| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-226486-14 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$[ ]

(Approximate Initial Pool Balance)

Wells Fargo Commercial Mortgage Trust 2020-C56

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Column Financial, Inc.

LMF Commercial, LLC

UBS AG

Barclays Capital Real Estate Inc.

Ladder Capital Finance LLC

Argentic Real Estate Finance LLC

Wells Fargo Bank, National Association

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2020-C56

May 18, 2020

WELLS FARGO SECURITIES Co-Lead Manager and Joint Bookrunner | CREDIT SUISSE Co-Lead Manager and Joint Bookrunner | UBS SECURITIES LLC Co-Lead Manager and Joint Bookrunner | BARCLAYS Co-Lead Manager and Joint Bookrunner |

Academy Securities Co-Manager | | | Drexel Hamilton Co-Manager |

| | | | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-226486) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., Credit Suisse Securities (USA) LLC, UBS Securities LLC, Academy Securities, Inc., Drexel Hamilton, LLC, or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| No. 1 – Supor Industrial Portfolio |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | LMF Commercial, LLC | | Single Asset/Portfolio: | Single Asset |

Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type – Subtype: | Industrial – Warehouse |

| Original Principal Balance: | $53,000,000 | | Location: | Harrison, NJ |

| Cut-off Date Balance: | $52,737,103 | | Net Rentable Area: | 626,134 SF |

| % of Initial Pool Balance: | [ ]% | | Cut-off Date Balance Per SF: | $84.23 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per SF: | $68.95 |

| Borrower Sponsor(1): | Joseph Supor III | | Year Built/Renovated: | 1930/NAP |

| Guarantor(1): | Joseph Supor III | | Title Vesting: | Fee |

| Mortgage Rate: | 4.7200% | | Property Manager: | Self-managed |

| Note Date: | January 31, 2020 | | Current Occupancy (As of)(4)(5): | 100.0% (6/1/2020) |

| Seasoning: | 4 months | | YE 2019 Occupancy(4): | NAV |

| Maturity Date: | February 6, 2030 | | YE 2018 Occupancy(4): | NAV |

| IO Period: | 0 months | | YE 2017 Occupancy(4): | NAV |

| Loan Term (Original): | 120 months | | YE 2016 Occupancy(4): | NAV |

| Amortization Term (Original): | 360 months | | As-Is Appraised Value(5): | $96,800,000 |

| Loan Amortization Type: | Amortizing Balloon | | As-Is Appraised Value Per SF(5): | $154.60 |

| Call Protection: | L(28),D(88),O(4) | | As-Is Appraisal Valuation Date: | December 20, 2019 |

| Lockbox Type: | Springing | | Underwriting and Financial Information(5) |

| Additional Debt(2): | Yes | | TTM NOI (3/31/2020)(6): | $6,877,516 |

| Additional Debt Type (Balance)(2): | Future Mezzanine | | YE 2019 NOI(6): | $6,313,260 |

| | | | YE 2018 NOI(6): | $3,712,953 |

| | | | YE 2017 NOI(6): | $4,300,264 |

| | | | U/W Revenues: | $7,379,667 |

| | | | U/W Expenses: | $3,129,667 |

| Escrows and Reserves(3) | | U/W NOI(7): | $4,250,000 |

| | Initial | Monthly | Cap | | U/W NCF: | $4,250,000 |

| Taxes | $0 | Springing | NAP | | U/W DSCR based on NOI/NCF: | 1.29x / 1.29x |

| Insurance | $0 | Springing | NAP | | U/W Debt Yield based on NOI/NCF: | 8.1% / 8.1% |

| Replacement Reserve | $0 | Springing | NAP | | U/W Debt Yield at Maturity based on NOI/NCF: | 9.8% / 9.8% |

| | | | | | Cut-off Date LTV Ratio: | 54.5% |

| | | | | | LTV Ratio at Maturity: | 44.6% |

| | | | | | | |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original loan amount | $53,000,000 | | 100.0% | | Loan payoff | $45,233,020 | | 85.3% |

| | | | | | Closing costs | 1,525,786 | | 2.9 |

| | | | | | Return of equity | 6,241,194 | | 11.8 |

| Total Sources | $53,000,000 | | 100.0% | | Total Uses | $53,000,000 | | 100.0% |

| (1) | The borrower sponsor and the Supor Guarantor (as defined below) is Joseph Supor III, both individually and in his capacity as trustee of the Marital Trust Under the Last Will and Testament of Joseph Supor, Jr. See “The Borrowers and Borrower Sponsors” section below. |

| (2) | See “Subordinate and Mezzanine Indebtedness” section below. |

| (3) | See “Escrows” section below. |

| (4) | The Current Occupancy reflects the Supor Operating Lease (as defined below). See “The Property” section below. Historical occupancy is not available because the Supor Operating Lease was signed at origination. |

| (5) | All NOI, NCF and occupancy information, as well as the appraised value, were determined prior to the emergence of the novel coronavirus pandemic and the economic disruption resulting from measures to combat the pandemic, and all DSCR, LTV and Debt Yield metrics were calculated, and the Supor Industrial Portfolio Mortgage Loan was underwritten, based on such prior information. See “Risk Factors—Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” in the Preliminary Prospectus. |

| (6) | The TTM NOI, YE 2019 NOI, YE 2018 NOI and YE 2017 NOI reflect the look-through to the Supor Industrial Portfolio Property (as defined below) operating on a multi-tenant level. At origination, the Supor Operating Lease was put in place, and underwriting is based on the Supor Operating Lease. Increase in YE 2019 NOI from YE 2018 NOI was mainly due to increases in rents charged to the third party user tenants at the Supor Industrial Portfolio Property. |

| (7) | The Supor Operating Lease is a 20-year, absolute net operating lease. U/W NOI reflects the contractual rent due under the Operating Lease, which such rent is due regardless of the amount of rents collected from end-user tenants. See “The Property” section below. |

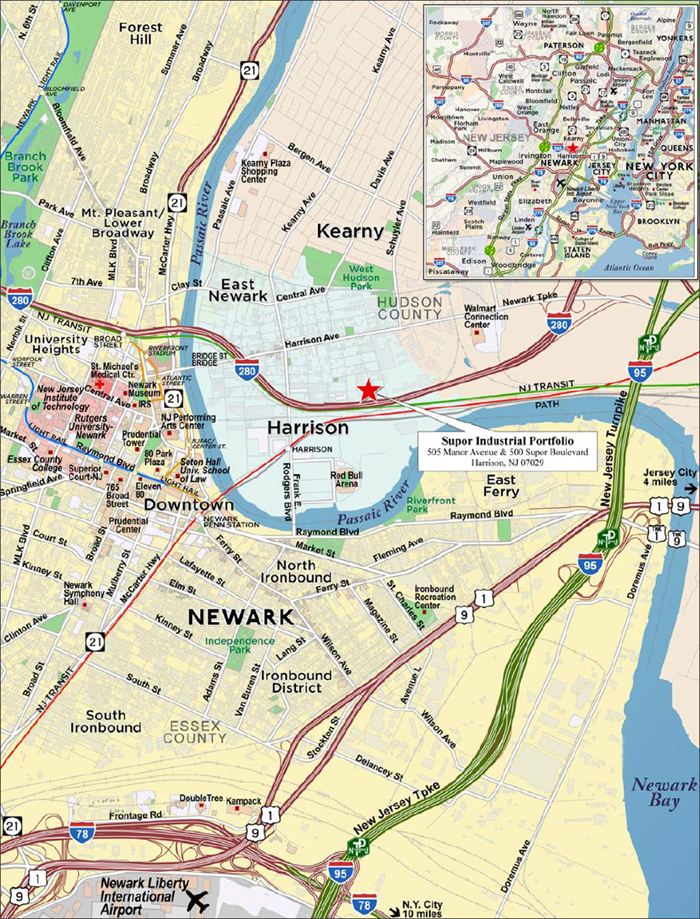

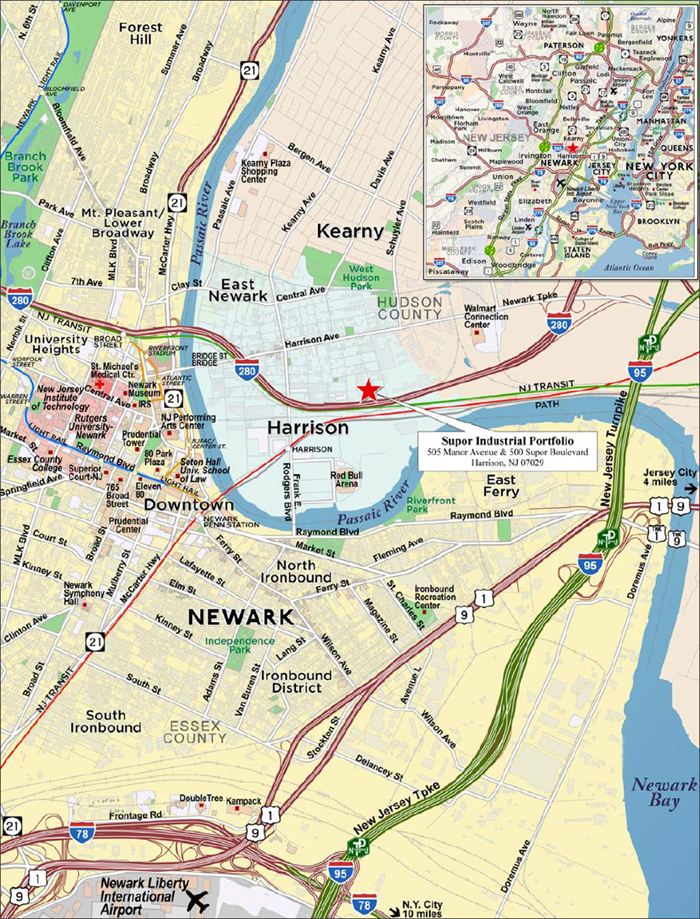

The Mortgage Loan. The mortgage loan (the “Supor Industrial Portfolio Mortgage Loan”) is evidenced by a first mortgage encumbering the fee simple interest in a 626,134 square foot industrial warehouse complex property located in Harrison, NJ (the “Supor Industrial Portfolio Property”).

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

The Borrowers and Borrower Sponsors.The borrowers are J. Supor Realty Group LLC and Supor Manor Realty Group LLC (collectively, the “Supor Industrial Portfolio Borrowers”), each a Delaware limited liability company structured to be bankruptcy remote, with two independent directors. Legal counsel to the Supor Industrial Portfolio Borrowers delivered a non-consolidation opinion in connection with the origination of the Supor Industrial Portfolio Mortgage Loan. The borrower sponsor and non-recourse carveout guarantor of the Supor Industrial Portfolio Mortgage Loan is Joseph Supor III, individually, and Joseph Supor III as trustee of the Marital Trust Under the Last Will and Testament of Joseph Supor, Jr. (together, “Supor Guarantor”). In addition to the non-recourse carveouts, the Supor Guarantor has guaranteed the payment obligations under the Super Operating Lease (as defined below).

Joseph Supor III is the principal owner, CEO, and Chairman of J. Supor & Son, a privately held company founded in 1948, which has been a family owned and operated company for 60 years with its headquarters in Kearny, New Jersey. J. Supor & Son specializes in heavy hauling, transportation, rigging, storage and recovery of substantial projects and provides import/export shipping expertise using its indoor/outdoor, industrial grade equipment. J. Supor & Son services include, but are not limited to, the rigging, transportation, permitting, logistics and storage of large and sophisticated industrial cargo, using specially trained operators and heavy machinery. These services span across North America and select international markets.

The Property.The Supor Industrial Portfolio Property is comprised of a 626,134 square foot industrial warehouse complex situated on two separate parcels located approximately 0.2 miles from each other at 500 Supor Boulevard and 505 Manor Avenue, Harrison, New Jersey. The Supor Industrial Portfolio Property is utilized as an industrial storage and staging space for tenants traditionally involved in large manufacturing or infrastructure projects in Manhattan and the greater Tri-state area. The Supor Industrial Portfolio Property is structured with a 20-year, absolute net operating lease agreement (the “Supor Operating Lease”) between the Supor Industrial Portfolio Borrowers and J. Supor Realty LLC & Supor Manor Realty LLC, each of which is a borrower affiliated entity, as the direct tenants under the Supor Operating Lease (together, the “Operating Tenant”). The Operating Tenant enters into subleases with third party user tenants at the Supor Industrial Portfolio Property. The Supor Operating Lease provides for initial annual triple net rent of $4.25 million subject to a 2.0% rent escalation every five years, beginning in January 2025, and has four, five-year lease extensions. Payments under the Supor Operating Lease are not contingent upon any underlying sub-leases, and the Supor Operating Lease is guaranteed by the Supor Guarantor.

The Supor Industrial Portfolio Property is located approximately 12.9 miles from the Port of New York & New Jersey, and 10.8 miles west of Manhattan. The Supor Industrial Portfolio Property is a staging location for tenants involved in large infrastructure projects such as the LaGuardia and Newark Airports terminal renovations, Hudson Yards, Grand Central Terminal, Port Authority, and the American Dream Mall. Over the past 12 months, the Supor Industrial Portfolio Property has been rented to and utilized by over 80 companies; the three largest sub-tenants at the Supor Industrial Portfolio Property by rent, PSE&G Company (Fitch/Moody’s/S&P: BBB+/Baa1/BBB+), Siemens Energy Inc. (Fitch/Moody’s/S&P: A/A1/A+) and Con Edison (Supor Trucking LLC) (Fitch/Moody’s/S&P: BBB+/Baa1/A-), have been at the Supor Industrial Portfolio Property for over 15 years and represent approximately 39.5% of the third-party rent generated during the fiscal year ended March 2020.

The 500 Supor Boulevard building parcel, situated on a 21.5 acre site, is used for the storage of heavy equipment and machinery with 16 overhead cranes used for the movement of bulk goods. The improvements consist of one, single-story building developed in 1930, with 307,907 square feet of ground level space and an additional 144,763 square feet of useable mezzanine space. The 500 Supor Boulevard building has variable ceiling heights that range from 22 to 80 feet, along with eight grade level doors. Additionally, the 500 Supor Boulevard building includes eight, 160’ x 72’ outdoor storage tents that are anchored into four-square-foot concrete blocks, which tents add an additional 92,160 square feet of covered storage and staging space that are excluded from the net rentable area.

The 505 Manor Avenue building parcel is used for the storage of heavy equipment and machinery with four overhead cranes to assist with the movement of items in and out of the building. The 505 Manor Avenue building is situated on a 5.7-acre site improved with 173,464 square feet of warehouse space.

COVID-19 Update. As of May 15, 2020, the Supor Industrial Portfolio Property is open and operating. All Supor Industrial Portfolio Mortgage Loan May 2020 debt service payments have been made to date. The Operating Tenant underwritten base rent has been paid for May 2020. As of May 1, 2020, the borrower sponsor did not report any sub-tenant’s request for rent relief at the Supor Industrial Portfolio Property. April 2020 rent collection from sub-tenants was on the same level with April 2019 rent collection from sub-tenants. As of the date hereof, the Supor Industrial Portfolio Mortgage Loan is not subject to any modification or forbearance request.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

The following table presents certain information relating to the Supor Operating Lease at the Supor Industrial Portfolio Property:

Operating Tenant(1)

| Tenant Name | Credit Rating (Fitch/Moody’s/

S&P) | Tenant NRSF | % of

NRSF | Annual

U/W Base

Rent PSF | Annual

U/W Base Rent | % of Total Annual U/W Base Rent | Lease

Expiration

Date | Extension Options | Termination Option (Y/N) |

| | | | | | | | | |

| J. Supor Realty LLC & Supor Manor Realty LLC(2) | NR/NR/NR | 626,134 | 100.0%(3) | $6.79 | $4,250,000 | 100.0% | 1/31/2040 | 4, 5-year | N |

| Occupied Collateral Total | 626,134 | 100.0% | $6.79 | $4,250,000 | 100.0% | | | |

| | | | | | | | | |

| Vacant Space | 0 | 0.0% | | | | | | |

| | | | | | | | | |

| Collateral Total | 626,134 | 100.0% | | | | | | |

| | | | | | | | | | |

| (1) | Information is based on the Supor Operating Lease as of 6/1/2020. |

| (2) | J. Supor Realty LLC & Supor Manor Realty LLC are affiliates of the Supor Industrial Portfolio Borrowers and enter into subleases and contracts at the Supor Industrial Portfolio Property with various end-user tenants. |

| (3) | % of NRSF reflects solely the square footage leased under the Supor Operating Lease. For information on the sub-tenants see the table below. |

The following table presents certain information relating to the top 10 sub-tenant accounts/end users at the Supor Industrial Portfolio Property:

Top 10 Sub-tenant Accounts(1)

| Customer | Rental

Revenue | % of

Rental

Revenue(2) | Sub-tenant Start

Date(3) |

| PSE&G Company | $2,178,681 | 21.5% | 2005 |

| Siemens Energy Inc. | $924,034 | 9.1% | 2005 |

| Con Edison (Supor Trucking LLC) | $898,732 | 8.9% | 2004 |

| Permasteelisa N.A. | $606,405 | 6.0% | 2005 |

| Williams-Transco(4) | $576,400 | 5.7% | 2017 |

| Machinery Values(5) | $575,025 | 5.7% | 1994 |

| Harrison Warehouse | $540,000 | 5.3% | 1994 |

| SC Group, LLC | $475,656 | 4.7% | 2018 |

| Elicc Americas Corp | $272,272 | 2.7% | 2013 |

| Owen Steel Company | $248,578 | 2.5% | 2018 |

| | $7,295,782 | 72.0% | |

| (1) | Based on the Super Industrial Portfolio Borrowers’ customer rent roll. |

| (2) | % of Rental Revenue is based on the trailing 12-month period ending March 31, 2020 and includes rental income, storage and handling charges totaling $10,133,547. |

| (3) | Sub-tenant Start Date refers to the year the related sub-tenant began leasing space at the Supor Industrial Portfolio Property. |

| (4) | As of May 1, 2020, Williams-Transco is no longer utilizing the Supor Industrial Portfolio Property after finishing its project. Increased usage by other tenants has replaced a portion of the revenue previously generated from Williams-Transco. |

| (5) | A portion of the space leased to Machinery Values is included in the Release Parcel (as defined below). See “Release of Property” section below. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

The following table presents certain information relating to the lease rollover schedule at the Supor Industrial Portfolio Property:

Lease Expiration Schedule(1)

Year Ending

December 31, | No. of

Leases

Expiring | Expiring

NRSF | % of

Total

NRSF | Cumulative

Expiring

NRSF | Cumulative %

of Total

NRSF | Annual

U/W

Base Rent | % of Total Annual U/W Base Rent | Annual

U/W

Base Rent

PSF |

| MTM | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2020 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2021 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2022 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2023 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2024 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2025 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2026 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2027 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2028 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2029 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| 2030 | 0 | 0 | 0.0% | 0 | 0.0% | $0 | 0.0% | $0.00 |

| Thereafter | 1 | 626,134 | 100.0% | 626,134 | 100.0% | $4,250,000 | 100.0% | $6.79 |

| Vacant | 0 | 0 | 0.0% | 626,134 | 100.0% | $0 | 0.0% | $0.00 |

| Total/Weighted Average | 1 | 626,134 | 100.0% | | | $4,250,000 | 100.0% | $6.79 |

| (1) | Information is based on the Supor Operating Lease. This table pertains to the Supor Operating Lease with Operating Tenant and does not reflect the expirations of the subleases between Operating Tenant and any sub-tenants. |

The following table presents historical occupancy percentages at the Supor Industrial Portfolio Property:

Historical Occupancy(1)

12/31/2017 | 12/31/2018 | 12/31/2019 | 6/1/2020 |

| | | | |

| NAV | NAV | NAV | 100.0% |

| (1) | June 1, 2020 occupancy reflects the Supor Operating Lease, which lease was effective as of the origination date of the Supor Industrial Portfolio Mortgage Loan. Historical occupancy is not available because the Operating Lease was signed at origination. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the underwritten net cash flow at the Supor Industrial Portfolio Property:

Cash Flow Analysis(1)

| | 2017 | 2018 | 2019 | TTM 3/31/2020 | U/W(2)(3) | %(4) | U/W $ per

SF |

| Rents in Place | $6,824,224 | $6,557,044 | $9,328,594 | $10,133,547 | $4,250,000 | 57.6% | $6.79 |

| Contractual Rent Steps | 0 | 0 | 0 | 0 | 0 | 0.0 | 0.00 |

| Grossed Up Vacant Space | 0 | 0 | 0 | 0 | 0 | 0.0 | 0.00 |

| Gross Potential Rent | $6,824,224 | $6,557,044 | $9,328,594 | $10,133,547 | $4,250,000 | 57.6% | $6.79 |

| Other Income | 0 | 0 | 0 | 0 | 0 | 0.0 | 0.00 |

| Total Recoveries | 0 | 0 | 0 | 0 | 3,129,667 | 42.4 | 5.00 |

| Net Rental Income | $6,824,224 | $6,557,044 | $9,328,594 | $10,133,547 | $7,379,667 | 100.0% | $11.79 |

| (Vacancy & Credit Loss) | 0 | 0 | 0 | 0 | (0) | (0.0) | (0.00) |

| Effective Gross Income | $6,824,224 | $6,557,044 | $9,328,594 | $10,133,547 | $7,379,667 | 100.0% | $11.79 |

| | | | | | | | |

| Real Estate Taxes | 710,233 | 837,279 | 842,617 | 843,951 | 843,951 | 11.4 | 1.35 |

| Insurance | 213,901 | 244,766 | 246,223 | 270,779 | 270,779 | 3.7 | 0.43 |

| Management Fee | 198,238 | 271,818 | 391,015 | 421,550 | 295,187 | 4.0 | 0.47 |

| Other Operating Expenses | 1,401,588 | 1,490,228 | 1,535,479 | 1,719,750 | 1,719,750 | 23.3 | 2.75 |

| Total Operating Expenses | $2,523,960 | $2,844,091 | $3,015,334 | $3,256,031 | $3,129,667 | 42.4% | $5.00 |

| | | | | | | | |

| Net Operating Income | $4,300,264 | $3,712,953 | $6,313,260 | $6,877,516 | $4,250,000 | 57.6% | $6.79 |

| Replacement Reserves | 0 | 0 | 0 | 0 | 0 | 0.0 | 0.00 |

| TI/LC | 0 | 0 | 0 | 0 | 0 | 0.0 | 0.00 |

| Net Cash Flow | $4,300,264 | $3,712,953 | $6,313,260 | $6,877,516 | $4,250,000 | 57.6% | $6.79 |

| | | | | | | | |

| NOI DSCR | 1.30x | 1.12x | 1.91x | 2.08x | 1.29x | | |

| NCF DSCR | 1.30x | 1.12x | 1.91x | 2.08x | 1.29x | | |

| NOI Debt Yield | 8.2% | 7.0% | 12.0% | 13.0% | 8.1% | | |

| NCF Debt Yield | 8.2% | 7.0% | 12.0% | 13.0% | 8.1% | | |

| (1) | Cash Flow Analysis is based on the historical operating history, which reflects the look-through to the Supor Industrial Portfolio Property operating on a multi-tenant level prior to origination. At origination, the Supor Operating Lease was put in place, and the U/W analysis is based on the Supor Operating Lease. |

| (2) | U/W reflects the contractual rent due under the Supor Operating Lease from the Operating Tenants, which rent is due regardless of the amount of rents collected from sub-tenants. |

| (3) | For the avoidance of doubt, no COVID-19 specific adjustments have been incorporated in the lender U/W. |

| (4) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

Appraisal.The appraiser concluded to an “as-is” appraised value of $96,800,000 as of December 20, 2019.

Environmental Matters. According to Phase I environmental site assessments dated December 4, 2019, there was no evidence of any recognized environmental conditions at the Supor Industrial Portfolio Property. The Phase I environmental site assessments identified two controlled recognized environmental conditions (“CREC”) for the Supor Boulevard site and one CREC for the Manor Boulevard site. See “Environmental Considerations” in the Preliminary Prospectus.

Market Overview and Competition.The Supor Industrial Portfolio Property is located in Harrison, Hudson County, New Jersey, within the New York-Newark-Jersey City, NY-NJ-PA metropolitan statistical area (the “New York MSA”). The New York MSA is the most populated area within the United States, according to the appraisal. Hudson County is bordered by the Hudson River and the Upper New York Bay to the east, Kill Van Kull Newark Bay, the Hackensack River and the Passaic River to the west. According to the appraisal, the New York MSA had a 2019 total population of 20.0 million and experienced an annual growth rate of 0.3%.

The Supor Industrial Portfolio Property is located approximately 9.4 miles west of the New York central business district. Primary access to the region is provided by Interstate 280 and Interstate 95. The Supor Industrial Portfolio Property neighborhood is developed primarily for industrial/warehouse use along arterials that are interspersed with multi-family complexes and single-family residential developments removed from arterials. Other developments in the neighborhood include the Red Bull soccer stadium, the new Harrison Port Authority Trans-Hudson (“PATH”) station, Rutgers University at Newark and the New Jersey Institute of Technology. In June 2019, PATH opened the new eastbound PATH station in Harrison, completing the second phase of a $256 million redevelopment project that is anticipated to improve travel for the riders who use the facility daily. This four phase redevelopment program also includes the construction of the westbound station house that opened in October 2018, the renovation of the two existing buildings on the site, and the creation of other amenities and services in the station and vicinity. Additionally, Newark Liberty International Airport is located

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

approximately 5.3 miles southwest of the Supor Industrial Portfolio Property. According to a third-party market research report, the 2019 population within a one-, three- and five-mile-radius of the Supor Industrial Portfolio Property was 34,405, 256,433 and 758,393, respectively. The 2019 average household income within a one-, three- and five-mile radius of the Supor Industrial Portfolio Property was $75,821, $61,473 and $70,795.

According to a third-party market report, the Supor Industrial Portfolio Property is located in the Northern New Jersey industrial market and the Lyndhurst/Harrison industrial submarket. As of the third quarter 2019, the Northern New Jersey industrial market consisted of 216.9 million square feet of industrial space. The Northern New Jersey industrial market reported a vacancy rate of 3.8% and asking rents of $8.11 per square foot. As of the third quarter 2019, there was 134,576 square feet under construction and positive net absorption of 939,603 square feet. The Lyndhurst/Harrison industrial submarket consisted of 22.0 million square feet of industrial space. The Lyndhurst/Harrison industrial submarket reported a vacancy rate of 2.0% and asking rents of $10.42 per square foot. As of the third quarter 2019, there was no new construction and positive net absorption of 117,529 square feet.

The table below presents certain information relating to comparable sales for the Supor Industrial Portfolio Property identified by the appraiser:

Comparable Sales(1)

| Property Name | Location | Rentable

Area (SF) | Sale Date | Sale Price | Sale

Price (PSF) |

| 1000-1108 Jefferson Avenue and 2-38 Pershing Avenue | Elizabeth, NJ | 190,000 | May-19 | $24,808,700 | $131 |

| 21 Caven Point Avenue | Jersey City, NJ | 134,500 | Apr-19 | $16,750,000 | $125 |

| 101 Railroad Avenue | Ridgefield, NJ | 330,199 | Sep-19 | $45,750,000 | $139 |

| 75 Mill Road | Edison, NJ | 570,100 | Nov-18 | $83,000,000 | $146 |

| 18 Van Veghten Drive | Bridgewater, NJ | 220,929 | Oct-19 | $28,000,000 | $127 |

| 350 Starke Road | Carlstadt, NJ | 368,175 | Oct-18 | $60,200,000 | $164 |

| (1) | Information obtained from the appraisal. |

The following table presents certain information relating to five comparable leases to those at the Supor Industrial Portfolio Property:

Comparable Leases(1)

| Property Name/Location | Year

Built/

Renovated | Total

GLA

(SF) | Distance

from

Subject | Occupancy | Lease Term | Tenant

Size

(SF) | Annual

Base

Rent

PSF | Reimbursement

Amount

PSF | Lease Type |

5 Ethel Boulevard 5 Ethel Boulevard Wood Ridge, NJ | 2019/NAP | 84,600 | 7.6 miles | 65.0% | 15.3 Yrs | 124,888 | $15.24 | NAV | NNN |

201 Bay Avenue 201 Bay Avenue Elizabeth, NJ | 1980/2013 | 508,202 | 4.5 miles | 100.0% | 2.8 Yrs | 142,874 | $9.25 | NAV | NNN |

100 Industrial Drive 100 Industrial Drive Jersey City, NJ | 2003/NAP | 181,032 | 5.4 miles | 100.0% | 5.0 Yrs | 126,672 | $9.35 | NAV | NNN |

35 State Street 35 State Street Moonacie, NJ | 1967/NAP | 106,841 | 8.3 miles | 100.0% | 10.0 Yrs | 106,841 | $9.50 | NAV | NNN |

Elizabeth Seaport Building 10 North Avenue E Elizabeth, NJ | 2017/NAP | 204,176 | 5.6 miles | 100.0% | 7.0 Yrs | 114,950 | $12.25 | NAV | NNN |

Jersey City Warehouse 25 Colony Road Jersey City, NJ | 2004/NAP | 340,848 | 5.4 miles | 100.0% | 10.3 Yrs | 340,849 | $9.00 | NAV | NNN |

| (1) | Information obtained from the appraisal. |

Escrows.

Real Estate Taxes – The lender did not require an upfront real estate tax reserve. Ongoing monthly real estate tax reserves will not be required as long as (i) no event of default has occurred or is continuing, (ii) the Operating Tenant is obligated to directly pay its required portion of the taxes prior to the due date, (iii) the Supor Operating Lease is in full force and effect, (iv) the Operating Tenant has paid (or caused to be paid) all taxes prior to the due date, (v) the Supor Industrial Portfolio Borrowers have provided (or caused to be provided) to the lender paid receipts or reasonable evidence of payment of taxes and (vi) no Operating Tenant Trigger Event (as defined below) has occurred or is continuing (collectively (i), (ii), (iii), (iv), (v) and (vi), the “Tax Waiver Conditions”). Notwithstanding the foregoing, for so long as the Tax Waiver Conditions are satisfied, the amount of monthly tax deposit will be reduced by the

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

percentage of taxes that Operating Tenant is obligated to directly pay under the Supor Operating Lease during the next ensuring 12 month period.

Insurance – The lender did not require an upfront insurance reserve. Ongoing monthly insurance reserves will not be required as long as (i) no event of default has occurred or is continuing, (ii) the Operating Tenant is obligated to directly pay its required portion of insurance premiums prior to the expiration of the policies, (iii) the Supor Operating Lease is in full force and effect, (iv) the Operating Tenant has paid (or caused to be paid) all insurance premiums prior to the expiration of the polices, (v) the Supor Industrial Portfolio Borrowers have provided (or caused to be provided) to the lender evidence that all insurance premiums have been paid and (vi) no Operating Tenant Trigger Event has occurred or is continuing (collectively, (i), (ii), (iii), (iv), (v) and (vi), the “Insurance Waiver Conditions”). Notwithstanding the foregoing, for so long as the Insurance Waiver Conditions are satisfied, the amount of monthly insurance deposit will be reduced by the percentage of insurance premiums that Operating Tenant is obligated to directly pay under the Supor Operating Lease during the next ensuring 12 month period.

Replacement Reserves – The lender did not require an upfront replacement reserve. Ongoing monthly replacement reserves of $5,147 will not be required as long as (i) no event of default has occurred or is continuing, (ii) the Operating Tenant is obligated to directly make and pay for all replacement reserves as required under the Supor Operating Lease, (iii) the Supor Operating Lease being in full force and effect, (iv) the Operating Tenant has made (or caused to be made) and paid (or caused to be paid) for all replacement reserves within the timeframe as set forth within the Supor Operating Lease, (v) the Supor Industrial Portfolio Borrowers has provided (or caused to be provided) to the lender that the replacement reserves have been performed and all costs associated with the replacement reserves have been paid and (vi) no Operating Tenant Trigger Event has occurred or is continuing (collectively, (i), (ii), (iii), (iv), (v) and (vi), the “Replacement Reserves Waiver Conditions”). Notwithstanding the foregoing, for so long as the Replacement Reserve Waiver Conditions is satisfied, the Supor Industrial Portfolio Borrowers will not be required to make monthly replacement reserve payments.

Lockbox and Cash Management.The Supor Industrial Portfolio Mortgage Loan has a springing lockbox with springing cash management. Upon the occurrence and continuance of a Cash Management Trigger Event (as defined below), the Supor Industrial Portfolio Borrowers are required to instruct the Operating Tenant to deposit rents and other amounts due into the lockbox account and funds in the lockbox account are required to be transferred to the cash management account within two business days. All funds in the cash management account are required to be applied on each monthly payment date in accordance with the related mortgage loan documents. Pursuant to the related mortgage loan documents, all excess funds on deposit (after payment of monthly reserve deposits, debt service payment and cash management bank fees) will be applied as follows: (a) to the extent a Cash Sweep Event (as defined below) does not exist, to the Supor Industrial Portfolio Borrowers, (b) if a Cash Sweep Event is in effect due to the existence of an Operating Tenant Trigger Event to the Operating Tenant Trigger TI/LC reserve account until the applicable Operating Tenant Trigger Event cure has occurred and (c) if a Cash Sweep Event is in effect, but an Operating Tenant Trigger Event is not in effect, then to the lender controlled excess cash flow account.

A “Cash Management Trigger Event” will commence upon the occurrence of the following:

| (i) | an event of default under the Supor Industrial Portfolio Mortgage Loan documents; |

| (ii) | a bankruptcy action of any of the Supor Industrial Portfolio Borrowers or the Supor Guarantor; |

| (iii) | at any time the Supor Industrial Portfolio Property is being managed by the property manager, any bankruptcy action of the property manager;provided that, a Cash Management Trigger Event will not occur if the Supor Industrial Portfolio Borrowers replaces the property manager with a qualified manager in accordance with the Supor Industrial Portfolio Mortgage Loan documents within 30 days of the filing of a bankruptcy filing against the property manager; |

| (iv) | a Cash Management DSCR Trigger Event (as defined below); or |

| (v) | an Operating Tenant Trigger Event (as defined below). |

A Cash Management Trigger Event will end upon the occurrence of:

| ● | with regard to clause (i) above, the cure of such event of default and acceptance of such cure by the lender; |

| ● | with regard to clause (ii) above, when such bankruptcy action petition has been discharged, stayed, or dismissed within 60 days of such filing among other conditions for the Supor Industrial Portfolio Borrowers or the Supor Guarantors; |

| ● | with regard to clause (iii) above, when such bankruptcy action petition has been discharged, stayed or dismissed within 120 days among other conditions for the property manager (and the Supor Industrial Portfolio Borrowers have replaced the property manager with a qualified property manager acceptable to the lender); |

| ● | with regard to clause (iv) above, the date the amortizing debt service coverage ratio based on the trailing 12-month period immediately preceding the date of such determination is greater than 1.25x for two consecutive quarters; and |

| ● | with regard to clause (v) above, an Operating Tenant Trigger Event Cure (as defined below). |

A “Cash Management DSCR Trigger Event” will occur on any day the debt service coverage ratio, based on the trailing 12-month period immediately preceding the date of determination, is less than 1.25x.

A “Cash Sweep Event” will commence upon the occurrence of the following:

| (i) | an event of default under the Supor Industrial Portfolio Mortgage Loan documents; |

| (ii) | a bankruptcy action of either of the Supor Industrial Portfolio Borrowers, either of the Supor Guarantors or the property manager,provided that, the Supor Industrial Portfolio Property is being managed by the property manager; |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

| Industrial - Warehouse | Loan #1 | Cut-off Date Balance: | | $52,737,103 |

| 505 Manor Avenue and 500 | Supor Industrial Portfolio | Cut-off Date LTV: | | 54.5% |

| Supor Boulevard | | U/W NCF DSCR: | | 1.29x |

| Harrison, NJ 07029 | | U/W NOI Debt Yield: | | 8.1% |

| (iii) | a Cash Sweep DSCR Trigger Event (as defined below); or |

| (iv) | an Operating Tenant Trigger Event (as defined below). |

A Cash Sweep Event will end upon the occurrence of:

| ● | with regard to clause (i) above, the cure of such event of default and acceptance of such cure by the lender; |

| ● | with regard to clause (ii) above, when such bankruptcy action petition has been discharged, stayed, or dismissed within 60 days of such filing among other conditions for the Supor Industrial Portfolio Borrowers or either Supor Guarantor, and within 120 days for the property manager (or, solely with respect to the bankruptcy of the property manager, when the Supor Industrial Portfolio Borrowers have replaced the property manager with a qualified property manager acceptable to the lender); |

| ● | with regard to clause (iii) above, the date the amortizing debt service coverage ratio based on the trailing 12-month period immediately preceding the date of such determination is greater than 1.15x for two consecutive quarters; and |

| ● | with regard to clause (iv) above, an Operating Tenant Trigger Event Cure (as defined below). |

A “Cash Sweep DSCR Trigger Event” will occur on any day the debt service coverage ratio, based on the trailing 12-month period immediately preceding the date of determination, is less than 1.15x.

A “Operating Tenant Trigger Event” will occur upon any of the following with respect to the Operating Tenant and the Supor Operating Lease:

| (i) | the applicable Supor Operating Lease is terminated; |

| (ii) | an event of default occurs under the Supor Operating Lease; |

| (iii) | a bankruptcy action of the related Operating Tenant or any guarantors of the Supor Operating Lease occurs; or |

| (iv) | the related Operating Tenant discontinues its normal business operations at its leased premises (other than a temporary cessation of business operations for permitted renovations or necessary repairs). |

A “Operating Tenant Trigger Event Cure” will occur upon:

| ● | with regard to clause (i), above, the date an Operating Tenant Space Re-Tenanting Event (as defined below) has occurred; |

| ● | with regard to clause (ii) above, the cure of the applicable event of default under the related Supor Operating Lease as determined by the lender; |

| ● | with regard to clause (iii) above, the affirmation of the related Supor Operating Lease in the applicable bankruptcy proceeding,provided that the Operating Tenant is paying all rents and other amounts due under its lease; |

| ● | with regard to clause (iv) above, the related Operating Tenant re-commences its normal business operation at its leased premises or an Operating Tenant Space Re-Tenanting Event has occurred. |

A “Operating Tenant Space Re-Tenanting Event” will occur on the date each of the following conditions have been satisfied: (i) the Operating Tenant space has been leased to one or more replacement tenants (or the Operating Tenant) for a term of at least twenty (20) years on terms and conditions that acceptable to the lender, (ii) all tenant improvement costs, leasing commissions and other material costs and expensed related to the re-letting of the Operating Tenant space, if any, have been paid in full and (iii) the replacement tenant(s) have accepted the Operating Tenant Space and are paying full contractual rent as evidenced by a tenant estoppel certificate(s).

Property Management. The Supor Industrial Portfolio Property is managed by an affiliate of the Supor Industrial Portfolio Borrowers.

Partial Release. On or about May 15, 2020 the Supor Industrial Portfolio Borrowers obtained the permitted release of a 4.9-acre parcel, which consists of the parcel located at 4010 Supor Boulevard and is described in the related mortgage loan documents (the “Release Parcel”). The Release Parcel was excluded from the appraised value and the underwriting of the Supor Industrial Portfolio Mortgage Loan.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.The owners of the direct or indirect equity interest in the Supor Industrial Portfolio Borrowers are permitted to incur mezzanine financing, upon satisfaction of certain terms and conditions including, among others (i) no event of default has occurred or is continuing, (ii) the mezzanine loan is junior and subordinate to the Supor Industrial Portfolio Mortgage Loan, (iii) the term of the mezzanine loan is coterminous with the Supor Industrial Portfolio Mortgage Loan, (iv) the mezzanine loan is a fixed rate loan, (v) the combined loan-to-value ratio does not exceed 55%, (vi) the combined debt service coverage ratio is not less than 1.29x, (vii) the debt service on the mezzanine loan is payable solely from excess cash flow remaining after required payments under the Supor Industrial Portfolio Mortgage Loan, (viii) the mezzanine lender has entered into an intercreditor agreement acceptable to the lender and (ix) the mezzanine lender delivers a rating agency confirmation to the lender.

Ground Lease. None.

Terrorism Insurance.The Supor Industrial Portfolio Mortgage Loan documents require that the “all risk” insurance policy required to be maintained by the Supor Industrial Portfolio Borrowers provides coverage for terrorism in an amount equal to the full replacement cost of the Supor Industrial Portfolio Property, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a 6-month extended period of indemnity.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

| Multifamily – Mid Rise | Loan #2 | Cut-off Date Balance: | | $52,348,530 |

50, 60 and 66, Franklin Street; 507-518

Main Street; 8-16 and 26 Portland Street | The Grid | Cut-off Date LTV: | | 67.4% |

| Worcester, MA 01608 | | U/W NCF DSCR: | | 1.41x |

| | | U/W NOI Debt Yield: | | 8.1% |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

| No.2 – The Grid |

| |

| Mortgage Loan Information | | Mortgaged Property Information |

| Mortgage Loan Seller: | Ladder Capital Finance LLC | | Single Asset/Portfolio: | Single Asset |

Credit Assessment (Fitch/KBRA/Moody’s): | NR/NR/NR | | Property Type – Subtype: | Multifamily – Mid Rise |

| Original Principal Balance(1): | $52,500,000 | | Location: | Worcester, MA |

| Cut-off Date Balance(1): | $52,348,530 | | Size: | 466 Units |

| % of Initial Pool Balance: | [ ]% | | Cut-off Date Balance Per Unit(1): | $144,432 |

| Loan Purpose: | Refinance | | Maturity Date Balance Per Unit(1): | $114,221 |

| Borrower Sponsor: | John McGrail | | Year Built/Renovated: | 1912/2017 |

| Guarantor: | John McGrail | | Title Vesting: | Fee |

| Mortgage Rate: | 3.8000% | | Property Manager: | Self-managed |

| Note Date: | March 11, 2020 | | Current Occupancy (As of)(3): | 98.5% (3/23/2020) |

| Seasoning: | 2 months | | YE 2019 Occupancy: | 97.6% |

| Maturity Date: | April 6, 2030 | | YE 2018 Occupancy: | 79.0% |

| IO Period: | 0 months | | YE 2017 Occupancy: | 77.0% |

| Loan Term (Original): | 120 months | | YE 2016 Occupancy: | 69.0% |

| Amortization Term (Original): | 360 months | | Appraised Value(3): | $99,800,000 |

| Loan Amortization Type: | Amortizing Balloon | | Appraised Value Per Unit: | $214,163 |

| Call Protection: | L(26),D(90),O(4) | | Appraisal Valuation Date: | March 1, 2020 |

| Lockbox Type: | Soft/Springing Cash Management | | Underwriting and Financial Information(3) |

| Additional Debt(1): | Yes | | TTM NOI (3/31/2020)(4): | $4,394,161 |

| Additional Debt Type (Balance)(1): | Pari Passu($14,956,723) | | YE 2019 NOI(4): | $3,329,641 |

| | | | YE 2018 NOI(4): | $1,967,388 |

| | | | YE 2017 NOI(4): | $443,629 |

| | | | U/W Revenues: | $8,830,546 |

| | | | U/W Expenses: | $3,347,813 |

| Escrows and Reserves(2) | | U/W NOI(4): | $5,482,733 |

| | Initial | Monthly | Cap | | U/W NCF: | $5,307,661 |

| Taxes | $45,793 | $45,793 | NAP | | U/W DSCR based on NOI/NCF(1): | 1.45x / 1.41x |

| Insurance | $187,521 | $23,440 | NAP | | U/W Debt Yield based on NOI/NCF(1): | 8.1% / 7.9% |

| TI/LC Reserve | $0 | $4,863 | NAP | | U/W Debt Yield at Maturity based on NOI/NCF(1): | 10.3% / 10.0% |

| Replacement Reserve | $0 | $9,708 | NAP | | Cut-off Date LTV Ratio(1): | 67.4% |

| Outstanding TI/LC Reserve | $162,500 | $0 | NAP | | LTV Ratio at Maturity(1): | 53.3% |

| | | | | | | |

| | | | | | | | |

| Sources and Uses |

| Sources | | | | | Uses | | | |

| Original whole loan amount | $67,500,000 | | 100.0% | | Loan payoff | $60,264,088 | | 89.3% |

| | | | | | Upfront reserves | 395,814 | | 0.6 |

| | | | | | Closing costs | 1,268,720 | | 1.9 |

| | | | | | Return of equity | 5,571,378 | | 8.3 |

| Total Sources | $67,500,000 | | 100.0% | | Total Uses | $67,500,000 | | 100.0% |

| (1) | The Cut-off Date Balance Per Unit, Maturity Date Balance Per Unit, U/W DSCR based on NOI/NCF, U/W Debt Yield based on NOI/NCF, U/W Debt Yield at Maturity based on NOI/NCF, Cut-off Date LTV Ratio and LTV Ratio at Maturity numbers presented above are based on The Grid Whole Loan (as defined below). |

| (2) | See “Escrows” section below. |

| (3) | See“Historical Occupancy”table and“COVID-19 Update”section below. All NOI, NCF and occupancy information, as well as the appraised value, were determined prior to the emergence of the novel coronavirus pandemic, and the economic disruption resulting from measures to combat the pandemic, and all DSCR, LTV and Debt Yield metrics were calculated, and The Grid Whole Loan was underwritten, based on such prior information. See “Risk Factors—Risks Related to Market Conditions and Other External Factors—The Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans” in the Preliminary Prospectus. |

| (4) | See “Cash Flow Analysis” table below for an explanation on the increase in NOI from 2017 to U/W. |

The Mortgage Loan. The mortgage loan is part of a whole loan (“The Grid Whole Loan”) that is evidenced by threepari-passupromissory notes in the aggregate original principal amount of $67,500,000. The Grid Whole Loan is secured by a first priority mortgage encumbering the fee interest in a five building multifamily property, with approximately 60,000 square feet of ground floor commercial space, located in Worcester, Massachusetts (“The Grid Property”). The controlling Note A-1 and non-controlling Note A-2, with an aggregate original principal balance of $52,500,000 (“The Grid Mortgage Loan”), will be included in the WFCM 2020-C56 securitization trust. The non-controlling Note A-3, with an original principal balance of $15,000,000, is expected to be contributed to one or more future securitization trusts. The Grid Whole Loan will be serviced pursuant to the pooling and servicing agreement for the WFCM 2020-C56 securitization trust. See “Description of the Mortgage Pool—The Whole Loans—The Serviced Pari Passu Whole Loans” and “Pooling and Servicing Agreement” in the Preliminary Prospectus.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

| Multifamily – Mid Rise | Loan #2 | Cut-off Date Balance: | | $52,348,530 |

50, 60 and 66, Franklin Street; 507-518

Main Street; 8-16 and 26 Portland Street | The Grid | Cut-off Date LTV: | | 67.4% |

| Worcester, MA 01608 | | U/W NCF DSCR: | | 1.41x |

| | | U/W NOI Debt Yield: | | 8.1% |

Note Summary

| Notes | Original Principal Balance | Cut-off Date

Balance | Note Holder | Controlling Interest |

| A-1 | $36,500,000 | $36,394,692 | WFCM 2020-C56 | Yes |

| A-2 | $16,000,000 | $15,953,838 | WFCM 2020-C56 | No |

| A-3 | $15,000,000 | $14,956,723 | LCF or an affiliate | No |

| Total | $67,500,000 | $67,305,253 | | |

The Borrower and Borrower Sponsor.The borrower is Grid Worcester Holdings, LLC (the “The Grid Borrower”), a Delaware limited liability company and single purpose entity with two independent directors. Legal counsel to The Grid Borrower delivered a non-consolidation opinion in connection with the origination of The Grid Whole Loan. The borrower sponsor and non-recourse carveout guarantor is John McGrail.

Mr. McGrail is the president and CEO of MG2 Group (“MG2”) and has over 25 years of experience in the construction and real estate industries. With a background in construction, he bought his first property in 1991 and founded a construction and remodeling business which expanded to include property maintenance and management. MG2 is a commercial real estate firm, specializing in multifamily development and owns six other properties in Massachusetts. MG2 began as an investment in a three-family home in Dorchester, Massachusetts more than 20 years ago and has grown into a vertically integrated commercial real estate investment and development company. The company focuses on value-add investments, acquiring vacant land or and buildings for redevelopment. MG2 handles all of the aspects of real estate investment process, including development, construction, and property management.

The borrower sponsor had been subject to past charges from the Massachusetts Attorney General, resulting in probation and fines. See“Description of the Mortgage Pool—Litigation and Other Considerations”in the Preliminary Prospectus. Additionally, the borrower sponsor experienced several past property foreclosures. See“Description of the Mortgage Pool—Loan Purpose; Default History, Bankruptcy Issues and Other Proceedings”in the Preliminary Prospectus.

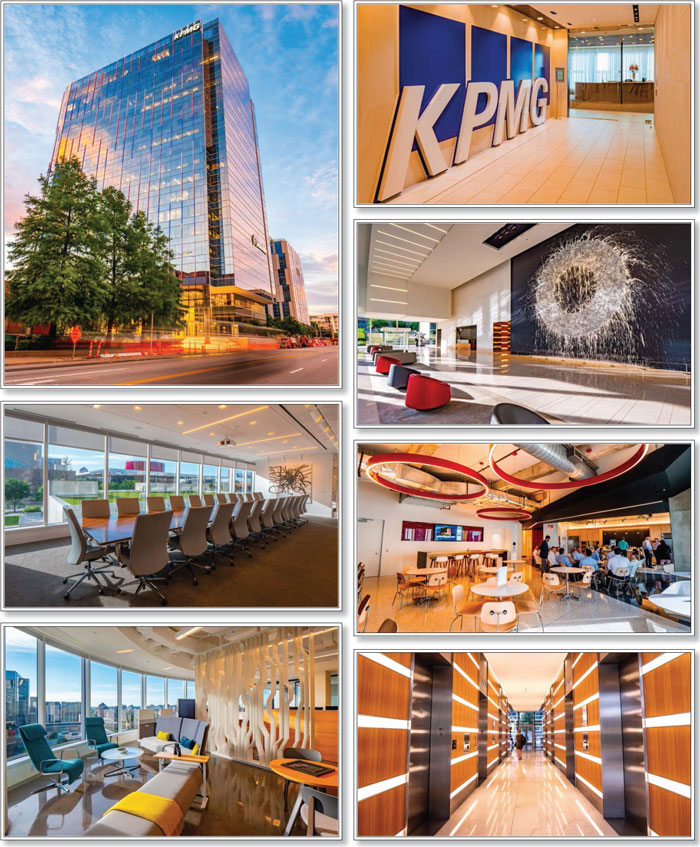

The Property.The Grid Property is a 466-unit Class A multifamily development located in Worcester, Massachusetts. Constructed in 1912, renovated multiple times, most recently in 2017, and situated on a 5.0-acre site, The Grid Property contains five buildings that include 170 studio units, 246 one-bedroom units, 44 two-bedroom units, five three-bedroom units and one five-bedroom unit. There is also approximately 60,000 square feet of ground floor commercial space. The commercial space is largely occupied by restaurants and other food service tenants, which serve as amenities to residents and are leased generally to the borrower sponsor’s affiliates. Other tenants include Santander Bank and various local offices. The Grid Property is located in downtown Worcester directly across from Worcester Common and two blocks from Union Station, which provides direct commuter rail service to Boston and Amtrak service to New York. The Grid Property contains 262 surface parking spaces, resulting in a parking ratio of approximately 0.6 spaces per unit.

Common area amenities at The Grid Property include a complete renovated lobby, on-site business center and a 4,000 square foot fitness center.

According to the appraisal, the current ownership has completed approximately $57.3 million in renovations to the property in the last three years.

COVID-19 Update. As of the May 6, 2020 payment, the residential portion of The Grid Property was open and operating. Given the collection and reporting timing, The Grid Borrower is unable to determine the exact percentage of residential tenants who have not paid, but as of April 2020, the residential portion of The Grid Property was 90.8% occupied. As of early May, three tenants representing 5.3% of U/W base rent asked for April 2020 rent deferrals. The Grid Borrower anticipates that all three tenants will make April’s deferred payment in June 2020. Most commercial tenants at The Grid Property are currently closed by government mandate. The May 2020 debt service payment for The Grid Mortgage Loan has been made by The Grid Borrower. As of the date hereof, The Grid Mortgage Loan is not subject to any modification or forbearance request. See “Description of the Mortgage Pool—COVID-19 Considerations” in the Preliminary Prospectus.

The following table presents certain information relating to the unit mix of The Grid Property:

Unit Mix Summary(1)

| Unit Type | Total

No. of

Units | % of

Total

Units | Average

Unit Size

(SF) | Average

Underwritten

Monthly Rent per Unit |

| Studio | 170 | 36.5% | 342 | $1,106 |

| 1 Bedroom / 1 Bathroom | 246 | 52.8% | 522 | $1,273 |

| 2 Bedroom / 1 Bathroom | 44 | 9.4% | 837 | $1,738 |

| 3 Bedroom / 1 Bathroom | 5 | 1.1% | 1,100 | $2,310 |

| 5 Bedroom / 5 Bathroom | 1 | 0.2% | 1,580 | $3,600 |

| Total/Weighted Average | 466 | 100.0% | 495 | $1,272 |

| (1) | Information obtained from the appraisal. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Multifamily – Mid Rise | Loan #2 | Cut-off Date Balance: | | $52,348,530 |

50, 60 and 66, Franklin Street; 507-518

Main Street; 8-16 and 26 Portland Street | The Grid | Cut-off Date LTV: | | 67.4% |

| Worcester, MA 01608 | | U/W NCF DSCR: | | 1.41x |

| | | U/W NOI Debt Yield: | | 8.1% |

The following table presents historical occupancy percentages at The Grid Property:

Historical Occupancy

12/31/2016(1)(2) | 12/31/2017(1)(2) | 12/31/2018(1)(2) | 12/31/2019(1)(2) | 3/23/2020(1)(3)(4) |

| 69.0% | 77.0% | 79.0% | 97.6% | 98.5% |

| (1) | The Grid Property also includes approximately 60,000 square feet of ground floor commercial space, which accounts for approximately 19.8% of Gross Potential Rent. The commercial component, which was 87.5% leased as of 3/23/2020, is not reflected in the occupancy percentages provided. |

| (2) | Information obtained from The Grid Borrower. |

| (3) | Information obtained from the underwritten rent roll. |

| (4) | See “COVID-19 Update” section above. |

Operating History and Underwritten Net Cash Flow. The following table presents certain information relating to the historical operating performance and underwritten net cash flow at The Grid Property:

Cash Flow Analysis

| | 2017(1) | 2018(1) | 2019(1) | TTM 3/31/ 2020(1) | U/W(2)(3) | %(4) | U/W $ per Unit |

| Base Rent | $3,740,297 | $5,691,000 | $6,302,407 | $7,171,453 | $8,579,596 | 91.6% | $18,411 |

| Grossed Up Vacant Space | 0 | 0 | 0 | 0 | 286,800 | 3.1 | 615 |

| Gross Potential Rent | $3,740,297 | $5,691,000 | $6,302,407 | $7,171,453 | $8,866,396 | 94.7% | $19,027 |

| Other Income(5) | 353,191 | 376,015 | 410,027 | 455,164 | 500,491 | 5.3 | 1,074 |

| Net Rental Income | $4,093,488 | $6,067,015 | $6,712,435 | $7,626,617 | $9,366,887 | 100.0% | $20,101 |

| (Vacancy) | 0 | 0 | 0 | 0 | (524,003)(6) | (5.9) | (1,124) |

| (Concessions & Credit Loss) | (203,865) | (503,859) | (111,773) | (72,286) | (12,338) | (0.1) | (26) |

| Effective Gross Income | $3,889,623 | $5,563,156 | $6,600,662 | $7,554,331 | $8,830,546 | 94.3% | $18,950 |

| | | | | | | | |

| Real Estate Taxes | 516,018 | 551,925 | 552,222 | 577,715 | 1,003,096 | 11.4 | 2,153 |

| Insurance | 232,217 | 195,296 | 221,630 | 228,521 | 281,282 | 3.2 | 604 |

| Management Fee | 116,689 | 166,895 | 198,020 | 226,630 | 264,916 | 3.0 | 568 |

| Other Operating Expenses | 2,581,070 | 2,681,652 | 2,299,149 | 2,127,305 | 1,798,519 | 20.4 | 3,859 |

| Total Operating Expenses | $3,445,994 | $3,595,768 | $3,271,021 | $3,160,170 | $3,347,813 | 37.9% | $7,184 |

| | | | | | | | |

| Net Operating Income | $443,629 | $1,967,388 | $3,329,641 | $4,394,161 | $5,482,733 | 62.1% | $11,766 |

| Capital Expenditures(7) | 0 | 0 | 0 | 0 | $175,072 | 2.0 | 376 |

| Net Cash Flow | $443,629 | $1,967,388 | $3,329,641 | $4,394,161 | $5,307,661 | 60.1% | $11,390 |

| | | | | | | | |

| NOI DSCR | 0.12x | 0.52x | 0.88x | 1.16x | 1.45x | | |

| NCF DSCR | 0.12x | 0.52x | 0.88x | 1.16x | 1.41x | | |

| NOI Debt Yield | 0.7% | 2.9% | 4.9% | 6.5% | 8.1% | | |

| NCF Debt Yield | 0.7% | 2.9% | 4.9% | 6.5% | 7.9% | | |

| (1) | In 2017 the borrower sponsor began renovating The Grid Property to market towards young professionals. During the renovation, there was a drop in units available, but the borrower sponsor was able to bring the occupancy from 77.0% in 2017 to 98.5% as of March 23, 2020. See “Historical Occupancy” table above. |

| (2) | The borrower sponsor signed 78 new residential unit leases in 2019 and received leases for Santander, Rake Nail Salon and Metro PCS bringing the total U/W occupancy to 94.1%. |

| (3) | For the avoidance of doubt, no COVID-19 specific adjustments have been incorporated in the lender U/W. |

| (4) | Represents (i) percent of Net Rental Income for all revenue fields, (ii) percent of Gross Potential Rent for Vacancy and Concessions & Credit Loss and (iii) percent of Effective Gross Income for all other fields. |

| (5) | Other Income primarily includes Parking Income and other miscellaneous income generated from late fees, laundry income, lease termination fees, pet rent fees, and storage income. |

| (6) | The underwritten economic vacancy is 5.9%. |

| (7) | Capital Expenditures includes $58,572 ($1.00 per square foot) of TI/LCs allocated to the commercial space at The Grid Property. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Multifamily – Mid Rise | Loan #2 | Cut-off Date Balance: | | $52,348,530 |

50, 60 and 66, Franklin Street; 507-518

Main Street; 8-16 and 26 Portland Street | The Grid | Cut-off Date LTV: | | 67.4% |

| Worcester, MA 01608 | | U/W NCF DSCR: | | 1.41x |

| | | U/W NOI Debt Yield: | | 8.1% |

Appraisal.The appraiser concluded to an “as-is” appraised value for The Grid Property of $99,800,000 as of March 1, 2020.

Environmental Matters. According to the Phase I environmental site assessment dated November 18, 2019, there was no evidence of any recognized environmental conditions at The Grid Property.

Market Overview and Competition.The Grid Property is located in downtown Worcester, Massachusetts directly across from Worcester Common and two blocks from Union Station, which provides direct commuter rail service to Boston and Amtrak service to New York City. Access to The Grid Property is also provided by the Route 9 (1.0 miles south), Route 20 (3.1 miles south), and the Massachusetts Turnpike (3.4 miles south). Worcester has a population of approximately 175,000 making Worcester New England’s second largest city behind Boston (40.0 miles west). According to a third-party market report, Worcester has approximately $2.4 billion of public and private investments underway or planned. Part of this large investment in downtown Worcester includes $30 million to add a 66,000 square foot Cancer and Wellness Center to Saint Vincent Hospital campus (0.4 miles north) and a $75 million investment to acquire and renovate the Mercantile Center, a 640,000 square foot office and retail complex located a block east of The Grid Property. UMass Memorial Health Care has executed a lease at the Mercantile Center for approximately 90,000 square feet of office space that will bring 700 UMass Memorial Health Care employees downtown. Worcester is currently spending $90 million to construct Polar Park (0.6 miles southwest), a 10,000 seat ballpark expected to be completed in 2021 which will house the Boston Red Sox’s AAA farm team.

According to a third-party market report Worcester has an average income of $95,679 and a median household income of $71,024, which is expected to increase by 13.2% over the next five years to reach a median household income of $80,408 by 2024.

Submarket Information – According to a third-party market research report, The Grid Property is situated within the metropolitan Worcester apartment submarket. As of the fourth quarter of 2019, the metropolitan Worcester apartment submarket reported a total inventory of 25,412 units with a 3.4% vacancy rate and an average asking rental rate of $1,455 per month.

Appraiser’s Comp Set – The appraiser identified eight primary competitive properties for The Grid Property totaling 1,726 units, which reported an average occupancy rate of approximately 97.6%. The appraiser concluded to weighted average monthly market rents per unit at The Grid Property of $1,352 per unit (see “Market Rent Summary” table below).

Market Rent Summary(1)

| Unit Type | Total No. of

Units | Average Unit

Size (SF) | Market Monthly

Rent per Unit |

| Studio | 170 | 343 | $1,025-$1,450 |

| 1 Bedroom / 1 Bathroom | 246 | 518 | $1,250–$1,457 |

| 2 Bedroom / 1 Bathroom | 44 | 852 | $1,675-$1,950 |

| 3 Bedroom / 1 Bathroom | 5 | 1,100 | $2,425 |

| 5 Bedroom / 5 Bathroom | 1 | 1,580 | $3,775 |

| Total/Weighted Average | 466 | 495 | $1,352 |

| (1) | Information obtained from the appraisal. |

The following table presents certain information relating to comparable multifamily properties for The Grid Property:

Competitive Set(1)

| | The Grid

(Subject) | 145 Front at City Square | The

Skymark

Tower | Canal

Lofts | Junction

Shop

Lofts | Voke

Lofts | Audubon Plantation Ridge | Quinn 35 | Wexford

Village |

| Location | Worcester, MA | Worcester, MA | Worcester, MA | Worcester, MA | Worcester, MA | Worcester, MA | Worcester, MA | Shrewsbury, MA | Worcester, MA |

| Distance to Subject | -- | 0.3 miles | 0.2 miles | 0.6 miles | 0.5 miles | 1.0 miles | 3.4 miles | 3.6 miles | 2.9 miles |

| Property Type | Mid Rise | Mid Rise | High Rise | Mid Rise | Mid Rise | Mid Rise | Mid Rise | Mid Rise | Mid Rise |

| Year Built/Renovated | 1912/2017 | 2018/NAP | 1990/2000 | 1890/2011 | 2015/NAP | 2014/NAP | 2004/NAP | 2018/NAP | 1974/NAP |

| Number of Units | 466 | 365 | 196 | 64 | 173 | 84 | 330 | 250 | 264 |

| Average Monthly Rent (per unit) | | | | | | | | | |

| Studio | $725-$2,400 | $1,615-$1,680 | NAP | NAP | NAP | NAP | NAP | $1,635 | $1,271 |

| 1 Bedroom | $892-$2,525 | $1,785-$1,980 | $1,550-$1,650 | $1,240-$1,475 | $1,325- $1,625 | $1,695-$2,245 | $1,590-$1,690 | $1,865 | $1,339-$1,421 |

| | | | | | | | | | |

| 2 Bedroom | $1,400-$2,500 | $2,185-$2,750 | $1,495-1,815 | $1,580-$1,880 | $1,600-$1,650 | $2,139-$2,714 | $1,870-$1,955 | $2,260 | $1,652 |

| | | | | | | | | | |

| Occupancy | 98.5% | 98.0% | 96.0% | 100.0% | 94.0% | 98.0% | 99.0% | 98.0% | 98.0% |

| (1) | Information obtained from the appraisal and underwritten rent roll. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

| Multifamily – Mid Rise | Loan #2 | Cut-off Date Balance: | | $52,348,530 |

50, 60 and 66, Franklin Street; 507-518

Main Street; 8-16 and 26 Portland Street | The Grid | Cut-off Date LTV: | | 67.4% |

| Worcester, MA 01608 | | U/W NCF DSCR: | | 1.41x |

| | | U/W NOI Debt Yield: | | 8.1% |

Escrows.

Real Estate Taxes –The Grid Whole Loan documents require an upfront real estate tax reserve of $45,793 and ongoing monthly real estate tax reserves in an amount equal to one-twelfth of the real estate taxes that the lender estimates will be payable during the next twelve months (initially $45,793).

Insurance–The Grid Whole Loan documents require an upfront insurance reserve of $187,521 and ongoing monthly insurance reserves in an amount equal to one-twelfth of the insurance premiums that the lender estimates will be payable for the renewal of the coverage during the next twelve months (initially $23,440).

TI/LC Reserve –The Grid Whole Loan documents require ongoing monthly TI/LC reserves of $4,863.

Replacement Reserve –The Grid Whole Loan documents require ongoing monthly replacement reserves of $9,708.

Outstanding TI/LC Reserve –The Grid Whole Loan documents require an upfront reserve of $162,500 for certain outstanding approved leasing expenses under the lease with Santander Bank.

Lockbox and Cash Management. The Grid Whole Loan is structured with a soft lockbox, which is already in place, and springing cash management. Prior to the occurrence of a Cash Management Trigger Event (as defined below), The Grid Whole Loan documents require that The Grid Borrower or the property manager deposit all rents into the lockbox account within one business day of receipt and all funds in the lockbox account are required to be distributed to The Grid Borrower. During a Cash Management Trigger Event, funds in the lockbox account are required to be swept to a lender-controlled cash management account and all excess funds are required to be swept to an excess cash flow subaccount controlled by the lender.

A “Cash Management Trigger Event” will commence upon the earlier of the following:

| (i) | the occurrence and continuance of an event of default under The Grid Mortgage Loan; |

| (ii) | the occurrence and continuance of an event of default under the property management agreement beyond any notice or cure; or |

| (iii) | the net cash flow debt service coverage ratio falling below 1.15x. |

A “Cash Management Trigger Event” will end upon the occurrence of the following:

| ● | with regard to clause (i) above, the cure of such event of default; |

| ● | with regard to clause (ii) above, the date on which the default under the property management agreement has been cured or the date on which The Grid Borrower has entered into a replacement property management agreement with a qualified manager; or |

| ● | with regard to clause (iii) above, the net cash flow debt service coverage ratio being equal to or greater than 1.25x for one calendar quarter |

Property Management. The Grid Property is managed by Grid Management, LLC an affiliate of the borrower sponsor.

Partial Release.Not permitted.

Real Estate Substitution.Not permitted.

Subordinate and Mezzanine Indebtedness.Not permitted.

Ground Lease. None.

Terrorism Insurance. The Grid Whole Loan documents require that the “all risk” insurance policy required to be maintained by The Grid Borrower provide coverage for terrorism in an amount equal to the full replacement cost of The Grid Property, as well as business interruption insurance covering no less than the 18-month period following the occurrence of a casualty event, together with a six-month extended period of indemnity.