Exhibit 13

Feeding Tomorrow

2011 Annual Report

Inside:

| | |

Introduction |

| |

| 2 | | CEO Letter |

| |

| 7 | | A Comparison of Our Nutrients |

| |

| 8 | | Comparison to Peers |

|

| |

|

Management’s Discussion & Analysis |

|

Operating Context |

| |

| 10 | | Business Overview |

| |

| 12 | | The Value of Fertilizer |

|

Business Model |

| |

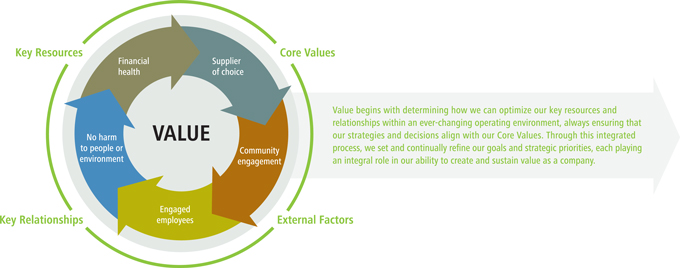

| 15 | | How We Create Value |

| |

| 20 | | Risks to Our Strategy |

|

Performance |

| |

| 23 | | Highlights |

| |

| 26 | | Factors Affecting Our 2011 Performance |

| |

| 28 | | 2012 Outlook |

| |

| 31 | | Goals & Targets |

|

Our Nutrients |

|

Potash |

| |

| 44 | | What Matters |

| |

| 45 | | Our Markets |

| |

| 46 | | Our Strategic Approach |

| |

| 46 | | Priorities |

| |

| 49 | | Results & Performance |

|

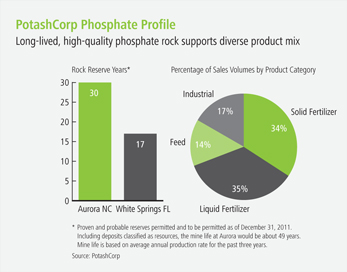

Phosphate |

| |

| 53 | | What Matters |

| |

| 53 | | Our Markets |

| |

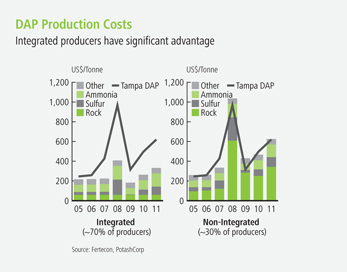

| 54 | | Our Strategic Approach |

| |

| 54 | | Priorities |

| |

| 55 | | Results & Performance |

| | |

Nitrogen |

| |

| 59 | | What Matters |

| |

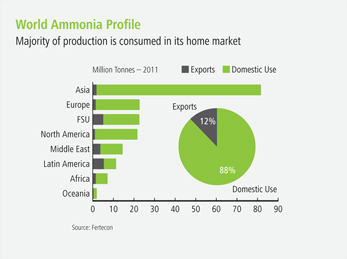

| 59 | | Our Markets |

| |

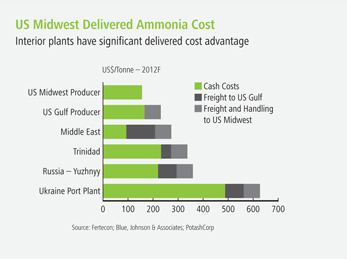

| 60 | | Our Strategic Approach |

| |

| 60 | | Priorities |

| |

| 61 | | Results & Performance |

|

Financial Structure |

| |

| 64 | | Expenses & Other Income |

| |

| 65 | | Quarterly Results |

| |

| 67 | | Financial Condition Review |

| |

| 68 | | Liquidity & Capital Resources |

| |

| 70 | | Capital Structure & Management |

| |

| 72 | | Other Financial Information |

| |

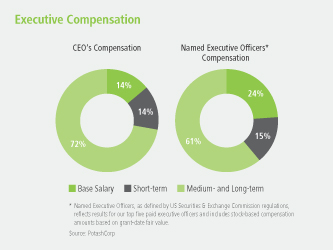

| 73 | | Governance & Remuneration |

| |

| 77 | | Forward-Looking Statements |

| |

| 78 | | Non-IFRS Financial Measures |

|

| |

| |

| 79 | | 11 Year Data |

|

| |

|

Financials |

| |

| 85 | | Management’s Responsibility for Financial Reporting |

| |

| 86 | | Independent Registered Chartered Accountants’ Reports |

| |

| 88 | | Consolidated Financial Statements |

|

| |

| |

| 156 | | Shareholder Information |

| |

| 157 | | Appendix |

|

| |

|

| Financial data in this report are stated in US dollars unless otherwise noted. |

Food and Our Future

We look to tomorrow with big aspirations.

We envision a world where no child goes to bed hungry, where dinner tables in every home are filled with healthy food. This aspiration motivates us as stewards of the resources and relationships with which we have been entrusted.

Our products play an important role in helping feed a rising world population. We are proud of our contribution to global food production, and excited by the value we believe can be generated for our stakeholders as we grow our company.

This report provides an update on our performance and strategies in all areas of our business, each designed to create lasting value. As we create such value, we know that what we do today is helping to feed tomorrow.

| | |

| PotashCorp 2011 Annual Report | | 1 |

Value Reporting

To be successful in a changing world, you have to evolve. Our reporting continues to reflect an evolution in the way we discuss how we create and sustain value in our business.

Although we have always managed our business in an integrated manner, this year we sought to improve the way we convey the connections among the factors that inform our strategies. We are doing this because we believe we have a responsibility not just to create value, but to help people better understand what we offer to the world.

You will see the same level of accountability for the company’s financial performance in the pages that follow, and online, but we have taken a step forward by discussing our financial and sustainability strategies and performance together, reflecting their interdependence. Our reporting will continue to evolve as we look for better ways to clearly and concisely communicate the role our strategies play in creating value for our key stakeholders.

This integrated report is a record of our process and progress in our pursuit of that worthy goal.

William J. Doyle

President and

Chief Executive Officer

CEO Letter

Part of a Bigger World

Throughout history, human progress has been rooted in agriculture. The ability to grow nutritious food has provided people with the opportunity to lead healthier lives, build stronger communities and create industries and social systems that support continuing advancement.

As the world’s largest fertilizer producer by capacity, PotashCorp plays an integral role in agriculture. Approximately 50 percent of global food production can be attributed to the use of nitrogen, phosphate and potash – the three essential crop nutrients we produce. In simple terms, our products help grow food.

| | |

| 2 | | PotashCorp 2011 Annual Report |

Ours is a business that connects us to people on every continent and inspires us to contribute to positive change – where we work, where we live and where we serve our customers. We recognize that we are part of a bigger world and that our performance as a fertilizer supplier, an employer, a community leader and an investment choice can create value beyond traditional measures.

Rather than accept a narrow view of our role, we work closely with our stakeholders to understand their needs and maximize the long-term benefits of our world-class assets.

By building strong relationships, prudently managing our resources and operating according to consistent, transparent values, we believe we can generate superior long-term financial performance. And, with strong and sustainable financial returns, we can grow to meet the needs of our customers and create opportunities for our people and our communities.

It is a circle of success that not only serves our company and our stakeholders, we believe it can help increase global food security and drive social and economic progress.

As Aristotle wrote 2,500 years ago, the whole is greater than the sum of its parts. At PotashCorp, we understand that our contributions to food production are felt on a broad scale.

A World With Growing Needs

While the past half-century brought unprecedented growth in food production, the challenge today is to keep pace with ongoing population and economic development.

World population has surpassed 7 billion – nearly double the number on the planet when I joined the fertilizer business almost 40 years ago. In recent decades, we have seen prosperity improve on a global scale, especially in the developing world, making it possible for millions of additional people to enjoy more and better food. While this is a tremendously positive human development story, the need to produce more food per acre puts constant pressure on the world’s farmers and their soils.

This challenge of feeding a growing world is not expected to subside. The United Nations estimates that the global population will exceed 9 billion by 2050 – another 2 billion people who need to eat. It is not good enough to hope for a record harvest; the world must generate higher crop yields year after year.

This is the reality facing global agriculture. To feed tomorrow, we need to start today.

“We believe we have a responsibility not just to create value, but to help people better understand what we offer the world.”

– William J. Doyle

| | |

| PotashCorp 2011 Annual Report | | 3 |

2011 Highlights

$3.51 per share*

80 percent increase in earnings from the previous year

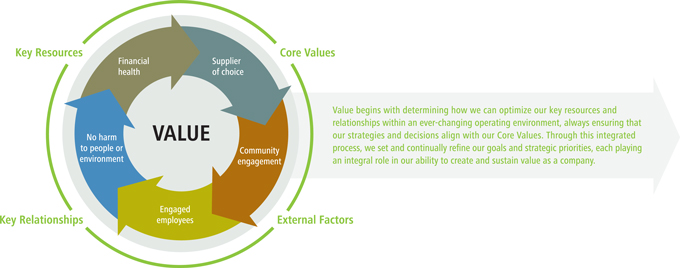

$3.5 billion

Record cash provided by operating activities

$21 million

Contribution to community organizations and causes

30%

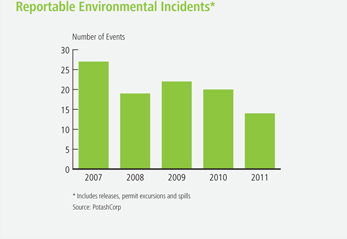

Reduction in reportable environmental incidents

Preparing Today

At PotashCorp, we recognize that creating sustainable value requires an integrated focus which acknowledges the needs of all those who are key to the ongoing success of our business.

To achieve this, we pursue long-term priorities which stem from the company goals that support our continuing growth and that of our stakeholders. In 2011, we took important steps forward in each of these areas.

We delivered the second-highest earnings per share in our history, 80 percent more than the previous year. Despite this strong financial result, our share performance was affected by macroeconomic uncertainty in the second half of the year and the resulting temporary slowdown in fertilizer demand. While we outperformed our fertilizer peer group, our total shareholder return failed to exceed that of our benchmark, the DAXglobal Agribusiness Index.

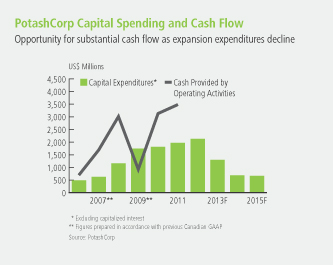

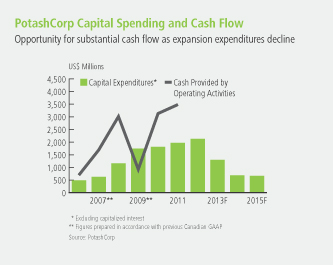

However, our strong financial performance and record cash flow allowed us to raise our dividend in both 2011 and 2012, and supported ongoing investment in our industry-leading potash expansion program. In 2011, we spent nearly $1.5 billion and moved a step closer to our expected 17.1 million tonnes of operational capability by 2015.

Our willingness and ability to prepare for our customers’ long-term needs, combined with the knowledge of our sales team and strength of our distribution system, helped us remain the supplier

| * | Diluted net income per share. |

| | |

| 4 | | PotashCorp 2011 Annual Report |

of choice in customer surveys again in 2011. While these results suggest that we are doing many things right, we know we must earn our stripes each and every day.

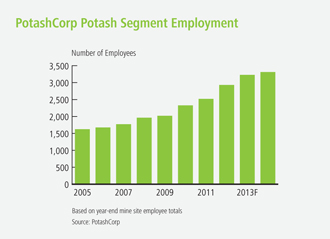

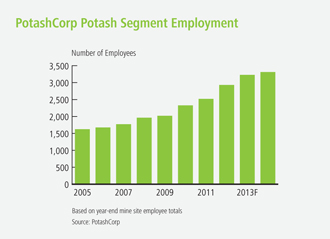

The value of our operations and ongoing expansion program is also being felt in our communities, as we create opportunities for people inside our company and attract new talent for the future. In 2011, we hired and trained 475 new employees and worked closely with local suppliers, creating economic benefits that help keep our communities growing. According to a recent economic impact study, our potash expansions are expected to create more than 36,000 person-years of employment in Saskatchewan, helping to drive the province’s strong economy.

We recognize that a community is built on more than its economy and that we can play a leadership role in improving the areas where we operate. We contributed a record $21 million to organizations and causes in 2011 – a product of our continuing financial strength. I am so proud that our employees also stepped up to the plate, not only through their financial contributions that we match as a company but through their tremendous volunteerism and participation in community events.

By being a good neighbor, we earn trust and support that are necessary to fuel our future growth. In each of the communities surveyed in 2011, PotashCorp earned recognition for leadership and contributions, but we also asked for feedback about things we could do better.

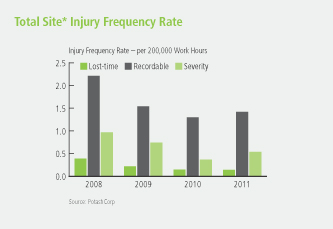

Every relationship is important to understanding the full measure of our performance, but we place one priority above all others: protecting our people.

Sadly, we experienced a fatality at our Aurora phosphate operation during the year – a painful reminder to every person in our company that we must always be vigilant in our focus on safety. This commitment resonates from the Board of Directors through our executive team to each and every front-line employee.

We also place priority on reducing our environmental impact. In 2011, our reportable environmental incidents decreased by 30 percent from the 2010 level – the lowest total in our company history. This demonstrates the commitment of our people to environmental responsibility today, so we can do our part in providing a better world tomorrow.

Feeding Tomorrow

We are confident that our value as a company and the importance of our contribution to global food production will rise in the years ahead.

The push to increase crop yields, underpinned by the basics of soil science and supportive crop economics, is expected to create more demand for all three essential crop nutrients. However, we believe it will have the greatest effect on potash, which historically has been under-applied in many developing regions.

| | |

| PotashCorp 2011 Annual Report | | 5 |

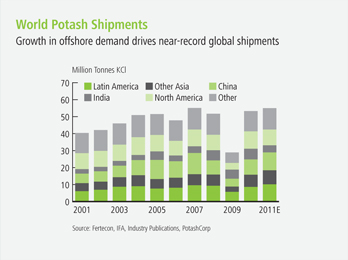

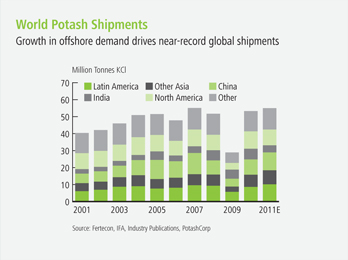

In 2011, global potash shipments reached an estimated 55 million tonnes, nearly eclipsing the previous record. We expect further increases in 2012 and beyond, and new supply will be required to meet this demand.

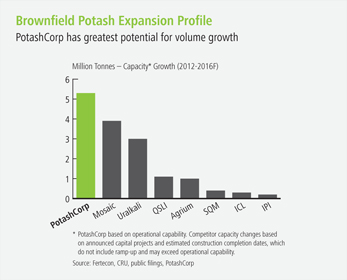

Many companies are now making announcements about staking new potash deposits, beginning feasibility studies or commencing early development work. These are initiatives that – if they proceed – will take significant capital investment and require many years to construct and ramp up to full production.

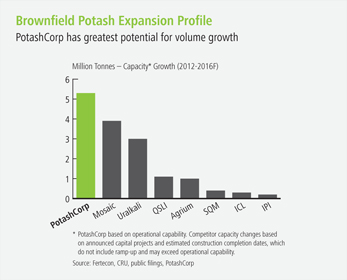

Against this backdrop, our decision to initiate expansions almost a decade ago differentiates us from our peers. We have now spent approximately 75 percent of the anticipated capital designed to almost double the capability we had when the program was initiated in 2003. We have completed projects at Rocanville, Allan, Lanigan, Cory and Patience Lake and have introduced new production in response to growing demand. We are ramping up production at Cory in 2012 and continue our major projects at Allan, Rocanville and New Brunswick.

While others are prospecting, planning or searching for capital, we are ready to bring on more new supply over the next five years than any other company. Our commitment to these projects – even through the depths of the recession in 2009 – means we were building when few others were, giving us what we believe will be a clear time and cost advantage.

By recognizing the long-term nature of our business, we are ready to contribute to feeding tomorrow and to deliver the benefits to all our stakeholders.

Responsible Long-Term Stewardship

Today’s world brings heightened expectations and new opportunities for our company, but we will continue to follow the same patient, disciplined and responsible approach that has defined PotashCorp for more than two decades.

We have access to some of the world’s best potash resources and we recognize our responsibility to be a good steward and maximize their long-term value – for our company and for those who will depend on them to protect soil fertility for generations to come.

As optimistic as we are about the future, we know that growth in the fertilizer industry does not follow a straight line. Even with the increase in global food demand, commodity and financial markets were volatile in 2011 because of macroeconomic issues such as concerns related to sovereign debt. This caused farmers and fertilizer dealers to move cautiously as the year came to a close.

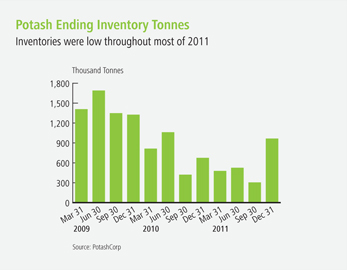

We responded as we have in the past by taking production downtime. This strategy of matching supply to demand reflects our continuing operational discipline and our commitment to thinking for the future. Our priority is long-term, responsible resource management rather than short-term rewards.

Measuring Value

In 2011, the Canadian Institute of Chartered Accountants (CICA) honored us with an award for the best financial reporting in Canada – the ninth consecutive year we have earned a place on the CICA awards list. Still, for the benefit of our stakeholders, we strive for continuing improvement.

This year you will see a further evolution in our reporting as we endeavor to provide all those who share our interest in PotashCorp with the best information possible to assess our performance. This approach is supported by a progressive and engaged Board of Directors which sets the stage for a high-performing company that delivers more than financial excellence.

This integrated way of operating – and now reporting – reflects the thinking of management and the commitment of our people. We believe that our approach will help us evolve as a company while playing a key role in feeding tomorrow.

William J. Doyle

President and Chief Executive Officer

February 21, 2012

| | |

| 6 | | PotashCorp 2011 Annual Report |

| | | | | | |

| |  | |  | |  |

| | | |

| How Used | | Fertilizer: | | Fertilizer: | | Fertilizer: |

| | | |

| | Improves root strength and disease resistance, assists water retention, enhances taste, color and texture of food | | Aids in photosynthesis, speeds crop maturity | | Builds proteins and enzymes, speeds plant growth |

| | | |

| | Feed: | | Feed: | | Feed: |

| | | |

| | Aids in animal growth and milk production | | Assists in muscle repair and skeletal development | | Essential to RNA, DMA and cell maturation |

| | | |

| | Industrial: | | Industrial: | | Industrial: |

| | | |

| | | Used in soaps, water softeners, de-icers, drilling muds and food products | | Used in soft drinks, food additives and metal treatments | | Used in plastics, resins and adhesives |

| | | |

| How Produced | | Mined from evaporated sea deposits | | Mined from ancient sea fossils | | Synthesized from air using steam and natural gas or coal |

| | | | |

| Number of Producing Countries | | 12 | | ~ 40 | | ~ 60 |

| | | |

| Percentage of Global Production Traded | | 76% | | 11% | | 12% |

| | | | |

| Raw Material Volatility | | Low | | Moderate-High | | Low-High |

| | | |

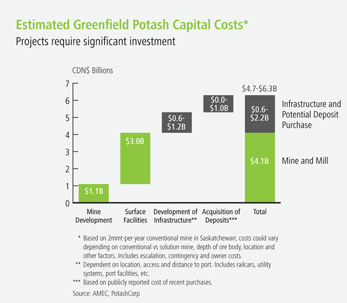

Time for Greenfield (including ramp-up) | | Minimum 7 years1 | | 3-4 years | | Minimum 3 years |

| | | | |

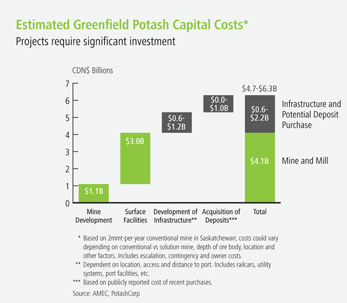

Cost of Greenfield (excluding infrastructure) | | CDN $4.1 billion1 2 million tonnes KCl | | US $1.6 billion2 1 million tonnes P2O5 | | US $1.7 billion3 1 million tonnes NH3 |

| | | |

Cost of Greenfield (including infrastructure)4 | | CDN $4.7-$6.3 billion 2 million tonnes KCl | | US $2.1-$2.3 billion 1 million tonnes P2O5 | | US $1.8-$2.0 billion 1 million tonnes NH3 |

| 1 | Estimated time and cost for a conventional greenfield mine in Saskatchewan |

| 2 | Phosphate rock mine, sulfuric acid plant, phosphoric acid plant and DAP/MAP granulation plant |

| 4 | Includes rail, utility systems, port facilities and, if applicable, cost of deposit |

Source: Fertecon, CRU, AMEC, PotashCorp

| | |

| PotashCorp 2011 Annual Report | | 7 |

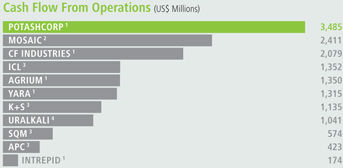

Comparison to Peers

Peers in Our Industry

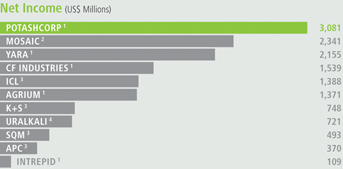

In our efforts to achieve the highest sustainable results for our shareholders, management evaluated our 2011 performance against the DAXglobal Agribusiness Index and our peers in the fertilizer sector. Some of the key metrics tracked are set out on this page.

Comparability of peer information

This information is included for comparison only. All peer group financial information included in the performance summary was obtained from publicly available reports published by the respective companies. We have not independently verified and cannot guarantee the accuracy or completeness of such information.

Readers are cautioned that not all of the companies identified in this group prepare their financial statements (and accompanying notes) in accordance with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB). Accounting principles generally accepted in the foreign jurisdictions in which these peers operate may vary in certain material respects from IFRS, as issued by the IASB. Further, companies which do prepare their statements according to IFRS may use varying interpretations of the standards. Such differences (if and as applicable) have not been identified or quantified for this performance summary. For those companies with fiscal year-ends other than December 31, all financial information was based on the 12-month period comprising the most recent four fiscal quarters reported upon by such companies. In addition to the issues described above, the different reporting periods among the peer group may affect comparability of the information presented.

Source: Bloomberg

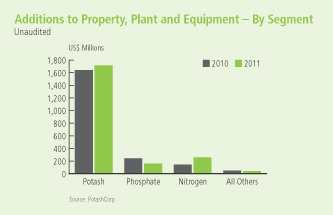

* Capital expenditures = additions to property, plant and equipment

1 Year ended December 31, 2011

2 Most recent four fiscal quarters ended November 30, 2011

3 Most recent four fiscal quarters ended September 30, 2011

4 Most recent two fiscal halfs ended June 30, 2011

| | |

| 8 | | PotashCorp 2011 Annual Report |

Management’s Discussion & Analysis

of Financial Condition and Results of Operations (in US dollars)

The following discussion and analysis is the responsibility of management and is as of February 21, 2012. The Board of Directors carries out its responsibility for review of this disclosure principally through its audit committee, comprised exclusively of independent directors. The audit committee reviews this disclosure and recommends its approval by the Board of Directors. Additional information relating to PotashCorp (which is not incorporated by reference herein) can be found in our regulatory filings on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

All references to per-share amounts pertain to diluted net income per share (EPS) as described in Note 22 to the consolidated financial statements.

Laboratory technician Karrie-Ann Noble observes construction of the new mill at our Rocanville potash mine.

Our Business – An Overview

Our Vision:

To play a key role in the global food solution while building long-term value for all stakeholders.

Who We Are:

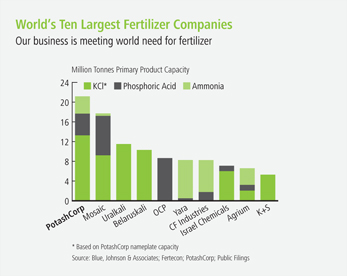

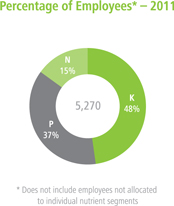

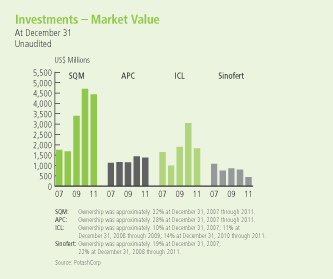

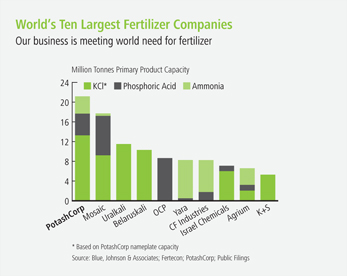

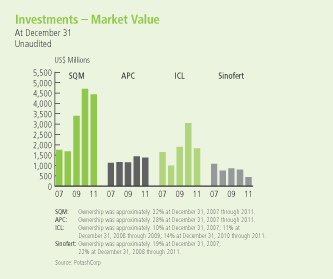

PotashCorp is the world’s largest fertilizer company by capacity1, producing the three primary crop nutrients – potash (K), phosphate (P) and nitrogen (N). Through our Canadian operations, we are responsible for about 20 percent of global potash capacity. In addition, we hold strategic investments in other potash-related businesses in South America, the Middle East and Asia. We complement our potash assets with focused positions in phosphate and nitrogen.

With operations and business interests in seven countries, PotashCorp is an international enterprise and a major player in meeting the growing challenge of feeding the world.

Our Operations and Communities:

| | | | | | |

| Potash | | Phosphate | | Nitrogen | | Investments |

| 1 Cory SK | | Mining/Processing: | | 1 Geismar LA | | 1 SQM, Chile (32%) |

| 2 Patience Lake SK | | 1 Aurora NC | | 2 Lima OH | | 2 ICL, Israel (14%) |

| 3 Allan SK | | 2 White Springs FL | | 3 Augusta GA | | 3 APC, Jordan (28%) |

| 4 Lanigan SK | | Upgrading: | | 4 Trinidad | | 4 Sinofert, China (22%) |

| 5 Rocanville SK | | 3 Weeping Water NE | | | | |

| 6 Sussex NB | | 4 Joplin MO | | | | |

| | 5 Marseilles IL | | | | |

| | 6 Cincinnati OH | | | | |

| | 7 Geismar LA | | | | |

| | |

| 10 | | PotashCorp 2011 Annual Report |

Our Business Segments

| | | | | | |

| 2011 DATA | | POTASH | | PHOSPHATE | | NITROGEN |

| | | |

| Percentage of World Capacity1 | | 20% #1 in the world | | 5% #3 in the world | | 2% #3 in the world |

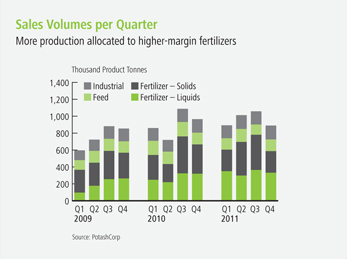

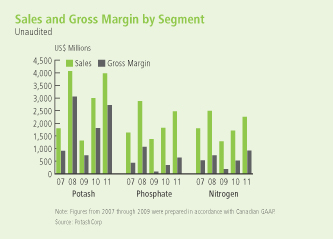

Sales Volumes by Segment

n Fertilizer

n Feed

n Industrial

Sales Volumes by Region

n North America

n Offshore

Gross Margin

Percentage of Net Sales

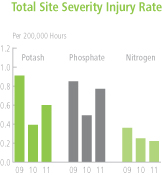

Total Site3Severity Injury Rate4

| 1 | Based on nameplate capacity at year-end 2011, which may exceed operational capability (estimated annual achievable production level) |

| 2 | Does not include employees not allocated to individual nutrient segments |

| 3 | Total site includes PotashCorp employees, contractors and all others on site. |

| 4 | Site severity injury rate is the total of lost-time injuries and modified work injuries for every 200,000 hours worked. |

| | |

| PotashCorp 2011 Annual Report | | 11 |

The Value of Fertilizer

| | |

| | As population rises to a projected 9 billion-plus by 2050 and diets improve in developing countries, the world faces unprecedented challenges to keep pace with the growing demand for food. Modern agriculture – which includes the use of balanced fertilization – is essential to address this need. |

| | Research shows that approximately 50 percent of food production can be attributed to fertilizer use, and we believe fertilizer will become even more important in the coming years. By following science-based fertilization practices, farmers today can grow more food while using less land, sparing the forests that protect our air and preserving the resources upon which life depends. |

| | The Food and Agriculture Organization of the United Nations (FAO) estimates that crop production must rise 70 percent by 2050 to meet the accelerating need for food. With declining arable land per capita, this means every acre must become more productive. |

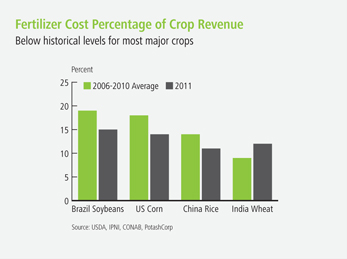

| | To grow more food, the world needs more fertilizer. This is particularly true in developing countries where farmers often do not apply crop nutrients at recommended levels and yields are well below those of the developed world. |

| | With demand for food rising and farmers motivated by strong agricultural fundamentals, the need for fertilizer has never been greater. As the world’s largest producer by capacity*, we play an important role in meeting this need. |

9billion +

Expected global population by 2050

Source: United Nations

~ 50%

Current crop yield directly attributable to fertilizer use

Source: Agronomy Journal (January-February 2005), IPNI

70%

Estimated increase in crop production required by 2050

Source: FAO

590billion

Equivalent tonnes of CO2that modern agriculture has kept from entering the atmosphere since the early 1960s

Source: PNAS (May 2010)

| * | See nameplate capacity description on Page 11. |

| | |

| 12 | | PotashCorp 2011 Annual Report |

| | |

| PotashCorp 2011 Annual Report | | 13 |

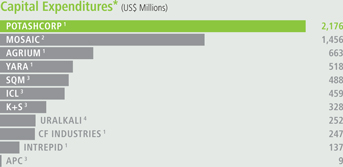

An Integrated Business Model

We believe that our ability to deliver superior long-term financial returns is the cornerstone of establishing enduring value for all stakeholders. Strong financial performance rewards our shareholders and, at the same time, allows us to focus on our broader social and environmental responsibilities and contribute to the long-term prosperity of our customers, employees, suppliers and communities.

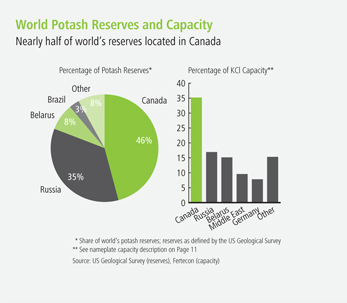

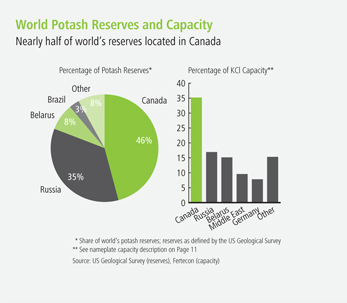

Industry-leading potash position

With six potash mines in Canada, we are the world’s largest producer by capacity* in an industry characterized by substantial barriers to entry, few producers and no known substitutes. We enhance this position with strategic investments in four global potash-focused companies.

Access to long-lived, high-quality potash reserves

Our potash facilities have access to decades of reserves and are among the lowest-cost potash mines in the world, with well-established infrastructure in place.

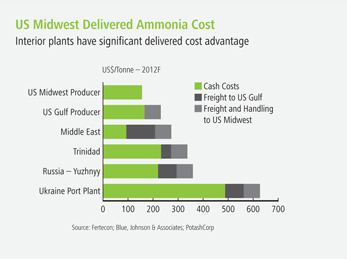

Focused positions in phosphate and nitrogen

Our high-quality, long-lived phosphate rock reserves give us the flexibility to produce a variety of products to maximize gross margin and reduce volatility. In nitrogen, the proximity of our plants to key markets provides a delivered cost advantage.

Financial strength and flexibility

A strong balance sheet – with what we consider low debt to equity – and proven track record of generating robust cash flow help ensure the access to capital we need to grow our business. We use this capital to invest in our company’s competitive advantages, further enhancing the value of our business.

Management team with extensive industry experience

Our experienced management team has deep-rooted knowledge and a long track record of leadership in conceiving, developing and implementing effective long-term strategies designed to protect and increase the company’s value.

Talented and engaged employees

Fair compensation and a commitment to develop and promote from within have helped build a workforce focused on using best practices to drive efficiency.

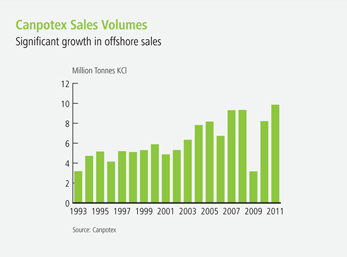

Strong supply chain and partnerships

In North America, we leverage our world-class distribution network to help us be the supplier of choice to our customers. Offshore, our partnership with marketing organizations Canpotex and PhosChem enables us to reliably and efficiently meet the growing needs of our customers.

Customers

Through regular communication and annual surveys, we work to understand how we can best serve the needs of our customers in ways that benefit their businesses and ours. We incorporate customer feedback to improve our service, products and processes.

Investors

We strive to communicate and report clearly to build trust with our investors, using ongoing engagement and annual surveys to gather feedback that improves our strategies and performance.

Communities

We seek to maximize our positive economic and social impact by building strong relationships within our communities, investing time and money in development initiatives that benefit the public and eliciting feedback through surveys and in-person meetings.

Employees

We engage with our employees and gather feedback to enhance their satisfaction and motivation. We look for ways to align performance with incentives and to cultivate long-term positive relationships with our workforce.

Suppliers and partners

We strive to establish strong relationships and partnerships to improve our ability to navigate through the opportunities and risks that impact our business. We focus on opportunities that enhance growth for our company and our partners.

| * | See nameplate capacity description on Page 11. |

We operate with integrity

We seek to treat people fairly and communicate promptly, completely and accurately with our stakeholders.

Our overriding concern is safety of people and the environment

We strive to create a “culture of caring” that extends throughout the workplace and beyond, constantly seeking ways to improve our safety and environmental performance and process.

We listen to all stakeholders

We engage in ongoing dialogue with all our stakeholders, looking for opportunities to strengthen our relationships, understand their needs and improve our performance.

We strive for continuing improvement

Through review and implementation of our Best Practices program, we focus on making management, safety, environmental and production processes more efficient and successful.

We share what we learn

Education is vital to our business. We work to empower all our employees to learn and teach, creating leaders within the company and our communities.

We are accessible, accountable and transparent

We establish annual goals and objectives for our fiscal, safety, environmental and social performance to help stakeholders understand the company’s direction, values and progress. We are committed to best practices in stakeholder communication and reporting on our performance.

Global economy

Population growth and improving economic conditions in the developing world are the key long-term drivers of the rising demand for food and fertilizer, and the performance and growth prospects for our company. Macroeconomic factors can affect short-term customer behaviors.

Supply/demand drivers

We monitor supply/demand fundamentals for each of our nutrients, as they play an integral role in the development of our strategies and in the company’s performance.

Laws and regulations

We operate in multiple jurisdictions and are subject to legal and regulatory mandates in all of those areas. We monitor compliance with the changing regulatory landscape in all aspects of our business.

Workforce demographics

Competition for skilled labor has increased substantially in recent years, particularly in Western Canada. We work continually to improve our recruitment and retention efforts to meet the needs of our business.

Tax environment

Our assets are located in regions of the world that historically are politically stable, with typically fair taxation policies.

| | |

| 16 | | PotashCorp 2011 Annual Report |

GOAL

Create superior long-term shareholder value

Our Strategic Approach

| • | | Devise and execute strategies that prioritize future earnings growth and reduce volatility across all business segments |

| • | | Strategically use capital to build competitive advantages, especially in potash |

| • | | Develop and implement governance practices that minimize risk, maximize management performance and ensure we operate with integrity and transparency |

Targets

| 32 | Total shareholder return |

| 33 | Governance practices ranking |

GOAL

Be the supplier of choice to the markets we serve

Our Strategic Approach

| • | | Build our potash operational capability to meet expected growth in global demand |

| • | | Invest in our transportation and distribution system to efficiently meet our customers’ needs |

| • | | Establish standards for customer service and product quality that set us apart from our competitors |

Targets

| 34 | Product quality and service measurements |

| 35 | Number of quality-related customer complaints |

GOAL

Build strong relationships with and improve the socioeconomic well-being of our communities

Our Strategic Approach

| • | | Contribute to economic growth by creating direct and indirect jobs, purchasing locally, attracting investment and paying our fair share of taxes |

| • | | Target community investments in organizations and projects that bring sustaining value in the regions where we operate, and more widely, through corporate and site contributions, matching of employee gifts, in-kind contributions and employee volunteerism. |

| • | | Participate in outreach projects to share information and best practices about fertilizer use, environmental matters and safety |

Targets

| 37 | Community leader surveys |

| 37 | Employee matching gift and donation participation |

| | |

| PotashCorp 2011 Annual Report | | 17 |

GOAL

Attract and retain talented, motivated and productive employees who are committed to our long-term goals

Our Strategic Approach

| • | | Offer competitive compensation and provide opportunities for employee development and advancement |

| • | | Promote from within when qualified candidates are available for open positions |

| • | | Provide equal opportunity in hiring, promotions, wages, benefits, and terms and conditions of employment |

| • | | Communicate our goals and expectations clearly, particularly in matters regarding ethics and workplace behavior |

Targets

| 38 | Employee engagement scores |

| 38 | Senior staff internal promotion metrics |

| 39 | External staff-level employment acceptance rate |

GOAL

Achieve no harm to people and no damage to the environment

Our Strategic Approach

| • | | Use peer-to-peer behavior-based process to improve safety and environmental performance |

| • | | Meet or exceed all federal, state, provincial and local environmental and safety requirements |

| • | | Use our Best Practices program to pilot and refine innovative processes that improve safety and efficiency and minimize water, waste and emissions |

| • | | Actively preserve habitat and promote natural biodiversity in areas where we operate |

Targets

| 40 | Site severity injury rates and life-altering injuries |

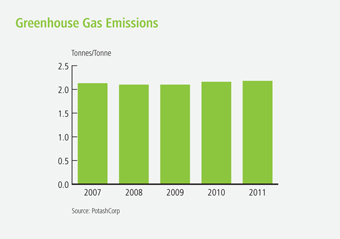

| 40 | Greenhouse gas emissions |

| 41 | Reportable environmental incidents |

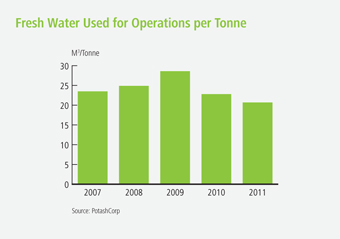

| 41 | Water usage per product tonne |

Creating Value Through Strategy

In all areas of our business, we set goals and design strategies that focus on delivering sustainable value while appropriately balancing stakeholder interests. We demonstrate our accountability by tracking and reporting our progress against targets related to each goal.

Risks to Our Strategy

Our Approach to Managing Risk

We must effectively manage risks associated with our business goals, which we achieve through the successful execution of our corporate strategy. After evaluating risks for their potential severity and likelihood to adversely affect the company, we rank them and determine the most appropriate responses among accept, control, share, transfer, diversify or avoid.

The risks that can threaten our business are often integrated, and affect each other. Only by understanding the inherent risks within each risk category can we design and implement mitigation activities so we can execute our strategies and meet our business goals within acceptable residual risk tolerances.

Our assessment of risk considers both financial and non-financial items. Six categories of risks have been identified within our global environment: market/business, distribution, operational, financial, compliance and organizational.

We view damage to our reputation as the most severe risk consequence faced by PotashCorp, which could impact the

execution of our corporate strategy. We mitigate this risk by acting ethically and with integrity while striving to continually build goodwill through a commitment to sustainability, transparency, effective communication and corporate governance best practices.

Our Risk Management Process

After identifying an inherent risk, we assess it against our risk ranking matrix as if no mitigation measures had been taken. Through the matrix, we weigh the severity and likelihood of such a potential event, and establish relative risk levels from A through E to guide our mitigation activities.

We can lower risk by reducing the likelihood of the initiating event occurring or by reducing significance of the consequence if it does occur.

Residual risk remains after mitigation and control measures are applied to an identified risk. We endeavor to be fully aware of all potential risks that could adversely affect PotashCorp, and to choose appropriately the levels of residual risk we accept.

| | | | | | | | | | | | | | | | |

| PotashCorp Risk Management Ranking Methodology |

Risk Ranking Matrix | | SEVERITY OF CONSEQUENCE |

| | 1 | | 2 | | 3 | | 4 | | 5 |

| | Negligible | | Low | | Acceptable | | Major | | Extreme |

LIKELIHOOD OR FREQUENCY | | | 5 | | | Probable(0-6 months) | | C | | B | | B | | A | | A |

| | | 4 | | | High(6 months-2 years) | | D | | C | | B | | B | | A |

| | | 3 | | | Medium(2-10 years) | | D | | D | | C | | B | | B |

| | | 2 | | | Low(10-50 years) | | E | | D | | D | | C | | B |

| | | 1 | | | Remote(> 50 years) | | E | | E | | D | | D | | C |

A Extreme: Initiate mitigation activities immediately to reduce risk. If such activities cannot sufficiently reduce risk level, consider discontinuation of the applicable business operation to avoid the risk.

B Major: Initiate mitigation activities at next available opportunity to reduce risk. If such activities cannot sufficiently reduce the risk level, Board approval is required to confirm acceptance of this level of risk.

C Acceptable: Level of risk is acceptable within tolerances of the risk management policy. Additional risk mitigation activities may be considered if benefits significantly exceed cost.

D Low: Monitor risk according to risk management policy requirements, but no additional activities required.

E Negligible:Consider discontinuing any related mitigation activities so resources can be directed to higher-value activities, provided such discontinuance does not adversely affect any other risk areas.

| | |

| 20 | | PotashCorp 2011 Annual Report |

Risk Management Roles and Responsibilities

The roles and responsibilities of the various participants in our risk management program are outlined in our risk governance structure.

Board of Directors:

| • | | Oversees the risk management process to ensure the program is appropriate and regularly reviewed and evaluated. The responsibilities include ensuring adequate policies, procedures and systems are in place to implement the strategy and manage risk. This is primarily accomplished through its committees: |

| | - | The audit committee monitors the company risk management process quarterly, or more frequently if required, focusing primarily on financial and regulatory compliance risk. |

| | - | The safety, health and environment committee and corporate governance and nominating committee focus primarily on risks in their areas of oversight. |

| | - | The compensation committee focuses on risks in its area of oversight, including assessment of compensation programs to ensure they do not encourage increased corporate risk. |

Risk management committee:

| • | | Comprised of cross-functional members of the senior management team, this committee monitors our overall risk profile associated with our business goals and corporate strategy. |

| • | | Establishes the risk management process to identify, assess, rank, monitor and manage risks. |

| | • | | Maintains our company-wide risk management framework, and regularly reviews our risk management policy and regulatory requirements. |

| | • | | Reports quarterly, or more frequently if required, to the CEO and the audit committee on all significant risks, including new or increased risks resulting from changes in operations or external factors. |

| | • | | Reports to the Board of Directors at an annual presentation and discussion on risk management. |

Internal audit:

| • | | Provides independent and objective assurance and consulting services to evaluate and report to management and the audit committee on the effectiveness of governance, risk management and control processes. |

Internal control compliance team:

| • | | Ensures identification and management of risks related to internal controls over financial reporting by reviewing and testing such controls. |

Business segments:

| • | | Identify and manage risks within their areas of responsibility. |

Key Business Risks

Risks specific to our company are discussed below. In addition to the following, please refer to the information under the section entitled “Risk Factors” in Item 1 of our Form 10-K for the fiscal year ended December 31, 2011 for a more complete discussion of significant risks we face.

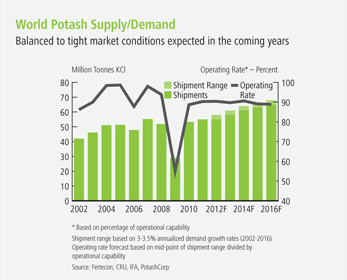

New potash supply creates market imbalance

Tight supply/demand fundamentals and strong gross margins have encouraged investment in new potash capacity. If supply rises faster than world consumption, prices could be depressed for a prolonged period, negatively affecting our financial performance. While we anticipate that long-term growth in consumption will require increased supply, we know that fluctuations in demand are characteristic of this market. We attempt to mitigate this risk and protect our margins by producing to meet market demand.

| | |

| PotashCorp 2011 Annual Report | | 21 |

Global potash demand insufficient to consume PotashCorp capacity

In preparation for an anticipated increase in world potash demand, we are investing in expansion and debottlenecking projects that we expect will be completed by 2015. If our estimates of future potash demand prove to be overstated, our return on this investment may be lower than expected due to lower earnings and the related opportunity cost of expending significant capital before it was needed. Our low percentage of fixed costs and other operating processes allows us to remain profitable at reduced production rates.

Lack of adequate transportation and distribution infrastructure

An integrated transportation and distribution infrastructure of railcars, barges, ocean freightliners, and warehouse and port storage facilities delivers potash to our customers quickly and efficiently. Short-term problems – such as railcar shortages, strikes, derailments or adverse weather – could disrupt or slow delivery time, which could lead to customer dissatisfaction, loss of sales and higher distribution costs, making it difficult to achieve our growth plans.

We attempt to mitigate this risk by working internally and through Canpotex to ensure processes are streamlined and sufficient investment is made in transportation and distribution infrastructure to help potash move as smoothly as possible.

Underground potash mines face particular risks

Water-bearing strata that pose the risk of water inflow often exist in the vicinity of underground mines. We are successfully managing water inflows at our New Brunswick operation, while our other conventional mines currently have no significant water inflows. At Esterhazy, where our mineral rights are mined by another producer under a mining and processing agreement, water inflows are being managed.

Unexpected rock falls that can result in life-threatening injuries are a risk for all underground mining companies. We use advanced monitoring and geophysical techniques to help predict problematic situations.

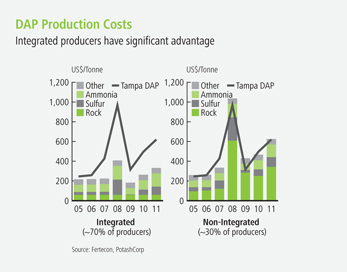

Cyclicality in phosphate

Fluctuations in demand, changes in available supply and volatility in raw material costs have historically caused short-term cyclicality in phosphate markets. Volatility has often been exacerbated because of the significant involvement in

the industry by governments, which typically follow operating philosophies that favor production over profitability.

Growth in world consumption may be outpaced over the next few years by increased competitive supply of solid fertilizer, potentially depressing prices and affecting our phosphate margins. We take action to mitigate this risk through our product diversification, leveraging our strengths in less cyclical industrial and feed products and streamlining our operations and logistics to minimize costs.

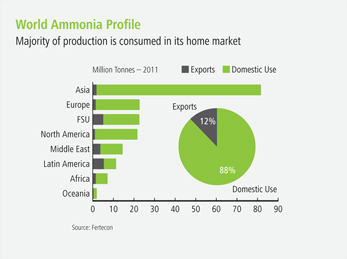

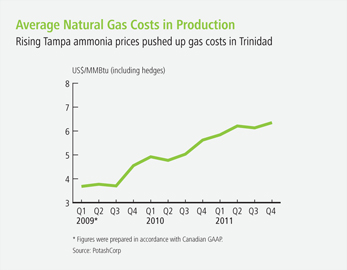

Cyclicality in nitrogen

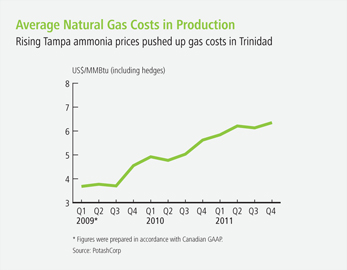

Price cyclicality can result when nitrogen supply is increased without consideration of demand, a situation that may occur in an industry that is highly fragmented and regional due to the extensive availability of natural gas. To mitigate this risk, we have longer-term gas contracts in Trinidad primarily indexed to ammonia prices and employ gas price hedging strategies for our US plants. We focus on supplying less cyclical industrial markets.

Security and downstream products risks

Deliberate, malicious acts involving our facilities or our downstream products could cause injury, property damage or harm to our reputation. We regularly monitor and evaluate ongoing security risks at our facilities and take steps to address potential issues. We have a comprehensive system for tracking the transport and delivery of all our industrial ammonium nitrate and ammonia sales, and our systems are regularly reviewed to ensure they remain effective. We address and mitigate risk of intentional adulteration with testing and recall procedures for our food grade and animal feed products.

Security risks related to information technology systems

As an integrated fertilizer and related industrial and feed products company, information technology and related processes do not form the core of our business. However, in response to a risk of unauthorized access to confidential information, which could result from a breach of our information technology systems, we have taken measures to protect confidential information and the manner in which it is processed and communicated. Because the information systems we use continue to change, we regularly test them, and we also periodically employ third-party security providers to monitor and strengthen them. We provide education to our employees to attempt to minimize the risk of breaches, error, malfeasance or other irregularities.

| | |

| 22 | | PotashCorp 2011 Annual Report |

Jamie Collins, Mine Practical Training Coordinator, supervises the operations of a boring machine at our Lanigan potash mine.

Performance

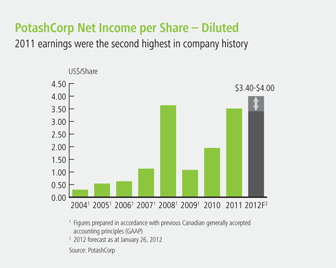

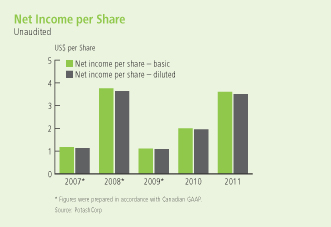

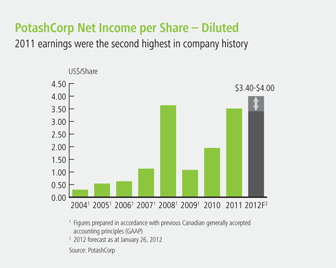

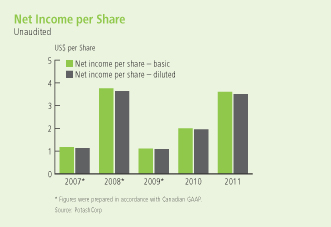

In 2011, we delivered our second-highest earnings per share on record, nearly surpassing the total achieved in 2008. These strong earnings – and the potential for rising earnings in the years ahead – not only create opportunities for our shareholders, they enhance our ability to generate value for all stakeholders.

* Figures prepared in accordance with previous Canadian GAAP

Financial Performance Highlights

| | | | | | | | | | |

| (in millions of US dollars except ratio percentages and per-share amounts) | | 2011 | | 2010 | | 20091 | | 20081 | | 20071 |

| | | | | | | | | | |

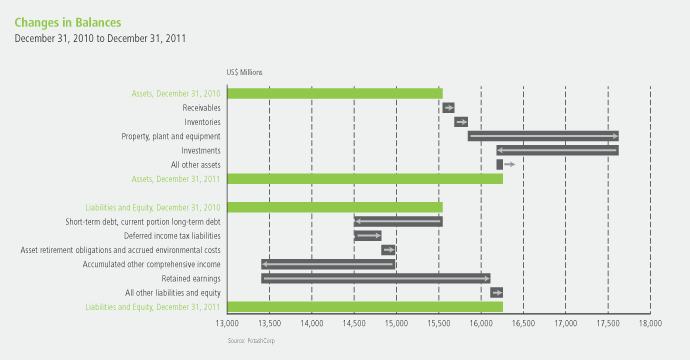

Financial Position | | | | | | | | | | |

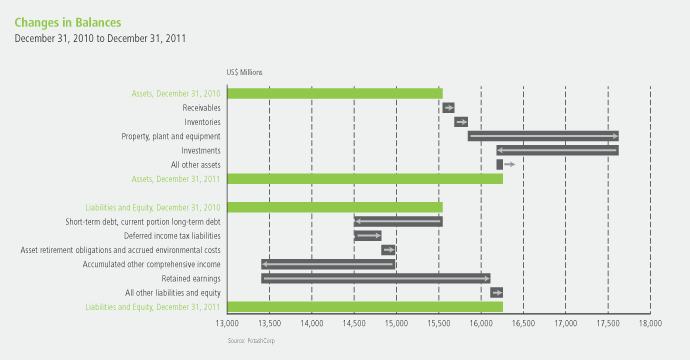

Current assets | | 2,408 | | 2,095 | | 2,272 | | 2,267 | | 1,811 |

Property, plant and equipment | | 9,922 | | 8,141 | | 6,413 | | 4,812 | | 3,887 |

Other long-term assets | | 3,927 | | 5,311 | | 4,237 | | 3,170 | | 4,019 |

Total assets | | 16,257 | | 15,547 | | 12,922 | | 10,249 | | 9,717 |

Current liabilities | | 2,194 | | 3,144 | | 1,577 | | 2,623 | | 1,002 |

Long-term debt | | 3,705 | | 3,707 | | 3,319 | | 1,740 | | 1,339 |

Other long-term liabilities | | 2,511 | | 2,011 | | 1,586 | | 1,351 | | 1,382 |

Shareholders’ equity | | 7,847 | | 6,685 | | 6,440 | | 4,535 | | 5,994 |

Total liabilities and shareholders’ equity | | 16,257 | | 15,547 | | 12,922 | | 10,249 | | 9,717 |

Total debt to capital percentage | | 36.6 | | 45.5 | | 38.6 | | 40.3 | | 19.3 |

Working capital ratio | | 1.10 | | 0.67 | | 1.44 | | 0.86 | | 1.81 |

| | | | | |

Financial Results | | | | | | | | | | |

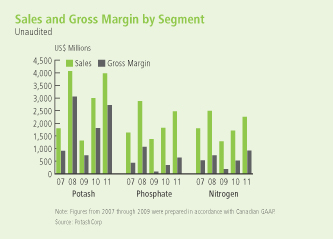

Sales | | 8,715 | | 6,539 | | 3,977 | | 9,447 | | 5,234 |

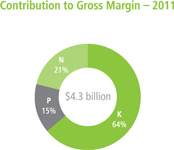

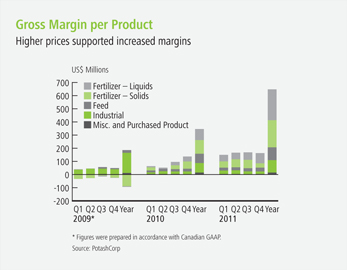

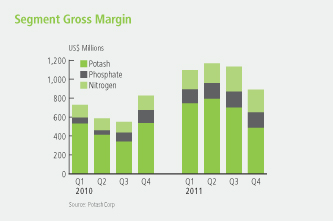

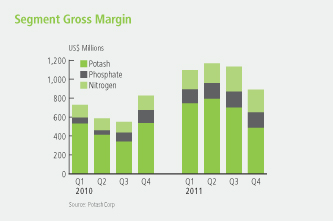

Gross margin – Potash | | 2,722 | | 1,816 | | 731 | | 3,056 | | 912 |

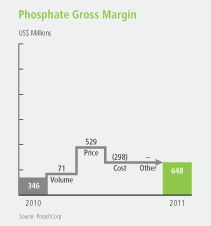

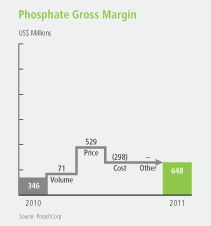

Gross margin – Phosphate | | 648 | | 346 | | 92 | | 1,068 | | 434 |

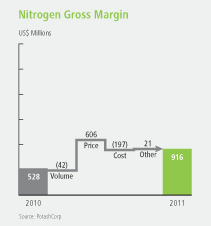

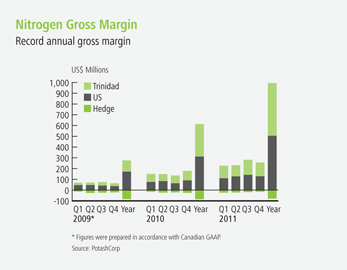

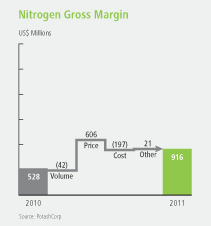

Gross margin – Nitrogen | | 916 | | 528 | | 192 | | 737 | | 536 |

Total gross margin | | 4,286 | | 2,690 | | 1,015 | | 4,861 | | 1,882 |

Total gross margin as a percentage of sales | | 49 | | 41 | | 26 | | 51 | | 36 |

Net income | | 3,081 | | 1,775 | | 981 | | 3,466 | | 1,104 |

Net income per share – diluted | | 3.51 | | 1.95 | | 1.08 | | 3.64 | | 1.13 |

Cash provided by operating activities | | 3,485 | | 3,131 | | 924 | | 3,013 | | 1,689 |

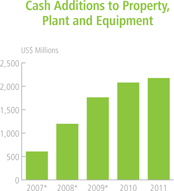

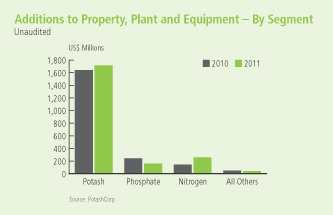

Cash additions to property, plant and equipment | | 2,176 | | 2,079 | | 1,764 | | 1,198 | | 607 |

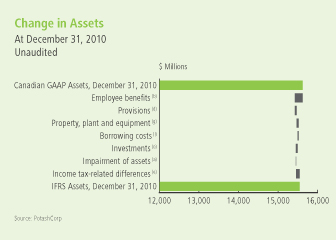

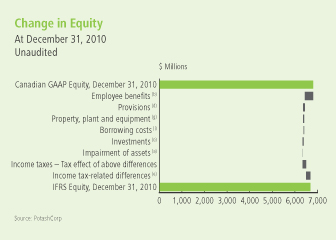

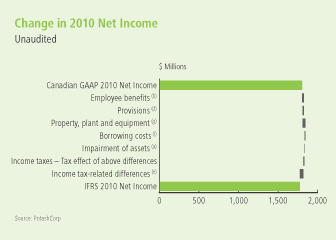

| 1 | As we adopted International Financial Reporting Standards (IFRS) with effect from January 1, 2010, our 2007 to 2009 information is presented on a previous Canadian generally accepted accounting principles (GAAP) basis. Accordingly, information for prior years may not be comparable to 2010 and 2011. |

| | |

| PotashCorp 2011 Annual Report | | 23 |

We report our results (including gross margin) in three business segments: potash, phosphate and nitrogen, as described in Note 16 to the consolidated financial statements. Our reporting structure reflects how we manage our business and how we classify our operations for planning and measuring performance. We include net sales in our segment disclosures in the consolidated financial statements pursuant to International Financial Reporting Standards (IFRS) as issued by the International Accounting Standards Board (IASB), which require segmentation based upon our internal organization and reporting of revenue and profit

measures derived from internal accounting methods. As a component of gross margin, net sales (and the related per-tonne amounts) are primary revenue measures we use and review in making decisions about operating matters on a business segment basis. These decisions include assessments about performance and the resources to be allocated to these segments. We also use net sales (and the related per-tonne amounts) for business planning and monthly forecasting. Net sales are calculated as sales revenues less freight, transportation and distribution expenses. Realized prices refer to net sales prices.

2011 Earnings Compared to Guidance

Our initial midpoint estimate for 2011 EPS, based on the outlook and assumptions described in our 2010 Financial Review Annual Report, was approximately $3.00. The final result was $3.51. The factors contributing to this increase from our guidance midpoint were:

| | | | |

| Potash offshore realized prices | | $ | 0.18 | |

| Potash North America realized prices | | | 0.08 | |

| Potash offshore sales volumes | | | (0.06 | ) |

| Potash North America sales volumes | | | (0.13 | ) |

| Increased other potash costs | | | (0.02 | ) |

| Increased provincial mining taxes | | | (0.02 | ) |

| Subtotal potash | | | 0.03 | |

| Phosphate realized prices | | | 0.23 | |

| Phosphate sales volumes | | | 0.08 | |

| Increased sulfur input costs | | | (0.05 | ) |

| Increased ammonia input costs | | | (0.05 | ) |

| Increased rock costs | | | (0.02 | ) |

| Increased other phosphate costs | | | (0.03 | ) |

| Subtotal phosphate | | | 0.16 | |

| Nitrogen realized prices | | | 0.36 | |

| Manufactured nitrogen sales volumes | | | (0.01 | ) |

| Increased cost of natural gas | | | (0.12 | ) |

| Decreased other nitrogen costs | | | 0.04 | |

| Subtotal nitrogen | | | 0.27 | |

| Increased share of earnings of equity-accounted investees | | | 0.06 | |

| Increased dividend income | | | 0.01 | |

| Increased other expenses | | | (0.01 | ) |

| Increased finance costs | | | (0.03 | ) |

| Subtotal other | | | 0.03 | |

| Subtotal of the above | | | 0.49 | |

| Lower income tax rate on ordinary income | | | 0.05 | |

| Discrete items impacting income taxes | | | (0.03 | ) |

| Total variance from 2011 EPS guidance | | $ | 0.51 | |

2011 Earnings Compared to 2010

Our EPS for 2010 was $1.95. The final EPS for 2011 was $3.51. The factors contributing to this increase from last year’s actual results were:

| | | | |

| Potash offshore realized prices | | $ | 0.44 | |

| Potash North America realized prices | | | 0.30 | |

| Potash offshore sales volumes | | | 0.11 | |

| Potash North America sales volumes | | | (0.06 | ) |

| Increased potash costs due to foreign exchange | | | (0.04 | ) |

| Increased other potash costs | | | (0.01 | ) |

| Increased provincial mining taxes | | | (0.06 | ) |

| Subtotal potash | | | 0.68 | |

| Phosphate realized prices | | | 0.43 | |

| Phosphate sales volumes | | | 0.06 | |

| Increased sulfur input costs | | | (0.13 | ) |

| Increased ammonia input costs | | | (0.03 | ) |

| Increased rock costs | | | (0.02 | ) |

| Increased other phosphate costs | | | (0.07 | ) |

| Subtotal phosphate | | | 0.24 | |

| Nitrogen realized prices | | | 0.49 | |

| Manufactured nitrogen sales volumes | | | (0.04 | ) |

| Increased cost of natural gas | | | (0.12 | ) |

| Increased other nitrogen costs | | | (0.01 | ) |

| Subtotal nitrogen | | | 0.32 | |

| Decreased selling and administrative expenses | | | 0.01 | |

| Increased share of earnings of equity-accounted investees | | | 0.07 | |

| Decreased dividend income | | | (0.02 | ) |

| Decreased other expenses | | | 0.09 | |

| Increased finance costs | | | (0.03 | ) |

| Subtotal other | | | 0.12 | |

| Subtotal of the above | | | 1.36 | |

Reduction in weighted average shares outstanding | | | 0.12 | |

| Discrete items impacting income taxes | | | 0.08 | |

| Total variance from 2010 EPS | | $ | 1.56 | |

| | |

| 24 | | PotashCorp 2011 Annual Report |

Non-Financial Performance Highlights

| | | | | | | | | | |

Customers | | | | | | | | | | |

Average customer survey scores1 | | 90% | | 90% | | 89% | | 91% | | 90% |

| | | | | |

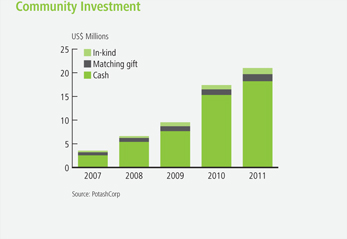

Community | ���� | | | | | | | | | |

Community investment ($ millions)2 | | 21 | | 17 | | 10 | | 7 | | 4 |

Taxes and royalties ($ millions) 3 | | 997 | | 620 | | (8) | | 1,684 | | 507 |

| | | | | |

Employees | | | | | | | | | | |

Average employee engagement score4 | | 73% | | 73% | | 76% | | 79% | | 69% |

| | | | | |

Environment | | | | | | | | | | |

Environmental incidents5 | | 14 | | 20 | | 22 | | 19 | | 25 |

| | | | | |

Safety | | | | | | | | | | |

Total site 6 severity injury rate7 | | 0.54 | | 0.38 | | 0.74 | | 0.97 | | n/a |

| | n/a | = not available as data had not been previously compiled consistent with current methodology |

| | 1 | The annual customer satisfaction survey is conducted online by an independent third party and includes a select group of top customers from each sales segment and region to form a Customer Advisory Council. Customers were asked to commit to participate in annual satisfaction surveys for five years, to ensure consistent measurement and reporting of customer satisfaction. Results are determined by taking a simple average of the eight metrics described on Page 34. |

| | 2 | Represents cash disbursements, matching of employee gifts and in-kind contributions of equipment, goods, services and employee volunteerism (on corporate time). |

| | 3 | Includes current income taxes, potash production tax, resource surcharge, royalties, municipal taxes and other miscellaneous taxes less investment tax credits calculated on an accrual basis. |

| | 4 | A confidential external survey is administered to every employee every second year. |

| | 5 | Includes reportable quantity releases (a release whose quantity equals or exceeds the US Environmental Protection Agency’s notification level and is reportable to the National Response Center (NRC)), permit excursions (an exceedance of a federal, state, provincial or local permit condition or regulatory limit) and provincial reportable spills (an unconfined spill or release into the environment). |

| | 6 | Total site includes PotashCorp employees, contractors and all others on site. |

| | 7 | Total of lost-time injuries (a lost-time injury or illness occurs when the injured person is unable to return to work on his/her next scheduled workday after the injury) and modified work injuries (a work-related injury or illness where a licensed health care professional or the employer recommends that the employee not perform one or more of the routine functions of the job or not work the full workday that the employee would have otherwise worked) for every 200,000 hours worked. |

| | |

| PotashCorp 2011 Annual Report | | 25 |

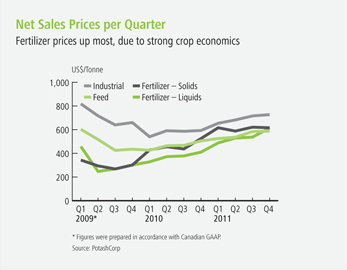

Factors Affecting Our 2011 Performance

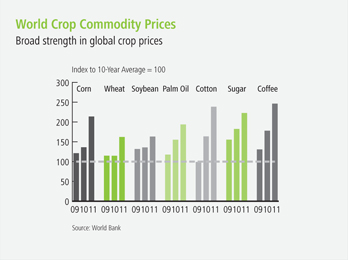

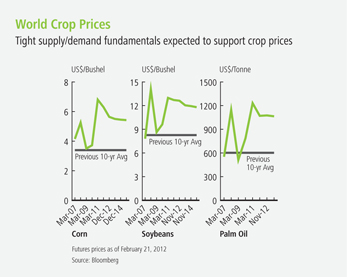

Broad strength in crop commodity prices supports farmer returns

Rising demand for agricultural commodities continued to pressure global grain supplies in 2011. Prices for a wide range of crops remained well above historical averages, despite increased volatility related to global economic uncertainties in the second half of the year.

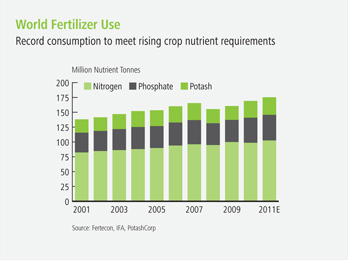

Higher prices for their crops more than offset farmers’ increased input costs, resulting in record or near-record returns in most growing regions. This economic incentive and the nutrient requirements necessary to produce increased yields contributed to record global fertilizer demand.

Record demand pressures global fertilizer supply; prices climb

Potash

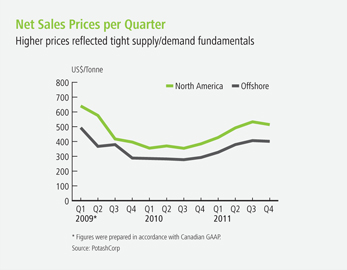

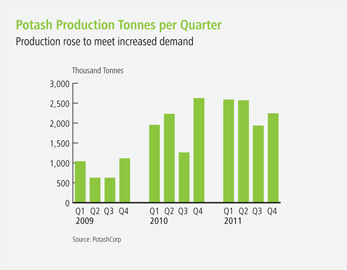

World potash demand increased by more than 3 percent to approximately 55 million tonnes in 2011. Strong demand in Latin America, China and Southeast Asian countries offset reduced shipments to North America and India. Deliveries to India were impacted by extended contract negotiations. We believe global producers operated at or near full capability for most of the year to meet increased demand.

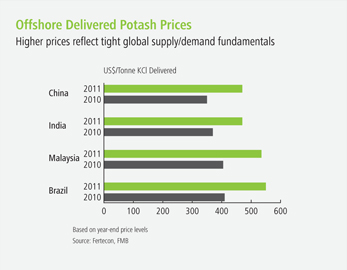

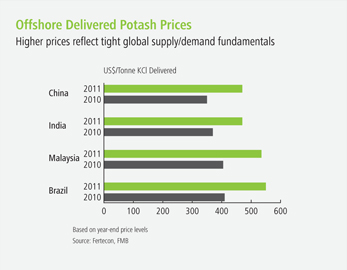

Potash prices rose in response to the strength in agriculture fundamentals and the pressure on world potash supply. Prices in offshore spot markets such as Brazil and Malaysia increased by more than $125 per tonne during the year and contracts with customers in China and India climbed $120 per tonne and $100 per tonne, respectively, compared to the end of 2010. US Midwest wholesale prices rose by approximately $55 per tonne during the year.

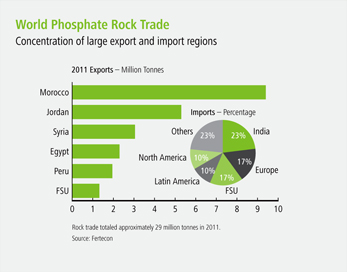

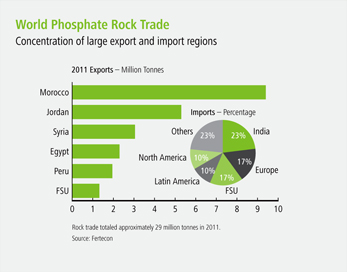

Phosphate

Global phosphate fertilizer trade was similar to 2010 levels as increased shipments to Latin America offset lower sales to India. Supply tightened due to production outages in North Africa and the Middle East and permanent shutdowns of plants in the US and Spain.

Phosphate rock prices increased, impacting costs for producers without their own supply, and prices for sulfur and ammonia inputs rose. Phosphate prices increased in response to relatively tight supply/demand fundamentals and higher production costs.

| | |

| 26 | | PotashCorp 2011 Annual Report |

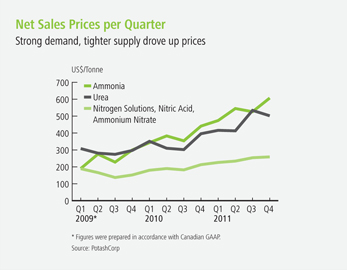

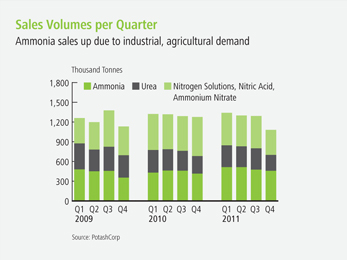

Nitrogen

Strong agricultural and industrial markets drove nitrogen consumption to record levels in 2011. Supply was affected by unplanned maintenance and gas supply outages in major producing regions such as Trinidad, Europe, Australia and North Africa, construction delays on new projects and reduced urea exports from China.

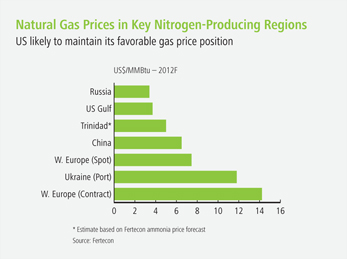

Prices for nitrogen products moved higher in response to robust demand and tight supply. US nitrogen producers benefited from favorable natural gas costs compared to suppliers in Ukraine, Western Europe and China.

Global macroeconomic concerns make fertilizer buyers cautious in fourth quarter

While supportive crop economics kept consumption relatively strong in most markets throughout the fourth quarter, fertilizer dealers purchased more cautiously in response to global macroeconomic concerns. They focused on immediate needs by drawing down inventories and purchasing limited quantities from suppliers.

As demand slowed, prices for nitrogen and phosphate softened during the quarter. While potash pricing remained relatively stable in most major markets, the North American market pulled back slightly on weak demand and increased pressure from record offshore imports.

Competition for materials and skilled labor increases potash expansion costs

Despite weakness in many developed economies, Western Canada remained a region of significant economic strength.

In this environment, the cost for securing certain materials and skilled labor rose in 2011. As a result, the estimated cost of our potash expansion program increased from CDN $7.3 billion to CDN $7.7 billion.

| | |

| PotashCorp 2011 Annual Report | | 27 |

2012 Outlook

Strong agricultural markets expected to support fertilizer demand

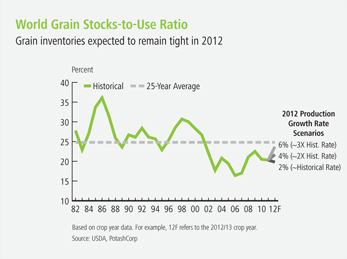

Global demand for grain and oilseeds is projected to increase by more than 2 percent in the 2012/13 crop year, driven by population growth and the ongoing expansion of developing economies. We anticipate that rising demand will continue to pressure world grain inventories, already well below historical levels.

While global macroeconomic concerns are expected to continue in 2012 and could result in crop price volatility, we project that underlying tight supply/demand fundamentals will support pricing above historical average levels. This environment is expected to encourage farmers around the world to apply the nutrients required to maximize production, driving increased fertilizer consumption. The International Fertilizer Industry Association (IFA) projects that world fertilizer use will increase by 2.3 percent in 2012, with potash rising by more than 3 percent.

Growth in major offshore markets expected to push potash demand to record levels

Potash customers are expected to purchase cautiously early in 2012 but we anticipate shipments will accelerate as the year progresses, to meet strong projected consumption. We estimate that global demand will rise from approximately 55 million tonnes in 2011 to 55-58 million tonnes in 2012.

We anticipate that Latin American demand could exceed the 2011 record, supported by strong crop economics and increased acreage for key crops such as soybeans, sugar cane and corn. China is expected to increase its potash purchases in 2012 to stimulate yields in order to meet its rising crop requirements. India’s demand is unlikely to materially exceed 2011 levels due to uncertainty around its government subsidy levels and higher retail potash prices. Demand from other Asian markets is expected to be similar to the record volumes purchased in 2011. Shipments to North American customers are projected to exceed those of the previous year as growers increase acreage of important consuming crops such as corn.

Limited new capacity is likely to become operational in 2012, and we believe global potash operating rates may approach historical highs later in the year.

| | |

| 28 | | PotashCorp 2011 Annual Report |

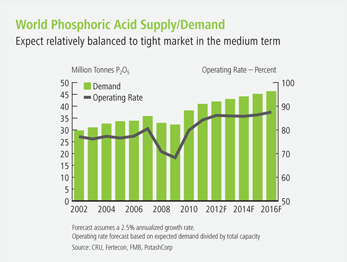

Balanced to tight markets anticipated for phosphate

Limited new phosphate capacity is expected to come on line in 2012 beyond the ongoing ramp-up of the Ma’aden facility in Saudi Arabia. China’s total phosphate exports are expected to decline from the 2011 record as the government adjusts export tax policies in an attempt to keep more resources in the country. With phosphate fertilizer consumption forecast to grow at 3 percent, we anticipate balanced to tight phosphate markets in 2012.

Global rock prices are expected to remain well above historical levels. Prices for sulfur and ammonia inputs are expected to soften from levels established in the second half of 2011.

US nitrogen producers expected to benefit from lower gas prices

Global nitrogen fertilizer consumption is expected to rise by approximately 2 percent in 2012, driven by strong agricultural fundamentals and relatively stable industrial consumption. New export-oriented capacity is anticipated to come on line in the second half of 2012 in North Africa and the Middle East, potentially leading to some softening in markets later in the year.

Natural gas prices for producers in Europe, Ukraine and China are expected to be well above historical average levels. US nitrogen producers are expected to maintain their favorable cost position relative to suppliers in those countries.

| | |

| PotashCorp 2011 Annual Report | | 29 |

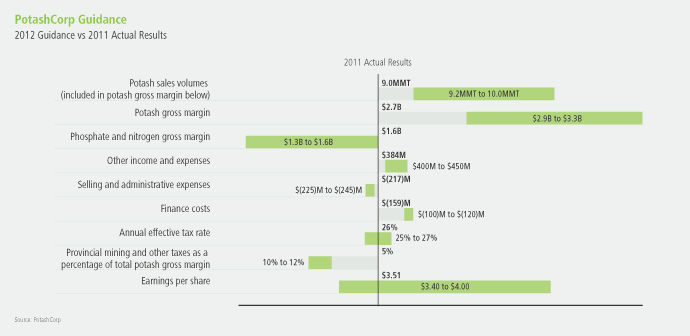

2012 Earnings per Share and Related Sensitivities

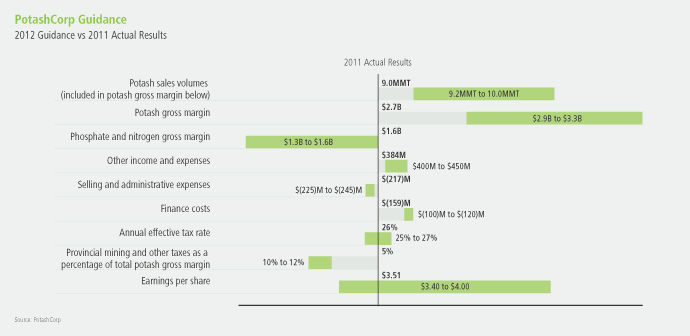

The company’s estimate for 2012 EPS (as of January 26, 2012) ranged from $3.40 to $4.00 based on the outlook and assumptions as at that date described herein, which compared to the 2011 actual results of $3.51. The expected primary causes of this variance are presented in the accompanying graph.

A number of factors affect the earnings of the company’s three nutrient segments. The table below shows the key factors and their approximate effect on EPS based on the assumptions used in the 2012 earnings guidance.

| | | | |

| Input Cost Sensitivities | | Effect on

EPS |

| NYMEX gas price increases by $1/MMBtu | | Nitrogen | | + 0.02 |

| | Potash | | – 0.01 |

| Sulfur changes by $20/long ton | | Phosphate | | ± 0.03 |

| Canadian to US dollar strengthens by $0.01 | | Canadian operating expenses net of provincial taxes | | – 0.01 |

| | Translation gain/loss | | – 0.00 |

| Saskatchewan potash capital expenditures reduced by $100 million | | Provincial mining and other taxes | | – 0.02 |

| | | | |

| Price and Volume Sensitivities | | Effect on

EPS |

Price | | Potash changes by $20/tonne | | ± 0.14 |

| | | DAP/MAP changes by $20/tonne | | ± 0.02 |

| | | Ammonia increases by $20/tonne | | |

| | | • Nitrogen | | + 0.02 |

| | | • Phosphate | | – 0.00 |

| | | Urea changes by $20/tonne | | ± 0.02 |

Volume | | Potash changes by 100,000 tonnes | | ± 0.03 |

| | | |

| | | Nitrogen changes by 50,000 N tonnes | | ± 0.02 |

| | | |

| | | Phosphate changes by 50,000 P2O5 tonnes | | ± 0.01 |

| | |

| 30 | | PotashCorp 2011 Annual Report |

Goals and Targets

GOAL

Create superior long-term shareholder value

Why Our Performance Matters

Strong financial performance enables us to generate superior returns for our shareholders, which makes it possible for us to access capital to help grow our business. Further, it affords us the ability to maintain employment and create new jobs, to support our communities, to contribute taxes to local economies and to invest in the people and resources that will serve the long-term needs of our customers.

Targets

Total Shareholder Return (TSR)

Context

By tracking the return to investors through capital gains and dividends, then comparing that number to the performance of our peers and benchmark, we measure our ability to create and execute strategies that deliver shareholder value.

Target

Exceed TSR performance for our sector* and the DAXglobal Agribusiness Index (DXAG)

Performancepartially achieved

PotashCorp’s TSR of -19.5 percent outperformed the sector’s return of -22.8 percent. However, our performance trailed the DAXglobal Agribusiness Index return of -10.2 percent. While we outperformed this index for most of 2011, the slowdown in fertilizer demand in the fourth quarter resulted in weaker relative performance for the balance of the year.

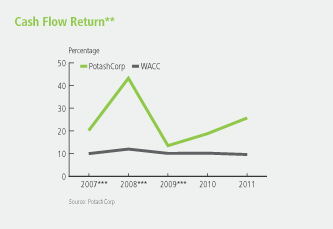

Cash Flow Return (CFR)

Context

Calculated on the total cost basis of the company’s assets rather than on their depreciated value, cash flow return measures the effectiveness of our investment outlay.

Target

Exceed CFR** for our sector*

Performanceachieved

We continue to generate CFR above our weighted average cost of capital (WACC), which was 9.6 percent. This produced positive returns for investors on capital deployed. Our 2011 CFR of 26 percent exceeded that of our sector. This was driven primarily by a 66 percent increase in our operating income due to improved earnings across all three nutrients.

| * | Sector: Weighted average (based on market capitalization) for Agrium, APC, CF Industries, ICL, Intrepid, K+S, Mosaic, SQM, Uralkali and Yara for most recent four fiscal quarters available |

| ** | See reconciliation and description of certain non-IFRS measures on Page 78 |

| *** | Figures prepared in accordance with previous Canadian GAAP |

| | |

| 32 | | PotashCorp 2011 Annual Report |

Governance

Context

Our governance practices grow from our Core Values. By listening and being accountable to our stakeholders, we build trust and support, which enhances our ability to execute our strategies.

Target

Remain in the top quartile of governance practices as measured by predetermined external reviews

Performanceachieved

We ranked in the top quartile in all predetermined reviews. PotashCorp’s corporate governance practices received top ranking out of 253 companies evaluated by The Globe and Mail Board Games in 2011.

Progress Toward Our Goal

1 Delivering long-term earnings growth

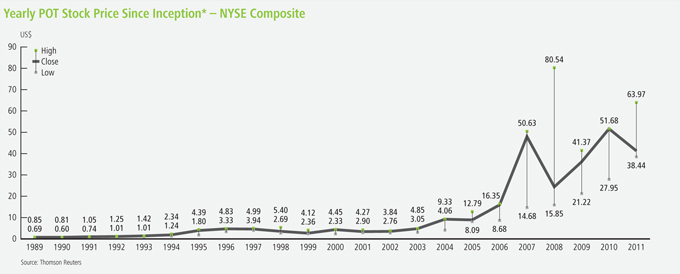

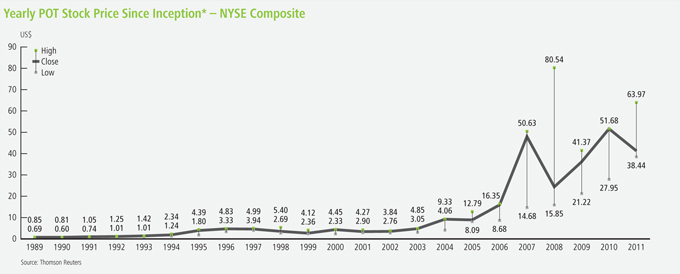

In 2011, we delivered earnings per share of $3.51, up 80 percent from 2010. Nearly two-thirds of our gross margin was from potash. Our cumulative 20-year TSR of 5,140 percent reflects the long-term effectiveness of our strategies.

2 Strengthening our global potash business

By 2015, we expect to increase our operational capability by more than 50 percent from 2011 levels. We have already spent approximately 75 percent of the anticipated CDN $7.7 billion in capital.

Expected to represent approximately half of the operational capability likely to be added in the industry by 2015, our expansions should provide us with a substantial growth opportunity, relative to our peers, as potash demand rises.

3 Strategic use of capital

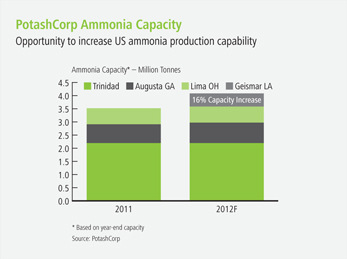

In addition to our potash expansions, we have committed to resume our ammonia production at Geismar in 2012 to capitalize on advantageous US natural gas costs.

In 2011, we paid down a portion of our long-term debt. We doubled our dividend in both 2011 and 2012.

With most of our major potash capital expenditures expected in subsequent years. We will continue to look for ways to deploy our assets that provide the greatest returns for our shareholders, such as organic growth, mergers and acquisitions, dividends and share repurchases.

2012 Targets

| 1 | Exceed total shareholder return performance for our sector* and the DAXglobal Agribusiness Index |

| 2 | Exceed cash flow return** on investment for our sector* |

| 3 | Remain in the top quartile of governance practices as measured by predetermined external reviews |

| 4 | Increase potash operational capability to 17.1 million tonnes by 2015 |

| | |

| PotashCorp 2011 Annual Report | | 33 |

GOAL

Be the supplier of choice

to the markets we serve

Why Our Performance Matters

By helping improve our customers’ opportunities for success, we strengthen our own ability to grow, to remain profitable for the long term and to serve the interests of all our stakeholders.

Targets

Product Quality and Service Measurements

Context

We continually seek to meet the needs of our customers, emphasizing the criteria they have identified as most important: quality and customer service.

Target

Outperform competitors on quality and service as measured by independent surveys

Performanceachieved

We outperformed our competitors in all quality and service categories in 2011. Customer surveys show that we consistently outperform competitors in these areas and that our sales team stands out for its knowledge of our customers, products and industry.

| | |

| 34 | | PotashCorp 2011 Annual Report |

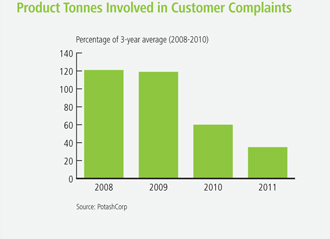

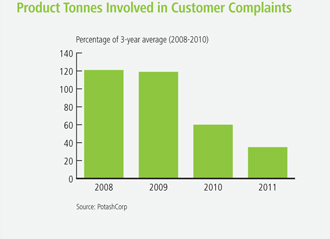

Number of Quality-Related Customer Complaints

Context

Product quality is an important aspect of our ability to be the supplier of choice to the markets we serve. We work hard to ensure our products are best-in-class.

Target

Reduce the number of product tonnes involved in customer complaints below the average of the prior three years

Performanceachieved

Our commitment to producing quality products continues to be evident in both our survey results and our low number of quality-related claims. In 2011, this focus on quality reduced the number of tonnes involved in customer complaints to 35 percent of the previous three-year average.

Progress Toward Our Goal

1 Improving rail cycle times through investment

Our potash expansion projects not only give our customers a reliable source for needed products, they are designed to improve our loading speed and capability to move product more quickly.

As a member of Canpotex, we are contributing to the development of a state-of-the-art railcar maintenance and staging facility in Saskatchewan. This investment is expected to improve the cost, reliability and efficiency of the distribution network, benefiting the railways, Canpotex and customers.

In the domestic market, PotashCorp has begun construction of a regional distribution center in Hammond, Indiana, which is expected to reduce rail cycle times and improve distribution efficiency.

2 Maintaining commitment to sharing information

We continue to provide information that helps customers make informed decisions for their businesses. We prioritize relationship building, providing 24/7 access to customer service agents.

We use our website to provide analysis on current trends in the fertilizer industry, as well as updates on our own company developments, to help customers understand the factors that are likely to affect their businesses.

3 Building the next generation sales force

In 2011, we added new customer representative and sales positions as we prepare to meet tomorrow’s service challenges. Each new employee is given hands-on opportunities to learn about our markets, our customers and our way of doing business from one of the most experienced teams in the industry.

2012 Targets

| 1 | Outperform competitor groups on quality and service as measured by independent surveys |

| 2 | Reduce the number of product tonnes involved in customer complaints below the prior three-year average |

| 3 | Reduce domestic rail cycle time by 10 percent in 2014, compared to 2011 levels |

| | |

| PotashCorp 2011 Annual Report | | 35 |

GOAL

Build strong relationships with and improve the socioeconomic well-being of our communities

Why Our Performance Matters

To grow our company and sustain our success, we strive to create long-term, mutually beneficial relationships with the communities where we operate. By building trust and goodwill, we are more likely to receive support for our development plans and attract talent for our operations. By being a good neighbor, we can invest with confidence in the company’s future.

Targets

Community Investments

Context

We strive to enhance quality of life in the places where we operate by focusing our community investment strategy on education, health care and the development and improvement of recreational facilities. The amount we invest in each community is guided by the gross margin we generate in its region.

Target

Invest 1 percent of consolidated income before income taxes (on a five-year rolling average) in community initiatives

Performanceachieved

Our 2011 community investments were 1 percent of the five-year average of consolidated income before income taxes – a total of $21 million. This record-setting investment was driven by two key factors: a change in our target from after-tax to pre-tax earnings, and higher overall company earnings.

Local Purchasing

Context

By supporting local suppliers, PotashCorp benefits from proximity and security of supply, contributes to local economies and helps attract additional investment to the area. Each of these factors can contribute to improved community support for our operations.

Target

Purchase 60 percent of goods locally*

Performanceachieved

Local spending was 69 percent in 2011.

| * | Local purchasing excludes major expansions, energy, raw materials and transportation |

| | |

| 36 | | PotashCorp 2011 Annual Report |

Community Leader Surveys

Context

We ask community leaders to assess our social and environmental responsibility, and what impact we have on their communities.

Target

Achieve 4 (performing well) out of 5 on community leader surveys

Performanceachieved

Our 2011 average community survey score was 4.4. Scores for each community surveyed were: Allan (4.0), Lanigan (4.4), Lima (4.4), New Brunswick (4.2) and White Springs (4.8).

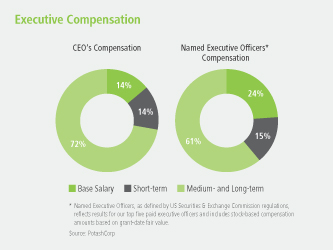

Employee Matching Gift and Donation Participation