Nourishing Potential

2014 Annual Integrated Report

To learn more online, watch for the following icon:

POTASHCORP.COM

POTASHCORP.COM

Financial data in this report are stated in US dollars unless otherwise noted.

Nourishing Potential

Our drivers are simple, yet profound. More people. Improving diets. Growing food requires fertilizer. And PotashCorp can respond.

As the world’s population continues to increase and diets improve, we know this presents challenges for global food production. We also know that fertilizer is vitally important, accounting for approximately 50 percent of the world’s food production.

This situation provides an opportunity for companies that can respond – like PotashCorp. The potash, nitrogen and phosphate fertilizer products we produce help farmers nourish the potential of their soil. They also create potential for our investors to earn superior returns, our customers to grow their businesses, our employees to build their careers and our communities to thrive.

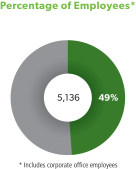

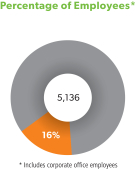

As we pursue long-term value, our path is defined by our goals and strategies and marked by accountability for our performance. This report reflects the focus of our people – from our Board of Directors and management team to our more than 5,000 employees – as we seek to nourish the potential of this company and positively impact our stakeholders.

Highlights

| | | | | | | | | | | | | | | | | | | | |

| Year ended December 31 | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

Financial ($ millions) | | | | | | | | | | | | | | | | | | | | |

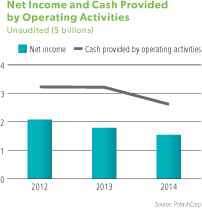

Net income | | | 1,536 | | | | 1,785 | | | | 2,079 | | | | 3,081 | | | | 1,775 | |

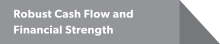

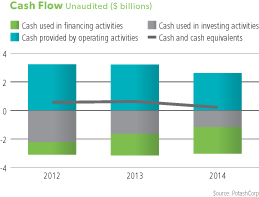

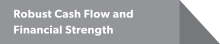

Cash provided by operating activities | | | 2,614 | | | | 3,212 | | | | 3,225 | | | | 3,485 | | | | 3,131 | |

Dividends paid | | | 1,141 | | | | 997 | | | | 467 | | | | 208 | | | | 119 | |

| | | | | |

Customers | | | | | | | | | | | | | | | | | | | | |

Customer survey score | | | 89% | | | | 90% | | | | 92% | | | | 90% | | | | 90% | |

| | | | | |

Community | | | | | | | | | | | | | | | | | | | | |

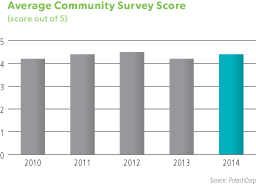

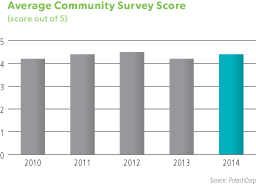

Community survey score (out of 5) | | | 4.4 | | | | 4.2 | | | | 4.5 | | | | 4.4 | | | | 4.2 | |

| | | | | |

Employees | | | | | | | | | | | | | | | | | | | | |

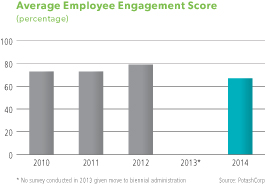

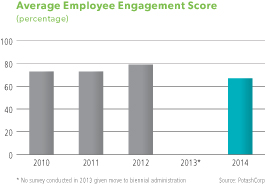

Employee engagement score* | | | 67% | | | | n/a | | | | 79% | | | | 73% | | | | 73% | |

| | | | | |

Safety and Environment | | | | | | | | | | | | | | | | | | | | |

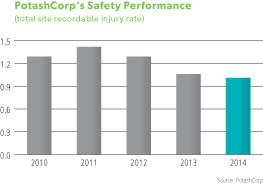

Life-altering injuries | | | 1 | | | | 0 | | | | 1 | | | | 1 | | | | 0 | |

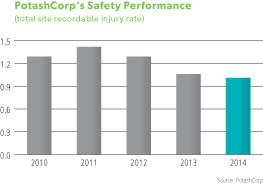

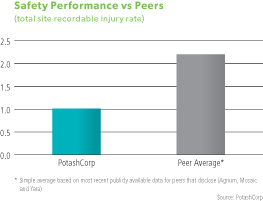

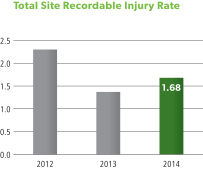

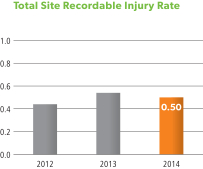

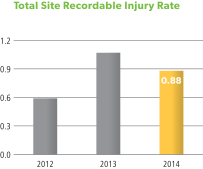

Total site recordable injury rate | | | 1.01 | | | | 1.06 | | | | 1.29 | | | | 1.42 | | | | 1.29 | |

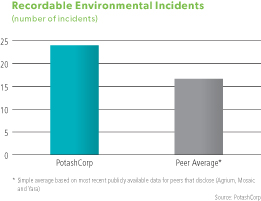

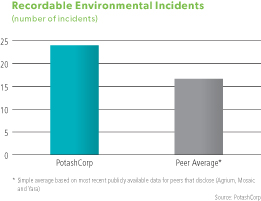

Environmental incidents | | | 24 | | | | 17 | | | | 19 | | | | 14 | | | | 20 | |

| * | No survey was conducted in 2013. Engagement survey completed annually by half of employees prior to 2013; beginning in 2014, survey conducted biennially with all employees. |

| | |

| | Cover image:Selina Kabusia of Kenya learned new approaches to food production as part of Free The Children’s outreach, specifically through the Agriculture and Food Security pillar established with PotashCorp’s support. With her training, Selina is able to nourish her family as well as raise healthy hens, selling the eggs to help send her daughter, Naserian, to school.  Read more about Selina at potashcorp.com/selinas_story Read more about Selina at potashcorp.com/selinas_story

|

| | |

| PotashCorp 2014 Annual Integrated Report | | 1 |

CEO Letter

Jochen Tilk

President and Chief Executive Officer

Dear Shareholders,

In many respects, 2014 was a year of transition for PotashCorp that will help define our future direction. If I were to describe the year simply: We moved to a more tempered, but supportive, environment.

Certainly this was the case for the broader economy in 2014. Despite a strong US recovery, concerns regarding weakening growth in China and other key regions weighed on the global outlook for most commodities.

This was apparent in global agriculture as the backdrop shifted from exceptionally tight crop supplies to healthier levels. Crop prices fell amid this transition, but we believe today’s levels remain supportive for both farmer economics and our business.

In the global potash market, after a period of significant uncertainty, customers re-engaged early in the year and pricing stabilized. Underpinned by agronomic need and affordability, strong consumption and replenishment of distributor inventories

raised global demand to an all-time record. This situation not only tested the industry’s supply capability, it renewed confidence in long-term growth.

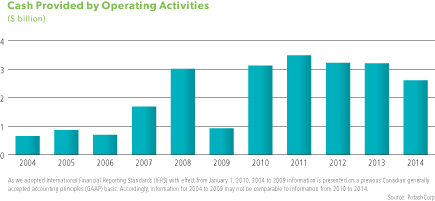

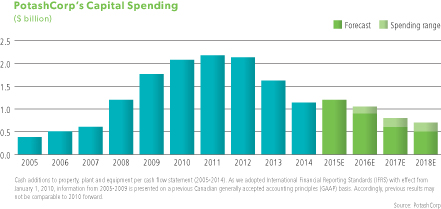

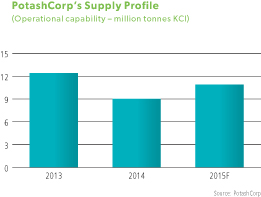

From PotashCorp’s standpoint, 2014 provided greater definition of our path forward. With our decade-long potash expansion program nearing completion, our focus shifted to optimization. We aligned our operational capability with market expectations to improve our competitive position while maintaining operating flexibility. We also returned cash to our shareholders through the completion of our share repurchase program and payment of a strong dividend.

It was a year of change – in both our business and our industry – but the steps we are taking are designed to create value not only for today, but for tomorrow.

Our Results

We cannot speak to our performance without it being overshadowed by two fatalities at our operations during the past 12 months. Sadly, workplace accidents resulted in the loss of an employee at our Cory potash facility in February 2014 and another at our White Springs phosphate operation in early 2015. Such losses are unacceptable and something we are working tirelessly to address. It highlights that our pursuit of no harm is never complete, and that our commitment to improve preventive safety measures must always be at the forefront.

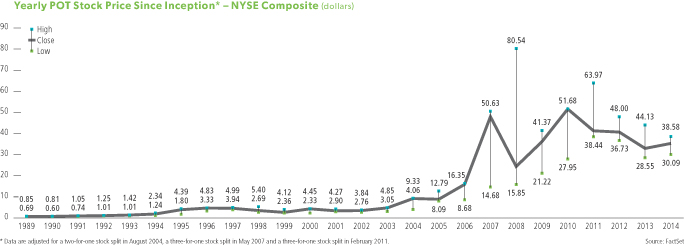

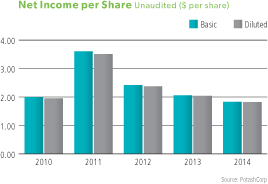

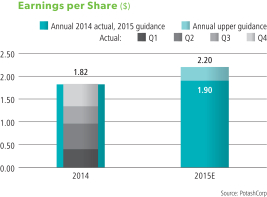

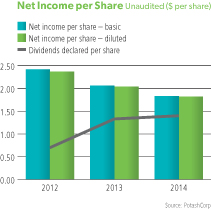

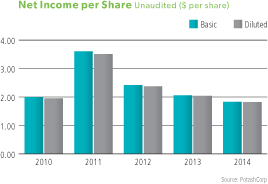

When we look back at the year from a financial perspective, what unfolded in 2014 was more positive than initially expected. We began the year anticipating a challenging earnings environment as nutrient prices had declined through the second half of 2013, most notably in potash. Our earnings of $1.82 per share did fall short of the $2.04 per share earned in 2013, but exceeded our initial estimates.

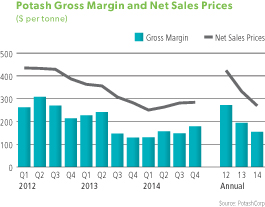

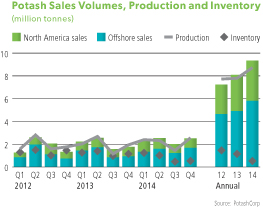

In potash, market conditions improved throughout the year, so did our results. Record global shipments – estimated at more than 61 million tonnes – propelled our sales volumes and supported higher realizations in major spot markets relative to the beginning

Nourishing Potential

| | | | | | | | |

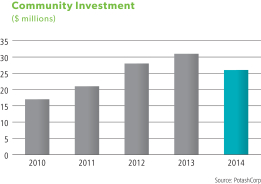

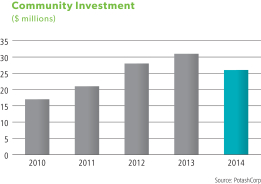

$2.2 billion Cash returned to shareholders in 2014* | | | | $26 million Invested in community initiatives in 2014 | | | | 20 percent Reduction in number of safety incidents in 2014* |

* Includes dividends paid of $1.1B and share repurchases of $1.1B | | | | | | | | * Measured by total site recordable injuries compared to 2013 |

| | |

| 2 | | PotashCorp 2014 Annual Integrated Report |

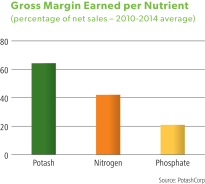

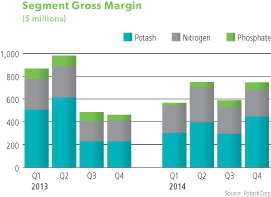

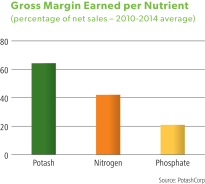

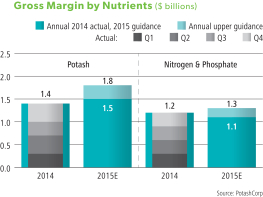

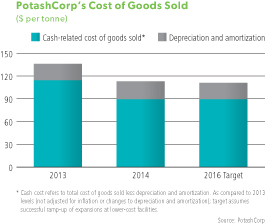

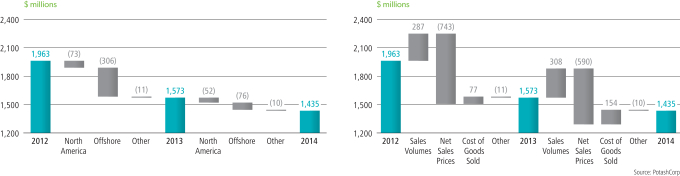

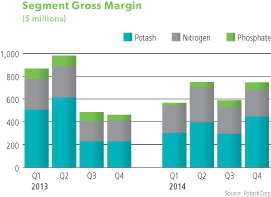

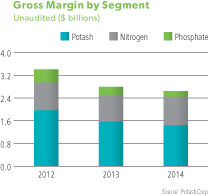

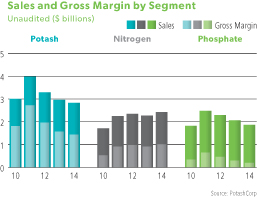

of the year. Achieving the first milestone of our 2016 target, potash cash operating costs moved approximately $17 per tonne lower – excluding the positive impact of foreign exchange and royalties – as we benefited from operational savings and higher production levels. Despite these improving conditions, our full-year gross margin of $1.4 billion did not match the 2013 total.

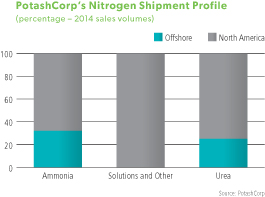

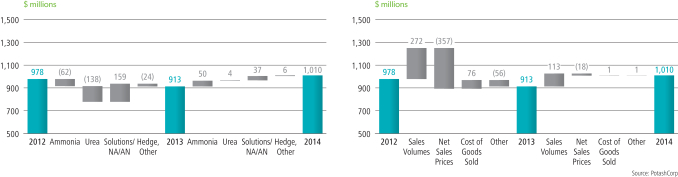

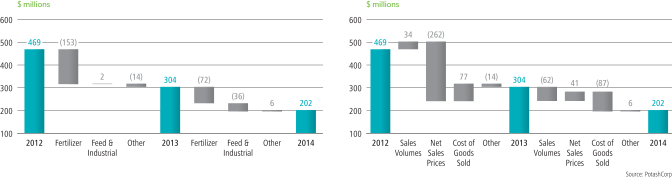

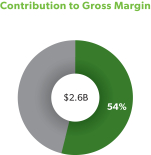

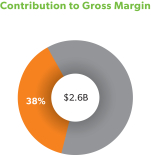

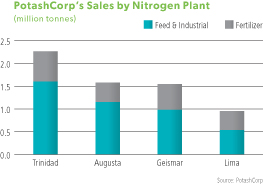

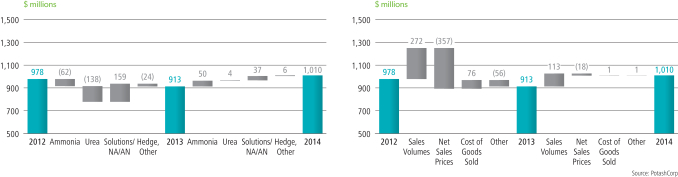

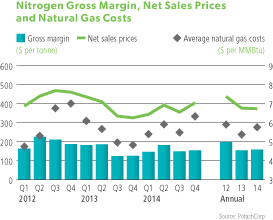

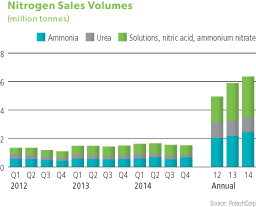

Our nitrogen business again contributed meaningfully to our bottom line and highlighted the value of our advantaged position and recent brownfield expansions. We delivered a record gross margin year, surpassing $1 billion for the first time. In phosphate, gross margin of approximately $200 million declined from 2013 levels as our costs rose due to shutdown-related expenses and operational reliability issues.

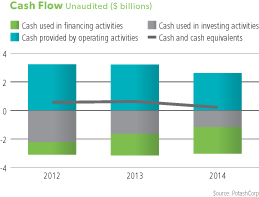

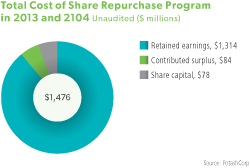

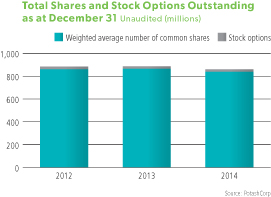

We took steps to further enhance shareholder value by completing the share repurchase program initiated in 2013. In 2014, we bought back 29 million shares at an average price of $35 per share with the entire program reducing our outstanding share count by approximately 5 percent. We also returned approximately $1.1 billion to investors through quarterly dividends, an important element of our capital allocation strategy.

Operationally, our efforts to improve the competitiveness of our assets and achieve best-in-class performance continued.

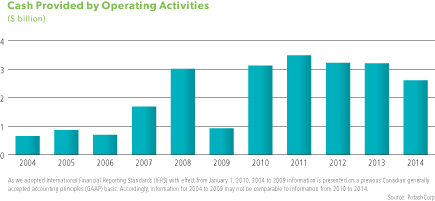

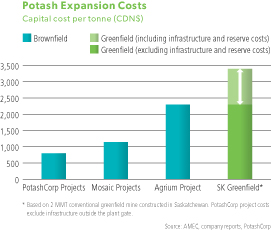

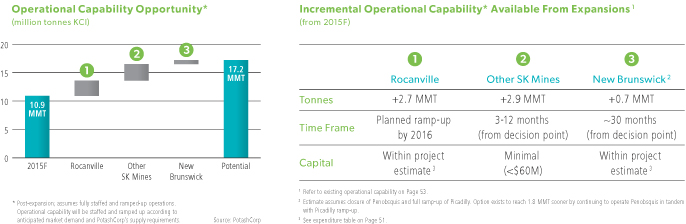

We safely and successfully advanced our expansion efforts. In potash, our remaining projects at Rocanville and New Brunswick are now in early ramp-up stage with capital spending largely complete. These projects represent the final pieces of an unprecedented potash expansion program that will raise our nameplate capacity to approximately 19 million tonnes, improve our overall cost structure and help us respond to market growth.

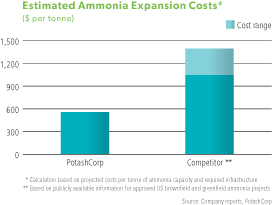

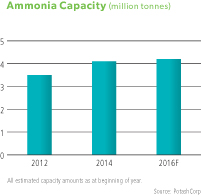

In nitrogen, we completed the first phase of our Lima expansion project. Lima is now readying for the final phase in late 2015, which will enhance product diversity and increase our lower-cost, US-based ammonia production.

From an environmental standpoint, our performance fell short on certain improvement targets we set for 2014. It is evident to me that a commitment to fulfilling our environmental responsibilities is

deeply rooted throughout the company and one of my objectives is to continually seek ways to reduce our environmental footprint.

A Broader View of Performance

Beyond financial and operational performance, we understand that our ability to impact value extends to our customers, employees and communities.

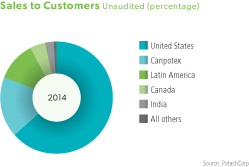

For our customers, 2014 brought some unique challenges. Production and logistical constraints were evident through much of the year with availability of supply at the forefront. We worked with our operating teams and logistical partners to do everything possible to meet our customers’ needs and set a standard that differentiated us. We continued to invest in building on this competitive advantage, including the development of our distribution platform and the addition of railcars to our fleet.

We have an extremely talented and motivated group of people at PotashCorp. Even as we worked through staffing reductions, our people remained focused and committed to building a safer and stronger company. We continue to set targets and track performance in a number of areas to ensure that we attract, retain, develop and engage a world-class workforce. Results from our biennial engagement survey suggest we are doing many things right. At the same time, we are working on action plans where we can continue to improve.

As a new member of the PotashCorp team, I find it especially rewarding to see first-hand the company’s impact on our communities. In 2014, we invested $26 million in initiatives that improve quality of life for those locally and in certain regions around the globe. By providing both time and capital, we strive to create shared prosperity in our communities and forge strong relationships with organizations that share our vision. Through important partnerships, a significant portion of our investment was directed to helping address local and global food security. It is a priority of our community investment program because we know our company can contribute solutions to this vital area beyond the products we produce.

| | | | | | | | |

40,402 youth Informed about food security issues through speaking tours* | | | | 32 percent Decrease in severe food insecurity in six communities* | | | | 4,798 people In Trinidad attended training* at PotashCorp’s Model Farm |

* Through PotashCorp’s sponsorship of the international charity and education partner, Free The Children, in 2013 and 2014 | | | | * Through sponsorship of Free The Children and PotashCorp’s direct support of six communities on agricultural initiatives | | | | * Calculated by training course attendance from 2010 to 2014 |

| | |

| PotashCorp 2014 Annual Integrated Report | | 3 |

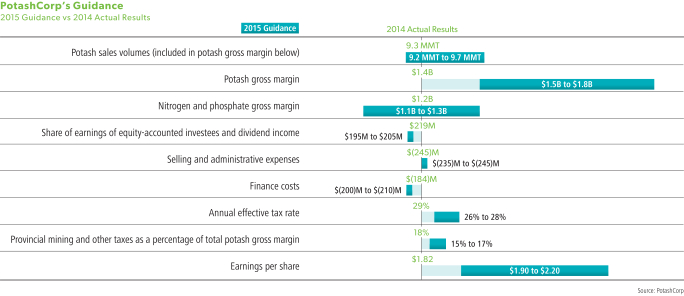

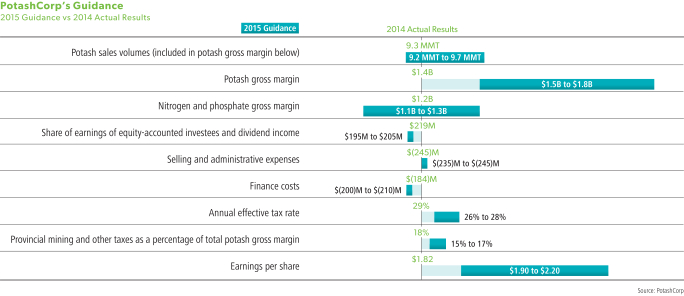

Outlook for 2015

As we begin a new year, we believe we are well positioned to respond effectively to any market scenario. We enter 2015 with supportive market conditions, particularly in potash. Although our global shipment expectation of 58-60 million tonnes in 2015 trails the record 2014 level, lower producer inventories and potential supply constraints in certain producing regions are expected to keep operating rates elevated. With higher realized prices in virtually every key market and our position as one of the few producers expected to have incremental operational capability, we believe PotashCorp has an opportunity to capture improved gross margin.

This – along with our expectations of relatively flat contributions from our nitrogen and phosphate businesses – is expected to generate earnings of $1.90-$2.20 per share in 2015.

What We’re Working On

Our leadership team has been – and will continue to be – focused on reviewing and evolving the company’s strategic objectives, including a comprehensive assessment of opportunities and risks associated with our asset portfolio and growth opportunities. In 2014, we initiated and completed a thorough review of our potash and nitrogen businesses.

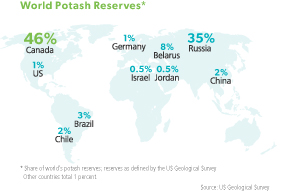

In potash, we are in an enviable position. We currently represent nearly 20 percent of global capacity and account for close to 40 percent of the estimated new operational capability being built in the industry over the next five years. Our emphasis is on protecting – and growing – the value of our enterprise.

When we considered our path ahead, we began with an objective view of the potash market. We arrived at an expectation that global operating rates should remain supportive and that demand growth will largely offset new capacity over the coming five years. This past year was a reminder that markets can be tighter than expected when demand is stronger or operational disruptions occur. But, as we have also seen in the past, there are scenarios in which market conditions could prove more challenging.

The exercise reaffirmed two points – to be successful over the long term, we must ensure that we have the ability to capture growth opportunities and are positioned for success in any market conditions. Through our increased focus on managing our operational flexibility and enhanced cost-competitiveness, we believe we are prepared for both.

Beyond this, we are challenging ourselves to pursue innovative ways to maximize long-term profitability, including plans to review our investments and market development strategies.

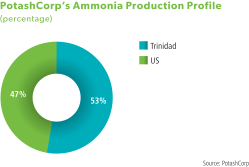

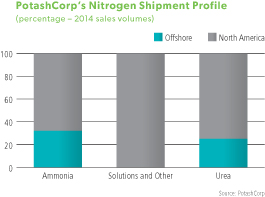

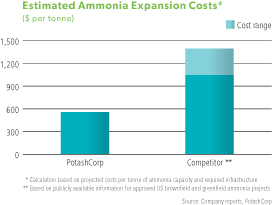

Based on our assessment of the nitrogen business, we expect the US will remain in a favorable cost position over the coming years, and this nutrient will continue to be a key contributor to our earnings. Our focus is on maximizing the reliability of our operations, successfully bringing our Lima expansion online and working to reduce the impact from natural gas-related curtailments in Trinidad. Additionally, our team continues to explore other lower-cost, quick-payback US brownfield opportunities that can deliver high rates of return for our shareholders.

Similar to our other nutrients, we will complete a strategic review of our phosphate business in 2015. We have great assets but after a challenging year we know we can improve our performance. We are working on a number of initiatives designed to increase reliability and enhance margins and expect to deliver better results in 2015.

Our potential to grow earnings – coupled with diminishing expansion spending – makes it important that we have a sound capital allocation strategy in place. Our management team and Board of Directors remain focused on better defining our priorities in 2015 and look forward to providing greater clarity as we move ahead.

Finally, in conjunction with the Board, we will re-examine our performance evaluation process and compensation program to ensure we have the right programs to monitor, measure and hold ourselves accountable to the priorities that drive value for both the company and our stakeholders.

Nourishing Tomorrow

I am extremely proud to call myself an employee of PotashCorp, and am excited by the opportunity to lead this great company forward. I would like to thank Bill Doyle for his tremendous leadership and contributions to the company and the fertilizer industry. Under Bill’s tenure as CEO, significant shareholder value was created. Moreover, he helped PotashCorp become a supplier of choice, a company at which employees are safe and proud to work and a great community member.

I would also like to thank our Board and all our employees. PotashCorp has an excellent foundation for growth that would not have been possible without the dedication and contributions made by each and everyone.

Along with the entire management team, I am committed to building on our past successes, delivering on our full potential and nourishing long-term value for all our stakeholders.

Jochen Tilk

President and Chief Executive Officer

February 20, 2015

| | |

| 4 | | PotashCorp 2014 Annual Integrated Report |

Management’s Discussion & Analysis

of Financial Condition and Results of Operations (in US dollars)

To learn more, watch for the following icons:

| | | | | | | | | | | | | | | | | | |

| | POTASHCORP.COM* | |  | | ANNUAL INTEGRATED REPORT | |  | | FORM 10-K | |  | | PROXY CIRCULAR | |  | | FINANCIAL STATEMENTS |

The following discussion and analysis is the responsibility of management and is as of February 20, 2015. The Board of Directors carries out its responsibility for review of this disclosure principally through its audit committee, comprised exclusively of independent directors. The audit committee reviews this disclosure and recommends its approval by the Board of Directors. The term “PCS” refers to Potash Corporation of Saskatchewan Inc. and the terms “we,” “us,” “our,” “PotashCorp” and “the company” refer to PCS and, as applicable, PCS and its direct and indirect subsidiaries as a group. Additional information relating to PotashCorp (which is not incorporated by reference herein) can be found in our regulatory filings on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

All references to per-share amounts pertain to diluted net income per share (EPS) as described in Note 9 to the consolidated financial statements.

| * | The information contained on or accessible from our website or any other website is not incorporated by reference into this “Management’s Discussion & Analysis of Financial Conditions and Results of Operations” or any other report or document we file with or furnish to the US Securities and Exchange Commission or Canadian securities regulatory authorities. |

| | |

| PotashCorp 2014 Annual Integrated Report | | 5 |

Company Overview

Who We Are

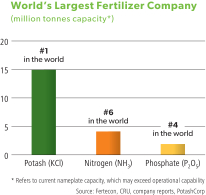

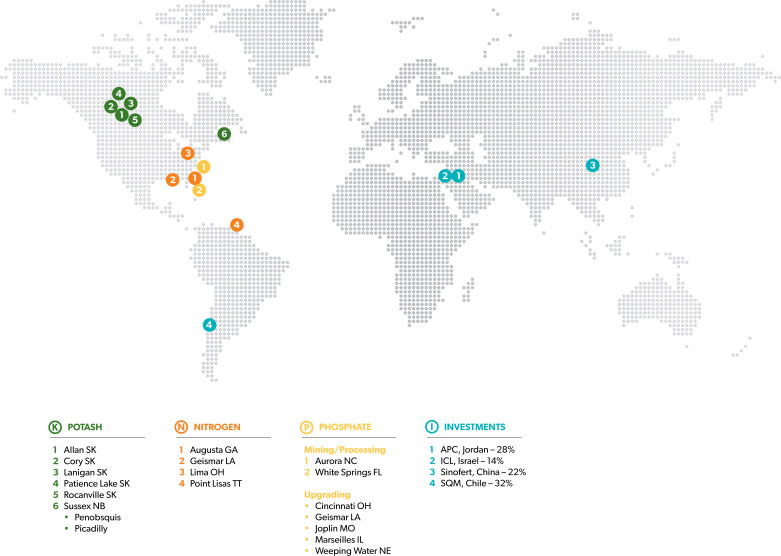

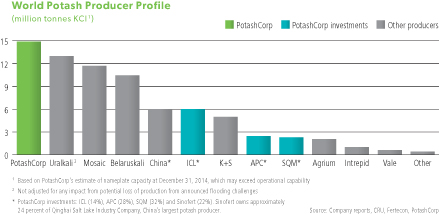

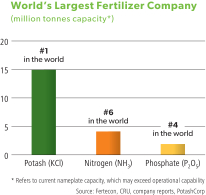

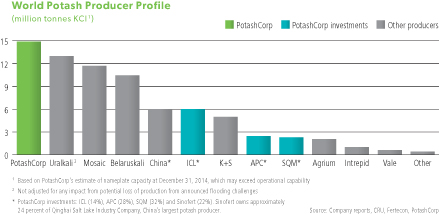

PotashCorp is the world’s largest fertilizer company by capacity, producing the three primary crop nutrients: potash (K), nitrogen (N) and phosphate (P).

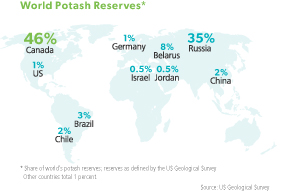

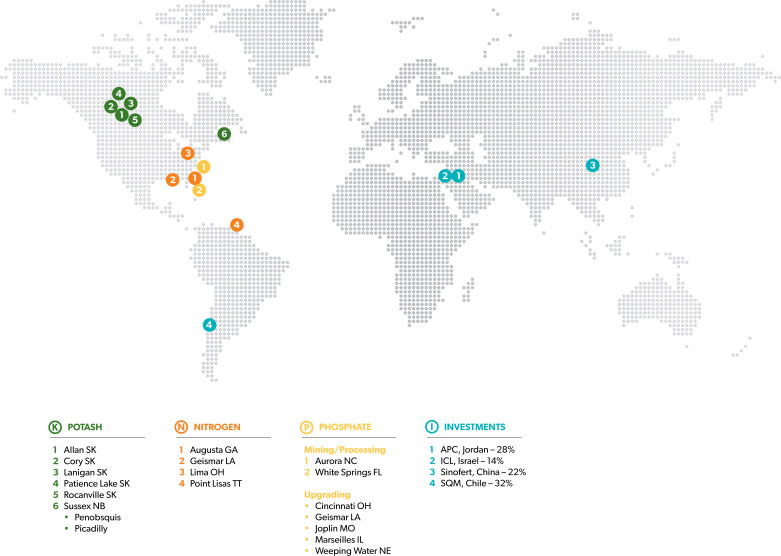

We are the world’s leading potash producer by capacity and our Canadian operations represent one-fifth of global capacity 1.

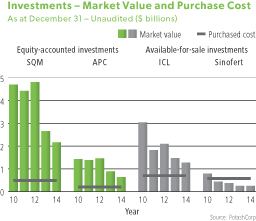

To enhance our global footprint, we also have investments in four potash-related businesses in South America, the Middle East and Asia.

With operations and business interests in seven countries, PotashCorp is an international enterprise and plays an important role in helping the world grow the food it needs.

Our Operations

| | |

| 6 | | PotashCorp 2014 Annual Integrated Report |

Company and Strategy

| | | | | | | | | | | | | | | | | | |

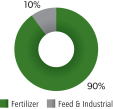

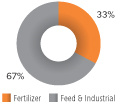

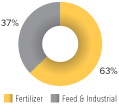

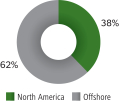

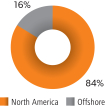

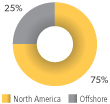

| Our Business Segments (2014) | | |  | | | POTASH | | |  | | | NITROGEN | | |  | | | PHOSPHATE |

| | | | | | | | | | |

| | |  | | | |  | | | |  |

| | | | | |

Share of Global Capacity1 | | 20% | | | | 2% | | | | 3% |

| | | | | |

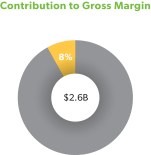

| Contribution to Gross Margin | | 54% | | | | 38% | | | | 8% |

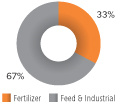

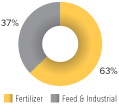

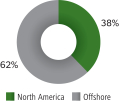

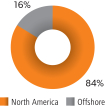

| Sales Volumes by Product Category | |

| | | |

| | | |

|

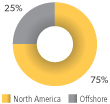

Sales Volumes by Region | |

| | | |

| | | |

|

| | | | | | | | | | |

Community Survey Score2 | | 4.1 | | | | 4.8 | | | | 4.5 |

| | | | | | | | | | |

| | | | | |

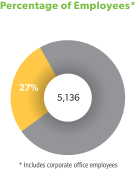

Employees3 | | 2,534 | | | | 802 | | | | 1,385 |

| | | | | |

Total Site Recordable Injury Rate | | 1.68 | | | | 0.50 | | | | 0.88 |

| | | | | | | | | | |

Environmental Incidents | | 14 | | | | 6 | | | | 4 |

| | | | | | | | | | |

| | | | | |

| |  Page 44 Page 44 | | | |  Page 54 Page 54 | | | |  Page 62 Page 62

|

| |

| | 1 Based on nameplate capacity at December 31, 2014, which may exceed operational capability 2 Scores (out of 5) based on 2014 survey results for: Potash – Allan and Lanigan; Nitrogen – Lima; Phosphate – Marseilles and White Springs 3 Only includes employees within individual nutrient segments as at December 31, 2014 |

| | |

| PotashCorp 2014 Annual Integrated Report | | 7 |

A Roadmap for Our Report

OUR VISION

To play a key role in the global food

solution while building long-term value

for all stakeholders.

Our Reporting Approach

As a publicly traded company, we are in business to be profitable for our shareholders and build sustainable value over the long term. We know this cannot be accomplished without understanding the needs of our many stakeholders that contribute to PotashCorp’s success. When we help our customers, employees and communities prosper – and keep our people and environment free from harm – our investors and everyone associated with our business can thrive.

This is how we run our business, and our aim in integrated reporting is to discuss financial and non-financial elements in a way that explains how we create value for our stakeholders, and makes their interdependence clear.

How We Determine What We Report

In a complex operating and reporting environment, we believe good disclosure means having a relevant and transparent discussion about what has the greatest potential impact on value creation. To achieve this, we consider what matters most to both our company and our key stakeholders.

Informed by our Priority Matrix – which includes input gathered from interviews within PotashCorp and from our stakeholder surveys – this report provides the information considered to be of most importance to our investors. For other stakeholders who wish to explore in greater depth the areas of our business of most interest to them, we provide relevant references throughout the report to our online Integrated Reporting Center.

| | |

| | potashcorp.com/toppriorities |

| | |

| 8 | | PotashCorp 2014 Annual Integrated Report |

Company and Strategy

| | |

| | KEY FACTORS |

| | Core Values |

| | On Page 10, we highlight the principles that guide our day-to-day actions and interactions with our stakeholders. |

| | Key Relationships |

| | On Page 10, we explain the key relationships and expectations that we consider as we strive to create mutually beneficial outcomes. |

| | Operating Environment |

| | On Pages 12-13, we discuss the opportunities and challenges we face in each nutrient. |

| | Competitive Advantages |

| | On Pages 14-15, we detail the unique characteristics on which we base our value-enhancing strategies. |

| |

| | GOALS AND STRATEGIES |

| | How We Create Value |

| | On Pages 16-19, we explore how we use our Value Model to set goals and develop strategies designed to create long-term, sustainable value for all our stakeholders. |

| |

| | RISK AND GOVERNANCE |

| | How We Approach Risk |

| | On Pages 21-25, we highlight the key risks to our company and the way we identify, assess, monitor and seek to mitigate them on an ongoing basis. |

| | Governance and Remuneration |

| | On Pages 26-29, we detail how our Board of Directors strives to ensure that the company is managed in a way that builds and protects value for all stakeholders. |

| |

| | VALUE |

| | Our Performance |

| | On Pages 31-41, we discuss our performance against our targets and highlight the priorities for achieving shared success. |

| | |

| PotashCorp 2014 Annual Integrated Report | | 9 |

Key Factors

As we develop, review and refine our strategies, we continually assess the main factors that influence our ability to create value for our stakeholders. Guided by our Core Values and understanding what is most important in our key relationships, we consider the ever-changing operating environment and how we can best leverage our competitive advantages.

The basic principles that guide how we operate

| | | | | | | | | | | | | | | | | | | | |

| | | |  | | | |  | | | |  | | | |  | | | |  |

| | | | | | | | | | |

We Operate With Integrity | | | | Our Overriding Concern Is the Safety of People and the Environment | | | | We Listen to All PotashCorp Stakeholders | | | | We Seek Continuous Improvement | | | | We Share What We Learn | | | | We Are Accessible, Accountable and Transparent |

potashcorp.com/corevalues

potashcorp.com/corevalues

Understanding what is most important to our stakeholders

| | | | | | |

| Investors | | Customers | | Communities | | Employees |

| | | | | | |

| | | | |

| |  | |  | |  |

| | | | | | |

• Earnings and cash flow growth with reduced volatility • Strategic use of capital to enhance shareholder returns • Management of major business and operational risks | | • Product quality and competitive pricing • Customer service, including reliability and sales representatives’ knowledge | | • Economic and social

contributions, including jobs,

local procurement, taxes and

community investment • Safe operations with

minimal environmental

impact | | • Safe work environment • Career growth and

development opportunities • Competitive compensation |

potashcorp.com/keyrelationships

potashcorp.com/keyrelationships

| | |

| 10 | | PotashCorp 2014 Annual Integrated Report |

Company and Strategy

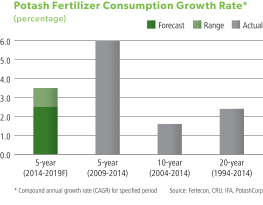

A world that requires more food and more fertilizer

We believe PotashCorp’s long-term opportunity is simple: As demand for food increases, so does the need for fertilizer. Our products play an essential role in helping farmers increase crop yields to sustainably meet the world’s growing need for food.

| | | | | | | | | | | | | | | | |

2.4B

| | | | 11%

| | | | 50%

| | | | 80%

| |

| |

|

Increase in number of

people to feedby 2050 | | | | Increase in per capita

caloric consumption by 2050 | | | | Estimated impact of

fertilizer oncrop yields | | | | Increase in crop

production expected

from yield improvements | | | |

| Source: United Nations (as compared to 2014) | | | | Source: FAO (as compared to 2005/07) | | | | Source: IPNI

| | | | Source: FAO (as compared to 2005/07) | | | | |

Page 12

Page 12

What makes us unique

We believe PotashCorp has significant potential to create long-term value by sustainably leveraging our advantages.

Our strategies are built on our unique strengths to drive our success.

| | | | | | | | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

|

| Access to Long-Lived, High-Quality Reserves | | | | Industry-Leading Potash Position | | | | Advantaged Positions in Nitrogen and Phosphate | | | | Strong Marketing Position | | | | Robust Cash Flow and Financial Strength | | | | Experienced and Engaged Workforce |

Page 14

Page 14

| | |

| PotashCorp 2014 Annual Integrated Report | | 11 |

Operating Environment

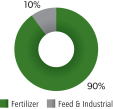

We monitor the market opportunities and challenges in each nutrient to determine how best to position the company for long-term success. While we produce products for fertilizer, feed and industrial purposes, our growth is closely tied to the important role crop nutrients play in helping feed a growing world.

| | | | | | | | | | |

| | Nutrient | | | Global Use as Fertilizer | | Industry Highlights |

| | | | | | | | | | | |

| |  | | | |  | | | ~90% | | • Number of major producing countries: 12 • Global production traded (KCl): 76% • Barriers to entry: High |

| | | | | | | | | | |

| | | | | | | | | | | |

| |  | | | |  | | | ~80% | | • Number of major producing countries: ~60 • Global production traded (NH3): 11% • Barriers to entry: Low-Moderate |

| | | | | | | | | | | |

| | | | | | | | | | | |

| |  | | | |  | | | ~90% | | • Number of major producing countries: ~40 • Global production traded (P2O5): 10% • Barriers to entry: Moderate |

| | | | | | | | | | | |

Page 42

Page 42

| | | | | | |

| Market Opportunities | | Market Challenges | | | | |

| | | | | | |

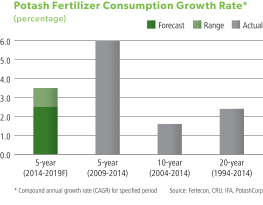

• Improvement in global soil fertility practices is expected to increase demand for the under-applied nutrients, especially potash. • Producers that can increase their operational and export capabilities have the potential to raise sales volumes as demand grows. | | • In recent years, changes in economic conditions, government policies and potash affordability have heightened variability in demand growth. • Attractive long-term growth prospects and historically high margins have attracted investment in new capacity. | |  |

| | | |

| | | | | | |

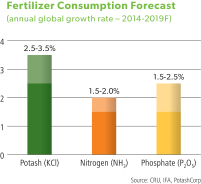

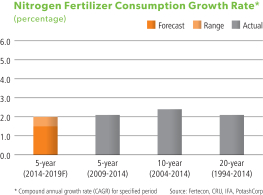

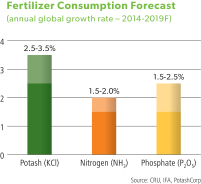

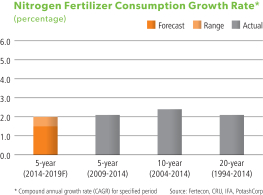

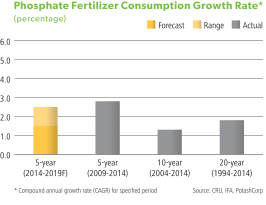

| | | | 2.5-3.5% | | Estimated five-year annual growth rate |

| | | | | | |

| | |

| 12 | | PotashCorp 2014 Annual Integrated Report |

Company and Strategy

| | | | | | |

| Market Opportunities | | Market Challenges | | | | |

| | | | | | |

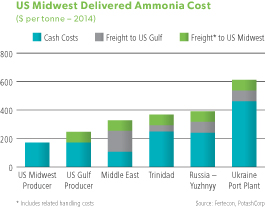

•Lower natural gas prices due to increased US shale gas supply have improved the cost position of domestic nitrogen producers. •Trinidad is less than a week’s sailing time from the US and has logistical advantages compared to most exporters supplying that market. | | •Favorable natural gas costs and strong demand in the US have resulted in development of new nitrogen capacity. •Significant excess urea export capacity in China and the Middle East can result in price volatility. | |

|

| | | |

| | | |

| | | |

| | | |

| | |

| | | | | |

| | | | 1.5-2.0% | | Estimated five-year annual growth rate |

| | | | | | |

| | | | | | |

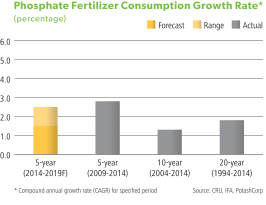

| Market Opportunities | | Market Challenges | | | | |

| | | | | | |

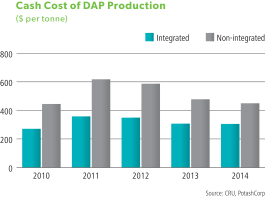

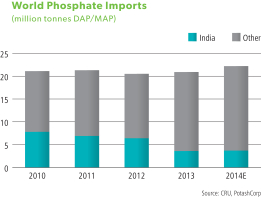

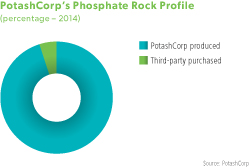

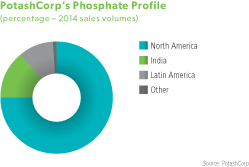

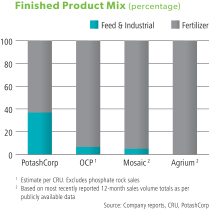

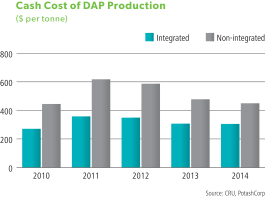

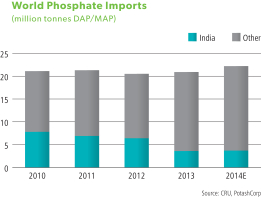

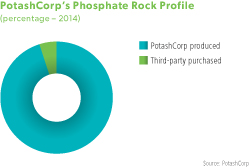

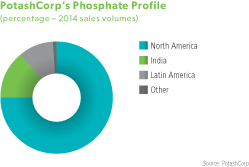

•Producers with their own phosphate rock supply have the potential to earn higher margins as their mining costs are typically lower than the prices non-integrated competitors must pay for traded rock. •Only producers with access to higher-quality rock can make feed, industrial and certain liquid fertilizer products, which are in increasing demand and typically generate higher margins. | | •Rising capacity from offshore suppliers (largely China, Morocco and Saudi Arabia) can impact global trade and market fundamentals. •In India, changing fertilizer subsidies have affected demand. Given India’s influence on global phosphate trade, its fluctuating demand can cause variability in both shipments and world prices. | |  |

| | | |

| | | | | | |

| | | 1.5-2.5% | | Estimated five-year annual growth rate |

| | | |

| | | | | | |

| | |

| PotashCorp 2014 Annual Integrated Report | | 13 |

Competitive Advantages

| | |

| 14 | | PotashCorp 2014 Annual Integrated Report |

PotashCorp’s unique strengths provide us with competitive advantages that let us capitalize on global opportunities and create long-term value for all our stakeholders. We leverage these advantages and seek to enhance what differentiates us from our peers.

| | | | | | | | | | | | | | | | | | |

| | | | | |  | | | | | |  |

| | | | | | |

| | | | | |

| | | | | |

|

| | | | | | |

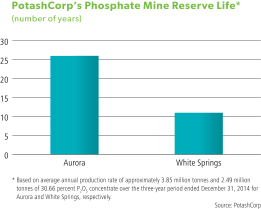

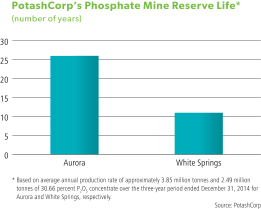

We have access to decades ofhigh-quality permitted potash and phosphate reserves withwell-established infrastructure in politically stable regions

of the world. | | | | | | We are the largest potash producer by capacity, with fivelower-cost operations in Saskatchewan and one in New Brunswick. We also have strategic investments in four global potash-related companies with exposure to important growth markets. | | | | | | We have nitrogen assets with accessto lower-cost natural gas and proximity to key markets, and a phosphate portfolio with the most diversified product offering in the industry, which has historically provided more stable returns. |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

54-89 years | | Estimated remaining mine life at our potash operations | | | | | | 20% | | Percentage of global potash nameplate capacity | | | | | | $1.2 billion | | Nitrogen and phosphate gross margin in 2014 |

| | | | | | | | | | | | | | | | | | | |

Page 4 – Potash Operations – Reserves Page 4 – Potash Operations – Reserves

|

|

Company and Strategy

| | | | | | |

| | | |  | | |

| | | | | | | | | | | | | | | | | | |

| | | | | |  | | | | | |  |

| | | | | | |

| | | | | |

| | | | | |  |

| | | | | | |

We have long-term customer relationships, extensive distribution networks and experienced sales teams through both PCS Sales and Canpotex. These networks allow us to reliably and efficiently meet the needs of a global customer base. | | | | | | Our business model and asset portfolio have consistently generated positive cash flows, even through volatile market conditions. As our potash expansion program nears completion, our ability to generate free cash flow increases, enabling us to improve shareholder returns. | | | | | | Our people have deep-rooted knowledge in all aspects of our industry and operations, along with significant skills and experience. This helps us set sound strategies and improve efficiency, innovation and safety performance. |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

17 MMT | | Anticipated export terminal capacity for Canpotex* | | | | | | $2.6 billion | | Cash provided by operating activities in 2014 | | | | | | 13.4 years | | Average workforce experience |

| | | | | | | | | | | | | | | | | | | |

* Assumes completion of existing expansion project. Does not reflect PotashCorp’s export capability. | | | | | | | | | | | | | | | | |

|

|

| | |

| PotashCorp 2014 Annual Integrated Report | | 15 |

How We Create Value

|

Our Value Model informs the goals and

strategies we put in place to create value for all

stakeholders. It is designed to ensure that we

consider the needs of all the stakeholders that

contribute to PotashCorp’s long-term success. |

|

|

|

|

|

|

|

| | |

| | | Goals |

| |

| | | |

| |

| | Financial Health Create superior long-term shareholder value |

| |

| |

| | Supplier of Choice Attract and retain customers through superior quality, reliability and service |

| |

| | Community Engagement Build strong relationships with and improve thesocioeconomic well-being of our communities |

| |

| | Engaged Employees Attract, retain, develop and engage employees to achieve our long-term goals |

| |

| | No Harm to People

or Environment Achieve no harm to people or damage to the environment |

| | |

| 16 | | PotashCorp 2014 Annual Integrated Report |

Company and Strategy

| | | | | | |

| | | Top Priorities | | Target Metrics (2014) | | Risk Considerations |

| | | |

| | | | |  Page 31 Page 31 | |  Page 22 Page 22 |

| | | |

| | | • Deliver earnings and cash flow growth • Minimize earnings volatility • Return capital to shareholders  Page 18 Page 18

| | • Total shareholder return • Cash flow return • Potash expansion project execution • Potash cost reduction | | Items that could impact PotashCorp’s financial performance or ability to execute on our business strategies. Given its significance in our portfolio, risks pertaining to our potash business tend to have the greatest potential effect. |

| | | |

| | | • Customer service • Market development • Transportation and distribution  potashcorp.com/supplierofchoice potashcorp.com/supplierofchoice

| | • Product quality and service scores • Domestic rail cycle times | | Factors that may affect our ability to deliver product safely and reliably to our customers, impair our customer relationships or impact our reputation. |

| | | |

| | | • Reputation and trust • Economic and social impact  potashcorp.com/communities potashcorp.com/communities

| | • Community investment • Community survey scores • Employee matching gift participation | | Items that could impair our reputation or negatively affect our social license to operate in our communities and investment locales. |

| | | |

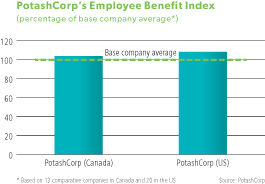

| | | • Talent and organizational development • Competitive compensation • Workforce engagement • Diversity and inclusion  potashcorp.com/employees potashcorp.com/employees

| | • Employee engagement scores • Internal promotions for senior staff positions • External employment acceptance rates | | Factors that may impact our ability to attract, retain, develop and engage qualified employees who can deliver on our business plans. |

| | | |

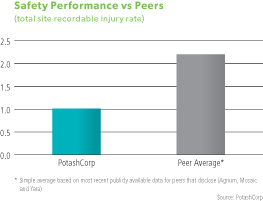

| | • Safety performance • Environmental performance  potashcorp.com/safetyandenvironment potashcorp.com/safetyandenvironment

| | • Life-altering injuries and site severity injury rates • Safety performance ranking againstbest-in-class peer group • Greenhouse gas (GHG) emissions • Reportable environmental incidents • Water usage per product tonne | | Items that could result in harm to our people or the environment. Risks considered include events that have both direct financial impacts and indirect consequences, including damage to our reputation. |

| | |

| PotashCorp 2014 Annual Integrated Report | | 17 |

Business Strategies

| | |

We believe strong financial performance is the cornerstone of PotashCorp’s value creation. It rewards our shareholders while allowing us to fulfill our broader social and environmental responsibilities. It begins by using our capital strategically, allocating it towards the opportunities that we believe generate the greatest return for our shareholders. Our objective is to achieve earnings and cash flow growth while minimizing volatility. We believe the strategies we deploy enhance our cash flow, which can then be reinvested in our business or returned to our shareholders. When it comes to our nutrients, we target disciplined growth opportunities while building competitive positions with operations flexible enough to adapt to changing market conditions. | |

|

| |

| |

Corporate

| | | | | | | | |

Deliver Earnings Growth • Maximize long-term growth potential and value by prioritizing opportunities, particularly in potash. • Create sustainable competitive positions in each nutrient by optimizing cost structure and investing in high-return opportunities that exceed our weighted average cost of capital (WACC). | | | | Minimize Earnings Volatility • Manage potash capacity responsibly to maximize long-term profitability. • Enhance stability through diversified nitrogen and phosphate businesses. • Focus on maintaining an investment-grade debt rating to safeguard access to lower-cost credit in order to operate and grow our business. | | | | Return Capital to Shareholders • Focus on dividends as an important element of our capital allocation strategy. • Optimize our capital structure through strategic share repurchase programs. |

| | | | | | |

| | | | Investing in Potential (2005-2014) |

| | | | | | |

| | | | $13.6

billion | | Amount invested in opportunity and sustaining capital projects |

| | | | | | |

| | | | | | |

| | | | $11.1

billion | | Amount returned to shareholders through dividends and share repurchases |

| | | | | | |

| | | | | | |

| | |

| 18 | | PotashCorp 2014 Annual Integrated Report |

Company and Strategy

Operational

| | | | | | | | |

| | | | |

| | | |  | | | |  |

| | | | |

| Growth Initiatives | | | | Growth Initiatives | | | | Growth Initiatives |

| | | | |

• Improve ability to respond to future growth in demand by completing brownfield projects. • Enhance transportation and distribution capabilities to new and existing markets. | | | | • Enhance production facilities by pursuing quick-payback, cost-advantaged US brownfield projects. | | | | • Develop partnerships and invest in quick-payback opportunities that leverage existing capacity. |

| | | | |

| Operational Flexibility | | | | Operational Flexibility | | | | Operational Flexibility |

| | | | |

• Match operational capability to anticipated market demand while maintaining ability to restart idled operations. | | | | • Optimize product mix, focusing on more stable, higher-margin industrial markets. | | | | • Target production toward less-volatile, higher-margin products. |

| | | | |

| Advantaged Competitive Positions | | | | Advantaged Competitive Positions | | | | Advantaged Competitive Positions |

| | | | |

• Mine reserves in a sustainable, cost-effective manner. • Protect low-cost position through operational and logistical efficiencies. • Improve safety and environmental performance. | | | | • Improve cost position by enhancing reliability and efficiencies. • Improve safety and environmental performance with a specific focus on reducing GHG emissions. | | | | • Mine reserves in a sustainable, cost-effective manner. • Optimize portfolio and pursue operational reliability and efficiencies. • Improve safety and environmental performance, focusing specifically on land and water use. |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

17.2 MMT | | Anticipated operational capability* available upon completion of projects | | | | $225 million | | Estimated 2014 incremental* gross margin from expansions | | | | 77% per ton | | PotashCorp’s margin premium in 2014 from non-fertilizer products* |

| | | | | | | | | | | | | | | |

* Post-expansion; assumes fully staffed and ramped-up operations | | | | * Contributions based on 2014 per-tonne margins for incremental production for Aurora and gross margin charge for Geismar which also includes the benefit of displaced purchased ammonia. | | | | * Based on 2010-2014 gross margin per short ton of P2O5 |

| | |

| PotashCorp 2014 Annual Integrated Report | | 19 |

Risk and Governance

Chief Mine Geologist Anastasia Vander Most and Mine Engineer David Murray underground at our Allan, Saskatchewan potash mine.

Risk and Governance

| | | | |

How We Approach Risk Successful execution of our corporate strategies and achievement of our business goals require that we regularly address the uncertainties in our global business environment. | |  | | |

Overview of Our Approach

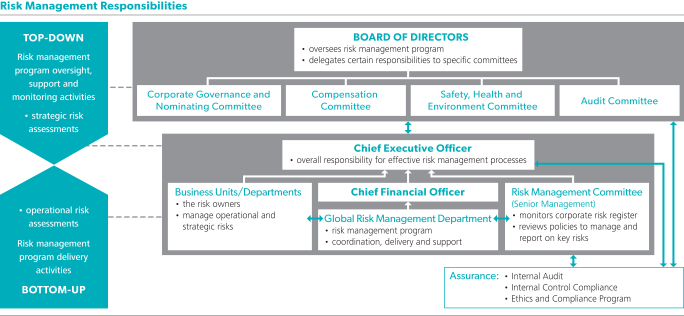

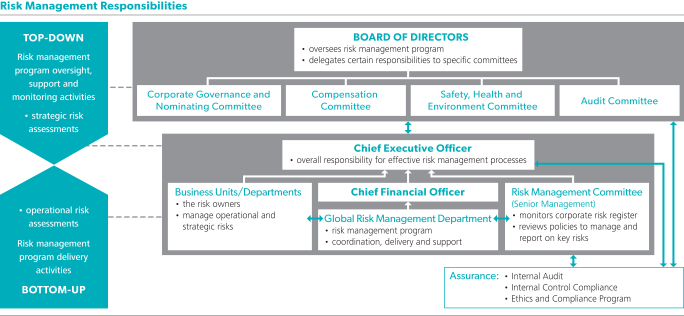

Our business is subject to constant and significant change that requires us to regularly assess our corporate strategies. At PotashCorp, risk management is an integrated discipline that supports informed decision-making throughout the company. We recognize the pivotal role it plays in balancing strategic planning with business execution and compliance. This facilitates informed decision-making and a conscious evaluation of the upside opportunity and downside aspect of risk.

Our integrated approach to managing risk recognizes the need for clear, timely direction and support from the Board of Directors, senior management and our business unit management(top-down activities). Risk management is embedded into day-to-day decision-making and operational activities (bottom-up activities).

Our starting point for managing risk is our strategic planning process, from which relevant external and internalthreats and opportunities are derived and key risks are identified. Risks and opportunities are identified by observing, analyzing and anticipating trends along with macroeconomic, industry-specific, regional and local developments.

Senior management assesses the risks to achieving our strategic objectives, and incorporates measures into corporate and operating plans to mitigate these risks if they exceed our appetite and tolerance. We intentionally accept certain risks we believe are manageable and appropriate in relation to expected opportunities. These risks and opportunities are regularly monitored for changes, and further action taken, if necessary.

| | |

| PotashCorp 2014 Annual Integrated Report | | 21 |

Program Priorities

Global risk management priorities are to:

| • | | Promote and develop a risk-aware culture within the company. Staging risk workshops with focus groups of employees makes management aware of the risk-based activities that are part of employees’ daily responsibilities. |

| • | | Ensure there is adequate education and training for the development of risk awareness by all business units. |

| • | | Improve internal processes and mechanisms for risk management. Ensure the risk roles within each business unit are clearly established. Risk registers that align with the corporate risk register and identify responsibilities are being developed within business units. |

| • | | Coordinate comprehensive regular reporting on risk to the company’s stakeholders. All such external reporting is reviewed and approved by the risk management committee at regularly convened meetings. |

Risk Profile and Key Risks

PotashCorp uses a risk management ranking methodology to assess the key risks specific to our company. Risks with A or B residual ranking, or those for which we identify elevated changes within C, D or E residual ranking with long- or medium-term implications that could cause a deviation from the desired strategic results of our Value Model, are monitored closely and viewed as key risks. The external factors that affect our business environment are constantly changing and, as a result, our business strategy setting is a dynamic process. In addition, there are key overriding internal factors which

drive our operating strategies. We place a high priority on preserving and maintaining our reputation. Further, sustaining and growing our business greatly depend on our employees. Therefore, we place significant emphasis on attracting, retaining, developing and engaging our PotashCorp team members. Potential damage to our reputation and inability to deliver on our talent needs are important consequences we consider in our mitigation responses to our key business and strategic risks listed on Pages 23 to 25.

Page 18 –Risk Factors

Page 18 –Risk Factors

| | | | | | | | | | | | | | | | |

Our key risks, in terms of severity of consequence and likelihood, are displayed as follows: |

Risk Ranking Matrix | | Severity of Consequence | | | | AExtreme: Initiate mitigation activities immediately to reduce risk. If such activities cannot sufficiently reduce risk level, consider discontinuation of the applicable business operation to avoid the risk. B Major: Initiate mitigation activities at next available opportunity to reduce risk. If such activities cannot sufficiently reduce risk level, Board of Directors approval is required to confirm acceptance of this level of risk. C Medium: Level of risk is acceptable within tolerances of the risk management policy. Additional risk mitigation activities may be considered if benefits significantly exceed cost. DLow: Monitor risk according to risk management policy requirements, but no additional activities required. E Negligible: Consider discontinuing any related mitigation activities so resources can be directed tohigher-value activities, provided such discontinuance does not adversely affect any other risk areas. |

| | Negligible | | Low | | Medium | | Major | | Extreme | | |

Likelihood | | Probable | | C | | B | | B | | A | | A | | |

| | High | | D

| | C

| | B | | B

| | A | | |

| | Medium | | D | | D | | C

| | B

| | B | | |

| | Low | | E | | D | | D | | C

| | B | | |

| | Remote | | E

| | E

| | D

| | D | | C | | |

| | | | | | | | | | | | | | | | | | |

| B | | | | C |

| | Global potash demand | | | |  | | Potash operating capability | | |  | | | Product transportation mishaps | |  | | Trinidad natural gas supply |

| | Competitive potash supply | | | |  | | Safety, health, environmental and security | | |  | | | Sustaining growth opportunities | |  | | Cyber security |

| | Offshore potash sales and distribution | | | | | |  | | | Transportation and

| | | | |

| | | | |  | | International operations | | | | | | distribution infrastructure | | | | |

| | |

| 22 | | PotashCorp 2014 Annual Integrated Report |

Risk and Governance

| | | | | | | | | | |

No change to risk No change to risk  Increased risk Increased risk  Decreased risk Decreased risk  Risk has materialized in part Risk has materialized in part |

| Risk | | Risk

Level | | Description and Context | | Status | | Risk Management Approach | | Link to Business Strategies  Pages 18-19 Pages 18-19

|

| Global potash demand | | B | | Our capital investment in major potash expansion and debottlenecking projects is expected to be completed by the end of 2015, with ramp-up planned in 2015 and 2016. If our estimates of future potash demand prove to be overstated due to variable market, governmental, seasonal, economic or other conditions, our return on this investment and our ability to meet our growth expectations in a timely manner may be lower than anticipated. | |

| | We engage in market development, education, training and government relations initiatives. We also strive to make necessary operational changes to maintain optimal operating flexibility and maximize long-term profitability. | |  |

| Competitive potash supply | | B | | Investment in new competitive potash capacity (in response to market conditions or otherwise) may result in product supply that outpaces growth in consumption. Potash prices could be depressed for a prolonged period, negatively affecting our financial performance and reputation. | |

| | We produce potash to meet market demand, strive to be a low-cost producer (on a delivered basis) in the key markets we serve, develop and leverage logistic advantages, maintain operational flexibility and offer a diversified product line. | |  |

Offshore

potash sales and distribution | | B | | We rely heavily on Canpotex, our offshore marketing, transportation and distribution company, to deliver our Saskatchewan product to customers around the world. If Canpotex were to dissolve, or its ability to operate became impaired – due to unexpected changes in laws or regulations, market or economic conditions, our (or our venture partners’) businesses, or otherwise – a trusted potash brand would be lost and our access to key offshore markets could be impacted. This could result in a less efficient logistics system and might lead to decreased market share, higher costs and/or lower net earnings from offshore sales. We increased the ranking of this risk since 2013 as the strategic importance of being a low-cost producer on a delivered basis to key markets continues to rise. | |  | | We engage directly with international customers to foster relationships with them, develop internal capacity to market and distribute products offshore and preserve access to Canpotex distribution facilities. | |  |

| Potash operating capability | | C | | Unexpected surges in potash demand can negatively impact our ability to operationally respond in a timely manner, adversely affecting our financial performance and reputation. We increased the ranking of this risk since 2013. While global potash production rose sharply during 2014, it did not keep pace with the increase in demand. Logistical issues, planned downtime and unplanned outages affected global supply capability, including PotashCorp’s. | |

| | We have developed an integrated, robust distribution and storage system and a flexible potash operating strategy to meet a variety of demand scenarios. | |  |

| | |

| PotashCorp 2014 Annual Integrated Report | | 23 |

| | | | | | | | | | |

No change to risk No change to risk  Increased risk Increased risk  Decreased risk Decreased risk  Risk has materialized in part Risk has materialized in part |

| Risk | | Risk

Level | | Description and Context | | Status | | Risk Management Approach | | Link to Business Strategies  Pages 18-19 Pages 18-19

|

| Safety, health, environmental and security | | C | | Our operations are subject to various safety, health, environmental and security laws and regulations, and we engage in mining and industrial activities that can result in serious accidents causing injuries or fatalities to our people or impact to the environment. Failure to adhere to these laws and regulations or failure to prevent or respond to a major safety, environmental or security incident could adversely impact our employees, operations, financial performance and reputation. | |

| | Safety of our people and the environment are fundamental values to us. Structured incident prevention and response systems are in place to protect our employees, and leading indicators help us proactively monitor effectiveness. Environmental monitoring and control systems exist to limit the impact to the natural environment. Crisis communication protocols and emergency response programs and personnel are in place. We have also formed partnerships for mutual aid with local area community emergency response organizations. | |  |

| International operations | | C | | We operate and invest in countries outside of Canada and the US. Differences in political and economic conditions, culture and laws may result in higher business risk in these jurisdictions, potentially impacting earnings growth and volatility. | |

| | We are guided by a strong set of Core Values and supporting internal policies. We have government relations programs and engage in a positive and supportive way with governmental and non-governmental organizations wherever we operate. | |  |

| Product transportation mishaps | | C | | A mishap occurring during transport could have serious impact on people, property and/or the environment. | |  | | We maintain relations with reputable carriers and employ effective risk transfer through contract terms and insurance coverage. | |  |

| Sustaining growth opportunities | | C | | Our opportunities to strategically reinvest available capital may be limited for geopolitical, market or other reasons, negatively affecting our growth. | |  | | We regularly evaluate all strategic opportunities, including investments in diversified and downstream areas, to ensure our capital generates returns that exceed our cost of capital on a risk-adjusted basis. | |  |

Transportation and

distribution infrastructure | | C | | Reliability of supply is an important factor in sales of product to our customers worldwide. Our (or the third parties upon which we rely) inability to provide cost-effective, timely and secure transportation and storage of product – due to labor disputes, adverse operating, economic or weather conditions, system failures, accidents or delays, demand swings for our or others’ products, or otherwise – could result in customer dissatisfaction and inhibit earnings and market share growth. | |

| | We have established a strategic storage and distribution network, backed by a comprehensive and reliable transportation fleet, to support our customers. | |  |

| | |

| 24 | | PotashCorp 2014 Annual Integrated Report |

Risk and Governance

| | | | | | | | | | |

No change to risk No change to risk  Increased risk Increased risk  Decreased risk Decreased risk  Risk has materialized in part Risk has materialized in part |

| Risk | | Risk

Level | | Description and Context | | Status | | Risk Management Approach | | Link to Business Strategies  Pages 18-19 Pages 18-19

|

Trinidad

natural gas supply | | C | | Natural gas is a key raw material for the manufacture of our nitrogen products. We have experienced significant natural gas curtailments at our Trinidad facility over the last several years due to decreased industry investment in exploration and development activity and major supplier maintenance activities. While recent changes in government policy in Trinidad are intended to lead to an increase in natural gas exploration and development activity, we continue to expect curtailments of natural gas supply. Prolonged interruption of our natural gas supply could result in loss of nitrogen production, adversely affecting our financial performance and reputation. | |

| | Operational flexibility is maintained at our other plants, and we are working actively with the Government of Trinidad & Tobago to address reliability issues and security of long-term natural gas supply. | |  |

| Cyber security | | C | | Our business processes rely on IT systems, including internal and external communications, ordering and managing shipments of materials for our operations, coordinating transportation of our products and reporting our results. Targeted attacks on our systems (or third parties that we rely on), failure of a key IT system or a breach in security measures designed to protect our IT systems could result in financial or reputational loss. | |

| | We have implemented – and test – system controls, disaster recovery and business continuity arrangements for critical IT systems and activities. As the threat landscape is ever-changing, our primary focuses include: risk-prioritized controls to protect against known and emerging threats and comply with standards and regulations; situational risk and threat awareness across our company to detect incidents and anomalies; and, the ability to handle critical incidents, quickly return to normal operations, and repair damage to the business and our brand. | |  |

| | |

| PotashCorp 2014 Annual Integrated Report | | 25 |

Governance and Remuneration

Good governance begins at the top. Our Board provides guidance and oversight to ensure the company has the right strategies and risk processes to create sustainable value for all stakeholders. The Board continually monitors performance to make sure the necessary steps are taken to protect and enhance our assets and that our compensation plans appropriately motivate employees to achieve the company’s goals.

Building Blocks of Good Governance

Board Composition

PotashCorp believes having a diverse group of individuals with the relevant skills and experience is necessary to strategically nourish the company’s future. Our Board is comprised of members with wide-ranging skill sets, varying tenure and diversity. As a result of the expected retirements of two directors, including the Board Chair, the Board is actively undergoing a director identification process in an effort to identify the highest-quality Board candidates. The Board also has in place a process for the identification and appointment of a new Board Chair.

Board Skills

Each Board member brings different perspectives with complementary skill sets, which help them better identify areas of potential stakeholder value creation or diminution.

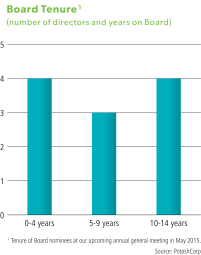

Board Tenure

We believe the Board demonstrates a good balance of continuity of company knowledge and fresh perspectives from newer members. A subcommittee of the Board has been tasked with review of term limits, tenure and retirement age.

Diversity and Independence

PotashCorp meets all independence requirements and has formal processes for director succession and recruitment that expressly encourage the promotion of diversity. Under the Board’s oversight, the company is developing a diversity policy.

| | |

| | | |

| 27% | | Percentage of women represented on PotashCorp’s Board 1 |

| | | |

| | |

| | | |

| 82% | | Percentage of PotashCorp Board 1 who are independent directors |

| | | |

1 – As nominees at our upcoming annual general meeting

| | |

| |

| | Pages 9-14 – Board profiles |

| | Page 30 – Board skills matrix |

| | |

| | Page 17 – Director independence |

| | Page 18 – Board Interlocks |

| | Page 31 – Diversity |

| | |

| | |

| 26 | | PotashCorp 2014 Annual Integrated Report |

Risk and Governance

| | | | |

| |  | | |

Oversight

To enhance value, the company’s goals and strategies need to take into consideration the objectives of our key stakeholders. Of utmost importance is the Board’s oversight of the company’s strategy and risk management approaches. This is achieved by actively engaging with management and challenging their assumptions, monitoring stakeholder feedback and independently assessing strategic execution. The Board dedicated two offsite meetings in 2014 to integrated discussions of risk and strategy.

The Board also dedicated significant resources in 2013 and 2014 to the succession planning process for the company’s President and Chief Executive Officer. An ad hoc succession planning committee comprised of the Board Chair and each committee chair held 23 meetings and identified and met with potential candidates. Throughout the process, the succession planning committee provided regular updates to, and received input from, the Board. Jochen Tilk took over from Bill Doyle effective July 1, 2014.

| | |

| | | |

34 | | Number of Board and committee meetings held by directors in 2014 |

| | | |

| | | | |

| | Page 25 – | | Letter from and report of the audit committee |

| | Page 29 – | | Letter from and report of the corporate governance and nominating committee |

| | Page 34 – | | Letter from and report of the safety, health and environment committee |

| | Page 36 – | | Letter from and report of the compensation committee |

Stakeholder Engagement

The Board encourages stakeholders to engage with appropriate company representatives on relevant matters and actively monitors stakeholder feedback. Under its oversight, the company has an active stakeholder outreach program.

| | | | |

| | Page 32 – | | How to engage with the Board |

| | | | |

| |

| | potashcorp.com/stakeholderengagement |

Board Evaluation

Good governance includes a regular evaluation of processes and results to ensure value creation is occurring at the company. Our Board adopted a six-part effectiveness evaluation for review of the Board, committees and directors.

Page 19 – Board, committee and director assessment

Page 19 – Board, committee and director assessment

Board Continuing Education

Board education is important to ensure directors have the latest information to help minimize risks and maximize opportunities. Through its new director orientation procedures, new directors are provided a baseline of knowledge about the company. On an ongoing basis, an appropriate mix of internal and external educational opportunities is provided.

Page 32 – Director education activities

Page 32 – Director education activities

PotashCorp’s 2013 AIR and Related Reporting

| | | | | | | | | | | | |

Ranked #5 in the world | | | | Ranked Top10 for governance | | | | AWARD OF EXCELLENCE Overall in 2014 | | | | MINING WINNER since 2003 |

| First in North America by reportwatch.net | | | | Globe and Mail Board Games since 2006 | | | | at the Chartered Professional Accountants of Canada Corporate Reporting Awards |

| | |

| PotashCorp 2014 Annual Integrated Report | | 27 |

Remuneration

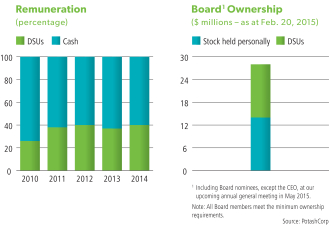

Director Remuneration

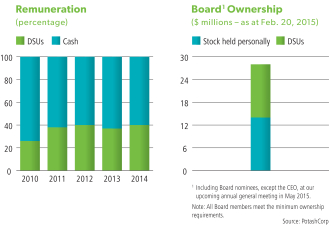

Directors are compensated for their significant contributions and commitment to the company. To ensure their interests are aligned with those of shareholders, a director must, within five years of starting on the Board, own shares and/or deferred share units (DSUs) with a value equal to at least five times the annual retainer paid to directors.

In 2014, three directors elected to receive their Board retainer in cash, while nine members elected to receive deferred share units for all or a portion of the retainer.

| | |

| | Page 21 – Director compensation |

Employee Remuneration

Our compensation program is designed to be competitive with our peers to attract, retain, develop and engage employees able to establish and execute value-building strategies. Just as our corporate goals have different time horizons, so do the components of our compensation program. We believe the design, structure and implementation of our executive compensation program should not encourage executives to take unnecessary or inappropriate risks or engage in other improper behavior.

Page 36 – Letter from and report of the compensation committee

Page 36 – Letter from and report of the compensation committee

In addition, PotashCorp’s compensation plans are designed to:

| • | | Motivate actions to align with the long-term interests of our shareholders and other stakeholders; |

| • | | Create an ‘ownership mentality’ in our management team; |

| • | | Provide an appropriate level of value sharing between our shareholders and executives; and |

| • | | Incent and reward performance in line with our corporate goals and shareholder experience. |

Key Employee Remuneration Components

| | | | | | | | |

| Category | | Component | | 2014 Impact | | Design | |  |

| Base Salaries | | Salary and wages (5,136 people) | | $472 million expense | | • The only fixed component of total direct compensation. • Typically set annually and at the median of comparative compensation information. | | Page 48 |

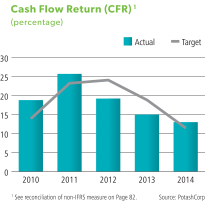

| At-Risk Compensation | | Short-Term Incentive Plan (STIP) (5,028 people) | | $48 million expense | | • Annual cash bonus – one-year performance period with payout based on achieving a Board-established cash flow return (CFR) metric and achievement of certain safety, environmental, sales and operational targets. | | Page 48 |

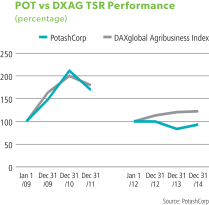

| | Medium-Term Incentive Plan (MTIP) (77 people) | | $(1) million expense | | • Three-year performance period (MTIP began on January 1, 2012 and ended on December 31, 2014). • One-half of payout was based on corporate total shareholder returns (TSR) and the other half on TSR relative to the DAXglobal Agribusiness Index (DXAG). There were no payouts under the plan. • Our incentive compensation programs are under review and instead of starting a new MTIP program during the review, the company granted eligible employees additional performance options under the 2014 POP. | | Page 49 |

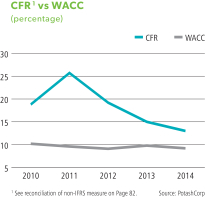

| | Performance Option Plan (POP) (291 people) | | $27 million expense | | • Option vesting is based on the amount by which our cash flow return on investment exceeds the weighted average cost of capital over a three-year performance period. Value of options is based on share price appreciation, if any. • The POP is submitted to shareholders every year. | | Page 50 |

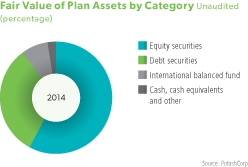

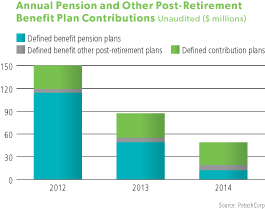

Retirement Plans | | Retirement benefits | | $1,806 million obligation | | • Employees are eligible to participate in either defined benefit or defined contribution pension plans, some of which include a savings feature, a performance contribution feature or stock purchase plan. Supplemental plans are designed to deliver average benefits based on comparative compensation information. | | Page 47 |

| | | | | | |

| | | |

| | Page 60 – Summary named executive officer compensation table | | Pages 44-45 – Compensation consultant and comparative compensation information | | |

| | Pages 43-57 – Compensation discussion and analysis | | Page 52 – Chief Executive Officer compensation | | |

| | |

| 28 | | PotashCorp 2014 Annual Integrated Report |

Risk and Governance

Key Employee Remuneration Results

How Financial Performance Metrics Are Considered

How Non-Financial Performance Metrics Are Considered

| | |

| Be the supplier of choice to the markets we serve | | Our STIP considers Board-approved annual goals for sales and productivity. The only way to achieve target or higher STIP payments is to meet those goals, which requires meeting the needs of customers throughout the year. |

| Build strong relationships with and improve the socioeconomic well-being of our communities | | We actively encourage all employees to participate in philanthropic programs in our communities and offer significant gift-matching opportunities. To encourage investments in our communities, it is important to sustain earnings and provide opportunities for meaningful compensation on a consistent basis. |

| Attract, retain, develop and engage employees to achieve our long-term goals | | Target compensation is competitive within our industry and employees are motivated to achieve strong results through opportunities to earn above-target compensation for above-target company and individual performance and are provided opportunities for growth and promotion. Employees are provided opportunities for growth and promotion through professional development and/or experience in other areas of the company. |

| Achieve no harm to people and no damage to the environment | | At plant locations, one-half of the annual STIP payout depends on performance in relation to local metrics, a significant portion of which relates to safety and environmental performance. At corporate offices, 5 percent of the annual STIP payout depends on PotashCorp’s overall safety performance. |

| | |

|

| |

| | Pages 52-54 – Chief Executive Officer compensation |

| | |

| PotashCorp 2014 Annual Integrated Report | | 29 |

Our Performance

Volunteers Nirvaan Soogrim (a Chemical Engineer from our Trinidad operation) and Drayden Ollivier (son of Rocanville employees Chantelle and Trent Ollivier) help to reinforce the mud walls of a home in a Free The Children community in India.

Performance

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Metric | | Target* | | | Historical Performance | | |

|

| | | | | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | |

Financial Health | | | | | | | | | | | | | | | | | | | | | | | | | | |

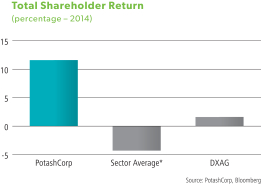

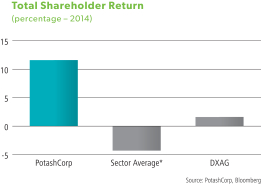

Total shareholder return (TSR) | | |

| | | | 11.6% | | | | (16.4)% | | | | (0.2)% | | | | (19.7)% | | | | 43.2% | | | Page 36

|

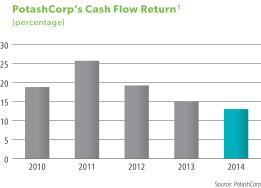

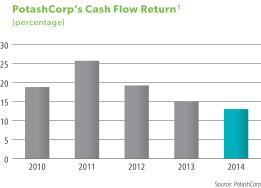

Cash flow return (CFR)1 | | |

| | | | 13.0% | | | | 15.0% | | | | 19.2% | | | | 25.7% | | | | 18.8% | | |

Potash nameplate capacity | | |

| | | |

| | | |

| | | | n/a | | | | n/a | | | | n/a | | |

Potash per-tonne cash cost savings | | |

| | | |

| | | | n/a | | | | n/a | | | | n/a | | | | n/a | | |

Supplier of Choice |

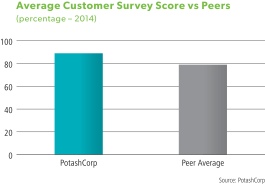

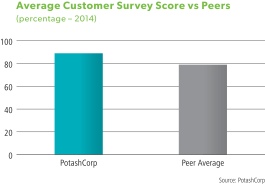

Customer survey score | | |

| | | | 89% | | | | 90% | | | | 92% | | | | 90% | | | | 90% | | | Page 37 |

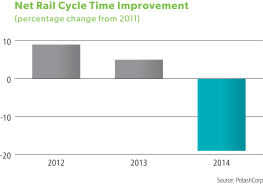

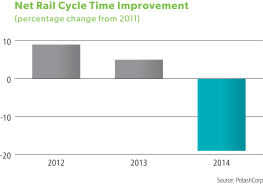

Net rail cycle time improvement (compared to 2011) | | |

| | | | (19)% | | | | 5% | | | | 9% | | | | n/a | | | | n/a | | |

Community Engagement |

Community investment | | |

| | | | $26M | | | | $31M | | | | $28M | | | | $21M | | | | $17M | | | Page 38 |

Community survey score (out of 5) | | |

| | | | 4.4 | | | | 4.2 | | | | 4.5 | | | | 4.4 | | | | 4.2 | | |

Employee matching gift participation change | | |

| | | | (7)% | | | | (1)% | | | | 11% | | | | 12% | | | | 9% | | |

Engaged Employees |

Employee engagement score | | |

| | | | 67% | | | | n/a | | | | 79% | | | | 73% | | | | 73% | | | Page 39

|

Percentage of senior staff positions filled internally | | |

| | | | 78% | | | | 79% | | | | 80% | | | | 92% | | | | 94% | | |

Average external acceptance rate | | |

| | | | 95% | | | | 92% | | | | 93% | | | | 93% | | | | 86% | | |

No Harm to People or Environment |

Life-altering injuries at our sites | | |

| | | | 1 | | | | 0 | | | | 1 | | | | 1 | | | | 0 | | | Page 40 |

Total site recordable injury rate | | |

| | | | 1.01 | | | | 1.06 | | | | 1.29 | | | | 1.42 | | | | 1.29 | | |

Become one of the safest resource companies | | |

| | | |

| | | | n/a | | | | n/a | | | | n/a | | | | n/a | | |

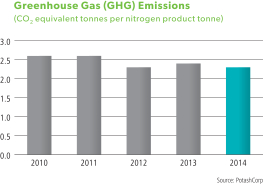

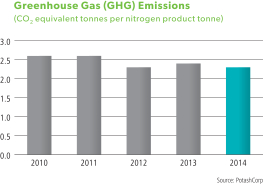

Greenhouse gas emissions (CO2 equivalent per tonne of nitrogen product) | | |

| | | | 2.3MT | | | | 2.4MT | | | | 2.3MT | | | | 2.6MT | | | | 2.6MT | | | Page 41 |

Environmental incidents | | |

| | | | 24 | | | | 17 | | | | 19 | | | | 14 | | | | 20 | | |

Water consumption per tonne of phosphate product | | |

| | | | 26m3 | | | | 26m3 | | | | 33m3 | | | | 33m3 | | | | 29m3 | | |

| * | Relative to 2014 stated target |

| n/a | = not a stated target in noted year |

| 1 | See reconciliation and description of certain non-IFRS measures on Page 82. |

| | |

| PotashCorp 2014 Annual Integrated Report | | 31 |

Year in Review

Factors Affecting Our 2014 Performance

Record Global Shipments

Record Global Shipments

Potash markets rebounded in 2014 after an especially volatile demand and pricing environment in the second half of 2013. Stronger and more consistent buying activity re-emerged early in the year as pricing stabilized and dealers looked to replenish low inventories. Demand in all key markets strengthened and raised global shipments for the year to an all-time record of more than 61 million tonnes.

The strength in demand was most apparent in granular potash markets such as Brazil and North America as farmers worked to address nutrient requirements and capitalize on supportive crop economics. Significant product needs – in addition to logistical constraints in North America early in the year – further tightened granular fundamentals and kept dealers focused on supply availability. China and India remained engaged throughout the year as buyers worked to meet growing consumption needs, particularly for compound fertilizers, and procured tonnage under contracts signed in early 2014. In the Other Asia region, agronomic need and supportive grower economics resulted in robust demand.

This environment tested supply and logistical capacity. Even as most producers reportedly operated at, or above, historical levels, shipments outpaced global production and resulted in a substantial inventory drawdown at the producer level.

Given improved market fundamentals, potash prices stabilized early in the year and rose modestly from those levels. Increases were most evident in granular markets, although prices in standard grade spot markets improved on tighter supply/demand conditions through the second half of 2014.

Supply Challenges Remain a Factor

Supply Challenges Remain a Factor

Ammonia market fundamentals were supportive throughout most of 2014, given supply interruptions in key exporting regions due to

geopolitical events and natural gas availability. Prices remained elevated for much of the year before declining late in the fourth quarter as supply challenges began to abate and demand seasonally weakened – including in regions of the US where early winter conditions limited fall applications.

In urea, record Chinese exports and increased production in the Middle East weighed on market fundamentals. This environment resulted in lower global prices although strong demand in the US and supply constraints early in 2014 kept North American prices above those in international markets.

Access to lower-cost natural gas continued to provide US producers with a delivered-cost advantage relative to offshore importers, leading to robust margins. During 2014, this environment resulted in increased production from US producers – and fewer ammonia imports – in addition to continued advancement of and interest in North American plant expansions and greenfield projects.

Strong Demand Outside of India

Strong Demand Outside of India

Strong agronomic needs and supportive grower economics pushed phosphate demand in Latin America to a record level and increased shipments to other significant markets such as North America and Southeast Asia. This strength helped support market fundamentals despite subdued purchasing activity from India – the world’s largest importer of phosphate products – given a delayed monsoon and weak importer margins.

Supply dynamics were largely influenced by increased shipments of solid fertilizer products from China, Morocco and Saudi Arabia. Exports from Russia and the US declined due largely to mining challenges and capacity curtailments as a result of higher input costs for sulfur and ammonia.

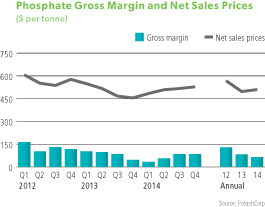

Although prices lifted in most markets through the first half, they remained seasonally volatile throughout the year, responding to periods of peak and off-season demand.

Market Change (2014 vs 2013)

| | | | | | |

| | | | |

| Nutrient1 | | Global Demand | | Global Production | | Average Price2 |

| | +16% | | +13% | | -22% |

| | +2% | | +2% | | +0% |

| | +3% | | +3% | | +2% |

| 1 | Data represent: KCl – potash (K); NH3 – nitrogen (N); P2O5 – phosphate (P) |

| 2 | Reference pricing based on: K – Vancouver MOP; N – Tampa Ammonia; P – Central Florida DAP |

| Source: | Company reports, CRU, Fertecon, PotashCorp |

| | |

| 32 | | PotashCorp 2014 Annual Integrated Report |

Performance

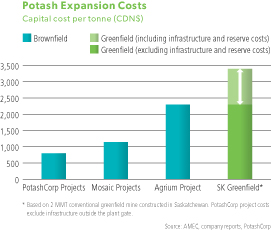

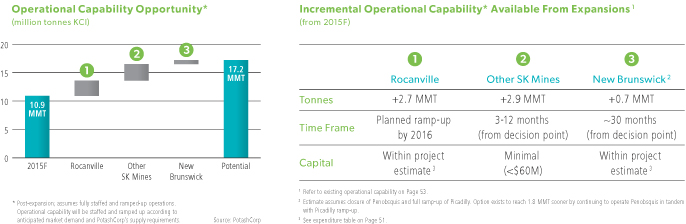

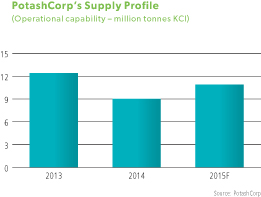

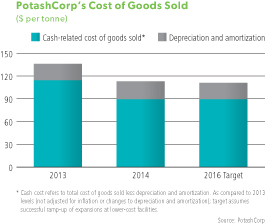

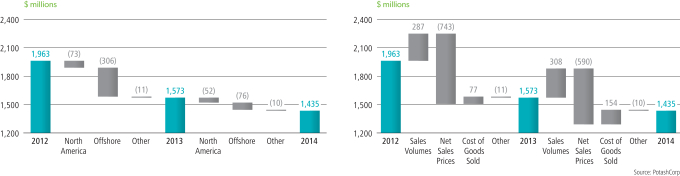

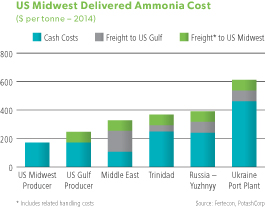

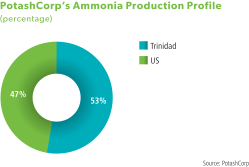

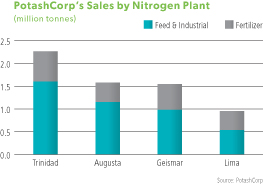

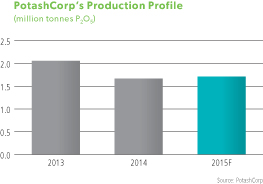

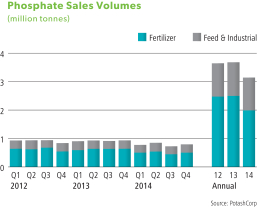

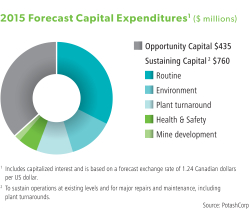

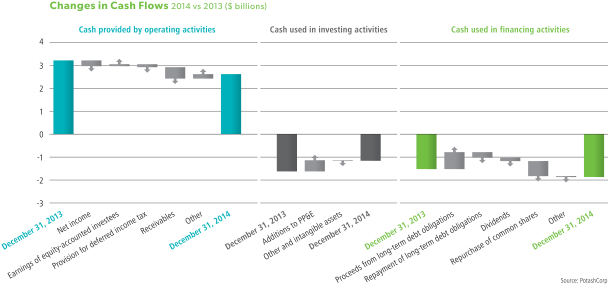

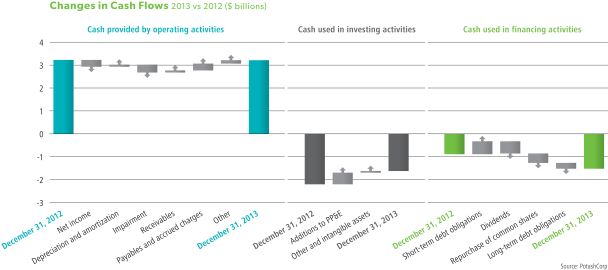

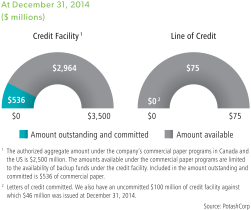

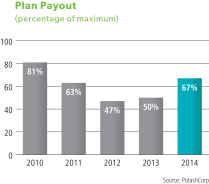

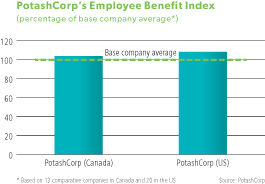

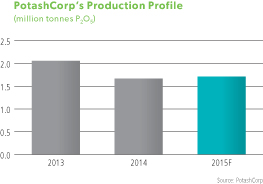

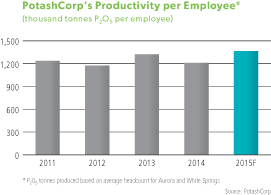

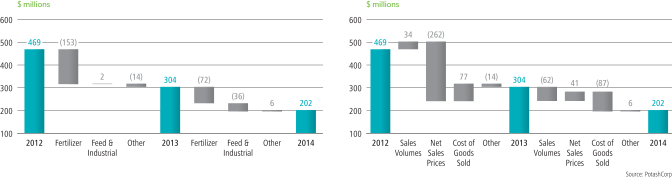

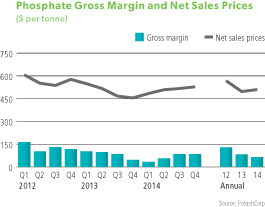

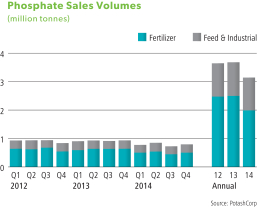

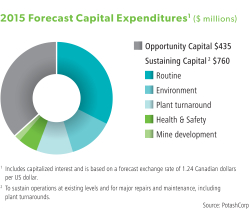

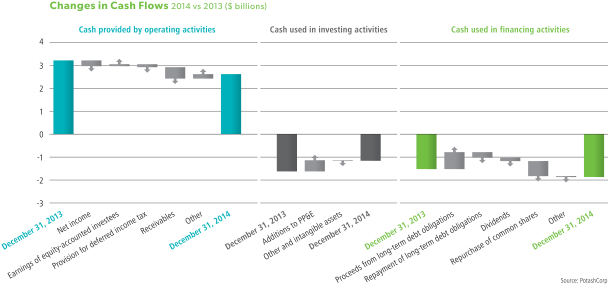

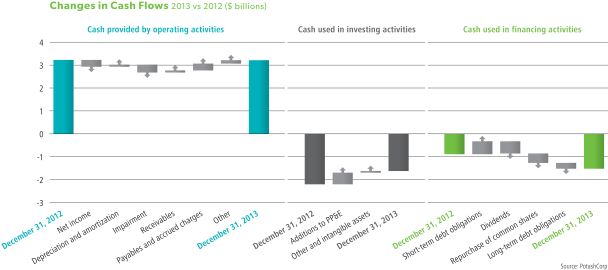

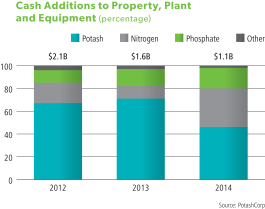

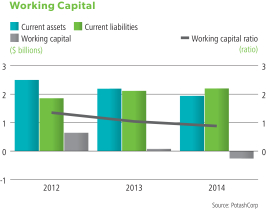

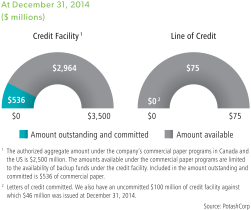

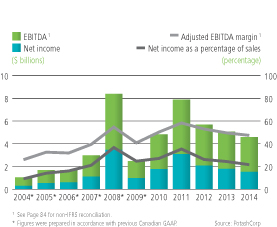

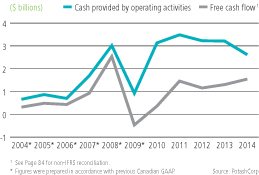

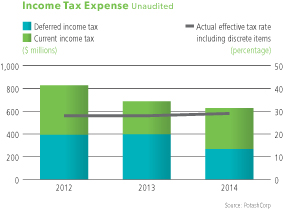

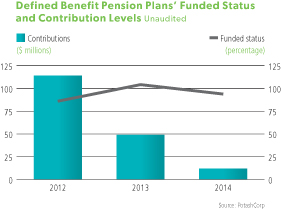

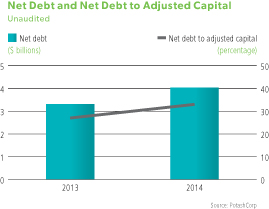

Earnings per Share