| |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

| |

| FORM N-CSR |

| |

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| |

| MANAGEMENT INVESTMENT COMPANIES |

| |

| Investment Company Act file number 811- 5979 |

| |

| John Hancock California Tax-Free Income Fund |

| (Exact name of registrant as specified in charter) |

| |

| 601 Congress Street, Boston, Massachusetts 02210 |

| (Address of principal executive offices) (Zip code) |

| |

| Salvatore Schiavone |

| Treasurer |

| |

| 601 Congress Street |

| |

| Boston, Massachusetts 02210 |

| |

| (Name and address of agent for service) |

| |

| Registrant's telephone number, including area code: 617-663-4497 |

| |

| Date of fiscal year end: | May 31 |

| |

| Date of reporting period: | May 31, 2013 |

ITEM 1. REPORTS TO STOCKHOLDERS.

A look at performance

Total returns for the period ended May 31, 2013

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | Tax- |

| | Average annual total | | | Cumulative total | | | SEC 30-day | | SEC 30-day | | equivalent |

| | returns (%) | | | | returns (%) | | | | yield (%) | | yield (%) | | subsidized |

| | with maximum sales charge | | with maximum sales charge | | subsidized | | unsubsidized1 | | yield (%)2 |

|

| | | | | | | | | | as of | | as of | | as of |

| | 1-year | 5-year | 10-year | | 1-year | 5-year | 10-year | | 5-31-13 | | 5-31-13 | | 5-31-13 |

|

| Class A | –0.16 | 4.94 | 4.02 | | –0.16 | 27.23 | 48.37 | | 2.61 | | 2.61 | | 5.32 |

|

| Class B | –1.24 | 4.73 | 3.80 | | –1.24 | 26.00 | 45.16 | | 1.98 | | 1.88 | | 4.03 |

|

| Class C | 2.77 | 5.04 | 3.64 | | 2.77 | 27.90 | 42.98 | | 1.98 | | 1.88 | | 4.03 |

|

| Index 1† | 3.91 | 5.94 | 4.89 | | 3.91 | 33.44 | 61.11 | | — | | — | | — |

|

| Index 2† | 3.05 | 5.70 | 4.68 | | 3.05 | 31.93 | 58.00 | | — | | — | | — |

|

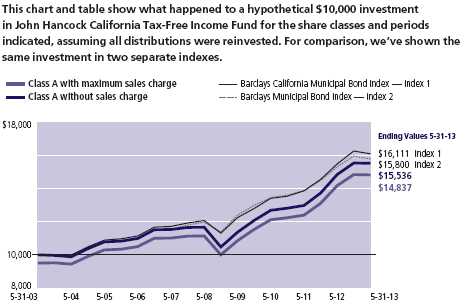

Performance figures assume all distributions have been reinvested. Figures reflect maximum sales charges on Class A shares of 4.5% and the applicable contingent deferred sales charge (CDSC) on Class B shares and Class C shares. The returns for Class C shares have been adjusted to reflect the elimination of the front-end sales charge effective 7-15-04. The Class B shares’ CDSC declines annually between years 1 to 6 according to the following schedule: 5, 4, 3, 3, 2, 1%. No sales charge will be assessed after the sixth year. Class C shares held for less than one year are subject to a 1% CDSC.

The expense ratios of the fund, both net (including any fee waivers or expense limitations) and gross (excluding any fee waivers or expense limitations), are set forth according to the most recent publicly available prospectus for the fund and may differ from those disclosed in the Financial highlights tables in this report. The fee waivers and expense limitations are contractual at least until 9-30-13 for Class B and Class C shares. For Class A shares, the net expenses equal the gross expenses. The expense ratios are as follows:

| | | | | | | |

| | Class A | Class B* | Class C* | | | | |

| Net (%) | 0.86 | 1.61 | 1.61 | | | | |

| Gross (%) | 0.86 | 1.71 | 1.71 | | | | |

* The fund’s distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees for Class B and Class C shares. The current waiver agreement will remain in effect through 9-30-13.

The returns reflect past results and should not be considered indicative of future performance. The return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Due to market volatility, the fund’s current performance may be higher or lower than the performance shown. For current to the most recent month end performance data, please call 800-225-5291 or visit the fund’s website at jhfunds.com.

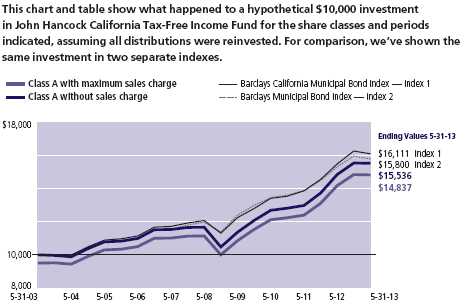

The performance table above and the chart on the next page do not reflect the deduction of taxes that a shareholder may pay on fund distributions or on the redemption of fund shares. Please note that a portion of the fund’s income may be subject to taxes, and some investors may be subject to the Alternative Minimum Tax (AMT). Also note that capital gains are taxable. The fund’s performance results reflect any applicable fee waivers or expense reductions, without which the expenses would increase and results would have been less favorable.

† Index 1 is the Barclays California Municipal Bond Index. Index 2 is the Barclays Municipal Bond Index.

See the following page for footnotes.

| |

| 6 | California Tax-Free Income Fund | Annual report |

| | | | | |

| | | With maximum | Without | | |

| | Start date | sales charge | sales charge | Index 1 | Index 2 |

|

| Class B3 | 5-31-03 | $14,516 | $14,516 | $16,111 | $15,800 |

|

| Class C3 | 5-31-03 | 14,298 | 14,298 | 16,111 | 15,800 |

|

Performance of the classes will vary based on the difference in sales charges paid by shareholders investing in the different classes and the fee structure of those classes.

The Class C shares investment with maximum sales charge has been adjusted to reflect the elimination of the front-end sales charge effective 7-15-04.

Barclays California Municipal Bond Index is an unmanaged index composed of California investment-grade municipal bonds.

Barclays Municipal Bond Index is an unmanaged index representative of the tax-exempt bond market.

Prior to December 14, 2012, the fund compared its performance solely to the Barclays Municipal Bond Index. After this date, the fund added the Barclays California Municipal Bond Index as the primary benchmark index and retained the Barclays Municipal Bond Index as the secondary benchmark index to which the fund compares its performance to better reflect the universe of investment opportunities based on the fund’s investment strategy.

It is not possible to invest directly in an index. Index figures do not reflect expenses or sales charges, which would have resulted in lower values if they did.

Footnotes related to performance pages

1 Unsubsidized yield reflects what the yield would have been without the effect of reimbursements and waivers.

2 Tax-equivalent yield is based on the maximum federal income tax rate of 43.4% and a state tax rate of 13.3%. Share classes will differ due to varying expenses.

3 The contingent deferred sales charge is not applicable.

| |

| Annual report | California Tax-Free Income Fund | 7 |

Management’s discussion of

Fund performance

John Hancock Asset Management a division of Manulife Asset Management (US) LLC

Effective June 28, 2013, Frank Lucibella, CFA, retired from our municipal bond portfolio management team. His responsibilities are being assumed by the fund’s existing portfolio manager, Dianne Sales, CFA, who has been with John Hancock since 1989 and has 29 years of investment experience.

Municipal bonds posted positive returns for the year ended May 31, 2013. The municipal bond market’s advance occurred primarily in the first half of the reporting period, fueled by robust demand and limited supply in the municipal market. Over the last six months of the period, the municipal market gave back some ground as demand tapered off. Improving economic conditions led investors to shift toward higher-risk assets, such as stocks and higher-yielding bonds. For the 12-month period, longer-term municipal securities generated the highest returns, while lower-quality municipal bonds outperformed higher-rated municipal securities.

The most important development in California over the past twelve months was voter approval of Proposition 30, which instituted a temporary state sales tax increase and a tax surcharge for individuals in the highest income-tax bracket. The tax hikes helped sustain funding for local school districts and helped shore up the state budget. In response, the major credit-rating agencies upgraded California’s credit rating in January and again in March—the state’s first upgrades in nearly seven years.

For the year ended May 31, 2013, John Hancock California Tax-Free Income Fund’s Class A shares posted a total return of 4.55%, excluding sales charges. By comparison, Morningstar, Inc.’s muni California long fund category produced an average return of 4.70%,† while the fund’s benchmark, the Barclays California Municipal Bond Index, returned 3.91%. In a period of declining interest rates and narrowing credit spreads, investors in search of incremental returns focused on municipal bonds with greater interest-rate sensitivity and lower credit quality. Fund sectors benefiting from this trend included tobacco, healthcare, and tax allocation. The fund’s education bonds gained from the passage of Proposition 30. The fund also benefited from its exposure to California general obligation and state appropriation bonds, which received credit-rating upgrades. The fund’s holdings of bonds related to the Commonwealth of Puerto Rico detracted from fund results amid a persistent fiscal deficit and weaker economic growth.

This commentary reflects the views of the portfolio manager through the end of the period discussed in this report. As such, they are in no way guarantees of future events and are not intended to be used as investment advice or a recommendation regarding any specific security. They are also subject to change at any time as market and other conditions warrant.

Past performance is no guarantee of future results.

† Figures from Morningstar, Inc. include reinvested distributions and do not take into account sales charges. Actual load-adjusted performance is lower.

| |

| 8 | California Tax-Free Income Fund | Annual report |

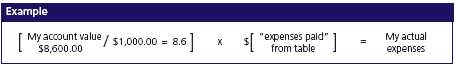

Your expenses

These examples are intended to help you understand your ongoing operating expenses of investing in the fund so you can compare these costs with the ongoing costs of investing in other mutual funds.

Understanding fund expenses

As a shareholder of the fund, you incur two types of costs:

▪ Transaction costs, which include sales charges (loads) on purchases or redemptions (varies by share class), minimum account fee charge, etc.

▪ Ongoing operating expenses, including management fees, distribution and service fees (if applicable), and other fund expenses.

We are going to present only your ongoing operating expenses here.

Actual expenses/actual returns

This example is intended to provide information about the fund’s actual ongoing operating expenses and is based on the fund’s actual return. It assumes an account value of $1,000.00 on December 1, 2012, with the same investment held until May 31, 2013.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 12-1-12 | on 5-31-13 | period ended 5-31-131 |

|

| Class A | $1,000.00 | $998.80 | $4.24 |

|

| Class B | 1,000.00 | 995.10 | 7.96 |

|

| Class C | 1,000.00 | 995.10 | 7.96 |

|

Together with the value of your account, you may use this information to estimate the operating expenses that you paid over the period. Simply divide your account value at May 31, 2013, by $1,000.00, then multiply it by the “expenses paid” for your share class from the table above. For example, for an account value of $8,600.00, the operating expenses should be calculated as follows:

| |

| Annual report | California Tax-Free Income Fund | 9 |

Your expenses

Hypothetical example for comparison purposes

This table allows you to compare the fund’s ongoing operating expenses with those of any other fund. It provides an example of the fund’s hypothetical account values and hypothetical expenses based on each class’s actual expense ratio and an assumed 5% annualized return before expenses (which is not the fund’s actual return). It assumes an account value of $1,000.00 on December 1, 2012, with the same investment held until May 31, 2013. Look in any other fund shareholder report to find its hypothetical example and you will be able to compare these expenses. Please remember that these hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period.

| | | |

| | Account value | Ending value | Expenses paid during |

| | on 12-1-12 | on 5-31-13 | period ended 5-31-131 |

|

| Class A | $1,000.00 | $1,020.70 | $4.28 |

|

| Class B | 1,000.00 | 1,017.00 | 8.05 |

|

| Class C | 1,000.00 | 1,017.00 | 8.05 |

|

Remember, these examples do not include any transaction costs, therefore, these examples will not help you to determine the relative total costs of owning different funds. If transaction costs were included, your expenses would have been higher. See the fund’s prospectus for details regarding transaction costs.

1 Expenses are equal to the fund’s annualized expense ratio of 0.85%, 1.60%, and 1.60% for Class A, Class B, and Class C shares, respectively, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period).

| |

| 10 | California Tax-Free Income Fund | Annual report |

Portfolio summary

| |

| Top 10 Holdings (26.8% of Net Assets on 5-31-13)1,2 | |

|

| Golden State Tobacco Securitization Corp., 5.000%, 6-1-35 | 5.2% |

|

| Santa Ana Financing Authority, 6.250%, 7-1-24 | 4.2% |

|

| Foothill Eastern Transportation Corridor Agency, Zero Coupon, 1-15-36 | 2.8% |

|

| Commonwealth of Puerto Rico, 6.500%, 7-1-15 | 2.3% |

|

| San Bernardino County, 5.500%, 8-1-17 | 2.2% |

|

| State of California, 6.500%, 4-1-33 | 2.2% |

|

| California State Public Works Board, 5.000%, 12-1-19 | 2.0% |

|

| Inglewood Unified School District, 5.250%, 10-15-26 | 2.0% |

|

| San Joaquin Hills Transportation Corridor Agency, Zero Coupon, 1-1-22 | 2.0% |

|

| California State Public Works Board, 5.500%, 6-1-18 | 1.9% |

|

| | | | |

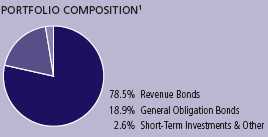

| Sector Composition1 | | | | |

|

| General Obligation Bonds | 18.9% | | Health Care | 5.4% |

| |

|

| Revenue Bonds | | | Utilities | 2.2% |

| |

|

| Facilities | 18.4% | | Water & Sewer | 1.8% |

| |

|

| Other Revenue | 16.7% | | Development | 0.8% |

| |

|

| Tobacco | 12.5% | | Pollution | 0.8% |

| |

|

| Transportation | 12.4% | | Short-Term Investments & Other | 2.6% |

| |

|

| Education | 7.5% | | | |

| | |

| | | | |

| Quality Composition1,3 | | | | |

| | | |

| AAA | 4.3% | | | |

| | | |

| AA | 11.9% | | | |

| | | |

| A | 39.6% | | | |

| | | |

| BBB | 26.0% | | | |

| | | |

| BB | 6.0% | | | |

| | | |

| B | 3.4% | | | |

| | | |

| Not Rated | 6.2% | | | |

| | | |

| Short-Term Investments & Other | 2.6% | | | |

| | | |

1 As a percentage of net assets on 5-31-13.

2 Cash and cash equivalents not included.

3 Ratings are from Moody’s Investors Service, Inc. If not available, we have used ratings from Standard & Poor’s Ratings Services. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not Rated” securities are those with no ratings available from these agencies. All ratings are as of 5-31-13 and do not reflect subsequent downgrades or upgrades, if any. Fixed-income investments are subject to interest-rate and credit risk; their value will normally decline as interest rates rise or if the creditor is unable to make principal or interest payments. Investments in higher-yielding, lower-rated securities involve additional risks as these securities include a higher risk of default and loss of principal. Municipal bond prices can decline due to fiscal mismanagement or tax shortfalls, or if related projects become unprofitable. Because the fund is non-diversified, the fund may invest its assets in a small number of issuers. Performance could suffer significantly from adverse events affecting these issuers. If the fund invests heavily in any one state or region, performance could be disproportionately affected by factors particular to that state or region. Because the fund may focus on particular sectors of the economy, its performance may depend on the performance of those sectors and investments focused in one sector may fluctuate more widely than investments diversified across sectors. For additional information on these and other risk considerations, please see the fund’s prospectus.

| |

| Annual report | California Tax-Free Income Fund | 11 |

Fund’s investments

As of 5-31-13

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| |

| Municipal Bonds 97.4% | | | | | $268,955,269 |

|

| (Cost $248,323,552) | | | | | |

| |

| California 88.6% | | | | | 244,778,162 |

|

| ABAG Finance Authority for Nonprofit Corps. | | | | | |

| Institute on Aging (D) | 5.650 | | 08-15-38 | $1,000,000 | 1,113,430 |

|

| ABAG Finance Authority for Nonprofit Corps. | | | | | |

| Sharp Healthcare | 6.250 | | 08-01-39 | 1,000,000 | 1,163,330 |

|

| Anaheim Certificates of Participation | | | | | |

| Convention Center (D)(P)(S) | 11.519 | | 07-16-23 | 2,000,000 | 2,018,320 |

|

| Anaheim Public Financing Authority | | | | | |

| Public Improvement Project, Series C (D)(Z) | Zero | | 09-01-18 | 3,000,000 | 2,652,300 |

|

| Antioch Public Financing Authority, Series B | 5.850 | | 09-02-15 | 555,000 | 556,487 |

|

| Bay Area Toll Authority | | | | | |

| San Francisco Bay Area | 5.000 | | 04-01-31 | 1,000,000 | 1,136,690 |

|

| Belmont Community Facilities | | | | | |

| Library Project, Series A (D) | 5.750 | | 08-01-24 | 1,000,000 | 1,228,020 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Fresno County Funding Corp. | 6.000 | | 06-01-35 | 1,765,000 | 1,764,859 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Kern County Corp., Series A | 6.125 | | 06-01-43 | 5,000,000 | 4,999,550 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Public Improvements | 5.250 | | 06-01-21 | 4,465,000 | 4,514,874 |

|

| California County Tobacco | | | | | |

| Securitization Agency | | | | | |

| Stanislaus Funding, Series A | 5.500 | | 06-01-33 | 785,000 | 788,038 |

|

| California Educational Facilities Authority | | | | | |

| College and University Financing Project | 5.000 | | 02-01-26 | 4,525,000 | 4,416,898 |

|

| California Educational Facilities Authority | | | | | |

| Woodbury University | 5.000 | | 01-01-25 | 1,800,000 | 1,822,050 |

|

| California Educational Facilities Authority | | | | | |

| Woodbury University | 5.000 | | 01-01-30 | 2,000,000 | 2,014,740 |

|

| California Health Facilities Financing | | | | | |

| Kaiser Permanente, Series A | 5.250 | | 04-01-39 | 2,500,000 | 2,704,275 |

|

| California Health Facilities Financing Authority | | | | | |

| Catholic Healthcare West, Series G | 5.250 | | 07-01-23 | 1,000,000 | 1,042,460 |

|

| California Health Facilities Financing Authority | | | | | |

| Providence Health and Services, Series C | 6.500 | | 10-01-33 | 1,000,000 | 1,198,660 |

|

| California Health Facilities Financing Authority | | | | | |

| Scripps Health, Series A | 5.000 | | 11-15-36 | 1,000,000 | 1,085,670 |

| | |

| 12 | California Tax-Free Income Fund | Annual report | See notes to financial statements |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| | | | | | |

| California (continued) | | | | | |

|

| California Infrastructure & Economic | | | | | |

| Development Bank | | | | | |

| California Independent System Operator, | | | | | |

| Series A | 6.250 | | 02-01-39 | $2,000,000 | $2,147,920 |

|

| California Infrastructure & Economic | | | | | |

| Development Bank | | | | | |

| Performing Arts Center | 5.000 | | 12-01-27 | 500,000 | 531,870 |

|

| California Pollution Control Financing Authority | | | | | |

| Waste Management Inc., Series C, AMT (P) | 5.125 | | 11-01-23 | 2,000,000 | 2,143,620 |

|

| California State Public Works Board | 5.000 | | 03-01-38 | 1,000,000 | 1,070,010 |

|

| California State Public Works Board | | | | | |

| Department of Corrections, Series A (D) | 5.000 | | 12-01-19 | 5,000,000 | 5,637,500 |

|

| California State Public Works Board | | | | | |

| Department of Corrections, Series C | 5.500 | | 06-01-18 | 5,000,000 | 5,131,600 |

|

| California State Public Works Board | | | | | |

| Trustees California State University, Series D | 6.250 | | 04-01-34 | 2,000,000 | 2,401,360 |

|

| California State Public Works Board | | | | | |

| Various Capital Projects, Series G | 5.000 | | 11-01-37 | 1,000,000 | 1,070,490 |

|

| California State Public Works Board | | | | | |

| Various Capital Projects, Series A | 5.000 | | 04-01-37 | 1,000,000 | 1,066,840 |

|

| California State University Revenue | | | | | |

| College and University Revenue, Series A | 5.250 | | 11-01-34 | 1,000,000 | 1,123,040 |

|

| California Statewide Communities | | | | | |

| Development Authority | | | | | |

| American Baptist Homes West | 6.250 | | 10-01-39 | 2,000,000 | 2,235,220 |

|

| California Statewide Communities | | | | | |

| Development Authority | | | | | |

| Kaiser Permanente, Series A | 5.000 | | 04-01-42 | 2,000,000 | 2,167,620 |

|

| California Statewide Communities | | | | | |

| Development Authority | | | | | |

| Senior Living of Southern California | 7.250 | | 11-15-41 | 1,700,000 | 1,960,389 |

|

| California Statewide Communities | | | | | |

| Development Authority | | | | | |

| Thomas Jefferson School of Law, Series A (S) | 7.250 | | 10-01-38 | 2,000,000 | 2,043,020 |

|

| California Statewide Communities | | | | | |

| Development Authority | | | | | |

| University of California — Irvine | 5.750 | | 05-15-32 | 1,230,000 | 1,325,866 |

|

| California Statewide Financing Authority | | | | | |

| Tobacco Settlement, Series A | 6.000 | | 05-01-37 | 2,500,000 | 2,499,900 |

|

| California Statewide Financing Authority | | | | | |

| Tobacco Settlement, Series B | 6.000 | | 05-01-37 | 4,000,000 | 4,000,440 |

|

| Capistrano Unified School District | | | | | |

| No. 90-2 Talega | 5.875 | | 09-01-23 | 500,000 | 502,540 |

|

| Capistrano Unified School District | | | | | |

| No. 90-2 Talega | 6.000 | | 09-01-33 | 750,000 | 752,805 |

|

| Center Unified School District, Series C (D)(Z) | Zero | | 09-01-16 | 2,145,000 | 2,046,137 |

|

| Cloverdale Community Development Agency | 5.500 | | 09-01-38 | 3,000,000 | 2,670,630 |

|

| Contra Costa County Public Financing | | | | | |

| Authority, Series A (D) | 5.000 | | 06-01-28 | 1,230,000 | 1,233,764 |

|

| Corona Community Facilities District | | | | | |

| No. 97-2 | 5.875 | | 09-01-23 | 975,000 | 979,212 |

|

| East Side Union High School District-Santa | | | | | |

| Clara County (D) | 5.250 | | 09-01-24 | 2,500,000 | 3,054,100 |

| | |

| See notes to financial statements | Annual report | California Tax-Free Income Fund | 13 |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| | | | | | |

| California (continued) | | | | | |

|

| Folsom Public Financing Authority, Series B | 5.125 | | 09-01-26 | $1,000,000 | $1,025,420 |

|

| Foothill Eastern Transportation Corridor Agency | | | | | |

| Highway Revenue Tolls (Z) | Zero | | 01-15-25 | 6,615,000 | 3,330,983 |

|

| Foothill Eastern Transportation Corridor Agency | | | | | |

| Highway Revenue Tolls (Z) | Zero | | 01-15-36 | 30,000,000 | 7,727,700 |

|

| Fresno Sewer Revenue, Series A–1 (D) | 5.250 | | 09-01-19 | 1,000,000 | 1,130,730 |

|

| Golden State Tobacco Securitization Corp. | | | | | |

| Escrowed to Maturity, Series 2003 A–1 | 6.250 | | 06-01-33 | 1,495,000 | 1,495,000 |

|

| Golden State Tobacco Securitization Corp., | | | | | |

| Series A (D) | 5.000 | | 06-01-35 | 13,750,000 | 14,334,375 |

|

| Inglewood Unified School District (D) | 5.250 | | 10-15-26 | 5,000,000 | 5,612,550 |

|

| Kern County, Capital Improvements Project, | | | | | |

| Series A (D) | 5.750 | | 08-01-35 | 1,000,000 | 1,154,680 |

|

| Laguna Salada Union School District, | | | | | |

| Series C (D)(Z) | Zero | | 08-01-26 | 1,000,000 | 600,910 |

|

| Lancaster School District | | | | | |

| School Improvements (D)(Z) | Zero | | 04-01-19 | 1,730,000 | 1,566,013 |

|

| Lancaster School District | | | | | |

| School Improvements (D)(Z) | Zero | | 04-01-22 | 1,380,000 | 1,109,065 |

|

| Lee Lake Water District Community Facilities | | | | | |

| District No: 2 | | | | | |

| Montecito Ranch | 6.125 | | 09-01-27 | 1,200,000 | 1,209,576 |

|

| Long Beach Harbor Revenue, Series A, AMT (D) | 6.000 | | 05-15-18 | 2,660,000 | 3,242,460 |

|

| Long Beach Special Tax Community Facilities | | | | | |

| District 6-Pike Project | 6.250 | | 10-01-26 | 2,480,000 | 2,482,356 |

|

| Los Angeles Community College District | | | | | |

| 2008 Election, Series A | 6.000 | | 08-01-33 | 4,000,000 | 4,895,160 |

|

| Los Angeles Community Facilities District No: 3 | | | | | |

| Cascades Business Park | 6.400 | | 09-01-22 | 655,000 | 658,884 |

|

| Los Angeles County Public Works | | | | | |

| Financing Authority | | | | | |

| Multiple Capital Projects II | 5.000 | | 08-01-42 | 1,000,000 | 1,079,240 |

|

| Los Angeles Department of Water & Power | | | | | |

| Power Systems, Series B | 5.000 | | 07-01-43 | 3,500,000 | 3,882,410 |

|

| M-S-R Energy Authority | | | | | |

| Natural Gas Revenue, Series B | 6.500 | | 11-01-39 | 2,500,000 | 3,310,500 |

|

| Modesto Community Facilities District No: 4-1 | 5.100 | | 09-01-26 | 3,000,000 | 3,057,270 |

|

| Orange County Improvement Bond Act 1915, | | | | | |

| Series B | 5.750 | | 09-02-33 | 1,365,000 | 1,369,668 |

|

| Oxnard Community Facilities District: No. 3 | | | | | |

| Seabridge | 5.000 | | 09-01-35 | 1,490,000 | 1,504,274 |

|

| Paramount Unified School District, Series B (D)(Z) | Zero | | 09-01-25 | 4,735,000 | 2,939,441 |

|

| Pasadena Certificates Participation Refunding | | | | | |

| Old Pasadena Parking Facility Project | 6.250 | | 01-01-18 | 525,000 | 588,856 |

|

| Ripon Redevelopment Agency | | | | | |

| Ripon Community Redevelopment Project (D) | 4.750 | | 11-01-36 | 1,540,000 | 1,495,432 |

|

| San Bernardino County | | | | | |

| Capital Facilities Project, Escrowed to | | | | | |

| Maturity, Series B | 6.875 | | 08-01-24 | 350,000 | 485,895 |

|

| San Bernardino County | | | | | |

| Medical Center Financing Project, Series B (D) | 5.500 | | 08-01-17 | 5,910,000 | 6,164,721 |

| | |

| 14 | California Tax-Free Income Fund | Annual report | See notes to financial statements |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| | | | | | |

| California (continued) | | | | | |

|

| San Bruno Park School District | | | | | |

| School Improvements, Series B (D)(Z) | Zero | | 08-01-21 | $1,015,000 | $802,977 |

|

| San Diego Public Facilities Financing Authority | | | | | |

| Lease Revenue | 5.250 | | 03-01-40 | 1,000,000 | 1,094,390 |

|

| San Diego Redevelopment Agency | | | | | |

| City Heights, Series A | 5.750 | | 09-01-23 | 1,000,000 | 1,000,910 |

|

| San Diego Redevelopment Agency | | | | | |

| City Heights, Series A | 5.800 | | 09-01-28 | 1,395,000 | 1,395,990 |

|

| San Diego Redevelopment Agency | | | | | |

| Public Improvements, Series B (Z) | Zero | | 09-01-17 | 1,600,000 | 1,359,792 |

|

| San Diego Redevelopment Agency | | | | | |

| Public Improvements, Series B (Z) | Zero | | 09-01-18 | 1,700,000 | 1,350,939 |

|

| San Diego Unified School District, Election of | | | | | |

| 1998, Series A (D)(Z) | Zero | | 07-01-21 | 2,500,000 | 2,009,600 |

|

| San Francisco City & County | | | | | |

| Redevelopment Agency | | | | | |

| Department of General Services Lease, No. 6, | | | | | |

| Mission Bay South, Series A | 5.150 | | 08-01-35 | 1,250,000 | 1,271,688 |

|

| San Francisco City & County | | | | | |

| Redevelopment Agency | | | | | |

| Mission Bay South Redevelopment, Series D | 7.000 | | 08-01-41 | 1,000,000 | 1,143,780 |

|

| San Francisco City & County Redevelopment | | | | | |

| Financing Authority | | | | | |

| Mission Bay South Redevelopment, Series D | 6.625 | | 08-01-39 | 1,000,000 | 1,128,400 |

|

| San Francisco City & County Redevelopment | | | | | |

| Financing Authority | | | | | |

| San Francisco Redevelopment Projects, | | | | | |

| Series B | 6.625 | | 08-01-39 | 700,000 | 797,853 |

|

| San Francisco State Building Authority, Series A | 5.000 | | 10-01-13 | 475,000 | 482,505 |

|

| San Joaquin County | | | | | |

| County Administration Building (D) | 5.000 | | 11-15-29 | 2,965,000 | 3,119,447 |

|

| San Joaquin Hills Transportation | | | | | |

| Corridor Agency | | | | | |

| Highway Revenue Tolls, Escrowed to | | | | | |

| Maturity (Z) | Zero | | 01-01-14 | 5,000,000 | 4,992,150 |

|

| San Joaquin Hills Transportation | | | | | |

| Corridor Agency | | | | | |

| Highway Revenue Tolls, Escrowed to | | | | | |

| Maturity (Z) | Zero | | 01-01-22 | 6,500,000 | 5,409,950 |

|

| San Joaquin Hills Transportation | | | | | |

| Corridor Agency | | | | | |

| Highway Revenue Tolls, Series A | 5.750 | | 01-15-21 | 5,000,000 | 5,002,100 |

|

| San Mateo County Joint Power Authority (D) | 5.000 | | 07-01-21 | 1,815,000 | 2,090,717 |

|

| Santa Ana Financing Authority | | | | | |

| Police Administration & Holding Facility, | | | | | |

| Series A (D) | 6.250 | | 07-01-19 | 1,790,000 | 2,125,464 |

|

| Santa Ana Financing Authority | | | | | |

| Police Administration & Holding Facility, | | | | | |

| Series A (D) | 6.250 | | 07-01-24 | 10,000,000 | 11,470,100 |

|

| Santa Fe Springs Community | | | | | |

| Development Commission | | | | | |

| Construction Redevelopment Project, | | | | | |

| Series A (D)(Z) | Zero | | 09-01-20 | 1,275,000 | 1,006,600 |

| | |

| See notes to financial statements | Annual report | California Tax-Free Income Fund | 15 |

| | | | | |

| | | | Maturity | | |

| | Rate (%) | | date | Par value | Value |

| | | | | | |

| California (continued) | | | | | |

|

| Southern California Public Power Authority | | | | | |

| Natural Gas Revenue, Series A | 5.250 | | 11-01-26 | $2,000,000 | $2,328,100 |

|

| State of California | 5.000 | | 02-01-38 | 2,500,000 | 2,757,700 |

|

| State of California | 5.000 | | 02-01-38 | 3,000,000 | 3,282,120 |

|

| State of California | 5.000 | | 09-01-41 | 1,500,000 | 1,624,155 |

|

| State of California | 5.000 | | 10-01-41 | 2,000,000 | 2,166,980 |

|

| State of California | 5.000 | | 09-01-42 | 1,000,000 | 1,089,540 |

|

| State of California | | | | | |

| Public Improvements | 5.125 | | 04-01-23 | 2,000,000 | 2,074,680 |

|

| State of California | | | | | |

| Recreation Facilities and | | | | | |

| School Improvements | 6.500 | | 04-01-33 | 5,000,000 | 6,155,400 |

|

| State of California | | | | | |

| Water, Utility and Highway Improvements | 5.250 | | 03-01-30 | 2,000,000 | 2,299,380 |

|

| Torrance Hospital Revenue | | | | | |

| Torrance Memorial Medical Center, Series A | 5.500 | | 06-01-31 | 2,000,000 | 2,004,220 |

|

| Tuolumne Wind Project Authority | | | | | |

| Tuolumne County Project, Series A | 5.625 | | 01-01-29 | 1,000,000 | 1,168,130 |

|

| Vallejo Sanitation & Flood Control District (D) | 5.000 | | 07-01-19 | 1,742,000 | 1,809,032 |

|

| West Covina Redevelopment Agency | | | | | |

| Fashion Plaza | 6.000 | | 09-01-22 | 3,000,000 | 3,493,260 |

| | | | | | |

| Puerto Rico 8.8% | | | | | 24,177,107 |

|

| Commonwealth of Puerto Rico | 6.500 | | 07-01-15 | 6,000,000 | 6,415,320 |

|

| Commonwealth of Puerto Rico | | | | | |

| Public Improvement, Series A | 5.500 | | 07-01-39 | 1,500,000 | 1,513,800 |

|

| Commonwealth of Puerto Rico | | | | | |

| Public Improvement, Series A | 5.750 | | 07-01-41 | 5,000,000 | 5,123,000 |

|

| Commonwealth of Puerto Rico, Series A | 5.375 | | 07-01-33 | 1,250,000 | 1,255,175 |

|

| Puerto Rico Aqueduct & Sewer Authority | | | | | |

| Water Revenue, Series A | 6.125 | | 07-01-24 | 1,750,000 | 1,866,725 |

|

| Puerto Rico Aqueduct & Sewer Authority | | | | | |

| Water Revenue, Series A | 5.125 | | 07-01-37 | 1,000,000 | 947,670 |

|

| Puerto Rico Highway & | | | | | |

| Transportation Authority | | | | | |

| Fuel Sales Tax Revenue, Series A (D) | 5.000 | | 07-01-38 | 80,000 | 76,154 |

|

| Puerto Rico Highway & | | | | | |

| Transportation Authority | | | | | |

| Prerefunded, Series Z (D) | 6.250 | | 07-01-14 | 940,000 | 1,000,122 |

|

| Puerto Rico Highway & | | | | | |

| Transportation Authority | | | | | |

| Unrefunded, Series Z (D) | 6.250 | | 07-01-14 | 2,310,000 | 2,406,281 |

|

| Puerto Rico Industrial Tourist Education | | | | | |

| Medical & Environment Authority | | | | | |

| Hospital de la Concepcion | 6.500 | | 11-15-20 | 500,000 | 502,480 |

|

| Puerto Rico Sales Tax Financing Corp. | | | | | |

| Sales Tax Revenue, Series A (Zero coupon | | | | | |

| steps up to 6.750% on 8-1-16) | Zero | | 08-01-32 | 3,000,000 | 3,070,380 |

| | |

| 16 | California Tax-Free Income Fund | Annual report | See notes to financial statements |

| | |

| | Par value | Value |

| |

| Short-Term Investments 1.6% | | $4,471,000 |

|

| (Cost $4,471,000) | | |

| | | |

| Repurchase Agreement 1.6% | | |

|

| Repurchase Agreement with State Street Corp. dated 5-31-13 at | | |

| 0.010% to be repurchased at $4,471,004 on 6-3-13, collateralized | | |

| by $4,585,000 U.S. Treasury Note, 0.625% due 5-31-17 (valued at | | |

| $4,562,433, including interest) | $4,471,000 | 4,471,000 |

| |

| Total investments (Cost $252,794,552)† 99.0% | | $273,426,269 |

|

| |

| Other assets and liabilities, net 1.0% | | $2,815,138 |

|

| |

| Total net assets 100.0% | | $276,241,407 |

|

The percentage shown for each investment category is the total value of that category as a percentage of the net assets of the Fund.

AMT Interest earned from these securities may be considered a tax preference item for purpose of the Federal Alternative Minimum Tax.

(D) Bond is insured by one or more of the following companies:

| | | | | |

| Insurance coverage | As a % of total investments | | | | |

| | | | |

| Ambac Financial Group, Inc. | 2.9% | | | | |

| Assured Guaranty Corp. | 0.4% | | | | |

| Assured Guaranty Municipal Corp. | 6.2% | | | | |

| California Mortgage Insurance | 0.4% | | | | |

| Financial Guaranty Insurance Company | 5.2% | | | | |

| National Public Finance Guarantee Corp. | 16.4% | | | | |

(P) Variable rate obligation. The coupon rate shown represents the rate at period end.

(S) These securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be resold, normally to qualified institutional buyers, in transactions exempt from registration.

(Z) Zero coupon bonds are issued at a discount from their principal amount in lieu of paying interest periodically.

† At 5-31-13, the aggregate cost of investment securities for federal income tax purposes was $250,951,215. Net unrealized appreciation aggregated $22,475,054, of which $23,023,440 related to appreciated investment securities and $548,386 related to depreciated investment securities.

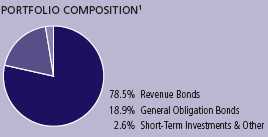

The Fund had the following sector composition as a percentage of total net assets on 5-31-13:

| | | | | | | |

| General Obligation Bonds 18.9% | | | | | | | |

| | | | | | | | |

| Revenue Bonds | | | | | | | |

| Facilities | 18.4% | | | | | | |

| Other Revenue | 16.7% | | | | | | |

| Tobacco | 12.5% | | | | | | |

| Transportation | 12.4% | | | | | | |

| Education | 7.5% | | | | | | |

| Health Care | 5.4% | | | | | | |

| Utilities | 2.2% | | | | | | |

| Water & Sewer | 1.8% | | | | | | |

| Development | 0.8% | | | | | | |

| Pollution | 0.8% | | | | | | |

| Short-Term Investments & Other | 2.6% | | | | | | |

| | |

| See notes to financial statements | Annual report | California Tax-Free Income Fund | 17 |

FINANCIAL STATEMENTSFinancial statements

Statement of assets and liabilities 5-31-13

This Statement of assets and liabilities is the fund’s balance sheet. It shows the value of what the fund owns, is due and owes. You’ll also find the net asset value and the maximum offering price per share.

| |

| Assets | |

|

| Investments, at value (Cost $252,794,552) | $273,426,269 |

| Cash | 672 |

| Receivable for fund shares sold | 602,657 |

| Interest receivable | 3,676,563 |

| Other receivables and prepaid expenses | 31,122 |

| | |

| Total assets | 277,737,283 |

| |

| Liabilities | |

|

| Payable for fund shares repurchased | 1,009,598 |

| Distributions payable | 216,876 |

| Payable to affiliates | |

| Accounting and legal services fees | 9,141 |

| Transfer agent fees | 14,020 |

| Distribution and service fees | 30,877 |

| Trustees’ fees | 22,702 |

| Investment management fees | 129,699 |

| Other liabilities and accrued expenses | 62,963 |

| | |

| Total liabilities | 1,495,876 |

| | |

| Net assets | $276,241,407 |

| |

| Net assets consist of | |

|

| Paid-in capital | $254,364,009 |

| Undistributed net investment income | 551,050 |

| Accumulated net realized gain (loss) on investments | 694,631 |

| Net unrealized appreciation (depreciation) on investments | 20,631,717 |

| | |

| Net assets | $276,241,407 |

| |

| Net asset value per share | |

|

| Based on net asset values and shares outstanding — the Fund has an | |

| unlimited number of shares authorized with no par value | |

| Class A ($240,854,332 ÷ 21,774,880 shares)1 | $11.06 |

| Class B ($2,515,022 ÷ 227,254 shares)1 | $11.07 |

| Class C ($32,872,053 ÷ 2,971,859 shares)1 | $11.06 |

| |

| Maximum offering price per share | |

|

| Class A (net asset value per share ÷ 95.5%)2 | $11.58 |

1 Redemption price is equal to net asset value less any applicable contingent deferred sales charge.

2 On single retail sales of less than $100,000. On sales of $100,000 or more and on group sales the offering price is reduced.

| | |

| 18 | California Tax-Free Income Fund | Annual report | See notes to financial statements |

FINANCIAL STATEMENTS

Statement of operations For the year ended 5-31-13

This Statement of operations summarizes the fund’s investment income earned and expenses incurred in operating the fund. It also shows net gains (losses) for the period stated.

| |

| Investment income | |

|

| Interest | $13,923,518 |

| | |

| Total investment income | 13,923,518 |

| |

| Expenses | |

|

| Investment management fees | 1,533,839 |

| Distribution and service fees | 704,845 |

| Accounting and legal services fees | 43,988 |

| Transfer agent fees | 169,575 |

| Trustees’ fees | 16,752 |

| State registration fees | 17,095 |

| Printing and postage | 13,509 |

| Professional fees | 70,004 |

| Custodian fees | 35,497 |

| Registration and filing fees | 25,308 |

| Other | 10,210 |

| | |

| Total expenses | 2,640,622 |

| Less expense reductions | (33,709) |

| | |

| Net expenses | 2,606,913 |

| | |

| Net investment income | 11,316,605 |

| |

| Realized and unrealized gain (loss) | |

|

| Net realized gain (loss) on investments | 820,548 |

| Change in net unrealized appreciation (depreciation) of investments | (10,560) |

| | |

| Net realized and unrealized gain | 809,988 |

| | |

| Increase in net assets from operations | $12,126,593 |

| | |

| See notes to financial statements | Annual report | California Tax-Free Income Fund | 19 |

FINANCIAL STATEMENTSStatements of changes in net assets

These Statements of changes in net assets show how the value of the fund’s net assets has changed during the last two periods. The difference reflects earnings less expenses, any investment gains and losses, distributions, if any, paid to shareholders and the net of fund share transactions.

| | |

| | Year | Year |

| | ended | ended |

| | 5-31-13 | 5-31-12 |

| |

| Increase (decrease) in net assets | | |

|

| From operations | | |

| Net investment income | $11,316,605 | $11,761,423 |

| Net realized gain | 820,548 | 580,901 |

| Change in net unrealized appreciation (depreciation) | (10,560) | 23,065,500 |

| | | |

| Increase in net assets resulting from operations | 12,126,593 | 35,407,824 |

| | | |

| Distributions to shareholders | | |

| From net investment income | | |

| Class A | (10,029,977) | (10,448,639) |

| Class B | (85,302) | (85,506) |

| Class C | (1,039,549) | (1,028,477) |

| | | |

| Total distributions | (11,154,828) | (11,562,622) |

| | | |

| From Fund share transactions | 1,652,293 | (2,231,172) |

| | | |

| Total increase | 2,624,058 | 21,614,030 |

| |

| Net assets | | |

|

| Beginning of year | 273,617,349 | 252,003,319 |

| | | |

| End of year | $276,241,407 | $273,617,349 |

| | | |

| Undistributed net investment income | $551,050 | $318,753 |

| | |

| 20 | California Tax-Free Income Fund | Annual report | See notes to financial statements |

Financial highlights

The Financial highlights show how the fund’s net asset value for a share has changed during the period.

| | | | | | |

| CLASS A SHARES Period ended | 5-31-13 | 5-31-12 | 5-31-11 | 5-31-10 | 5-31-091 | 8-31-08 |

| |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $11.02 | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 |

| Net investment income2 | 0.46 | 0.48 | 0.49 | 0.50 | 0.36 | 0.47 |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | 0.04 | 0.94 | (0.26) | 0.61 | (0.65) | (0.25) |

| Total from investment operations | 0.50 | 1.42 | 0.23 | 1.11 | (0.29) | 0.22 |

| Less distributions | | | | | | |

| From net investment income | (0.46) | (0.47) | (0.48) | (0.49) | (0.36) | (0.46) |

| From net realized gain | — | — | — | — | (0.01) | (0.01) |

| Total distributions | (0.46) | (0.47) | (0.48) | (0.49) | (0.37) | (0.47) |

| Net asset value, end of period | $11.06 | $11.02 | $10.07 | $10.32 | $9.70 | $10.36 |

| Total return (%)3 | 4.55 | 14.43 | 2.29 | 11.69 | (2.63)4 | 2.18 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $241 | $243 | $224 | $250 | $248 | $294 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions | 0.84 | 0.86 | 0.86 | 0.85 | 0.915,6 | 0.81 |

| Expenses net of fee waivers | 0.84 | 0.86 | 0.86 | 0.85 | 0.915,6 | 0.81 |

| Net investment income | 4.15 | 4.56 | 4.79 | 4.97 | 5.106 | 4.45 |

| Portfolio turnover (%) | 7 | 9 | 2 | 9 | 26 | 22 |

1 For the nine-month period ended 5-31-09. The Fund changed its fiscal year end from August 31 to May 31.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Not annualized.

5 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.04%.

6 Annualized.

| | |

| See notes to financial statements | Annual report | California Tax-Free Income Fund | 21 |

| | | | | | |

| CLASS B SHARES Period ended | 5-31-13 | 5-31-12 | 5-31-11 | 5-31-10 | 5-31-091 | 8-31-08 |

| |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $11.03 | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 |

| Net investment income2 | 0.38 | 0.40 | 0.40 | 0.41 | 0.30 | 0.38 |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | 0.03 | 0.95 | (0.26) | 0.61 | (0.65) | (0.25) |

| Total from investment operations | 0.41 | 1.35 | 0.14 | 1.02 | (0.35) | 0.13 |

| Less distributions | | | | | | |

| From net investment income | (0.37) | (0.39) | (0.39) | (0.40) | (0.30) | (0.37) |

| From net realized gain | — | — | — | — | (0.01) | (0.01) |

| Total distributions | (0.37) | (0.39) | (0.39) | (0.40) | (0.31) | (0.38) |

| Net asset value, end of period | $11.07 | $11.03 | $10.07 | $10.32 | $9.70 | $10.36 |

| Total return (%)3,4 | 3.76 | 13.67 | 1.43 | 10.75 | (3.25)5 | 1.31 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $3 | $2 | $2 | $4 | $7 | $10 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions | 1.69 | 1.71 | 1.71 | 1.70 | 1.766,7 | 1.66 |

| Expenses net of fee waivers | 1.59 | 1.62 | 1.71 | 1.70 | 1.766,7 | 1.66 |

| Net investment income | 3.40 | 3.79 | 3.92 | 4.12 | 4.257 | 3.59 |

| Portfolio turnover (%) | 7 | 9 | 2 | 9 | 26 | 22 |

1 For the nine-month period ended 5-31-09. The Fund changed its fiscal year end from August 31 to May 31.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.04%.

7 Annualized.

| | | | | | |

| CLASS C SHARES Period ended | 5-31-13 | 5-31-12 | 5-31-11 | 5-31-10 | 5-31-091 | 8-31-08 |

| |

| Per share operating performance | | | | | | |

|

| Net asset value, beginning of period | $11.02 | $10.07 | $10.32 | $9.70 | $10.36 | $10.61 |

| Net investment income2 | 0.38 | 0.40 | 0.40 | 0.41 | 0.30 | 0.38 |

| Net realized and unrealized gain (loss) | | | | | | |

| on investments | 0.03 | 0.94 | (0.26) | 0.61 | (0.65) | (0.25) |

| Total from investment operations | 0.41 | 1.34 | 0.14 | 1.02 | (0.35) | 0.13 |

| Less distributions | | | | | | |

| From net investment income | (0.37) | (0.39) | (0.39) | (0.40) | (0.30) | (0.37) |

| From net realized gain | — | — | — | — | (0.01) | (0.01) |

| Total distributions | (0.37) | (0.39) | (0.39) | (0.40) | (0.31) | (0.38) |

| Net asset value, end of period | $11.06 | $11.02 | $10.07 | $10.32 | $9.70 | $10.36 |

| Total return (%)3,4 | 3.77 | 13.56 | 1.43 | 10.76 | (3.25)5 | 1.31 |

| |

| Ratios and supplemental data | | | | | | |

|

| Net assets, end of period (in millions) | $33 | $29 | $26 | $25 | $17 | $14 |

| Ratios (as a percentage of average net assets): | | | | | | |

| Expenses before reductions | 1.69 | 1.71 | 1.71 | 1.70 | 1.766,7 | 1.66 |

| Expenses net of fee waivers | 1.59 | 1.62 | 1.71 | 1.70 | 1.766,7 | 1.66 |

| Net investment income | 3.40 | 3.79 | 3.95 | 4.11 | 4.227 | 3.60 |

| Portfolio turnover (%) | 7 | 9 | 2 | 9 | 26 | 22 |

1 For the nine-month period ended 5-31-09. The Fund changed its fiscal year end from August 31 to May 31.

2 Based on the average daily shares outstanding.

3 Does not reflect the effect of sales charges, if any.

4 Total returns would have been lower had certain expenses not been reduced during the applicable periods shown.

5 Not annualized.

6 Includes proxy fees. The impact of this expense to the gross and net expense ratios was 0.04%.

7 Annualized.

| | |

| 22 | California Tax-Free Income Fund | Annual report | See notes to financial statements |

Notes to financial statements

Note 1 — Organization

John Hancock California Tax-Free Income Fund (the Fund), the sole series of John Hancock California Tax-Free Income Fund (the Trust), is an open-end management investment company organized as a Massachusetts business trust and registered under the Investment Company Act of 1940, as amended (the 1940 Act). The investment objective of the Fund is to seek a high level of current income, consistent with preservation of capital, that is exempt from federal and California personal income taxes.

The Fund may offer multiple classes of shares. The shares currently offered are detailed in the Statement of assets and liabilities. Class A and Class C shares are offered to all investors. Class B shares are closed to new investors. Shareholders of each class have exclusive voting rights to matters that affect that class. The distribution and service fees, if any, and transfer agent fees for each class may differ. Class B shares convert to Class A shares eight years after purchase.

Note 2 — Significant accounting policies

The financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which require management to make certain estimates and assumptions as of the date of the financial statements. Actual results could differ from those estimates and those differences could be significant. Events or transactions occurring after the end of the fiscal period through the date that the financial statements were issued have been evaluated in the preparation of the financial statements. The following summarizes the significant accounting policies of the Fund:

Security valuation. Investments are stated at value as of the close of regular trading on the New York Stock Exchange (NYSE), normally at 4:00 P.M., Eastern Time. In order to value the securities, the Fund uses the following valuation techniques: Debt obligations are valued based on the evaluated prices provided by an independent pricing service, which utilizes both dealer-supplied and electronic data processing techniques, taking into account factors such as institutional-size trading in similar groups of securities, yield, quality, coupon rate, maturity, type of issue, trading characteristics and other market data. Certain securities traded only in the over-the-counter market are valued at the last bid price quoted by brokers making markets in the securities at the close of trading. Certain short-term securities are valued at amortized cost. Other portfolio securities and assets, for which reliable market quotations are not readily available, are valued at fair value as determined in good faith by the Fund’s Pricing Committee following procedures established by the Board of Trustees, which include price verification procedures. The frequency with which these fair valuation procedures are used cannot be predicted and fair value of securities may differ significantly from the value that would have been used had a ready market for such securities existed.

The Fund uses a three-tier hierarchy to prioritize the pricing assumptions, referred to as inputs, used in valuation techniques to measure fair value. Level 1 includes securities valued using quoted prices in active markets for identical securities. Level 2 includes securities valued using other significant observable inputs. Observable inputs may include quoted prices for similar securities, interest rates, prepayment speeds and credit risk. Prices for securities valued using these inputs are received from independent pricing vendors and brokers and are based on an evaluation of the inputs described. Level 3 includes securities valued using significant unobservable inputs when market prices are not readily available or reliable, including the Fund’s own assumptions in determining the fair value of investments. Factors used in determining value may include

| |

| Annual report | California Tax-Free Income Fund | 23 |

market or issuer specific events or trends, changes in interest rates and credit quality. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy.

As of May 31, 2013, all investments are categorized as Level 2 under the hierarchy described above.

Repurchase agreements. The Fund may enter into repurchase agreements. When the Fund enters into a repurchase agreement, it receives collateral that is held in a segregated account by the Fund’s custodian. The collateral amount is marked-to-market and monitored on a daily basis to ensure that the collateral held is in an amount not less than the principal amount of the repurchase agreement plus any accrued interest. In the event of a default by the counterparty, realization of the collateral proceeds could be delayed, during which time the collateral value may decline.

Security transactions and related investment income. Investment security transactions are accounted for on a trade date plus one basis for daily net asset value calculations. However, for financial reporting purposes, investment transactions are reported on trade date. Interest income is accrued as earned. Interest income includes coupon interest and amortization/accretion of premiums/discounts on debt securities. Debt obligations may be placed in a non-accrual status and related interest income may be reduced by stopping current accruals and writing off interest receivable when the collection of all or a portion of interest has become doubtful. Gains and losses on securities sold are determined on the basis of identified cost and may include proceeds from litigation.

Line of credit. The Fund may borrow from banks for temporary or emergency purposes, including meeting redemption requests that otherwise might require the untimely sale of securities. Pursuant to the Fund’s custodian agreement, the custodian may loan money to the Fund to make properly authorized payments. The Fund is obligated to repay the custodian for any overdraft, including any related costs or expenses. The custodian may have a lien, security interest or security entitlement in any fund property that is not otherwise segregated or pledged, to the maximum extent permitted by law, to the extent of any overdraft.

In addition, the Fund and other affiliated funds have entered into an agreement with Citibank N.A. that enables them to participate in a $300 million unsecured committed line of credit. A commitment fee, payable at the end of each calendar quarter, based on the average daily unused portion of the line of credit, is charged to each participating fund on a pro rata basis and is reflected in other expenses on the Statement of operations. Prior to March 27, 2013, the Fund participated in a $100 million unsecured line of credit, also with Citibank, with terms otherwise similar to the existing agreement. Commitment fees for the year ended May 31, 2013 were $962. For the year ended May 31, 2013, the Fund had no borrowings under either line of credit.

Expenses. Within the John Hancock Funds complex, expenses that are directly attributable to an individual fund are allocated to such fund. Expenses that are not readily attributable to a specific fund are allocated among all funds in an equitable manner, taking into consideration, among other things, the nature and type of expense and the fund’s relative net assets. Expense estimates are accrued in the period to which they relate and adjustments are made when actual amounts are known.

Class allocations. Income, common expenses and realized and unrealized gains (losses) are determined at the fund level and allocated daily to each class of shares based on the net assets of the class. Class-specific expenses, such as distribution and service fees, if any, and transfer agent fees, are calculated daily for each class, based on the net asset value of the class and the applicable specific expense rates.

| |

| 24 | California Tax-Free Income Fund | Annual report |

Federal income taxes. The Fund intends to continue to qualify as a regulated investment company by complying with the applicable provisions of the Internal Revenue Code and will not be subject to federal income tax on taxable income that is distributed to shareholders. Therefore, no federal income tax provision is required.

Under the Regulated Investment Company Modernization Act of 2010, the Fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 for an unlimited period. Any losses incurred during those taxable years will be required to be utilized prior to the losses incurred in pre-enactment taxable years. As a result of this ordering rule, pre-enactment capital loss carryforwards may be more likely to expire unused. Additionally, post-enactment capital losses that are carried forward will retain their character as either short-term or long-term capital losses rather than being considered all short-term as under previous law.

For federal income tax purposes, the Fund has a capital loss carryforward of $937,776 available to offset future net realized capital gains as of May 31, 2013.

The following table details the capital loss carryforward available as of May 31, 2013:

| | | | | |

| CAPITAL LOSS CARRYFORWARD EXPIRING AT MAY 31 | | | | |

| 2017 | 2018 | | | | |

| | | | |

| $731,359 | $206,417 | | | | |

Net capital losses of $210,930 that are the result of security transactions occurring after October 31, 2012, are treated as occurring on June 1, 2013, the first day of the Fund’s next taxable year.

As of May 31, 2013, the Fund had no uncertain tax positions that would require financial statement recognition, derecognition or disclosure. The Fund’s federal tax returns are subject to examination by the Internal Revenue Service for a period of three years.

Distribution of income and gains. Distributions to shareholders from net investment income and net realized gains, if any, are recorded on the ex-date. The Fund generally declares dividends daily and pays them monthly. Capital gain distributions, if any, are distributed at least annually. The tax character of distributions for the years ended May 31, 2013 and 2012 was as follows:

| | | | | | |

| | MAY 31, 2013 | MAY 31, 2012 | | | | |

| | | | |

| Ordinary Income | $190,134 | $122,283 | | | | |

| Exempt Interest | 10,964,694 | 11,440,339 | | | | |

Distributions paid by the Fund with respect to each class of shares are calculated in the same manner, at the same time and in the same amount, except for the effect of class level expenses that may be applied differently to each class. As of May 31, 2013, the components of distributable earnings on a tax basis consisted of $778,110 of undistributed exempt interest.

Such distributions and distributable earnings, on a tax basis, are determined in conformity with income tax regulations, which may differ from accounting principles generally accepted in the United States of America. Material distributions in excess of tax basis earnings and profits, if any, are reported in the Fund’s financial statements as a return of capital.

Capital accounts within the financial statements are adjusted for permanent book-tax differences. These adjustments have no impact on net assets or the results of operations. Temporary book-tax differences, if any, will reverse in a subsequent period. Book-tax differences are primarily attributable to accretion on debt securities and distributions payable.

| |

| Annual report | California Tax-Free Income Fund | 25 |

Note 3 — Guarantees and indemnifications

Under the Trust’s organizational documents, its Officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. The risk of material loss from such claims is considered remote.

Note 4 — Fees and transactions with affiliates

John Hancock Advisers, LLC (the Advisor) serves as investment advisor for the Fund. John Hancock Funds, LLC (the Distributor), an affiliate of the Advisor, serves as principal underwriter of the Fund. The Advisor and the Distributor are indirect, wholly owned subsidiaries of Manulife Financial Corporation (MFC).

Management fee. The Fund has an investment management agreement with the Advisor under which the Fund pays a monthly management fee to the Advisor equivalent, on an annual basis, to the sum of: (a) 0.550% of the first $500,000,000 of the Fund’s average daily net assets; (b) 0.500% of the next $500,000,000 of the Fund’s average daily net assets; (c) 0.475% of the next $1,000,000,000 of the Fund’s average daily net assets; and (d) 0.450% of the Fund’s average daily net assets in excess of $2,000,000,000. The Advisor has a subadvisory agreement with John Hancock Asset Management a division of Manulife Asset Management (US) LLC, an indirectly owned subsidiary of MFC and an affiliate of the Advisor. The Fund is not responsible for payment of the subadvisory fees.

The investment management fees incurred for the year ended May 31, 2013 were equivalent to a net annual effective rate of 0.55% of the Fund’s average daily net assets.

Accounting and legal services. Pursuant to the Accounting and Legal Services Agreement, the Fund reimburses the Advisor for all expenses associated with providing the administrative, financial, legal, accounting and recordkeeping services to the Fund, including the preparation of all tax returns, periodic reports to shareholders and regulatory reports, among other services. These expenses are allocated to each share class based on its relative net assets at the time the expense was incurred. These accounting and legal services fees incurred for the year ended May 31, 2013 amounted to an annual rate of 0.02% of the Fund’s average daily net assets.

Distribution and service plans. The Fund has a distribution agreement with the Distributor. The Fund has adopted distribution and service plans with respect to Class A, Class B and Class C shares pursuant to Rule 12b-1 under the 1940 Act, to pay the Distributor for services provided as the distributor of shares of the Fund. The Fund pays the following contractual rates of distribution fees under these arrangements, expressed as an annual percentage of average daily net assets for each class of the Fund’s shares:

| | | | | | | | |

| CLASS | RULE 12b–1 FEE | | | | | | | |

| | | | | | | |

| Class A | 0.15% | | | | | | | |

| Class B | 1.00% | | | | | | | |

| Class C | 1.00% | | | | | | | |

The Distributor has contractually agreed to waive 0.10% of Rule 12b-1 fees for Class B and Class C shares. The current waiver agreement expires on September 30, 2013, unless renewed by mutual agreement of the Fund and the Distributor based upon a determination that this is appropriate under the circumstances at that time.

| |

| 26 | California Tax-Free Income Fund | Annual report |

Accordingly, these fee limitations amounted to $2,558 and $31,151 for Class B and Class C shares, respectively, for the year ended May 31, 2013.

Sales charges. Class A shares are assessed up-front sales charges, which resulted in payments to the Distributor amounting to $402,779 for the year ended May 31, 2013. Of this amount, $66,385 was retained and used for printing prospectuses, advertising, sales literature and other purposes, $327,093 was paid as sales commissions to broker-dealers and $9,301 was paid as sales commissions to sales personnel of Signator Investors, Inc., a broker-dealer affiliate of the Advisor.

Class A, Class B and Class C shares may be subject to contingent deferred sales charges (CDSCs). Certain Class A shares that are acquired through purchases of $1 million or more and are redeemed within one year of purchase are subject to a 1.00% sales charge. Class B shares that are redeemed within six years of purchase are subject to CDSCs, at declining rates, beginning at 5.00%. Class C shares that are redeemed within one year of purchase are subject to a 1.00% CDSC. CDSCs are applied to the lesser of the current market value at the time of redemption or the original purchase cost of the shares being redeemed. Proceeds from CDSCs are used to compensate the Distributor for providing distribution-related services in connection with the sale of these shares. During the year ended May 31, 2013, CDSCs received by the Distributor amounted to $23,756, $1,727 and $1,511 for Class A, Class B and Class C shares, respectively.

Transfer agent fees. The Fund has a transfer agent agreement with John Hancock Signature Services, Inc. (Signature Services), an affiliate of the Advisor. The transfer agent fees paid to Signature Services are determined based on the cost to Signature Services (Signature Services Cost) of providing recordkeeping services. The Signature Services Cost includes a component of allocated John Hancock corporate overhead for providing transfer agent services to the Fund and to all other John Hancock affiliated funds. It also includes out-of-pocket expenses that are comprised of payments made to third-parties for recordkeeping services provided to their clients who invest in one or more John Hancock funds. In addition, Signature Services Cost may be reduced by certain fees that Signature Services receives in connection with retirement and small accounts. Signature Services Cost is calculated monthly and allocated, as applicable, to four categories of share classes: Institutional Share Classes, Retirement Share Classes, Municipal Bond Classes and all other Retail Share Classes. Within each of these categories, the applicable costs are allocated to the affected John Hancock affiliated funds and/or classes, based on the relative average daily net assets.

Class level expenses. Class level expenses for the year ended May 31, 2013 were:

| | | | | | | |

| | DISTRIBUTION AND | TRANSFER | | | | | |

| CLASS | SERVICE FEES | AGENT FEES | | | | | |

| | | | | |

| Class A | $367,756 | $149,070 | | | | | |

| Class B | 25,583 | 1,557 | | | | | |

| Class C | 311,506 | 18,948 | | | | | |

| Total | $704,845 | $169,575 | | | | | |

Trustee expenses. The Fund compensates each Trustee who is not an employee of the Advisor or its affiliates. Under the John Hancock Group of Funds Deferred Compensation Plan (the Plan) which was terminated in November 2012, certain Trustees could have elected, for tax purposes, to defer receipt of this compensation. Any deferred amounts were invested in various John Hancock funds. The investment of deferred amounts and the offsetting liability are included within Other receivables and prepaid expenses and Payable to affiliates — Trustees’ fees, respectively, in the accompanying Statement of assets and liabilities. Plan assets will be liquidated in accordance with the Plan documents.

| |

| Annual report | California Tax-Free Income Fund | 27 |

Note 5 — Fund share transactions

Transactions in Fund shares for the years ended May 31, 2013 and 2012 were as follows:

| | | | |

| | Year ended 5-31-13 | Year ended 5-31-12 |

| | Shares | Amount | Shares | Amount |

| Class A shares | | | | |

|

| Sold | 2,659,701 | $29,614,660 | 2,252,330 | $23,781,930 |

| Distributions reinvested | 675,066 | 7,512,939 | 680,924 | 7,213,593 |

| Repurchased | (3,567,974) | (39,724,603) | (3,179,921) | (33,579,890) |

| | | | | |

| Net decrease | (233,207) | ($2,597,004) | (246,667) | ($2,584,367) |

| |

| Class B shares | | | | |

|

| Sold | 46,439 | $518,547 | 61,476 | $648,780 |

| Distributions reinvested | 5,973 | 66,511 | 5,011 | 53,125 |

| Repurchased | (46,281) | (516,659) | (69,935) | (730,853) |

| | | | | |

| Net increase (decrease) | 6,131 | $68,399 | (3,448) | ($28,948) |

| |

| Class C shares | | | | |

|

| Sold | 643,100 | $7,162,575 | 429,795 | $4,520,556 |

| Distributions reinvested | 50,256 | 559,345 | 47,072 | 498,358 |

| Repurchased | (317,698) | (3,541,022) | (436,227) | (4,636,771) |

| | | | | |

| Net increase | 375,658 | $4,180,898 | 40,640 | $382,143 |

| |

| Net increase (decrease) | 148,582 | $1,652,293 | (209,475) | ($2,231,172) |

|

Note 6 — Purchase and sale of securities

Purchases and sales of securities, other than short-term securities, amounted to $18,504,375 and $21,892,351, respectively, for the year ended May 31, 2013.

| |

| 28 | California Tax-Free Income Fund | Annual report |

Auditor’s report

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of

John Hancock California Tax-Free Income Fund:

In our opinion, the accompanying statement of assets and liabilities, including the schedule of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of John Hancock California Tax-Free Income Fund (the “Fund”) at May 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at May 31, 2013 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Boston, Massachusetts

July 25, 2013

| |

| Annual report | California Tax-Free Income Fund | 29 |

Tax information

Unaudited

For federal income tax purposes, the following information is furnished with respect to the distributions of the Fund, if any, paid during its taxable year ended May 31, 2013.

98.41% of dividends from net investment income are exempt-interest dividends.

Eligible shareholders will be mailed a 2013 Form 1099-DIV in early 2014. This will reflect the tax character of all distributions paid in calendar year 2013.

Please consult a tax advisor regarding the tax consequences of your investment in the Fund.

| |

| 30 | California Tax-Free Income Fund | Annual report |

Evaluation of Advisory and Subadvisory Agreements by the Board of Trustees

This section describes the evaluation by the Board of Trustees (the Board) of John Hancock California Tax-Free Income Fund (the Trust) of the Advisory Agreement (the Advisory Agreement) with John Hancock Advisers, LLC (the Advisor) and the Subadvisory Agreement (the Subadvisory Agreement) with John Hancock Asset Management a division of Manulife Asset Management (US) LLC (the Subadvisor) for John Hancock California Tax-Free Income Fund (the Fund). The Advisory Agreement and Subadvisory Agreement are collectively referred to as the Agreements.

Approval of Advisory and Subadvisory Agreements

At in-person meetings held on May 16-17, 2013, the Board, including the Trustees who are not considered to be interested persons of the Trust under the Investment Company Act of 1940, as amended (the 1940 Act) (the Independent Trustees), reapproved for an annual period the continuation of the Advisory Agreement between the Trust and the Advisor and the Subadvisory Agreement between the Advisor and the Subadvisor with respect to the Fund.

In considering the Advisory Agreement and the Subadvisory Agreement, the Board received in advance of the meeting a variety of materials relating to the Fund, the Advisor and the Subadvisor, including comparative performance, fee and expense information for peer groups of similar mutual funds prepared by an independent third-party provider of mutual fund data; performance information for relevant indexes; and, with respect to the Subadvisor, comparative performance information for comparably managed accounts; and other information provided by the Advisor and the Subadvisor regarding the nature, extent and quality of services provided by the Advisor and the Subadvisor under their respective Agreement, as well as information regarding the Advisor’s revenues and costs of providing services to the Fund and compensation paid to affiliates of the Advisor. At the meeting at which the renewal of the Advisory Agreement and Subadvisory Agreement is considered, particular focus is given to information concerning Fund performance, comparability of fees and total expenses and profitability. However, the Board notes that the evaluation process with respect to the Advisor and the Subadvisor is an ongoing one. In this regard, the Board also took into account discussions with management and information provided to the Board at prior meetings with respect to the services provided by the Advisor and the Subadvisor to the Fund, including quarterly performance reports prepared by management containing reviews of investment results, and periodic presentations from the Subadvisor with respect to the Fund. The Board noted the affiliation of the Subadvisor with the Advisor, noting any potential conflicts of interest. The Board also considered the nature, quality and extent of the services to be provided to John Hancock Fund portfolios by the Advisor’s affiliates, including distribution services.

Throughout the process, the Board asked questions of and requested additional information from management. The Board is assisted by counsel for the Trust and the Independent Trustees are also separately assisted by independent legal counsel throughout the process. The Independent Trustees also received a memorandum from their independent counsel discussing the legal standards for their consideration of the proposed continuation of the Agreements and discussed the proposed continuation of the Agreements in private sessions with their independent legal counsel at which no representatives of management were present.

Approval of Advisory Agreement

In approving the Advisory Agreement with respect to the Fund, the Board, including the Independent Trustees, considered a variety of factors, including those discussed below. The Board also considered other factors (including conditions and trends prevailing generally in the economy, the securities markets and the industry) and does not treat any single factor as determinative, and each Trustee may attribute different weights to different factors. The Board’s conclusions may be based in part on its consideration of the advisory and subadvisory arrangements in prior years and on the Board’s ongoing regular review of Fund performance and operations throughout the year.

| |

| Annual report | California Tax-Free Income Fund | 31 |