As filed with the Securities and Exchange Commission on October 27, 2009

Registration No. 333-132031

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3/A

(Post-Effective Amendment No. 3 to Form SB-2)

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation or organization)

62-1407522

(I.R.S. Employer Identification No.)

Melbourne Towers

1511 Third Avenue, Suite 788

Seattle, Washington 98101

Telephone: (206) 621-9888

(Address and telephone number of principal executive offices and principal place of business)

Norbert Sporns

Chief Executive Officer and President

HQ Sustainable Maritime Industries, Inc.

Melbourne Towers

1511 Third Avenue, Suite 788

Seattle, Washington 98101

Telephone: (206) 621-9888

Facsimile: (206) 621-0318

(Name, address and telephone number of agent for service)

copies of communications to:

Howard Jiang, Esq.

Troutman Sanders LLP

405 Lexington Avenue

New York, New York 10174

Telephone: (212) 704-6000

Facsimile: (212) 704-6288

Approximate date of commencement of proposed sale to the public:From time to time after this registration statement becomes effective.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | x |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Explanatory Note

The Registrant hereby files this post-effective amendment number three to its Registration Statement on Form SB-2 (No. 333-132031) as initially filed with the Securities and Exchange Commission (the “SEC”) on February 24, 2006, as last amended May 1, 2007, to (i) incorporate the Registrant’s audited financial statements for the year ended December 31, 2008; (ii) incorporate information disclosed in the Registrant’s annual report on Form 10-K for the year ended December 31, 2008, as filed with the SEC on March 12, 2009, as amended by Amendment No. 1 on Form 10-K/A, as filed with the SEC on June 9, 2009, and Amendment No. 2 on Form 10-K/A, as filed with the SEC on October 16, 2009; (iii) incorporate the Registrant’s unaudited financial statements for the quarter ended March 31, 2009; (iv) incorporate information disclosed in the Registrant’s quarterly report on Form 10-Q for the quarter ended March 31, 2009, as filed with the SEC on May 11, 2009; (v) incorporate the Registrant’s unaudited financial statements for the quarter ended June 30, 2009; (vi) incorporate information disclosed in the Registrant’s quarterly report on Form 10-Q for the quarter ended June 30, 2009, as filed with the SEC on August 10, 2009; (vii) update information about the Registrant’s business subsequent to the quarter ended June 30, 2009; and (viii) update the selling security holders table to reflect changes in beneficial ownership, based on the records of the Registrant as of the date of this Registration Statement.

The Registrant is filing this amendment to its previous Registration Statement on Form SB-2 under the cover of Form S-3 pursuant to the compliance provisions in SEC Release No. 33-8876, which allows registrants that filed a registration statement under cover of Form SB-2 to amend such registration statements under cover of Form S-3.

Pursuant to Rule 429 of the Securities Act of 1933, as amended, this Registration Statement also serves as post-effective amendment number two to the Registration Statement on Form SB-2 (No. 333-117558) initially filed with the SEC on July 22, 2004, as last amended July 11, 2005.

The Registrant previously paid a registration fee of $1488.00 in connection with the filing of the initial registration statement on Form SB-2 (No. 333-132031) filed with the SEC on February 24, 2006. The Registrant previously paid a registration fee of $2,750.20 in connection with the filing of the initial registration statement on Form SB-2 (No. 333-117558) filed with the SEC on July 22, 2004.

The current number of shares in the prospectus reflects shares that have been sold under the Registration Statements on Form SB-2, based on the records of the Registrant as of the date of this Registration Statement.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

Subject to completion, dated October 27, 2009

PROSPECTUS

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

2,063,028 Shares of Common Stock

This prospectus relates to the sale, transfer or distribution of up to 2,063,028 shares of common stock, par value $0.001 per share, of HQ Sustainable Maritime Industries, Inc. by the selling stockholders described herein. The price at which the selling stockholders may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. The shares of common stock registered for resale include:

| | • | | 1,002,637 shares of common stock held by the selling stockholders; |

| | • | | 398,723 shares of common stock issued upon exercise of Class A Warrants; |

| | • | | 522,510 shares of common stock issuable upon exercise of Class B Warrants; |

| | • | | 96,074 shares of common stock issued upon exercise of Class C Warrants; and |

| | • | | 43,084 shares of common stock issued upon exercise of Class D Warrants. |

We will not receive any proceeds from the sale or distribution of the common stock by the selling stockholders. We may receive proceeds from the exercise of the warrants, if any, and will use the proceeds from any exercise for general working capital purposes.

Our common stock trades on the NYSE Amex Stock Exchange (“NYSE Amex”) under the symbol “HQS.” The last reported sale price of our common stock on the NYSE Amex on October 26, 2009 was $8.10 per share.

Investing in our common stock involves a high degree of risk. SeeRISK FACTORS beginning on page 6.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2009.

TABLE OF CONTENTS

You should rely on the information contained in this prospectus, in any applicable prospectus supplement and in the documents incorporated by reference in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where their offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only at the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the securities. Our business, financial condition, results of operations and prospects may have changed since the date indicated on the front cover of this prospectus.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, and reference is made to the actual documents filed with the United States Securities and Exchange Commission for complete information. Copies of some of the documents referred to herein have been filed or will be filed or incorporated by reference as exhibits to one or more of the registration statements of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

i

PROSPECTUS SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus or incorporated herein by reference. This summary does not contain all the information you should consider before investing in our common stock. You should read the entire prospectus carefully, especially the discussion of “Risk Factors” and our consolidated financial statements and the related notes, before deciding to invest in shares of our common stock. In this prospectus, when we use phrases such as “we,” “us,” “our,” “HQS” or “our company,” we are referring to HQ Sustainable Maritime Industries, Inc. and all of its subsidiaries and affiliated companies as a whole, unless it is clear from the context that any of these terms refer only to HQ Sustainable Maritime Industries, Inc.

About Our Company

We are a multi-national company with our headquarters and primary sales offices based in Seattle, Washington. We are a vertically integrated aquatic product producer, processor, and farmer (e.g. through cooperative arrangements with pond farmers), with operations in the People’s Republic of China, or the PRC, of all natural tilapia, other aquatic products, and marine bio and healthcare products. We use state-of-the-art and environment-friendly technologies in our production, processing, and cooperative farm operations. Our facilities are currently certified according to the Hazard Analysis and Critical Control Point (“HACCP”) standards, currently assigned a European Union (“EU”) code required for exporting aquatic products to the EU, and are currently certified in accordance with the Aquaculture Certification Counsel (“ACC”) standards. Our products are sold principally to customers in North America, Europe and Asia. Our current sales activity is primarily directed to distributors within the PRC, rather than within the U.S.

Established in 1999, our aquatic farming and processing operations are in Hainan Province, an island in the South China Sea, which is situated within the most desirable latitude for raising tilapia. The Chinese government has designated Hainan Province in southern China a “green” province, where only environmentally friendly agri-food related industry and tourism are permitted. We purchase and process farm bred and farm raised tilapia through cooperative supply arrangements with local farmers and cooperatives. Our supply cooperatives, under our guidance, use feed formulated by us to optimize the all natural growth of farm raised tilapia. Starting in 2009, we will supply the farmers and cooperatives the feed formulation from our feed processing mill. We believe our tilapia products have achieved such a high level of purity that we market these products as all natural tilapia. In addition, we purchase and process ocean-caught aquatic products through cooperative supply arrangements with local fisherman for our marine bio healthcare products.

In August 2004, the company acquired Hainan Jiahua Marine BioProducts Co. Ltd., or Jiahua Marine, which develops, produces and sells marine bio and healthcare products, including nutraceutical products for the enrichment of our feed formulas, exclusively in China. The principal products of Jiahua Marine are manufactured from fish by-products (tilapia and shark) that include shark cartilage capsules and shark liver oil products that are distributed exclusively in China. The products undergo substantial independent laboratory testing administered by the Ministry of Health in China, which has resulted in a PRC National Certification for these products. These products have various perceived medicinal and health benefits. As part of HQS’s vertical integration plan with respect to tilapia, Jiahua Marine introduced new bio and healthcare products made from tilapia in 2009.

In order to maintain the high quality of our products and to position ourselves for attaining completely organic production certification in the future, we have completed the construction of our own feed mill and processing plant for the production of floating feed formulations. We produce the feed using grains grown without chemical fertilizers, free of antibiotics and fishmeal, and use feed additives manufactured in our nutraceutical plant. We plan for this expanded production to satisfy our own demand through the 20,000 mu (or 3,294 acres) of production in Wenchang and Qionghai, as well as to manufacture feed for others’ farmed operations in Hainan, such as shrimp and other farmed species.

From our headquarters in Seattle, Washington, we market and brand our high-quality, all natural tilapia products under the name TILOVEYA®. In early 2009, we introduced a new family of frozen tilapia meals under the brand name “Lillian’s Healthy Gourmet.” This new family of products includes an organic, natural and regular line of frozen tilapia meals.

We are incorporated in Delaware. The address of our Unites States headquarters is Melbourne Towers, 1511 Third Avenue, Suite 788, Seattle, Washington 98101 and our telephone number is (206) 621-9888. Our website is located atwww.hqfish.com. The information contained on our website or that can be accessed through our website does not constitute part of this prospectus.

Our Principal Competitive Strengths

We believe we have the following principal competitive strengths:

| | • | | Quality All Natural Tilapia Products.We produce all natural tilapia products and have developed a farming system that avoids the use of antibiotics, hormones and other potentially toxic chemicals. Our tilapia is raised in ponds of pure rain water collected for aquaculture. Two other species of fish are introduced into the ponds to maintain the ponds’ health |

1

| | naturally. One of the species is a bottom feeder that cleans up all the waste at the bottom of the ponds (carp), and the other species is a predator fish that eliminates all of the unhealthy fish (snakehead). We formulate feed without fishmeal and produce feed supplements in our healthcare products processing plant to enrich this feed. It is our policy to raise all natural tilapia to distinguish our company from other tilapia producers. The latitude and the pristine environment of the Hainan province of China have provided us with what we believe to be the optimal conditions for all natural aquaculture production. |

| | • | | Vertically Integrated Operations. Our newly completed feed mill is an important additional step towards our goal of complete vertical integration of our operations, which will allow us to further control and monitor the quality of our aquaculture products, as well as control our costs. The local farmers that we have cooperative arrangements with use our production methods and allow us to constantly monitor the production process for highly consistent production that results in high quality products at the time of harvest. |

| | • | | Environmental and Quality Assurances.We are a leader in environmental and quality assurances of aquaculture products. We have adopted and implemented stringent quality control measures and procedures throughout the production process, in order to comply with the various environmental and quality standards, such as the HACCP and the EU import standards. We are also certified in accordance with the ACC standards and positioning ourselves for completely organic production certification of our tilapia products in accordance with market demands. We use state-of-the-art technologies in our farming, feed formulation and processing operations. We have adopted modern and environmentally friendly and responsible technology in our production and processing of tilapia, shrimp, and marine bio and healthcare products, which we believe have been recognized as such through the certifications our plants possess. |

| | • | | Strategic Location in Hainan Province, China. Our processing facilities are geographically well-positioned in Hainan Province to leverage favorable climatic conditions, abundant water supply, pristine environment and a readily available source of labor for our processing plant. We are also located near a seaport, near the city of Wenchang, and our processing facilities are conveniently located near the farmers from whom we obtain our supply of tilapia and shrimp. |

| | • | | International and Domestic Sales and Marketing Efforts.Our Seattle office allows us to differentiate our TILOVEYA® brand and marketing initiative of our all natural tilapia products. Following the success of the TILOVEYA® brand, we introduced in 2009 a family of frozen tilapia meal products under the brand name of “Lillian’s Healthy Gourmet.” The family of products will have three lines focusing on organic, natural and regular frozen meals. The “Lillian’s Healthy Gourmet” brand will help us continue to establish our products as the all natural tilapia products of choice both domestically and internationally. Sales from both the Seattle and China offices complement our multi-national sales efforts to become a world leader in all natural tilapia products. |

| | • | | An Established Track Record and Brand Name in the Industry.We have an established track record and recognized brand name in the industry and have received numerous awards and certifications, which we believe reflects the success of the company in distinguishing itself from its competition. |

| | • | | Competitive Cost Structure.We benefit from competitive cost structures due to the lower labor costs in China as compared to other companies that produce similar products. |

Our Growth Strategies

Our objective is to become the world leader in vertically integrated production, processing and raising of all natural tilapia products. This includes the use of tilapia by-products to increase the range and variety of our marine bio and healthcare products, with a primary focus on increasing our own seafood products. To achieve this goal, we intend to implement the following strategies:

| | • | | Our newly completed large-scale feed mill to supply our existing and anticipated new cooperative fish farmers with our fish food formula. We anticipate that the new feed mill will help increase our aquatic profit margin, help guarantee our product quality and further vertically integrate our operations; |

| | • | | We intend to achieve completely organic production of our tilapia products and to pursue organic certification of our farms as market demand dictates; |

| | • | | We plan to expand direct and retail sales of our health products in China and internationally and to add other products we currently have in the development pipeline; |

| | • | | We plan to expand our development of health products by using the by-products of tilapia, which will help increase the overall aquatic products’ gross margins; |

| | • | | We plan to expand our cooperative farming arrangements to increase the availability of tilapia to meet anticipated growth in demand; |

| | • | | We plan to construct our own tilapia farmed ponds to improve growth time and quality of our product and further vertically integrate our operations; |

2

| | • | | We plan to continue to expand our production and processing facilities in China to satisfy the anticipated growing demand for our products; |

| | • | | Our Seattle office allows us to increase awareness of the importance of our all natural products and to benefit from more direct sales. The Seattle office also allows us to expand our distribution options in North America and Europe by broadening the variety of products we offer to cater to the demands of our customers; and |

| | • | | We plan to expand our product offerings, including our family of frozen tilapia meals. We will continue our branding and marketing initiatives in North America and Europe to introduce our new family of products to major retail and food service chains. |

Industry Overview

Aquaculture Industry

Aquaculture is the farming of aquatic animals or plants. Aquaculture is also the world’s fastest growing segment in the food production system and has been for the past two decades. According to a recent study by the World Food and Agriculture Organization (“FAO”) published on March 2, 2009, world fisheries production reached a new high of 143.6 million metric tonnes in 2006, including farmed and ocean caught product. The contribution of aquaculture to the world fisheries production in 2006 was 51.7 million tonnes of fish, which is 36 percent of world fisheries production up from 3.6 percent in 1970. Global aquaculture accounted for 6 percent of the fish available for human consumption in 1970. In 2006 global aquaculture accounted for 47 percent of the fish available for human consumption according to the FAO. The FAO report also describes that over half of the global aquaculture in 2006 was freshwater finfish. Based on the FAO’s projections, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach in excess of 80 million tonnes of fish by 2050.

As the availability of sites for aquaculture is becoming increasingly limited and the ability to develop non-agricultural land is often restricted, the competition to develop additional aquaculture production systems is intensifying. As the intensification for aquaculture production systems increases, the demand for institutional support, services and skilled persons is anticipated to increase, along with the demand for more knowledge-based aquaculture education and training as aquaculture becomes more important worldwide. China remains the largest producer of aquaculture products throughout the world with fishes in China reportedly producing approximately 41.3 million tonnes of fish in 2004. Within the global aquaculture industry, China accounted for 71.0% of the world’s supply of fish for direct human consumption and 29.9% of the total production by live weight in 2002.

Tilapia Industry

In 2005, according to the American Tilapia Association (“ATA”), tilapia production worldwide was second in volume to carp, and it is projected by the ATA that tilapia will become the most important aquaculture crop in this century, potentially reaching $5.0 billion in global sales by 2010. Commercial production of tilapia has become popular in many countries around the world. Touted as the “new white fish” to replace the depleted ocean stocks of cod, pollock, and hake, world tilapia production continues to rise and at least 100 countries currently raise tilapia, with the PRC being the largest producer. The American Tilapia Association further reports that world production of tilapia products reached approximately 2.5 million metric tonnes in 2007, of which China produced the dominant share of 45.0 percent.

One of the major outlets for Chinese-produced tilapia has been, and should continue to be, the United States. The following chart reflects the increase in per-capita consumption of tilapia in pounds in the United States in relation to other traditional types of seafood.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Consumer Consumption Per Capita (lbs) |

| 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008(est.) |

| Tuna | | 3.5 | | Shrimp | | 3.4 | | Shrimp | | 3.7 | | Shrimp | | 4.0 | | Shrimp | | 4.2 | | Shrimp | | 4.1 | | Shrimp | | 4.4 | | Shrimp | | 4.1 | | Shrimp | | 4.0 |

| Shrimp | | 3.2 | | Tuna | | 2.9 | | Tuna | | 3.1 | | Tuna | | 3.4 | | Tuna | | 3.4 | | Tuna | | 3.1 | | Tuna | | 2.9 | | Tuna | | 2.7 | | Tuna | | 2.6 |

| Pollock | | 1.6 | | Salmon | | 2.0 | | Salmon | | 2.0 | | Salmon | | 2.2 | | Salmon | | 2.2 | | Salmon | | 2.4 | | Salmon | | 2.0 | | Salmon | | 2.3 | | Salmon | | 2.2 |

| Salmon | | 1.5 | | Pollock | | 1.2 | | Pollock | | 1.1 | | Pollock | | 1.7 | | Pollock | | 1.7 | | Pollock | | 1.5 | | Pollock | | 1.6 | | Pollock | | 1.7 | | Pollock | | 1.6 |

| Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.0 | | Tilapia | | 1.0 | | Tilapia | | 1.1 | | Tilapia | | 1.2 |

| Cod | | 0.8 | | Cod | | 0.6 | | Cod | | 0.7 | | Cod | | 0.6 | | Tilapia | | 0.7 | | Tilapia | | 0.8 | | Catfish | | 1.0 | | Catfish | | 1.0 | | Catfish | | 1.0 |

| Clams | | 0.5 | | Clams | | 0.5 | | Crabs | | 0.6 | | Crabs | | 0.6 | | Cod | | 0.6 | | Cod | | 0.6 | | Crabs | | 0.7 | | Crabs | | 0.7 | | Crabs | | 0.7 |

| Crabs | | 0.4 | | Crabs | | 0.4 | | Clams | | 0.5 | | Tilapia | | 0.5 | | Crabs | | 0.6 | | Crabs | | 0.6 | | Cod | | 0.5 | | Cod | | 0.5 | | Clams | | 0.4 |

| Flatfish | | 0.4 | | Flatfish | | 0.4 | | Tilapia | | 0.4 | | Clams | | 0.5 | | Clams | | 0.5 | | Clams | | 0.4 | | Clams | | 0.4 | | Clams | | 0.4 | | Cod | | 0.4 |

| Scallops | | 0.3 | | Tilapia | | 0.4 | | Flatfish | | 0.4 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 |

| Tilapia | | 0.3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

3

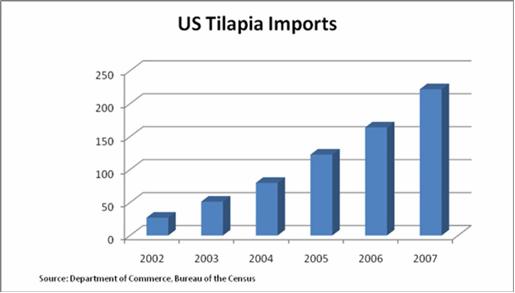

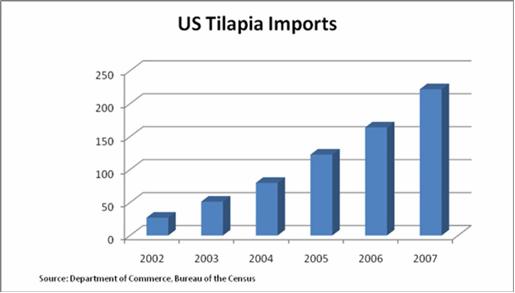

The following chart reflects the increase in imported tilapia to the United States during the periods indicated.

Separately, according to the International Trade Report produced in 2005 by the United States Department of Agriculture, or the USDA,“U.S. per-capita seafood consumption has remained around 15 billion pounds through the late 1980s and 1990s; it is expected to increase as farm-raised products become cheaper. Currently, the United States consumes nearly 12 billion pounds of fish a year. By 2025, demand for seafood is projected to grow by another 4.4 billion pounds (2 million metric tonnes) above what is consumed today. In addition, it is estimated that by 2020, 50 percent of the U.S. seafood supply will come from aquaculture. Presently, more than 70 percent of the seafood consumed in the United States is imported, and at least 40 percent of that is farm-raised. Major changes in U.S. population, along with shifting demographics and economic growth, will alter the U.S. seafood market over the next decade, affecting the selection of products consumed. It is expected that fresh and frozen fish products will account for a growing share of overall seafood consumption, with shrimp remaining at the top. By 2020, shrimp, salmon, tilapia, and catfish will be the top four seafood products consumed…”

According to Globefish.org, during the past ten years, tilapia captured by fisheries have stabilized at 0.6 million metric tonnes, while their aquaculture production has grown from 0.55 million metric tonnes to 2.0 million metric tonnes. Tilapia is one of the top five seafood imports in the world. In 2005, more than $2.4 billion of tilapia was sold worldwide according to the FAO Fishstat 2007. In 2005, tilapia moved up to the fourth-ranked most popular seafood after farm-raised shrimp, tuna and Atlantic salmon in terms of aquaculture products imported into the United States. The United States is now the world’s largest consumer of tilapia after China, having imported 437 thousand metric tonnes of tilapia in 2007. In terms of volume, frozen whole round fish ranks first, followed by frozen fillets and then fresh fillets.

The growing consumer demand for seafood is largely evolving from a new public awareness regarding its health and nutritional benefits. The USDA “pyramid” guidelines continue to support frequent fish consumption, and the USDA recently completed a highly technical nutritional analysis report about tilapia for the general public. The USDA’s Agriculture Research Service Lab reports that tilapia is moderate in polyunsaturated fatty acid (0.387 g/100g raw, 0.600 g/100g cooked), moderate in omega 3 fatty acids (0.141g/100g raw, 0.220g/100g cooked) and low in mercury (0.010 parts per million, which we refer to as PPM), which is considered to be non-detectable. With the increased awareness of the health concerns surrounding mercury, tilapia’s low mercury levels (0.010 PPM) distinguish tilapia favorably from other types of fish with higher mercury levels, such as swordfish (0.976 PPM), mackerel (0.730 PPM) and yellow fin tuna (0.325 PPM).

Over-the-Counter Marine Bio and Healthcare Products

As in the United States, because of the aging population, China is demographically attractive for healthcare companies. According to China’s Ministry of Health 2009 figures, of the 1.3 billion people in China currently, less than 8 percent of China’s population is 65 or older; however, by 2050 that proportion is expected to rise to 24 percent. It is expected as well that Chinese will benefit from double-digit annual growth in disposable incomes during this period. We anticipate that this will lead to increasing use of western therapeutics and “over the counter” remedies. In addition, the market place is highly fragmented with more than 4,000 manufacturers of such remedies in China, most of whom lack scale and access to capital. From 2009 to 2011, we believe approximately $124 billion will be allocated to healthcare expenditure in China. HQS has benefited from regulatory consolidation that resulted in the imposition of higher Chinese Good Manufacturing Practice (“GMP”) standards in 2007 and intends to be a leader in its emphasis on the highest quality standards.

4

The marine bio and healthcare products industry in China is also sizable, with approximately $6 billion in sales, which still constitutes only 3 percent of the world market. Currently, overall sales of these products in China have fallen slightly as compared to the previous year, as consumers gravitate toward branded products meeting international quality standards and with proven benefit for consumers, and away from less known brands and traditional remedies.

In general, sales of marine bio and healthcare products are made through retail and direct sales channels. Direct sales in China are relatively new, and restrictions on direct sales imposed on large foreign companies have been implemented in China, which has allowed for a growth in sales for PRC-based direct sales companies. These restrictions require foreign direct sellers to manufacture their products and to capitalize their businesses in China. Several companies have met these requirements, including HQS through its PRC-subsidiaries, and growth in this sector is expected to be strong in the next few years.

We believe that nutraceutical supplements in the feed industry is a sector that has strong growth potential, as the importance of aquaculture and aquaculture feeds increases. We manufacture actualized feeds, which involves choosing additives to be included in the feed, such as vitamin E, that promote health in fish, thus reducing the need for curative measures such as antibiotics. Once ingested and present in the flesh of the fish, vitamin E increases the shelf life of the fish and also introduces an additional source of vitamin E to its consumers. Other similar nutraceutical supplements can also be used.

5

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information contained in this prospectus and in the documents incorporated by reference into this prospectus, before investing in our common stock. If any of the events anticipated by the risks described below occur, our results of operations and financial condition could be adversely affected which could result in a decline in the market price of our common stock, causing you to lose all or part of your investment.

Risks Relating To Our Business

We rely on cooperative suppliers and any adverse changes in these relationships may adversely affect us.

We have developed a network of aquaculture farmers in Hainan Province for the supply of tilapia and shrimp by entering into cooperative supply agreements. Pursuant to the cooperative supply agreements, we are assured the necessary supply of aquatic products that meet our quality standards. Smooth continual operation of this cooperative network is essential in controlling our costs, meeting quality standards and the timely fulfillment of our customer orders. Any adverse change to our cooperative network, including any early termination or non-renewal of any supply agreement or any failure of suppliers to fulfill their obligations under the supply agreements, could have a material adverse effect on our business model, operations and competitiveness.

We may require additional capital in the future, which may not be available on favorable terms or at all.

Our future capital requirements will depend on many factors, including industry and market conditions, our ability to successfully implement our branding and marketing initiatives and expansion of our production capabilities. We anticipate that we may need to raise additional funds in order to grow our business and implement our business strategy. We anticipate that any such additional funds would be raised through equity or debt financings. In addition, we may enter into a revolving credit facility or a term loan facility with one or more syndicates of lenders. Any equity or debt financing, if available at all, may be on terms that are not favorable to us. Even if we are able to raise capital through equity or debt financings, as to which there can be no assurance, the interest of existing stockholders in our company will be diluted, and the securities we issue may have rights, preferences and privileges that are senior to those of our common stock or may otherwise materially and adversely affect the holdings or rights of our existing stockholders. If we cannot obtain adequate capital, we may not be able to fully implement our business strategy, and our business, results of operations and financial condition would be adversely affected. In addition, we have and will continue to raise additional capital through private placements or registered offerings, in which broker-dealers will be engaged. The activities of such broker-dealers are highly regulated and we cannot assure that the activities of such broker-dealers will not violate relevant regulations and generate liabilities despite our expectation otherwise.

We depend on the availability of additional human resources for future growth.

We have recently experienced a period of significant growth in our sales volume. We believe that continued expansion is essential for us to remain competitive and to capitalize on the growth potential of our business. Such expansion may place a significant strain on our management and operations and financial resources. As our operations continue to grow, we will have to continually improve our management, operational and financial systems, procedures and controls, and other resources infrastructure, and expand our workforce. There can be no assurance that our existing or future management, operating and financial systems, procedures and controls will be adequate to support our operations, or that we will be able to recruit, retain and motivate our personnel. Further, there can be no assurance that we will be able to establish, develop or maintain the business relationships beneficial to our operations, or to do so or to implement any of the above activities in a timely manner. Failure to manage our growth effectively could have a material adverse effect on our business and the results of our operations and financial condition.

We depend on our key management personnel, and the loss of any of their services could materially adversely affect us.

Our operations are dependent upon the experience and expertise of a small number of key management personnel, which includes Lillian Wang Li, our Chairman of the Board, Norbert Sporns, our Chief Executive Officer and President, and Harry Wang Hua, our Chief Operating Officer. Lillian Wang Li and Harry Wang Hua are brother and sister, and Ms. Wang Li is married to Norbert Sporns. Although we have obtained life insurance on Ms. Wang Li and have begun the process of obtaining life insurance on Mr. Sporns, the loss of the services of any of these key personnel for any reason would likely have a material adverse effect on our business, and the results of our operations and financial condition, or could delay or prevent us from fully implementing our business strategy.

A few of our customers account for a significant portion of our business.

We have derived, and over the near term we expect to continue to derive, a significant portion of our sales from a limited number of customers. For example, our five largest customers accounted for a total of 38.6 percent of our consolidated sales for the year ended December 31, 2008, and they are all related to the aquaculture product segment. At December 31, 2008, approximately 46.3 percent of our trade receivables was from transactions with these five largest customers. The loss of any of these customers or non-payment of outstanding amounts due to the company from these customers could materially and adversely affect our results of operations, financial position and liquidity.

6

We may be unable to continue to take advantage of the seasonal pricing fluctuation in sales of our products, and we may be adversely affected by the seasonal fluctuation in the prices we earn for our products.

We have experienced seasonal fluctuation in the prices we earn for our products, generally in the range of 15 to 20%. Pricing fluctuation occurs during the winter season when fish farms in the northern part of the PRC suspend production due to cold weather conditions. These weather related disruptions in supply permit us to increase the sales prices of our tilapia products. However, there can be no assurance that such premium pricing, benefiting our profitability, can be maintained in the future. Other factors, such as an increase in the cost of feed, might also adversely impact on the cost of fish and lessen our margins and profitability.

Any adverse changes in the supply of our tilapia and other raw materials, including contamination or disease or increased costs of raw materials, may adversely affect our operations or reduce our margins or profits.

We are dependent on the availability of raw materials from Hainan Province and the oceans in that region. The supply of these raw materials can be adversely affected by any material change in the climatic or environmental conditions in and around Hainan Province. In addition, if there is contamination resulting from disease, pollution or other foreign substances, our supply of raw materials could be jeopardized or disrupted. The shortage or lack of raw materials and any consequential change in their cost would, in turn, have a material adverse effect on the cost on our operations and margins and our ability to provide products to our customers.

Any actual contamination of our products resulting from processing, packaging or transit of our products, or negative press from contamination experienced by other companies in our industry may adversely affect our operations or reduce our margins or profits.

We actively seek to control the quality of our products and avoid risk of contamination in our processing, packaging and distribution of such products; however no quality control program is guaranteed to be completely effective. We are dependent on others for the reliable safe transportation of our products to the market place and the quality of our final product as experienced by the consumer may be impacted by disruptions in the transit process beyond our control. In addition, if our competitors experience problems with contamination of their products, even if we do not concurrently suffer similar adverse events, publicity of such problems could negatively impact our reputation. Actual contamination or reports of industry problems with contamination or poor quality may have a material adverse effect on our operations, including an increase in product liability claims, higher quality control and transport costs, reduced margins and decreased consumer interest in our products.

We may be adversely affected by the fluctuation in raw material prices and selling prices of our products.

Neither our products nor the raw materials we use have experienced any significant price fluctuations since we began operation, but there is no assurance that they will not be subject to future price fluctuations or pricing control. The products and raw materials we use may experience price volatility caused by events such as market fluctuations or changes in governmental programs. The market price of these raw materials may also experience significant upward adjustment, if, for instance, there is a material under-supply or over-demand in the market. These price changes may ultimately result in increases in the selling prices of our products, and may, in turn, adversely affect our sales volume, revenue and operating profit.

We could be adversely affected by the occurrence of natural disasters in Hainan Province.

From time to time, Hainan Province experiences typhoons, particularly from June through September of any given year. Natural disasters could impede operations, damage infrastructure necessary to our operations or adversely affect the logistical services to and from Hainan Province. Even though we currently have insurance against damages caused by natural disasters, including typhoons, accidents or similar events, the occurrence of natural disasters in Hainan Province could adversely affect our business, the results of our operations, prospects and financial condition, through business disruptions and/or any losses in excess of our policy limits.

Intense competition from existing and new entities may adversely affect our revenues and profitability.

In general, the aquaculture industry is intensely competitive and highly fragmented. We compete with various companies, many of which are developing or can be expected to develop products similar to ours. For example, 8th Sea–The Organic Seafood Company currently produces and processes tilapia fillets in Brazil’s Parana state. Many of our competitors are more established than we are and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We intend to create greater awareness for our brand name in an attempt to successfully compete with our competitors. We cannot assure you that we will be able to compete effectively or successfully with current or future competitors or that the competitive pressures we face will not harm our business.

7

Our operating subsidiaries must comply with environmental protection laws that could adversely affect our profitability.

We are required to comply with the environmental protection laws and regulations promulgated by the national and local governments of the PRC. Some of these regulations govern the level of fees payable to government entities providing environmental protection services and the prescribed standards relating to the discharge of effluent, or liquid waste. Yearly inspections of waste treatment systems require the payment of a license fee which could become a penalty fee if standards are not maintained. Currently, our plant treats all of its effluent completely to level one, which is consistent with releasing potable water back to the environment, and there is currently no charge being levied. Although our production technologies allow us to efficiently control the level of pollution resulting from our production process, and notwithstanding the fact that we have received evidence of compliance with environmental protection requirements from government authorities, due to the nature of our business, effluent wastes are unavoidably generated in the aquaculture production processes. If we fail to comply with any of these environmental laws and regulations in the PRC, depending on the types and seriousness of the violation, we may be subject to, among other things, warning from relevant authorities, imposition of fines, specific performance and/or criminal liability, forfeiture of profits made, being ordered to close down our business operations and suspension of relevant permits.

Our operations, revenue and profitability could be adversely affected by changes in laws and regulations in the countries where we do business.

The governments of countries into which we sell our products, including the United States, Canada and the European Union, from time to time, consider regulatory proposals relating to raw materials, food safety and markets, and environmental regulations, which, if adopted, could lead to disruptions in distribution of our products and increase our operational costs, which, in turn, could affect our profitability. To the extent that we increase our product prices as a result of such changes, our sales volume and revenues may be adversely affected.

Furthermore, these governments may change import regulations or impose additional taxes or duties on certain Chinese imports from time to time. For example, in 2004, the United States government imposed heavy tariffs of more than 100 percent on certain Chinese shrimp exporters. Similar regulations and fees or new regulatory developments may have a material adverse impact on our operations, revenue and profitability. If one or more of the countries into which we sell our products bars the import or sale of fish or related products from China, our available market would shrink significantly, adversely impacting our results of operations and growth potential.

Our business could be adversely affected by the recent negative public reports on seafood imported from China.

In June 2007, the U.S. Food and Drug Administration issued an alert report on the sale of five types of farm-raised seafood from China in the United States because of unapproved chemical residues. The five types of farm-raised seafood are shrimp, catfish, eel, basa and dace. As a result, in order for the seafood to be sold in the United States, importers must provide independent testing that shows the seafood does not contain the unapproved residues. Although tilapia is not included in the list and we believe our main seafood product, which is tilapia, does not contain any of the unapproved residues, it is possible that our business may be adversely impacted as a result of the recent negative public reports on seafood imported from China.

There could be changes in the policies of the PRC government that may adversely affect our business.

The aquaculture industry in the PRC is subject to policies implemented by the PRC government. The PRC government may, for instance, impose control over aspects of our business such as distribution of raw materials, product pricing and sales. If the raw materials used by us or our products become subject to any form of government control, then depending on the nature and extent of the control and our ability to make corresponding adjustments, there could be a material adverse effect on our business and operating results.

Separately, our business and operating results also could be adversely affected by changes in policies of the Chinese government such as: changes in laws, regulations or the interpretation thereof; confiscatory taxation; restrictions on currency conversion, imports on sources of supplies; or the expropriation or nationalization of private enterprises. Although the Chinese government has been pursuing economic reform policies for approximately two decades to liberalize the economy and introduce free market aspects, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting China’s political, economic and social life.

8

Certain political and economic considerations relating to PRC could adversely affect our company.

The PRC is passing from a planned economy to a market economy. The Chinese government has confirmed that economic development will follow a model of market economy under socialism. While the PRC government has pursued economic reforms since its adoption of the open-door policy in 1978, a large portion of the PRC economy is still operating under five-year plans and annual state plans adopted by the government that set down national economic development goals. Through these plans and other economic measures, such as control on foreign exchange, taxation and restrictions on foreign participation in the domestic market of various industries, the PRC government exerts considerable direct and indirect influence on the economy. Many of the economic reforms are unprecedented or experimental for the PRC government, and are expected to be refined and improved. Other political, economic and social factors can also lead to further readjustment of such reforms. This refining and readjustment process may not necessarily have a positive effect on our operations or future business development. Our operating results may be adversely affected by changes in the PRC’s economic and social conditions as well as by changes in the policies of the PRC government, which we may not be able to foresee, such as changes in laws and regulations (or the official interpretation thereof), measures which may be introduced to control inflation, changes in the rate or method of taxation, and imposition of additional restrictions on currency conversion.

The recent nature and uncertain application of many PRC laws applicable to us create an uncertain environment for business operations and they could have a negative effect on us.

The PRC legal system is a civil law system. Unlike the common law system, such as the legal system used in the United States, the civil law system is based on written statutes in which decided legal cases have little value as precedents. In 1979, the PRC began to promulgate a comprehensive system of laws and has since introduced many laws and regulations to provide general guidance on economic and business practices in the PRC and to regulate foreign investment. Progress has been made in the promulgation of laws and regulations dealing with economic matters such as corporate organization and governance, foreign investment, commerce, taxation and trade. The promulgation of new laws, changes of existing laws and the abrogation of local regulations by national laws could have a negative impact on our business and business prospects. In addition, as these laws, regulations and legal requirements are relatively recent, their interpretation and enforcement involve significant uncertainty.

If relations between the United States and China worsen, we may be unable to serve a portion of our customer base, our stock price may decrease and we may have difficulty accessing the U.S. capital markets.

At various times during recent years, the United States and China have had disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China could adversely affect our ability to continue to sell to U.S. customers, the value of our securities and our ability to access U.S. capital markets.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. Currently, the Renminbi is not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency denominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of loans and corporate debt obligations denominated in foreign currencies.

The PRC government may also at its discretion restrict access in the future to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

The fluctuation of the Renminbi may materially and adversely affect your investment.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC’s political and economic conditions. Any significant revaluation of the Renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. dollars into Renminbi for our operations, appreciation of the Renminbi against the U.S. dollar could have a material adverse effect on our business, financial condition and results of operations.

Conversely, if we decide to convert our Renminbi into U.S. dollars for the purpose of making dividend payments on our common or preferred stock or for other business purposes and the U.S. dollar appreciates against the Renminbi, the U.S. dollar equivalent of the Renminbi we convert would be reduced. Any significant devaluation of Renminbi may reduce our operation costs in U.S. dollars but may also reduce our earnings in U.S. dollars. In addition, the depreciation of significant U.S. dollar denominated assets could result in a charge to our income statement and a reduction in the value of these assets.

9

Commencing from July 21, 2005, China has adopted a managed floating exchange rate regime based on market demand and supply with reference to a basket of currencies. The exchange rate of the US dollar against the RMB was adjusted from approximately RMB 8.28 per US dollar to approximately RMB 8.11 per US dollar on July 21, 2005. Since then, The People’s Bank of China administers and regulates the exchange rate of US dollar against RMB taking into account demand and supply of RMB, as well as domestic and foreign economic and financial conditions.

In addition, there can be no assurance that we will be able to obtain sufficient foreign exchange to pay dividends or satisfy other foreign exchange requirements in the future. We currently do not intend to pay dividends.

It may be difficult to effect service of process and enforcement of legal judgments upon our company and our officers and directors because some of them reside outside the United States.

As our operations are presently based in China and some of our key directors and officers reside outside the United States, service of process on our key directors and officers may be difficult to effect within the United States. Also, substantially all of our assets are located outside the United States and any judgment obtained in the United States against us may not be enforceable outside the United States. We have appointed Norbert Sporns, our Chief Executive Officer and President, as our agent to receive service of process in any action against our company in the United States.

Risks Relating to our Common Stock

There are a large number of shares underlying our Series A preferred stock and warrants that may be available for future sale and the sale of these shares may depress the market price of our common stock.

As of October 23, 2009, we had 14,657,163 shares of common stock issued and outstanding. We currently have outstanding Class B warrants to purchase up to 114,583 shares of our common stock and stock purchase warrants to purchase up to 30,000 shares of our common stock issued in connection with the November 2006 financing. In addition, we currently have 100,000 shares of Series A preferred stock issued and outstanding, and the holders of our Series A preferred stock have an option right to convert each share of Series A Preferred Stock into 0.1 shares of our common stock. These shares, including all of the shares issuable upon conversion of our Series A preferred stock and upon exercise of our warrants, may be sold into the market place currently. The sale of these shares may adversely affect the market price of our common stock.

Our principal stockholders, current executive officers and directors own a significant percentage of our company and will be able to exercise significant influence over our company.

Our executive officers and directors and principal stockholders together beneficially own approximately 90.10% of the total voting power of our outstanding voting capital stock, primarily as a result of their ownership of Series A preferred stock of our company which, while convertible into shares of our common stock on a 0.1-for-1 basis, carries 1,000 votes per Series A preferred share rather than the 1 vote per share of our common stock. The Series A preferred stock and the common stock vote together as one class on all matters to be voted upon by the stockholders. In particular, our three largest stockholders, Mr. Sporns, Ms. Wang Li and Mr. Wang Hua, are family members who share approximately 90.06% of the total voting power of our company. Ms. Wang Li is the wife of Mr. Sporns and Mr. Wang Hua is the brother of Ms. Wang Li. These stockholders will be able to determine the composition of our board of directors, will retain the voting power to approve all matters requiring stockholder approval and will continue to have significant influence over our affairs. This concentration of ownership could have the effect of delaying or preventing a change in our control or otherwise discouraging a potential acquirer from attempting to obtain control of us, which in turn could have a material and adverse effect on the market price of the common stock or prevent our stockholders from realizing a premium over the market prices for their shares of common stock.

Investors may experience dilution from any exercise of warrants.

We currently have outstanding Class B warrants to purchase up to 114,583 shares of our common stock and stock purchase warrants to purchase up to 30,000 shares of our common stock. The Class B warrants expire on January 25, 2011 and the stock purchase warrants expire on December 28, 2011.

10

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement, and the documents we incorporate by reference in this prospectus contain forward-looking statements within the meaning of Section 27A of the Securities Act (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements involve known and unknown risks, uncertainties and other important factors which may cause our actual results, performance or achievements to be materially different from any future results, performances or achievements expressed or implied by the forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| | • | | our marketing, sales and distribution initiatives in North America, Europe and China; |

| | • | | our estimates of production, market sizes and anticipated consumption of our marine bio and healthcare products and our aquaculture products; |

| | • | | our new organic feed mill and our current and future processing facilities; |

| | • | | our ability to enter into and maintain cooperative farming arrangements and other partnerships with respect to our marine bio products and the performance of our partners under such arrangements; |

| | • | | our relationship with local governments in Hainan Province and the potential support and financing they may provide to us; |

| | • | | our estimates of future performance and growth potential; |

| | • | | our ability to obtain sufficient capital to fund our operations and expansion plans; and |

| | • | | our operating income, future revenue, expenses, capital requirements and needs for additional financing. |

In some cases, you can identify forward-looking statements by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “would” and similar expressions intended to identify forward-looking statements. Forward-looking statements reflect our current views with respect to future events and are based on assumptions and subject to risks and uncertainties. These risks and uncertainties include, among others, those set forth above under the heading “Risk Factors,” and in the other documents that we file with the Securities and Exchange Commission (the “SEC”). There are also other risks and uncertainties that we may not describe, generally because we currently do not perceive them to be material, which could cause actual results to differ materially from our expectations. Because of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus and in any prospectus supplement may not transpire.

Given these uncertainties, you should not place undue reliance on these forward-looking statements. You should read this document, any supplements to this document and the documents that we reference in this prospectus with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we do not undertake any obligation to update or revise any forward-looking statements contained in this prospectus and any supplements to this prospectus, whether as a result of new information, future events or otherwise.

11

USE OF PROCEEDS

This prospectus relates to shares of our common stock that may be offered and sold from time to time by the selling stockholders. We will not receive any proceeds from the sale of shares of common stock in this offering. However, we may receive proceeds from the exercise of the warrants, if any. We expect to use the proceeds received from the exercise of the warrants, if any, for general working capital purposes.

DESCRIPTION OF CAPITAL STOCK

General

The following description summarizes the material terms and provisions of our capital stock. The following summary description of our common stock and preferred stock is based on the provisions of our certificate of incorporation and by-laws, which are incorporated by reference, and the applicable provisions of Delaware General Corporation Law. This information is only a summary and is qualified in its entirety by reference to our certificate of incorporation and by-laws and the applicable provisions of Delaware General Corporation Law.

Our authorized capital stock consists of 200,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share, of which 100,000 are designated as Series A preferred stock.

Common Stock

Authorized. We currently have authority to issue up to 200,000,000 shares of common stock, par value $0.001 per share.

Voting. Each holder of common stock is entitled to one vote for each share owned on all matters voted upon by stockholders. In addition, our Series A preferred stock is entitled to vote on all matters to be voted on by holders of our common stock. The Series A preferred stock is entitled to 1,000 votes per share. A majority vote is required for all actions to be taken by stockholders, except that a plurality is required for the election of directors. The common stock has no preemptive rights, no cumulative voting rights and no redemption, sinking fund or conversion provisions.

Dividends. Holders of common stock are entitled to receive dividends, if and when declared by our board of directors, out of funds legally available for such purpose, subject to the dividend and liquidation rights of any preferred stock that may then be outstanding, including, but not limited to, the Series A preferred stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. In addition, as stipulated by the relevant laws and regulations for enterprises operating in the PRC, Hainan Quebec Ocean Fishing Co. Ltd. and Jiahua Marine are required to make annual appropriations to two reserve funds, consisting of the statutory surplus and public welfare funds, which amounts are not available for the payment of dividends. As a result, we do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds to legally pay dividends.

Liquidation and Dissolution. In the event we liquidate, dissolve or wind-up our operations, the holders of the common stock are entitled to share equally and ratably in our assets, if any, remaining after the payment of all our debts and liabilities and the liquidation preference of any shares of preferred stock that may then be outstanding.

Fully Paid and Nonassessable. All shares of our outstanding common stock are fully paid and nonassessable and any additional shares of common stock that we issue will be fully paid and nonassessable.

Listing. Our common stock is listed on the NYSE Amex under the symbol “HQS.”

Transfer Agent and Registrar. The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, NY 10038.

Preferred Stock

Under the terms of our certificate of incorporation, our board of directors has the authority, without further action by the stockholders and subject to the limits imposed by Delaware General Corporation Law, to issue up to 10,000,000 shares of preferred stock, par value $0.001 per share, in one or more series and to designate the rights, preferences, privileges and restrictions of each

12

such series. The issuance of preferred stock could have the effect of restricting dividends on the common stock, diluting the voting power for the common stock, impairing the liquidation rights of the common stock or delaying or preventing a change in control without further action by the stockholders.

Series A Preferred Stock

Authorized. Of the 10,000,000 shares of preferred stock we are authorized to issue, 100,000 shares have been designated as Series A preferred stock. All of the 100,000 shares of Series A preferred stock are issued and outstanding.

Voting. Each holder of shares of our Series A preferred stock is entitled to 1,000 votes per share on all matters to be voted on by holders of our common stock;provided, however, that the vote or consent of the holders of at least a majority of the shares of Series A preferred stock then outstanding is required for us to (1) authorize, create or issue, or increase the authorized number of shares of, any class or series of capital stock ranking prior to or on a parity with the Series A preferred stock either as to dividends or liquidation; (2) authorize, create or issue any class or series of our stock other than the common stock; (3) authorize any reclassification of the Series A preferred stock; (4) authorize, create or issue any securities convertible into or exercisable for capital stock prohibited by clauses (1) through (3) above; (5) amend our certificate of incorporation; or (6) enter into any disposal, merger or reorganization involving 20% of our total capitalization.

Conversion Rights. The holders of our Series A preferred stock have an optional right to convert each share of Series A preferred stock into 0.1 shares of our common stock.

Dividends. Subject to the rights of the holders of any class or series of capital stock ranking senior to or on parity with the Series A preferred stock, the holders of our Series A preferred stock have the right to receive cumulative dividends when and as declared by the board of directors.

Liquidation. The holders of our Series A preferred stock have the right to receive a liquidation preference of $1.00 per share of Series A preferred stock, plus an amount equal to all dividends accrued and unpaid, in preference to the holders of our common stock or any other class or series of capital stock ranking junior to the Series A preferred stock. This liquidation preference will be adjusted to reflect any stock dividend, stock distribution or stock split with respect to the Series A preferred stock.

Reaquired Shares. Any shares of Series A preferred stock acquired by us will be retired and not reissued.

Warrants

Class A and Class B Warrants

The Class A warrants expired in January 2009.

The Class B warrants can be exercised at any time until January 25, 2011. The adjusted exercise price of the Class B warrants is $6.00 per share. The number of shares of common stock or other securities at the time issuable upon exercise of such warrants will be appropriately adjusted to reflect any stock dividend, stock split, combination of shares, reclassification, recapitalization or other similar event affecting the number of outstanding shares of stock or securities. In case of any consolidation or merger by us with or into any other corporation, entity or person, or any other corporate reorganization, in which we shall not be the continuing or surviving entity of such consolidation, merger or reorganization (any such transaction being hereinafter referred to as a “Reorganization”), then, in each case, the holder of the warrants on exercise any time after the consummation or effective date of such Reorganization (such date, the “Effective Date”), shall receive, in lieu of the shares of stock or other securities at any time issuable upon the exercise of the warrants prior to the Effective Date, the stock and other securities and property (including cash) to which such holder would have been entitled upon the Effective Date if such holder had exercised the warrants immediately prior thereto.

The Class B warrants can be exercised pursuant to a cashless exercise. Under the terms of the warrants, the holders thereof agreed not to elect for a period of one (1) year from the date of issuance a cashless exercise of the warrants and also agreed not to elect a cashless exercise so long as there is an effective registration statement for the shares underlying the respective warrants. As of October 23, 2009, there were outstanding Class B warrants to purchase up to 114,583 shares of common stock.

Class C and Class D Warrants

The Class C and Class D warrants expired in April 2009.

13

Stock Purchase Warrants

We issued non-denominated stock purchase warrants in connection with our November 2006 financing. These stock purchase warrants have an adjusted exercise price of $5.00 per share and expire on December 28, 2011. These stock purchase warrants can be exercised on a cashless basis. As of October 23, 2009, there were outstanding non-denominated stock purchase warrants to purchase up to 30,000 shares of our common stock.

Anti-Takeover Effects of Provisions of Delaware Law,Our Certificate of Incorporation and By-laws

Some provisions of Delaware General Corporation Law, our certificate of incorporation and our by-laws contain provisions that could make the following transactions more difficult: acquisition of us by means of a tender offer; acquisition of us by means of a proxy contest or otherwise; or removal of our incumbent officers and directors.

These provisions, summarized below, are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors. We believe that the benefits of increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging these proposals because negotiation of these proposals could result in an improvement of their terms.

Business Combinations. We are subject to the provisions of Section 203 of Delaware General Corporation Law. Subject to certain exceptions, Section 203 prohibits a Delaware corporation from engaging in a “business combination” with an “interested stockholder” for a period of three years after the person became an interested stockholder, unless the business combination is approved in a prescribed manner. A “business combination” includes mergers, asset sales and other transactions resulting in a financial benefit to the interested stockholder. Subject to exceptions, an “interested stockholder” is a person who, together with affiliates and associates, owns, or within the prior three years did own, 15% or more of the corporation’s voting stock.

Undesignated Preferred Stock. The ability to authorize undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control of us. These and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of our company.

Stockholder Action; Special Meeting of Stockholders. Our by-laws provide that action required or permitted to be taken by our stockholders at an annual meeting of stockholders may only be taken if it is properly brought before the meeting. Our by-laws also provide that special meetings of stockholders may only be called by the chairman of our board or by a majority of our board of directors. These provisions could have the effect of delaying until the next stockholders’ meeting stockholder actions which are favored by the holders of a majority of our outstanding voting securities.

Advance Notice Requirements for Stockholder Proposals and Director Nominations. Our by-laws provide that nominations for election to our board of directors may be made either by our board of directors (or a proxy committee appointed by the board of directors) or by any stockholder who complies with specified notice provisions. Our by-laws contain similar advance notice provisions for stockholder proposals for action at stockholder meetings. These provisions prevent stockholders from making nominations for directors and stockholder proposals from the floor at any stockholder meeting and require any stockholder making a nomination or proposal to submit the name of the nominees for board seats or the stockholder proposal, together with specified information about the nominee or any stockholder proposal, prior to the meeting at which directors are to be elected or action is to be taken. These provisions ensure that stockholders have adequate time to consider nominations and proposals before action is required, and they may also have the effect of delaying stockholder action.

Limitation of Liability and Indemnification Provisions

Our certificate of incorporation contains provisions permitted under Delaware General Corporation Law relating to the liability of directors. The provisions eliminate a director’s liability for monetary damages for a breach of fiduciary duty, except to the extent that the elimination or limitation of such liability is not permitted by Delaware General Corporation Law. The limitation of liability described above does not alter the liability of our directors and officers under federal securities laws. Furthermore, our certificate of incorporation contains provisions to indemnify our directors and officers to the fullest extent permitted by Delaware General Corporation Law.

14

SELLING STOCKHOLDERS