As filed with the Securities and Exchange Commission on April 19, 2007

Registration No. 333-132031

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1

To

FORM SB-2

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

(Name of small business issuer in its charter)

| | | | |

| Delaware | | 3550 | | 62-1407522 |

(State or jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

Melbourne Towers

1511 Third Avenue, Suite 788

Seattle, Washington 98101

Telephone: (206) 621-9888

(Address and telephone number of principal executive offices and principal place of business)

Norbert Sporns

Chief Executive Officer and President

HQ Sustainable Maritime Industries, Inc.

Melbourne Towers

1511 Third Avenue, Suite 788

Seattle, Washington 98101

Telephone: (206) 621-9888

Facsimile: (206) 621-0318

(Name, address and telephone number of agent for service)

Copies of communications to:

| | |

| | Norbert Sporns |

| | HQ Sustainable Maritime Industries, Inc. |

| Joseph I. Emas, Esq. | | Melbourne Towers |

| 1224 Washington Avenue | | 1511 Third Avenue, Suite 788 |

| Miami Beach, Florida 33139 | | Seattle, Washington 98101 |

| Telephone: (305) 531-1174 | | Telephone: (206) 621-9888 |

| Facsimile: (305) 531-1274 | | Facsimile: (206) 621-0318 |

Approximate date of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. x

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | |

| Title of each Class of Securities to be registered | | Amount to be Registered(1) | | Proposed Maximum Offering Price per share (2) | | Proposed Maximum Aggregate Offering price | | Amount of Registration Fee | |

Common stock, issuable upon conversion of the secured convertible notes | | 489,201 | | $ | 8.09 | | $ | 3,957,636.09 | | $ | 121.50 | |

Common stock, issuable upon exercise of class A warrants | | 418,747 | | $ | 8.09 | | $ | 3,387,663.23 | | $ | 104.00 | |

Common stock, issuable upon exercise of class B warrants | | 504,480 | | $ | 8.09 | | $ | 4,081,243.20 | | $ | 125.30 | |

Total | | 1,412,418 | | $ | 8.09 | | $ | 11,426,380.72 | | $ | 350.80 | * |

(1) | Includes shares of our common stock, par value $0.001 per share, such shares issuable upon conversion of the equivalent of 175% of our secured convertible notes, and the exercise of warrants held by the selling stockholders, which may be offered pursuant to this registration statement. In addition to the shares set forth in the table, the amount to be registered includes an indeterminate number of shares issuable upon conversion of the secured convertible notes and exercise of the warrants, as such number may be adjusted as a result of stock splits, stock dividends and similar transactions in accordance with Rule 416. The number of shares of common stock registered hereunder represents a good faith estimate by us of the number of shares of common stock issuable upon conversion of the secured convertible notes and upon exercise of the warrants. For purposes of estimating the number of shares of common stock to be included in this registration statement, we calculated a good faith estimate of the number of shares of our common stock that we believe will be issuable upon conversion of the secured convertible notes and upon exercise of the warrants to account for market fluctuations, and anti-dilution and price protection adjustments, respectively. Should the conversion ratio result in our having insufficient shares, we will not rely upon Rule 416, but will file a new registration statement to cover the resale of such additional shares should that become necessary. In addition, should a decrease in the exercise price as a result of an issuance or sale of shares below the then current market price, result in our having insufficient shares, we will not rely upon Rule 416, but will file a new registration statement to cover the resale of such additional shares should that become necessary. |

(2) | Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(c) and Rule 457(g) under the Securities Act of 1933, using the average of the high and low price as reported on the Over-The-Counter Bulletin Board on April 9, 2007, which was $8.09 per share. |

| * | $1,488.00 Previously paid |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Commission, acting pursuant to Section 8(a), may determine.

The Registrant files this post-effective amendment to update the financial statements presented.

The information contained in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED April , 2007

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

1,412,418 SHARES OF COMMON STOCK

This prospectus relates to the resale by the selling stockholders of up to 1,412,418 shares of our common stock (such total includes sufficient shares of common stock to cover a contractual obligation to register 175% of the number of shares of common stock underlying the convertible notes, (which includes 489,201 shares of our common stock underlying secured convertible notes) and up to 923,227 shares of common stock issuable upon the exercise of common stock purchase warrants. The selling stockholders may sell common stock from time to time in the principal market on which the stock is traded at the prevailing market price or in negotiated transactions. The selling stockholders may be deemed underwriters of the shares of common stock, which they are offering. We will pay the expenses of registering these shares.

Our common stock is registered under Section 15(d) of the Securities Exchange Act of 1934 and is listed on the Over-The-Counter Bulletin Board under the symbol “HQSB”. The last reported sales price per share of our common stock as reported by the Over-The-Counter Bulletin Board on April 13, 2007, was $8.85.

The selling stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

The purchase of the securities offered through this prospectus involves a high degree of risk. See section entitled “Risk Factors” on pages 11 through 24.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The Date of this Prospectus is: April , 2007.

All dealers that effect transactions in these securities whether or not participating in this offering may be required to deliver a prospectus. This is in addition to the dealer’s obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

TABLE OF CONTENTS

Our website is at www.hqfish.com. We have not incorporated by reference into this prospectus the information on our website and you should not consider it to be a part of this document. Our website address is included as an inactive textual reference only.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. Under no circumstances should the delivery to you of this prospectus or any sale made pursuant to this prospectus create any implication that the information contained in this prospectus is correct as of any time after the date of this prospectus.

i

PROSPECTUS SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all the information you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the discussion of “Risk Factors” and our consolidated financial statements and the related notes, before deciding to invest in shares of our common stock. In this prospectus, when we use phrases such as “we,” “us,” “our,” “HQSB” or “our company,” we are referring to HQ Sustainable Maritime Industries, Inc. and all of its subsidiaries and affiliated companies as a whole, unless it is clear from the context that any of these terms refer only to HQ Sustainable Maritime Industries, Inc.

About Our Company

We are an integrated aquatic product producer and processor in China, or the PRC, of toxin free tilapia, other aquatic products, and marine bio and healthcare products. We use state-of-the-art and environment-friendly technologies in our production and processing operations. Our facilities are certified according to Hazard Analysis Critical Control Points, or HACCP, standards that are used by the United States Food and Drug Administration, or the FDA, to help ensure food safety and control sanitary hazards. In addition, our facilities have been assigned a European Union, or EU, code required for exporting aquatic products to the EU. We are also in the process of being certified in accordance with the standards of the Aquaculture Certification Counsel, Inc., or ACC, which is a U.S.-based non-governmental body established to certify social, environmental and food safety standards at aquaculture facilities throughout the world. Our products are sold principally to customers in North America, Europe and Asia.

Established in 1999, our aquatic farming and processing operations are in Hainan Province, an island in the South China Sea, which is situated within the most desirable latitude for raising tilapia. Hainan Province in southern China is designated by the Chinese government as a green province, where environmentally friendly agri-food related industry is encouraged. We purchase and process farm-bred and ocean caught aquatic products through cooperative supply arrangements with local fishermen and cooperatives. Our supply cooperatives, under our guidance, use feed formulated by us to optimize natural toxin free growth. Our tilapia products have achieved such a high level of purity that we have successfully begun marketing these products as toxin free and natural.

In August 2004, the company acquired Hainan Jiahua Marine BioProducts Co. Ltd., or Jiahua Marine, which develops, produces and sells marine bio and healthcare products, which includes nutraceutical products for the enrichment of our feed formulas exclusively in China. The principal products of Jiahua Marine are shark cartilage capsules and shark liver oil products which are distributed exclusively in China. The products undergo substantial independent laboratory testing in China administered by the Ministry of Health in China and have resulted in a PRC National Certification for these products. These products have various perceived medicinal and health benefits.

In order to maintain the high quality of our products and to position ourselves for attaining completely organic production certification, we plan to construct our own organic feed mill and processing plant for the production of organic, floating feed formulations. We plan to produce the feed using grains grown without chemical fertilizers that are also free of antibiotics and fishmeal, and use feed additives manufactured in our nutraceutical plant. We plan for this expanded production to satisfy our own demand through the 20,000 mu (or 3,294 acres) of production in Wenchang and Qionghai, as well as to manufacture feed for such other farmed operations in Hainan as shrimp and other farmed species.

Our financial operations consist of two segments, the marine bio and healthcare product segment and the aquaculture product segment. Since the acquisition of Jiahua Marine, which represents the marine bio and healthcare segment, these product sales have made a significant contribution to the net income of the company and currently have a higher profit margin than our aquaculture products. For the year ended December 31, 2006, the marine bio and healthcare product segment and our aquaculture product segment had sales to external customers of $15,302,713 and $23,792,690, respectively, and net income of $7,339,374 and $1,273,290, respectively. For the year ended December 31, 2005, the marine bio and healthcare product segment and the aquaculture product segment had sales to external customers of $9,772,762 and $17,780,268, respectively, and net income of $4,116,398 and $1,003,857, respectively. As the marketing efforts increase in connection with the aquaculture product segment and the investment in plant and equipment for additional processing capacity is completed in 2008, we expect that the aquaculture product segment will begin to contribute a greater portion of income and a higher profit margin in 2008 and thereafter.

1

We have also commenced branding and marketing our high quality, differentiated tilapia products under the name TILOVEYA™ from our new United States headquarters based in Seattle, Washington.

We are incorporated in Delaware. Our telephone number at our United States headquarters is (206) 621-9888. Our website is located atwww.hqfish.com. The information contained on our website or that can be accessed through our website does not constitute part of this prospectus.

Our Principal Competitive Strengths

We believe we have the following principal competitive strengths:

| | • | | Strategic Location in Hainan Province, China. Our processing facilities are geographically well-positioned in Hainan Province to leverage favorable climatic conditions, abundant water supply and pristine environment, and a readily available source of labor for our processing plant. Additionally, our processing facilities are conveniently located near the farmers from whom we obtain our supply of tilapia and shrimp. In addition, our intended new processing plant and feed mill will be in close proximity to our new cooperative fish farms. |

| | • | | Quality Toxin Free Tilapia Products.We produce toxin free tilapia products and have developed a farming system that avoids the use of antibiotics, hormones and other potentially toxic chemicals. Our tilapia are raised in ponds of pure rain water collected for aquaculture. Two other species of fish are introduced into the ponds to maintain the pond’s health naturally. We formulate feed without fishmeal and produce feed supplements in our healthcare products processing plant to enrich this feed. It is our policy to raise toxin free tilapia to distinguish our company from other tilapia producers. The latitude and the pristine environment of Hainan have provided us with the optimal conditions for toxin free aquaculture production. |

| | • | | Unique Health Products. We produce health products that we believe meet the highest quality standards, which we currently market exclusively in China through direct marketing and through retail channels. These products are certified to China national health product standards. Our marine bio and healthcare products processing plant also produces nutraceutical products for the inclusion into our tilapia feed additives. |

| | • | | Vertically Integrated Operations. Vertical integration of our operations allows us to control and monitor quality, as well as reduce costs. Through our cooperative arrangements with local farmers, we train them to our production methods, while monitoring constantly the quality of production until harvest. |

| | • | | International and Domestic Sales and Marketing Efforts.The recent establishment of our Seattle office will advance our new branding and marketing initiative around our TILOVEYA™ brand of our toxin free tilapia products. Sales from this office complement our China based sales efforts and other international sales initiatives. |

| | • | | Environmental and Quality Assurances.We have adopted and implemented stringent quality control measures and procedures throughout the production process, in order to comply with the various environmental and quality standards, such as the HACCP and the EU import standards. We are also in the process of being certified in accordance with the ACC standards and positioning ourselves for completely organic production certification of our tilapia products. We use state-of-the-art technologies in our farming, feed formulation and processing operations. We have adopted modern and environmentally friendly and responsible technology in our production and processing of tilapia, shrimp, and marine bio and healthcare products, which we believe have been recognized through the certifications our plants possess. |

| | • | | An Established Track Record and Brand Name in the Industry.We have an established track record and recognized brand name in the industry and have received numerous awards and certifications confirming the success of the company in distinguishing itself from its competition. |

| | • | | Competitive Cost Structure.We benefit from competitive cost structures due to the lower labor costs in China as compared to U.S. based companies of similar products. |

2

Our Growth Strategies

Our objective is to continue building a diversified array of seafood and marine bio and healthcare products, with a primary focus on increasing our own seafood products. To achieve this goal, we intend to implement the following strategies:

| | • | | We plan to build a new large scale organic feed mill to supply our existing and anticipated new cooperative fish farmers with our fish food formula and a processing plant to increase our profit margin and to guarantee our product quality and further vertically integrate our operations; |

| | • | | We intend to achieve completely organic production of our tilapia products and to pursue organic certification of our farms; |

| | • | | We plan to expand our direct and retail sales efforts of our health products in China and internationally and to add other products we currently have in the development pipeline; |

| | • | | We plan to expand our cooperative farming arrangements to increase the availability of tilapia to meet anticipated growth in demand; |

| | • | | We plan to continue to expand our production and processing facilities in China to satisfy the anticipated growing demand for our products; |

| | • | | The new sales office in Seattle allows us to increase awareness of the importance of our toxin free product and to benefit from more direct sales. The new Seattle office also allows us to expand our distribution options in North America and Europe by broadening the variety of products we offer to cater to the demands of our customers; and |

| | • | | We plan to expand our branding and marketing initiatives in North America and Europe to introduce our products to major retail and food service chains. Our marketing and branding of tilapia and other seafood products is headed by Trond Ringstad, a pioneer in marketing tilapia in the United States. Our new branding focuses on the TILOVEYA™ brand and our toxin-free approach. |

Market Opportunities

Over the past ten years, we believe there has been a dramatic increase in health conscience eating habits and a growing consumption of fish as an alternative source of protein. As the demand for fish continues to increase, current ocean stocks are anticipated to be unable to meet this demand. An alternative is aquaculture. Already operating as an aquaculture producer, we are in a strong position to take advantage of this market opportunity.

Aquaculture, which is the farming of aquatic animals and plants, has been the world’s fastest growing segment in the food production system for the past two decades. The contribution of aquaculture to the world aquatic production in 2004 was about 59.4 million tonnes of fish. According to the projections of the Food and Agriculture Organization of the United States, or FAO, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach 80 million tonnes of fish by 2050. The FAO also reports that most of the new demand for fish will have to be met by aquaculture, which could account for approximately 39.0% of all fish production by 2015.

As the availability of sites for aquaculture is becoming increasingly limited and the ability to develop non-agricultural land is restricted, the competition to develop additional aquaculture production systems is intensifying. As the intensification for aquaculture production systems increase, the demand for institutional support, services and skilled persons is anticipated to increase; along with the demand for more knowledge-based aquaculture education and training as aquaculture becomes more important worldwide.

China remains the largest producer of aquaculture products throughout the world with reported fisheries producing approximately 41.3 million tonnes in 2004, as reported by the FAO. Within the global aquaculture industry, China accounted for 71.0% of the world’s supply of fish for direct human consumption and 29.9% of the total production by live weight in 2002.

3

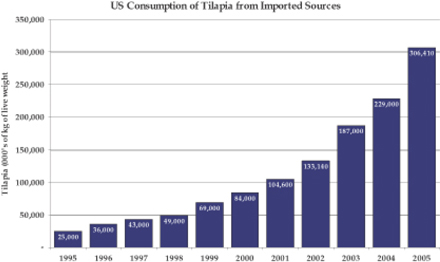

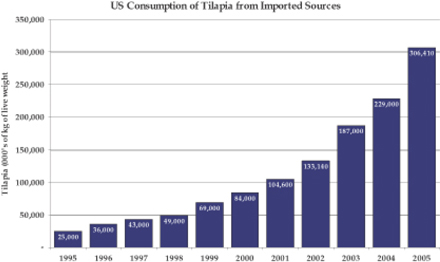

In 2005, according to the American Tilapia Association, tilapia production was second in volume to carps, and it is projected that tilapia will become the most important aquaculture crop in this century, potentially reaching $5.0 billion in global sales. The American Tilapia Association further reports that world production of tilapia products reached approximately 2.0 million metric tonnes in 2004, of which China produced the dominant share of 45.0%.

Over-the-counter marine bio and health product sales in China are currently in excess of $6 billion and represent 3% of total world consumption. We believe that shifts in consumer preferences toward stronger branded products meeting international standards, and away from local traditional remedies, are currently being experienced in China.

Reverse Stock Split

On September 14, 2006, our board of directors unanimously adopted and shareholders holding a majority of the voting capital stock approved a resolution to effect reverse stock split in which of all the issued and outstanding shares of our common stock, referred to as “old common stock,” was combined and reconstituted as a smaller number of shares of common stock, referred to as “new common stock,” in a ratio of 1-for-20,

On January 31, 2007, we effected a 1-for-20 reverse stock split. The principal effect of the reverse stock split was to decrease the number of shares of common stock outstanding from 128,337,120 shares to approximately 6,416,856 shares (not giving effect to rounding up to 100 shares where appropriate).

4

The Resale Offering

| | |

| Issuer | | HQ Sustainable Maritime Industries, Inc. |

| |

| Securities Being Offered | | up to 1,412,418 shares of common stock underlying secured convertible notes (includes a good faith estimate of the 175% of the shares underlying secured convertible notes) |

| |

| Class A Warrants | | up to 418,747 shares of common stock issuable upon the exercise of Class A common stock purchase warrants at an exercise price of $0.30 per share; |

| |

| Class B Warrants | | up to 504,480 shares of common stock issuable upon the exercise of Class A common stock purchase warrants at an exercise price of $0.30 per share |

| |

| Common Stock issued and outstanding | | Before the exercise of any warrants or conversion of the Notes: 7,093,247. The selling shareholders are each contractually limited in the number of shares of common stock underlying the secured convertible notes and warrants they can receive upon conversion in that such selling shareholders would not result in beneficial ownership by the selling shareholders and its affiliates of more than 4.99% of the outstanding shares of common stock of the Company on such conversion date. |

| |

| Use of Proceeds | | We will not receive any proceeds from the sale of our common stock by the Selling Shareholders although we will receive proceeds from the exercise of certain warrants (the underlying shares of common stock are being registered in this Prospectus). |

EXPLANATORY NOTE:On January 25, 2006, we entered into a Securities Purchase Agreement with certain accredited investors.Any issuance of shares of common stock pursuant to the Securities Purchase Agreement and issuance of shares underlying the Class A and Class B Warrants that would require us to issue shares of common stock in excess of our authorized capital is contingent upon us obtaining shareholder approval to increase our authorized shares of common stock from and filing the certificate of amendment to our certificate of incorporation.

5

SECURITIES PURCHASE AGREEMENT

To obtain funding for our ongoing operations, effective January 25, 2006, the Company closed on a financing transaction with a group of private investors (“Investors”) of $5,225,000. After deducting commissions and other costs of the offering of $522,500, the Company received proceeds of $4,702,500.00. The financing consisted of two components: (a) promissory notes of the Company (“Note” or “Notes”), in the principal aggregate amount of $5,225,000, due January 25, 2008, such Notes convertible into shares of the Company’s common stock, $0.001 par value (the “Common Stock”) at a per share conversion price at the rate of $0.30 per share of Common Stock; and (b) Class A and Class B Warrants registered in the name of each Investor.

The Notes are due January 25, 2008. The Notes are convertible into shares of the Company’s Common Stock at a per share conversion price at the rate of $0.30 per share of Common Stock. The Notes accrue interest on the principal amount of the Notes at a rate per annum of eight percent (8%) from January 25, 2006 and shall be payable, in arrears, subject to the terms and conditions of the Notes, together with principal amount payments, on January 25, 2008.

One Class A Warrant and one Class B Warrant will be issued for each two shares of Common Stock which would be issued on the Closing Date assuming the complete conversion of the Note issued on the Closing Date at the rate of $0.30 per share of Common Stock. The exercise price to acquire a share of Common Stock upon exercise of a Class A Warrant was set at $0.35 and, subsequently adjusted to $0.30 per share. The exercise price to acquire a share of Common Stock upon exercise of a Class B Warrant was set at $0.40 and, subsequently adjusted to $0.30 per share. The Class A Warrants shall be exercisable until January 25, 2009 (three (3) years after the closing of the financing). The Class B Warrants shall be exercisable until January 25, 2011 (five (5) years after the closing of the financing).

On November 8, 2006, we issued to certain private investors (a) convertible promissory notes of our company, in the principal aggregate amount of $5,000,000, and (b) warrants to purchase an aggregate of up to 200,000 shares of our common stock, registered in the name of each investor.

Our selling shareholders have contractually agreed to restrict their ability to convert or exercise their warrants and receive shares of our common stock such that the number of shares of common stock held by them and their affiliates after such conversion or exercise does not exceed 4.99% of the then issued and outstanding shares of common stock.

6

Summary Financial Information

The following table presents selected historical financial data derived from our financial statements, together with adjusted information which reflects the receipt of the net offering proceeds from this offering. This summary financial information should be read in conjunction with our financial statements and the notes to those statements appearing elsewhere in the prospectus.

| | | | | | |

Statement of income data: (In thousands, except per share data) | | Year ended December 31, |

| | | 2006 | | 2005 |

Sales | | $ | 39,095 | | $ | 27,553 |

Gross profit | | $ | 17,178 | | $ | 11,550 |

Income from operations | | $ | 7,042 | | $ | 4,583 |

Net income (loss) | | $ | 874 | | $ | 3,254 |

Earnings (loss) per share, (basic and diluted) | | $ | 0.145 | | $ | 0.630 |

Earnings (loss) per share, adjusted for a reverse split of 1:20 shares (diluted) | | $ | 0.145 | | $ | 0.633 |

Earnings (loss) per share, adjusted for a reverse split of 1:20 shares, and before financing costs (diluted) | | $ | 1.00 | | $ | 0.690 |

7

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this prospectus, before investing in our common stock. If any of the events anticipated by the risks described below occur, our results of operations and financial condition could be adversely affected which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

Risks Relating To Our Business

We rely on cooperative suppliers and any adverse changes in these relationships may adversely affect us.

We have developed a network of aquaculture farmers in Hainan Province for the supply of tilapia and shrimp by entering into cooperative supply agreements. Pursuant to the cooperative supply agreements, we are assured the necessary supply of aquatic products that meet our quality standards. The continuance and smooth operations of these cooperative networks are essential in controlling our costs, meeting quality standards and the timely fulfillment of our customer orders. Any adverse change to our cooperative network, including any early termination or non-renewal of any supply agreement or any failure of suppliers to fulfill their obligations under the supply agreements, could have a material adverse effect on our business model, operations and competitiveness.

We may require additional capital in the future, which may not be available on favorable terms or at all.

Our future capital requirements will depend on many factors, including industry and market conditions, our ability to successfully implement our new branding and marketing initiative and expansion of our production capabilities. We anticipate that we may need to raise additional funds in order to grow our business and implement our business strategy. We anticipate that any such additional funds would be raised through equity or debt financings. In addition, we may enter into a revolving credit facility or a term loan facility with one or more syndicates of lenders. Any equity or debt financing, if available at all, may be on terms that are not favorable to us. Even if we are able to raise capital through equity or debt financings, as to which there can be no assurance, the interest of existing shareholders in our company may be diluted, and the securities we issue may have rights, preferences and privileges that are senior to those of our common stock or may otherwise materially and adversely effect the holdings or rights of our existing shareholders. If we cannot obtain adequate capital, we may not be able to fully implement our business strategy, and our business, results of operations and financial condition would be adversely affected. See also “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.” In addition, we have and will continue to raise additional capital through private placements or registered offerings, in which broker-dealers will be engaged. The activities of such broker-dealers are highly regulated and we cannot assure that the activities of such broker-dealers will not violate relevant regulations and generate liabilities despite our expectation otherwise.

We depend on the availability of additional human resources for future growth.

We are currently experiencing a period of significant growth in our sales volume. We believe that continued expansion is essential for us to remain competitive and to capitalize on the growth potential of our business. Such expansion may place a significant strain on our management and operations and financial resources. As our operations continue to grow, we will have to continually improve our management, operational and financial systems, procedures and controls, and other resources infrastructure, and expand our workforce. There can be no assurance that our existing or future management, operating and financial systems, procedures and controls will be adequate to support our operations, or that we will be able to recruit, retain and motivate our personnel. Further, there can be no assurance that we will be able to establish, develop or maintain the business relationships beneficial to our operations, or to do so or to implement any of the above activities in a timely manner. Failure to manage our growth effectively could have a material adverse effect on our business and the results of our operations and financial condition.

We depend on our key management personnel, and the loss of any of their services could materially adversely affect us.

Our operations are dependent upon the experience and expertise of a small number of key management personnel, which includes Lillian Wang Li, our Chairman of the Board, Norbert Sporns, our Chief Executive Officer and President, and Harry Wang Hua, our Chief Operating Officer. Lillian Wang Li and Harry Wang Hua are brother and sister, and Ms. Wang Li is married to Norbert Sporns. We do not maintain key man life insurance on the lives of these individuals. The loss of the services of any of them for any reason would have a material adverse effect on our business, and the results of our operations and financial condition, or could delay or prevent us from fully implementing our business strategy.

8

A few of our customers account for a significant portion of our business.

We have derived, and over the near term we expect to continue to derive, a significant portion of our sales from a limited number of customers. For example, five customers accounted for a total of 53.3% of our consolidated sales for the year ended December 31, 2006, three of which individually accounted for 13.8%, 12.2% and 11.7%, respectively, all related to the aquaculture product segment. At December 31, 2006, approximately 46.45% of our trade receivables were from transactions with the above five customers. The loss of any of these customers or non-payment of outstanding amounts due to the company may materially and adversely affect our business, results of operations, financial position and liquidity.

We may be unable to continue to take advantage of the seasonal pricing fluctuation in sales of our products, and we may be adversely affected by the seasonal fluctuation in the prices we earn for our products.

We have experienced seasonal fluctuation in the prices we earn for our products, generally in the range of 15 to 20%. Pricing fluctuation occurs during the winter season when fish farms in the northern part of the PRC suspend production due to cold weather conditions. These weather related disruptions in supply permit us to increase the sales prices of our tilapia products. However, there can be no assurance that such premium pricing, benefiting our profitability, can be maintained in the future. Other factors, such as an increase in the cost of feed, might adversely impact on the cost of fish and lessen our margins and profitability.

Any adverse changes in the supply of our tilapia and other raw materials, including contamination or disease or increased costs of raw materials, may adversely affect our operations or reduce our margins or profits.

We are dependent on the availability of raw materials from Hainan Province and the oceans in that region. The supply of these raw materials can be adversely affected by any material change in the climatic or environmental conditions in and around Hainan Province. In addition, if there is contamination resulting from disease, pollution or other foreign substances, our supply of raw materials could be jeopardized or disrupted. The shortage or lack of raw materials and any consequential change in their cost would, in turn, have a material adverse effect on the cost on our operations and margins and our ability to provide products to our customers.

We may be adversely affected by the fluctuation in raw material prices and selling prices of our products.

Neither our products nor the raw materials we use have experienced any significant price fluctuations in the past, but there is no assurance that they will not be subject to future price fluctuations or pricing control. The products and raw materials we use may experience price volatility caused by events such as market fluctuations or changes in governmental programs. The market price of these raw materials may also experience significant upward adjustment, if, for instance, there is a material under-supply or over-demand in the market. These price changes may ultimately result in increases in the selling prices of our products, and may, in turn, adversely affect our sales volume, revenue and operating profit.

We could be adversely affected by the occurrence of natural disasters in Hainan Province.

From time to time, Hainan Province experiences typhoons, particularly from June through September of any given year. Natural disasters could impede operations, damage infrastructure necessary to our operations or adversely affect the logistical services to and from Hainan Province. The occurrence of natural disasters in Hainan Province could adversely affect our business, the results of our operations, prospects and financial condition, even though we currently have insurance against damages caused by natural disasters, including typhoons, accidents or similar events.

Intense competition from existing and new entities may adversely affect our revenues and profitability.

In general, the aquaculture industry is intensely competitive and highly fragmented. We compete with various companies, many of which are developing or can be expected to develop products similar to ours. For example, 8th Sea–The Organic Seafood Company currently produces and processes tilapia fillets in Brazil’s Parana state. Many of our competitors are more established than we are and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have

9

greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We intend to create greater awareness for our brand name so that we can successfully compete with our competitors. We cannot assure you that we will be able to compete effectively or successfully with current or future competitors or that the competitive pressures we face will not harm our business.

Our operating subsidiary must comply with environmental protection laws that could adversely affect our profitability.

We are required to comply with the environmental protection laws and regulations promulgated by the national and local governments of the PRC. Some of these regulations govern the level of fees payable to government entities providing environmental protection services and the prescribed standards relating to the discharge of effluent, or liquid waste. Yearly inspections of waste treatment systems require the payment of a license fee which could become a penalty fee if standards are not maintained. Currently, our plant treats all of its effluent completely to level one, which is consistent with releasing potable water back to the environment, and there is currently no charge being levied. Although our production technologies allow us to efficiently control the level of pollution resulting from our production process, and notwithstanding the fact that we have received evidence of compliance with environmental protection requirements from government authorities, due to the nature of our business, effluent wastes are unavoidably generated in the aquaculture production processes. If we fail to comply with any of these environmental laws and regulations in the PRC, depending on the types and seriousness of the violation, we may be subject to, among other things, warning from relevant authorities, imposition of fines, specific performance and/or criminal liability, forfeiture of profits made, being ordered to close down our business operations and suspension of relevant permits.

There can be no assurance that the intended investment in our aquaculture product segment will result in a significant increase in our profitability or significantly increase our net income for that segment when compared to the marine bio and healthcare product segment.

To date, the marine bio and healthcare product segment has generated significantly greater net income than the aquaculture product segment on a smaller amount of sales to external customers. In the financial years ended December 31, 2006 and 2005, the marine bio and healthcare product segment had sales of $15,302,713 and $9,772,762, respectively, compared to sales for the aquaculture product segment of $23,792,690 and $17,780,268, respectively. On those sales, however, for the financial years ended December 31, 2006 and 2005, the marine bio and healthcare product segment had net income of $7,339,374 and $4,116,398, respectively, compared to net income for the aquaculture product segment of $1,273,290 and $1,003,857, respectively. Therefore, the marine bio and healthcare product segment contributed approximately 85% of the net income in 2006 and 80% in 2005, before unallocated items, in both periods. The greater part of the proceeds of this offering, however, are intended to further develop the aquaculture product segment through increasing processing capacity, construction of a large scale organic feed mill and marketing our tilapia products. Over the longer term, the company plans to focus much of its economic and other resources on the aquaculture product segment under the belief that it will generate greater amounts of sales and result in higher profit margins. It is not anticipated that a change in the contribution to net income will be apparent between the segments until the 2008 fiscal year when the new processing plant and other aspects of the aquaculture expansion will be competed and operational. There can be no assurance given to investors that the investment in plant and equipment and the marketing expansion efforts for the aquaculture product segment will increase the sales to external customers, the profit margin and net income of this segment as anticipated.

Our operations, revenue and profitability could be adversely affected by changes in laws and regulations in the countries where we do business.

The governments of countries into which we sell our products, including the United States, Canada and the European Union, from time to time, consider regulatory proposals relating to raw materials, food safety and market, and environmental regulations, which, if adopted, could lead to disruptions in distribution of our products and increase our operational costs, which, in turn, could affect our profitability. To the extent that we increase our product prices as a result of such changes, our sales volume and revenues may be adversely affected.

Furthermore, these governments may change import regulations or impose additional taxes or duties on certain Chinese imports from time to time. For example, in 2004, the United States government imposed heavy tariffs of more than 100 percent on certain Chinese shrimp exporters. Similar regulations and fees or new regulatory developments may have a material adverse impact on our operations, revenue and profitability.

10

There could be changes in the policies of the PRC government that may adversely affect our business.

The aquaculture industry in the PRC is subject to policies implemented by the PRC government. The PRC government may, for instance, impose control over aspects of our business such as distribution of raw materials, product pricing and sales. On the other hand, the PRC government may also make available subsidies or preferential treatment, which could be in the form of tax benefits or favorable financing arrangements.

If the raw materials used by us or our products become subject to any form of government control, then depending on the nature and extent of the control and our ability to make corresponding adjustments, there could be a material adverse effect on our business and operating results.

Separately, our business and operating results also could be adversely affected by changes in policies of the Chinese government such as: changes in laws, regulations or the interpretation thereof; confiscatory taxation; restrictions on currency conversion, imports or sources of supplies; or the expropriation or nationalization of private enterprises. Although the Chinese government has been pursuing economic reform policies for approximately two decades to liberalize the economy and introduce free market aspects, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting China’s political, economic and social life.

Certain political and economic considerations relating to PRC could adversely affect our company.

The PRC is passing from a planned economy to a market economy. The Chinese government has confirmed that economic development will follow a model of market economy under socialism. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans adopted by the government that set down national economic development goals. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms are unprecedented or experimental for the PRC government, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions as well as by changes in the policies of the PRC government, which we may not be able to foresee, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the rate or method of taxation, and imposition of additional restrictions on currency conversion.

The recent nature and uncertain application of many PRC laws applicable to us create an uncertain environment for business operations and they could have a negative effect on us.

The PRC legal system is a civil law system. Unlike the common law system, such as the legal system used in the United States, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

If relations between the United States and China worsen, our stock price may decrease and we may have difficulty accessing the U.S. capital markets.

At various times during recent years, the United States and China have had disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China could adversely affect the market price of our common stock and our ability to access U.S. capital markets.

11

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. Currently, the Renminbi is not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans and corporate debt obligations denominated in foreign currencies.

The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

The fluctuation of the Renminbi may materially and adversely affect your investment.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. Any significant revaluation of the Renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. dollars we receive from this offering of our common stock into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar could have a material adverse effect on our business, financial condition and results of operations.

Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of making payments for dividends on our common shares or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of the Renminbi we convert would be reduced. Any significant devaluation of Renminbi may reduce our operation costs in U.S. dollars but may also reduce our earnings in U.S. dollars. In addition, the depreciation of significant U.S. dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

Since 1994 the PRC has pegged the value of the Renminbi to the U.S. dollar. We do not believe that this policy has had a material effect on our business. There can be no assurance that Renminbi will not be subject to devaluation. We may not be able to hedge effectively against Renminbi devaluation, so there can be no assurance that future movements in the exchange rate of Renminbi and other currencies will not have an adverse effect on our financial condition.

In addition, there can be no assurance that we will be able to obtain sufficient foreign exchange to pay dividends or satisfy other foreign exchange requirements in the future.

It may be difficult to effect service of process and enforcement of legal judgments upon our company and our officers and directors because some of them reside outside the United States.

As our operations are presently based in China and some of our key directors and officers reside outside the United States, service of process on our key directors and officers may be difficult to effect within the United States. Also, substantially all of our assets are located outside the United States and any judgment obtained in the United States against us may not be enforceable outside the United States. We have appointed Norbert Sporns, our Chief Executive Officer and President, as our agent to receive service of process in any action against our company in the United States.

Risks Relating to our Common Stock and the Offering

There are a large number of shares underlying our secured convertible notes and warrants that may be available for future sale and the sale of these shares may depress the market price of our common stock.

As of March 31, 2007, we 7,093,247 shares of common stock and outstanding , 1,150,108 shares of common stock underlying our Warrants, 10,000 shares of common stock underlying our preferred stock and 489,191 shares of common stock underlying the convertible notes issued and outstanding. These shares, including all of the shares issuable upon conversion of the secured convertible notes and upon exercise of our warrants, may be sold into the market place currently or in the next two years. The sale of these shares may adversely affect the market price of our common stock.

12

Our principal stockholders, current executive officers and directors own a significant percentage of our company and will be able to exercise significant influence over our company.

Our executive officers and directors and principal stockholders together will beneficially own approximately 96.60% of the total voting power of our outstanding voting capital stock. In particular, our three largest shareholders, Mr. Sporns, Ms. Wang Li and Mr. Wang Hua, are family members who share approximately 96.58% of the total voting power of our Company. Ms. Wang Li is the wife of Mr. Sporns and Mr. Wang Hua is the brother of Ms. Wang Li. These stockholders will be able to determine the composition of our Board of Directors, will retain the voting power to approve all matters requiring stockholder approval and will continue to have significant influence over our affairs. This concentration of ownership could have the effect of delaying or preventing a change in our control or otherwise discouraging a potential acquirer from attempting to obtain control of us, which in turn could have a material and adverse effect on the market price of the common stock or prevent our stockholders from realizing a premium over the market prices for their shares of common stock. See “Principal Stockholders” for information about the ownership of common stock and Series A Preferred Stock by our executive officers, directors and principal stockholders.

We cannot guarantee the existence of an established public trading market.

Although application has been made to have our common stock listed on the American Stock Exchange under the symbol “HQS” and our common stock currently trades on the NASD OTC Bulletin Board, a regular trading market for our securities may not be sustained in the future. The OTC Bulletin Board is an inter-dealer, over-the-counter market that provides significantly less liquidity than the NASD’s automated quotation system (the NASDAQ Stock Market). Quotes for stocks included on the OTC Bulletin Board are not listed in the financial sections of newspapers as are those for the NASDAQ Stock Market. Therefore, prices for securities traded solely on the OTC Bulletin Board may be difficult to obtain and holders of common stock may be unable to resell their securities at or near their original offering price or at any price. Market prices for our common stock will be influenced by a number of factors, including:

| | • | | the issuance of new equity securities pursuant to an offering; |

| | • | | changes in interest rates; |

| | • | | competitive developments, including announcements by competitors of new products or services or significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; |

| | • | | variations in quarterly operating results; |

| | • | | change in financial estimates by securities analysts; |

| | • | | the depth and liquidity of the market for our common stock; |

| | • | | investor perceptions of our company and the aquaculture industry generally; and |

| | • | | general economic and other national conditions. |

13

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will not receive any proceeds from the sale of shares of common stock in this offering. However, we will receive the sale price of any common stock we sell to the selling stockholder upon exercise of the warrants. We expect to use the proceeds received from the exercise of the warrants, if any, for general working capital purposes.

We have never declared or paid any cash dividends on our common stock. We do not anticipate paying any cash dividends to stockholders in the foreseeable future. In addition, any future determination to pay cash dividends will be at the discretion of the Board of Directors and will be dependent upon our financial condition, results of operations, capital requirements, and such other factors as the Board of Directors deem relevant.

DILUTION

Effect of Offering on Net Tangible Book Value Per Share

This offering is for sales of shares by the selling stockholder on a continuous or delayed basis in the future. Sales of common stock by the selling stockholder will not result in a change to the net tangible book value per share before or after the distribution of shares by the selling stockholder. There will be no change in the net book value per share attributable to cash payments made by the purchasers of the shares being offered. Prospective investors should be aware, however, that the market price of our shares may not bear any relationship to net tangible book value per share.

14

Selling Shareholders

The following table presents information regarding the Selling Shareholders. Unless otherwise stated below, to our knowledge no Selling Shareholders nor any affiliate of such shareholder has held any position or office with, been employed by, or otherwise has had any material relationship with us or our affiliates, during the three years prior to the date of this prospectus.

None of the Selling Shareholders are members of the National Association of Securities Dealers, Inc. The Selling Shareholders may be deemed to be “underwriters” within the meaning of the Securities Act of 1933.

Any of the Selling Shareholders, acting alone or in concert with one another, may be considered statutory underwriters under the Securities Act of 1933 in they are directly or indirectly conducting an illegal distribution of the securities on behalf of our corporation. For instance, an illegal distribution may occur if any of the Selling Shareholders were to provide us with cash proceeds from their sales of the securities. If any of the Selling Shareholders are determined to be underwriters, they may be liable for securities violations in connection with any material misrepresentations or omissions made in this prospectus.

In addition, the Selling Shareholders and any brokers and dealers through whom sales of the securities may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, and the commissions or discounts and other compensation paid to such persons may be regarded as underwriters’ compensation.

The number and percentage of shares beneficially owned before and after the sales is determined in accordance with Rule 13d-3 and 13d-5 of the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. We believe that each individual or entity named has sole investment and voting power with respect to the securities indicated as beneficially owned by them, subject to community property laws, where applicable, except where otherwise noted. The total number of common shares sold under this prospectus may be adjusted to reflect adjustments due to stock dividends, stock distributions, splits, combinations or recapitalizations.

The Selling Shareholders named in this prospectus are offering all of the shares of common stock offered through this prospectus. These shares were acquired from us in a private placement that was exempt from registration under Regulation D of the Selling Shareholders are hereby advised that Regulation M of the General Rules and Regulations promulgated under the Securities Exchange Act of 1934 will be applicable to their sales of these shares of our common stock. These rules contain various prohibitions against trading by persons interested in a distribution and against so-called “stabilization” activities.

The following table provides information regarding the beneficial ownership of our common stock held by each of the selling shareholders, including:

1. the number of shares owned by each prior to this offering;

2. the percentage owned prior to the offering;

3. the total number of shares that are to be offered for each;

4. the total number of shares that will be owned by each upon completion of the offering; and

the percentage owned by each upon completion of the offering.

15

| | | | | | | | | | | | | | | |

Name of selling stockholder | | Shares of

common

Stock owned

prior to offering

(including shares

underlying all

convertible

securities) (2) | | Percent of

Common

Stock owned

prior to

offering(1) | | | Shares of

common

stock to be

sold

underlying

the

promissory

notes(2) | | Shares of

common

Stock

underlying

the Class A

warrants

owned Prior to the

offering | | Shares of

common

Stock

underlying

the Class B

warrants

owned Prior

to the

offering | | Shares of

common

stock, including

shares

underlying the

warrants and

notes, to be sold | | Shares of

common

Stock

owned

After

offering(3) |

Castle Creek Technologies Partners, LLC(4) | | 224,444 | | 2.6 | % | | 99,444 | | 62,500 | | 62,500 | | 224,444 | | -0- |

Nite Capital, LP(5) | | 74,814 | | * | | | 33,148 | | 20,833 | | 20,833 | | 74,814 | | -0- |

Brio Capital, LP(6) | | 44,889 | | * | | | 19,889 | | 12,500 | | 12,500 | | 44,889 | | -0- |

Double U Master Fund, LP(7) | | 83,334 | | * | | | __ | | 41,667 | | 41,667 | | 83,334 | | -0- |

Michael P. Ross | | 29,925 | | * | | | 13,259 | | 8,333 | | 8,333 | | 29,925 | | -0- |

Richard M. Ross | | 29,925 | | * | | | 13,259 | | 8,333 | | 8,333 | | 29,925 | | -0- |

Vision Opportunity Master Fund, Ltd. (8) | | 181,657 | | 2.1 | % | | 48,323 | | 66,667 | | 66,667 | | 181,657 | | -0- |

First Mirage, Inc. (9) | | 29,925 | | * | | | 13,259 | | 8,333 | | 8,333 | | 29,925 | | -0- |

Generation Capital Associate(10) | | 44,889 | | * | | | 19,889 | | 12,500 | | 12,500 | | 44,889 | | -0- |

The Hart Organization Corp. (11) | | 29,925 | | * | | | 13,259 | | 8,333 | | 8,333 | | 29,925 | | -0- |

Omega Capital Smallcap Fund, LP (12) | | 29,925 | | * | | | 13,259 | | 8,333 | | 8,333 | | 29,925 | | -0- |

Professional Traders Fund(13) | | 29,925 | | * | | | 13,259 | | 8,333 | | 8,333 | | 29,925 | | -0- |

Solomon Strategic Holdings, Inc. (14) | | 14,964 | | * | | | 6,630 | | 4,167 | | 4,167 | | 14,964 | | -0- |

The Tail Wind Fund Ltd. (15) | | 259,480 | | 3.0 | % | | 92,814 | | 83,333 | | 83,333 | | 259,480 | | -0- |

Mordechai Vogel | | 7,481 | | * | | | 3,315 | | 2,083 | | 2,083 | | 7,481 | | -0- |

Simon Vogel | | 7,481 | | * | | | 3,315 | | 2,083 | | 2,083 | | 7,481 | | -0- |

Tower Paper Co. Inc. Ret. Plan(16) | | 7,481 | | * | | | 3,315 | | 2,083 | | 2,083 | | 7,481 | | -0- |

Chestnut Ridge Partners, LP(17) | | 16,666 | | * | | | — | | 8,333 | | 8,333 | | 16,666 | | -0- |

Netwise Holdings Limited(18) | | 83,334 | | * | | | — | | 41,667 | | 41,667 | | 83,334 | | -0- |

Paragon Capital LP(19) | | 29,925 | | * | | | 13,259 | | 8,333 | | 8,333 | | 29,925 | | -0- |

Camofi Master, LDC(20) | | 66,296 | | * | | | 66,296 | | — | | — | | 66,296 | | -0- |

Bursteine & Lindsay Securities(21) | | 85,733 | | * | | | — | | — | | 85,733 | | 85,733 | | -0- |

16

| (1) | Based on 8,722,546 shares of common stock, consisting of 7,093,247 shares of common stock issued as of March 31, 2007, and 1,150,108 shares of common stock underlying our Warrants, 10,000 shares of common stock underlying our preferred stock and 489,191 shares of common stock underlying the convertible notes (which includes shares issuable upon conversion of the equivalent of 175% of our secured convertible notes). |

| (2) | Includes shares issuable upon conversion of the equivalent of 175% of our secured convertible notes. |

| (3) | Assumes the sale of all shares registered by each selling shareholder (including shares issuable upon conversion of the equivalent of 175% of our secured convertible notes). |

| (4) | Castle Creek Technologies Partners, LLC . As investment manager under a management agreement, Castle Creek Partners, LLC may exercise dispositive and voting power with respect to the shares owned by Castle Creek Technology Partners LLC. Castle Creek Partners, LLC disclaims beneficial ownership of such shares. Daniel Asher is the managing member of Castle Creek Partners, LLC. Mr. Asher disclaims beneficial ownership of the shares owned by Castle Creek Technology Partners LLC. |

| (5) | Nite Capital, LP. Keith Goodman, Manager of the General Partner of Nite Capital, LP, is the control person for the shares owned by Nite Capital, LP. Mr. Goodman disclaims beneficial ownership is the shares owned by Nite Capital, LP. |

| (6) | Brio Capital, LP is controlled by Shaye Hirsch. |

| (7) | Double U Master Fund, LP. Double U Master Fund L.P. is a master fund in a master-feeder structure with B&W Equities, LLC as its general partner. Isaac Winehouse is the manager of B&W Equities, LLC and Mr. Winehouse has ultimate responsibility of trading with respect to Double U Master Fund L.P. Mr. Winehouse disclaims beneficial ownership of the shares being registered hereunder. |

| (8) | Vision Opportunity Master Fund, Ltd is controlled by its managing member, Adam Benowitz |

| (9) | First Mirage, Inc. Frank E. Hart, David A. Rapaport and Fred A. Brasch exercise dispositive and voting power with respect to the shares of common stock owned by First Mirage, Inc. |

| (10) | Generation Capital Associate. Frank E. Hart, David A. Rapaport and Fred A. Brasch exercise dispositive and voting power with respect to the shares of common stock owned by Generation Capital Associates. |

| (11) | The Hart Organization Corp. Frank E. Hart, David A. Rapaport and Fred A. Brasch exercise dispositive and voting power with respect to the shares of common stock owned by The Hart Organization Corp. |

| (12) | Omega Capital Smallcap Fund, LP is controlled by Herman Segal. |

| (13) | Professional Traders Fund is controlled by Mark Swickle. |

| (14) | Solomon Strategic Holdings, Inc. Andrew P. Mackellar has been authorized by the Board of Directors of Solomon Strategic Holdings, Inc. (“SSH”) to make voting and disposition decisions with respect to the shares on behalf of SSH. By reason of such delegated authority, Mr. Mackellar may be deemed to share dispositive power over the shares of common stock owned by SSH. Mr. Mackellar expressly disclaims any equitable or beneficial ownership of the shares being registered hereunder and held by SSH, and he does not have any legal right to maintain such delegated authority. |

| (15) | The Tail Wind Fund Ltd. Tail Wind Advisory & Management Ltd., a UK corporation authorized and regulated by the Financial Services Authority of Great Britain (“TWAM”), is the investment manager for The Tail Wind Fund Ltd., and David Crook is the CEO and controlling shareholder of TWAM. Each of TWAM and David Crook expressly disclaims any equitable or beneficial ownership of the shares being registered hereunder and held by The Tail Wind Fund Ltd. |

| (16) | Tower Paper Co. Inc. Ret. Plan is controlled by Simon Vogel. |

| (17) | Chestnut Ridge Partners, LP is controlled by Kenneth Pasternack. |

| (18) | Netwise Holdings Limited is controlled by Arthur Ashton. |

| (19) | Paragon Capital LP is controlled by Alan P. Donefeld. |

| (20) | Camofi Master, LDC is controlled by Richard Smithline. |

| (21) | Bursteine & Lindsay Securities is controlled by Mosi Kraus |

17

The named party beneficially owns and has sole voting and investment power over all shares or rights to these shares. The numbers in this table assume that none of the selling shareholders sells shares of common stock not being offered in this prospectus or purchases additional shares of common stock, and assumes that all shares offered are sold.

Except as disclosed below, none of the Selling Shareholders:

| | (a) | has had a material relationship with us other than as a shareholder at any time within the past three years; or |

| | (b) | has ever been one of our officers or directors. |

Plan of Distribution

The selling stockholders and any of their respective pledgees, donees, assignees and other successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. The selling stockholders may use any one or more of the following methods when selling shares:

| | • | | ordinary brokerage transactions and transactions in which the broker-dealer solicits the purchaser; |

| | • | | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| | • | | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| | • | | an exchange distribution in accordance with the rules of the applicable exchange; |

| | • | | privately-negotiated transactions; |

| | • | | broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share; |

| | • | | a combination of any such methods of sale; and |

| | • | | any other method permitted pursuant to applicable law. |

The selling stockholders may also sell shares under Rule 144 under the Securities Act, if available, or Regulation S, rather than under this prospectus. The selling stockholders shall have the sole and absolute discretion not to accept any purchase offer or make any sale of shares if they deem the purchase price to be unsatisfactory at any particular time.

The selling stockholders or their respective pledgees, donees, transferees or other successors in interest, may also sell the shares directly to market makers acting as principals and/or broker-dealers acting as agents for themselves or their customers. Such broker-dealers may receive compensation in the form of discounts, concessions or commissions from the selling stockholders and/or the purchasers of shares for whom such broker-dealers may act as agents or to whom they sell as principal or both, which compensation as to a particular broker-dealer might be in excess of customary commissions. Market makers and block purchasers purchasing the shares will do so for their own account and at their own risk. It is possible that a selling stockholder will attempt to sell shares of common stock in block transactions to market makers or other purchasers at a price per share which may be below the then market price. The selling stockholders cannot assure that all or any of the shares offered in this prospectus will be issued to, or sold by, the selling stockholders. The selling stockholders and any brokers, dealers or agents, upon effecting the sale of any of the shares offered in this prospectus, may be deemed to be “underwriters” as that term is defined under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or the rules and regulations under such acts. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are required to pay all fees and expenses incident to the registration of the shares, including fees and disbursements of counsel to the selling stockholders, but excluding brokerage commissions or underwriter discounts.

The selling stockholders, alternatively, may sell all or any part of the shares offered in this prospectus through an underwriter. No selling stockholder has entered into any agreement with a prospective underwriter and there is no assurance that any such agreement will be entered into.

The selling stockholders may pledge their shares to their brokers under the margin provisions of customer agreements. If a selling stockholders defaults on a margin loan, the broker may, from time to time, offer and sell the pledged shares. The selling

18

stockholders and any other persons participating in the sale or distribution of the shares will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations under such act, including, without limitation, Regulation M. These provisions may restrict certain activities of, and limit the timing of purchases and sales of any of the shares by, the selling stockholders or any other such person. In the event that the selling stockholders are deemed affiliated purchasers or distribution participants within the meaning of Regulation M, then the selling stockholders will not be permitted to engage in short sales of common stock. Furthermore, under Regulation M, persons engaged in a distribution of securities are prohibited from simultaneously engaging in market making and certain other activities with respect to such securities for a specified period of time prior to the commencement of such distributions, subject to specified exceptions or exemptions.

We have agreed to indemnify the selling stockholders, or their transferees or assignees, against certain liabilities, including liabilities under the Securities Act of 1933, as amended, or to contribute to payments the selling stockholders or their respective pledgees, donees, transferees or other successors in interest, may be required to make in respect of such liabilities.

If the selling stockholders notify us that they have a material arrangement with a broker-dealer for the resale of the common stock, then we would be required to amend the registration statement of which this prospectus is a part, and file a prospectus supplement to describe the agreements between the selling stockholders and the broker-dealer.

PENNY STOCK RULES / SECTION 15(G) OF THE EXCHANGE ACT

Our shares are covered by Section 15(g) of the Securities Exchange Act of 1934, as amended, and Rules 15g-1 through 15g-6 promulgated thereunder. They impose additional sales practice requirements on broker/dealers who sell our securities to persons other than established customers and accredited investors who are generally institutions with assets in excess of $5,000,000, or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000, or $300,000 jointly with their spouses.

Rule 15g-1 exempts a number of specific transactions from the scope of the penny stock rules. Rule 15g-2 declares unlawful broker/dealer transactions in penny stocks unless the broker/dealer has first provided to the customer a standardized disclosure document.