UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-5867

Oppenheimer Multi-State Municipal Trust

(Exact name of registrant as specified in charter)

6803 South Tucson Way, Centennial, Colorado 80112-3924

(Address of principal executive offices) (Zip code)

Cynthia Lo Bessette

OFI Global Asset Management, Inc.

225 Liberty Street, New York, New York 10281-1008

(Name and address of agent for service)

Registrant’s telephone number, including area code: (303) 768-3200

Date of fiscal year end: July 31

Date of reporting period: 1/31/2018

Item 1. Reports to Stockholders.

Table of Contents

Class A Shares

AVERAGE ANNUAL TOTAL RETURNS AT 1/31/18

| | | | | | |

| | | Class A Shares of the Fund | | |

| | | Without Sales Charge | | With Sales Charge | | Bloomberg Barclays

Municipal Bond Index |

| 6-Month | | -5.18% | | -9.68% | | -0.19% |

| 1-Year | | -6.18 | | -10.64 | | 3.52 |

| 5-Year | | 0.18 | | -0.79 | | 2.69 |

| 10-Year | | 2.72 | | 2.23 | | 4.20 |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Fund returns include changes in share price, reinvested distributions, and a 4.75% maximum applicable sales charge except where “without sales charge” is indicated. Current performance may be lower or higher than the performance quoted. Returns for periods of less than one year are cumulative and not annualized. Returns do not consider capital gains or income taxes on an individual’s investment. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677).

Our Twitter handle is @RochesterFunds.

|

| 2 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Fund Performance Discussion

Oppenheimer Rochester New Jersey Municipal Fund continued to generate attractive levels of tax-free income during the most recent reporting period. As of January 31, 2018, the Class A shares provided a distribution yield at net asset value (NAV) of 3.44%. The Fund’s 12-month distribution yield at NAV of 4.17% was the second highest in Lipper’s New Jersey Municipal Debt Funds category, second only to this Fund’s Y shares. Falling bond prices during this reporting period had an adverse effect on the performance of the overall market, including the Class A shares of this Fund.

MARKET OVERVIEW

U.S. equities rallied during the 6 months ended January 31, 2018, repeatedly topping previous record high closes before dropping sharply in the waning days of the reporting period. The prices of Treasury bonds and municipal bonds declined during this reporting period, and the 6-month total return of the Bloomberg Barclays Municipal Bond Index, this Fund’s benchmark, was negative.

On December 14, 2017, the Federal Reserve Open Market Committee (FOMC) voted to increase the Fed Funds target rate by one-

| | |

The average 12-month distribution yield at NAV in Lipper’s New Jersey Municipal Debt Funds category was 3.21% at the end of this reporting period. At 4.17%, the 12-month distribution yield at NAV for this Fund’s Class A shares was 96 basis points higher than the category average. | | |

quarter of 1 percentage point to a range of 1.25% to 1.50%. The FOMC cited the recent

| | | | |

YIELDS & DISTRIBUTIONS FOR CLASS A SHARES | | | | |

| Dividend Yield w/o sales charge | | | 3.44% | |

| Dividend Yield with sales charge | | | 3.28 | |

| Standardized Yield | | | 1.53 | |

| Taxable Equivalent Yield | | | 2.99 | |

| Last distribution (1/23/18) | | $ | 0.024 | |

| Total distributions (8/1/17 to 1/31/18) | | $ | 0.154 | |

Endnotes for this discussion begin on page 15 of this report.

|

| 3 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

trends in employment, household spending, and business fixed income investment as factors in its decision. Inflation for items other than food and energy continued to remain below the Fed’s target rate of 2%. The FOMC also reiterated its intent to increase the rate three times in 2018, while raising the forecast for economic growth.

The Fed began to “normalize” its balance sheet earlier in this reporting period. Reductions of $10 billion a month began in October 2017 and the January 2018 reduction was $18 billion. The Fed expects reductions to reach $50 billion a month by year-end 2018.

The FOMC left interest rates unchanged at Janet Yellen’s final meeting as chair on January 31, 2018. The FOMC said it expected the rate of inflation “to move up this year” and stabilize around its 2% objective “over the medium term.” Also late in January, the U.S. Senate confirmed Jerome Powell as Ms. Yellen’s successor as Fed chair. Mr. Powell, who was nominated by President Trump in November 2017, has been a member of the Fed Board of Governors since 2012.

We remind investors that a change in the Fed Funds rate does not automatically translate into a change in longer-term interest rates, which are determined by the marketplace.

During this reporting period, the muni market’s reactions to the Fed’s announcements did not appear to be especially significant or lasting. This Fund’s

portfolio managers do not adjust their investment style in response to Fed actions.

Late in the reporting period, President Donald J. Trump signed the Tax Cuts and Jobs Act of 2017. The top federal income tax rate for 2018 was lowered to 37%, from 39.6%. Although it had been targeted for elimination, the federal tax exemption on the net investment income generated by muni bonds and muni bond funds remained intact. Additionally, this income will continue to be exempt from the 3.8% tax on unearned income that applies to the income generated by investments in other asset classes. The maximum deduction for state and local income taxes, property taxes, and sales taxes was set at $10,000, providing investors with greater incentives to seek tax-free income. Any increase in demand for municipal securities would benefit existing muni market investors.

At the end of this reporting period, the ICE BofA Merrill Lynch AAA Municipal Securities Index – the AAA subset of the broader ICE BofA Merrill Lynch US Municipal Securities Index – yielded 2.24%, 49 basis points higher than at the reporting period’s outset.

The high-grade muni yield curve and the Treasury yield curve both rose and flattened during this reporting period, and the yield changes were greatest at the short end of the curves. At the end of this reporting period, the muni yield curve was slightly steeper than it had been in December 2017, when it was at its flattest since late 2007. Flatter yield curves

|

| 4 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

provide investors with fewer incentives to purchase longer-maturity bonds and typically reflect expectations of rising interest rates.

On a nominal basis, yields on Treasuries with maturities of 10 years and less were higher than municipal yields with comparable maturities as of January 31, 2018. Nonetheless, a muni bond would provide more yield on an after-tax basis than a Treasury security with the same maturity for any investor in the three highest federal tax brackets. Treasury bonds are backed by the full faith and credit of the U.S. government.

This reporting period was also characterized by credit spread tightening, which occurs when the difference between yields on low-rated municipal bonds and higher-rated bonds decreases. As credit spreads tighten, investments in BBB-rated, lower-rated, and unrated securities typically outperform municipal securities with higher credit ratings.

Governor Phil Murphy was sworn into office in January 2018, succeeding Chris Christie. The new governor, a Democrat, campaigned on a proposal to increase revenue by authorizing higher taxes on the wealthy and by legalizing and taxing marijuana. Gov. Murphy must also deal with the long-stalled $12.7 billion Gateway Tunnel project, which received funding commitments in December 2017 from Gov. Christie and New York Gov. Andrew Cuomo. Gov. Murphy also inherited a variety of fiscal problems that factored

into 11 bond rating downgrades during Gov. Christie’s two terms in office.

The Garden State’s American Dream Meadowlands megamall project, located in East Rutherford, is expected to deliver an average of $3.5 billion in tax revenues from a variety of sources, including sales and income taxes over the next two decades. In the near term, the development and construction of the project is projected to generate $70 million in sales tax revenues and $10 million in corporate business taxes. The megamall is slated to open in March 2019.

The New Jersey Economic Development Authority (NJEDA), which issued $350 million in bonds in September 2017, returned to the market in January 2018 with $376 million in bonds that the NJEDA had authorized the prior month. Some New Jersey lawmakers filed suit in the Mercer County Superior Court to block this second bond offering on the grounds that it required voter approval. The agency prevailed, and the bond sale occurred as planned. Proceeds will be used to finance two new buildings for the state’s departments of taxation, agriculture and health.

As of January 31, 2018, New Jersey’s general obligation (G.O.) bonds were rated A3 by Moody’s, A-minus by S&P Global Ratings, and A by Fitch Ratings. G.O.s are backed by the full faith and taxing authority of the state or local government that issues them.

The Commonwealth of Puerto Rico remained in the headlines throughout this reporting

|

| 5 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

period, and more detailed information about the developments discussed below can be found on our online PR Roundup (oppenheimerfunds.com/puerto-rico).

At the end of the reporting period, many of the Commonwealth’s residents were still without power and/or potable water in the aftermath of Hurricane Maria, which battered the island in late September and caused extensive structural damage.

Scores of U.S. military and medical personnel were deployed to deal with the territory’s immediate needs, and government officials, already under scrutiny because of decisions regarding Puerto Rico’s debt, were soon embroiled in new storm-related controversies.

The administration of Gov. Ricardo Rosselló Nevares repeatedly voiced concerns this reporting period about the Commonwealth’s weakening cash position. Nonetheless, an offer designed to provide immediate financial relief to PREPA (Puerto Rico’s electric utility authority) and help it qualify for matching funds from FEMA (the Federal Emergency Management Agency) was rejected. The offer – from a creditors’ group that included Oppenheimer Rochester – would have given PREPA a loan of $1 billion in the form of debtor in possession notes (DIPs). In addition, creditors would have had the right to exchange up to $1 billion of existing bonds for $850 million of additional DIP notes, enabling PREPA to cancel up to $150 million of existing debt. “We sincerely believed our loan would have helped PREPA finance its

recovery and rebuilding efforts as quickly as possible,” the bondholders’ financial advisor said at the time.

Puerto Rico did not make debt payments on its G.O. securities during this reporting period, despite a requirement in the Commonwealth’s Constitution that general fund revenues be used to pay G.O. debt service ahead of any other government expense. The legal protections for our G.O. holdings have not yet been tested before a court.

As long-time investors know, the portfolio management team has worked for many years to reach negotiated settlements with various issuers in Puerto Rico. In May 2017, before the start of this reporting period, the federal oversight board commenced proceedings under Title III of PROMESA, (the Puerto Rico Oversight, Management and Economic Stability Act) similar to a Chapter 9 bankruptcy, for the Commonwealth, the Puerto Rico Sales Tax Financing Corporation (issuer of COFINA bonds), the Highway and Transportation Authority (PRHTA), and the Employee Retirement System. According to PROMESA, the government of Puerto Rico must develop a new fiscal plan that includes methods to access capital markets, develop and enact budgets and legislation that conform to the fiscal plan, and deliver audited financial results in a timely fashion in order to take advantage of certain of the law’s provisions.

In Title III, the unresolved issues among debtors and creditors proceed along separate

|

| 6 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

tracks: mediation and litigation. Protracted litigation remains a very real possibility. The Title III proceedings are being overseen by U.S. District Judge Laura Taylor Swain, who was selected by the Chief Justice of the U.S. Supreme Court, John Roberts. The filing of the Title III proceedings has temporarily halted litigation against some Puerto Rican issuers.

Also in May 2017, debt payments on COFINA bonds, which are backed by the sales and use tax, were temporarily suspended by Judge Swain, pending the resolution of the proper application of funds among COFINA bondholders. The COFINA trustee reported that the bonds’ debt-service account held nearly $904 million in December 2017 and $1.02 billion in mid-January 2018. Note: In a filing dated February 9, 2018, the trustee reported a balance of $1.14 billion.

Investors should note that several Puerto Rico issuers remained current in their payments during the year: PRASA (Puerto Rico’s aqueduct and sewer authority), the University of Puerto Rico, the Municipal Finance Agency, and the Children’s Trust, which is responsible for payments on the tobacco bonds backed by Puerto Rico’s share of the proceeds from the 1997 Master Settlement Agreement (MSA).

In August 2017, the Puerto Rico Legislature and the federal oversight board approved a budget for fiscal year 2018 and announced plans to conduct a “comprehensive investigation” of the Commonwealth’s debt. Also in August, the Commonwealth’s Supreme Court denied the governor’s request to keep

his initial draft budget and other documents under wraps.

For fiscal year 2017, which ended June 30, 2017, general fund net revenues exceeded estimates by 2.6% (or $235 million), which Puerto Rico’s Treasury Secretary called “a significant fiscal accomplishment.”

The work of the oversight board and Title III proceedings were temporarily halted in September 2017 while the government of Puerto Rico focused on its immediate needs in the aftermath of Hurricanes Irma and Maria. The deadlines for providing information to the board and for the approval of the fiscal plan were extended into 2018.

In the latter half of this reporting period, the oversight board, the Rosselló administration, and owners of Puerto Rico debt remained at odds about the extent of the board’s authority. Representatives of the oversight board, the government, and the bondholders also appeared at Congressional hearings during this time period.

In late December 2017, Puerto Rico announced that it had found an additional $5 billion deposited in more than 800 government accounts, bringing the total to nearly $6.9 billion. At one point, the government said it would run out of money by December 1; on that date, however, it reported a cash position of $1.73 billion. Earlier in this reporting period, government officials reported a June 30, 2017 cash position that was $1.5 billion higher than

|

| 7 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Judge Swain had been told it would be. While the governor has complained about the “incorrect figures” that the oversight board used during the Congressional hearings, the government has yet to release audited financials for fiscal years 2015 through 2017.

In January 2018, creditors raised concerns about a plan to loan $1.3 billion to PREPA and the government’s proposal to privatize PREPA, among other issues; the investment firm Aurelius Capital argued in court that

PROMESA itself was unconstitutional; and the oversight board and creditors found the governor’s new fiscal plan to be lacking. The plan, which was released January 24, 2018, anticipates 4 years of budget gaps, assumes at least $35 billion in federal hurricane aid from FEMA, increases payroll and operating expenses while projecting a sizable decline in population, proposes to reduce the Sales and Use Tax on some transactions and to eliminate it entirely for commercial transactions, and fails to allocate any money

|

| 8 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

|

| 9 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

to debt payments. In response to the oversight board’s request for a revised plan, the administration submitted a new draft budget with the disclaimer that “the Government has had to rely upon preliminary information and unaudited financials for 2015, 2016, and 2017 in addition to the inherent complexities resulting from a prolonged period of lack of financial transparency.”

The new federal budget proposal included an additional $11 billion in disaster relief for Puerto Rico and the U.S. Virgin Islands; the governor of Puerto Rico had requested close to $95 billion. FEMA and the U.S. Department of the Treasury established a program to provide low-interest-rate loans of up to $5 million to every Puerto Rico municipality willing to pledge collateral.

Recovery efforts have continued to be slow relative to other storm-ravaged geographies. Electrical rescue crews were brought to the island by FEMA but their work was hampered by an equipment shortage. In January, “critical materials” were discovered in warehouses by FEMA and U.S. Army Corps of Engineers personnel, who accused PREPA of “hoarding.”

Developments after January 31: In early February 2018, the oversight board told Gov. Rosselló to revise the fiscal plans for the central government, PREPA, and PRASA by February 12, saying that they did not comply with PROMESA. The revised plan for the Commonwealth called for tax reductions

and anticipated an accumulated surplus of $3.4 billion by fiscal year 2023. The plan used various state debt metrics to suggest that Puerto Rico has an “unsustainable” debt portfolio but it failed to address the fact that Puerto Ricans who live on the island are not subject to federal income tax, rendering the comparisons invalid. Like its predecessors, the plan relied on financial data that has yet to be audited or released to the public. The oversight board has said that it expects to certify the plans by March 30.

The government’s proposal to loan $1 billion to PREPA was rejected by Judge Swain in mid-February. The electric utility contended that it would have to start cutting off power (to those fortunate enough to have it) without the loan. The judge said that the parties could submit another petition, but the Commonwealth’s payments could not be senior to other creditors and that the loan could not exceed $300 million and had to be unsecured.

Late in the month, the oversight board extended the deadline for the government’s fiscal plan for fiscal year 2019. The oversight board set a mid-April due date and said that the new plan must demonstrate “consistency with historical actual expenditures.” In the state of the Commonwealth speech, the governor promised to increase salaries, reduce taxes, and protect pensions; his assertion that the oversight board had endorsed the plan to maintain pensions was contradicted by the executive director of the oversight board, Natalie Jaresko, and later walked back. Ms.

|

| 10 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Jaresko, meanwhile, reportedly asked for a significant tuition hike at the University of Puerto Rico but walked back that claim, citing “bad communication.” Meanwhile, several organizations, including the Hispanic Leadership Fund, called for Ms. Jaresko’s dismissal, citing her annual salary ($625,000) and her refusal to define the “essential services” mentioned in various fiscal plans.

The disputes continued to mount as the 6-month anniversary of Maria approached. New criticism arose in the Puerto Rico House about the government’s analysis – the chairman of the finance committee called it “practically elementary school” – and about how much is being spent on lawyers and advisors. The governor complained that the U.S. Treasury loan was being delayed. The Commonwealth’s energy commission challenged the oversight board’s efforts to make decisions about PREPA, and creditors sought to stop the governor from “effectively eliminating” the energy commission. Meanwhile, the governor criticized the work of the U.S. Army Corps of Engineers and continued to advocate for the privatization of PREPA.

FUND PERFORMANCE

Oppenheimer Rochester New Jersey Municipal Fund held more than 160 securities as of January 31, 2018. The Fund was invested in a broad range of sectors, providing shareholders with a diversity of holdings that we believe would be difficult and costly to replicate in an individual portfolio.

During this reporting period, a rally in U.S. equities and persistent low interest rates put pressure on the dividends of many fixed income investments. This Fund’s Class A dividend, which was 2.8 cents per share at the outset of this reporting period, was reduced to 2.6 cents per share beginning with the September 2017 payout, and to 2.4 cents per share beginning with the December 2017 payout. In all, the Fund distributed 15.4 cents per Class A share this reporting period. Shareholders should note that market conditions during this reporting period did not affect the Fund’s overall investment goals or cause it to pay any capital gain distributions.

While this Fund is managed to deliver competitive levels of tax-free income and yield-driven total returns over the long term, market conditions can at times cause it to underperform the overall market and its own benchmark, the Bloomberg Barclays Municipal Bond Index; that was the case this reporting period. As noted earlier, the Fund had a highly competitive distribution yield at NAV. The value of the team’s approach to investing in bonds from a wide variety of sectors was evident this reporting period, as many sectors delivered strong performance.

Six of the Fund’s 10 largest sectors were among the 10 strongest sectors this reporting period. The marine/aviation facilities sector, this Fund’s fourth largest, was the strongest performer. Bonds in this sector, which included one bond issued in the Northern Mariana Islands, are typically high-grade investments backed by valuable collateral. The

|

| 11 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Fund’s second-largest sector (transportation infrastructure) and its seventh-through tenth-largest sectors (government appropriation, hospital/healthcare, casino, and student loans, respectively) were also ranked among the 10 best-performing sectors.

Research-based security selection continued to be a factor in the strong performance of these sectors. The transportation infrastructure sector was the second strongest performer this reporting period; this type of financing supports the construction of critical projects such as rail, bridges, ports, and public buildings. The government appropriation sector, which included one bond issued in the Commonwealth of Puerto Rico, was the fourth strongest performer this reporting period. The municipal issuer of this type of security agrees to include an allocation in its budget that will be used to make its debt payments. Because municipalities need reliable access to future capital, these appropriations tend to be off limits during budget negotiations. Most of the securities in the hospital/healthcare sector, the Fund’s seventh strongest this reporting period, are investment grade, though the Fund also invests across the credit spectrum in this sector; one of the Fund’s holdings in this sector was issued in Puerto Rico. The casino sector was the third strongest performer as of January 31, 2018. The Fund’s holdings in this sector are secured by specific tax revenue streams that have traditionally exceeded the debt-service obligations with ease and have been isolated from financial difficulties in the industry. The student loans sector was the tenth-strongest performer this reporting

period. Bonds in this sector provide a service to students, families, schools, and educators through municipal public-purpose entities with the mission of increasing post-secondary education access, affordability, and success.

Seven sectors detracted from the Fund’s total return during the reporting period. Securities in the G.O. sector (the Fund’s fifth largest), the sales tax revenue sector (the sixth largest), the municipal leases sector (the fifteenth largest), and the Special Tax sector (the twenty-fourth largest) as well as PREPA bonds, which are included in the electric utility sector (the thirteenth largest), were adversely affected by developments in Puerto Rico, as discussed above. Also detracting from the Fund’s performance were the MSA-backed tobacco bond sector (the Fund’s largest sector) and the sewer utilities sector (which was the Fund’s third smallest sector as of January 31, 2017 but no securities at the end of this reporting period).

In aggregate, the Fund’s substantial investments in securities issued in the Commonwealth of Puerto Rico detracted from performance this reporting period. (As discussed above, the Commonwealth continued to experience significant financial difficulties this reporting period; the Fund’s current dividend distribution calculations reflect adjustments based on the failure of various Commonwealth issuers to make their debt-service payments on time and in full.) The securities are exempt from federal, state, and local income taxes, and the Fund’s holdings include the aforementioned bonds

|

| 12 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

and securities from many different sectors. Most of the Fund’s investments in securities issued in Puerto Rico are supported by taxes and other revenues and are designed to help finance electric utilities, highways, and education, among other entities.

Investors should note that some of this Fund’s investments in securities issued in Guam and Puerto Rico are insured. A complete listing of securities held by this Fund can be found in this report’s Statement of Investments.

INVESTMENT STRATEGY

The Rochester investment team focuses exclusively on municipal bonds, and this Fund invests primarily in investment-grade municipal securities. It may invest up to 25% of its total assets in below-investment grade securities, or “junk” bonds; the percentage of assets is measured at the time of purchase as is the credit quality of the securities. Additionally, the credit quality is based on Nationally Recognized Statistical Rating Organization (“NRSRO”) ratings or, if no NRSRO rating, on internal ratings. As

of January 31, 2018, market movements or rating changes of municipal bonds, notably the Fund’s investments in Puerto Rico paper, caused the Fund’s below-investment-grade holdings to exceed this threshold. As a result, no further purchases of below-investment grade bonds will be made until the Fund’s holdings of these types of bonds is once again below 25% of total assets.

While market conditions can and do fluctuate, the Fund’s portfolio management team adheres to a consistent investment approach based on its belief that tax-free yield can help investors achieve their long-term financial objectives. The team does not manage its funds based on predictions of interest rate changes. Further details about the Rochester team’s investment approach can be found on our landing page, oppenheimerfunds. com/rochesterway.

In closing, we believe that the structure and sector composition of this Fund and the team’s use of time-tested strategies will continue to benefit fixed income investors through interest rate and economic cycles.

| | |

| |

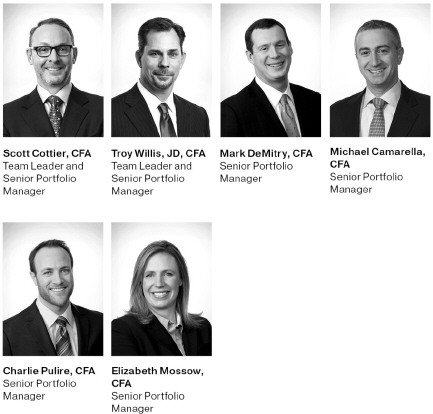

Scott S. Cottier, CFA Senior Vice President, Senior Portfolio Manager and Team Leader |

| | |

| |

Troy E. Willis, CFA, J.D. Senior Vice President, Senior Portfolio Manager and Team Leader |

On behalf of the rest of the Rochester portfolio managers: Mark R. DeMitry, Michael L. Camarella, Charles S. Pulire and Elizabeth S. Mossow.

|

| 13 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Top Holdings and Allocations

TOP TEN CATEGORIES

| | | | |

| Tobacco Master Settlement Agreement | | | 11.8 | % |

| Transportation Infrastructure | | | 8.8 | |

| Higher Education | | | 8.0 | |

| Marine/Aviation Facilities | | | 7.4 | |

| General Obligation | | | 7.2 | |

| Sales Tax Revenue | | | 7.2 | |

| Government Appropriation | | | 7.2 | |

| Hospital/Healthcare | | | 6.6 | |

| Casino | | | 4.6 | |

| Student Loans | | | 4.2 | |

Portfolio holdings and allocations are subject to change. Percentages are as of January 31, 2018 and are based on total assets.

CREDIT ALLOCATION

| | | | | | | | | | | | |

| | | NRSRO-

Rated | | | Sub-

Adviser-

Rated | | | Total | |

| AAA | | | 4.2% | | | | 0.0% | | | | 4.2% | |

| AA | | | 14.6 | | | | 0.0 | | | | 14.6 | |

| A | | | 22.2 | | | | 0.0 | | | | 22.2 | |

| BBB | | | 30.8 | | | | 0.6 | | | | 31.4 | |

| BB or lower | | | 26.6 | | | | 1.0 | | | | 27.6 | |

| Total | | | 98.4% | | | | 1.6% | | | | 100.0% | |

The percentages above are based on the market value of the securities as of January 31, 2018 and are subject to change. OppenheimerFunds, Inc. determines the credit allocation of the Fund’s assets using ratings by nationally recognized statistical rating organizations (NRSROs), such as S&P Global Ratings (S&P). For any security rated by an NRSRO other than S&P, the sub-adviser, OppenheimerFunds, Inc., converts that security’s rating to the equivalent S&P rating. If two or more NRSROs have assigned a rating to a security, the highest rating is used. For securities not rated by an NRSRO, the sub-adviser uses its own credit analysis to assign ratings in categories similar to those of S&P. The use of similar categories is not an indication that the sub-adviser’s credit analysis process is consistent or comparable with any NRSRO’s process were that NRSRO to rate the same security.

For the purposes of this Credit Allocation table, securities rated within the NRSROs’ four highest categories—AAA, AA, A, and BBB—are investment-grade securities. For further details, please consult the Fund’s prospectus or Statement of Additional Information.

|

| 14 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Performance

DISTRIBUTION YIELDS

As of 1/31/18

| | | | |

| | | Without Sales

Charge | | With Sales

Charge |

| Class A | | 3.44% | | 3.28% |

| Class B | | 2.88 | | N/A |

| Class C | | 2.94 | | N/A |

| Class Y | | 3.62 | | N/A |

TAXABLE EQUIVALENT YIELDS

| | | | |

| As of 1/31/18 |

| Class A | | 2.99% | | |

| Class B | | 1.74 | | |

| Class C | | 1.86 | | |

| Class Y | | 3.59 | | |

STANDARDIZED YIELDS

| | | | |

| For the 30 Days Ended 1/31/18 |

| Class A | | 1.53% | | |

| Class B | | 0.89 | | |

| Class C | | 0.95 | | |

| Class Y | | 1.84 | | |

UNSUBSIDIZED STANDARDIZED YIELDS

| | | | |

| For the 30 Days Ended 1/31/18 |

| Class A | | 1.52% | | |

| Class B | | 0.89 | | |

| Class C | | 0.95 | | |

| Class Y | | 1.84 | | |

AVERAGE ANNUAL TOTAL RETURNS WITHOUT SALES CHARGE AS OF 1/31/18

| | | | | | | | | | | | |

| | | Inception Date | | 6-Month | | 1-Year | | 5-Year | | 10-Year | | Since Inception |

| Class A (ONJAX) | | 3/1/94 | | -5.18% | | -6.18% | | 0.18% | | 2.72% | | 4.14% |

| Class B (ONJBX) | | 3/1/94 | | -5.49 | | -6.81 | | -0.57 | | 2.22 | | 3.94 |

| Class C (ONJCX) | | 8/29/95 | | -5.59 | | -6.80 | | -0.56 | | 1.95 | | 3.42 |

| Class Y (ONJYX) | | 11/29/10 | | -5.16 | | -5.96 | | 0.34 | | N/A | | 3.13 |

AVERAGE ANNUAL TOTAL RETURNS WITH SALES CHARGE AS OF 1/31/18

| | | | | | | | | | | | |

| | | Inception Date | | 6-Month | | 1-Year | | 5-Year | | 10-Year | | Since Inception |

| Class A (ONJAX) | | 3/1/94 | | -9.68% | | -10.64% | | -0.79% | | 2.23% | | 3.92% |

| Class B (ONJBX) | | 3/1/94 | | -10.15 | | -11.33 | | -0.89 | | 2.22 | | 3.94 |

| Class C (ONJCX) | | 8/29/95 | | -6.52 | | -7.71 | | -0.56 | | 1.95 | | 3.42 |

| Class Y (ONJYX) | | 11/29/10 | | -5.16 | | -5.96 | | 0.34 | | N/A | | 3.13 |

Performance data quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted. Returns do not consider capital gains or income taxes on an individual’s investments. Returns for periods of less than one year are not annualized. For performance data current to the most recent month-end, visit oppenheimerfunds.com or call 1.800. CALL OPP (225.5677). Fund returns include changes in share price, reinvested distributions and the applicable sales charge: for Class A shares, the current maximum initial sales charge of 4.75%; for Class B shares, the contingent deferred sales charge of 5% (1-year) and 2% (5-year); and for Class C, the contingent deferred sales charge of 1% for the 1-year period. There is no sales charge for Class Y shares. Because Class B shares

|

| 15 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

convert to Class A shares 72 months after purchase, the 10-year return for Class B shares uses Class A performance for the period after conversion.

The Fund’s performance is compared to the performance of the Bloomberg Barclays Municipal Bond Index, an index of a broad range of investment-grade municipal bonds that measures the performance of the general municipal bond market. Indices are unmanaged and cannot be purchased by investors. While index comparisons may be useful to provide a benchmark for the Fund’s performance, it must be noted that the Fund’s investments are not limited to the investments comprising the index. Index performance includes reinvestment of income, but does not reflect transaction costs, fees, expenses, or taxes. Index performance is shown for illustrative purposes only as a benchmark for the Fund’s performance, and does not predict or depict performance of the Fund. The Fund’s performance reflects the effects of the Fund’s business and operating expenses.

Distribution yields for Class A shares are based on dividends of $0.024 for the 23-day accrual period ended January 23, 2018. The yield without sales charge for Class A shares is calculated by dividing annualized dividends by the Class A net asset value (NAV) on January 23, 2018; for the yield with charge, the denominator is the Class A maximum offering price on that date. Distribution yields for Class B, C, and Y are annualized based on dividends of $0.0201, $0.0205, and $0.0252, respectively, for the 23-day accrual period ended January 23, 2018 and on the corresponding net asset values on that date.

Standardized yield is based on an SEC-standardized formula designed to approximate the Fund’s annualized hypothetical current income from securities less expenses for the 30-day period ended January 31, 2018 and that date’s maximum offering price (for Class A shares) or net asset value (for all other share classes). Each result is compounded semiannually and then annualized. Falling share prices will tend to artificially raise yields. The unsubsidized standardized yield is computed under an SEC-standardized formula based on net income earned for the 30-day period ended January 31, 2018. The calculation excludes any expense reimbursements and thus may result in a lower yield.

The average 12-month distribution yield in Lipper’s New Jersey Municipal Debt Funds category was calculated based on the distributions and the final net asset values (NAVs) of the reporting period for the funds in each category. The 12-month distribution yield is the sum of a fund’s total interest and dividend payments for the trailing 12 months divided by the sum of the share price (at NAV) on January 31, 2018 and any capital gains distributed over the same period. The calculation included 49 NAVs, one for each class of each fund in the category; a fund can have up to 4 classes. Lipper yields do not include sales charges, which – if included – would reduce results.

Taxable equivalent yield is based on the standardized yield and the 2017 top federal and New Jersey tax rate of 48.8%. Calculations factor in the 3.8% tax on unearned income under the Patient Protection and Affordable Care Act, as applicable. A portion of the Fund’s distributions may be subject to tax; distributions may also increase an investor’s exposure to the alternative minimum tax. Capital gains distributions are taxable as capital gains. Tax treatments of the Fund’s distributions and capital gains may vary by state; investors should consult a tax advisor to determine if the Fund is appropriate for them. Each result is compounded semiannually and annualized. Falling share prices artificially increase yields. This Report must be preceded or accompanied by a Fund prospectus.

|

| 16 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Investments in “tobacco bonds,” which are backed by the proceeds a state or territory receives from the 1998 national litigation settlement with tobacco manufacturers, may be vulnerable to economic and/or legislative events that affect issuers in a particular municipal market sector. Annual payments by MSA-participating manufacturers, for example, hinge on many factors, including annual domestic cigarette shipments, inflation and the relative market share of non-participating manufacturers. To date, we believe consumption figures remain within an acceptable range of the assumptions used to structure MSA bonds. Future MSA payments could be reduced if consumption were to fall more rapidly than originally forecast.

The ICE BofA Merrill Lynch AAA Municipal Securities index is the AAA subset of the ICE BofA Merrill Lynch US Municipal Securities Index, which tracks the performance of dollar-denominated, investment-grade, tax-exempt debt issued by U.S. states and territories and their political subdivisions; index constituents are weighted based on capitalization, and accrued interest is calculated assuming next-day settlement.

The views in the Fund Performance Discussion represent the opinions of this Fund’s portfolio managers and are not intended as investment advice or to predict or depict the performance of any investment. These views are as of the close of business on January 31, 2018, and are subject to change based on subsequent developments. The Fund’s portfolio and strategies are subject to change.

Before investing in any of the Oppenheimer funds, investors should carefully consider a fund’s investment objectives, risks, charges and expenses. Fund prospectuses and summary prospectuses contain this and other information about the funds, and may be obtained by asking your financial advisor, visiting oppenheimerfunds.com, or calling 1.800. CALL OPP (225.5677). Read prospectuses and summary prospectuses carefully before investing.

Shares of Oppenheimer funds are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including the possible loss of the principal amount invested.

|

| 17 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Fund Expenses

Fund Expenses. As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and/or contingent deferred sales charges on redemptions; and (2) ongoing costs, including management fees; distribution and service fees; and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000.00 invested at the beginning of the period and held for the entire 6-month period ended January 31, 2018.

Actual Expenses. The first section of the table provides information about actual account values and actual expenses. You may use the information in this section for the class of shares you hold, together with the amount you invested, to estimate the expense that you paid over the period. Simply divide your account value by $1,000.00 (for example, an $8,600.00 account value divided by $1,000.00 = 8.60), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During 6 Months Ended January 31, 2018” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes. The second section of the table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio for each class of shares, and an assumed rate of return of 5% per year for each class before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as front-end or contingent deferred sales charges (loads). Therefore, the “hypothetical” section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| 18 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

| | | | | | |

| Actual | | Beginning Account Value August 1, 2017 | | Ending Account Value January 31, 2018 | | Expenses Paid During 6 Months Ended January 31, 2018 |

| Class A | | $ 1,000.00 | | $ 948.20 | | $ 6.50 |

| Class B | | 1,000.00 | | 945.10 | | 9.76 |

| Class C | | 1,000.00 | | 944.10 | | 9.70 |

| Class Y | | 1,000.00 | | 948.40 | | 5.22 |

| | |

Hypothetical (5% return before expenses) | | | | |

| Class A | | 1,000.00 | | 1,018.55 | | 6.74 |

| Class B | | 1,000.00 | | 1,015.22 | | 10.11 |

| Class C | | 1,000.00 | | 1,015.27 | | 10.06 |

| Class Y | | 1,000.00 | | 1,019.86 | | 5.41 |

Expenses are equal to the Fund’s annualized expense ratio for that class, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). Those annualized expense ratios, excluding indirect expenses from affiliated funds, based on the 6-month period ended January 31, 2018 are as follows:

| | | | |

| Class | | Expense Ratios | |

| Class A | | | 1.32% | |

| Class B | | | 1.98 | |

| Class C | | | 1.97 | |

| Class Y | | | 1.06 | |

|

| 19 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

STATEMENT OF INVESTMENTS January 31, 2018 Unaudited

| | | | | | | | | | | | | | |

| Principal Amount | | | | Coupon | | Maturity | | | Value | |

| Municipal Bonds and Notes—111.4% | | | | | | | | | |

| New Jersey—80.7% | | | | | | | | | |

| $1,000,000 | | Atlantic City, NJ GO1 | | | 5.000 | % | | | 03/01/2037 | | | $ | 1,121,581 | |

| 1,250,000 | | Atlantic City, NJ GO1 | | | 5.000 | | | | 03/01/2042 | | | | 1,389,612 | |

| 1,000,000 | | Atlantic County, NJ Improvement Authority (Stockton University)1 | | | 5.000 | | | | 07/01/2034 | | | | 1,136,570 | |

| 1,000,000 | | Camden County, NJ Improvement Authority (Cooper Health System)1 | | | 5.000 | | | | 02/15/2033 | | | | 1,082,100 | |

| 1,000,000 | | Camden County, NJ Improvement Authority (Cooper Health System)1 | | | 5.000 | | | | 02/15/2034 | | | | 1,079,840 | |

| 1,000,000 | | Camden County, NJ Improvement Authority (Cooper Health System)1 | | | 5.000 | | | | 02/15/2035 | | | | 1,078,150 | |

| 2,000,000 | | Casino Reinvestment Devel. Authority of NJ1 | | | 5.000 | | | | 11/01/2031 | | | | 2,186,340 | |

| 1,665,000 | | Casino Reinvestment Devel. Authority of NJ1 | | | 5.250 | | | | 01/01/2024 | | | | 1,706,292 | |

| 3,000,000 | | Casino Reinvestment Devel. Authority of NJ1 | | | 5.250 | | | | 11/01/2039 | | | | 3,199,140 | |

| 3,000,000 | | Casino Reinvestment Devel. Authority of NJ1 | | | 5.250 | | | | 11/01/2044 | | | | 3,185,010 | |

| 395,000 | | Casino Reinvestment Devel. Authority of NJ (Hotel Room Fee)1 | | | 5.000 | | | | 01/01/2025 | | | | 399,945 | |

| 760,000 | | Casino Reinvestment Devel. Authority of NJ (Hotel Room Fee)1 | | | 5.250 | | | | 01/01/2022 | | | | 775,215 | |

| 1,000,000 | | Casino Reinvestment Devel. Authority of NJ (Luxury Tax)1 | | | 5.000 | | | | 11/01/2028 | | | | 1,105,850 | |

| 140,000 | | Essex County, NJ Improvement Authority (Newark)1 | | | 5.125 | | | | 04/01/2029 | | | | 140,522 | |

| 250,000 | | Essex County, NJ Improvement Authority (Newark)1 | | | 6.250 | | | | 11/01/2030 | | | | 264,812 | |

| 140,000 | | Garden State Preservation Trust, NJ Open Space & Farmland Preservation | | | 3.565 | 2 | | | 11/01/2026 | | | | 107,433 | |

| 1,000,000 | | Hudson County, NJ Improvement Authority1 | | | 6.000 | | | | 01/01/2040 | | | | 1,077,660 | |

| 2,655,000 | | Hudson County, NJ Improvement Authority (Lincoln Park Golf Course)1 | | | 5.500 | | | | 06/01/2041 | | | | 2,941,129 | |

| 20,000 | | Middlesex County, NJ Improvement Authority (South Plainfield Urban Renewal)1 | | | 5.500 | | | | 09/01/2030 | | | | 20,068 | |

| 10,000 | | Neptune City, NJ Hsg. Authority1 | | | 6.000 | | | | 04/01/2019 | | | | 10,026 | |

| 445,000 | | New Brunswick, NJ Parking Authority1 | | | 5.000 | | | | 09/01/2027 | | | | 495,507 | |

| 605,000 | | New Brunswick, NJ Parking Authority1 | | | 5.000 | | | | 09/01/2029 | | | | 672,560 | |

| 1,000,000 | | New Brunswick, NJ Parking Authority1 | | | 5.000 | | | | 09/01/2042 | | | | 1,156,420 | |

| 1,000,000 | | New Brunswick, NJ Parking Authority1 | | | 5.000 | | | | 09/01/2047 | | | | 1,153,730 | |

| 430,000 | | Newark, NJ GO1 | | | 5.000 | | | | 07/15/2029 | | | | 453,779 | |

| 3,000,000 | | Newark, NJ GO1 | | | 5.000 | | | | 07/15/2029 | | | | 3,175,770 | |

| 315,000 | | Newark, NJ Hsg. Authority (Port Newark Marine Terminal Rental)1 | | | 5.000 | | | | 01/01/2032 | | | | 364,156 | |

| 2,000,000 | | Newark, NJ Hsg. Authority (Secured Police Facility)1 | | | 5.000 | | | | 12/01/2038 | | | | 2,258,520 | |

| 600,000 | | NJ Building Authority1 | | | 5.000 | | | | 06/15/2028 | | | | 669,858 | |

| 300,000 | | NJ Building Authority1 | | | 5.000 | | | | 06/15/2029 | | | | 333,081 | |

| 2,095,000 | | NJ EDA1 | | | 5.000 | | | | 06/15/2028 | | | | 2,249,318 | |

| 750,000 | | NJ EDA1 | | | 5.000 | | | | 06/15/2029 | | | | 803,662 | |

| 3,000,000 | | NJ EDA1 | | | 5.000 | | | | 06/15/2035 | | | | 3,197,580 | |

| 3,000,000 | | NJ EDA1 | | | 5.000 | | | | 06/15/2036 | | | | 3,191,670 | |

|

| 20 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

| | | | | | | | | | | | | | |

| Principal Amount | | | | Coupon | | Maturity | | | Value | |

| New Jersey (Continued) | | | | | | | | | |

| $3,100,000 | | NJ EDA (Cranes Mill)1 | | | 5.100 | % | | | 06/01/2027 | | | $ | 3,104,092 | |

| 85,000 | | NJ EDA (Dept. of Human Services)1 | | | 6.250 | | | | 07/01/2024 | | | | 85,271 | |

| 2,820,000 | | NJ EDA (Harrogate)1 | | | 5.875 | | | | 12/01/2026 | | | | 2,819,831 | |

| 90,000 | | NJ EDA (Metromall Urban Renewal)1 | | | 6.500 | | | | 04/01/2031 | | | | 87,856 | |

| 3,000,000 | | NJ EDA (Motor Vehicle Surcharges)1 | | | 5.000 | | | | 07/01/2033 | | | | 3,243,090 | |

| 160,000 | | NJ EDA (Municipal Rehabilitation)1 | | | 5.000 | | | | 04/01/2028 | | | | 162,386 | |

| 5,320,000 | | NJ EDA (New Jersey American Water Company)1 | | | 5.600 | | | | 11/01/2034 | | | | 5,671,971 | |

| 4,350,000 | | NJ EDA (New Jersey American Water Company)1 | | | 5.700 | | | | 10/01/2039 | | | | 4,595,775 | |

| 800,000 | | NJ EDA (Newark Downtown District Management Corp.)1 | | | 5.125 | | | | 06/15/2027 | | | | 800,568 | |

| 1,400,000 | | NJ EDA (Newark Downtown District Management Corp.)1 | | | 5.125 | | | | 06/15/2037 | | | | 1,400,882 | |

| 1,000,000 | | NJ EDA (North Star Academy Charter School of Newark)1 | | | 5.000 | | | | 07/15/2047 | | | | 1,077,230 | |

| 650,000 | | NJ EDA (Paterson Charter School Science & Technology)1 | | | 6.000 | | | | 07/01/2032 | | | | 655,967 | |

| 1,900,000 | | NJ EDA (Paterson Charter School Science & Technology)1 | | | 6.100 | | | | 07/01/2044 | | | | 1,913,718 | |

| 1,500,000 | | NJ EDA (Paterson Charter School)1 | | | 5.000 | | | | 07/01/2032 | | | | 1,389,300 | |

| 2,500,000 | | NJ EDA (Paterson Charter School)1 | | | 5.300 | | | | 07/01/2044 | | | | 2,297,225 | |

| 500,000 | | NJ EDA (Provident Group-Kean Properties)1 | | | 5.000 | | | | 07/01/2037 | | | | 541,845 | |

| 1,000,000 | | NJ EDA (Provident Group-Montclair Properties)1 | | | 5.000 | | | | 06/01/2042 | | | | 1,121,860 | |

| 1,000,000 | | NJ EDA (School Facilities)1 | | | 5.250 | | | | 09/01/2026 | | | | 1,060,560 | |

| 50,000 | | NJ EDA (St. Barnabas Medical Center) | | | 6.743 | 2 | | | 07/01/2018 | | | | 49,710 | |

| 65,000 | | NJ EDA (St. Barnabas Medical Center) | | | 6.827 | 2 | | | 07/01/2021 | | | | 61,040 | |

| 25,000 | | NJ EDA (St. Barnabas Medical Center) | | | 7.147 | 2 | | | 07/01/2020 | | | | 23,947 | |

| 3,000,000 | | NJ EDA (State Government Buildings)1 | | | 5.000 | | | | 06/15/2047 | | | | 3,204,630 | |

| 20,000 | | NJ EDA (State Office Buildings)1 | | | 5.000 | | | | 06/15/2020 | | | | 20,049 | |

| 3,200,000 | | NJ EDA (Team Academy Charter School)1 | | | 6.000 | | | | 10/01/2043 | | | | 3,558,976 | |

| 10,000,000 | | NJ EDA (The Goethals Bridge Replacement)1 | | | 5.375 | | | | 01/01/2043 | | | | 11,106,300 | |

| 1,500,000 | | NJ EDA (UMM Energy Partners)1 | | | 5.000 | | | | 06/15/2037 | | | | 1,559,520 | |

| 1,250,000 | | NJ EDA (UMM Energy Partners)1 | | | 5.125 | | | | 06/15/2043 | | | | 1,302,750 | |

| 125,000 | | NJ Educational Facilities Authority (Drew University)1 | | | 5.250 | | | | 07/01/2019 | | | | 131,477 | |

| 1,590,000 | | NJ Educational Facilities Authority (Georgian Court University)1 | | | 5.000 | | | | 07/01/2033 | | | | 1,759,669 | |

| 1,485,000 | | NJ Educational Facilities Authority (Georgian Court University)1 | | | 5.000 | | | | 07/01/2035 | | | | 1,635,995 | |

| 1,640,000 | | NJ Educational Facilities Authority (Georgian Court University)1 | | | 5.000 | | | | 07/01/2036 | | | | 1,802,655 | |

| 5,000 | | NJ Educational Facilities Authority (Public Library)1 | | | 5.000 | | | | 09/01/2022 | | | | 5,016 | |

| 1,000,000 | | NJ Educational Facilities Authority (Rider University)1 | | | 5.000 | | | | 07/01/2037 | | | | 1,042,380 | |

| 2,250,000 | | NJ Educational Facilities Authority (Rider University)1 | | | 5.000 | | | | 07/01/2047 | | | | 2,454,503 | |

| 2,025,000 | | NJ Educational Facilities Authority (Stockton University)1 | | | 5.000 | | | | 07/01/2041 | | | | 2,219,927 | |

|

| 21 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | | | | | | | |

| Principal Amount | | | | Coupon | | Maturity | | | Value | |

| New Jersey (Continued) | | | | | | | | | |

| $2,000,000 | | NJ Educational Facilities Authority (William Patterson University)1 | | | 5.000 | % | | | 07/01/2047 | | | $ | 2,264,500 | |

| 5,000,000 | | NJ GO3 | | | 5.000 | | | | 06/01/2028 | | | | 5,682,125 | |

| 5,000,000 | | NJ GO3 | | | 5.000 | | | | 06/01/2028 | | | | 5,682,125 | |

| 3,000,000 | | NJ Health Care Facilities Financing Authority (Barnabas Health)1 | | | 5.000 | | | | 07/01/2044 | | | | 3,271,320 | |

| 5,085,000 | | NJ Health Care Facilities Financing Authority (Catholic Health East)1 | | | 5.000 | | | | 11/15/2033 | | | | 5,473,697 | |

| 690,000 | | NJ Health Care Facilities Financing Authority (Hebrew Old Age Center of Atlantic City)1 | | | 5.300 | | | | 11/01/2026 | | | | 690,014 | |

| 450,000 | | NJ Health Care Facilities Financing Authority (Hebrew Old Age Center of Atlantic City)1 | | | 5.375 | | | | 11/01/2036 | | | | 432,742 | |

| 2,000,000 | | NJ Health Care Facilities Financing Authority (Hospital Asset Transformation)1 | | | 5.000 | | | | 10/01/2038 | | | | 2,153,460 | |

| 65,000 | | NJ Health Care Facilities Financing Authority (Hospital Asset Transformation)1 | | | 5.250 | | | | 10/01/2038 | | | | 66,682 | |

| 230,000 | | NJ Health Care Facilities Financing Authority (Hospital Asset Transformation)1 | | | 5.250 | | | | 10/01/2038 | | | | 235,796 | |

| 1,500,000 | | NJ Health Care Facilities Financing Authority (Kennedy Health System)1 | | | 5.000 | | | | 07/01/2031 | | | | 1,703,445 | |

| 500,000 | | NJ Health Care Facilities Financing Authority (SJHS/SJH&MC Obligated Group)1 | | | 5.000 | | | | 07/01/2036 | | | | 544,350 | |

| 1,960,000 | | NJ Health Care Facilities Financing Authority (St. Luke’s Warren Hospital)1 | | | 5.000 | | | | 08/15/2034 | | | | 2,140,183 | |

| 2,000,000 | | NJ Health Care Facilities Financing Authority (University Hospital)1 | | | 5.000 | | | | 07/01/2046 | | | | 2,216,380 | |

| 125,000 | | NJ Health Care Facilities Financing Authority (Virtua Health/Virtua Memorial Hospital Burlington County Obligated Group)1 | | | 5.750 | | | | 07/01/2033 | | | | 131,860 | |

| 1,905,000 | | NJ Higher Education Assistance Authority1 | | | 5.500 | | | | 12/01/2025 | | | | 2,065,268 | |

| 55,000 | | NJ Higher Education Assistance Authority1 | | | 5.750 | | | | 12/01/2029 | | | | 59,357 | |

| 8,905,000 | | NJ Higher Education Student Assistance Authority (Student Loans)1 | | | 6.125 | | | | 06/01/2030 | | | | 8,993,961 | |

| 3,075,000 | | NJ Hsg. & Mtg. Finance Agency (Single Family Hsg.)3 | | | 4.625 | | | | 10/01/2027 | | | | 3,180,939 | |

| 495,000 | | NJ Hsg. & Mtg. Finance Agency (Single Family Hsg.)3 | | | 5.000 | | | | 10/01/2037 | | | | 391,335 | |

| 9,580,000 | | NJ Tobacco Settlement Financing Corp.1 | | | 5.000 | | | | 06/01/2041 | | | | 9,481,709 | |

| 10,980,000 | | NJ Tobacco Settlement Financing Corp. | | | 5.477 | 2 | | | 06/01/2041 | | | | 3,063,530 | |

| 1,625,000 | | NJ Transportation Trust Fund Authority1 | | | 5.000 | | | | 06/15/2038 | | | | 1,698,759 | |

| 5,000,000 | | NJ Transportation Trust Fund Authority1 | | | 5.500 | | | | 06/15/2041 | | | | 5,310,100 | |

| 4,518,000 | | NJ Transportation Trust Fund Authority1 | | | 6.000 | | | | 06/15/2035 | | | | 4,984,212 | |

| 850,000 | | NJ Turnpike Authority1 | | | 5.000 | | | | 01/01/2040 | | | | 975,188 | |

| 20,000 | | Passaic County, NJ Improvement Authority (Paterson Parking Deck)1 | | | 4.100 | | | | 04/15/2019 | | | | 20,024 | |

| 6,330,000 | | Rutgers State University NJ3 | | | 5.000 | | | | 05/01/2029 | | | | 7,163,884 | |

| 5,380,000 | | Rutgers State University NJ3 | | | 5.000 | | | | 05/01/2030 | | | | 6,075,083 | |

| 4,000,000 | | Rutgers State University NJ3 | | | 5.000 | | | | 05/01/2038 | | | | 4,458,820 | |

| 1,350,000 | | South Jersey, NJ Port Corp. (Marine Terminal)1 | | | 5.000 | | | | 01/01/2039 | | | | 1,434,173 | |

| 3,650,000 | | South Jersey, NJ Transportation Authority1 | | | 5.000 | | | | 11/01/2039 | | | | 3,971,748 | |

|

| 22 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

| | | | | | | | | | | | | | |

| Principal Amount | | | | Coupon | | Maturity | | | Value | |

| New Jersey (Continued) | | | | | | | | | |

| $55,000 | | Union County, NJ Improvement Authority (Linden Airport)1 | | | 5.000 | % | | | 03/01/2028 | | | $ | 55,155 | |

| 40,000 | | West Milford Township, NJ (Municipal Utilities Authority)1 | | | 5.375 | | | | 08/01/2031 | | | | 40,143 | |

| | | | | | | | | | | | | 204,262,944 | |

| | | | | | | | | | | | | | | |

| New York—7.4% | | | | | | | | | | | | |

| 2,689,000 | | Port Authority NY/NJ (JFK International Air Terminal)1 | | | 5.750 | | | | 12/01/2022 | | | | 2,833,399 | |

| 8,685,000 | | Port Authority NY/NJ (JFK International Air Terminal)1 | | | 5.750 | | | | 12/01/2025 | | | | 9,151,211 | |

| 5,100,000 | | Port Authority NY/NJ (JFK International Air Terminal)1 | | | 6.500 | | | | 12/01/2028 | | | | 5,377,950 | |

| 1,305,000 | | Port Authority NY/NJ (KIAC)1 | | | 6.750 | | | | 10/01/2019 | | | | 1,369,532 | |

| | | | | | | | | | | | | 18,732,092 | |

| | | | | | | | | | | | | | | |

| U.S. Possessions—23.3% | | | | | | | | | | | | |

| 10,000 | | Guam Hsg. Corp. (Single Family Mtg.)1 | | | 5.750 | | | | 09/01/2031 | | | | 10,322 | |

| 125,000 | | Guam Power Authority, Series A1 | | | 5.000 | | | | 10/01/2024 | | | | 138,387 | |

| 250,000 | | Guam Power Authority, Series A1 | | | 5.000 | | | | 10/01/2030 | | | | 272,407 | |

| 2,105,000 | | Northern Mariana Islands Ports Authority, Series A1 | | | 6.250 | | | | 03/15/2028 | | | | 1,988,046 | |

| 19,195,000 | | Puerto Rico Children’s Trust Fund (TASC)1 | | | 5.625 | | | | 05/15/2043 | | | | 17,611,412 | |

| 2,150,000 | | Puerto Rico Commonwealth GO4 | | | 5.250 | | | | 07/01/2037 | | | | 542,875 | |

| 8,350,000 | | Puerto Rico Commonwealth GO4 | | | 5.750 | | | | 07/01/2036 | | | | 2,108,375 | |

| 3,205,000 | | Puerto Rico Commonwealth GO4 | | | 5.750 | | | | 07/01/2041 | | | | 809,262 | |

| 5,000,000 | | Puerto Rico Commonwealth GO4 | | | 6.000 | | | | 07/01/2029 | | | | 1,262,500 | |

| 6,085,000 | | Puerto Rico Commonwealth GO4 | | | 6.000 | | | | 07/01/2039 | | | | 1,536,462 | |

| 3,000,000 | | Puerto Rico Commonwealth GO4 | | | 6.500 | | | | 07/01/2040 | | | | 757,500 | |

| 168,097 | | Puerto Rico Electric Power Authority4 | | | 10.000 | | | | 07/01/2019 | | | | 60,095 | |

| 168,096 | | Puerto Rico Electric Power Authority4 | | | 10.000 | | | | 07/01/2019 | | | | 60,094 | |

| 165,099 | | Puerto Rico Electric Power Authority4 | | | 10.000 | | | | 01/01/2021 | | | | 59,023 | |

| 165,099 | | Puerto Rico Electric Power Authority4 | | | 10.000 | | | | 07/01/2021 | | | | 59,023 | |

| 55,033 | | Puerto Rico Electric Power Authority4 | | | 10.000 | | | | 01/01/2022 | | | | 19,674 | |

| 55,033 | | Puerto Rico Electric Power Authority4 | | | 10.000 | | | | 07/01/2022 | | | | 19,674 | |

| 1,700,000 | | Puerto Rico Electric Power Authority, Series A4 | | | 5.000 | | | | 07/01/2029 | | | | 607,750 | |

| 1,990,000 | | Puerto Rico Electric Power Authority, Series A4 | | | 5.000 | | | | 07/01/2042 | | | | 711,425 | |

| 45,000 | | Puerto Rico Electric Power Authority, Series A4 | | | 5.050 | | | | 07/01/2042 | | | | 16,088 | |

| 3,000,000 | | Puerto Rico Electric Power Authority, Series A4 | | | 7.000 | | | | 07/01/2043 | | | | 1,072,500 | |

| 3,000,000 | | Puerto Rico Electric Power Authority, Series AAA4 | | | 5.250 | | | | 07/01/2028 | | | | 1,072,500 | |

| 5,000,000 | | Puerto Rico Electric Power Authority, Series AAA4 | | | 5.250 | | | | 07/01/2030 | | | | 1,787,500 | |

| 550,000 | | Puerto Rico Electric Power Authority, Series AAA4 | | | 5.250 | | | | 07/01/2031 | | | | 196,625 | |

| 50,000 | | Puerto Rico Electric Power Authority, Series CCC4 | | | 5.000 | | | | 07/01/2021 | | | | 17,875 | |

| 90,000 | | Puerto Rico Electric Power Authority, Series CCC4 | | | 5.000 | | | | 07/01/2025 | | | | 32,175 | |

| 45,000 | | Puerto Rico Electric Power Authority, Series SS, NPFGC | | | 5.000 | | | | 07/01/2020 | | | | 44,786 | |

| 100,000 | | Puerto Rico Electric Power Authority, Series TT4 | | | 5.000 | | | | 07/01/2023 | | | | 35,750 | |

| 80,000 | | Puerto Rico Electric Power Authority, Series TT4 | | | 5.000 | | | | 07/01/2037 | | | | 28,600 | |

|

| 23 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

STATEMENT OF INVESTMENTS Unaudited / Continued

| | | | | | | | | | | | | | |

| Principal Amount | | | | Coupon | | Maturity | | | Value | |

| U.S. Possessions (Continued) | | | | | | | | | |

| $750,000 | | Puerto Rico Highway & Transportation Authority, FGIC5 | | | 5.750 | % | | | 07/01/2020 | | | $ | 551,250 | |

| 575,000 | | Puerto Rico Infrastructure4 | | | 5.000 | | | | 07/01/2027 | | | | 26,163 | |

| 4,750,000 | | Puerto Rico Infrastructure4 | | | 5.000 | | | | 07/01/2037 | | | | 216,125 | |

| 2,610,000 | | Puerto Rico Infrastructure6 | | | 5.000 | | | | 07/01/2041 | | | | 118,755 | |

| 975,000 | | Puerto Rico Infrastructure, AMBAC | | | 6.995 | 2 | | | 07/01/2035 | | | | 342,449 | |

| 3,000,000 | | Puerto Rico Infrastructure, FGIC5 | | | 7.046 | 2 | | | 07/01/2042 | | | | 563,940 | |

| 400,000 | | Puerto Rico Infrastructure (Mepsi Campus)4 | | | 6.500 | | | | 10/01/2037 | | | | 199,000 | |

| 100,000 | | Puerto Rico ITEMECF (Ana G. Mendez University) | | | 5.000 | | | | 04/01/2027 | | | | 94,750 | |

| 930,000 | | Puerto Rico ITEMECF (Ana G. Mendez University) | | | 5.000 | | | | 03/01/2036 | | | | 811,425 | |

| 100,000 | | Puerto Rico ITEMECF (Ana G. Mendez University) | | | 5.125 | | | | 04/01/2032 | | | | 90,250 | |

| 100,000 | | Puerto Rico ITEMECF (Ana G. Mendez University) | | | 5.375 | | | | 04/01/2042 | | | | 88,250 | |

| 175,000 | | Puerto Rico ITEMECF (Cogeneration Facilities) | | | 6.625 | | | | 06/01/2026 | | | | 143,719 | |

| 1,000,000 | | Puerto Rico ITEMECF (Polytechnic University), ACA1 | | | 5.000 | | | | 08/01/2032 | | | | 927,120 | |

| 2,000,000 | | Puerto Rico Municipal Finance Agency, Series A, AGC1 | | | 5.250 | | | | 08/01/2020 | | | | 2,026,940 | |

| 305,000 | | Puerto Rico Public Buildings Authority4 | | | 5.250 | | | | 07/01/2033 | | | | 89,213 | |

| 5,000,000 | | Puerto Rico Public Buildings Authority6 | | | 5.250 | | | | 07/01/2042 | | | | 1,462,500 | |

| 1,000,000 | | Puerto Rico Public Buildings Authority6 | | | 5.625 | | | | 07/01/2039 | | | | 292,500 | |

| 1,000,000 | | Puerto Rico Public Buildings Authority, NPFGC1 | | | 6.000 | | | | 07/01/2028 | | | | 1,002,740 | |

| 5,235,000 | | Puerto Rico Public Finance Corp., Series B4 | | | 6.000 | | | | 08/01/2026 | | | | 117,788 | |

| 9,850,000 | | Puerto Rico Sales Tax Financing Corp., Series A4 | | | 5.375 | | | | 08/01/2039 | | | | 1,539,063 | |

| 2,500,000 | | Puerto Rico Sales Tax Financing Corp., Series A4 | | | 5.500 | | | | 08/01/2021 | | | | 390,625 | |

| 4,850,000 | | Puerto Rico Sales Tax Financing Corp., Series A4 | | | 5.500 | | | | 08/01/2022 | | | | 757,813 | |

| 10,935,000 | | Puerto Rico Sales Tax Financing Corp., Series A4 | | | 5.500 | | | | 08/01/2042 | | | | 1,708,594 | |

| 16,675,000 | | Puerto Rico Sales Tax Financing Corp., Series A, NPFGC | | | 5.807 | 2 | | | 08/01/2041 | | | | 3,638,485 | |

| 325,000 | | Puerto Rico Sales Tax Financing Corp., Series A4 | | | 6.375 | | | | 08/01/2039 | | | | 50,781 | |

| 6,800,000 | | Puerto Rico Sales Tax Financing Corp., Series A4 | | | 6.500 | | | | 08/01/2044 | | | | 1,062,500 | |

| 14,000,000 | | Puerto Rico Sales Tax Financing Corp., Series C4 | | | 5.750 | | | | 08/01/2057 | | | | 6,650,000 | |

| 1,100,000 | | V.I. Tobacco Settlement Financing Corp. | | | 6.497 | 2 | | | 05/15/2035 | | | | 286,792 | |

| 3,100,000 | | V.I. Tobacco Settlement Financing Corp. | | | 7.622 | 2 | | | 05/15/2035 | | | | 730,391 | |

| | | | | | | | | | | | | 58,918,626 | |

| | | | | | | | | | | | | | | |

| Total Investments, at Value (Cost $346,685,559)—111.4% | | | | | | | | | | | 281,913,662 | |

| Net Other Assets (Liabilities)—(11.4) | | | | | | | | | | | (28,819,424 | ) |

| Net Assets—100.0% | | | | | | | | | | $ | 253,094,238 | |

| | | | | | | | | | | | | | |

Footnotes to Statement of Investments

1. All or a portion of the security position has been segregated for collateral to cover borrowings. See Note 9 of the accompanying Notes.

2. Zero coupon bond reflects effective yield on the original acquisition date.

|

| 24 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

Footnotes to Statement of Investments (Continued)

3. Security represents the underlying municipal bond with respect to an inverse floating rate security held by the Fund. The bond was purchased by the Fund and subsequently transferred to a trust, which issued the related inverse floating rate security. See Note 4 of the accompanying Notes.

4. This security is not accruing income because its issuer has missed or is expected to miss interest and/or principal payments. The rate shown is the contractual interest rate. See Note 4 of the accompanying Notes.

5. The issuer of this security has missed or is expected to miss interest and/or principal payments on this security. The security is insured and is accruing partial income at a rate anticipated to be recovered through the insurer. The rate shown is the contractual interest rate.

6. This security is accruing partial income at an anticipated effective rate based on expected interest and/or principal payments. The rate shown is the contractual interest rate.

To simplify the listings of securities, abbreviations are used per the table below:

| | |

| ACA | | American Capital Access |

| AGC | | Assured Guaranty Corp. |

| AMBAC | | AMBAC Indemnity Corp. |

| EDA | | Economic Devel. Authority |

| FGIC | | Financial Guaranty Insurance Co. |

| GO | | General Obligation |

| ITEMECF | | Industrial, Tourist, Educational, Medical and Environmental Community Facilities |

| JFK | | John Fitzgerald Kennedy |

| NPFGC | | National Public Finance Guarantee Corp. |

| NY/NJ | | New York/New Jersey |

| SJH&MC | | St. Joseph’s Health and Medical Center |

| SJHS | | St. Joseph Health System |

| TASC | | Tobacco Settlement Asset-Backed Bonds |

| V.I. | | United States Virgin Islands |

See accompanying Notes to Financial Statements.

|

| 25 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

STATEMENT OF ASSETS AND LIABILITIES January 31, 2018 Unaudited

| | |

|

| Assets | | |

| Investments, at value (cost $346,685,559)—see accompanying statement of investments | | $ 281,913,662 |

|

| Cash | | 669,206 |

|

| Receivables and other assets: | | |

| Interest | | 2,332,499 |

| Shares of beneficial interest sold | | 300,864 |

| Investments sold on a when-issued or delayed delivery basis | | 5,000 |

| Other | | 86,043 |

| | |

| Total assets | | 285,307,274 |

| | |

|

| Liabilities | | |

| Payables and other liabilities: | | |

| Payable for short-term floating rate notes issued (See Note 4) | | 21,060,000 |

| Payable for borrowings (See Note 9) | | 10,700,000 |

| Dividends | | 197,502 |

| Shares of beneficial interest redeemed | | 72,493 |

| Trustees’ compensation | | 70,246 |

| Distribution and service plan fees | | 43,204 |

| Interest expense on borrowings | | 12,063 |

| Shareholder communications | | 3,569 |

| Other | | 53,959 |

| | |

| Total liabilities | | 32,213,036 |

| | |

|

| Net Assets | | $ 253,094,238 |

| | |

| | |

|

| Composition of Net Assets | | |

| Paid-in capital | | $ 457,678,513 |

|

| Accumulated net investment loss | | (24,188) |

|

| Accumulated net realized loss on investments | | (139,788,190) |

|

| Net unrealized depreciation on investments | | (64,771,897) |

| | |

| Net Assets | | $ 253,094,238 |

| | |

|

| 26 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

| | | | |

| Net Asset Value Per Share | | | | |

| Class A Shares: | | | | |

Net asset value and redemption price per share (based on net assets of $156,885,082 and 18,684,438 shares of beneficial interest outstanding) | | $ | 8.40 | |

Maximum offering price per share (net asset value plus sales charge of 4.75% of offering price) | | $ | 8.82 | |

| |

| |

| Class B Shares: | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $802,997 and 95,298 shares of beneficial interest outstanding) | | $ | 8.43 | |

| |

| |

| Class C Shares: | | | | |

Net asset value, redemption price (excludes applicable contingent deferred sales charge) and offering price per share (based on net assets of $73,394,986 and 8,729,889 shares of beneficial interest outstanding) | | $ | 8.41 | |

| |

| |

| Class Y Shares: | | | | |

Net asset value, redemption price and offering price per share (based on net assets of $22,011,173 and 2,618,345 shares of beneficial interest outstanding) | | $ | 8.41 | |

See accompanying Notes to Financial Statements.

|

| 27 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

STATEMENT

OF OPERATIONS For the Six Months Ended January 31, 2018 Unaudited

| | |

|

| Investment Income | | |

| Interest | | $ 6,752,282 |

|

| Expenses | | |

| Management fees | | 874,355 |

|

| Distribution and service plan fees: | | |

| Class A | | 222,080 |

| Class B | | 5,593 |

| Class C | | 389,790 |

|

| Transfer and shareholder servicing agent fees: | | |

| Class A | | 91,397 |

| Class B | | 621 |

| Class C | | 43,331 |

| Class Y | | 15,121 |

|

| Shareholder communications: | | |

| Class A | | 6,737 |

| Class B | | 171 |

| Class C | | 3,627 |

| Class Y | | 1,085 |

|

| Borrowing fees | | 202,492 |

|

| Legal, auditing and other professional fees | | 201,833 |

|

| Interest expense on borrowings | | 83,493 |

|

| Interest expense and fees on short-term floating rate notes issued (See Note 4) | | 71,307 |

|

| Trustees’ compensation | | 1,922 |

|

| Custodian fees and expenses | | 1,428 |

|

| Other | | 5,383 |

| | |

| Total expenses | | 2,221,766 |

|

| Net Investment Income | | 4,530,516 |

|

| Realized and Unrealized Gain (Loss) | | |

| Net realized gain on investment transactions in unaffiliated companies | | 606,896 |

|

| Net change in unrealized appreciation/depreciation on investment transactions in unaffiliated companies | | (23,037,808) |

|

| Net Decrease in Net Assets Resulting from Operations | | $ (17,900,396) |

| | |

See accompanying Notes to Financial Statements.

|

| 28 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | |

| | | Six Months Ended

January 31, 2018

(Unaudited) | | | Year Ended

July 31, 2017 |

|

| Operations | | | | | | |

| Net investment income | | $ | 4,530,516 | | | $ 14,549,519 |

|

| Net realized gain | | | 606,896 | | | 762,842 |

|

| Net change in unrealized appreciation/depreciation | | | (23,037,808) | | | (27,232,735) |

| | | |

| Net decrease in net assets resulting from operations | | | (17,900,396) | | | (11,920,374) |

| | | | | | |

|

| Dividends and/or Distributions to Shareholders | | | | | | |

| Dividends from net investment income: | | | | | | |

| Class A | | | (3,250,893) | | | (9,969,457) |

| Class B | | | (17,561) | | | (77,318) |

| Class C | | | (1,254,341) | | | (4,031,761) |

| Class Y | | | (572,283) | | | (1,454,078) |

| | | |

| | | (5,095,078) | | | (15,532,614) |

| | | | | | |

|

| Beneficial Interest Transactions | | | | | | |

| Net increase (decrease) in net assets resulting from beneficial interest transactions: | | | | | | |

| Class A | | | (37,218,135) | | | (32,878,334) |

| Class B | | | (773,526) | | | (1,052,793) |

| Class C | | | (17,571,357) | | | (18,824,104) |

| Class Y | | | (12,207,524) | | | 10,270,816 |

| | | |

| | | (67,770,542) | | | (42,484,415) |

| | | | | | |

|

| Net Assets | | | | | | |

| Total decrease | | | (90,766,016) | | | (69,937,403) |

|

| Beginning of period | | | 343,860,254 | | | 413,797,657 |

| | | |

| End of period (including accumulated net investment income (loss) of $(24,188) and $540,374, respectively) | | $ | 253,094,238 | | | $ 343,860,254 |

| | | |

See accompanying Notes to Financial Statements.

|

| 29 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

STATEMENT

OF CASH FLOWS For the Six Months Ended January 31, 2018 Unaudited

| | | | |

| |

| Cash Flows from Operating Activities | | | | |

| Net decrease in net assets from operations | | $ | (17,900,396) | |

| |

| Adjustments to reconcile net decrease in net assets from operations to net cash provided by operating activities: | | | | |

Purchase of investment securities | | | (31,501,967) | |

Proceeds from disposition of investment securities | | | 103,755,144 | |

Short-term investment securities, net | | | 71,199 | |

Premium amortization | | | 750,735 | |

Discount accretion | | | (330,167) | |

Net realized gain on investment transactions | | | (606,896) | |

Net change in unrealized appreciation/depreciation on investment transactions | | | 23,037,808 | |

| Change in assets: | | | | |

Decrease in other assets | | | 42,350 | |

Decrease in interest receivable | | | 546,980 | |

Decrease in receivable for securities sold | | | 4,398,210 | |

| Change in liabilities: | | | | |

Decrease in other liabilities | | | (50,895) | |

Decrease in payable for securities purchased | | | (1,165,990) | |

| | | | |

| Net cash provided by operating activities | | | 81,046,115 | |

| | | | |

| |

| Cash Flows from Financing Activities | | | | |

| Proceeds from borrowings | | | 76,100,000 | |

| Payments on borrowings | | | (85,000,000) | |

| Payments and proceeds on short-term floating rate notes issued | | | 2,185,000 | |

| Proceeds from shares sold | | | 9,494,993 | |

| Payments on shares redeemed | | | (83,033,946) | |

| Cash distributions paid | | | (675,288) | |

| | | | |

| Net cash used in financing activities | | | (80,929,241) | |

| |

| Net increase in cash | | | 116,874 | |

| |

| Cash, beginning balance | | | 552,332 | |

| | | | |

| Cash, ending balance | | $ | 669,206 | |

| | | | |

Supplemental disclosure of cash flow information:

Noncash financing activities not included herein consist of reinvestment of dividends and distributions of $4,442,650.

Cash paid for interest on borrowings—$88,683.

Cash paid for interest on short-term floating rate notes issued—$71,307.

See accompanying Notes to Financial Statements.

|

| 30 OPPENHEIMER ROCHESTER NEW JERSEY MUNICIPAL FUND |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | |

| Class A | | Six Months

Ended

January 31,

2018

(Unaudited) | | | Year Ended

July 31, 2017 | | | Year Ended

July 31, 2016 | | | Year Ended

July 31, 2015 | | | Year Ended

July 31, 2014 | | | Year Ended

July 31, 2013 |

|

| Per Share Operating Data | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | | $9.02 | | | | $9.70 | | | | $9.34 | | | | $9.67 | | | | $9.60 | | | $10.68 |

|

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income1 | | | 0.14 | | | | 0.38 | | | | 0.43 | | | | 0.48 | | | | 0.52 | | | 0.50 |

| Net realized and unrealized gain (loss) | | | (0.61) | | | | (0.66) | | | | 0.40 | | | | (0.31) | | | | 0.07 | | | (1.05) |

| | | |

| Total from investment operations | | | (0.47) | | | | (0.28) | | | | 0.83 | | | | 0.17 | | | | 0.59 | | | (0.55) |

|

| Dividends and/or distributions to shareholders: | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.15) | | | | (0.40) | | | | (0.47) | | | | (0.50) | | | | (0.52) | | | (0.53) |

|

| Net asset value, end of period | | | $8.40 | | | | $9.02 | | | | $9.70 | | | | $9.34 | | | | $9.67 | | | $9.60 |

| | | |

| | | | | | | | | | | | | | | | | | | | | | |

|

| Total Return, at Net Asset Value2 | | | (5.18)% | | | | (3.01)% | | | | 9.25% | | | | 1.64% | | | | 6.40% | | | (5.43)% |

| | | | | | | | | | | | | | | | | | | | | | |

|

| Ratios/Supplemental Data | | | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | | $156,885 | | | | $207,958 | | | | $257,608 | | | | $263,873 | | | | $306,172 | | | $368,177 |

|

| Average net assets (in thousands) | | | $180,899 | | | | $231,289 | | | | $260,521 | | | | $301,779 | | | | $326,496 | | | $425,664 |

|

| Ratios to average net assets:3 | | | | | | | | | | | | | | | | | | | | | | |