EXHIBIT (c)(iv)

Queensland State Accounts for the Quarter Ended September 30, 2006

For further information

| | | | |

| CONTACT | | ENQUIRIES | | TELEPHONE |

Martin Pavelka | | Concepts and Interpretation | | (07) 3224 5321 |

Sylvia Sivo | | Data and Compilation | | (07) 3224 4201 |

| | |

| | EMAIL | | |

| | qsa@treasury.qld.gov.au | | |

Websites

www.oesr.qld.gov.au

or

www.treasury.qld.gov.au

| | | | |

| | Electronic Subscription Information: | | Rinie Klein |

| | | | Office of the Government Statistician |

| | | | Level 8 |

| | | | 33 Charlotte Street |

| | | | Brisbane Q 4000 |

| | |

| | | | Telephone: (07) 3224 5326 |

| | | | Facsimile: (07) 3220 0831 |

| | | | E-mail qsa@treasury.qld.gov.au |

© The State of Queensland (Queensland Treasury)

2007

Copyright protects this publication. Except for purposes permitted

under the Copyright Act, reproduction by whatever means is prohibited without

the prior written permission of the Under Treasurer

ISSN 1321-2338

| | |

| | Queensland State Accounts, September Quarter 2006 |

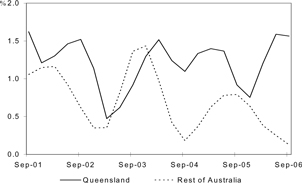

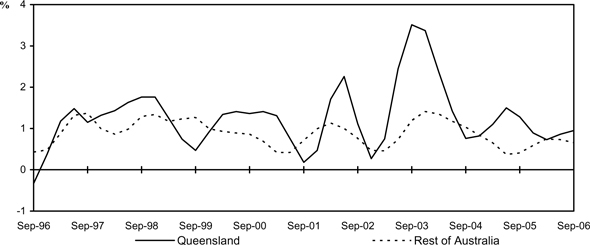

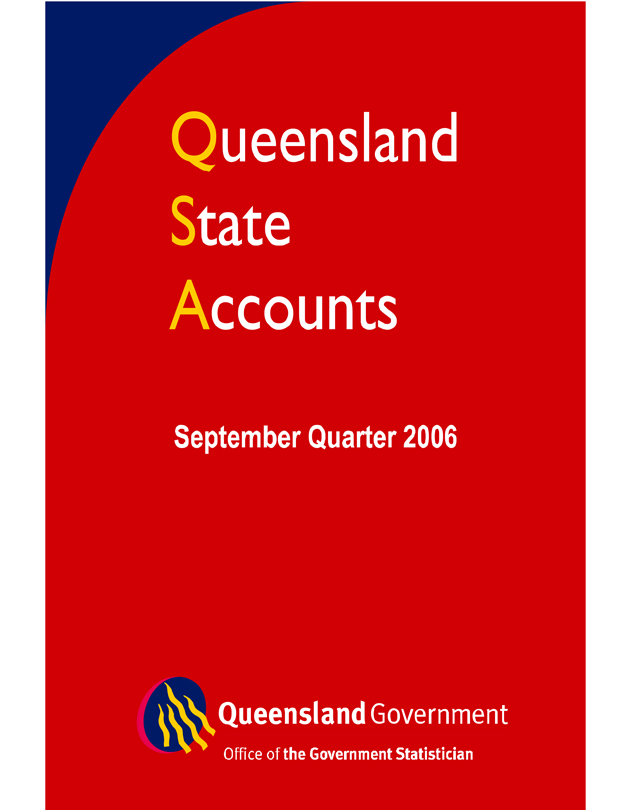

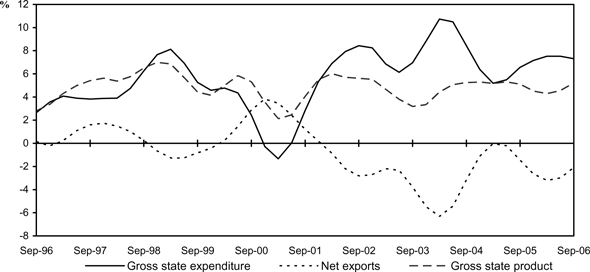

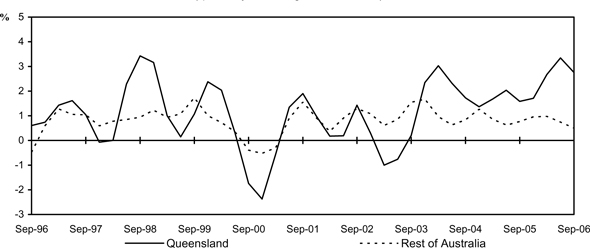

Chart 1

Gross State Product

(quarterly % change, CVM, trend)

Table I

Percentage Change in Gross State/Domestic Product

Chain volume measures (reference year 2004-05)

| | | | | | |

| | | Queensland(a) | | Rest of Australia (a) | | Australia (b) |

TREND | | | | | | |

Jun qtr 06 to Sep qtr 06 | | 1.6 | | 0.1 | | 0.4 |

Sep qtr 05 to Sep qtr 06 | | 5.2 | | 1.4 | | 2.1 |

ORIGINAL | | | | | | |

Year-average (c) | | 4.5 | | 2.3 | | 2.7 |

| (a) | Source Office of the Government Statistician, Queensland State Accounts |

| (c) | Reference quarter and the three preceding quarters compared with the same period a year earlier |

September Quarter 2006 – Main Features

Quarterly Results

| n | Queensland’s gross state product (GSP) recorded real trend growth of 1.6 per cent in September quarter 2006 following similar growth in June Quarter 2006. |

| n | Domestic economic activity continued to support growth in GSP, mainly driven by the combination of private gross fixed capital formation and household final consumption expenditure. |

| n | Private gross fixed capital formation increased by 2.2 per cent in the quarter and contributed 0.6 percentage point to growth in GSP. This was underpinned by continued growth in investment in dwellings and other buildings and structures. Household final consumption expenditure rose 1.0 per cent and contributed 0.6 percentage point to GSP growth. |

| n | Public final demand rose 2.8 per cent in September quarter 2006, with public consumption and public investment increasing 1.4 per cent and 6.6 per cent respectively. Strong growth in public investment over the quarter was driven by both higher general government (up 6.8 per cent) and public trading enterprises capital formation (up 6.4 per cent). |

| n | Gross state expenditure increased 1.6 per cent in the quarter and contributed 1.7 percentage points to economic growth. Net exports detracted 0.1 percentage point from GSP growth, with weaker exports more than offsetting lower imports. |

Notes

The reader should be aware that this September quarter 2006 edition of the Queensland State Accounts incorporates the ABS annual benchmarks for the income components of GSP data for 2005-06, which were not available and hence not incorporated in the June quarter 2006 edition. These benchmarks, apart from compensation of employees and gross operating surplus and mixed income for 2005-06, have been incorporated in this September quarter edition of Queensland State Accounts (see Methodological Issues in the Explanatory Notes, on page 12, for the derivation of compensation of employees and gross operating surplus and mixed income). As a result, Queensland’s GSP growth has been revised to 4.4 per cent for 2005-06, from the preliminary growth estimate of 3.8 per cent published in the June quarter edition.

| | |

| | Queensland State Accounts, September Quarter 2006 |

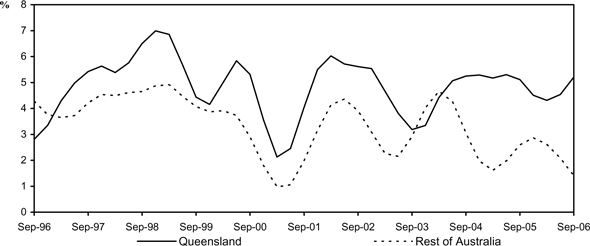

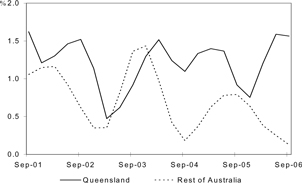

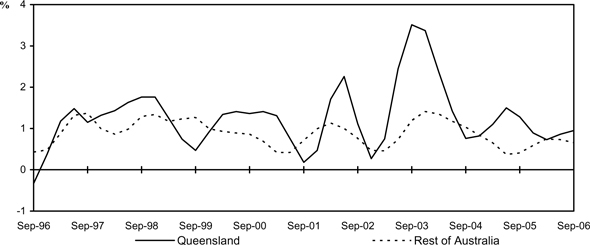

Annual Results

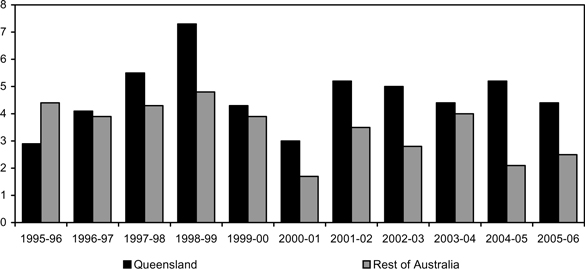

| n | The Queensland economy grew by 5.2 per cent in real trend terms over the year to September quarter 2006, compared with only 1.4 per cent growth in the Rest of Australia. |

| n | Household final consumption expenditure in Queensland increased by 3.5 per cent over the year to September quarter 2006 and contributed 2.1 percentage points to economic growth. |

| n | Private gross fixed capital formation increased 13.2 per cent and was the largest contributor (3.4 percentage points) to GSP growth in Queensland, underpinned by rises in the three major components of private gross fixed capital formation. Investment growth was strong in other buildings and structures (up 20.8 per cent) and machinery and equipment (up 20.3 per cent), with private dwellings recording more moderate growth (3.7 per cent). |

| n | Exports of goods and services were unchanged in volume terms, while imports of goods and services grew by 5.8 per cent, largely due to continued strong growth in Queensland’s domestic demand. |

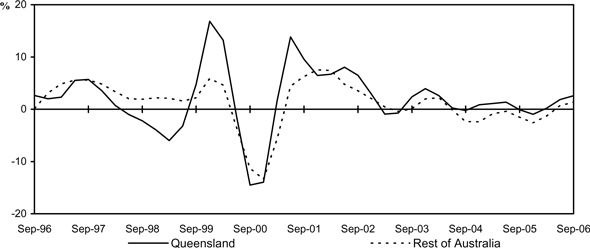

Chart 2: Gross State/Rest of Australia Product

(annual % change, CVM, trend)

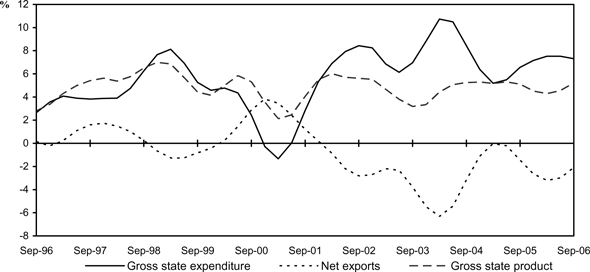

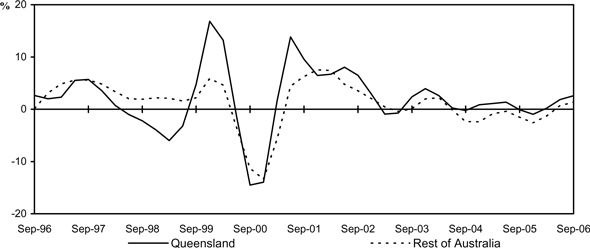

Chart 3: Contribution to Growth, Queensland

(annual % point contribution, CVM, trend)

ii

| | |

| | Queensland State Accounts, September Quarter 2006 |

Expenditure on GSP – Key Points

Household Final Consumption Expenditure

| n | Queensland household final consumption expenditure rose 1.0 per cent in real trend terms in September quarter 2006, above the quarterly growth of 0.7 per cent in the Rest of Australia. |

Chart 4: Household Final Consumption Expenditure

(quarterly % change, CVM, trend)

Dwelling Investment

| n | Queensland’s dwelling investment increased by 2.6 per cent in the September quarter (Rest of Australia up 1.4 percent). |

Chart 5: Dwelling Investment

(quarterly % change, CVM, trend)

iii

| | |

| | Queensland State Accounts, September Quarter 2006 |

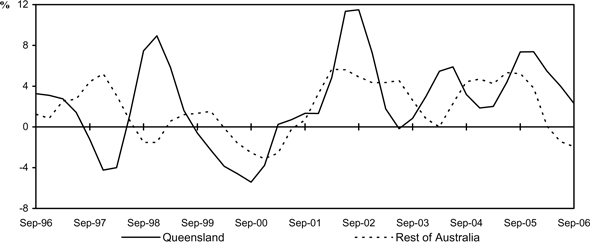

Business Investment

| n | Queensland business investment (defined as other buildings and structures and machinery and equipment) rose 2.3 per cent in the September quarter. Both components of business investment remain strong, with investment in machinery and equipment rising 0.9 per cent (up 20.3 per cent over the year), and other buildings and structures increasing 4.5 per cent in the quarter (up 20.8 over the year). In contrast, business investment in the Rest of Australia declined 1.9 per cent in September quarter 2006. |

Chart 6: Business Investment

(quarterly % change, CVM, trend)

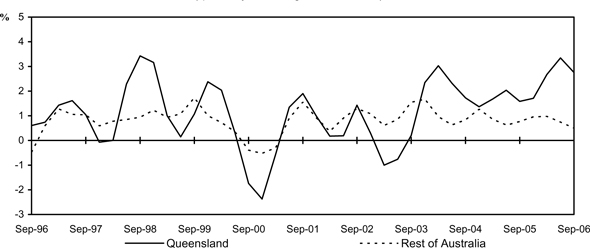

Public Final Demand

| n | Public final demand continued to rise during the September quarter (up 2.8 per cent) as a result of higher public investment (up 6.6 per cent) and a moderate rise in public consumption (up 1.4 per cent). |

| n | Sustained growth in public investment reflects strong increases in both general government gross fixed capital formation (up 6.8 per cent) and public trading enterprise gross fixed capital formation (up 6.4 per cent). |

Chart 7: Public Final Demand

(quarterly % change, CVM, trend)

iv

| | |

| | Queensland State Accounts, September Quarter 2006 |

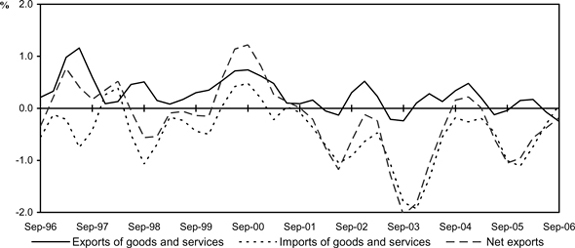

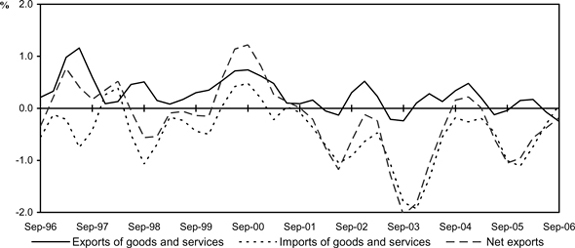

Net Exports

| n | Net exports of goods and services detracted 0.1 percentage point from Queensland’s GSP growth in September quarter 2006, with weaker exports more than offsetting a decline in imports. For the Rest of Australia, however, net exports contributed 0.1 percentage point to growth in the September quarter. |

| n | The volume of Queensland’s goods and services exports overseas fell by 0.8 per cent in the September quarter. Lower exports of sugar (down 12.2 per cent) and non-ferrous metals (down 7.1 per cent) more than offset higher exports of coal (up 0.9 per cent) and meat (1.4 per cent). Exports of goods and services interstate declined by 1.1 per cent in the quarter. |

| n | In the September quarter, imports of overseas goods and services fell 0.4 per cent, driven by a decline in overseas goods imports (down 1.4 per cent). Lower imports of mineral fuels and lubricants (down 4.3 per cent), and other machinery and transport equipment (down 3.7 per cent), more than outweighed higher imports of food, beverages and tobacco (up 3.9 per cent), machinery and transport equipment (up 1.2 per cent) and chemicals (up 0.3 per cent). Imports of goods and services from interstate were unchanged in the September quarter from the previous quarter. |

| n | In annual terms, net exports detracted 2.1 percentage points from GSP growth. This reflected growth in imports (up 5.8 per cent) as exports were unchanged over the year. Import growth was mainly driven by overseas imports of other machinery and equipment, reflecting strong private and public investment spending. In comparison, net exports detracted 0.2 percentage point from economic growth in the Rest of Australia over the year. |

Chart 8: Exports, Imports and Net Exports, Contribution to Growth, Queensland

(quarterly % point contribution, CVM, trend)

v

| | |

| | Queensland State Accounts, September Quarter 2006 |

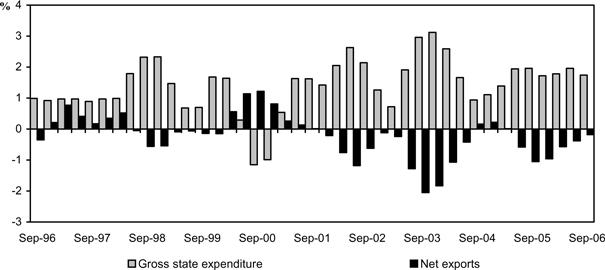

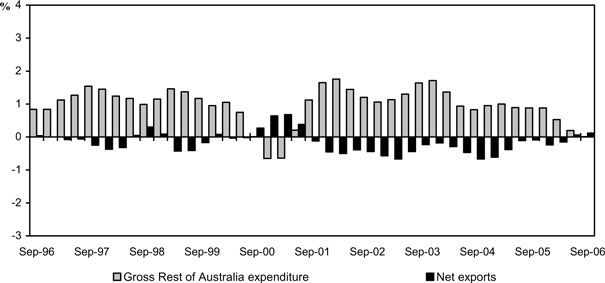

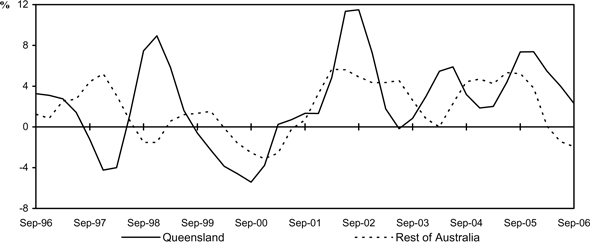

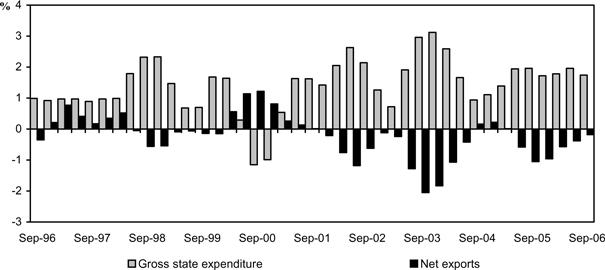

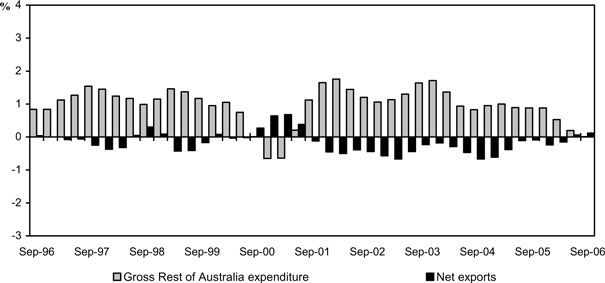

Growth Composition

Chart 9: Contribution to Growth, Queensland

(quarterly % point contribution, CVM, trend)

| n | Chart 9 shows that gross state expenditure contributed 1.7 percentage points to Queensland economic growth in September quarter 2006 while net exports detracted 0.1 percentage point. |

| n | Gross Rest of Australia expenditure was unchanged in September quarter 2006 while net exports contributed 0.1 percentage point to the Rest of Australia’s economic growth, resulting in 0.1 per cent growth in Gross Rest of Australia product (see Chart 10). |

Chart 10: Contribution to Growth, Rest of Australia

(quarterly % point contribution, CVM, trend)

vi

| | |

| | Queensland State Accounts, September Quarter 2006 |

Summary Tables

Table II

Changes and Contribution to Growth, Quarterly, Trend, Chain Volume Measures (a)

| | | | | | | | |

| | | Queensland | | Rest of Australia (b) |

| | | Quarterly % change Jun-06 to Sep-06 | | % point contribution to growth in GSP Jun-06 to Sep-06 | | Quarterly % change Jun-06 to Sep-06 | | % point contribution to growth in GSP Jun-06 to Sep-06 |

Final consumption expenditure | | | | | | | | |

Households | | 1.0 | | 0.6 | | 0.7 | | 0.4 |

General government | | 1.4 | | 0.2 | | 1.1 | | 0.2 |

Gross fixed capital formation | | | | | | | | |

Private | | 2.2 | | 0.6 | | -0.7 | | -0.2 |

Dwellings | | 2.6 | | 0.2 | | 1.4 | | 0.1 |

Other buildings and structures | | 4.5 | | 0.3 | | 0.2 | | 0.0 |

Machinery and equipment | | 0.9 | | 0.1 | | -3.5 | | -0.3 |

Public enterprises | | 6.4 | | 0.2 | | -2.4 | | 0.0 |

General government | | 6.8 | | 0.2 | | -2.8 | | -0.1 |

Changes in inventories | | n.a. | | -0.2 | | n.a. | | -0.5 |

Gross state expenditure | | 1.6 | | 1.7 | | 0.0 | | 0.0 |

Exports of goods and services overseas | | -0.8 | | -0.2 | | 1.6 | | 0.3 |

Exports of goods and services interstate | | -1.1 | | -0.1 | | 0.0 | | 0.0 |

less Imports of goods and services overseas | | -0.4 | | -0.1 | | 0.9 | | 0.2 |

less Imports of goods and services interstate | | 0.0 | | 0.0 | | -1.1 | | 0.0 |

Gross state product | | 1.6 | | 1.6 | | 0.1 | | 0.1 |

| (a) | Chain volume measure reference year 2004-05. |

| (b) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the real trend quarterly changes and contributions to growth in the September quarter:

| n | Household final consumption expenditure in Queensland rose 1.0 per cent and contributed 0.6 percentage point to overall growth, compared with lower growth of 0.7 per cent in the Rest of Australia. |

| n | General government final consumption expenditure in Queensland increased by 1.4 per cent. The Rest of Australia recorded slightly weaker growth of 1.1 per cent. |

| n | Growth in private gross fixed capital formation eased to 2.2 per cent following 3.1 per cent growth in the June quarter. All three major components of private gross fixed capital formation increased: investment in other buildings and structures (up 4.5 per cent), dwelling investment (2.6 per cent), and machinery and equipment investment (up 0.9 per cent). |

| n | Public investment increased in September quarter 2006, reflecting higher investment by both general government (up 6.8 per cent) and public enterprises (up 6.4 per cent). |

| n | Queensland’s exports of goods and services overseas (down by 0.8 per cent) declined for the second consecutive quarter. Imports of overseas goods and services also fell (down 0.4 per cent) after rising 1.4 per cent and 0.4 per cent in the March and June quarters of 2006 respectively. |

vii

| | |

| | Queensland State Accounts, September Quarter 2006 |

Table III

Changes and Contribution to Growth, Annual, Trend, Chain Volume Measures (a)

| | | | | | | | |

| | | Queensland | | Rest of Australia (b) |

| | | Annual % change Sep-05 to Sep-06 | | % point contribution to growth in GSP Sep-05 to Sep-06 | | Annual % change

Sep-05 to Sep-06 | | % point contribution to growth in GSP Sep-05 to Sep-06 |

Final consumption expenditure | | | | | | | | |

Households | | 3.5 | | 2.1 | | 2.8 | | 1.6 |

General government | | 7.1 | | 1.2 | | 4.2 | | 0.8 |

Gross fixed capital formation | | | | | | | | |

Private | | 13.2 | | 3.4 | | 0.8 | | 0.2 |

Dwellings | | 3.7 | | 0.3 | | -1.9 | | -0.1 |

Other buildings and structures | | 20.8 | | 1.2 | | 7.0 | | 0.4 |

Machinery and equipment | | 20.3 | | 1.7 | | -4.2 | | -0.3 |

Public enterprises | | 38.8 | | 0.9 | | 3.7 | | 0.1 |

General government | | 9.7 | | 0.3 | | -6.1 | | -0.1 |

Changes in inventories | | n.a. | | -0.7 | | n.a. | | -1.2 |

Gross state expenditure | | 6.8 | | 7.3 | | 1.6 | | 1.6 |

Exports of goods and services overseas | | 0.5 | | 0.1 | | 5.7 | | 1.0 |

Exports of goods and services interstate | | -1.1 | | -0.1 | | 7.5 | | 0.3 |

less Imports of goods and services overseas | | 3.9 | | 0.7 | | 7.0 | | 1.6 |

less Imports of goods and services interstate | | 7.5 | | 1.4 | | -1.1 | | 0.0 |

Gross state product | | 5.2 | | 5.2 | | 1.4 | | 1.4 |

| (a) | Chain volume measure reference year 2004-05. |

| (b) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the real trend annual changes and contributions to growth over the year to the September quarter:

| n | Household final consumption expenditure increased 3.5 per cent, compared with 2.8 per cent growth recorded in the Rest of Australia. |

| n | Private gross fixed capital formation increased 13.2 per cent, making it the largest contributor to annual economic growth with 3.4 percentage points. Strong growth was recorded in other buildings and structures (up 20.8 per cent), and machinery and equipment investment (up 20.3 per cent) together with modest growth in dwelling investment of 3.7 per cent. In comparison, private investment in the Rest of Australia increased by only 0.8 per cent over the year with higher investment in other buildings and structures (up 7.0 per cent) more than offsetting lower investment in machinery and equipment (down 4.2 per cent) and dwellings (down 1.9 per cent). |

| n | Public final demand rose strongly (up 10.9 per cent), the highest on record. This was largely underpinned by public investment with public enterprises capital formation rising 38.8 per cent and investment by general government increasing 9.7 per cent over the year. Additionally, general government final public consumption increased by 7.1 per cent over the year to September quarter 2006. |

| n | Net exports detracted 2.1 percentage points from Queensland’s economic growth, reflecting the continued growth in imports of goods and services from overseas and interstate of 5.8 per cent as exports were unchanged over the year to September quarter 2006. |

viii

| | |

| | Queensland State Accounts, September Quarter 2006 |

Table IV

Changes and Contribution to Growth, Quarterly, Trend, Current Prices

| | | | | | | | |

| | | Queensland | | Rest of Australia (a) |

| | | Quarterly % change Sep-06 to Dec-06 | | % point contribution to growth in GSP Sep-06 to Dec-06 | | Quarterly % change Sep-06 to Dec-06 | | % point contribution to growth in GSP Sep-06 to Dec-06 |

Compensation of employees | | 2.3 | | 1.0 | | 1.8 | | 0.9 |

Gross operating surplus and mixed income | | 1.2 | | 0.5 | | 1.6 | | 0.7 |

Gross state product at factor cost | | 1.7 | | 1.5 | | 1.8 | | 1.6 |

Taxes less subsidies on production and imports | | 3.0 | | 0.3 | | 0.8 | | 0.1 |

Gross state product | | 2.0 | | 2.0 | | 1.8 | | 1.8 |

| | | | |

Final consumption expenditure | | | | | | | | |

Households | | 0.9 | | 0.5 | | 1.5 | | 0.8 |

General government | | 0.3 | | 0.1 | | 1.9 | | 0.3 |

| | | | |

Gross fixed capital formation | | | | | | | | |

Private | | 1.9 | | 0.5 | | 0.6 | | 0.1 |

Dwellings | | 2.5 | | 0.2 | | 2.5 | | 0.1 |

Other buildings and structures | | 8.5 | | 0.6 | | 2.9 | | 0.2 |

Machinery and equipment | | -3.6 | | -0.3 | | -2.4 | | -0.2 |

| | | | |

Public enterprise | | 3.7 | | 0.1 | | 3.6 | | 0.1 |

General government | | 8.5 | | 0.3 | | 5.9 | | 0.1 |

| | | | |

Changes in inventories | | n.a. | | 0.2 | | n.a. | | 0.2 |

| | | | |

Gross state expenditure | | 1.9 | | 1.9 | | 1.9 | | 1.9 |

Exports of goods and services overseas | | -0.8 | | -0.2 | | 1.9 | | 0.4 |

Exports of goods and services interstate | | 0.7 | | 0.1 | | -2.5 | | -0.1 |

less Imports of goods and services overseas | | 1.4 | | 0.2 | | 1.5 | | 0.3 |

less Imports of goods and services interstate | | -2.5 | | -0.4 | | 0.7 | | 0.0 |

| | | | |

Gross state product | | 2.0 | | 2.0 | | 1.8 | | 1.8 |

| (a) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the current price trend quarterly changes and contributions to growth in the September quarter:

| n | Compensation of employees increased 1.8 per cent in Queensland, slightly above the growth of 1.7 per cent in the Rest of Australia. |

| n | Gross operating surplus and mixed income increased 2.2 per cent in Queensland, compared with lower growth of 1.0 per cent in the Rest of Australia. |

| n | Exports of goods and services overseas declined 0.8 per cent in the quarter. The goods component of overseas exports fell 1.7 per cent with mixed outcomes in the major categories of goods exports. The nominal value of sugar and coal exports fell by 9.2 per cent and 4.4 pert cent respectively, more than offsetting higher exports of non-ferrous metals (up 2.8 per cent) and meat (up 0.6 per cent). While the fall in the nominal value of sugar exports reflected lower sugar volumes, the decline in the nominal value of coal exports was driven by weaker coal prices (down 5.2 per cent) in the quarter. |

| n | Imports of goods and services overseas increased 0.4 per cent in the quarter with the tourism component of services imports rising by 4.8 per cent and outweighing the decline in the goods component of imports overseas (down 0.2 per cent). Imports of other machinery and transport equipment fell by 4.3 per cent and imports of mineral fuels and lubricants declined by 0.3 per cent. |

ix

| | |

| | Queensland State Accounts, September Quarter 2006 |

Table V

Changes and Contribution to Growth, Annual, Trend, Current Prices

| | | | | | | | |

| | | Queensland | | Rest of Australia (a) |

| | | Annual %

change Sep-05

to Sep-06 | | % point contribution to growth in GSP Sep-05 to Sep-06 | | Annual % change Sep-05 to Sep-06 | | % point contribution to growth in GSP Sep-05 to Sep-06 |

Compensation of employees | | 9.7 | | 4.5 | | 6.3 | | 3.0 |

Gross operating surplus and mixed income | | 11.0 | | 4.8 | | 5.2 | | 2.1 |

Gross state product at factor cost | | 10.3 | | 9.3 | | 5.8 | | 5.2 |

Taxes less subsidies on production and imports | | 9.9 | | 1.0 | | 5.2 | | 0.6 |

Gross state product | | 10.5 | | 10.5 | | 5.9 | | 5.9 |

| | | | |

Final consumption expenditure | | | | | | | | |

Households | | 7.4 | | 4.2 | | 5.6 | | 3.2 |

General government | | 15.9 | | 2.6 | | 8.8 | | 1.6 |

| | | | |

Gross fixed capital formation | | | | | | | | |

Private | | 16.4 | | 4.1 | | 3.3 | | 0.7 |

Dwellings | | 6.9 | | 0.6 | | 2.0 | | 0.1 |

Other buildings and structures | | 31.1 | | 1.7 | | 12.6 | | 0.7 |

Machinery and equipment | | 18.1 | | 1.4 | | -5.6 | | -0.4 |

| | | | |

Public enterprise | | 64.3 | | 1.4 | | 4.6 | | 0.1 |

General government | | 14.8 | | 0.5 | | -5.4 | | -0.1 |

| | | | |

Changes in inventories | | n.a. | | -0.8 | | n.a. | | -1.1 |

| | | | |

Gross state expenditure | | 11.2 | | 11.6 | | 4.8 | | 4.8 |

| | | | |

Exports of goods and services overseas | | 10.5 | | 2.4 | | 17.7 | | 3.3 |

Exports of goods and services interstate | | 6.2 | | 0.5 | | 12.8 | | 0.5 |

less Imports of goods and services overseas | | 10.2 | | 1.8 | | 11.8 | | 2.6 |

less Imports of goods and services interstate | | 12.8 | | 2.3 | | 6.2 | | 0.1 |

| | | | |

Gross state product | | 10.5 | | 10.5 | | 5.9 | | 5.9 |

| (a) | Due to the ABS methodology of estimating trend estimates in aggregate, rather than as the sum of the trend estimates of their components, the Rest of Australia contributions to growth are not additive. |

With respect to the current price annual changes and contributions to growth over the year to the September quarter:

| n | Queensland recorded growth in nominal GSP of 10.5 per cent. This was 4.6 percentage points higher than the 5.9 per cent current price growth in the Rest of Australia. |

| n | Compensation of employees rose 9.7 per cent in Queensland compared with lower growth of 6.3 per cent in the Rest of Australia. |

| n | Queensland gross operating surplus and mixed income rose 11.0 per cent compared with 5.2 per cent growth in the Rest of Australia. |

| n | Queensland exports of goods and services overseas increased 10.5 per cent in annual terms. This reflected growth in both overseas tourism services exports (up 16.2 per cent) and overseas goods exports (up 9.4 per cent). There were mixed outcomes in the major categories of overseas goods exports with higher exports of sugar (up 47.8 per cent), non-ferrous metals (up 38.4 per cent) and meat (up 3.0 per cent) and lower exports of coal (down 3.7 per cent). |

x

| | |

| | Queensland State Accounts, September Quarter 2006 |

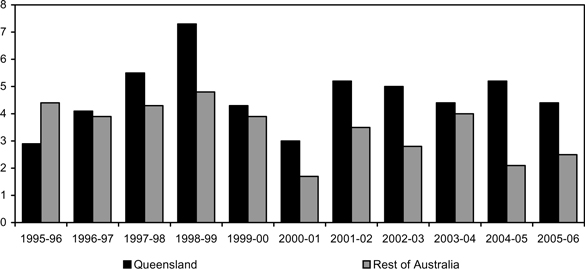

Performance of the Queensland Economy in 2005-06

Information made available since the release of the June Quarter 2006 edition of Queensland State Accounts has resulted in the preliminary estimate of Queensland’s GSP growth of 3.8 per cent for 2005-06 being revised to 4.4 per cent. This year-average growth of 4.4 per cent in 2005-06 followed revised growth of 5.2 per cent in 2004-05 and 4.4 per cent in 2003-04.

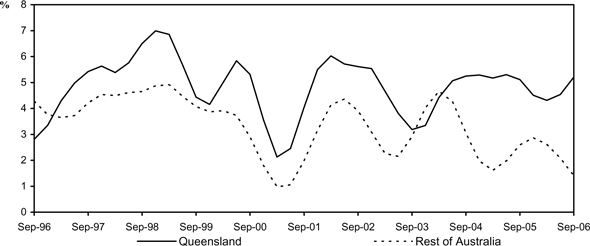

Economic growth in Queensland has been above that in the Rest of Australia for the past 10 years. The average annual growth rate in Queensland GSP for the past 10 years is 4.9 per cent compared with 3.3 per cent for the Rest of Australia (see Chart 11).

Chart 11 Economic Growth

(year-average % change, CVM, 2004-05 prices)

The growth of the Queensland economy in 2005-06 was driven by growth in domestic final demand (as measured by gross state expenditure, up 6.6 per cent) and this more than offset the detraction from growth by net exports of 2.6 percentage points.

Household final consumption expenditure grew by 4.6 per cent in 2005-06, easing from growth of 5.3 per cent in 2004-05, and contributed 2.7 percentage points to GSP in 2005-06.

Private gross fixed capital formation grew by 12.3 per cent in 2005-06 and contributed 3.0 percentage points to Queensland’s GSP growth in 2005-06. The largest contributors to growth in private capital formation were other buildings and structures (up 30.1 per cent), and machinery and equipment (up 17.8 per cent), with dwellings increasing only slightly (up 1.6 per cent).

Public final demand grew by 7.3 per cent in 2005-06, driven by solid growth in government final consumption expenditure (up 4.4 per cent) and growth in the State and local component of public enterprise gross fixed capital formation. Public enterprise gross fixed capital formation grew by 36.5 per cent and contributed 0.8 percentage point to Queensland’s economic growth over 2005-06, largely due to strong growth in State and local public enterprises investment.

As outlined above, net exports detracted 2.6 percentage points from growth in 2005-06 due to the increase in imports of goods and services from interstate and overseas (up 7.4 per cent and 7.1 per cent respectively). The high growth in import volumes resulted from the continued strength of domestic

xi

| | |

| | Queensland State Accounts, September Quarter 2006 |

economic activity, particularly business investment. Exports of goods and services interstate fell by 4.1 per cent, offsetting a 2.0 per cent rise in exports of goods and services overseas. As a result, total exports from Queensland remained unchanged over the year

The pattern of economic activity was more subdued in the Rest of Australia compared with Queensland. Gross Rest of Australia product increased 2.5 per cent in 2005-06, some 1.9 percentage points lower than Queensland. The Rest of Australia’s imports of goods and services from overseas recorded solid growth over the year (up 7.3 per cent), reflecting the strength of domestic economic activity in the region.

In the Rest of Australia, household consumption and private investment grew strongly (2.2 per cent and 8.4 per cent respectively). Further, public final demand in the Rest of Australia recorded growth of 3.3 per cent and contributed 0.7 percentage point to overall economic growth in 2005-06.

Table VII

Changes and Contribution to Growth, 2005-06, Chain Volume Measures (a)

| | | | | | | | |

| | | Queensland | | Rest of Australia |

| | | Year-average % change 2004-05 to 2005-06 | | % point contribution to growth in GSP 2004-05 to 2005-06 | | Year-average % change 2004-05 to 2005-06 | | % point contribution to growth in GSP 2004-05 to 2005-06 |

Final consumption expenditure | | | | | | | | |

Households | | 4.6 | | 2.7 | | 2.2 | | 1.2 |

General government | | 4.4 | | 0.7 | | 3.1 | | 0.6 |

| | | | |

Gross fixed capital formation | | | | | | | | |

Private (b) | | 12.1 | | 3.0 | | 8.4 | | 1.8 |

Dwellings | | 1.6 | | 0.1 | | -5.6 | | -0.3 |

Other buildings and structures (b) | | 28.6 | | 1.4 | | 21.2 | | 1.0 |

Machinery and equipment (b) | | 17.8 | | 1.4 | | 13.5 | | 1.0 |

| | | | |

Public enterprises (b) | | 34.5 | | 0.7 | | 13.0 | | 0.2 |

General government (b) | | 7.0 | | 0.2 | | -1.7 | | 0.0 |

| | | | |

Changes in inventories | | n.a. | | -0.3 | | n.a. | | -0.3 |

| | | | |

Gross state expenditure | | 6.6 | | 7.0 | | 3.3 | | 3.3 |

| | | | |

Exports of goods and services overseas | | 2.0 | | 0.4 | | 2.3 | | 0.4 |

Exports of goods and services interstate | | -4.1 | | -0.4 | | 7.4 | | 0.3 |

less Imports of goods and services overseas | | 7.1 | | 1.2 | | 7.3 | | 1.6 |

less Imports of goods and services interstate | | 7.4 | | 1.4 | | -4.1 | | -0.1 |

Gross state product | | 4.4 | | 4.4 | | 2.5 | | 2.5 |

| (a) | Chain volume measure reference year 2004-05. |

| (b) | Queensland data adjusted for net purchases of second hand public sector assets. |

xii

| | |

| | Queensland State Accounts, September Quarter 2006 |

Queensland State Accounts – Tables

| | | | |

Table | | | | Page |

| | Domestic Production Accounts – Queensland | | |

1 | | Trend, chain volume measures, $m | | 1 |

2 | | Trend, chain volume measures, quarterly % change | | 3 |

3 | | Trend, chain volume measures, quarterly contribution to growth, % point | | 5 |

4 | | Trend, chain volume measures, annual % change – quarterly | | 7 |

5 | | Trend, chain volume measures, annual contribution to growth - quarterly, % point | | 9 |

| | Explanatory Notes | | 11 |

| | |

| | Additional tables available on the Internet | | |

| | |

| | URL: http://www.oesr.qld.gov.au/releases/qsatables/ | | |

| | |

| | Domestic Production Accounts – Queensland | | |

6 | | Seasonally adjusted, chain volume measures, $m | | |

7 | | Seasonally adjusted, chain volume measures, quarterly % change | | |

8 | | Seasonally adjusted, chain volume measures, annual % change - quarterly | | |

9 | | Original, chain volume measures, $m | | |

10 | | Original, chain volume measures, annual % change - quarterly | | |

11 | | Trend, current prices, $m | | |

12 | | Trend, current prices, quarterly % change | | |

13 | | Trend, current prices, quarterly contribution to growth, % point | | |

14 | | Seasonally adjusted, current prices, $m | | |

15 | | Seasonally adjusted, current prices, quarterly % change | | |

16 | | Seasonally adjusted, current prices, quarterly contribution to growth, % point | | |

17 | | Original, current prices, $m | | |

18 | | Original, current prices, annual % change – quarterly | | |

19 | | Trend, implicit price deflators, 2004-05 = 100 | | |

20 | | Original, implicit price deflators, 2004-05 = 100 | | |

| | |

| | Domestic Production Accounts - Rest of Australia | | |

21 | | Trend, chain volume measures, $m | | |

22 | | Trend, chain volume measures, quarterly % change | | |

23 | | Seasonally adjusted, chain volume measures, $m | | |

24 | | Original, chain volume measures, $m | | |

25 | | Trend, current prices, $m | | |

26 | | Original, current prices, $m | | |

27 | | Trend, implicit price deflators, 2004-05 = 100 | | |

The Queensland State Accounts, including previous issues, additional tables and the complete time series for Queensland and the Rest of Australia, are available through the Office of Economic and Statistical Research website, at: http://www.oesr.qld.gov.au/releases/qsatables/.

xiii

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 1 |

(Trend, chain volume measure, $m)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003-04 | | 2004-05 | | 2005-06 | | 2006-07 |

| | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep |

Household final consumption expenditure | | 21,840 | | 22,576 | | 23,111 | | 23,439 | | 23,617 | | 23,810 | | 24,072 | | 24,432 | | 24,744 | | 24,963 | | 25,146 | | 25,363 | | 25,605 |

Internal consumption expenditure | | 20,958 | | 21,630 | | 22,135 | | 22,478 | | 22,673 | | 22,857 | | 23,101 | | 23,461 | | 23,789 | | 24,003 | | 24,132 | | 24,290 | | 24,478 |

Non-tourism | | 20,084 | | 20,759 | | 21,268 | | 21,626 | | 21,811 | | 21,992 | | 22,257 | | 22,649 | | 23,005 | | 23,210 | | 23,324 | | 23,509 | | 23,738 |

Tourism | | 874 | | 871 | | 867 | | 852 | | 862 | | 865 | | 844 | | 812 | | 784 | | 793 | | 808 | | 781 | | 740 |

External consumption expenditure | | 882 | | 946 | | 976 | | 961 | | 944 | | 953 | | 971 | | 971 | | 955 | | 960 | | 1,014 | | 1,073 | | 1,127 |

Imports of tourism services, overseas | | 281 | | 324 | | 361 | | 385 | | 402 | | 415 | | 426 | | 427 | | 423 | | 423 | | 438 | | 461 | | 485 |

Imports of tourism services, interstate | | 601 | | 622 | | 615 | | 576 | | 542 | | 538 | | 545 | | 544 | | 532 | | 537 | | 576 | | 612 | | 642 |

| | | | | | | | | | | | | |

General government final consumption expenditure | | 6,523 | | 6,569 | | 6,618 | | 6,694 | | 6,796 | | 6,869 | | 6,906 | | 6,937 | | 6,986 | | 7,092 | | 7,242 | | 7,383 | | 7,485 |

National | | 2,288 | | 2,291 | | 2,291 | | 2,323 | | 2,383 | | 2,430 | | 2,447 | | 2,449 | | 2,455 | | 2,476 | | 2,524 | | 2,583 | | 2,635 |

State and local | | 4,235 | | 4,278 | | 4,327 | | 4,371 | | 4,413 | | 4,439 | | 4,459 | | 4,488 | | 4,531 | | 4,616 | | 4,718 | | 4,800 | | 4,850 |

| | | | | | | | | | | | | |

Private gross fixed capital formation | | 9,009 | | 9,315 | | 9,591 | | 9,762 | | 9,829 | | 9,933 | | 10,087 | | 10,362 | | 10,752 | | 11,159 | | 11,546 | | 11,907 | | 12,174 |

Dwellings | | 3,379 | | 3,512 | | 3,604 | | 3,613 | | 3,604 | | 3,635 | | 3,675 | | 3,725 | | 3,722 | | 3,686 | | 3,694 | | 3,762 | | 3,859 |

Other buildings and structures | | 1,649 | | 1,702 | | 1,782 | | 1,831 | | 1,862 | | 1,898 | | 1,959 | | 2,121 | | 2,317 | | 2,472 | | 2,571 | | 2,678 | | 2,799 |

Machinery and equipment | | 2,512 | | 2,584 | | 2,738 | | 2,955 | | 3,076 | | 3,132 | | 3,172 | | 3,234 | | 3,432 | | 3,701 | | 3,939 | | 4,092 | | 4,127 |

Livestock | | 179 | | 216 | | 224 | | 218 | | 221 | | 222 | | 223 | | 224 | | 225 | | 227 | | 227 | | 225 | | 223 |

Intangible fixed assets | | 270 | | 277 | | 282 | | 287 | | 292 | | 299 | | 305 | | 309 | | 316 | | 328 | | 342 | | 353 | | 360 |

Ownership transfer costs | | 1,020 | | 1,024 | | 961 | | 858 | | 774 | | 747 | | 753 | | 749 | | 740 | | 745 | | 773 | | 797 | | 806 |

| | | | | | | | | | | | | |

Public enterprises gross fixed capital formation | | 396 | | 457 | | 609 | | 729 | | 796 | | 835 | | 882 | | 956 | | 998 | | 1,072 | | 1,182 | | 1,302 | | 1,385 |

Commonwealth | | 125 | | 121 | | 137 | | 159 | | 173 | | 172 | | 162 | | 160 | | 172 | | 196 | | 214 | | 218 | | 209 |

State and local | | 271 | | 336 | | 472 | | 570 | | 623 | | 663 | | 720 | | 796 | | 826 | | 876 | | 968 | | 1,084 | | 1,176 |

| | | | | | | | | | | | | |

General government gross fixed capital formation | | 1,019 | | 1,098 | | 1,143 | | 1,141 | | 1,120 | | 1,127 | | 1,191 | | 1,269 | | 1,323 | | 1,302 | | 1,295 | | 1,359 | | 1,451 |

National | | 149 | | 167 | | 173 | | 162 | | 145 | | 136 | | 140 | | 145 | | 143 | | 137 | | 134 | | 135 | | 138 |

State and local | | 870 | | 931 | | 970 | | 979 | | 975 | | 991 | | 1,051 | | 1,124 | | 1,180 | | 1,165 | | 1,161 | | 1,224 | | 1,313 |

| | | | | | | | | | | | | |

Change in inventories | | 334 | | 266 | | 179 | | 110 | | 90 | | 132 | | 184 | | 207 | | 197 | | 131 | | 48 | | -36 | | -107 |

Statistical discrepancy (E) | | -4 | | 19 | | 44 | | 67 | | 63 | | 48 | | -5 | | -51 | | -72 | | -71 | | -61 | | -41 | | -2 |

| | | | | | | | | | | | | |

Gross state expenditure | | 39,117 | | 40,300 | | 41,295 | | 41,942 | | 42,311 | | 42,754 | | 43,317 | | 44,112 | | 44,928 | | 45,648 | | 46,398 | | 47,237 | | 47,991 |

| | | | | | | | | | | | | |

Exports of goods and services | | 11,697 | | 11,735 | | 11,841 | | 11,891 | | 12,025 | | 12,216 | | 12,295 | | 12,247 | | 12,230 | | 12,293 | | 12,365 | | 12,336 | | 12,229 |

| | | | | | | | | | | | | |

Exports of goods and services, overseas | | 7,804 | | 7,884 | | 8,060 | | 8,156 | | 8,278 | | 8,441 | | 8,540 | | 8,563 | | 8,584 | | 8,655 | | 8,714 | | 8,691 | | 8,624 |

Exports of goods, overseas | | 6,234 | | 6,273 | | 6,411 | | 6,489 | | 6,579 | | 6,730 | | 6,823 | | 6,836 | | 6,850 | | 6,883 | | 6,881 | | 6,801 | | 6,687 |

Exports of services, less tourism services, overseas | | 985 | | 1,007 | | 1,027 | | 1,029 | | 1,030 | | 1,021 | | 1,025 | | 1,052 | | 1,082 | | 1,117 | | 1,152 | | 1,183 | | 1,209 |

Exports of tourism services, overseas | | 585 | | 604 | | 622 | | 638 | | 669 | | 690 | | 692 | | 675 | | 652 | | 655 | | 681 | | 707 | | 728 |

Exports of goods and services, interstate | | 3,893 | | 3,851 | | 3,781 | | 3,735 | | 3,747 | | 3,775 | | 3,755 | | 3,684 | | 3,646 | | 3,638 | | 3,651 | | 3,645 | | 3,605 |

Exports of goods, interstate | | 2,611 | | 2,624 | | 2,544 | | 2,445 | | 2,412 | | 2,449 | | 2,495 | | 2,505 | | 2,517 | | 2,507 | | 2,487 | | 2,474 | | 2,468 |

Exports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

Exports of tourism services, interstate | | 1,282 | | 1,227 | | 1,237 | | 1,290 | | 1,335 | | 1,326 | | 1,260 | | 1,179 | | 1,129 | | 1,131 | | 1,164 | | 1,171 | | 1,137 |

less Imports of goods and services | | 12,931 | | 13,661 | | 14,180 | | 14,394 | | 14,464 | | 14,566 | | 14,643 | | 14,830 | | 15,248 | | 15,715 | | 16,028 | | 16,159 | | 16,127 |

| | | | | | | | | | | | | |

less Imports of goods and services, overseas | | 5,682 | | 6,027 | | 6,385 | | 6,714 | | 6,937 | | 7,100 | | 7,229 | | 7,324 | | 7,494 | | 7,683 | | 7,787 | | 7,819 | | 7,788 |

less Imports of goods, overseas | | 4,218 | | 4,443 | | 4,715 | | 5,008 | | 5,201 | | 5,323 | | 5,413 | | 5,494 | | 5,661 | | 5,837 | | 5,902 | | 5,885 | | 5,805 |

less Imports of services, less tourism services, overseas | | 1,183 | | 1,260 | | 1,309 | | 1,321 | | 1,334 | | 1,362 | | 1,390 | | 1,403 | | 1,410 | | 1,423 | | 1,447 | | 1,473 | | 1,498 |

less Imports of tourism services, overseas | | 281 | | 324 | | 361 | | 385 | | 402 | | 415 | | 426 | | 427 | | 423 | | 423 | | 438 | | 461 | | 485 |

| | | | | | | | | | | | | |

less Imports of goods and services, interstate | | 7,249 | | 7,634 | | 7,795 | | 7,680 | | 7,527 | | 7,466 | | 7,414 | | 7,506 | | 7,754 | | 8,032 | | 8,241 | | 8,340 | | 8,339 |

less Imports of goods, interstate | | 6,648 | | 7,012 | | 7,180 | | 7,104 | | 6,985 | | 6,928 | | 6,869 | | 6,962 | | 7,222 | | 7,495 | | 7,665 | | 7,728 | | 7,697 |

less Imports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

less Imports of tourism services, interstate | | 601 | | 622 | | 615 | | 576 | | 542 | | 538 | | 545 | | 544 | | 532 | | 537 | | 576 | | 612 | | 642 |

| | | | | | | | | | | | | |

Expenditure on gross state product | | 37,883 | | 38,374 | | 38,956 | | 39,439 | | 39,872 | | 40,404 | | 40,969 | | 41,529 | | 41,910 | | 42,226 | | 42,735 | | 43,414 | | 44,093 |

Chain volume measure reference year 2004-05

1

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 2 |

(Trend, chain volume measure, quarterly percentage change, %)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003-04 | | 2004-05 | | 2005-06 | | 2006-07 |

| | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep |

Household final consumption expenditure | | 3.5 | | 3.4 | | 2.4 | | 1.4 | | 0.8 | | 0.8 | | 1.1 | | 1.5 | | 1.3 | | 0.9 | | 0.7 | | 0.9 | | 1.0 |

Internal consumption expenditure | | 3.2 | | 3.2 | | 2.3 | | 1.5 | | 0.9 | | 0.8 | | 1.1 | | 1.6 | | 1.4 | | 0.9 | | 0.5 | | 0.7 | | 0.8 |

Non-tourism | | 3.3 | | 3.4 | | 2.5 | | 1.7 | | 0.9 | | 0.8 | | 1.2 | | 1.8 | | 1.6 | | 0.9 | | 0.5 | | 0.8 | | 1.0 |

Tourism | | 2.2 | | -0.3 | | -0.5 | | -1.7 | | 1.2 | | 0.3 | | -2.4 | | -3.8 | | -3.4 | | 1.1 | | 1.9 | | -3.3 | | -5.2 |

External consumption expenditure | | 10.9 | | 7.3 | | 3.2 | | -1.5 | | -1.8 | | 1.0 | | 1.9 | | 0.0 | | -1.6 | | 0.5 | | 5.6 | | 5.8 | | 5.0 |

Imports of tourism services, overseas | | 12.0 | | 15.3 | | 11.4 | | 6.6 | | 4.4 | | 3.2 | | 2.7 | | 0.2 | | -0.9 | | 0.0 | | 3.5 | | 5.3 | | 5.2 |

Imports of tourism services, interstate | | 10.5 | | 3.5 | | -1.1 | | -6.3 | | -5.9 | | -0.7 | | 1.3 | | -0.2 | | -2.2 | | 0.9 | | 7.3 | | 6.2 | | 4.9 |

| | | | | | | | | | | | | |

General government final consumption expenditure | | 1.1 | | 0.7 | | 0.7 | | 1.1 | | 1.5 | | 1.1 | | 0.5 | | 0.4 | | 0.7 | | 1.5 | | 2.1 | | 1.9 | | 1.4 |

National | | 1.5 | | 0.1 | | 0.0 | | 1.4 | | 2.6 | | 2.0 | | 0.7 | | 0.1 | | 0.2 | | 0.9 | | 1.9 | | 2.3 | | 2.0 |

State and local | | 0.9 | | 1.0 | | 1.1 | | 1.0 | | 1.0 | | 0.6 | | 0.5 | | 0.7 | | 1.0 | | 1.9 | | 2.2 | | 1.7 | | 1.0 |

| | | | | | | | | | | | | |

Private gross fixed capital formation | | 2.6 | | 3.4 | | 3.0 | | 1.8 | | 0.7 | | 1.1 | | 1.6 | | 2.7 | | 3.8 | | 3.8 | | 3.5 | | 3.1 | | 2.2 |

Dwellings | | 2.4 | | 3.9 | | 2.6 | | 0.2 | | -0.2 | | 0.9 | | 1.1 | | 1.4 | | -0.1 | | -1.0 | | 0.2 | | 1.8 | | 2.6 |

Other buildings and structures | | -0.1 | | 3.2 | | 4.7 | | 2.7 | | 1.7 | | 1.9 | | 3.2 | | 8.3 | | 9.2 | | 6.7 | | 4.0 | | 4.2 | | 4.5 |

Machinery and equipment | | 1.5 | | 2.9 | | 6.0 | | 7.9 | | 4.1 | | 1.8 | | 1.3 | | 2.0 | | 6.1 | | 7.8 | | 6.4 | | 3.9 | | 0.9 |

Livestock | | 42.1 | | 20.7 | | 3.7 | | -2.7 | | 1.4 | | 0.5 | | 0.5 | | 0.4 | | 0.4 | | 0.9 | | 0.0 | | -0.9 | | -0.9 |

Intangible fixed assets | | 1.5 | | 2.6 | | 1.8 | | 1.8 | | 1.7 | | 2.4 | | 2.0 | | 1.3 | | 2.3 | | 3.8 | | 4.3 | | 3.2 | | 2.0 |

Ownership transfer costs | | 5.8 | | 0.4 | | -6.2 | | -10.7 | | -9.8 | | -3.5 | | 0.8 | | -0.5 | | -1.2 | | 0.7 | | 3.8 | | 3.1 | | 1.1 |

| | | | | | | | | | | | | |

Public enterprises gross fixed capital formation | | -19.2 | | 15.4 | | 33.3 | | 19.7 | | 9.2 | | 4.9 | | 5.6 | | 8.4 | | 4.4 | | 7.4 | | 10.3 | | 10.2 | | 6.4 |

Commonwealth | | -5.3 | | -3.2 | | 13.2 | | 16.1 | | 8.8 | | -0.6 | | -5.8 | | -1.2 | | 7.5 | | 14.0 | | 9.2 | | 1.9 | | -4.1 |

State and local | | -24.3 | | 24.0 | | 40.5 | | 20.8 | | 9.3 | | 6.4 | | 8.6 | | 10.6 | | 3.8 | | 6.1 | | 10.5 | | 12.0 | | 8.5 |

| | | | | | | | | | | | | |

General government gross fixed capital formation | | 4.1 | | 7.8 | | 4.1 | | -0.2 | | -1.8 | | 0.6 | | 5.7 | | 6.5 | | 4.3 | | -1.6 | | -0.5 | | 4.9 | | 6.8 |

National | | 9.6 | | 12.1 | | 3.6 | | -6.4 | | -10.5 | | -6.2 | | 2.9 | | 3.6 | | -1.4 | | -4.2 | | -2.2 | | 0.7 | | 2.2 |

State and local | | 3.2 | | 7.0 | | 4.2 | | 0.9 | | -0.4 | | 1.6 | | 6.1 | | 6.9 | | 5.0 | | -1.3 | | -0.3 | | 5.4 | | 7.3 |

| | | | | | | | | | | | | |

Gross state expenditure | | 2.9 | | 3.0 | | 2.5 | | 1.6 | | 0.9 | | 1.0 | | 1.3 | | 1.8 | | 1.8 | | 1.6 | | 1.6 | | 1.8 | | 1.6 |

| | | | | | | | | | | | | |

Exports of goods and services | | -0.8 | | 0.3 | | 0.9 | | 0.4 | | 1.1 | | 1.6 | | 0.6 | | -0.4 | | -0.1 | | 0.5 | | 0.6 | | -0.2 | | -0.9 |

| | | | | | | | | | | | | |

Exports of goods and services, overseas | | -1.4 | | 1.0 | | 2.2 | | 1.2 | | 1.5 | | 2.0 | | 1.2 | | 0.3 | | 0.2 | | 0.8 | | 0.7 | | -0.3 | | -0.8 |

Exports of goods, overseas | | -1.8 | | 0.6 | | 2.2 | | 1.2 | | 1.4 | | 2.3 | | 1.4 | | 0.2 | | 0.2 | | 0.5 | | 0.0 | | -1.2 | | -1.7 |

Exports of services, less tourism services, overseas | | -0.4 | | 2.2 | | 2.0 | | 0.2 | | 0.1 | | -0.9 | | 0.4 | | 2.6 | | 2.9 | | 3.2 | | 3.1 | | 2.7 | | 2.2 |

Exports of tourism services, overseas | | 1.2 | | 3.2 | | 3.0 | | 2.6 | | 4.9 | | 3.1 | | 0.3 | | -2.5 | | -3.4 | | 0.5 | | 4.0 | | 3.8 | | 3.0 |

| | | | | | | | | | | | | |

Exports of goods and services, interstate | | 0.5 | | -1.1 | | -1.8 | | -1.2 | | 0.3 | | 0.7 | | -0.5 | | -1.9 | | -1.0 | | -0.2 | | 0.4 | | -0.2 | | -1.1 |

Exports of goods, interstate | | 3.1 | | 0.5 | | -3.0 | | -3.9 | | -1.3 | | 1.5 | | 1.9 | | 0.4 | | 0.5 | | -0.4 | | -0.8 | | -0.5 | | -0.2 |

Exports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

Exports of tourism services, interstate | | -4.3 | | -4.3 | | 0.8 | | 4.3 | | 3.5 | | -0.7 | | -5.0 | | -6.4 | | -4.2 | | 0.2 | | 2.9 | | 0.6 | | -2.9 |

less Imports of goods and services | | 5.6 | | 5.6 | | 3.8 | | 1.5 | | 0.5 | | 0.7 | | 0.5 | | 1.3 | | 2.8 | | 3.1 | | 2.0 | | 0.8 | | -0.2 |

| | | | | | | | | | | | | |

less Imports of goods and services, overseas | | 4.4 | | 6.1 | | 5.9 | | 5.2 | | 3.3 | | 2.3 | | 1.8 | | 1.3 | | 2.3 | | 2.5 | | 1.4 | | 0.4 | | -0.4 |

less Imports of goods, overseas | | 3.7 | | 5.3 | | 6.1 | | 6.2 | | 3.9 | | 2.3 | | 1.7 | | 1.5 | | 3.0 | | 3.1 | | 1.1 | | -0.3 | | -1.4 |

less Imports of services, less tourism services, overseas | | 5.5 | | 6.5 | | 3.9 | | 0.9 | | 1.0 | | 2.1 | | 2.1 | | 0.9 | | 0.5 | | 0.9 | | 1.7 | | 1.8 | | 1.7 |

less Imports of tourism services, overseas | | 12.0 | | 15.3 | | 11.4 | | 6.6 | | 4.4 | | 3.2 | | 2.7 | | 0.2 | | -0.9 | | 0.0 | | 3.5 | | 5.3 | | 5.2 |

| | | | | | | | | | | | | |

less Imports of goods and services, interstate | | 6.4 | | 5.3 | | 2.1 | | -1.5 | | -2.0 | | -0.8 | | -0.7 | | 1.2 | | 3.3 | | 3.6 | | 2.6 | | 1.2 | | 0.0 |

less Imports of goods, interstate | | 6.1 | | 5.5 | | 2.4 | | -1.1 | | -1.7 | | -0.8 | | -0.9 | | 1.4 | | 3.7 | | 3.8 | | 2.3 | | 0.8 | | -0.4 |

less Imports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

less Imports of tourism services, interstate | | 10.5 | | 3.5 | | -1.1 | | -6.3 | | -5.9 | | -0.7 | | 1.3 | | -0.2 | | -2.2 | | 0.9 | | 7.3 | | 6.2 | | 4.9 |

| | | | | | | | | | | | | |

Expenditure on gross state product | | 0.9 | | 1.3 | | 1.5 | | 1.2 | | 1.1 | | 1.3 | | 1.4 | | 1.4 | | 0.9 | | 0.8 | | 1.2 | | 1.6 | | 1.6 |

Chain volume measure reference year 2004-05

2

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 3 |

(Trend, chain volume measure, quarterly contributions to growth, %)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003-04 | | 2004-05 | | 2005-06 | | 2006-07 |

| | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep |

Household final consumption expenditure | | 2.0 | | 1.9 | | 1.4 | | 0.8 | | 0.5 | | 0.5 | | 0.6 | | 0.9 | | 0.8 | | 0.5 | | 0.4 | | 0.5 | | 0.6 |

Internal consumption expenditure | | 1.7 | | 1.8 | | 1.3 | | 0.9 | | 0.5 | | 0.5 | | 0.6 | | 0.9 | | 0.8 | | 0.5 | | 0.3 | | 0.4 | | 0.4 |

Non-tourism | | 1.7 | | 1.8 | | 1.3 | | 0.9 | | 0.5 | | 0.5 | | 0.7 | | 1.0 | | 0.9 | | 0.5 | | 0.3 | | 0.4 | | 0.5 |

Tourism | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | -0.1 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | -0.1 | | -0.1 |

External consumption expenditure | | 0.2 | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 |

Imports of tourism services, overseas | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 |

Imports of tourism services, interstate | | 0.2 | | 0.1 | | 0.0 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 |

| | | | | | | | | | | | | |

General government final consumption expenditure | | 0.2 | | 0.1 | | 0.1 | | 0.2 | | 0.3 | | 0.2 | | 0.1 | | 0.1 | | 0.1 | | 0.3 | | 0.4 | | 0.3 | | 0.2 |

National | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | 0.1 |

State and local | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.1 | | 0.1 | | 0.2 | | 0.2 | | 0.2 | | 0.1 |

| | | | | | | | | | | | | |

Private gross fixed capital formation | | 0.6 | | 0.8 | | 0.7 | | 0.4 | | 0.2 | | 0.3 | | 0.4 | | 0.7 | | 0.9 | | 1.0 | | 0.9 | | 0.8 | | 0.6 |

Dwellings | | 0.2 | | 0.4 | | 0.2 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | -0.1 | | 0.0 | | 0.2 | | 0.2 |

Other buildings and structures | | 0.0 | | 0.1 | | 0.2 | | 0.1 | | 0.1 | | 0.1 | | 0.2 | | 0.4 | | 0.5 | | 0.4 | | 0.2 | | 0.3 | | 0.3 |

Machinery and equipment | | 0.1 | | 0.2 | | 0.4 | | 0.6 | | 0.3 | | 0.1 | | 0.1 | | 0.2 | | 0.5 | | 0.6 | | 0.6 | | 0.4 | | 0.1 |

Livestock | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

Intangible fixed assets | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

Ownership transfer costs | | 0.1 | | 0.0 | | -0.2 | | -0.3 | | -0.2 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.0 |

| | | | | | | | | | | | | |

Public enterprises gross fixed capital formation | | -0.3 | | 0.2 | | 0.4 | | 0.3 | | 0.2 | | 0.1 | | 0.1 | | 0.2 | | 0.1 | | 0.2 | | 0.3 | | 0.3 | | 0.2 |

Commonwealth | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.0 | | 0.0 | | 0.0 |

State and local | | -0.2 | | 0.2 | | 0.4 | | 0.3 | | 0.1 | | 0.1 | | 0.1 | | 0.2 | | 0.1 | | 0.1 | | 0.2 | | 0.3 | | 0.2 |

| | | | | | | | | | | | | |

General government gross fixed capital formation | | 0.1 | | 0.2 | | 0.1 | | 0.0 | | -0.1 | | 0.0 | | 0.2 | | 0.2 | | 0.1 | | -0.1 | | 0.0 | | 0.1 | | 0.2 |

National | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

State and local | | 0.1 | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.2 |

| | | | | | | | | | | | | |

Change in inventories | | 0.2 | | -0.2 | | -0.2 | | -0.2 | | -0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | -0.2 | | -0.2 | | -0.2 | | -0.2 |

Statistical discrepancy (E) | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | -0.1 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.1 |

| | | | | | | | | | | | | |

Gross state expenditure | | 3.0 | | 3.1 | | 2.6 | | 1.7 | | 0.9 | | 1.1 | | 1.4 | | 1.9 | | 2.0 | | 1.7 | | 1.8 | | 2.0 | | 1.7 |

| | | | | | | | | | | | | |

Exports of goods and services | | -0.2 | | 0.1 | | 0.3 | | 0.1 | | 0.3 | | 0.5 | | 0.2 | | -0.1 | | 0.0 | | 0.2 | | 0.2 | | -0.1 | | -0.2 |

Exports of goods and services, overseas | | -0.3 | | 0.2 | | 0.5 | | 0.2 | | 0.3 | | 0.4 | | 0.2 | | 0.1 | | 0.1 | | 0.2 | | 0.1 | | -0.1 | | -0.2 |

Exports of goods, overseas | | -0.3 | | 0.1 | | 0.4 | | 0.2 | | 0.2 | | 0.4 | | 0.2 | | 0.0 | | 0.0 | | 0.1 | | 0.0 | | -0.2 | | -0.3 |

Exports of services, less tourism services, overseas | | 0.0 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 |

Exports of tourism services, overseas | | 0.0 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | -0.1 | | 0.0 | | 0.1 | | 0.1 | | 0.0 |

| | | | | | | | | | | | | |

Exports of goods and services, interstate | | 0.1 | | -0.1 | | -0.2 | | -0.1 | | 0.0 | | 0.1 | | 0.0 | | -0.2 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | -0.1 |

Exports of goods, interstate | | 0.2 | | 0.0 | | -0.2 | | -0.3 | | -0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 |

Exports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

Exports of tourism services, interstate | | -0.2 | | -0.1 | | 0.0 | | 0.1 | | 0.1 | | 0.0 | | -0.2 | | -0.2 | | -0.1 | | 0.0 | | 0.1 | | 0.0 | | -0.1 |

less Imports of goods and services | | 1.8 | | 1.9 | | 1.4 | | 0.5 | | 0.2 | | 0.3 | | 0.2 | | 0.5 | | 1.0 | | 1.1 | | 0.7 | | 0.3 | | -0.1 |

| | | | | | | | | | | | | |

less Imports of goods and services, overseas | | 0.6 | | 0.9 | | 0.9 | | 0.8 | | 0.6 | | 0.4 | | 0.3 | | 0.2 | | 0.4 | | 0.5 | | 0.2 | | 0.1 | | -0.1 |

less Imports of goods, overseas | | 0.4 | | 0.6 | | 0.7 | | 0.8 | | 0.5 | | 0.3 | | 0.2 | | 0.2 | | 0.4 | | 0.4 | | 0.2 | | 0.0 | | -0.2 |

less Imports of services, less tourism services, overseas | | 0.2 | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 |

less Imports of tourism services, overseas | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 |

| | | | | | | | | | | | | |

less Imports of goods and services, interstate | | 1.2 | | 1.0 | | 0.4 | | -0.3 | | -0.4 | | -0.2 | | -0.1 | | 0.2 | | 0.6 | | 0.7 | | 0.5 | | 0.2 | | 0.0 |

less Imports of goods, interstate | | 1.0 | | 1.0 | | 0.4 | | -0.2 | | -0.3 | | -0.1 | | -0.1 | | 0.2 | | 0.6 | | 0.7 | | 0.4 | | 0.1 | | -0.1 |

less Imports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

less Imports of tourism services, interstate | | 0.2 | | 0.1 | | 0.0 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 |

| | | | | | | | | | | | | |

Expenditure on gross state product | | 0.9 | | 1.3 | | 1.5 | | 1.2 | | 1.1 | | 1.3 | | 1.4 | | 1.4 | | 0.9 | | 0.8 | | 1.2 | | 1.6 | | 1.6 |

Chain volume measure reference year 2004-05

3

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 4 |

(Trend, chain volume measure, annual percentage change - quarterly, %)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003-04 | | 2004-05 | | 2005-06 | | 2006-07 |

| | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep |

Household final consumption expenditure | | 7.1 | | 10.4 | | 12.2 | | 11.1 | | 8.1 | | 5.5 | | 4.2 | | 4.2 | | 4.8 | | 4.8 | | 4.5 | | 3.8 | | 3.5 |

Internal consumption expenditure | | 6.6 | | 9.7 | | 11.4 | | 10.7 | | 8.2 | | 5.7 | | 4.4 | | 4.4 | | 4.9 | | 5.0 | | 4.5 | | 3.5 | | 2.9 |

Non-tourism | | 6.8 | | 10.1 | | 11.9 | | 11.2 | | 8.6 | | 5.9 | | 4.7 | | 4.7 | | 5.5 | | 5.5 | | 4.8 | | 3.8 | | 3.2 |

Tourism | | 2.2 | | 0.5 | | 0.9 | | -0.4 | | -1.4 | | -0.7 | | -2.7 | | -4.7 | | -9.0 | | -8.3 | | -4.3 | | -3.8 | | -5.6 |

External consumption expenditure | | 21.2 | | 31.6 | | 33.0 | | 20.9 | | 7.0 | | 0.7 | | -0.5 | | 1.0 | | 1.2 | | 0.7 | | 4.4 | | 10.5 | | 18.0 |

Imports of tourism services, overseas | | 18.1 | | 35.6 | | 50.4 | | 53.4 | | 43.1 | | 28.1 | | 18.0 | | 10.9 | | 5.2 | | 1.9 | | 2.8 | | 8.0 | | 14.7 |

Imports of tourism services, interstate | | 22.7 | | 29.6 | | 24.5 | | 5.9 | | -9.8 | | -13.5 | | -11.4 | | -5.6 | | -1.8 | | -0.2 | | 5.7 | | 12.5 | | 20.7 |

| | | | | | | | | | | | | |

General government final consumption expenditure | | 6.3 | | 5.6 | | 4.4 | | 3.7 | | 4.2 | | 4.6 | | 4.4 | | 3.6 | | 2.8 | | 3.2 | | 4.9 | | 6.4 | | 7.1 |

National | | 9.2 | | 7.7 | | 4.8 | | 3.1 | | 4.2 | | 6.1 | | 6.8 | | 5.4 | | 3.0 | | 1.9 | | 3.1 | | 5.5 | | 7.3 |

State and local | | 4.8 | | 4.6 | | 4.2 | | 4.1 | �� | 4.2 | | 3.8 | | 3.1 | | 2.7 | | 2.7 | | 4.0 | | 5.8 | | 7.0 | | 7.0 |

| | | | | | | | | | | | | |

Private gross fixed capital formation | | 8.8 | | 7.9 | | 10.1 | | 11.1 | | 9.1 | | 6.6 | | 5.2 | | 6.1 | | 9.4 | | 12.3 | | 14.5 | | 14.9 | | 13.2 |

Dwellings | | 3.6 | | 4.6 | | 8.4 | | 9.5 | | 6.7 | | 3.5 | | 2.0 | | 3.1 | | 3.3 | | 1.4 | | 0.5 | | 1.0 | | 3.7 |

Other buildings and structures | | -3.9 | | -4.4 | | 4.2 | | 11.0 | | 12.9 | | 11.5 | | 9.9 | | 15.8 | | 24.4 | | 30.2 | | 31.2 | | 26.3 | | 20.8 |

Machinery and equipment | | 21.4 | | 13.3 | | 13.0 | | 19.3 | | 22.5 | | 21.2 | | 15.9 | | 9.4 | | 11.6 | | 18.2 | | 24.2 | | 26.5 | | 20.3 |

Livestock | | 47.9 | | 166.7 | | 173.2 | | 73.0 | | 23.5 | | 2.8 | | -0.4 | | 2.8 | | 1.8 | | 2.3 | | 1.8 | | 0.4 | | -0.9 |

Intangible fixed assets | | 4.7 | | 4.9 | | 6.0 | | 7.9 | | 8.1 | | 7.9 | | 8.2 | | 7.7 | | 8.2 | | 9.7 | | 12.1 | | 14.2 | | 13.9 |

Ownership transfer costs | | 18.9 | | 17.3 | | 6.2 | | -11.0 | | -24.1 | | -27.1 | | -21.6 | | -12.7 | | -4.4 | | -0.3 | | 2.7 | | 6.4 | | 8.9 |

| | | | | | | | | | | | | |

Public enterprises gross fixed capital formation | | -48.5 | | -39.6 | | -3.0 | | 48.8 | | 101.0 | | 82.7 | | 44.8 | | 31.1 | | 25.4 | | 28.4 | | 34.0 | | 36.2 | | 38.8 |

Commonwealth | | 13.6 | | 4.3 | | 6.2 | | 20.5 | | 38.4 | | 42.1 | | 18.2 | | 0.6 | | -0.6 | | 14.0 | | 32.1 | | 36.2 | | 21.5 |

State and local | | -58.9 | | -47.5 | | -5.4 | | 59.2 | | 129.9 | | 97.3 | | 52.5 | | 39.6 | | 32.6 | | 32.1 | | 34.4 | | 36.2 | | 42.4 |

| | | | | | | | | | | | | |

General government gross fixed capital formation | | -10.2 | | 0.7 | | 12.4 | | 16.5 | | 9.9 | | 2.6 | | 4.2 | | 11.2 | | 18.1 | | 15.5 | | 8.7 | | 7.1 | | 9.7 |

National | | 16.4 | | 23.7 | | 29.1 | | 19.1 | | -2.7 | | -18.6 | | -19.1 | | -10.5 | | -1.4 | | 0.7 | | -4.3 | | -6.9 | | -3.5 |

State and local | | -13.6 | | -2.5 | | 9.9 | | 16.1 | | 12.1 | | 6.4 | | 8.4 | | 14.8 | | 21.0 | | 17.6 | | 10.5 | | 8.9 | | 11.3 |

| | | | | | | | | | | | | |

Gross state expenditure | | 7.0 | | 8.8 | | 10.7 | | 10.4 | | 8.2 | | 6.1 | | 4.9 | | 5.2 | | 6.2 | | 6.8 | | 7.1 | | 7.1 | | 6.8 |

| | | | | | | | | | | | | |

Exports of goods and services | | 0.9 | | -0.4 | | -0.2 | | 0.9 | | 2.8 | | 4.1 | | 3.8 | | 3.0 | | 1.7 | | 0.6 | | 0.6 | | 0.7 | | 0.0 |

| | | | | | | | | | | | | |

Exports of goods and services, overseas | | -0.4 | | -1.6 | | 0.0 | | 3.1 | | 6.1 | | 7.1 | | 6.0 | | 5.0 | | 3.7 | | 2.5 | | 2.0 | | 1.5 | | 0.5 |

Exports of goods, overseas | | -0.7 | | -2.4 | | -0.9 | | 2.3 | | 5.5 | | 7.3 | | 6.4 | | 5.3 | | 4.1 | | 2.3 | | 0.9 | | -0.5 | | -2.4 |

Exports of services, less tourism services, overseas | | 0.5 | | 0.4 | | 2.4 | | 4.0 | | 4.6 | | 1.4 | | -0.2 | | 2.2 | | 5.0 | | 9.4 | | 12.4 | | 12.5 | | 11.7 |

Exports of tourism services, overseas | | 0.7 | | 2.5 | | 6.3 | | 10.4 | | 14.4 | | 14.2 | | 11.3 | | 5.8 | | -2.5 | | -5.1 | | -1.6 | | 4.7 | | 11.7 |

| | | | | | | | | | | | | |

Exports of goods and services, interstate | | 3.7 | | 2.3 | | -0.7 | | -3.6 | | -3.8 | | -2.0 | | -0.7 | | -1.4 | | -2.7 | | -3.6 | | -2.8 | | -1.1 | | -1.1 |

Exports of goods, interstate | | 3.6 | | 6.8 | | 3.9 | | -3.5 | | -7.6 | | -6.7 | | -1.9 | | 2.5 | | 4.4 | | 2.4 | | -0.3 | | -1.2 | | -1.9 |

Exports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

Exports of tourism services, interstate | | 3.9 | | -6.2 | | -9.0 | | -3.7 | | 4.1 | | 8.1 | | 1.9 | | -8.6 | | -15.4 | | -14.7 | | -7.6 | | -0.7 | | 0.7 |

less Imports of goods and services | | 13.1 | | 17.0 | | 19.7 | | 17.5 | | 11.9 | | 6.6 | | 3.3 | | 3.0 | | 5.4 | | 7.9 | | 9.5 | | 9.0 | | 5.8 |

| | | | | | | | | | | | | |

less Imports of goods and services, overseas | | 13.2 | | 16.6 | | 20.4 | | 23.4 | | 22.1 | | 17.8 | | 13.2 | | 9.1 | | 8.0 | | 8.2 | | 7.7 | | 6.8 | | 3.9 |

less Imports of goods, overseas | | 13.6 | | 15.3 | | 18.6 | | 23.1 | | 23.3 | | 19.8 | | 14.8 | | 9.7 | | 8.8 | | 9.7 | | 9.0 | | 7.1 | | 2.5 |

less Imports of services, less tourism services, overseas | | 10.8 | | 16.8 | | 20.3 | | 17.8 | | 12.8 | | 8.1 | | 6.2 | | 6.2 | | 5.7 | | 4.5 | | 4.1 | | 5.0 | | 6.2 |

less Imports of tourism services, overseas | | 18.1 | | 35.6 | | 50.4 | | 53.4 | | 43.1 | | 28.1 | | 18.0 | | 10.9 | | 5.2 | | 1.9 | | 2.8 | | 8.0 | | 14.7 |

| | | | | | | | | | | | | |

less Imports of goods and services, interstate | | 12.9 | | 17.4 | | 19.1 | | 12.8 | | 3.8 | | -2.2 | | -4.9 | | -2.3 | | 3.0 | | 7.6 | | 11.2 | | 11.1 | | 7.5 |

less Imports of goods, interstate | | 12.1 | | 16.4 | | 18.6 | | 13.4 | | 5.1 | | -1.2 | | -4.3 | | -2.0 | | 3.4 | | 8.2 | | 11.6 | | 11.0 | | 6.6 |

less Imports of services, less tourism services, interstate | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — |

less Imports of tourism services, interstate | | 22.7 | | 29.6 | | 24.5 | | 5.9 | | -9.8 | | -13.5 | | -11.4 | | -5.6 | | -1.8 | | -0.2 | | 5.7 | | 12.5 | | 20.7 |

| | | | | | | | | | | | | |

Expenditure on gross state product | | 3.2 | | 3.3 | | 4.4 | | 5.1 | | 5.3 | | 5.3 | | 5.2 | | 5.3 | | 5.1 | | 4.5 | | 4.3 | | 4.5 | | 5.2 |

Chain volume measure reference year 2004-05

4

| | |

| DOMESTIC PRODUCTION ACCOUNT - QUEENSLAND | | TABLE 5 |

(Trend, chain volume measure, annual contribution to growths - quarterly, %)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2003-04 | | 2004-05 | | 2005-06 | | | 2006-07 |

| | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | Sep | | Dec | | Mar | | Jun | | | Sep |

Household final consumption expenditure | | 4.0 | | 5.7 | | 6.7 | | 6.2 | | 4.7 | | 3.2 | | 2.5 | | 2.5 | | 2.8 | | 2.9 | | 2.6 | | 2.2 | | | 2.1 |

Internal consumption expenditure | | 3.5 | | 5.1 | | 6.1 | | 5.8 | | 4.5 | | 3.2 | | 2.5 | | 2.5 | | 2.8 | | 2.8 | | 2.5 | | 2.0 | | | 1.6 |

Non-tourism | | 3.5 | | 5.1 | | 6.1 | | 5.8 | | 4.6 | | 3.2 | | 2.5 | | 2.6 | | 3.0 | | 3.0 | | 2.6 | | 2.1 | | | 1.7 |

Tourism | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | -0.1 | | -0.1 | | -0.2 | | -0.2 | | -0.1 | | -0.1 | | | -0.1 |

External consumption expenditure | | 0.4 | | 0.6 | | 0.6 | | 0.4 | | 0.2 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.2 | | | 0.4 |

Imports of tourism services, overseas | | 0.1 | | 0.2 | | 0.3 | | 0.4 | | 0.3 | | 0.2 | | 0.2 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | | 0.1 |

Imports of tourism services, interstate | | 0.3 | | 0.4 | | 0.3 | | 0.1 | | -0.2 | | -0.2 | | -0.2 | | -0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.2 | | | 0.3 |

| | | | | | | | | | | | | |

General government final consumption expenditure | | 1.1 | | 0.9 | | 0.8 | | 0.6 | | 0.7 | | 0.8 | | 0.7 | | 0.6 | | 0.5 | | 0.6 | | 0.8 | | 1.1 | | | 1.2 |

National | | 0.5 | | 0.4 | | 0.3 | | 0.2 | | 0.3 | | 0.4 | | 0.4 | | 0.3 | | 0.2 | | 0.1 | | 0.2 | | 0.3 | | | 0.4 |

State and local | | 0.5 | | 0.5 | | 0.5 | | 0.5 | | 0.5 | | 0.4 | | 0.3 | | 0.3 | | 0.3 | | 0.4 | | 0.6 | | 0.8 | | | 0.8 |

| | | | | | | | | | | | | |

Private gross fixed capital formation | | 2.0 | | 1.8 | | 2.4 | | 2.6 | | 2.2 | | 1.6 | | 1.3 | | 1.5 | | 2.3 | | 3.0 | | 3.6 | | 3.7 | | | 3.4 |

Dwellings | | 0.3 | | 0.4 | | 0.7 | | 0.8 | | 0.6 | | 0.3 | | 0.2 | | 0.3 | | 0.3 | | 0.1 | | 0.0 | | 0.1 | | | 0.3 |

Other buildings and structures | | -0.2 | | -0.2 | | 0.2 | | 0.5 | | 0.6 | | 0.5 | | 0.5 | | 0.7 | | 1.1 | | 1.4 | | 1.5 | | 1.3 | | | 1.2 |

Machinery and equipment | | 1.2 | | 0.8 | | 0.8 | | 1.3 | | 1.5 | | 1.4 | | 1.1 | | 0.7 | | 0.9 | | 1.4 | | 1.9 | | 2.1 | | | 1.7 |

Livestock | | 0.2 | | 0.4 | | 0.4 | | 0.2 | | 0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | | 0.0 |

Intangible fixed assets | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | | 0.1 |

Ownership transfer costs | | 0.4 | | 0.4 | | 0.2 | | -0.3 | | -0.6 | | -0.7 | | -0.5 | | -0.3 | | -0.1 | | 0.0 | | 0.0 | | 0.1 | | | 0.2 |

| | | | | | | | | | | | | |

Public enterprises gross fixed capital formation | | -1.0 | | -0.8 | | -0.1 | | 0.6 | | 1.1 | | 1.0 | | 0.7 | | 0.6 | | 0.5 | | 0.6 | | 0.7 | | 0.8 | | | 0.9 |

Commonwealth | | 0.0 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | | 0.1 |

State and local | | -1.1 | | -0.8 | | -0.1 | | 0.6 | | 0.9 | | 0.9 | | 0.6 | | 0.6 | | 0.5 | | 0.5 | | 0.6 | | 0.7 | | | 0.8 |

| | | | | | | | | | | | | |

General government gross fixed capital formation | | -0.3 | | 0.0 | | 0.3 | | 0.4 | | 0.3 | | 0.1 | | 0.1 | | 0.3 | | 0.5 | | 0.4 | | 0.3 | | 0.2 | | | 0.3 |

National | | 0.1 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | -0.1 | | -0.1 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | 0.0 | | | 0.0 |

State and local | | -0.4 | | -0.1 | | 0.2 | | 0.4 | | 0.3 | | 0.2 | | 0.2 | | 0.4 | | 0.5 | | 0.4 | | 0.3 | | 0.2 | | | 0.3 |

Change in inventories | | 1.2 | | 1.0 | | 0.3 | | -0.4 | | -0.6 | | -0.3 | | 0.0 | | 0.2 | | 0.3 | | 0.0 | | -0.3 | | -0.6 | | | -0.7 |

Statistical discrepancy (E) | | 0.1 | | 0.1 | | 0.3 | | 0.3 | | 0.2 | | 0.1 | | -0.1 | | -0.3 | | -0.3 | | -0.3 | | -0.1 | | 0.0 | | | 0.2 |

| | | | | | | | | | | | | |

Gross state expenditure | | 7.0 | | 8.8 | | 10.7 | | 10.5 | | 8.4 | | 6.4 | | 5.2 | | 5.5 | | 6.6 | | 7.2 | | 7.5 | | 7.5 | | | 7.3 |

| | | | | | | | | | | | | |

Exports of goods and services | | 0.3 | | -0.1 | | -0.1 | | 0.3 | | 0.9 | | 1.3 | | 1.2 | | 0.9 | | 0.5 | | 0.2 | | 0.2 | | 0.2 | | | 0.0 |

| | | | | | | | | | | | | |

Exports of goods and services, overseas | | -0.1 | | -0.4 | | 0.0 | | 0.6 | | 1.3 | | 1.5 | | 1.2 | | 1.0 | | 0.8 | | 0.5 | | 0.4 | | 0.3 | | | 0.1 |

Exports of goods, overseas | | -0.1 | | -0.4 | | -0.2 | | 0.4 | | 0.9 | | 1.2 | | 1.1 | | 0.9 | | 0.7 | | 0.4 | | 0.1 | | -0.1 | | | -0.4 |

Exports of services, less tourism services, overseas | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.1 | | 0.2 | | 0.3 | | 0.3 | | | 0.3 |

Exports of tourism services, overseas | | 0.0 | | 0.0 | | 0.1 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.1 | | 0.0 | | -0.1 | | 0.0 | | 0.1 | | | 0.2 |

| | | | | | | | | | | | | |

Exports of goods and services, interstate | | 0.4 | | 0.2 | | -0.1 | | -0.4 | | -0.4 | | -0.2 | | -0.1 | | -0.1 | | -0.3 | | -0.3 | | -0.3 | | -0.1 | | | -0.1 |

Exports of goods, interstate | | } 0.2 | | 0.4 | | 0.3 | | -0.2 | | -0.5 | | -0.5 | | -0.1 | | 0.2 | | 0.3 | | 0.1 | | 0.0 | | -0.1 | } | | -0.1 |

Exports of services, less tourism services, interstate | | } — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | } | | — |

Exports of tourism services, interstate | | 0.1 | | -0.2 | | -0.3 | | -0.1 | | 0.1 | | 0.3 | | 0.1 | | -0.3 | | -0.5 | | -0.5 | | -0.2 | | 0.0 | | | 0.0 |

less Imports of goods and services | | 4.1 | | 5.4 | | 6.2 | | 5.7 | | 4.0 | | 2.4 | | 1.2 | | 1.1 | | 2.0 | | 2.8 | | 3.4 | | 3.2 | | | 2.1 |

less Imports of goods and services, overseas | | 1.8 | | 2.3 | | 2.9 | | 3.4 | | 3.3 | | 2.8 | | 2.2 | | 1.5 | | 1.4 | | 1.4 | | 1.4 | | 1.2 | | | 0.7 |

less Imports of goods, overseas | | 1.4 | | 1.6 | | 2.0 | | 2.5 | | 2.6 | | 2.3 | | 1.8 | | 1.2 | | 1.2 | | 1.3 | | 1.2 | | 0.9 | | | 0.3 |

less Imports of services, less tourism services, overseas | | 0.3 | | 0.5 | | 0.6 | | 0.5 | | 0.4 | | 0.3 | | 0.2 | | 0.2 | | 0.2 | | 0.2 | | 0.1 | | 0.2 | | | 0.2 |

less Imports of tourism services, overseas | | 0.1 | | 0.2 | | 0.3 | | 0.4 | | 0.3 | | 0.2 | | 0.2 | | 0.1 | | 0.1 | | 0.0 | | 0.0 | | 0.1 | | | 0.1 |

less Imports of goods and services, interstate | | 2.3 | | 3.0 | | 3.3 | | 2.3 | | 0.7 | | -0.4 | | -1.0 | | -0.4 | | 0.6 | | 1.4 | | 2.0 | | 2.0 | | | 1.4 |

less Imports of goods, interstate | | } 2.0 | | 2.7 | | 3.0 | | 2.2 | | 0.9 | | -0.2 | | -0.8 | | -0.4 | | 0.6 | | 1.4 | | 1.9 | | 1.8 | } | | 1.1 |

less Imports of services, less tourism services, interstate | | } — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | | — | } | | — |

less Imports of tourism services, interstate | | 0.3 | | 0.4 | | 0.3 | | 0.1 | | -0.2 | | -0.2 | | -0.2 | | -0.1 | | 0.0 | | 0.0 | | 0.1 | | 0.2 | | | 0.3 |

| | | | | | | | | | | | | |

Expenditure on gross state product | | 3.2 | | 3.3 | | 4.4 | | 5.1 | | 5.3 | | 5.3 | | 5.2 | | 5.3 | | 5.1 | | 4.5 | | 4.3 | | 4.5 | | | 5.2 |

Chain volume measure reference year 2004-05

5

| | |

| | Queensland State Accounts, September Quarter 2006 |

EXPLANATORY NOTES

Overview

The Queensland State Accounts are compiled in accordance with the international standards contained in the System of National Accounts 1993 (SNA93).

Readers interested in more detailed information on the changes to national and state accounts are referred to the following Australian Bureau of Statistics (ABS) information papers:

| • | | Australian System of National Accounts: Concepts, Sources and Methods (ABS 5216.0); |

| • | | Upgraded Australian National Accounts (ABS 5253.0); |

| • | | Implementation of Revised International Standards in the Australian National Accounts (ABS 5251.0); and |

| • | | Introduction of Chain Volume Measure in the Australian National Accounts (ABS 5248.0). |

The broad structure of the Queensland State Accounts is that of a social accounting matrix comprising two regions: Queensland and the Rest of Australia. This enables the appropriate comparison to be made of the performance of Queensland with respect to the performance of the rest of the nation, rather than with Australia as a whole.

For both regions, four fundamental accounts have been specified: domestic (or State) production account, state consumption account, state accumulation account and the external account. The state consumption and accumulation accounts have been further disaggregated into sectoral accounts. These sectoral accounts include household, State and local general government, Commonwealth general government and private and public trading and financial enterprises. This publication reports only on the domestic production accounts of these two regions.

The Queensland State Accounts are designed to allow consolidation of the two regions into the single region of Australia. The Australian National Accounts, produced by the ABS, form a clear national framework and set of estimates, with which the Queensland State Accounts is congruent.

The ABS also produces the Australian National Accounts, National Income, Expenditure and Product. The Queensland State Accounts uses as much Queensland information contained in this ABS publication as is appropriate and relevant. However, since the purpose of the Queensland State Accounts is to measure the structure and performance of the Queensland economy as accurately and comprehensively as possible, it significantly extends the information contained in the Australian National Accounts, National Income, Expenditure and Product series. Since this extension is feasible in the case of a single State, especially one with the statistical resources of Queensland, the Queensland State Accounts is not necessarily bound to agree exactly with any ABS estimates. Nevertheless, the quality of the Australian National Accounts is such that the Queensland State Accounts estimates are generally and routinely benchmarked to them. In all cases, the ABS estimates are taken into strong initial consideration.

The major extension of the domestic production accounts in the Queensland State Accounts system is the addition of estimates of interstate trade in goods and trade in services, including tourism transactions. This enables the system to derive quarterly estimates of gross state product in volume terms. As well, this provides a more comprehensive understanding of Queensland’s overall trade performance, and replaces the more limited understanding provided by the common misperception of overseas State trade as total State trade.

6

| | |

| | Queensland State Accounts, September Quarter 2006 |

Methodological issues

As noted below in Definitions and source notes, the estimates in the Queensland State Accounts generally agree with those of the ABS Australian National Accounts, National Income, Expenditure and Product when available, except in cases where the Office of the Government Statistician has improved on, or corrected, ABS estimates.

Differences between the Queensland estimates in the Australian National Accounts, National Income, Expenditure and Product and those in the Queensland State Accounts reflect corrections and improvements in data construction made by the Office of the Government Statistician. These corrections generally arise from data confrontation exercises which involve alternative sources of evidence or information, and which often involve the input of further primary information.

Compensation of employees

The OGS estimate of Compensation of employees (COE) differs from that published by the ABS in Australian National Accounts: National Income, Expenditure and Product (ABS 5206.0). As reported in the September quarter 1994 issue of the Queensland State Accounts, the Office of the Government Statistician (OGS) is of the opinion that the compensation of employees (COE) series published in the ABS 5206.0 substantially under-recorded COE from the period commencing September quarter 1993. As a result, in the period starting with September quarter 1993 and ending December quarter 2001, the average of the quarterly movements in average weekly earnings, and survey of employment and earnings is combined with the number of wage and salary earners to derive the COE series published in the Queensland State Accounts. From March 2002 onwards, the OGS COE series is extrapolated using the quarterly movements in the compensation of employees series published in ABS 5206.0.

Further analysis by the OGS indicates that the June quarter 2005 quarter estimate of COE published in ABS 5206.0 has been underestimated. The movement in implied average earnings is contrary to other measures of earnings in Queensland. The OGS has adjusted the COE estimate for June quarter 2005 to reflect the movement in the wage price index for Queensland.

Gross operating surplus and gross mixed income

The OGS estimate of gross operating surplus and gross mixed income (GOS/GMI) differs from that published by the ABS in Australian National Accounts, State Accounts, 2005-06 (ABS 5220.0) for 2005-06. This difference reflects the OGS using a different methodology to the ABS to allocate the Australian estimate of mining GOS/GMI between Queensland and the Rest of Australia in 2005-06.

Public final demand

In some instances, there are differences between the Queensland State Accounts estimate of Queensland public final demand and those published by the ABS Australian National Accounts: National Income, Expenditure and Product (ABS 5206.0). In these cases, additional information has become available after the release of ABS estimates. The OGS has incorporated this additional information into its estimate of Queensland public final demand. No adjustments have been made to Rest of Australia. As a result, the OGS estimate of public final demand for Rest of Australia is consistent with ABS State Details (ABS 5206.0).

Input-output tables

The Queensland State Accounts and Queensland’s State and regional input-output tables, which are also produced by the Office of the Government Statistician, have been developed in close association, so that these two components of the overall system of State accounts are congruent. An intention is to use the input-output tables to assist in the future reconciliation of the income and expenditure estimates of domestic production in the State, as well as the production based estimates when available.

7

| | |

| | Queensland State Accounts, September Quarter 2006 |

Seasonally adjusted and trend estimates

In interpreting movements in quarterly time series, it is useful to recognise and take account of changes due to seasonal and other types of calendar influences. Seasonal effects usually reflect the influences of the seasons themselves, either directly (e.g. farm production) or indirectly, through activity related to them, such as social conventions (e.g. the incidence of holidays), or administrative practices (e.g. the timing of wage and salary payments). Other types of calendar variations may occur as a result of influences such as the number and composition of days in a calendar period, the accounting or the recording procedures adopted, or the incidence of moveable holidays such as Easter. For example, Easter can fall either in the March quarter, the June quarter, or in both quarters.

Movements in a time series can be due to a complex interaction of up to six notional influences. These influences are:

| • | | the seasonal pattern which reflects the systematically recurring rise (fall) of the quarters; |

| • | | the “trading day” pattern which reflects how the series systematically varies with changes in the composition of the quarters; |

| • | | moving holiday impacts; |

| • | | other systematic calendar related effects; |

| • | | the trend which reflects the fundamental and long-term direction of the series; and |

| • | | the residual/irregular influences which reflect the short-term erratic factors in the series. |

Statistical techniques may be used to evaluate the effects on normal and calendar influences operating on a series and to produce seasonally adjusted estimates by the removal of these influences. One of the most widely used seasonal adjustment methods is the X-11 variant of the Census Method 11 Seasonal Adjustment Program and its companion program X-11Q developed by the U.S. Bureau of the Census.

The X-11Q procedure uses an iterative system of moving averages and linear regression techniques to obtain seasonal and other systematic calendar effects. For quarterly series, prior adjustments can be incorporated for moving holidays and trading day adjustments. However, in accordance with the methodology used by the ABS to adjust the Australian National Accounts, it was assumed that the trading day effects on quarterly State Accounts series are likely to be insignificant except in the case of private final consumption expenditure. At each estimation stage, the adverse effects of “extreme” movements are reduced to minimise distortion of extremes. Final estimates of the seasonal effects are combined and divided into the original data series to produce a seasonally adjusted series.