Potash Corporation of Saskatchewan Inc.

February 20, 2015

Dear Shareholder:

The Board and management are pleased to invite you to join us at the Corporation’s twenty-sixth annual meeting, which will be held at 3:30 p.m. (Central Standard Time) on Tuesday, May 12, 2015 at the Radisson Hotel, Michelangelo A, 405-20th Street East, Saskatoon, Saskatchewan, Canada.

The Annual and Special Meeting is your opportunity to hear first-hand about our performance and plans for the future and also to consider and vote on a number of important matters. We hope that you can join us in person. We will also webcast the meeting on our website at www.potashcorp.com.

The accompanying Management Proxy Circular describes the business to be conducted at the meeting and provides information on PotashCorp’s approach to executive compensation and governance practices. We value your views and encourage you to read the Management Proxy Circular in advance of the meeting. At the meeting members of management and our Board of Directors will be present and you will have the opportunity to meet with them and ask questions.

Your participation in voting at the meeting is important to us. You can vote by attending in person, or alternatively by telephone, via the Internet or by completing and returning the enclosed proxy or voting information form. Please refer to the “About Voting” and “How to Vote” sections of the accompanying Management Proxy Circular for further information.

The Board and management look forward to your participation at the meeting and thank you for your continued support.

| | |

| Sincerely, | | |

| |

| |  |

DALLAS J. HOWE Board Chair | | JOCHEN E. TILK President and Chief Executive Officer |

Suite 500, 122 — 1st Avenue South, Saskatoon, Saskatchewan Canada S7K 7G3

Notice of Annual and Special Meeting of Shareholders

NOTICE IS HEREBY GIVEN that the Annual and Special Meeting (such meeting and any adjournments and postponements thereof referred to as the “Meeting”) of shareholders of Potash Corporation of Saskatchewan Inc. (the “Corporation”), a corporation organized under the laws of Canada, will be held on:

Tuesday, May 12, 2015

3:30 p.m. (Central Standard Time)

Radisson Hotel, Michelangelo A

405 — 20th Street East

Saskatoon, Saskatchewan

Canada S7K 6X6

for the following purposes:

| 1. | to receive the consolidated financial statements of the Corporation for the fiscal year ended December 31, 2014 and the report of the auditors thereon; |

| 2. | to elect the Board of Directors of the Corporation for 2015; |

| 3. | to appoint auditors of the Corporation for 2015; |

| 4. | to consider and, if deemed appropriate, adopt, with or without variation, a resolution authorizing the Corporation to implement a new performance option plan which is attached as Appendix B to the accompanying Management Proxy Circular; |

| 5. | to consider and approve, on an advisory basis, a resolution accepting the Corporation’s approach to executive compensation; |

| 6. | to consider and, if deemed appropriate, adopt, with or without variation, a resolution confirming amendments to the Corporation’s general by-law; |

| 7. | to consider a shareholder proposal; and |

| 8. | to transact such other business as may properly come before the Meeting. |

This Notice of Annual and Special Meeting of Shareholders and Management Proxy Circular are available on the Corporation’s website (www.potashcorp.com).

Shareholders who are unable to attend the Meeting are encouraged to complete, sign and return the enclosed proxy form. To be valid, proxies must be received by the Corporation’s transfer agent, CST Trust Company, at its Toronto office no later than 3:30 p.m. (Central Standard Time) on Friday, May 8, 2015, or if the Meeting is adjourned or postponed, at least 48 hours (excluding weekends and holidays) before the Meeting resumes.

DATED at Saskatoon, Saskatchewan this 20thday of February, 2015.

BY ORDER OF THE BOARD OF DIRECTORS

JOSEPH A. PODWIKA

Secretary

POTASH CORPORATION OF SASKATCHEWAN INC.

SUITE 500, 122 — 1st AVENUE SOUTH, SASKATOON, SK CANADA S7K 7G3

2015 MANAGEMENT PROXY CIRCULAR

What’s Inside

Introduction

Management of Potash Corporation of Saskatchewan Inc. (“PotashCorp” or the “Corporation”) is providing this Management Proxy Circular to solicit proxies for the Annual and Special Meeting on May 12, 2015 (such meeting and any adjournments and postponements thereof, the “Meeting”).

Common Shares Outstanding

As at February 20, 2015, 831,300,039 common shares in the capital of the Corporation (the “Shares”) were outstanding. The Shares trade under the symbol “POT” on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”).

Record Date and Entitlement to Vote

Each shareholder of record at the close of business on March 16, 2015 (the “Record Date”) will be entitled to vote at the Meeting the Shares registered in his or her name on that date. Each Share carries the right to one vote for each director nominee and one vote on each other matter voted on at the Meeting.

Holders of 10% or More Shares

Other than as described below, to the knowledge of the Corporation’s directors and officers, no person or company owns or exercises control or direction over more than 10% of the outstanding Shares.

Based on a Schedule 13G filed on February 13, 2015 with the United States Securities and Exchange Commission (the “SEC”), Capital World Investors beneficially owns 85,298,200 Shares representing approximately 10.2% of the outstanding Shares.

Additional Information

Financial information relating to the Corporation is contained in its comparative financial statements and Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) for the fiscal year ended December 31, 2014.

Additional information relating to the Corporation that is not contained in this Management Proxy Circular, including the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2014 (the “Form 10-K”), together with any document incorporated by reference therein, is available on SEDAR at www.sedar.com or EDGAR at www.sec.gov. Copies may be obtained, free of charge, upon request from the Corporate Secretary, Potash Corporation of Saskatchewan Inc., Suite 500, 122 — 1st Avenue South, Saskatoon, Saskatchewan, Canada, S7K 7G3.

Currency

Except as otherwise stated, all dollar amounts are expressed in United States dollars.

Date of Information

Except as otherwise stated, the information contained in this Management Proxy Circular is given as of February 20, 2015.

About Voting

Proxy Solicitation

Management of the Corporation is soliciting proxies of all Registered and Beneficial (Non-Registered) Shareholders (“Beneficial Shareholders”) primarily by mail and electronic means, supplemented by telephone or other contact by employees of the Corporation (who will receive no additional compensation), and all such costs will be borne by the Corporation. We have retained the services of D.F. King Canada (the “Proxy Solicitation Agent”) to solicit proxies in Canada and in the United States at an estimated cost of Cdn$26,000.

This Management Proxy Circular and related proxy materials are being sent to both Registered and Beneficial Shareholders. The Corporation does not send proxy-related materials directly to Beneficial Shareholders and is not relying on the notice-and-access provisions of securities laws for delivery to either Registered or Beneficial Shareholders. The Corporation will deliver proxy-related materials to nominees, custodians and fiduciaries, and they will be asked to promptly forward them to Beneficial Shareholders. If you are a Beneficial Shareholder, your nominee should send you a voting instruction form or proxy form along with this Management Proxy Circular. The Corporation has elected to pay for the delivery of our proxy-related materials to objecting Beneficial Shareholders.

If you have any questions about the information contained in this Management Proxy Circular or require assistance in voting your Shares, please contact the Proxy Solicitation Agent toll-free in North America at 1-800-835-0437 or by email at inquiries@dfking.com.

Voting

If you hold Shares as of the Record Date you may vote on six items:

| (1) | the election of nominees to the Corporation’s Board of Directors (the “Board”); |

| (2) | the appointment of auditors of the Corporation; |

| (3) | a resolution authorizing the Corporation to implement a new performance option plan (the “2015 Performance Option Plan”); |

| (4) | an advisory resolution accepting the Corporation’s approach to executive compensation; |

| (5) | a resolution confirming amendments to the Corporation’s general by-law (the “By-Law”); and |

| (6) | a shareholder proposal. |

The Board and management recommend that you voteFOR each of the director nominees listed in this Management Proxy Circular,FOR items (2), (3), (4) and (5) andAGAINST item (6).

Unless otherwise noted, all matters to be considered at the Meeting will be determined by a majority of votes cast at the Meeting in person or by proxy.

Quorum

In accordance with amendments to the Corporation’s By-Law adopted by the Board on February 20, 2015, a quorum for the Meeting shall be two or more persons present and holding or representing by proxy not less than 33.33% of the total number of outstanding Shares.

Proxy Voting

The persons named in the proxy form must vote or withhold from voting your Shares in accordance with your instructions on the proxy form. Signing the proxy form gives authority to Mr. Dallas J. Howe, Mr. Jochen E. Tilk, Mr. Wayne R. Brownlee or Mr. Joseph A. Podwika, each of whom is either a director or officer of the Corporation, to vote your Shares at the Meeting in accordance with your voting instructions.

In the absence of such instructions, however, your Shares will be voted as follows:

| (1) | FOR the election to the Board of each of the nominees listed on the Corporation’s proxy form; |

| (2) | FOR the appointment of Deloitte LLP as auditors of the Corporation until the close of the next annual meeting; |

| (3) | FOR the resolution authorizing the Corporation to implement the 2015 Performance Option Plan; |

| (4) | FOR the advisory resolution accepting the Corporation’s approach to executive compensation; |

| (5) | FOR the resolution confirming amendments to theBy-Law; |

| (6) | AGAINST the shareholder proposal; and |

| (7) | FOR management proposals generally. |

A proxy must be in writing and must be executed by you or by an attorney duly authorized in writing or, if the shareholder is a corporation or other legal entity, by an officer or attorney duly authorized. A proxy may also be completed over the telephone or over the Internet. To be valid your proxy must be received by our

| | |

| 1 | | PotashCorp 2015 Management Proxy Circular |

transfer agent, CST Trust Company, at its Toronto office no later than 3:30 p.m. (CST) on Friday, May 8, 2015. Please see “How to Vote” on page 3 for further information.

Amendments and Other Matters

The persons named in the proxy form will have discretionary authority with respect to amendments or variations to matters identified in the Notice of the Meeting and with respect to other matters that properly come before the Meeting.

As of the date of this Management Proxy Circular, our management knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the proxy form will vote on them in accordance with their best judgment.

Transfer Agent

You can contact CST Trust Company, the Corporation’s transfer agent as follows:

By Telephone:

1-800-387-0825 (toll-free within Canada and the United States)

or

1-416-682-3860 (from any country other than Canada or the United States)

By Fax:

1-514-985-8843 (all countries)

By Mail:

P.O. Box 700

Station B

Montreal, Quebec, Canada H3B 3K3

Through the Internet:

www.canstockta.com

| | |

| PotashCorp 2015 Management Proxy Circular | | 2 |

How to Vote

REGISTERED SHAREHOLDER VOTING

You are a Registered Shareholder if your Shares are held in your name and you have a share certificate. The enclosed proxy form indicates whether you are a Registered Shareholder.

Voting Options

| | | | |

| | In person at the Meeting; or |

| | By proxy: |

| |

| | By Telephone or Fax; or |

| |

| | By Mail; or |

| |

| | On the Internet. |

See below for details on each option.

Voting in Person

If you wish to vote in person at the Meeting, do not complete or return the proxy form. Please register with the transfer agent, CST Trust Company, when you arrive at the Meeting.

Voting by Proxy

Registered Shareholders have four options to vote by proxy:

| (a) | By Telephone (only available to Registered Shareholders resident in Canada or the United States): |

Call 1-888-489-5760 from a touch-tone phone and follow the instructions. You will need the control number located on the enclosed proxy form. You do not need to return your proxy form.

Complete, date and sign the enclosed proxy form and return it by fax to 1-866-781-3111 (toll-free within Canada and the United States) or 1-416-368-2502 (from any country other than Canada or the United States).

Complete, date and sign the enclosed proxy form and return it in the envelope provided.

Go to www.cstvotemyproxy.com and follow the instructions on screen. You will need the control number located on the enclosed proxy form. You do not need to return your proxy form.

At any time, CST Trust Company may cease to provide telephone and Internet voting, in which case Registered Shareholders can elect to vote by mail or by fax, as described above.

The persons already named in the enclosed proxy are either directors or officers of the Corporation. Please see “About Voting

— Proxy Voting” on page 1.You have the right to appoint some other person of your choice, who need not be a shareholder, to attend and act on your behalf at the Meeting. If you wish to do so, please strike out the four printed names appearing on the proxy form, and insert the name of your chosen proxyholder in the space provided on the proxy form.

If you decide to vote by telephone or on the Internet, you cannot appoint a person to vote your Shares other than our directors or officers whose printed names appear on the proxy form.

It is important to ensure that any other person you appoint is attending the Meeting and is aware that his or her appointment has been made to vote your Shares.

Deadlines for Voting

| (a) | Attending the Meeting— If you are planning to attend the Meeting and wish to vote your Shares in person at the Meeting, your vote will be taken and counted at the Meeting. |

| (b) | Using the Proxy Form— If you are voting using the proxy form, your proxy form should be received at the Toronto office of CST Trust Company by mail or fax no later than 3:30 p.m. (CST) on Friday, May 8, 2015 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding weekends and holidays) before the Meeting resumes. |

| (c) | Telephone or Internet— If you are voting your proxy by telephone or on the Internet, your vote should be received by CST Trust Company no later than 3:30 p.m. (CST) on Friday, May 8, 2015. |

Revoking Your Proxy

As a Registered Shareholder who has voted by proxy, you may revoke it by timely voting again in any manner (telephone, fax, mail or Internet), or by depositing an instrument in writing (which includes another proxy form with a later date) executed by you or by your attorney authorized in writing with our Corporate Secretary at Suite 500, 122 — 1st Avenue South, Saskatoon, Saskatchewan, Canada, S7K 7G3, at any time up to and including the last business day preceding the date of the Meeting (or any adjournment or postponement, if the Meeting is adjourned or postponed), or by depositing it with the Chairman of the Meeting before the Meeting starts or any adjournment or postponement continues. A Registered Shareholder may also revoke a proxy in any other manner permitted by law. In addition, participation in person in a vote by ballot at the Meeting will automatically revoke any proxy previously given by you in respect of business covered by that vote.

| | |

| 3 | | PotashCorp 2015 Management Proxy Circular |

BENEFICIAL SHAREHOLDER VOTING

You are a Beneficial Shareholder if your Shares are held in a nominee’s name such as a bank, trust company, securities broker or other nominee. Typically, the proxy form or voting instruction form sent or to be sent by your nominee indicates whether you are a Beneficial Shareholder.

Voting Options

| | |

| | In person at the Meeting; or |

| | By voting instructions. |

See below for details on each option.

Voting in Person

If you wish to vote in person at the Meeting, insert your own name in the space provided on the request for voting instructions or proxy form to appoint yourself as proxyholder and follow the instructions of your nominee.

Beneficial Shareholders who instruct their nominee to appoint themselves as proxyholders should, at the Meeting, present themselves to a representative of the transfer agent, CST Trust Company, at the table identified as “Beneficial Shareholders”. Do not otherwise complete the form sent to you as your vote will be taken and counted at the Meeting.

Voting Instructions

Your nominee is required to seek voting instructions from you in advance of the Meeting. Accordingly, you will receive, or will have already received, a request for voting instructions or a proxy form for the number of Shares held by you.

Each nominee has its own procedures, which you should carefully follow to ensure that your Shares are voted at the Meeting. These

procedures generally allow voting in person or by proxy (telephone, fax, mail or on the Internet). Beneficial Shareholders should contact their nominee for instructions in this regard.

Whether or not you attend the Meeting, you can appoint someone else to attend and vote as your proxyholder. To do this, please follow the procedures of your nominee carefully. The persons already named in the proxy form are either directors or officers of the Corporation. Please see “About Voting — Proxy Voting” on page 1.

It is important to ensure that any other person you appoint is either attending the Meeting in person or returning a proxy reflecting your instructions and is aware that his or her appointment has been made to vote your Shares.

Deadline for Voting

| (a) | Attending the Meeting — If you are planning to attend the Meeting and wish to vote your Shares in person at the Meeting, your vote will be taken and counted at the Meeting. |

| (b) | Voting Instructions — Every nominee has its own procedures which you should carefully follow to ensure that your Shares are voted at the Meeting. |

If voting by voting instructions, your nominee must receive your voting instructions in sufficient time for your nominee to act on it. For your vote to count, it must be received by CST Trust Company at its Toronto office no later than 3:30 p.m. (CST) on Friday, May 8, 2015 or, if the Meeting is adjourned or postponed, at least 48 hours (excluding weekends and holidays) before the Meeting resumes.

Revoking Voting Instructions

To revoke your voting instructions, follow the procedures provided by your nominee.

| | |

| PotashCorp 2015 Management Proxy Circular | | 4 |

Business of the Meeting

Financial Statements

The Consolidated Financial Statements for the fiscal year ended December 31, 2014 are included in the Form 10-K filed with the SEC and the Canadian Securities Administrators (the “CSA”).

Nominees for Election to the Board of Directors

The 11 nominees proposed for election as directors of the Corporation are listed on page 7. All nominees have established their eligibility and willingness to serve as directors. Directors will hold office until the next annual meeting of shareholders of the Corporation or until their successors are elected or appointed.

Unless otherwise instructed, the persons designated in the form of proxy intend to voteFOR the election to the Board of each of the nominees listed on the Corporation’s proxy form. If, for any reason, at the time of the Meeting any of the nominees listed on the Corporation’s proxy form are unable to serve, it is intended that the persons designated in the form of proxy will vote in their discretion for a substitute nominee or nominees. Alternatively, the Board may determine to reduce the size of the Board.

The Board unanimously recommends that shareholders vote FOR the election of each of the nominees listed on the Corporation’s proxy form. Unless otherwise instructed, the persons designated in the form of proxy intend to voteFOR the election of each of the Corporation’s nominees listed herein.

Appointment of Auditors

At the Meeting, shareholders will be asked to vote to reappoint the firm of Deloitte LLP, the present auditors of the Corporation, as auditors of the Corporation to hold office until the next annual meeting of shareholders of the Corporation.

The Audit Committee recently recommended the reappointment of Deloitte LLP after conducting a competitive selection process with respect to the Corporation’s external audit services, as discussed in the “Report of the Audit Committee and Appointment of Auditors” beginning on page 25.

The Board unanimously recommends that shareholders vote FOR the reappointment of Deloitte LLP as auditors of the Corporation to hold office until the next annual meeting of shareholders of the Corporation.Unless otherwise instructed, the persons designated in the form of proxy intend to voteFOR the reappointment of Deloitte LLP as auditors of the Corporation.

Adoption of the 2015 Performance Option Plan

At the Meeting, shareholders will be asked to consider and, if deemed appropriate, adopt, with or without variation, the following resolution authorizing the Corporation to implement the

2015 Performance Option Plan, which has been approved by the Board and is attached as Appendix B to this Management Proxy Circular:

“Resolved that:

| 1. | the 2015 Performance Option Plan is hereby adopted and approved by the shareholders of the Corporation; and |

| 2. | any officer of the Corporation be and is hereby authorized and directed for and on behalf of the Corporation to do such things and to take such actions as may be necessary or desirable to carry out the intent of the foregoing resolution and the matters authorized thereby.” |

The Board unanimously recommends that shareholders vote FOR the resolution to authorize the Corporation to implement the 2015 Performance Option Plan. Unless otherwise instructed, the persons designated in the form of proxy intend to voteFOR the resolution to authorize the Corporation to implement the 2015 Performance Option Plan.

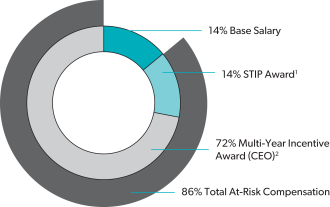

Advisory Vote on Executive Compensation

The Board has spent considerable time and effort defining and implementing its executive compensation program and believes that its program achieves the goal of maximizing long-term shareholder value while attracting, engaging and retaining world-class talent. At the 2014 annual and special meeting (the “2014 Annual Meeting”), PotashCorp’s approach to executive compensation was approved by 96.55% of the Shares voted on the advisory “Say on Pay” resolution.

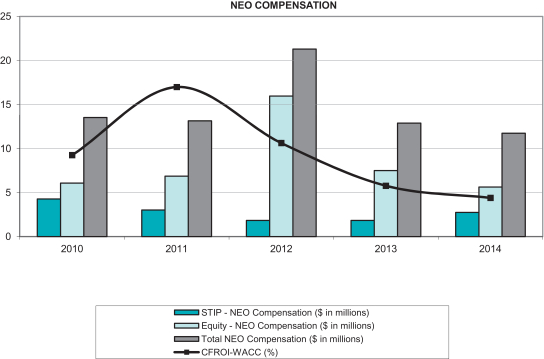

For further information regarding the Corporation’s approach to executive compensation and its shareholder outreach program, please see the “Report of the CG&N Committee” and “Compensation” sections of this Management Proxy Circular beginning on pages 29 and 36, respectively.

As this is an advisory vote, the results will not be binding upon the Board or the Corporation. However, the Board will take the results of the advisory vote into account, as appropriate, when considering future executive compensation policies, procedures and decisions and in determining whether there is a need to significantly increase its engagement with shareholders on executive compensation related matters. In the event that a significant number of shareholders oppose the resolution, the Board expects to consult with shareholders to understand their concerns and will review the Corporation’s approach to executive compensation in the context of these concerns.

The Board proposes that you indicate your support for the Corporation’s approach to executive compensation disclosed in

| | |

| 5 | | PotashCorp 2015 Management Proxy Circular |

this Management Proxy Circular by voting in favor of the following advisory resolution:

“RESOLVED, on an advisory basis and not to diminish the role and responsibilities of the Board of Directors, that the shareholders accept the approach to executive compensation disclosed in the Corporation’s Management Proxy Circular delivered in advance of the 2015 Annual and Special Meeting of Shareholders.”

The Board unanimously recommends that shareholders vote FOR the approach to executive compensation disclosed in this Management Proxy Circular. Unless otherwise instructed, the persons designated in the form of proxy intend to voteFOR the advisory resolution.

By-Law Amendments

On February 20, 2015, the Board, on the recommendation of the Corporate Governance and Nominating (“CG&N”) Committee, adopted certain amendments to the By-Law.

The following is an overview only of the provisions of the amendments to the By-Law and is qualified by reference to the full text of the amended By-Law attached as Appendix C to this Management Proxy Circular (which is a blackline version of the amended By-Law reflecting the amendments). The full-text of the amended By-Law has been filed with the CSA under PotashCorp’s profile on SEDAR at www.sedar.com and with the SEC on EDGAR at www.sec.gov/edgar.shtml.

The amendments to the By-Law provide for:

| Ÿ | | the adoption of advance notice requirements for nominations of directors by shareholders; |

| Ÿ | | an increase to the quorum requirement for meetings of shareholders from a person or persons present and holding or representing by proxy not less than five percent (5%) of the total number of issued shares of the Corporation having voting rights at such meeting to two or more persons holding or representing not less than thirty three and a third percent (33.33%) of the total number of issued shares of the Corporation having voting rights; |

| Ÿ | | elimination of the chairman being entitled to a second or casting vote in the event of equal votes at a meeting of shareholders; and |

| Ÿ | | explicit authorization for the Corporation to send by electronic means notices and other documentation to shareholders, including materials relating to future meetings of shareholders, where permitted by law, by way of “notice-and-access”. |

The amendments were adopted in light of evolving governance practices. In particular, the Board believes that the adoption of advance notice requirements for nominations of directors by shareholders provides a clear and transparent process for all shareholders who intend to nominate directors at a shareholders’

meeting, by providing a reasonable time frame for shareholders to notify the Corporation of their intention to nominate directors (in the case of an annual meeting of shareholders, not less than 30 days before the date of the meeting) and by requiring nominating shareholders to disclose information concerning the proposed nominees. The Board will be able to evaluate the proposed nominees’ qualifications and suitability as directors and respond as appropriate in the best interests of the Corporation.

The advance notice requirements are also intended to facilitate an orderly and efficient meeting process. The advance notice requirements do not interfere with the ability of shareholders to requisition a meeting or to nominate directors by way of a shareholder proposal in accordance with theCanada Business Corporations Act (“CBCA”).

The amendments to the By-Law are in effect until they are confirmed, confirmed as amended or rejected by shareholders at the Meeting, and if confirmed, will continue in effect. Accordingly, shareholders are being asked to confirm the amendments to the By-Law at the Meeting so that the amendments will continue in effect.

The resolution to confirm the amendments to the By-Law is as follows:

“Resolved that:

| 1. | the amendments to the Corporation’s General By-Law, in the form adopted by the Board of Directors of the Corporation on February 20, 2015 and attached as Appendix C to this Management Proxy Circular, be and are hereby confirmed as amendments to the Corporation’s General By-Law; and |

| 2. | any officer of the Corporation be and is hereby authorized and directed for and on behalf of the Corporation to do such things and to take such actions as may be necessary or desirable to carry out the intent of the foregoing resolution and the matters authorized hereby.” |

The Board unanimously recommends that shareholders vote FOR the resolution to confirm the amendments to the By-Law as described in this Management Proxy Circular. Unless otherwise instructed, the persons designated in the form of proxy intend to voteFOR the resolution confirming the amendments to the By-Law.

Shareholder Proposal

A proposal has been submitted by shareholders for consideration at the Meeting. Such proposal and the Board’s response thereto are set forth in Appendix D attached to this Management Proxy Circular.

The Board unanimously recommends that shareholders vote AGAINST the shareholder proposal. Unless otherwise instructed, the persons designated in the form of proxy intend to voteAGAINST the shareholder proposal.

| | |

| PotashCorp 2015 Management Proxy Circular | | 6 |

Director Nominees

Introduction

The articles of the Corporation provide that the Board shall consist of a minimum of six directors and a maximum of twenty directors, with the actual number to be determined from time to time by the Board. The Board has determined that, at the present time, the appropriate number of directors is 11.

Proxies solicited, unless otherwise specified, will be voted for each of the nominees set out below (or for substitute nominees in the event of contingencies not known at present) who will, subject to the By-Law and applicable corporate law, hold office until the next annual meeting of shareholders or until their successors are elected or appointed in accordance with the By-Law or applicable law.

Nominees

The 11 individuals being nominated for election in 2015 are:

| | |

| Christopher M. Burley | | Consuelo E. Madere |

| Donald G. Chynoweth | | Keith G. Martell |

| John W. Estey | | Jeffrey J. McCaig |

| Gerald W. Grandey | | Jochen E. Tilk |

| C. Steven Hoffman | | Elena Viyella de Paliza |

| Alice D. Laberge | | |

Dallas J. Howe and Mary Mogford will be retiring as directors at the expiry of their current terms and will not be standing forre-election at the Meeting. Mr. Howe has been a director since 1991 and has served as Board Chair since 2003. Ms. Mogford has been a director since 2001. The Corporation wishes to thank Mr. Howe and Ms. Mogford for their long service and wishes them the very best in their future endeavors.

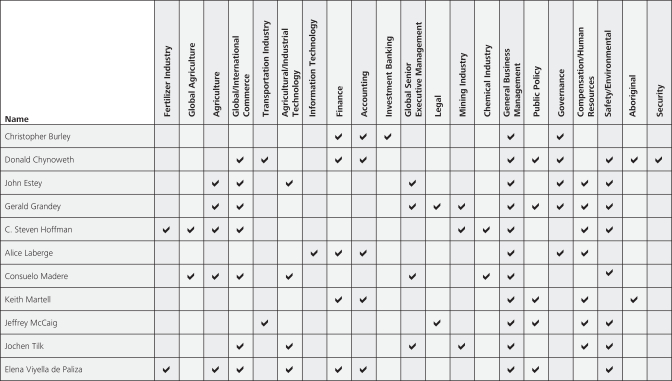

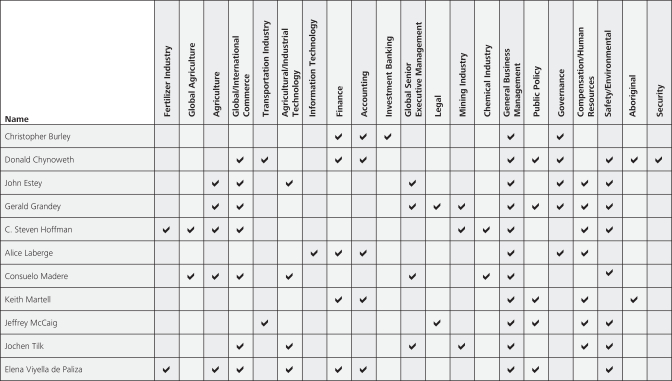

The goal of the CG&N Committee is to assemble a Board with the appropriate background, knowledge, skills and diversity to effectively carry out its duties, including overseeing the Corporation’s strategy and business affairs and foster an environment that allows the Board to constructively engage with and guide management.

For the CG&N Committee to recommend an individual for Board membership, candidates are assessed on their individual qualifications, diversity, experience and expertise and must exhibit the highest degree of integrity, professionalism, values and independent judgment.

The CG&N Committee is of the view that the above director nominees represent an appropriate mix of expertise and qualities required for the Board. See the following biographies for information on each director nominee’s professional experience, background and qualifications on page 30 for information regarding their diverse skill set.

Independence

The Board has determined that all director nominees, except for Mr. Tilk and Ms. Viyella de Paliza, are independent. See pages 17 and 18 for details.

As President and Chief Executive Officer, Mr. Tilk is not independent. Ms. Viyella de Paliza is also not considered to be independent in light of a familial relationship with certain executives of a customer of the Corporation. However Ms. Viyella de Paliza has no direct or indirect interest in transactions between the Corporation and such customer and all transactions are completed on customary and arms-length trade terms. Ms. Viyella de Paliza provides a valuable contribution to the Board and her presence on the Board has not played any role in the Corporation’s decision to transact business with such customer.

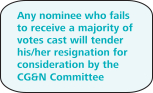

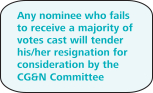

Majority Voting Policy

In an uncontested election, any director nominee who fails to receive votes in favor of his or her election representing a majority of the Shares voted and withheld for the election of the director will tender his or her resignation for consideration by the CG&N Committee. Except in extenuating circumstances, it is expected that the CG&N Committee will recommend to the Board that the resignation be accepted and effective within a period of ninety days and that the action taken by the Board be publicly disclosed. To the extent possible, the CG&N Committee and Board members who act on the resignation shall be directors who have themselves received a majority of votes cast.

| | |

| 7 | | PotashCorp 2015 Management Proxy Circular |

Biographies

The following biographies highlight the specific experience, attributes and qualifications of each nominee for director that led to the Board’s conclusion that the person should serve as a director of the Corporation.

Specifically, the following table states their names and ages, all other positions and offices they have held with the Corporation, their present principal occupation or employment, their business experience over the last five years (including, where applicable, current and past directorships of public companies over the last five years), the period during which they have served as directors of the Corporation, their principal areas of expertise and their independence status. Also disclosed below is each nominee’s current security holdings and their value of at-risk holdings as at February 20, 2015, the percentage of votes voted in favor of their election at last year’s meeting and their overall Board and committee meeting attendance in 2014.

For further detailed information on director independence, attendance, at-risk holdings and compensation, please see the tables and narratives following the biographies under “About the Board” on page 15.

| | |

| PotashCorp 2015 Management Proxy Circular | | 8 |

| | | | | | | | |

| | | |

| | | | Christopher M. Burley Age: 53 Calgary, Alberta, Canada Director since 2009 Independent(1) | | Mr. Burley is a Corporate Director and former Managing Director and Vice Chairman, Energy of Merrill Lynch Canada Inc., an investment banking firm. A graduate of the Institute of Corporate Directors’ Education Program, he has 23 years of experience in the investment banking industry. He is Chairman of the board of directors of Parallel Energy Inc. and is a director of the United Way of Calgary and area. |

| | Principal Areas of Expertise/Experience: | | Board Committee Membership: |

| | Finance Investment Banking Governance | | Audit (Chair) CG&N |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 12/12 Audit: 9/9 CG&N: 4/4 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: Parallel Energy Inc. | | Past Boards: n/a |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 30,000 DSU Ownership: 8,944 Stock Options: None | | Value of At-Risk Holdings: $1,440,137 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.69% |

| | | | | | | | |

| | | |

| | | | Donald G. Chynoweth Age: 54 Calgary, Alberta, Canada Director since 2012 Independent(1) | | Mr. Chynoweth is Senior Vice President of SNC Lavalin O&M, one of the world’s leading engineering and construction groups. He is a graduate of the University of Saskatchewan, with more than 31 years of management experience in business, politics, investment and business development. He is a graduate of the Institute of Corporate Directors’ Education Program. |

| | Principal Areas of Expertise/Experience: Global/International Commerce Security Public Policy | | Board Committee Membership: Audit SH&E |

| | 2014 Board & Committee Meeting Attendance: |

| | Board: 12/12 Audit: 9/9 SH&E: 4/4 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: n/a | | Past Boards: AltaLink, L.P. |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 10,000 DSU Ownership: 7,581 Stock Options: None | | Value of At-Risk Holdings: $650,147 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.67% |

| | |

| 9 | | PotashCorp 2015 Management Proxy Circular |

| | | | | | | | |

| | | | John W. Estey Age: 64 Glenview, Illinois, USA Director since 2003 Independent(1) | | Mr. Estey is Chairman of the Board of S&C Electric Company, a global provider of equipment and services for electric power systems. He is a member of the Board of Governors of the National Electrical Manufacturers Association, a director of the Executives’ Club of Chicago and Southwire Company and Past Chair of the Board of Trustees of the Adler Planetarium & Astronomy Museum. |

| | Principal Areas of Expertise/Experience: Global/International Commerce Business Management Compensation Safety/Environmental | | Board Committee Membership: Compensation CG&N (chair) |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 12/12 Compensation: 5/5 CG&N: 4/4 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: n/a | | Past Boards: n/a |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 3,000 DSU Ownership: 85,484 Stock Options: None | | Value of At-Risk Holdings: $3,272,148 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.03% |

| | | | | | | | |

| | | |

| | | | Gerald W. Grandey Age: 68 Saskatoon, Saskatchewan, Canada Director since 2011 Independent(1) | | Mr. Grandey was formerly Chief Executive Officer of Cameco Corporation, a Saskatoon-based uranium provider. He is a director of Canadian Oil Sands Limited, Rare Element Resources Ltd. and Sandspring Resources Ltd. Mr. Grandey is Chairman Emeritus on the board of directors of the World Nuclear Association. He also serves on the Dean’s Advisory Council of the University of Saskatchewan’s Edwards School of Business, the Board of Governors of the Colorado School of Mines Foundation and the board of directors of the Institute of Corporate Directors (“ICD”). Mr. Grandey is a former director of Centerra Gold Inc., Bruce Power and Inmet Mining Corporation. |

| | Principal Areas of Expertise/Experience: Mining Industry Global/International Commerce Global Senior Executive Management | | Board Committee Membership: Compensation SH&E |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 12/12 Compensation: 5/5 SH&E: 4/4 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: Canadian Oil Sands Limited Rare Element Resources Ltd. Sandspring Resources Ltd. | | Past Boards: Cameco Corporation Centerra Gold Inc. Inmet Mining Corporation |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 10,500 DSU Ownership: 18,220 Stock Options: None | | Value of At-Risk Holdings: $1,062,082 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.18% |

| | |

| PotashCorp 2015 Management Proxy Circular | | 10 |

| | | | | | | | |

| | | |

| | | | C. Steven Hoffman Age: 66 Tampa, Florida, USA Director since 2008 Independent(1) | | Mr. Hoffman is a former senior executive of IMC Global Inc. With over 23 years of global fertilizer sales and marketing management experience, he retired as Senior Vice President and President, Sales and Marketing of IMC Global upon completion of the IMC Global and Cargill Fertilizer merger, which created the Mosaic Company. He is a former Chairman and President of the Phosphate Chemicals Export Association, Inc. and a former Chairman of Canpotex Limited. |

| | Principal Areas of Expertise/Experience: Fertilizer/Mining/Chemical Industry Global Agriculture/International Commerce Business Management | | Board Committee Membership: SH&E (chair) Compensation |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 12/12 SH&E: 4/4 Compensation 5/5 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: n/a | | Past Boards: n/a |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 6,600 DSU Ownership: 33,327 Stock Options: None | | Value of At-Risk Holdings: $1,476,486 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.22% |

| | | | | | | | |

| | | |

| | | | Alice D. Laberge Age: 58 Vancouver, British Columbia, Canada Director since 2003 Independent(1) | | Ms. Laberge is a Corporate Director and the former President, Chief Executive Officer and Chief Financial Officer of Fincentric Corporation, a global provider of software solutions to financial institutions. She was previously Senior Vice President and Chief Financial Officer of MacMillan Bloedel Limited. She is a director of the Royal Bank of Canada, Russel Metals Inc. and Silverbirch Holdings Inc. and has served as a director of Catalyst Paper Corporation and St. Paul’s Hospital Foundation in Vancouver. She is also a member of the Board of Governors of the University of British Columbia. |

| | Principal Areas of Expertise/Experience: e-Commerce/Technology Finance/Accounting Compensation/Human Resources | | Board Committee Membership: Audit CG&N |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 12/12 CG&N: 4/4 Audit: 9/9 | | | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: Royal Bank of Canada Russel Metals Inc. | | | | Past Boards: n/a |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 17,000 DSU Ownership: 64,225 Stock Options: None | | | | Value of At-Risk Holdings: $3,003,697 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.37% |

| | |

| 11 | | PotashCorp 2015 Management Proxy Circular |

| | | | | | | | |

| | | |

| | | | Consuelo E. Madere Age: 54 Destin, Florida, USA Director since 2014 Independent(1) | | Ms. Madere is a former executive officer of Monsanto Company, a leading global provider of agricultural products. Ms. Madere has over 30 years of domestic and global experience, spanning manufacturing, strategy, technology, business development, profit & loss responsibility and general management, and she retired from Monsanto Company as Vice President, Global Vegetables and Asia Commercial. Ms. Madere serves on the Strategic Planning Committee of the Hispanic Association on Corporate Responsibility and the Dean’s Advisory Council of the Louisiana State University Honors College. Ms. Madere received her Masters of Business Administration from the University of Iowa, and her Bachelor of Science degree in Chemical Engineering from Louisiana State University. She has also been certified by the National Association of Corporate Directors (“NACD”) as a Governance Fellow, and in 2013 attended the Stanford Director’s College. |

| | Principal Areas of Expertise/Experience: Global Agriculture Global/International Commerce Global Senior Executive Management | | Board Committee Membership: Audit SH&E |

| | 2014 Board & Committee Meeting Attendance(3): |

| | | Board: 7/7 SH&E: 2/2 Audit: 4/4 | | | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: n/a | | Past Boards: n/a |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: None DSU Ownership: 4,263 Stock Options: None | | Value of At-Risk Holdings: $157,632 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.61% |

| | | | | | | | |

| | | |

| | | | Keith G. Martell Age: 52 Saskatoon, Saskatchewan, Canada Director since 2007 Independent(1) | | Mr. Martell is Chairman and Chief Executive Officer of First Nations Bank of Canada, a Canadian chartered bank primarily focused on providing financial services to the Aboriginal marketplace in Canada. He is a chartered accountant, formerly with KPMG LLP. He is a director of the Canadian Chamber of Commerce and serves on the Dean’s Advisory Council of the University of Saskatchewan’s Edwards School of Business. He is a former director of the Public Sector Pension Investment Board of Canada, The North West Company Inc. and the Saskatoon Friendship Inn, and a former trustee of the North West Company Fund. He is also a trustee of Primrose Lake Trust. |

| | Principal Areas of Expertise/Experience: Finance/Accounting First Nations Business Management | | Board Committee Membership: Audit Compensation (Chair) |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 11/12 Compensation: 5/5 Audit: 9/9 | | | | Total Board & Committee Attendance: 96% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: n/a | | Past Boards: The North West Company Inc. North West Company Fund |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 3,800 DSU Ownership: 24,163 Stock Options: None | | Value of At-Risk Holdings: $1,034,076 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:94.08% |

| | |

| PotashCorp 2015 Management Proxy Circular | | 12 |

| | | | | | | | |

| | | |

| | | | Jeffrey J. McCaig Age: 63 Calgary, Alberta, Canada Director since 2001 Independent(1) | | Mr. McCaig is Chairman and Chief Executive Officer of the Trimac Group of Companies, a North American provider of bulk trucking and third-party logistics services. Prior to that, he practiced law, specializing in corporate financing and securities. He is Chairman and director of Bantrel Co., an engineering, procurement and construction company, a director of Orbus Pharma Inc.(4) and MEG Energy Corp and a director and co-owner of the Calgary Flames Hockey Club. Mr. McCaig is a former director of The Standard Life Assurance Company of Canada. |

| | Principal Areas of Expertise/Experience: Transportation Industry Legal Business Management | | Board Committee Membership: Compensation SH&E |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 12/12 Compensation: 5/5 SH&E: 4/4 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: MEG Energy Corp. Trimac Transportation Ltd. | | Past Boards: Trimac Income Fund Orbus Pharma Inc. |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 252,000 DSU Ownership: 116,094 Stock Options: None | | Value of At-Risk Holdings: $13,612,111 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:89.52% |

| | | | | | | | |

| | | |

| | | | Jochen E. Tilk Age: 51 Saskatoon, Saskatchewan, Canada Director since 2014 Non-Independent(1) | | Mr. Tilk came to PotashCorp after a 30-year career in the mining industry, most recently serving as President and CEO of Inmet Mining Corporation (2009-2013), a Canadian metals company with operations and projects in numerous countries around the world. During his 24 years at Inmet, Mr. Tilk helped grow that company’s market capitalization through asset optimization, organic growth and strategic acquisitions. He led a multi-billion dollar capital expenditure program — including new mine developments in Spain and Central America — and helped establish a portfolio of assets that was recognized as a leader in quality and cost. Mr. Tilk is a mining engineer and holds a Master’s degree in engineering from the University of Aachen in Germany. |

| | Principal Areas of Expertise/Experience: Mining Industry Global/International Commerce Global Senior Executive Management | | Board Committee Membership: None |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 6/6 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: n/a | | Past Boards: Inmet Mining Corporation |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015 Share Ownership: 385 DSU Ownership:(5) Stock Options: None | | Value of At-Risk Holdings:(5) |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:N/A |

| | |

| 13 | | PotashCorp 2015 Management Proxy Circular |

| | | | | | | | |

| | | |

| | | | Elena Viyella de Paliza Age: 60 Dominican Republic Director since 2003 Non-Independent(1) | | Ms. Viyella de Paliza is President of Inter-Quimica, S.A., a chemicals importer and distributor, Monte Rio Power Corp. and Jaraba Import, S.A., a subsidiary of Monte Rio Power Corp. She is a member of the board of the Inter-American Dialogue, EDUCA (Action for Education) and Universidad APEC. She was formerly the President of Indescorp, S.A. |

| | Principal Areas of Expertise/Experience: Fertilizer Industry Finance/Business Management Global/International Commerce | | Board Committee Membership: SH&E |

| | 2014 Board & Committee Meeting Attendance: |

| | | Board: 12/12 SH&E: 4/4 | | Total Board & Committee Attendance: 100% |

| | | Other Public Board Memberships — Present & Past Five Years: |

| | | Present Boards: n/a | | Past Boards: n/a |

| | | Ownership and Value of At-Risk Holdings(2): |

| | | As at February 20, 2015: Share Ownership: 57,000 DSU Ownership: 49,410 Stock Options: None | | Value of At-Risk Holdings: $3,935,058 |

| | | Ownership Requirement Compliance:Yes | | 2014 Annual Meeting Votes in Favor:84.02% |

| (1) | See “Director Independence and Other Relationships” on page 17 and “Director Independence” on pages 17 and 18. |

| (2) | See “At-Risk” Investment and Year Over Year Changes” on pages 23 and 24 for additional detail. |

| (3) | Ms. Madere was elected to the Board on May 15, 2014. |

| (4) | Mr. McCaig is a director of Orbus Pharma Inc. (“Orbus”). On or about May 17, 2010, Orbus commenced proposal proceedings pursuant to the provisions of the Bankruptcy and Insolvency Act (Canada) by filing a notice of intention to make a proposal. A proposal was submitted and approved by the creditors of Orbus on September 28, 2010 and approved by the court on October 18, 2010. The proposal was implemented in accordance with the terms and conditions approved by the creditors of Orbus and the court. During 2010, securities regulators for the Provinces of Alberta, British Columbia, Manitoba, Ontario and Quebec issued cease trading orders in relation to the securities of Orbus for the failure by Orbus to timely file financial statements as well as related continuous disclosure documents. Such cease trade orders continue to be in effect. On January 25, 2012, the common shares of Orbus were delisted from TSX Venture Exchange at the request of Orbus. |

| (5) | Mr. Tilk, who was appointed CEO in July 2014, is subject to the Corporation’s executive share ownership requirements. For a discussion of Mr. Tilk’s executive share ownership requirements and the value of his at-risk holdings see “Compensation — Compensation Discussion and Analysis — Executive Share Ownership Requirements” on pages 54 and 55. |

| | |

| PotashCorp 2015 Management Proxy Circular | | 14 |

About the Board

Overview

The Board’s Charter (attached as Appendix E to this Management Proxy Circular) provides that the Board is responsible for the stewardship and oversight of management of the Corporation and its global business. The Board’s principal duties include overseeing and approving the Corporation’s business strategy and strategic planning process as well as approving policies, procedures and systems for implementing strategy and managing risk. The Board normally schedules eight meetings a year, including two dedicated meetings where risk management and corporate strategy are reviewed. Special meetings of the Board are convened as appropriate.

The Board exercises its duties directly and through its Committees. The Board has four standing committees: the Audit Committee, the CG&N Committee, the Safety, Health and Environment (“SH&E”) Committee and the Compensation Committee. The reports of the Audit Committee, CG&N Committee, SH&E Committee and Compensation Committee can be found beginning on pages 25, 29, 34 and 36, respectively, each of which provide an overview of the respective committee’s area of responsibilities and recent activities.

Core Values, Code of Conduct and Governance Principles

The Board has adopted the “PotashCorp Core Values and Code of Conduct”, which sets out our core values: (a) we operate with integrity, (b) our overriding concern is the safety of people and the environment, (c) we listen to all PotashCorp stakeholders, (d) we seek continuous improvement, (e) we share what we learn and (f) we are accessible, accountable and transparent.

We expect all directors, officers, employees and representatives of PotashCorp, all of its subsidiaries and, where applicable, joint ventures, to comply with our Code of Conduct. The Code of Conduct, in line with our core values, contains principles and guidelines for ethical behavior in the following key areas:

| Ÿ | | financial reporting and the maintenance of accurate books and records; |

| Ÿ | | commitment to safety, health and the environment; |

| Ÿ | | complying with the laws, rules and regulations in the countries and communities in which we operate; |

| Ÿ | | honesty and respectful workplaces; |

| Ÿ | | reporting violations of the Code of Conduct. |

To assist with compliance and the achievement of best corporate governance practices, the Board has also adopted the PotashCorp Governance Principles. The Board is committed to establishing and following board governance principles that are designed to facilitate the successful exercise of each director’s responsibilities to the Corporation. The Governance Principles contain principles and guidelines in the following key areas:

| Ÿ | | Board independence and integrity; |

| Ÿ | | functions of the Board; |

| Ÿ | | selection and composition of the Board; |

| Ÿ | | performance evaluation and compensation; |

| Ÿ | | evaluation of CEO performance and succession planning; |

| Ÿ | | access to management and outside advisors; and |

| Ÿ | | communications from and with shareholders. |

The PotashCorp Core Values and Code of Conduct and Governance Principles, together with other governance related documents, can be found on the Corporation’s website, www.potashcorp.com, and are available in print to any shareholder who requests a copy.

Expectations of Directors

Each member of the Board is expected to act honestly and in good faith and to exercise business judgment that is in the Corporation’s best interest.

In addition, pursuant to the PotashCorp Governance Principles each director is, among other things:

| Ÿ | | bound by the PotashCorp Code of Conduct and expected to comply with the PotashCorp Governance Principles; |

| Ÿ | | expected to attend all meetings of the Board and the committees upon which they serve and to come to such meetings fully prepared (where a director’s absence is unavoidable, the director should, as soon as practicable, contact the Board Chair, the CEO or the Corporate Secretary for a briefing on the substantive elements of the meeting); |

| Ÿ | | expected to participate in the Board, committee and related effectiveness evaluation program; and |

| Ÿ | | expected to take personal responsibility for and participate in continuing director education programs. |

| | |

| 15 | | PotashCorp 2015 Management Proxy Circular |

Board Meetings and Attendance of Directors

The following table provides a summary of the Board and Committee meetings held during fiscal 2014. Each individual director nominee’s attendance record for such meetings, as applicable, is set forth above in their respective biographies. Overall, the director nominees attended 99.6% of applicable Board and committee meetings in 2014.

| | | | |

| Type of Meeting Held | | Number of Meetings | |

Board of Directors | | | 12 | |

Audit Committee | | | 9 | |

Compensation Committee | | | 5 | |

CG&N Committee | | | 4 | |

SH&E Committee | | | 4 | |

In an effort to provide directors with a more complete understanding of the issues facing the Corporation and in line with the Corporation’s core values, directors are encouraged to attend committee meetings of which they are not a member. In addition to the committees of which he or she is a member, the Board Chair regularly attends other committee meetings. Mr. Howe, as Board Chair during 2014, attendedall of the committee meetings held in 2014. At the invitation of the applicable committees, the CEO also attends all or a portion of many of the committee meetings.

Pursuant to the PotashCorp Governance Principles, the Board has adopted a policy of meeting in executive session, without management present, at each meeting of the Board. In practice, two such sessions occur at each meeting of the Board; one prior to the business of the meeting and one at the conclusion of the meeting. The Board has also adopted a policy of meeting in executive session, with only independent directors present, at each meeting of the Board. The presiding director at these executive sessions is the Board Chair or, in his or her absence, a director selected by majority vote of those directors present. Sessions are of no fixed duration and participating directors are encouraged to raise and discuss any issues of concern. Each Committee of the Board also meets in executive session, without management present, at each meeting of the respective Committee. These policies were complied with for all meetings of the Board and each Committee in 2014.

Directors and new director nominees are also expected to attend each annual meeting of shareholders of the Corporation. Each director and nominee was present at the Corporation’s 2014 Annual Meeting.

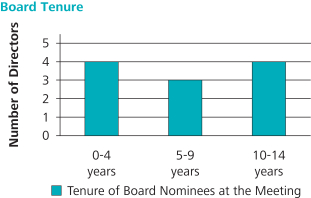

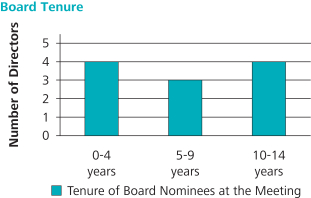

Board Tenure and Retirement Policy

As at February 20, 2015, the Corporation’s average Board tenure is 9.1 years. Following the Meeting, should all director nominees be elected, the average Board tenure will be 7.3 years.

Pursuant to the PotashCorp Governance Principles, directors should not generally stand for re-election after reaching the age of seventy years. At this time, the Board does not believe that arbitrary term limits are appropriate, nor does it believe that

directors should expect to be re-nominated annually until they reach the normal retirement age established by the Board. On an ongoing basis a balance must be struck between ensuring that there are fresh ideas and viewpoints while not losing the insight, experience and other benefits of continuity contributed by longer serving directors. In light of recent developments, appropriate members of the Board have been tasked with reviewing the Corporation’s current approach with respect to term limits and the Corporation’s retirement policy.

Pursuant to the PotashCorp Governance Principles, the CEO must resign from the Board immediately upon retirement or otherwise resigning as CEO. Also, a director should offer to resign in the event of a change in principal job responsibilities or in the event of any other significant change in his or her circumstances, including one where continued service on the Board might bring the Corporation into disrepute. For greater certainty, a determination by the Board that a director is no longer independent shall be considered a significant change in such director’s circumstances. The CG&N Committee will consider the change in circumstance and recommend to the Board whether the resignation should be accepted.

| | |

| PotashCorp 2015 Management Proxy Circular | | 16 |

Director Independence and Other Relationships

| | | | | | | | |

| | | Committees (Number of Members) |

| | | Audit(1) (5) | | Compensation(1) (6) | | CG&N(1) (5) | | SH&E(2) (6) |

Management Director — Not Independent | | | | | | | | |

Jochen E. Tilk(3) | | | | | | | | |

William J. Doyle(3) | | | | | | | | |

| | | | |

Outside Director — Not Independent | | | | | | | | |

Elena Viyella de Paliza (family business relationship) | | | | | | | | Ö |

| | | | |

Outside Director — Independent | | | | | | | | |

Christopher M. Burley(4) | | Chair | | | | Ö | | |

Donald G. Chynoweth | | Ö | | | | | | Ö |

John W. Estey | | | | Ö | | Chair | | |

Gerald W. Grandey | | | | Ö | | | | Ö |

C. Steven Hoffman | | | | Ö | | | | Chair |

Dallas J. Howe (Board Chair)(5) | | | | | | Ö | | |

Alice D. Laberge(4) | | Ö | | | | Ö | | |

Consuelo E. Madere | | Ö | | | | | | Ö |

Keith G. Martell(4) | | Ö | | Chair | | | | |

Jeffrey J. McCaig | | | | Ö | | | | Ö |

Mary Mogford(5) | | | | Ö | | Ö | | |

| (1) | All members of the Audit, Compensation and CG&N Committees are independent in accordance with all applicable regulatory requirements and the charter of each such committee requires that each member of the respective committee be independent. |

| (2) | A majority of the SH&E Committee members are independent. |

| (3) | Mr. Tilk was appointed as President and Chief Executive Officer of the Corporation and to the Board in July 2014. Mr. Doyle resigned as President and Chief Executive Officer and a director of the Corporation in July 2014 and transitioned to the non-executive officer role of Senior Advisor. |

| (4) | Audit Committee financial expert under the rules of the SEC. |

| (5) | Mr. Howe, who is an independent director and Board Chair, will continue to serve as Board Chair and a member of the CG&N Committee until the expiration of his term as director at the Meeting. Ms. Mogford, who is an independent director, will continue to serve as a member of the CG&N Committee and as a member of the Compensation Committee until the expiration of her term as a director at the Meeting. |

Director Independence

The Board has determined that all of the directors of the Corporation, and the proposed nominees, with the exception of Mr. Tilk and Ms. Viyella de Paliza, are independent within the meaning of the PotashCorp Governance Principles, National Instrument 58-101 “Disclosure of Corporate Governance Practices” (“NI 58-101”), applicable rules of the SEC and the NYSE rules.

For a director to be considered independent, the Board must determine that the director does not have any material relationship with the Corporation, either directly or indirectly (e.g., as a partner, shareholder or officer of an organization that has a relationship with the Corporation). Pursuant to the PotashCorp Governance Principles and the PotashCorp Core Values and Code of Conduct, directors and executive officers of the Corporation inform the Board as to their relationships with the Corporation and provide other pertinent information pursuant to questionnaires that they complete, sign and certify on an annual basis. The Board reviews such relationships under applicable director independence standards and in connection with the related person transaction disclosure

requirements of Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934 (the “Exchange Act”).

As permitted by the NYSE rules, the Board has adopted categorical standards (the “Categorical Standards”) to assist it in making determinations of director independence. These standards are set out in the PotashCorp Governance Principles and are outlined in Schedule A to Appendix A of this Management Proxy Circular under “Independence Standards”.

Mr. Tilk is the President and Chief Executive Officer of the Corporation and is therefore not independent.

Two of Ms. Viyella de Paliza’s brothers are executive officers of Fertilizantes Santo Domingo, C. por A (“Fersan”), a fertilizer bulk blender and distributor of agrichemicals based in the Dominican Republic, which is a customer of the Corporation. In 2014, receipts and payments in the amount of approximately $23 million were transacted between the Corporation and Fersan, which exceeded 2% of Fersan’s gross revenues in 2014. The transactions between the Corporation and Fersan in 2013 and 2012 also exceeded 2% of Fersan’s gross revenues in such years. Although a former employee of Fersan, Ms. Viyella de Paliza has no direct or indirect interest in transactions between the Corporation and Fersan, and all such transactions are completed on normal trade

| | |

| 17 | | PotashCorp 2015 Management Proxy Circular |

terms. Even though she does not meet the aforementioned independence standards, Ms. Viyella de Paliza provides a valuable contribution to the Board through her industry knowledge and experience and international business perspective. Her presence on the Board has not played any role in the Corporation’s decision to transact business with Fersan. The Corporation makes this decision on the basis of the best interests of the Corporation.

In determining the independence of its other directors, the Board evaluated business and other relationships that each director had with the Corporation. In doing so, it determined as immaterial (i) any relationships falling below the thresholds set forth in paragraph (c) of our Categorical Standards and not otherwise required to be disclosed pursuant to Item 404(a) of Regulation S-K under the Exchange Act, including certain relationships of Mr. Chynoweth, Mr. Estey and Mr. McCaig; (ii) any relationships falling below the transaction thresholds or otherwise falling outside the scope of paragraph (d) of our Categorical Standards, including certain relationships of Mr. Howe, Mr. Estey and Mr. Martell; and (iii) any business relationship between the Corporation and an entity as to which the director in question has no relationship other than as a director thereof, including certain directorships of Ms. Laberge.

Mr. Doyle, until his resignation from the Board, was also not independent in light of his roles as the President and Chief Executive Officer of the Corporation.

Board Interlocks

In addition to the independence requirements, the Corporation has established an additional requirement that there shall be no more than two board interlocks at any given time. A board interlock occurs when two of the Corporation’s directors also serve together on the board of another for-profit company. As of the date of this Management Proxy Circular, there are no board interlocks among the Board members.

Limitations on Other Board Service

The PotashCorp Governance Principles also contain limitations on the number of other directorships that directors and the CEO of the Corporation may hold. Directors who are employed as CEOs, or in other senior executive positions on a full-time basis, should not serve on more than two boards of public companies in addition to the Corporation’s Board. Other directors should not serve on more than three boards of public companies in addition to the Corporation’s Board. The CEO of the Corporation should not serve on the board of more than two other public companies and should not serve on the board of any other company where the CEO of that other company serves on the Corporation’s Board. In all cases, prior to accepting an appointment to the board of any company, the CEO of the Corporation must review and discuss the appointment with the Board Chair of the Corporation and obtain Board approval.

| | |

| PotashCorp 2015 Management Proxy Circular | | 18 |

Board, Committee & Director Assessment

Pursuant to the PotashCorp Governance Principles, the Board has adopted a six-part effectiveness evaluation program for the Board, each Committee and each individual director, which is summarized in the following table.

| | | | | | |

Review

(Frequency) | | By | | Action | | Outcome1 |

Full Board (Annual) | | All Members

of the Board | | Ÿ Board members complete a detailed questionnaire which: (a) provides for quantitative ratings in key areas and (b) seeks subjective comment in each of those areas. Ÿ Responses are reviewed by the Chair of the CG&N Committee. Ÿ The Board also reviews and considers any proposed changes to the Board Charter. | | Ÿ A summary report is prepared by the Chair of the CG&N Committee and provided to the Board Chair, the CG&N Committee and the CEO. Ÿ The summary report is reported to the full Board by the CG&N Committee Chair. Ÿ Matters requiring follow-up are identified and action plans are developed and monitored on ago-forward basis by the CG&N Committee. |

Full Board (Periodic) | | Management | | Ÿ Members of senior management who regularly interact with the Board and/or its Committees are surveyed to solicit their input and perspective on the operation of the Board and how the Board might improve its effectiveness. Ÿ Survey includes a questionnaire and one-on-one interviews between the management respondents and the Chair of the CG&N Committee. | | Ÿ Results are reported by the Chair of the CG&N Committee to the full Board. |

Board Chair (Annual) | | All Members

of the Board | | Ÿ Board members assess and comment on the Board Chair’s discharge of his or her duties. The CEO provides specific input from his or her perspective, as CEO, regarding the Board Chair’s effectiveness. Ÿ Individual responses are received by the Chair of the CG&N Committee. | | Ÿ A summary report is prepared by the Chair of the CG&N Committee and provided to the Board Chair and the full Board. Ÿ The Board also reviews and considers any proposed changes to the Board Chair position description. |

Board Committees (Annual) | | All Members

of each

Committee | | Ÿ Members of each Committee complete a detailed questionnaire to evaluate how well their respective Committee is operating and to make suggestions for improvement. Ÿ The Chair of the CG&N Committee receives responses and reviews them with the appropriate Committee Chair. Ÿ The Board reviews and considers any proposed changes to the Committee Charters. | | Ÿ A summary report is prepared and provided to the Board Chair, the Chair of the CG&N Committee, the appropriate Committee and the CEO. The summary report for each Committee is then reported to the full Board by the appropriate Committee Chair. Ÿ The Committee Chair is expected to follow-up on any matters raised in the assessment and take action, as appropriate. |

Committee Chair (Annual) | | All Members

of each

Committee | | Ÿ Members of each Committee assess and comment on their respective Committee Chair’s discharge of his or her duties. Ÿ Responses are received by the Chair of the CG&N Committee and the Committee Chair under review. | | Ÿ A summary report is provided to the appropriate Committee and to the full Board. Ÿ The Board reviews and considers any proposed changes to the Committee Chair position descriptions. |

Individual Directors (Annual) | | Each Director | | Ÿ Each director formally meets with the Board Chair (and if desired, the Chair of the CG&N Committee) to engage in a full and frank discussion of any and all issues either wishes to raise, with a focus on maximizing each director’s contribution to the Board and his or her respective Committees. Ÿ Each director is expected to be prepared to discuss how the directors, individually and collectively, can operate more effectively. | | Ÿ The Board Chair employs a checklist, discussing both short- and long-term goals, and establishes action items for each director to enhance his or her personal contributions to the Board and to overall Board effectiveness. Ÿ The Board Chair shares peer feedback with each director as appropriate and reviews progress and action taken. Ÿ The Board Chair discusses the results of the individual evaluations with the Chair of the CG&N Committee and reports summary findings to the full Board. |

| 1 | Attribution of comments to specific individuals is generally only made if authorized by the individual. |

| | |

| 19 | | PotashCorp 2015 Management Proxy Circular |

Director Compensation

Approach to Director Compensation

As we look to director compensation, we have three goals:

| 1. | recruit and retain qualified individuals to serve as members of our Board and contribute to our overall success; |

| 2. | align the interests of our Board and shareholders by requiring directors to own Shares and/or Deferred Share Units (“DSUs”), and receive up to 100% of their annual retainer in DSUs; and |

| 3. | pay competitively by positioning compensation at the median of the Comparator Group. |

2014 Director Compensation Package

We establish director compensation after considering the advice of Towers Watson, our independent compensation consultant, with a view to establishing compensation at the median of the Comparator Group (see “Compensation — Compensation Discussion and Analysis — Compensation Principles” on page 44). Only non-employee directors (the “outside directors”) are compensated for service on the Board. Due to the economic challenges faced in 2013, including the operating changes and workforce reductions we announced in December 2013, the Board determined not to grant any increase in director compensation for 2014.

The following table displays the compensation structure for 2014 for outside directors.

| | | | |

| Outside Director – 2014 Compensation Structure | | Fee | |

Board Chair retainer | | $ | 400,000 | |

Director retainer | | $ | 200,000 | |

Committee Chair retainers | | | | |

Audit Committee | | $ | 20,000 | |

Compensation Committee | | $ | 20,000 | |

CG&N Committee | | $ | 15,000 | |

SH&E Committee | | $ | 15,000 | |

Non-Chair Committee member retainer | | $ | 5,000 | |

Travel fee (per day) | | $ | 500 | |

Per diem for Committee meeting | | $ | 1,500 | (1) |

| (1) | Each outside director who was a member of a Board Committee, including the CEO succession planning committee, other than the Board Chair, received a per diem fee of $1,500 for committee meetings he or she attended, provided such meetings were not held the same day as a Board meeting. |

Stock-Based Compensation

Effective November 20, 2001, we adopted the Deferred Share Unit Plan (the “DSU Plan”), which allows outside directors to defer, in the form of DSUs, up to 100% of the annual retainer payable to him or her in respect of serving as a director that would otherwise be payable in cash. The DSU Plan is intended to enhance our ability to attract and retain highly qualified individuals to serve as directors and to promote a greater alignment of interests between

such directors and our shareholders. Each DSU has an initial value equal to the market value of a Share at the time of deferral. The DSU Plan also provides for discretionary grants of DSUs, which the Board discontinued on January 24, 2007 in connection with an increase to the annual retainer.

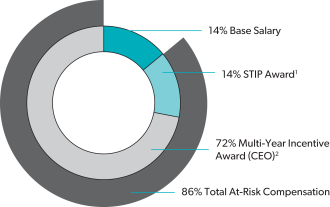

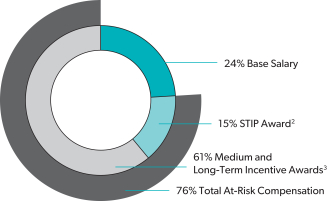

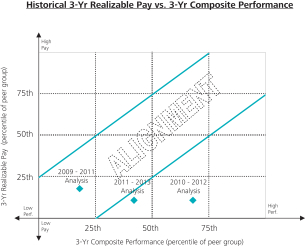

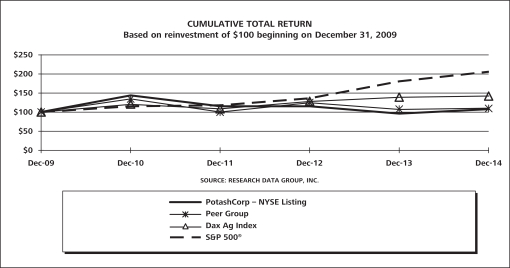

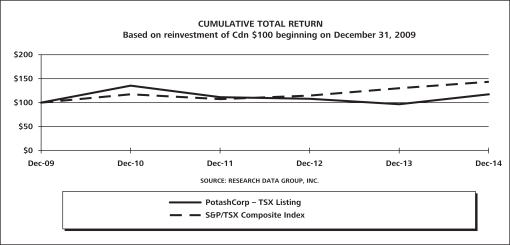

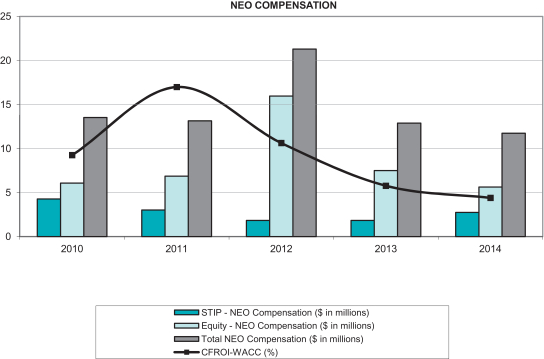

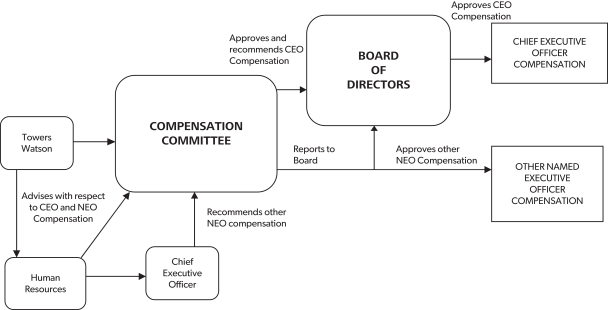

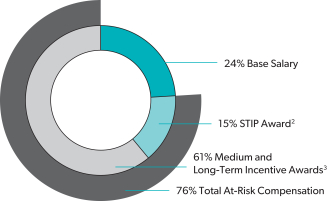

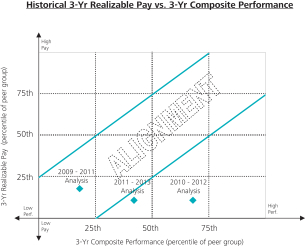

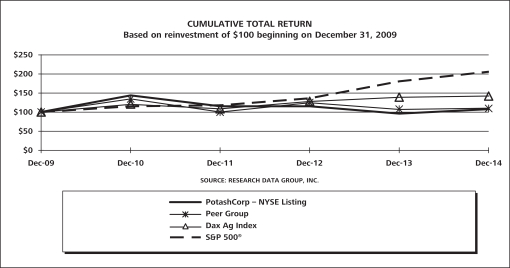

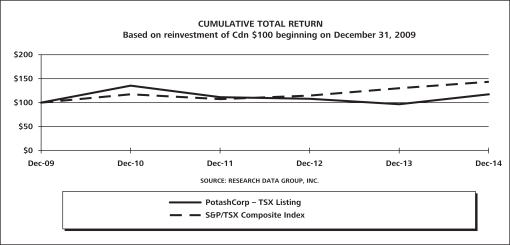

Each DSU is credited to the account of an individual director and is fully vested at the time of grant, but is distributed only when the outside director ceases to be a member of the Board, provided that the director is neither our employee nor an employee of any of our subsidiaries. In accordance with elections made pursuant to the terms of the DSU Plan, the director will receive, within a specified period following retirement, a cash payment equal to the number of his or her DSUs multiplied by the applicable Share price at the date of valuation (reduced by the amount of applicable withholding taxes). While the Compensation Committee, with Board approval, has the discretion to distribute Shares in lieu of cash, the Compensation Committee and Board have determined that all distributions pursuant to the DSU Plan will be made in cash. DSUs earn dividends in the form of additional DSUs at the same rate as dividends are paid on Shares.