UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-05845

Invesco Senior Loan Fund

(Exact name of registrant as specified in charter)

1555 Peachtree Street, N.E., Suite 1800 Atlanta, Georgia 30309

(Address of principal executive offices) (Zip code)

Sheri Morris 1555 Peachtree Street, N.E., Suite 1800 Atlanta, Georgia 30309

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 2/28

Date of reporting period: 2/28/22

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

(a) The Registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

(b) Not applicable.

| | |

| | |

| Annual Report to Shareholders | | February 28, 2022 |

Invesco Senior Loan Fund

Nasdaq:

A: VSLAX ∎ C: VSLCX ∎ Y: VSLYX ∎ IB: XPRTX ∎ IC: XSLCX

Management’s Discussion of Fund Performance

| | | | |

| |

Performance summary | |

For the fiscal year ended February 28, 2022, Class A shares of Invesco Senior Loan Fund (the Fund), at net asset value (NAV), outperformed the Credit Suisse Leveraged Loan Index, the Fund’s style-specific benchmark. Your Fund’s long-term performance appears later in this report. | |

| |

Fund vs. Indexes | |

Total returns, 2/28/21 to 2/28/22, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. | |

Class A Shares | | | 6.14 | % |

Class C Shares | | | 5.35 | |

Class Y Shares | | | 6.24 | |

Class IB Shares | | | 6.41 | |

Class IC Shares | | | 6.25 | |

Credit Suisse Leveraged Loan Indexq (Style-Specific Index) | | | 3.24 | |

| |

Source(s): qBloomberg LP | | | | |

Market conditions and your Fund

For the fiscal year ended February 28, 2022, the senior loan market, as represented by the Credit Suisse Leveraged Loan Index, returned 3.24%.1 Prices briefly weakened in late November 2021 as investors first became aware of the highly transmissible coronavirus (COVID-19) Omicron variant and naturally eschewed risk assets of all stripes. However, concerns eased in December 2021 as consensus emerged that Omicron posed a lower risk of severity and thus, lowered the risk of lasting economic disruption. In late February 2022, Russia’s invasion of Ukraine roiled investor sentiment and cast a shadow of uncertainty over markets. While loans did not entirely escape the resulting broad market volatility, loans did outperform other risk assets such as S&P 500, High Yield, Treasuries and High Grade for the first two months of 2022 and exhibited lower relative volatility.2

Relative stability in loan prices was aided by highly supportive demand in technicals throughout the fiscal year. Demand from retail/institutional buyers and even more impactfully from record CLO formation provided a steady bid for loan assets despite the choppy macro backdrop. Ascending interest rates remained at the forefront of market discussion amid rising inflation and an increasingly hawkish US Federal Reserve (the Fed) intent on managing that inflation through tighter financial conditions. We believe rising rates would likely bode well for continued loan appetite among income-oriented investors also seeking a low-interest rate sensitivity in the fiscal year ahead.

Fundamentally speaking, we observed that company issuers continued to exhibit healthy balance sheets, still improving earnings and high accessibility to capital markets during the fiscal year. Collectively, these trends minimized restructuring activity in the syndicated loan market over the fiscal year. We expect much of this to continue in what we expect to be a fairly benign default backdrop going forward.

During the fiscal year, the Fund used leverage, which allowed us to enhance the Fund’s yield while keeping credit standards relatively high as compared to the benchmark. As of the close of the fiscal year, leverage accounted for 13% of the Fund’s NAV plus borrowings. Leverage involves borrowing at a floating short-term rate and reinvesting the proceeds at a higher rate. Unlike other fixed income asset classes, using leverage in conjunction with senior loans typically does not involve the same degree of risk from rising short-term interest rates since the income from senior loans generally adjusts to changes in interest rates, as do the rates which determine the Fund’s borrowing costs. (Similarly, should short-term rates fall, borrowing costs also would decline.) For more information about the Fund’s use of leverage, see the Notes to Financial Statements later in this report.

During the 12 months ending February 28, 2022, QuarterNorth Energy, Vistra and California Resources contributed to the Fund’s relative performance as compared to the benchmark, while Telesat, Riverbed Technology and Diamond Sports detracted from the Fund’s relative performance. We exited our

position in California Resources during the fiscal year.

The senior loan asset class behaves differently from many traditional fixed income investments. The interest income generated by a portfolio of senior loans is usually determined by a fixed credit spread over the base rate. Because senior loans generally have a very short duration due to their coupons or interest rates adjusting every 30 to 90 days as the base rate changes, the yield on the portfolio adjusts. Interest rate risk refers to the tendency for traditional fixed income prices to decline when interest rates rise. We are monitoring interest rates, the market and economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the Fed and certain central banks. For senior loans, however, interest rates and income are variable and the prices of senior loans are therefore less sensitive to interest rate changes than traditional fixed income bonds. If interest rates rise faster than expected, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Fund’s investments or the market price of the Fund’s shares.

Looking ahead to what we anticipate will be a multi-year period of ascending interest rates, we believe that loans can continue to offer high-income with low-duration risk. If the case for loans at the start of 2021 was built on strong coupon, plus upside potential from pandemic recovery, then we believe the case for loans in 2022 will be predicated upon strong coupon plus low-duration sensitivity. In our view, exposure to loans can help investors not only generate strong yields for their portfolios but also provide insulation to what we believe to be one of the key macroeconomic risks in 2022 –of potentially significant inflation that could force the Fed to raise rates sooner and with greater magnitude than expected. For this reason, we believe loans continue to merit a core role in investors’ portfolios.

As always, we appreciate your continued participation in Invesco Senior Loan Fund.

| 2 | Sources: Leveraged Commentary & Data (LCD); Bank of America Merrill Lynch as of February 28, 2022. The S&P/LSTA Leveraged |

| | |

| 2 | | Invesco Senior Loan Fund |

| | Loan Index represents Loans, the S&P 500 Index represents Equities, the ICE BofA US High Yield Index represents High Yield, and the ICE BofA US Corporate Index represents Investment Grade. |

Portfolio manager(s):

Scott Baskind

Tom Ewald

Philip Yarrow

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. and its affiliates. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| 3 | | Invesco Senior Loan Fund |

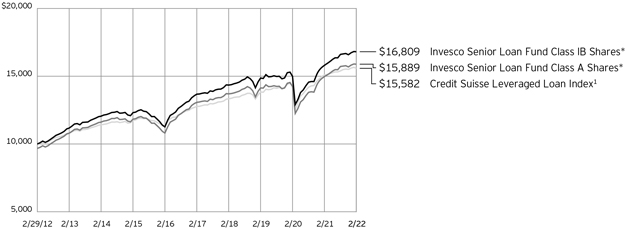

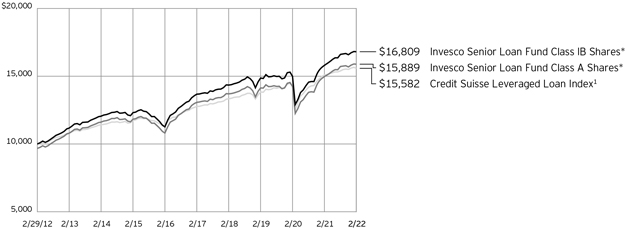

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 2/29/12

1 Source: Bloomberg LP

*The Fund’s oldest share class (IB shares) does not have a sales charge; therefore, the second-oldest share class with a sales charge (Class A) is also included in the chart.

Past performance cannot guarantee future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including

management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects Fund expenses and management fees;

performance of a market index does not. Performance shown in the chart does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

| | | | |

| |

Average Annual Total Returns | |

As of 2/28/22, including maximum applicable sales charges | |

Class A Shares | | | | |

Inception (2/18/05) | | | 3.47 | % |

10 Years | | | 4.74 | |

5 Years | | | 3.30 | |

1 Year | | | 2.77 | |

| |

Class C Shares | | | | |

Inception (2/18/05) | | | 2.91 | % |

10 Years | | | 4.31 | |

5 Years | | | 3.19 | |

1 Year | | | 4.35 | |

| |

Class Y Shares | | | | |

Inception (11/8/13) | | | 4.36 | % |

5 Years | | | 4.24 | |

1 Year | | | 6.24 | |

| |

Class IB Shares | | | | |

Inception (10/4/89) | | | 4.87 | % |

10 Years | | | 5.33 | |

5 Years | | | 4.21 | |

1 Year | | | 6.41 | |

| |

Class IC Shares | | | | |

Inception (6/13/03) | | | 4.31 | % |

10 Years | | | 5.19 | |

5 Years | | | 4.09 | |

1 Year | | | 6.25 | |

The performance data quoted represent past performance and cannot guarantee future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Performance figures do not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

Class A share performance reflects the maximum 3.25% sales charge. Class C share performance reflects a maximum early withdrawal charge of 1% for the first year after purchase. Class IB shares and Class IC shares are not continuously offered and have no early withdrawal charges. Class Y shares do not have a front-end sales charge or a CDSC, therefore performance is at net asset value. Class Y shares do not have early withdrawal charges.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had the adviser not waived fees and/or reimbursed expenses currently or in the past, returns would have been lower. See current prospectus for more information.

| | |

| 4 | | Invesco Senior Loan Fund |

Supplemental Information

Invesco Senior Loan Fund’s investment objective is to seek to provide a high level of current income, consistent with preservation of capital.

| ∎ | Unless otherwise stated, information presented in this report is as of February 28, 2022, and is based on total net assets. |

| ∎ | Unless otherwise noted, all data is provided by Invesco. |

| ∎ | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About indexes used in this report

| ∎ | The Credit Suisse Leveraged Loan Index represents tradable, senior-secured, US-dollar-denominated, noninvestment-grade loans. |

| ∎ | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

|

|

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing. |

|

| NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE |

| | |

| 5 | | Invesco Senior Loan Fund |

Fund Information

Portfolio Composition†

| | |

| By credit quality | | % of total investments |

BBB- | | 1.86% |

BB+ | | 1.17 |

BB | | 2.32 |

BB- | | 9.45 |

B+ | | 9.89 |

B | | 22.82 |

B- | | 23.79 |

CCC+ | | 5.92 |

CCC | | 2.34 |

CCC- | | 0.81 |

CC | | 0.15 |

C | | 0.33 |

D | | 0.94 |

Non-Rated | | 10.76 |

Equity | | 7.45 |

†Source: Standard & Poor’s. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations, including specific securities, money market instruments or other debts. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest); ratings are subject to change without notice. “Non- Rated” indicates the debtor was not rated, and should not be interpreted as indicating low quality. For more information on Standard & Poor’s rating methodology, please visit standardandpoors.com and select “Understanding Ratings” under Rating Resources on the homepage.

Top Five Debt Issuers

| | | | |

| | | | | % of total net assets |

| 1. | | Boeing Co. | | 2.00% |

| 2. | | Crown Finance US, Inc. | | 1.87 |

| 3. | | Monitronics International, Inc. | | 1.61 |

| 4. | | NAS LLC | | 1.61 |

| 5. | | Al Aqua Merger Sub, Inc. | | 1.25 |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

Data presented here are as of February 28, 2022.

| | |

| 6 | | Invesco Senior Loan Fund |

Schedule of Investments

February 28, 2022

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal Amount (000)(a) | | | Value |

Variable Rate Senior Loan Interests–107.81%(b)(c) | | | | | | | | | | | | | | |

| | | | |

Aerospace & Defense–6.59% | | | | | | | | | | | | | | |

| | | | |

Boeing Co., Revolver Loan (d)(e) | | | 0.00% | | | | 10/30/2022 | | | | $ 9,182 | | | $ 9,112,711 |

Brown Group Holding LLC, Term Loan B (3 mo. USD LIBOR + 2.50%) | | | 3.00% | | | | 06/07/2028 | | | | 502 | | | 497,472 |

Castlelake Aviation Ltd., Term Loan B (3 mo. USD LIBOR + 2.75%) | | | 3.25% | | | | 10/25/2026 | | | | 1,496 | | | 1,478,680 |

CEP IV Investment 16 S.a.r.l. (ADB Safegate) (Luxembourg), Term Loan B (3 mo. EURIBOR + 3.50%) | | | 3.50% | | | | 10/03/2024 | | | | EUR 161 | | | 172,798 |

Dynasty Acquisition Co., Inc. | | | | | | | | | | | | | | |

Term Loan B-1 (3 mo. USD LIBOR + 3.50%) | | | 3.72% | | | | 04/08/2026 | | | | 2,068 | | | 2,010,959 |

Term Loan B-2 (3 mo. USD LIBOR + 3.50%) | | | 3.72% | | | | 04/08/2026 | | | | 1,111 | | | 1,080,273 |

Gogo Intermediate Holdings LLC, Term Loan B (3 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 04/30/2028 | | | | 787 | | | 782,194 |

Greenrock Finance, Inc., First Lien Term Loan B (3 mo. USD LIBOR + 3.50%) | | | 4.50% | | | | 06/28/2024 | | | | 1,604 | | | 1,595,449 |

IAP Worldwide Services, Inc. | | | | | | | | | | | | | | |

Revolver Loan (Acquired 08/05/2014-02/08/2019; Cost $1,946,523)(d)(e)(f) | | | 0.00% | | | | 07/18/2023 | | | | 1,946 | | | 1,946,523 |

Second Lien Term Loan (3 mo. USD LIBOR + 6.50%) | | | | | | | | | | | | | | |

(Acquired 07/18/2014-02/08/2019; Cost $2,086,159)(d)(f) | | | 6.72% | | | | 07/18/2023 | | | | 2,110 | | | 2,110,034 |

KKR Apple Bidco LLC | | | | | | | | | | | | | | |

First Lien Term Loan(g) | | | - | | | | 09/22/2028 | | | | 68 | | | 67,667 |

Second Lien Term Loan (1 mo. USD LIBOR + 5.75%) | | | 6.25% | | | | 09/21/2029 | | | | 212 | | | 213,412 |

Peraton Corp. | | | | | | | | | | | | | | |

First Lien Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 02/01/2028 | | | | 2,255 | | | 2,245,293 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | | | 8.50% | | | | 02/01/2029 | | | | 1,335 | | | 1,352,783 |

Propulsion (BC) Finco S.a.r.l. (Spain), Term Loan B(d)(g) | | | - | | | | 02/10/2029 | | | | 388 | | | 388,190 |

Spirit AeroSystems, Inc., Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 01/15/2025 | | | | 1,117 | | | 1,115,125 |

TransDigm, Inc. | | | | | | | | | | | | | | |

Term Loan E (1 mo. USD LIBOR + 2.25%) | | | 2.46% | | | | 05/30/2025 | | | | 305 | | | 299,912 |

Term Loan F (1 mo. USD LIBOR + 2.25%) | | | 2.46% | | | | 12/09/2025 | | | | 3,315 | | | 3,265,519 |

Vectra Co., First Lien Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 03/08/2025 | | | | 215 | | | 204,387 |

| | | | | | | | | | | | | | | 29,939,381 |

| | | | |

Air Transport–2.86% | | | | | | | | | | | | | | |

| | | | |

AAdvantage Loyalty IP Ltd., Term Loan B (3 mo. USD LIBOR + 4.75%) | | | 5.50% | | | | 04/20/2028 | | | | 3,320 | | | 3,388,396 |

Air Canada (Canada), Term Loan B (3 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 08/15/2028 | | | | 1,337 | | | 1,332,798 |

American Airlines, Inc., Term Loan (1 mo. USD LIBOR + 1.75%) | | | 1.96% | | | | 06/27/2025 | | | | 1,032 | | | 992,481 |

Avolon TLB Borrower 1 (US) LLC, Term Loan B-4 (1 mo. USD LIBOR + 1.50%) | | | 2.25% | | | | 02/10/2027 | | | | 187 | | | 184,814 |

eTraveli Group (Sweden), Term Loan B-1 (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 08/02/2024 | | | | EUR 411 | | | 458,270 |

Mileage Plus Holdings LLC/Mileage Plus Intellectual Property Assets Ltd., Term Loan (3 mo. USD LIBOR + 5.25%) | | | 6.25% | | | | 06/21/2027 | | | | 1,494 | | | 1,564,698 |

PrimeFlight Aviation Services, Inc., Term Loan (1 mo. USD LIBOR + 6.25%)(d) | | | 7.25% | | | | 05/09/2024 | | | | 424 | | | 418,013 |

SkyMiles IP Ltd., Term Loan (3 mo. USD LIBOR + 3.75%) | | | 4.75% | | | | 10/20/2027 | | | | 1,797 | | | 1,883,445 |

United Airlines, Inc., Term Loan B (3 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 04/21/2028 | | | | 2,382 | | | 2,374,803 |

WestJet Airlines Ltd. (Canada), Term Loan B (3 mo. USD LIBOR + 3.00%) | | | 4.00% | | | | 12/11/2026 | | | | 400 | | | 390,339 |

| | | | | | | | | | | | | | | 12,988,057 |

| | | | |

Automotive–2.31% | | | | | | | | | | | | | | |

| | | | |

Adient PLC, Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 04/08/2028 | | | | 1,029 | | | 1,025,544 |

Autokiniton US Holdings, Inc., Term Loan B (3 mo. USD LIBOR + 4.50%) | | | 5.00% | | | | 04/06/2028 | | | | 1,876 | | | 1,867,879 |

BCA Marketplace (United Kingdom) | | | | | | | | | | | | | | |

Second Lien Term Loan B (1 mo. SONIA + 7.50%) | | | 7.99% | | | | 07/30/2029 | | | | GBP 481 | | | 642,865 |

Term Loan B (6 mo. SONIA + 4.75%) | | | 4.95% | | | | 06/30/2028 | | | | GBP 184 | | | 244,126 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 7 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Automotive–(continued) | | | | | | | | | | | | | | |

| | | | |

DexKo Global, Inc. | | | | | | | | | | | | | | |

Delayed Draw Term Loan (3 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 09/30/2028 | | | | $ 62 | | | $ 61,519 |

Delayed Draw Term Loan(e) | | | 0.00% | | | | 09/30/2028 | | | | 12 | | | 11,443 |

Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 09/30/2028 | | | | 387 | | | 383,048 |

Driven Holdings LLC, Term Loan B (3 mo. USD LIBOR + 3.00%)(d) | | | 3.52% | | | | 11/20/2028 | | | | 346 | | | 343,408 |

Highline Aftermarket Acquisition LLC, Term Loan (3 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 11/09/2027 | | | | 1,520 | | | 1,499,343 |

Mavis Tire Express Services TopCo L.P., Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 05/01/2028 | | | | 2,734 | | | 2,726,896 |

PowerStop LLC, Term Loan B (3 mo. USD LIBOR + 4.75%) | | | 5.25% | | | | 01/24/2029 | | | | 635 | | | 631,280 |

Project Boost Purchaser LLC, Term Loan (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 06/01/2026 | | | | 332 | | | 330,828 |

Superior Industries International, Inc., Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.21% | | | | 05/22/2024 | | | | 525 | | | 524,355 |

ThermaSys Corp., Term Loan(d)(g) | | | - | | | | 10/02/2023 | | | | 4 | | | 2,804 |

Winter Park Intermediate, Inc., Term Loan B (1 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 05/11/2028 | | | | 185 | | | 183,345 |

| | | | | | | | | | | | | | | 10,478,683 |

| | | | |

Beverage & Tobacco–2.25% | | | | | | | | | | | | | | |

| | | | |

AI Aqua Merger Sub, Inc., Incremental Term Loan (g) | | | - | | | | 07/30/2028 | | | | 1,373 | | | 1,364,905 |

Al Aqua Merger Sub, Inc. | | | | | | | | | | | | | | |

Delayed Draw Term Loan(g) | | | - | | | | 06/18/2028 | | | | 380 | | | 378,055 |

Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 07/31/2028 | | | | 5,313 | | | 5,292,769 |

Arctic Glacier U.S.A., Inc., Term Loan (3 mo. USD LIBOR + 3.50%) | | | 4.50% | | | | 03/20/2024 | | | | 292 | | | 272,123 |

City Brewing Co. LLC, Term Loan B (3 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 03/31/2028 | | | | 1,405 | | | 1,331,120 |

Naked Juice LLC, Second Lien Term Loan(g) | | | - | | | | 01/20/2030 | | | | 798 | | | 804,316 |

Waterlogic Holdings Ltd. (United Kingdom), Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.25% | | | | 08/04/2028 | | | | 789 | | | 785,567 |

| | | | | | | | | | | | | | | 10,228,855 |

| | | | |

Brokers, Dealers & Investment Houses–0.12% | | | | | | | | | | | | | | |

| | | | |

AqGen Island Intermediate Holdings, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan B(g) | | | - | | | | 08/02/2028 | | | | 528 | | | 522,402 |

Second Lien Term Loan B(g) | | | - | | | | 08/05/2029 | | | | 20 | | | 20,707 |

| | | | | | | | | | | | | | | 543,109 |

| | | | |

Building & Development–1.91% | | | | | | | | | | | | | | |

| | | | |

Brookfield Retail Holdings VII Sub 3 LLC, Term Loan B (1 mo. USD LIBOR + 2.50%) | | | 2.71% | | | | 08/27/2025 | | | | 191 | | | 187,191 |

Icebox Holdco III, Inc. | | | | | | | | | | | | | | |

Delayed Draw Term Loan(e) | | | 0.00% | | | | 12/15/2028 | | | | 171 | | | 169,493 |

Second Lien Term Loan (3 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 12/21/2029 | | | | 303 | | | 302,753 |

Term Loan B(g) | | | - | | | | 12/22/2028 | | | | 825 | | | 819,216 |

LBM Holdings LLC, Term Loan(g) | | | - | | | | 12/17/2027 | | | | 86 | | | 85,036 |

LHS Borrow LLC (Leaf Home Solutions), Term Loan B(d)(g) | | | - | | | | 02/17/2029 | | | | 1,355 | | | 1,341,851 |

Mayfair Mall LLC, Term Loan(d)(g) | | | - | | | | 04/20/2023 | | | | 707 | | | 646,658 |

Modulaire (United Kingdom), Term Loan B (1 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 10/08/2028 | | | | EUR 233 | | | 254,111 |

Quikrete Holdings, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 2.50%) | | | 2.71% | | | | 02/01/2027 | | | | 551 | | | 541,993 |

Term Loan B(g) | | | - | | | | 06/11/2028 | | | | 1,295 | | | 1,285,017 |

Re/Max LLC, Term Loan (3 mo. USD LIBOR + 2.50%) | | | 3.00% | | | | 07/21/2028 | | | | 1,399 | | | 1,383,519 |

SRS Distribution, Inc. | | | | | | | | | | | | | | |

Incremental Term Loan(g) | | | - | | | | 06/02/2028 | | | | 381 | | | 376,455 |

Incremental Term Loan(g) | | | - | | | | 06/04/2028 | | | | 192 | | | 190,382 |

TAMKO Building Products LLC, Term Loan (3 mo. USD LIBOR + 3.00%) | | | 3.30% | | | | 05/29/2026 | | | | 167 | | | 166,049 |

Werner FinCo L.P., Term Loan (3 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 07/24/2024 | | | | 915 | | | 914,660 |

| | | | | | | | | | | | | | | 8,664,384 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 8 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Business Equipment & Services–13.39% | | | | | | | | | | | | | | |

Aegion Corp., Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.50% | | | | 05/17/2028 | | | | $ 490 | | | $ 491,166 |

Allied Universal Holdco LLC | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 05/12/2028 | | | | 1,281 | | | 1,266,270 |

Term Loan B(g) | | | - | | | | 05/12/2028 | | | | EUR 111 | | | 122,157 |

Atlas CC Acquisition Corp., Term Loan B (1 mo. USD LIBOR + 4.25%) | | | 5.00% | | | | 05/25/2028 | | | | 1 | | | 973 |

Blucora, Inc., Term Loan (3 mo. USD LIBOR + 4.00%)(d) | | | 5.00% | | | | 05/22/2024 | | | | 924 | | | 923,967 |

Camelot Finance L.P. | | | | | | | | | | | | | | |

Incremental Term Loan B (1 mo. USD LIBOR + 3.00%) | | | 4.00% | | | | 10/30/2026 | | | | 1,847 | | | 1,839,279 |

Term Loan (1 mo. USD LIBOR + 3.00%) | | | 3.21% | | | | 10/30/2026 | | | | 1,238 | | | 1,227,768 |

Checkout Holding Corp. | | | | | | | | | | | | | | |

PIK Term Loan, 9.50% PIK Rate, 2.00% Cash Rate

(Acquired 02/15/2019-02/28/2022; Cost $ 547,319)(f)(h) | | | 9.50% | | | | 08/15/2023 | | | | 552 | | | 235,582 |

Term Loan (1 mo. USD LIBOR + 7.50%)

(Acquired 02/15/2019-11/12/2020; Cost $ 334,703)(f) | | | 8.50% | | | | 02/15/2023 | | | | 345 | | | 315,888 |

Cimpress USA, Inc., Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 05/17/2028 | | | | 748 | | | 744,435 |

Constant Contact | | | | | | | | | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 7.50%)(d) | | | 8.25% | | | | 02/15/2029 | | | | 818 | | | 802,088 |

Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 02/10/2028 | | | | 1,556 | | | 1,542,895 |

CRCI Longhorn Holdings, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 7.25%) | | | 7.43% | | | | 08/08/2026 | | | | 72 | | | 71,490 |

Creation Technologies, Inc., Term Loan B (1 mo. USD LIBOR + 5.50%)(d) | | | 6.00% | | | | 10/05/2028 | | | | 756 | | | 747,448 |

Dakota Holding Corp. | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.75% | | | | 04/09/2027 | | | | 1,559 | | | 1,554,483 |

Second Lien Term Loan (1 mo. USD LIBOR + 6.75%)(d) | | | 7.50% | | | | 04/07/2028 | | | | 678 | | | 684,272 |

Dun & Bradstreet Corp. (The) | | | | | | | | | | | | | | |

Incremental Term Loan B(g) | | | - | | | | 01/17/2029 | | | | 415 | | | 410,535 |

Revolver Loan(d)(e) | | | 0.00% | | | | 09/11/2025 | | | | 2,120 | | | 1,928,990 |

Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 02/06/2026 | | | | 849 | | | 841,202 |

Ensono L.P., Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 05/19/2028 | | | | 767 | | | 762,531 |

Garda World Security Corp. (Canada) | | | | | | | | | | | | | | |

Incremental Term Loan(g) | | | - | | | | 02/11/2029 | | | | 965 | | | 957,129 |

Term Loan (1 mo. USD LIBOR + 4.25%) | | | 4.43% | | | | 10/30/2026 | | | | 1,714 | | | 1,700,264 |

GI Revelation Acquisition LLC, First Lien Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 05/12/2028 | | | | 2,887 | | | 2,856,591 |

Grandir (France) | | | | | | | | | | | | | | |

Delayed Draw Term Loan(e) | | | 0.00% | | | | 10/21/2028 | | | | EUR 35 | | | 38,846 |

Term Loan B-1(g) | | | - | | | | 10/21/2028 | | | | EUR 209 | | | 233,073 |

Holding Socotec (France), Term Loan B (3 mo. USD LIBOR + 4.25%)(d) | | | 5.00% | | | | 06/30/2028 | | | | 81 | | | 80,198 |

INDIGOCYAN Midco Ltd. (Jersey), Term Loan B (3 mo. SONIA + 4.75%) | | | 5.31% | | | | 06/23/2024 | | | | GBP 2,109 | | | 2,793,657 |

ION Trading Technologies S.a.r.l. (Luxembourg) | | | | | | | | | | | | | | |

Term Loan B (3 mo. EURIBOR + 4.25%) | | | 4.25% | | | | 03/31/2028 | | | | EUR 456 | | | 507,430 |

Term Loan B (3 mo. USD LIBOR + 4.75%) | | | 4.97% | | | | 03/31/2028 | | | | 1,033 | | | 1,029,776 |

Karman Buyer Corp., Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 10/28/2027 | | | | 2,622 | | | 2,598,634 |

Monitronics International, Inc. | | | | | | | | | | | | | | |

Term Loan (3 mo. USD LIBOR + 7.50%) | | | 8.75% | | | | 03/29/2024 | | | | 5,117 | | | 4,299,123 |

Term Loan (3 mo. USD LIBOR + 5.00%) | | | 7.50% | | | | 07/03/2024 | | | | 3,005 | | | 3,020,268 |

NAS LLC | | | | | | | | | | | | | | |

Incremental Term Loan (3 mo. USD LIBOR + 6.50%)(d) | | | 7.50% | | | | 06/03/2024 | | | | 1,743 | | | 1,751,706 |

Revolver Loan (3 mo. USD LIBOR + 5.50%)(d) | | | 8.75% | | | | 06/01/2024 | | | | 103 | | | 103,233 |

Revolver Loan(d)(e) | | | 0.00% | | | | 06/01/2024 | | | | 411 | | | 412,932 |

Term Loan (3 mo. USD LIBOR + 6.00%)(d) | | | 7.50% | | | | 06/03/2024 | | | | 5,020 | | | 5,045,383 |

OCM System One Buyer CTB LLC, Term Loan (1 mo. USD LIBOR + 4.00%)(d) | | | 4.75% | | | | 03/02/2028 | | | | 743 | | | 740,115 |

Orchid Merger Sub II LLC, Term Loan B(d)(g) | | | - | | | | 05/15/2027 | | | | 1,681 | | | 1,622,087 |

Prime Security Services Borrower LLC, Term Loan B-1 (1 mo. USD LIBOR + 2.75%) | | | 3.50% | | | | 09/23/2026 | | | | 984 | | | 975,184 |

Protect America, Revolver Loan (1 mo. USD LIBOR + 3.00%)(d) | | | 3.18% | | | | 09/01/2024 | | | | 1,510 | | | 1,441,605 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 9 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Business Equipment & Services–(continued) | | | | | | | | | | | | | | |

| | | | |

Red Ventures LLC (New Imagitas, Inc.), Term Loan B-3 (1 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 11/08/2024 | | | | $ 877 | | | $ 876,034 |

Sitel Worldwide Corp., Term Loan B (3 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 08/28/2028 | | | | 286 | | | 284,467 |

Skillsoft Corp., Term Loan B (3 mo. USD LIBOR + 4.75%) | | | 5.50% | | | | 07/01/2028 | | | | 979 | | | 980,080 |

Solera, Term Loan B (1 mo. SONIA + 5.25%) | | | 5.74% | | | | 06/05/2028 | | | | GBP 236 | | | 313,544 |

Spin Holdco, Inc., Term Loan B (3 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 03/04/2028 | | | | 4,312 | | | 4,296,542 |

Sportradar Capital (Switzerland), Term Loan (6 mo. EURIBOR + 3.50%) | | | 3.50% | | | | 11/22/2027 | | | | EUR 233 | | | 258,088 |

Tempo Acquisition LLC, Term Loan B (1 mo. SOFR + 3.00%) | | | 3.50% | | | | 08/31/2028 | | | | 33 | | | 32,718 |

Thermostat Purchaser III, Inc. | | | | | | | | | | | | | | |

First Lien Delayed Draw Term Loan (3 mo. USD LIBOR + 4.50%)(d) | | | 5.25% | | | | 08/31/2028 | | | | 23 | | | 23,195 |

First Lien Delayed Draw Term Loan(d)(e) | | | 0.00% | | | | 08/31/2028 | | | | 87 | | | 86,982 |

Term Loan B (1 mo. USD LIBOR + 4.50%)(d) | | | 5.25% | | | | 08/30/2028 | | | | 497 | | | 494,346 |

Thevelia (US) LLC, First Lien Term Loan B(g) | | | - | | | | 02/10/2029 | | | | 773 | | | 765,544 |

UnitedLex Corp., Term Loan (1 mo. USD LIBOR + 5.75%)(d) | | | 5.96% | | | | 03/20/2027 | | | | 534 | | | 536,493 |

Verra Mobility Corp., Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 3.47% | | | | 03/19/2028 | | | | 985 | | | 980,647 |

Virtusa Corp. | | | | | | | | | | | | | | |

Incremental Term Loan B(g) | | | - | | | | 02/08/2029 | | | | 893 | | | 885,515 |

Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 02/11/2028 | | | | 714 | | | 705,787 |

WebHelp (France), Term Loan B (3 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 07/30/2028 | | | | 629 | | | 626,899 |

| | | | | | | | | | | | | | | 60,867,534 |

| | | | |

Cable & Satellite Television–1.65% | | | | | | | | | | | | | | |

| | | | |

Altice Financing S.A. (Luxembourg) | | | | | | | | | | | | | | |

Term Loan (3 mo. USD LIBOR + 2.75%) | | | 2.99% | | | | 07/15/2025 | | | | 356 | | | 347,399 |

Term Loan (3 mo. USD LIBOR + 2.75%) | | | 2.99% | | | | 01/31/2026 | | | | 165 | | | 161,053 |

Atlantic Broadband Finance LLC, Incremental Term Loan(g) | | | - | | | | 07/28/2028 | | | | 101 | | | 100,152 |

CSC Holdings LLC | | | | | | | | | | | | | | |

Incremental Term Loan (1 mo. USD LIBOR + 2.25%) | | | 2.44% | | | | 01/15/2026 | | | | 425 | | | 413,382 |

Term Loan (1 mo. USD LIBOR + 2.25%) | | | 2.44% | | | | 07/17/2025 | | | | 705 | | | 684,897 |

Numericable-SFR S.A. (France), Incremental Term Loan B-13 (3 mo. USD LIBOR + 4.00%) | | | 4.51% | | | | 08/14/2026 | | | | 533 | | | 528,925 |

ORBCOMM, Inc., Term Loan B (3 mo. USD LIBOR + 4.25%) | | | 5.00% | | | | 09/01/2028 | | | | 389 | | | 386,347 |

Telenet - LG, Term Loan AR (1 mo. USD LIBOR + 2.00%) | | | 2.19% | | | | 04/30/2028 | | | | 205 | | | 200,037 |

UPC - LG | | | | | | | | | | | | | | |

Term Loan AT (1 mo. USD LIBOR + 2.25%) | | | 2.44% | | | | 04/30/2028 | | | | 255 | | | 249,969 |

Term Loan AX (1 mo. USD LIBOR + 3.00%) | | | 3.19% | | | | 01/31/2029 | | | | 1,980 | | | 1,960,754 |

Virgin Media 02 - LG (United Kingdom), Term Loan Q (1 mo. USD LIBOR + 3.25%) | | | 3.44% | | | | 01/31/2029 | | | | 2,443 | | | 2,427,101 |

Vodafone Ziggo - LG, Term Loan I (1 mo. USD LIBOR + 2.50%) | | | 2.69% | | | | 04/30/2028 | | | | 27 | | | 26,222 |

| | | | | | | | | | | | | | | 7,486,238 |

| | | | |

Chemicals & Plastics–3.53% | | | | | | | | | | | | | | |

| | | | |

AkzoNobel Chemicals, Term Loan (1 mo. USD LIBOR + 3.00%) | | | 3.21% | | | | 10/01/2025 | | | | 862 | | | 852,356 |

Altadia (Spain), Term Loan B(g) | | | - | | | | 02/17/2029 | | | | EUR 173 | | | 190,037 |

Aruba Investments, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 11/24/2027 | | | | 410 | | | 409,165 |

Second Lien Term Loan (3 mo. USD LIBOR + 7.75%) | | | 8.50% | | | | 11/24/2028 | | | | 814 | | | 814,485 |

Arxada (Switzerland) | | | | | | | | | | | | | | |

Term Loan B(g) | | | - | | | | 07/02/2028 | | | | EUR 184 | | | 203,196 |

Term Loan B(g) | | | - | | | | 07/03/2028 | | | | 122 | | | 121,574 |

Ascend Performance Materials Operations LLC, Term Loan (3 mo. USD LIBOR + 4.75%) | | | 5.50% | | | | 08/27/2026 | | | | 2,672 | | | 2,672,378 |

BASF Construction Chemicals (Germany), Term Loan B-3 (3 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 09/29/2027 | | | | 552 | | | 551,478 |

BCPE Max Dutch Bidco B.V. (Netherlands), Term Loan B (6 mo. EURIBOR + 4.25%) | | | 4.25% | | | | 10/31/2025 | | | | EUR 124 | | | 131,196 |

Caldic B.V. (Netherlands), Term Loan B(g) | | | - | | | | 02/04/2029 | | | | 432 | | | 428,855 |

Charter NEX US, Inc., Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 12/01/2027 | | | | 956 | | | 953,004 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 10 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Chemicals & Plastics–(continued) | | | | | | | | | | | | | | |

| | | | |

Colouroz Investment LLC (Germany) | | | | | | | | | | | | | | |

PIK First Lien Term Loan B-2, 0.75% PIK Rate, 5.25% Cash Rate(h) | | | 0.75% | | | | 09/21/2023 | | | | $ 975 | | | $ 968,064 |

PIK First Lien Term Loan C, 0.75% PIK Rate, 5.25% Cash Rate(h) | | | 0.75% | | | | 09/21/2023 | | | | 146 | | | 144,442 |

PIK First Lien Term Loan, 0.75% PIK Rate, 5.00% Cash Rate(h) | | | 0.75% | | | | 09/21/2023 | | | | EUR 37 | | | 40,698 |

PIK Second Lien Term Loan B-2, 5.75% PIK Rate, 5.25% Cash Rate(h) | | | 5.75% | | | | 09/21/2024 | | | | 15 | | | 14,383 |

Eastman Tire Additives, Term Loan B (1 mo. USD LIBOR + 5.25%)(d) | | | 6.00% | | | | 11/01/2028 | | | | 725 | | | 725,036 |

Fusion | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 6.50%)(d) | | | 7.50% | | | | 12/30/2026 | | | | 877 | | | 899,279 |

Term Loan B(d)(g) | | | - | | | | 02/01/2029 | | | | 501 | | | 498,194 |

ICP Group Holdings LLC | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 12/29/2027 | | | | 792 | | | 768,606 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | | | 8.50% | | | | 12/29/2028 | | | | 167 | | | 164,606 |

Kersia International S.A.S. (Belgium), Term Loan B (3 mo. EURIBOR + 3.93%) | | | 3.93% | | | | 12/23/2027 | | | | EUR 187 | | | 209,104 |

Kraton Corp., Term Loan (3 mo. SOFR + 3.25%) | | | 3.99% | | | | 11/18/2028 | | | | 224 | | | 222,750 |

Lummus Technology, Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 3.71% | | | | 06/30/2027 | | | | 63 | | | 62,739 |

Oxea Corp., Term Loan B-2 (3 mo. USD LIBOR + 3.25%) | | | 3.38% | | | | 10/14/2024 | | | | 280 | | | 277,218 |

Perstorp Holding AB (Sweden), Term Loan B (3 mo. USD LIBOR + 4.75%) | | | 4.91% | | | | 02/27/2026 | | | | 1,089 | | | 1,088,998 |

Potters Industries LLC, Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 12/14/2027 | | | | 430 | | | 428,766 |

Proampac PG Borrower LLC, First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 11/03/2025 | | | | 1,105 | | | 1,098,676 |

W.R. Grace & Co., Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 09/22/2028 | | | | 1,097 | | | 1,094,015 |

| | | | | | | | | | | | | | | 16,033,298 |

| | | | |

Clothing & Textiles–1.22% | | | | | | | | | | | | | | |

| | | | |

ABG Intermediate Holdings 2 LLC | | | | | | | | | | | | | | |

Second Lien Term Loan(g) | | | - | | | | 12/10/2029 | | | | 405 | | | 407,906 |

Term Loan B-1(g) | | | - | | | | 01/31/2029 | | | | 272 | | | 269,951 |

Term Loan B-2(g) | | | - | | | | 01/31/2029 | | | | 1,734 | | | 1,720,940 |

Term Loan B-3(e) | | | 0.00% | | | | 01/31/2029 | | | | 272 | | | 269,951 |

BK LC Lux SPV S.a.r.l., Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 3.75% | | | | 04/28/2028 | | | | 1,112 | | | 1,103,124 |

Gloves Buyer, Inc., Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 12/29/2027 | | | | 816 | | | 810,200 |

International Textile Group, Inc., First Lien Term Loan (3 mo. USD LIBOR + 5.00%) | | | 5.21% | | | | 05/01/2024 | | | | 120 | | | 111,115 |

Mascot Bidco OYJ (Finland), Term Loan B (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 03/30/2026 | | | | EUR 772 | | | 861,486 |

| | | | | | | | | | | | | | | 5,554,673 |

| | | | |

Conglomerates–0.21% | | | | | | | | | | | | | | |

| | | | |

APi Group DE, Inc., Incremental Term Loan (g) | | | - | | | | 01/01/2029 | | | | 529 | | | 526,662 |

CeramTec (Germany), Term Loan B(g) | | | - | | | | 01/19/2029 | | | | EUR 234 | | | 260,392 |

Safe Fleet Holdings LLC, Second Lien Term Loan (3 mo. USD LIBOR + 6.75%) | | | 7.75% | | | | 02/02/2026 | | | | 193 | | | 191,513 |

| | | | | | | | | | | | | | | 978,567 |

| | | | |

Containers & Glass Products–2.64% | | | | | | | | | | | | | | |

| | | | |

Berlin Packaging LLC, Term Loan B-5 (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 03/11/2028 | | | | 734 | | | 730,580 |

Brook & Whittle Holding Corp. | | | | | | | | | | | | | | |

Delayed Draw Term Loan (1 mo. USD LIBOR + 3.00%) | | | 6.50% | | | | 12/05/2028 | | | | 9 | | | 8,918 |

Delayed Draw Term Loan(e) | | | 0.00% | | | | 12/05/2028 | | | | 85 | | | 84,954 |

Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 12/05/2028 | | | | 356 | | | 354,835 |

Duran Group (Germany), Term Loan B-2 (3 mo. USD LIBOR + 4.00%)(d) | | | 5.25% | | | | 03/29/2024 | | | | 2,498 | | | 2,460,099 |

Hoffmaster Group, Inc., First Lien Term Loan B-1 (1 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 11/21/2023 | | | | 2,161 | | | 2,021,335 |

Keter Group B.V. (Netherlands), Term Loan B-5(g) | | | - | | | | 10/01/2023 | | | | EUR 322 | | | 354,699 |

Klockner Pentaplast of America, Inc. | | | | | | | | | | | | | | |

Term Loan B (3 mo. EURIBOR + 4.75%) | | | 4.75% | | | | 02/12/2026 | | | | EUR 313 | | | 328,292 |

Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.55% | | | | 02/12/2026 | | | | 239 | | | 224,984 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 11 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Containers & Glass Products–(continued) | | | | | | | | | | | | | | |

LABL, Inc. | | | | | | | | | | | | | | |

Term Loan B(g) | | | - | | | | 10/31/2028 | | | | EUR 490 | | | $ 548,913 |

Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 5.50% | | | | 10/31/2028 | | | | $ 2,230 | | | 2,221,571 |

Libbey Glass, Inc., PIK Term Loan, 6.00% PIK Rate, 5.00% Cash Rate

(Acquired 11/13/2020-01/13/2022; Cost $692,707)(f)(h) | | | 6.00% | | | | 11/12/2025 | | | | 748 | | | 776,995 |

Logoplaste (Portugal), Term Loan B (1 mo. USD LIBOR + 4.25%) | | | 4.75% | | | | 07/07/2028 | | | | 422 | | | 419,711 |

Mold-Rite Plastics LLC | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%)(d) | | | 4.25% | | | | 10/04/2028 | | | | 361 | | | 356,597 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.00%)(d) | | | 7.50% | | | | 10/04/2029 | | | | 224 | | | 220,482 |

Pretium Packaging | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 10/02/2028 | | | | 694 | | | 687,162 |

Second Lien Term Loan B (1 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 09/30/2029 | | | | 184 | | | 183,331 |

| | | | - | | | | | | | | | | | 11,983,458 |

| | | | |

Cosmetics & Toiletries–0.95% | | | | | | | | | | | | | | |

Anastasia Parent LLC, Term Loan (3 mo. USD LIBOR + 3.75%) | | | 3.97% | | | | 08/11/2025 | | | | 461 | | | 401,805 |

Coty, Inc., Term Loan B (3 mo. USD LIBOR + 2.25%) | | | 2.37% | | | | 04/05/2025 | | | | 2,895 | | | 2,844,567 |

KDC/One (Canada), Term Loan (3 mo. EURIBOR + 5.00%) | | | 5.00% | | | | 12/22/2025 | | | | EUR 106 | | | 118,477 |

Rodenstock (Germany), Term Loan B (3 mo. EURIBOR + 5.00%) | | | 5.00% | | | | 06/29/2028 | | | | EUR 650 | | | 726,863 |

Wella, Term Loan B(g) | | | - | | | | 01/27/2029 | | | | EUR 220 | | | 244,124 |

| | | | | | | | | | | | | | | 4,335,836 |

| | | | |

Drugs–0.58% | | | | | | | | | | | | | | |

Bausch Health Americas, Inc., First Lien Incremental Term Loan (3 mo. USD LIBOR + 2.75%) | | | 2.96% | | | | 11/27/2025 | | | | 424 | | | 419,096 |

Endo LLC, Term Loan (1 mo. USD LIBOR + 5.00%) | | | 5.75% | | | | 03/27/2028 | | | | 1,875 | | | 1,817,981 |

Grifols Worldwide Operations USA, Inc., Term Loan B (3 mo. USD LIBOR + 2.00%) | | | 2.21% | | | | 11/15/2027 | | | | 5 | | | 4,660 |

Valeant Pharmaceuticals International, Inc. (Canada), Term Loan (3 mo. USD LIBOR + 3.00%) | | | 3.21% | | | | 06/02/2025 | | | | 397 | | | 393,812 |

| | | | | | | | | | | | | | | 2,635,549 |

| | | | |

Ecological Services & Equipment–1.12% | | | | | | | | | | | | | | |

Anticimex (Sweden) | | | | | | | | | | | | | | |

Incremental Term Loan B(d)(g) | | | - | | | | 11/16/2028 | | | | 416 | | | 413,206 |

Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.01% | | | | 07/21/2028 | | | | 913 | | | 903,446 |

EnergySolutions LLC, Term Loan (3 mo. USD LIBOR + 3.75%) | | | 4.75% | | | | 05/11/2025 | | | | 516 | | | 511,807 |

GFL Environmental, Inc. (Canada), Incremental Term Loan (1 mo. USD LIBOR + 3.00%) | | | 3.50% | | | | 05/30/2025 | | | | 417 | | | 415,743 |

Groundworks LLC | | | | | | | | | | | | | | |

Delayed Draw Term Loan(d)(e) | | | 0.00% | | | | 01/17/2026 | | | | 251 | | | 250,980 |

Delayed Draw Term Loan (3 mo. USD LIBOR + 5.00%)(d) | | | 1.00% | | | | 01/17/2026 | | | | 1,097 | | | 1,094,827 |

Term Loan (3 mo. USD LIBOR + 5.00%)(d) | | | 5.22% | | | | 01/17/2026 | | | | 50 | | | 50,196 |

OGF (France), Term Loan B-2(g) | | | - | | | | 12/31/2025 | | | | EUR 166 | | | 174,255 |

Patriot Container Corp., First Lien Term Loan (1 mo. USD LIBOR + 3.75%)(d) | | | 4.75% | | | | 03/20/2025 | | | | 441 | | | 424,760 |

TruGreen L.P., Second Lien Term Loan (1 mo. USD LIBOR + 7.50%)(d) | | | 9.25% | | | | 11/02/2028 | | | | 827 | | | 833,408 |

| | | | | | | | | | | | | | | 5,072,628 |

| | | | |

Electronics & Electrical–13.45% | | | | | | | | | | | | | | |

Altar BidCo, Inc., Second Lien Term Loan (1 mo. SOFR + 5.60%) | | | 6.10% | | | | 12/01/2029 | | | | 206 | | | 207,180 |

AppLovin Corp., Term Loan B (1 mo. USD LIBOR + 3.00%) | | | 3.50% | | | | 10/21/2028 | | | | 920 | | | 912,840 |

Barracuda Networks, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.50% | | | | 10/30/2028 | | | | 111 | | | 111,639 |

Boxer Parent Co., Inc., Term Loan B (3 mo. EURIBOR + 4.00%) | | | 4.00% | | | | 10/02/2025 | | | | EUR 20 | | | 22,302 |

Brave Parent Holdings, Inc., First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | | | 4.21% | | | | 04/18/2025 | | | | 455 | | | 453,456 |

CommerceHub, Inc., Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 01/01/2028 | | | | 1,062 | | | 1,048,976 |

CommScope, Inc., Term Loan (3 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 04/06/2026 | | | | 635 | | | 621,774 |

ConnectWise LLC, Term Loan (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 10/01/2028 | | | | 603 | | | 598,681 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 12 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Electronics & Electrical–(continued) | | | | | | | | | | | | | | |

Cornerstone OnDemand, Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 10/16/2028 | | | | $ 575 | | | $ 571,124 |

Delta Topco, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 12/01/2027 | | | | 2,567 | | | 2,552,895 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.25%) | | | 8.00% | | | | 12/01/2028 | | | | 358 | | | 357,987 |

Devoteam (Castillon S.A.S. -Bidco) (France), Term Loan B (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 12/09/2027 | | | | EUR 304 | | | 339,975 |

Diebold Nixdorf, Inc., Term Loan B (3 mo. USD LIBOR + 2.75%) | | | 2.88% | | | | 11/06/2023 | | | | 898 | | | 888,282 |

Digi International, Inc., Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 5.50% | | | | 12/01/2028 | | | | 954 | | | 954,845 |

E2Open LLC, Term Loan (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 02/04/2028 | | | | 1,177 | | | 1,170,060 |

Emerald Technologies AcquisitionCo, Inc., Term Loan B(d)(g) | | | - | | | | 12/29/2027 | | | | 200 | | | 199,640 |

ETA Australia Holdings III Pty. Ltd. (Australia), First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | | | 4.21% | | | | 05/06/2026 | | | | 1,038 | | | 1,026,956 |

EverCommerce, Term Loan B (1 mo. USD LIBOR + 3.00%) | | | 3.50% | | | | 07/01/2028 | | | | 510 | | | 507,607 |

Finastra USA, Inc. (United Kingdom), First Lien Term Loan (3 mo. USD LIBOR + 3.50%) | | | 4.50% | | | | 06/13/2024 | | | | 394 | | | 389,381 |

Forcepoint, Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.00% | | | | 01/07/2028 | | | | 912 | | | 908,349 |

Hyland Software, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 07/01/2024 | | | | 455 | | | 453,398 |

Second Lien Term Loan (1 mo. USD LIBOR + 6.25%) | | | 7.00% | | | | 07/07/2025 | | | | 210 | | | 211,285 |

Imperva, Inc. | | | | | | | | | | | | | | |

Second Lien Term Loan (3 mo. USD LIBOR + 7.75%) | | | 8.75% | | | | 01/11/2027 | | | | 988 | | | 990,378 |

Term Loan (3 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 01/10/2026 | | | | 349 | | | 347,517 |

Infinite Electronics | | | | | | | | | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 7.00%) | | | 7.51% | | | | 03/02/2029 | | | | 295 | | | 294,844 |

Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 03/02/2028 | | | | 419 | | | 416,207 |

Informatica Corp., Term Loan (1 mo. USD LIBOR + 2.75%) | | | 3.00% | | | | 10/15/2028 | | | | 119 | | | 117,706 |

ION Corp., Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 3.97% | | | | 03/11/2028 | | | | 480 | | | 477,640 |

Learning Pool (United Kingdom) | | | | | | | | | | | | | | |

Term Loan (Acquired 01/07/2022; Cost $398,008)(d)(f)(g) | | | - | | | | 08/17/2028 | | | | GBP 297 | | | 392,639 |

Term Loan 2 (Acquired 01/07/2022; Cost $386,795)(d)(f)(g) | | | - | | | | 08/17/2028 | | | | 393 | | | 386,698 |

LogMeIn, Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 4.89% | | | | 08/28/2027 | | | | 3,803 | | | 3,746,797 |

Marcel Bidco LLC, Incremental Term Loan B (1 mo. USD LIBOR + 4.00%)(d) | | | 4.75% | | | | 12/31/2027 | | | | 93 | | | 92,488 |

Mavenir Systems, Inc., Term Loan B (1 mo. USD LIBOR + 4.75%) | | | 5.25% | | | | 08/13/2028 | | | | 1,129 | | | 1,120,161 |

Maverick Bidco, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 05/18/2028 | | | | 450 | | | 450,308 |

Second Lien Term Loan (1 mo. USD LIBOR + 6.75%)(d) | | | 7.50% | | | | 05/18/2029 | | | | 49 | | | 48,886 |

McAfee Enterprise | | | | | | | | | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 8.25%) | | | 9.00% | | | | 07/27/2029 | | | | 628 | | | 623,424 |

Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 5.75% | | | | 07/27/2028 | | | | 2,078 | | | 2,062,542 |

McAfee LLC | | | | | | | | | | | | | | |

First Lien Term Loan B(g) | | | - | | | | 02/03/2029 | | | | 3,458 | | | 3,416,151 |

Term Loan B(g) | | | - | | | | 02/02/2029 | | | | EUR 485 | | | 538,264 |

Mediaocean LLC, Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 12/15/2028 | | | | 659 | | | 655,733 |

Natel Engineering Co., Inc., Term Loan (3 mo. USD LIBOR + 6.25%) | | | 7.25% | | | | 04/29/2026 | | | | 2,108 | | | 2,063,781 |

Native Instruments (Germany), Term Loan (3 mo. USD LIBOR + 6.00%)(d) | | | 6.25% | | | | 03/03/2028 | | | | EUR 784 | | | 866,237 |

NCR Corp., Term Loan B (1 mo. USD LIBOR + 2.50%) | | | 2.80% | | | | 08/28/2026 | | | | 657 | | | 646,726 |

Oberthur Tech (France) | | | | | | | | | | | | | | |

Term Loan B-4 (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 01/10/2026 | | | | EUR 1,455 | | | 1,624,305 |

Term Loan B-4 (3 mo. EURIBOR + 4.50%) (Acquired 07/23/2021; Cost $186,336)(f) | | | 4.50% | | | | 01/10/2026 | | | | EUR 159 | | | 177,153 |

Oberthur Technologies of America Corp., Term Loan B (1 mo. USD LIBOR + 4.50%)

(Acquired 04/01/2021-09/14/2021; Cost $1,293,408)(f) | | | 5.25% | | | | 01/09/2026 | | | | 1,302 | | | 1,297,229 |

Optiv, Inc. | | | | | | | | | | | | | | |

Second Lien Term Loan (3 mo. USD LIBOR + 7.25%) | | | 8.25% | | | | 01/31/2025 | | | | 490 | | | 486,963 |

Term Loan (3 mo. USD LIBOR + 3.25%) | | | 4.25% | | | | 02/01/2024 | | | | 3,691 | | | 3,653,367 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 13 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Electronics & Electrical–(continued) | | | | | | | | | | | | | | |

| | | | |

Project Accelerate Parent LLC, First Lien Term Loan (3 mo. USD LIBOR + 4.25%)(d) | | | 5.25% | | | | 01/02/2025 | | | | $ 1,201 | | | $ 1,194,771 |

Project Leopard Holdings, Inc. | | | | | | | | | | | | | | |

Incremental Term Loan (3 mo. USD LIBOR + 4.75%) | | | 5.75% | | | | 07/05/2024 | | | | 1,557 | | | 1,556,055 |

Term Loan (3 mo. USD LIBOR + 4.75%) | | | 5.75% | | | | 07/05/2024 | | | | 464 | | | 463,927 |

Proofpoint, Inc., Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 3.76% | | | | 08/31/2028 | | | | 1,320 | | | 1,307,398 |

Quest Software US Holdings, Inc. | | | | | | | | | | | | | | |

Second Lien Term Loan (3 mo. SOFR + 7.50%) | | | 8.00% | | | | 01/20/2030 | | | | 136 | | | 133,272 |

Term Loan B(g) | | | - | | | | 01/19/2029 | | | | 3,145 | | | 3,104,775 |

RealPage, Inc., Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 3.75% | | | | 04/24/2028 | | | | 1,375 | | | 1,362,295 |

Renaissance Holding Corp., Second Lien Term Loan (3 mo. USD LIBOR + 7.00%) | | | 7.21% | | | | 05/29/2026 | | | | 359 | | | 357,849 |

Resideo Funding, Inc., Term Loan B (1 mo. USD LIBOR + 2.25%) | | | 2.75% | | | | 02/08/2028 | | | | 367 | | | 366,559 |

Riverbed Technology, Inc., PIK Term Loan, 2.00% PIK Rate, 7.00% Cash Rate

(Acquired 12/06/2021-12/31/2021; Cost $3,877,163)(f)(h) | | | 2.00% | | | | 12/08/2026 | | | | 3,097 | | | 2,854,735 |

Sandvine Corp. | | | | | | | | | | | | | | |

First Lien Term Loan (3 mo. USD LIBOR + 4.50%) | | | 4.71% | | | | 10/31/2025 | | | | 1,378 | | | 1,372,900 |

Second Lien Term Loan (1 mo. USD LIBOR + 8.00%) | | | 8.21% | | | | 11/02/2026 | | | | 190 | | | 188,856 |

SmartBear (AQA Acquisition Holdings, Inc), Term Loan B (1 mo. USD LIBOR + 4.25%) | | | 4.75% | | | | 03/03/2028 | | | | 333 | | | 331,549 |

SonicWall U.S. Holdings, Inc., Term Loan(g) | | | - | | | | 05/16/2025 | | | | 131 | | | 129,892 |

Tenable Holdings, Inc., Term Loan B (1 mo. USD LIBOR + 2.75%) | | | 3.27% | | | | 07/07/2028 | | | | 265 | | | 262,776 |

Ultimate Software Group, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan (3 mo. USD LIBOR + 3.75%) | | | 3.96% | | | | 05/04/2026 | | | | 1,578 | | | 1,568,541 |

Second Lien Term Loan (1 mo. USD LIBOR + 5.25%) | | | 5.75% | | | | 05/03/2027 | | | | 154 | | | 154,356 |

UST Holdings Ltd., Term Loan B(g) | | | - | | | | 10/15/2028 | | | | 708 | | | 700,581 |

Veritas US, Inc. | | | | | | | | | | | | | | |

Term Loan B (3 mo. EURIBOR + 4.75%) | | | 5.75% | | | | 09/01/2025 | | | | EUR 446 | | | 499,743 |

Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 6.00% | | | | 09/01/2025 | | | | 679 | | | 671,890 |

WebPros, Term Loan (1 mo. USD LIBOR + 5.25%) | | | 5.75% | | | | 02/18/2027 | | | | 1,051 | | | 1,051,943 |

| | | | | | | | | | | | | | | 61,137,439 |

| | | | |

Financial Intermediaries–0.82% | | | | | | | | | | | | | | |

| | | | |

Alter Domus (Participations S.a.r.l.) (Luxembourg), Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 02/17/2028 | | | | 375 | | | 371,684 |

AssuredPartners, Inc., Incremental Term Loan(g) | | | - | | | | 02/13/2027 | | | | 162 | | | 159,530 |

Edelman Financial Center LLC (The) | | | | | | | | | | | | | | |

Incremental Term Loan (1 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 04/07/2028 | | | | 1,831 | | | 1,818,870 |

Second Lien Term Loan (3 mo. USD LIBOR + 6.75%) | | | 6.96% | | | | 07/20/2026 | | | | 111 | | | 111,500 |

LendingTree, Inc., First Lien Term Loan B(e) | | | 0.00% | | | | 09/15/2028 | | | | 841 | | | 841,295 |

Stiphout Finance LLC, Incremental Term Loan (1 mo. USD LIBOR + 3.75%)(d) | | | 4.75% | | | | 10/26/2025 | | | | 123 | | | 122,545 |

Tegra118 Wealth Solutions, Inc., Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.49% | | | | 02/18/2027 | | | | 324 | | | 324,305 |

| | | | | | | | | | | | | | | 3,749,729 |

| | | | |

Food Products–2.27% | | | | | | | | | | | | | | |

| | | | |

Arnott’s (Snacking Investments US LLC), Term Loan (1 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 12/18/2026 | | | | 864 | | | 864,723 |

Biscuit Intl (Cookie Acq S.A.S., De Banketgroep Holding) (France), First Lien Term Loan (3 mo. EURIBOR + 4.00%) | | | 4.00% | | | | 02/15/2027 | | | | EUR 275 | | | 294,340 |

BrightPet | | | | | | | | | | | | | | |

Delayed Draw Term Loan(d)(e) | | | 0.00% | | | | 10/05/2026 | | | | 671 | | | 673,627 |

Revolver Loan (3 mo. USD LIBOR + 6.25%)(d) | | | 7.25% | | | | 10/05/2026 | | | | 260 | | | 261,030 |

Revolver Loan(d)(e) | | | 0.00% | | | | 10/05/2026 | | | | 76 | | | 75,783 |

Term Loan B (3 mo. USD LIBOR + 6.25%)(d) | | | 7.25% | | | | 10/05/2026 | | | | 2,326 | | | 2,334,116 |

Florida Food Products LLC | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 5.00%) | | | 5.75% | | | | 10/18/2028 | | | | 2,901 | | | 2,843,148 |

Second Lien Term Loan (1 mo. USD LIBOR + 8.00%) | | | 8.75% | | | | 10/08/2029 | | | | 609 | | | 593,243 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 14 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Food Products–(continued) | | | | | | | | | | | | | | |

| | | | |

H-Food Holdings LLC | | | | | | | | | | | | | | |

Incremental Term Loan B-3 (1 mo. USD LIBOR + 5.00%) | | | 6.00% | | | | 05/23/2025 | | | | $ 94 | | | $ 93,433 |

Term Loan (3 mo. USD LIBOR + 3.69%) | | | 3.90% | | | | 05/23/2025 | | | | 596 | | | 581,008 |

Panzani/Pimente (France), Term Loan B(g) | | | – | | | | 12/02/2028 | | | | EUR 174 | | | 194,156 |

Shearer’s Foods LLC | | | | | | | | | | | | | | |

Second Lien Term Loan (1 mo. USD LIBOR + 7.75%) | | | 8.75% | | | | 09/22/2028 | | | | 232 | | | 230,956 |

Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.25% | | | | 09/23/2027 | | | | 274 | | | 265,127 |

Sigma Bidco B.V. (Netherlands), Term Loan B-1 (3 mo. EURIBOR + 3.50%) | | | 3.50% | | | | 07/02/2025 | | | | EUR 427 | | | 445,296 |

Valeo Foods (Jersey) Ltd. (United Kingdom), First Lien Term Loan B (6 mo. SONIA + 5.00%) | | | 5.05% | | | | 06/28/2028 | | | | GBP 429 | | | 568,229 |

| | | | | | | | | | | | | | | 10,318,215 |

| | | | |

Food Service–0.68% | | | | | | | | | | | | | | |

| | | | |

Euro Garages (Netherlands) | | | | | | | | | | | | | | |

Term Loan (3 mo. USD LIBOR + 4.00%) | | | 4.22% | | | | 02/06/2025 | | | | 538 | | | 533,215 |

Term Loan (1 mo. USD LIBOR + 4.25%) | | | 4.75% | | | | 03/31/2026 | | | | 312 | | | 310,685 |

Term Loan B (3 mo. USD LIBOR + 4.00%) | | | 4.22% | | | | 02/06/2025 | | | | 439 | | | 434,951 |

Financiere Pax S.A.S., Term Loan B (3 mo. EURIBOR + 4.75%) | | | 4.75% | | | | 07/01/2026 | | | | EUR 1,400 | | | 1,450,312 |

NPC International, Inc., Second Lien Term Loan(i)(j) | | | 1.00% | | | | 04/18/2025 | | | | 239 | | | 4,791 |

Weight Watchers International, Inc., Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 04/13/2028 | | | | 377 | | | 338,537 |

| | | | | | | | | | | | | | | 3,072,491 |

| | | | |

Health Care–6.21% | | | | | | | | | | | | | | |

| | | | |

Acacium (United Kingdom) | | | | | | | | | | | | | | |

Term Loan (1 mo. SONIA + 5.25%) | | | 5.74% | | | | 05/19/2028 | | | | GBP 295 | | | 393,547 |

Term Loan(d)(g) | | | – | | | | 06/08/2028 | | | | 590 | | | 584,513 |

Ascend Learning LLC | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 11/18/2028 | | | | 95 | | | 94,016 |

Second Lien Term Loan (1 mo. USD LIBOR + 5.75%) | | | 6.25% | | | | 12/10/2029 | | | | 413 | | | 413,572 |

athenahealth, Inc. | | | | | | | | | | | | | | |

Delayed Draw Term Loan B(e) | | | 0.00% | | | | 02/15/2029 | | | | 566 | | | 561,426 |

Term Loan B(g) | | | – | | | | 01/26/2029 | | | | 3,339 | | | 3,312,413 |

Biogroup-LCD (France), Term Loan B (3 mo. EURIBOR + 3.75%) | | | 3.75% | | | | 02/09/2028 | | | | EUR 292 | | | 324,274 |

Cerba (Chrome Bidco) (France), Term Loan(g) | | | – | | | | 02/14/2029 | | | | EUR 248 | | | 275,387 |

Certara Holdco, Inc., Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 3.71% | | | | 08/14/2026 | | | | 405 | | | 402,466 |

Cheplapharm Arzneimittel GmbH (Germany), Term Loan B(g) | | | – | | | | 11/02/2029 | | | | EUR 312 | | | 345,653 |

Curium BidCo S.a.r.l. (Luxembourg), Term Loan (1 mo. USD LIBOR + 4.25%) | | | 5.00% | | | | 12/02/2027 | | | | 731 | | | 727,004 |

embecta, Term Loan(g) | | | – | | | | 01/27/2029 | | | | 777 | | | 771,627 |

Ethypharm (France), Term Loan B (3 mo. SONIA + 4.50%) | | | 4.84% | | | | 04/17/2028 | | | | GBP 371 | | | 477,584 |

ExamWorks Group, Inc./Electron Bidco, Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.75% | | | | 11/01/2028 | | | | 277 | | | 274,823 |

Explorer Holdings, Inc., First Lien Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.50% | | | | 02/04/2027 | | | | 1,028 | | | 1,028,298 |

Gainwell Holding Corp., Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 10/01/2027 | | | | 2,369 | | | 2,361,569 |

Global Healthcare Exchange LLC, First Lien Term Loan (3 mo. USD LIBOR + 3.25%) | | | 4.25% | | | | 06/28/2024 | | | | 298 | | | 296,571 |

Global Medical Response, Inc. | | | | | | | | | | | | | | |

Term Loan (3 mo. USD LIBOR + 4.25%) | | | 5.25% | | | | 03/14/2025 | | | | 314 | | | 312,871 |

Term Loan (1 mo. USD LIBOR + 4.25%) | | | 5.25% | | | | 10/02/2025 | | | | 1,499 | | | 1,493,495 |

HC Group Holdings III, Inc., Term Loan B (1 mo. USD LIBOR + 2.75%) | | | 3.25% | | | | 10/25/2028 | | | | 248 | | | 246,430 |

ICON PLC | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 2.25%) | | | 2.75% | | | | 07/03/2028 | | | | 16 | | | 15,398 |

Term Loan (1 mo. USD LIBOR + 2.25%) | | | 2.75% | | | | 07/03/2028 | | | | 62 | | | 61,800 |

Inovie Group Bidco (Labosud) (France), Term Loan B(g) | | | – | | | | 03/03/2028 | | | | EUR 438 | | | 485,945 |

Insulet Corp., Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.75% | | | | 05/04/2028 | | | | 154 | | | 153,289 |

International SOS L.P., Term Loan B (1 mo. USD LIBOR + 3.75%)(d) | | | 4.25% | | | | 09/07/2028 | | | | 637 | | | 636,285 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 15 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Health Care–(continued) | | | | | | | | | | | | | | |

| | | | |

MedAssets Software Intermediate Holdings, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 4.00%) | | | 4.50% | | | | 11/19/2028 | | | | $ 1,080 | | | $ 1,074,735 |

Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 11/22/2029 | | | | 401 | | | 397,476 |

MJH Healthcare Holdings LLC, Term Loan B(d)(g) | | | – | | | | 01/25/2029 | | | | 456 | | | 453,492 |

Nemera (Financiere N BidCo) (France), Incremental Term Loan B (3 mo. EURIBOR + 3.75%) | | | 3.75% | | | | 01/22/2026 | | | | EUR 80 | | | 88,479 |

Neuraxpharm (Cerebro BidCo/Blitz F20-80 GmbH) (Germany) | | | | | | | | | | | | | | |

Term Loan B (3 mo. EURIBOR + 4.25%) | | | 4.25% | | | | 12/15/2027 | | | | EUR 138 | | | 154,751 |

Term Loan B-2 (3 mo. EURIBOR + 4.25%) | | | 4.25% | | | | 12/15/2027 | | | | EUR 80 | | | 89,391 |

Nidda Healthcare Holding AG (Germany), Term Loan F (3 mo. SONIA + 4.50%) | | | 4.95% | | | | 08/21/2026 | | | | GBP 314 | | | 410,587 |

Ortho-Clinical Diagnostics, Inc., Term Loan (3 mo. USD LIBOR + 3.00%) | | | 3.11% | | | | 06/30/2025 | | | | 239 | | | 238,464 |

Packaging Coordinators Midco, Inc., First Lien Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 11/30/2027 | | | | 191 | | | 190,342 |

PAREXEL International Corp., Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 11/15/2028 | | | | 193 | | | 191,559 |

Revint Intermediate II LLC, Term Loan (1 mo. USD LIBOR + 4.25%) | | | 4.75% | | | | 10/15/2027 | | | | 1,973 | | | 1,969,978 |

Sharp Midco LLC, Term Loan B (1 mo. USD LIBOR + 4.00%)(d) | | | 4.50% | | | | 12/15/2028 | | | | 341 | | | 339,413 |

Stamina BidCo B.V. (Netherlands), Term Loan B (3 mo. EURIBOR + 4.50%) | | | 4.50% | | | | 11/02/2028 | | | | EUR 127 | | | 141,472 |

Summit Behavioral Healthcare LLC, First Lien Term Loan (1 mo. USD LIBOR + 4.75%)(d) | | | 5.50% | | | | 11/24/2028 | | | | 1,350 | | | 1,324,917 |

TTF Holdings LLC, Term Loan B (1 mo. USD LIBOR + 4.25%)(d) | | | 5.00% | | | | 03/31/2028 | | | | 540 | | | 538,386 |

Unified Womens Healthcare L.P., Term Loan B (1 mo. USD LIBOR + 4.25%) | | �� | 5.00% | | | | 12/17/2027 | | | | 1,446 | | | 1,442,852 |

Verscend Holding Corp., Term Loan B-1 (1 mo. USD LIBOR + 4.00%) | | | 4.21% | | | | 08/27/2025 | | | | 840 | | | 838,440 |

Waystar, Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.21% | | | | 10/23/2026 | | | | 530 | | | 528,552 |

Women’s Care Holdings, Inc. LLC | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.25% | | | | 01/15/2028 | | | | 546 | | | 544,654 |

Second Lien Term Loan (1 mo. USD LIBOR + 8.25%) | | | 9.00% | | | | 01/15/2029 | | | | 235 | | | 234,583 |

WP CityMD Bidco LLC, First Lien Incremental Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.75% | | | | 12/22/2028 | | | | 981 | | | 974,547 |

| | | | | | | | | | | | | | | 28,217,326 |

| | | | |

Home Furnishings–2.24% | | | | | | | | | | | | | | |

| | | | |

Hilding Anders AB (Sweden), Term Loan B (3 mo. EURIBOR + 5.00%) | | | 0.75% | | | | 11/29/2024 | | | | EUR 393 | | | 327,645 |

Hunter Douglas, Inc. | | | | | | | | | | | | | | |

First Lien Term Loan(g) | | | – | | | | 02/09/2029 | | | | 2,082 | | | 2,054,968 |

First Lien Term Loan(g) | | | – | | | | 02/09/2029 | | | | EUR 1,317 | | | 1,467,644 |

| | | | |

Mattress Holding Corp., Term Loan B (1 mo. USD LIBOR + 4.25%)

(Acquired 09/22/2021-12/09/2021; Cost $1,582,156)(f) | | | 5.00% | | | | 09/30/2028 | | | | 1,597 | | | 1,585,514 |

Serta Simmons Bedding LLC | | | | | | | | | | | | | | |

First Lien Term Loan (1 mo. USD LIBOR + 7.50%) | | | 8.50% | | | | 08/10/2023 | | | | 717 | | | 723,843 |

Second Lien Term Loan (1 mo. USD LIBOR + 7.50%) | | | 8.50% | | | | 08/10/2023 | | | | 1,798 | | | 1,734,894 |

SIWF Holdings, Inc., Term Loan B (1 mo. USD LIBOR + 4.00%) | | | 4.75% | | | | 10/16/2028 | | | | 1,385 | | | 1,346,590 |

TGP Holdings III LLC | | | | | | | | | | | | | | |

Delayed Draw Term Loan(e) | | | 0.00% | | | | 06/23/2028 | | | | 55 | | | 53,551 |

Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 4.00% | | | | 06/29/2028 | | | | 413 | | | 406,128 |

VC GB Holdings, Inc., Second Lien Term Loan (1 mo. USD LIBOR + 6.75%) | | | 7.25% | | | | 07/01/2029 | | | | 319 | | | 311,101 |

Weber-Stephen Products LLC, Incremental Term Loan(d)(g) | | | – | | | | 10/30/2027 | | | | 47 | | | 45,645 |

Webster-Stephen Products LLC, Term Loan B (1 mo. USD LIBOR + 3.25%) | | | 4.00% | | | | 10/30/2027 | | | | 145 | | | 141,568 |

| | | | | | | | | | | | | | | 10,199,091 |

| | | | |

Industrial Equipment–3.70% | | | | | | | | | | | | | | |

| | | | |

Alpha AB Bidco B.V. (Netherlands), Term Loan B (3 mo. EURIBOR + 3.50%) | | | 3.50% | | | | 07/30/2025 | | | | EUR 359 | | | 395,627 |

Apex Tool Group LLC, Term Loan B(g) | | | – | | | | 02/08/2029 | | | | 817 | | | 815,139 |

Brush (United Kingdom) | | | | | | | | | | | | | | |

Term Loan (3 mo. EURIBOR + 7.00%)(d) | | | 7.00% | | | | 06/09/2028 | | | | EUR 882 | | | 968,000 |

Term Loan A (3 mo. SONIA + 7.00%)(d) | | | 7.28% | | | | 06/09/2028 | | | | GBP 759 | | | 997,919 |

CIRCOR International, Inc., Term Loan (1 mo. USD LIBOR + 4.50%) | | | 5.00% | | | | 12/20/2028 | | | | 734 | | | 730,233 |

Crosby US Acquisition Corp., Term Loan B (3 mo. USD LIBOR + 4.75%) | | | 4.91% | | | | 06/27/2026 | | | | 291 | | | 289,760 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 16 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Industrial Equipment–(continued) | | | | | | | | | | | | | | |

| | | | |

Delachaux Group S.A. (France), Term Loan B-2 (3 mo. USD LIBOR + 4.50%) | | | 4.80% | | | | 04/16/2026 | | | | $ 324 | | | $ 321,198 |

DXP Enterprises, Inc., Term Loan (1 mo. USD LIBOR + 4.75%) | | | 5.75% | | | | 12/16/2027 | | | | 667 | | | 664,245 |

Engineered Machinery Holdings, Inc. | | | | | | | | | | | | | | |

Incremental Term Loan (1 mo. USD LIBOR + 3.75%) | | | 4.50% | | | | 05/19/2028 | | | | 511 | | | 509,742 |

Second Lien Incremental Term Loan (1 mo. USD LIBOR + 6.00%) | | | 6.75% | | | | 05/21/2029 | | | | 117 | | | 117,380 |

Kantar (United Kingdom) | | | | | | | | | | | | | | |

Term Loan B (1 mo. USD LIBOR + 5.00%) | | | 5.18% | | | | 12/04/2026 | | | | 987 | | | 984,320 |

Term Loan B-3 (3 mo. EURIBOR + 4.25%) | | | 4.25% | | | | 12/04/2026 | | | | EUR 700 | | | 782,772 |

Madison IAQ LLC, Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.75% | | | | 06/21/2028 | | | | 1,736 | | | 1,711,417 |

MX Holdings US, Inc., Term Loan B-1-C (3 mo. USD LIBOR + 2.50%) | | | 3.25% | | | | 07/31/2025 | | | | 263 | | | 261,050 |

New VAC US LLC, Term Loan B (3 mo. USD LIBOR + 4.00%) | | | 5.00% | | | | 03/08/2025 | | | | 783 | | | 768,168 |

Platin2025 Holdings S.a r.l. (Germany), Term Loan B(g) | | | – | | | | 11/19/2028 | | | | EUR 863 | | | 960,710 |

Robertshaw US Holding Corp., Second Lien Term Loan (3 mo. USD LIBOR + 8.00%) | | | 9.00% | | | | 02/28/2026 | | | | 388 | | | 305,840 |

S2P Acquisiton Borrower, Inc., First Lien Term Loan (3 mo. USD LIBOR + 4.00%) | | | 4.21% | | | | 08/14/2026 | | | | 871 | | | 867,435 |

Thyssenkrupp Elevators (Vertical Midco GmbH) (Germany), Term Loan B (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 07/31/2027 | | | | 3,742 | | | 3,722,272 |

Victory Buyer LLC | | | | | | | | | | | | | | |

Second Lien Term Loan B(d)(g) | | | – | | | | 11/15/2029 | | | | 165 | | | 163,531 |

Term Loan B (1 mo. USD LIBOR + 3.75%)(d) | | | 4.25% | | | | 11/15/2028 | | | | 460 | | | 458,084 |

| | | | | | | | | | | | | | | 16,794,842 |

| | | | |

Insurance–1.73% | | | | | | | | | | | | | | |

| | | | |

Acrisure LLC | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 3.50%) | | | 3.72% | | | | 02/15/2027 | | | | 1,599 | | | 1,577,297 |

Term Loan B (1 mo. USD LIBOR + 3.75%) | | | 4.25% | | | | 02/15/2027 | | | | 619 | | | 613,263 |

Term Loan B-2 (1 mo. USD LIBOR + 4.25%) | | | 4.75% | | | | 02/15/2027 | | | | 773 | | | 767,289 |

Alliant Holdings Intermediate LLC | | | | | | | | | | | | | | |

Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 05/09/2025 | | | | 77 | | | 76,132 |

Term Loan (1 mo. USD LIBOR + 3.50%) | | | 4.00% | | | | 11/06/2027 | | | | 1,970 | | | 1,957,164 |

HUB International Ltd. | | | | | | | | | | | | | | |

Incremental Term Loan B-3 (1 mo. USD LIBOR + 3.25%) | | | 4.00% | | | | 04/25/2025 | | | | 1,671 | | | 1,661,673 |

Term Loan (1 mo. USD LIBOR + 2.75%) | | | 3.02% | | | | 04/25/2025 | | | | 95 | | | 93,682 |

Ryan Specialty Group LLC, Term Loan (1 mo. USD LIBOR + 3.00%) | | | 3.75% | | | | 09/01/2027 | | | | 167 | | | 165,649 |

Sedgwick Claims Management Services, Inc., Term Loan (3 mo. USD LIBOR + 3.25%) | | | 3.46% | | | | 12/31/2025 | | | | 416 | | | 411,385 |

USI, Inc. | | | | | | | | | | | | | | |

Term Loan (3 mo. USD LIBOR + 3.00%) | | | 3.22% | | | | 05/16/2024 | | | | 188 | | | 186,837 |

Term Loan (1 mo. USD LIBOR + 3.25%) | | | 3.47% | | | | 12/02/2026 | | | | 337 | | | 333,837 |

| | | | | | | | | | | | | | | 7,844,208 |

| | | | |

Leisure Goods, Activities & Movies–8.51% | | | | | | | | | | | | | | |

| | | | |

Alpha Topco Ltd. (United Kingdom), Term Loan B (3 mo. USD LIBOR + 2.50%) | | | 3.50% | | | | 02/01/2024 | | | | 1,383 | | | 1,373,427 |

AMC Entertainment, Inc., Term Loan B-1 (3 mo. USD LIBOR + 3.00%) | | | 3.12% | | | | 04/22/2026 | | | | 2,951 | | | 2,683,958 |

Carnival Corp. | | | | | | | | | | | | | | |

Incremental Term Loan (1 mo. USD LIBOR + 3.25%) | | | 4.00% | | | | 10/18/2028 | | | | 3,729 | | | 3,692,775 |

Term Loan (1 mo. USD LIBOR + 3.00%) | | | 3.75% | | | | 06/30/2025 | | | | 384 | | | 380,172 |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

| | |

| 17 | | Invesco Senior Loan Fund |

| | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount (000)(a) | | | Value |

Leisure Goods, Activities & Movies–(continued) | | | | | | | | | | | | | | |

| | | | |

Crown Finance US, Inc. | | | | | | | | | | | | | | |

Incremental Term Loan (1 mo. USD LIBOR + 8.25%) | | | 9.25% | | | | 05/23/2024 | | | | $ 473 | | | $ 503,403 |

Revolver Loan (3 mo. USD LIBOR + 3.00%) | | | 0.50% | | | | 03/02/2023 | | | | 557 | | | 465,192 |

Revolver Loan (3 mo. USD LIBOR + 5.00%) | | | 6.00% | | | | 05/23/2024 | | | | 513 | | | 496,357 |

Revolver Loan(e) | | | 0.00% | | | | 03/02/2023 | | | | 10 | | | 8,501 |

Term Loan (3 mo. EURIBOR + 2.63%) | | | 2.63% | | | | 02/28/2025 | | | | EUR 359 | | | 313,422 |

Term Loan (1 mo. USD LIBOR + 2.50%) | | | 3.50% | | | | 02/28/2025 | | | | 2,931 | | | 2,277,518 |

Term Loan (1 mo. USD LIBOR + 2.75%) | | | 3.75% | | | | 09/30/2026 | | | | 1,899 | | | 1,436,172 |

Term Loan B-1 (3 mo. USD LIBOR + 7.00%) | | | 7.00% | | | | 05/23/2024 | | | | 2,523 | | | 2,990,850 |

CWGS Group LLC, Term Loan B (1 mo. USD LIBOR + 2.50%) | | | 3.25% | | | | 06/03/2028 | | | | 983 | | | 970,954 |

Dorna Sports S.L. (Spain) | | | | | | | | | | | | | | |

Term Loan B | | | | | | | | | | | | | | |

(Acquired 02/03/2022; Cost $486,152)(f)(g) | | | – | | | | 02/03/2029 | | | | EUR 427 | | | 473,742 |

Term Loan B-2 (3 mo. USD LIBOR + 3.00%) | | | | | | | | | | | | | | |

(Acquired 03/21/2017-01/28/2021; Cost $1,398,791)(f) | | | 3.22% | | | | 04/12/2024 | | | | 1,425 | | | 1,424,164 |

Eagle Midco Ltd. (United Kingdom), Term Loan (3 mo. GBP LIBOR + 4.25%) | | | 4.98% | | | | 03/10/2028 | | | | GBP 233 | | | 309,271 |

Fender Musical Instruments Corp., Term Loan B (1 mo. SOFR + 4.00%)(d) | | | 4.50% | | | | 11/17/2028 | | | | 344 | | | 343,202 |

Fitness International LLC, Term Loan B (3 mo. USD LIBOR + 3.25%) | | | 4.25% | | | | 04/18/2025 | | | | 762 | | | 711,967 |

Hornblower Holdings LLC, Term Loan(g) | | | – | | | | 11/25/2025 | | | | 272 | | | 282,433 |

Invictus Media S.L.U. (Spain) | | | | | | | | | | | | | | |

Second Lien Term Loan | | | | | | | | | | | | | | |

(Acquired 05/17/2021-06/28/2021; Cost $1,582,544)(f)(j) | | | 7.50% | | | | 12/26/2025 | | | | EUR 1,898 | | | 1,861,951 |

Term Loan A-1 | | | | | | | | | | | | | | |

(Acquired 05/18/2021-06/28/2021; Cost $412,914)(f)(j) | | | 4.25% | | | | 06/26/2024 | | | | EUR 363 | | | 401,880 |

Term Loan A-2 | | | | | | | | | | | | | | |

(Acquired 05/18/2021-06/28/2021; Cost $259,106)(f)(j) | | | 5.25% | | | | 06/26/2024 | | | | EUR 228 | | | 252,182 |

Term Loan B-1 | | | | | | | | | | | | | | |

(Acquired 05/31/2018-06/28/2021; Cost $1,620,188)(f)(j) | | | 5.75% | | | | 06/26/2025 | | | | EUR 1,421 | | | 1,573,197 |

Term Loan B-2 | | | | | | | | | | | | | | |

(Acquired 05/31/2018-08/31/2021; Cost $1,404,303)(f)(j) | | | 4.75% | | | | 06/26/2025 | | | | EUR 1,234 | | | 1,365,965 |

Lakeland Tours LLC | | | | | | | | | | | | | | |

PIK Second Lien Term Loan, 6.00% PIK Rate, 2.75% Cash Rate(h) | | | 6.00% | | | | 09/25/2025 | | | | 209 | | | 203,191 |

PIK Term Loan, 13.25% PIK Rate(h) | | | 13.25% | | | | 09/25/2027 | | | | 285 | | | 199,673 |

Term Loan (1 mo. USD LIBOR + 6.00%) | | | 7.25% | | | | 09/25/2023 | | | | 117 | | | 118,138 |

Third Lien Term Loan B (1 mo. USD LIBOR + 1.50%) | | | 6.00% | | | | 09/25/2025 | | | | 263 | | | 234,771 |

Merlin (Motion Finco S.a.r.l. and LLC) (United Kingdom) | | | | | | | | | | | | | | |

Term Loan B-1 (1 mo. USD LIBOR + 3.25%) | | | 3.47% | | | | 11/12/2026 | | | | 135 | | | 132,259 |

Term Loan B-2 (1 mo. USD LIBOR + 3.25%) | | | 3.47% | | | | 11/12/2026 | | | | 16 | | | 15,671 |

Parques Reunidos (Spain) | | | | | | | | | | | | | | |

Incremental Term Loan B-2 (3 mo. EURIBOR + 7.50%) | | | 7.50% | | | | 09/17/2026 | | | | EUR 580 | | | 654,512 |