EXHIBIT (c)(vii)

Queensland State Budget Papers for 2008-09

1

APPROPRIATION BILL 2008

(Second Reading Speech, 3 June 2008)

TREASURER

The Honourable Andrew Fraser MP

Treasurer

APPROPRIATION BILL 2008

(Second Reading Speech, 3 June 2008)

TREASURER

The Honourable Andrew Fraser MP

Treasurer

Mr Speaker, I move that the bill be now read a second time.

Mr Speaker, “the duty of placing before the [House] the annual review of the finances of the State and the Estimates for the current year imposes, on this occasion, a more difficult task than usual.”1

So began the Budget Speech in 1915. It serves also to introduce the Budget of 2008-09.

It is my unique privilege to present the first Budget of the Bligh Government.

It is a Budget that sets a course for a government determined to meet the challenges of the future.

This is a Budget that looks beyond tomorrow and out to the horizon.

It describes our priorities and reflects our commitments.

To delivering front line services.

To building infrastructure.

To delivering a massive boost to our health and hospital system.

To helping out Queenslanders most in need—the vulnerable and the elderly.

To tackling climate change.

And to improving housing affordability for the next generation.

It is a Budget that looks beyond today to the Queensland of the future.

We have framed this Budget against challenging times. An unprecedented credit crunch hit global finances as the fall out from the US sub-prime mortgage crisis washed around the world.

And our drought stricken state was soaked by flooding rains.

Interest rates were hiked and smashed demand in the economy, as demand for services and infrastructure escalated in our growing state.

We are facing these challenges, meeting them head on and charting a course for our future.

1 | Hon E G Theodore, Hansard, 13 October 1915. |

3

Economic and Fiscal Outlook

Mr Speaker, Queensland has a strong economy, strong population growth, a strong balance sheet and a strong future. However, the modern Queensland economy is strongly enmeshed in the global economy.

The slow down in global economic growth has hit our nation, at the same time as inflation pressures have produced higher interest rates. We are not immune.

Nationally, economic growth is now estimated to be 3 1/2 % in 2007-08, down from previous forecasts.

Australia’s economic growth is forecast to slow further in 2008-09—down to 2 3/4 %.

Queensland is again outpacing the national economy. Our estimated growth for 2007-08 is 3 3/4 % and in contrast to the nation, we are forecast to gather pace and grow at 4 1/4 % in 2008-09.

This will be the thirteenth year we have outpaced the national rate of economic growth.

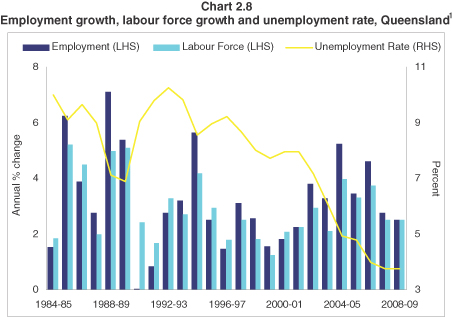

While jobs growth slows nationally, our economy is set to deliver a year average rate of unemployment that is the lowest in a generation—and it is forecast to stay there, at 3 3/4 % in 2008-09.

This will be the fifth straight year Queensland’s unemployment rate has been well below the national average and is the lowest rate of unemployment in 34 years.

Employment is forecast to grow at double the national rate.

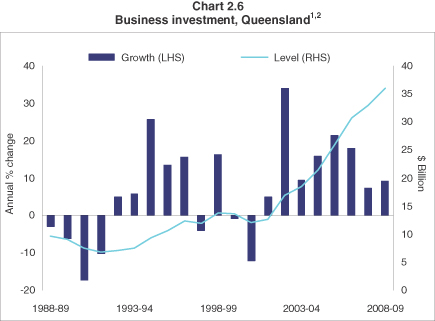

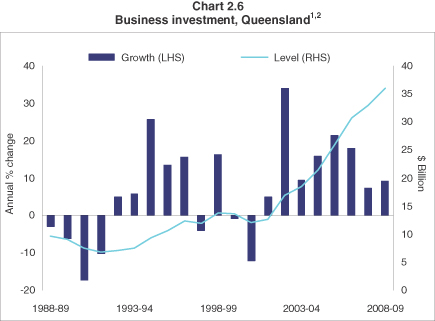

It is not just the quantum of our growth, it’s the composition of our growth that is the real story. Business investment in Queensland is forecast to grow by 9 1/4 %. Real business investment will have doubled to $36 billion over the last six years.

While the cost of the flood has included mine and export disruption in 2007-08, the breaking of the drought and rising agricultural prices are expected to result in a recovery in farm incomes and see our primary industries make a strong contribution to growth. Reforms to the Department of Primary Industries and Fisheries will support this growth.

Our resource industries are experiencing unprecedented prosperity.

While mining and agriculture represent just 12 % of the output in the modern Queensland economy, they will play a strong role in achieving exports growth of 4 1/4 % in the year ahead.

This is the strongest rate for four years and benefits from export infrastructure expansions coming on line and improved weather conditions.

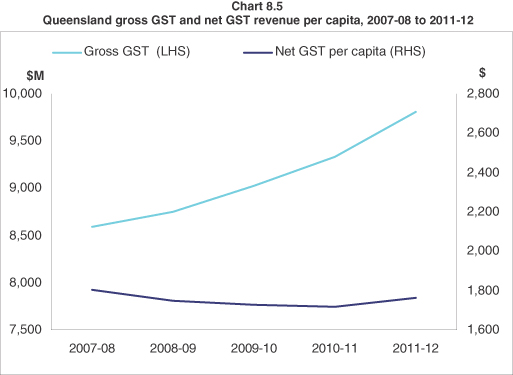

Mr Speaker, the demand for further infrastructure investment comes at a challenging time. In 2008-09, for the first time, Queensland will receive less than a per capita share of GST revenue. We will be a donor State.

At the end of the Budget’s forward estimates in 2011-12, Queensland will have had a cumulative loss in GST funding of more than $1.8 billion since the 2004 Review of the Methodology by the Commonwealth Grants Commission.

In addition, by 2011-12, the revenue foregone from the abolition of State taxes will be over $1.3 billion.

Together this curtails our capacity to meet the funding challenges before us.

4

I am a strong supporter of the Federal Treasurer’s initiative to engage in a comprehensive review of Federal, state and local taxation. The financing of our federation is the dominant fiscal challenge before our nation and the time to address it is now.

The quest for reform is a task that begins at home and the Bligh Government is taking a fresh approach to reform of the Queensland public sector with changes designed to deliver real savings that can be redeployed to frontline service delivery.

We are creating a new Public Service Commission, committed to reducing the number of government boards and statutory bodies, creating one amalgamated Civil and Administrative Tribunal, and have established the Expenditure Review Committee.

We have applied a productivity dividend to the non-service delivery areas of government and are redeploying the $80 million in annual savings to frontline service delivery.

Our amalgamation of the Service Delivery and Performance Commission and the Office of Public Service Commissioner has already generated savings of $1.5 million.

This Budget reallocates these savings to neonatal equipment and night vision goggles in rescue helicopters and to the Healthy Hearing Program for indigenous children.

One of our first acts as a new government was to comprehensively audit the Queensland Ambulance Service, where we identified $12.2 million worth of savings to be returned to frontline service delivery.

It is a record budget for the Ambulance Service of $455.7 million, including 250 additional ambulance officers and 145 new ambulances.

We will continue this task and expand it across government as we strive to achieve the best value for the Queensland taxpayer.

Housing Affordability

Mr Speaker, our decade of unprecedented prosperity has not been enjoyed by everyone.

Many young Queenslanders have been locked out of the great Australian dream by a property market that has risen above their reach.

Housing affordability can not be solved by any one act by any one government. But we can assist, and we will.

Through sweeping changes to our stamp duty regime any Queenslander seeking to break into home ownership through buying a first home under $500 000 will not pay one red cent of stamp duty.

We will immediately raise the first home owner concession to $350 000 from the start of the financial year and then to $500 000 by 1 September this year.

We will bring forward and abolish in full mortgage duty on day one of the start of the new financial year.

We will extend the principal place of residence concession available to all home buyers to provide further savings of up to $750.

These reforms will mean that a Queensland couple looking to take out a mortgage and purchase their first home—whether they are in the growth suburbs of the Gold Coast or the booming city of Mackay—will save up to $9,800 on a $500 000 home.

5

They will not pay one cent of stamp duty on the purchase price, and not one cent of duty on their mortgage.

We are proposing to abolish the First Home Owners Grant and reform duty rates for homes above $1 million to finance the cuts aimed at the Queenslanders who are seeking to break in to the property market.

Our reforms mean that for every home purchase under $1 million—whether first homes or to families upgrading to a new home—Queenslanders will pay the lowest stamp duty in the country.

This reform is at the core of our Budget and of our beliefs as a Government.

I also announce further tax reform to reduce the impact of higher land values on tax liability, with cuts to threshold payments for land tax and a simplification of the rate schedules.

We have the highest threshold in the nation for resident individuals and our top marginal rate of 1.25 % is lower than any State.

In this Budget we will add to our competitive regime which sees the number of land tax payers in Queensland equal to about one-third of that of other major states.

In Queensland a couple could own a home on land worth more than $1 million and three or four other average priced properties before being liable for land tax.

Tax payable at the land tax threshold will be reduced from $1,200 to $500 for resident individuals and from $2,250 to $1,450 for companies, trusts and absentees, which will ensure that the majority of land tax payers will benefit from our reforms.

On the supply side, this Budget will assist with housing affordability through the planned release of $125 million in 2008-09 from the Queensland Future Growth Fund for social housing, as well as $9.5 million for the Urban Land Development Authority.

Health

Mr Speaker, every government around the world of every persuasion faces the challenges of health service delivery. With an ageing population and rapid technological advancement, health costs are ever increasing.

We are facing up to this challenge with the single biggest injection ever into our health and hospital system. A massive boost of $1.2 billion will take the Health budget to a record $8.35 billion in 2008-09.

The capital works component of the Health budget tops more than $1 billion.

This Budget provides funding for the commencement of the new Mackay hospital and the redevelopment of the Cairns and Mt Isa hospitals. These projects are being funded by the sale of Cairns and Mackay airports together with the sale of our 12 % stake in Brisbane Airport.

More than $200 million is allocated towards our program of building three new tertiary hospitals in the south east corner: the Gold Coast University Hospital, the Queensland Children’s Hospital and the Sunshine Coast Hospital.

$55 million will commence the $240 million expansion of the Robina Hospital on the Gold Coast.

A funding injection of $7 million this year will go towards an expansion of the Emergency Department at the Townsville Hospital, while $10 million is also provided to bring on line more beds as we fulfil our election commitment to Townsville.

6

The upgrade of the Rockhampton Hospital Emergency Department will continue, and more than $15 million will be spent on the Yeppoon Hospital Redevelopment. A new community based care initiative will be piloted at Toowoomba Hospital.

The Budget also allocates $200 million over four years to sustain increased elective surgery activity and to relieve pressure on other essential health services.

Other new funding provided includes:

| | • | | $54.9 million over four years to meet the increased demand for medical aids, together with increased subsidies for clients of the Medical Aids Subsidy Scheme |

| | • | | $45.6 million over three years for new health technology and equipment with a further $3.9 million over three years to enhance the Tele-Radiology Network to enable Queenslanders in regional and remote areas access to rapid response radiology reporting |

| | • | | $35.8 million to employ 50 new nurse practitioners over four years and train more nurses to work in neonate intensive care units and special care nurseries |

| | • | | Enhanced Maternity Care—$9 million over four years has been allocated to support the trial of a patient-focussed nurse-led, community-based midwifery model of care in rural and outer urban sites. |

Dental health is a priority of the Bligh Government and we are also allocating $14 million over three years to acquire nine new mobile dental clinics and refurbish the existing fleet.

We will also provide $26 million over the next four years in support of our decision to fluoridate public water supplies—the single most important preventative health measure undertaken for a generation, which will benefit generations to come.

Assisting our Elderly

Mr Speaker, the generations of Queenslanders who have completed their working life and now rely on fixed incomes find the cost of living particularly challenging.

The Budget implements our commitment to introduce a Pensioner Water Subsidy Scheme for eligible pensioners in the south-east corner to reduce the impact of increased water price rises in the future. This scheme, at a cost of $50 million over four years, will provide a rebate of $40 this year, rising to $100 in 2010-11.

This scheme is in addition to the Pensioner Rate Rebate Scheme which applies across the state and provides up to $180 off local government rates charges.

To assist with rising energy costs the Government funds its commitment to introduce a $2.96 million Reticulated Natural Gas Rebate Scheme for pensioners and seniors. Around 50,000 pensioner and concession card holders will benefit from the rebate, which we will index with CPI.

Today I announce the allocation of $10.6 million to increase the pensioner and seniors electricity rebate by $20 to $165. The increase in the rebate at 13.8% is more than double the announced 5.3% increase to electricity prices and demonstrates our commitment to assisting older Queenslanders with rise in the cost of electricity.

Mr Speaker, many Queenslanders have a need for ongoing care and with an ageing population this proportion of the State’s population will grow. To assist our seniors, the Government will change a number of State tax arrangements that apply to Queensland’s aged care facilities and affect Queensland’s aged persons.

We will make aged care facilities, under the Commonwealth’s Aged Care Act, exempt from land tax.

7

We will extend the principal place of residence land tax exemption when the owner is absent due to illness or care requirements—a situation often encountered by the elderly.

These changes will ease the burden on many older Queenslanders and will be subject to appropriate safeguards to ensure the benefits reach their intended recipients. The value of these tax reforms is calculated at $5 million in savings to older Queenslanders.

Climate Change and the Environment

Mr Speaker, dealing with climate change is not only the dominant environmental challenge of our time, it’s the dominant economic challenge before us.

Pricing carbon, calibrating climate change into our economy, will have ramifications for generations to come. Denying and doing nothing is not an option to be contemplated.

The Budget will fund a new service, the ClimateSmart Home Service, to assist households to meet the challenges of climate change.

The service is modelled on the successful Home Waterwise Service—and we will make this new service available State-wide.

The new ClimateSmart Home Service—funded through the Queensland Climate Change Fund—will assist Queensland households with curtailing energy use, reducing greenhouse gas emissions and saving money on energy bills.

Residents will receive over $250 worth of value for a $50 fee which will include the installation of a wireless energy monitor, providing up to 15 compact fluorescent light bulbs, a water efficient shower rose per household and a comprehensive energy audit.

Climate change will have disproportionate impacts on different households and on different locations.

Accordingly, $7.25 million has been allocated over four years for the ClimateSmart Homes Rebate Program to provide financial incentives for households and small business in isolated and remote areas of the State to implement energy conservation measures.

The Budget also provides the $50 million planned for the Queensland Renewable Energy Fund to support the commercialisation of new technologies as well as the $50 million planned for the Smart Energy Savings Fund.

The Funds will support Queensland businesses to implement energy efficient technologies in buildings, appliances and industrial processes.

The Funds will reduce greenhouse gases, and save business money.

Other environmental initiatives funded in this Budget include:

| | • | | the $17 million for a structural adjustment package for commercial fishers affected by the Moreton Bay Marine Park Zoning Plan, to secure the long term health of the bay, |

| | • | | $12 million for land management under the new Cape York Peninsula Heritage Act, and |

| | • | | over $60 million in additional funding over four years for an expanded State-wide compliance program for environmentally relevant activities, including on industrial sites. |

8

Indigenous Queenslanders

Mr Speaker, governments through history have struggled to improve the circumstances of our Indigenous population.

Determined as we are to confront this challenge, our government is tackling the root causes of disadvantage and trauma.

A new regime to tackle alcohol abuse and reduce harm, including divesting local councils of canteens to break the link between alcohol profits and council coffers, is being supported by more than $58 million in funding over four years.

This allocation will deliver new alcohol and drug detoxification and rehabilitation programs, diversionary activities, family support programs and greater enforcement of alcohol restrictions as well as compensating councils for lost revenue from canteen closures.

We are also providing $40 million over five years, commencing in 2007-08, for the Cape York Welfare Reform initiative, an investment in breaking the cycle of generational disadvantage.

We are increasing our funding to those most in need—indigenous children. We will provide $21.5 million for facilities for pre-Prep programs for children aged between three and a half and four and a half in indigenous communities.

More than $13.6 million will be allocated to build and operate four residentials to house children taken into care with another $10.4 million to operate safe havens for indigenous children affected by family violence.

The success of the PCYC program in indigenous communities will be built upon with an injection of $7.6 million over four years.

We don’t want to just repair damage, we want to provide a future for our indigenous population. A healthy future, a safe and economic future that recognises unique cultures.

New funds will support improved land management and tenure reform to promote economic development and enable the provision of essential infrastructure on Aboriginal and Torres Strait Islander lands.

An additional $4.7 million will be provided over three years to support the growth and development of the vibrant Aboriginal and Torres Strait Islander arts industry—a pathway to prosperity for the future.

Safer Queensland Communities

Mr Speaker, prosperity provides opportunity. Opportunity allows for potential, and we aspire to safe and supportive communities to nurture that opportunity.

This Budget sees funding to the Queensland Police Service increase by $134 million to $1.57 billion in 2008-09, a 9 % increase.

An extra 200 police will ensure we maintain our election commitment to having a police to population ratio at national levels. An initial $3.5 million over four years is provided to the Office of the Director of Public Prosecutions to increase the number of prosecutors. An assessment of future resourcing of the DPP is an early priority this financial year. The State Coroner also receives a funding increase.

Construction on the new $600 million Supreme and District Courthouse in Brisbane will commence.

9

In addition, this year sees construction start on the new South East Queensland Correctional Precinct near Gatton with $196 million in this Budget.

The $445 million expansion of Lotus Glen Correctional Centre in Far North Queensland will also commence and $11.4 million is allocated for the purchase of land and detailed planning for increased youth detention capacity at the Cleveland Youth Detention Centre in North Queensland.

Transport Infrastructure and Congestion Busting

Mr Speaker, strong population and economic growth, particularly in South East Queensland, is putting increasing pressure on our roads and public transport. It’s adding to costs within the economy, and costing commuting families precious time.

We are in the midst of the single biggest program of infrastructure upgrades: roads, tunnels, busways, bridges, extending and duplicating rail-lines.

It’s a program that reaches across the State.

More than 40,000 cars will be travelling a day on the $543 million Tugun Bypass, opening this week—6 months ahead of schedule.

250 buses are running beneath our city centre through the $333 million Inner Northern Busway tunnel, opened ahead of schedule.

Queenslanders can see the $980 million we have spent on the Gateway Bridge duplication and upgrade so far ….and we will spend half a billion more this year as the bridge climbs above the ground.

You can see the $68 million we have spent on the Houghton Highway duplication …and we will spend $150 million in this Budget as the bridge stretches over to Redcliffe.

You can see the $52 million on the Caloundra Road upgrade …we will spend $27 million to finish this year. And we’ll finish the Pacific Paradise interchange and David Low Way access on the Sunshine Motorway with $32 million this year on top of the $52 million we’ve already spent.

You can see the $21 million spent building the new Hospital bridge in Mackay …and we’ll spend $11 million this year to finish it along with $66 million on the Forgan Bridge.

You can see the $76 million spent on the Townsville Ring Road already… and we’ll finish it off this year with $42 million in this Budget.

This year we will ramp up our spend on transport infrastructure to service the Western Corridor—the growth corridor of the south-east corner.

We will allocate $200 million to the widening of the Ipswich Motorway.

A massive $254 million will see the work on the Darra to Springfield transport corridor—duplicating the Centenary Highway and duplicating the rail line to enable the extension to Springfield.

Twelve new three car train sets will arrive this year as the Budget funds $162 million over the next four years for an order of 58 new three car units for future years. That’s more train carriages on the line to cope with demand increases.

10

More than $168 million will be pumped into the Translink public transport system to pay for more services including funding for 90 new buses for Brisbane this financial year.

$10 million will be set aside next year to pursue strategies including proven initiatives which promote public transport, cycling and walking.

Delivering on Infrastructure

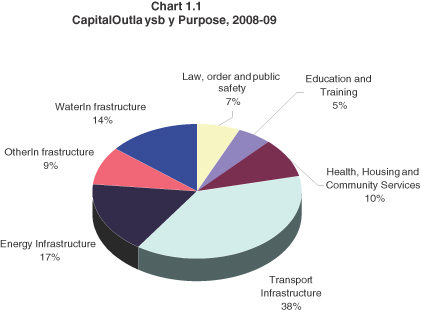

The Budget’s record $6.968 billion transport and roads capital works program heads up the single biggest infrastructure funding program ever financed in this State.

This year the capital budget is a massive $17 billion—up 21 % on last year’s budget.

That’s $17 billion to be invested over the next 12 months across our state.

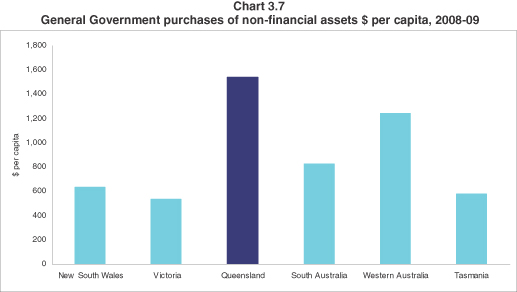

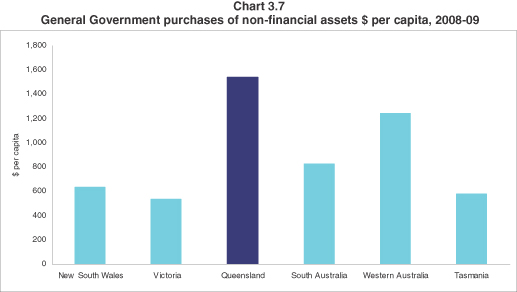

To put that in perspective, on average other states will spend $733 per person on capital works in 2008-09. This budget provides for Queensland to spend $1,541 per person: more than double.

Today Mr Speaker, following a major review, the South East Queensland Infrastructure Plan and Program for 2008-2026 is released.

The Plan provides for expenditure of $107 billion over the period with the highlights including:

| | • | | $83.5 billion on road, rail and public transport |

| | • | | $8 billion on water infrastructure |

| | • | | $3.5 billion over five years on energy projects, and |

| | • | | $12 billion in social and community infrastructure. |

A massive task—the $9 billion Water Grid—has a watershed year. More than $2.2 billion is being invested in this Budget to finish:

| | • | | The $900 million Southern Regional Pipeline to be fully operational by the end of November |

| | • | | The $2.5 billion Western Corridor Recycled Water Project to be completed in December |

| | • | | Stage 1 of the Northern Pipeline Interconnectors to be completed by December, and |

| | • | | the $1.2 billion Gold Coast Desalination Project at Tugun to be fully operational by January 2009 |

and we will continue the work on other vital projects such as the Traveston Crossing Dam.

An improved export performance for next financial year comes on the back of capacity enhancements in export infrastructure, including our $5.4 billion Coal Transport Infrastructure Investment Program.

We have already invested $96 million in the expansion of the Abbot Point Coal Terminal to 21 mtpa which opened in November. We have already announced approval for the next stage through to 25 mtpa at a further cost of $95 million and today I announce that we will double capacity at Abbot Point Coal Terminal to 50 mtpa in a massive $818 million project.

This investment, supported through the Future Growth Fund, is an investment in exports. It’s a vote of confidence in our resources sector and demonstrates our commitment to accelerating expansion.

We are also giving the green light to a $107 million project to upgrade the Mt Isa rail link to improve export efficiency for the Northern Minerals Province.

11

This year QR will invest $400 million on the Jilalan Yard Upgrade in central Queensland, and more than $300 million on upgrading the locomotive and wagon fleet.

The booming Bowen Basin will be further supported with a $150 million commitment to roads building, including an upgrade to the Dawson Highway at the Calliope Range and work on the Leichhardt Highway to improve flood immunity and safety.

As our economy powers forward, our energy sector will invest $3.1 billion in the statewide network as we build for growth.

Mr Speaker, we are right in the middle of the resources boom, and that requires a boom in infrastructure spending. We are committed to sustaining that prosperity, and for all of Queensland to share in that prosperity.

State Royalties Reform Package

Mr Speaker, the people of Queensland, as the owners of the resource, should receive a fair share of the resource value of our minerals.

The mining industry is experiencing boom times at the moment—suggesting our mineral wealth has been undervalued in the past.

The Government has examined all of Queensland’s royalty arrangements, many of which have been in place for many years.

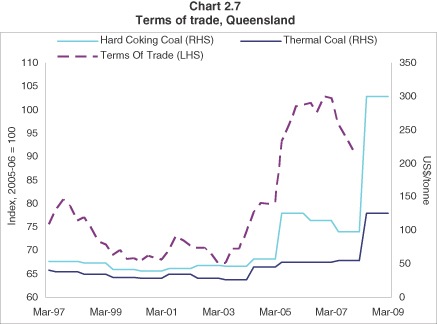

Profitability of mining is soaring as is the value of Queensland’s mineral wealth. Coal prices in particular are sharply increasing, trebling in some cases. There is also an expected moderation in prices in future years.

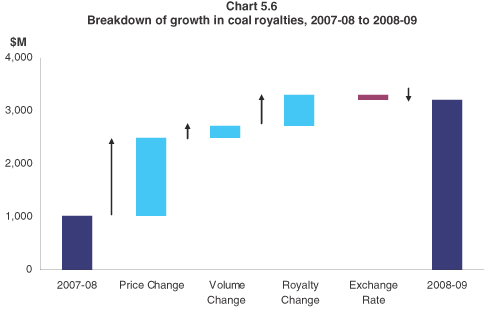

Recent significant increases in contract prices for export coal have greatly increased the value of our coal resource. This Budget introduces a coal royalty rate structure designed to increase the return to the Queensland community as the value of coal increases.

A new two tier royalty for coal is to be introduced. The current 7 % rate will apply to the value of coal produced by a mine below $100 per tonne and a higher 10 % rate will apply to the value of coal above $100. Should coal prices drop below $100, the existing 7 % rate will apply.

New arrangements for base metals—which have also experienced sharp increases in value of up to 469 % since 2000—will also be implemented.

These new arrangements will ensure Queenslanders receive an appropriate return for their mineral wealth, help sustain the infrastructure to sustain export growth and help sustain the communities growing with the growth in mining.

Our reforms will also make the clean coal levy deductible for royalty purposes, and backdate that to 2007. This recognises the need to focus on calibrating climate change into our economy, to meet the imperative of sustainability.

A range of new spending—from construction of a new drill core facility in Mt Isa to additional mining inspectors to additional specialist staff at SIMTARS—demonstrates our commitment to supporting the ongoing prosperity of our resources sector.

Growing the Queensland Economy

Mr Speaker, with this infrastructure spend and our fiscal strategy aligned to the State’s economic outlook, we are charting a course for future growth.

12

We have long maintained not only a lead on other states when it comes to growth and to capital works, but also when it comes to our taxation regime. As we meet the challenges of financing improved services and our infrastructure spend, we seek also to maintain our competitiveness.

Small to medium sized businesses stand to benefit from the total abolition of mortgage duty and land tax reforms outlined earlier.

Queensland currently has a highly competitive payroll tax regime—among the highest thresholds in the country—at $1 million—and the lowest tax rate in country—of 4.75 %. Roughly 1 in 10 business in Queensland pays payroll tax.

Today I announce a further reform, and a policy commitment to seeking to adjust this setting each Budget I deliver.

The current threshold phases out at $4 million. This will be increased to $5 million from 1 July 2008. This change will benefit over 40 % of employers currently paying payroll tax.

Queensland will retain its competitive tax status with per capita state tax estimated at $2,342 in 2008-09 compared to an average of $2,616 for the other states and territories.

It affirms our competitive edge, as we finance the biggest expansion in our State’s history.

Budgeting for Surpluses

Mr Speaker, as Members will be aware, Queensland has financial assets set aside to meet future employee superannuation and other obligations. These funds are invested with Queensland Investment Corporation.

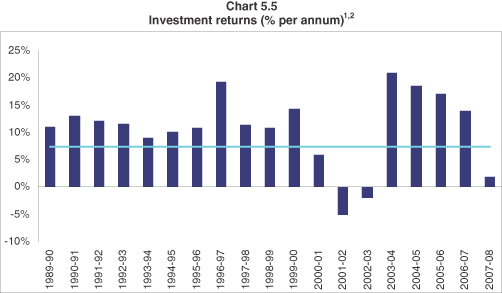

While the intention is that these funds earn a long term average rate of 7.5 %, the actual returns have fluctuated between minus 5 % and plus 21 % over the past seven years.

The returns on these investments are not available for other purposes. However, movements in investment returns have had a significant impact on the Budget’s headline operating balance, although not its capacity to fund services.

The Government has decided to transfer the financial assets set aside to meet future employee and other obligations to the Queensland Treasury Corporation.

The transfer will allow Queensland to remove the earnings volatility from the Budget’s net operating balance in the General Government sector. The funds will continue to be reported in the Report on State Finances, tabled in the Parliament annually and signed off by the Auditor-General.

This change has been discussed with ratings agencies, Moody’s and Standard and Poors, who support the move and have confirmed this reform will not in any way jeopardise our AAA credit rating.

Last year’s Budget forecast an operating surplus of $268 million for 2007-08. This was revised down to $213 million at the Mid Year Economic and Fiscal Review, which noted explicitly that our investment earnings were then below the 7.5 % long term average assumed in that report, and in Budgets before it.

The headline estimated actual outcome for 2007-08 is a deficit of $995 million. This is due to the buffeting of our investment returns from the fallout of global financial turmoil with returns to mid-May of 2 % rather than the long term average of 7.5 % achieved.

13

The estimated actual result for the 2007-08 underlying surplus is $272 million, marginally above the original Budget forecast.

The Budget I present today, with a record infrastructure spend, with a record injection into our health and hospital systems and with our tax reforms to stamp duty and other taxes paid for, is framed with a surplus in 2008-09 of $809million, the second highest budgeted surplus in a decade.

The strength of that forecast is very much built on the upside from our resources sector, and accordingly the forecast surpluses are moderating over time as prices are expected to moderate.

The strong surpluses I am budgeting for in 2008-09 and 2009-10 will greatly assist in funding our record capital program.

Under our legislated Charter of Social and Fiscal Responsibility, responsible borrowings may only be undertaken for investment in capital expansion—like long term infrastructure.

We will continue with our strategy of modest, responsible and economically appropriate borrowings in this Budget.

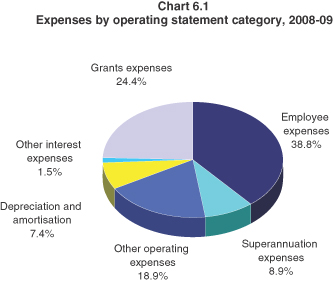

Our interest expense on Budget in 2008-09 will be just 1.5 %. It will grow modestly as we expand exponentially to average 2.4 % of revenue over the full forward estimates forecast period.

In fact, our planned borrowings of $2.9 billion in 2008-09 are significantly lower than we forecast for 2008-09 in last year’s Budget and at the Mid Year Review. Estimated net borrowings on Budget of $2.9 billion will finance the $6.65 billion capital program in the General Government sector.

Every business I know, every family I know, would love to have an interest expense of just 1.5 % of revenue. This fiscal strategy underpins our economic strategy and its soundness is demonstrated in our continued prosperity.

Our Government Owned Corporations will also undertake responsible borrowings—underpinned by commercial undertakings. They do as other businesses do. They will have a capital structure that recognises their operating environment.

Our financial assets will continue to exceed our financial liabilities in the Budget Sector: the fact is the Queensland Budget has no net debt. Our debt levels are sound, responsible and we maintain our AAA credit rating. We equally maintain a critical assessment of our balance sheet, with a constant guiding principle of seeking maximum advantage for the Queensland taxpayer.

And looking to the future

Mr Speaker, we passionately believe in opportunity, in giving every child every chance to prosper.

It’s not just economics—its our passion.

We are funding for growth and for the future.

Our investment in education and training tops $6 billion for the first time.

We will expand our teaching and teacher aide workforce by 270 this coming year, as we meet the task of educating the next generation of Queenslanders.

The Budget provides for a $100 million 2 year injection into school maintenance through the Tomorrow’s Schools initiative.

14

That will spike maintenance spending, recognising that many of our schools are older than our federation. As anyone who owns a Queenslander knows, with heritage comes obligation.

Beyond the normal capital program funded each year for education, we are funding two new schools both on the northern parts of the baby booming Gold Coast.

$56 million will build a new primary school at Western Oxenford and a new High School at Ormeau.

In fact, three of the four new schools to be funded in this Budget are on the Gold Coast.

The fourth school—a new primary school in the North Lakes area—will be in addition to an announced primary school in Ormeau around Norfolk Village.

The students of these new schools will enter a system graduating a generation of school leavers moving into an employment market not seen before.

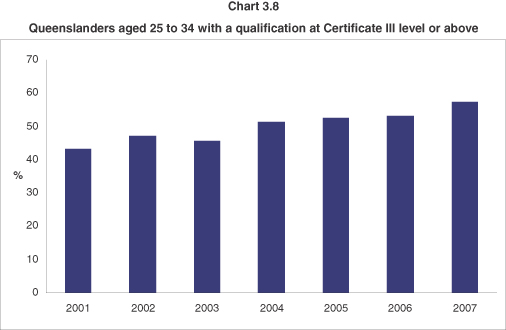

That requires an investment in skills, in post school qualifications. Our future lies in the Smart State. That’s where our economic future lies—in skills enhancement, in investing in human capital.

The Budget recognises the immediacy of the skills challenge—with additional funding of $43.4 million over four years to increase apprenticeship and traineeship training places with over 7,500 places in 2008-09.

The Budget provides $50 million over two years, commencing in 2009-10, for the development of specialist trade campuses at Acacia Ridge, Mackay and Townsville.

While we arm ourselves with the skills in demand, we need also to look beyond immediate demands and look to the future over the horizon.

Not just in skills development, but in the demands of our community. Of an ageing population, of a community with changing expectations and changing demography.

Of a Queensland community where the most common type of household is no longer parents and the kids. The makeup of homes throughout the State will dramatically change with couples without children and lone persons households overtaking couples with children by 2011.

Where we will live longer, have fewer children, and later. Where medical technology will greatly enhance quality of care for illness, while rates of illness are expected to greatly increase.

Our abiding commitment to increased disability services funding goes to the core of our Government’s beliefs. This year we will increase the budget for Disability Services Queensland to $1.23 billion—a 14 % increase.

This Budget will provide Disability Services Queensland with $99 million over four years to increase early intervention and other support services available to people with a disability in Queensland.

This is about supporting people with a disability—and their carers, their families—to avoid crisis.

To provide for sustainable living in the most nurturing environment, within their own homes and amongst their loved ones whether their disability is physical or mental—this funding is not about least dollar cost, it’s about least cost to individuals and their families.

We will also increase the budget for the Department of Child Safety—which will be $592 million in 2008-09.

15

More than $15 million is allocated to recruit 40 new frontline child safety workers along with additional support for existing workers at the coalface.

An additional $14 million is allocated for family early intervention services to help avoid the incalculable human cost of family breakdown and harm to children.

Across Government we face the challenge of meeting the demands from growth—in every service, and in every way.

As we seek to meet that demand we are quarantining funds for front-end solutions that can avoid all the costs of back-end fixes—both human and economic.

I announce a $70 million allocation over four years for a new Prevention and Early Intervention Incentives Pool.

The funding will be allocated to departments on a contestable basis for innovative projects where there is the potential to improve longer term outcomes—not in immediate raw dollar terms, but in the currency more relevant to our central beliefs as a Government: in the avoidable human cost of suffering, breakdown, abuse or harm.

The fund will be an incubator of policy innovation and looks beyond the immediacy of this Parliament’s challenges and focuses on a longer term view. We are investing today, for the benefit of our tomorrows.

Conclusion

Mr Speaker,

This Budget funds the frontline services to meet today’s demands.

It funds a record injection into our health and hospital system.

It is delivering on infrastructure today for tomorrow.

It smashes stamp duty for Queenslanders trying to break into home ownership.

It looks to the future challenges of a growing State with a global outlook.

It confronts the central challenge of our times: climate change and its impacts on the household.

It provides for Queenslanders to receive a fair share of our resource value.

It uses that dividend to provide services and infrastructure for all Queenslanders.

This Budget recognises our circumstances—smack bang in the middle of an unprecedented boom.

The decisions we make as a community right now matter. We are charting a course for growth, for a new Queensland not even imagined just a few short years ago.

It is the first Budget of the Bligh Government. It lays down our priorities for the future well beyond electoral cycles.

We look to the longer term and to the need to invest now and take on the huge tasks before us.

We look forward with confidence, commitment and courage as we seek to include all Queenslanders in our bright future.

I commend the Bill to the House.

16

STATE BUDGET

2008-09

BUDGET STRATEGY AND

OUTLOOK

Budget Paper No. 2

TABLE OF CONTENTS

18

19

1. BUDGET STRATEGY, PERFORMANCE AND OUTLOOK

FEATURES

| | • | | The forecast underlying operating result for 2007-08 (adjusted for superannuation arrangements comparable to other states) is a surplus of $272 million. This compares to a forecast surplus at the Mid Year Fiscal and Economic Review of $213 million and at Budget of $268 million. |

| | • | | Under the Uniform Presentation Framework, the General Government sector is forecast to have a headline net operating deficit of $995 million in 2007-08. This is primarily due to the subdued performance of investment markets, which has impacted on the returns the State receives on the substantial funds set aside to meet future liabilities. |

| | • | | The 2008-09 budgeted net operating surplus for the General Government sector is $809 million with a strong surplus of $540 million in 2009-10 and a surplus of $265 million by 2011-12. |

| | • | | Cash deficits in the General Government sector are projected for each year across the forward estimates and are the result of the State’s significant planned capital expansion. |

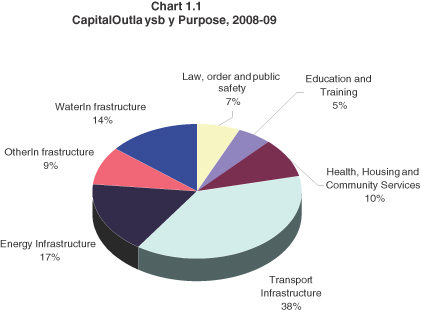

| | • | | The State’s capital program is an estimated $17 billion, a 19% increase on 2007-08 estimated outlays. The capital outlays of Public Non-financial Corporations (commercial) sector entities constitute approximately 52% of total outlays in 2008-09. |

| | • | | The State’s net worth is forecast to increase to $128.563 billion in 2008-09 and rise to $140.243 billion by 2011-12. |

This chapter discusses:

| | • | | the summary of financial aggregates for the General Government sector for the 2008-09 Budget. A discussion of the Public Non-financial Corporations (PNFC) sector can be found in Chapter 4 |

| | • | | the Government’s fiscal strategy as outlined in the Charter of Social and Fiscal Responsibility. |

20

SUMMARY OF KEY FINANCIAL AGGREGATES

Table 1.1 provides aggregate actual outcome information for 2006-07, estimated actual outcome information for 2007-08, forecasts for 2008-09 and projections for the outyears.

Table 1.1

General Government sector – key financial aggregates1

| | | | | | | | | | | | | | | | | | |

| | | 2006-07

Actual2

$ million | | | 2007-08

Est. Act.

$ million | | | 2008-09

Budget

$ million | | | 2009-10

Projection

$ million | | | 2010-11

Projection

$ million | | | 2011-12

Projection

$ million | |

Revenue | | 31,981 | | | 32,276 | | | 36,582 | | | 37,240 | | | 38,638 | | | 40,385 | |

Expenses | | 30,125 | | | 33,271 | | | 35,772 | | | 36,700 | | | 38,422 | | | 40,120 | |

Net operating balance | | 1,856 | | | (995 | ) | | 809 | | | 540 | | | 215 | | | 265 | |

Cash surplus/(deficit) | | 2,304 | | | (3,547 | ) | | (1,970 | ) | | (2,654 | ) | | (2,669 | ) | | (2,059 | ) |

Capital purchases | | 4,418 | | | 5,223 | | | 6,651 | | | 6,693 | | | 6,590 | | | 5,824 | |

Net borrowing | | (262 | ) | | 3,531 | | | 2,915 | | | 4,448 | | | 4,383 | | | 3,593 | |

Net worth | | 117,831 | | | 123,095 | | | 128,563 | | | 132,708 | | | 136,490 | | | 140,243 | |

Net debt | | (26,686 | ) | | (24,371 | ) | | (21,928 | ) | | (18,670 | ) | | (15,560 | ) | | (13,227 | ) |

| 1. | Numbers may not add due to rounding. |

| 2. | Reflects published actuals. Does not include any recasting of data that may have occurred subsequently. |

BUDGET OUTCOMES 2007-08

Key financial aggregates

Table 1.2

General Government sector – key financial aggregates1

| | | | | | | | | |

| | | 2007-08

Budget

$ million | | | 2007-08

MYFER

$ million | | | 2007-08

Est. Act.

$ million | |

Revenue | | 32,551 | | | 33,342 | | | 32,276 | |

Expenses | | 32,282 | | | 33,129 | | | 33,271 | |

Net operating balance | | 268 | | | 213 | | | (995 | ) |

Cash surplus/(deficit) | | (892 | ) | | (2,481 | ) | | (3,547 | ) |

Capital purchases | | 5,463 | | | 5,888 | | | 5,223 | |

Net borrowing | | 3,569 | | | 4,427 | | | 3,531 | |

Net worth | | 119,799 | | | 124,642 | | | 123,095 | |

Net debt | | (24,709 | ) | | (25,226 | ) | | (24,371 | ) |

| | | | | | | | | |

| 1. | Numbers may not add due to rounding. |

Operating balance

The operating balance expected for 2007-08 is a deficit of $995 million. The estimated 2007-08 deficit reflects the subdued performance of equity markets, with investment returns well below the long-term assumed rate of return of 7.5%.

With around $27 billion in funds invested in a portfolio of equities, property, cash and fixed interest, the performance of international financial markets has a major influence on the Budget result. While Budget and Mid

21

Year Fiscal and Economic Review (MYFER) estimates for investment returns were based on the expected long-term average result for the portfolio of 7.5%, the 2007-08 estimated actual is based on returns as at mid-May which were around 2%. This compares favourably with the ASX 200 Index which has declined by 6% between June 2007 and mid-May 2008.

The estimate of expenditure in 2007-08 is similar to the MYFER forecast. Revenue is estimated to decrease from the MYFER forecast as a result of low investment returns, as outlined above.

Further details on revenue and expenditure projections are contained in Chapters 5 and 6 respectively.

The underlying operating balance

Investment market volatility impacts on the Queensland Budget in 2007-08 more than it does for other states. This is due to differences in the way Queensland’s public sector superannuation arrangements are structured and the size of Queensland’s investments compared to other states. Queensland’s financial assets set aside to meet future superannuation liabilities are held as General Government sector assets and associated superannuation liabilities are similarly recorded as General Government sector financial liabilities. In contrast, other jurisdictions generally have structures whereby all investments are held in superannuation funds and only the net superannuation liability is recorded in the General Government balance sheet.

This results in investment market volatility in Queensland in the current year and represents the difference between the actuary’s assumption on investment returns (currently 7.5%) and actual results achieved during the year.

If Queensland’s superannuation arrangements were structured on the same basis as generally applied in other states, the General Government sector underlying operating balance for 2007-08 would be a surplus of approximately $272 million. The result is outlined in Table 1.3 and is calculated on a consistent basis with that used in the other states.

Table 1.3

Calculation of underlying net operating balance1

| | | |

| | | 2007-08

Est. Act.

$ million | |

Net operating balance | | (995 | ) |

Add investment earnings below long term rate2 | | 1,267 | |

Underlying balance | | 272 | |

Notes:

| 1. | With the transfer of assets to Queensland Treasury Corporation (see Box 1.1), the calculation of an underlying surplus in the outyears is no longer relevant. |

| 2. | Represents the long-term rate of 7.5% less estimated investment returns on financial assets held to meet future defined benefit superannuation liabilities that would be foregone if those assets were transferred to the superannuation fund. |

The Queensland Government has decided to remove investment return volatility from the General Government net operating balance through transferring the Consolidated Fund’s superannuation and other assets held to meet long term liabilities of the Government to the Queensland Treasury Corporation (QTC) (see Box 1.1). The outcome of this will mean that, like other states, there will be no difference between the underlying and headline surplus.

22

Box 1.1

Removing investment volatility in the General Government Sector

Queensland has financial assets set aside to meet future employee and other obligations. These funds are invested with the Queensland Investment Corporation (QIC) and, while the assumption is that these funds earn a long-term average rate of 7.5%, the actual returns have fluctuated between negative 5% and positive 21% over the past seven years.

While returns on these investments are not available for other purposes, movements in investment returns have a significant impact on the General Government net operating balance. This can mask the real quantum of funding available for service delivery.

To overcome this, the Government has decided to transfer the assets to the Queensland Treasury Corporation (QTC) in exchange for a debt instrument that earns the General Government sector 7.5% per annum. Given QTC sits outside of the General Government sector, the transfer allows Queensland to remove the earnings volatility from the General Government sector net operating balance. Instead, QTC will bear the investment return volatility of the assets invested with QIC.

The transfer will have no impact on the current governance or investment arrangements with the investments continuing to be managed by QIC.

This transfer is intended to improve the legibility of the General Government sector accounts as the net operating balance will no longer be significantly impacted by movements in investment returns. Standard and Poor’s and Moody’s ratings agencies have advised that this transaction will have no impact on the State’s credit rating.

Cash surplus/(deficit)

Consistent with running a large capital program, the General Government sector is estimated to record a cash deficit in 2007-08 of $3.547 billion.

At the time of the MYFER, a cash deficit of $2.481 billion was expected in 2007-08 for the General Government sector. The larger than expected cash deficit is predominantly the result of the cash impact of the downward revision to investment returns from 7.5% to 2%.

Capital purchases

General Government investment in capital (purchases of non-financial assets) in 2007-08 is estimated to be $5.223 billion. The estimated 2007-08 capital spend is below the 2007-08 Budget and MYFER estimates, reflecting capacity constraints in the construction and civil engineering sector resulting in a modest level of capital deferrals. Capital spending in the PNFC sector is $837 million more than forecast at the time of the Budget primarily due to increased spending on water infrastructure.

The total capital program for 2007-08, including capital grants, is expected to be $14.285 billion, $257 million higher than expected at the time of the 2007-08 Budget. For further details see Budget Paper 3—Capital Statement.

Borrowing

Responsible borrowing for capital purposes is consistent with the Government’s fiscal principles. Net borrowings of $3.531 billion are expected in 2007-08, $896 million less than forecast at the time of the MYFER and $38 million less than forecast at the 2007-08 Budget.

23

Net worth

The net worth, or equity, of the State is the amount by which the State’s assets exceed its liabilities. This is the value of the investment held on behalf of the people of Queensland by public sector entities. The net worth of the General Government sector at 30 June 2008 is estimated at $123.095 billion. This is $3.296 billion higher than the forecast in the 2007-08 Budget and $5.264 billion higher than the 30 June 2007 audited actual. Net worth is $1.547 billion lower than the net worth forecast at the time of the MYFER primarily as a result of the low return on investments.

Net debt

The net debt of the General Government sector is estimated to be negative $24.371 billion at 30 June 2008, compared to negative $25.226 billion estimated at the time of the MYFER. The change in net debt reflects the impact of lower investment returns than forecast, partially offset by lower borrowings.

BUDGET 2008-09 AND OUTYEAR PROJECTIONS

Key financial aggregates

Table 1.4

General Government sector – key financial aggregates1

| | | | | | | | | | | | |

| | | 2008-09

Budget

$ million | | | 2009-10

Projection

$ million | | | 2010-11

Projection

$ million | | | 2011-12

Projection

$ million | |

Revenue | | 36,582 | | | 37,240 | | | 38,638 | | | 40,385 | |

Expenses | | 35,772 | | | 36,700 | | | 38,422 | | | 40,120 | |

Net operating balance | | 809 | | | 540 | | | 215 | | | 265 | |

Cash surplus/(deficit) | | (1,970 | ) | | (2,654 | ) | | (2,669 | ) | | (2,059 | ) |

Capital purchases | | 6,651 | | | 6,693 | | | 6,590 | | | 5,824 | |

Net borrowing | | 2,915 | | | 4,448 | | | 4,383 | | | 3,593 | |

Net worth | | 128,563 | | | 132,708 | | | 136,490 | | | 140,243 | |

Net debt | | (21,928 | ) | | (18,670 | ) | | (15,560 | ) | | (13,227 | ) |

Note:

| 1. | Numbers may not add due to rounding. |

Operating balance

The budgeted position for the General Government sector is for an operating surplus of $809 million in 2008-09. This surplus is being driven by increased coal royalty revenue, reflecting an increase in the value of coal and a change in the royalty rate.

The forecast budget surpluses are expected to moderate across the forward estimates as a result of expected reductions in royalty revenues, the abolition of a number of State taxes including mortgage duty from 1 July 2008 and duty on the transfer of core business assets progressively from 1 January 2010, growth in recurrent expenditure in support of the capital program and slower growth in GST receipts particularly as a result of Queensland becoming a net donor state. Queensland’s relativity is likely to further decline given the growth in the State’s royalty revenue.

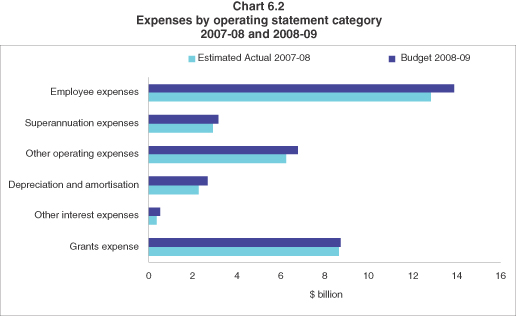

The increase in expenditure relative to 2007-08 primarily relates to service enhancements in key service delivery areas, recurrent expenditure in support of the capital program and moderate increases in wages.

Further details on revenue and expenditure projections are contained in Chapters 5 and 6 respectively.

24

Cash surplus and capital purchases

A cash deficit of $1.970 billion is expected in 2008-09 for the General Government sector. The cash deficit is forecast to be $2.654 billion in 2009-10, reducing to $2.059 billion by 2011-12.

Apart from the cash impact of smaller recurrent operating surpluses relative to 2008-09, the major factor contributing to lower cash results is the significant planned capital expansion. The Government will continue to have cash invested with QTC which has been quarantined for use on Queensland Future Growth Fund projects.

Total General Government capital purchases of $6.651 billion are budgeted for 2008-09, reflecting a range of infrastructure initiatives including those announced in the South East Queensland Infrastructure Plan and Program. Budget Paper No. 3—Capital Statement provides details, by portfolio, of budgeted 2008-09 capital outlays.

Over the period 2008-09 to 2011-12, purchases of non-financial assets (capital purchases) in the General Government sector of $25.758 billion are planned.

Borrowing

Responsible borrowing for capital purposes is consistent with the Government’s fiscal principles. Net borrowings of $2.915 billion are budgeted for 2008-09 in support of $6.651 billion in purchases of non-financial assets.

The remainder of the General Government capital program will continue to be financed through the operating cash flow with the exception of the Mount Isa, Cairns and Mackay Hospitals. These hospitals will be funded through the long-term lease of the Mackay and Cairns airports and the disposal of the Port of Brisbane Corporation’s remaining stake in Brisbane Airport Corporation Pty Ltd.

Over the Budget and forward estimates period, total General Government borrowings of $15.339 billion are planned. Of this amount, some $2.023 billion is to fund net equity injections to Queensland’s PNFC sector entities to support expansion of the State’s water, ports, energy and rail infrastructure.

Net worth

State net worth is projected to increase from the 2007-08 estimated actual by $5.468 billion to $128.563 billion at 30 June 2009. Net worth is also expected to increase in all outyears.

Net debt

In 2008-09, net debt in the General Government sector is estimated to be negative $21.928 billion compared to the MYFER estimate of negative $22.716 billion. The change in net debt from the MYFER primarily reflects the flow through of lower than forecast investment returns on the estimated value of investments, partly offset by lower levels of borrowings. More information on the State’s net worth, assets and liabilities is provided in Chapter 7.

RECONCILIATION OF NET OPERATING BALANCE

Table 1.5 provides a reconciliation of the current General Government sector net operating balances for 2007-08 and 2008-09 to the MYFER estimates.

25

Table 1.5

Reconciliation of 2007-08 and 2008-09 net operating balance to MYFER estimates1

| | | | | | |

| | | 2007-08

Est. Act.

$ million | | | 2008-09

Budget

$ million | |

MYFER net operating balance | | 213 | | | 156 | |

Expenditure policy decisions2 | | (33 | ) | | (353 | ) |

Taxation and royalty policy decisions3 | | — | | | 520 | |

Other significant variations impacting on operating balance | | | | | | |

— Investment returns and interest earnings4 | | (1,261 | ) | | (116 | ) |

— Revenue from the Australian Government5 | | 79 | | | (226 | ) |

— Taxation, royalty and revisions to net flows from PNFC sector entities6 | | (91 | ) | | 1,386 | |

— Other parameter adjustments7 | | 98 | | | (559 | ) |

2008-09 Budget | | (995 | ) | | 809 | |

Notes:

| 1. | Denotes impact on net operating balance. Numbers may not add due to rounding. |

| 2. | Reflects expenditure policy decisions taken since the MYFER. Budget Paper 4—Budget Measures, outlines in detail the policy decisions taken since the 2007-08 Budget. |

| 3. | Reflects changes in transfer duty, royalties, land tax, payroll tax and mortgage duty. These changes are outlined in further detail in Chapter 5 and in Budget Paper 4—Budget Measures. |

| 4. | Reflects revisions of estimated rate of return on investments from 7.5% to 2% in 2007-08 and earnings on cash balances. |

| 5. | Includes outcomes of Commonwealth Grants Commission 2008 Update, population changes and most recent estimates of GST revenue included in the 2008-09 Australian Government Budget as well as changes to Specific Purpose Payments. |

| 6. | Refers to adjustments of a non-policy nature in taxation and royalty estimates. Includes adjustments to net flows in Public Non-financial Corporations and Public Financial Sector entities. |

| 7. | Refers to adjustments of a non-policy nature such as movements in expenditure and revenue relating to economic and technical parameters and expenditure lapses in 2007-08. Major contributors are increased spending for natural disaster relief, growth funding provided to support service delivery in key agencies, increased depreciation expense. |

FISCAL STRATEGY

The Charter of Social and Fiscal Responsibility outlines the Government’s fiscal principles and is an integral part of the Government’s commitment to the community. The fiscal principles, detailed in Box 1.2, have been framed to meet a number of objectives, with the overriding requirement to maintain the integrity of the State’s finances.

The fiscal principles establish the basis for sustainability of the Government’s policies. They require services provided by Government be funded from tax and other revenue sources over the long term. The principles are supported by an accrual budgeting framework, which recognises future liabilities of the State and highlights the full cost of sustaining the Government’s operations on an ongoing basis.

The fiscal principles recognise the importance of a strong financial position for the State. A state government, because of its more limited tax base, does not have the same capacity as a national government to cushion economic and financial shocks. At the same time, state governments have a responsibility to provide continuity of services, such as health, police and education.

A strong financial position, as indicated by a AAA credit rating, enables lower borrowing costs and is an indication of the soundness of the financial position and policies of the Government, rather than a goal in itself.

The success of Queensland’s financial and economic management has been consistently affirmed by international ratings agencies. These agencies have cited Queensland’s strong balance sheet and dynamic economic base as reasons underpinning the State’s AAA credit rating.

26

Box 1.2

The fiscal principles of the Queensland Government

| | | | |

Principle | | Achievement

Budgeted

for 2008-09 | | Indicator |

Competitive tax environment The Government will ensure that State taxes and charges remain competitive with the other states and territories in order to maintain a competitive tax environment for business development and jobs growth. | | ü | | Taxation revenue per capita: Queensland: $2,342 Average of other states and territories: $2,616 |

| | |

Affordable service provision The Government will ensure that its level of service provision is sustainable by maintaining an overall General Government operating surplus, as measured in Government Finance Statistics terms. | | ü | | GFS operating surplus: $809 million |

| | |

Sustainable borrowings for capital investment Borrowings or other financial arrangements will only be undertaken for capital investments and only where these can be serviced within the operating surplus, consistent with maintaining a AAA credit rating. | | ü | | General Government borrowings: $2.915 billion General Government total purchases of non-financial assets: $6.651 billion AAA credit rating confirmed by Moody’s and Standard and Poor’s (highest rating available) |

| | |

Prudent management of financial risk The Government will ensure that the State’s financial assets cover all accruing and expected future liabilities of the General Government sector. | | ü | | General Government net financial worth: $15.164 billion |

| | |

Building the State’s net worth The Government will maintain and seek to increase total State net worth. | | ü | | Net worth to increase to $128.563 billion |

Competitive tax environment

One of the Queensland Government’s key social and fiscal objectives is to maintain a competitive tax environment that raises sufficient revenue to meet the infrastructure and government service delivery needs of the people of Queensland, while at the same time providing a low-cost environment for business to promote economic development and jobs’ growth.

The competitiveness of a state’s tax system is usually assessed by using one of the following measures:

| | • | | taxation revenue on a per capita basis |

| | • | | taxation relativities based on the Commonwealth Grants Commission methodology |

| | • | | taxation revenue expressed as a percentage of gross state product (GSP). |

Queensland’s competitive tax position is confirmed by all three measures:

| | • | | per capita tax collections in Queensland in 2008-09 are estimated at $2,342, compared with an estimated $2,616 for the average of the other states |

| | • | | Commonwealth Grants Commission data indicate that Queensland’s taxation effort ratio is 84.6% compared with the standard (100%) |

| | • | | latest Australian Bureau of Statistics data shows Queensland’s tax collections are 4.34% of GSP compared to 4.75% for the average of the other states. |

27

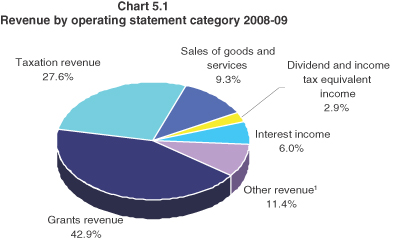

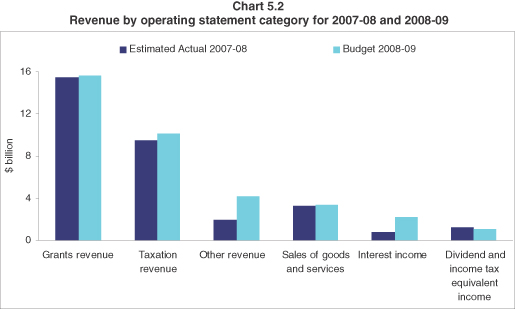

The 2008-09 Budget includes changes to transfer duty, land tax, payroll tax and mortgage duty, in addition to adjustments to the royalty regime. Details of these changes and other revenue items are provided in Chapter 5.

Affordable service provision

The objective of maintaining affordable service provision requires the maintenance of a budget operating surplus, to ensure recurrent services can be funded from recurrent revenue sources.

The 2008-09 Budget and forward estimates provide funding for implementation of the Government’s key priority areas including health, congestion management and frontline services.

More information on these initiatives is provided in Budget Paper 4—Budget Measures.

Queensland is already one of the more efficient providers of government services among the states. Nevertheless, further improving the efficiency and effectiveness of government services is an essential element of delivering on these key policy priorities in a way that is both affordable and sustainable.

Sustainable borrowings for capital investment

The provision of adequate levels of infrastructure is an ongoing challenge for a state such as Queensland that continues to experience high levels of economic and population growth. In meeting this challenge, the Government funds capital expenditure per capita well above the average of the other states and territories.

Investment in core infrastructure is a key feature of the 2008-09 Budget with a record capital program of $17 billion. This represents an increase of 19% over the estimated 2007-08 outlays. The capital outlays of the PNFC sector constitute approximately 52% of total outlays in 2008-09.

In recognition of Queensland’s capital requirements, the Charter of Social and Fiscal Responsibility allows borrowing for capital where the costs of the borrowing can be serviced within the context of an overall operating surplus.

Queensland’s 2008-09 capital program will be funded from a mix of recurrent sources, cash balances and borrowings. Details of the State capital program for 2008-09 and sources of funds are provided in Budget Paper No. 3—Capital Statement.

Prudent management of financial risk

Queensland has a long-standing policy of setting aside funds to accumulate financial assets sufficient to meet future liabilities, the largest being for future employee entitlements, most notably superannuation.

In this respect, Queensland is far better placed than any of the other state or territory governments to fund future accruing liabilities, as most other jurisdictions have substantial unfunded superannuation liabilities.

The State’s policy of setting aside funds to meet future liabilities and reinvesting all earnings provides the capacity to manage cycles in investment markets without impacting on the Government’s ability to fund ongoing services to the community.

Building the State’s net worth

The Charter of Social and Fiscal Responsibility policy of building the State’s net worth is intended to ensure infrastructure and other assets are not run down to the detriment of future citizens and taxpayers. It is an important element in ensuring intergenerational equity.

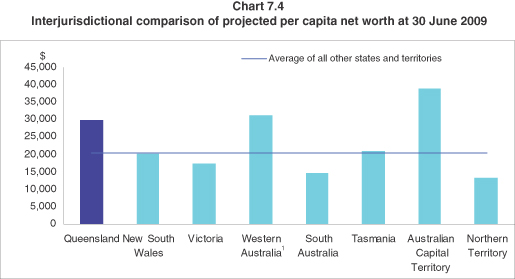

Queensland’s net worth is forecast to grow over the forward estimates. Queensland’s per capita net worth is expected to be 46% greater in 2008-09 than the average per capita net worth of the other states.

28

Further information on State net worth and other balance sheet aggregates can be found in Chapter 7.

INDICATORS OF FISCAL CONDITION

Table 1.6 provides information on the Government’s service delivery capacity, financial sustainability and financial capacity.

Service delivery capacity

This financial data provides an indication of the non-financial capital resources of the General Government sector. These resources generally relate to capital infrastructure and therefore indicate the capacity of the Government to provide services to the community. The data, showing increasing levels of, and additions to, non-financial assets, reflect the State’s heightened commitment to infrastructure provision in recent years.

Financial sustainability

These ratios provide an indication of the sustainability of current policy settings—including the size of the operating surplus (relative to expenses) and the level of debt servicing costs (relative to revenue). A large operating balance and stable low debt servicing costs indicate that current policies are sustainable.

Financial capacity

These ratios provide an indication of the State’s capacity to respond to unexpected events or opportunities. Low levels of borrowing and taxation and large negative net debt provide the State with the capacity for additional resources to be called upon if required.

Table 1.6

Indicators of fiscal condition - General Government sector1

| | | | | | | | |

| | | 2007-08

Est. Act. | | | 2008-09

Budget | | | Other

States2

2008-09 |

Service Delivery Capacity | | | | | | | | |

Non-financial assets3/population ($) | | 23,663 | | | 24,930 | | | 15,329 |

Purchases of non-financial assets/non-financial assets (%) | | 5.2 | | | 6.2 | | | 4.8 |

Financial Sustainability | | | | | | | | |

Operating balance/total expenses (%) | | (3.0 | ) | | 2.3 | | | 3.4 |

Debt servicing cost/total revenue (%) | | 1.2 | | | 1.5 | | | 1.9 |

Financial Capacity | | | | | | | | |

Total borrowings/total assets (%) | | 3.6 | | | 5.2 | | | 6.3 |

Total liabilities/total assets (%) | | 22.5 | | | 23.6 | | | 24.8 |

Net worth/population ($) | | 29,164 | | | 29,795 | | | 20,444 |

Net debt/GSP (%) | | (11.1 | ) | | (9.3 | ) | | 0.4 |

Taxation/GSP (%) | | 4.4 | | | 4.3 | | | 4.6 |

Notes:

| 1. | 2006-07 actual has not been included as the new reporting framework (see Chapter 9) makes inter-year and interstate comparisons difficult. |

| 2. | Weighted average of all states and territories, excluding Queensland. |

| 3. | Refers to land and other fixed assets. |

Source: QLD, VIC, WA, NT, ACT State Budgets, NSW, SA, TAS Mid-Year Reviews/Budget Updates

29

2. ECONOMIC PERFORMANCE AND OUTLOOK

FEATURES

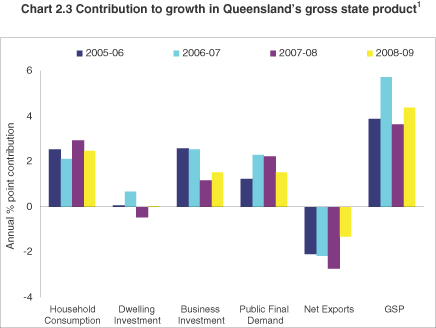

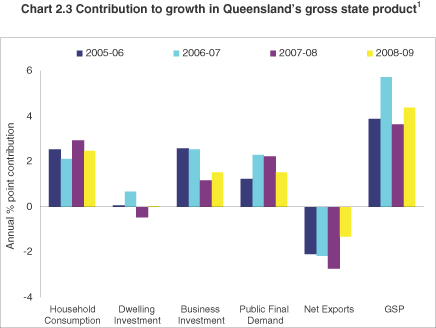

| | • | | The Queensland economy is estimated to expand by 3 3/4% in 2007-08 and exceed growth nationally for the 12th successive year. |

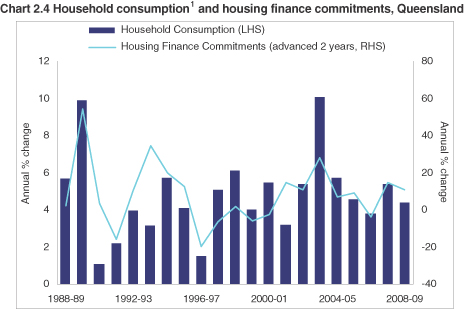

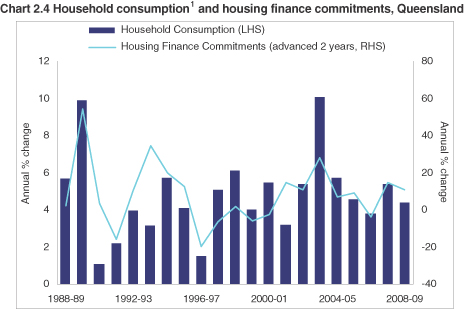

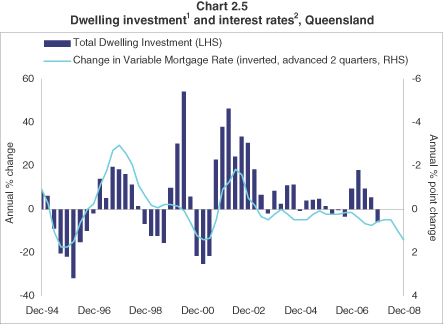

| | • | | Reflecting strong growth in consumer incomes and house prices, household consumption growth is estimated to strengthen to 5 1/4% in 2007-08. Limited spare capacity in the economy is estimated to drive further growth in private and public investment, albeit at more modest rates than in recent years. |

| | • | | Temporary disruptions to supply are estimated to subdue growth in export volumes in 2007-08, while growth in imports of consumer and capital goods is estimated to remain strong. As a result, the trade sector is estimated to continue to detract from overall economic growth. |

| | • | | Economic growth in Queensland is forecast to strengthen to 4 1/ 4% in 2008-09, compared with an anticipated moderation in growth for the nation as a whole. |

| | • | | Queensland is forecast to experience some rebalancing in economic growth, with improved trade sector performance and stronger growth in business investment more than offsetting an easing in household consumption growth. |

| | • | | Capacity expansions and improved weather conditions are forecast to drive exports growth of 4 1/4% in 2008-09, the strongest rate in four years. Business investment is forecast to grow by 9 1/4% to a total of $36 billion, representing a doubling in real investment over the past six years. |

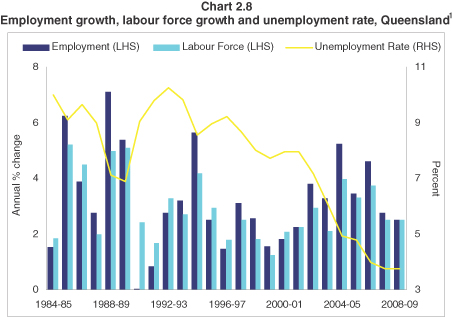

| | • | | Reflecting some easing in domestic demand growth, jobs growth is forecast to ease to 2 3/4% in 2007-08 and 2 1/2% in 2008-09. This growth still represents an increase in employment of more than 105,000 persons over the two years. |

| | • | | The State’s year-average unemployment rate is estimated to fall to a 34 year low of 3 3/4% in 2007-08 and remain there in 2008-09, representing a rate well below that nationally for the fifth consecutive year. |

INTRODUCTION

This chapter presents the economic context within which the 2008-09 State Budget has been prepared. It provides an overview of recent developments in Queensland’s external economic environment, examines the performance of and outlook for the Queensland economy and highlights risks to, and opportunities for, economic growth during the forecast period. The chapter details estimated actuals and forecasts for growth in the major components of State economic activity for 2007-08 and 2008-09 respectively (see Table 2.1) and presents projections for key economic variables over the medium term to 2011-12 (see Table 2.2).

EXTERNAL ENVIRONMENT

International conditions

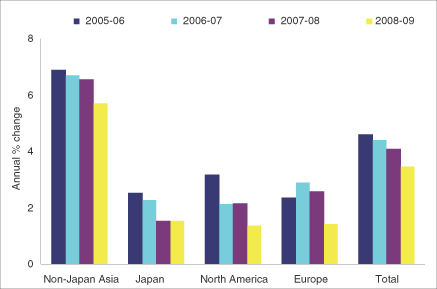

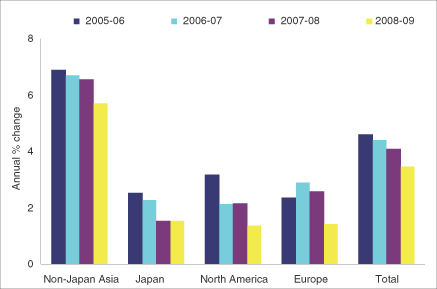

The world economic outlook has been clouded by uncertainty over the extent of the slowing in the US economy, as well as tighter credit conditions triggered by the sub-prime mortgage fallout. Further, rising inflationary pressures may limit the extent of any accommodative easing in monetary policy around the globe. As a consequence, economic growth in Queensland’s major trading partners is estimated to ease from 4.4% in 2006-07 to 4% in 2007-08, and moderate further to 3 1/2% in 2008-09 (see Chart 2.1), its lowest rate in six years.

Despite some relief since mid-March 2008, global credit conditions remain tight. This has been reflected in a widening spread between yields of debt instruments issued by the banking and corporate sectors compared with government bonds and also in the greater difficulty faced by the corporate sector in borrowing directly from capital markets.

30

Tight credit conditions have exacerbated the housing downturn in the US, where the number of housing starts has fallen almost 60% from its peak. It also appears that the impact of the housing downturn has spread to the household and business sectors, coinciding with softer labour market outcomes so far in 2008.

Chart 2.1

Economic growth in Queensland’s major trading partners1

Note:

| 1. | 2007-08 is an estimate, 2008-09 is a forecast. |

Sources: Queensland Treasury and Consensus Economics.

The US economic downturn is expected to not only spill over to other advanced economies, such as Japan and Europe, but also to emerging economies, such as China and India, through trade and financial linkages. In particular, underdeveloped financial infrastructure has led some emerging economies to become overly reliant on foreign capital, which also leaves these economies vulnerable to restrictive credit conditions.

Another development clouding the world economic outlook is the possibility of high global inflation. Prices for petroleum and thermal coal have risen more than 75% and 100% respectively since July 2007. Also, a substantial rise in iron ore and coking coal prices should see steel prices rise significantly in 2008-09. Further, global food prices have surged, including a near tripling of rice prices in Asia since the beginning of 2008 and substantial price rises for other major sources of carbohydrates, such as corn and wheat. With elevated global inflation, major central banks may have to limit the extent of their monetary easing despite the weaker economic outlook.

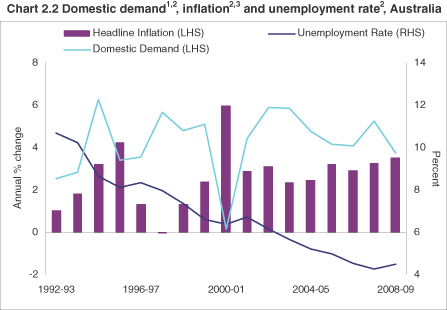

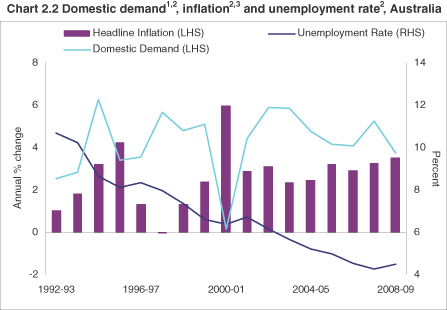

AUSTRALIAN ECONOMY

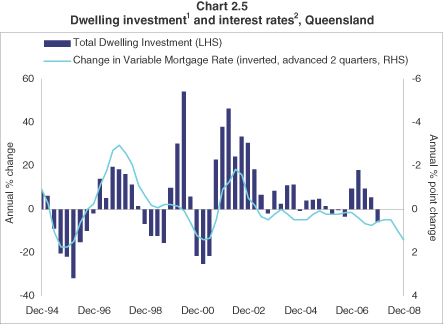

In the 2008-09 Budget, the Australian Government forecast that a moderation in world economic growth, tighter credit conditions and significantly higher interest rates will adversely affect the household sector and slow growth in the national economy from 3 1/2% in 2007-08 to 2 3/4% in 2008-09. With households becoming more indebted, higher interest rates are expected to have a greater impact on consumption than in previous tightening cycles. Falls in share prices have suppressed growth in household wealth and are anticipated to induce saving for precautionary purposes. Higher mortgage rates are also forecast to suppress dwelling investment growth.

31

Partly offsetting the subdued outlook for the household sector, business investment and exports are forecast to support economic growth in 2008-09. Investment should benefit from a large amount of work under construction, a strong Australian dollar (A$) and high levels of capacity utilisation, while an increase in the terms of trade flowing from a surge in coal and iron ore prices is expected to support mining investment. A return to more normal seasonal conditions and recent rises in agricultural prices are also expected to result in a recovery in farm incomes. Reflecting increases in mining and agricultural production, exports growth is forecast to strengthen significantly.

In line with an expected easing in overall economic growth, national employment growth is forecast to moderate from 2 1/2% in 2007-08 to 1 1/4% in 2008-09, causing the year-average unemployment rate to rise 1 /4 of a percentage point, to 4 1/2% in 2008-09.

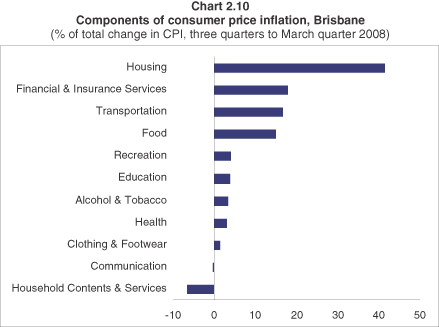

Despite a forecast moderation in domestic demand, inflation is expected to stay above the Reserve Bank of Australia’s (RBA) target band of 2-3%, at 3 1/2% in 2008-09. This reflects the fact that the Australian economy has been running at close to full capacity for some time, as well as higher energy and food prices and further rises in housing costs.

Notes:

| 1. | CVM, 2005-06 reference year. |

| 2. | 2007-08 is an estimated actual, 2008-09 is a forecast. |

| 3. | 2007-08 year-average estimate is derived from Australian Government 2008-09 Budget through-the-year estimate. |

Sources: ABS 5206.0, 6202.0, 6401.0, Queensland Treasury and Australian Government 2008-09 Budget.

32

THE QUEENSLAND ECONOMY

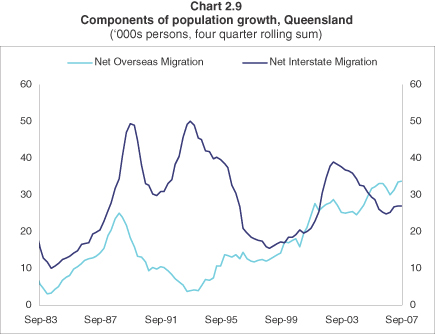

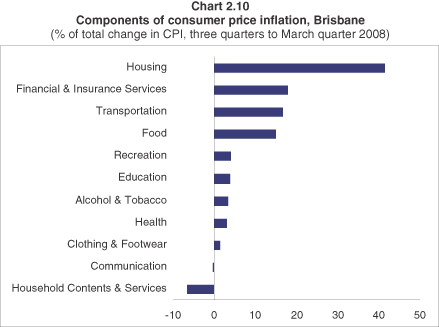

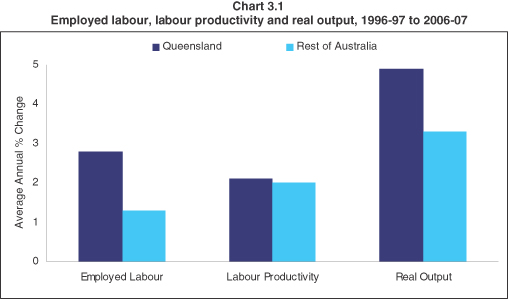

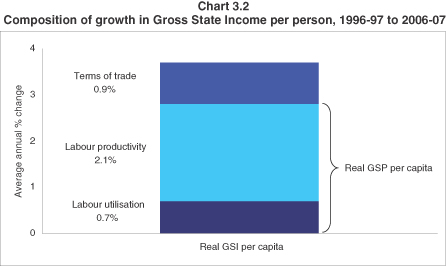

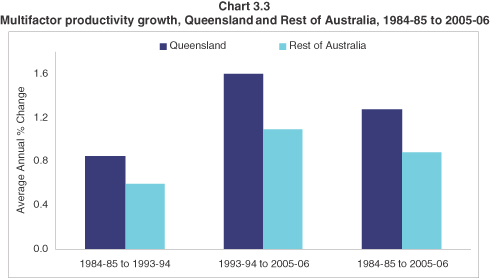

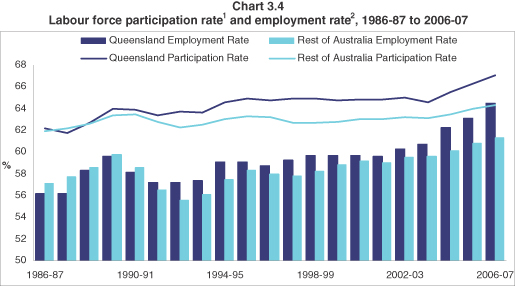

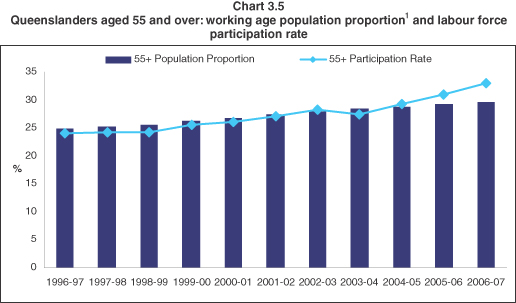

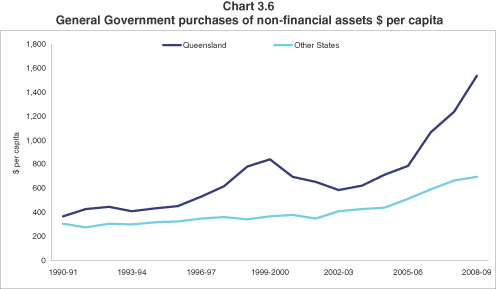

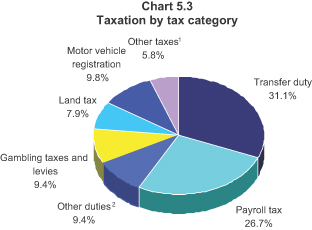

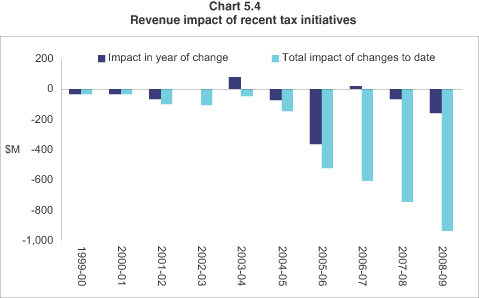

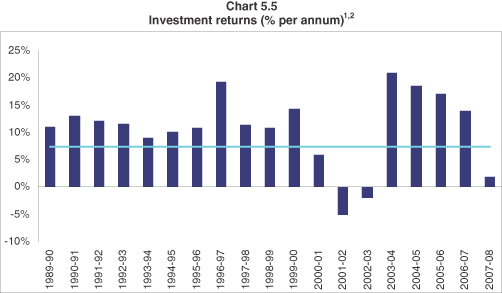

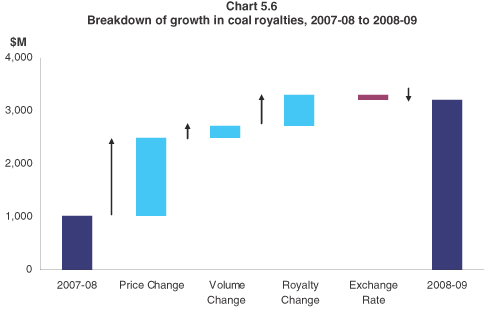

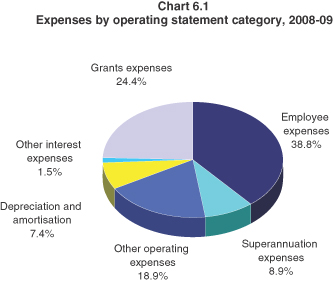

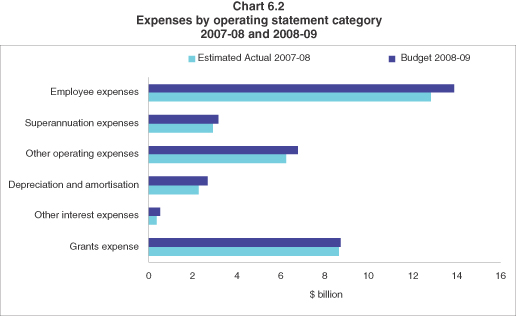

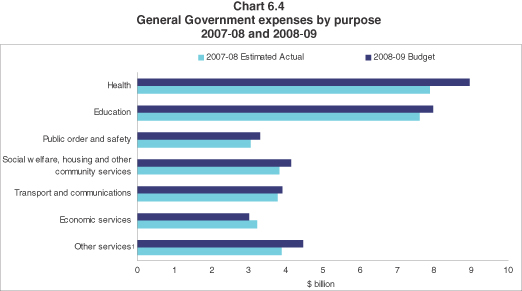

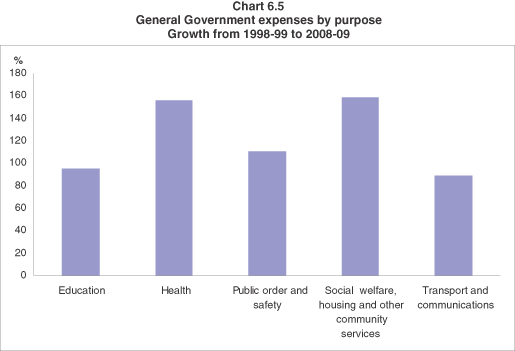

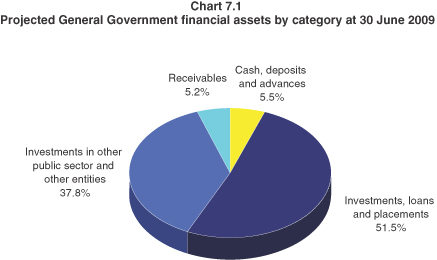

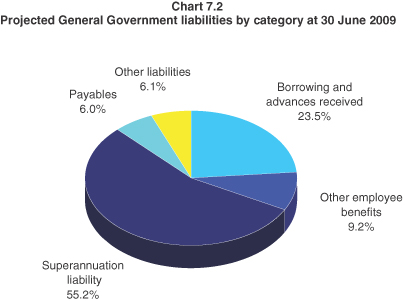

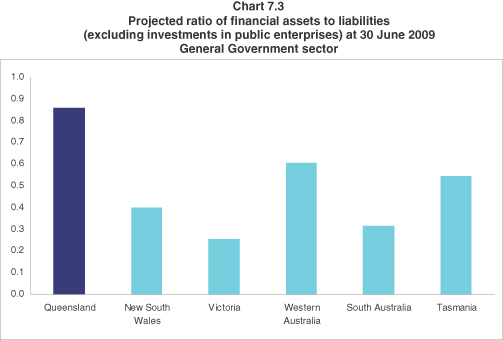

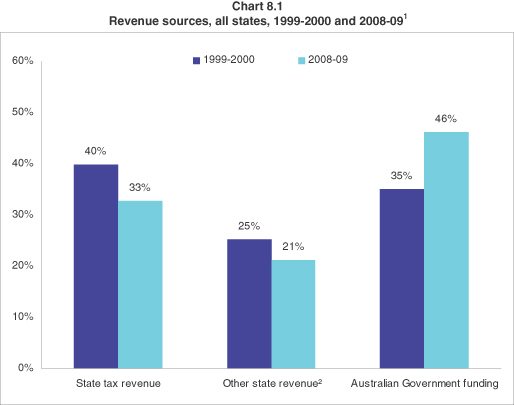

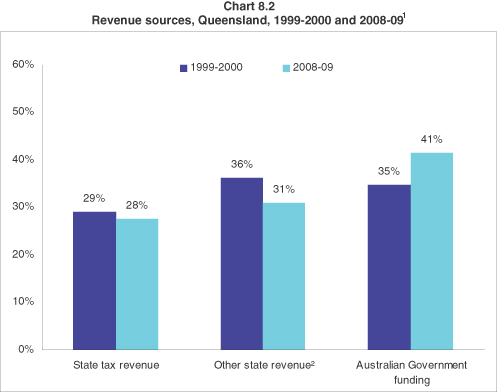

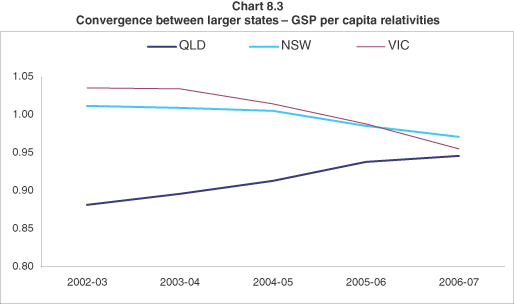

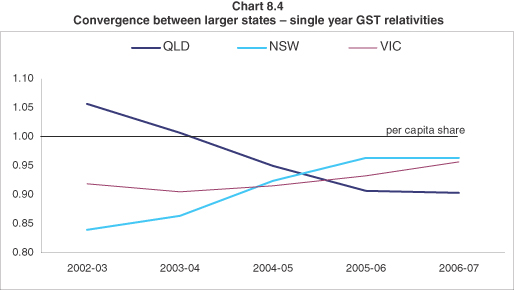

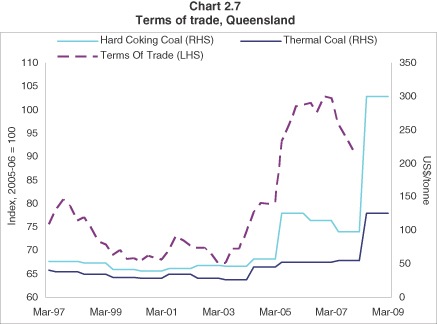

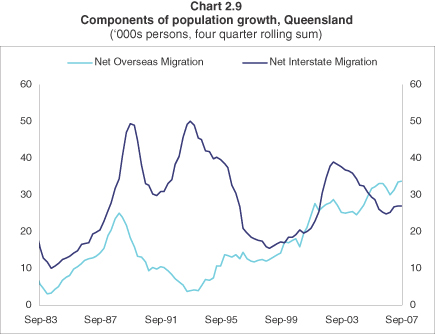

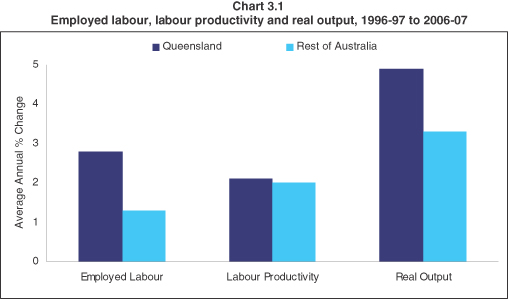

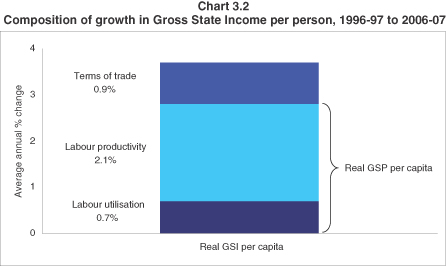

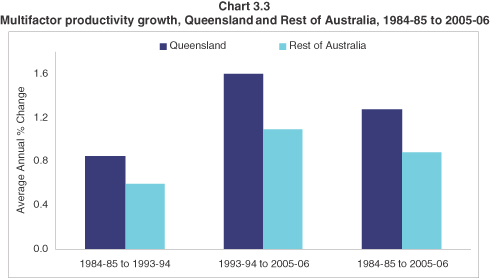

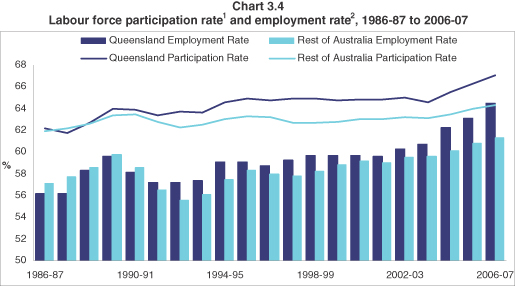

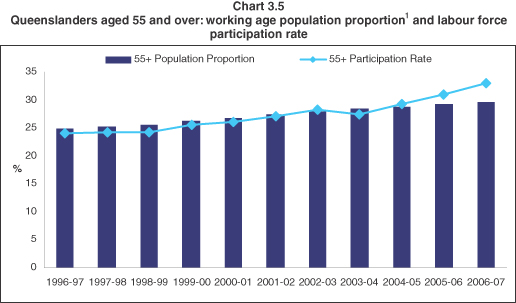

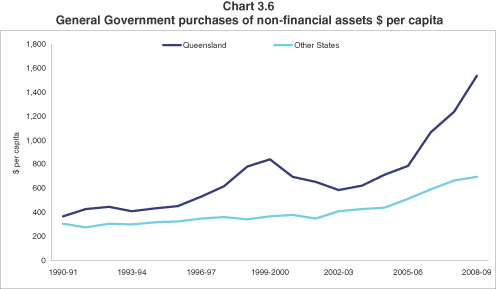

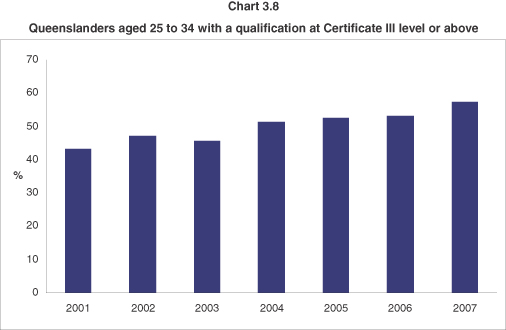

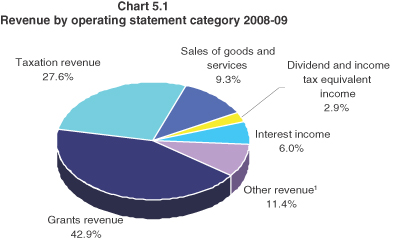

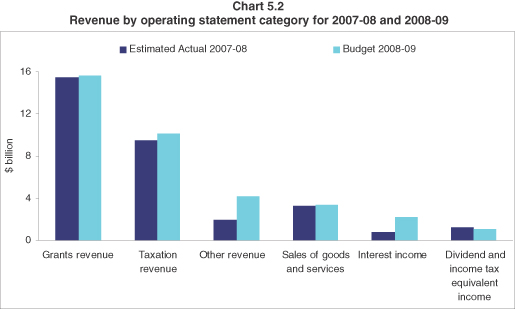

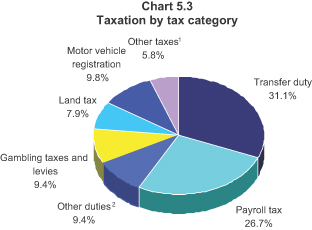

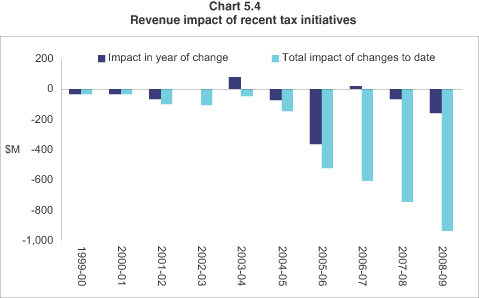

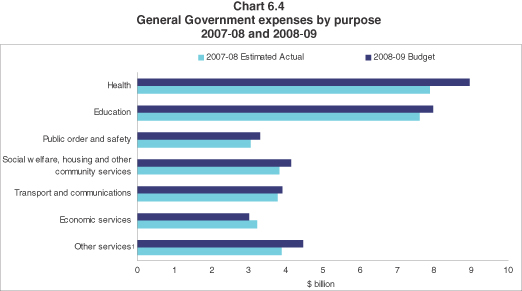

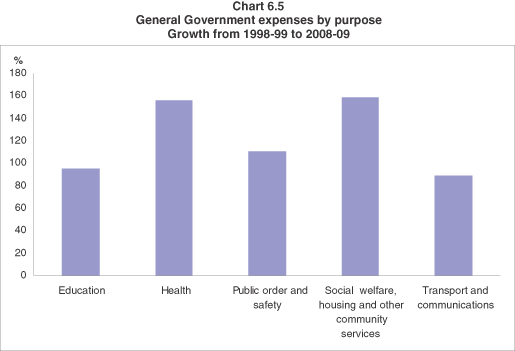

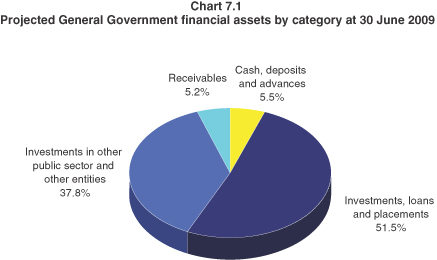

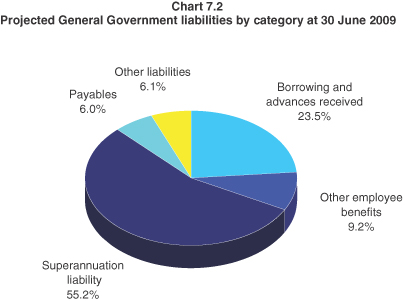

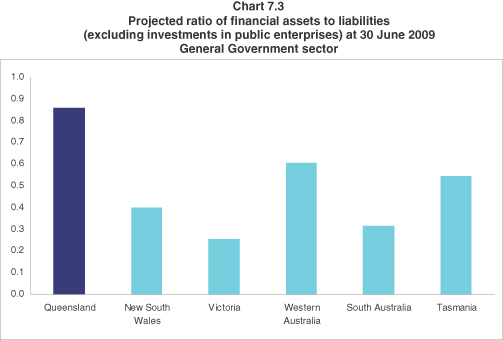

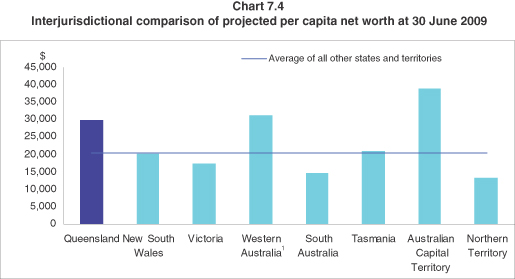

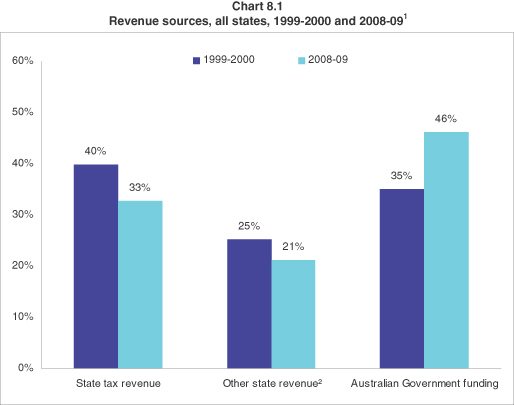

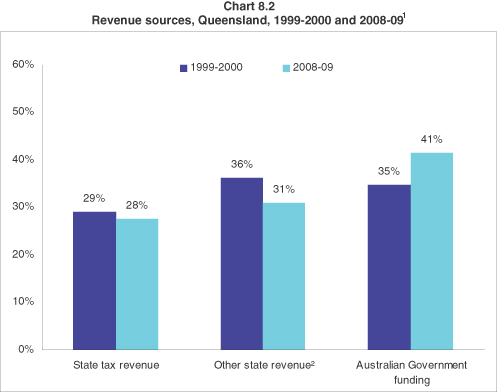

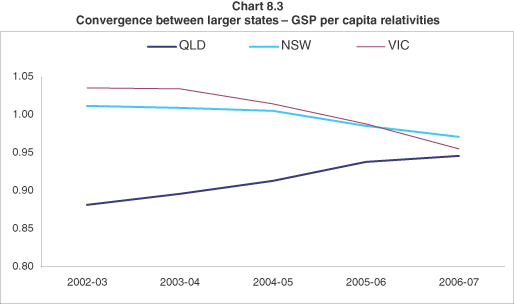

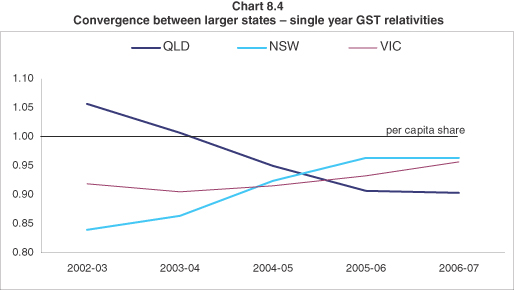

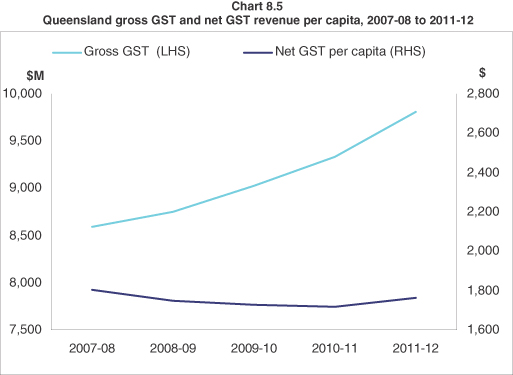

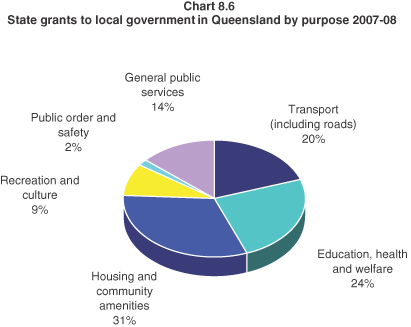

External forecast assumptions