Disputes between (1) Cable and Wireless plc and IBM United Kingdom Limited, (2) Cable & Wireless USA, Inc. and International Business Machines Corporation and (3) IBM Japan Limited and Cable & Wireless IDC Incorporated (collectively ‘Cable & Wireless’ and ‘IBM’ respectively) have arisen out of a Global Framework Agreement (GFA) dated 20 December 2000, and related agreements, pursuant to which IBM agreed to supply to Cable & Wireless information technology services.

In order to monitor the quality of the services provided by IBM, including price and service levels, the GFA contains ‘benchmarking’ provisions, which set out the processes and procedures by which the services provided by IBM are to be assessed against a pre-determined objective. In February 2002, the parties engaged Compass America Inc (Compass) to conduct a benchmark for the 14 month period from 1 January 2001 to 28 February 2002, the results of which revealed significant levels of overcharging by IBM.

Disputes arose as to whether the GFA obliged IBM to repay to Cable & Wireless the amounts that the benchmark established it has been overcharged and as to whether the Compass reports were valid both in terms of their substance and conformity with the GFA benchmarking requirements. On 4 July 2002, the Company issued proceedings for a declaration that it is entitled to compensation from IBM UK for any period of overcharging, including past overcharging, and to compensation in respect of overcharging as identified by Compass.

After an inconclusive Court-ordered mediation that took place in December 2002, the Court ordered an expedited trial of all matters in issue between the parties. Full pleadings were then exchanged. Cable & Wireless seeks a declaration as to the meaning of certain overcharging related provisions of the GFA and compensation for overcharging by IBM. From January 2001 to the date Cable & Wireless’ proceedings were issued, its claim in respect of overcharging by IBM amounts to approximately £115 million in respect of the United Kingdom and approximately US$22 million in respect of the United States. For each month that IBM refuses to reduce its charges a further substantial overcharge arises. IBM UK and IBM US seek the declaration in respect of the Compass reports referred to above and IBM UK has brought counterclaims in respect of work it alleges Cable & Wireless should have given to it under the GFA and claims damages to be assessed. IBM Japan Limited seeks payment of certain charges allegedly due and payable to it by Cable & Wireless IDC Inc. Subsequently, on 21 February 2003, the Court directed that Cable & Wireless’ claim as to the meaning of certain overcharging related provisions of the GFA should be heard separately from the other claims and counterclaims as a preliminary issue. The preliminary issue has been set for trial in September 2003.

Cable & Wireless believes that it has meritorious defences to the counter claims asserted by IBM and intends to vigorously defend itself in this litigation.

On 30 March 2001, a complaint was filed in the US District Court for the District of Columbia against Cable & Wireless USA, Inc. and was served on Cable & Wireless USA, Inc. on 25 June 2001. The complaint was filed by a group of billing and collection agents on behalf of hundreds of entities that own and operate public payphones throughout the United States. The complaint alleges that Cable & Wireless USA, Inc. violated the US Communications Act and the rules, regulations, and orders of the Federal Communications Commission by not adequately compensating the independent payphone operators for toll free and access code calls that were made from the independent payphone operators’ payphones and carried over Cable & Wireless USA, Inc.’s network.

The complaint seeks approximately US$5 million in monetary damages. In August 2001, Cable & Wireless USA, Inc. and the plaintiff entered into a tolling agreement whereby the obligations of the parties in litigation would be suspended until 1 November 2001, while the parties attempted to resolve the dispute informally. Plaintiffs refiled their complaint which is now pending in the US District Court for the District of Columbia. The parties agreed to a confidential, non-binding, third-party neutral evaluation for settlement purposes which is currently ongoing.

Cable & Wireless USA, Inc. believes that it has meritorious defences to the claims. If the dispute is not resolved through the neutral evaluation process, Cable & Wireless USA, Inc. intends to vigorously defend the action.

As described in ‘Business Description – History’, in 2002 Cable & Wireless acquired 100 per cent of Digital Island, which is now known as Cable & Wireless Internet Services, Inc.

Back to Contents

notes to the financial statements

Akamai Technologies, Inc. (Akamai) and the Massachusetts Institute of Technology (MIT) filed a patent infringement suit against Digital Island on 13 September 2000 in the US District Court for the District of Massachusetts, alleging that a version of Digital Island’s content delivery service infringes a patent owned by MIT and licensed exclusively to Akamai. On 20 September 2000, Akamai and MIT filed a further claim alleging infringement by Digital Island of a second Akamai patent.

On 21 December 2001, a jury invalidated three of the claims related to one of the Akamai patents. The jury also found that Digital Island infringed one independent claim and three dependent claims of this patent. Digital Island was found not to have infringed the other patent. On 23 August 2002, the Court entered a permanent injunction prohibiting further infringement of certain of the surviving claims. Cable & Wireless has revised its content delivery service (at little cost to and with no other effect on its customers) in such a way that Cable & Wireless believes that the infringement no longer exists and that the injunction is of no effect. Nevertheless, on 17 September 2002, Akamai filed a contempt motion with the Court asserting that Cable & Wireless Internet Services, Inc. is violating the injunction by continuing to infringe the surviving Akamai claims. The Court denied Akamai’s motion on 1 November 2002. A damages trial has not yet been scheduled on the infringed claims.

On 22 January 2003, Akamai filed a patent infringement suit against Cable & Wireless Internet Services, Inc. in the US District Court for the Eastern District of Virginia, alleging that the Cable & Wireless content delivery service infringes a recently-issued patent owned by Akamai. Upon motion by Cable & Wireless Internet Services, Inc. the case was transferred to the District Court for the District of Massachusetts.

On 22 April 2003, Akamai filed a patent infringement suit against Cable & Wireless Internet Services, Inc. in the US District Court for the District of Massachusetts, alleging that the Cable & Wireless content delivery service infringes a patent issued to Akamai that same day. Akamai has not yet effected service of the complaint in this case.

On 29 August 2002, Teknowledge Corporation (Teknowledge) filed a patent infringement suit against Cable & Wireless Internet Services, Inc., Akamai, and Inktomi Corporation in the US District Court for the District of Delaware, alleging that the content delivery service of each defendant infringes a patent owned by Teknowledge. Upon motion by Cable & Wireless Internet Services, Inc. the case was transferred to the District Court for the Northern District of California.

Cable & Wireless Internet Services, Inc. believes that it has meritorious defences to the outstanding claims asserted in these cases and intends to vigorously defend itself in these cases.

Class actions against Digital Island, Inc. in connection with its initial public offering |

In August 2001, Digital Island became aware that two purported shareholder class action lawsuits were filed in the US District Court for the Southern District of New York naming Digital Island as a defendant along with certain of its present and former officers and directors and alleging violations of certain sections of the Securities Act 1933 and the Securities Exchange Act 1934.

The actions (which now include a third suit making virtually identical claims and allegations) allege that the Registration Statement and Prospectus through which Digital Island conducted its initial public offering (IPO) in June 1999 was false and misleading because it failed to disclose, amongst other things, that:

| (i) | the underwriters of the IPO allegedly had solicited and received excessive and undisclosed commissions from certain investors in exchange for which the underwriters allocated to those investors material portions of the restricted number of Digital Island shares issued in connection with the IPO; and |

| | |

| (ii) | the underwriters allegedly had entered into agreements with customers whereby the underwriters agreed to allocate Digital Island shares to those customers in the IPO in exchange for which the customers agreed to purchase additional Digital Island shares in the after market at pre-determined prices. |

On 15 July 2002, Cable & Wireless Internet Services, Inc. moved to dismiss all claims against it. On 19 February 2003, the Court denied the motion to dismiss.

Cable & Wireless Internet Services, Inc. is now engaged in settlement discussions with the plaintiffs. Notwithstanding this Cable & Wireless Internet Services, Inc. believes that it has meritorious defences to these claims and, should the settlement discussions prove unsuccessful, intends to vigorously defend itself in any such litigation.

Page 133

Back to Contents

notes to the financial statements

Class action securities litigation against Digital Island, Inc., Cable & Wireless and others |

Digital Island, Cable and Wireless plc, Dali Acquisition Corp. (Dali) (a former subsidiary of Cable & Wireless), and certain of the then present and former directors of Digital Island, have been named as defendants in six separate putative class action lawsuits alleging various claims arising out of Cable & Wireless’ acquisition of Digital Island in August 2001. Three of the lawsuits were filed in the US District Court for the District of Delaware and three were filed in the Delaware Court of Chancery. The three federal lawsuits were consolidated into a single case, and, while the plaintiffs’ motion to consolidate the three state cases was granted on 24 April 2002, the plaintiffs have yet to file a consolidated, amended complaint.

The federal suit alleged that the defendants violated federal securities laws by failing to disclose on a timely basis that Digital Island had entered into certain business agreements with Bloomberg, L.P., and Major League Baseball. It further alleged that compensation agreements with certain officers and/or directors of the company violated the federal securities ‘all-holders’ rule. One state lawsuit alleged violations of Delaware law based upon similar allegations.

The other two state lawsuits alleged various violations of Delaware law against the same corporate defendants and the present and former Digital Island directors, including that they failed to disclose all material facts relating to Digital Island’s relationship with Microsoft, and that they failed to obtain a fair price for Digital Island shares.

On 10 September 2002, a federal judge granted the defendants’ motion to dismiss the federal lawsuits with prejudice. Plaintiffs have appealed the decision to the US Circuit Court of Appeals for the Third Circuit. Cable & Wireless believes that it and its subsidiaries have meritorious defences to the claims asserted in these lawsuits, and intends to continue to vigorously defend itself in that litigation as well should the plaintiffs pursue those claims.

Litigation with Cibertec International, S.A. and Inversiones Kamasu, S.A. |

Cibertec International, S.A. and Inversiones Kamasu, S.A. initiated proceedings against Cable & Wireless Panama, S.A. and Cable and Wireless (CALA Management Services) Limited in Panama on 29 October 1999. The claim is for approximately US$125 million and alleges breach of contract. On 18 November 2002, the Panamanian Circuit Court handed down a decision against Cable & Wireless Panama, S.A. awarding damages of US$67,255,000, including moral damages and costs. The Court decided that Cable & Wireless Panama, S.A. had failed to maintain in sufficient confidence certain of the proprietary information of the plaintiffs.

Cable & Wireless Panama, S.A. appealed the judgement on 3 December 2002 and intends to pursue this appeal vigorously. Pending the resolution of its appeal, Cable & Wireless Panama, S.A. is not obliged to pay, and has not paid, any of the awards against it.

Claim against the Minister of Finance and Economy |

On 16 December 2002, a complaint was filed at the Supreme Court of Justice of Panama against the Minister of Finance and Economy in Panama alleging that the Operating Agreement executed between Cable and Wireless (CALA Management Services) Limited and INTEL, S.A. (now Cable & Wireless Panama, S.A.) as part of the privatisation agreements was null and void ab initio, on the grounds that it had not been published in the Official Gazette in Panama.

On 21 March 2003, the Court admitted the claim against the Minister of Finance and Economy.

Panamanian counsel consider this claim to be without merit and none of Cable and Wireless plc, Cable & Wireless Panama, S.A. or Cable and Wireless (CALA Management Services) Limited are parties to the complaint. However, if the complaint were to be successful and the Operating Agreement declared null and void, then the complainants could file a complaint against Cable and Wireless (CALA Management Services) Limited requiring the return of all management fees collected under the agreement since its execution. This would amount to approximately £60 million. In the event that this complaint is successful, Cable & Wireless and its subsidiaries intends to vigorously pursue any legal recourse available to them.

Claim by Caribtel (Caribbean) Limited |

On 9 May 2003, Caribtel (Caribbean) Limited, a telecommunications operator specialising in calling cards, filed a suit against Cable & Wireless Jamaica Limited in the Supreme Court of Judicature of Jamaica. Caribtel has alleged that Cable & Wireless Jamaica Limited wrongfully disconnected Caribtel’s local access telephone services, resulting in a breach of contract and a violation of the Jamaican Fair Competition Act and the Telecommunications Act. Caribtel is claiming US$50 million of lost income to its pre-paid local access calling card business for the period from 25 April 2003 to 25 April 2006. Caribtel has also claimed aggravated and/or exemplary damages of Jamaica $300 million (approximately £2.94 million) and is seeking injunctive relief to have Cable & Wireless Jamaica Limited reinstate Caribtel’s local access telephone service.

Page 134

Back to Contents

notes to the financial statements

On 22 May 2003, Caribtel presented a petition for injunctive relief before the Supreme Court of Jamaica requesting that Cable & Wireless Jamaica Limited be required to reinstate Caribtel’s local access telephone service; be restrained from disconnecting any other telecommunications facility currently supplied to Caribtel’s business premises until trial; and be prevented from calling on a prior bank guarantee that Caribtel had provided to Cable & Wireless Jamaica Limited in conjunction with a settlement agreement entered into between the parties in February 2003 relating to breaches of contract by Caribtel in December 2002. The injunctions were not granted by the court. However, Cable & Wireless Jamaica Limited gave an undertaking that it would not disconnect the direct internet access facility pending a hearing scheduled for 2 June 2003.

Prior to the hearing of 2 June 2003, Caribtel approached Cable & Wireless Jamaica Limited with a view to arriving at a settlement. The parties entered into negotiations as a result of which the matter was taken off the court list by consent of both parties. A new court date will be set if the parties are unable to arrive at a settlement. Cable & Wireless Jamaica Limited believes that its actions were lawful and that it was entitled to disconnect Caribtel’s services under its contract with Caribtel. If the settlement negotiations prove unsuccessful, Cable & Wireless Jamaica Limited will continue to defend itself vigorously in this matter.

Arbitration between Tilts Communications A/S/Cable and Wireless plc/Sonera OY and Republic of Latvia/Lattelekom SIA |

In September 2001, Cable and Wireless plc was joined as a party to an arbitration in connection with its former participation with Sonera OY (Sonera) in the joint venture Tilts Communications A/S (Tilts). Through Tilts, Cable and Wireless plc and Sonera purchased a 49 per cent shareholding in a Latvian telecommunications company, Lattelekom SIA (Lattelekom) in 1994. Cable and Wireless plc sold its interest in Tilts to Sonera in June 1998.

Tilts commenced arbitration proceedings in August 2000 against the Republic of Latvia alleging a number of breaches of an agreement signed in 1994 by Tilts, Lattelekom and the Republic of Latvia (the ‘Umbrella Agreement’). Tilts claims a total of approximately LVL87.6 million (approximately £95 million) from the Republic of Latvia as compensation for, amongst other things, losses sustained as a consequence of the shortening of the twenty year exclusivity period granted to Lattelekom as the provider of fixed line telecommunications services.

The Republic of Latvia has asserted nine counterclaims for a total of approximately LVL599.5 million (approximately £656 million) against Tilts, alleging that Tilts has failed to comply with various obligations it assumed under the Umbrella Agreement including (i) to digitalise and otherwise improve Lattelekom’s network in accordance with its contractual commitments, (ii) to meet certain quality of service and network performance commitments, and (iii) to procure that Sonera sell its shares in GSM operator Latvijas Mobilais Telefons to Lattelekom. Tilts considers that the counterclaims asserted by the Republic of Latvia are unfounded.

Cable and Wireless plc was joined as a party to the arbitration by the Republic of Latvia because it (and Sonera) guaranteed the performance by Tilts of its obligations under the Umbrella Agreement to the Republic of Latvia by performance and parental guarantees. However, as part of the arrangements relating to Sonera’s purchase of Cable and Wireless plc’s shares in Tilts, Sonera provided Cable and Wireless plc with an indemnity for any liability incurred by Cable and Wireless plc under these guarantees. Provided Sonera honours its obligations under the indemnity, Cable and Wireless plc will not be exposed to any liability under these guarantees. Cable and Wireless plc has taken legal advice. Based on this advice, Cable and Wireless plc believes that the indemnity is binding. In addition, Sonera provided Cable and Wireless plc with a letter dated 11 December 2001, confirming that in its view all liabilities, costs and expenses incurred by Cable and Wireless plc in connection with the arbitration fell within the scope of the indemnity. Following the acquisition of Sonera in 2002, the successor entity to Sonera, TeliaSonera, provided Cable and Wireless plc with a further letter dated 23 February 2003, acknowledging Sonera’s obligations under the indemnity and stating that TeliaSonera’s acquisition of Sonera did not alter the validity of the confirmations given by Sonera in its earlier letter of 11 December 2001.

Other than the above, there are no pending legal or regulatory proceeding against the Company or any of its Subsidiaries which the Company believes will if determined adversely to the Group have a material adverse effect on the Group’s liquidity or results of operation.

Page 135

Back to Contents

notes to the financial statements

| 35 | Subsidiary undertakings, joint ventures and associates at 31 March 2003 |

| | | | | | | | | Ownership

| | | | | | | | | | |

Subsidiaries | | | Local currency | | | Issued Share Capital (m) | | | Direct | | | Via subsidiaries | | | Class of shares | | | Country of incorporation | | | Area of operation | |

| |

| Cable & Wireless UK | | | £ | | | 2,333 | | | – | | | 100 | % | | Ordinary | | | England | | | UK | |

| Cable & Wireless USA, Inc. | | | US$ | | | – | | | – | | | 100 | % | | Ordinary | | | US | | | US | |

| Cable & Wireless Jamaica Limited | | | J$ | | | 15,883 | | | – | | | 82 | % | | Ordinary | | | Jamaica | | | Jamaica | |

| Cable and Wireless (Cayman Islands) Limited | | | Cay$ | | | – | | | – | | | 100 | % | | Ordinary | | | Cayman Islands | | | Cayman Islands | |

Cable & Wireless Panama SAa | | | Balboa | | | 316 | | | – | | | 49 | % | | Ordinary | | | Panama | | | Panama | |

Companhia de Telecomunicacoes de Macau, S.A.R.L.b | | | Pataca | | | 150 | | | 51 | % | | – | | | Ordinary | | | Macau | | | Macau and China | |

| Cable & Wireless Global Limited | | | £ | | | – | | | – | | | 100 | % | | Ordinary | | | Rep. of Ireland | | | World wide | |

| Cable & Wireless IDC Inc. | | | Yen | | | 36,200 | | | – | | | 98 | % | | Ordinary | | | Japan | | | Japan | |

| Cable & Wireless Internet Services Inc. | | | US$ | | | – | | | – | | | 100 | % | | Ordinary | | | US | | | US | |

| Cable & Wireless (Barbados) Limited | | | B$ | | | – | | | – | | | 81 | % | | Ordinary | | | Barbados | | | Barbados | |

| Cable and Wireless (West Indies) Limited | | | £ | | | 5 | | | – | | | 100 | % | | Ordinary | | | England | | | Caribbean | |

Yemen International Telecommunications Company LLCb | | | YRiyal | | | 192 | | | 51 | % | | – | | | Ordinary | | | Yemen | | | Yemen | |

Dhivehi Raajjeyge Gulhun Private Limitedbc | | | Rufiya | | | 190 | | | 45 | % | | – | | | Ordinary | | | Maldives | | | Maldives | |

| | | | | | | | | | | | | | | | | | | | | | | |

Joint ventures | | | | | | | | | | | | | | | | | | | | | | |

| |

Telecommunications Services of Trinidad and Tobago Limitedd | | | T$ | | | 283 | | | – | | | 49 | % | | Ordinary | | | Trinidad and Tobago | | | Trinidad and Tobago | |

| | | | | | | | | | | | | | | | | | | | | | | |

Associates | | | | | | | | | | | | | | | | | | | | | | |

| |

Bahrain Telecommunications Company B.S.C.b | | | Dinar | | | 100,000 | | | 20 | % | | – | | | Ordinary | | | Bahrain | | | Bahrain | |

| |

| The Group comprises a large number of companies and it is not practical to include all of them in this list. The list therefore, only includes those companies whose results or financial position, in the opinion of the Directors, principally affects the figures shown in the Group’s Financial Statements. |

| Full details of all subsidiary undertakings, joint ventures, associates and trade investments will be attached to the Company’s Annual Return, to be filed with the Registrar of Companies in England and Wales. |

| a | The Group regards this company as a subsidiary because it controls the majority of the Board of Directors through a shareholders’ agreement. |

| b | This company had a financial year end of 31 December 2002 due to the requirements of the shareholders’ agreement. |

| c | The Group regards this company as a subsidiary undertaking because it exercises dominant influence through a management agreement. |

| d | This company is audited by a firm other than KPMG International member firms. |

Page 136

Back to Contents

notes to the financial statements

| | |

| 36 | Summary of differences between United Kingdom and United States GAAP |

The Group prepares its consolidated accounts in accordance with generally accepted accounting principles (GAAP) in the United Kingdom which differ in certain material respects from US GAAP. The following is a summary of the significant differences applicable to the Group, and the adjustments necessary to present net income and shareholders’ equity in accordance with US GAAP are shown on pages 142 and 143.

UK GAAP | | US GAAP |

| |

|

Goodwill | | |

| | | |

Goodwill arising on acquisitions prior to 1 April 1998 was eliminated directly against reserves. Amounts are transferred from reserves and charged through the profit and loss account when the related investments are sold or written down as a result of an impairment. Following the adoption of FRS 10 ‘Goodwill and intangible assets’, goodwill arising after 31 March 1998 is capitalised and amortised through the profit and loss account over the intangible assets estimated useful economic lives. The profit or loss on the disposal of all or part of a previously acquired business is calculated after taking account of the gross amount of any goodwill previously eliminated directly against reserves and not already charged to the profit and loss account. An adjustment to profit or loss on disposal is required in respect of the unamortised portion of goodwill. | | For acquisitions completed prior to 1 July 2001, goodwill was capitalised and amortised by charges against income over the period, not exceeding 20 years, over which the benefit arises. Goodwill acquired prior to 30 June 2001 ceased to be amortised from 31 March 2002. For acquisitions completed after 1 July 2001, Statement of Financial Accounting Standards (SFAS) 141 ‘Business Combinations’ and 142 ‘Goodwill and Other Intangible Assets’ require that goodwill is not amortised. From 1 April 2002 all goodwill is tested at least annually for impairment. Certain elements of goodwill under UK GAAP must be classified as other intangible assets under US GAAP, which are also capitalised and amortised over their estimated useful economic lives. |

| | | |

Customer acquisition costs | | |

| | | |

| Customer acquisition costs are written off over the expected customer life. | | Customer acquisition costs are written off over the initial contract period. |

| | | |

Restructuring | | |

| | | |

| Redundancy provisions relating to a restructuring can only be recognised once an entity has a constructive obligation in respect of a past event. This is the case where an entity has raised a valid expectation in those affected that it will carry out the restructuring and has in place a detailed formal plan. | | Redundancy provisions relating to a restructuring provision can only be recognised when the company is irrevocably committed to the plan and has communicated the arrangements to the employees. If there is a requirement for future service, the company should accrue the liability over the future service period. Employees are required to render ‘future service’ if they must render service until they are terminated and the service period extends beyond a minimum retention period, limited to 60 days unless a contract or law mandates otherwise. |

Page 137

Back to Contents

notes to the financial statements

UK GAAP | | US GAAP |

| |

|

| The costs of terminating property leases under a restructuring may be recognised when the decision to restructure has been taken. | | The costs of terminating property leases may not be recognised until the contract has been terminated and liabilities for remaining lease rentals are not recognised until the property is physically vacated. If a property has been vacated, but the contract has not been terminated, a liability for the fair value of the future costs may be recognised but must be reduced by the estimated sublease income that could reasonably be obtained, even if the company has no intention of entering into a sublease. |

| | | |

Onerous contracts | | |

| | | |

| If an entity has a contract that is onerous, the present obligation under the contract should be recognised and measured as a provision. An onerous contract is one where the unavoidable costs of meeting the obligations under it exceed the expected benefits to be received. | | The costs of an onerous contract will be recognised as they are incurred. |

| | | |

Derivative and hedge accounting | | |

| | | |

Derivative instruments are recorded at appropriate historical cost amounts, with fair values shown as a disclosure item. Profits and losses from hedging activities are matched with the underlying cash flows and profits being hedged. The notional amounts of interest rate swaps and FRAs are not recorded on the balance sheet. Forward exchange contracts are carried on the balance sheet at the difference between the amounts of the payable and receivable currency revalued at the closing exchange rate. | | In accordance with SFAS 133 ‘Accounting for Derivative Instruments and Hedging Activities’ all derivatives are recognised on the balance sheet at their fair value. The accounting for subsequent changes in the fair value of a derivative (that is, gains and losses) depends on the intended use: |

| | |

• | if a derivative is designated as either a hedge of the fair value of a recognised asset or liability or of an unrecognised firm commitment (‘fair value hedge’), gains or losses are recorded in earnings together with the gain or loss on the hedged asset or liability or unrecognised firm commitment; |

| • | if the derivative is designated as a hedge of a forecasted transaction or the variability of cash flows to be received or paid related to a recognised asset or liability (‘cash flow hedge’), any gain or loss is included as a component of other comprehensive income and recycled to earnings when the forecasted transaction affects earnings; |

| • | if the derivative is designated as a hedge of a net investment in a foreign operation, any gain or loss is included as a component of other comprehensive income, together with the associated gain or loss on the hedged item; and |

| • | changes in the fair values of derivatives that do not qualify as a hedge, together with the ineffective portion of any hedges, are reported in current period earnings. |

| | | |

Capitalisation of interest | | |

| | | |

| Interest cost may be capitalised as part of the cost of acquiring and making ready for use certain qualifying assets. | | Interest cost must be capitalised as part of the cost of acquiring and making ready for use certain qualifying assets. |

Page 138

Back to Contents

notes to the financial statements

UK GAAP | | US GAAP |

| |

|

Deferred tax | | |

| | | |

| Deferred taxes relating to investments in subsidiaries, joint ventures or associates are only provided for to the extent that dividends have been accrued as receivable or a binding agreement to distribute the past earnings has been entered into by the joint venture or associate. | | Deferred taxes relating to investments in joint ventures or associates must be recognised, with limited exceptions. Deferred taxes relating to investments in foreign subsidiaries must be recognised unless earnings are permanently re-invested. |

| | | |

Marketable securities | | |

| | | |

| Investments in marketable securities are recorded at historical cost less provision for impairments in value. A loss resulting from a decline in fair value that is judged to be other than temporary is recorded in earnings. | | Investments classified as available for sale are reported at fair value, with unrealised gains or losses reported as a separate component of shareholders’ equity. |

| | | |

Defined benefit schemes | | |

| | | |

| The expected cost of pensions is charged to the profit and loss account so as to spread the cost of pensions over the expected service lives of employees. Scheme assets are valued based on projected future income streams discounted at a long-term rate of return. Liabilities are valued on an actuarial basis discounted using a long-term rate. Surpluses arising from actuarial valuations are similarly spread. | | Pension costs are determined in accordance with SFAS 87 ‘Employers’ accounting for pensions’. SFAS 87 requires a similar method of actuarial valuation for liabilities but requires assets to be valued at fair market rates and liabilities to be discounted using current settlement rates for high-quality bonds. Cumulative experience gains or losses are amortised to income, over a maximum period of the average remaining service life of employees, if they exceed a minimum threshold of 10 per cent of the greater of plans assets or obligations. Adjustments to plan benefits affecting current participants (unrecognised prior service costs) are also generally recognised over the average remaining service life of company employees. When the accumulated benefit obligation exceeds the fair value of plan assets, the excess must be recognised as an additional liability with an offsetting intangible asset. However, any intangible asset recognised cannot exceed the amount of unrecognised prior service cost and the excess of the additional liability above the intangible asset is charged to other comprehensive income. |

| | | |

ESOP shares | | |

| | | |

| ESOP shares are carried as fixed asset investments. | | ESOP shares are treated as a reduction of shareholders’ equity. |

| | | |

Gain on sale of subsidiary | | |

| | | |

| Changes to the value of any share consideration received between the transaction date and the end of any mandatory retention period are included as part of the gain on sale of the subsidiary. | | The value of the consideration received (ie marketable securities of the buyer) is measured and recognised at the date of the transaction. |

Page 139

Back to Contents

notes to the financial statements

UK GAAP | | US GAAP |

| |

|

| Exchange gains and losses on the retranslation of the net assets and results of foreign subsidiary and associated undertakings and joint ventures are recognised in the statement of total recognised gains and losses as incurred, and are therefore excluded from the gain or loss arising on subsequent sale or liquidation. | | Exchange gains and losses on the retranslation of the net assets and results of foreign subsidiary and associated undertakings are accumulated as a separate component of shareholders’ equity and included in the gain or loss on sale or liquidation. |

| | | |

Proposed final dividends | | |

| | | |

| Dividends declared after the period end are recorded in the period to which they relate. | | Dividends are recorded in the period in which they are declared. |

| | | |

Capacity sales | | |

| | | |

As set out on page 90 the Group adopted UITF 36 for the year ended 31 March 2003 and the results for the three years then ended have been adjusted to reflect the change in accounting policy required under UK GAAP. Following the adoption of UITF 36 revenues or gains in respect of capacity sales to carriers from whom capacity or other services were also acquired are no longer recognised as the transactions are not considered to meet all the conditions required under the new abstract, in particular the requirement for the capacity provided or received to have a readily ascertainable market value as set out in FRS 10. The Group’s cash sales to carriers with no related purchase continue to be recognised at the time of delivery and acceptance where:

| | Under US GAAP, cash sales of capacity entered into after the issuance of FASB Interpretation No. 43 in June 1999 are required to be accounted for as operating leases, unless title is transferred to the lessee by the end of the lease term. The IRU sales that Cable & Wireless enters into generally do not contain such title-transfer clauses, and accordingly, the related IRU revenue, which is recognised up-front for UK purposes, is deferred and recognised on a straight-line basis over the term of the contract for US purposes. Exchanges of capacity for capacity on alternative routes, are recognised only if the fair value of the assets can be established by reference to comparable cash transactions. To be considered comparable for US reporting, transactions must generally occur in the same quarter, be for similar fibres, with similar transmission features, over similar distances with counter-parties of a similar credit quality. In the absence of such comparable cash sales, the exchanges generally receive no accounting recognition. No revenue or net income on exchanges of capacity is recognised under either UK or US GAAP. |

| | | |

• | the purchaser’s right of use is exclusive and irrevocable; | |

| • | the asset is specific and separable; | |

| • | the term of the contract is for the major part of the asset’s useful economic life; | |

| • | the attributable cost of carrying value can be measured reliably; and | |

| • | no significant risks are retained by the Group. | |

| | | |

| Income relating to operations and maintenance contracts is spread over the period of the contract. | |

| | | |

Stock based compensation | | |

| | | |

| Where share options are issued with an exercise price below market value on the date of grant, the discount will be charged to the profit and loss account over the vesting period. For long term incentive schemes, the fair value of the shares awarded is charged to the profit and loss account over the vesting period. | | The Group has adopted SFAS123 ‘Accounting for stock based compensation’. As permitted by SFAS 123 entities are allowed to continue to apply the provisions of APB No. 25 ‘Accounting for stock issued to employees’. |

Page 140

Back to Contents

notes to the financial statements

UK GAAP | | US GAAP |

| |

|

| To the extent that the number of options/shares that will be granted/awarded changes as performance conditions are met or not met, the compensation charge is adjusted based on the original fair value at the date of grant. | | To the extent that the number of options/shares that will be granted/awarded changes as performance conditions are met or not met, the company follows ‘variable plan’ accounting and a compensation charge is adjusted based on the fair value at the date of change. |

| | | |

| Save As You Earn (SAYE) Type Schemes are exempt from the requirement to recognise a charge to the profit and loss account. | | The Cable & Wireless SAYE Scheme is regarded as compensatory and the discount is accrued

over the vesting period of the grant. |

| | | |

Operating leases | | |

| | | |

In respect of operating leases, disclosure is required of the payments which are committed to be made during the next year, analysed by the period in which the commitment expires (see

Note 28). | | In respect of operating leases with an initial minimum lease term in excess of one year, disclosure is required of the total payments due over the non-cancellable period of the lease. |

| | | |

The cash flow statement is prepared in accordance with the UK Financial Reporting Standard No 1 Revised, ‘Cash flow statements’ (FRS 1 Revised) for UK GAAP reporting. Its objective and principles are similar to those set out in SFAS 95 – ‘Statement of cash flows’. The principal difference between the standards is in respect of classification. Under FRS 1 Revised, the Group presents its cash flows for: operating activities; returns on investments and servicing of finance; taxation; capital expenditure and financial investment; acquisitions and disposals; equity dividends paid; management of liquid resources; and financing. SFAS 95 requires only three categories of cash flow activity: operating; investing; and financing.

Summary consolidated cash flow information as presented in accordance with US GAAP is provided below:

| | | | 2003 | | | 2002 | * | | 2001 | * |

| | | | £m | | | £m | | | £m | |

| |

| Cash was (used in)/provided by: | | | | | | | | | | |

| Operating activities | | | (679 | ) | | 2,358 | | | 1,060 | |

| Investing activities | | | (77 | ) | | 251 | | | 963 | |

| Financing activities | | | (1,364 | ) | | (974 | ) | | (1,600 | ) |

| |

| Net (decrease)/increase in cash | | | (2,120 | ) | | 1,635 | | | 423 | |

| Exchange movements | | | 9 | | | 13 | | | 20 | |

| Cash at the beginning of year | | | 2,445 | | | 797 | | | 354 | |

| |

| Cash at end of year | | | 334 | | | 2,445 | | | 797 | |

| |

| * | The results for 2002 and 2001 have been adjusted to reflect the change in accounting policy for capacity sales in light of the adoption of UITF Abstract 36 ‘Contracts for sales of capacity’ and related consequential effects. |

Page 141

Back to Contents

notes to the financial statements

Net income reconciliation |

The effects of these different accounting principles are as follows:

| | | | 2003 | | | 2002 | * | | 2001 | * |

| | | | £m | | | £m | | | £m | |

| |

| (Loss)/profit as reported under UK GAAP | | | (6,533 | ) | | (4,954 | ) | | 2,738 | |

| US GAAP adjustments: | | | | | | | | | | |

| Capacity sales | | | 2 | | | (13 | ) | | (48 | ) |

| Customer acquisition costs | | | (5 | ) | | 16 | | | 7 | |

| Pension costs | | | 18 | | | (15 | ) | | (19 | ) |

| Stock based compensation | | | (4 | ) | | (26 | ) | | (3 | ) |

| Partial depreciation | | | – | | | (3 | ) | | 6 | |

| Amortisation and impairment of goodwill and other intangible assets | | | 53 | | | (242 | ) | | 51 | |

| Gain on sale of subsidiary | | | – | | | 33 | | | 4,487 | |

| Restructuring costs and onerous contracts | | | 149 | | | (69 | ) | | 69 | |

| Profit on sale and leaseback | | | – | | | – | | | (33 | ) |

| Derivative and hedge accounting | | | (59 | ) | | 64 | | | 1 | |

| ESOP shares | | | 120 | | | – | | | – | |

| Capitalisation of interest | | | (6 | ) | | (28 | ) | | (80 | ) |

| Marketable securities | | | 4 | | | (126 | ) | | (4,618 | ) |

| Deferred tax – difference in accounting for income tax standards | | | 58 | | | (27 | ) | | (62 | ) |

| – tax effect of other US GAAP reconciling items | | | – | | | – | | | 130 | |

| Other | | | 10 | | | (10 | ) | | (10 | ) |

| Minority interests on reconciling items | | | (21 | ) | | 21 | | | 100 | |

| |

| Net (loss)/income under US GAAP before cumulative effect of change in accounting principle | | | (6,214 | ) | | (5,379 | ) | | 2,716 | |

| Cumulative effect of change in accounting principle, for derivatives in 2002 | | | – | | | 8 | | | – | |

| |

| Net (loss)/income under US GAAP | | | (6,214 | ) | | (5,371 | ) | | 2,716 | |

| |

(Loss)/earnings per share under US GAAP | | | | | | | | | | |

| – Basic | | | (266.7 | )p | | (196.5 | )p | | 99.5 | p |

| – Diluted | | | (266.7 | )p | | (196.5 | )p | | 98.4 | p |

| (Loss)/earnings per ADR under US GAAP** | | | | | | | | | | |

| – Basic | | | (800.1 | )p | | (589.5 | )p | | 298.5 | p |

| – Diluted | | | (800.1 | )p | | (589.5 | )p | | 295.2 | p |

| |

| * | The results for 2002 and 2001 have been adjusted to reflect the change in accounting policy for capacity sales in light of the adoption of UITF Abstract 36 ‘Contracts for sales of capacity’. The results for 2002 also include an increase of £233 million in US GAAP net income relating to impairment charges and asset write-downs which are no longer required. |

| ** | Computed on the basis that one American Depositary Receipt (ADR) represents three Ordinary Shares. |

Page 142

Back to Contents

notes to the financial statements

| |

Shareholders’ equity reconciliation |

| | | | 2003 | | | 2002 | * |

| | | | £m | | | £m | |

| |

| Shareholders’ equity as reported under UK GAAP | | | 2,149 | | | 8,958 | |

| US GAAP adjustments: | | | | | | | |

| Capacity sales | | | (27 | ) | | (29 | ) |

| Customer acquisition costs | | | (11 | ) | | (8 | ) |

| Pension costs | | | (454 | ) | | (36 | ) |

| Restructuring costs and onerous contracts | | | 146 | | | – | |

| Goodwill and other intangible assets | | | 307 | | | 284 | |

| Derivative and hedge accounting | | | (1 | ) | | 60 | |

| Capitalisation of interest | | | 16 | | | 22 | |

| Gain/(loss) on marketable securities | | | 42 | | | (2 | ) |

| Deferred tax – difference in accounting for income tax standards | | | – | | | (58 | ) |

| Proposed final dividend | | | – | | | 83 | |

| ESOP shares | | | (38 | ) | | (123 | ) |

| Other | | | (5 | ) | | (15 | ) |

| Minority interests on reconciling items | | | 1 | | | 22 | |

| |

| Shareholders’ equity under US GAAP | | | 2,125 | | | 9,158 | |

| |

| * | The shareholders’ equity reconciliation for 2002 has been adjusted to reflect the change in accounting policy for capacity sales in light of the adoption of UITF Abstract 36 ‘Contracts for sales of capacity’ and related consequential effects. |

| |

Other US Accounting Standards issued but not adopted |

In June 2001, the FASB issued FASB Statement No. 143, ‘Accounting for asset retirement obligations’. The standard is effective for fiscal years beginning after 15 June 2002, with earlier application encouraged. This standard requires entities to record the fair value of a liability for an asset retirement obligation in the period in which it is incurred. When the liability is initially recorded, the entity capitalises a cost by increasing the carrying amount of the related long-lived asset. Over time, the liability is accreted to its present value each period, and the capitalised cost is depreciated over the useful life of the related asset. Upon settlement of the liability, an entity either settles the obligation for its recorded amount or incurs a gain or loss upon settlement. Management has not determined the effect of the adoption of FASB Statement No. 143.

In December 2002, the FASB issued SFAS No. 148, ‘Accounting of stock-based compensation – transition and disclosure – an amendment of FASB Statement No. 123’. This statement amends SFAS No. 123 to provide alternative methods of transition for a voluntary change to the fair value based method on accounting for stock-based employee compensation. In addition, SFAS No. 148 requires prominent disclosures about the method of accounting for stock-based employee compensation and the effect of the method used on reported results. As Cable & Wireless continues to apply the provisions of APB No. 25 ‘Accounting for stock issued to employees’, the adoption of SFAS No. 148 will not impact reported net income or shareholders’ equity.

In April 2003, the FASB issued SFAS No.149, ‘Amendment of Statement 133 on derivative instruments and hedging activities’. SFAS 149 amends and clarifies accounting for derivative instruments, including certain derivative instruments embedded in other contracts, and for hedging activities under SFAS 133. SFAS 149 is effective for contracts entered into or modified after 30 June 2003 and for hedging relationships designated after 30 June 2003. Management has not determined the effect of the adoption of SFAS 149.

In May 2003, the FASB issued SFAS No. 150, ‘Accounting for certain financial instruments with characteristics of both liabilities and equity’. SFAS 150 improves the accounting for certain financial instruments that, under previous guidance, issuers could account for as equity. SFAS 150 requires these instruments to be classified as liabilities in the balance sheet. SFAS 150 is effective from 15 June 2003. SFAS 150 is not expected to have an impact on the financial statements.

Page 143

Back to Contents

shareholder information

SHAREHOLDER INFORMATION

This section contains information about:

| Trading market | 144 | | Taxation | 146 |

| Dividends | 145 | | Memorandum and Articles of Association | 148 |

| Exchange rate information | 145 | | Material contracts | 148 |

| Exchange controls and other limitations affecting security holders | 146 | | | |

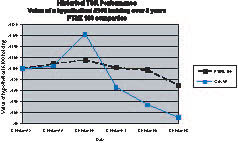

The principal trading market for the Ordinary Shares is the London Stock Exchange on which 7,759,288,538 Ordinary Shares were traded during the period from 1 April 2002 to 31 March 2003. As at 31 March 2003, the Company had a market capitalisation of approximately £1.64 billion (US$2.59 billion, based on the Noon Buying Rate on 31 March 2003).

American Depositary Receipts (ADRs), each representing three Ordinary Shares, have been issued by Citibank N.A. as Depositary and are listed on the New York Stock Exchange under the symbol CWP.

The table below sets forth, for the fiscal quarters indicated, the high and low middle market quotations for the Ordinary Shares on the London Stock Exchange as reported on its Daily Official List and the high and low market quotations for the ADRs on the New York Stock Exchange.

| | | Pence Per Ordinary Share | | US$ Per ADR | |

| | | | High | | | Low | | | High | | | Low | |

| |

| Year ended 31 March 1999 | | | 994.5 | | | 516.0 | | | 48.0 | | | 24.9 | |

| Year ended 31 March 2000 | | | 1,561.5 | | | 658.0 | | | 74.5 | | | 31.4 | |

| Year ended 31 March 2001 | | | 1,325.0 | | | 430.0 | | | 56.4 | | | 18.3 | |

| Year ended 31 March 2002 | | | 531.5 | | | 207.0 | | | 22.9 | | | 8.9 | |

| Year ended 31 March 2003 | | | 223.0 | | | 41.0 | | | 10.3 | | | 1.9 | |

| | | | | | | | | | | | | | |

| Year ended 31 March 2002 | | | | | | | | | | | | | |

| First quarter | | | 531.5 | | | 369.0 | | | 22.9 | | | 15.7 | |

| Second quarter | | | 417.0 | | | 253.0 | | | 17.7 | | | 11.0 | |

| Third quarter | | | 389.0 | | | 266.0 | | | 16.7 | | | 11.7 | |

| Fourth quarter | | | 345.0 | | | 207.0 | | | 15.0 | | | 8.9 | |

| | | | | | | | | | | | | | |

| Year ended 31 March 2003 | | | | | | | | | | | | | |

| First quarter | | | 223.0 | | | 163.2 | | | 9.6 | | | 7.5 | |

| Second quarter | | | 179.2 | | | 114.4 | | | 8.3 | | | 5.4 | |

| Third quarter | | | 153.4 | | | 41.0 | | | 7.2 | | | 1.9 | |

| Fourth quarter | | | 73.2 | | | 46.0 | | | 3.5 | | | 2.2 | |

| | | Pence Per Ordinary Share | | US$ Per ADR | |

| | | | High | | | Low | | | High | | | Low | |

| |

| December 2002 | | | 87.2 | | | 41.0 | | | 4.1 | | | 1.9 | |

| January 2003 | | | 69.4 | | | 46.0 | | | 3.4 | | | 2.2 | |

| February 2003 | | | 67.0 | | | 55.4 | | | 3.2 | | | 2.7 | |

| March 2003 | | | 73.2 | | | 57.2 | | | 3.4 | | | 2.7 | |

| April 2003 | | | 83.4 | | | 69.6 | | | 4.0 | | | 3.3 | |

| May 2003 | | | 102.6 | | | 71.4 | | | 5.1 | | | 3.4 | |

At 3 June 2003, 893,979 Ordinary Shares were held in the United States representing 0.04 per cent of the total number of issued and outstanding Ordinary Shares on that date. These Ordinary Shares were held by 792 holders of record. At 3 June 2003, 42,871,909 ADRs (representing 128,615,727 Ordinary Shares) were held in the United States by 2,092 holders of record. Since certain of such Ordinary Shares (or ADRs, as the case may be) are held by broker nominees, the number of holders or record may not be representative of the number of beneficial owners. At 3 June 2003, the Company had 156,531 shareholders of record.

Distribution and classification of ordinary shareholdings| | | | | | | | | | | | | | |

| At 31 March 2003 | | | Number of Accounts | | | Percentage of total | | | Number of Shares | | | Percentage

of total | |

| |

| Up to 1,000 | | | 105,147 | | | 66.07 | | | 48,693,320 | | | 2.04 | |

| 1,001 – 5,000 | | | 46,740 | | | 29.37 | | | 94,444,678 | | | 3.96 | |

| 5,001– 100,000 | | | 6,391 | | | 4.02 | | | 84,426,058 | | | 3.54 | |

| 100,001 – 1,000,000 | | | 598 | | | 0.38 | | | 215,101,315 | | | 9.03 | |

| 1,000,001 and over | | | 259 | | | 0.16 | | | 1,940,459,323 | | | 81.43 | |

| |

| | | | 159,135 | | | 100.00 | | | 2,383,124,694 | | | 100.00 | |

| |

| Individuals | | | 137,254 | | | 86.25 | | | 163,752,493 | | | 6.87 | |

| Corporate bodies | | | 2,526 | | | 1.59 | | | 89,177,602 | | | 3.74 | |

| Banks/nominee companies | | | 19,300 | | | 12.13 | | | 2,097,826,519 | | | 88.03 | |

| Insurance companies/ pension funds | | | 55 | | | 0.03 | | | 32,368,080 | | | 1.36 | |

| |

| Total | | | 159,135 | | | 100.00 | | | 2,383,124,694 | | | 100.00 | |

| |

Page 144

Back to Contents

shareholder information

The table below sets out the sterling amounts of interim, final and total gross dividends paid per Ordinary Share and also the US dollar amounts per American Depositary Share (ADS) evidenced by ADRs (each representing three Ordinary Shares) translated at the Noon Buying Rate at 31 March each year. The dividends for the year ended 1999 are not increased by the associated ACT rebates as the Company elected to pay these as Foreign Income Dividends. The Company is no longer required to account for ACT on dividends paid on or after 6 April 1999.

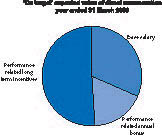

To give greater financial flexibility during the current transitional period, the Board decided in June 2003 to suspend dividends for 12 months. Thus no final dividend will be proposed for 2003 and no interim dividend declared for 2004. However, the Board intends to pay a final dividend for 2004. The level of this payment will be determined by reference to progress made against the restructuring plan and the resultant financial performance of the Group.

There are currently no UK governmental restrictions on dividend payments to non-UK shareholders applicable to the Company.

| Year ended 31 March | | Pence per Ordinary Share | | US dollars per ADR | |

| |

| | | | Interim | | | Special | | | Final | | | Total | | | Interim | | | Special | | | Final | | | Total | |

| | |

| |

| 1999 | | | 4.10 | | | – | | | 9.40 | | | 13.50 | | | 0.20 | | | – | | | 0.45 | | | 0.65 | |

| 2000 | | | 4.50 | | | – | | | 10.50 | | | 15.00 | | | 0.21 | | | – | | | 0.50 | | | 0.71 | |

| 2001 | | | 4.95 | | | – | | | 11.55 | | | 16.50 | | | 0.21 | | | – | | | 0.49 | | | 0.70 | |

| 2002 | | | 1.50 | | | 11.50 | * | | 3.50 | | | 16.50 | | | 0.06 | | | 0.49 | | | 0.15 | | | 0.70 | |

| 2003 | | | 1.60 | | | – | | | – | | | 1.60 | | | 0.08 | | | – | | | – | | | 0.08 | |

| |

| * | Paid at the same time as the interim dividend. |

| |

| EXCHANGE RATE INFORMATION |

| |

The Company presents its Consolidated Financial Statements in pounds sterling (£). In this Annual Report, references to ‘£’, ‘pound(s) sterling’, ‘GBP’, ‘pence’ and ‘p’ are to the lawful currency of the United Kingdom, references to ‘US$’, ‘US dollars’ ‘cents’ and ‘c’ are to the lawful currency of the United States. This Annual Report contains translations of certain pound sterling amounts into US dollars at specified rates solely for the convenience of the reader. These translations should not be construed as representations that the pound sterling amounts actually represent such US dollar amounts or could be converted into US dollars at the rate indicated. Unless otherwise indicated, the translation of pounds sterling into such US dollars have been made at the Noon Buying Rate in New York City for cable transfers in pounds sterling as certified for customs purposes by the Federal Reserve Bank of New York in effect on 31 March 2003, which was £1.00 to US$1.58.

The following table sets forth the high and low Noon Buying Rates for pounds sterling expressed in US dollars per £1.00 for the previous six months:

| | | | High | | | Low | |

| |

| December 2002 | | | 1.61 | | | 1.56 | |

| January 2003 | | | 1.65 | | | 1.60 | |

| February 2003 | | | 1.65 | | | 1.57 | |

| March 2003 | | | 1.61 | | | 1.56 | |

| April 2003 | | | 1.60 | | | 1.55 | |

| May 2003 | | | 1.65 | | | 1.59 | |

| |

The following table sets forth, for the periods indicated, the average, high, low and period-end Noon Buying Rates for pounds sterling expressed in US dollars per £1.00.

| Year ended 31 March | | | Average | 1 | | High | | | Low | | | Period End | |

| |

| 1999 | | | 1.65 | | | 1.69 | | | 1.61 | | | 1.61 | |

| 2000 | | | 1.61 | | | 1.68 | | | 1.55 | | | 1.59 | |

| 2001 | | | 1.47 | | | 1.60 | | | 1.40 | | | 1.42 | |

| 2002 | | | 1.43 | | | 1.48 | | | 1.37 | | | 1.43 | |

| 2003 | | | 1.55 | | | 1.65 | | | 1.43 | | | 1.58 | |

| |

| 1 The average of the Noon Buying Rates on the last day of each full month during the relevant period. |

Page 145

Back to Contents

shareholder information

On 3 June 2003 the Noon Buying Rate was £1.00 to US$1.63. A substantial portion of Cable & Wireless’ assets, gross turnover and operating costs are denominated in

currencies other than pounds sterling. See ‘Operating and Financial Review – Quantitative and Qualitative Disclosures about Market Risk’.

| EXCHANGE CONTROLS AND OTHER LIMITATIONS AFFECTING SECURITY HOLDERS |

Certain of the countries in which Cable & Wireless and its associated companies operate have exchange controls. Operations in the countries that currently have exchange controls are not, however, material to

the business of Cable & Wireless and its associated companies, and the controls themselves have not materially restricted payments within Cable & Wireless and its associated companies.

The following is a summary, under current law, of the principal UK and US federal income tax considerations relating to an investment by a US taxpayer in Ordinary Shares or ADRs. This summary applies to investors only if:

| • | they are individual US citizens or residents, US corporations, or otherwise subject to US federal income tax on a net income basis in respect of the Ordinary Shares or ADRs; |

| • | they hold the Ordinary Shares or ADRs as a capital asset for tax purposes; and |

| • | they are not resident or ordinarily resident in the United Kingdom for UK tax purposes, and do not hold the Ordinary Shares or ADRs for the purposes of a trade, profession, or vocation that they carry on in the United Kingdom through a branch or agency. |

This summary does not purport to be a comprehensive description of all of the tax considerations that may be relevant to any particular investor, and does not address the tax treatment of investors that are subject to special rules. It is assumed that investors are familiar with the tax rules applicable to investments in securities generally and with any special rules to which they may be subject. In particular, the discussion does not address the tax treatment of investors that are subject to special rules, such as banks, insurance companies, dealers in securities or currencies, persons that elect mark-to-market treatment, persons that hold Ordinary Shares or ADRs as a position in a straddle, conversion transaction, synthetic security, or other integrated financial transaction, and persons whose functional currency is not the US dollar.

The discussion is based on laws, treaties, judicial decisions, and regulatory interpretations in effect on the date of this document, all of which are subject to change. On 31 March 2003, representatives of the United Kingdom and United States exchanged instruments of ratification for a new income tax convention (the New Treaty). The New Treaty has the force and effect of law in respect of withholding taxes on dividends from 1 May 2003. As discussed below, investors will no longer be entitled to claim a special foreign

tax credit in respect of dividends that was available under the terms of the prior treaty, except for a limited period of time during which investors may elect to apply the entirety of the prior treaty in preference to the New Treaty.

Investors should consult their own advisers regarding the tax consequences of the acquisition, ownership, and disposition of the Ordinary Shares or ADRs in the light of their particular circumstances, including the effect of any state, local, or other national laws.

UK Taxation

Dividends

Under current UK taxation legislation, no tax is required to be withheld at source from cash dividend payments on the Ordinary Shares or ADRs.

Capital Gains

Subject to the following, if investors are not resident or ordinarily resident in the United Kingdom for UK tax purposes they will not generally be liable to UK tax on gains realised or accrued on the disposal of Ordinary Shares or ADRs, unless they carry on a trade, profession, or vocation in the United Kingdom through a branch or agency and the Ordinary Shares or ADRs are used in or for the purposes of the trade, profession, or vocation or are used or held for the purposes of the branch or agency or acquired for use by or for the purposes of the branch or agency. Particular rules may apply to investors who have previously been resident in the United Kingdom, who dispose of Ordinary Share or ADRs while they are not so resident, and who subsequently again become resident in the United Kingdom within specified time periods. Such rules may have the effect of subjecting such an investor to United Kingdom capital gains tax in the year in which they again become resident in the United Kingdom.

Inheritance Tax

Ordinary Shares or ADRs held by an individual who is domiciled in the United States for purposes of the current

Page 146

Back to Contents

shareholder information

estate and gift tax convention between the United Kingdom and the United States and is not a national of the United Kingdom for such purposes do not generally attract UK inheritance tax on the individual’s death or on transfer during his lifetime.| |

Stamp Duty And Stamp Duty Reserve Tax |

UK stamp duty reserve tax (SDRT) is chargeable where Ordinary Shares are issued or transferred to the depositary or nominee or agent for the depositary pursuant to an arrangement under which the depositary issues depositary receipts (such as the ADRs). The SDRT, payable by the depositary, will generally be 1.5 per cent of the purchase or issue price of the Ordinary Shares. In certain circumstances, the transfer to the depositary’s nominee or agent may give rise to a liability to ad valorem stamp duty, in which case the SDRT charge is reduced or eliminated accordingly. Such SDRT or stamp duty liability will ordinarily (in accordance with the terms of the deposit agreement) be charged to the person to whom ADRs are delivered in connection with the deposit of Ordinary Shares.

No UK stamp duty is payable on any transfer of an ADR provided that the ADR and any separate instrument of transfer is executed and remains outside the United Kingdom. Nor is any agreement for transfer of ADRs subject to SDRT. However, if the seller of an ADR fulfils his obligations by requiring the transfer of the underlying Ordinary Shares (whether or not to the purchaser), the transfer instrument is, it is thought, subject to stamp duty at approximately 0.5 per cent of the purchase price. A transfer of Ordinary Shares which does not complete a sale is dutiable at the fixed rate of £5.

If Ordinary Shares themselves are sold, SDRT at 0.5 per cent of the consideration will, subject to exceptions, be payable, generally by the purchaser. If, within six years of the date on which the agreement is made or (if later) becomes unconditional, the Ordinary Shares are

transferred to the person with whom the agreement is made or (where the agreement was to transfer the Ordinary Shares to that person’s nominee) his nominee and the transfer instrument is stamped on payment of the applicable stamp duty (approximately 0.5 per cent of the

consideration), the stamp duty will cancel the SDRT charge and the SDRT may be repaid on making of a claim within the six year period.

US Federal Income Taxation |

Beneficial owners of ADRs will be treated as owners of the underlying Ordinary Shares for US federal income tax purposes and for purposes of the Current Treaty. Deposits and withdrawals of Ordinary Shares in exchange for ADRs

will not result in the realisation of gain or loss for US federal income tax purposes.

If Cable & Wireless pays dividends, investors must include those dividends in their income for US federal income tax purposes when they receive them. The dividends will be treated as foreign source income. Investors should determine the amount of their dividend income by

converting pounds sterling into US dollars at the exchange rate in effect on the date of their (or the depositary’s, in the case of ADRs) receipt of the dividend. Subject to certain exceptions for positions that are hedged or held for less than 60 days, an individual US holder

generally will be subject to US taxation at a maximum rate of 15 per cent in respect of dividends received after 2002 and before 2009.

Special Foreign Tax Credit Benefits Under Prior Treaty |

Investors who qualified for benefits under the income tax convention between the United States and the United Kingdom in force before 31 March 2003 may be eligible, subject to generally applicable limitations, to receive a special US foreign tax credit equal to one-ninth of the amount of certain cash dividends that they receive on the Ordinary Shares or ADRs, so long as they make an election to include in their income, as an additional notional dividend, an amount equal to the tax credit. This foreign tax credit benefit is generally only available

with respect to dividends paid before 1 May 2003, unless an investor elects to apply the prior income tax convention in its entirety for an optional 12 month extension period. Investors should consult their own tax advisers regarding their potential eligibility for this foreign tax

credit benefit.

If investors sell their Ordinary Shares or ADRs, investors will recognise capital gain or loss. Gain on the sale of Ordinary Shares or ADRs held for more than one year will be treated as long-term capital gain. The net amount of long-term capital gain realised by a non-

corporate holder generally is subject to taxation at a maximum rate of 20 per cent; however, net long-term capital gain recognised after 5 May 2003 and before 2009 generally is subject to taxation at a maximum rate of 15 per cent. An investor’s ability to offset capital losses

against ordinary income is subject to limitations.

US Information Reporting And Backup Withholding Rules |

Payments in respect of the Ordinary Shares or ADRs that are made within the United States or through certain US-related

Page 147

Back to Contents

shareholder information

financial intermediaries are subject to information reporting and may be subject to backup withholding unless the holder (1) is a corporation or other exempt recipient or (2) provides a taxpayer identification number and certifies that no loss of exemption from backup withholding has occurred. Holders that are not US persons generally are not subject to

information reporting or backup withholding. However, such a holder may be required to provide a certification of its non-US status in connection with payments received within the United States or through a US-related financial intermediary.

| MEMORANDUM AND ARTICLES OF ASSOCIATION |

| |

The Memorandum and Articles of Association are registered with the Registrar of Companies of England and Wales and the registered number of the Company is 238525. The summary of the material terms of Cable and Wireless plc’s Memorandum and Articles of Association contained in the

Company’s Annual Report on Form 20-F for the year ended 31 March 2002 under the caption ‘Memorandum and Articles of Association’ is incorporated by reference herein.

Acquisition of ExodusOn 30 November 2001, Cable and Wireless plc announced that it and certain of its wholly owned subsidiaries had entered into a conditional contract with EXDS to acquire for cash the Exodus business for an enterprise value of approximately US$850 million.

In connection with the acquisition, Cable and Wireless plc and DI entered into an Asset Purchase Agreement dated 29 November 2001 (the APA) with EXDS and certain of EXDS’ US subsidiaries.

Under the terms of the APA, the base purchase price for the assets was US$560 million, subject to certain adjustments, including those relating to security deposits under property leases, the redesignation of financing leases as operating leases, the assumptions of obligations under property leases, intellectual property and the levels of accounts receivable and prepaid accounts. The APA contemplated that the acquisition of the Exodus business’ UK and German assets and Japanese shares would be documented under separate purchase agreements.

The APA was conditional upon, amongst other things, receipt of the required orders of the US Bankruptcy Court for the District of Delaware (the Court), receipt of consents to the assignments of all contracts not capable of being

assigned by order of the Court and to the transfer of certain ownership interests and the absence of governmental lawsuits seeking to enjoin the transaction or make it illegal.The acquisition of the Exodus business in the United States was completed on 1 February 2002.

The acquisition of the Exodus business in the United Kingdom and Japan was completed on 20 February 2002.

On 6 March 2002, Cable & Wireless announced that it had decided not to pursue the proposed acquisition of the Exodus business in Germany.

Pursuant to the terms of the APA, Cable & Wireless and EXDS entered into a review process with an independent accountant in relation to a dispute connected to a proposed downward adjustment of the purchase price in connection with the levels of accounts receivable and associated matters. The review process is ongoing and the decision of the independent accountant is expected late in 2003. The decision will be final and binding on the parties.

Copies of Material Contracts are filed in the United States with the SEC.

Page 148

Back to Contents

| cross reference guide to form 20-F |

| |

CROSS REFERENCE GUIDE TO FORM 20-F |

| |

| Item | | | Page | |

| |

| |

1. | | | Identity of directors, senior management and advisers | | | n/a | |

| |

2. | | | Offer statistics and expected timetable | | | n/a | |

| |

3. | | | Key information | | | | |

| | | | Selected financial data | | | 41 | |

| | | | Exchange rates | | | 145 | |

| | | | Capitalisation and indebtedness | | | n/a | |

| | | | Reasons for offer and use of proceeds | | | n/a | |

| | | | Risk factors | | | 45 | |

| |

4. | | | Information on the company | | | | |

| | | | History and development of the company | | | 6 | |

| | | | Principal capital expenditure | | | 7 | |

| | | | Business overview | | | 8 | |

| | | | Organisational structure | | | 7 | |

| | | | Property, plant and equipment | | | 14 and 18 | |

| |

5. | | | Operating and financial review and prospects | | | | |

| | | | Operating results | | | 26 | |

| | | | Liquidity and capital resources | | | 36 | |

| | | | Research and development, patents and licences etc | | | n/a | |

| | | | Trend information | | | 24 | |

| |

6. | | | Directors, senior management and employees | | | | |

| | | | Directors and senior management | | | 57 | |

| | | | Compensation | | | 65 | |

| | | | Board practices | | | 62 | |

| | | | Employees | | | 56 | |

| | | | Share ownership | | | 72 | |

| |

7. | | | Major shareholders and related party transactions | | | | |

| | | | Major shareholders | | | 61 | |

| | | | Related party transactions | | | 61 | |

| | | | Interests of experts and counsel | | | n/a | |

| |

8. | | | Financial information | | | | |

| | | | Consolidated accounts and other financial information | | | See item 17 | |

| | | | Legal proceedings | | | 19 | |

| | | | Dividend policy | | | 145 | |

| | | | Significant changes | | | 4 | |

| |

9. | | | The offer and listing | | | | |

| | | | Offer and listing details – price history of stock | | | 144 | |

| | | | Plan of distribution | | | n/a | |

| | | | Markets | | | 144 | |

| | | | Selling shareholders | | | n/a | |

| | | | Dilution | | | n/a | |

| | | | Expenses of the issue | | | n/a | |

| |

Page 149

Back to Contents

| cross reference guide to form 20-F |

| Item | | | Page | |

| |

10. | | | Additional information | | | | |

| | | | Share capital | | | n/a | |

| | | | Memorandum and Articles of Association | | | 148 | |

| | | | Material contracts | | | 148 | |

| | | | Exchange controls | | | 146 | |

| | | | Taxation | | | 146 | |

| | | | Dividends and paying agents | | | n/a | |

| | | | Statement by experts | | | n/a | |

| | | | Documents on display | | | filed separately | |

| | | | Subsidiary information | | | n/a | |

| |

11. | | | Quantitative and qualitative disclosures about market risk | | | 39 | |

| |

12. | | | Description of securities other than equity securities | | | n/a | |

| |

13. | | | Defaults, dividend arrearages and delinquencies | | | n/a | |

| |

14. | | | Material modifications to the rights of security holders and use of proceeds | | | n/a | |

| |

| | |

15. | | | Controls and procedures | | | 63 | |

| |

17. | | | Financial statements | | | 82 | |

| |

18. | | | Financial statements | | | n/a | |

| |

| 19. | | | Exhibits | | | Back pages | |

| |

Page 150

Back to Contents

GLOSSARY OF TERMS

| Terms used in this Annual Report | Brief description of meaning or US equivalent |

| | |

| ACCESS SERVICES | Services giving customers the ability to connect to the internet. |

| | |

| ACCOUNTING RATES | Cost per call minute to connect international calls. |

| | |

| ADRs | The American Depositary Receipts evidencing ADSs. |

| | |

| ADSL | (Asymmetrical Digital Subscriber Line) A transmission technology that transforms existing copper wires from a subscriber’s premises to the local exchange into high bandwidth lines. |

| | |

| ADSs | The American Depositary Shares, each of which represents three Ordinary shares. |

| | |

| ATM | (Asynchronous Transfer Mode) A very high-speed transmission technology for transporting voice, data and video in digital format. |

| | |

| BACKBONE | A high-capacity network linking networks of lower capacity, such as LANs. |

| | |

| BANDWIDTH | The information-carrying capacity of a network. |

| | |

| BROADBAND | A broadband network is one on which a number of independent, simultaneous data flows are transmitted on each cable. |

| | |

| CALLED-UP SHARE CAPITAL | Ordinary shares, issued and fully paid. |

| | |

| CAPACITY SALES | Sales of transmission space on a network to business and wholesale customers. |

| | |

| CAPITAL ALLOWANCES | Tax term equivalent to US tax depreciation allowances. |

| | |

| CASH AT BANK AND IN HAND | Cash |

| | |

| CHAPTER 11 | Bankruptcy restructuring under Chapter 11 of the US Bankruptcy Code. |

| | |

| COMPANY | Cable and Wireless plc. |

| | |

| CONNECTIVITY | Providing customers with access to the internet. |

| | |

| CONTENT DELIVERY/DISTRIBUTION | Service providing geographically diverse distribution of web pages ensuring the fastest possible delivery to the end user. |

| | |

| CORPORATION TAX | Income tax. |

| | |

CREDITORS:

AMOUNTS FALLING DUE AFTER MORE THAN

ONE YEAR | Long-term debt |

| | |

CREDITORS:

AMOUNT FALLING DUE WITHIN ONE YEAR | Current liabilities |

| | |

| DIGITAL | Sound, text or video coded into binary form, a series of 1s and 0s, to enable more effective transmission. |

| | |

Page 151

Back to Contents

| Terms used in this Annual Report | Brief description of meaning or US equivalent |

| | |

| FIBRE OPTIC | The use of special glass fibres to transmit laser light pulses, giving the ‘on’ & ‘off’ signals of digital information. |

| | |

| FID | Foreign Income Dividend, under the provisions of the UK Finance Act 1994. |

| | |

| FINANCE LEASE | Capital lease. |

| | |

| FRAME RELAY | A high-speed data transmission technology. |

| | |

| FREEHOLD | Ownership with absolute rights in perpetuity. |

| | |

| GSM | Global system for mobile communications, a standard for digital mobile telephone transmissions at a frequency of 900 MHz, 1800 MHz or 1900 MHz. |

| | |

| INTELLIGENT NETWORK | A network where the transmission logic is located separately from the switching equipment, greatly simplifying the provision of value added services. |

| | |

| INTERCONNECT | Connection arrangements between carriers. |

| | |

| INTEREST RECEIVABLE | Interest income. |

| | |

| INTERNET | The system comprising all networks interconnected using the Internet Protocol (IP). The internet supports access to databases, websites, email, and file downloading world wide. |

| | |

| IP | The data transmission standard on which the internet is based. |

| | |

| IP DEDICATED ACCESS | Direct access to the internet. |

| | |

| IP TRANSIT | Transmission of IP traffic across the network backbone. |

| | |

| IP-VPN | A network using Internet Protocol to provide companies with an internal communications system linking employees in different offices worldwide. |

| | |

| IP WHOLESALE DIAL | Dial-up access to the internet via telephone lines. |

| | |

| IRU | (Indefeasible Rights of Use) The right to use a cable fibre or wavelength for a fixed period of time. |

| | |

| ISP | (Internet Service Provider) A business that provides internet access to users. It may also provide additional services such as web-hosting. |

| | |

| LAN | (Local Area Network) A network that covers only short distances (usually less than 1 km) and is normally confined to one building or site. |

| | |