| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-15 |

| | | |

Free Writing Prospectus

Collateral Term Sheet

$1,008,188,843

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

BANK 2017-BNK4

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Bank of America, National Association

Morgan Stanley Mortgage Capital Holdings LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2017-BNK4

March 24, 2017

WELLS FARGO

SECURITIES | BofA MERRILL LYNCH | MORGAN STANLEY |

Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner |

| | | |

| | Academy Securities Co-Manager | |

| | | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC, Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

1

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| No. 1 – D.C. Office Portfolio |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Bank of America, N.A. | | Single Asset/Portfolio: | Portfolio |

| Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type: | Office |

| Original Principal Balance(1): | $70,000,000 | | Specific Property Type: | CBD |

| Cut-off Date Balance(1): | $70,000,000 | | Location: | Washington, D.C. |

| % of Initial Pool Balance: | 6.9% | | Size: | 328,319 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $319.81 |

| Borrower Names: | ZG 1900 L Street, LLC; ZG 1920 L Street, LLC; ZG 1020 19th Street, LLC | | Year Built/Renovated: | Various/Various |

| Sponsors: | Charles Gravely; Shelton Zuckerman | | Title Vesting: | Fee |

| Mortgage Rate: | 4.7579% | | Property Manager: | Self-Managed |

| Note Date: | February 13, 2017 | | 4thMost Recent Occupancy (As of): | 93.8% (12/31/2013) |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of): | 92.7% (12/31/2014) |

| Maturity Date: | March 1, 2027 | | 2ndMost Recent Occupancy (As of): | 91.0% (12/31/2015) |

| IO Period: | 120 months | | Most Recent Occupancy (As of): | 94.4% (12/31/2016) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of): | 85.9% (Various) |

| Seasoning: | 1 month | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | | |

| Interest Accrual Method: | Actual/360 | | 4thMost Recent NOI (As of): | $9,670,234 (12/31/2013) |

| Call Protection(2): | L(25),D(90),O(5) | | 3rdMost Recent NOI (As of): | $9,553,851 (12/31/2014) |

| Lockbox Type: | Hard/Springing Cash Management | | 2ndMost Recent NOI (As of): | $9,384,675 (12/31/2015) |

| Additional Debt(1)(3): | Yes | | Most Recent NOI (As of): | | $8,856,380 (12/31/2016) |

| Additional Debt Type(1)(3): | Pari Passu; Mezzanine | | |

| | | | | |

| | | | U/W Revenues: | $15,106,635 |

| | | | U/W Expenses: | $5,846,676 |

| Escrows and Reserves(4): | | | | | U/W NOI: | $9,259,959 |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NCF: | $8,652,568 |

| Taxes | $1,614,433 | $230,633 | NAP | | U/W NOI DSCR(1): | 1.83x |

| Insurance | $0 | Springing | NAP | | U/W NCF DSCR(1): | 1.71x |

| Replacement Reserve | $0 | $4,925 | $237,000 | | U/W NOI Debt Yield(1)(5): | 9.3% |

| TI/LC Reserve | $0 | $41,040 | $1,970,000 | | U/W NCF Debt Yield(1)(5): | 8.7% |

| Free Rent Reserve | $806,797 | $0 | NAP | | As-Is Appraised Value: | $186,800,000 |

| Rent Reserve | $310,546 | $0 | NAP | | As-Is Appraisal Valuation Date: | December 22, 2016 |

| Existing TI/LC Reserve | $816,325 | $0 | NAP | | Cut-off Date LTV Ratio(1)(5)(6): | 53.5% |

| Earnout Reserve | $5,000,000 | $0 | NAP | | LTV Ratio at Maturity or ARD(1)(5)(6): | 53.5% |

| | | | | | | |

| | | | | | | | | |

| (1) | The D.C. Office Portfolio Whole Loan (as defined below), which had an original principal balance of $105,000,000, is comprised of twopari passu promissory notes. The controlling D.C. Office Portfolio Mortgage Loan (as defined below) had an original principal balance of $70,000,000, has an outstanding principal balance of $70,000,000 as of the Cut-off Date and will be contributed to the BANK 2017-BNK4 Trust. The Cut-off Date Balance Per SF and U/W NOI DSCR and U/W NCF DSCR are based on the D.C. Office Portfolio Whole Loan. |

| (2) | The defeasance lockout period will be at least 25 payment dates beginning with and including the first payment date of April 1, 2017. Defeasance of the D.C. Office Portfolio Whole Loan is permitted after the date that is the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized, and (ii) March 1, 2020. The assumed lockout period of 25 payments is based on the expected BANK 2017-BNK4 Trust closing date in April 2017. |

| (3) | See “Subordinate and Mezzanine Indebtedness” section. |

| (4) | See “Escrows” section. |

| (5) | The D.C. Office Portfolio Whole Loan included the funding of a $5,000,000 earnout reserve, which may be released to the borrower in partial disbursements provided among other conditions a 6.73% debt yield is achieved. Any amounts not disbursed within 30 months of the closing date of the D.C. Office Portfolio Whole Loan will be used to pay down the D.C. Office Portfolio Whole Loan with the borrower’s payment of a yield maintenance premium. The U/W NOI Debt Yield, U/W NCF Debt Yield, Cut-off Date LTV Ratio and LTV Ratio at Maturity or ARD as shown are based on the D.C. Office Portfolio Whole Loan net of the $5,000,000 earnout reserve. The U/W NOI Debt Yield, U/W NCF Debt Yield and Cut-off Date LTV Ratio based on the D.C. Office Portfolio Whole Loan amount of $105,000,000 are 8.8%, 8.2% and 56.2%, respectively. |

| (6) | The D.C. Office Portfolio Property was given an “As-Is” appraised assemblage land value of $203,000,000 as of December 22, 2016 resulting in a Cut-off Date LTV ratio of 51.7% based on the D.C. Office Portfolio Whole Loan. |

The Mortgage Loan.The mortgage loan (the “D.C. Office Portfolio Mortgage Loan”) is part of a whole loan (“D.C. Office Portfolio Whole Loan”) evidenced by twopari passu notes, including Note A-1 and Note A-2, both secured by a first lien mortgage encumbering three office buildings located in Washington, D.C. (the “D.C. Office Portfolio Property” or the “D.C. Office Portfolio Properties”). The D.C. Office Portfolio Whole Loan was originated on February 13, 2017 by Bank of America, N.A. The D.C. Office Portfolio Whole Loan had an original principal balance of $105,000,000, has an outstanding principal balance as of the Cut-off Date of $105,000,000 and accrues interest at an interest rate of approximately 4.7579%per annum. The D.C. Office Portfolio Whole Loan had an initial term of 120 months, has a remaining term of 119 months as of the Cut-off Date and requires payments of interest only through the term of the D.C. Office Portfolio Whole Loan. The D.C. Office Portfolio Whole Loan matures on March 1, 2027.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

The D.C. Office Portfolio Mortgage Loan is evidenced by Note A-1, had an original principal balance of $70,000,000, has an outstanding principal balance as of the Cut-off Date of $70,000,000, represents the controlling interest in the D.C. Office Portfolio Whole Loan and will be contributed to the BANK 2017-BNK4 Trust. The D.C. Office Portfolio Companion Loan is evidenced by Note A-2, had an original principal balance of $35,000,000, has an outstanding principal balance as of the Cut-off Date of $35,000,000, is currently held by Bank of America, N.A. and is expected to be contributed to one or more future securitization trusts. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” in the Preliminary Prospectus.

Note Summary

| Notes | Original Balance | Note Holder | Controlling Interest |

| A-1 | $70,000,000 | BANK 2017-BNK4 | Yes |

| A-2 | $35,000,000 | Bank of America, N.A. | No |

| Total | $105,000,000 | | |

Following the lockout period, the borrower has the right to defease the D.C. Office Portfolio Whole Loan in whole or in part on any date before November 1, 2026. The D.C. Office Portfolio Whole Loan is prepayable without penalty on or after November 1, 2026. The lockout period will expire on the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) March 1, 2020.

Sources and Uses(1)(2)

| Sources | | | | | Uses | | | |

| Original whole loan amount | $105,000,000 | | 80.8% | | Loan Payoff | $107,197,954 | | 82.5% |

| Mezzanine loan | 25,000,000 | | 19.2 | | Reserves | 8,548,101 | | 6.6 |

| | | | | | Closing costs | 1,091,974 | | 0.8 |

| | | | | | Return of equity | 13,161,971 | | 10.1 |

| Total Sources | $130,000,000 | | 100.0% | | Total Uses | $130,000,000 | | 100.0% |

| (1) | The D.C. Office Portfolio sponsors purchased the D.C. Office Portfolio Properties between 2001 and 2007 for an aggregate purchase price of $112,100,000 and maintain a total cost basis of approximately $140,564,075. |

| (2) | The D.C. Office Portfolio Property was previously securitized in the WBCMT 2007-C31 transaction. |

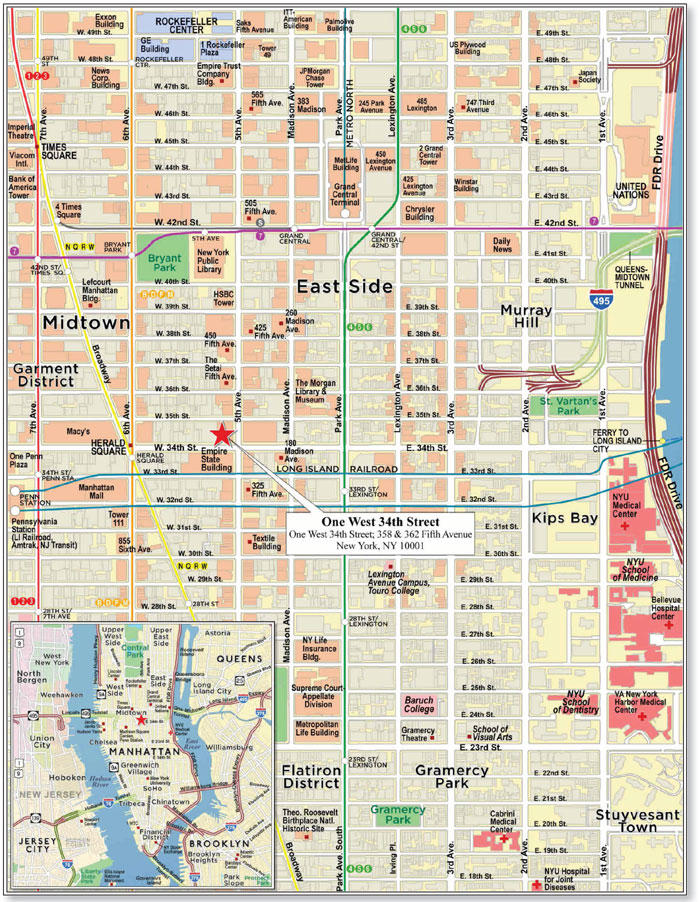

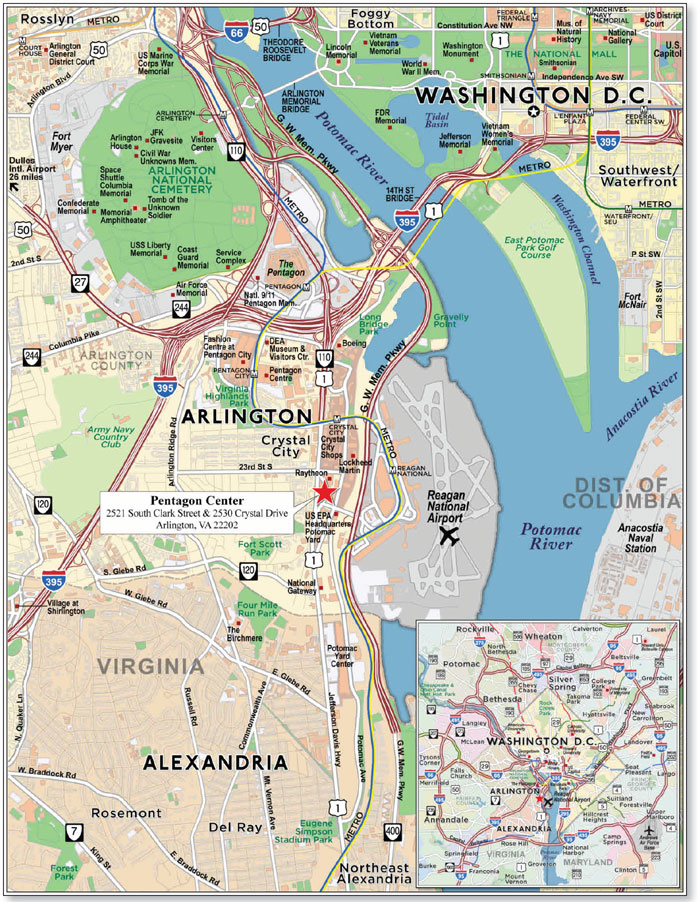

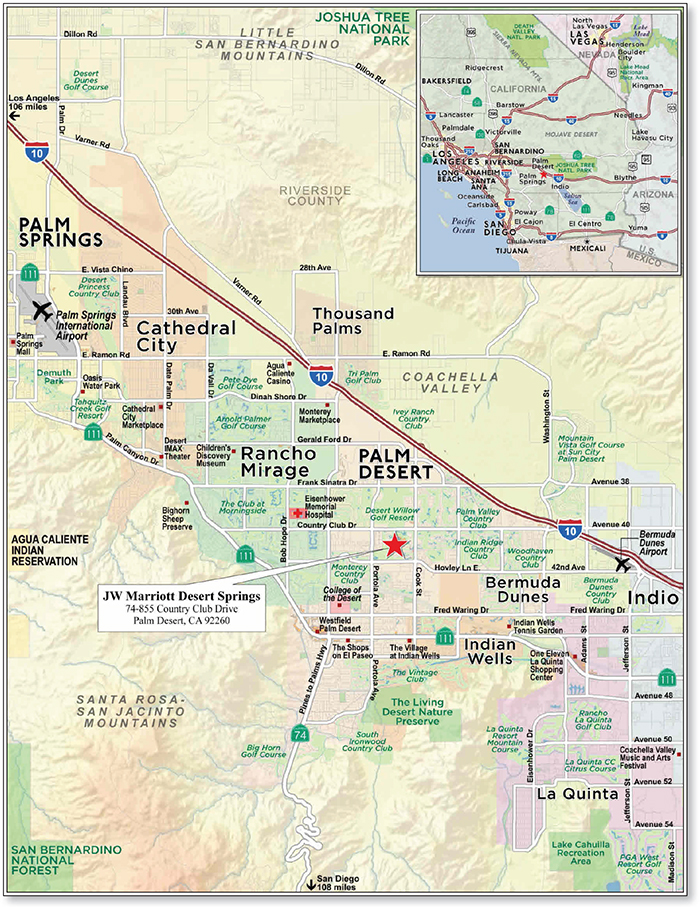

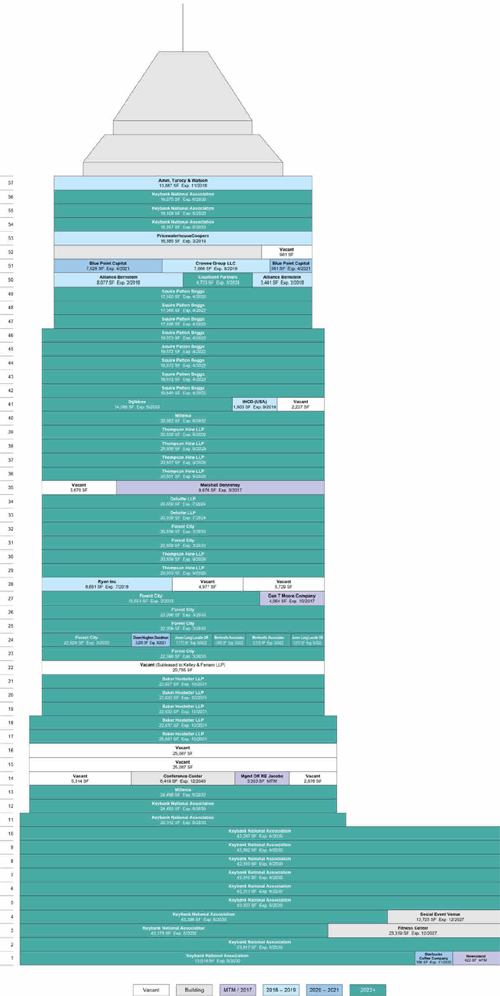

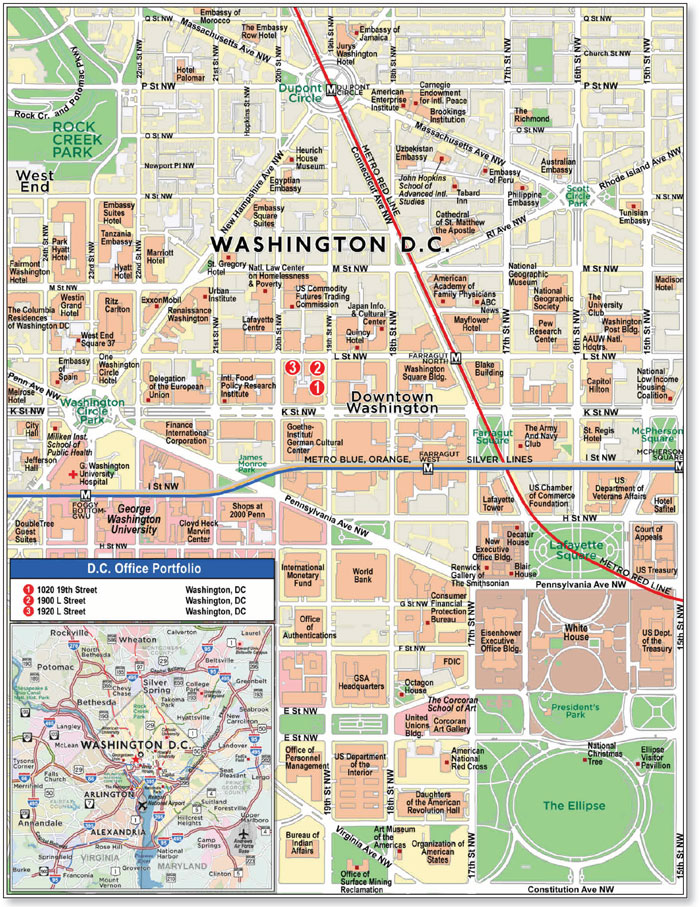

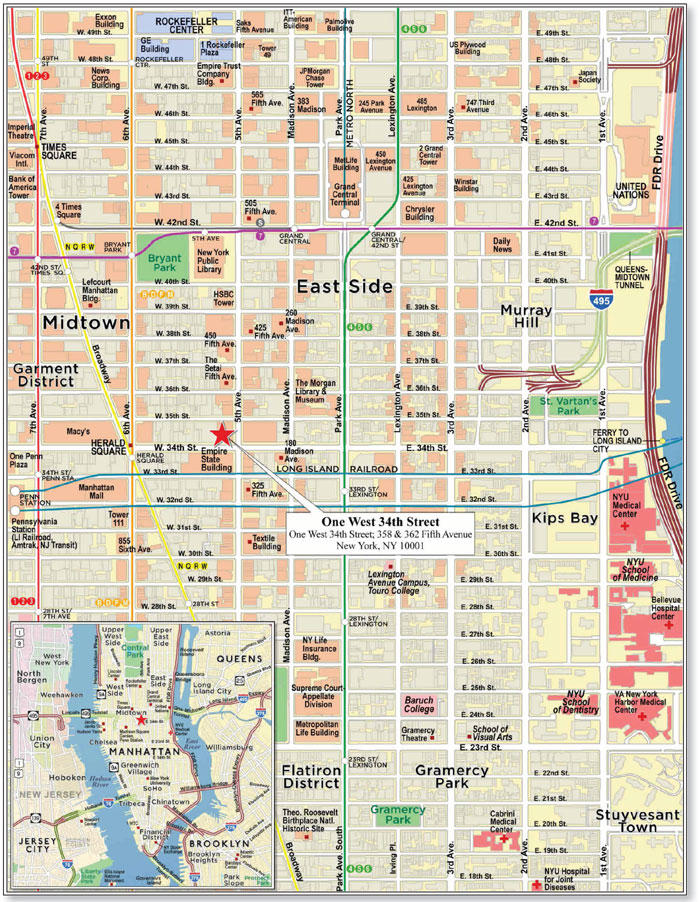

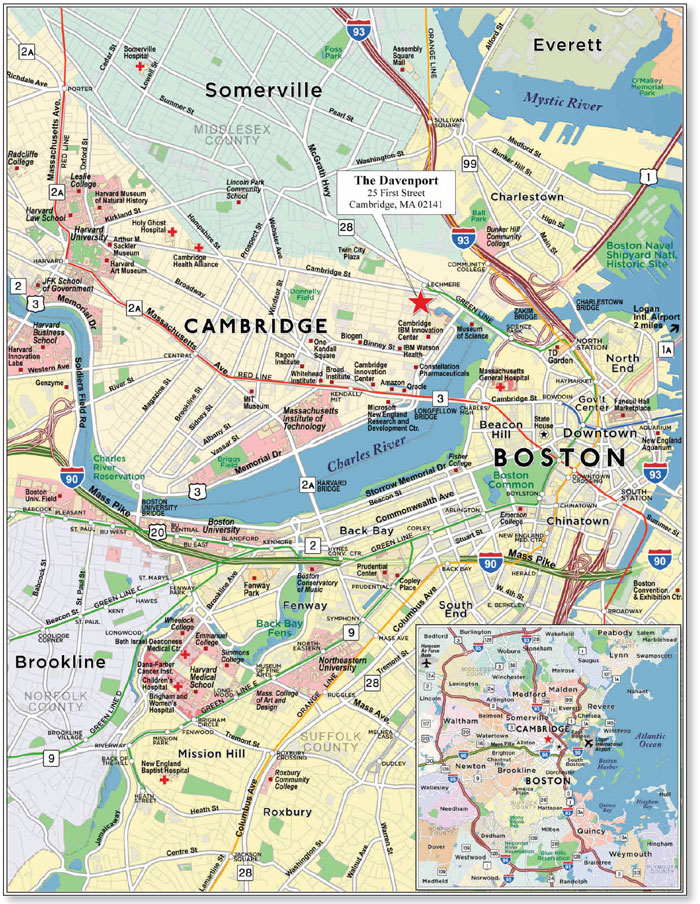

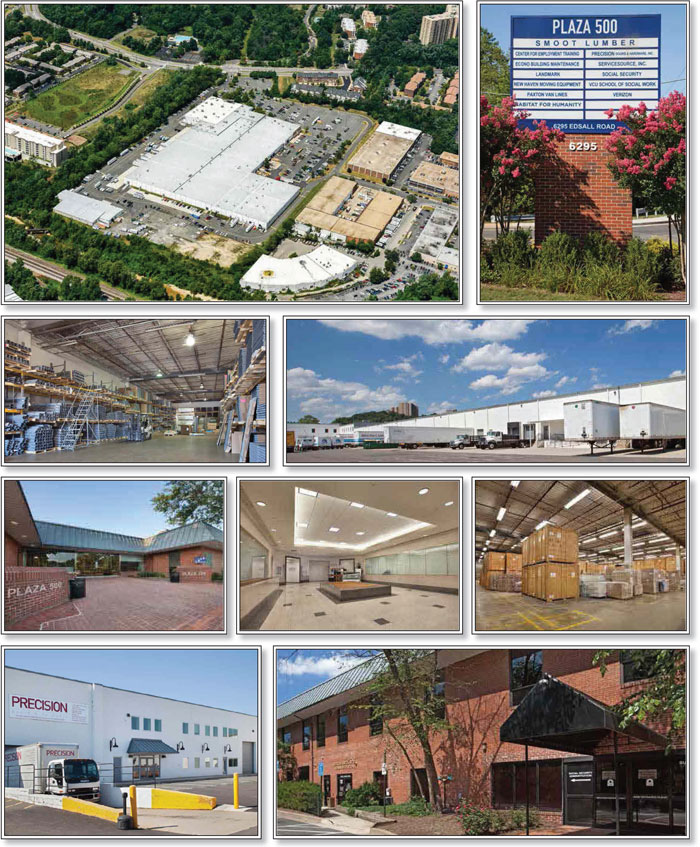

The Property.The D.C. Office Portfolio Properties consists of the fee interests in three Class “B” office buildings, the “1020 19th Street Property”, “1900 L Street Property” and “1920 L Street Property”, totaling 328,319 square feet in the Washington, D.C. central business district.

The following table presents certain information relating to the D.C. Office Portfolio Properties:

Property Schedule

| Property Name/Location | Allocated

Cut-Off

Date

Balance | % of

Portfolio Cut-Off

Date

Balance | Allocated Loan Amount | Occupancy(1) | Year Built/ Renovated | Net Rentable Area (SF)(1) | Appraised Value | Allocated LTV(2) |

1020 19th Street Property 1020 19th Street Northwest Washington, D.C., 20036 | $23,646,667 | 33.8% | $35,470,000 | 87.4% | 1982/1999 | 115,737 | $63,100,000 | 53.5% |

| | | | | | | | | |

1900 L Street Property 1900 L Street Northwest Washington, D.C., 20036 | $23,233,333 | 33.2% | $34,850,000 | 87.6% | 1965/2002 | 104,859 | $62,000,000 | 53.5% |

| | | | | | | | | |

1920 L Street Property 1920 L Street Northwest Washington, D.C., 20036 | $23,120,000 | 33.0% | $34,680,000 | 82.6% | 1963/1999 | 107,723 | $61,700,000 | 53.5% |

| Total/Weighted Average | $70,000,000 | 100.00% | $105,000,000 | 85.9% | | 328,319 | $186,800,000(3) | |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | The Allocated LTV as shown is based on the D.C. Office Portfolio Whole Loan net of the $5,000,000 earnout reserve. |

| (3) | The D.C. Office Portfolio Property was given an “As-Is” appraised assemblage land value of $203,000,000 as of December 22, 2016. |

The 1020 19th Street Property is an eight-story office building located mid-block on the west side of 19th Street NW, between L Street NW and K Street NW. The 1020 19th Street Property was built in 1982 and most recently renovated in 1999 to include a new lobby and elevator updates. The D.C. Office Portfolio sponsor acquired the 1020 19th Street Property in 2007 for $48 million and has spent an additional $3,258,550 in capital improvements and approximately $5,516,725 in tenant improvements and leasing costs since acquisition. The 1020 19th Street Property contains 115,737 square feet of rentable area and 90 subterranean garage spaces. As of January 26, 2017, the 1020 19th Street Property was 87.4% occupied.

The 1900 L Street Property is an eight-story office building located at the southwest corner of L Street NW and 19th Street NW. The 1900 L Street Property was built in 1965 and most recently renovated in 2002 to include a new lobby and updates to the elevators, common areas, restrooms, building systems, garage and exterior storefronts and entrance. The D.C. Office Portfolio sponsor acquired the 1900 L Street Property in 2001 for $16.6 million and has spent an additional $4,831,096 in capital improvements and approximately $4,388,351 in tenant improvements and leasing costs since acquisition. The 1900 L Street Property contains 104,859

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

square feet of rentable area and 144 subterranean garage spaces. 90 spaces are leased to Avis Budget Car Rental, LLC on a lease expiring February 28, 2026. As of January 26, 2017, the 1900 L Street Property was 87.6% occupied.

The 1920 L Street Property is an eight-story office building located at the southeast corner of L Street NW and 20th Street NW. The 1920 L Street Property was built in 1963 and most recently renovated in 1999 to include a new lobby and updates to the elevators, common areas, restrooms, building systems, garage and exterior storefronts and entrance. The D.C. Office Portfolio sponsor acquired the 1920 L Street Property in 2006 for $47.5 million and has spent an additional $1,879,570 in capital improvements and approximately $3,551,550 in tenant improvements and leasing costs since acquisition. The 1920 L Street Property contains 107,723 square feet of rentable area and 143 subterranean garage spaces. As of January 11, 2017, the 1920 L Street Property was 82.6% occupied.

The following table presents certain information relating to the tenancy at the D.C. Office Portfolio Property:

Major Tenants(1)

| Tenant Name | Tenant

NRSF | % of

NRSF | Annual

U/W Base

Rent PSF(2) | Annual

U/W Base Rent | % of Total

Annual U/W

Base Rent | Lease

Expiration

Date |

| 1020 19th Street Property | | | | | | |

| Major Tenant | | | | | | |

| Farr, Miller & Washington | 7,661 | 6.6% | $47.10 | $360,796 | 7.5% | 3/31/2018 |

| Strategic Marketing Innovations | 6,045 | 5.2% | $50.90 | $307,662 | 6.4% | 5/31/2021 |

| Community Action Partnership | 6,291 | 5.4% | $40.42 | $254,272 | 5.3% | 4/30/2026 |

| Major Tenant Total | 19,997 | 17.3% | $46.14 | $922,730 | 19.2% | |

| Other Tenants(3) | 86,058 | 74.4% | $45.93 | $3,880,142 | 80.8% | |

| Total Occupied Space(4) | 106,055 | 91.6% | $45.97 | $4,802,872 | 100.0% | |

| Vacant Space(5) | 9,682 | 8.4% | | | | |

| Collateral Total | 115,737 | 100.0% | | | | |

| 1900 L Street Property | | | | | | |

| Major Tenant | | | | | | |

| Questex Media Group, LLC | 12,513 | 11.9% | $44.15 | $552,480 | 12.3% | 5/31/2020 |

| Change to Win(6) | 12,711 | 12.1% | $42.43 | $539,280 | 12.0% | 9/30/2020 |

| Potbelly Sandwich Works | 2,333 | 2.2% | $97.65 | $227,826 | 5.1% | 1/31/2023 |

| Major Tenant Total | 27,557 | 26.3% | $47.89 | $1,319,586 | 29.3% | |

| Other Tenants(7) | 68,273 | 65.1% | $46.76 | $3,182,618 | 70.7% | |

| Total Occupied Space(8) | 95,830 | 91.4% | $47.08 | $4,502,204 | 100.0% | |

| Vacant Space | 9,029 | 8.6% | | | | |

| Collateral Total | 104,859 | 100.0% | | | | |

| 1920 L Street Property | | | | | | |

| Major Tenant | | | | | | |

| Liquidity Services, Inc. | 27,347 | 25.4% | $48.60 | $1,329,069 | 30.9% | 9/30/2019 |

| League of Conservation Voters(9) | 13,030 | 12.1% | $53.49 | $696,986 | 16.2% | 12/31/2017 |

| PNC Bank | 5,304 | 4.9% | $71.29 | $378,120 | 8.8% | 12/31/2018 |

| Major Tenant Total | 45,681 | 42.4% | $52.63 | $2,404,174 | 55.8% | |

| Other Tenants | 43,342 | 40.2% | $46.40 | $1,903,380 | 44.2% | |

| Total Occupied Space(10) | 89,023 | 82.6% | $49.68 | $4,307,554 | 100.0% | |

| Vacant Space | 18,700 | 17.4% | | | | |

| Collateral Total | 107,723 | 100.0% | | | | |

| (1) | Information based on the underwritten rent roll. |

| (2) | Annual U/W Base Rent PSF for “Other Tenants” excludes conference room/storage space that attracts $0 rent. |

| (3) | Includes Breastfeeding Coalition (3,885 square feet) with a signed lease commencing July 15, 2017 and Consortium of Universities (3,567 square feet) with a signed lease commencing October 1, 2017. |

| (4) | Total Occupied Space includes a 1,571 square foot conference room. |

| (5) | Vacant space includes Café Carvey (2,598 square feet) due to the tenant’s lease maturity of March 31, 2017. |

| (6) | Change to Win is entitled to a two month rent abatement commencing April 2017. |

| (7) | Includes NRI Staffing, Inc (2,772 square feet) with a signed lease commencing June 1, 2017. |

| (8) | Total Occupied Space includes 208 square feet of storage space. |

| (9) | The League of Conservation Voters, has given notice of termination option effective December 31, 2017, however will remain in occupancy and paying rent until that date. |

| (10) | Total Occupied Space includes 2,323 square feet of storage space |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

The following table presents certain information relating to the lease rollover schedule at the D.C. Office Portfolio Property:

Lease Expiration Schedule(1)(2)(3)

Year Ending

December 31, | No. of Leases Expiring | Expiring

NRSF | % of

Total

NRSF | Cumulative Expiring

NRSF | Cumulative % of Total

NRSF | Annual

U/W

Base Rent | % of Total Annual

U/W Base Rent | Annual

U/W

Base Rent

PSF(4) |

| 1020 19th Street Property | | | | | | | | |

| MTM | 0 | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | $0.00 |

| 2017 | 4 | 8,178 | 7.2% | 8,178 | 7.2% | 392,785 | 8.2% | $48.03 |

| 2018 | 3 | 11,300 | 9.9% | 19,478 | 17.1% | 519,207 | 10.8% | $45.95 |

| 2019 | 4 | 9,197 | 8.1% | 28,675 | 25.1% | 407,086 | 8.5% | $44.26 |

| 2020 | 2 | 5,707 | 5.0% | 34,382 | 30.1% | 260,202 | 5.4% | $45.59 |

| 2021 | 11 | 31,824 | 27.9% | 66,206 | 58.0% | 1,431,229 | 29.8% | $44.97 |

| 2022 | 5 | 15,615 | 13.7% | 81,821 | 71.7% | 757,866 | 15.8% | $48.53 |

| 2023 | 2 | 5,369 | 4.7% | 87,190 | 76.4% | 246,623 | 5.1% | $45.93 |

| 2024 | 0 | 0 | 0.0% | 87,190 | 76.4% | 0 | 0.0% | $0.00 |

| 2025 | 0 | 0 | 0.0% | 87,190 | 76.4% | 0 | 0.0% | $0.00 |

| 2026 | 1 | 6,291 | 5.5% | 93,481 | 81.9% | 254,272 | 5.3% | $40.42 |

| 2027(5) | 4 | 11,003 | 9.6% | 104,484 | 91.5% | 533,602 | 11.1% | $48.50 |

| Thereafter | 0 | 0 | 0.0% | 104,484 | 91.5% | 0 | 0.0% | $0.00 |

| Vacant(6) | 0 | 9,682 | 8.5% | 114,166 | 100.0% | 0 | 0.0% | $0.00 |

| Total/Weighted Average(7) | 36 | 114,166 | 100.0% | | | 4,802,872 | 100.0% | $45.97 |

| 1900 L Street Property | | | | | | | | |

| MTM | 1 | 649 | 0.6% | 649 | 0.6% | 7200 | 0.2% | $11.09 |

| 2017 | 8 | 12,171 | 11.6% | 12,820 | 12.3% | 563,988 | 12.5% | $46.34 |

| 2018 | 2 | 3,278 | 3.1% | 16,098 | 15.4% | 151,307 | 3.4% | $46.16 |

| 2019 | 11 | 18,811 | 18.0% | 34,909 | 33.4% | 816,576 | 18.1% | $43.41 |

| 2020 | 5 | 29,475 | 28.2% | 64,384 | 61.5% | 1,281,683 | 28.5% | $43.48 |

| 2021 | 2 | 3,059 | 2.9% | 67,443 | 64.4% | 132,205 | 2.9% | $43.22 |

| 2022(8) | 6 | 11,398 | 10.9% | 78,841 | 75.3% | 582,713 | 12.9% | $51.12 |

| 2023 | 1 | 2,333 | 2.2% | 81,174 | 77.6% | 227,826 | 5.1% | $97.65 |

| 2024 | 0 | 0 | 0.0% | 81,174 | 77.6% | 0 | 0.0% | $0.00 |

| 2025 | 2 | 3,374 | 3.2% | 84,548 | 80.8% | 147,711 | 3.3% | $43.78 |

| 2026 | 5 | 9,862 | 9.4% | 94,410 | 90.2% | 494,035 | 11.0% | $50.09 |

| 2027 | 1 | 1,212 | 1.2% | 95,622 | 91.4% | 96,960 | 2.2% | $80.00 |

| Thereafter | 0 | 0 | 0.0% | 95,622 | 91.4% | 0 | 0.0% | $0.00 |

| Vacant | 0 | 9,029 | 8.6% | 104,651 | 100.0% | 0 | 0.0% | $0.00 |

| Total/Weighted Average(9) | 44 | 104,651 | 100.0% | | | 4,502,204 | 100.0% | $47.08 |

| 1920 L Street Property | | | | | | | | |

| MTM | 0 | 0 | 0.0% | 0 | 0.0% | 0 | 0.0% | $0.00 |

| 2017 | 2 | 16,723 | 15.9% | 16,723 | 15.9% | 870,395 | 20.2% | $52.05 |

| 2018 | 4 | 11,308 | 10.7% | 28,031 | 26.6% | 655,570 | 15.2% | $57.97 |

| 2019 | 4 | 32,659 | 31.0% | 60,690 | 57.6% | 1,563,185 | 36.3% | $47.86 |

| 2020 | 3 | 8,860 | 8.4% | 69,550 | 66.0% | 426,793 | 9.9% | $48.17 |

| 2021 | 0 | 0 | 0.0% | 69,550 | 66.0% | 0 | 0.0% | $0.00 |

| 2022 | 1 | 2,599 | 2.5% | 72,149 | 68.5% | 129,203 | 3.0% | $49.71 |

| 2023 | 0 | 0 | 0.0% | 72,149 | 68.5% | 0 | 0.0% | $0.00 |

| 2024 | 1 | 2,857 | 2.7% | 75,006 | 71.2% | 135,770 | 3.2% | $47.52 |

| 2025 | 2 | 10,609 | 10.1% | 85,615 | 81.2% | 477,087 | 11.1% | $44.97 |

| 2026 | 0 | 0 | 0.0% | 85,615 | 81.2% | 0 | 0.0% | $0.00 |

| 2027 | 1 | 1,085 | 1.0% | 86,700 | 82.3% | 49,552 | 1.2% | $45.67 |

| Thereafter | 0 | 0 | 0.0% | 86,700 | 82.3% | 0 | 0.0% | $0.00 |

| Vacant | 0 | 18,700 | 17.7% | 105,400 | 100.0% | 0 | 0.0% | $0.00 |

| Total/Weighted Average(10) | 18 | 105,400 | 100.0% | | | $4,307,554 | 100.0% | $49.68 |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination or contraction options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Certain tenants may have multiple leases that are combined for purposes of this rollover schedule. |

| (4) | Weighted Average Annual U/W Base Rent PSF excludes vacant space. |

| (5) | Includes Breastfeeding Coalition (3,885 square feet) with a signed lease commencing July 15, 2017 and Consortium of Universities (3,567 square feet) with a signed lease commencing October 1, 2017. |

| (6) | Vacant space includes Café Carvey (2,598 square feet) due to the tenant’s lease maturity of March 31, 2017. |

| (7) | Total NRSF excludes a 1,571 square foot conference room. |

| (8) | Includes NRI Staffing, Inc (2,772 square feet) with a signed lease commencing June 1, 2017. |

| (9) | Total NRSF excludes 208 square feet of storage space. |

| (10) | Total NRSF excludes 2,323 square feet of storage space. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

The following table presents historical occupancy percentages at the D.C. Office Portfolio Property:

Historical Occupancy(1)

| | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 |

| 1020 19th Street Property | 92.0% | 86.0% | 92.0% | N/A | 86.0% | 93.0% | 91.0% | 97.2% |

| 1900 L Street Property | 94.0% | 90.0% | 94.0% | 94.0% | 97.0% | 94.0% | 89.0% | 92.8% |

| 1920 L Street Property | 85.0% | 85.0% | 98.0% | 98.0% | 99.0% | 91.0% | 93.0% | 92.9% |

| Weighted Average | 90.3% | 86.9% | 94.6% | N/A | 93.8% | 92.7% | 91.0% | 94.4% |

| (1) | Information obtained from the borrower. |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and the underwritten net cash flow at the D.C. Office Portfolio Property:

Cash Flow Analysis(1)

| | 2012 | 2013 | 2014 | 2015 | 2016 | U/W | % of U/W Effective Gross Income | U/W

$ per SF |

| Base Rent | $14,063,490 | $14,462,883 | $14,775,631 | $15,038,036 | $15,026,439 | $13,690,622 | 90.6% | $41.70 |

| Grossed Up Vacant Space | 0 | 0 | 0 | 0 | 0 | 1,556,782 | 10.3 | 4.74 |

| Total Reimbursables | 535,905 | 621,234 | 504,022 | 698,655 | 566,870 | 462,308 | 3.1 | 1.41 |

| Other Income | 65,730 | 28,828 | 38,823 | 52,518 | 69,896 | 49,362 | 0.3 | 0.15 |

| Parking Income | 632,383 | 586,674 | 527,370 | 564,016 | 851,269 | 904,277 | 6.0 | 2.75 |

| Less Vacancy & Credit Loss | (554,630) | (676,242) | (719,443) | (1,115,671) | (1,873,727) | (1,556,716) | (10.3) | (9.9%) |

| Effective Gross Income | $14,742,878 | $15,023,377 | $15,126,403 | $15,237,554 | $14,640,747 | $15,106,635 | 100.0% | $46.01 |

| | | | | | | | | |

| Total Operating Expenses | 5,158,468 | 5,353,143 | 5,572,552 | 5,852,879 | 5,784,367 | 5,846,676 | 38.7 | 17.81 |

| Net Operating Income | $9,584,410 | $9,670,234 | $9,553,851 | $9,384,675 | $8,856,380 | $9,259,959 | 61.3% | $28.20 |

| | | | | | | | | |

| TI/LC | 0 | 0 | 0 | 0 | 0 | 541,727 | 3.6 | 1.65 |

| Capital Expenditures | 0 | 0 | 0 | 0 | 0 | 65,664 | 0.4 | 0.20 |

| Net Cash Flow | $9,584,410 | $9,670,234 | $9,553,851 | $9,384,675 | $8,856,380 | $8,652,568 | 57.3% | $26.35 |

| | | | | | | | | |

| | | | | | | | | |

| NOI DSCR(2) | 1.89x | 1.91x | 1.89x | 1.85x | 1.75x | 1.83x | | |

| NCF DSCR(2) | 1.89x | 1.91x | 1.89x | 1.85x | 1.75x | 1.71x | | |

| NOI DY(3) | 9.6% | 9.7% | 9.6% | 9.4% | 8.9% | 9.3% | | |

| NCF DY(3) | 9.6% | 9.7% | 9.6% | 9.4% | 8.9% | 8.7% | | |

| (1) | U/W Base Rent includes income from three tenants who are not yet in occupancy:Breastfeeding Coalition (3,885 square feet) with a signed lease commencing July 15, 2017, Consortium of Universities (3,567 square feet) with a signed lease commencing October 1, 2017 and NRI Staffing, Inc (2,772 square feet) with a signed lease commencing June 1, 2017. For each of the three tenants, lender reserved six months of their respective rent. |

| (2) | The debt service coverage ratios are based on the D.C. Office Portfolio Whole Loan. |

| (3) | The debt yields are based on the D.C. Office Portfolio Whole Loan net of the $5,000,000 earnout reserve. |

Appraisal. As of the appraisal valuation date of December 22, 2016, the D.C. Office Portfolio Property had a total “as-is” appraised value of $186,800,000 and an assemblage land value of $203,000,000.

Environmental Matters. According to Phase I environmental assessments dated December 28, 2016 to December 30, 2016, recommendations were made to implement O&M programs relating to asbestos and lead based paint at the each D.C. Office Portfolio Property, and to implement an O&M program relating to a UST at the 1900 L Street Property.

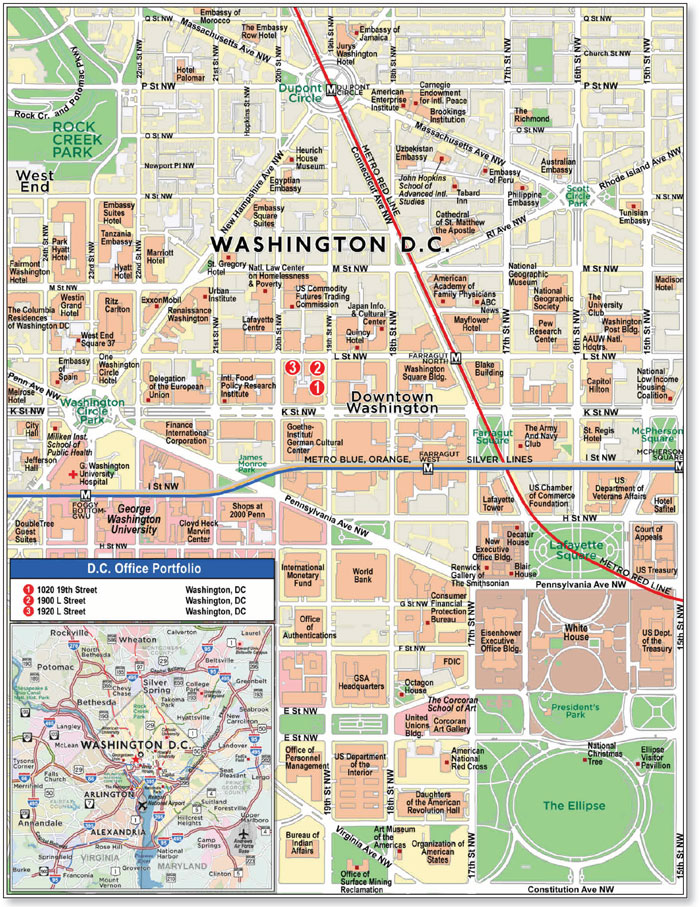

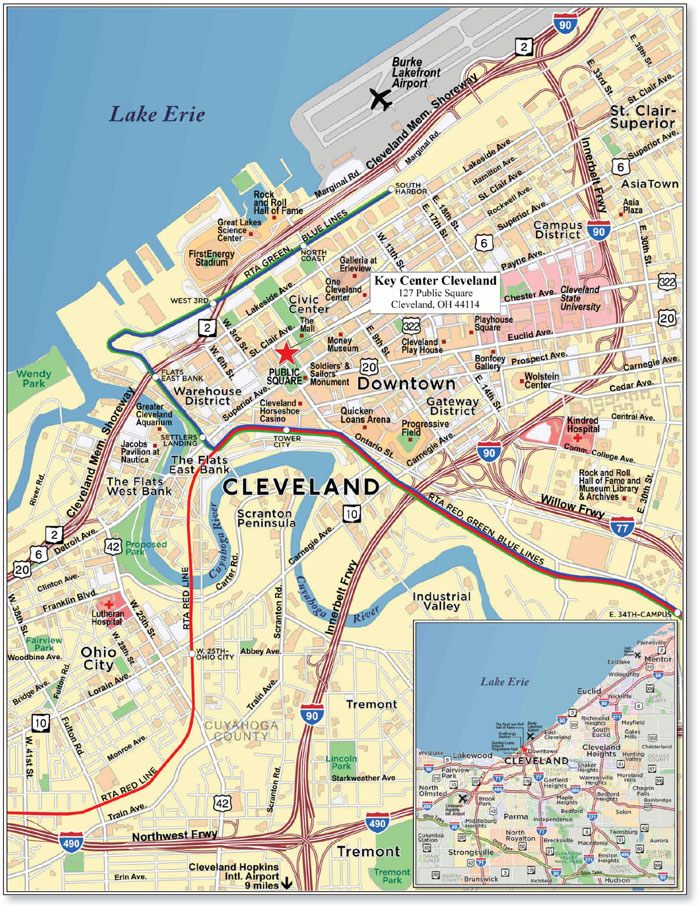

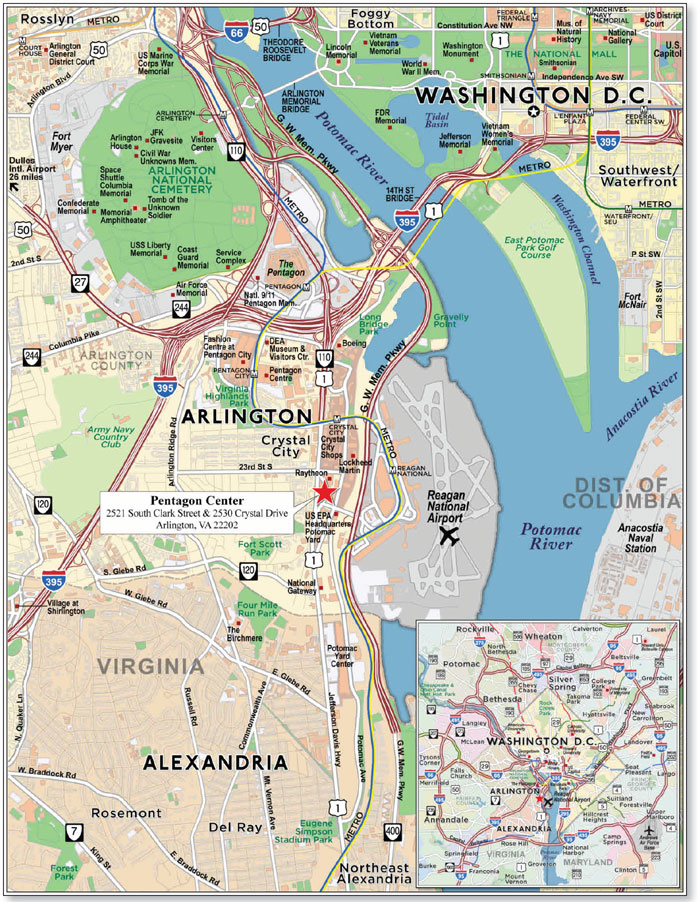

Market Overview and Competition.The D.C. Office Portfolio Property is located in the Central Business District (“CBD”) of Washington, D.C., situated prominently one block from the Farragut West Metrorail station and two blocks from the Farragut North Metrorail station, approximately two blocks east of George Washington University Hospital, between DuPont Circle to the north and the White House to the south. The D.C. Office Portfolio Property is immediately surrounded by Class “A” office buildings with street-level retail shops and restaurants. The Executive Buildings, Blair House and the Department of Treasury are located just southeast, and the World Bank Headquarters, George Washington University campus and hospital center are located south of the D.C. Office Portfolio Property. The D.C. Office Portfolio Property abuts Foggy Bottom, an area dominated by the U.S. Department of State.

The Federal Government, Defense, and High Technology sectors are the primary economic drivers in the Washington, D.C. metropolitan statistical area (“MSA”) and Washington, D.C. continues to be a popular tourist destination. According to the appraisal, the Washington, D.C. MSA has continued to expand as the private sector, particularly the leisure and hospitality and education and health services industries, continues to make up for federal payroll losses. The region’s gross metro product rose by 2.2% in 2015 and is projected to rise an estimated 2.6% annually over the next five years. Employment grew 1.8% in 2015 and is projected to grow 2.0% in 2016.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

The Washington, D.C. MSA has one of the most well-educated and well-paid populations in the country. Approximately 47.3% of the region’s residents hold a four-year degree or higher with approximately 22.6% of the region’s population having received or is pursuing, an advanced degree. According to the appraisal, the 2016 estimated population within a one-, three-, and five-mile radius was 62,231, 363,451 and 777,025, respectively and the 2016 average household income within the same radii was $143,208, $130,898 and $126,916, respectively.

The D.C. Office Portfolio Property is located within the CBD submarket of the District of Columbia office market. According to the appraisal, the CBD submarket has the lowest vacancy rate in the city with a direct vacancy at pre-recession low of 8.7% with weighted average rents of $54.10 PSF at the end of 2016 Q3. For the same period, the CBD submarket had approximately 33.5 million square feet of inventory with positive absorption of 372,715 square feet. According to a market report, the third quarter 2016 vacancy rate for “3 Star” buildings within the CBD submarket was 6.5% with asking rents of $46.11 PSF.

According to the appraisal, there are five properties currently under construction or under renovation in the CBD submarket totaling approximately 1.55 million square feet of net rentable area, of which 57% has been preleased.

The following table presents certain information relating to comparable office leases for the D.C. Office Portfolio Property:

Comparable Leases(1)

| Property Name/Location | Year

Built/ Renov. | Total

GLA

(SF) | Total Occ. | Distance

from

Subject | Tenant Name | Lease Date/Term | Lease Area (SF) | Annual Base Rent

PSF | Lease Type |

| 1220 19th Street NW | 1976/NA | 102,304 | 99.1% | 0.5 miles | Ankura Consulting Group LLC | Nov-16/4 Yrs | 5,968 | $49.00 | FSG |

Air Line Pilots Association Building 1625 Massachusetts Avenue NW | 1972/NA | 111,546 | 100% | 0.9 miles | International Organization for Migration | Oct-16/8 Yrs | 5,240 | $48.00 | FSG |

| | | | | | | | | | |

Marshall Coyne Building 1156 15th Street NW | NAV | NAV | NAV | 0.9 miles | American Jewish Committee | Sep-16/7 Yrs | 6,354 | $47.00 | FSG |

| | | | | | | | | | |

Barr Building 910 17th Street NW | 1927/1997 | 100,644 | 85.7% | 0.5 miles | Sparks Personnel Services Inc. | Aug-16/8 Yrs | 2,930 | $43.00 | FSG |

| | | | | | | | | | |

The Ring Building 1200 18th Street NW | 1947/NA | 198,492 | 95.8% | 0.6 miles | National Council for Community & Education Partnerships | Aug-16/10 Yrs | 4,500 | $37.50 | FSG |

| | | | | | | | | | |

The Ring Building 1200 18th Street NW | 1947/NA | 198,492 | 95.8% | 0.6 miles | Chorus America | Aug-16/10 Yrs | 2,530 | $39.00 | FSG |

| | | | | | | | | | |

1220 19th Street NW | 1976/NA | 102,304 | 99.1% | 0.5 miles | Geosyntec Consultants | Jun-16/5 Yrs | 2,728 | $46.00 | FSG |

| | | | | | | | | | |

1350 Connecticut Avenue NW | 1938/1988 | 190,389 | 93.7% | 0.8 miles | Oceana Inc | Apr-16/2 Yrs | 3,325 | $44.00 | FSG |

| | | | | | | | | | |

| (1) | Information obtained from the appraisals. |

The Borrower.The borrowers are ZG 1900 L Street, LLC, ZG 1920 L Street, LLC and ZG 1020 19th Street, LLC, each a single purpose Delaware limited liability company with two independent directors. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of the D.C. Office Portfolio Whole Loan.

The Sponsor.The sponsors and nonrecourse carveout guarantors are Charles Gravely and Shelton Zuckerman, each a principal of Zuckerman Gravely Development, Inc., a full service real estate company specializing in property management, development, leasing, finance and construction. Zuckerman Gravely Development, Inc. has a portfolio of approximately 1.7 million square feet of commercial office and retail space that is currently over 95% leased, and approximately 1,700 apartment units in the Washington, D.C. metropolitan area.

Escrows.The borrower deposited at closing $1,614,433 for taxes and insurance and is required to deposit on each monthly payment date (i) an amount equal to one-twelfth of the taxes the lender estimates will be payable in the next 12 months and (ii) an amount equal to one-twelfth of the insurance premiums the lender estimates will be payable in the next 12 months;provided that the requirement to deposit insurance premiums will be suspended if the borrower provides satisfactory evidence to the lender that the insurance coverage required by the D.C. Office Portfolio Whole Loan documents is being provided under acceptable blanket insurance policies.

The borrower is required to deposit on each monthly payment date $4,925 to a replacement reserve subject to a cap of $237,000 and $41,040 to a leasing reserve subject to a cap of $1,970,000.

The borrower has deposited at closing $806,797 to a rent reserve for abated rent periods through March 31, 2022 relating to 21 various tenants, $310,546 to a rent reserve relating to six various tenants with signed leases or letters of intent who are not yet in occupancy, and $816,325 to an existing tenant improvement and leasing reserve for landlord obligations relating to nine various tenants.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

The borrower has deposited at closing $5,000,000 to an earnout reserve, which borrower may not more than one time per quarter request a partial disbursement of provided that certain conditions are satisfied,inter alia(i) no event of default is continuing; and (ii) following the partial disbursement, the Earn Out Debt Yield (as defined below) shall be no less than 6.73%. On the later of 1) 30 months after the closing date of the D.C. Office Portfolio Whole Loan and 2) the end of the lockout period, any amount remaining in the earnout reserve will be applied to prepay the D.C. Office Portfolio Whole Loan and borrower shall be required to pay a prepayment premium equal to yield maintenance.

The “Earn Out Debt Yield” shall be calculated based on (a)(i) annualized in-place base rents (including expense reimbursements and contractual rent steps occurring within the next twelve months received under bona fide leases for tenants in occupancy or in occupancy within 60 days and excluding rent due from leases expiring within 60 days) and actual percentage rents and recurring operating income received for the preceding twelve months, (ii) less operating expenses for the last 12 months (excluding non-recurring items) adjusted to assume a vacancy rate of the greater of 6% or actual vacancy, management fees of 3% of effective gross income, capital expenditures of $0.18 PSF and tenant improvement and leasing costs equal to $1.60 PSF, divided by (b) the principal amount outstanding on the D.C. Office Portfolio Whole Loan plus the proposed earnout partial disbursement, plus the principal amount outstanding on the D.C. Office Mezzanine Loan.

Lockbox and Cash Management.The D.C. Office Portfolio Whole Loan is structured with a lender-controlled lockbox, which is already in place. The D.C. Office Portfolio Whole Loan documents require the borrower to direct all tenants to pay rent directly into such lockbox account, and also require that all rents received by the borrower or the property manager be deposited into the lockbox account. Prior to the occurrence of a Cash Sweep Period (as defined below), all funds in the lockbox account are distributed to the borrower. During a Cash Sweep Period, all funds in the lockbox account are swept to a lender-controlled cash management account and applied as provided in the loan documents. Also during the continuation of a Cash Sweep Period, all excess cash flow shall be retained and held by lender as additional security for the D.C. Office Portfolio Whole Loan.

A “Cash Sweep Period” will commence upon the earliest of (i) a D.C. Office Portfolio Mezzanine Loan default or (ii) upon the debt service coverage ratio being less than 1.10x for two consecutive calendar quarters, and will end upon as applicable (y) the cure of such D.C. Office Portfolio Mezzanine Loan default, and (z) the debt service coverage ratio being at least 1.15x for the trailing six months.

Property Management. The D.C. Office Portfolio Property is managed by Zuckerman Gravely Management, Inc., an affiliate of the borrower.

Assumption. The borrower has the right to transfer the D.C. Office Portfolio Property provided that certain conditions are satisfied,inter alia (i) no event of default is continuing; (ii) lender has approved of the transferee based on factors including its underwriting and credit requirements, the experience, track record and financial strength of the transferee and its principals; (iii) if required by lender, lender has received rating agency confirmation; and (iv) if required by the D.C. Office Portfolio Mezzanine Loan documents, the transferee shall have assumed the obligations of the D.C. Office Portfolio Mezzanine Loan borrower.

Partial Release.Following the lockout period, the D.C. Office Portfolio borrower is permitted to release any individual property provided that certain conditions are satisfied,inter alia (i) no event of default is continuing; (ii) if required by lender rating agency confirmation has been received; (iii) the D.C. Office Portfolio Mezzanine Loan borrower shall have defeased the applicable portion of the D.C. Office Portfolio Mezzanine Loan; and (iv) the D.C. Office Whole Loan shall be prepaid by an amount equal to the Release Amount.

The “Release Amount” means (I) in connection with a property release pursuant to an arm’s length sale, an amount equal to the greater of (i) 110% of the allocated loan amount for such individual property being released and (ii) an amount such that (a) the loan to value ratio excluding the individual property being released is no more than (1) 69.59%, and (2) the loan to value ratio immediately prior to the release; (b) the debt service coverage ratio excluding the individual property being released is no less than (1) 1.25x and (2) the debt service coverage ratio immediately prior to the release; and (c) the debt yield excluding the individual property being released is no less than (1) 6.7267%, and (2) the debt yield immediately prior to the release (the amount determined in the foregoing clause the “Base Release Amount”); or (II) in connection with any other property release, an amount equal to the greater of (i) 125% of the allocated loan amount for such individual property being released and (ii) the Base Release Amount for such individual property.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Bank of America, N.A. has made a $25,000,000 mezzanine loan (the “D.C. Office Portfolio Mezzanine Loan”) to ZG Walker Holdings, LLC and 1900 L Holding, LLC, the sole members of the borrower under the D.C. Office Portfolio Whole Loan. The D.C. Office Portfolio Mezzanine Loan accrues interest at an interest rate of 6.75%per annum, requires payments of interest only through its 120-month term, and matures on March 1, 2027. The Cut-off Date LTV Ratio, U/W NCF DSCR and U/W NCF DY based on the combined D.C. Office Portfolio Whole Loan including the D.C. Office Portfolio Mezzanine Loan are 69.6%, 1.28x and 6.7%, respectively.

Ground Lease.None.

Terrorism Insurance. The loan documents require that the “all risk” insurance policy required to be maintained by the borrower provides coverage for terrorism in an amount equal to the full replacement cost of the D.C. Office Portfolio Property, provided, however, that borrower will not be required to pay annual terrorism insurance premiums greater than two times the premium for a stand-alone policy for only the D.C. Office Portfolio Property. The loan documents also require business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a 12-month extended period of indemnity.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

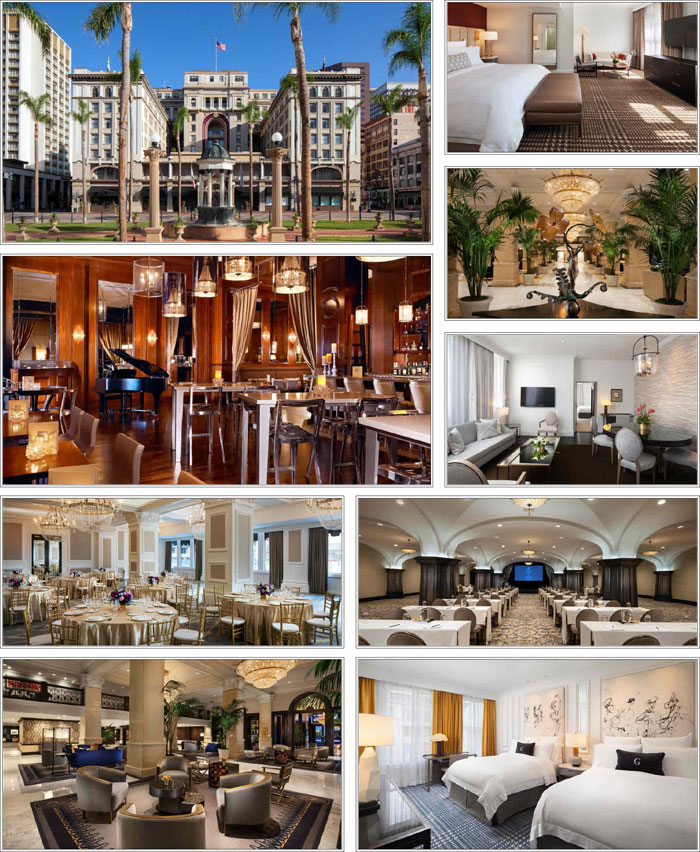

| No. 2– The Summit Birmingham |

| |

| Loan Information | | Property Information |

| Mortgage Loan Seller: | Bank of America, N.A. | | Single Asset/Portfolio: | Single Asset |

Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type: | Retail |

| Original Principal Balance(1): | $61,875,000 | | Specific Property Type: | Lifestyle Center |

| Cut-off Date Balance(1): | $61,875,000 | | Location: | Birmingham, AL |

| % of Initial Pool Balance: | 6.1% | | Size: | 681,245 SF |

| Loan Purpose: | Refinance | | Cut-off Date Balance Per SF(1): | $305.32 |

| Borrower Name: | BRC Holding Company, L.L.C. | | Year Built/Renovated: | 1997/2009 |

| Sponsors: | JDJ Birmingham Company, L.L.C.; Institutional Mall Investors LLC | | Title Vesting: | Fee |

| Mortgage Rate: | 4.762% | | Property Manager: | Bayer Properties, L.L.C. |

| Note Date: | December 20, 2016 | | 4thMost Recent Occupancy (As of): | NAV |

| Anticipated Repayment Date: | NAP | | 3rdMost Recent Occupancy (As of)(4): | 98.9% (12/31/2013) |

| Maturity Date: | January 1, 2027 | | 2ndMost Recent Occupancy (As of)(4): | 96.4% (12/31/2014) |

| IO Period: | 120 months | | Most Recent Occupancy (As of)(4): | 97.8% (12/31/2015) |

| Loan Term (Original): | 120 months | | Current Occupancy (As of)(5): | 98.5% (12/14/2016) |

| Seasoning: | 3 months | | |

| Amortization Term (Original): | NAP | | Underwriting and Financial Information: |

| Loan Amortization Type: | Interest-only, Balloon | | | |

| Interest Accrual Method: | Actual/360 | | 4thMost Recent NOI (As of)(6): | $19,160,179 (12/31/2013) |

| Call Protection(2): | L(27),D(86),O(7) | | 3rdMost Recent NOI (As of)(6): | $19,415,127 (12/31/2014) |

| Lockbox Type: | Hard/Springing Cash Management | | 2ndMost Recent NOI (As of)(6): | $19,589,778 (12/31/2015) |

| Additional Debt(1): | Yes | | Most Recent NOI (As of): | $17,296,891 (12/31/2016) |

| Additional Debt Type(1): | Pari Passu | | |

| | | | U/W Revenues: | $24,205,097 |

| | | | U/W Expenses: | $6,134,767 |

| | | | U/W NOI: | $18,070,330 |

| | | | | | U/W NCF: | $16,883,902 |

| Escrows and Reserves(3): | | | | | U/W NOI DSCR(1): | 1.80x |

| Type: | Initial | Monthly | Cap (If Any) | | U/W NCF DSCR(1): | 1.68x |

| Taxes | $0 | Springing | NAP | | U/W NOI Debt Yield(1): | 8.7% |

| Insurance | $0 | Springing | NAP | | U/W NCF Debt Yield(1): | 8.1% |

| Replacement Reserves | $0 | Springing | $225,984 | | As-Is Appraised Value: | $383,000,000 |

| TI/LC Reserve | $1,989,285 | Springing | $2,146,872 | | As-Is Appraisal Valuation Date: | November 7, 2016 |

| Gap Rent Reserve | $346,727 | $0 | NAP | | Cut-off Date LTV Ratio(1): | 54.3% |

| Overage Rent Reserve | $506,123 | $0 | NAP | | LTV Ratio at Maturity or ARD(1): | 54.3% |

| | | | | | | |

| | | | | | | | |

| (1) | The Summit Birmingham Whole Loan (as defined below) is comprised of fourpari passu promissory notes with an aggregate original principal balance of $208,000,000. The non-controlling The Summit Birmingham Mortgage Loan (as defined below) had an original principal balance of $61,875,000, has an outstanding principal balance of $61,875,000 as of the Cut-off Date and will be contributed to the BANK 2017-BNK4 Trust. All statistical financial information related to balances per square foot, loan-to-value ratios, debt service coverage ratios and debt yields are based on The Summit Birmingham Whole Loan. |

| (2) | The defeasance lockout period will be at least 27 payment dates beginning with and including the first payment date of February 1, 2017. Defeasance of The Summit Birmingham Whole Loan is permitted after the date that is the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized, and (ii) February 1, 2020. The assumed lockout period of 27 payments is based on the expected BANK 2017-BNK4 Trust closing date in April 2017. |

| (3) | See “Escrows” section. |

| (4) | Historical occupancy includes tenants at Phase IB (non-collateral) of The Summit. |

| (5) | Current Occupancy includes three tenants (2.0% of NRA) with executed leases but who are not yet in occupancy at The Summit Birmingham Property. The lender has reserved 100.0% of the rent associated with each tenant from the Note Date through each lease’s scheduled commencement date. See “Escrows” below for further details. |

| (6) | Historical NOI includes income and expenses from Phase IB (non-collateral) of The Summit. |

The Mortgage Loan. The mortgage loan (“The Summit Birmingham Mortgage Loan”) is part of a whole loan (“The Summit Birmingham Whole Loan”) evidenced by fourpari passu promissory notes, secured by the fee interest in a 681,245 square foot portion of The Summit, an upscale mixed-use development in Birmingham, Alabama (the “The Summit Birmingham Property”). The Summit Birmingham Whole Loan was co-originated on December 20, 2016 by Bank of America, N.A. and Barclays Bank PLC. The Summit Birmingham Whole Loan had an original principal balance of $208,000,000, has an outstanding principal balance as of the Cut-off Date of $208,000,000 and accrues interest at an interest rate of 4.762%per annum. The Summit Birmingham Whole Loan had an initial term of 120 months, has a remaining term of 117 months as of the Cut-off Date and requires payments of interest-only through its term. The Summit Birmingham Whole Loan matures on January 1, 2027.

The Summit Birmingham Mortgage Loan, evidenced by Note A-1 will be contributed to the BANK 2017-BNK4 Trust, had an original principal balance of $61,875,000, has an outstanding principal balance as of the Cut-off Date of $61,875,000 and represents apari passu non-controlling interest in The Summit Birmingham Whole Loan. The controlling Note A-2 had an original principal balance of $73,325,000 and was contributed to the BACM 2017-BNK3 Trust. The non-controlling Note A-3 had an original principal balance of

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

$50,000,000 and was contributed to the BBCMS 2017-C1 Trust, and the non-controlling Note A-4 had an original principal balance of $22,800,000, is currently held by Barclays Bank PLC and is expected to be contributed to the WFCM 2017-RB1 Trust. The lender provides no assurances that any non-securitized notes will not be split further. See “Description of the Mortgage Pool—The Whole Loans—The Non-Serviced Whole Loans” in the Preliminary Prospectus.

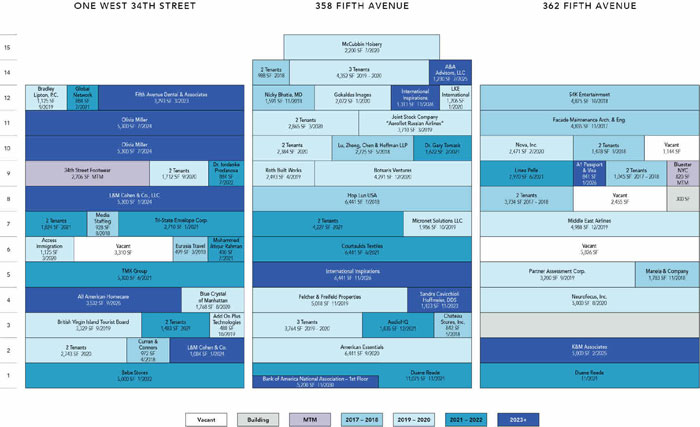

Note Summary

| Notes | Original Balance | Note Holder | Controlling Interest |

| A-1 | $61,875,000 | BANK 2017-BNK4 | No |

| A-2 | $73,325,000 | BACM 2017-BNK3 | Yes |

| A-3 | $50,000,000 | BBCMS 2017-C1 | No |

| A-4 | $22,800,000 | WFCM 2017-RB1 | No |

| Total | $208,000,000 | | |

Following the lockout period, on any date before July 1, 2026, the borrower has the right to defease The Summit Birmingham Whole Loan in whole, but not in part. In addition, The Summit Birmingham Whole Loan is prepayable without penalty on or after July 1, 2026. The lockout period will expire on the earlier to occur of (i) two years after the closing date of the securitization that includes the last note to be securitized and (ii) February 1, 2020.

Sources and Uses

| Sources | | | | | Uses | | | |

| Original whole loan amount | $208,000,000 | | 100.0% | | Loan payoff | $155,905,651 | | 75.0% |

| | | | | | Reserves | 2,842,135 | | 1.4 |

| | | | | | Closing costs | 2,260,319 | | 1.1 |

| | | | | | Return of equity | 46,991,895 | | 22.6 |

| Total Sources | $208,000,000 | | 100.0% | | Total Uses | $208,000,000 | | 100.0% |

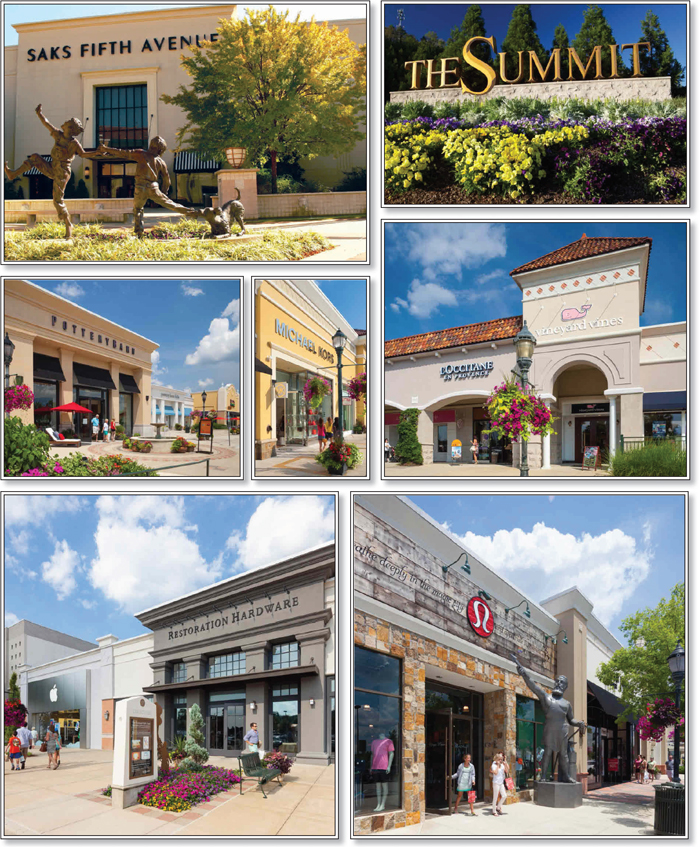

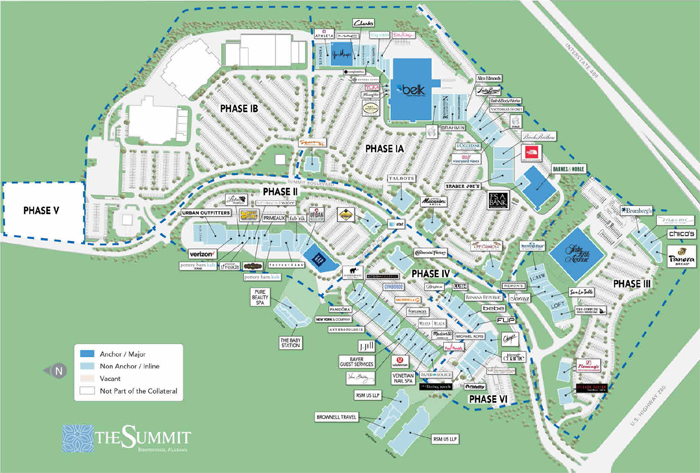

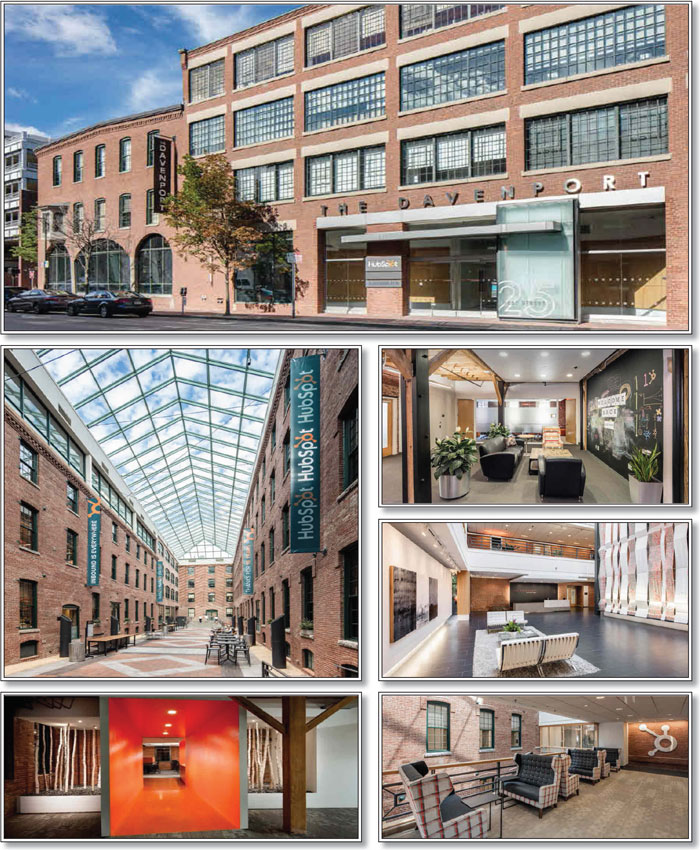

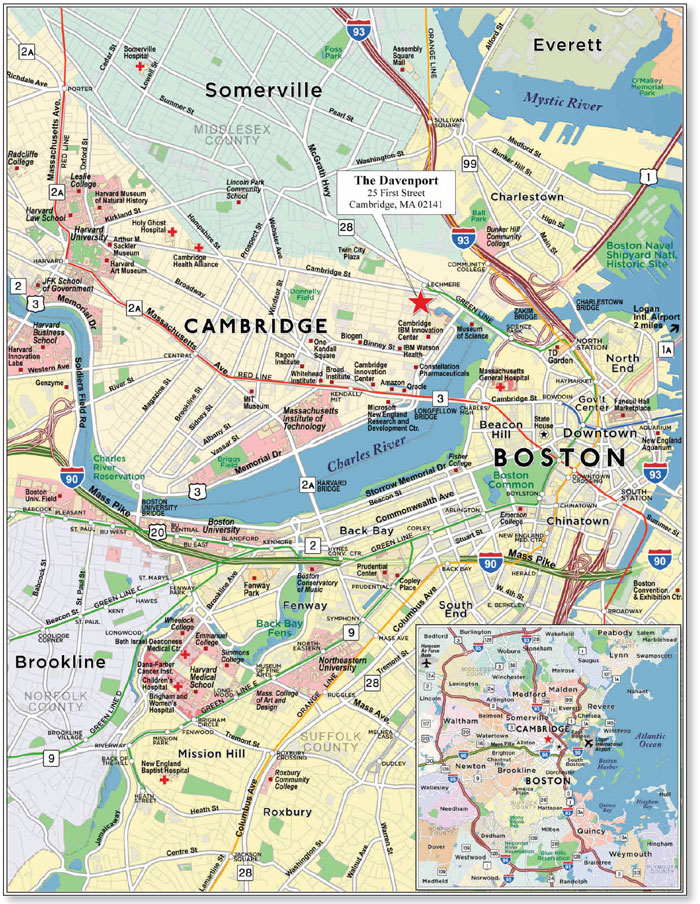

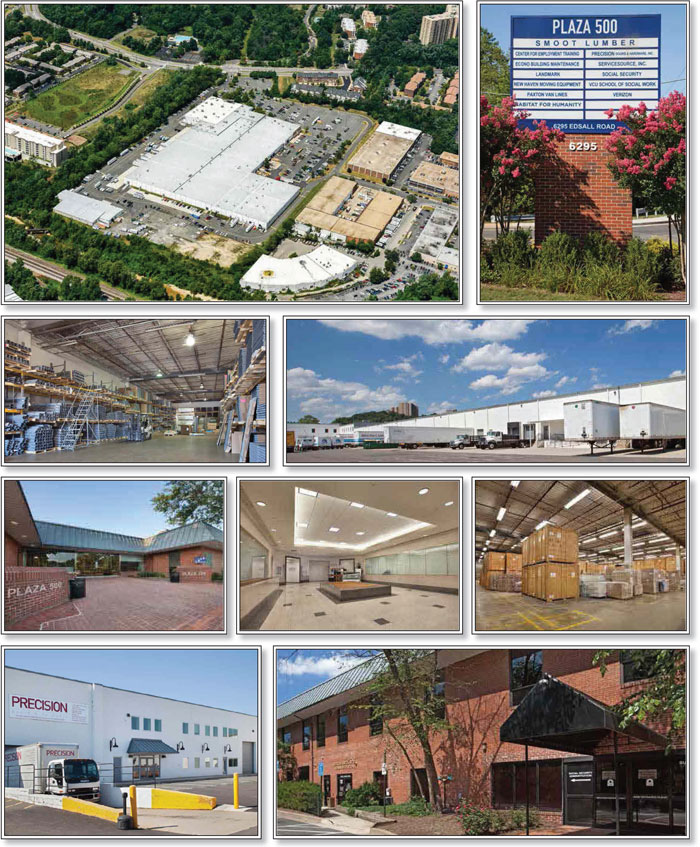

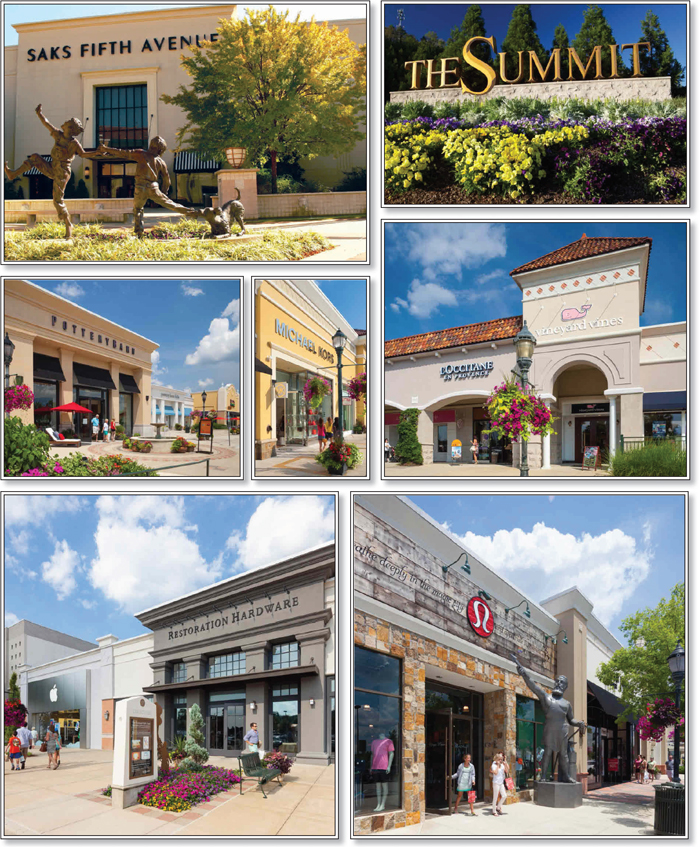

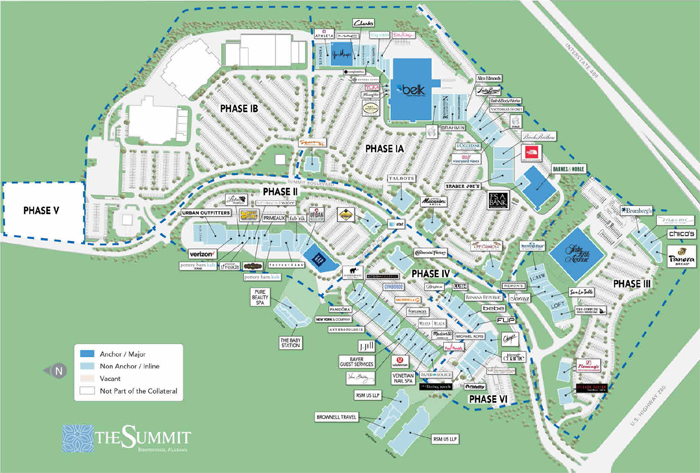

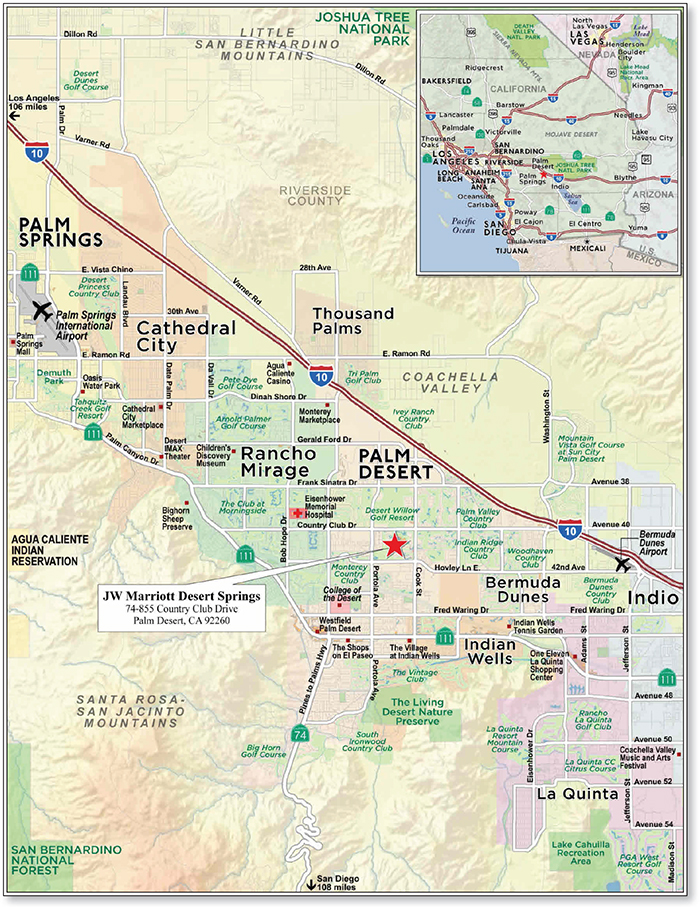

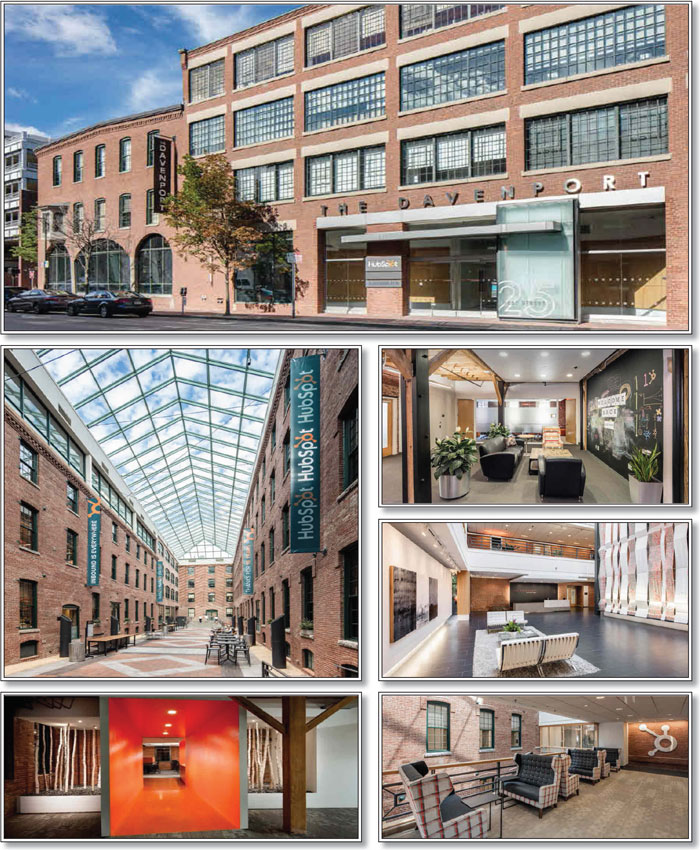

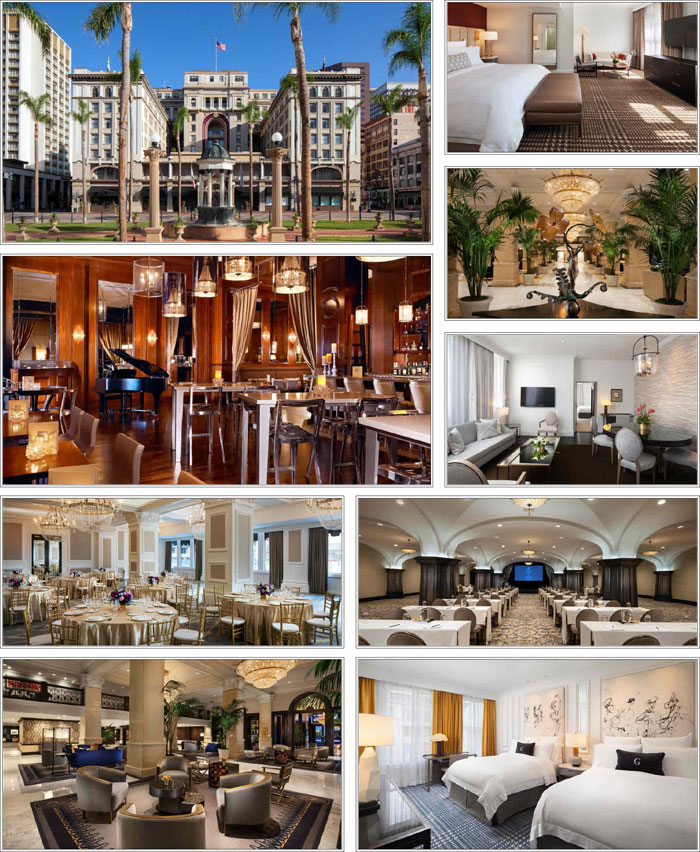

The Property. The Summit Birmingham Property consists of a 681,245 square foot portion of The Summit. The Summit is an upscale mixed-use development comprised of a total of 1,036,240 square feet of retail and office space, built in phases between 1997 and 2009. Phases IA and IB (non-collateral) were opened in 1997 with over 400,000 square feet featuring tenants including Barnes & Noble, Banana Republic, Williams-Sonoma, Ann Taylor, Victoria’s Secret, P.F. Chang’s and Macaroni Grill. Phase II was opened in 2000 and brought new-to-the-market retailers including California Pizza Kitchen, Everything But Water, Pottery Barn and Pottery Barn Kids and also allowed Gap to relocate and add Gap Kids and Gap Body to its offerings. Phase III opened in 2001, bringing Saks Fifth Avenue to open its first and only store in the state of Alabama, adding J. Crew, Fleming’s and Panera Bread, and allowing Chico’s and Talbots to expand its stores. Phase IV opened in 2005 bringing The Cheesecake Factory, Anthropologie, Vera Bradley and Swoozie’s as first-time retailers in the state of Alabama. Phase VI opened in 2009 with 50,000 square feet of office and 50,000 square feet of retail space including tenants Banana Republic, Charming Charlie and Michael Kors. Phase V (non-collateral) is an unimproved 2.1 acre parcel which as with Phase IB (non-collateral) may be developed or redeveloped in the future by The Summit Birmingham Mortgage Loan sponsor.

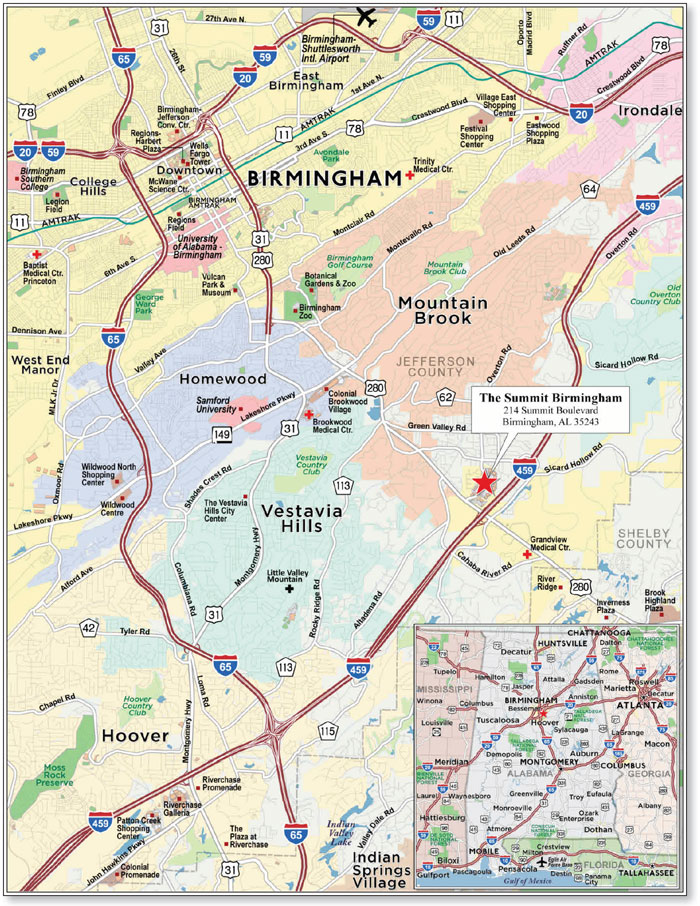

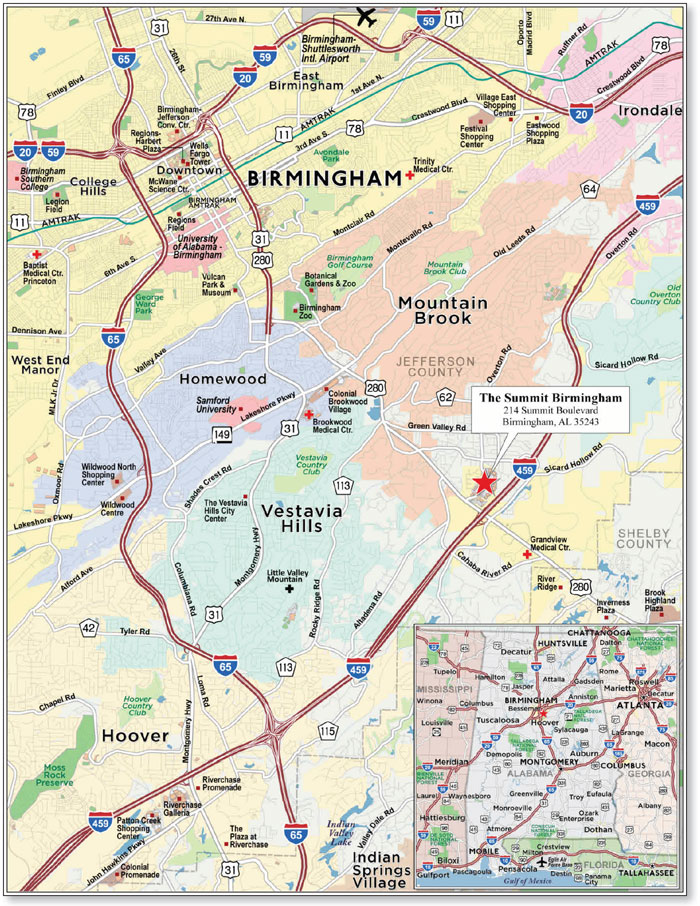

Access to The Summit is available from seven points of ingress and eight points of egress all controlled by stop signs or traffic lights. The Summit is located at the intersection of Highway 280 (73,970 average daily traffic count) leading northwest through the affluent suburbs of Mountain Brook, Vestavia Hills and Homewood to the Birmingham central business district, and I-459 (101,020 average daily traffic count) leading southwest to the wealthy suburb of Hoover. Highway 280 and I-459 are the area’s primary commercial thoroughfares and, according to the appraiser, the intersection of these roadways is the center of the growth corridor of the Birmingham metropolitan area.

The Summit is Birmingham’s single largest generator of sales tax revenue, comprising over 10% of the city’s sales tax revenues. Due to this success, the City of Birmingham has continued to support the development of The Summit and has invested an additional $7.5 million in infrastructure improvements and expansions through tax sharing arrangements. Approximately 50 of The Summit’s retailers are exclusive to the property in Alabama or Birmingham including Saks Fifth Avenue, Trader Joe’s, Art of Shaving, Apple, Pottery Barn, Restoration Hardware and lululemon athletica. Historical occupancy at The Summit has averaged 97.6% for the period 2012 to 2015.

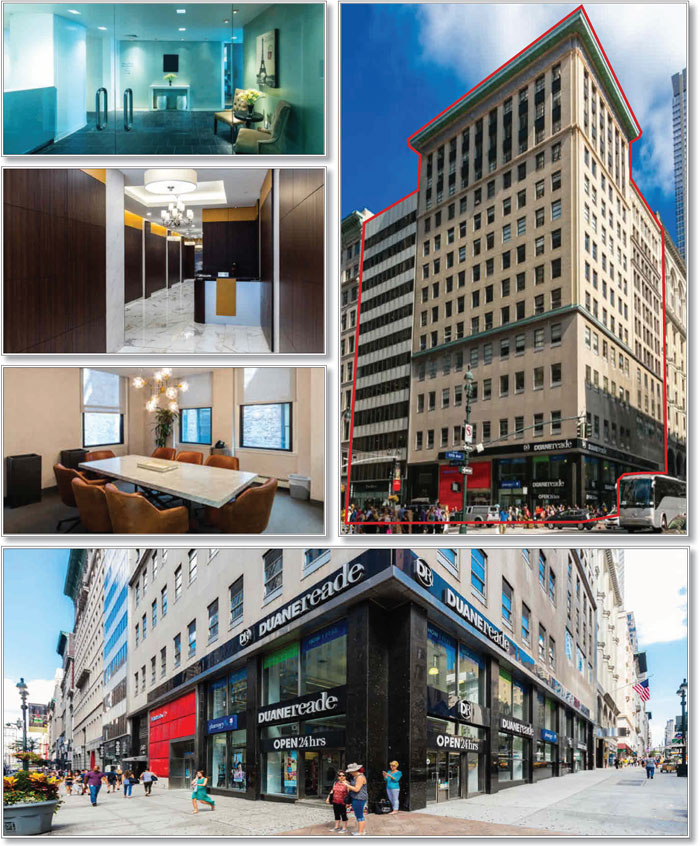

The Summit Birmingham Property is contained across 19 buildings. Included in the collateral are 3,474 parking spaces (approximately 5.10 spaces per 1,000 SF). The Summit Birmingham Property is anchored by Belk and Saks Fifth Avenue (non-collateral), with other large retail tenants including Gap, Barnes & Noble, Trader Joe’s and Gus Mayer. No other retail tenant occupies more than 1.8% of NRA or represents more than 2.0% of base rent. Other noteworthy tenants include: Apple, Anthropologie, The Cheesecake Factory, J Crew, lululemon athletica, Madewell, Pottery Barn, Restoration Hardware, Sephora, Vineyard Vines and West Elm. The two office tenants representing 7.5% of NRA and 8.2% of base rent are RSM US LLP, an audit, tax and consulting firm, and Brownell Travel, a luxury travel agency.

The Summit Birmingham Property was 98.5% leased as of December 2016 to 102 retail, restaurant and office tenants. Total inline sales at The Summit Birmingham Property for the trailing 12 months ending August 31, 2016 were approximately $213.77 million with an average of $603 PSF ($513 PSF excluding Apple), resulting in an occupancy cost of 8.0% (9.4% excluding Apple).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

The following table presents certain information relating to the tenancy at The Summit Birmingham Property:

Major Tenants

| Tenant Name | Credit Rating (Fitch/Moody’s/

S&P)(1) | Tenant NRSF(2) | % of

NRSF | Annual U/W

Base

Rent

PSF(3)(4) | Annual

U/W Base

Rent(4) | % of

Total Annual

U/W

Base

Rent | Sales

PSF(5)(6) | Occupancy Cost(5) | Lease

Expiration

Date |

| | | | | | | | | | |

| Major Retail Tenants(7) | | | | | | | | | |

| Belk | NR/B2/B | 163,480 | 24.0% | $6.41 | $1,047,986 | 5.3% | $245 | 3.2% | 1/31/2018 |

| Gap | BB+/Baa2/BB+ | 17,522 | 2.6% | $40.09 | $702,507 | 3.6% | $267 | 17.5% | 3/31/2020 |

| Barnes & Noble | NR/NR/NR | 25,397 | 3.7% | $20.97 | $532,575 | 2.7% | N/A | N/A | 2/1/2018 |

| Trader Joe’s | NR/NR/NR | 12,922 | 1.9% | $36.00 | $465,192 | 2.4% | N/A | N/A | 9/30/2025 |

| Gus Mayer | NR/NR/NR | 16,410 | 2.4% | $23.39 | $383,760 | 2.0% | $711 | 5.2% | 1/31/2019 |

| Total Major Retail Tenants | 235,731 | 34.6% | $13.29 | $3,132,020 | 15.9% | | | |

| | | | | | | | | | |

| Other Retail Tenants | | 384,236 | 56.4% | $38.83 | $14,920,610 | 75.9% | | | |

| Occupied Retail Collateral Total | | 619,967 | 91.0% | $29.12 | $18,052,630 | 91.8% | | | |

| | | | | | | | | | |

| Vacant Retail Space | | 10,428 | 1.5% | | | | | | |

| Retail Collateral Total | 630,395 | 92.5% | | | | | | |

| | | | | | | | | | |

| Office Tenants | | | | | | | | | |

| RSM US LLP | | 35,724 | 5.2% | $33.84 | $1,208,900 | 6.2% | | | 10/31/2021 |

| Brownell Travel | | 15,126 | 2.2% | $26.00 | $393,276 | 2.0% | | | 3/31/2018 |

| Occupied Office Total | | 50,850 | 7.5% | $31.51 | $1,602,176 | 8.2% | | | |

| | | | | | | | | | |

| Vacant Office | | 0 | 0.0% | | | | | | |

| Office Collateral Total | | 50,850 | 7.5% | | | | | | |

| | | | | | | | | | |

| Collateral Total | 681,245 | 100.0% | | | | | | |

| | | | | | | | | | |

| (1) | Certain ratings are those of the parent company whether or not the parent company guarantees the lease. |

| (2) | Tenant NRSF includes storage space. |

| (3) | Total Annual U/W Base Rent PSF excludes vacant space. |

| (4) | Annual U/W Base Rent includes contractual rent increases through January, 2018. |

| (5) | Sales PSF and Occupancy Costs are for the trailing 12-month period ending August 31, 2016. |

| (6) | Sales PSF excludes storage space. |

| (7) | Major Retail Tenants ordered by Annual U/W Base Rent. |

The following table presents certain information relating to the historical sales and occupancy costs at The Summit Birmingham Property:

Historical Tenant Sales (PSF) and Occupancy Costs(1)

| | Historical Tenant Sales (PSF) | |

| | 2014 | 2015 | 8/31/2016

TTM | 8/31/2016 Occupancy

Cost |

| Total In-Line | | | | |

| Comparable Sales PSF w/Apple | $601 | $604 | $603 | 8.0% |

| Comparable Sales PSF w/o Apple | $516 | $518 | $513 | 9.4% |

| | | | | |

| (1) | Historical Tenant Sales (PSF) and Occupancy Costs obtained from the underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

The following table presents certain information relating to the lease rollover schedule at The Summit Birmingham Property:

Lease Expiration Schedule(1)(2)

Year Ending

December 31, | No. of

Leases Expiring(3) | Expiring

NRSF | % of

Total

NRSF | Cumulative Expiring

NRSF | Cumulative % of Total

NRSF | Annual

U/W

Base Rent | % of Total

Annual

U/W Base

Rent | Annual

U/W

Base

Rent

PSF(4) |

| MTM | 3 | 3,486 | 0.5% | 3,486 | 0.5% | $94,217 | 0.5% | $27.03 |

| 2017 | 13 | 47,241 | 6.9% | 50,727 | 7.4% | $1,567,170 | 8.0% | $33.17 |

| 2018 | 12 | 235,982 | 34.6% | 286,709 | 42.1% | $3,159,659 | 16.1% | $13.39 |

| 2019 | 12 | 65,570 | 9.6% | 352,279 | 51.7% | $2,301,694 | 11.7% | $35.10 |

| 2020 | 6 | 40,535 | 6.0% | 392,814 | 57.7% | $1,612,627 | 8.2% | $39.78 |

| 2021 | 9 | 78,078 | 11.5% | 470,892 | 69.1% | $2,825,302 | 14.4% | $36.19 |

| 2022 | 7 | 25,290 | 3.7% | 496,182 | 72.8% | $1,067,334 | 5.4% | $42.20 |

| 2023 | 11 | 55,727 | 8.2% | 551,909 | 81.0% | $2,060,614 | 10.5% | $36.98 |

| 2024 | 10 | 39,789 | 5.8% | 591,698 | 86.9% | $1,651,661 | 8.4% | $41.51 |

| 2025 | 8 | 37,072 | 5.4% | 628,770 | 92.3% | $1,586,300 | 8.1% | $42.79 |

| 2026 | 4 | 7,295 | 1.1% | 636,065 | 93.4% | $392,140 | 2.0% | $53.75 |

| 2027 | 6 | 32,752 | 4.8% | 668,817 | 98.2% | $1,242,087 | 6.3% | $37.92 |

| 2028 & Beyond | 1 | 2,000 | 0.3% | 670,817 | 98.5% | $94,000 | 0.5% | $47.00 |

| Vacant | 0 | 10,428 | 1.5% | 681,245 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Wtd. Avg. | 102 | 681,245 | 100.0% | | | $19,654,807 | 100.0% | $29.30 |

| (1) | Information obtained from the underwritten rent roll. |

| (2) | Certain tenants may have lease termination or contraction options that are exercisable prior to the originally stated expiration date of the subject lease and that are not considered in the Lease Expiration Schedule. |

| (3) | Certain tenants may have leases for storage space, which are not counted as separate leases for purposes of this Lease Expiration Schedule. |

| (4) | Weighted Average Annual U/W Base Rent PSF excludes vacant space. |

The following table presents historical occupancy percentages at The Summit Birmingham Property:

Historical Occupancy(1)

12/31/2013(2) | 12/31/2014(2) | 12/31/2015(2) | 12/14/2016(3) |

| 98.9% | 96.4% | 97.8% | 98.5% |

| (1) | Information obtained from the borrower. |

| (2) | Historical occupancy includes tenants at Phase IB (non-collateral) of The Summit. |

| (3) | December 14, 2016 occupancy includes three tenants (2.0% of NRA) with executed leases but who are not yet in occupancy at The Summit Birmingham Property. The lender has reserved 100.0% of the rent associated with each tenant from the Note Date through each lease’s scheduled commencement date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at The Summit Birmingham Property:

Cash Flow Analysis

| | | 2013(1) | | 2014(1) | | 2015(1) | | 2016 | | U/W | | % of U/W

Effective

Gross Income | | U/W $

per SF | |

| Base Rent(2) | | $20,815,763 | | $21,292,859 | | $21,886,070 | | $19,370,283 | | $20,333,193(3) | | 84.0% | | $29.85 | |

| Grossed Up Vacant Space | | 0 | | 0 | | 0 | | 0 | | 557,813 | | 2.3 | | 0.82 | |

| Total Reimbursables | | 4,613,871 | | 4,492,764 | | 4,656,167 | | 3,878,724 | | 4,075,464 | | 16.8 | | 5.98 | |

| Specialty Leasing | | 163,190 | | 162,542 | | 178,150 | | 168,497 | | 120,292 | | 0.5 | | 0.18 | |

| Other Income(4) | | 460,762 | | 417,690 | | 405,592 | | 357,847 | | 366,658 | | 1.5 | | 0.54 | |

| Less Vacancy & Credit Loss | | (79,446) | | 15,402 | | (191,313) | | (479,711) | | (1,248,324) | | (5.2) | | (5.0%) | |

| Effective Gross Income | | $25,974,140 | | $26,381,257 | | $26,934,666 | | $23,295,640 | | $24,205,097 | | 100.0% | | $35.53 | |

| | | | | | | | | | | | | | | | |

| Total Operating Expenses | | 6,813,961 | | 6,966,130 | | 7,344,888 | | 5,998,750 | | 6,134,767 | | 25.3 | | 9.01 | |

| Net Operating Income | | $19,160,179 | | $19,415,127 | | $19,589,778 | | $17,296,891 | | $18,070,330 | | 74.7% | | $26.53 | |

| | | | | | | | | | | | | | | | |

| TI/LC | | 0 | | 0 | | 0 | | 0 | | 1,073,437 | | 4.4 | | 1.58 | |

| Capital Expenditures | | 0 | | 0 | | 0 | | 0 | | 112,991 | | 0.5 | | 0.17 | |

| Net Cash Flow | | $19,160,179 | | $19,415,127 | | $19,589,778 | | $17,296,891 | | $16,883,902 | | 69.8% | | $24.78 | |

| | | | | | | | | | | | | | | | |

| NOI DSCR(5) | | 1.91x | | 1.93x | | 1.95x | | 1.72x | | 1.80x | | | | | |

| NCF DSCR(5) | | 1.91x | | 1.93x | | 1.95x | | 1.72x | | 1.68x | | | | | |

| NOI DY(5) | | 9.2% | | 9.3% | | 9.4% | | 8.3% | | 8.7% | | | | | |

| NCF DY(5) | | 9.2% | | 9.3% | | 9.4% | | 8.3% | | 8.1% | | | | | |

| (1) | Historical NOI includes income and expenses from Phase IB (non-collateral) of The Summit. |

| (2) | Base Rent includes percentage rent. |

| (3) | U/W Base Rent includes contractual rent steps through January 2018. |

| (3) | Other Income includes income from media, events, sponsorships, gift card fees and other miscellaneous income. |

| (4) | Based on The Summit Birmingham Whole Loan. |

Appraisal.As of the appraisal valuation date of November 7, 2016, The Summit Birmingham Property had an “as-is” appraised value of $383,000,000.

Environmental Matters.According to the Phase I environmental report dated November 10, 2016, there was no evidence of any recognized environmental conditions at The Summit Birmingham Property.

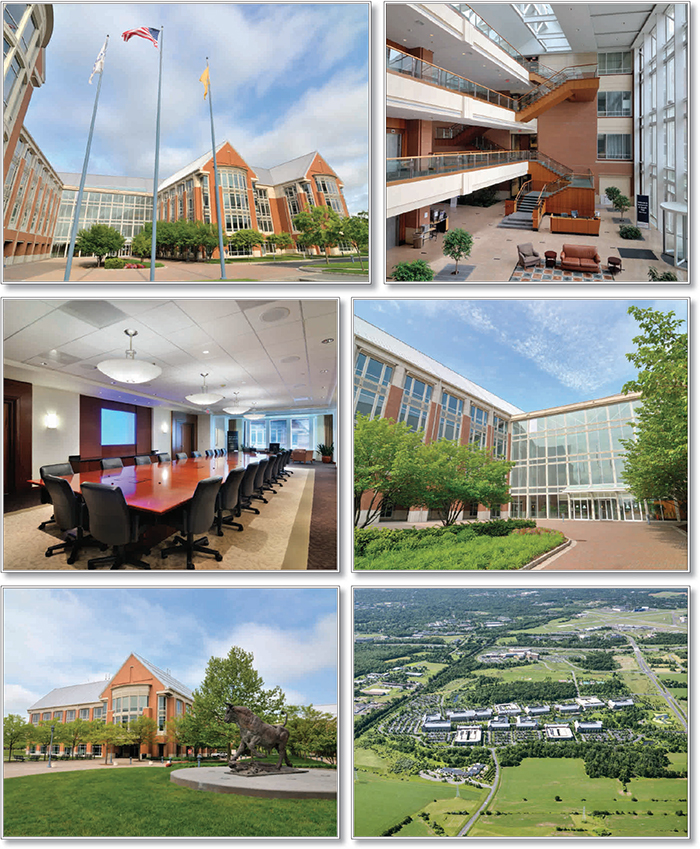

Market Overview and Competition.The Summit Birmingham Property is located in Birmingham, Alabama. According to the Birmingham business alliance, the Birmingham metropolitan area has a current population of over 1.1 million and contains over 70% of the total jobs in North Central Alabama. Corporations headquartered in the Birmingham metropolitan area include Alabama Power, Associated Grocers of the South, Inc., BBVA Compass, Books-A-Million, Cadence Bank, Hibbett Sports, Liberty National Life Insurance Company, Ready Mix USA, Regions and Thompson/CAT. There are over 23 universities, colleges, technical and professional schools in the Birmingham metropolitan area employing nearly 20,000 and enrolling nearly 100,000 people, with higher education generating an economic impact of more than $1 billion annually to the area. The 2015 unemployment rate for the Birmingham metropolitan area was 5.5%, the lowest rate since 2008.

The Summit Birmingham Property is located approximately five miles southeast of the Birmingham central business district (“CBD”). The Birmingham CBD is home to the four largest area employers including the University of Alabama at Birmingham (23,000 employees), Regions Bank (7,000 employees), St. Vincent’s Health System (4,644 employees) and Children’s of Alabama (4,578 employees). Just west of the Birmingham CBD and adjacent to The Summit Birmingham Property lay three of Birmingham’s most affluent suburbs including Mountain Brook, Vestavia Hills and Homewood, with the wealthy city of Hoover to the south.

According to the appraisal, the estimated 2016 population within a three-, five- and ten-mile radius around The Summit Birmingham Property was 38,765, 134,309 and 403,058, respectively. The estimated 2016 average household income within a three-, five- and ten-mile radius was $115,309, $114,008 and $81,258, respectively.

According to the appraisal, as of the third quarter 2016, the Birmingham retail market consisted of 100,229,766 square feet with a vacancy rate of 5.5%, the lowest rate in the last ten years. There is no proposed new competitive supply noted by the appraisal.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18

The following table presents certain information relating to competitive properties for The Summit Birmingham Property:

Competitive Properties(1)

| Property | Year Built/ Renovated | Total GLA (SF) | Est. Sales PSF | Occupancy | Distance | Major/Anchor Tenants | |

| The Summit Birmingham (Subject) | 1997/2009 | 681,245 | $603(2) | 98.5%(3) | -- | Saks (non-collateral), Belk, Restoration Hardware, Apple, Trader Joe’s |

Riverchase Galleria

Hoover, AL | 1986/2014 | 762,541 | $450 | 92% | 8.1 miles | Belk, JCPenney (non-collateral), Macy’s (non-collateral), Sears (non-collateral), Von Maur |

Colonial Brookwood Village

Birmingham, AL | 1973/2002 | 688,000 | N/A | 89% | 3.9 miles | Macy’s, Belk, Books A Million |

Shoppes at East Chase

Montgomery, AL | 2002/N/A | 431,635 | $245 | 98% | 97.4 miles | DSW Shoe Warehouse, Books A Million, Versona |

Bridge Street Town Centre(4)

Huntsville, AL | 2007/N/A | 622,862 | $565 | 98% | 104.0 miles | Belk, Barnes & Noble, Apple, BB&B |

Avalon

Alpharetta, GA | 2014/2017 | 495,907 | $490 | 99% | 167.0 miles | Regal, Whole Foods, Crate & Barrel, Anthropologie |

| | | | | | | | | | | |

| (1) | Information obtained from the appraisal and underwritten rent roll. |

| (2) | Comparable inline sales shown as of August 31, 2016. Comparable inline sales excluding Apple for that period were $513 per SF. |

| (3) | Occupancy as of December 14, 2016 including three tenants (2.0% of NRA) with executed leases but who are not yet in occupancy at The Summit Birmingham Property. |

| (4) | Bridge Street Town Centre is also owned by Bayer Properties, LLC, one of The Summit Birmingham sponsors. |

The Borrower.The borrower is BRC Holding Company, L.L.C. (“The Summit Birmingham Borrower”), a single-purpose Delaware limited liability company, with at least two independent managers. Legal counsel to the borrower delivered a non-consolidation opinion in connection with the origination of The Summit Birmingham Whole Loan. The nonrecourse carveout guarantors are Jeffery A. Bayer, David L. Silverstein and Jon W. Rotenstreich (collectively, the “Bayer Guarantor”) and Institutional Mall Investors LLC (the “IMI Guarantor”). The obligations of the Bayer Guarantor and the IMI Guarantor under the non-recourse carveout guaranty are several (not joint and several); provided that, among the individuals comprising the Bayer Guarantor, the obligations of such individuals are joint and several. See “Description of the Mortgage Pool–Certain Terms of the Mortgage Loans—Non-Recourse Obligations” in the Preliminary Prospectus.

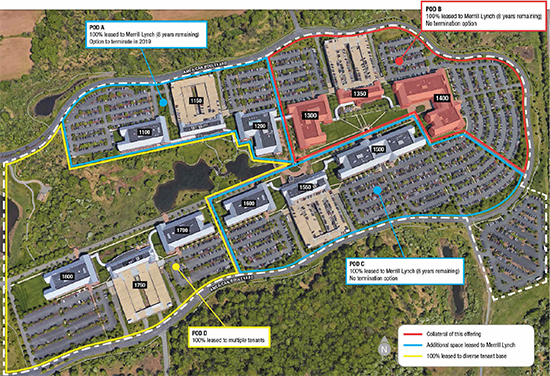

The Sponsors.The loan sponsors are JDJ Birmingham Company, L.L.C. and Institutional Mall Investors LLC.