The Board of Directors has appointed an Executive Committee, Audit Committee, Compensation Committee, and Governance and Nominating Committee. All committees operate under individual charters from the Board of Directors.

Nominating Committee did not meet during fiscal 2006; however, it met in December 2006 following the end of the fiscal year to recommend nominees to the Board to be voted on at the February 28, 2007 Annual Meeting. The members of the Governance and Nominating Committee are Messrs. Greenawalt, Hailey and Carlos P. Salas, all of which are independent directors under the definition set forth in Marketplace Rule 4200(a)(15) of the NASDAQ Stock Market. The Governance and Nominating Committee operates pursuant to a formal written charter, a copy of which is available on the Company’s Internet web site at the following address: www.wmco.com.

Independence of the Board of Directors

Upon consideration of the criteria and requirements regarding director independence set forth in the Marketplace Rules of The NASDAQ Stock Market, the Board of Directors has determined that, upon election of the above nominees for director, a majority of the members of the Board of Directors will be “independent directors” as such term is defined in the Marketplace Rules. Specifically, the Board of Directors have determined that Messrs. Goodson, Greenawalt, Hailey, Carlos P. Salas, Peter E. Salas and Viola meet such criteria and requirements. The Company’s independent directors meet in no less than two separate executive sessions during each fiscal year.

Director Nomination Procedures

The nominees, Messrs. Cavanagh, Goodson, Greenawalt, Hailey, Carlos P. Salas, Peter E. Salas, and Viola are existing directors. The Board of Directors is recommending that all nominees be re-elected as directors because the Board of Directors believes they have served the Company admirably and it is in the best interests of the Company and its stockholders to re-elect these individuals to the Board of Directors. The Board of Directors believes that all of these nominees possess a desirable understanding of the Company and the industries in which it operates.

It is the role of the Governance and Nominating Committee to seek qualified candidates to serve on the Company’s Board of Directors and recommend them for the Board of Director’s consideration. In recommending candidates for election to the Board of Directors, the Nominating Committee considers nominees recommended by directors, officers, employees, stockholders, and others, using the same criteria to evaluate all candidates. The Nominating Committee may also engage a third-party search firm to assist in identifying and evaluating potential nominees. The Nominating Committee reviews each candidate’s qualifications, including whether a candidate possesses any of the specific qualities and skills desirable in certain members of the Board of Directors and other factors relating to diversity, skills, occupation, experience in the context of the needs of the Board of Directors, and whether the candidate would meet the definition of “independent” under applicable SEC rules and the rules of The Nasdaq Stock Market. Evaluations of candidates generally involve a review of background materials and internal discussions, as well as interviews with selected candidates as appropriate. Upon selection of a qualified candidate, the Nominating Committee recommends the candidate for consideration by the full Board of Directors. The Board of Directors has required and will continue to require that all nominees for the Board of Directors have a reputation for integrity, honesty and adherence to high ethical standards.

Stockholders wishing to propose director candidates for consideration by the Nominating Committee may do so by writing to the Secretary of the Company and providing information specified in the Company’s Bylaws, including the candidate’s name, biographical data, and qualifications. To be timely, notice must be delivered to, or mailed to and received at, the principal executive offices of the Company not less than (ten) 10 days nor more than (sixty) 60 days prior to the date of the meeting, provided that at least two (2) days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders. If less than (ten) 10 days’ notice or prior public disclosure of the date of the meeting is given or made to stockholders, notice by the stockholder to be timely must be received by the Company not later than the close of business on the second day following the date on which such notice of the date of the meeting was mailed or such public disclosure was made. Stockholders also may be subject to other conditions and limitations regarding the nomination of directors. See “Stockholder Proposals for 2008 Annual Meeting” below.

6

Meeting Attendance

The Board of Directors met four times in person and twice via telephone during fiscal 2006. Each director attended at least 75% of the meetings of the Board of Directors and each committee on which he served and which met during fiscal 2006, except Mr. Ferguson who did not attend the one telephonic board meeting held prior to his resignation. See “Certain Relationships and Related Party Transactions” below. All current members of the Board of Directors attended the Company’s annual meeting held during fiscal year 2006.

Required Vote

Assuming the existence of a quorum, the seven nominees receiving the most votes will be elected directors.

Director Compensation

Each non-employee director of the Company receives a total of $30,000 per year for service on the Board of Directors. This fee is all-inclusive and no additional board or committee attendance fees are paid, except that the Company reimburses its directors for reasonable costs incurred to attend board and committee meetings.

The Company has a stock option plan for the non-employee directors of the Company. For the fiscal year ended September 30, 2006, all non-employee directors each received non-statutory stock option exercisable for ten years to purchase up to 1,666 shares of Common Stock at $12.24 per share. Messrs. Carlos P. Salas and Peter E. Salas were also granted 1,666 shares of Common Stock each at $7.20 per share.

The Company has a Management Services Agreement with Dolphin Advisors, L.L.C. Messrs. Carlos P. Salas and Peter E. Salas are affiliated with Dolphin Advisors, L.L.C. See “Certain Relationships and Related Party Transactions” below.

Communication with Directors

Any stockholder who wishes to communicate with members of the Board of Directors, individually or as a group, may do so by writing to the intended member or members of the Board of Directors, c/o Secretary, Williams Controls, Inc., 14100 S.W. 72nd Ave., Portland, Oregon 97224. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be submitted to the Board of Directors in a timely manner.

Recommendation of the Board of Directors

The Board of Directors urges the stockholders to vote“FOR” each of Messrs. Cavanagh, Goodson, Greenawalt, Hailey, Carlos P. Salas, Peter E. Salas, and Viola. If a quorum is present, the Company’s Bylaws provide that directors are elected by a plurality of the votes cast by the stockholders who are entitled to vote and are present in person or represented by proxy at the meeting. In other words, the seven nominees receiving the most votes, even if less than a majority of the shares cast, will be elected to the Board of Directors. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the Annual Meeting, but are not counted and have no effect on the determination of whether a plurality exists with respect to a given nominee.

7

MANAGEMENT

Executive Officers

The following table sets forth certain information with respect to the Company’s officers as of January 11, 2006. Executive officers of the Company are appointed by the Board of Directors at the meeting of the Board of Directors immediately following the annual meeting of the stockholders, and hold office until they resign, they are terminated by the Board of Directors, or their successors are elected and qualified. Gary A. Hafner, listed below as our Vice President, Manufacturing, was appointed by the Company’s Chief Executive Officer in fiscal 2006.

| Name | | | Age | | Current Position | | Tenure |

| Patrick W. Cavanagh | | 53 | | President and Chief Executive Officer | | October 1, 2004 to present |

| | | | | | | |

| Dennis E. Bunday | | 56 | | Chief Financial Officer | | 2001 to present |

| | | | | | Executive Vice President, and | | 2002 to present |

| | | | | | Secretary | | |

| | | | | | | | |

| Gary A. Hafner | | 56 | | Vice President, Manufacturing | | July 2006 to present |

| | | | | | | |

| Mark S. Koenen | | 40 | | Vice President, Sales and Marketing | | September 1, 2005 to present |

Information concerning the principal occupation of Mr. Cavanagh is set forth under “Election of Directors.” Information concerning the principal occupation during at least the last five years of the other executive officers of the Company who are not also directors of the Company is set forth below.

Dennis E. Bunday joined Williams Controls, Inc. as Executive Vice President, Chief Financial Officer, and Secretary in July 2002. From January 2001 until June 2002, he served the Company as its Chief Financial Officer as an independent contractor. Prior to joining the Company, he served as Vice President - Finance and Chief Financial Officer from 1998 to 2001, for Babler Bros., Inc., a manufacturer of pre-cast concrete products. From 1996 until 1998, he held the same positions with Quality Veneer & Lumber, Inc., and its predecessor, the Morgan Company, a producer of forest products. Prior to 1996, he was Financial Controller and Treasurer of Pope & Talbot, Inc., a New York Stock Exchange company. Mr. Bunday received a Bachelors degree in Accounting from Washington State University.

Mark S. Koenen was appointed Vice President, Sales and Marketing in September 2005. From 1996 until September 2005, he was Sales and Marketing Manager for the Company. Prior to joining the Company, he held the position of corporate strategic market analyst at Rockwell International. Mr. Koenen has a Masters of Science in Foreign Service from Georgetown University and a Bachelors of Arts from Trinity College.

Gary A. Hafner was appointed Vice President, Manufacturing in July 2006. From February 2006 to July 2006, he was manufacturing manager for the Company and from 1999 until February 2006 he was manufacturing manager for the Company’s Portland operations. Prior to joining Williams, he held the position of production manager at Warn Industries in Milwaukie, Oregon, a company that designs, manufactures and markets off-road equipment and accessories for four-wheel-drive vehicles, ATV’s and utility vehicles. Mr. Hafner earned a bachelor’s degree in mechanical engineering from Oregon Institute of Technology.

There are no family relationships among the executive officers of the Company.

8

EXECUTIVE COMPENSATION

The table below sets forth the compensation received by the Chief Executive Officer of the Company and four other named executive officers of the Company, each of whom, if employed by the Company during the relevant year, received compensation in excess of $100,000 during the fiscal years ended September 30, 2006, September 30, 2005 and September 30, 2004. The Company has not granted restricted stock to its Chief Executive Officer or any of its named executive officers and has not establish any long-term incentive plans, as such term is defined in applicable rules of the SEC.

Summary Compensation Table

| | | | | | | | | | | | Securities | | | |

| | | | | | | | | | Other Annual | | Underlying | | All Other |

| Name and Principal Position | | | Year | | Salary ($) | | Bonus ($) | | Compensation($) | | Options(#) | | Compensation($) |

| Patrick W. Cavanagh (1) | | 2006 | | 240,000 | | 329,042 | (2) | | — | | — | | | 8,800 | (5) |

| President and Chief | | 2005 | | 240,000 | | 500,000 | (3) | | — | | 166,666 | (4) | | 107,957 | (6) |

| Executive Officer | | 2004 | | — | | — | | | — | | — | | | — | |

| | | | | | | | | | | | | | | | |

| Dennis E. Bunday | | 2006 | | 162,500 | | 116,325 | | | — | | 8,333 | (7) | | 8,800 | (5) |

| Executive Vice President and | | 2005 | | 150,000 | | 91,969 | | | — | | — | | | 8,400 | (5) |

| Chief Financial Officer | | 2004 | | 150,000 | | 108,400 | | | — | | — | | | 8,200 | (5) |

| | | | | | | | | | | | | | | | |

| Gary A. Hafner (8) | | 2006 | | 117,123 | | 60,869 | | | — | | 5,832 | (9) | | 7,120 | (5) |

| Vice President, Global | | 2005 | | 109,107 | | 41,605 | | | — | | — | | | 6,028 | (5) |

| Manufacturing | | 2004 | | 102,642 | | 32,607 | | | — | | 26,666 | (10) | | 5,410 | (5) |

| | | | | | | | | | | | | | | | |

| Mark S. Koenen (11) | | 2006 | | 116,439 | | 49,559 | | | — | | 2,500 | (12) | | 6,640 | (5) |

| Vice President, Sales and | | 2005 | | 104,648 | | 39,685 | | | — | | — | | | 5,773 | (5) |

| Marketing | | 2004 | | 103,802 | | 34,200 | | | — | | 26,666 | (10) | | 5,520 | (5) |

| | | | | | | | | | | | | | | | |

| Sajid Parvez | | 2006 | | 118,168 | | 28,575 | | | — | | — | | | 5,870 | (5) |

| Global Procurement | | 2005 | | 114,726 | | 31,083 | | | — | | — | | | 5,832 | (5) |

| Manager | | 2004 | | 114,726 | | 19,618 | | | — | | 26,666 | (10) | | 5,374 | (5) |

____________________

| (1) | Mr. Cavanagh was appointed the Company’s President and Chief Executive Officer effective October 1, 2004. |

| |

| (2) | Mr. Cavanagh’s fiscal 2006 annual bonus of $329,042 was paid with 6,401 shares of Common Stock valued a $13.91 per share, which was the closing price of the stock on the date of the board meeting, which was held on December 5, 2006 and he received the remaining $240,002 in cash. |

| |

| (3) | Mr. Cavanagh’s fiscal 2005 bonus includes a $200,000 one-time signing bonus to replace a retention bonus that Mr. Cavanagh would have received from his former employer in May 2005. Mr. Cavanagh’s bonuses were paid with a combination of Common Stock of the Company and cash. His one-time signing bonus was paid with 12,722 shares of Common Stock of the Company valued at $7.86 per share, which was the average of the trading price of the stock for the 30 days immediately preceding the issuance of the stock and above the price on the date of grant, and the remaining $100,000 in cash. His fiscal 2005 annual bonus of $300,000 was paid with 6,223 shares of Common Stock valued at $9.66 per share, which was the average trading price of the stock for the 30 days immediately preceding the issuance of the stock, and he received the remaining $240,000 in cash. |

| |

| (4) | Mr. Cavanagh was granted stock options under the Company’s Restated 1993 Stock Option Plan for 166,666 shares of Common Stock at an exercise price of $6.00 per share, which was above the stock price on October 1, 2004, the date of grant. |

| |

| (5) | Represents contributions from the Company to each of the named executive’s 401(k) accounts. |

| |

| (6) | Represents $8,400 contributions from the Company to Mr. Cavanagh’s 401(k) account and $99,557 for relocation expenses to move his family and personal effects from Chicago, Illinois to Portland Oregon. |

| |

| (7) | Mr. Bunday was granted stock options under the Company’s Restated 1993 Stock Option Plan for 8,333 shares of Common Stock at an exercise price of $8.22 per share, which was above the stock price on October 1, 2005, the date of grant. |

9

| (8) | Mr. Hafner was named Vice President, Global Manufacturing effective July 2006. Prior to July 2006, Mr. Hafner was production manager for the Company’s Portland, Oregon facility. Compensation includes amounts paid to Mr. Hafner prior to being named Vice President. |

| |

| (9) | Mr. Hafner was granted stock options under the Company’s Restated 1993 Stock Option Plan for 1,666 shares of Common Stock at an exercise price of $8.22 per share, which was above the stock price on October 1, 2005, the date of grant. Mr. Hafner was also granted stock options for 4,166 shares of Common Stock at an exercise price of $14.04 per share, which was equal to the stock price on February 1, 2006, the date of grant. |

| |

| (10) | Messrs. Hafner, Koenen, and Parvez were each granted stock options under the Company’s Restated 1993 Stock Option Plan for 26,666 shares of Common Stock at an exercise price of $4.62 per share, which was above the stock price on March 26, 2004, the date of grant. |

| |

| (11) | Mr. Koenen was named Vice President, Sales and Marketing effective September 1, 2005. Prior to September 1, 2005, Mr. Koenen was sales and marketing manager for Williams Controls. Compensation includes amounts paid to Mr. Koenen prior to being named Vice President. |

| |

| (12) | Mr. Koenen was granted stock options under the Company’s Restated 1993 Stock Option Plan for 2,500 shares of Common Stock at an exercise price of $8.22 per share, which was above the stock price on October 1, 2005, the date of grant. |

Stock Option Grants in Last Fiscal Year

Stock options were granted to the named individuals in the Summary Compensation Table in the following amounts during the fiscal year ended September 30, 2006.

| | | | | | | | | | | | | Potential Realizable |

| | | | | | | | | | | | | Value at Assumed |

| | | | | % of Total | | | | | | | Annual Rates of Stock |

| | | Options | | Options Granted | | Exercise or | | | | Price Appreciation for |

| | | Granted | | to Employees in | | Base Price | | Expiration | | Option Term (3) |

| Name | | | (#)(1) | | Fiscal Year | | ($/share) (2) | | Date | | 5% | | 10% |

| Dennis E. Bunday | | 8,333 | | 18.1 | % | | $ | 8.22 | | 10/01/2015 | | $ | 37,377 | | $ | 100,089 |

| Gary A. Hafner | | 1,666 | | 3.6 | % | | $ | 8.22 | | 10/01/2015 | | $ | 7,473 | | $ | 20,011 |

| Gary A. Hafner | | 4,166 | | 9.1 | % | | $ | 14.04 | | 2/1/2016 | | $ | 36,784 | | $ | 93,219 |

| Mark S. Koenen | | 2,500 | | 5.4 | % | | $ | 8.22 | | 10/01/2015 | | $ | 11,213 | | $ | 30,028 |

____________________

| (1) | The options shown in the table above become exercisable with respect to 20% of the total number of shares on each of the one-year periods from the date of grant. All options will become fully vested upon the approval by the Company’s stockholders of a merger, sale of substantially all of the Company’s assets or stock, or a plan of liquidation. |

| |

| (2) | The exercise price for the options was greater than the market price of the Company’s Common Stock on the date the Board of Directors authorized the grant, which was the grant date. |

| |

| (3) | Assumed annual appreciation rates are set by the SEC and are not a forecast of future appreciation. The actual realized value depends on the market value of the common stock on the exercise date and no gain to the optionees is possible without an increase in the price of the common stock. All values are before taxes and do not include dividends. |

10

Stock Option Exercises and Holdings in Last Fiscal Year

The table below summarizes fiscal year-end option values of the individuals named in the Summary Compensation Table.

| | | | | | Securities Underlying | | Value of In-the Money |

| Shares | | | | Unexercised Options | | Options at Fiscal Year End |

| | Acquired on | | Value | | at FiscalYear End (#) | | ($)(1) |

| Name | | Exercise (#) | | Realized ($) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| Patrick W. Cavanagh | — | | | — | | 33,333 | | 133,333 | | | 221,331 | | 889,331 | |

| Dennis E. Bunday | — | | | — | | 33,333 | | 16,666 | | | 290,330 | | 109,662 | |

| Gary A. Hafner | 19,666 | | | 161,891 | | 4,333 | | 24,832 | | | 26,130 | | 162,344 | |

| Mark S. Koenen | — | | | — | | 25,332 | | 21,833 | | | 203,034 | | 168,955 | |

| Sajid Parvez | — | | | — | | 19,999 | | 18,333 | | | 167,152 | | 149,120 | |

____________________

| (1) | | The dollar values are calculated by determining the difference between the fair market value of the underlying Common Stock and the exercise price of the options at fiscal year-end. |

Employment Contracts

The Company entered into an employment agreement effective October 1, 2004 with the Company’s President and Chief Executive Officer, Patrick W. Cavanagh. The agreement specifies an initial base salary of $240,000 per year plus a potential annual bonus of up to 150% of base salary based on financial performance and strategic objectives as established by the Board of Directors. In accordance with the terms of the employment agreement, Mr. Cavanagh purchased $50,000 of the Company’s Common Stock during fiscal 2005 at the then current market price. The employment agreement provides for a $200,000 signing bonus, of which $100,000 will be paid in cash and $100,000 in shares of Common Stock, valued at the average trading price for the preceding 30 days. This signing bonus was paid in fiscal 2005. Additionally, the agreement provides for assistance in relocating from Chicago, Illinois to Portland, Oregon, the granting of 166,666 options at $6.00 per share under the Company’s 1993 Stock Option Plan, and severance payments of between 1.5 and 2 times his base compensation under certain circumstances.

On January 10, 2003, the Company entered into an employment agreement with Mr. Bunday. The contract is for a term of four years beginning on October 1, 2002 and is automatically renewable unless either the Company or Mr. Bunday elects not to do so. The contract specifies a base salary plus bonus based on parameters established by the Board of Directors annually. The agreements also provide for a one-year severance payment under certain circumstances in the event the Company terminates the agreements prior to the end of the contract period, or any extended contract period.

Equity Compensation Plan Information

The table below sets forth certain information as of the end of the Company’s 2006 fiscal year for (i) all compensation plans previously approved by our stockholders, and (ii) all compensation plans not previously approved by our stockholders.

| | | | | | | Number of securities |

| | | | | | | remaining available for |

| | | | | Weighted-average | | future issuance under |

| Number of securities to | | exercise price of | | equity compensation |

| be issued upon exercise | | outstanding options, | | plans (excluding securities |

| Plan category | | of outstanding options | | warrants andrights | | reflected in column (a)) |

| | (a) | | | | (b) | | | | (c) | |

| Equity compensation plans approved by | | | | | | | | | | | |

| security holders | | 586,255 | | | | $5.85 | | | | 163,463 | |

| Equity compensation plans not approved | | | | | | | | | | | |

| by security holders | | — | | | | — | | | | — | |

| Total | | 586,255 | | | | $5.85 | | | | 163,463 | |

11

_____________

BOARD COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee of the Board of Directors administers, among other things, the compensation of the executive officers of the Company.

Compensation Philosophy

The Compensation Committee reviews and makes recommendations to the Board of Directors regarding all forms of salary, bonus, and equity-based compensation provided to the Chief Executive Officer and other executive officers of the Company. It also oversees the overall administration of the Company’s stock option plans and addresses such other compensation matters as may from time to time be directed by the Board of Directors. The Compensation Committee’s compensation policy for executive officers is designed to attract, motivate, and retain talented executives responsible for the success of the Company and to promote the long-term interests of the Company and its stockholders. The Compensation Committee places emphasis on performance-based components, such as stock options and bonuses, the value of which could increase or decrease to reflect changes in corporate and individual performance. These short-term and long-term incentive compensation policies are intended to reinforce management’s objectives to enhance profitability and stockholder value.

Executive Compensation

At the beginning of each fiscal year, the Compensation Committee meets with the Chief Executive Officer to review the objectives of the Company and its executive officers for such year and to establish parameters for performance-based year-end bonuses. At the conclusion of each fiscal year, the Compensation Committee meets with the Chief Executive Officer to review the performance of the Company and its executive officers against the objectives and parameters that were established at the beginning of the year and to establish the basis for making recommendations to the Board of Directors for executive compensation, including year-end bonuses. In making recommendations to the Board of Directors, the Compensation Committee takes into account various qualitative and quantitative indicators of corporate and individual performance in determining the level and composition of compensation for the executive officers.

Executive officers are paid base salaries in line with their responsibilities, as determined in the discretion of the Board of Directors based on recommendations provided by the Compensation Committee. Executive officers are also eligible to receive incentive bonuses based on the achievement of performance targets established at the beginning of the fiscal year. During fiscal 2006, the objectives used as the basis for incentive bonuses were the achievement of designated earnings levels, management of expenses, including legal fees, the management of the realignment program and other objectives for each executive officer.

Long-term equity incentives for executive officers are effected through stock option grants under the Company’s Restated 1993 Stock Option Plan. The Compensation Committee believes that equity-based compensation in the form of stock options links the interests of management and employees with those of the stockholders.

Chief Executive Officer Compensation

The annual base salary for the President and Chief Executive Officer of the Company is reviewed and approved annually by the Board of Directors based on recommendations provided by the Compensation Committee and upon the criteria set forth under the discussion of Executive Compensation above. The target incentive bonus for the President and Chief Executive Officer is tied to achieving designated corporate objectives and satisfactorily managing the Company’s overall corporate business plan.

Compliance with Section 162(m) of the Internal Revenue Code of 1986

Section 162(m) of the Internal Revenue Code limits the tax deduction to $1.0 million for compensation paid to certain executives of public companies. Having considered the requirements of Section 162(m), the Compensation Committee believes that grants made pursuant to the Restated 1993 Stock Option Plan meet the requirements that such grants be “performance based” and are, therefore, exempt from the limitations on deductibility. Historically,

12

the combined salary and bonus of each executive officer has been below the $1.0 million limit. The Compensation Committee’s present intention is to comply with Section 162(m) unless it believes that required changes would not be in the best interest of the Company or its stockholders.

The Compensation Committee members for Fiscal 2006 were:

Donn J. Viola, Chairman

Douglas E. Hailey

Carlos P. Salas

Compensation Committee Interlocks and Insider Participation

The members of the Company’s Compensation Committee include Messrs. Donn J. Viola, Douglas E. Hailey and Carlos P. Salas. None of the named current or former members of the Compensation Committee is or ever was an executive officer of the Company. Mr. Carlos P. Salas is a member of Dolphin Advisors, LLC, the Managing General Partner of Dolphin Direct Equity Partners LP. See “Certain Relationships and Related Party Transactions” below for a description of the relationships between the Company and the Dolphin entities. This Committee makes the determinations for stock issuances pursuant to the Company’s compensation policies and plans.

AUDIT COMMITTEE REPORT

The Audit Committee held four meetings during our 2006 fiscal year. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) and issuing a report thereon. The Audit Committee’s responsibility is to monitor and oversee these processes.

With respect to the Company’s audited financial statements for the Company’s fiscal year ended September 30, 2006, management of the Company represented to the Audit Committee that the financial statements were prepared in accordance with accounting principles generally accepted in the United States of America and the Audit Committee reviewed and discussed those financial statements with management. The Audit Committee also discussed with the Company’s independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees), as modified or supplemented.

The Audit Committee received the written disclosures from the Company’s independent registered public accounting firm required by Independence Standards Board Standard No. 1 (Independence Standards Board Standard No. 1, Independence Discussions With Audit Committees), as modified or supplemented, and discussed with the Company’s independent registered public accounting firm their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended September 30, 2006, be included in the Company’s Annual Report on Form 10-K for that fiscal year.

The Audit Committee members for fiscal 2006 were:

H. Samuel Greenawalt, Chairman

Douglas E. Hailey

Donn J. Viola

13

SHARE OWNERSHIP OF MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of our Common Stock as of January 11, 2006, by each director, each executive officer or employee named in the Summary Compensation Table, and all directors and executive officers as a group. Except as indicated in the footnotes to this table, each person has sole voting and investment power with respect to the shares attributed to such person.

Ownership of Common Stock

| Amount | | | |

| Beneficially | | Percentage |

| Non-Employee Directors | | Owned | | Owned* |

| R. Eugene Goodson | 89,705 | (1) | | 1.2 | |

| H. Samuel Greenawalt | 41,267 | (1) | | ** | |

| Douglas E. Hailey | 76,871 | (1) | | 1.03 | |

| Carlos P. Salas | 709,291 | (1)(2) | | 9.52 | |

| Peter E. Salas | 1,814,733 | (1)(3) | | 24.35 | |

| Donn J. Viola | 5,945 | (1) | | ** | |

| |

| Named Executive Officers | | | | | | |

| Patrick W. Cavanagh (5) | 215,065 | (1)(4) | | 2.86 | |

| Dennis E. Bunday | 156,800 | (1)(4) | | 2.09 | |

| Gary A. Hafner | 30,998 | | | ** | |

| Mark S. Koenen | 32,498 | | | ** | |

| Sajid Parvez | 26,665 | | | ** | |

| | |

| All directors and executive officers as a group | 2,384,905 | | | 31.1 | |

____________________

| * | | The percentages of beneficial ownership of the Common Stock assumes the exercise of all options exercisable for Common Stock beneficially owned by such person or entity currently exercisable on or before March 11, 2007. |

| | | |

| ** | | Less than one percent. |

| | | |

| (1) | | Includes shares issuable upon exercise of stock options exercisable on or before March 11, 2007 as follows: Mr. Goodson 34,165; Mr. Greenawalt 15,409; Mr. Hailey 8,745; Mr. Carlos P. Salas 1,664; Mr. Peter E. Salas 1,664; Mr. Viola 5,412; Mr. Cavanagh 66,666; Mr. Bunday 34,999; Mr. Hafner 4,666; Mr. Koenen 25,832; and Mr. Parvez 19,999. |

| |

| (2) | | Includes shares held by Dolphin Direct Equity Partners, LP. Mr. Carlos P. Salas disclaims beneficial ownership of shares held by Dolphin Direct Equity Partners, LP, except to the extent of his individual pecuniary interest therein. |

| |

| (3) | | Includes shares held by Dolphin Direct Equity Partners, LP and Dolphin Offshore Partners, L.P. Mr. Peter E. Salas disclaims beneficial ownership of shares held by Dolphin Direct Equity Partners, LP and Dolphin Offshore Partners, L.P., except to the extent of his individual pecuniary interest therein. |

| |

| (4) | | Includes 107,722 shares owned by Williams Controls, Inc. employee benefit plans of which Mr. Cavanagh and Mr. Bunday are trustees and over which Mr. Cavanagh and Mr. Bunday have shared voting and dispositive power. Mr. Cavanagh and Mr. Bunday disclaim beneficial ownership of shares held in the Company’s employee benefit plans, except to the extent of their individual pecuniary interest therein. |

| |

| (5) | | Mr. Cavanagh is also a director of the Company. |

14

PERSONS OWNING MORE THAN FIVE PERCENT OF WILLIAMS CONTROLS

The table below sets forth certain information regarding the beneficial ownership of the Company’s Common Stock as of January 11, 2007 by each person known to us to beneficially own more than five percent of our Common Stock. Except as expressly noted, each person listed has sole voting power and investment authority with respect to all shares of Common Stock listed as beneficially owned by such person.

Ownership of Common Stock

| | Number of | | Percentage |

| Principal Holders | | Shares | | Owned |

| Dolphin Offshore Partners, L.P. | 1,106,274 | | | 14.9 |

| c/o Dolphin Asset Management Corp. | | | | |

| 129 East 17th Street | | | | |

| New York, NY 10007 | | | | |

| |

| Dolphin Direct Equity Partners LP | 707,211 | | | 9.5 |

| c/o Dolphin Asset Management Corp. | | | | |

| 129 East 17th Street | | | | |

| New York, NY 10007 | | | | |

| |

| Eubel Suttman & Brady Asset Management Inc. | 349,578 | | | 4.7 |

| 7777 Washington Village Drive | | | | |

| Suite 210 | | | | |

| Dayton, OH 45459 | | | | |

| |

| Mark E. Brady | 425,972 | (1) | | 5.7 |

| Eubel Suttman & Brady Asset Management Inc. | | | | |

| 7777 Washington Village Drive | | | | |

| Suite 210 | | | | |

| Dayton, OH 45459 | | | | |

| |

| Robert J. Suttman, II | 427,194 | (1) | | 5.7 |

| Eubel Suttman & Brady Asset Management Inc. | | | | |

| 7777 Washington Village Drive | | | | |

| Suite 210 | | | | |

| Dayton, OH 45459 | | | | |

| |

| Ronald L. Eubel | 425,972 | (1) | | 5.7 |

| Eubel Suttman & Brady Asset Management Inc. | | | | |

| 7777 Washington Village Drive | | | | |

| Suite 210 | | | | |

| Dayton, OH 45459 | | | | |

| |

| Bernard J. Holtgreive | 425,972 | (1) | | 5.7 |

| Eubel Suttman & Brady Asset Management Inc. | | | | |

| 7777 Washington Village Drive | | | | |

| Suite 210 | | | | |

| Dayton, OH 45459 | | | | |

| |

| William E. Hazel | 425,972 | (1) | | 5.7 |

| Eubel Suttman & Brady Asset Management Inc. | | | | |

| 7777 Washington Village Drive | | | | |

| Suite 210 | | | | |

| Dayton, OH 45459 | | | | |

____________________

| (1) | | Messrs. Brady, Suttman, Eubel, Holtgreive, and Hazel are general partners or principals of Eubel Suttman & Brady Asset Management Inc. and disclaim beneficial ownership of these securities except to the extent of their individual pecuniary interest therein. |

15

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Management Services Agreement

Peter E. Salas, one of our directors, is the founder and President of Dolphin Asset Management Corp. and founder of its affiliated companies, which include Dolphin Offshore Partners, L.P., Dolphin Direct Equity Partners, LP, and Dolphin Advisors, L.L.C. (together, the “Dolphin Entities”). Carlos P. Salas, another of our directors, is a member of Dolphin Advisors, L.L.C., a Dolphin Entity. Kirk Ferguson, who resigned as a director on October 19, 2005, is a former partner and managing director of American Industrial Partners (“AIP”). William Morris, who also resigned as a director on October 19, 2005, was a vice president at AIP. On September 30, 2004, the Company, Dolphin Advisors, L.L.C. (“Dolphin Advisors”) and AIP, entered into a Management Services Agreement (the “Agreement”). Under the Agreement, AIP and Dolphin Advisors were to provide advisory and management services to the Company and its subsidiaries. In consideration of the services to be provided by AIP and Dolphin Advisors, the Company was required to pay each of AIP and Dolphin Advisors an annual management fee, payable in quarterly installments commencing January 1, 2005, equal to $80,000 payable to AIP and $120,000 payable to Dolphin Advisors. Under the Agreement, the Company’s obligation to pay the annual fee to AIP or Dolphin Advisors terminates automatically as of August 1, 2007, or earlier under certain circumstances.

During fiscal 2006, AIP sold all of its shares of Common Stock in the Company to three purchasers: (i) the Company; (ii) Dolphin Offshore Partners L.P., an affiliate of Dolphin Advisors; and (iii) an investment group arranged by Taglich Brothers, Inc. In conjunction with the sales by AIP, the portion of the Agreement pertaining to AIP was terminated, including the Company’s obligation to pay the $80,000 per year management fee to AIP for any period after September 30, 2005. AIP no longer has any financial position in the Company. Additionally, subsequent to September 30, 2005 the Agreement with respect to Dolphin Advisors was amended to reduce the annual management fee to $60,000 under certain circumstances for fiscal 2005 and subsequent years and to extend the Agreement one year to August 1, 2008. For fiscal 2006, the Company paid $60,000 to Dolphin Advisors and nothing to AIP.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s officers and directors, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file reports of ownership and changes in ownership with the Securities and Exchange Commission (“SEC”). Officers, directors, and greater than ten-percent stockholders are required by the SEC regulation to furnish the Company with copies of Section 16(a) forms they file. Based solely on review of the copies of such forms furnished to the Company, or written representations of the reporting persons, the Company believes that all required reports were timely filed during the year, except that Messrs. Bunday, Hailey, Goodson, Greenawalt, Koenen and Viola each failed to file one Form 4 in a timely manner and Mr. Hafner failed to file one Form 3 in a timely manner. All such Forms 4 and 3 have been filed prior to the date of the Proxy Statement.

16

PERFORMANCE INFORMATION

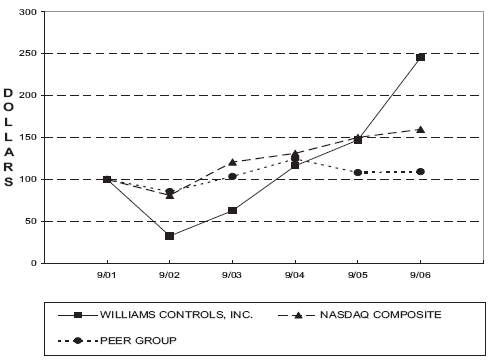

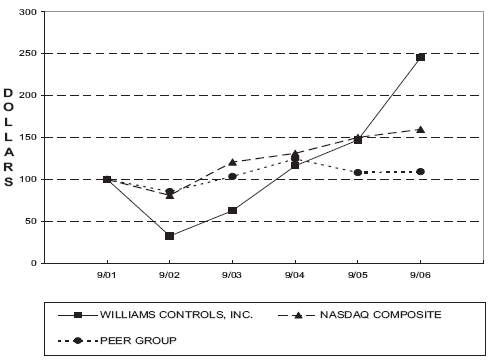

The following graph sets forth the percentage changes in the Company’s cumulative stockholder return on its Common Stock for the five-year period ended September 30, 2006, with the cumulative total return of (1) the NASDAQ Stock Market (US Companies) and (2) a peer group comprised of the companies traded on the NASDAQ Stock Market in the Standard Industry Classification Code 3710 (motor vehicles and equipment) (the “Peer Group”).

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG WILLIAMS CONTROLS, INC., THE NASDAQ COMPOSITE INDEX AND A PEER GROUP

____________________

* $100 invested on 9/30/01 in stock or index — including reinvestment of dividends. Fiscal year ending September 30.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Independent Registered Public Accounting Firm

KPMG LLP, an independent registered public accounting firm, audited the consolidated financial statements of the Company and subsidiaries for fiscal years 2006, 2005 and 2004.

Attendance at Annual Meeting

Representatives of KPMG LLP are expected to be present at the Annual Meeting and will be given the opportunity to make a statement if they so desire, and be available to respond to appropriate questions.

17

Fees Billed to the Company by KPMG LLP During Each of the Last Two Fiscal Years

Aggregate fees billed by KPMG LLP for audit services related to the two most recent fiscal years, and for other professional services billed in the two most recent fiscal years were as follows:

| Services Provided | | | 2006 | | 2005 |

| Audit Fees (1) | $ 285,350 | | $ 201,000 |

| Audit Related Fees (2) | 39,500 | | 82,950 |

| Tax Fees (3) | 84,270 | | 108,150 |

| All Other Fees | 0 | | 0 |

| Total | $ 409,120 | | $ 392,100 |

| (1) | | Fees in connection with the audit of the Company’s annual financial statements and reviews of the Company’s quarterly reports on Form 10-Q for the fiscal year ended September 30, 2006. |

| |

| (2) | | Fees include audit of benefit plans and work related to the Company’s Registration Statement on Form S-1 to register certain shares of the Company’s common stock in June 2005. |

| |

| (3) | | Fees include assistance with tax planning analysis and tax compliance. |

Before KPMG LLP is engaged by the Company or its subsidiaries to render audit or non-audit services, the engagement must be approved by the Audit Committee of the Board of Directors. The Audit Committee has considered each of the services rendered by KPMG LLP other than the audit of the Company’s financial statements and has determined that the provision of each of these services is compatible with maintaining the firm’s independence.

CODE OF ETHICS

The Company has adopted a Code of Ethics that is applicable to the Company’s Chief Executive Officer, Chief Financial Officer and all other persons performing similar functions, as well as to all directors, officers, and employees of the Company. The Company’s Code of Ethics is available free of charge on the Company’s Internet web site at the following address: www.wmco.com and is available by writing to Williams Controls, Inc., Investor Relations, 14100 SW 72nd Avenue, Portland, Oregon 97224.

STOCKHOLDER PROPOSALS FOR 2008 ANNUAL MEETING

Pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, some stockholder proposals may be eligible for inclusion in the Company’s 2008 proxy statement. Any such proposal must be received by the Company not later than September 20, 2007. Stockholders interested in submitting such a proposal are advised to contact knowledgeable counsel with regard to the detailed requirements of the applicable securities law. The submission of a stockholder proposal does not guarantee that it will be included in the Company’s proxy statement. Alternatively, under the Company’s bylaws, a proposal or nomination that a stockholder does not seek to include in the Company’s proxy statement pursuant to Rule 14a-8 may be delivered to the Secretary of the Company not less than ten days nor more than 60 days prior to the date of an annual meeting, unless notice or public disclosure of the date of the meeting occurs less than two days prior to the date of such meeting, in which event, stockholders may deliver such notice not later than the second day following the day on which notice of the date of the meeting was mailed or public disclosure thereof was made. A stockholder’s submission must include certain specified information concerning the proposal or nominee, as the case may be, and information as to the stockholder’s ownership of Common Stock of the Company. Proposals or nominations not meeting these requirements will not be entertained at the annual meeting. If the stockholder does not also comply with the requirements of Rule 14a-4(c)(2) under the Securities Exchange Act of 1934, the Company may exercise discretionary voting authority under proxies it solicits to vote in accordance with its best judgment on any such proposal or nomination submitted by a stockholder.

18

OTHER MATTERS

As of the date of this Proxy Statement, the Board of Directors is not aware of any business other than the proposals discussed above that will be presented for consideration at the Annual Meeting. If other matters properly come before the Annual Meeting, it is the intention of the persons named in the enclosed proxy to vote on such matters in accordance with their best judgment.

ANNUAL REPORT ON FORM 10-K

A copy of the Company’s Annual Report on Form 10-K for fiscal 2006 accompanies this Proxy Statement. The Company is required to file an Annual Report on Form 10-K for its fiscal year ended September 30, 2006 with the Securities and Exchange Commission. A stockholder also may obtain a copy of the Company’s annual report on Form 10-K at no charge, or a copy of exhibits thereto for a reasonable charge, by writing to Williams Controls, Inc., Investor Relations, 14100 S.W. 72nd Avenue, Portland, Oregon 97224.

______________

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, THE COMPANY HOPES THAT YOU WILL HAVE YOUR STOCK REPRESENTED BY COMPLETING, SIGNING, DATING AND RETURNING YOUR ENCLOSED PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE AS SOON AS POSSIBLE.

| By Order of the Board of Directors, |

|  |

| Dennis E. Bunday |

| Executive Vice President, Chief Financial |

| Officer and Secretary |

January 22, 2007

Portland, Oregon

19

ATTACHMENT A

Charter of the Audit Committee of the Board of Directors

Of Williams Controls, Inc

Purpose

The Audit Committee shall provide assistance to the Board of Directors in fulfilling their responsibility to the stockholders, potential stockholders and the investment community. The Audit Committee’s function is to oversee the Company’s accounting and financial reporting processes, including the quality of internal controls over those processes and audits of the Company’s financial statements and internal control reports.

Membership

The Audit Committee shall consist of at least three directors appointed by the Board of Directors on the recommendation of the Nominating and Governance Committee of the Board of Directors. Actions to remove any individual of this Committee shall be taken by a resolution passed by a majority of the Board of Directors. Each member of the committee is to be an “independent” director as defined under applicable federal securities laws and shall satisfy the independence standards for Audit Committee members as established by the rules of The NASDAQ Stock Market. Each employee must be able to read and understand fundamental financial statements, including a balance sheet, statement of operations and statement of cash flows. At least one member of the committee must have past employment experience in finance or accounting or comparable experience or background that results in the individual’s financial sophistication and be designated as an “Audit Committee financial expert” as required by applicable federal securities laws. Members will serve until the board decides to reassess the committee structure.

Meetings

The Audit Committee shall meet as often as it deems necessary to fulfill its responsibilities, but not less than four times per fiscal year. The chairman will determine meeting agendas and will involve or exclude management and independent auditors as considered appropriate to fulfill the committee’s responsibilities. Minutes of each meeting are to be prepared and distributed to committee members and to all Board members.

Funding

The Company shall provide for appropriate funding for the Audit Committee, as determined by the Audit Committee, in its capacity as a committee of the Board of Directors, for payment of (a) compensation to any registered public accounting firm engaged for the purpose of preparing or issuing an audit report or performing other audit, review, or attest services for the Company, (b) compensation to any independent counsel and advisers employed by the Audit Committee, and (c) ordinary administrative expenses of the Audit Committee that are necessary or appropriate to carry out its responsibilities and duties.

Responsibilities

| | 1. | | Appointment, retention and oversight of the work of any accounting firm engaged (including resolution of disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. The accounting firm is engaged by the Audit Committee and reports directly to the committee. |

| |

| 2. | | Review and discuss with management the internal audit plan and budget, including the audit/risk assessment and the results of audit activities. Periodically assess the quality of the internal audit activity. |

| |

| 3. | | Review and discuss with management the audited financial statements. |

20

| | 4. | | Discuss with the independent auditors any matters required to be discussed under current auditing standards, including Statement of Auditing Standards No. 61, and other matters as may become required by regulatory agencies. |

| |

| 5. | | Obtain from the independent auditors the written disclosures and the letter required by Independence Standards Board Standard No. 1; discuss with the auditors any disclosed relationships or services that may impact the objectivity and independence of the auditors; and take appropriate actions with respect to the independence of the auditors. |

| |

| 6. | | Recommend to the Board of Directors, based on reviews and discussions referred to in items 3 - 5, that the audited financial statements be included in the Company’s Annual Report on Form 10-K. |

| |

| 7. | | Review with management and the independent auditors the Company’s quarterly financial statements prior to filing of its Form 10-Q and earnings releases. |

| |

| 8. | | Review major changes to the Company’s auditing and accounting principles and practices. |

| |

| 9. | | Discuss with the external auditor, their opinion on the acceptability and appropriateness of material accounting principles and practices implemented by the Company. |

| |

| 10. | | Review management’s internal control report prior to its inclusion in the Company’s annual report, which addresses the effectiveness of the Company’s internal controls and procedures for purposes of financial reporting. Review and discuss with the external auditor, the internal auditor, and management all identified significant or material deficiencies in internal control over financial reporting. |

| |

| 11. | | Establish procedures for the receipt, retention, and treatment of complaints received by the Company regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

| |

| 12. | | Pre-approve all audit, review or attest engagements and permissible non-audit services to be provided to the Company by the independent auditors, and approve the fees of the independent auditors for such services; provided, however, that in no event shall the committee have the authority to pre-approve any non-audit services which may not be performed by the independent auditors under applicable law. |

| |

| 13. | | Review the findings, comments and recommendations of the independent auditors. |

| |

| 14. | | Provide a report in the Company’s proxy statement as required by the Securities and Exchange Commission. |

| |

| 15. | | At least annually, review this charter and any proposed changes shall be submitted to the Board of Directors for approval. |

| |

| 16. | | Engage independent counsel and all other advisers as the Audit Committee deems necessary to carry out its duties and responsibilities. |

21

WILLIAMS CONTROLS, INC.

Annual shareholder meeting, February 28, 2007

PROXY SOLICITED BY BOARD OF DIRECTORS

PLEASE SIGN AND RETURN THIS PROXY

The undersigned hereby appoints each of R. Eugene Goodson and Carlos P. Salas proxy with power of substitution and resubstitution to vote on behalf of the undersigned all shares that the undersigned may be entitled to vote at the annual shareholder meeting of Williams Controls, Inc. (the “Company”), on February 28, 2007, and any adjournments or postponements of that meeting, with all powers that the undersigned would possess, if personally present, with respect to the following:

| | 1. | | PROPOSAL TO ELECT THE FOLLOWING NOMINEES TO SERVE AS DIRECTORS OF THE COMPANY: |

| |

| | | Patrick W. Cavanagh | | |

| | | R. Eugene Goodson | | |

| | | Samuel H. Greenawalt | | |

| | | Douglas E. Hailey | | |

| | | Carlos P. Salas | | |

| | | Peter E. Salas | | |

| | | Donn J. Viola | | |

| |

| | | YOU MAY WITHHOLD AUTHORITY TO VOTE FOR EITHER OF BOTH OF THE NOMINEES BY WRITING THEIR NAME IN THE SPACE PROVIDED BELOW. |

| |

| | | [ ] FOR all seven nominees | | [ ] WITHHOLD AUTHORITY |

| | | listed above (except as indicated to | | to vote for all nominees listed above |

| | | the contrary below) | | |

| | | | | | | |

| | | (Instructions: Write the name of each nominee in the space above for whom authority to vote is withheld) |

| |

| 2. | | TRANSACTION OF ANY OTHER BUSINESS THAT MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENTS OF THE MEETING. A MAJORITY OF THE PROXIES OR SUBSTITUTES AT THE MEETING MAY EXERCISE ALL THE POWERS GRANTED BY THIS PROXY. |

The shares represented by this proxy will be voted as specified on the front of this proxy, but if no specification is made, this proxy will be voted FOR election of Patrick W. Cavanagh, R. Eugene Goodson, Samuel H. Greenawalt, Douglas E. Hailey, Carlos P. Salas, Peter E. Salas, and Donn J. Viola, unless an exception is indicated to the contrary above. The proxies may vote in their discretion as to other matters that may properly come before this meeting.

| | No. of Shares: | | Date: | | , 2007 | |

| | | |

| | Signature or Signatures |

Please date and sign above as your name is printed to the left of the signature line, including designation as executor, trust, etc., if applicable. A corporation must be signed for by the president or other authorized officer.

The annual shareholder meeting of Williams Controls, Inc. will be held at the offices of the Company located at 14100 South West 72nd Avenue, Portland, Oregon on February 28, 2007, at 8:30 a.m. Pacific Standard Time.

Please Note: Any shares of stock of the Company held in the name of fiduciaries, custodians or brokerage houses for the benefit of their clients may only be voted by the fiduciary, custodian or brokerage house itself. The beneficial owner may not directly vote or appoint a proxy to vote the shares and must instruct the person or entity in whose name the shares are held how to vote the shares held for the beneficial owner. Therefore, if any shares of stock of the Company are held in “street name” by a brokerage house, only the brokerage house, at the instructions of its client, may vote or appoint a proxy to vote the shares.