UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-05845 |

Invesco Senior Loan Fund

(Exact name of registrant as specified in charter)

1555 Peachtree Street, N.E., Suite 1800 Atlanta, Georgia 30309

(Address of principal executive offices) | (Zip code) |

Sheri Morris 1555 Peachtree Street, N.E., Suite 1800 | Atlanta, Georgia 30309 |

(Name and address of agent for service)

Registrant's telephone number, including area code: | (713) 626-1919 |

Date of fiscal year end: | 02/29 | | |

Date of reporting period: | 02/29/20 | | |

Item 1. Report to Stockholders.

Annual Report to Shareholders | February 29, 2020 |

Invesco Senior Loan Fund

Nasdaq:

A: VSLAX C: VSLCX Y: VSLYX IB: XPRTX IC: XSLCX

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Fund's web- site, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you are a direct investor, by enrolling at invesco.com/edelivery.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Fund, you can call (800) 959-4246 to let the Fund know you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds held with your financial intermediary or all funds held with the fund complex if you invest directly with the Fund.

Andrew Schlossberg

Letters to Shareholders

Dear Shareholders:

This annual report includes information about your Fund, including performance data and a com- plete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period.

The reporting period proved to be another tumultuous time for both global equities and fixed- income securities. In early 2019, global equity markets were buoyed by a more accommodative stance from central banks and optimism about a potential US-China trade deal. In May, US-China trade concerns and slowing global growth led to a global equity sell-off and rally in US Treasuries. Despite the May sell-off, domestic equity markets rallied in June in anticipation of a US Federal Reserve (the Fed) interest rate cut and closed the second quarter with modest gains. Continued US-China trade worries and signs of slowing global economic growth led to increased market vola-

tility in August. The US Treasury yield curve inverted several times as fears of a US recession increased. As a result, global equity markets were largely flat for the third quarter. In the final months of 2019, geopolitical and macroeconomic issues largely abated. This combined with better-than-expected third quarter corporate earnings and initial agreement of the phase one US-China trade deal provided a favorable backdrop for equities and impressive fourth quarter global equity returns.

As the new year began, US equities were largely buoyed in January by the signing of the phase one trade agreement and strong economic data although returns were dampened by the spread of the Coronavirus (COVID-19). Concerns over the virus had a greater impact on international equities, which were largely lower for the month. As the virus spread outside of China and the number of cases increased, fears of diminished global growth led to a sharp global equity sell-off at the end of February 2020 and sent the yield on the US 10-year Treasury to a new all-time low.

Throughout 2019, central banks continued to be accommodative, providing sources of liquidity. In July, the Fed lowered interest rates for the first time in 11 years. It again lowered rates in September and once again in October. During the rest of the year, the Fed left rates unchanged. Overseas, the European Central Bank left its policy rate unchanged and continued its bond purchasing program. In 2020, with the increased spread of the coronavirus, the Fed shifted from a more neutral policy to the possibility of further rate cuts in the new year. As 2020 unfolds, we'll see how the interplay of interest rates, economic data, geopolitics and a host of other factors affect US and overseas equity and fixed income markets.

Investor uncertainty and market volatility, such as we witnessed during the reporting period, are unfortunate facts of life when it comes to investing. That's why Invesco encourages investors to work with a professional financial adviser who can stress the importance of starting to save and invest early and the importance of adhering to a disciplined investment plan. A financial adviser who knows your unique financial situation, investment goals and risk tolerance can be an invaluable partner as you seek to achieve your financial goals. Financial advisers can also offer a long-term perspective when markets are vola- tile and time-tested advice and guidance when your financial situation or investment goals change.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you'll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. To do so, select "Log In" on the right side of the homepage, and then select "Register for Individual Account Access."

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets and the economy by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I'm pleased to share with you Invesco's commitment to both the Principles for Responsible Investment and to con- sidering environmental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Andrew Schlossberg

Head of the Americas,

Senior Managing Director, Invesco Ltd.

2Invesco Senior Loan Fund

Bruce Crockett

Dear Shareholders:

Among the many important lessons I've learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate.

As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco's mutual funds. We work hard to represent your interests through oversight of the quality of the investment management ser- vices your funds receive and other matters important to your investment, including but not limited to:

Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time.

Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions.

Assessing each portfolio management team's investment performance within the context of the investment strategy described in the fund's prospectus.

Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive.

We believe one of the most important services we provide our fund shareholders is the annual review of the funds' advisory

and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the rea- sonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3Invesco Senior Loan Fund

Management's Discussion of Fund Performance

Performance summary

For the fiscal year ended February 29, 2020, Class A shares of Invesco Senior Loan Fund (the Fund), at net asset value (NAV), underperformed the Credit Suisse Leveraged Loan Index, the Fund's style-specific benchmark.

Your Fund's long-term performance appears later in this report.

Fund vs. Indexes

Total returns, February 28, 2019 to February 29, 2020, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance.

Class A Shares | 0.73% |

Class C Shares | –0.16 |

Class Y Shares | 0.99 |

Class IB Shares | 0.84 |

Class IC Shares | 0.84 |

Credit Suisse Leveraged Loan Index (Style-Specific Index) | 3.25 |

Source(s): Bloomberg L.P.

steady returns during the fiscal year rela- tive to traditional asset classes.

For the fiscal year ended February 29, 2020, the senior loan market, as repre- sented by the Credit Suisse Leveraged Loan Index, returned 3.25%. Through- out calendar year 2019, risk assets per- formed well, and loans were no exception

— returning 8.17%.1 However, as fears |

of COVID-19's impact began to ripple |

throughout capital markets at the begin- |

ning of 2020, loans followed the broader |

risk sentiment, albeit in a more muted |

fashion. |

During the fiscal year, Libor decreased |

from 2.62% to 1.46% as the US Federal |

Reserve (the Fed) cut interest rates |

three times in response to concerns over |

slowing economic growth. While these |

Market conditions and your Fund

Senior loans' position at the top of the capital structure and secured status helped the asset class weather the spo- radic risk sentiment that underlined capi- tal markets during the fiscal year. Namely, volatility induced by US-China trade tensions resulted in investors hav- ing an "on-again, off-again" appetite for

Portfolio Composition*

By credit quality | % of total investments |

AA | 0.2% |

A | 0.2 |

BBB- | 7.8 |

BB+ | 8.4 |

BB | 10.0 |

BB- | 12.4 |

B+ | | 15.7 |

B | | 16.0 |

B- | | 11.0 |

CCC+ | | 2.0 |

CCC | | 1.6 |

CCC- | | 0.1 |

CC | | 0.1 |

D | | 1.0 |

Non-Rated | | 8.2 |

Equity | | 5.3 |

risk throughout most of 2019. This cul- minated with increased volatility toward the end of the fiscal year as fears sur- rounding the Coronavirus (COVID-19) began to increase and impact financial markets. Senior loans' defensive position- ing at the top of the capital structure benefited the asset class during bouts of risk aversion, while the relatively high level of coupon helped the asset class log

Top Five Debt Issuers

| % of total net assets |

1. TransDigm, Inc. | 2.4% |

2. New Red Finance, Inc. | 2.3 |

3. Calpine Corp. | 2.2 |

4. McDermott Technology | |

(Americas), Inc. | 1.9 |

5. Virgin Media Bristol LLC | 1.6 |

changes did lower the overall coupon of |

the senior loan asset class (due to their |

floating rate structure), the credit spread |

of new issue loans increased during the |

fiscal year, helping to offset the decrease |

in overall coupon. (Libor is the London |

Interbank offered rate, which is the rate |

that international banks charge for short- |

term loans to one another). |

The Fund's holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

Data presented here are as of February 29, 2020.

*Source: Standard & Poor's. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. "Non- Rated" indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on Standard & Poor's rating methodology, please visit standardandpoors.com and select "Understanding Ratings" under Rating Resources on the homepage.

4Invesco Senior Loan Fund

From a fundamental standpoint, the backdrop for loans remained firm during the Fund's fiscal year. Despite the impact from US–China trade tensions, economic growth remained supportive. The overall earnings environment for loan issuers remained supportive of profit growth, which, in turn, enabled them to comfort- ably service their outstanding debt obli- gations. That said, it is clear that COVID-19 will have an impact on the US and global economy, and ,thus, loan issu- ers; however, the extent of the impact has yet to be realized as of the end of the fiscal year.

Loan defaults remained below their long-term historical averages during the fiscal year. Issuer distress continued to be focused in secularly-challenged indus- tries, such as retail or companies facing idiosyncratic headwinds. While default rates are likely to increase from their current levels, we expect default rates to be just below or in line with their long- term historical average.

At the close of the fiscal year, it was our view that senior loans were well- positioned, providing investors with a relatively high level of current income, all while sitting atop the capital structure. While concerns around an economic slowdown increased due to COVID-19, given the senior secured status of loans and the reliable cash flow from issuers servicing their debt, we believe the asset class remains well-positioned even amid uncertainty. We anticipate loans will likely present compelling relative value oppor- tunities for long-term investors as more information becomes available.

During the fiscal year, the Fund used leverage, which allowed us to enhance the Fund's yield while keeping credit standards high relative to the bench- mark. As of the close of the fiscal year, leverage accounted for 15% of the Fund's NAV plus borrowings. Leverage involves borrowing at a floating short- term rate and reinvesting the proceeds at a higher rate. Unlike other fixed in- come asset classes, using leverage in conjunction with senior loans does not involve the same degree of risk from ris- ing short-term interest rates since the income from senior loans generally ad- justs to changes in interest rates, as do the rates which determine the Fund's borrowing costs. (Similarly, should short term rates fall, borrowing costs also would decline.) For more information about the Fund's use of leverage, see the Notes to Financial Statements later in this report.

At the end of the fiscal year, the Fund's holdings in Calpine Corporation, New Red Finance and Twin River Worldwide Holdings were the largest overweight allocations relative to the Fund's benchmark. Conversely, Asurion, TransDigm and CenturyLink were the largest underweight allocations com- pared to the Fund's benchmark.

The senior loan asset class behaves differently from many traditional fixed income investments. The interest income generated by a portfolio of senior loans is usually determined by a fixed credit spread over Libor. Because senior loans generally have a very short duration and the coupons or interest rates are usually adjusted every 30 to 90 days as Libor changes, the yield on the portfolio ad- justs. Interest rate risk refers to the ten- dency for traditional fixed income prices to decline when interest rates rise. For senior loans, however, interest rates and income are variable, and the prices of senior loans are therefore less sensitive to interest rate changes than traditional fixed income bonds. We are monitoring interest rates, the market and economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the ma- turity spectrum, including the potential impact of monetary policy changes by the Fed and certain central banks. The risk may be greater in the current mar- ket environment because interest rates are near historic lows. If interest rates rise or fall faster than expected, markets may experience increased volatility, which may affect the value and/or liquid- ity of certain of the Fund's investments or the market price of the Fund's shares.

As always, we appreciate your contin- ued participation in Invesco Senior Loan Fund.

1 Source: Credit Suisse

Portfolio Managers:

Scott Baskind

Tom Ewald

Philip Yarrow

The views and opinions expressed in management's discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their

completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

5Invesco Senior Loan Fund

Your Fund's Long-Term Performance

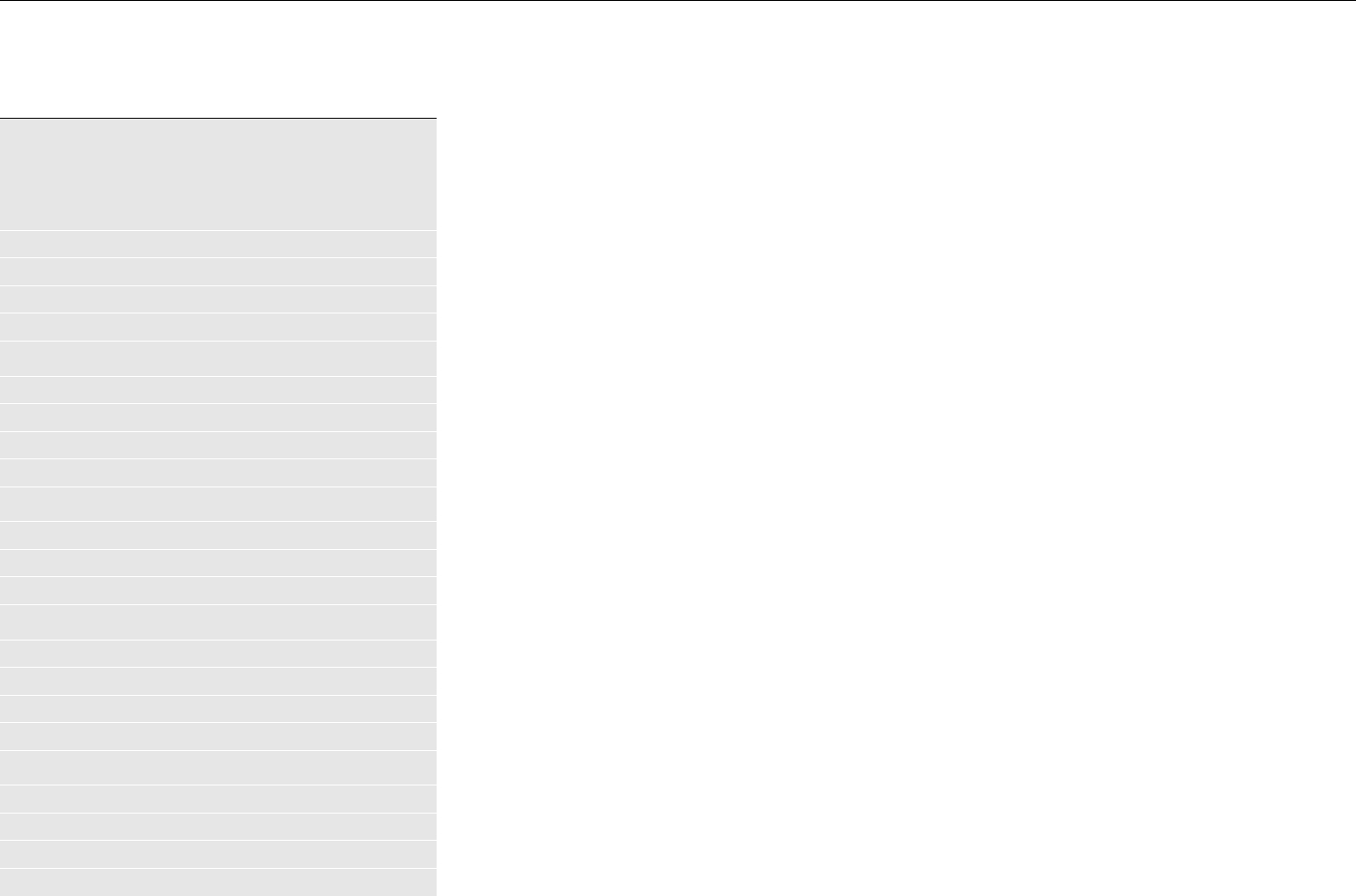

Average Annual Total Returns

As of 2/29/20, including maximum applicable sales charges

Class A Shares

Inception (2/18/05) | 3.19% |

10 | Years | 5.19 |

5 | Years | 3.09 |

1 | Year | –2.51 |

Class C Shares | |

Inception (2/18/05) | 2.65% |

10 | Years | 4.74 |

5 | Years | 2.98 |

1 | Year | –1.12 |

Class Y Shares | |

Inception (11/8/13) | 3.88% |

5 | Years | 4.02 |

1 | Year | 0.99 |

Class IB Shares | |

Inception (10/4/89) | 4.80% |

10 | Years | 5.73 |

5 | Years | 4.02 |

1 | Year | 0.84 |

Class IC Shares | |

Inception (6/13/03) | 4.14% |

10 | Years | 5.61 |

5 | Years | 3.86 |

1 | Year | 0.84 |

The performance of the Fund's share classes will differ primarily due to dif- ferent sales charge structures and class expenses.

Fund performance reflects any appli- cable fee waivers and/or expense reim- bursements. Had the adviser not waived fees and/or reimbursed ex- penses currently or in the past, returns would have been lower. See current prospectus for more information.

The performance data quoted repre- sent past performance and cannot guarantee future results; current per- formance may be lower or higher. Please visit invesco.com/performance for the most recent month-end perfor- mance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maxi- mum sales charge unless otherwise stated. Performance figures do not re- flect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 3.25% sales charge. Class C share performance reflects an early withdrawal charge of 1% for the first year after purchase. Class IB shares and Class IC shares are not continuously offered and have no early withdrawal charges. Class Y shares do not have a front-end sales charge or a CDSC, therefore performance is at net asset value. Class Y shares do not have early withdrawal charges.

6Invesco Senior Loan Fund

Invesco Senior Loan Fund's investment objective is to seek to provide a high level of current income, consistent with preservation of capital.

Unless otherwise stated, information presented in this report is as of February 29, 2020, and is based on total net assets.

Unless otherwise noted, all data provided by Invesco.

To access your Fund's reports/prospectus, visit invesco.com/fundreports.

About indexes used in this report

The Credit Suisse Leveraged Loan Index represents tradable, senior- secured, US dollar-denominated, non- investment grade loans.

The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the in- dex(es).

A direct investment cannot be made in an index. Unless otherwise indi- cated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not.

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

7Invesco Senior Loan Fund

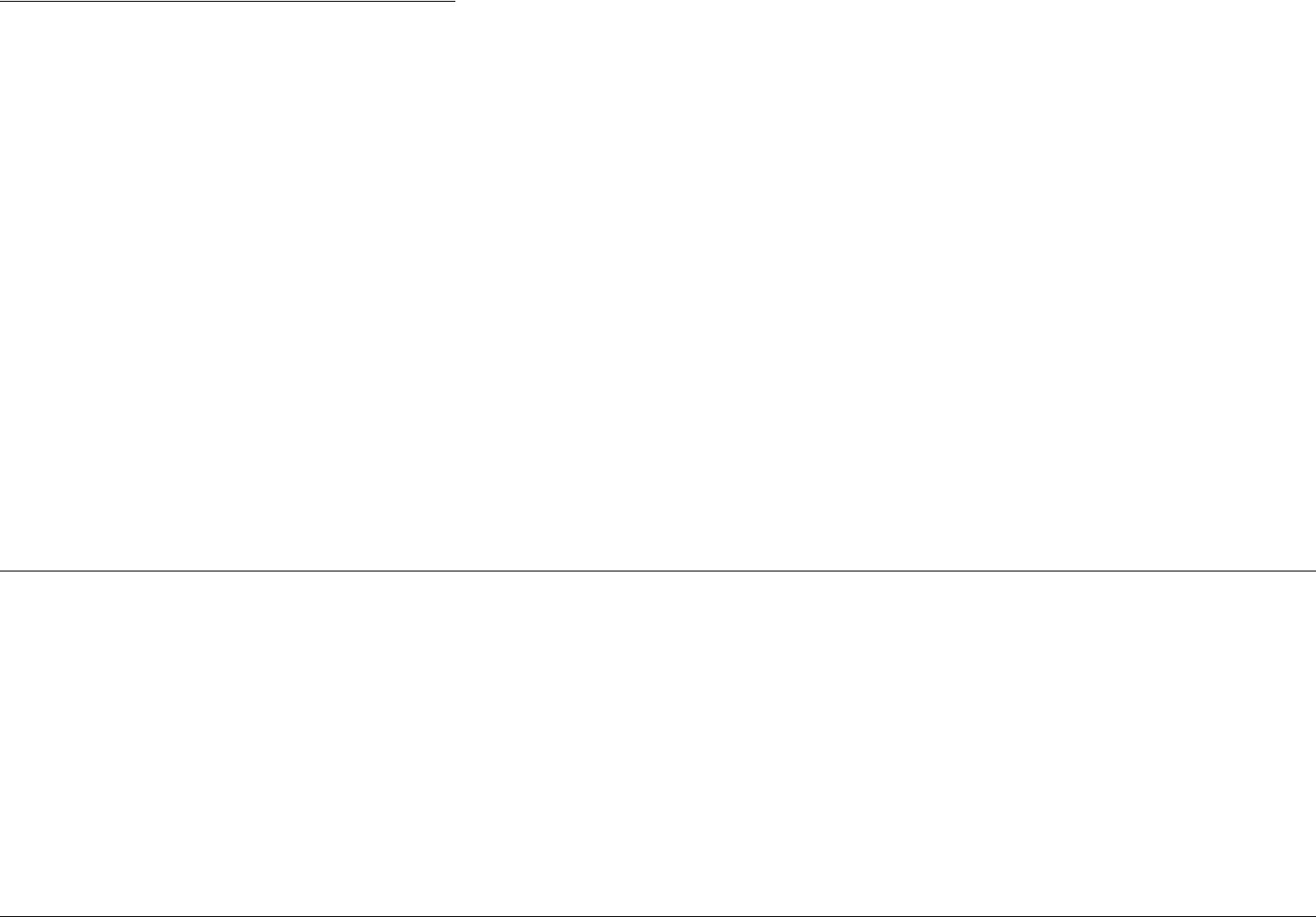

Schedule of Investments

February 29, 2020 | | | Principal | | |

| | | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Variable Rate Senior Loan Interests–102.19%(b)(c) | | | | | | |

Aerospace & Defense–3.74% | | | | | | |

Aernnova Aerospace S.A.U. (Spain) | | | | | | |

Delayed Draw Term Loan (d) | 0.00% | 01/29/2027 | EUR | 31 | $ | 34,390 |

Term Loan B-1 (e) | – | 01/29/2027 | EUR | 122 | | 136,210 |

Booz Allen Hamilton, Inc., Term Loan B (e) | – | 11/26/2026 | $ | 92 | | 91,863 |

Dynasty Acquisition Co., Inc. | | | | | | |

Term Loan B-1 (1 mo. USD LIBOR + 3.50%) | 5.21% | 04/06/2026 | | 1,078 | | 1,059,375 |

Term Loan B-2 (1 mo. USD LIBOR + 3.50%) | 5.21% | 04/06/2026 | | 579 | | 569,557 |

Greenrock Finance, Inc., Term Loan B (3 mo. USD LIBOR + 3.50%) | 5.44% | 06/28/2024 | | 1,637 | | 1,630,703 |

| | | | | | |

IAP Worldwide Services, Inc. | | | | | | |

Revolver Loan | | | | | | |

(Acquired 08/05/2014-02/08/2019; Cost $1,946,523)(d)(f) | 1.42% | 07/19/2021 | | 1,946 | | 1,946,523 |

Second Lien Term Loan (3 mo. USD LIBOR + 6.50%) | | | | | | |

(Acquired 07/18/2014-02/08/2019; Cost $1,999,696)(f) | 8.44% | 07/18/2020 | | 2,159 | | 2,158,903 |

Maxar Technologies Ltd. (Canada), Term Loan B (1 mo. USD LIBOR + 2.75%) | 4.36% | 10/04/2024 | | 2,240 | | 2,111,249 |

Peraton Corp., Term Loan (1 mo. USD LIBOR + 5.25%) | 6.86% | 04/29/2024 | | 857 | | 839,828 |

| | | | | | |

Perspecta, Inc., Term Loan B (1 mo. USD LIBOR + 2.25%) | 3.85% | 05/30/2025 | | 657 | | 651,045 |

TransDigm, Inc. | | | | | | |

Term Loan E (1 mo. USD LIBOR + 2.25%) | 3.85% | 05/30/2025 | | 5,658 | | 5,539,207 |

Term Loan F (1 mo. USD LIBOR + 2.25%) | 3.85% | 06/09/2023 | | 869 | | 851,264 |

| | | | | | |

Term Loan G (1 mo. USD LIBOR + 2.25%) | 3.85% | 08/22/2024 | | 839 | | 825,203 |

Vectra Co., First Lien Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 03/08/2025 | | 219 | | 216,898 |

Xebec Global Holdings, LLC, Term Loan (1 wk. USD LIBOR + 5.25%)(f) | 7.20% | 02/12/2024 | | 1,468 | | 1,475,499 |

| | | | | | 20,137,717 |

| | | | | | |

Air Transport–1.09% | | | | | | |

American Airlines, Inc., Term Loan (1 mo. USD LIBOR + 1.75%) | 3.36% | 06/27/2025 | | 74 | | 70,348 |

Avolon TLB Borrower 1 (US) LLC, Term Loan B-3 (1 mo. USD LIBOR + 1.75%) | 3.40% | 01/15/2025 | | 1,349 | | 1,338,688 |

| | | | | | |

eTraveli Group Holding AB (Sweden), Term Loan B-1 (3 mo. EURIBOR + 4.00%) | 4.00% | 08/02/2024 | EUR | 329 | | 364,419 |

| | | | | | |

Gol LuxCo S.A. (Luxembourg), Term Loan (6 mo. USD LIBOR + 6.50%) | | | | | | |

(Acquired 08/21/2015; Cost $2,994,515)(f) | 6.50% | 08/31/2020 | | 2,998 | | 3,012,955 |

WestJet Airlines Ltd. (Canada), Term Loan B (1 mo. USD LIBOR + 3.00%) | | | | | | |

(Acquired 08/08/2019-08/13/2019; Cost $2,136,825) | 4.65% | 08/07/2026 | | 1,127 | | 1,090,797 |

| | | | | | 5,877,207 |

| | | | | | |

Automotive–3.32% | | | | | | |

Allison Transmission, Inc., Term Loan (1 mo. USD LIBOR + 2.00%) | 3.38% | 03/29/2026 | | 11 | | 11,466 |

| | | | | | |

American Axle & Manufacturing, Inc., Term Loan B (1 mo. USD LIBOR + 2.25%) | 3.88% | 04/06/2024 | | 996 | | 973,094 |

| | | | | | |

Autokiniton US Holdings, Inc., Term Loan B (3 mo. USD LIBOR + 5.75%) | | | | | | |

(Acquired 09/26/2019; Cost $1,240,931)(f) | 7.35% | 05/22/2025 | | 1,303 | | 1,305,889 |

BCA Marketplace PLC (United Kingdom) | | | | | | |

Term Loan B-1 (3 mo. GBP LIBOR + 4.75%) | 5.46% | 11/13/2026 | GBP | 354 | | 455,811 |

Term Loan B-2 (3 mo. EURIBOR + 3.25%) | 3.25% | 09/24/2026 | EUR | 260 | | 287,037 |

Dayco Products LLC, Term Loan (3 mo. USD LIBOR + 4.25%) | 5.86% | 05/19/2023 | | 676 | | 611,800 |

| | | | | | |

Garrett Borrowing LLC | | | | | | |

Term Loan B (3 mo. EURIBOR + 2.75%) | 2.75% | 09/27/2025 | EUR | 101 | | 111,627 |

Term Loan B (3 mo. USD LIBOR + 2.50%) | 4.45% | 09/27/2025 | | 416 | | 405,888 |

| | | | | | |

IAA Spinco, Inc., Term Loan (3 mo. USD LIBOR + 2.25%) | 3.88% | 06/29/2026 | | 751 | | 750,074 |

| | | | | | |

Mavis Tire Express Services Corp. | | | | | | |

Delayed Draw Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 03/20/2025 | | 144 | | 139,022 |

Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 03/20/2025 | | 1,129 | | 1,090,842 |

| | | | | | |

Navistar, Inc., Term Loan B (1 mo. USD LIBOR + 3.50%) | 5.16% | 11/06/2024 | | 0 | | 263 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

8Invesco Senior Loan Fund

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Automotive–(continued) | | | | | | |

Panther BF Aggregator 2 L.P. (Canada) | | | | | | |

Term Loan (1 mo. EURIBOR + 3.75%) | 3.75% | 04/30/2026 | EUR | 783 | $ | 855,664 |

Term Loan (1 mo. USD LIBOR + 3.50%) | 5.10% | 04/30/2026 | $ | 2,251 | | 2,197,179 |

| | | | | | |

Superior Industries International, Inc., Term Loan (1 mo. USD LIBOR + 4.00%)(f) | 5.60% | 05/22/2024 | | 935 | | 893,147 |

Tenneco, Inc., Term Loan B (1 mo. USD LIBOR + 3.00%) | 4.60% | 10/01/2025 | | 2,625 | | 2,470,822 |

ThermaSys Corp. | | | | | | |

Term Loan (3 mo. USD LIBOR + 6.00%) | | | | | | |

(Acquired 12/31/2018; Cost $114,862)(f) | 7.94% | 10/02/2023 | | 115 | | 104,524 |

Term Loan (3 mo. USD LIBOR + 6.00%)(f) | 7.94% | 12/31/2023 | | 628 | | 537,118 |

TI Group Automotive Systems LLC, Term Loan (1 mo. USD LIBOR + 2.50%) | 4.10% | 06/30/2022 | | 295 | | 292,104 |

| | | | | | |

Transtar Holding Co. | | | | | | |

Delayed Draw Term Loan (d)(f) | 0.00% | 04/11/2022 | | 170 | | 169,960 |

First Lien Term Loan (2 mo. USD LIBOR + 4.25%) | | | | | | |

(Acquired 10/03/2012-06/13/2016; Cost $2,130,521)(f) | 5.91% | 04/11/2022 | | 2,134 | | 2,107,076 |

PIK Term Loan, 7.75% PIK Rate, 1.00% Cash Rate | | | | | | |

(Acquired 04/11/2017-10/11/2019; Cost $740,153)(f)(g) | 7.75% | 04/11/2022 | | 783 | | 783,044 |

Wand NewCo 3, Inc., Term Loan B-1 (1 mo. USD LIBOR + 3.00%) | 4.60% | 02/05/2026 | | 603 | | 592,773 |

| | | | | | |

Winter Park Intermediate, Inc., Term Loan (1 mo. USD LIBOR + 4.75%) | 6.35% | 04/04/2025 | | 738 | | 729,175 |

| | | | | | 17,875,399 |

| | | | | | |

Beverage & Tobacco–0.64% | | | | | | |

AI Aqua Merger Sub, Inc. | | | | | | |

First Lien Incremental Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 12/13/2023 | | 689 | | 674,278 |

First Lien Incremental Term Loan (1 mo. USD LIBOR + 4.25%) | 5.85% | 12/13/2023 | | 202 | | 200,325 |

First Lien Incremental Term Loan (3 mo. USD LIBOR + 4.25%)(f) | 6.16% | 12/13/2023 | | 707 | | 699,663 |

First Lien Term Loan B-1 (1 mo. USD LIBOR + 3.25%) | 4.85% | 12/13/2023 | | 1,910 | | 1,873,943 |

| | | | | | |

| | | | | | 3,448,209 |

| | | | | | |

Building & Development–1.80% | | | | | | |

ACProducts, Inc., Term Loan B (e) | – | 02/14/2025 | | 289 | | 292,807 |

Advanced Drainage Systems, Inc., Term Loan (3 mo. USD LIBOR + 2.25%) | 3.94% | 09/30/2026 | | 544 | | 542,368 |

| | | | | | |

American Builders & Contractors Supply Co., Inc., Term Loan (1 mo. USD LIBOR + 2.00%) | 3.60% | 01/15/2027 | | 2,059 | | 2,041,949 |

| | | | | | |

Apcoa Parking Holdings GmbH (Germany), Term Loan B (e) | – | 03/20/2024 | EUR | 283 | | 310,487 |

Beacon Roofing Supply, Inc., Term Loan B (1 mo. USD LIBOR + 2.25%) | 3.85% | 01/02/2025 | | 12 | | 11,278 |

DiversiTech Holdings, Inc., Second Lien Term Loan (3 mo. USD LIBOR + 7.50%)(f) | 9.44% | 06/02/2025 | | 52 | | 49,929 |

Financiere Persea (Proxiserve) (France), Term Loan B (6 mo. EURIBOR + 3.75%) | 3.75% | 03/26/2026 | EUR | 170 | | 188,983 |

Foncia Groupe SAS (France), Term Loan B-3 (3 mo. EURIBOR + 3.00%) | 3.25% | 09/07/2023 | EUR | 377 | | 413,662 |

Neptune Bidco S.a r.l. (Luxembourg), Term Loan B (e) | – | 02/05/2027 | EUR | 356 | | 392,611 |

Quikrete Holdings, Inc., First Lien Term Loan (e) | – | 02/01/2027 | | 703 | | 692,390 |

Quimper AB (Sweden) | | | | | | |

Second Lien Term Loan (6 mo. EURIBOR + 8.25%)(f) | 8.25% | 02/15/2027 | EUR | 309 | | 341,478 |

Term Loan B-1 (2 mo. EURIBOR + 4.25%) | 4.25% | 02/13/2026 | EUR | 782 | | 860,248 |

| | | | | | |

Re/Max LLC, Term Loan (1 mo. USD LIBOR + 2.75%) | 4.35% | 12/15/2023 | | 2,292 | | 2,280,366 |

Realogy Group LLC, Term Loan (1 mo. USD LIBOR + 2.25%) | 3.90% | 02/08/2025 | | 243 | | 234,169 |

Werner FinCo L.P., Term Loan (3 mo. USD LIBOR + 4.00%) | 5.60% | 07/24/2024 | | 1,046 | | 1,030,128 |

| | | | | | |

| | | | | | 9,682,853 |

Business Equipment & Services–7.55% | | | | | | |

Alorica, Inc., Term Loan B (1 mo. USD LIBOR + 4.75%) | 9.50% | 06/30/2022 | | 1,115 | | 979,761 |

Asurion LLC, Term Loan B-6 (1 mo. USD LIBOR + 3.00%) | 4.60% | 11/03/2023 | | 248 | | 246,716 |

| | | | | | |

Blackhawk Network Holdings, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 7.00%) | 8.69% | 06/15/2026 | | 236 | | 235,782 |

| | | | | | |

Blucora, Inc., Term Loan (2 mo. USD LIBOR + 3.00%) | 4.76% | 05/22/2024 | | 715 | | 709,516 |

Brightview Landscapes LLC, Term Loan (1 mo. USD LIBOR + 2.50%) | 4.13% | 08/15/2025 | | 706 | | 700,832 |

| | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

9Invesco Senior Loan Fund

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Business Equipment & Services–(continued) | | | | | | |

Camelot Finance L.P., Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 10/31/2026 | $ | 805 | $ | 803,359 |

Cast & Crew Payroll LLC, First Lien Term Loan (1 mo. USD LIBOR + 4.00%) | 5.36% | 02/09/2026 | | 435 | | 430,514 |

Checkout Holding Corp. | | | | | | |

PIK Term Loan, 9.50% PIK Rate, 2.00% Cash Rate (g) | 9.50% | 08/15/2023 | | 455 | | 175,276 |

Term Loan (1 mo. USD LIBOR + 7.50%) | 9.13% | 02/15/2023 | | 340 | | 261,406 |

CRCI Longhorn Holdings, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 7.25%) | 8.90% | 08/10/2026 | | 72 | | 70,412 |

Crossmark Holdings, Inc., Term Loan (3 mo. USD LIBOR + 10.00%) | 11.94% | 07/26/2023 | | 301 | | 277,071 |

| | | | | | |

Dream Secured Bondco AB (Sweden), Term Loan B-1-F (3 mo. EURIBOR + 3.50%) | 3.50% | 10/21/2022 | EUR | 277 | | 307,036 |

Dun & Bradstreet Corp. (The), Term Loan (1 mo. USD LIBOR + 4.00%) | 5.61% | 02/06/2026 | | 272 | | 273,005 |

FleetCor Technologies Operating Co. LLC, Term Loan B-3 (1 mo. USD LIBOR + 2.00%) | 3.35% | 08/02/2024 | | 527 | | 528,554 |

| | | | | | |

Garda World Security Corp. (Canada), Term Loan (3 mo. USD LIBOR + 4.75%) | 6.39% | 10/30/2026 | | 570 | | 569,282 |

| | | | | | |

GI Revelation Acquisition LLC | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 5.00%) | 6.60% | 04/16/2025 | | 735 | | 702,286 |

Second Lien Term Loan (1 mo. USD LIBOR + 9.00%) | 10.60% | 04/16/2026 | | 375 | | 341,213 |

| | | | | | |

GlobalLogic Holdings, Inc., Term Loan (1 mo. USD LIBOR + 2.75%) | 4.35% | 08/01/2025 | | 3 | | 3,193 |

Holding Socotec (France), Term Loan B-4 (1 wk. EURIBOR + 4.00%) | 4.00% | 07/29/2024 | EUR | 346 | | 380,782 |

I-Logic Technologies Bidco Ltd. (United Kingdom), Term Loan (3 mo. EURIBOR + 2.75%) | 3.75% | 12/21/2024 | EUR | 169 | | 187,737 |

| | | | | | |

INDIGOCYAN Midco Ltd. (Jersey), Term Loan B (3 mo. GBP LIBOR + 5.00%) | 5.67% | 06/23/2024 | GBP | 440 | | 535,537 |

Institutional Shareholder Services, Inc. | | | | | | |

First Lien Term Loan (3 mo. USD LIBOR + 4.50%) | | | | | | |

(Acquired 03/05/2019; Cost $1,019,785)(f) | 6.44% | 03/05/2026 | | 1,029 | | 1,013,496 |

Second Lien Term Loan (3 mo. USD LIBOR + 8.50%) | | | | | | |

(Acquired 03/05/2019; Cost $679,966)(f) | 10.44% | 03/05/2027 | | 701 | | 672,956 |

ION Trading Technologies S.a.r.l. (Luxembourg), Term Loan (6 mo. USD LIBOR + 4.00%) | 6.06% | 11/21/2024 | | 597 | | 572,716 |

| | | | | | |

Iron Mountain, Inc., Term Loan B (1 mo. USD LIBOR + 1.75%) | 3.35% | 01/02/2026 | | 796 | | 778,376 |

KAR Auction Services, Inc., Term Loan B-6 (3 mo. USD LIBOR + 2.50%) | 3.94% | 09/15/2026 | | 1,073 | | 1,066,097 |

Karman Buyer Corp. | | | | | | |

First Lien Term Loan (3 mo. USD LIBOR + 3.25%) | 4.85% | 07/23/2021 | | 612 | | 593,839 |

First Lien Term Loan B-2 (3 mo. USD LIBOR + 3.25%) | 4.85% | 07/25/2021 | | 430 | | 416,600 |

KBR, Inc., Term Loan B (1 mo. USD LIBOR + 2.75%) | 4.35% | 02/05/2027 | | 1,489 | | 1,483,893 |

| | | | | | |

Monitronics International, Inc. | | | | | | |

First Lien Term Loan (3 mo. USD LIBOR + 6.50%) | 8.10% | 03/29/2024 | | 2,908 | | 2,413,975 |

Term Loan (1 mo. USD LIBOR + 5.00%) | 6.61% | 07/03/2024 | | 3,005 | | 3,035,294 |

Outfront Media Capital LLC, Term Loan (1 mo. USD LIBOR + 1.75%) | 3.40% | 11/18/2026 | | 1,656 | | 1,647,348 |

| | | | | | |

Prime Secuirty Services Borrower LLC, Term Loan B-1 (3 mo. USD LIBOR + 3.25%) | 4.91% | 09/23/2026 | | 1,759 | | 1,717,658 |

Prometric Holdings, Inc., Term Loan (1 mo. USD LIBOR + 3.00%) | 4.61% | 01/29/2025 | | 195 | | 190,040 |

Refinitiv US Holdings, Inc., Term Loan (3 mo. USD LIBOR + 3.25%) | 4.85% | 10/01/2025 | | 285 | | 284,779 |

| | | | | | |

ServiceMaster Co. (The), Term Loan B (1 mo. USD LIBOR + 1.75%) | 3.38% | 10/30/2026 | | 647 | | 643,305 |

SMS Systems Maintenance Services, Inc., First Lien Term Loan (1 mo. USD LIBOR + 5.00%) | 6.60% | 10/30/2023 | | 1,352 | | 1,070,070 |

Speedster Bidco GmbH (Germany), Term Loan B (e) | – | 02/12/2027 | EUR | 790 | | 861,394 |

Spin Holdco, Inc., First Lien Term Loan B-1 (3 mo. USD LIBOR + 3.25%) | 5.09% | 11/14/2022 | | 3,944 | | 3,890,988 |

| | | | | | |

Techem GmbH (Germany), Term Loan B-4 (e) | – | 07/15/2025 | EUR | 133 | | 146,641 |

Trans Union LLC, Term Loan B-5 (1 mo. USD LIBOR + 1.75%) | 3.35% | 11/16/2026 | | 1,951 | | 1,938,581 |

Ventia Deco LLC, Term Loan B (3 mo. USD LIBOR + 3.50%)(f) | 5.44% | 05/21/2026 | | 1,293 | | 1,294,641 |

Verra Mobility Corp., First Lien Term Loan (e) | – | 02/28/2025 | | 228 | | 225,928 |

Wash MultiFamily Acquisition, Inc. | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 05/14/2022 | | 882 | | 874,081 |

First Lien Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 05/16/2022 | | 120 | | 119,172 |

| | | | | | |

West Corp. | | | | | | |

Incremental Term Loan B-1 (1 mo. USD LIBOR + 3.50%) | 5.10% | 10/10/2024 | | 1,508 | | 1,194,862 |

Term Loan B (1 mo. USD LIBOR + 4.00%) | 5.60% | 10/10/2024 | | 1,508 | | 1,208,046 |

| | | | | | |

WEX, Inc., Term Loan B-3 (1 mo. USD LIBOR + 2.25%) | 3.85% | 05/17/2026 | | 1,857 | | 1,841,031 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Business Equipment & Services–(continued) | | | | | | |

WowMidco S.A.S. (France), Term Loan B (2 mo. EURIBOR + 3.50%) | 3.50% | 11/19/2026 | EUR | 604 | $ | 665,823 |

| | | | | | 40,580,900 |

| | | | | | |

Cable & Satellite Television–4.90% | | | | | | |

Altice Financing S.A. (Luxembourg), Term Loan (1 mo. USD LIBOR + 2.75%) | 4.41% | 07/15/2025 | $ | 616 | | 596,977 |

Atlantic Broadband Finance LLC, Term Loan B (1 mo. USD LIBOR + 2.00%) | 3.60% | 01/03/2025 | | 3,851 | | 3,793,577 |

| | | | | | |

Charter Communications Operating LLC | | | | | | |

Term Loan B-1 (1 mo. USD LIBOR + 1.75%) | 3.36% | 04/30/2025 | | 95 | | 94,738 |

Term Loan B-2 (1 mo. USD LIBOR + 1.75%) | 3.36% | 02/01/2027 | | 356 | | 351,611 |

| | | | | | |

CSC Holdings LLC | | | | | | |

Incremental Term Loan (1 mo. USD LIBOR + 2.25%) | 3.91% | 01/15/2026 | | 585 | | 577,757 |

Term Loan (1 mo. USD LIBOR + 2.25%) | 3.91% | 07/17/2025 | | 1,027 | | 1,017,839 |

| | | | | | |

Term Loan (1 mo. USD LIBOR + 2.50%) | 4.16% | 04/15/2027 | | 779 | | 771,786 |

| | | | | | |

ION Media Networks, Inc., Term Loan B-4 (1 mo. USD LIBOR + 3.00%) | 4.63% | 12/18/2024 | | 1,038 | | 1,028,164 |

Numericable-SFR S.A. (France), Incremental Term Loan B-13 (1 mo. USD LIBOR + 4.00%) | 5.66% | 08/14/2026 | | 1,331 | | 1,307,764 |

Telenet Financing USD LLC, Term Loan AR (e) | – | 08/15/2026 | | 3,394 | | 3,302,599 |

UPC Financing Partnership | | | | | | |

Term Loan AT (1 mo. USD LIBOR + 2.25%) | 3.91% | 04/30/2028 | | 921 | | 918,959 |

Term Loan AU (e) | – | 04/30/2029 | EUR | 246 | | 270,184 |

Virgin Media Bristol LLC (United Kingdom) | | | | | | |

Term Loan (3 mo. EURIBOR + 2.50%) | 2.50% | 01/15/2029 | EUR | 446 | | 490,187 |

Term Loan N (1 mo. USD LIBOR + 2.50%) | 4.16% | 01/31/2028 | | 7,466 | | 7,359,736 |

| | | | | | |

Ziggo Secured Finance Partnership | | | | | | |

Term Loan H (4 mo. EURIBOR + 3.00%) | 3.00% | 01/15/2029 | EUR | 765 | | 829,204 |

Term Loan I (1 mo. USD LIBOR + 2.50%) | 4.16% | 04/15/2025 | | 3,752 | | 3,648,854 |

| | | | | | |

| | | | | | 26,359,936 |

Chemicals & Plastics–3.07% | | | | | | |

Ascend Performance Materials Operations LLC, Term Loan B (3 mo. USD LIBOR + 5.25%)(f) | 7.19% | 08/27/2026 | | 2,436 | | 2,432,799 |

Cabot Microelectronics Corp., Term Loan B-1 (1 mo. USD LIBOR + 2.00%) | 3.63% | 11/17/2025 | | 750 | | 748,359 |

Charter NEX US, Inc. | | | | | | |

First Lien Incremental Term Loan (1 mo. USD LIBOR + 3.50%) | 5.10% | 05/16/2024 | | 328 | | 325,098 |

First Lien Term Loan (1 mo. USD LIBOR + 3.00%) | 4.60% | 05/16/2024 | | 79 | | 77,473 |

Ferro Corp. | | | | | | |

Term Loan B-2 (3 mo. USD LIBOR + 2.25%) | 4.19% | 02/14/2024 | | 122 | | 119,087 |

Term Loan B-3 (3 mo. USD LIBOR + 2.25%) | 4.19% | 02/14/2024 | | 119 | | 116,553 |

H.B. Fuller Co., Term Loan (1 mo. USD LIBOR + 2.00%) | 3.65% | 10/20/2024 | | 92 | | 91,241 |

Hexion International Holdings B.V. (Netherlands), Term Loan B (3 mo. EURIBOR + 4.00%) | 4.00% | 07/01/2026 | EUR | 245 | | 267,757 |

| | | | | | |

Ineos US Finance LLC, Term Loan (2 mo. USD LIBOR + 2.00%) | 3.60% | 03/31/2024 | | 15 | | 14,429 |

Inovyn Finance PLC (United Kingdom), Term Loan B (e) | – | 02/25/2027 | EUR | 415 | | 458,116 |

Invictus US NewCo LLC | | | | | | |

First Lien Term Loan (2 mo. USD LIBOR + 3.00%) | 4.78% | 03/28/2025 | | 586 | | 555,891 |

Second Lien Term Loan (2 mo. USD LIBOR + 6.75%) | 8.53% | 03/30/2026 | | 379 | | 346,347 |

KPEX Holdings, Inc. | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 7.00%) | 8.60% | 01/31/2026 | | 149 | | 119,745 |

Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 01/31/2025 | | 342 | | 312,787 |

Messer Industries USA, Inc., Term Loan B-1 (3 mo. USD LIBOR + 2.50%) | 4.44% | 03/02/2026 | | 4,264 | | 4,202,566 |

Natgasoline LLC, Term Loan (3 mo. USD LIBOR + 3.50%)(f) | 5.28% | 11/14/2025 | | 650 | | 648,121 |

Oxea Corp., Term Loan B-2 (1 mo. USD LIBOR + 3.50%) | 5.19% | 10/14/2024 | | 1,135 | | 1,129,063 |

| | | | | | |

Perstorp Holding AB (Sweden) | | | | | | |

Term Loan B (3 mo. EURIBOR + 4.75%) | 4.75% | 02/27/2026 | EUR | 147 | | 154,263 |

Term Loan B (1 mo. USD LIBOR + 4.75%) | 6.69% | 02/27/2026 | | 410 | | 380,888 |

| | | | | | |

PQ Corp., Term Loan B-1 (e) | – | 02/07/2027 | | 409 | | 403,603 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Chemicals & Plastics–(continued) | | | | | | |

Starfruit US Holdco LLC, Term Loan (1 mo. USD LIBOR + 3.00%) | 4.67% | 10/01/2025 | $ | 2,492 | $ | 2,417,395 |

Tata Chemicals North America, Inc., Term Loan (3 mo. USD LIBOR + 2.75%)(f) | 4.44% | 08/07/2020 | | 902 | | 902,264 |

Univar, Inc., Term Loan B-5 (1 mo. USD LIBOR + 2.00%) | 3.60% | 07/01/2026 | | 294 | | 291,344 |

| | | | | | |

| | | | | | 16,515,189 |

Clothing & Textiles–0.27% | | | | | | |

ABG Intermediate Holdings 2 LLC, First Lien Term Loan (1 mo. USD LIBOR + 3.50%) | 5.10% | 09/27/2024 | | 98 | | 96,889 |

International Textile Group, Inc., First Lien Term Loan (1 mo. USD LIBOR + 5.00%) | 6.66% | 05/01/2024 | | 226 | | 180,829 |

Kontoor Brands, Inc., Term Loan B (3 mo. USD LIBOR + 4.25%) | 5.89% | 05/15/2026 | | 354 | | 353,133 |

| | | | | | |

Mascot Bidco OYJ (Finland), Term Loan B (6 mo. EURIBOR + 4.50%) | 4.50% | 03/30/2026 | EUR | 724 | | 775,439 |

Tumi, Inc., Term Loan B (1 mo. USD LIBOR + 1.75%) | 3.35% | 04/25/2025 | | 29 | | 27,495 |

| | | | | | 1,433,785 |

| | | | | | |

Conglomerates–0.57% | | | | | | |

APi Group DE, Inc., Term Loan (3 mo. USD LIBOR + 2.50%) | 4.10% | 09/30/2026 | | 1,788 | | 1,772,765 |

| | | | | | |

CTC AcquiCo GmbH (Germany), Term Loan B-1 (3 mo. EURIBOR + 2.50%) | 2.50% | 03/07/2025 | EUR | 426 | | 461,734 |

Safe Fleet Holdings LLC | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.00%) | 4.66% | 02/03/2025 | | 382 | | 367,695 |

First Lien Term Loan B-1 (1 mo. USD LIBOR + 3.75%) | 5.41% | 02/03/2025 | | 262 | | 256,461 |

Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | 8.41% | 02/02/2026 | | 193 | | 187,153 |

| | | | | | 3,045,808 |

| | | | | | |

Containers & Glass Products–3.26% | | | | | | |

Berlin Packaging LLC | | | | | | |

Term Loan (1 mo. USD LIBOR + 3.00%) | 4.95% | 11/07/2025 | | 89 | | 85,316 |

Term Loan B-1 (3 mo. USD LIBOR + 3.00%) | 4.95% | 11/07/2025 | | 652 | | 622,203 |

Berry Global, Inc. | | | | | | |

Term Loan W (3 mo. USD LIBOR + 2.00%) | 3.67% | 10/01/2022 | | 638 | | 631,809 |

Term Loan Y (1 mo. USD LIBOR + 2.00%) | 3.67% | 07/01/2026 | | 7,407 | | 7,300,494 |

BWAY Holding Co., Term Loan (3 mo. USD LIBOR + 3.25%) | 5.08% | 04/03/2024 | | 182 | | 174,703 |

| | | | | | |

Consolidated Container Co. LLC, Incremental Term Loan (1 mo. USD LIBOR + 3.00%) | 4.60% | 06/14/2026 | | 821 | | 816,653 |

| | | | | | |

Duran Group (Germany), Term Loan B-2 (3 mo. USD LIBOR + 4.25%)(f) | 6.12% | 03/21/2024 | | 2,515 | | 2,436,309 |

Flex Acquisition Co., Inc. | | | | | | |

Incremental Term Loan B (3 mo. USD LIBOR + 3.25%) | 5.16% | 06/29/2025 | | 2,231 | | 2,140,639 |

Term Loan (3 mo. USD LIBOR + 3.00%) | 4.91% | 12/29/2023 | | 21 | | 19,887 |

Fort Dearborn Holding Co., Inc. | | | | | | |

First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | 5.91% | 10/19/2023 | | 705 | | 666,682 |

Second Lien Term Loan (3 mo. USD LIBOR + 8.50%)(f) | 10.41% | 10/21/2024 | | 166 | | 151,699 |

Hoffmaster Group, Inc., First Lien Term Loan B-1 (3 mo. USD LIBOR + 4.00%) | 5.60% | 11/21/2023 | | 657 | | 643,940 |

Keter Group B.V. (Netherlands) | | | | | | |

Term Loan B-1 (1 mo. EURIBOR + 4.25%) | 5.25% | 10/31/2023 | EUR | 292 | | 287,911 |

Term Loan B-3 (1 mo. EURIBOR + 4.25%) | 5.25% | 10/31/2023 | EUR | 280 | | 276,783 |

Klockner Pentaplast of America, Inc. | | | | | | |

Term Loan (3 mo. EURIBOR + 4.75%) | 4.75% | 06/30/2022 | EUR | 302 | | 283,696 |

Term Loan (1 mo. USD LIBOR + 4.25%) | 6.01% | 06/30/2022 | | 303 | | 265,516 |

Refresco Group N.V. (Netherlands), Term Loan B-1 (3 mo. EURIBOR + 3.25%) | 3.25% | 03/28/2025 | EUR | 145 | | 159,686 |

Trident TPI Holdings, Inc. | | | | | | |

Term Loan B-1 (1 mo. USD LIBOR + 3.25%) | 4.60% | 10/17/2024 | | 424 | | 410,468 |

Term Loan B-2 (3 mo. EURIBOR + 3.50%) | 3.25% | 10/17/2024 | EUR | 155 | | 165,396 |

| | | | | | 17,539,790 |

| | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Cosmetics & Toiletries–1.22% | | | | | | |

Alphabet Holding Co., Inc. | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.50%) | 5.10% | 09/26/2024 | $ | 1,990 | $ | 1,908,379 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | 9.35% | 09/26/2025 | | 812 | | 729,644 |

| | | | | | |

Anastasia Parent LLC, Term Loan (1 mo. USD LIBOR + 3.75%) | 5.35% | 08/11/2025 | | 471 | | 369,175 |

| | | | | | |

Coty, Inc., Term Loan B (1 mo. USD LIBOR + 2.25%) | 3.92% | 04/07/2025 | | 3,316 | | 3,250,244 |

Rodenstock GmbH (Germany), Term Loan B (3 mo. EURIBOR + 5.25%) | 5.25% | 06/05/2026 | EUR | 294 | | 324,108 |

| | | | | | |

| | | | | | 6,581,550 |

Drugs–1.92% | | | | | | |

Catalent Pharma Solutions, Inc., Term Loan B-2 (1 mo. USD LIBOR + 2.25%) | 3.85% | 05/17/2026 | | 1,260 | | 1,246,213 |

Endo LLC, Term Loan (1 mo. USD LIBOR + 4.25%) | 5.88% | 04/29/2024 | | 2,317 | | 2,223,490 |

Grifols Worldwide Operations USA, Inc., Term Loan B (1 mo. USD LIBOR + 2.00%) | 3.58% | 11/15/2027 | | 777 | | 771,565 |

| | | | | | |

Valeant Pharmaceuticals International, Inc. (Canada) | | | | | | |

First Lien Incremental Term Loan (1 mo. USD LIBOR + 2.75%) | 4.41% | 11/27/2025 | | 2,734 | | 2,724,332 |

Term Loan (1 mo. USD LIBOR + 3.00%) | 4.66% | 06/02/2025 | | 3,386 | | 3,372,092 |

| | | | | | |

| | | | | | 10,337,692 |

Ecological Services & Equipment–0.61% | | | | | | |

Advanced Disposal Services, Inc., Term Loan (1 wk. USD LIBOR + 2.25%) | 3.83% | 11/10/2023 | | 485 | | 484,288 |

EnergySolutions LLC, Term Loan (3 mo. USD LIBOR + 3.75%) | 5.69% | 05/09/2025 | | 696 | | 654,722 |

GFL Environmental, Inc. (Canada), Incremental Term Loan (1 mo. USD LIBOR + 3.00%) | 4.60% | 05/30/2025 | | 1,008 | | 991,784 |

| | | | | | |

Patriot Container Corp. | | | | | | |

First Lien Term Loan (e) | – | 03/20/2025 | | 127 | | 126,533 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%)(f) | 9.35% | 03/20/2026 | | 105 | | 98,183 |

Tunnel Hill Partners L.P., Term Loan (1 mo. USD LIBOR + 3.50%) | 5.15% | 02/06/2026 | | 622 | | 616,027 |

| | | | | | |

US Ecology, Inc., Term Loan (1 mo. USD LIBOR + 2.50%) | 4.10% | 08/14/2026 | | 293 | | 294,777 |

| | | | | | 3,266,314 |

| | | | | | |

Electronics & Electrical–11.64% | | | | | | |

Applied Systems, Inc., Second Lien Term Loan (3 mo. USD LIBOR + 7.00%) | 8.94% | 09/19/2025 | | 58 | | 59,197 |

| | | | | | |

Boxer Parent Co., Inc. | | | | | | |

Term Loan (3 mo. EURIBOR + 4.75%) | 4.75% | 10/02/2025 | EUR | 128 | | 142,171 |

Term Loan (1 mo. USD LIBOR + 4.25%) | 5.85% | 10/02/2025 | | 439 | | 422,820 |

Brave Parent Holdings, Inc., First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | 5.78% | 04/18/2025 | | 354 | | 349,076 |

| | | | | | |

Cision Ltd.,Term Loan (1 mo. USD LIBOR + 3.75%) | 3.75% | 01/29/2027 | EUR | 379 | | 413,505 |

CommScope, Inc., Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 04/06/2026 | | 3,128 | | 3,085,209 |

Dell International LLC, Term Loan B-1 (1 mo. USD LIBOR + 2.00%) | 3.61% | 09/19/2025 | | 1,019 | | 1,009,157 |

| | | | | | |

Diebold Nixdorf, Inc. | | | | | | |

Term Loan A (1 mo. USD LIBOR + 4.75%) | 6.44% | 04/30/2022 | | 333 | | 328,493 |

Term Loan A-1 (1 mo. USD LIBOR + 9.25%) | 10.88% | 08/31/2022 | | 2,008 | | 2,109,817 |

| | | | | | |

Term Loan B (1 mo. EURIBOR + 3.00%) | 3.00% | 11/06/2023 | EUR | 463 | | 487,260 |

| | | | | | |

Term Loan B (1 mo. USD LIBOR + 2.75%) | 4.44% | 11/06/2023 | | 1,526 | | 1,437,885 |

Energizer Holdings, Inc., Term Loan B (1 mo. USD LIBOR + 2.25%) | 3.94% | 12/17/2025 | | 800 | | 799,541 |

ETA Australia Holdings III Pty. Ltd. (Australia), First Lien Term Loan (1 mo. USD LIBOR + | | | | | | |

4.00%) | 5.60% | 05/06/2026 | | 919 | | 916,217 |

Finastra USA, Inc. (United Kingdom) | | | | | | |

First Lien Term Loan (3 mo. EURIBOR + 3.00%) | 4.00% | 06/13/2024 | EUR | 877 | | 968,977 |

First Lien Term Loan (3 mo. USD LIBOR + 3.50%) | 5.28% | 06/13/2024 | | 1 | | 600 |

Go Daddy Operating Co. LLC, Term Loan B-2 (1 mo. USD LIBOR + 2.00%) | 3.35% | 02/15/2024 | | 2,114 | | 2,087,394 |

Hyland Software, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 7.00%) | 8.60% | 07/07/2025 | | 234 | | 235,528 |

| | | | | | |

IGT Holding IV AB (Sweden) | | | | | | |

Term Loan B (e) | – | 07/26/2024 | EUR | 281 | | 310,563 |

Term Loan B (3 mo. USD LIBOR + 3.50%) | 5.95% | 07/29/2024 | | 1,040 | | 1,025,566 |

| | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Electronics & Electrical–(continued) | | | | | | |

Imperva, Inc. | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | 9.44% | 01/10/2027 | $ | 562 | $ | 520,130 |

Term Loan (1 mo. USD LIBOR + 4.00%) | 5.70% | 01/10/2026 | | 48 | | 46,629 |

| | | | | | |

Informatica Corp. | | | | | | |

Term Loan (e) | – | 02/26/2027 | EUR | 540 | | 595,242 |

Term Loan (e) | – | 02/26/2027 | | 710 | | 697,241 |

ION Corp. | | | | | | |

Term Loan (1 mo. EURIBOR + 4.25%) | 4.25% | 10/24/2025 | EUR | 684 | | 752,217 |

Term Loan (3 mo. USD LIBOR + 4.25%) | 5.85% | 10/24/2025 | | 355 | | 354,920 |

MA Finance Co. LLC, Term Loan B-2 (1 mo. USD LIBOR + 2.25%) | 3.85% | 11/19/2021 | | 45 | | 44,408 |

| | | | | | |

Marcel Bidco LLC, Term Loan B-1 (1 mo. USD LIBOR + 3.25%) | 4.85% | 03/11/2025 | | 241 | | 236,976 |

Mavenir Systems, Inc., Term Loan (3 mo. USD LIBOR + 6.00%) | 7.68% | 05/08/2025 | | 1,597 | | 1,600,777 |

McAfee LLC, Term Loan B (3 mo. EURIBOR + 3.50%) | 3.50% | 09/30/2024 | EUR | 888 | | 962,870 |

| | | | | | |

Mirion Technologies, Inc., Term Loan (3 mo. USD LIBOR + 4.00%) | 5.94% | 03/06/2026 | | 943 | | 936,720 |

| | | | | | |

MTS Systems, Term Loan B (1 mo. USD LIBOR + 3.25%) | 4.86% | 07/05/2023 | | 247 | | 246,904 |

Natel Engineering Co., Inc., Term Loan (1 mo. USD LIBOR + 5.00%) | | | | | | |

(Acquired 04/25/2019; Cost $1,405,237) | 6.60% | 04/30/2026 | | 1,418 | | 1,361,502 |

NCR Corp., Term Loan B (1 mo. USD LIBOR + 2.50%) | 4.11% | 08/28/2026 | | 1,473 | | 1,469,490 |

Neustar, Inc. | | | | | | |

Term Loan B-4 (1 mo. USD LIBOR + 3.50%) | 5.10% | 08/08/2024 | | 1,863 | | 1,704,441 |

Term Loan B-5 (1 mo. USD LIBOR + 4.50%) | 6.10% | 08/08/2024 | | 634 | | 615,847 |

| | | | | | |

Oberthur Technologies of America Corp., Term Loan B (3 mo. EURIBOR + 3.75%) | 3.75% | 01/10/2024 | EUR | 1,000 | | 1,086,999 |

Omnitracs, Inc., Term Loan (3 mo. USD LIBOR + 2.75%) | 4.68% | 03/23/2025 | | 1,290 | | 1,285,309 |

ON Semiconductor Corp., Term Loan B-4 (3 mo. USD LIBOR + 2.00%) | 3.60% | 09/19/2026 | | 1,924 | | 1,905,782 |

| | | | | | |

Open Text Corp. (Canada), Term Loan (1 mo. USD LIBOR + 1.75%) | 3.35% | 05/30/2025 | | 48 | | 48,377 |

Optiv, Inc. | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 7.25%) | 8.85% | 02/01/2025 | | 417 | | 268,848 |

Term Loan (1 mo. USD LIBOR + 3.25%) | 4.85% | 02/01/2024 | | 1,810 | | 1,562,560 |

Plantronics, Inc., Term Loan B (1 mo. USD LIBOR + 2.50%) | 4.10% | 07/02/2025 | | 1,936 | | 1,784,748 |

Project Accelerate Parent LLC, First Lien Term Loan (1 mo. USD LIBOR + 4.25%) | 5.89% | 01/02/2025 | | 1,226 | | 1,219,597 |

| | | | | | |

Project Leopard Holdings, Inc. | | | | | | |

Incremental Term Loan (6 mo. USD LIBOR + 4.25%) | 5.85% | 07/07/2023 | | 625 | | 622,930 |

Term Loan (6 mo. USD LIBOR + 4.50%) | 6.10% | 07/07/2023 | | 522 | | 519,952 |

Quest Software US Holdings, Inc., First Lien Term Loan (3 mo. USD LIBOR + 4.25%) | 6.03% | 05/16/2025 | | 3,839 | | 3,757,490 |

| | | | | | |

Renaissance Holding Corp., Second Lien Term Loan (1 mo. USD LIBOR + 7.00%) | 8.60% | 05/29/2026 | | 242 | | 235,107 |

Riverbed Technology, Inc., Term Loan (1 mo. USD LIBOR + 3.25%) | 4.86% | 04/24/2022 | | 3,247 | | 2,964,026 |

Sandvine Corp. | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 4.50%) | 6.10% | 11/02/2025 | | 1,181 | | 1,182,888 |

Second Lien Term Loan (1 mo. USD LIBOR + 8.00%) | | | | | | |

(Acquired 10/31/2018; Cost $176,538)(f) | 9.60% | 11/02/2026 | | 180 | | 173,481 |

Science Applications International Corp., Term Loan B (1 mo. USD LIBOR + 1.75%) | 3.35% | 10/31/2025 | | 1,084 | | 1,076,124 |

| | | | | | |

Sophos (Surf Holdings LLC) (United Kingdom) | | | | | | |

Term Loan (e) | – | 01/15/2027 | EUR | 90 | | 99,226 |

Term Loan (e) | – | 03/05/2027 | | 477 | | 470,341 |

SS&C Technologies, Inc. | | | | | | |

Term Loan B-3 (1 mo. USD LIBOR + 1.75%) | 3.40% | 04/16/2025 | | 1,793 | | 1,773,817 |

Term Loan B-4 (1 mo. USD LIBOR + 1.75%) | 3.40% | 04/16/2025 | | 1,279 | | 1,265,740 |

| | | | | | |

Term Loan B-5 (1 mo. USD LIBOR + 2.25%) | 3.35% | 04/16/2025 | | 2,973 | | 2,944,477 |

| | | | | | |

STG-Fairway Acquisitions, Inc., Term Loan B (e) | – | 01/22/2027 | | 451 | | 450,027 |

Sybil Software LLC, Term Loan (3 mo. USD LIBOR + 2.25%) | 4.19% | 09/29/2023 | | 1,144 | | 1,143,056 |

TIBCO Software, Inc. | | | | | | |

Term Loan B-2 (e) | – | 06/30/2026 | | 1,171 | | 1,160,979 |

Term Loan B-3 (e) | – | 06/30/2026 | | 163 | | 161,922 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Electronics & Electrical–(continued) | | | | | | |

TTM Technologies, Inc., Term Loan B (1 mo. USD LIBOR + 2.50%) | 4.16% | 09/28/2024 | $ | 1,520 | $ | 1,504,963 |

Ultimate Software Group, Inc., First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | 5.35% | 05/04/2026 | | 2,512 | | 2,508,797 |

Veritas US, Inc., Term Loan (3 mo. EURIBOR + 4.50%) | 5.50% | 01/27/2023 | EUR | 98 | | 104,313 |

| | | | | | |

VS Buyer LLC, Term Loan (e) | – | 02/19/2027 | | 197 | | 195,794 |

Xperi Corp., Term Loan B-1 (1 mo. USD LIBOR + 2.50%) | 4.10% | 12/01/2023 | | 787 | | 786,725 |

| | | | | | 62,599,685 |

| | | | | | |

Financial Intermediaries–1.20% | | | | | | |

Evergood 4 APS (Denmark) | | | | | | |

Term Loan B-1-E (3 mo. EURIBOR + 3.25%) | 3.25% | 02/06/2025 | EUR | 232 | | 253,914 |

Term Loan B-2 (3 mo. EURIBOR + 3.75%) | 3.75% | 02/06/2025 | EUR | 321 | | 353,918 |

Fiserv Investment Solutions, Inc., Term Loan (1 mo. USD LIBOR + 4.75%) | 6.44% | 02/10/2027 | | 364 | | 366,136 |

| | | | | | |

LPL Holdings, Inc., Term Loan B (1 mo. USD LIBOR + 1.75%) | 3.36% | 11/12/2026 | | 862 | | 862,533 |

| | | | | | |

MoneyGram International, Inc., Term Loan (1 mo. USD LIBOR + 6.00%) | 7.60% | 06/30/2023 | | 2,951 | | 2,808,710 |

RPI Finance Trust, Term Loan B (e) | – | 02/11/2027 | | 1,349 | | 1,343,368 |

SGG Holdings S.A. (Luxembourg), Term Loan B (6 mo. EURIBOR + 3.75%) | 3.75% | 07/18/2025 | EUR | 423 | | 464,023 |

| | | | | | |

Stiphout Finance LLC, Second Lien Term Loan (1 mo. USD LIBOR + 7.25%) | | | | | | |

(Acquired 07/23/2015; Cost $21,796)(f) | 8.85% | 10/26/2023 | | 22 | | 20,763 |

| | | | | | 6,473,365 |

Food Products–4.45% | | | | | | |

Arnott's Biscuits Ltd., Term Loan (3 mo. USD LIBOR + 4.00%) | 5.61% | 12/18/2026 | | 882 | | 882,922 |

| | | | | | |

B&G Foods, Inc., Term Loan B-4 (3 mo. USD LIBOR + 2.50%) | 4.10% | 10/10/2026 | | 376 | | 372,370 |

Biscuit International S.A.S. (De Banketgroep Holding International B.V.) (France), First Lien | | | | | | |

Term Loan (e) | – | 02/05/2027 | EUR | 231 | | 256,012 |

CSM Bakery Supplies LLC, First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | 5.87% | 07/03/2020 | | 1,877 | | 1,829,812 |

Dole Food Co., Inc., Term Loan B (1 mo. USD LIBOR + 2.75%) | 4.35% | 04/06/2024 | | 1,586 | | 1,566,881 |

Froneri International PLC (United Kingdom) | | | | | | |

Second Lien Term Loan (3 mo. EURIBOR + 5.75%) | 5.75% | 01/31/2028 | EUR | 62 | | 70,274 |

Second Lien Term Loan (1 mo. USD LIBOR + 5.75%) | 7.35% | 01/31/2028 | | 441 | | 443,363 |

Term Loan B-1 (3 mo. EURIBOR + 2.63%) | 2.63% | 01/29/2027 | EUR | 958 | | 1,039,150 |

| | | | | | |

Term Loan B-2 (1 mo. USD LIBOR + 2.25%) | 3.85% | 01/29/2027 | | 1,512 | | 1,491,505 |

| | | | | | |

H-Food Holdings LLC | | | | | | |

Incremental Term Loan B-2 (1 mo. USD LIBOR + 4.00%) | 5.60% | 05/23/2025 | | 89 | | 86,832 |

Term Loan (1 mo. USD LIBOR + 3.69%) | 5.29% | 05/23/2025 | | 3,093 | | 3,043,927 |

| | | | | | |

Jacobs Douwe Egberts International B.V., Term Loan B (1 mo. USD LIBOR + 2.00%) | 3.69% | 11/01/2025 | | 728 | | 724,453 |

JBS USA Lux S.A., Term Loan (1 mo. USD LIBOR + 2.50%) | 3.60% | 05/01/2026 | | 6,561 | | 6,475,018 |

Manna Pro Products LLC | | | | | | |

Delayed Draw Term Loan | | | | | | |

(Acquired 05/30/2019; Cost $269,935)(d)(f) | 2.33% | 12/08/2023 | | 272 | | 269,502 |

Incremental Term Loan (1 mo. USD LIBOR + 6.00%) | | | | | | |

(Acquired 05/30/2019; Cost $908,270)(f) | 7.60% | 12/08/2023 | | 916 | | 906,999 |

Mastronardi Produce-USA, Inc., Term Loan (1 mo. USD LIBOR + 2.75%) | 4.35% | 05/01/2025 | | 276 | | 276,588 |

Nomad Foods US LLC (United Kingdom), Term Loan B-4 (1 mo. USD LIBOR + 2.25%) | 3.91% | 05/15/2024 | | 1,164 | | 1,153,648 |

Shearer's Foods LLC | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | 8.35% | 06/30/2022 | | 246 | | 244,488 |

Term Loan (1 mo. USD LIBOR + 4.25%) | 5.85% | 03/31/2022 | | 1,410 | | 1,411,400 |

Sigma Bidco B.V. (Netherlands), Term Loan B-1 (e) | – | 07/02/2025 | EUR | 427 | | 456,104 |

United Natural Foods, Inc., Term Loan B (1 mo. USD LIBOR + 4.25%) | 5.85% | 10/22/2025 | | 1,110 | | 934,251 |

| | | | | | |

| | | | | | 23,935,499 |

| | | | | | |

Food Service–4.00% | | | | | | |

Aramark Services, Inc., Term Loan B-4 (1 mo. USD LIBOR + 1.75%) | 3.35% | 01/15/2027 | | 505 | | 502,266 |

| | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 | Invesco Senior Loan Fund |

| | | | Principal | | |

| Interest | Maturity | | Amount | | |

| Rate | Date | | (000)(a) | | Value |

Food Service–(continued) | | | | | | | |

Carlisle FoodService Products, Inc. | | | | | | | |

Delayed Draw Term Loan (e) | – | 03/20/2025 | | $ | 37 | $ | 35,873 |

Term Loan (1 mo. USD LIBOR + 3.00%) | 4.60% | 03/20/2025 | | | 405 | | 389,990 |

| | | | | | | |

Euro Garages (Netherlands) | | | | | | | |

Term Loan (3 mo. USD LIBOR + 4.00%) | 5.96% | 02/07/2025 | | | 39 | | 37,572 |

Term Loan B (3 mo. EURIBOR + 4.00%) | 4.00% | 02/06/2025 | EUR | | 703 | | 745,534 |

Term Loan B (3 mo. GBP LIBOR + 4.75%) | 5.54% | 02/06/2025 | GBP | | 544 | | 670,942 |

| | | | | | | |

Term Loan B (3 mo. USD LIBOR + 4.00%) | 5.96% | 02/07/2025 | | | 381 | | 371,287 |

Houston Foods, Inc., Term Loan (1 mo. USD LIBOR + 3.75%) | 5.35% | 07/20/2025 | | | 820 | | 805,959 |

New Red Finance, Inc., Term Loan B-4 (1 mo. USD LIBOR + 1.75%) | 3.35% | 11/19/2026 | | | 12,285 | | 12,100,617 |

| | | | | | | |

NPC International, Inc. | | | | | | | |

Second Lien Term Loan (h) | 7.50% | 04/18/2025 | | | 240 | | 6,387 |

Term Loan (3 mo. USD LIBOR + 10.00%) | | | | | | | |

(Acquired 01/21/2020-01/23/2020; Cost $122,989)(f) | 11.64% | 04/17/2020 | | | 66 | | 65,842 |

Restaurant Technologies, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.50%) | 8.10% | 10/01/2026 | | | 442 | | 442,651 |

US Foods, Inc., Term Loan (1 mo. USD LIBOR + 1.75%) | 3.35% | 06/27/2023 | | | 4,303 | | 4,265,664 |

Weight Watchers International, Inc., Term Loan (3 mo. USD LIBOR + 4.75%) | 6.72% | 11/29/2024 | | | 1,072 | | 1,073,205 |

| | | | | | | |

| | | | | | | 21,513,789 |

| | | | | | | |

Health Care–4.66% | | | | | | | |

Acadia Healthcare Co., Inc. | | | | | | | |

Term Loan B-3 (1 mo. USD LIBOR + 2.50%) | 4.10% | 02/11/2022 | | | 656 | | 654,621 |

Term Loan B-4 (1 mo. USD LIBOR + 2.50%) | 4.10% | 02/16/2023 | | | 1,588 | | 1,584,670 |

| | | | | | | |

AI Sirona (Luxembourg) Acquisition S.a.r.l. (Luxembourg), Term Loan B (e) | – | 09/29/2025 | EUR | | 379 | | 417,262 |

athenahealth, Inc., First Lien Term Loan B (1 mo. USD LIBOR + 4.50%) | 6.16% | 02/11/2026 | | | 952 | | 943,230 |

Biogroup-LCD (France) | | | | | | | |

First Lien Term Loan (3 mo. EURIBOR + 3.75%) | 3.75% | 04/25/2026 | EUR | | 197 | | 217,108 |

Term Loan B-7 (2 mo. EURIBOR + 3.75%) | 3.75% | 04/25/2026 | EUR | | 335 | | 370,597 |

Curie Merger Sub LLC (Luxembourg), Term Loan (2 mo. USD LIBOR + 4.25%) | 6.19% | 11/04/2026 | | | 205 | | 205,881 |

| | | | | | | |

Curium BidCo S.a.r.l. (Luxembourg), Term Loan B (3 mo. USD LIBOR + 4.00%) | 5.94% | 06/27/2026 | | | 989 | | 990,787 |

| | | | | | | |

DaVita HealthCare Partners, Inc., Term Loan B-1 (1 mo. USD LIBOR + 1.75%) | 3.35% | 08/12/2026 | | | 1,790 | | 1,774,374 |

Dentalcorp Perfect Smile ULC (Canada) | | | | | | | |

First Lien Term Loan (e) | – | 06/06/2025 | | | 24 | | 23,884 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.50%) | 9.10% | 06/06/2026 | | | 655 | | 642,192 |

Diaverum Holding S.a.r.l. (Sweden), Term Loan B (e) | – | 07/04/2024 | EUR | | 199 | | 218,489 |

Explorer Holdings, Inc., Term Loan (2 mo. USD LIBOR + 4.50%) | 6.23% | 02/04/2027 | | | 1,726 | | 1,719,929 |

| | | | | | | |

EyeCare Partners LLC | | | | | | | |

Delayed Draw Term Loan (d) | 0.00% | 02/05/2027 | | | 13 | | 12,766 |

Term Loan B (e) | – | 02/05/2027 | | | 55 | | 54,711 |

Financiere Mendel (France), Term Loan B (3 mo. EURIBOR + 4.75%) | 4.75% | 04/13/2026 | EUR | | 1,257 | | 1,388,750 |

| | | | | | | |

Global Healthcare Exchange LLC, Term Loan (3 mo. USD LIBOR + 3.25%) | 5.21% | 06/28/2024 | | | 29 | | 28,380 |

GoodRx, Inc., Term Loan (1 mo. USD LIBOR + 2.75%) | 4.35% | 10/10/2025 | | | 314 | | 312,527 |

Greatbatch Ltd., Term Loan B (1 mo. USD LIBOR + 2.50%) | 4.17% | 10/27/2022 | | | 90 | | 89,171 |

| | | | | | | |

HC Group Holdings III, Inc., Term Loan B (1 mo. USD LIBOR + 4.50%) | 6.10% | 08/06/2026 | | | 1,563 | | 1,562,083 |

IQVIA, Inc. | | | | | | | |

Incremental Term Loan B-2 (3 mo. USD LIBOR + 2.00%) | 3.69% | 01/17/2025 | | | 373 | | 370,773 |

Term Loan B-1 (3 mo. USD LIBOR + 1.75%) | 3.69% | 03/07/2024 | | | 53 | | 52,650 |

Term Loan B-3 (3 mo. USD LIBOR + 1.75%) | 3.69% | 06/11/2025 | | | 18 | | 18,023 |

IWH UK Midco Ltd. (United Kingdom), Term Loan B (3 mo. EURIBOR + 4.00%) | 4.00% | 01/31/2025 | EUR | | 918 | | 999,939 |

| | | | | | | |

Nidda Healthcare Holding AG (Germany), Term Loan F (3 mo. EURIBOR + 4.50%) | 5.26% | 08/21/2026 | GBP | | 172 | | 220,742 |

| | | | | | | |

Ortho-Clinical Diagnostics, Inc., Term Loan (3 mo. USD LIBOR + 3.25%) | 4.91% | 06/30/2025 | | | 323 | | 308,845 |

Prophylaxis B.V. (Netherlands), Term Loan B (6 mo. EURIBOR + 4.00%) | 4.00% | 06/05/2025 | EUR | | 1,729 | | 1,486,922 |

Sunshine Luxembourg VII S.a.r.l. (Switzerland), Term Loan (3 mo. USD LIBOR + 4.25%) | 6.19% | 07/23/2026 | | | 2,332 | | 2,297,961 |

| | | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

16 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Health Care–(continued) | | | | | | |

Surgery Center Holdings, Inc., Term Loan (1 mo. USD LIBOR + 3.25%) | 4.86% | 09/02/2024 | $ | 7 | $ | 6,383 |

Synlab Bondco PLC (United Kingdom), First Lien Term Loan (3 mo. EURIBOR + 3.75%) | 3.75% | 07/01/2026 | EUR | 1,011 | | 1,120,519 |

Team Health Holdings, Inc., Term Loan (1 mo. USD LIBOR + 2.75%) | 4.35% | 02/06/2024 | | 742 | | 567,854 |

| | | | | | |

Terveys-ja hoivapalvelut Suomi Oy (Finland) | | | | | | |

First Lien Term Loan B (1 mo. EURIBOR +3.75%) | 3.75% | 08/09/2025 | EUR | 1,042 | | 1,153,844 |

Second Lien Term Loan (3 mo. EURIBOR + 7.25%) | | | | | | |

(Acquired 07/04/2018; Cost $385,096) | 7.25% | 08/09/2026 | EUR | 333 | | 373,461 |

Unilabs Diagnostics AB (Sweden), Revolver Loan (d)(f) | 0.00% | 04/01/2021 | EUR | 769 | | 840,495 |

Upstream Newco, Inc., Term Loan (3 mo. USD LIBOR + 4.50%)(f) | 6.10% | 11/20/2026 | | 300 | | 296,396 |

Verscend Holding Corp., Term Loan B (1 mo. USD LIBOR + 4.50%) | 6.10% | 08/27/2025 | | 1,757 | | 1,753,464 |

| | | | | | |

| | | | | | 25,079,683 |

Home Furnishings–0.86% | | | | | | |

Global Appliance, Inc., Term Loan B (1 mo. USD LIBOR + 4.00%) | 5.61% | 09/29/2024 | | 1,002 | | 977,118 |

Hayward Industries, Inc., First Lien Term Loan (1 mo. USD LIBOR + 3.50%) | 5.10% | 08/05/2024 | | 239 | | 234,789 |

Hilding Anders AB (Sweden), Term Loan B (3 mo. EURIBOR + 5.00%) | 5.00% | 11/30/2024 | EUR | 388 | | 366,253 |

| | | | | | |

Serta Simmons Bedding LLC | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.50%) | 5.16% | 11/08/2023 | | 1,863 | | 1,102,859 |

Second Lien Term Loan (1 mo. USD LIBOR + 8.00%) | 9.63% | 11/08/2024 | | 1,155 | | 336,613 |

| | | | | | |

TGP Holdings III LLC | | | | | | |

First Lien Term Loan (3 mo. USD LIBOR + 4.25%) | 6.03% | 09/25/2024 | | 1,414 | | 1,315,092 |

Second Lien Term Loan (3 mo. USD LIBOR + 8.50%) | 10.28% | 09/25/2025 | | 330 | | 305,197 |

| | | | | | |

| | | | | | 4,637,921 |

Industrial Equipment–2.53% | | | | | | |

Airxcel, Inc., First Lien Term Loan (1 mo. USD LIBOR + 4.50%) | 6.10% | 04/28/2025 | | 237 | | 234,525 |

Alpha AB Bidco B.V. (Netherlands), Term Loan B (e) | – | 07/30/2025 | EUR | 359 | | 388,266 |

Arconic Rolled Products Corp., Term Loan B (e) | – | 02/04/2027 | | 528 | | 523,665 |

Clark Equipment Co., Term Loan (1 mo. USD LIBOR + 1.75%) | 3.69% | 05/18/2024 | | 1,399 | | 1,387,011 |

Columbus McKinnon Corp., Term Loan (3 mo. USD LIBOR + 2.50%) | 4.44% | 01/31/2024 | | 17 | | 17,267 |

Crosby US Acquisition Corp., Term Loan B (1 mo. USD LIBOR + 4.75%) | 6.38% | 06/26/2026 | | 594 | | 586,342 |

| | | | | | |

Delachaux Group S.A. (France), Term Loan B-2 (3 mo. USD LIBOR + 4.50%) | 6.35% | 04/16/2026 | | 343 | | 339,321 |

| | | | | | |

DXP Enterprises, Inc., Term Loan (1 mo. USD LIBOR + 4.75%) | 6.35% | 08/29/2023 | | 59 | | 58,549 |

Engineered Machinery Holdings, Inc. | | | | | | |

First Lien Incremental Term Loan (3 mo. USD LIBOR + 4.25%) | 6.19% | 07/19/2024 | | 411 | | 409,728 |

First Lien Term Loan (3 mo. USD LIBOR + 3.00%) | 4.94% | 07/19/2024 | | 274 | | 266,116 |

Second Lien Term Loan (3 mo. USD LIBOR + 7.25%) | 9.19% | 07/18/2025 | | 577 | | 572,840 |

Gardner Denver, Inc. | | | | | | |

Term Loan B-1 (e) | – | 02/05/2027 | | 934 | | 921,065 |

Term Loan B-2 (e) | – | 02/05/2027 | EUR | 105 | | 116,161 |

Term Loan B-2 (1 mo. USD LIBOR + 1.75%) | 3.35% | 02/05/2027 | | 1,941 | | 1,914,306 |

| | | | | | |

Generac Power Systems, Inc., Term Loan (1 mo. USD LIBOR + 1.75%) | 3.41% | 12/13/2026 | | 412 | | 411,960 |

| | | | | | |

Hamilton Holdco LLC, Term Loan (3 mo. USD LIBOR + 2.00%) | 3.95% | 01/02/2027 | | 2,190 | | 2,154,513 |

Kantar (United Kingdom), Term Loan B-1 (e) | – | 12/04/2026 | EUR | 434 | | 479,325 |

MX Holdings US, Inc., Term Loan B-1-C (1 mo. USD LIBOR + 3.00%) | 4.35% | 07/31/2025 | | 1,151 | | 1,158,301 |

| | | | | | |

New VAC US LLC, Term Loan B (3 mo. USD LIBOR + 4.00%)(f) | 5.94% | 03/08/2025 | | 421 | | 352,468 |

Rexnord LLC/RBS Global, Inc., Term Loan B (1 mo. USD LIBOR + 1.75%) | 3.38% | 08/21/2024 | | 332 | | 331,771 |

Robertshaw US Holding Corp., Second Lien Term Loan (1 mo. USD LIBOR + 8.00%) | 9.63% | 02/28/2026 | | 388 | | 319,109 |

| | | | | | |

S2P Acquisiton Borrower, Inc., First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | 5.60% | 08/14/2026 | | 382 | | 380,639 |

| | | | | | |

Terex Corp., Term Loan (1 mo. USD LIBOR + 2.75%) | 4.35% | 01/31/2024 | | 301 | | 301,901 |

| | | | | | 13,625,149 |

| | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

17 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Insurance–0.21% | | | | | | |

FrontDoor, Inc., Term Loan (1 mo. USD LIBOR + 2.50%) | 4.13% | 08/16/2025 | $ | 308 | $ | 308,880 |

Hub International Ltd. | | | | | | |

Incremental Term Loan (3 mo. USD LIBOR + 4.00%) | 5.69% | 04/25/2025 | | 788 | | 787,801 |

Term Loan (2 mo. USD LIBOR + 2.75%) | 4.39% | 04/25/2025 | | 18 | | 17,680 |

| | | | | | |

| | | | | | 1,114,361 |

| | | | | | |

Leisure Goods, Activities & Movies–4.96% | | | | | | |

Alpha Topco Ltd. (United Kingdom), Term Loan B (1 mo. USD LIBOR + 2.50%) | 4.10% | 02/01/2024 | | 6,560 | | 6,355,502 |

AMC Entertainment, Inc., Term Loan B-1 (1 mo. USD LIBOR + 3.00%) | 4.61% | 04/22/2026 | | 124 | | 120,590 |

| | | | | | |

Ancestry.com Operations, Inc., First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | 5.36% | 10/19/2023 | | 1,960 | | 1,823,157 |

Callaway Golf Co., Term Loan (1 mo. USD LIBOR + 4.50%) | 6.15% | 01/02/2026 | | 362 | | 361,951 |

Crown Finance US, Inc. | | | | | | |

Term Loan (1 mo. USD LIBOR + 2.25%) | 3.85% | 02/28/2025 | | 2,107 | | 1,959,174 |

Term Loan (1 mo. USD LIBOR + 2.50%) | 4.10% | 09/30/2026 | | 1,282 | | 1,196,016 |

Term Loan (e) | – | 02/05/2027 | | 5,406 | | 5,067,772 |

CWGS Group LLC, Term Loan (1 mo. USD LIBOR + 2.75%) | 4.42% | 11/08/2023 | | 595 | | 546,746 |

| | | | | | |

Dorna Sports S.L. (Spain) | | | | | | |

Term Loan B-2 (e) | – | 05/03/2024 | EUR | 41 | | 45,323 |

Term Loan B-2 (6 mo. USD LIBOR + 3.00%) | 4.92% | 05/03/2024 | | 723 | | 713,429 |

| | | | | | |

Fitness International LLC, Term Loan B (1 mo. USD LIBOR + 3.25%) | 4.85% | 04/18/2025 | | 447 | | 443,404 |

Invictus Media S.L.U. (Spain) | | | | | | |

Term Loan B-1 (6 mo. EURIBOR + 4.50%) | 4.50% | 06/26/2025 | EUR | 455 | | 498,101 |

Term Loan B-2 (6 mo. EURIBOR + 4.50%) | 4.50% | 06/26/2025 | EUR | 274 | | 299,523 |

| | | | | | |

Lakeland Tours LLC, Term Loan (3 mo. USD LIBOR + 4.00%) | 6.15% | 12/16/2024 | | 798 | | 739,942 |

Live Nation Entertainment, Inc., Term Loan B-4 (3 mo. USD LIBOR + 1.75%) | 3.44% | 10/19/2026 | | 106 | | 104,148 |

Markermeer Finance B.V., Term Loan B (3 mo. EURIBOR + 3.50%) | 3.50% | 01/29/2027 | EUR | 620 | | 682,507 |

| | | | | | |

Merlin Entertainments PLC (United Kingdom) | | | | | | |

Term Loan B (3 mo. EURIBOR + 3.00%) | 3.00% | 10/16/2026 | EUR | 333 | | 366,130 |

Term Loan B-1 (3 mo. USD LIBOR + 3.25%) | 4.94% | 10/16/2026 | | 41 | | 40,051 |

| | | | | | |

Term Loan B-2 (3 mo. USD LIBOR + 3.25%) | 4.90% | 10/16/2026 | | 4 | | 4,142 |

| | | | | | |

Parques Reunidos (Spain), Term Loan B-1 (6 mo. EURIBOR + 3.75%) | 3.75% | 09/27/2026 | EUR | 760 | | 788,207 |

Sabre GLBL, Inc., Term Loan B (1 mo. USD LIBOR + 2.00%) | 3.60% | 02/22/2024 | | 79 | | 75,927 |

SRAM LLC, Term Loan B (3 mo. USD LIBOR + 2.75%) | 4.35% | 03/15/2024 | | 349 | | 350,338 |

| | | | | | |

USF S&H TopCo, LLC | | | | | | |

Delayed Draw Term Loan | | | | | | |

(Acquired 12/02/2019; Cost $533,132)(d)(f) | 1.53% | 11/26/2024 | | 536 | | 527,645 |

Revolver Loan | | | | | | |

(Acquired 12/02/2019; Cost $176,012)(d)(f) | 3.49% | 11/26/2024 | | 179 | | 175,882 |

Term Loan A (3 mo. USD LIBOR + 5.50%) | | | | | | |

(Acquired 12/02/2019; Cost $3,141,472)(f) | 7.15% | 11/26/2024 | | 3,187 | | 3,139,485 |

Vue International Bidco PLC (United Kingdom) | | | | | | |

Delayed Draw Term Loan (d) | 0.00% | 07/03/2026 | EUR | 38 | | 41,114 |

Term Loan B-1 (3 mo. EURIBOR + 4.75%) | 4.75% | 07/03/2026 | EUR | 209 | | 228,649 |

| | | | | | |

| | | | | | 26,694,855 |

| | | | | | |

Lodging & Casinos–4.02% | | | | | | |

AMCP Clean Acquisition Co. LLC | | | | | | |

Delayed Draw Term Loan (3 mo. USD LIBOR + 4.25%) | 6.19% | 06/16/2025 | | 133 | | 130,686 |

Term Loan (3 mo. USD LIBOR + 4.25%) | 6.19% | 06/16/2025 | | 549 | | 540,114 |

| | | | | | |

B&B Hotels S.A.S. (France) | | | | | | |

Second Lien Term Loan B (3 mo. EURIBOR + 8.50%) | 8.50% | 07/12/2027 | EUR | 264 | | 294,535 |

Term Loan B-3-A (1 mo. EURIBOR + 3.88%) | 3.88% | 07/31/2026 | EUR | 579 | | 635,261 |

| | | | | | |

Boyd Gaming Corp., Term Loan B (1 wk. USD LIBOR + 2.25%) | 3.83% | 09/15/2023 | | 69 | | 68,087 |

Caesars Entertainment Operating Co. LLC, Term Loan B (3 mo. USD LIBOR + 2.00%) | 3.60% | 10/07/2024 | | 538 | | 536,936 |

| | | | | | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

18 | Invesco Senior Loan Fund |

| | | Principal | | |

| Interest | Maturity | Amount | | |

| Rate | Date | (000)(a) | | Value |

Lodging & Casinos–(continued) | | | | | | |

Caesars Resort Collection LLC, Term Loan B (1 mo. USD LIBOR + 2.75%) | 4.35% | 12/23/2024 | $ | 6,944 | $ | 6,736,125 |

CityCenter Holdings LLC, Term Loan B (1 mo. USD LIBOR + 2.25%) | 3.85% | 04/18/2024 | | 1,103 | | 1,092,623 |

ESH Hospitality, Inc., Term Loan (3 mo. USD LIBOR + 2.00%) | 3.60% | 09/18/2026 | | 195 | | 192,602 |

| | | | | | |

Four Seasons Hotels Ltd. (Canada), First Lien Term Loan (1 mo USD LIBOR + 2.00%) | 3.60% | 11/30/2023 | | 58 | | 57,616 |

| | | | | | |

Hilton Worldwide Finance LLC, Term Loan B-2 (1 mo. USD LIBOR + 1.75%) | 3.38% | 06/22/2026 | | 438 | | 434,741 |

PCI Gaming Authority, Term Loan B (1 mo. USD LIBOR + 3.00%) | 4.10% | 05/29/2026 | | 882 | | 878,813 |

Penn National Gaming, Inc., Incremental Term Loan B-1 (1 mo. USD LIBOR + 2.25%) | 3.86% | 10/15/2025 | | 928 | | 918,119 |

| | | | | | |