Potash Corporation of Saskatchewan Inc.

February 20, 2014

Dear Shareholder:

The Board and management are pleased to invite you to join us at the Company’s twenty-fifth annual general meeting, which will be held at 10:30 a.m. (Central Standard Time) on May 15, 2014 in the Grand Salon of TCU Place, 35 — 22nd Street East, Saskatoon, Saskatchewan, Canada.

The Annual and Special Meeting is your opportunity to hear first-hand about our performance and plans for the future and also to consider and vote on a number of important matters. We hope that you can join us in person. We will also webcast the meeting on our website at www.potashcorp.com.

The accompanying Management Proxy Circular describes the business to be conducted at the meeting and provides information on PotashCorp’s approach to executive compensation and governance practices. We value your views and encourage you to read the Management Proxy Circular in advance of the meeting. At the meeting members of management and our Board of Directors will be present and you will have the opportunity to meet with them and ask questions.

Your participation in voting at the Meeting is important to us. You can vote by attending in person, or alternatively by telephone, via the Internet or by completing and returning the enclosed proxy or voting information form. Please refer to the “General Voting Information” and “Voting Instructions” sections of the accompanying Management Proxy Circular for further information.

The Board and management look forward to your participation at the meeting and we thank you for your continued support.

| | |

| Sincerely, | | |

| |

| |  |

D. J. HOWE Board Chair | | W. J. DOYLE President and Chief Executive Officer |

Suite 500, 122 — 1st Avenue South, Saskatoon, Saskatchewan Canada S7K 7G3

Notice of Annual and Special Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the Annual and Special Meeting (such meeting and any adjournments and postponements thereof referred to as the “Meeting”) of shareholders of Potash Corporation of Saskatchewan Inc. (“PotashCorp” or the “Corporation”), a corporation organized under the laws of Canada, will be held on:

May 15, 2014

10:30 a.m. (Central Standard Time)

Grand Salon, TCU Place

35 — 22nd Street East

Saskatoon, Saskatchewan, Canada

for the following purposes:

| 1. | to receive the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2013 and the report of the auditors thereon; |

| 2. | to elect the Board of Directors for 2014; |

| 3. | to appoint auditors for 2014; |

| 4. | to consider and, if deemed appropriate, adopt, with or without variation, a resolution (the full text of which is reproduced in Appendix B to the accompanying Management Proxy Circular) authorizing the Corporation to implement a new performance option plan, which is attached as Appendix C to the accompanying Management Proxy Circular; |

| 5. | to consider and approve, on an advisory basis, a resolution accepting the Corporation’s approach to executive compensation; and |

| 6. | to transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

This Notice of Annual and Special Meeting of Shareholders and Management Proxy Circular are available on the Corporation’s website (www.potashcorp.com).

Shareholders who are unable to attend the Meeting are encouraged to complete, sign and return the enclosed proxy form. To be valid, proxies must be received by our transfer agent, CST Trust Company, at its Toronto office no later than 10:30 a.m. (Central Standard Time) on May 14, 2014, or if the Meeting is adjourned or postponed, at least 24 hours (excluding weekends and holidays) before the Meeting resumes.

DATED at Saskatoon, Saskatchewan this 20thday of February, 2014.

BY ORDER OF THE BOARD OF DIRECTORS

JOSEPH A. PODWIKA

Secretary

POTASH CORPORATION OF SASKATCHEWAN INC.

SUITE 500, 122 — 1st AVENUE SOUTH, SASKATOON, SK CANADA S7K 7G3

’14 MANAGEMENT PROXY CIRCULAR

What’s Inside

General Information

Management of the Corporation provides this Management Proxy Circular to solicit proxies for the Annual and Special Meeting on May 15, 2014 (such meeting and any adjournments and postponements thereof the “Meeting”).

Common Shares Outstanding

As at February 20, 2014, 852,517,231 common shares in the capital of the Corporation (the “Shares”) were outstanding. The Shares trade under the symbol “POT” on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”).

Record Date and Entitlement to Vote

Each shareholder of record at the close of business on March 17, 2014 (the “Record Date”) is entitled to vote at the Meeting the Shares registered in his or her name on that date. Each Share carries the right to one vote on each matter voted on at the Meeting.

Holders of 10% or More Shares

To the knowledge of the Corporation’s directors and officers, no person or company owns or exercises control or direction over more than 10% of the outstanding Shares.

Additional Information

Financial information relating to the Corporation is contained in its comparative financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) for the fiscal year ended December 31, 2013.

Additional information relating to the Corporation that is not contained in this Management Proxy Circular, including the Corporation’s financial information as well as its most recent Form 10-K together with any document incorporated by reference therein, is available on SEDAR at www.sedar.com or EDGAR at www.sec.gov. Copies may be obtained, free of charge, upon request from the Corporate Secretary, Potash Corporation of Saskatchewan Inc., Suite 500, 122 — 1st Avenue South, Saskatoon, Saskatchewan, Canada, S7K 7G3.

Currency

Unless otherwise specified, all dollar amounts are expressed in United States dollars.

Date of Information

Except as otherwise stated, the information contained in this Management Proxy Circular is given as of February 20, 2014.

General Voting Information

Proxy Solicitation

Management of the Corporation is soliciting proxies of all Registered and Beneficial (Non-Registered) Shareholders (“Beneficial Shareholders”) primarily by mail and electronic means, supplemented by telephone or other contact by employees of the Corporation (who will receive no additional compensation), and all such costs will be borne by the Corporation. The services of CST Phoenix Advisors (the “Proxy Solicitation Agent”), have been retained by the Corporation for the solicitation of proxies in Canada and in the United States and are estimated to cost $25,000.

This Management Proxy Circular and related proxy materials are being sent to both Registered and Beneficial Shareholders. The Corporation does not send proxy-related materials directly to Beneficial Shareholders and is not relying on the notice-and-access provisions of securities laws for delivery to either Registered or Beneficial Shareholders. The Corporation will deliver proxy-related materials to nominees, custodians and fiduciaries, and they will be asked to promptly forward them to Beneficial Shareholders. If you are a Beneficial Shareholder, your nominee should send you a voting instruction form or proxy form along with this Management Proxy Circular. The Corporation has elected to pay for the delivery of our proxy-related materials to objecting Beneficial Shareholders.

If you have any questions about the information contained in this Management Proxy Circular or require assistance in voting your Shares, please contact the Proxy Solicitation Agent toll-free in North America at 1-800-835-0437 or by email at inquiries@phoenixadvisorscst.com.

Voting

If you hold Shares as of the Record Date you may vote on four items:

| (1) | the election of nominees to the Corporation’s Board of Directors (the “Board”); |

| (2) | the appointment of auditors; |

| (3) | a resolution authorizing the Corporation to implement a new performance option plan (the “2014 Performance Option Plan”); and |

| (4) | an advisory vote on the Corporation’s approach to executive compensation. |

The Board and management recommend that you voteFORitems (1), (2), (3) and (4).

All matters to be considered at the Meeting will each be determined by a majority of votes cast at the Meeting by proxy or in person. In the event of equal votes, the Meeting chair is entitled to a second or casting vote.

Quorum

Quorum for any meeting of shareholders is one or more persons present and holding or representing by proxy not less than 5% of the total number of outstanding Shares.

Proxy Voting

The persons named in the proxy form must vote or withhold from voting your Shares in accordance with your instructions on the proxy form. Signing the proxy form gives authority to Mr. Dallas J. Howe, Mr. William J. Doyle, Mr. Wayne R. Brownlee or Mr. Joseph A. Podwika, each of whom is either a director or officer of the Corporation, to vote your Shares at the Meeting in accordance with your voting instructions.

In the absence of such instructions, however, your Shares will be voted as follows:

| (1) | FOR the election to the Board, each of the nominees listed on the proxy form; |

| (2) | FOR the appointment of Deloitte LLP as auditors of the Corporation until the close of the next annual meeting; |

| (3) | FOR the resolution authorizing the Corporation to implement the 2014 Performance Option Plan; |

| (4) | FOR the advisory resolution accepting the Corporation’s approach to executive compensation; and |

| (5) | FOR management’s proposals generally. |

A proxy must be in writing and must be executed by you or by an attorney duly authorized in writing, or, if the shareholder is a corporation or other legal entity, by an officer or attorney duly authorized. A proxy may also be completed over the telephone or over the Internet. To be valid your proxy must be received by our transfer agent, CST Trust Company, at its Toronto office no later than 10:30 a.m. (CST) on May 14, 2014. Please see “Voting Instructions” on page 3 for further information.

Amendments and Other Matters

The persons named in the proxy form have discretionary authority with respect to amendments or variations to matters identified in the Notice of the Meeting and with respect to other matters that properly come before the Meeting.

As of the date of this Management Proxy Circular, our management knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the proxy form will vote on them in accordance with their best judgment.

| | |

| 1 | | PotashCorp 2014 Management Proxy Circular |

Transfer Agent

You can contact CST Trust Company, the Corporation’s transfer agent as follows:

By Telephone:

1-800-387-0825 (toll-free within Canada and the United States)

or

1-416-682-3860 (from any country other than Canada and the United States)

By Fax:

1-514-985-8843 (all countries)

By Mail:

P.O. Box 700

Station B

Montreal, Quebec, Canada H3B 3K3

Through the Internet:

www.canstockta.com

| | |

| PotashCorp 2014 Management Proxy Circular | | 2 |

Voting Instructions

REGISTERED SHAREHOLDER VOTING

You are a Registered Shareholder if your Shares are held in your name and you have a share certificate. The enclosed proxy form indicates whether you are a Registered Shareholder.

Voting Options

| | | | |

| | In person at the meeting; or |

| | By proxy: |

| |

| | By Telephone or Fax; or |

| |

| | By Mail; or |

| |

| | On the Internet. |

See below for details on each option.

Voting in Person

If you wish to vote in person at the Meeting, do not complete or return the proxy form. Please register with the transfer agent when you arrive at the Meeting.

Voting by Proxy

Registered Shareholders have four options to vote by proxy:

| (a) | By Telephone (only available to Registered Shareholders resident in Canada or the United States): |

Call 1-888-489-5760 from a touch-tone phone and follow the instructions. You will need the control number located on the enclosed proxy form. You do not need to return your proxy form.

Complete, date and sign the enclosed proxy form and return it by fax to 1-866-781-3111 (toll-free within Canada and the United States) or 1-416-368-2502 (from any country other than Canada or the United States).

Complete, date and sign the enclosed proxy form and return it in the envelope provided.

Go to www.cstvotemyproxy.com and follow the instructions on screen. You will need the control number located on the enclosed proxy form. You do not need to return your proxy form.

At any time, CST Trust Company may cease to provide telephone and Internet voting, in which case Registered Shareholders can elect to vote by mail or by fax, as described above.

The persons already named in the enclosed proxy are either directors or officers of the Corporation. Please see “General Voting

Information — Proxy Voting” on page 1.You have the rightto appoint some other person of your choice, who need not be a shareholder, to attend and act on your behalf at the Meeting. If you wish to do so, please strike out those four printed names appearing on the proxy form, and insert the name of your chosen proxyholder in the space provided on the proxy form.

If you decide to vote by telephone or on the Internet, you cannot appoint a person to vote your Shares other than our directors or officers whose printed names appear on the proxy form.

It is important to ensure that any other person you appoint is attending the Meeting and is aware that his or her appointment has been made to vote your Shares.

Deadlines for Voting

| (a) | Attending the Meeting — If you are planning to attend the Meeting and wish to vote your Shares in person at the Meeting, your vote will be taken and counted at the Meeting. |

| (b) | Using the Proxy Form — If you are voting using the proxy form, your proxy form should be received at the Toronto office of CST Trust Company by mail or fax no later than 10:30 a.m. (CST) on Wednesday, May 14, 2014, or, if the Meeting is adjourned or postponed, at least 24 hours (excluding weekends and holidays) before the Meeting resumes. |

| (c) | Telephone or Internet — If you are voting your proxy by telephone or on the Internet, your vote should be received by CST Trust Company no later than 10:30 a.m. (CST) on Wednesday, May 14, 2014. |

Revoking Your Proxy

As a Registered Shareholder who has voted by proxy, you may revoke it by timely voting again in any manner (telephone, fax, mail or Internet), or by depositing an instrument in writing (which includes another proxy form with a later date) executed by you or by your attorney authorized in writing with our Corporate Secretary at Suite 500, 122 — 1st Avenue South, Saskatoon, Saskatchewan, Canada, S7K 7G3, at any time up to and including the last business day preceding the date of the Meeting (or any adjournment or postponement, if the Meeting is adjourned or postponed), or by depositing it with the Chairman of the Meeting before the Meeting starts or any adjournment or postponement continues. A Registered Shareholder may also revoke a proxy in any other manner permitted by law. In addition, participation in person in a vote by ballot at the Meeting will automatically revoke any proxy previously given by you in respect of business covered by that vote.

| | |

| 3 | | PotashCorp 2014 Management Proxy Circular |

BENEFICIAL SHAREHOLDER VOTING

You are a Beneficial Shareholder if your Shares are held in a nominee’s name such as a bank, trust company, securities broker or other nominee.Typically, the proxy form or voting instruction form sent or to be sent by your nominee indicates whether you are a Beneficial Shareholder.

Voting Options

| | |

| | In person at the meeting; or |

| | By voting instructions. |

See below for details on each option.

Voting in Person

If you wish to vote in person at the Meeting, insert your own name in the space provided on the request for voting instructions or proxy form to appoint yourself as proxyholder and follow the instructions of your nominee.

Beneficial Shareholders who instruct their nominee to appoint themselves as proxyholders should, at the Meeting, present themselves to a representative of the transfer agent at the table identified as “Beneficial Shareholders”. Do not otherwise complete the form sent to you as your vote will be taken and counted at the Meeting.

Voting Instructions

Your nominee is required to seek voting instructions from you in advance of the Meeting. Accordingly, you will receive, or will have already received, a request for voting instructions or a proxy form for the number of Shares held by you.

Each nominee has its own procedures, which you should carefully follow to ensure that your Shares are voted at the Meeting. These procedures generally allow voting in person or by proxy

(telephone, fax, mail or on the Internet). Beneficial Shareholders should contact their nominee for instructions in this regard.

Whether or not you attend the Meeting, you can appoint someone else to attend and vote as your proxyholder. To do this, please follow the procedures of your nominee carefully. The persons already named in the proxy form are either directors or officers of the Corporation. Please see “General Voting Information — Proxy Voting” on page 1.

It is important to ensure that any other person you appoint is either attending the Meeting in person or returning a proxy reflecting your instructions and is aware that his or her appointment has been made to vote your Shares.

Deadline for Voting

| (a) | Attending the Meeting — If you are planning to attend the Meeting and wish to vote your Shares in person at the Meeting, your vote will be taken and counted at the Meeting. |

| (b) | Voting Instructions — Every nominee has its own procedures which you should carefully follow to ensure that your Shares are voted at the Meeting. |

If voting by voting instructions, your nominee must receive your voting instructions in sufficient time for your nominee to act on it. For your vote to count, it must be received by CST Trust Company at its Toronto office no later than 10:30 a.m. (CST) on May 14, 2014, or, if the Meeting is adjourned or postponed, at least 24 hours (excluding weekends and holidays) before the Meeting resumes.

Revoking Voting Instructions

To revoke your voting instructions, follow the procedures provided by your nominee.

| | |

| PotashCorp 2014 Management Proxy Circular | | 4 |

Business of the Meeting

Financial Statements

The Consolidated Financial Statements for the fiscal year ended December 31, 2013 are included in the Corporation’s Annual Report on Form 10-K for the fiscal year ended December 31, 2013 filed with the U.S. Securities and Exchange Commission (“SEC”) and the Canadian securities regulatory authorities.

Nominees for Election to the Board of Directors

The 13 nominees proposed for election as directors of the Corporation are listed on page 6. All nominees have established their eligibility and willingness to serve as directors. Directors will hold office until the next annual meeting of shareholders of the Corporation or until their successors are elected or appointed.

Unless otherwise instructed, the persons designated in the form of proxy intend to vote for the election of the nominees listed on page 6. If, for any reason, at the time of the Meeting any of the nominees are unable to serve, it is intended that the persons designated in the form of proxy will vote in their discretion for a substitute nominee or nominees.

Appointment of Auditors

At the Meeting, shareholders will be asked to vote to reappoint the firm of Deloitte LLP, the present auditors of the Corporation, as auditors of the Corporation to hold office until the next annual meeting of shareholders of the Corporation.

Unless otherwise instructed, the persons designated in the form of proxy intend to vote to reappoint Deloitte LLP as auditors of the Corporation.

Adoption of the 2014 Performance Option Plan

At the Meeting, shareholders will be asked to consider and, if deemed appropriate, adopt, with or without variation, a resolution (the full text of which is reproduced as Appendix B to this Management Proxy Circular) authorizing the Corporation to implement the 2014 Performance Option Plan, which is attached as Appendix C to this Management Proxy Circular.

Unless otherwise instructed, the persons designated in the form of proxy intend to vote for the resolution to approve the 2014 Performance Option Plan.

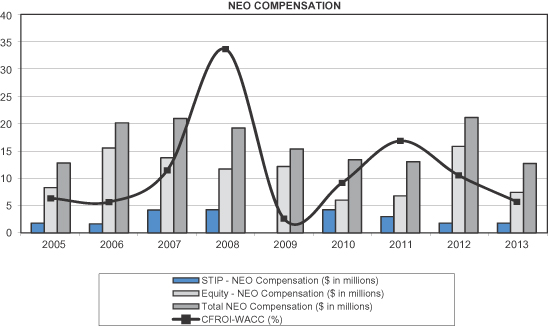

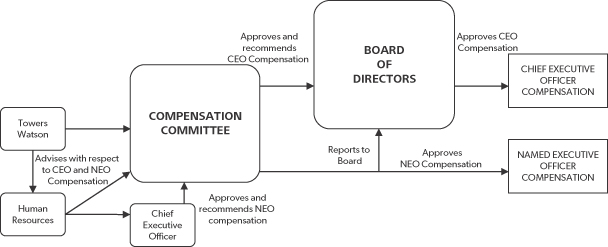

Advisory Vote on Executive Compensation

The Board has spent considerable time and effort defining and implementing its executive compensation program and believes that its program achieves the goal of maximizing long-term shareholder value while attracting, motivating and retaining world-class talent. At the 2013 Annual Meeting, PotashCorp’s approach to executive compensation was approved by 97.47% of the Shares voted on the advisory say on pay resolution.

For further information regarding the Corporation’s approach to executive compensation and its shareholder outreach program, please see the “Corporate Governance” and “Compensation” sections of this Management Proxy Circular beginning on pages 28 and 34, respectively.

As this is an advisory vote, the results will not be binding upon the Board. However, the Board will take the results of the advisory vote into account, as appropriate, when considering future executive compensation policies, procedures and decisions and in determining whether there is a need to significantly increase their engagement with shareholders on executive compensation related matters. In the event that a significant number of shareholders oppose the resolution, the Board will consult with shareholders to understand their concerns and will review the Corporation’s approach to executive compensation in the context of these concerns.

The Board proposes that you indicate your support for the Corporation’s approach to executive compensation disclosed in this Management Proxy Circular by voting in favor of the following advisory resolution:

“RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in the Corporation’s Management Proxy Circular delivered in advance of the 2014 Annual and Special Meeting of Shareholders”.

Unless otherwise instructed, the persons designated in the form of proxy intend to vote for the advisory resolution.

| | |

| 5 | | PotashCorp 2014 Management Proxy Circular |

Board of Directors

Nominees

The 13 directors being nominated for election in 2014 are:

| | |

| Christopher M. Burley | | Alice D. Laberge |

| Donald G. Chynoweth | | Consuelo E. Madere* |

| William J. Doyle | | Keith G. Martell |

| John W. Estey | | Jeffrey J. McCaig |

| Gerald W. Grandey | | Mary Mogford |

| C. Steven Hoffman | | Elena Viyella de Paliza |

| Dallas J. Howe | | |

The Corporate Governance and Nominating (“CG&N”) Committee is of the view that these director nominees represent an appropriate mix of expertise and qualities required for the Board. See pages 8 through 13 for information on each director nominee’s professional experience, background and qualifications and page 30 for information regarding the diverse skill set of the Board.

Independent Board

The Board has determined that all director nominees, except for Mr. Doyle and Ms. Viyella de Paliza, are independent. See pages 15 and 16 for more details.

Meeting Attendance

Directors attended 99.56% of Board and committee meetings in 2013. See pages 17 and 18 for details.

Retirement and Succession

Pursuant to the PotashCorp Governance Principles, directors should not generally stand for re-election after reaching the age of seventy years.

Details regarding the Corporation’s retirement policy and its on-going Board nomination processes, succession planning and renewal are set out on page 14 under “Retirement Policy” and page 29 under “Corporate Governance — Nomination Processes, Succession Planning and Board Renewal”.

Director Compensation

We establish director compensation after considering the advice of independent consultants, with a view to establishing compensation at the median of the Comparative Compensation Information (as defined under “Compensation — Compensation Discussion and Analysis” beginning on page 39). See pages 19 through 23 for more details.

Total fees and retainers earned by all Board members in 2013 were $3,405,806.

“At-Risk” Investment

In accordance with our share ownership requirements, by the time a director has served on the Board for five years, he or she must own Shares and/or Deferred Share Units (“DSUs”) with a value at least five times the annual retainer paid to directors. One-half of this ownership threshold is required to be achieved within 2 1/2 years.

All director nominees are currently in compliance with the applicable ownership requirements of the Corporation.

See pages 22 and 23 for details.

| | |

| PotashCorp 2014 Management Proxy Circular | | 6 |

Nominees for Election to the Board of Directors

The articles of the Corporation provide that the Board shall consist of a minimum of six directors and a maximum of twenty directors, with the actual number to be determined from time to time by the Board. The Board has determined that, at the present time, the appropriate number of directors is 13.

Proxies solicited, unless otherwise specified, will be voted for the following proposed nominees (or for substitute nominees in the event of contingencies not known at present) who will, subject to the bylaws of the Corporation and applicable corporate law, hold office until the next annual meeting of shareholders or until their successors are elected or appointed in accordance with the bylaws of the Corporation or applicable corporate law.

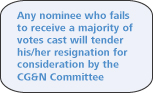

Majority Voting Policy

| | |

| | In an uncontested election, any director nominee who fails to receive votes in favor of his or her election representing a majority of the shares voted and withheld for the election of the director |

| will tender his or her resignation for consideration by the CG&N Committee. Except in extenuating circumstances, it is expected that the CG&N Committee will recommend to the Board that the resignation be accepted and effective within a period of ninety days and that the action taken by the Board be publicly disclosed. To the extent possible, the CG&N Committee and Board members who act on the resignation shall be directors who have themselves received a majority of votes cast. |

The following biographies, and information set forth on pages 8 through 14, highlight the specific experience, attributes and qualifications of each nominee for director that led to the Board’s conclusion that the person should serve as a director of the Corporation. Specifically, the following table states their names and ages, all other positions and offices they have held with the Corporation, their present principal occupation or employment, their business experience over the last five years (including, where applicable, current and past directorships of public companies over the last five years), the period during which they have served as directors, their principal areas of expertise and their independence status. Also disclosed below is each nominee’s current security holdings and their value of at-risk holdings as at February 20, 2014, the percentage of votes voted in favor of their election at last year’s meeting and their overall Board and committee meeting attendance in 2013.

For further detailed information on director independence, attendance, at-risk holdings and compensation, please see the tables and narratives following this table.

| | |

| 7 | | PotashCorp 2014 Management Proxy Circular |

| | | | | | | | |

| | | | Christopher M. Burley Age: 52 Calgary, Alberta, Canada Director since 2009 Independent(1) | | Mr. Burley is a Corporate Director and former Managing Director and Vice Chairman, Energy of Merrill Lynch Canada Inc., an investment banking firm. A graduate of the Institute of Corporate Directors’ Education Program, he has 23 years of experience in the investment banking industry. He is a member of the board of directors of Parallel Energy Trust and the United Way of Calgary. |

| | | Principal Areas of Expertise/Experience: | | Board Committee Membership: |

| | | Finance Investment Banking Governance | | Audit CG&N |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Audit: 7/7 Corporate Governance & Nominating: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: Parallel Energy Trust | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 30,000 DSU Ownership: 7,084 Stock Options: None | | Value of At-Risk Holdings: $1,247,163 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.44% |

| | | | | | | | |

| | | | Donald G. Chynoweth Age: 53 Calgary, Alberta, Canada Director since 2012 Independent(1) | | Mr. Chynoweth is Senior Vice President of SNC Lavalin O&M, one of the world’s leading engineering and construction groups. He is a graduate of the University of Saskatchewan, with more than 30 years of management experience in business, politics, investment and business development. He is a graduate of the Institute of Corporate Directors’ Education Program and is a member of the board of directors of AltaLink, L.P., a subsidiary of SNC Lavalin Inc. |

| | | | Principal Areas of Expertise/Experience: Global/International Commerce Security Public Policy | | Board Committee Membership: Audit Safety, Health and Environment |

| | | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Audit: 7/7 Safety, Health and Environment: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: AltaLink, L.P. | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 7,000 DSU Ownership: 4,427 Stock Options: None | | Value of At-Risk Holdings: $384,290 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.33% |

| | |

| PotashCorp 2014 Management Proxy Circular | | 8 |

| | | | | | | | |

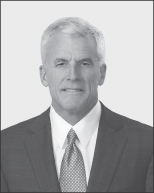

| | | | William J. Doyle Age: 63 Saskatoon, Saskatchewan, Canada Director since 1989 Non-Independent(1) | | Mr. Doyle is President and Chief Executive Officer of the Corporation (“CEO”). He joined PotashCorp as President of PCS Sales in 1987, after a career with International Minerals and Chemical Corporation. He is Chairman of Canpotex Limited, The Fertilizer Institute and International Plant Nutrition Institute, and previously served as the President of the International Fertilizer Industry Association. He is also a member of the Canadian Council of Chief Executives and the C.D. Howe Institute. Mr. Doyle is a graduate of Georgetown University in Washington, DC and is vice chair of its Board of Directors as well as a director of the Executives’ Club of Chicago and the Big Shoulders Fund. |

| | | Principal Areas of Expertise/Experience: Fertilizer/Mining/Chemical Industry Global Agriculture/International Commerce Global Senior Executive Management | | Board Committee Membership: None |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: n/a | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 2,929,421 DSU Ownership: 0 Stock Options: 5,889,250 | | Value of At-Risk Holdings: $98,516,429 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.30% |

| | | | | | | | |

| | | | John W. Estey Age: 63 Glenview, Illinois, USA Director since 2003 Independent(1) | | Mr. Estey is Executive Chairman of S&C Electric Company, a global provider of equipment and services for electric power systems. He is a member of the Board of Governors of the National Electrical Manufacturers Association, a director of the Executives’ Club of Chicago and Southwire Company and Chair of the Board of Trustees of the Adler Planetarium & Astronomy Museum. |

| | | Principal Areas of Expertise/Experience: Global/International Commerce Business Management Compensation Safety/Environmental | | Board Committee Membership: Compensation (chair) CG&N |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Compensation: 5/5 Corporate Governance & Nominating: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: n/a | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 3,000 DSU Ownership: 79,118 Stock Options: None | | Value of At-Risk Holdings: $2,761,647 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.25% |

| | |

| 9 | | PotashCorp 2014 Management Proxy Circular |

| | | | | | | | |

| | | | Gerald W. Grandey Age: 67 Saskatoon, Saskatchewan, Canada Director since 2011 Independent(1) | | Mr. Grandey was formerly Chief Executive Officer of Cameco Corporation, a Saskatoon-based uranium provider. He is a director of Canadian Oil Sands Limited, Rare Element Resources Ltd. and Sandspring Resources Ltd. Mr. Grandey is Chairman Emeritus on the board of directors of the World Nuclear Association. He also serves on the Dean’s Advisory Council of the University of Saskatchewan’s Edwards School of Business, the Board of Governors of the Colorado School of Mines Foundation and the board of directors of the Institute of Corporate Directors. Mr. Grandey is a former director of Centerra Gold Inc., Bruce Power and Inmet Mining Corporation. |

| | | Principal Areas of Expertise/Experience: Mining Industry Global/International Commerce Global Senior Executive Management | | Board Committee Membership: Compensation Safety, Health and Environment |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Compensation: 5/5 Safety, Health and Environment: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: Canadian Oil Sands Limited Sandspring Resources Ltd. Rare Element Resources Ltd. | | Past Boards: Cameco Corporation Centerra Gold Inc. Inmet Mining Corporation |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 5,500 DSU Ownership: 11,785 Stock Options: None | | Value of At-Risk Holdings: $581,312 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.44% |

| | | | | | | | |

| | | | C. Steven Hoffman Age: 65 Lincolnshire, Illinois, USA Director since 2008 Independent(1) | | Mr. Hoffman is a former senior executive of IMC Global Inc. With over 23 years of global fertilizer sales and marketing management experience, he retired as Senior Vice President and President, Sales and Marketing of IMC Global upon completion of the IMC Global and Cargill Fertilizer merger, which created the Mosaic Company. He is a former Chairman and President of the Phosphate Chemicals Export Association, Inc. and a former Chairman of Canpotex Limited. |

| | | Principal Areas of Expertise/Experience: Fertilizer/Mining/Chemical Industry Global Agriculture/International Commerce Business Management | | Board Committee Membership: Safety, Health and Environment (chair) Compensation |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Safety, Health and Environment: 4/4 Compensation: 5/5 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: n/a | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 6,600 DSU Ownership: 26,004 Stock Options: None | | Value of At-Risk Holdings: $1,096,495 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.43% |

| | |

| PotashCorp 2014 Management Proxy Circular | | 10 |

| | | | | | | | |

| | | | Dallas J. Howe Age: 69 Calgary, Alberta, Canada Director since 1991 Independent(1) | | Mr. Howe is owner and Chief Executive Officer of DSTC Ltd., a technology investment company. He is a director of Advanced Data Systems Ltd., the C.D. Howe Institute and the Global Food Security Institute at the University of Saskatchewan and a Fellow of the Institute of Corporate Directors. A director when PotashCorp was a Crown corporation from 1982 to 1989, he joined the Corporation’s Board in 1991 and was elected Chair in 2003. He previously served as a director of Viterra Inc. |

| | | Principal Areas of Expertise/Experience: Agriculture e-Commerce/Technology Governance | | Board Committee Membership: Board Chair CG&N |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Corporate Governance & Nominating: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: n/a | | Past Boards: Viterra Inc. |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 327,645 DSU Ownership: 117,306 Stock Options: None | | Value of At-Risk Holdings: $14,963,715 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:96.40% |

| | | | | | | | |

| | | | Alice D. Laberge Age: 57 Vancouver, British Columbia, Canada Director since 2003 Independent(1) | | Ms. Laberge is a Corporate Director and the former President, Chief Executive Officer and Chief Financial Officer of Fincentric Corporation, a global provider of software solutions to financial institutions. She was previously Senior Vice President and Chief Financial Officer of MacMillan Bloedel Limited. She is a director of the Royal Bank of Canada, Russel Metals Inc., Delta Hotels Limited and Silverbirch Management Ltd. and has served as a director of Catalyst Paper Corporation and St. Paul’s Hospital Foundation in Vancouver. She is also a member of the Board of Governors of the University of British Columbia. |

| | | Principal Areas of Expertise/Experience: e-Commerce/Technology Finance Accounting | | Board Committee Membership: Audit (chair) CG&N |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Audit: 7/7 Corporate Governance & Nominating: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: Royal Bank of Canada Russel Metals Inc. | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 17,000 DSU Ownership: 59,526 Stock Options: None | | Value of At-Risk Holdings: $2,573,578 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.34% |

| | |

| 11 | | PotashCorp 2014 Management Proxy Circular |

| | | | | | | | |

| | | | Consuelo E. Madere Age: 53 Destin, Florida, USA Independent(1) | | Ms. Madere is a former executive officer of Monsanto Company, a leading global provider of agricultural products. Ms. Madere has over 30 years of domestic and global experience, spanning manufacturing, strategy, technology, business development, profit & loss responsibility and general management, and she retired from Monsanto Company as Vice President, Global Vegetables and Asia Commercial. Ms. Madere serves on the Strategic Planning Committee of the Hispanic Association on Corporate Responsibility and the Dean’s Advisory Council of the Louisiana State University Honors College. Ms. Madere received her Masters of Business Administration from the University of Iowa, and her Bachelor of Science degree in Chemical Engineering from Louisiana State University. She has also been certified by the National Association of Corporate Directors as a Governance Fellow, and in 2013 attended the Stanford Director’s College. |

| | | Principal Areas of Expertise/Experience: Global Agriculture Global/International Commerce Global Senior Executive Management | | Board Committee Membership: n/a |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | n/a | | |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: n/a | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 0 DSU Ownership: 0 Stock Options: None | | Value of At-Risk Holdings: $0 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:n/a |

| | | | | | | | |

| | | | Keith G. Martell Age: 51 Saskatoon, Saskatchewan, Canada Director since 2007 Independent(1) | | Mr. Martell is Chairman and Chief Executive Officer of First Nations Bank of Canada, a Canadian chartered bank primarily focused on providing financial services to the Aboriginal marketplace in Canada. He is a chartered accountant, formerly with KPMG LLP. He is a director of the Canadian Chamber of Commerce and serves on the Dean’s Advisory Council of the University of Saskatchewan’s Edwards School of Business. He is a former director of the Public Sector Pension Investment Board of Canada, The North West Company Inc. and the Saskatoon Friendship Inn, and a former trustee of the North West Company Fund. He is also a trustee of Primrose Lake Trust. |

| | | Principal Areas of Expertise/Experience: Finance/Accounting First Nations Business Management | | Board Committee Membership: Audit Compensation |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Audit: 7/7 Compensation: 5/5 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: n/a | | Past Boards: The North West Company Inc. North West Company Fund |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 3,800 DSU Ownership: 21,672 Stock Options: None | | Value of At-Risk Holdings: $856,655 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.30% |

| | |

| PotashCorp 2014 Management Proxy Circular | | 12 |

| | | | | | | | |

| | | | Jeffrey J. McCaig Age: 62 Calgary, Alberta, Canada Director since 2001 Independent(1) | | Mr. McCaig is Chairman and Chief Executive Officer of the Trimac Group of Companies, a North American provider of bulk trucking and third-party logistics services. Prior to that, he practiced law, specializing in corporate financing and securities. He is Chairman and director of Bantrel Co., an engineering, procurement and construction company, a director of Orbus Pharma Inc.(4) and a director and co-owner of the Calgary Flames Hockey Club. Mr. McCaig is a former director of The Standard Life Assurance Company of Canada. |

| | | Principal Areas of Expertise/Experience: Transportation Industry Legal Business Management | | Board Committee Membership: Compensation Safety, Health and Environment |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Compensation: 5/5 Safety, Health and Environment: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: Trimac Transportation Ltd. Orbus Pharma Inc. | | Past Boards: Trimac Income Fund |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 252,000 DSU Ownership: 105,598 Stock Options: None | | Value of At-Risk Holdings: $12,026,049 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:98.92% |

| | | | | | | | |

| | | | Mary Mogford Age: 69 Newcastle, Ontario, Canada Director since 2001 Independent(1) | | Ms. Mogford is a Corporate Director and a former Ontario Deputy Minister of Finance and Deputy Minister of Natural Resources. She is currently a director of Nordion Inc. and an honorary member of the boards of the Hospital For Sick Children and Trent University. She is a Fellow of the Institute of Corporate Directors and an accredited director under the ICD/Rotman School of Business Directors’ Education Program. She has also previously served as a director of Falconbridge, Sears Canada and nine other public companies. |

| | | Principal Areas of Expertise/Experience: Finance Public Policy Governance | | Board Committee Membership: CG&N (chair) Compensation |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Corporate Governance & Nominating: 4/4 Compensation: 5/5 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: Nordion Inc. | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 67,193 DSU Ownership: 87,883 Stock Options: None | | Value of At-Risk Holdings: $5,215,214 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:99.32% |

| | |

| 13 | | PotashCorp 2014 Management Proxy Circular |

| | | | | | | | |

| | | | Elena Viyella de Paliza Age: 59 Dominican Republic Director since 2003 Non-Independent(1) | | Ms. Viyella de Paliza is President of Inter-Quimica, S.A., a chemicals importer and distributor, Monte Rio Power Corp. and Jaraba Import, S.A., a subsidiary of Monte Rio Power Corp. She is a member of the board of the Inter-American Dialogue, EDUCA (Action for Education) and Universidad APEC. She was formerly the President of Indescorp, S.A. |

| | | Principal Areas of Expertise/Experience: Fertilizer Industry Finance/Business Management Global/International Commerce | | Board Committee Membership: Safety, Health and Environment |

| | | 2013 Board & Committee Meeting Attendance(2): |

| | | | Board: 9/9 Safety, Health and Environment: 4/4 | | Total Board & Committee Attendance: 100% |

| | | | Other Public Board Memberships — Present & Past Five Years: |

| | | | Present Boards: n/a | | Past Boards: n/a |

| | | | Ownership and Value of At-Risk Holdings(3): |

| | | | As at February 20, 2014 Share Ownership: 57,000 DSU Ownership: 47,486 Stock Options: None | | Value of At-Risk Holdings: $3,513,888 |

| | | | Ownership Guideline Compliance:Yes | | 2013 Annual Meeting Votes in Favor:90.38% |

| (1) | See “Director Independence and Other Relationships” on page 15 and “Director Independence” on pages 15 and 16. |

| (2) | See “Board Meetings and Attendance of Directors” on pages 17 and 18 for additional detail. |

| (3) | See “’At-Risk’ Investment and Year Over Year Changes” on pages 22 and 23 for additional detail. |

| (4) | Mr. McCaig is a director of Orbus Pharma Inc. (“Orbus”). On or about May 17, 2010, Orbus commenced proposal proceedings pursuant to the provisions of theBankruptcy and Insolvency Act (Canada) by filing a notice of intention to make a proposal. A proposal was submitted and approved by the creditors of Orbus on September 28, 2010 and approved by the court on October 18, 2010. The proposal was implemented in accordance with the terms and conditions approved by the creditors of Orbus and the court. During 2010, securities regulators for the Provinces of Alberta, British Columbia, Manitoba, Ontario and Quebec issued cease trading orders in relation to the securities of Orbus for the failure by Orbus to timely file financial statements as well as related continuous disclosure documents. Such cease trade orders continue to be in effect. |

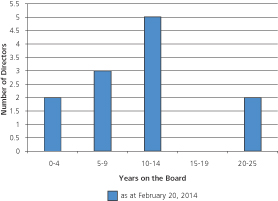

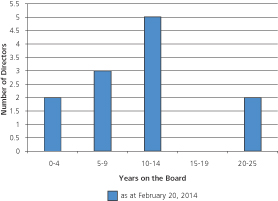

Board Tenure

As at February 20, 2014, the Corporation’s average Board tenure is 10.8 years. Following the Meeting, should all director nominees be elected, the average Board tenure will be 10.0 years.

Retirement Policy

Pursuant to the PotashCorp Governance Principles, directors should not generally stand for re-election after reaching the age of seventy years.

Ms. Mogford will be seventy as of the Meeting date; however, the Board has determined that it is appropriate for Ms. Mogford to serve for up to an additional year to accommodate the Board’s succession planning.

Pursuant to the PotashCorp Governance Principles, the full text of which is available on the Corporation’s website, www.potashcorp.com, the CEO must also resign from the Board immediately upon retirement or otherwise resigning as CEO. Also, the PotashCorp Governance Principles state that a director should offer to resign in the event of a change in principal job responsibilities or in the event of any other significant change in his or her circumstances, including one where continued service on the Board might bring the Corporation into disrepute. For greater certainty, a determination by the Board that a director is no longer independent shall be considered a significant change in such director’s circumstances. The CG&N Committee will consider the change in circumstance and recommend to the Board whether the resignation should be accepted.

| | |

| PotashCorp 2014 Management Proxy Circular | | 14 |

Director Independence and Other Relationships

| | | | | | | | |

| | | Committees (Number of Members) |

| | | Audit(1) (5) | | Compensation(1) (6) | | CG&N(1) (5) | | SH&E(2) (6) |

Management Director — Not Independent | | | | | | | | |

William J. Doyle | | | | | | | | |

Outside Director — Not Independent | | | | | | | | |

Elena Viyella de Paliza (family business relationship) | | | | | | | | Ö |

Outside Director — Independent | | | | | | | | |

Christopher M. Burley | | Ö | | | | Ö | | |

Donald G. Chynoweth | | Ö | | | | | | Ö |

Daniel Clauw(3) | | Ö | | | | | | Ö |

John W. Estey | | | | Chair | | Ö | | |

Gerald W. Grandey | | | | Ö | | | | Ö |

C. Steven Hoffman | | | | Ö | | | | Chair |

Dallas J. Howe (Board Chair) | | | | | | Ö | | |

Alice D. Laberge(4) | | Chair | | | | Ö | | |

Keith G. Martell(4) | | Ö | | Ö | | | | |

Jeffrey J. McCaig | | | | Ö | | | | Ö |

Mary Mogford | | | | Ö | | Chair | | |

| (1) | All members are independent. All Audit Committee and Compensation Committee members are independent under additional regulatory requirements applicable to them. The CG&N Committee Charter, the Compensation Committee Charter and the Audit Committee Charter each require that each member of the respective committee be independent. |

| (2) | A majority of the Safety, Health and Environment (“SH&E”) Committee members are independent. |

| (3) | Mr. Clauw resigned from the Board effective February 4, 2014. |

| (4) | Audit Committee financial expert under the rules of the SEC. |

Director Independence

The Board has determined that all of the directors of the Corporation, and proposed nominees, with the exception of Mr. Doyle and Ms. Paliza, are independent within the meaning of the PotashCorp Governance Principles, National Instrument 58-101 “Disclosure of Corporate Governance Practices” (“NI 58-101”), applicable rules of the SEC and the NYSE rules. Mr. Clauw, who resigned from the Board effective February 4, 2014, was also determined to be independent.

For a director to be considered independent, the Board must determine that the director does not have any material relationship with the Corporation, either directly or indirectly (e.g., as a partner, shareholder or officer of an organization that has a relationship with the Corporation). Pursuant to the PotashCorp Governance Principles and the PotashCorp Core Values and Code of Conduct, directors and executive officers of the Corporation inform the Board as to their relationships with the Corporation and provide other pertinent information pursuant to questionnaires that they complete, sign and certify on an annual basis. The Board reviews such relationships under applicable director independence standards and in connection with the related person transaction disclosure requirements of Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934 (the “Exchange Act”).

As permitted by the NYSE rules, the Board has adopted categorical standards (the “Categorical Standards”) to assist it in making determinations of director independence. These standards are set out in the PotashCorp Governance Principles and are outlined in

Schedule A to Appendix A of this Management Proxy Circular under “Independence Standards”.

Mr. Doyle is the CEO and is therefore not independent. Mr. Doyle is also a director of Canpotex Limited. The Corporation had sales of approximately $1,253 million to Canpotex Limited in 2013.

Two of Ms. Paliza’s brothers are executive officers of Fertilizantes Santo Domingo, C. por A (“Fersan”), a fertilizer bulk blender and distributor of agrichemicals based in the Dominican Republic, which is a customer of the Corporation. In 2013, receipts and payments in the amount of approximately USD 32 million were transacted between the Corporation and Fersan, which exceeded 2% of Fersan’s gross revenues in 2013. The transactions between the Corporation and Fersan in 2012 and 2011 also exceeded 2% of Fersan’s gross revenues in such years. Although a former employee of Fersan, Ms. Paliza has no direct or indirect interest in transactions between the Corporation and Fersan, and all such transactions are completed on normal trade terms. Even though she does not meet the aforementioned independence standards, Ms. Paliza provides a valuable contribution to the Board through her industry knowledge and experience and international business perspective. Her presence on the Board has not played any role in the Corporation’s decision to transact business with Fersan. The Corporation has made this decision on the basis of the best interests of the Corporation.

In determining the independence of its other directors, the Board evaluated business and other relationships that each director had with the Corporation. In doing so, it determined as immaterial (i) any relationships falling below the thresholds set forth in paragraph (c) of our Categorical Standards and not otherwise required to be disclosed pursuant to Item 404(a) of Regulation S-K

| | |

| 15 | | PotashCorp 2014 Management Proxy Circular |

under the Exchange Act, including certain relationships of Mr. Chynoweth, Mr. Estey and Mr. McCaig; (ii) any relationships falling below the transaction thresholds or otherwise falling outside the scope of paragraph (d) of our Categorical Standards, including certain relationships of Mr. Howe, Mr. Estey and Mr. Martell; and (iii) any business relationship between the Corporation and an entity as to which the director in question has no relationship other than as a director thereof, including certain directorships of Ms. Laberge.

Board Interlocks

In addition to the independence requirements, the Corporation has established an additional requirement that there shall be no more than two board interlocks at any given time. A board interlock occurs when two of the corporation’s directors also serve together on the board of another for-profit company. As of the date of this Management Proxy Circular, there are no board interlocks among the Board members.

Limitations on Other Board Service

The PotashCorp Governance Principles also contain limitations on the number of other directorships that directors and the CEO of the Corporation may hold. Directors who are employed as CEOs, or in other senior executive positions on a full-time basis, should not serve on more than two boards of public companies in addition to the Corporation’s Board. Other directors should not serve on more than three boards of public companies in addition to the Corporation’s Board. The CEO of the Corporation should not serve on the board of more than two other public companies and should not serve on the board of any other company where the CEO of that other company serves on the Corporation’s Board. In all cases, prior to accepting an appointment to the board of any company, the CEO of the Corporation must review and discuss the appointment with the Board Chair of the Corporation and obtain Board approval.

Board, Committee & Director Assessment

Pursuant to the PotashCorp Governance Principles, the Board has adopted a six-part effectiveness evaluation program for the Board, each Committee and each individual director, which is outlined in Appendix A under “Other Board Committees — Board Assessments” and summarized in the following table.

| | | | | | |

Review

(Frequency) | | By | | Action | | Outcome1 |

Full Board (Annual) | | All Members of

the Board | | Ÿ Board members complete a detailed questionnaire which: (a) provides for quantitative ratings in key areas and (b) seeks subjective comment in each of those areas. Ÿ Responses are reviewed by the Chair of the CG&N Committee. Ÿ The Board also reviews and considers any proposed changes to the Board Charter. | | Ÿ A summary report is prepared by the Chair of the CG&N Committee and provided to the Board Chair, the CG&N Committee and the CEO. Ÿ The summary report is reported to the full Board by the CG&N Committee Chair. Ÿ Matters requiring follow-up are identified and action plans are developed and monitored on a go-forward basis by the CG&N Committee. |

Full Board (Periodically) | | Management | | Ÿ Members of senior management who regularly interact with the Board and/or its Committees are surveyed to solicit their input and perspective on the operation of the Board and how the Board might improve its effectiveness. Ÿ Survey includes a questionnaire and one-on-one interviews between the management respondents and the Chair of the CG&N Committee. | | Ÿ Results are reported by the Chair of the CG&N Committee to the full Board. |

Board Chair (Annual) | | All Members of

the Board | | Ÿ Board members assess and comment on the Board Chair’s discharge of his duties. The CEO provides specific input from his perspective, as CEO, regarding the Board Chair’s effectiveness. Ÿ Individual responses are received by the Chair of the CG&N Committee. | | Ÿ A summary report is prepared by the Chair of the CG&N Committee and provided to the Board Chair and the full Board. |

Board Committees (Annual) | | All Members of

each Committee | | Ÿ Members of each Committee complete a detailed questionnaire to evaluate how well their respective Committee is operating and to make suggestions for improvement. Ÿ The Chair of the CG&N Committee receives responses and reviews them with the appropriate Committee Chair. Ÿ The Board reviews and considers any proposed changes to the Committee Charters. | | Ÿ A summary report is prepared and provided to the Board Chair, the Chair of the CG&N Committee, the appropriate Committee and the CEO. The summary report for each Committee is then reported to the full Board by the appropriate Committee Chair. Ÿ The Committee Chair is expected to follow-up on any matters raised in the assessment and take action, as appropriate. |

| | |

| PotashCorp 2014 Management Proxy Circular | | 16 |

| | | | | | |

Review

(Frequency) | | By | | Action | | Outcome1 |

Committee Chair (Annual) | | All Members

of

each

Committee | | Ÿ Members of each Committee assess and comment on their respective Committee Chair’s discharge of his or her duties. Ÿ Responses are received by the Chair of the CG&N Committee and the Committee Chair under review. | | Ÿ A summary report is provided to the appropriate Committee and to the full Board. Ÿ The Board reviews and considers any proposed changes to the Committee Chair position descriptions. |

Individual Directors (Annual) | | Each Director | | Ÿ Each director formally meets with the Board Chair (and if desired, the Chair of the CG&N Committee) to engage in a full and frank discussion of any and all issues either wishes to raise, with a focus on maximizing each director’s contribution to the Board and his or her respective Committees. Ÿ Each director is expected to be prepared to discuss how the directors, individually and collectively, can operate more effectively. | | Ÿ The Board Chair employs a checklist, discussing both short- and long-term goals, and establishes action items for each director to enhance his or her personal contributions to the Board and to overall Board effectiveness. Ÿ The Board Chair shares peer feedback with each director as appropriate and reviews progress and action taken. Ÿ The Board Chair discusses the results of the individual evaluations with the Chair of the CG&N Committee and reports summary findings to the full Board. |

| 1 | Attribution of comments to specific individuals is generally only made if authorized by the individual. |

Board Meetings and Attendance of Directors

Under the Corporation’s Board of Directors Charter, attached as Appendix D to this Management Proxy Circular, the Board’s principal duties include overseeing and approving the Corporation’s business strategy and strategic planning process as well as approving policies, procedures and systems for implementing strategy and managing risk. The Board normally schedules eight meetings a year, including a meeting where risk management is reviewed and a meeting where corporate strategy is reviewed. Special meetings of the Board are convened as appropriate.

The following items represent the significant activities and priorities for the Board in 2013:

| Ÿ | | Overseeing and approving the Corporation’s business strategy and strategic planning process, including a two-day meeting focused on the topic. The Board has adopted a strategic planning process and approves, on an annual basis, a strategic plan which takes into account, among other things, the opportunities and risks of the business. In doing so, it has the responsibility to ensure congruence between shareholder expectations, company plans and management performance. |

| Ÿ | | Significant dedication to a review and assessment of the Corporation’s succession planning process. The Board held meetings with the CEO and others to discuss succession plans for the positions of CEO and other senior executive officers. The Board regularly interacts with the senior management team and periodically attends company events to build relationships with the people who represent the Corporation’s future. |

| Ÿ | | Overseeing the Corporation’s rigorous risk management process, including a two-day meeting focused on the topic. |

| Ÿ | | Visiting company facilities, including a meeting at the Corporation’s New Brunswick facility. |

| Ÿ | | Obtaining ongoing director education as highlighted on page 32. |

The following table provides a summary of attendance at Board and Committee meetings held during fiscal 2013.

| | | | |

| Type of Meeting Held | | Number of Meetings | |

Board of Directors | | | 9 | |

Audit Committee (“AUD”) | | | 7 | |

Compensation Committee (“COMP”) | | | 5 | |

Corporate Governance and Nominating Committee (“CG&N”) | | | 4 | |

Safety, Health and Environment Committee (“SHE”) | | | 4 | |

| | |

| 17 | | PotashCorp 2014 Management Proxy Circular |

| | | | | | | | | | | | | | | | |

| Director | | Board meetings attended | | | Committee meetings attended | | | Total Board/Committee

meetings attended |

Christopher M. Burley | | 9 of 9 | | | 100% | | | 7 of 7 AUD | | | 100% | | | 20 of 20 | | 100% |

| | | | | | | | 4 of 4 CG&N | | | 100% | | | | | |

Donald G. Chynoweth | | 9 of 9 | | | 100% | | | 7 of 7 AUD | | | 100% | | | 20 of 20 | | 100% |

| | | | | | | | 4 of 4 SHE | | | | | | | | |

Daniel Clauw(1) | | 8 of 9 | | | 89% | | | 7 of 7 AUD | | | 100% | | | 19 of 20 | | 95% |

| | | | | | | | 4 of 4 SHE | | | 100% | | | | | |

William J. Doyle(2) | | 9 of 9 | | | 100% | | | | | | | | | 9 of 9 | | 100% |

John W. Estey | | 9 of 9 | | | 100% | | | 4 of 4 CG&N | | | 100% | | | 18 of 18 | | 100% |

| | | | | | | | 5 of 5 COMP (Chair) | | | 100% | | | | | |

Gerald W. Grandey | | 9 of 9 | | | 100% | | | 5 of 5 COMP | | | 100% | | | 18 of 18 | | 100% |

| | | | | | | | 4 of 4 SHE | | | 100% | | | | | |

C. Steven Hoffman | | 9 of 9 | | | 100% | | | 5 of 5 COMP | | | 100% | | | 18 of 18 | | 100% |

| | | | | | | | 4 of 4 SHE (Chair) | | | 100% | | | | | |

Dallas J. Howe(2) | | 9 of 9 | | | 100% | | | 4 of 4 CG&N | | | 100% | | | 13 of 13 | | 100% |

Alice D. Laberge | | 9 of 9 | | | 100% | | | 7 of 7 AUD (Chair) | | | 100% | | | 20 of 20 | | 100% |

| | | | | | | | 4 of 4 CG&N | | | 100% | | | | | |

Keith G. Martell | | 9 of 9 | | | 100% | | | 7 of 7 AUD | | | 100% | | | 21 of 21 | | 100% |

| | | | | | | | 5 of 5 COMP | | | 100% | | | | | |

Jeffrey J. McCaig | | 9 of 9 | | | 100% | | | 5 of 5 COMP | | | 100% | | | 18 of 18 | | 100% |

| | | | | | | | 4 of 4 SHE | | | 100% | | | | | |

Mary Mogford | | 9 of 9 | | | 100% | | | 4 of 4 CG&N (Chair) | | | 100% | | | 18 of 18 | | 100% |

| | | | | | | | 5 of 5 COMP | | | 100% | | | | | |

Elena Viyella de Paliza | | 9 of 9 | | | 100% | | | 4 of 4 SHE | | | 100% | | | 13 of 13 | | 100% |

Aggregate Attendance | | 116 of 117 | | | 99% | | | 35 of 35 AUD | | | 100% | | | 225 of 226 | | 99% |

| | | | | | | | 20 of 20 CG&N | | | 100% | | | | | |

| | | | | | | | 30 of 30 COMP | | | 100% | | | | | |

| | | | | | | | | 24 of 24 SHE | | | 100% | | | | | |

| (1) | Mr. Clauw resigned from the Board effective February 4, 2014. |

| (2) | In addition to the committees of which he is a member, Mr. Howe, as Board Chair, regularly attends other committee meetings as well. Mr. Howe attended all but one of the committee meetings held in 2013. At the invitation of applicable committees, Mr. Doyle attended all or a portion of many of the committee meetings held in 2013, including all of the Compensation and CG&N committee meetings. In an effort to provide directors with a more complete understanding of the issues facing the Corporation and in line with the Corporation’s core values, directors are encouraged to attend committee meetings of which they are not a member. |

Pursuant to the PotashCorp Governance Principles, the Board has adopted a policy of meeting in executive session, without management present, at each meeting of the Board. In practice, two such sessions occur at each meeting of the Board; one prior to the business of the meeting and one at the conclusion of the meeting. The Board has also adopted a policy of meeting in executive session, with only independent directors present, at each meeting of the Board. The presiding director at these executive sessions is Dallas J. Howe, the Board Chair, or, in his absence, a director selected by majority vote of those directors present. Sessions are of no fixed duration and participating directors are encouraged to raise and discuss any issues of concern. Each Committee of the Board also meets in executive session, without management present, at each meeting of the respective Committee. Directors are expected to attend each Annual Meeting of Shareholders of the Corporation. Each director nominee was present at the Corporation’s 2013 Annual Meeting of Shareholders.

| | |

| PotashCorp 2014 Management Proxy Circular | | 18 |

Director Compensation

2013 Director Compensation Package

We establish director compensation after considering the advice of independent consultants Towers Watson, with a view to establishing compensation at the median of the Comparator Group (see “Compensation — Compensation Discussion and Analysis — Compensation Principles” on page 40). Only non-employee directors (the “outside directors”) are compensated for service on the Board. The following table displays the compensation structure for 2013 for all outside directors.

| | | | |

| Item or Service | | Fee(1) | |

Board Chair retainer | | $ | 400,000 | (1) |

Director retainer | | $ | 200,000 | (1) |

Committee Chair retainers | | | | |

Audit Committee | | $ | 20,000 | |

Compensation Committee | | $ | 20,000 | |

CG&N Committee | | $ | 15,000 | |

SH&E Committee | | $ | 15,000 | |

Non-Chair Committee member retainer | | $ | 5,000 | |

Travel fee (per day) | | $ | 500 | |

Per diem for Committee meeting | | $ | 1,500 | (2) |

| (1) | Reflects annual retainer effective July 1, 2013, when the annual retainer for outside directors was increased by $15,000 from $185,000 and the annual retainer for the Board Chair was increased by $30,000 from $370,000, after considering the recommendations of Towers Watson. |

| (2) | Each outside director who was a member of a Board Committee, other than the Board Chair, received a per diem fee of $1,500 for committee meetings he or she attended, provided such meetings were not held the same day as a Board meeting. |

As described below, each outside director can defer, in the form of DSUs, up to 100% of the annual retainer payable to him or her in respect of serving as a director, which would otherwise be payable in cash. Due to the economic challenges faced in 2013, including the operating changes and workforce reductions we announced in December 2013, the Board determined not to grant any increase in director compensation for 2014.

Stock-Based Compensation

Effective November 20, 2001, we adopted the Deferred Share Unit Plan (the “DSU Plan”), which allows outside directors to defer, in the form of DSUs, up to 100% of the annual retainer payable to him or her in respect of serving as a director that would otherwise be payable in cash. Each DSU has an initial value equal to the market value of a Share at the time of deferral. The DSU Plan is intended to enhance our ability to attract and retain highly qualified individuals to serve as directors and to promote a greater alignment of interests between such directors and our shareholders. The DSU Plan also provides for discretionary grants of DSUs, which the Board discontinued on January 24, 2007 in connection with an increase to the annual retainer.

Each DSU is credited to the account of an individual director and is fully vested at the time of grant, but is distributed only when the outside director has ceased to be a member of the Board, provided that the director is neither our employee nor an employee of any of our subsidiaries. In accordance with elections made pursuant to the terms of the DSU Plan, the director will receive, within a specified period following retirement, a cash payment equal to his or her DSUs multiplied by the applicable Share price at the date of valuation (reduced by the amount of applicable withholding taxes). While the Compensation Committee, with Board approval, has the discretion to distribute Shares in lieu of cash, the Compensation Committee and Board have determined that all distributions pursuant to the DSU Plan will be made in cash. DSUs earn dividends in the form of additional DSUs at the same rate as dividends are paid on Shares.

The number of DSUs credited to the director’s account with respect to director retainer fees that the director elects to allocate to the DSU Plan is determined as of the last trading day of each calendar quarter and is equal to the quotient obtained by dividing (a) the aggregate amount of retainer fees allocated to the DSU Plan for the relevant calendar quarter by (b) the market value of a Share on such last trading day (determined on the basis of the closing price on the TSX for participants resident in Canada and on the basis of the closing price on the NYSE for all other participants).

In 2013, the following outside directors elected to receive all or a portion of 2013 director retainer fees in the form of DSUs: Mr. Burley, Mr. Chynoweth, Mr. Estey, Mr. Grandey, Mr. Hoffman, Ms. Laberge, Mr. Martell and Mr. McCaig.

The outside directors were not granted any stock options in 2013 and have not been granted any stock options since the Board’s decision in 2003 to discontinue stock option grants to outside directors.

Share Ownership Requirements

The Board believes that the economic interests of directors should be aligned with those of shareholders. By the time a director has served on the Board for five years, he or she must own Shares and/or DSUs with a value equal to at least five times the annual retainer paid to directors with at least one-half of such ownership requirement to be satisfied by the time a director has served on the Board for two and one-half years. The Board may make exceptions to these standards in particular circumstances.

If a director’s Share ownership falls below the minimum guidelines due to a decline in the Share price, such director will have three years to restore compliance. For purposes of determining compliance during this three-year period, the director’s Shares will be valued at the higher of cost or market value.

As of February 20, 2014, all of our directors were in compliance with the applicable requirements described above.

| | |

| 19 | | PotashCorp 2014 Management Proxy Circular |

Other Benefits

Directors participate in our Group Life Insurance coverage (Cdn$50,000), Accidental Death and Dismemberment coverage (Cdn$100,000), Business Travel Accidental coverage (Cdn$1,000,000) and Supplemental Business Travel Medical coverage (Cdn$1,000,000). The amounts set forth in parenthesis with respect to each benefit indicates the per calendar year coverage for each director.

The following table sets forth the compensation earned by our outside directors during fiscal 2013 as prescribed in accordance with Item 402(k) of Regulation S-K. The table in footnote (2) below sets forth further details, including the amount of each outside director’s 2013 annual retainer and committee meeting and other fees received in the form of cash and DSUs.

2013 Non-Employee Director Compensation(1)

(see explanatory notes)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned

or Paid in

Cash ($)(2) | | | Stock Awards ($)(2)(3)(4) | | | Option

Awards ($)(5) | | | Non-Equity

Incentive Plan

Compensation

($) | | | Change in

Pension Value

and Nonqualified

Deferred

Compensation

Earnings | | | All Other

Compensation

($)(6) | | | Total ($) | |

Christopher M. Burley | | | 165,875 | | | | 57,466 | | | | — | | | | — | | | | — | | | | 139 | | | | 223,480 | |

Donald G. Chynoweth | | | 115,750 | | | | 104,158 | | | | — | | | | — | | | | — | | | | 139 | | | | 220,047 | |

Daniel Clauw(7) | | | 222,000 | | | | — | | | | — | | | | — | | | | — | | | | 453 | | | | 222,453 | |

John W. Estey | | | 117,250 | | | | 197,620 | | | | — | | | | — | | | | — | | | | 453 | | | | 315,323 | |

Gerald W. Grandey | | | 8,500 | | | | 211,559 | | | | — | | | | — | | | | — | | | | 139 | | | | 220,198 | |

C. Steven Hoffman | | | 9,500 | | | | 238,117 | | | | — | | | | — | | | | — | | | | 453 | | | | 248,070 | |

Dallas J. Howe | | | 385,000 | | | | 129,692 | | | | — | | | | — | | | | — | | | | 139 | | | | 514,831 | |

Alice D. Laberge | | | 155,875 | | | | 140,447 | | | | — | | | | — | | | | — | | | | 139 | | | | 296,461 | |

Keith G. Martell | | | 164,375 | | | | 73,594 | | | | — | | | | — | | | | — | | | | 139 | | | | 238,108 | |

Jeffrey J. McCaig | | | 9,500 | | | | 315,275 | | | | — | | | | — | | | | — | | | | 139 | | | | 324,914 | |

Mary Mogford | | | 222,000 | | | | 97,162 | | | | — | | | | — | | | | — | | | | 139 | | | | 319,301 | |

Elena Viyella de Paliza | | | 207,500 | | | | 54,667 | | | | — | | | | — | | | | — | | | | 453 | | | | 262,620 | |

| (1) | Those amounts that were paid in Canadian dollars have been converted to United States dollars using the average exchange rate for the month prior to the date of payment. |

| (2) | Stock Award amounts set forth above include the amount of annual retainer deferred into DSUs plus dividend amounts on DSUs. The following table sets forth each outside director’s annual retainer, meeting and other fees for fiscal year 2013 that were earned or paid in the form of cash or deferred in the form of DSUs. |

Remuneration of Directors

For the Fiscal Year Ended December 31, 2013

| | | | | | | | | | | | | | | | | | | | |

| | | Annual Retainer | | | Committee Meeting

and Other Fees

($) | | | Total

Remuneration

($) | | | Percentage of Total

Remuneration in

DSUs

(%) | |

| Name | | Cash ($) | | | DSUs ($) | | | | |

Christopher M. Burley | | | 151,875 | | | | 50,625 | | | | 14,000 | | | | 216,500 | | | | 23.38 | |

Donald G. Chynoweth | | | 101,250 | | | | 101,250 | | | | 14,500 | | | | 217,000 | | | | 46.66 | |

Daniel Clauw | | | 202,500 | | | | — | | | | 19,500 | | | | 222,000 | | | | — | |

John W. Estey | | | 108,750 | | | | 108,750 | | | | 8,500 | | | | 226,000 | | | | 48.12 | |

Gerald W. Grandey | | | — | | | | 202,500 | | | | 8,500 | | | | 211,000 | | | | 95.97 | |