Intangible and tangible fixed assets are reviewed for impairment when events or changes in circumstances indicate that the carrying amount of the fixed asset may not be recoverable. Where an impairment indicator is identified, the carrying value of the income generating unit is compared with its recoverable amount. Where the recoverable amount is less than the carrying value an impairment is recognised.

Joint ventures and associates are accounted for in the Group accounts under the gross equity and equity methods of accounting respectively.

Other fixed asset investments in the Group accounts are stated at cost less amounts written off in respect of any impairments.

Investments in subsidiaries are included in the Company balance sheet at valuation.

Current asset investments are stated at the lower of cost and net realisable value.

The charge for tax is based on the result for the year and takes into account tax deferred due to timing differences between the treatment of certain items for tax and accounting purposes.

Deferred tax assets are recognised to the extent that they are regarded as recoverable. Deferred tax assets are regarded as recoverable to the extent that on the basis of all available evidence, it can be regarded as more likely than not that there will be suitable taxable profits from which the future reversal of the underlying timing differences can be deducted.

Except where otherwise required by accounting standards, full provision without discounting is made for all timing differences that have arisen but not reversed at the balance sheet date.

Stocks of equipment, held for use in the maintenance and expansion of the Group’s telecommunications systems, are stated at cost, including appropriate allocation of labour and overheads, less provision for deterioration and obsolescence. Stocks held for resale are stated at the lower of cost and net realisable value.

The Group complies with FRS3 ‘Reporting financial performance’, in determining the classification of operations as discontinued or continuing.

Group turnover, which excludes discounts, value added tax and similar sales taxes, represents the amount receivable in respect of telecommunications services provided to customers and is accounted for on the accruals basis, to match revenues with provision of service. It includes sales to joint ventures and associated companies but does not include sales by joint ventures and associated companies or sales between Group companies.

Turnover from voice, data and IP services are recognised as the services are provided. In respect of services invoiced in advance, amounts are deferred until provision of the service.

Amounts payable by and to telecommunications operators of national and international networks are recognised as services are provided. Charges are negotiated separately and are subject to continual review. Revenues generated through the provision

Back to Contents

statement of accounting policies

of these services are accounted for gross of any amounts payable to other telecommunications operators for interconnect fees.

The Group earns revenue from the transmission of content on its network originated by third-party providers. The Group assesses whether revenue should be recorded gross as principal or net as agent, based on the features of such arrangements including the following indicators:

• whether the Group holds itself out as an agent;

• establishment of the price;

• provision of customer remedies;

• performance of part of the service; and

• assumption of credit risk.

Mobile revenues comprise amounts charged to customers in respect of monthly access charges, airtime usage, messaging, the provision of other mobile telecommunications services, including data services and information provision, fees for connecting customers to a mobile network and revenues from the sale of equipment, including handsets.

Mobile monthly access charges are invoiced and recorded as part of a periodic billing cycle. Airtime, either from contract customers as part of the invoiced amount, or prepaid customers through the sale of prepaid top-up cards is recorded in the period in which the customer uses the service. Unbilled turnover resulting from mobile services provided to contract customers from the billing cycle date to the end of each period is accrued. Unearned monthly access charges relating to periods after each accounting period are deferred.

Revenues from sales of telecommunication equipment are recognised upon delivery to the customer. Connection revenues are recognised upon connection of the customer to the network. Costs of connecting a customer to a network are also charged to the profit and loss account at the point when the customer connects to the network.

Sales of network capacity to third parties pursuant to IRUs are accounted for as sales and recognised at the time of delivery and acceptance where:

• the purchaser’s right of use is exclusive and irrecoverable;

• the asset is specific and separable;

• the term of the contract is for the major part of the asset’s useful economic life;

• the attributable costs of carrying value can be measured reliably; and

• no significant risks are retained by the Group.

Capacity sales are made out of network capacity and infrastructure held as stock for re-sale. Transfers are made from fixed assets to stock at cost on completion of construction based on an estimate of what will be sold to third parties under IRU contracts (which typically form part of the original investment criteria). The cost of the construction is apportioned on a pro rata basis between stock and fixed assets. Income relating to operations and maintenance contracts is spread over the period of the contract.

Revenues or gains in respect of contracts involving the provision of capacity in exchange for receiving capacity, or other services, are not recognised on the basis that the capacity does not have a readily ascertainable market value as defined in accounting standards.

Revenues arising from the provision of other services, including maintenance contracts, are recognised evenly over the periods in which the service is provided.

The regular cost of providing benefits under defined benefit schemes is charged to operating profit over the expected remaining service lives of the members of the schemes so as to achieve a constant percentage of pensionable pay. Variations from the regular cost arising from periodic actuarial valuations of the principal defined benefit schemes are allocated to operating profit over the expected remaining service lives of the members.

The cost of providing benefits under defined contribution schemes is charged as it becomes payable.

Page 95

Back to Contents

statement of accounting policies

The Group has applied the transitional arrangements of FRS17 ‘Retirement benefits’ and appropriate additional disclosures have been included in Note 8.

Where assets are financed by leasing agreements that give rights approximating to ownership, the assets are treated as if they had been purchased outright. The amount capitalised is the present value of the minimum lease payments payable during the lease term. The corresponding lease commitments are shown as obligations to the lessor. Lease payments are split between capital and interest elements using the annuity method. Depreciation on the relevant assets and interest are charged to the profit and loss account. All other leases are operating leases and the rentals are charged to operating profit on a straight line basis over the lease term.

The costs of issue of capital instruments such as bonds and debentures are charged to the profit and loss account over the life of the instrument.

| |

Swaps and forward rate agreements |

The net interest paid or received under interest rate and cross currency swaps and forward rate agreements (“FRAs”) is recorded on an accruals basis and included within net interest in the profit and loss account.

The notional amounts of interest rate swaps and FRAs are not recorded on the balance sheet. Cross currency swaps are used to hedge the initial draw down and final repayment of foreign currency denominated debt, as well as the foreign currency interest flows.

Forward exchange contracts |

Forward exchange contracts are carried on the balance sheet at the difference between the amounts of the payable and receivable currency revalued at the closing exchange rate. The interest differential, being the difference between the contract rate and the spot rate on the date of entering into the forward exchange contract, is charged to the profit and loss account as interest over the life of the contract.

Exchange gains and losses |

Exchange gains and losses on revaluation and maturity of forward exchange contracts and cross currency swaps are treated differently depending on the underlying exposure they hedge:

| • | for contracts that hedge firm third party commitments the exchange gains and losses are recognised in the profit and loss account in the same period as the underlying transaction; |

| • | for contracts over underlying currency assets or liabilities the exchange gains and losses are offset against the equal and opposite exchange gains or losses arising on the retranslation of the underlying assets or liabilities; |

| • | for contracts taken out to hedge overseas equity investments the exchange gains and losses are taken to reserves to offset against the exchange differences arising on the retranslation of the net assets of the investments on consolidation; and |

| • | for contracts that hedge general trading flows the exchange gains or losses are taken to the profit and loss account in the period in which they arise. |

Where the underlying exposure changes, or ceases to exist, the contract would be terminated and the exchange gain or loss arising taken to the profit and loss account.

Page 96

Back to Contents

notes to the financial statements

NOTES TO THE FINANCIAL STATEMENTS

| 1 | Company’s profit and loss account |

The Company has taken advantage of the exemption contained in s230 of the Companies Act 1985 from presenting its own profit and loss account. The profit for the year of the Company amounted to £585 million (2003 – loss of £7,639 million, 2002 – loss of £6,696 million).

| 2 | Historical cost profits and losses |

There is no difference between the Group results as reported and on the historical cost basis. Accordingly no additional note of historical cost profits and losses has been prepared.

The Group’s operations are all considered to fall into one class of business, namely telecommunications.

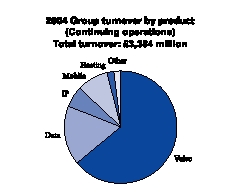

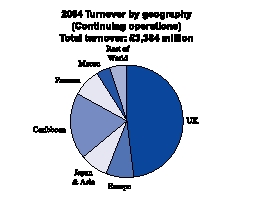

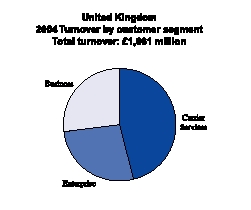

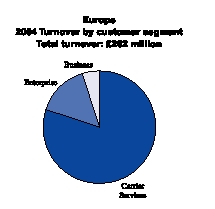

Cable & Wireless is an international telecommunications company. In the year ended 31 March 2004 the Group was operated on geographic lines. The UK, European and Japanese businesses provide communications solutions to business and wholesale customers offering IP, data and voice products. The National Telecommunications companies that are located in the Caribbean, Panama, Macau, the Middle East, South East Asia and in the Pacific, Indian and Atlantic Oceans provided a full range of telecommunications services to both consumer and business customers, including fixed and mobile voice, data and IP.

Turnover is reported in the geography in which the services are delivered. In previous periods revenue was reported in the geography in which customers were managed. Turnover for 2002 and 2003 has been adjusted to reflect where services were delivered.

Details of Group turnover, contributions to profit/(loss) on ordinary activities before interest and taxation, net operating assets/(liabilities) by geographical region are as follows:

| | | | 2004 | | | 2003 | | | 2002 | |

| Turnover | | | £m | | | £m | | | £m | |

| |

Geographical area | | | | | | | | | | |

| United Kingdom and United States | | | | | | | | | | |

| – United Kingdom | | | 1,661 | | | 1,684 | | | 1,985 | |

| – US network | | | 11 | | | – | | | – | |

| |

| | | | 1,672 | | | 1,684 | | | 1,985 | |

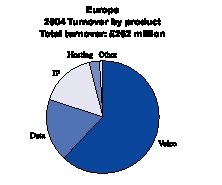

| Europe | | | 262 | | | 304 | | | 314 | |

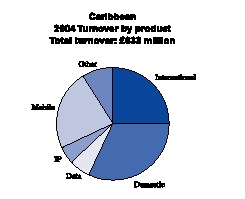

| Caribbean | | | 633 | | | 756 | | | 825 | |

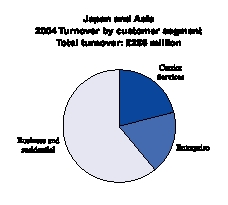

| Japan and Asia | | | 286 | | | 379 | | | 432 | |

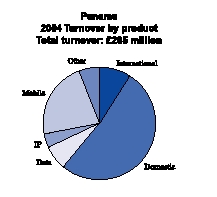

| Panama | | | 265 | | | 279 | | | 296 | |

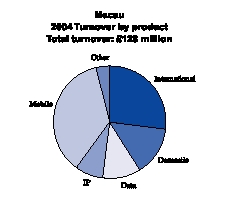

| Macau | | | 128 | | | 146 | | | 145 | |

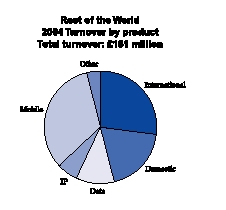

| Rest of the World | | | 161 | | | 159 | | | 138 | |

| Inter-regional turnover | | | (23 | ) | | (30 | ) | | (51 | ) |

| |

| Continuing operations | | | 3,384 | | | 3,677 | | | 4,084 | |

| Discontinued operations | | | 287 | | | 714 | | | 1,664 | |

| |

Group turnover | | | 3,671 | | | 4,391 | | | 5,748 | |

| |

The Group turnover figure disclosed represents turnover of the Company and its subsidiaries allocated to the location to which telecommunications services were delivered. It does not follow, however, that international telecommunications traffic which the Group may be responsible for carrying on part of its route would necessarily originate in that location. The Group does not have access to information on the original source or ultimate destination of international telecommunications traffic.

Page 97

Back to Contents

notes to the financial statements

Discontinued operations comprise sales in the United States £242 million and Yemen £45 million (2003 – United States £644 million and Yemen £70 million, 2002 – United States £821 million, Australia £764 million and Yemen £79 million).

Cash capacity sales of £nil (2003 – £nil, 2002 – £29 million) are included within Group turnover, with attributable cost of sales of £nil (2003 – £nil, 2002 – £10 million).

Loss on ordinary activities before interest and taxation |

| |

| | | | Profit/(loss) on ordinary activities before interest, taxation and exceptional | | | Exceptional | | Profit/(loss) on ordinary activities before interest and taxation

| |

| | | | items | | | items | | | 2004 | | | 2003 | | | 2002 | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

Geographical area | | | | | | | | | | | | | | | | |

| United Kingdom and United States | | | | | | | | | | | | | | | | |

| – United Kingdom | | | 33 | | | (256 | ) | | (223 | ) | | (3,929 | ) | | (2,180 | ) |

| – US network | | | (16 | ) | | – | | | (16 | ) | | – | | | – | |

| |

| | | | 17 | | | (256 | ) | | (239 | ) | | (3,929 | ) | | (2,180 | ) |

| Europe | | | (4 | ) | | (2 | ) | | (6 | ) | | (369 | ) | | (540 | ) |

| Caribbean | | | 115 | | | (243 | ) | | (128 | ) | | 195 | | | 80 | |

| Japan and Asia | | | 2 | | | (133 | ) | | (131 | ) | | (266 | ) | | (147 | ) |

| Panama | | | 70 | | | (73 | ) | | (3 | ) | | 77 | | | 62 | |

| Macau | | | 40 | | | (2 | ) | | 38 | | | 42 | | | 38 | |

| Rest of the World | | | 55 | | | (1 | ) | | 54 | | | 59 | | | 43 | |

| Other | | | (40 | ) | | (34 | ) | | (74 | ) | | (424 | ) | | (944 | ) |

| Joint ventures and associates | | | 41 | | | – | | | 41 | | | 129 | | | 71 | |

| |

| Continuing operations | | | 296 | | | (744 | ) | | (448 | ) | | (4,486 | ) | | (3,517 | ) |

| Discontinued operations | | | (31 | ) | | 242 | | | 211 | | | (1,989 | ) | | (1,247 | ) |

| |

| | | | 265 | | | (502 | ) | | (237 | ) | | (6,475 | ) | | (4,764 | ) |

| |

The exceptional items are described fully in Note 10.

Segmental information in respect of the Group’s investments in joint ventures and associates is given in Note 17.

Financing is dealt with at a Group level and therefore net interest and other similar income/(charges) cannot be allocated to a geographic region.

Page 98

Back to Contents

notes to the financial statements

Net operating assets/(liabilities) |

| | | | 2004 | | | 2003 | |

| | | | £m | | | £m | |

| |

Geographical area | | | | | | | |

| United Kingdom and United States | | | | | | | |

| – United Kingdom | | | (176 | ) | | (83 | ) |

| – US network | | | (33 | ) | | – | |

| |

| | | | (209 | ) | | (83 | ) |

| Europe | | | (57 | ) | | (60 | ) |

| Caribbean | | | 370 | | | 567 | |

| Japan and Asia | | | 32 | | | 114 | |

| Panama | | | 287 | | | 336 | |

| Macau | | | 48 | | | 42 | |

| Rest of the World | | | 88 | | | 95 | |

| Other | | | (7 | ) | | (227 | ) |

| |

| Continuing operations | | | 552 | | | 784 | |

| Discontinued operations | | | – | | | (735 | ) |

| |

| | | | 552 | | | 49 | |

| Other net assets | | | 1,441 | | | 2,471 | |

| |

Net assets | | | 1,993 | | | 2,520 | |

| |

Other net assets include tangible fixed assets not yet in service, fixed asset investments, current asset investments, short term deposits less loans and overdrafts.

Page 99

Back to Contents

notes to the financial statements

| | | | Continuing

operations

before

exceptional

items | | | Exceptional items

(Note 10) | | | Discontinued

operations

before

exceptional

items | | | 2004 | | | Continuing

operations

before

exceptional

items | | | Exceptional items

(Note 10) | | | Discontinued

operations

before

exceptional

items | | | 2003 | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

| Outpayments to other telecommunications administrations and carriers | | | 1,213 | | | – | | | 44 | | | 1,257 | | | 1,272 | | | – | | | 403 | | | 1,675 | |

| Other network costs | | | 270 | | | – | | | 15 | | | 285 | | | 275 | | | – | | | 7 | | | 282 | |

| Cost of sales relating to equipment sales and rentals | | | 303 | | | 13 | | | 1 | | | 317 | | | 276 | | | – | | | 18 | | | 294 | |

| Employee costs | | | 518 | | | 110 | | | 99 | | | 727 | | | 591 | | | 90 | | | 261 | | | 942 | |

| Pension costs | | | 44 | | | 3 | | | 3 | | | 50 | | | 44 | | | – | | | 19 | | | 63 | |

| Property rentals, taxes and utility costs | | | 59 | | | 92 | | | 32 | | | 183 | | | 101 | | | 211 | | | 85 | | | 397 | |

| Depreciation and impairment of owned tangible fixed assets | | | 250 | | | 526 | | | 2 | | | 778 | | | 659 | | | 2,381 | | | 66 | | | 3,106 | |

| Depreciation of tangible fixed assets held under finance leases | | | – | | | – | | | – | | | – | | | 6 | | | – | | | 4 | | | 10 | |

| Amortisation and impairment of capitalised goodwill | | | (3 | ) | | 10 | | | – | | | 7 | | | 65 | | | 2,725 | | | 61 | | | 2,851 | |

| Operating lease rentals: | | | | | | | | | | | | | | | | | | | | | | | | | |

| – network, plant and equipment | | | 104 | | | – | | | 66 | | | 170 | | | 119 | | | – | | | 60 | | | 179 | |

| – other | | | 71 | | | – | | | 22 | | | 93 | | | 52 | | | 28 | | | 43 | | | 123 | |

| Other operating costs | | | 326 | | | 26 | | | 33 | | | 385 | | | 324 | | | 113 | | | 107 | | | 544 | |

| |

| | | | 3,155 | | | 780 | | | 317 | | | 4,252 | | | 3,784 | | | 5,548 | | | 1,134 | | | 10,466 | |

| |

| | | | Continuing operations before exceptional items | | | Exceptional items

(Note10) | | | Discontinued operations before exceptional items | | | 2002 | |

| | | | £m | | | £m | | | £m | | | £m | |

| |

| Outpayments to other telecommunications administrations and carriers | | | 1,538 | | | – | | | 854 | | | 2,392 | |

| Other network costs | | | 232 | | | – | | | 69 | | | 301 | |

| Cost of sales relating to equipment sales and rentals | | | 127 | | | – | | | 38 | | | 165 | |

| Employee costs | | | 619 | | | – | | | 323 | | | 942 | |

| Pension costs | | | 30 | | | – | | | 16 | | | 46 | |

| Property rentals, taxes and utility costs | | | 74 | | | – | | | 79 | | | 153 | |

| Depreciation and impairment of owned tangible fixed assets | | | 684 | | | 1,909 | | | 369 | | | 2,962 | |

| Depreciation of tangible fixed assets held under finance leases | | | 9 | | | – | | | 10 | | | 19 | |

| Amortisation of capitalised goodwill | | | 303 | | | 2,007 | | | 259 | | | 2,569 | |

| Operating lease rentals: | | | | | | | | | | | | | |

| – network, plant and equipment | | | 113 | | | – | | | 59 | | | 172 | |

| – other | | | 42 | | | – | | | 45 | | | 87 | |

| Other operating costs | | | 417 | | | 210 | | | 338 | | | 965 | |

| |

| | | | 4,188 | | | 4,126 | | | 2,459 | | | 10,773 | |

| |

Page 100

Back to Contents

notes to the financial statements

All exceptional items relate to continuing operations except £22 million of costs relating to the restructuring of the US discontinued business, principally property and employee costs (2003 – depreciation £57 million, 2002 – other operating costs £6 million, depreciation £87 million and amortisation £213 million).

The remuneration of the auditors and their associates in respect of audit services provided to the Group during the year was £3.2 million (2003 – £4.9 million, 2002 – £2.6 million) and includes £0.8 million (2003 – £1.1 million, 2002 – £0.4 million) for the Company. The remuneration of the auditors and their associates in respect of non-audit services to the Company and its UK subsidiaries during the year was £1.6 million (2003 – £3.6 million, 2002 – £3.8 million) and to overseas subsidiaries £1.5 million (2003 – £1.4 million, 2002 – £1.8 million) as summarised below:

| | | | 2004 | | | 2003 | | | 2002 | |

| | | | £m | | | £m | | | £m | |

| |

| Further assurance services | | | 0.8 | | | 1.3 | | | 0.9 | |

| Tax services – compliance | | | 1.0 | | | 1.1 | | | 0.2 | |

| Tax services – advisory services | | | 1.2 | | | 1.4 | | | 0.8 | |

| Other services | | | 0.1 | | | 1.2 | | | 3.7 | |

| |

| | | | 3.1 | | | 5.0 | | | 5.6 | |

| |

The average monthly number of persons employed by the Group during the year was:

| | | | 2004 | | | 2003 | | | 2002 | |

| | | | Number | | | Number | | | Number | |

| |

| United Kingdom and United States | | | | | | | | | | |

| – United Kingdom | | | 4,991 | | | 6,147 | | | 7,657 | |

| – US network | | | 34 | | | – | | | – | |

| |

| | | | 5,025 | | | 6,147 | | | 7,657 | |

| Europe | | | 576 | | | 1,139 | | | 1,206 | |

| Caribbean | | | 4,363 | | | 5,198 | | | 5,527 | |

| Japan and Asia | | | 1,034 | | | 1,257 | | | 1,559 | |

| Panama | | | 1,983 | | | 2,717 | | | 3,443 | |

| Macau | | | 922 | | | 947 | | | 979 | |

| Rest of the World | | | 1,426 | | | 1,312 | | | 1,675 | |

| Other | | | 237 | | | 210 | | | 239 | |

| Discontinued operations (pro-rated) | | | 1,864 | | | 4,464 | | | 8,176 | |

| |

| | | | 17,430 | | | 23,391 | | | 30,461 | |

| |

Page 101

Back to Contents

notes to the financial statements

The aggregate remuneration and associated costs of Group employees, including amounts capitalised, were:

| | | | 2004 | | | 2003 | | | 2002 | |

| | | | £m | | | £m | | | £m | |

| |

| Salaries and wages | | | 675 | | | 895 | | | 1,003 | |

| Social security costs | | | 61 | | | 71 | | | 99 | |

| Pension costs | | | | | | | | | | |

| – Principal schemes (Note 8) | | | 24 | | | 31 | | | 12 | |

| – Other costs including defined contribution schemes | | | 26 | | | 32 | | | 34 | |

| |

| | | | 786 | | | 1,029 | | | 1,148 | |

| |

| | |

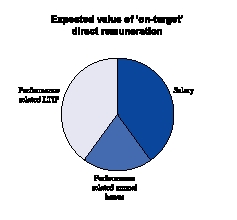

| 7 | Directors’ remuneration and shareholdings |

Information covering Directors’ remuneration (including pension entitlements), interest in shares and interests in share options (including in each case those arising under the Share Option Plan, Restricted Shares and Performance Share Plan) is included in the Directors’ Remuneration Report on pages 66 to 80.

The Company and its principal subsidiaries operate pension and other retirement schemes that cover the majority of employees of the Group. These schemes include both the defined benefit type, whereby retirement benefits are based on the employee’s final remuneration and length of service, and defined contribution schemes, whereby retirement benefits reflect the accumulated value of agreed contributions paid by, and in respect of, employees. With the exception of the unfunded, unapproved retirement benefit schemes, the remaining schemes are funded through separate trustee administered schemes. Contributions to the defined benefit schemes are made in accordance with the recommendations of independent actuaries who value the schemes at regular intervals, usually triennially.

An actuarial valuation of the principal United Kingdom defined benefit pension scheme (“the Scheme”) was prepared at 31 March 2002 for the purpose of UK Statement of Standard Accounting Practice 24 (“SSAP 24”) ‘Accounting for pension costs’.

The valuation of the Scheme disclosed a shortfall in the market value of the Scheme’s assets compared with the accrued liabilities. This was principally due to the fall in the Scheme’s asset values following the fall in global equity markets between 1 April 1999 and 31 March 2002. Thus, with agreement from the actuary, the Company increased its contributions to the Scheme to 20 per cent of salary with effect from 1 April 2002, and made a one-off contribution to the Scheme of £47 million in December 2002 in respect of the shortfall.

The Scheme was valued using the projected unit method and the principal assumptions were that future investment returns on existing assets would, on average, be 3.2 per cent a year above the level of price inflation, that the return on new investments would be 3.9 per cent a year above price inflation, that general salary growth would be 1.7 per cent a year above price inflation, and that inflation related pension increases would generally be in line with price inflation. The market value of the Scheme’s investments at the valuation date was £1,401 million. The Scheme also holds some insurance policies, which had an assessed value of £11 million. The total value of the assets was 97 per cent of the value of the aggregate benefits that had accrued to members of the Scheme, allowing for expected future earnings increases in the case of employees.

The assumptions used for calculating the pension cost for accounting purposes differ from the funding assumptions in that the assumed return on existing assets is 3.3 per cent a year above price inflation. In the Financial Statements, the deficit in the Scheme is spread over the remaining service lives of the employed members. Under those assumptions as at 31 March 2002, the total value of the investments was 99 per cent of the value of the aggregate benefits that had accrued to members of the Scheme.

Page 102

Back to Contents

notes to the financial statements

The principal pension costs as shown in Note 6 comprise:

| | | | 2004 | | | 2003 | |

| | | | £m | | | £m | |

| |

| Regular costs | | | 17 | | | 22 | |

| Variation from regular costs (including interest) | | | 7 | | | 9 | |

| |

| | | | 24 | | | 31 | |

| |

Pension schemes other than the principal scheme are accounted for on the basis of local custom and practice. Pension prepayments relating to the Scheme of £102 million (2003 – £112 million, 2002 – £72 million) are included in other debtors (Note 20). Provisions for obligations to pay terminal gratuities on retirement to staff who are not members of the pension and retirement schemes are included in provisions for pensions (Note 22).

Defined contribution schemes |

The pension cost for the year for the defined contribution schemes was £26 million (2003 – £19 million, 2002 – £10 million).

Disclosures in respect of FRS17 – ‘Retirement benefits’ |

The above figures have been prepared in accordance with the requirements of SSAP 24. FRS 17 has been published in the United Kingdom, however, its full introduction has been deferred. The accounting requirements of FRS 17 are broadly as follows:

| • | pension scheme assets are valued at market values at the balance sheet date; |

| | |

| • | pension scheme liabilities are measured using a projected unit method and discounted at the current rate of return on high quality (AA) corporate bonds of equivalent term and currency to the liability; |

| | |

| • | for accounting periods beginning on or after 1 January 2005 the pension scheme surplus (to the extent it is considered recoverable) or deficit will be recognised in full and presented on the face of the balance sheet; and |

| | |

| • | the movement in the scheme surplus/deficit will be split between operating charges, financing items and, in the statement of total recognised gains and losses, actuarial gains and losses. |

The transitional disclosures in respect of FRS 17 are set out below:

Qualified independent actuaries, Watson Wyatt LLP, updated the actuarial valuations of the major defined benefit schemes operated by the Group to 31 March 2004. The main financial assumptions in accordance with FRS 17 are as follows:

| | | At 31 March 2004

| | At 31 March 2003

| | At 31 March 2002

| |

| | | | UK | | | Rest of

Group | | | UK | | | Rest of

Group | | | UK | | | Rest of

Group | |

| | | | % | | | % | | | % | | | % | | | % | | | % | |

| |

| Inflation assumption | | | 2.8 | | | 3.8 | | | 2.5 | | | 4.3 | | | 2.5 | | | 4.9 | |

| Rate of increase in salaries | | | 4.6 | | | 5.4 | | | 4.3 | | | 5.6 | | | 4.3 | | | 6.3 | |

| Pension increases | | | 2.8-3.0 | | | 3.5 | | | 2.5-3.0 | | | 3.6 | | | 2.5-3.0 | | | 3.6 | |

| Discount rate | | | 5.5 | | | 6.4 | | | 5.5 | | | 6.9 | | | 5.8 | | | 7.5 | |

| Long term expected rate of return on: | | | | | | | | | | | | | | | | | | | |

| – Equities | | | 8.0 | | | 9.0 | | | 8.5 | | | 9.1 | | | 7.8 | | | 9.6 | |

| – Bonds | | | 5.0 | | | 6.6 | | | 5.0 | | | 7.1 | | | 5.5 | | | 7.3 | |

| – Other | | | 4.0 | | | 4.8 | | | 4.0 | | | 4.8 | | | 4.5 | | | 4.6 | |

| |

Page 103

Back to Contents

notes to the financial statements

The assumptions used by the actuaries are the best estimates chosen from a range of possible actuarial assumptions which may not necessarily be borne out in practice. The assumptions shown above for the Rest of Group represent a weighted average of the assumptions used for the individual funds.

The UK defined benefit scheme is closed to new entrants and under the projected unit method for closed schemes the current service cost will increase as the members of the scheme approach retirement.

The assets and liabilities of the defined benefit schemes operated by the Group are as follows:

| | | At 31 March 2004

| | At 31 March 2003

| | At 31 March 2002

| |

| | | | UK | | | Rest of

Group | | | UK | | | Rest of

Group | | | UK | | | Rest of

Group | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

| |

| Equities | | | 965 | | | 84 | | | 855 | | | 61 | | | 1,130 | | | 56 | |

| Bonds | | | 353 | | | 56 | | | 246 | | | 56 | | | 262 | | | 54 | |

| Other | | | 90 | | | 52 | | | 53 | | | 36 | | | 9 | | | 30 | |

| |

| Total fair value of scheme assets | | | 1,408 | | | 192 | | | 1,154 | | | 153 | | | 1,401 | | | 140 | |

| Present value of scheme liabilities | | | (1,744 | ) | | (213 | ) | | (1,630 | ) | | (207 | ) | | (1,434 | ) | | (154 | ) |

| |

| Deficit in funded defined benefit schemes | | | (336 | ) | | (21 | ) | | (476 | ) | | (54 | ) | | (33 | ) | | (14 | ) |

| Deficit in unfunded defined benefit schemes | | | (20 | ) | | (26 | ) | | (18 | ) | | (30 | ) | | (15 | ) | | (14 | ) |

| |

Total deficit in defined benefit schemes | | | (356 | ) | | (47 | ) | | (494 | ) | | (84 | ) | | (48 | ) | | (28 | ) |

| |

No material deferred tax asset would be recognised at 31 March 2004 if this liability were reflected in the Financial Statements. There will be a consequential impact on reserves once this liability is reflected in the Financial Statements.

If the above amounts were recognised in the Financial Statements, the Group’s shareholders’ funds at 31 March 2004 and 31 March 2003 would be as follows:

| | | | 2004 | | | 2003 | |

| | | | £m | | | £m | |

| |

| Shareholders’ funds as presented | | | 1,744 | | | 2,149 | |

| Less: SSAP 24 net assets | | | (52 | ) | | (71 | ) |

| |

| Shareholders funds’ excluding SSAP 24 net assets | | | 1,692 | | | 2,078 | |

| FRS 17 retirement benefits net liability | | | (403 | ) | | (578 | ) |

| |

Shareholders’ funds including FRS 17 retirement benefits net liability | | | 1,289 | | | 1,500 | |

| |

Under the transitional requirements of FRS 17, the following disclosures are given to show the impact on the profit and loss account and statement of total recognised gains and losses if FRS 17 had been adopted in full. These amounts have not been included in the profit and loss account or the statement of total recognised gains and losses.

Page 104

Back to Contents

notes to the financial statements

Analysis of amounts that would be charged to operating profit for the years ended 31 March 2004 and 31 March 2003 in respect of defined benefit schemes is as follows:

| | | 2004

| | 2003

| |

| | | | | | | Rest of | | | | | | | | | Rest of | | | | |

| | | | UK | | | Group | | | Total | | | UK | | | Group | | | Total | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

| Current service cost | | | 24 | | | 10 | | | 34 | | | 27 | | | 17 | | | 44 | |

| Past service cost | | | – | | | 5 | | | 5 | | | – | | | – | | | – | |

| |

Total charged to operating profit | | | 24 | | | 15 | | | 39 | | | 27 | | | 17 | | | 44 | |

| |

Analysis of other amounts that would be charged to the profit and loss account for the years ended 31 March 2004 and 31 March 2003 is as follows:

| | | 2004

| | 2003

| |

| | | | | | | Rest of | | | | | | | | | Rest of | | | | |

| | | | UK | | | Group | | | Total | | | UK | | | Group | | | Total | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

Loss/(gain) on curtailment | | | 1 | | | (4 | ) | | (3 | ) | | – | | | (3 | ) | | (3 | ) |

| |

Analysis of amounts that would be charged/(credited) to other finance income for the years ended 31 March 2004 and 31 March 2003 is as follows:

| | | 2004

| | 2003

| |

| | | | | | | Rest of | | | | | | | | | Rest of | | | | |

| | | | UK | | | Group | | | Total | | | UK | | | Group | | | Total | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

| Interest on pension scheme liabilities | | | 90 | | | 15 | | | 105 | | | 84 | | | 14 | | | 98 | |

| Expected return on pension scheme assets | | | (86 | ) | | (11 | ) | | (97 | ) | | (102 | ) | | (12 | ) | | (114 | ) |

| |

Net return | | | 4 | | | 4 | | | 8 | | | (18 | ) | | 2 | | | (16 | ) |

| |

Page 105

Back to Contents

notes to the financial statements

Analysis of amounts that would be recognised in the statement of total recognised gains and losses for the years ended 31 March 2004 and 31 March 2003 is as follows:

| | | | 2004 | | | 2003 | |

| | | |

| | |

| |

| | | | | | | Rest of | | | | | | | | | Rest of | | | | |

| | | | UK | | | Group | | | Total | | | UK | | | Group | | | Total | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

| Actual return less expected return on pension scheme assets | | | 192 | | | 41 | | | 233 | | | (380 | ) | | (16 | ) | | (396 | ) |

| Experience gains/(losses) on scheme liabilities | | | 47 | | | (8 | ) | | 39 | | | (18 | ) | | (12 | ) | | (30 | ) |

| Changes in the assumptions underlying the present value of the scheme liabilities | | | (91 | ) | | (3 | ) | | (94 | ) | | (111 | ) | | (7 | ) | | (118 | ) |

| |

Total actuarial gain/(loss) recognised in the statement of total recognised gains and losses | | | 148 | | | 30 | | | 178 | | | (509 | ) | | (35 | ) | | (544 | ) |

| |

History of experience gains and losses for the years ended 31 March 2004 and 31 March 2003 is as follows:

| | | 2004 | | 2003 | |

| | |

| |

| |

| | | UK | | Rest of Group | | Total | | UK | | Rest of Group | | Total | |

| | |

| |

| |

| |

| |

| |

| |

| | | | £m | | | % | | | £m | | | % | | | £m | | | % | | | £m | | | % | | | £m | | | % | | | £m | | | % | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Difference between expected and actual return on scheme assets | | | 192 | | | 14 | | | 41 | | | 21 | | | 233 | | | 15 | | | (380 | ) | | (33 | ) | | (16 | ) | | (10 | ) | | (396 | ) | | (30 | ) |

| Experience gains/(losses) on scheme liabilities | | | 47 | | | 3 | | | (8 | ) | | (3 | ) | | 39 | | | 2 | | | (18 | ) | | (1 | ) | | (12 | ) | | (5 | ) | | (30 | ) | | (1 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Total actuarial gain/(loss) recognised in the statement of total recognised gains and losses | | | 148 | | | 8 | | | 30 | | | 12 | | | 178 | | | 9 | | | (509 | ) | | (31 | ) | | (35 | ) | | (15 | ) | | (544 | ) | | (29 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Analysis of movement in the deficit during the years ended 31 March 2004 and 31 March 2003 is as follows:

| | | | 2004 | | | 2003 | |

| | | |

| | |

| |

| | | | | | | Rest of | | | | | | | | | Rest of | | | | |

| | | | UK | | | Group | | | Total | | | UK | | | Group | | | Total | |

| | | | £m | | | £m | | | £m | | | £m | | | £m | | | £m | |

| |

| Deficit at beginning of the year | | | (494 | ) | | (84 | ) | | (578 | ) | | (48 | ) | | (28 | ) | | (76 | ) |

| Contributions made | | | 19 | | | 19 | | | 38 | | | 72 | | | 15 | | | 87 | |

| Current service costs | | | (24 | ) | | (10 | ) | | (34 | ) | | (27 | ) | | (17 | ) | | (44 | ) |

| Past service costs | | | – | | | (5 | ) | | (5 | ) | | – | | | – | | | – | |

| Curtailment (loss)/gain | | | (1 | ) | | 4 | | | 3 | | | – | | | 3 | | | 3 | |

| Other finance (charge)/income | | | (4 | ) | | (4 | ) | | (8 | ) | | 18 | | | (2 | ) | | 16 | |

| Actuarial gain/(loss) | | | 148 | | | 30 | | | 178 | | | (509 | ) | | (35 | ) | | (544 | ) |

| Other movements | | | – | | | (6 | ) | | (6 | ) | | – | | | (26 | ) | | (26 | ) |

| Exchange gain | | | – | | | 9 | | | 9 | | | – | | | 6 | | | 6 | |

| |

Deficit at end of the year | | | (356 | ) | | (47 | ) | | (403 | ) | | (494 | ) | | (84 | ) | | (578 | ) |

| |

Other movements consist of acquisitions and certain immaterial overseas schemes, which had not previously been included.

Page 106

Back to Contents

notes to the financial statements

| 9 | Profits less (losses) on disposal of fixed assets |

Profits less (losses) on disposal of fixed assets before exceptional items amount to £25 million (2003 – £nil, 2002 loss of £7 million). The tax charge attributable is £nil (2003 – £nil, 2002 – £nil) and the minority interest is £nil (2003 – £nil, 2002 – £1 million).

Exceptional items in 2004, 2003 and 2002 comprise:

| | | | Note | | | Exceptional items

£m | | | Taxation

£m | | | Minority interest

£m | | | Total

2004

£m | | | Exceptional items

£m | | | Taxation

£m | | | Minority interest

£m | | | Total

2003

£m | |

| |

Operating items | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Other operating costs | | | (i), (v) | | | (244 | ) | | 9 | | | 9 | | | (226 | ) | | (442 | ) | | 10 | | | 11 | | | (421 | ) |

| Fixed asset impairment and amounts written off | | | (ii), (vi), (vii) | | | (526 | ) | | 64 | | | 41 | | | (421 | ) | | (2,381 | ) | | 48 | | | – | | | (2,333 | ) |

| Goodwill impairment charge | | | (ii), (vi) | | | (10 | ) | | – | | | – | | | (10 | ) | | (2,725 | ) | | – | | | – | | | (2,725 | ) |

| |

| | | | | | | (780 | ) | | 73 | | | 50 | | | (657 | ) | | (5,548 | ) | | 58 | | | 11 | | | (5,479 | ) |

Non operating items | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Profits less (losses) on sale and termination of operations | | | (iii) | | | 250 | | | – | | | – | | | 250 | | | (147 | ) | | – | | | – | | | (147 | ) |

| Profits less (losses) on disposal of fixed assets | | | (iv), (viii) | | | 28 | | | – | | | – | | | 28 | | | 62 | | | – | | | (33 | ) | | 29 | |

| Write down of investments | | | (ix) | | | – | | | – | | | – | | | – | | | (390 | ) | | – | | | – | | | (390 | ) |

| |

| | | | | | | (502 | ) | | 73 | | | 50 | | | (379 | ) | | (6,023 | ) | | 58 | | | (22 | ) | | (5,987 | ) |

| |

| | | | | | | | | | | | | | | | | |

| | | | Note | | | Exceptional items

£m | | | Taxation

£m | | | Minority interest

£m | | | Total

2002

£m | |

| |

Operating items | | | | | | | | | | | | | | | | |

| Other operating costs | | | (x) | | | (210 | ) | | – | | | 3 | | | (207 | ) |

| Fixed asset impairment and amounts written off | | | (xi) | | | (1,909 | ) | | – | | | 28 | | | (1,881 | ) |

| Goodwill impairment charge | | | (xi) | | | (2,007 | ) | | – | | | – | | | (2,007 | ) |

| |

| | | | | | | (4,126 | ) | | – | | | 31 | | | (4,095 | ) |

Non operating items | | | | | | | | | | | | | | | | |

| Profits less (losses) on sale and termination of operations | | | (xii) | | | 1,057 | | | (228 | ) | | 7 | | | 836 | |

| Write down of investments | | | (xiii) | | | (904 | ) | | – | | | – | | | (904 | ) |

| |

| | | | | | | (3,973 | ) | | (228 | ) | | 38 | | | (4,163 | ) |

| |

| | |

| (i) | Exceptional items included in other operating costs principally relate to the cost of restructuring Group businesses. These costs include £93 million in respect of redundancy costs in continuing businesses (United Kingdom £48 million, Panama £7 million, Caribbean £25 million, Japan £5 million, Other £8 million), £92 million in respect of property costs principally relating to the United Kingdom and £24 million of other costs of restructuring incurred by the UK and European businesses. |

| | |

| | Other exceptional costs include £13 million of customer acquisition costs no longer recoverable in light of circumstances that have given rise to certain fixed asset impairments. |

Page 107

Back to Contents

notes to the financial statements

| | Exceptional costs of restructuring the discontinued US business prior to its disposal totalled £22 million principally relating to employee costs. |

| | |

| (ii) | The Group has carried out a review to determine whether there has been an impairment of its fixed assets and goodwill. The carrying values of fixed assets of each of the Group’s income generating units have been compared with their recoverable amounts, represented by their value in use to the Group. The charge has been determined in accordance with FRS11 ‘Impairment of fixed assets and goodwill’ which involved, amongst other factors, using discount rates of between 10.5 and 20 per cent depending on the cost of capital of the respective businesses. |

| | |

| | The result of this assessment was a charge of £10 million in respect of goodwill in Jamaica and £526 million in respect of depreciation of fixed assets throughout the Group. Tax credits of £64 million are available on the National Telecommunications companies’ depreciation impairment charges. |

| | |

| | The depreciation impairment charge arose in the United Kingdom (£119 million), Japan (£126 million), Caribbean (£197 million), Panama (£65 million) and Macau and the Rest of the World (£19 million). |

| | |

| (iii) | On 8 December 2003 the Group’s US business filed for Chapter 11 bankruptcy protection under the US Bankruptcy Code. The effect of the filing for Chapter 11 together with the sale agreement with Gores was that the Group’s ability to control Cable & Wireless USA, Inc. and Cable & Wireless Internet Services, Inc. and their subsidiaries (‘CW America’) was severely restricted. Accordingly, the Group has deconsolidated Cable & Wireless USA, Inc. and Cable & Wireless Internet Services, Inc. and their subsidiaries from 8 December 2003. |

| | |

| | The gain on the exit of the US business of £191 million reflects the deconsolidation of third party net liabilities net of costs of exit. |

| | |

| | In addition £57 million of accrued costs relating to disposals in previous years, principally the disposal of the consumer operations of Cable & Wireless Communications plc on 30 May 2000, have been released (Discontinued £57 million). |

| | |

| | A £2 million gain arose on the disposal of certain European businesses after taking account of the release of provisions relating to these businesses. |

| | |

| (iv) | The gain on the disposal of fixed assets comprises £16 million relating to the disposal of certain properties in the United States as part of the restructuring of the US business prior to deconsolidation, and £12 million principally comprising disposal of properties in the United Kingdom and the Caribbean as part of restructuring. |

| | |

| (v) | The Group announced a restructuring in the United Kingdom, United States, Japan/Asia and Europe on 13 November 2002. Exceptional costs in the period of £248 million associated with this restructuring include £182 million in respect of property costs, £52 million in respect of redundancy costs and £14 million of other costs. |

| | |

| | Other exceptional costs relate to integration costs of Digital Island and the business activities of Exodus of £31 million, redundancy costs of £38 million principally in the Caribbean, Panama and Macau, £44 million of provisions in respect of rentals on vacant properties and £81 million in respect of onerous network contracts and distressed carrier asset write offs. |

| | |

| (vi) | The Group carried out a review to determine whether there had been an impairment of its fixed assets and goodwill. The carrying values of fixed assets and goodwill of each of the Group’s income generating units was compared to their recoverable amounts, represented by their value in use to the Group. The charge was determined in accordance with FRS 11 which involved, amongst other factors, using a growth rate of 2.5 per cent after five years (based on a nominal increase in GDP for the countries in which the Group operates) and a discount rate of 14 per cent. The resulting charge was £12 million in respect of goodwill and £1,479 million in respect of fixed assets. This charge was in addition to the charge of £2,713 million in respect of goodwill and £787 million in respect of fixed assets recognised at the half year. Exceptional depreciation also includes the write-off of redundant fixed assets of £58 million. Tax credits of £48 million were available on £191 million of the impairment charge, which was disclosed in the 2002 Group Financial Statements. |

| | |

| (vii) | The Group has exited its US retail voice business, as announced on 15 May 2002. The exceptional costs associated with this amount to £288 million and include exit costs of £200 million, redundant fixed asset write downs of £57 million |

Page 108

Back to Contents

notes to the financial statements

| | included in the exceptional depreciation charge and other write downs of £31 million. In addition, £84 million of accrued costs relating to disposals in previous years, principally the disposal of the consumer operations of Cable & Wireless Communications plc on 30 May 2000, have been released (Discontinued £204 million). |

| | |

| (viii) | The profit of £62 million on disposal of fixed assets principally comprises a £54 million gain on the sale of part of the Group’s interest in MobileOne (Asia) Pte Ltd. |

| | |

| (ix) | The current asset investments principally relating to PCCW Limited have been written down by £274 million to market value at 31 March 2003. The shares held by the Employee Share Ownership Plan Trust have been written down by £116 million to market value at 31 March 2003. |

| | |

| (x) | Exceptional items included in other operating costs related principally to provisions in respect of ongoing obligations associated with businesses withdrawn from and redundant assets (US discontinued operations £6 million), costs associated with the integration of the Web hosting businesses (£44 million) and redundancy and reorganisation costs incurred (£48 million). |

| | |

| (xi) | The Group carried out a review as at 31 March 2002 to determine whether there had been an impairment of its fixed assets and goodwill. The carrying values of fixed assets and goodwill of each of the Group’s income generating units were compared to their recoverable amounts, represented by their value in use to the Group. In accordance with FRS 11, the value in use of each of the Group’s income generating units was determined with reference to the Group’s five year projections, which had been approved by the Board, using a growth rate of 2.5 per cent in the period beyond the Group’s five year projections (based on a nominal increase in GDP for the countries in which the Group operates), and an average discount rate of 11 per cent. The resulting charge was £2,007 million in respect of goodwill and £1,780 million in respect of fixed assets, including £87 million in respect of fixed assets in discontinued operations. In addition, £129 million of fixed assets withdrawn from service were written off at 30 September 2001. |

| | |

| (xii) | The Group disposed of its interest in Cable & Wireless Optus Limited to Singapore Telecommunications Limited (“SingTel”) on 6 September 2001 resulting in a gain of £1,057 million. The consideration received included shares and bonds issued by SingTel which were converted into cash. |

| | |

| (xiii) | Current asset investments held in ntl Incorporated and CMGI, Inc. were written down to nil value and the investment in PCCW was written down to estimated realisable value. |

Page 109

Back to Contents

notes to the financial statements

| 11 | Net interest and other similar income/(charges) |

| | |

| | | | 2004 | | | 2003 | | | 2002 | |

| | | | £m | | | £m | | | £m | |

| |

Interest receivable and similar income | | | | | | | | | | |

| Deposits and short term loan interest and similar income | | | 108 | | | 198 | | | 319 | |

| Preference share dividends | | | – | | | – | | | 54 | |

| Share of profits of international telecommunications satellite organisations | | | – | | | – | | | 4 | |

| Exchange losses on retranslation of foreign currency denominated loans and deposits | | | (5 | ) | | (9 | ) | | – | |

| |

| | | | 103 | | | 189 | | | 377 | |

| |

Interest payable and other similar charges | | | | | | | | | | |

| Finance charges on leases | | | (1 | ) | | (3 | ) | | (5 | ) |

| Bank loans and overdrafts | | | (21 | ) | | (23 | ) | | (57 | ) |

| Other loans | | | (63 | ) | | (62 | ) | | (99 | ) |

| Discount charge | | | (8 | ) | | (3 | ) | | – | |

| |

| | | | (93 | ) | | (91 | ) | | (161 | ) |

| Less: Interest capitalised | | | 3 | | | 5 | | | 11 | |

| |

| | | | (90 | ) | | (86 | ) | | (150 | ) |

| |

Net interest and other similar income | | | 13 | | | 103 | | | 227 | |

| |

No tax relief is available on interest capitalised in the year ended 31 March 2004.

Page 110

Back to Contents

| notes to the financial statements |

| |

|

| |

| 12 | Tax on loss on ordinary activities |

The charge for tax, based on the Group loss for the year, comprises:

| | | 2004 | | 2003 | | 2002 | |

| | | £m | | £m | | £m | |

|

|

|

|

|

|

| |

United Kingdom | | | | | | | |

| Corporate tax at 30% (2003 – 30%, 2002 – 30%) | | | | | | |

| Current | | 28 | | 39 | | 59 | |

| Double taxation relief | | (28 | ) | (39 | ) | (37 | ) |

| Deferred | | – | | 1 | | (7 | ) |

| Adjustments in respect of prior years – current | (64 | ) | (54 | ) | (18 | ) |

| Adjustments in respect of prior years – deferred | – | | (7 | ) | – | |

|

|

|

|

|

|

| |

| | | (64 | ) | (60 | ) | (3 | ) |

Overseas | | | | | | | |

| Current | | 42 | | 65 | | 295 | |

| Deferred | | (60 | ) | 26 | | 11 | |

| Adjustments in respect of prior years – current | 63 | | 43 | | 19 | |

| Adjustments in respect of prior years – deferred | (3 | ) | (51 | ) | (31 | ) |

|

|

|

|

|

|

| |

| | | 42 | | 83 | | 294 | |

Joint ventures and associates | | | | | | | |

| Joint ventures | | 10 | | 13 | | 20 | |

|

|

|

|

|

|

| |

| | | 10 | | 13 | | 20 | |

|

|

|

|

|

|

| |

Tax on loss on ordinary activities | | (12 | ) | 36 | | 311 | |

|

|

|

|

|

|

| |

The Group’s effective tax rate varies from the statutory tax rate as a result of the following factors:

| | 2004 | | 2003 | | 2002 | |

| | % | | % | | % | |

|

|

|

|

|

|

|

| Statutory tax rate | 30.0 | | 30.0 | | 30.0 | |

| Income/expenses not taxable/allowable – permanent | (16.9 | ) | (12.9 | ) | (21.9 | ) |

| Income/expenses not taxable/allowable – timing | (25.2 | ) | (17.4 | ) | (11.9 | ) |

| Tax losses not utilised | (27.6 | ) | (6.6 | ) | (9.1 | ) |

| Tax rate differences | 13.1 | | 5.7 | | 5.5 | |

| Utilisation of tax losses brought forward | 3.5 | | – | | – | |

| Adjustments to tax charge in respect of previous periods | 0.4 | | 0.2 | | – | |

|

|

|

|

|

|

|

Current tax rate | (22.7 | ) | (1.0 | ) | (7.4 | ) |

|

|

|

|

|

|

|

Back to Contents

| notes to the financial statements |

| |

|

| |

| | 2004 | | 2003 | | 2002 | |

| | £m | | £m | | £m | |

|

|

|

|

|

| |

| Interim | – | | 37 | | 40 | |

| Special interim | – | | – | | 304 | |

| Final | – | | – | | 83 | |

| Full | 73 | | – | | – | |

|

|

|

|

|

| |

| | 73 | | 37 | | 427 | |

|

|

|

|

|

| |

| | |

| 14 | Earnings/(loss) per share |

| | |

| | 2004 | | 2003 | | 2002 | |

| | £m | | £m | | £m | |

|

|

|

|

|

| |

| Profit/(loss) before exceptional items and goodwill amortisation | 139 | | (420 | ) | (229 | ) |

| Exceptional items after tax and minority interests (Note 10) | (379 | ) | (5,987 | ) | (4,163 | ) |

| Amortisation of goodwill before exceptional items, after tax and minority interests | 3 | | (126 | ) | (562 | ) |

|

|

|

|

|

| |

| Basic and diluted loss for the financial year attributable to shareholders | (237 | ) | (6,533 | ) | (4,954 | ) |

|

|

|

|

|

| |

| Basic and diluted weighted average number of shares in issue | 2,327,738,940 | | 2,329,814,506 | | 2,733,445,915 | |

|

|

|

|

|

| |

| Basic earnings/(loss) of total Group per Ordinary Share before exceptional items and goodwill amortisation | 6.0 | p | (18.0 | )p | (8.4 | )p |

| Basic loss per Ordinary Share on exceptional items after tax and minorities | (16.3 | )p | (257.0 | )p | (152.3 | )p |

| Basic earnings/(loss) per Ordinary Share on goodwill amortisation after tax and minorities | 0.1 | p | (5.4 | )p | (20.5 | )p |

|

|

|

|

|

| |

| Basic and diluted loss per Ordinary Share | (10.2 | )p | (280.4 | )p | (181.2 | )p |

|

|

|

|

|

| |

Basic and diluted loss per Ordinary Share are equal in all periods as there is no impact of dilution on the loss for the financial year nor the weighted average number of shares.

Basic and diluted loss per Ordinary Share are based on the (loss)/profit for the year attributable to shareholders. Basic and diluted (loss)/earnings per Ordinary Share before exceptional items and goodwill amortisation is based on the weighted average number of shares in issue and has been provided in order to show the effects of exceptional items and the amortisation of capitalised goodwill on reported earnings.

Back to Contents

| notes to the financial statements |

| |

|

| |

| 15 | Intangible fixed assets |

| | |

| | | Negative goodwill | | Positive goodwill | | Licences and other intangibles | | Total | |

| | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

| |

Cost | | | | | | | | | |

| At 1 April 2003 | | (14 | ) | 6,141 | | 9 | | 6,136 | |

| Disposals | | – | | (2,252 | ) | – | | (2,252 | ) |

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | | (14 | ) | 3,889 | | 9 | | 3,884 | |

|

|

|

|

|

|

|

|

| |

Amortisation | | | | | | | | | |

| At 1 April 2003 | | 2 | | (6,131 | ) | (9 | ) | (6,138 | ) |

| Credit/(charge) for the year – amortisation | 3 | | – | | – | | 3 | |

| Credit/(charge) for the year – exceptional amortisation | – | | (10 | ) | – | | (10 | ) |

| Disposals | | – | | 2,252 | | – | | 2,252 | |

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | | 5 | | (3,889 | ) | (9 | ) | (3,893 | ) |

|

|

|

|

|

|

|

|

| |

Net book value | | | | | | | | | |

At 31 March 2004 | | (9 | ) | – | | – | | (9 | ) |

|

|

|

|

|

|

|

|

| |

| At 31 March 2003 | | (12 | ) | 10 | | – | | (2 | ) |

|

|

|

|

|

|

|

|

| |

Negative goodwill is being amortised over five years, reflecting the nature of the business acquired.

Back to Contents

| notes to the financial statements |

| |

|

| |

| | Group | | Company | |

| |

| |

| |

| | Land and buildings | | Plant and equipment | | Projects under construction | | Total | | Land and buildings | | Plant and equipment | | Projects under construction | | Total | |

| | £m | | £m | | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cost | | | | | | | | | | | | | | | | |

| At 1 April 2003 | 827 | | 9,871 | | 753 | | 11,451 | | 2 | | 62 | | 4 | | 68 | |

| Additions | 3 | | 84 | | 206 | | 293 | | – | | 17 | | – | | 17 | |

| Disposals | (244 | ) | (1,885 | ) | (41 | ) | (2,170 | ) | – | | – | | – | | – | |

| Transfers | 66 | | 348 | | (414 | ) | – | | – | | – | | – | | – | |

| Exchange and other adjustments | (59 | ) | (615 | ) | (49 | ) | (723 | ) | – | | (3 | ) | – | | (3 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | 593 | | 7,803 | | 455 | | 8,851 | | 2 | | 76 | | 4 | | 82 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Depreciation | | | | | | | | | | | | | | | | |

| At 1 April 2003 | 496 | | 9,018 | | – | | 9,514 | | 1 | | 45 | | – | | 46 | |

| Charge for the year | 21 | | 231 | | – | | 252 | | – | | 5 | | – | | 5 | |

| Impairment - exceptional depreciation | 103 | | 265 | | 158 | | 526 | | – | | 21 | | – | | 21 | |

| Disposals | (238 | ) | (1,907 | ) | – | | (2,145 | ) | – | | – | | – | | – | |

| Transfers | 41 | | (37 | ) | (4 | ) | – | | – | | – | | – | | – | |

| Exchange and other adjustments | (40 | ) | (470 | ) | – | | (510 | ) | – | | (1 | ) | – | | (1 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | 383 | | 7,100 | | 154 | | 7,637 | | 1 | | 70 | | – | | 71 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net book value | | | | | | | | | | | | | | | | |

At 31 March 2004 | 210 | | 703 | | 301 | | 1,214 | | 1 | | 6 | | 4 | | 11 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| At 31 March 2003 | 331 | | 853 | | 753 | | 1,937 | | 1 | | 17 | | 4 | | 22 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Included in the cost of tangible fixed assets is £48 million (2003 – £78 million) relating to assets held under finance leases. Accumulated depreciation on these assets is £46 million (2003 – £74 million).

Included within additions is interest and own work capitalised of £3 million (2003 – £5 million) and £42 million (2003 – £102 million) respectively.

| | Group | | Company | |

| |

| |

| |

| | 2004 | | 2003 | | 2004 | | 2003 | |

| | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

| |

Land and buildings at net book value | | | | | | | | |

| Freeholds | 175 | | 194 | | 1 | | 1 | |

| Long leaseholds | 2 | | 52 | | – | | – | |

| Short leaseholds | 33 | | 85 | | – | | – | |

|

|

|

|

|

|

|

| |

| | 210 | | 331 | | 1 | | 1 | |

|

|

|

|

|

|

|

| |

Back to Contents

| notes to the financial statements |

| |

|

| |

| 17 | Fixed asset investments |

| | |

| | Group | | Company | |

| |

| |

| |

| | Joint ventures and associates | | Other investments | | Total | | Joint ventures and associates | | Subsidiary undertakings | | Other investments | | Total | |

| | £m | | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cost/valuation | | | | | | | | | | | | | | |

| At 1 April 2003 | 83 | | 273 | | 356 | | 33 | | 27,221 | | 201 | | 27,455 | |

| Additions | – | | 5 | | 5 | | – | | 16,122 | | 4 | | 16,126 | |

| Transfers | – | | (1 | ) | (1 | ) | – | | – | | – | | – | |

| Disposals | (6 | ) | (29 | ) | (35 | ) | (7 | ) | (26,051 | ) | (18 | ) | (26,076 | ) |

| Revaluation | – | | – | | – | | – | | (1,020 | ) | – | | (1,020 | ) |

| Exchange adjustments | (6 | ) | (6 | ) | (12 | ) | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | 71 | | 242 | | 313 | | 26 | | 16,272 | | 187 | | 16,485 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans | | | | | | | | | | | | | | |

| At 1 April 2003 | 1 | | – | | 1 | | 1 | | 5,719 | | – | | 5,720 | |

| Additions | – | | – | | – | | – | | 12,542 | | – | | 12,542 | |

| Loans repaid and transferred | – | | – | | – | | – | | (5,554 | ) | – | | (5,554 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | 1 | | – | | 1 | | 1 | | 12,707 | | – | | 12,708 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| �� |

Provisions and amounts written off | | | | | | | | | | | | | | |

| At 1 April 2003 | (45 | ) | (150 | ) | (195 | ) | (9 | ) | (14,824 | ) | (116 | ) | (14,949 | ) |

| Increase in year | – | | (2 | ) | (2 | ) | – | | (9,225 | ) | – | | (9,225 | ) |

| Disposals | 5 | | 6 | | 11 | | 4 | | 14,770 | | (2 | ) | 14,772 | |

| Exchange adjustments | – | | 3 | | 3 | | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | (40 | ) | (143 | ) | (183 | ) | (5 | ) | (9,279 | ) | (118 | ) | (9,402 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Share of post acquisition reserves | | | | | | | | | | | | | | |

| At 1 April 2003 | 193 | | – | | 193 | | – | | – | | – | | – | |

| Share of retained profit | 6 | | – | | 6 | | – | | – | | – | | – | |

| Disposals | 2 | | – | | 2 | | – | | – | | – | | – | |

| Exchange adjustments | (25 | ) | – | | (25 | ) | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

At 31 March 2004 | 176 | | – | | 176 | | – | | – | | – | | – | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net book value | | | | | | | | | | | | | | |

At 31 March 2004 | 208 | | 99 | | 307 | | 22 | | 19,700 | | 69 | | 19,791 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| At 31 March 2003 | 232 | | 123 | | 355 | | 25 | | 18,116 | | 85 | | 18,226 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Following an internal reorganisation, substantially all of the Company’s investments were transferred to a wholly owned intermediate holding company during the year.

Back to Contents

| notes to the financial statements |

| |

|

| | Group | | Company | |

| |

|

|

| |

|

|

| |

| | Joint ventures and associates | | Other investments | | Joint ventures and associates | | Other investments | |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | 2004 | | 2003 | | 2004 | | 2003 | | 2004 | | 2003 | | 2004 | | 2003 | |

| | £m | | £m | | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Investments at net book value | | | | | | | | | | | | | | | | |

| Listed shares | 77 | | 84 | | 19 | | 21 | | 17 | | 17 | | – | | – | |

| Unlisted shares | 130 | | 147 | | 39 | | 64 | | 4 | | 7 | | 28 | | 47 | |

| Loans | 1 | | 1 | | – | | – | | 1 | | 1 | | – | | – | |

| Listed ESOP shares (Note 23) | – | | – | | 41 | | 38 | | – | | – | | 41 | | 38 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | 208 | | 232 | | 99 | | 123 | | 22 | | 25 | | 69 | | 85 | |

| |

The market value of the Group’s holdings in listed shares was £193 million (2003 – £196 million) for joint ventures and associates and £73 million (2003 – £62 million) for other investments. The market value of the Company’s holdings in listed shares of joint ventures and associates was £193 million (2003 – £196 million).

Reconciliation of Group share of profits less (losses) of joint ventures and associates with post acquisition retained reserves

| | Joint ventures | | Associates | | 2004 | | Joint ventures | | Associates | | 2003 | | Joint ventures | | Associates | | 2002 | |

| | £m | | £m | | £m | | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Share of turnover | 136 | | 61 | | 197 | | 195 | | 65 | | 260 | | 285 | | 65 | | 350 | |

| Operating costs | (113 | ) | (43 | ) | (156 | ) | (142 | ) | (43 | ) | (185 | ) | (190 | ) | (45 | ) | (235 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Operating profits less (losses) | 23 | | 18 | | 41 | | 53 | | 22 | | 75 | | 95 | | 20 | | 115 | |

| Net interest | – | | – | | – | | (2 | ) | 1 | | (1 | ) | (12 | ) | – | | (12 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Share of profits less (losses) before tax | 23 | | 18 | | 41 | | 51 | | 23 | | 74 | | 83 | | 20 | | 103 | |

| Taxation charge | (10 | ) | – | | (10 | ) | (13 | ) | – | | (13 | ) | (20 | ) | – | | (20 | ) |

| Dividends paid to Group companies | (12 | ) | (13 | ) | (25 | ) | (13 | ) | (15 | ) | (28 | ) | (11 | ) | (15 | ) | (26 | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| Share of retained profits | 1 | | 5 | | 6 | | 25 | | 8 | | 33 | | 52 | | 5 | | 57 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

| | | | | | | | | | | | | | | | | | | |

Back to Contents

| notes to the financial statements |

| |

|

Segmental analysis of Group share of turnover and operating profits/(losses) of joint ventures and associates

| | Turnover | | Operating profit/(loss) | |

| |

|

|

|

|

| |

|

|

|

|

| |

| | 2004 | | 2003 | | 2002 | | 2004 | | 2003 | | 2002 | |

| | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| United Kingdom | 6 | | 6 | | – | | (1 | ) | – | | (6 | ) |

| Caribbean | 108 | | 111 | | 109 | | 30 | | 33 | | 34 | |

| Other | – | | 52 | | 75 | | – | | 13 | | 17 | |

| Rest of the World | 83 | | 91 | | 97 | | 12 | | 29 | | 26 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Continuing operations | 197 | | 260 | | 281 | | 41 | | 75 | | 71 | |

| Discontinued operations | – | | – | | 69 | | – | | – | | 44 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 197 | | 260 | | 350 | | 41 | | 75 | | 115 | |

| |

Group share of net assets of joint ventures and associates

| | Joint ventures | | Associates | | 2004 | | Joint ventures | | Associates | | 2003 | |

| | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Fixed assets | 152 | | 55 | | 207 | | 177 | | 67 | | 244 | |

| Current assets | 38 | | 39 | | 77 | | 47 | | 35 | | 82 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Group share of gross assets | 190 | | 94 | | 284 | | 224 | | 102 | | 326 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| Current borrowings | (7 | ) | – | | (7 | ) | (5 | ) | – | | (5 | ) |

| Other current liabilities | (24 | ) | (18 | ) | (42 | ) | (33 | ) | (19 | ) | (52 | ) |

| Long term borrowings | (16 | ) | (1 | ) | (17 | ) | (25 | ) | – | | (25 | ) |

| Other long term liabilities | (11 | ) | – | | (11 | ) | (13 | ) | – | | (13 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Group share of gross liabilities | (58 | ) | (19 | ) | (77 | ) | (76 | ) | (19 | ) | (95 | ) |

|

|

|

|

|

|

|

|

|

|

|

| |

| Share of net assets | 132 | | 75 | | 207 | | 148 | | 83 | | 231 | |

| |

Segmental analysis of the Group share of net assets of joint ventures and associates

| | Joint ventures | | Associates | | 2004 | | Joint ventures | | Associates | | 2003 | |

| | £m | | £m | | £m | | £m | | £m | | £m | |

|

|

|

|

|

|

|

|

|

|

|

| |

| United Kingdom | – | | – | | – | | – | | – | | – | |

| Caribbean | 115 | | – | | 115 | | 121 | | – | | 121 | |

| Other | – | | – | | – | | – | | – | | – | |

| Rest of the World | 17 | | 75 | | 92 | | 27 | | 83 | | 110 | |

|

|

|

|

|

|

|

|

|

|

|

| |

| | 132 | | 75 | | 207 | | 148 | | 83 | | 231 | |

| |

| | |

Back to Contents

| notes to the financial statements |

| |

|

Stocks comprise network equipment and items held for resale.

| 19 | Current asset investments |

Current asset investments comprise £12 million of gilts (Company – £12 million).

| | Group | | Company | |

| |

|

|

| |

|

|

| |

| | 2004 | | 2003 | | 2004 | | 2003 | |

| | £m | | £m | | £m | | £m | |

| |

Amounts falling due within one year | | | | | | | | |

| Trade debtors | 591 | | 962 | | 2 | | 3 | |

| Amounts owed by subsidiary undertakings | – | | – | | 72 | | 82 | |

| Amounts owed by joint ventures and associates | 5 | | 8 | | 5 | | 5 | |

| Other taxation and social security | 7 | | 11 | | – | | – | |

| Other debtors | 149 | | 229 | | 36 | | 58 | |

| Prepayments and accrued income | 119 | | 241 | | 8 | | 6 | |

| Lease payments receivable | 4 | | 4 | | – | | – | |

| |

| | 875 | | 1,455 | | 123 | | 154 | |

Amounts falling due after more than one year | | | | | | | | |

| Deferred taxation | 28 | | 1 | | – | | – | |

| Other taxation and social security | 17 | | 15 | | – | | – | |

| Other debtors | 22 | | 45 | | – | | – | |

| Prepayments and accrued income | 103 | | 101 | | 102 | | 90 | |

| Lease payments receivable | 5 | | 4 | | – | | – | |

| |

| | 175 | | 166 | | 102 | | 90 | |

| |

Total debtors | 1,050 | | 1,621 | | 225 | | 244 | |

| |

| |

Back to Contents

| notes to the financial statements |

| |

|

| | Group | | Company | |

| |

|

|

| |

|

|

| |

| | 2004 | | 2003 | | 2004 | | 2003 | |

Amounts falling due within one year | £m | | £m | | £m | | £m | |

| |

Loans and obligations under finance leases | | | | | | | | |

| Bank loans and overdrafts | 1 | | 2 | | – | | – | |

| Current instalments due on loans | 40 | | 810 | | – | | 716 | |

| Obligations under finance leases | 3 | | 13 | | – | | – | |

| |

| | 44 | | 825 | | – | | 716 | |

Other creditors | | | | | | | | |

| Payments received on account | 6 | | 16 | | – | | – | |

| Trade creditors | 465 | | 846 | | – | | – | |

| Amounts owed to subsidiary undertakings | – | | – | | 61 | | 51 | |

| Dividends payable | 73 | | – | | 73 | | – | |

| Other taxation and social security | 302 | | 286 | | 205 | | 131 | |

| Other creditors | 154 | | 445 | | 66 | | 135 | |

| Accruals and deferred income | 624 | | 857 | | 110 | | 99 | |

| |

| | 1,624 | | 2,450 | | 515 | | 416 | |

| |

Total creditors falling due within one year | 1,668 | | 3,275 | | 515 | | 1,132 | |

| |

| | |

Back to Contents

| notes to the financial statements |

| |

|

| | Group | | Company | |

| |

|

|

| |

|

|

| |

| | 2004 | | 2003 | | 2004 | | 2003 | |

Amounts falling due after more than one year | £m | | £m | | £m | | £m | |

| |

Other loans | | | | | | | | |

| Sterling repayable at various dates up to 2019 | 520 | | 786 | | 320 | | 586 | |

| US dollars repayable at various dates up to 2038 | 125 | | 666 | | – | | 449 | |

| Other currencies repayable at various dates up to 2017 | 13 | | 74 | | – | | – | |

| 4 per cent convertible unsecured bond due 2010 | 252 | | – | | 252 | | – | |

| |

| | 910 | | 1,526 | | 572 | | 1,035 | |

| Less: Current instalments due | (40 | ) | (810 | ) | – | | (716 | ) |

| |

| | 870 | | 716 | | 572 | | 319 | |