UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

HQ Sustainable Maritime Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

1511 Third Avenue

Suite 788

Seattle, Washington 98101

(206) 621-9888

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 30, 2007

The Annual Meeting of Stockholders (the “Annual Meeting”) ofHQ SUSTAINABLE MARITIME INDUSTRIES, INC., a Delaware corporation (the “Company”), will be held at 5:00, local time, on November 30, 2007 at One Southeast Third Avenue, Ste 1400, Miami, FL, for the following purposes:

| | (1) | To elect the Company’s Board of Directors to hold office until the next Company’s Annual Meeting of Stockholders or until his successor is duly elected and qualified; and |

| | (2) | To ratify the appointment of Rotenberg & Co. LLP, as the Company’s independent certified public accountant; and |

| | (3) | To transact such other business as may properly come before the Annual Meeting and any adjournment thereof. |

The Board of Directors has fixed the close of business on October 1, 2007, as the record date for determining those Stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof.

| | |

| | By Order of the Board of Directors |

| |

| Seattle, Washington | | /s/ Norbert Sporns |

| September 19, 2007 | | NORBERT SPORNS |

| | CHIEF EXECUTIVE OFFICER |

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

1511 Third Avenue

Suite 788

Seattle, Washington 98101

(206) 621-9888

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors ofHQ SUSTAINABLE MARITIME INDUSTRIES, INC., a Delaware corporation (the “Company”), of proxies from the holders of the Company’s common stock, par value $.001 per share (the “Common Stock”), for use at the Annual Meeting of Stockholders of the Company to be held at 5:00, local time, on November 30, 2007 at One Southeast Third Avenue, Ste 1400, Miami, FL,or at any adjournment thereof (the “Annual Meeting”), pursuant to the enclosed Notice of Annual Meeting of Stockholders.

The approximate date that this Proxy Statement and the enclosed form of proxy are first being sent to Stockholders is October 1, 2007. Stockholders should review the information provided herein in conjunction with the Company’s 2006 Annual Report, which was filed with the Securities and Exchange Commission on March 20, 2007 (and amended on March 27, 2007) and the Company’s quarterly filings on Form 10-Q and other filings with the Securities and Exchange Commission. The Company’s principal executive offices are located at 1511 Third Avenue, Suite 788, Seattle, Washington 98101. Our telephone number is (206) 621-9888

INFORMATION CONCERNING PROXY

The enclosed proxy is solicited on behalf of the Company’s Board of Directors. Stockholders who hold their shares through an intermediary must provide instructions on voting as requested by their bank or broker. The giving of a proxy does not preclude the right to vote in person should any shareholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise thereof, either in person at the Annual Meeting or by filing with the Company’s President at the Company’s executive office a written revocation bearing a later date or duly executed, a subsequent proxy relating to the same shares of common stock; however, no such revocation will be effective until written notice of the revocation is received by the Company at or prior to the Annual Meeting.

The cost of preparing, assembling and mailing this Proxy Statement, the Notice of Annual Meeting of Stockholders and the enclosed proxy will be borne by the Company. In addition to the use of the mail, employees of the Company may solicit proxies personally and by telephone. The Company’s employees will receive no compensation for soliciting proxies other than their regular salaries. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. The Company may reimburse such persons for their expenses in so doing.

OTHER MATTERS; DISCRETIONARY VOTING

Our Board of Directors does not know of any matters, other than as described in the notice of Meeting attached to this Proxy Statement, that are to come before the Meeting.

The Board of Directors does not intend to present any business at the Annual Meeting other than the proposals described in this proxy statement. However, if any other matter properly comes before the Annual Meeting, including any stockholder proposal omitted from the proxy statement and form of proxy pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, your proxies will act on such matter in their discretion.

1

If the requested proxy is given to vote at the Meeting, the persons named in such proxy will have authority to vote in accordance with their best judgment on any other matter that is properly presented at the Meeting for action, including without limitation, any proposal to adjourn the Meeting or otherwise concerning the conduct of the Meeting.

RIGHT TO REVOKE PROXIES

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by:

| | • | | filing with the President of the Company, before the polls are closed with respect to the vote, a written notice of revocation bearing a later date than the proxy; |

| | • | | duly executing a subsequent proxy relating to the same shares of common stock and delivering it to the President of the Company; or |

| | • | | attending the Meeting and voting in person (although attendance at the Meeting will not in and of itself constitute a revocation of a proxy). |

Any written notice revoking a proxy should be sent to: Our principal executive office at 1511 Third Avenue, Suite 788, Seattle, Washington 98101. No such revocation will be effective until written notice of the revocation is received by the Company prior to the Annual Meeting.

PURPOSE OF THE MEETING

At the Annual Meeting, the Company’s Stockholders will consider and vote upon the following matters:

| | (1) | To elect the Company’s Board of Directors to hold office until the next Company’s Annual Meeting of Stockholders or until his successor is duly elected and qualified; and |

| | (2) | To ratify the appointment of Rotenberg & Co. LLP, as the Company’s independent certified public accountant; and |

| | (3) | To transact such other business as may properly come before the Annual Meeting and any adjournment thereof. |

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth above) will be voted (a) FOR the election of the nominees for director(s) named below; and (b) FOR the proposal to ratify the appointment of Rotenberg & Co. LLP, as the Company’s independent certified public accountant. In the event a shareholder specifies a different choice by means of the enclosed proxy, such shareholder’s shares will be voted in accordance with the specification so made.

2

MARKET FOR COMMON EQUITY AND OTHER STOCKHOLDER MATTERS

The Company trades on the American Stock Exchange under the symbol “HQS.” Inclusion on the American Stock Exchange permits price quotation for our shares to be published by such service.

OUTSTANDING VOTING SECURITIES AND VOTING RIGHTS

The Board of Directors has set the close of business on October 1, 2007 as the record date (the “Record Date”) for determining Stockholders of the Company entitled to receive notice of and to vote at the Annual Meeting. As of the date herein there are 8,037,420 shares of Common Stock, $.0001 par value (the “Common Stock”) issued and outstanding, all of which are entitled to be voted at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter submitted to Stockholders for approval at the Annual Meeting. In addition, the Company has Preferred stock, $0.001 par value, 10,000,000 shares authorized, of which 100,000 Class A Preferred Stock (“Series A Preferred Stock” and collectively with the Common Stock, the “capital shares”) are issued and outstanding. Each share of Class A Preferred Stock has 1,000 votes on all matters presented to be voted by the holders of common stock the Common Stock and the

The presence, in person or by proxy, of at least a majority of the total number of capital shares outstanding on the Record Date will constitute a quorum for purposes of the Annual Meeting. If less than a majority of the outstanding capital shares are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting from time to time without further notice. A plurality of the votes cast by holders of capital shares will be required for the election of directors. The ratification of the appointment of Rotenberg & Co. LLP as the Company’s independent certified public accountant will be approved if the number of capital shares voted in favor of ratification exceeds the number of shares voted against it. Abstentions and broker non-votes will be counted as shares present at the Annual Meeting for purposes of determining a quorum. With respect to the outcome of any matter brought before the Annual Meeting (i) abstentions will be considered as shares present and entitled to vote at the Annual Meeting, but will not be counted as votes cast for or against any given matter and (ii) broker non-votes will not be considered shares present and entitled to vote. Because directors will be elected by a plurality of the votes cast at the Annual Meeting and the other matters to be acted upon at the Annual Meeting will be approved if the number of votes cast in favor of the matter exceeds the number of votes cast against it, abstentions and broker non-votes will have no effect on the outcome of the proposals to be voted upon at the Annual Meeting.

Prior to the Annual Meeting, the Company will select one or more inspectors of election for the Annual Meeting. Such inspector(s) shall determine the number of shares of Common Stock represented at the Annual Meeting, the existence of a quorum, and the validity and effect of proxies, and shall receive, count, and tabulate ballots and votes, and determine the results thereof.

A list of Stockholders entitled to vote at the Annual Meeting will be available for examination by any shareholder at the Company’s principal executive office in Seattle for a period of 10 days prior to the Annual Meeting, and at the Annual Meeting itself.

3

BUSINESS

General Overview

We are an integrated aquatic product producer and processor in the PRC of toxin free tilapia, other aquatic products, and marine bio and healthcare products. We use state-of-the-art and environment-friendly technologies in our production and processing operations. Our facilities are certified according to the HACCP standards, have been assigned an EU code required for exporting aquatic products to the EU, and are in the process of being certified in accordance with the ACC standards. Our products are sold principally to customers in North America, Europe and Asia.

Established in 1999, our aquatic farming and processing operations are in Hainan Province, an island in the South China Sea which is situated within the most desirable latitude for raising tilapia. Hainan Province in southern China is designated by the Chinese government as a green province, where environmentally friendly agri-food related industry is encouraged. We purchase and process farm-bred and ocean caught aquatic products through cooperative supply arrangements with local fishermen and cooperatives. Our supply cooperatives, under our guidance, use feed formulated by us to optimize natural toxin-free growth, thus raising toxin free tilapia. Our tilapia products have achieved such a high level of purity that we have successfully begun marketing these products as toxin free and natural.

In August 2004, the company acquired Jiahua Marine, which develops, produces and sells marine bio and healthcare products in China. The principal products of Jiahua Marine are shark cartilage capsules and shark liver oil products which are distributed exclusively in China. The products undergo substantial independent laboratory testing in China administered by the Ministry of Health in China and have resulted in a PRC National Certification for these products. These products have various perceived medicinal and health benefits.

We have commenced branding and marketing of our high quality, differentiated tilapia products under the name TILOVEYA™ from our new United States headquarters based in Seattle, Washington.

Our subsidiary, Jiahua Marine, has been designated by both the Wenchang Municipality and the Hainan Province as a “Dragonhead Enterprise” in our field of production of aquaculture tilapia, shrimp and our fish processing methods. Such distinctions are typically given to the leading enterprises in each field and each locality based on an comprehensive evaluation of their strength, potential and contribution to the local economies according to an evaluation system used by all levels of government. We believe that this distinction also signifies that the government awarding the designation may be interested in assisting the recipient’s continued development of their specific field of operation.

Industry Overview

Aquaculture Industry

Aquaculture, which is the farming of aquatic animals and plants, has been the world’s fastest growing segment in the food production system for the past two decades. The contribution of aquaculture to the world aquatic production in 2004 was about 59.4 million tonnes of fish. According to the FAO’s projections, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach 80 million tonnes of fish by 2050. The FAO also reports that most of the new demand for fish will have to be met by aquaculture, which could account for approximately 39.0% of all fish production by 2015.

As the availability of sites for aquaculture is becoming increasingly limited and the ability to develop non-agricultural land is restricted, the competition to develop additional aquaculture production systems is intensifying. As the intensification for aquaculture production systems increase, the demand for institutional support, services and skilled persons is anticipated to increase; along with the demand for more knowledge- based aquaculture education and training as aquaculture becomes more important worldwide. China

4

remains the largest producer of aquaculture products throughout the world with reported fisheries producing approximately 41.3 million tonnes in 2004. Within the global aquaculture industry, China accounted for 71.0% of the world’s supply of fish for direct human consumption and 29.9% of the total production by live weight in 2002.

In addition, according to a recent article entitled “Impacts of Biodiversity Loss on Ocean Ecosystem Services” in the November 2006 issue of Science, an international team of scientists concluded that by 2048 the world’s oceans will be emptied of fish. The scientists concluded that “Human-dominated marine ecosystems are experiencing accelerating loss of populations and species, …Overall, rates of resource collapse increased and recovery potential, stability, and water quality decreased exponentially with declining diversity. …marine biodiversity loss is increasingly impairing the ocean’s capacity to provide food, maintain water quality, and recover from perturbations. Yet available data suggest that at this point, these trends are still reversible.” This evidences that aquaculture can alleviate pressure on the oceans and provide a quality source of protein for consumers.

Tilapia Industry

In 2005, according to the American Tilapia Association, tilapia production was second in volume to carps, and it is projected that tilapia will become the most important aquaculture crop in this century, potentially reaching $5.0 billion in global sales. Commercial production of tilapia has become popular in many countries around the world. Touted as the “new white fish” to replace the depleted ocean stocks of cod and hake, world tilapia production continues to rise and at least 100 countries currently raise tilapia, with the PRC being the largest producer. The American Tilapia Association further reports that world production of tilapia products reached approximately 2.0 million metric tonnes in 2004, of which China produced the dominant share of 45.0%.

One of the major outlets for Chinese-produced tilapia has been, and should continue to be, the United States. The following chart reflects the increase in per-capita consumption of tilapia in pounds in the United States in relation to other traditional types of seafood.

| | | | | | | | | | | | | | | | | | |

| 2002(1) | | 2003(1) | | 2004(1) | | 2005(1) | | 2006(2) |

| Shrimp | | 3.7 | | Shrimp | | 4.0 | | Shrimp | | 4.2 | | Shrimp | | 4.1 | | Shrimp | | 4.4 |

| Tuna | | 3.1 | | Tuna | | 3.4 | | Tuna | | 3.3 | | Tuna | | 3.1 | | Tuna | | 2.9 |

| Salmon | | 2.0 | | Salmon | | 2.2 | | Salmon | | 2.2 | | Salmon | | 2.4 | | Salmon | | 2.0 |

| Pollock | | 1.6 | | Pollock | | 1.7 | | Pollock | | 1.3 | | Pollock | | 1.5 | | Pollock | | 1.6 |

| Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.0 | | Tilapia | | 1.0 |

| Cod | | 0.7 | | Cod | | 0.6 | | Tilapia | | 0.7 | | Tilapia | | 0.9 | | Catfish | | 1.0 |

| Clams | | 0.6 | | Crabs | | 0.6 | | Crabs | | 0.6 | | Crab | | 0.6 | | Crab | | 0.7 |

| Crabs | | 0.5 | | Clams | | 0.5 | | Cod | | 0.6 | | Cod | | 0.6 | | Cod | | 0.5 |

| Flatfish | | 0.4 | | Tilapia | | 0.5 | | Clams | | 0.5 | | Clams | | 0.4 | | Clams | | 0.4 |

| Tilapia | | 0.3 | | Scallops | | 0.3 | | Flatfish | | 0.3 | | Flatfish | | 0.4 | | Scallops | | 0.3 |

(1) Source:http://www.aboutseafood.com/media/top_10.cfm

(2) Source:http://www.aboutseafood.com/media/top_10.cfm

5

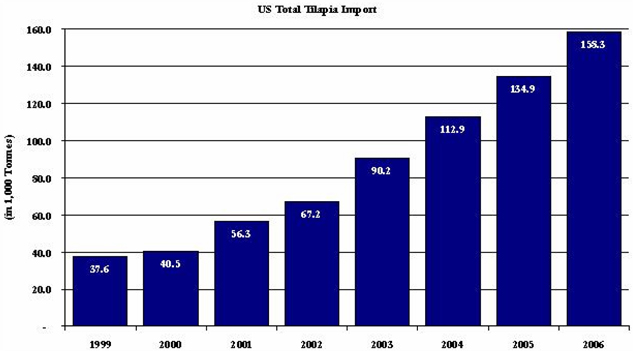

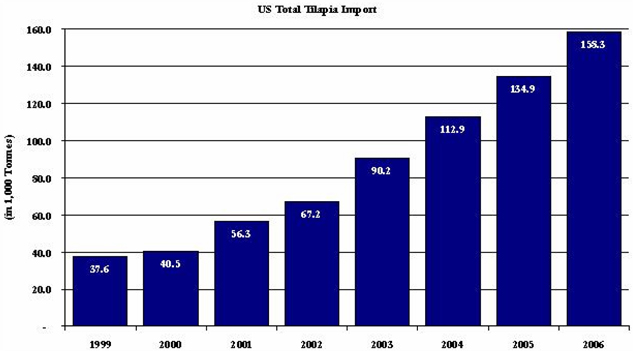

The following chart reflects the increase in imported tilapia to the United States during the periods indicated.

Separately, according to theInternational Trade Report produced in 2005 by the United States Department of Agriculture, or the USDA, “… U.S. per-capita seafood consumption has remained around 15 pounds through the late 1980s and 1990s, it is expected to increase as farm-raised products become cheaper. Currently, the United States consumes nearly 12 billion pounds of fish a year. By 2025, demand for seafood is projected to grow by another 4.4 billion pounds (2 million metric tonnes) above what is consumed today. In addition, it is estimated that by 2020, 50 percent of the U.S. seafood supply will come from aquaculture. Presently, more than 70 percent of the seafood consumed in the United States is imported, and at least 40 percent of that is farm-raised. Major changes in U.S. population, along with shifting demographics and economic growth, will alter the U.S. seafood market over the next decade, affecting the selection of products consumed . . . . It is expected that fresh and frozen fish products will account for a growing share of overall seafood consumption, with shrimp remaining at the top. By 2020, shrimp, salmon, tilapia, and catfish will be the top four seafood products consumed…”

According to Globefish.org, during the past ten years, tilapia capture fisheries have stabilized at 0.6 million metric tonnes, while their aquaculture production has grown from 0.55 million metric tonnes to 1.67 million metric tonnes. Tilapia is one of the top five seafood imports in the world. In 2005, more than $390 million of tilapia was sold worldwide. The United States is the world’s largest consumer of tilapia. Imported tilapia accounts for around 90% of total consumption of tilapia in the United States, and in 2005, tilapia moved up to the fourth-ranked most popular seafood after farm-raised shrimp, tuna and Atlantic salmon in terms of aquaculture products imported into the United States. In terms of volume, frozen whole round fish ranks first, followed by frozen fillets and, lastly, fresh fillets.

Health Benefits as the Driving Force for Growth in Tilapia Industry

The growing consumer demand for seafood is largely evolving from a new public awareness regarding its health and nutritional benefits. The USDA “pyramid” guidelines continue to support frequent fish consumption, and the USDA has recently completed a highly technical nutritional analysis and report on tilapia for the general public. The USDA’s Agriculture Research Service Lab reports that tilapia is moderate in polyunsaturated fatty acid (0.387 g/100g raw, 0.600 g/100g cooked) moderate in omega 3 fatty acids (0.141g/100g raw, 0.220g/100g cooked) and low in mercury (0.010 parts per million, which we refer to as PPM), which is considered

6

to be non-detectable. With the increased awareness of the health concerns surrounding mercury, tilapia’s low mercury levels (0.010 PPM) distinguish tilapia favorably from other types of fish with higher mercury levels, such as swordfish (0.976 PPM), mackerel (0.730 PPM) and yellow fin tuna (0.325 PPM).

Over-the-Counter Marine Bio and Healthcare Products

The marine bio and healthcare products industry in China is also sizable, with approximately $6 billion in sales, which still constitutes only 3% of the world market. We believe that China, with 25% of the world’s population and its affinity for natural remedies and health products, has substantial potential for growth. Currently, overall sales of these products in China have fallen slightly as compared to the previous year, as consumers gravitate toward branded products meeting international standards of excellence and proven benefit for consumers, and away from the less known brands and traditional remedies.

In general, sales of marine bio and healthcare products are made through retail and direct sales channels. Direct sales in China are relatively new, and restrictions on direct sales imposed on large foreign companies have been implemented in China, which has allowed for a growth in sales for domestic direct sales companies. These restrictions require foreign direct sellers to manufacture their products and to capitalize their businesses in China. Several companies have met these requirements, and growth in this sector is expected to be strong in the next few years.

We believe that nutraceutical supplements in the feed industry is a sector with strong growth potential, as the importance of aquaculture and aquaculture feeds increases. We manufacture actualized feeds, which involves choosing additives to be included in the feed, such as vitamin E, that promote health in fish, thus reducing the need for curative measures such as antibiotics. Once embedded in the flesh of the fish, vitamin E increases the shelf life of the fish and also introduces an additional source of vitamin E to its consumers. Other similar nutraceutical supplements can also be used.

Our Products

Tilapia

Tilapia is currently farmed throughout many countries around the world because this fish is usually disease-resistant, reproduces easily, eats a wide variety of feeds and tolerates poor water quality with low dissolved oxygen levels. Although there are many species of tilapia, only a few species are farmed for human consumption. The most common species that are farmed commercially is the black, or Nile, tilapia, which is grown in ponds, cages or rice fields.

In response to increasing demand for tilapia, we export varying quantities of tilapia in different forms to the United States, Europe, Asia and other regions. In addition, we are launching a new marketing and distribution initiative in the United States and Europe with our TILOVEYA™ brand tilapia. We are currently in discussions with several distributors in Europe interested in further promotion of the TILOVEYA™ brand, and we have had initial conversations with leading distributors, retail and food service chains in the United States, but there is no assurance that these discussions will materialize into sales for us. While these discussions are still preliminary, we believe that some of them will likely result in either an acquisition or the establishment of a limited partnership or joint venture with such distributors. The tilapia products sold by us are mainly in the following forms: whole round frozen, gutted and scaled, boneless-skinless tilapia fillets and, more recently, we began selling boneless-skin-on tilapia fillets.

On February 13, 2007, we have agreed to work with the Beijing division of Newly Weds® Foods, Inc. to introduce an exclusive, innovative line of battered and breaded flavored TILOVEYA™ fillet products to Chinese consumers. The new product line will use the widely used international taste technology of Newly Weds® Foods, Inc., as developed in its China operations, to manufacture value-added breaded TILOVEYA™ toxin-free fillet products to consumers in China. Most breaded value-added fish products currently marketed in China and the West suffer in quality from multiple rounds of freezing, deteriorating the taste, juiciness, texture

7

and quality of the product. In May 2007, after having co-developed a process and natural flavoring giving tilapia the taste, texture and aroma of fresh ocean-caught fish, we and Newly Weds entered into an agreement pursuant to which we will process the products supplied by Newly Weds to imitate “sea flavor” fish without the drawbacks of ocean-caught product.

Our principal operating subsidiary with respect to our seafood products is Hainan Quebec Ocean Fishing Co. Ltd., a company organized in the PRC, which we refer to as HQOF.

Marine Bio and Healthcare Products

Since the August 2004 acquisition of our current wholly-owned subsidiary, Hainan Jiahua Marine BioProducts Co. Ltd., a Chinese limited liability company, which we refer to as Jiahua Marine, we have also been engaged in the development, production and sales of marine bio and healthcare products in the PRC. We acquired Jiahua Marine pursuant to a purchase agreement with Sino-Sult Canada Limited, a Canadian limited liability company, which we refer to as SSC, and Sealink Weather Limited, or Sealink, a British Virgin Islands limited liability company, a wholly-owned subsidiary of SSC and the then sole shareholder of Jiahua Marine. See also “Certain Relationships and Related Transactions—Acquisition of Jiahua Marine.”

The principal products of Jiahua Marine are shark cartilage capsule, shark liver oil and shark liver (soft gel capsules), which are currently exclusively marketed and sold in China, harvested from non-endangered shark species which are a by-catch in Hainan Province. These products have proven medicinal and health benefits, such as increasing the efficacy of the immune system, correcting blood acidity, reducing fatigue, improving absorption of oxygen into the blood, activating the anti-cancer cells (a major component of the innate immune system), strengthening of bones and increasing subcutaneous moisture which has anti-wrinkle qualities. All of our healthcare products have undergone stringent independent laboratory testing in China. These tests are administered by the Ministry of Health in China. As part of this process, several laboratories are selected at random from a pool of top university laboratories to conduct tests which must confirm the results and claims of the applicant company. The applicant company can make claims about the health benefits of its products only after such stringent, independent validation of its claims by selected laboratories have been verified. Our claims in respect of our healthcare products have been rigorously tested and proven in China through the above process. Clinical trials and laboratory testing in China by selected university laboratories have resulted in a PRC National Certification of various Jiahua Marine’s healthcare products. These products are currently sold throughout China, are naturally derived from ocean-harvested by-products and are winners of Science and Technology Progress Awards in China. Jiahua Marine also has established a long-term relationship with the Qingdao University of Oceanography for research and training relating to the production of our marine bio and healthcare products.

8

Shark cartilage—This product is highly alkalescent, it contains chondroitin sulfate and calcium and impacts the human body positively in the following ways:

| | • | | increases efficiency of immune system and activates NK cells associated with combating cancer, as sharks are cancer free; and |

| | • | | reduces blood acidity, thus improving: |

Shark liver oil—This product is rich in squalene and other nutrients, to which we add vitamins D and E, and impacts the human body positively in the following ways:

| | • | | improves absorption of oxygen in the body; |

| | • | | eliminates fatigue; and |

| | • | | improves health, through the high levels of omega 3 oils. |

In addition to the marine bio and healthcare products that we currently produce, we started the manufacturing of nutraceuticals generated from palm oil, or other natural or organic matters to enrich feed formulations for tilapia and shrimp farmed in the Hainan area. The enriched feed will have a longer shelf life, and we expect that the benefits of the enriched feed will pass to the end users of our tilapia products, the ultimate customers. These ingredients help improve general health, growth, feed conversion and meat quality of fish and shrimp.

Our marine bio and healthcare products processing plant is located in the Wenchang City of Hainan Province and has two production lines, a powder-product line and an oil-product line. These production lines are suited for the manufacture of nutraceutical components. The plant is equipped with specific gravity molecular separator and accessory equipment for the manufacture of nutraceutical products that serve as feed additives in the production of feed, including tilapia and shrimp feed.

Shrimp

Our principal shrimp product is the white shrimp. Our shrimp is exported to the United States and Australia in the following forms: head-on shell-on shrimps, headless shell on shrimps, peeled tail-on shrimps, peeled and deveined shrimps, peeled and undeveined shrimps. All orders can be packaged in accordance with the requirements of the buyer, either block or individually quick frozen.

9

Our Principal Competitive Strengths

We believe we have the following principal competitive strengths:

| | • | | Quality Toxin Free Tilapia Products.We produce toxin free tilapia products and have developed a farming system that avoids the use of antibiotics, hormones and other potentially toxic chemicals. Our tilapia are raised in ponds of pure rain water collected for aquaculture. Two other species of fish are introduced into the ponds to maintain the pond’s health naturally. We formulate feed without fishmeal and produce feed supplements in our healthcare products processing plant to enrich this feed. It is our policy to raise toxin free tilapia to distinguish our company from other tilapia producers. The latitude and the pristine environment of Hainan have provided us with the optimal conditions for toxin free aquaculture production. |

| | • | | Vertically Integrated Operations. Vertical integration of our operations allows us to control and monitor quality, as well as reduce costs. Through our cooperative arrangements with local farmers, we train them to our production methods, while monitoring constantly the quality of production until harvest. |

| | • | | Environmental and Quality Assurances.We have adopted and implemented stringent quality control measures and procedures throughout the production process, in order to comply with the various environmental and quality standards, such as the HACCP and the EU import standards. We are also in the process of being certified in accordance with the ACC standards and positioning ourselves for completely organic production certification of our tilapia products. We use state-of-the-art technologies in our farming, feed formulation and processing operations. We have adopted modern and environmentally friendly and responsible technology in our production and processing of tilapia, shrimp, and marine bio and healthcare products, which we believe have been recognized through the certifications our plants possess. |

| | • | | Strategic Location in Hainan Province, China. Our processing facilities are geographically well-positioned in Hainan Province to leverage favorable climatic conditions, abundant water supply and pristine environment, and a readily available source of labor for our processing plant. Additionally, our processing facilities are conveniently located near the farmers from whom we obtain our supply of tilapia and shrimp. In addition, our intended new processing plant and feed mill will be in close proximity to our new cooperative fish farms. |

| | • | | International and Domestic Sales and Marketing Efforts.The recent establishment of our Seattle office will advance our new branding and marketing initiative around our TILOVEYA™ brand of our toxin free tilapia products. Sales from this office complement our China based sales efforts and other international sales initiatives. |

| | • | | An Established Track Record and Brand Name in the Industry.We have an established track record and recognized brand name in the industry and have received numerous awards and certifications confirming the success of the company in distinguishing itself from its competition. |

| | • | | Unique Health Products. We produce health products that we believe meet the highest quality standards, which we currently market exclusively in China through direct marketing and through retail channels. These products are certified to China’s national health product standards. Our marine bio and healthcare products processing plant also produces nutraceutical products for the inclusion into our tilapia feed additives. |

| | • | | Competitive Cost Structure.We benefit from competitive cost structures due to the lower labor costs in China as compared to U.S. based companies of similar products. |

10

Our Growth Strategies

Our objective is to continue building a diversified array of seafood and marine bio and healthcare products, with a primary focus on increasing our own seafood products. To achieve this goal, we intend to implement the following strategies:

| | • | | We started building a new large scale organic feed mill, to supply our existing and anticipated new cooperative fish farmers with our fish food formula, and a processing plant to increase our profit margin and to guarantee our product quality and further vertically integrate our operations; |

| | • | | We intend to achieve completely organic production of our tilapia products and to pursue organic certification of our farms; |

| | • | | We plan to expand direct and retail sales of our health products in China and internationally and to add other products we currently have in the development pipeline; |

| | • | | We plan to expand our cooperative farming arrangements to increase the availability of tilapia to meet anticipated growth in demand; |

| | • | | We plan to continue to expand our production and processing facilities in China to satisfy the anticipated growing demand for our products; |

| | • | | The new sales office in Seattle allows us to increase awareness of the importance of our toxin free product and to benefit from more direct sales. The new Seattle office also allows us to expand our distribution options in North America and Europe by broadening the variety of products we offer to cater to the demands of our customers; and |

| | • | | We plan to expand our branding and marketing initiatives in North America and Europe to introduce our products to major retail and food service chains. Our marketing and branding of tilapia and other seafood products is headed by Trond Ringstad, a pioneer in marketing tilapia in the United States. Our new branding focuses on the TILOVEYA™ brand and our toxin-free approach. |

Manufacturing and Production

Marine Bio and Healthcare Products

Our plant for processing marine bio and healthcare products consists of two production lines: a powder-product line and an oil-product line. The production lines are equipped with a complete set of imported and domestic made devices, including a vacuum frozen dryer for bio-products, a molecular distillation device, a micro-disintegrator, a packing machine and test instruments. We have raw material treatment workshops, such as an extraction workshop, a freezing and drying workshop, a powder distillation workshop and a finished product workshop for our powder line. We also have pre-treatment workshops, such as a cooling and filtration workshop, a molecular distillation workshop, a supplemental items workshop and a capsule workshop for our oil line.

This plant is equipped with a molecular distillation device, which produces vitamin E used for human consumption and as a supplement to tilapia and other feeds. These vitamins are processed from natural products, such as palm oil. This plant has been

11

certified in accordance with the China National Health Inspection program as a “Chinese Good Manufacturing Practice” (GMP) by the Hainan Provincial Health Bureau. We believe that our nutraceutical business is closely connected to our expansion plan, including the construction of our own feed mill described below. Actualized feed additives provide health benefits to the fish, such as increasing health and avoiding the use of curative measures involving antibiotics. The consumers of these fish products in turn benefit from increased shelf life of the fish products, and from the additional sources of vitamin E resulting from the consumption of such products.

Aquaculture Products

Our plant for processing aquatic products is a Canadian designed facility located in Hainan, China. We operate six processing lines, which consist of two filleting lines, two whole round fish processing lines (principally tilapia which is gutted, scaled and gilled), and two shrimp processing lines, that can be transformed to two additional tilapia fillet production lines according to our needs. This processing plant is capable of processing an average of approximately 10,000 tonnes per year of whole round fish (principally, tilapia), 3,000 tonnes per year of fillet tilapia and 3,000 tonnes per year of all forms of shrimp. Such capacity may become inadequate to meet our projected demand from our existing customers and the national retail food service chains targeted by us. Based on our projected need for expansion, we started a large scale organic feed mill, to supply our existing and anticipated new cooperative fish farmers with our fish food formula and processing plant. See “— Construction of Feed Mill and Processing Plant.” We are in the process of negotiating with several national retail food service chains, and we expect to phase in deliveries to coincide with the implementation of our plans to expand production which we anticipate will be in the second half of 2007 at the earliest. The scale of production is a critical factor for such chains, and we expect that such expanded production will enable us to enter into definitive arrangements with up to six such chains. However, no orders have materialized currently.

Construction of Feed Mill and Processing Plant

In order to maintain the high quality of our products and to position ourselves for attaining completely organic production certification, we decided to construct our own organic feed mill and processing plant for the production of organic, floating feed formulations. This type of feed is the most efficient feed for our farming operations. We plan to produce the feed using grains grown without chemical fertilizers that are also free of antibiotics and fishmeal, and use feed additives manufactured in our nutraceutical plant. We expect that the feed formulations will be prepared with the benefit of the latest technologies to assure a minimum of toxicity. The feed will be enriched using omega 3 rich algae and vitamin E, as well as naturally sourced amino acids, which provide actualized benefits to the fish and the consumers thereof. The new floating feed formulations will reduce waste in the aquaculture reservoirs, thus reducing the requirement for chemicals to stabilize reservoir health. The feed mill will allow us to complete our vertically integrated production strategy, ensuring quality control throughout the entire production and processing cycle. We plan to partner with other parties, as appropriate, to produce the optimum formulation of feed. Presently, there is no floating or organic feed production in Hainan. We plan for this expanded production to satisfy our own demand through the 20,000 mu (or 3,294 acres) of production in Wenchang and Qionghai, as well as to manufacture feed for such other farmed operations in Hainan as shrimp and other farmed species. We expect that the plant will manufacture some 100,000 tonnes annually of feed and will source organic non-genetically modified organisms corn and soya from China and abroad.

We expect that the new processing plant will provide for value added production, allowing us to make fish sticks and fish patties as well as the fillets and whole round products that we currently manufacture.

We believe that Hainan Province offers several opportunities in terms of the location of our new feed mill and processing plant, as tilapia fish are available from farms in various townships conveniently located close to our current operations. We expect that it will take approximately nine to twelve months to build the new feed mill and processing plant. We have indicated our preference with respect to a facility available in Tayang Town, Qionghai City, Hainan Province, within some forty minutes from our plant. We

12

entered into an agreement of intent in connection with our proposed facilities with the local government in December 2006. We expect that this location will allow us to receive some 20,000 tonnes of tilapia annually from some 10,000 mu of aquaculture area, or approximately 1,647 pond acres. In addition, the close proximity of each pond to the other is a significant factor in obtaining organic certification of our cooperative farms, which we plan to seek in the future.

We expect that the local government involved in these arrangements will provide the needed infrastructure and interim financing to the fish farmers for the construction of fish ponds built to our quality standards specifications. The ponds will be owned by the local farmers and are anticipated to be linked to our feed mill and processing plant through feed supply and fish purchase agreements. In addition, the farmers work within our cooperative operating framework, thus allowing us to train the farmers according to our quality standards and monitor their production on an ongoing basis. The total investment by the farmers to construct the fish ponds and by the local government to make available the related infrastructure (excluding our investment in the feed mill and processing plant), is in excess of $15 million. Combined with our investment in the feed mill of $7 million and in the processing plant of $13 million to make a total capital investment for such a production zone of excess of $35 million.

Distribution Channels

At the present time, we distribute our seafood products principally in the United States and Europe, and we sell all of our marine bio and healthcare products exclusively in the PRC. Through our new Seattle-based distribution and marketing facilities, we are able to work more directly with wholesale and retail buyers. The programs established with retail distributors are rather different than with wholesalers. Retailers require product introduction and marketing support and pay differently than wholesalers. The latter generally take delivery of product ex-plant and pay through a letter of credit, while the former take delivery in the United States and pay on negotiated terms.

One of the purposes of our new Seattle office is to introduce our toxin free tilapia products to our target buyers to the retail and food service industry purchasers. We are currently selling our toxin free tilapia products to the European market through distributors and retailers that we met at the Seafood Shows in Boston and Brussels. We are actively seeking a distributor in Northern Europe for our new tilapia brand TILOVEYA™.

Currently, all of our marine bio and healthcare products are sold in the PRC. Through our subsidiary Jiahua Marine, we currently sell four healthcare products, two of which are made from shark cartilage and two are made from shark liver oil under the brand name “Jiahua” in the PRC. Two of these products are produced from refined shark cartilage, and two other products are produced from shark liver oil, both harvested from non-endangered shark species. Please see “Marine Bio and Healthcare Products” for more detailed descriptions of these products.

Our China sales are principally marketed through our offices in Haikou, Beijing and Shanghai to customers that include domestic supermarkets, airlines, hotels and local distributors. Direct sales of healthcare products target tourists in various popular destinations in China, such as Sanya, Beihai and the Three Gorges project. Seminars are organized for these tourists that usually result in the purchase of our products. These products are also sold in various chain stores and through mail order sales throughout China.

Commencing in 2003, our subsidiary Jiahua Marine has been pursuing a sales strategy, which we believe will lead to strong growth in the current and future years. As part of this strategy, a unique direct marketing campaign has been introduced in conjunction with large scale tours organized throughout China in prime tourist destinations — Sanya, Beihai (China’s premiere tropical leisure vacation centers) and the Three Gorges project. These tours are captive audiences learning about the health advantages of the products during an outing associated with their leisure activities. In addition, since 2003, sales have begun in Hualian Supermarket Co. Ltd. (one of the largest specialty chains in China with over 1,200 outlets, the first publicly listed supermarket retailer

13

in China), as well as in health product and pharmaceutical outlets throughout China. Pursuant to a five year agreement with Hualian Supermarket Co. Ltd., Jiahua Marine provides products to Hualian Supermarket Co. Ltd.

On February 12, 2007, we announced that we will begin direct sales of our TILOVEYA™ toxin-free brand through the internet. “Ultimate Entrée” is a leader in direct marketing through the internet of superior seafood and meat products. The success as “an event food Headquarters,” as seen through their recent “Super Bowl Special,” works well with the sale of ‘tailgate party’ marketed products such as our “TailGate TiLoveYa™,” a skin-on boneless TILOVEYA™ toxin-free product sold by us, ideally suited for barbecue. Regular 1 pound and 1.5 pound bags of our boneless skinless fillet will also be marketed on the site and available directly online to Ultimate Entrée’s and our clients.

On April 2, 2007, we commenced sales of our branded “TiLoveYa”(™) products through nearly 150 stores of the Grocery Outlet on the West Coast. The Grocery Outlet chain (See http://www.groceryoutlets.com/home.aspx) is headquartered in Berkeley, California, and has annual revenues exceeding $600 million. The Grocery Outlet expects to sell our brand of frozen fillets within its chain of stores in the states of California, Washington, Oregon, Nevada, Idaho and Hawaii.

On April 23, 2007, we commenced online sales of various finished products of our branded “TiLoveYa(™)” tilapia products on the Sam’s Club website. Sam’s Club is a division of Wal-Mart Stores, Inc. and ranks as one of the nation’s largest warehouse clubs with more than 47 million U.S. members. Sam’s Club offers exceptional values on merchandise and services for business owners and consumers. Online merchandise and Club information is available at www.samsclub.com.

In May 2007, we commenced sales of our “TiLoveYa(™)” brand of frozen fillets through the QFC chain of the Kroger Company within its chain of stores in the states of Washington and Oregon. Headquartered in Cincinnati, Ohio, Kroger is one of the nation’s largest grocery retailers.

Advertising and Marketing

Our sales and marketing team consists of nine members and is under the overall supervision of Mr. Harry Wang Hua our Chief Operating Officer. Our sales and marketing team is responsible for establishing our sales and distribution networks both domestically and internationally promoting our image and product awareness, and maintaining our customer relationships. As part of his duties, Mr. Wang Hua leads our plant management teams for both marine bio and healthcare products and aquaculture products. Mr. Ringstad, our Executive Vice President of Sales and Distribution, heads our China and Seattle based sales teams. The Seattle personnel is responsible for increasing awareness and focus of our new branding and marketing initiative and the rollout of our toxin free TILOVEYA™ brand.

We believe that our principal operating subsidiary, HQOF, is the only vertically integrated PRC based producer present at the international seafood shows (e.g.,Brussels Seafood Show and Boston Seafood Expo). Participation in these industry events enables us to establish high level and immediate contacts with potential buyers. Buyer preferences and our response to these preferences, as well as prices and response to quality and quantity concerns, can be promptly addressed without the usual screening and middleman costs. We plan to aggressively market our products throughout North America, Europe and Asia.

In February 2006, we established our new corporate, marketing and sales office in Seattle, Washington, thus creating a strong presence in the U.S. market. This new office allows us to increase awareness of the importance of our toxin free product focus and to reap the benefits of more direct sales, increasing our overall sales, market penetration and profitability. We expect to also be able to broaden the scope of our products to cater to additional seafood purchasing requirements.

14

Sustainable Farming

The concept of sustainable development has been popularized by the 1987 World Commission on Environment and Development. It defined “sustainable development” as meeting the needs of the present generation, without compromising the needs of future generation. The idea of sustainability has caught up with aquaculture partly because of pressure from environmental groups. In 1998, the Holmenkollen Guidelines for Sustainable Aquaculture were formulated. These guidelines recommended, among other things, that new technologies and management procedures should be utilized so that the quality and quantity of aquaculture products is improved and the risk of adverse effects on the environment and on the livelihood of other people, including future generations, is reduced. The guidelines also recommended (1) strict compliance with the internationally agreed food safety, environmental safety and ethical criteria if genetically modified organisms or hormones are utilized in the production, as well as (2) giving priority to the development of integrated fish farming and of sources for animal feed other than fish protein and fish lipid. We fully endorse the idea of sustainable farming and implement it in our operations through our cooperative supply arrangements.

Organic Farming

We believe that organic farming may be considered to be the next step after sustainable farming. Organic farming is a trend towards simple and moderate farming methods that are inherently sustainable. Organic farming advocates against the use of hormones and certain drugs, genetically modified organisms, very intensive culture systems, use of fish meal from the fish meal industry and oils from animals. As the market demand for sustainable and environmentally sustainable practices increases, the aquaculture industry is in the process of adjusting to such demand by starting to offer organic products. Further, we believe that many companies are finding that the use of waste streams from aquaculture can be used as a nutrient source for the culture of other aquatic flora and fauna, as well as land based agriculture.

We believe that operating costs for organic culture should be lower than intensive farming, with the feed remaining the key operating cost. We have determined that organic production of tilapia is technically possible in Hainan Province. Further, our preliminary evaluation of farm production economics (such as feed costs, feed conversion ratios, growth rates and yields) as they relate to expected market demand indicates that we could engage in organic farming profitably. Therefore, we have started to construct a large scale organic feed mill so as to pursue organic certification of our farms and commence organic tilapia production.

We anticipate that, following our construction of a large scale organic feed mill and processing plant, our tilapia products will meet organic standards as defined by Naturland, which are the standards currently adopted by the FDA. See “—Manufacturing and Production—Construction of Feed Mill and Processing Plant.”

Our Cooperative Supply Arrangements

We purchase and process farm-bred and ocean caught aquatic products through cooperative supply arrangements with local fishermen and cooperatives. Our farmed tilapia products come from approximately 1,647 pond acres of farms situated in the Wenchang area of Hainan. These farms are grouped through cooperatives to supply us with the highest quality tilapia in accordance with sustainable farming standards described above.

We strive to implement the principles underlying sustainable farming and elements of organic farming in our cooperative supply arrangements with local fishermen and cooperatives, from which we purchase and process farm-bred and ocean caught aquatic products. Under our related cooperatives, or collaboration agreements, the farmers or holders of the concession retain their proprietary status, while agreeing to operate under planned and scheduled practices put forward by our company as cooperative partner of the concessions. The farmers are trained to our standards for deploying appropriate feeds and using poly-culture techniques, while we monitor compliance with these standards on an on-going basis. The farmers are also required to agree to treat waste water responsibly as a nutrient rich fertilizer for the vegetable fields maintained by neighboring farmers.

15

We typically have between five and ten cooperative supply agreements, which number may vary from time to time. We believe that these cooperative supply arrangements provide mutual benefits to the parties involved, as they help increase revenues of the local farmers, while ensuring a stable supply of raw tilapia to us.

Trademarks and Patents

We have the following patents on our products: Chinese Patent Number 460000X340-2001 – Shark Cartilage; Chinese Patent Number 460000X131-2001 – Shark Cartilage; Chinese Patent Number 460000X338-2001 – Shark Liver Oil; and Patent Number 460000X342-2001 – Shark Liver Oil. These patents are for a 20 year period and will expire in 2021. Two products are produced from refined shark cartilage and two from shark liver, both harvested from non-endangered shark species.

We consider our service marks, trademarks, trade secrets, patents and similar intellectual property to be critical to our success. We rely on trademark, patent and trade secret law, as well as confidentiality and license agreements with our employees, customers, partners and others to protect our proprietary rights. We have received patent protection and applied for trademark protection for our products in the PRC. We have also applied for trademark protection in the U.S., as described below, in connection with our branding of toxin free tilapia. Effective trademark, service mark, patent and trade secret protection may not be available in every country in which we sell or may in the future sell our products, and our competitors may independently develop formulations and processes that are substantially equivalent or superior to our own.

TILOVEYA™

In May 2006, we introduced our new toxin free tilapia brand TILOVEYA™ at the European Seafood Exposition in Brussels, the largest seafood show in the world. This brand is designed to celebrate the health benefits of our tilapia produced in Hainan Province, China. Our freshwater tilapia products are made without hormones, antibiotics and free of levels of heavy metals and other toxins associated with ocean sourced products. We have filed with the United States Patent and Trademark Office the following applications for trademark registrations in connection with our branding of toxin free tilapia:

| | • | | Application Serial Number 78/534,739 for the registration of the TILOVEYA™ mark; |

| | • | | Application Serial Number 78/932,194 for the registration of the TILOVEYA™ logo; and |

| | • | | Application Serial Number 78/932,173 for the registration of the TAILGATE TILOVEYA™ mark. |

Competition

In general, the aquaculture industry is intensely competitive and highly fragmented. The PRC aquaculture industry is further open to competition from local and overseas operators engaged in aquaculture and from other captured fish producers. We compete with various companies, many of which are developing or can be expected to develop products similar to ours. For example, 8th Sea—The Organic Seafood Company currently produces and processes tilapia fillets in Brazil’s Parana state. Our main aquaculture products, tilapia and shrimp, are also facing competition from some other domestic aquaculture producers. Some of the domestic aquaculture processing companies in Hainan Province have obtained certifications similar to those we possess. However, we believe that the competition from such producers is minimal because, to the best of our knowledge, there are no competitors in Hainan Province that have a similar operating scale and production capacity, or that have developed the vertically integrated business model under which we operate.

16

Many of our competitors are more established than we are, and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements, and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We intend to create greater brand awareness for our brand name so that we can successfully compete with our competitors. We cannot assure you that we will be able to compete effectively or successfully with current or future competitors, or that the competitive pressures we face will not harm our business.

With respect to potential new competitors, although there are no formal barriers to entry for engaging in similar aquaculture processing production and activities in the PRC, we believe that the high infrastructure costs associated with developing and constructing processing plants and facilities does pose a barrier to potential competitors. Fish farms are tied to a processing plant and a new processing plant must either enlist new farms or build its own. Furthermore, measures addressing environmental considerations, such as water quality and waste water processing requirements, are costly to deploy on a greenfield site and are not readily available to all new companies. Accordingly, potential competitors have to mobilize extensive resources in order to maintain a presence similar to ours.

Government Regulation

Our company complies with various national, provincial and local environmental protection laws and regulations, as well as certifications and inspections relating to the quality control of our production and the environmental and social impact of our operations. In addition to statutory and regulatory compliance, we actively ensure the environmental sustainability of our operations. Also, all of our healthcare products have met stringent independent testing by selected university laboratories in China. Our costs of compliance with applicable environmental laws are minimal. Penalties would be levied upon us if we fail to adhere to and maintain our compliance with the applicable environmental regulations in the PRC. Such failure has not occurred in the past, and we generally do not anticipate that it may occur in the future, although no assurance can be given in this regard.

HACCP Standards

Our facilities are certified in accordance with the Hazard Analysis Critical Control Points, or HACCP, standards for exporting aquatic products to the United States. The HACCP standards are developed by the FDA pursuant to the FDA’s HACCP regulation, Title 21, Code of Federal Regulations, part 123, and are used by the FDA to help ensure food safety and control sanitary standards. These standards focus on monitoring the quality of production and sanitation measures in processing plants for food products, and also take into account the environmental and social impact of the operations of the certified company. Compliance with the HACCP procedures is mandatory, and the successful implementation of these procedures depends on the design and performance of facilities and equipment, and excellent quality control and hygiene practices. HACCP conducts sample laboratory testing on our processed aquatic products to ensure no forbidden substances are present in them. Laboratory testing of our processed aquatic products was initiated by the HACCP in compliance with strict quarantine guidelines imposed by domestic export control government agencies and foreign import control government agencies.

In addition, our facilities continuously pass USDA inspection.

ACC Standards

We have recently commenced the process of certification of our processing plant in China in relation to shrimp processing in accordance with the Aquaculture Certification Counsel, Inc., or the ACC standards. The ACC standards are considered “super HACCP” standards, as they also take into account various environmental and social issues. ACC certification is required by many large retailers in the United States.

17

The ACC is a U.S.-based, non-governmental body established to certify social, environmental and food safety standards at aquaculture facilities throughout the world. The ACC uses a certification system that combines site inspections and effluent sampling with sanitary controls, therapeutic controls and traceability. Part of the ACC’s mission is to help educate the aquaculture public regarding the benefits of applying best management practices and the advancing scientific technology that directs them. The ACC believes that, by implementing such standards, seafood producers can better meet the demands of the growing global market for safe, wholesome seafood produced in an environmentally and socially responsible manner. The ACC offers a primarily “process,” rather than “product”, certification, with an orientation toward seafood buyers. Successful participation in the ACC program is visually represented by limited use of a “Best Aquaculture Practices” certification mark. The ACC currently certifies only shrimp hatcheries, farms and processing plants. New ACC guidelines with respect to the certification of tilapia are expected to be released by the ACC later this year. We expect to seek the ACC certification with respect to our processing of tilapia after the ACC makes available its guidelines in relation to such processing.

Assignment of EU Code

Our facilities have been assigned an European Economic Community or the EEC, approval registration, referred to as an EU Code, required for exporting aquatic products to the European Union, or the EU. This requirement applies to production both inside and outside of the EU, and defines the applicable standards of the EEC for handling, processing, storing and transporting fish. Our aquatic products processing plant in China must meet or exceed these standards every year, in order to maintain the assigned EU Code. The assignment of the EU Code to us, and our ability to maintain it on an annual basis, evidence the fact that our products meet the EU importable food standards set by the relevant inspection agencies.

Product Liability Insurance

We have purchased general commercial liability insurance effective from December 2006, which provides an aggregate product liability insurance of $5,000,000. However, there is a possibility that our customers, or the ultimate buyers of our products, may have adverse reactions to the tilapia and other aquatic products or marine bio and healthcare products that we process and sell. Any such adverse reaction may result in actual or potential product liability claims against us, which may not be covered by our insurance or if cover, may be significantly higher than the insurance amount. Such actual or potential product liability claims may have an adverse effect on our reputation and profitability.

Government Regulation in China

Aquaculture producers in the PRC have to comply with the environmental protection laws and regulations promulgated by the national and local governments of the PRC. Such rules and regulations include, among others, Environmental Protection Law of the PRC, Ocean Environmental Protection Law of the PRC, Regulations on Administration over Dumping of Wastes in the Ocean of the PRC, Ocean Aquatic Industry Administration Regulation, Fishing License Administration Regulation, Regulations on Administration of Hygiene Registration of Exported Food Manufacturers, and Regulations on Administration of Quality Control of Food Processors.

In addition, HACCP and sanitary programs in China in accordance with the FDA’s HACCP standards are verified by the China Inspection and Quarantine Office, or CIQ, which is a branch of the State Administration for Entry-Exit Inspection and Quarantine of the PRC and, in our case, also by the Hainan Entry-Exit Inspection and Quarantine Bureau of the PRC. In addition, the CIQ evaluates the compliance by our processing plant with the EEC standards described above under “—Assignment of EU Code.” As a result of such review, our aquatic products processing plant in China has received a CIQ certificate. The CIQ certificate must be renewed on an annual basis.

18

Our Work with the Hainan Province

We have enjoyed close collaboration with the local government as we conduct our operations in the Hainan Province. We plan to further expand our operations in that area and to foster close ties with the local government through our construction of a large scale organic feed mill and processing plant there. See “Business—Manufacturing and Production—Construction of Feed Mill and Processing Plant.” The success of our operations in the PRC depends in part on the continued investment by Hainan Province in the development of the local aquaculture industry. While there can be no assurances that such investment will continue, we believe that it should continue for the following reasons. The central government of China has limited Hainan Province to two areas of economic activity, agri-food and tourism. The resulting focus of the Hainan Province on agri-food and tourism sectors creates a strong potential synergy with private sector companies intent on further development of these sectors. Part of the attraction for investors is the low tax rate in Hainan. In addition, foreign companies setting up new ventures in Hainan do not pay any tax for the two first years of profitable operations, then pays 7.5% for the following three years and 15% thereafter. For this reason, we plan to continue to structure and conduct our operations in China through the use of separate subsidiaries, held by foreign holding companies which are separate and distinct from holding companies already incorporated. In turn, these holding companies are held by HQSM. Under these arrangements, we are not considered involved in joint ventures, but rather in wholly owned foreign enterprises, under the local law. Government support for such ventures meeting local needs is positive, and we believe our operations have already demonstrated our ability to channel this support in the manner favorable to our business and Hainan. We believe that not having a joint venture with the local government is the best way to minimize the potential for government interference and to maximize government support, and we plan to continue to conduct our business in China accordingly.

Employees

Through our subsidiaries, we currently employ approximately 400 employees, all of whom are full-time employees. They are located predominantly in the PRC. Of our key employees, Harry Wang Hua, He Jian Bo and Wang Fu Hai are located in China and are fully dedicated to our China operations. In addition, Lillian Wang Li, Norbert Sporns, William Sujian and Trond Ringstad contribute both to our China operations and our U.S. operations, depending on the needs of our business over time.

In addition, during the high season, we hire up to 100 part-time employees. We typically pay our local employees much higher wages than the required minimum wages, in order to attract and retain key employees. We have employment agreements with many of our full-time employees. None of our employees are covered by a collective bargaining agreement, and we believe our employee relations are good.

Properties

We own two processing plants located in Wenchang, Hainan Province, the PRC, and the related manufacturing equipment, office equipment and motor vehicles. We use one plant to process the seafood products we produce, and the other plant to process our marine bio and healthcare products. We have also purchased the piece of land for the construction of our new large organic feed mill.

In addition, we currently lease corporate premises for our new United States headquarters located in Seattle, Washington, consisting of approximately 4,170 square feet from Doncaster Investments NV, Inc. The term of the related lease is sixty months, which term commenced on December 1, 2005. Our monthly payment under the lease is $3,500 per month.

Our properties are in good condition and are sufficient to meet our needs at this time. We do not plan to obtain additional space in the foreseeable future for the above cited plants but we intend to build additional processing facilities from the proceeds of this offering.

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table provides information known to us about the beneficial ownership of our common stock as of August 10, 2007 for: (1) each person, entity or group that is known by us to beneficially own five percent or more of our common stock; (2) each of our directors (and former directors, as applicable); (3) each of our named executive officers (and former officers, as applicable) as defined in Item 402(a)(3) of Regulation S-K; and (4) our directors and executive officers as a group. To the best of our knowledge, each shareholder identified below has voting and investment power with respect to all shares of common stock shown, unless community property laws or footnotes to this table are applicable.

The number of shares beneficially owned and the percent of shares outstanding are based on 8,037,420 shares outstanding as of September 10, 2007. Except as otherwise noted below, the address of each of the Stockholders in the table is c/o HQ Sustainable Maritime Industries, Inc., Melbourne Towers, 1511 Third Avenue, Suite 788, Seattle, Washington 98101.

| | | | | | | | | | |

Name of Beneficial Owner(1) | | Number of Owned | | Percentage of Class Owned(1) | | | Total Votes Percentage(2) | |

The Tail Wind Fund Ltd(3) | | 882,897 | | 9.9 | % | | * | |

Red Coral Group Limited(4) | | 1,984,142 | | 24.69 | % | | 1.84 | % |

Sino-Sult Canada (S.S.C.) Limited(5) | | 1,431,529 | | 17.79 | % | | 93.88 | % |

Lillian Wang Li(6) | | 3,440,671 | | 42.63 | % | | 95.72 | % |

Norbert Sporns(7) | | 3,440,671 | | 42.63 | % | | 95.72 | % |

Harry Wang Hua(8) | | 3,440,671 | | 42.63 | % | | 95.72 | % |

Jean-Pierre Dallaire | | 10,000 | | * | | | * | |

Joseph I. Emas | | 13,000 | | * | | | * | |

Andrew Intrader | | 0 | | * | | | * | |

Fred Bild | | 813 | | * | | | * | |

Daniel Too | | 7,423 | | * | | | * | |

All directors and executive officers as a group (8 persons)(9) | | 3,515,650 | | 43.22 | % | | 95.74 | % |

| (1) | Based on (i) 8,037,420 shares of our common stock issued at August 10, 2007; and (ii) 100,000 shares of our Series A preferred stock, each of which shares is convertible at the option of the holder into two shares of common stock, in each case outstanding as of August 10, 2007. Under the rules of the SEC, a person is deemed to be the beneficial owner of a security if that person, directly or indirectly has or shares the power to direct the voting of the security or the power to dispose or direct the disposition of the security. Accordingly, more than one person may be deemed to be a beneficial owner of the same securities. A person is also deemed to be a beneficial owner of any securities with respect to which that person has the right to acquire beneficial ownership within 60 days of the relevant date. Unless otherwise indicted by the following footnotes, the named individuals have sole voting and investment power with respect to the shares of stock beneficially owned. |

| (2) | Each shares of common stock has one vote and each share of Class A preferred stock has 1,000 votes on all matters presented to be voted by the holders of common stock. |

20

| (3) | Subject to the limitation set forth below, Tail Wind Fund Ltd.’s ownership consists of (i)850,000 shares of our common stock issuable upon conversion of the convertible promissory notes issued in the November 2006 private placement and (ii) 170,000 shares of our common stock issuable upon exercise of the warrants issued in the November 2006 private placement. According to the Schedule 13G filed by Tail Wind Fund Ltd. on November 16, 2006, Tail Wind Fund Ltd. disclaims beneficial ownership of any and all shares of our common stock that would cause its beneficial ownership to exceed 9.9% of the total issued and outstanding shares of our common stock. Accordingly, Tail Wind Fund Ltd., based on the 8,037,420 shares of our common stock outstanding on August 10, 2007, beneficially owns 882,897 shares of our common stock and disclaims beneficial ownership of 137,103 shares of our common stock. The address of Tail Wind Fund Ltd. is c/o Tail Wind Advisory and Management Ltd., 77 Long Acre, London WC2E 9LB, England. |

| (4) | Owner of record of the shares beneficially owned by Messrs. Sporns (24%), Wang (51%) and Ms. Wang (25%), through their ownership of the issued capital of Red Coral Group Limited in the same percentages and sharing the voting and investment power over the shares held thereby of record pursuant to that certain Stockholders Agreement (the “Stockholders Agreement”) to which Mr. Harry Wang, Ms. Lillian Wang Li and Mr. Norbert Sporns are parties. The address of Red Coral Group Limited is TrustNet Chambers Road, Town Tortola, British Virgin Islands. |

| (5) | Owner of record of shares of our common stock and an aggregate of 10,000 shares of our common stock underlying 100,000 shares of our Series A preferred stock, all of which are beneficially owned by Messrs. Sporns (24%), Wang (51%) and Ms. Wang (25%), through their ownership of the issued capital of Sino-Sult Canada (S.S.C.) Limited in the same percentages and sharing the voting and investment power over the shares held thereby of record pursuant to the Stockholders Agreement. The address of Sino-Sult Canada (S.S.C.) Limited is 2500 Pierre Dupuy, Suite 512 Montreal Quebec, Canada H3C 4L1. |