loan (other than in connection with a defeasance permitted under the terms of the applicable Mortgage Loan documents);

(ix) any termination of, or modification of, any applicable franchise agreements related to a Mortgage Loan secured by a hotel;

(x) any termination of the related property manager for Mortgage Loans having an outstanding principal balance of greater than $5,000,000;

(xi) any determination to allow a borrower not to maintain terrorism or, to the extent provided in the Pooling and Servicing Agreement, windstorm insurance;

(xii) any adoption or implementation of a business plan submitted by the borrower with respect to the related Mortgaged Property;

(xiii) the execution or renewal of any lease;

(xiv) the release of any escrow held in conjunction with the Mortgage Loan to the borrower not expressly required by the terms of the Mortgage Loan documents or under applicable law;

(xv) alterations on the related Mortgaged Property if approval by the mortgagee is required by the related Mortgage Loan documents;

(xvi) any modification of, or waiver with respect to, the Mortgage Loan that would result in a discounted pay-off of the Mortgage Loan;

(xvii) any sale of the related Mortgaged Property or any material portion thereof (other than pursuant to a purchase option contained in the related Intercreditor Agreement or in the Pooling and Servicing Agreement) or, except, as specifically permitted in the related Mortgage Loan documents, the transfer of any direct or indirect interest in the borrower or any sale of the Mortgage Loan;

(xviii) any release of the borrower or any guarantor from liability with respect to the Mortgage Loan;

S-105

Table of Contents(xix) any material changes to or waivers of any of the insurance requirements under the related Mortgage Loan documents;

(xx) the voting on any plan of reorganization, restructuring or similar plan in the bankruptcy of the borrowers;

(xxi) any modification of, or waiver with respect to, the Mortgage Loan that would result in a discounted pay-off;

(xxii) any foreclosure upon or comparable conversion of the ownership of the Mortgaged Property or any acquisition of the Mortgaged Property by deed-in-lieu of foreclosure;

(xxiii) any incurrence of additional debt by the borrower to the extent such incurrence requires the consent of the mortgagee under the related Mortgage Loan documents;

(xxiv) any substitution of the bank holding the cash management account, unless such bank agrees in writing (x) to comply with the terms of the related Intercreditor Agreement and (y) to provide to the holder of the related Companion Loans copies of any reconciliation required to be prepared thereunder; and

(xxv) alterations on the Mortgaged Property if approval by the mortgagee is required by the related Mortgage Loan documents.

In addition, the Controlling Class Representative may direct the Special Servicer to take, or to refrain from taking, such other actions as the Controlling Class Representative may deem advisable or as to which provision is otherwise made in the Pooling and Servicing Agreement; provided that no such direction and no objection contemplated by the prior paragraph may (i) require or cause the Special Servicer to violate any REMIC provisions, any provision of the Pooling and Servicing Agreement or applicable law, including the Special Servicer’s obligation to act in accordance with the Servicing Standard, or (ii) expose the Master Servicer, the Special Servicer, the Trust Fund or the Trustee to liability, or materially expand the scope of the Special Servicer’s responsibilities under the Pooling and Servicing Agreement or cause the Special Servicer to act or fail to act in a manner which, in the reasonable judgment of the Special Servicer, is n ot in the best interests of the Certificateholders. An affiliate of the Special Servicer will be the initial Controlling Class Representative.

The holders of the Subordinate Companion Loans generally also have the right, among other things, to (i) approve the annual operating budget of the related borrower in accordance with the terms of the related Mortgage Loan documents with respect to such Subordinate Companion Loan; and (ii) cause the termination of the property manager with respect to such Mortgaged Property and approve successor managers subject to certain conditions set forth in the related A/B Loan Intercreditor Agreements.

The holders of the Subordinate Companion Loans generally have the right to be notified prior to the commencement of any enforcement action by the mortgagee with respect to the related Mortgaged Property and to cure any default causing such action in accordance with the provisions of the related A/B Loan Intercreditor Agreement.

The Mortgage Loan documents for a Subordinate Companion Loan generally may be amended without the consent of the holder of such Subordinate Companion Loans; except for certain amendments relating to, among other things, the economic terms of the related Mortgage Loan, the cash management provisions and the collateral for the related Mortgage Loan; provided, however, in a work-out context the foregoing consent is generally not required.

Certain Information Relating to the Sawgrass Mills Loan.

The Sawgrass Mills Loan is part of a split loan structure comprised of (i) the Sawgrass Mills Loan, (ii) the Sawgrass Mills Pari Passu Companion Loans and (iii) the Sawgrass Mills Subordinate Companion Loans, each of which is secured by the same mortgage instrument on the same underlying Mortgaged Property (the ‘‘Sawgrass Mills Mortgaged Property’’). The Sawgrass Mills Loan is evidenced by multiple promissory notes. The Sawgrass Mills Pari Passu Companion Loans and Sawgrass Mills Subordinate Companion Loans are evidenced by multiple pari passu promissory notes and multiple subordinate

S-106

Table of Contentspromissory notes, respectively. Only the Sawgrass Mills Loan is included in the Trust Fund. The Sawgrass Mills Loan, the Sawgrass Mills Pari Passu Companion Loans and the Sawgrass Mills Subordinate Companion Loans are collectively referred to in this prospectus supplement as the ‘‘Sawgrass Mills Whole Loan.’’

The initial holders of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans (such holders and any successor holders, the ‘‘Sawgrass Mills Senior Noteholders’’) as well as the initial holders of the Sawgrass Mills Subordinate Companion Loans (such holders and any successor holders, the ‘‘Sawgrass Mills Subordinate Noteholders’’) have entered into an intercreditor agreement that sets forth the respective rights of the Sawgrass Mills Senior Noteholders and the Sawgrass Mills Subordinate Noteholders (the ‘‘Sawgrass Mills Intercreditor Agreement&rsq uo;’). Pursuant to the terms of the Sawgrass Mills Intercreditor Agreement, the Sawgrass Mills Whole Loan will be serviced and administered pursuant to the pooling and servicing agreement for the J.P. Morgan Chase Commercial Mortgage Securities Trust 2007-LDP12, Commercial Mortgage Pass-Through Certificates, Series 2007-LDP12. The Sawgrass Mills Intercreditor Agreement provides that expenses, losses and shortfalls relating to the Sawgrass Mills Whole Loan will be allocated first, to the Sawgrass Mills Subordinate Noteholders and thereafter, to the Sawgrass Mills Senior Noteholders, on a pro rata and pari passu basis.

Pursuant to the Sawgrass Mills Intercreditor Agreement, prior to a Sawgrass Mills Control Appraisal Event, a majority of the Sawgrass Mills Subordinate Noteholders will have the right to consult with and advise the J.P. Morgan Series 2007-LDP12 special servicer; following the occurrence and during the continuance of a Sawgrass Mills Control Appraisal Event, the Sawgrass Mills Senior Noteholders, acting jointly, will have such rights. A ‘‘Sawgrass Mills Control Appraisal Event’’ will exist if, and for so long as, the initial aggregate principal balance of the Sawgrass Mills Subordinate Companion Loans (minus the sum of (i) any principal payments (whether as scheduled amortization, principal prepayments or otherwise) allocated to, and received on, the Sawgrass Mills Subordinate Companion Loans after the cut-off date, (ii) any a ppraisal reduction allocated to the Sawgrass Mills Subordinate Companion Loans and (iii) realized losses allocated to the Sawgrass Mills Subordinate Companion Loans) is less than 25% of its initial principal balance (minus the sum of any principal payments whether as scheduled amortization, principal prepayments or otherwise received on, the Sawgrass Mills Subordinate Companion Loans after the cut-off date).

For purposes of the information presented in this prospectus supplement with respect to the Sawgrass Mills Loan, the debt service coverage ratio and the loan-to-value ratio reflect the aggregate indebtedness evidenced by the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans but not the Sawgrass Mills Subordinate Companion Loans.

Servicing. The Sawgrass Mills Intercreditor Agreement generally provides that the Sawgrass Mills Whole Loan will be serviced by the master servicer and the special servicer under the pooling and servicing agreement for the J.P. Morgan Chase Commercial Mortgage Pass-Through Certificates, Series 2007-LDP12 securitization transaction.

Distributions. Under the terms of the Sawgrass Mills Intercreditor Agreement, prior to the occurrence and continuance of a monetary event of default or other material non-monetary event of default with respect to the Sawgrass Mills Whole Loan (or, if such a default has occurred, but one or more Sawgrass Mills Subordinate Noteholders have cured such a default) after payment of amounts payable or reimbursable under the J.P. Morgan Series 2007-LDP12 Pooling and Servicing Agreement, payments and proceeds received with respect to the Sawgrass Mills Whole Loan will generally be paid in the following manner, in each case to the extent of available funds:

First, each holder of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans will receive accrued and unpaid interest on its outstanding principal at its interest rate, on a pro rata and pari passu basis;

Second, scheduled and unscheduled principal payments in respect of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans will be paid to each of the holders of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans, on a pro rata and pari passu basis;

S-107

Table of ContentsThird, any prepayment premium actually received in respect of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans will be paid to each of the holders of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans respectively, on a pro rata and pari passu basis;

Fourth, the holders of the Sawgrass Mills Subordinate Companion Loans will receive accrued and unpaid interest on their outstanding principal balances at their respective interest rates, on a pro rata basis;

Fifth, scheduled and unscheduled principal payments in respect of the Sawgrass Mills Subordinate Companion Loans will be paid to the holders of the Sawgrass Mills Subordinate Companion Loans, on a pro rata and pari passu basis;

Sixth, any yield maintenance charge actually received in respect of the Sawgrass Mills Subordinate Companion Loans will be paid to each of the holders of the Sawgrass Mills Subordinate Companion Loans on a pro rata basis;

Seventh, any default interest (in excess of the interest paid in accordance with clauses first and fourth above and any such amounts required to be otherwise applied under the J.P. Morgan 2007-LDP12 Pooling and Servicing Agreement) will be paid to each of the holders of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans, on a pro rata and pari passu basis in accordance with the respective principal balance of ea ch loan;

Eighth, any default interest (in excess of the interest paid in accordance with clauses first, fourth and seventh above) shall be paid to the holders of the Subordinate Companion Loans, pro rata (based on the principal balance of the Subordinate Companion Loans), to the extent not applied to interest on advances or payable to any servicer or trustee pursuant to the J.P. Morgan 2007-LDP12 Pooling and Servicing Agreement; and

Ninth, if any excess amount is paid by the borrower and is not required to be returned to the borrower or to a party other than a holder under the loan documents, and not otherwise applied in accordance with the foregoing clauses first through eighth above, such amount shall paid to each of the holders of the Sawgrass Mills Loan, the Sawgrass Mills Pari Passu Companion Loans and the Sawgrass Mills Subordinate Companion Loans on a pro rata basis in accordance with the respective initial principal balance of each loan.

Following the occurrence and during the continuance of a monetary event of default or other material non-monetary event of default with respect to the Sawgrass Mills Whole Loan (unless the Sawgrass Mills Subordinate Noteholders have cured such a default), after payment of all amounts then payable or reimbursable under the J.P. Morgan Series 2007-LDP12 Pooling and Servicing Agreement, liquidation proceeds and other collections with respect to the Sawgrass Mills Whole Loan will generally be applied in the following manner, in each case to the extent of available funds:

First, each holder of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans will receive accrued and unpaid interest on its outstanding principal balance at its interest rate, on a pro rata and pari passu basis;

Second, each holder of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans will receive, on a pro rata and pari passu basis, based on the principal balance of each such loan, an amount up to its principal balance, until the principal balance has been paid in full;

Third, if the proceeds of any foreclosure sale or any liquidation of the Sawgrass Mills Whole Loan or the Sawgrass Mills Mortgaged Property exceed the amounts required to be applied in accordance with the foregoing clauses first and second and, as a result of a workout, the principal balance of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans have been reduced, such excess amount will be paid to the holder of the Sawgrass Mills Loan and each holder of the Sawgrass Mills Pari Passu Companion Loans, pro rata, in an amount up to the reduction, if any, of their respective principal balances as a result of such workout;

Fourth, to the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans, pro rata, in an amount equal to any yield maintenance charge actually received in respect of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans;

S-108

Table of ContentsFifth, any default interest (in excess of the interest paid in accordance with clause first above and any such amounts required to be otherwise applied under the J.P. Morgan 2007-LDP12 Pooling and Servicing Agreement), will be paid first to each holder of the Sawgrass Mills Loan and the Sawgrass Mills Pari Passu Companion Loans, pro rata, and then to the holders of the Sawgrass Mills Subordinate Companion Loans, based on the total amount of default interest then owing to each such party;

Sixth, the holders of the Sawgrass Mills Subordinate Companion Loans will receive accrued and unpaid interest on its outstanding principal balance at its interest rate, on a pro rata and pari passu basis;

Seventh, the holders of the Sawgrass Mills Subordinate Companion Loans will receive, on a pro rata and pari passu basis, based on the principal balance of each such loan, an amount up to its principal balance, until such principal has been paid in full;

Eighth, any yield maintenance charge that is allocable to the Sawgrass Mills Subordinate Companion Loans, pro rata; and

Ninth, if any excess amount is paid by the borrower that is not otherwise applied in accordance with the foregoing clauses first through eighth or the proceeds of any foreclosure sale or any liquidation of the Sawgrass Mills Whole Loan or the Sawgrass Mills Mortgaged Property are received in excess of the amounts required to be applied in accordance with the foregoing clauses first through eighth, such amount will generally be paid, pro rata, first to the holders of the Sawgrass Mills Loan and Sawgrass Mills Pari Passu Companion Loans (on a pro rata basis) on the one hand, and then to the holders of the Sawgrass Mills Subordinate Companion Loans on the other hand, in accordance with the respective initial principal balances of each loan.

Consent Rights of Sawgrass Mills Subordinate Noteholders. Unless a Sawgrass Mills Control Appraisal Event exists, the Sawgrass Mills Subordinate Noteholders, or an advisor on their behalf, are expected, under the J.P. Morgan 2007-LDP12 Pooling and Servicing Agreement, to be entitled (subject to the provisions in the J.P. Morgan 2007-LDP12 Pooling and Servicing Agreement regarding applicable time-frames and the right of the J.P. Morgan 2007-LDP12 special servicer to take action in emergency situations) to advise and direct the J.P. Morgan Series 2007-LDP12 Master Servicer and/or the J.P. Morgan Series 2007-LDP12 Special Servicer with respect to certain matters, including, among other things, (i) any proposed or actual foreclosure upon or comparable conversion (which may include acquisitions of an REO Property) of the ownership of properties securin g such of the mortgage loans as come into and continue in default; (ii) any modification, consent to a modification or waiver of any monetary term or material non-monetary term (including, without limitation, the timing of payments and acceptance of discounted payoffs) of a mortgage loan or any extension of the maturity date of such mortgage loan; (iii) any sale of a defaulted mortgage loan or REO Property (other than in connection with the termination of the J.P. Morgan 2007-LDP 12 trust) for less than the applicable purchase price (other than in connection with the exercise of a purchase option that certain specified parties have under the J.P. Morgan 2007-LDP12 pooling and servicing agreement to purchase defaulted loans); (iv) any determination to bring an REO Property into compliance with applicable environmental laws or to otherwise address hazardous material located at an REO Property; (v) any release of collateral or any acceptance of substitute or additional collateral for a mortgage loan or any cons ent to either of the foregoing, other than if required pursuant to the specific terms of the related mortgage loan; (vi) any waiver of a ‘‘due-on-sale’’ or ‘‘due-on-encumbrance’’ clause with respect to a loan or any consent to such a waiver or consent to a transfer of the Mortgaged Property or interests in the borrower or consent to the incurrence of additional; (vii) any property management company changes or franchise changes with respect to a mortgage loan for which the consent or approval of the lender is required under the related loan documents; (viii) releases of any escrow accounts, reserve accounts or letters of credit held as performance escrows or reserves, other than those required pursuant to the specific terms of the mortgage loan with no material lender discretion; (ix) any acceptance of an assumption agreement releasing a borrower from liability under a mortgage loan with no material lender discretion; and (x) any determination by the Special Se rvicer of an acceptable insurance default. However, no advice or direction may require or cause the related J.P. Morgan Series LDP12 Master Servicer or the J.P. Morgan Series 2007-LDP12 Special Servicer to violate any provision of the J.P. Morgan Series 2007-LDP12 pooling and servicing agreement, including the J.P. Morgan Series LDP12 Master Servicer’s and the J.P. Morgan Series 2007-LDP12 Special Servicer’s obligation to act in accordance with the Servicing Standards or the REMIC provisions of the Code.

S-109

Table of ContentsCure Rights. In the event that the borrower fails to make any payment of principal or interest on the Sawgrass Mills Whole Loan, resulting in a monetary event of default, the Sawgrass Mills Subordinate Noteholders will have the right to cure such monetary event of default, which right may be exercised several times, subject to certain limitations set forth in the Sawgrass Mills Intercreditor Agreement.