EXHIBIT (c)(viii)

Queensland Treasury Corporation’s 2014-15 Indicative Borrowing Program Update

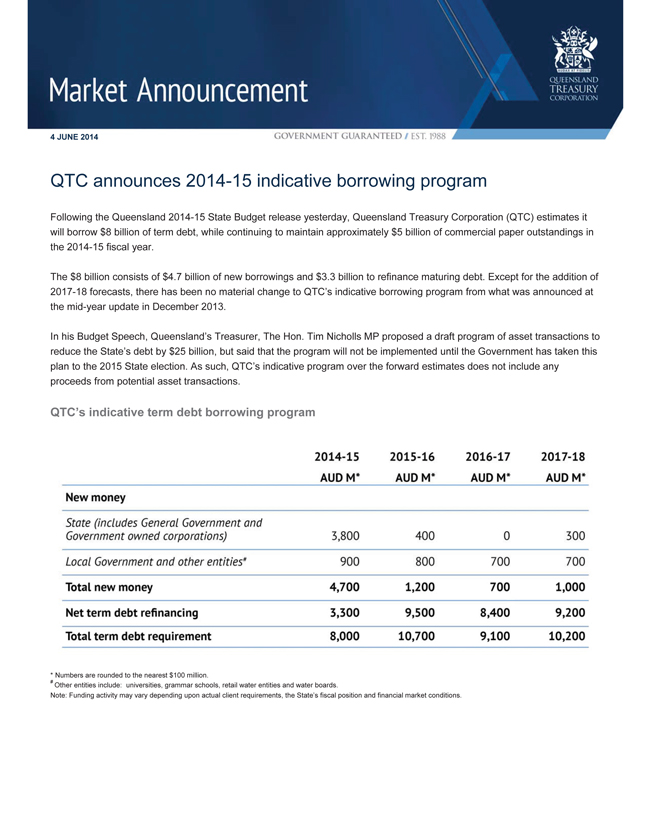

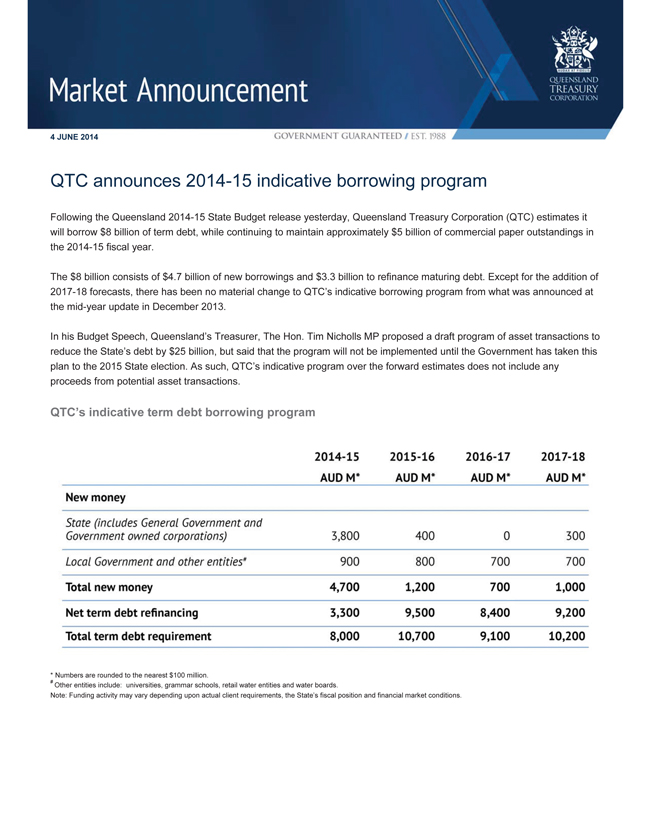

Market Announcement 4 JUNE 2014 GOVERNMENT GUARANTEED / EST. 1988 AUDAX AT FIDELIS QUEENSLAND TREASURY CORPORATION QTC announces 2014-15 indicative borrowing program Following the Queensland 2014-15 State Budget release yesterday, Queensland Treasury Corporation (QTC) estimates it will borrow $8 billion of term debt, while continuing to maintain approximately $5 billion of commercial paper outstandings in the 2014-15 fiscal year. The $8 billion consists of $4.7 billion of new borrowings and $3.3 billion to refinance maturing debt. Except for the addition of 2017-18 forecasts, there has been no material change to QTC’s indicative borrowing program from what was announced at the mid-year update in December 2013. In his Budget Speech, Queensland’s Treasurer, The Hon. Tim Nicholls MP proposed a draft program of asset transactions to reduce the State’s debt by $25 billion, but said that the program will not be implemented until the Government has taken this plan to the 2015 State election. As such, QTC’s indicative program over the forward estimates does not include any proceeds from potential asset transactions. QTC’s indicative term debt borrowing program 2014-15 AUD M* 2015-16 AUD M* 2016-17 AUD M* 2017-18 AUD m* New money State (includes General Government and Government owned corporations) 3,800 400 0 300 Local Government and other entities* 900 800 700 700 Total new money 4,700 1,200 700 1,000 Net term debt refinancing 3,300 9,500 8,400 9,200 Total term debt requirement 8,000 10,700 9,100 10,200 * Numbers are rounded to the nearest $100 million.

# Other entities include: universities, grammar schools, retail water entities and water boards. Note: Funding activity may vary depending upon actual client requirements, the State’s fiscal position and financial market conditions. Queensland Treasury Corporation ? Level 6 123 Albert Street Brisbane Queensland 4000 ? Tel: +61 7 3842 4600 Fax: +61 7 3221 2410

qtc.qld.gov.au ? Bloomberg ticker: QTC ? Reuters: QTC1 ? QTC information for institutional investors is available for iPad users

Market Announcement 4 JUNE 2014 GOVERNMENT GUARANTEED / EST. 1988 AUDAX AT FIDELIS QUEENSLAND TREASURY CORPORATION 2014-15 funding strategy To complete its 2014-15 borrowing program, QTC’s AUD benchmark bonds will remain the principal source of funding complemented by floating rate notes and other instruments. The composition of term debt issuance will be subject to market conditions and the borrowing requirements of QTC’s clients. In addition, QTC will consider cancelling shorter-dated QTC bonds to manage its refinancing task over the forward estimates. 2013-14 year in review During the fiscal year, QTC added a new 2025 AUD benchmark bond line (with US Rule 144A capability) to its debt profile, providing investors with a choice of benchmark bond maturities in each calendar year out to 2025. QTC also issued two benchmark-size floating rate notes maturing in 2016 and 2017 respectively. Investor demand was strong throughout the year, which was evidenced by the outperformance of QTC’s spreads. QTC has now issued sufficient term debt to fund its 2013-14 borrowing requirements. Next review of borrowing requirements QTC will revise its 2014-15 borrowing program following the Queensland Government’s release of its Mid-Year Fiscal and Economic Review. LEGAL NOTICE: QTC’S 2014-15 indicative borrowing program is hereby incorporated by reference into the disclosure documents for QTC’s funding facilities, including the domestic A$ Bond Information Memorandum dated 29 January 2014.QTC is also in the process of preparing and filing a US Form 18-K/A (exhibiting the borrowing program) with the US Securities and Exchange Commission. This announcement (i) does not constitute an offer to sell or the solicitation of an offer to buy any securities, (ii) may not be sent or disseminated in, directly or indirectly, any jurisdiction in which it is unlawful to so send or disseminate, and (iii) may not be sent or given to any person to whom it is unlawful to be so given. In particular, securities may not be offered or sold in the United States or to ‘US Persons’ (as defined in Regulation S under the US Securities Act of 1933, as amended (the ‘Securities Act’)) without registration under the Securities Act or pursuant to an exemption from the registration requirements of the Securities Act and any other applicable US state securities laws. This announcement is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor.