UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

HQ Sustainable Maritime Industries, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: Common Stock, $.001 par value |

| | (2) | Aggregate number of securities to which transaction applies: 14,657,163 shares of Common Stock |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

1511 Third Avenue

Suite 788

Seattle, Washington 98101

(206) 621-9888

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 21, 2009

The Annual Meeting of Stockholders (the “Annual Meeting”) ofHQ SUSTAINABLE MARITIME INDUSTRIES, INC., a Delaware corporation (the “Company”), will be held at 5:00, local time, on December 21, 2009 at 1 SE 3rd Ave Ste 1400, Miami, FL, for the following purposes:

| | (1) | To elect the Company’s Board of Directors to hold office until the next Company’s Annual Meeting of Stockholders or until his successor is duly elected and qualified; and |

| | (2) | To ratify the appointment of Schwartz Levitsky Feldman LLP , as the Company’s independent certified public accountant; and |

| | (3) | To ratify the 2009 Stock Option Plan; and |

| | (4) | To transact such other business as may properly come before the Annual Meeting and any adjournment thereof. |

The Board of Directors has fixed the close of business on November 9, 2009, as the record date for determining those Stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof.

| | | | |

| | | | By Order of the Board of Directors |

| | |

| Seattle, Washington | | | | /s/ NORBERT SPORNS |

| October 29, 2009 | | | | NORBERT SPORNS |

| | | | CHIEF EXECUTIVE OFFICER |

HQ SUSTAINABLE MARITIME INDUSTRIES, INC.

1511 Third Avenue

Suite 788

Seattle, Washington 98101

(206) 621-9888

PROXY STATEMENT

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors ofHQ SUSTAINABLE MARITIME INDUSTRIES, INC., a Delaware corporation (the “Company”), of proxies from the holders of the Company’s common stock, par value $.001 per share (the “Common Stock”), for use at the Annual Meeting of Stockholders of the Company to be held at 5:00, local time, on December 21, 2009 at 1 SE 3rd Ave Ste 1400, Miami, FL, or at any adjournment thereof (the “Annual Meeting”), pursuant to the enclosed Notice of Annual Meeting of Stockholders.

The approximate date that this Proxy Statement and the enclosed form of proxy are first being sent to Stockholders is November 9, 2009. Stockholders should review the information provided herein in conjunction with the Company’s 2008 Annual Report, as amended and the Company’s quarterly filings on Form 10-Q and other filings with the Securities and Exchange Commission. The Company’s principal executive offices are located at 1511 Third Avenue, Suite 788, Seattle, Washington 98101. Our telephone number is (206) 621-9888

INFORMATION CONCERNING PROXY

The enclosed proxy is solicited on behalf of the Company’s Board of Directors. Stockholders who hold their shares through an intermediary must provide instructions on voting as requested by their bank or broker. The giving of a proxy does not preclude the right to vote in person should any shareholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise thereof, either in person at the Annual Meeting or by filing with the Company’s President at the Company’s executive office a written revocation bearing a later date or duly executed, a subsequent proxy relating to the same shares of common stock; however, no such revocation will be effective until written notice of the revocation is received by the Company at or prior to the Annual Meeting.

The cost of preparing, assembling and mailing this Proxy Statement, the Notice of Annual Meeting of Stockholders and the enclosed proxy will be borne by the Company. In addition to the use of the mail, employees of the Company may solicit proxies personally and by telephone. The Company’s employees will receive no compensation for soliciting proxies other than their regular salaries. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. The Company may reimburse such persons for their expenses in so doing.

OTHER MATTERS; DISCRETIONARY VOTING

Our Board of Directors does not know of any matters, other than as described in the notice of Meeting attached to this Proxy Statement, that are to come before the Meeting.

The Board of Directors does not intend to present any business at the Annual Meeting other than the proposals described in this proxy statement. However, if any other matter properly comes before the Annual Meeting, including any stockholder proposal omitted from the proxy statement and form of proxy pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, your proxies will act on such matter in their discretion.

1

If the requested proxy is given to vote at the Meeting, the persons named in such proxy will have authority to vote in accordance with their best judgment on any other matter that is properly presented at the Meeting for action, including without limitation, any proposal to adjourn the Meeting or otherwise concerning the conduct of the Meeting.

RIGHT TO REVOKE PROXIES

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. Proxies may be revoked by:

| | • | | filing with the President of the Company, before the polls are closed with respect to the vote, a written notice of revocation bearing a later date than the proxy; |

| | • | | duly executing a subsequent proxy relating to the same shares of common stock and delivering it to the President of the Company; or |

| | • | | attending the Meeting and voting in person (although attendance at the Meeting will not in and of itself constitute a revocation of a proxy). |

Any written notice revoking a proxy should be sent to: Our principal executive office at 1511 Third Avenue, Suite 788, Seattle, Washington 98101. No such revocation will be effective until written notice of the revocation is received by the Company prior to the Annual Meeting.

PURPOSE OF THE MEETING

At the Annual Meeting, the Company’s Stockholders will consider and vote upon the following matters:

| | (1) | To elect the Company’s Board of Directors to hold office until the next Company’s Annual Meeting of Stockholders or until his successor is duly elected and qualified; and |

| | (2) | To ratify the appointment of Schwartz Levitsky Feldman LLP , as the Company’s independent certified public accountant; and |

| | (3) | To ratify the 2009 Stock Option Plan; and |

| | (4) | To transact such other business as may properly come before the Annual Meeting and any adjournment thereof. |

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth above) will be voted (a) FOR the election of the nominees for director(s) named below; and (b) FOR the proposal to ratify the appointment of Schwartz Levitsky Feldman LLP , as the Company’s independent certified public accountant and (c) FOR the proposal to ratify the 2009 Stock Option Plan. In the event a shareholder specifies a different choice by means of the enclosed proxy, such shareholder’s shares will be voted in accordance with the specification so made.

2

MARKET FOR COMMON EQUITY AND OTHER STOCKHOLDER MATTERS

The Company trades on the American Stock Exchange under the symbol “HQS.” Inclusion on the American Stock Exchange permits price quotation for our shares to be published by such service.

OUTSTANDING VOTING SECURITIES AND VOTING RIGHTS

The Board of Directors has set the close of business on November 9, 2009 as the record date (the “Record Date”) for determining Stockholders of the Company entitled to receive notice of and to vote at the Annual Meeting. As of the date herein there are 14,657,163 shares of Common Stock, $.0001 par value (the “Common Stock”) issued and outstanding, all of which are entitled to be voted at the Annual Meeting. Each share of Common Stock is entitled to one vote on each matter submitted to Stockholders for approval at the Annual Meeting. In addition, the Company has Preferred stock, $0.001 par value, 10,000,000 shares authorized, of which 100,000 Class A Preferred Stock (“Series A Preferred Stock” and collectively with the Common Stock, the “capital shares”) are issued and outstanding. Each share of Class A Preferred Stock has 1,000 votes on all matters presented to be voted by the holders of common stock the Common Stock and the

The presence, in person or by proxy, of at least a majority of the total number of capital shares outstanding on the Record Date will constitute a quorum for purposes of the Annual Meeting. If less than a majority of the outstanding capital shares are represented at the Annual Meeting, a majority of the shares so represented may adjourn the Annual Meeting from time to time without further notice. A plurality of the votes cast by holders of capital shares will be required for the election of directors. The ratification of the appointment of Schwartz Levitsky Feldman LLP as the Company’s independent certified public accountant will be approved if the number of capital shares voted in favor of ratification exceeds the number of shares voted against it. Abstentions and broker non-votes will be counted as shares present at the Annual Meeting for purposes of determining a quorum. With respect to the outcome of any matter brought before the Annual Meeting (i) abstentions will be considered as shares present and entitled to vote at the Annual Meeting, but will not be counted as votes cast for or against any given matter and (ii) broker non-votes will not be considered shares present and entitled to vote. Because directors will be elected by a plurality of the votes cast at the Annual Meeting and the other matters to be acted upon at the Annual Meeting will be approved if the number of votes cast in favor of the matter exceeds the number of votes cast against it, abstentions and broker non-votes will have no effect on the outcome of the proposals to be voted upon at the Annual Meeting.

Prior to the Annual Meeting, the Company will select one or more inspectors of election for the Annual Meeting. Such inspector(s) shall determine the number of shares of Common Stock represented at the Annual Meeting, the existence of a quorum, and the validity and effect of proxies, and shall receive, count, and tabulate ballots and votes, and determine the results thereof.

A list of Stockholders entitled to vote at the Annual Meeting will be available for examination by any shareholder at the Company’s principal executive office in Seattle for a period of 10 days prior to the Annual Meeting, and at the Annual Meeting itself.

3

BUSINESS

About Our Company

We are a multi-national company with our headquarters and primary sales offices based in Seattle, Washington. We are a vertically integrated aquatic product producer, processor, and farmer (e.g. through cooperative arrangements with pond farmers), with operations in the People’s Republic of China, or the PRC, of all natural tilapia, other aquatic products, and marine bio and healthcare products. We use state-of-the-art and environment-friendly technologies in our production, processing, and cooperative farm operations. Our facilities are currently certified according to the Hazard Analysis and Critical Control Point (“HACCP”) standards, currently assigned a European Union (“EU”) code required for exporting aquatic products to the EU, and are currently certified in accordance with the Aquaculture Certification Counsel (“ACC”) standards. Our products are sold principally to customers in North America, Europe and Asia.

Established in 1999, our aquatic farming and processing operations are in Hainan Province, an island in the South China Sea, which is situated within the most desirable latitude for raising tilapia. The Chinese government has designated Hainan Province in southern China a “green” province, where only environmentally friendly agri-food related industry and tourism are permitted. We purchase and process farm bred and farm raised tilapia through cooperative supply arrangements with local farmers and cooperatives. Our supply cooperatives, under our guidance, use feed formulated by us to optimize the all natural growth of farm raised tilapia. Starting in 2009, we will supply the farmers and cooperatives the feed formulation from our feed processing mill. We believe our tilapia products have achieved such a high level of purity that we market these products as all natural tilapia. In addition, we purchase and process ocean-caught aquatic products through cooperative supply arrangements with local fisherman for our marine bio healthcare products.

In August 2004, the company acquired Hainan Jiahua Marine BioProducts Co. Ltd., or Jiahua Marine, which develops, produces and sells marine bio and healthcare products, including nutraceutical products for the enrichment of our feed formulas, exclusively in China. The principal products of Jiahua Marine are manufactured from fish by-products (tilapia and shark) that include shark cartilage capsules and shark liver oil products that are distributed exclusively in China. The products undergo substantial independent laboratory testing administered by the Ministry of Health in China, which has resulted in a PRC National Certification for these products. These products have various perceived medicinal and health benefits. As part of HQS’s vertical integration plan with respect to tilapia, Jiahua Marine introduced new bio and healthcare products made from tilapia in 2009.

In order to maintain the high quality of our products and to position ourselves for attaining completely organic production certification in the future, we have completed the construction of our own feed mill and processing plant for the production of floating feed formulations. We produce the feed using grains grown without chemical fertilizers, free of antibiotics and fishmeal, and use feed additives manufactured in our nutraceutical plant. We plan for this expanded production to satisfy our own demand through the 20,000 mu (or 3,294 acres) of production in Wenchang and Qionghai, as well as to manufacture feed for others’ farmed operations in Hainan, such as shrimp and other farmed species.

From our headquarters in Seattle, Washington, we market and brand our high-quality, all natural tilapia products under the name TILOVEYA®. In early 2009, we introduced a new family of frozen tilapia meals under the brand name “Lillian’s Healthy Gourmet.” This new family of products includes an organic, natural and regular line of frozen tilapia meals.

4

We are incorporated in Delaware. The address of our Unites States headquarters is Melbourne Towers, 1511 Third Avenue, Suite 788, Seattle, Washington 98101 and our telephone number is (206) 621-9888. Our website is located atwww.hqfish.com. The information contained on our website or that can be accessed through our website does not constitute part of this prospectus.

Our Principal Competitive Strengths

We believe we have the following principal competitive strengths:

| | • | | Quality All Natural Tilapia Products.We produce all natural tilapia products and have developed a farming system that avoids the use of antibiotics, hormones and other potentially toxic chemicals. Our tilapia is raised in ponds of pure rain water collected for aquaculture. Two other species of fish are introduced into the ponds to maintain the ponds’ health naturally. One of the species is a bottom feeder that cleans up all the waste at the bottom of the ponds (carp), and the other species is a predator fish that eliminates all of the unhealthy fish (snakehead). We formulate feed without fishmeal and produce feed supplements in our healthcare products processing plant to enrich this feed. It is our policy to raise all natural tilapia to distinguish our company from other tilapia producers. The latitude and the pristine environment of the Hainan province of China have provided us with what we believe to be the optimal conditions for all natural aquaculture production. |

| | • | | Vertically Integrated Operations. Our newly completed feed mill is an important additional step towards our goal of complete vertical integration of our operations, which will allow us to further control and monitor the quality of our aquaculture products, as well as control our costs. The local farmers that we have cooperative arrangements with use our production methods and allow us to constantly monitor the production process for highly consistent production that results in high quality products at the time of harvest. |

| | • | | Environmental and Quality Assurances.We are a leader in environmental and quality assurances of aquaculture products. We have adopted and implemented stringent quality control measures and procedures throughout the production process, in order to comply with the various environmental and quality standards, such as the HACCP and the EU import standards. We are also certified in accordance with the ACC standards and positioning ourselves for completely organic production certification of our tilapia products in accordance with market demands. We use state-of-the-art technologies in our farming, feed formulation and processing operations. We have adopted modern and environmentally friendly and responsible technology in our production and processing of tilapia, shrimp, and marine bio and healthcare products, which we believe have been recognized as such through the certifications our plants possess. |

| | • | | Strategic Location in Hainan Province, China. Our processing facilities are geographically well-positioned in Hainan Province to leverage favorable climatic conditions, abundant water supply, pristine environment and a readily available source of labor for our processing plant. We are also located near a seaport, near the city of Wenchang, and our processing facilities are conveniently located near the farmers from whom we obtain our supply of tilapia and shrimp. |

| | • | | International and Domestic Sales and Marketing Efforts.Our Seattle office allows us to differentiate our TILOVEYA® brand and marketing initiative of our all natural tilapia products. Following the success of the TILOVEYA® brand, we introduced in 2009 a family of frozen tilapia meal products under the brand name of “Lillian’s Healthy Gourmet.” The family of products will have three lines focusing on organic, natural and regular frozen meals. The “Lillian’s Healthy Gourmet” brand will help us continue to establish our products as the all natural tilapia products of choice both domestically and internationally. Sales from both the Seattle and China offices complement our multi-national sales efforts to become a world leader in all natural tilapia products. |

5

| | • | | An Established Track Record and Brand Name in the Industry.We have an established track record and recognized brand name in the industry and have received numerous awards and certifications, which we believe reflects the success of the company in distinguishing itself from its competition. |

| | • | | Competitive Cost Structure.We benefit from competitive cost structures due to the lower labor costs in China as compared to other companies that produce similar products. |

Our Growth Strategies

Our objective is to become the world leader in vertically integrated production, processing and raising of all natural tilapia products. This includes the use of tilapia by-products to increase the range and variety of our marine bio and healthcare products, with a primary focus on increasing our own seafood products. To achieve this goal, we intend to implement the following strategies:

| | • | | Our newly completed large-scale feed mill to supply our existing and anticipated new cooperative fish farmers with our fish food formula. We anticipate that the new feed mill will help increase our aquatic profit margin, help guarantee our product quality and further vertically integrate our operations; |

| | • | | We intend to achieve completely organic production of our tilapia products and to pursue organic certification of our farms as market demand dictates; |

| | • | | We plan to expand direct and retail sales of our health products in China and internationally and to add other products we currently have in the development pipeline; |

| | • | | We plan to expand our development of health products by using the by-products of tilapia, which will help increase the overall aquatic products’ gross margins; |

| | • | | We plan to expand our cooperative farming arrangements to increase the availability of tilapia to meet anticipated growth in demand; |

| | • | | We plan to construct our own tilapia farmed ponds to improve growth time and quality of our product and further vertically integrate our operations; |

| | • | | We plan to continue to expand our production and processing facilities in China to satisfy the anticipated growing demand for our products; |

| | • | | Our Seattle office allows us to increase awareness of the importance of our all natural products and to benefit from more direct sales. The Seattle office also allows us to expand our distribution options in North America and Europe by broadening the variety of products we offer to cater to the demands of our customers; and |

| | • | | We plan to expand our product offerings, including our family of frozen tilapia meals. We will continue our branding and marketing initiatives in North America and Europe to introduce our new family of products to major retail and food service chains. |

Industry Overview

Aquaculture Industry

Aquaculture is the farming of aquatic animals or plants. Aquaculture is also the world’s fastest growing segment in the food production system and has been for the past two decades. According to a recent study by the World Food and Agriculture Organization (“FAO”) published on March 2, 2009, world fisheries production reached a new high of 143.6 million metric tonnes in 2006, including farmed and ocean caught product. The contribution of aquaculture to the world fisheries production in 2006 was 51.7 million tonnes of fish, which is 36 percent of world fisheries production up from 3.6 percent in 1970. Global aquaculture accounted for 6 percent of the fish available for human consumption in 1970. In 2006 global aquaculture accounted for 47 percent of the fish available for human consumption according to the FAO. The FAO report also describes that over half of the global aquaculture in 2006 was freshwater finfish. Based on the FAO’s projections, it is estimated that in order to maintain the current level of per capita consumption, global aquaculture production will need to reach in excess of 80 million tonnes of fish by 2050.

6

As the availability of sites for aquaculture is becoming increasingly limited and the ability to develop non-agricultural land is often restricted, the competition to develop additional aquaculture production systems is intensifying. As the intensification for aquaculture production systems increases, the demand for institutional support, services and skilled persons is anticipated to increase, along with the demand for more knowledge-based aquaculture education and training as aquaculture becomes more important worldwide. China remains the largest producer of aquaculture products throughout the world with fishes in China reportedly producing approximately 41.3 million tonnes of fish in 2004. Within the global aquaculture industry, China accounted for 71.0% of the world’s supply of fish for direct human consumption and 29.9% of the total production by live weight in 2002.

Tilapia Industry

In 2005, according to the American Tilapia Association (“ATA”), tilapia production worldwide was second in volume to carp, and it is projected by the ATA that tilapia will become the most important aquaculture crop in this century, potentially reaching $5.0 billion in global sales by 2010. Commercial production of tilapia has become popular in many countries around the world. Touted as the “new white fish” to replace the depleted ocean stocks of cod, pollock, and hake, world tilapia production continues to rise and at least 100 countries currently raise tilapia, with the PRC being the largest producer. The American Tilapia Association further reports that world production of tilapia products reached approximately 2.5 million metric tonnes in 2007, of which China produced the dominant share of 45.0 percent.

One of the major outlets for Chinese-produced tilapia has been, and should continue to be, the United States. The following chart reflects the increase in per-capita consumption of tilapia in pounds in the United States in relation to other traditional types of seafood.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| U.S. Consumer Consumption Per Capita (lbs) |

| 2000 | | 2001 | | 2002 | | 2003 | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 (est.) |

| Tuna | | 3.5 | | Shrimp | | 3.4 | | Shrimp | | 3.7 | | Shrimp | | 4.0 | | Shrimp | | 4.2 | | Shrimp | | 4.1 | | Shrimp | | 4.4 | | Shrimp | | 4.1 | | Shrimp | | 4.0 |

| Shrimp | | 3.2 | | Tuna | | 2.9 | | Tuna | | 3.1 | | Tuna | | 3.4 | | Tuna | | 3.4 | | Tuna | | 3.1 | | Tuna | | 2.9 | | Tuna | | 2.7 | | Tuna | | 2.6 |

| Pollock | | 1.6 | | Salmon | | 2.0 | | Salmon | | 2.0 | | Salmon | | 2.2 | | Salmon | | 2.2 | | Salmon | | 2.4 | | Salmon | | 2.0 | | Salmon | | 2.3 | | Salmon | | 2.2 |

| Salmon | | 1.5 | | Pollock | | 1.2 | | Pollock | | 1.1 | | Pollock | | 1.7 | | Pollock | | 1.7 | | Pollock | | 1.5 | | Pollock | | 1.6 | | Pollock | | 1.7 | | Pollock | | 1.6 |

| Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.1 | | Catfish | | 1.0 | | Tilapia | | 1.0 | | Tilapia | | 1.1 | | Tilapia | | 1.2 |

| Cod | | 0.8 | | Cod | | 0.6 | | Cod | | 0.7 | | Cod | | 0.6 | | Tilapia | | 0.7 | | Tilapia | | 0.8 | | Catfish | | 1.0 | | Catfish | | 1.0 | | Catfish | | 1.0 |

| Clams | | 0.5 | | Clams | | 0.5 | | Crabs | | 0.6 | | Crabs | | 0.6 | | Cod | | 0.6 | | Cod | | 0.6 | | Crabs | | 0.7 | | Crabs | | 0.7 | | Crabs | | 0.7 |

| Crabs | | 0.4 | | Crabs | | 0.4 | | Clams | | 0.5 | | Tilapia | | 0.5 | | Crabs | | 0.6 | | Crabs | | 0.6 | | Cod | | 0.5 | | Cod | | 0.5 | | Clams | | 0.4 |

| Flatfish | | 0.4 | | Flatfish | | 0.4 | | Tilapia | | 0.4 | | Clams | | 0.5 | | Clams | | 0.5 | | Clams | | 0.4 | | Clams | | 0.4 | | Clams | | 0.4 | | Cod | | 0.4 |

| Scallops | | 0.3 | | Tilapia | | 0.4 | | Flatfish | | 0.4 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 | | Scallops | | 0.3 |

| Tilapia | | 0.3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

7

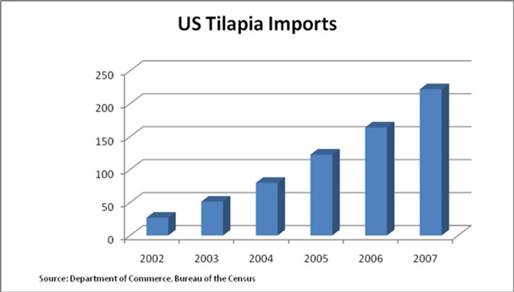

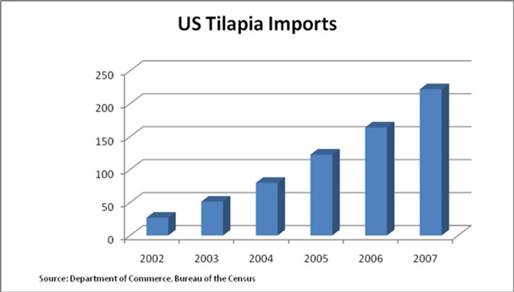

The following chart reflects the increase in imported tilapia to the United States during the periods indicated.

Separately, according to the International Trade Report produced in 2005 by the United States Department of Agriculture, or the USDA,“U.S. per-capita seafood consumption has remained around 15 billion pounds through the late 1980s and 1990s; it is expected to increase as farm-raised products become cheaper. Currently, the United States consumes nearly 12 billion pounds of fish a year. By 2025, demand for seafood is projected to grow by another 4.4 billion pounds (2 million metric tonnes) above what is consumed today. In addition, it is estimated that by 2020, 50 percent of the U.S. seafood supply will come from aquaculture. Presently, more than 70 percent of the seafood consumed in the United States is imported, and at least 40 percent of that is farm-raised. Major changes in U.S. population, along with shifting demographics and economic growth, will alter the U.S. seafood market over the next decade, affecting the selection of products consumed. It is expected that fresh and frozen fish products will account for a growing share of overall seafood consumption, with shrimp remaining at the top. By 2020, shrimp, salmon, tilapia, and catfish will be the top four seafood products consumed…”

According to Globefish.org, during the past ten years, tilapia captured by fisheries have stabilized at 0.6 million metric tonnes, while their aquaculture production has grown from 0.55 million metric tonnes to 2.0 million metric tonnes. Tilapia is one of the top five seafood imports in the world. In 2005, more than $2.4 billion of tilapia was sold worldwide according to the FAO Fishstat 2007. In 2005, tilapia moved up to the fourth-ranked most popular seafood after farm-raised shrimp, tuna and Atlantic salmon in terms of aquaculture products imported into the United States. The United States is now the world’s largest consumer of tilapia after China, having imported 437 thousand metric tonnes of tilapia in 2007. In terms of volume, frozen whole round fish ranks first, followed by frozen fillets and then fresh fillets.

The growing consumer demand for seafood is largely evolving from a new public awareness regarding its health and nutritional benefits. The USDA “pyramid” guidelines continue to support frequent fish consumption, and the USDA recently completed a highly technical nutritional analysis report about tilapia for the general public. The USDA’s Agriculture Research Service Lab reports that tilapia is moderate in polyunsaturated fatty acid (0.387 g/100g raw, 0.600 g/100g cooked), moderate in omega 3 fatty acids (0.141g/100g raw, 0.220g/100g cooked) and low in mercury (0.010 parts per million, which we refer to as PPM), which is considered to be non-detectable. With the increased awareness of the health concerns surrounding mercury, tilapia’s low mercury levels (0.010 PPM) distinguish tilapia favorably from other types of fish with higher mercury levels, such as swordfish (0.976 PPM), mackerel (0.730 PPM) and yellow fin tuna (0.325 PPM).

8

Over-the-Counter Marine Bio and Healthcare Products

As in the United States, because of the aging population, China is demographically attractive for healthcare companies. According to China’s Ministry of Health 2009 figures, of the 1.3 billion people in China currently, less than 8 percent of China’s population is 65 or older; however, by 2050 that proportion is expected to rise to 24 percent. It is expected as well that Chinese will benefit from double-digit annual growth in disposable incomes during this period. We anticipate that this will lead to increasing use of western therapeutics and “over the counter” remedies. In addition, the market place is highly fragmented with more than 4,000 manufacturers of such remedies in China, most of whom lack scale and access to capital. From 2009 to 2011, we believe approximately $124 billion will be allocated to healthcare expenditure in China. HQS has benefited from regulatory consolidation that resulted in the imposition of higher Chinese Good Manufacturing Practice (“GMP”) standards in 2007 and intends to be a leader in its emphasis on the highest quality standards.

The marine bio and healthcare products industry in China is also sizable, with approximately $6 billion in sales, which still constitutes only 3 percent of the world market. Currently, overall sales of these products in China have fallen slightly as compared to the previous year, as consumers gravitate toward branded products meeting international quality standards and with proven benefit for consumers, and away from less known brands and traditional remedies.

In general, sales of marine bio and healthcare products are made through retail and direct sales channels. Direct sales in China are relatively new, and restrictions on direct sales imposed on large foreign companies have been implemented in China, which has allowed for a growth in sales for PRC-based direct sales companies. These restrictions require foreign direct sellers to manufacture their products and to capitalize their businesses in China. Several companies have met these requirements, including HQS through its PRC-subsidiaries, and growth in this sector is expected to be strong in the next few years.

We believe that nutraceutical supplements in the feed industry is a sector that has strong growth potential, as the importance of aquaculture and aquaculture feeds increases. We manufacture actualized feeds, which involves choosing additives to be included in the feed, such as vitamin E, that promote health in fish, thus reducing the need for curative measures such as antibiotics. Once ingested and present in the flesh of the fish, vitamin E increases the shelf life of the fish and also introduces an additional source of vitamin E to its consumers. Other similar nutraceutical supplements can also be used.

Trademarks and Patents

We have the following patents on our products: Chinese Patent Number 460000X340-2001—Shark Cartilage; Chinese Patent Number 460000X131-2001—Shark Cartilage; Chinese Patent Number 460000X338-2001—Shark Liver Oil; and Patent Number 460000X342-2001—Shark Liver Oil. These patents are for a 20 year period and will expire in 2021. Two products are produced from refined shark cartilage and two from shark liver, both harvested from non-endangered shark species.

We consider our service marks, trademarks, trade secrets, patents and similar intellectual property to be critical to our success. We rely on trademark, patent and trade secret law, as well as confidentiality and license agreements with our employees, customers, partners and others to protect our proprietary rights. We have received patent protection and applied for trademark protection for our products in the PRC. We have also applied for trademark protection in the U.S., as described below, in connection with our branding of all natural tilapia. Effective trademark, service mark, patent and trade secret protection may not be available in every country in which we sell or may in the future sell our products, and our competitors may independently develop formulations and processes that are substantially equivalent or superior to our own.

9

TILOVEYA®

In May 2006, we introduced our all natural tilapia brand TILOVEYA® at the European Seafood Exposition in Brussels, the largest seafood show in the world. This brand is designed to celebrate the health benefits of our tilapia produced in Hainan Province, China. Our freshwater tilapia products are made without hormones, antibiotics and free of levels of heavy metals and other toxins associated with ocean sourced products. We have filed with the United States Patent and Trademark Office the following applications for trademark registrations in connection with our branding of all natural tilapia:

| | • | | Registration Number 3313536 for the TILOVEYA® mark; and |

| | • | | Registration Number 3304756 for the TILOVEYA® Logo. |

Lillian’s Healthy Gourmet®

In August 2008, we developed a family of products under the brand of “Lillian’s Healthy Gourmet” based on the concept of our all natural tilapia products produced in Hainan Province, China. Individuals should be able to eat a convenient healthy seafood meal at a reasonable price, while maintaining their demanding life style. The “Lillian’s Healthy Gourmet” products are designed to meet the need for a convenient healthy seafood meal at a reasonable price. We have filed with the United States Patent and Trademark Office for trademark registrations in connection with our branding of the “Lillian’s Healthy Gourmet” family of products and these filings are pending approval from the authorities.

Competition

In general, the aquaculture industry is intensely competitive and highly fragmented. The PRC aquaculture industry is further open to competition from local and overseas operators engaged in aquaculture and from other captured fish producers. We compete with various companies, many of which are developing or can be expected to develop products similar to ours. For example, 8th Sea—The Organic Seafood Company currently produces and processes tilapia fillets in Brazil’s Parana state. Our main aquaculture products (tilapia and shrimp) are also facing competition from some other PRC-based aquaculture producers. Some of the other aquaculture processing companies in Hainan Province have obtained certifications similar to those we possess. However, we believe that the competition from such producers is minimal because, to the best of our knowledge, there are no competitors in Hainan Province that have a similar operating scale and production capacity, or that have developed the vertically integrated business model under which we operate.

Many of our competitors are more established than we are, and have significantly greater financial, technical, marketing and other resources than we presently possess. Some of our competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements, and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We intend to create greater brand awareness for our brand name(s) so that we can successfully compete with our competitors. We cannot assure you that we will be able to compete effectively or successfully with current or future competitors, or that the competitive pressures we face will not harm our business.

With respect to potential new competitors, although there are no formal barriers to entry for engaging in similar aquaculture processing production and activities in the PRC, we believe that the high infrastructure costs associated with developing and constructing processing plants and facilities does pose a barrier to potential competitors. Fish farms are tied directly to a processing plant and a new processing plant must either enlist new farms or build its own. Furthermore, measures addressing environmental considerations, such as water quality and waste water processing requirements, are costly to deploy on a greenfield site and are not readily available to all new companies. Accordingly, potential competitors have to mobilize extensive resources in order to maintain a presence similar to ours.

10

Government Regulation

Our company complies with various national, provincial and local environmental protection laws and regulations, as well as certifications and inspections relating to the quality control of our production and the environmental and social impact of our operations. In addition to statutory and regulatory compliance, we actively seek to ensure the environmental sustainability of our operations. Also, all of our healthcare products have met stringent independent testing by selected university laboratories in China. Our costs of compliance with applicable environmental laws are minimal. Penalties would be levied upon us if we fail to adhere to and maintain our compliance with the applicable environmental regulations in the PRC. Such failure has not occurred in the past, and we generally do not anticipate that it may occur in the future, although no assurance can be given in this regard.

HACCP Standards

Our facilities are certified in accordance with the Hazard Analysis Critical Control Points, or HACCP, standards for exporting aquatic products to the United States. The HACCP standards are developed by the FDA pursuant to the FDA’s HACCP regulation, Title 21, Code of Federal Regulations, part 123, and are used by the FDA to help ensure food safety and control sanitary standards.

These standards focus on monitoring the quality of production and sanitation measures in processing plants for food products, and also take into account the environmental and social impact of the operations of the certified company. Compliance with the HACCP procedures is mandatory, and the successful implementation of these procedures depends on the design and performance of facilities and equipment, and excellent quality control and hygiene practices. HACCP conducts sample laboratory testing on our processed aquatic products to ensure no forbidden substances are present in them. Laboratory testing of our processed aquatic products was initiated by the HACCP in compliance with strict quarantine guidelines imposed by domestic export control government agencies and foreign import control government agencies.

In addition, our facilities continuously pass the United States Department of Commerce (USDC) inspection in conformity with the USDC Global Seafood Inspection Program (voluntary).

ACC Standards

We have completed the process of certification of our processing plant in China in relation to shrimp and tilapia processing in accordance with the Aquaculture Certification Counsel, Inc., or the ACC standards. The ACC standards are considered “super HACCP” standards, as they also take into account various environmental and social issues. ACC certification is required by many large retailers in the United States.

The ACC is a U.S.-based, non-governmental body established to certify social, environmental and food safety standards at aquaculture facilities throughout the world. The ACC uses a certification system that combines site inspections and effluent sampling with sanitary controls, therapeutic controls and traceability. Part of the ACC’s mission is to help educate the aquaculture public regarding the benefits of applying best aquaculture practices and the advancing scientific technology that directs them. The ACC believes that, by implementing such standards, seafood producers can better meet the demands of the growing global market for safe, wholesome seafood produced in an environmentally and socially responsible manner. The ACC offers a primarily “process,” rather than “product”, certification, with an orientation toward seafood buyers. Successful participation in the ACC program is visually represented by limited use of a “Best Aquaculture Practices” certification mark. The ACC currently certifies shrimp, talipia and catfish farms and processing plants. We anticipate that the certification will include hatcheries and feed mills in the near future.

Assignment of EU Code

Our facilities have been assigned a European Union (EU) approval registration, referred to as an EU Code, required for exporting aquatic products to the EU. This requirement applies to production both inside and outside of the EU, and defines the applicable standards of the EEC for handling, processing, storing and transporting fish. Our aquatic products processing plant in China must meet or exceed these standards every year, in order to maintain the assigned EU Code. The assignment of the EU Code to us, and our ability to maintain it on an annual basis, evidence the fact that our products meet the EU importable food standards set by the relevant inspection agencies.

11

Product Liability Insurance

We have purchased general commercial liability insurance, which provides adequate aggregate product liability insurance based on industry standards. However, there is a possibility that our customers, or the ultimate buyers of our products, may have adverse reactions to the tilapia and other aquatic products or marine bio and healthcare products that we process and sell. Any such adverse reaction may result in actual or potential product liability claims against us, which may not be covered by our insurance or, if covered, may be significantly higher than the insurance amount. Such actual or potential product liability claims may have an adverse effect on our reputation and profitability.

Government Regulation in China

Aquaculture producers in the PRC have to comply with the environmental protection laws and regulations promulgated by the national and local governments of the PRC. Such rules and regulations include, among others, Environmental Protection Law of the PRC, Ocean Environmental Protection Law of the PRC, Regulations on Administration over Dumping of Wastes in the Ocean of the PRC, Ocean Aquatic Industry Administration Regulation, Fishing License Administration Regulation, Regulations on Administration of Hygiene Registration of Exported Food Manufacturers, and Regulations on Administration of Quality Control of Food Processors.

In addition, HACCP and sanitary programs in China in accordance with the FDA’s HACCP standards are verified by the China Inspection and Quarantine Office, or CIQ, which is a branch of the State Administration for Entry-Exit Inspection and Quarantine of the PRC and, in our case, also by the Hainan Entry-Exit Inspection and Quarantine Bureau of the PRC. In addition, the CIQ evaluates the compliance by our processing plant with the EU standards described above under “—Assignment of EU Code.” As a result of such review, our aquatic products processing plant in China has received a CIQ certificate. The CIQ certificate must be renewed on an annual basis.

Our Work with the Hainan Province

We have enjoyed close collaboration with the local government as we conduct our operations in the Hainan Province. Our completed 100,000 metric tonnes per year capacity, state-of-the-art extruded feed mill, which will supply our farmers and other buyers of such quality feeds, expands our operations in that area and should foster close ties with the local government. See “Construction of Feed Mill and Processing Plant.” The success of our operations in the PRC depends in part on the continued investment by Hainan Province in the development of the local aquaculture industry. While there can be no assurances that such investment will continue, we believe that it should continue for the following reasons. The central government of China has limited Hainan Province to two areas of economic activity, agri-food and tourism. The resulting focus of the Hainan Province on the agri-food and tourism sectors creates a strong potential synergy with private sector companies intent on further development of these sectors. Part of the attraction for investors is the low tax rate in Hainan. In addition, foreign companies setting up new ventures in Hainan do not pay any tax for the two first years of profitable operations, then pay 7.5 percent for the following three years and 15 percent thereafter. For this reason, we plan to continue to structure and conduct our operations in China through the use of separate subsidiaries, held by foreign holding companies which are separate and distinct from holding companies already incorporated. In turn, these holding companies are held by HQS. Under these arrangements, we are not considered involved in joint ventures, but rather in wholly owned foreign enterprises, under the local law. Government support for such ventures meeting local needs is positive, and we believe our operations have already demonstrated our ability to channel this support in the manner favorable to our business and Hainan. We believe that not having a joint venture with the local government is the best way to minimize the potential for government interference and to maximize government support, and we plan to continue to conduct our business in China accordingly.

12

Furthermore, on March 17, 2007, a new PRC Enterprise Income Tax Law (EIT) was promulgated and introduced a new uniform tax regime in the PRC. The EIT became effective on January 1, 2008. That new EIT Law provides, amongst other issues, that income derived from processing of fishery products and processing of agricultural products will be exempt from the EIT tax rate. Starting in 2008, our existing fish processing unit and our feed mill plant under construction benefited from a “zero” percent tax rate. With regards to our nutraceutical unit, the income tax rate, under the new law, will increase by approximately 2 percent yearly until it reaches a maximum of 25 percent in 2012.

Distribution Channels

Our current sales activity is primarily directed to distributors within the People’s Republic of China (“PRC”), rather than within the U.S. At the present time, we sell more than 90% of our seafood products in China to Asian clients which are then distributed principally in the United States and Europe, and we sell all of our marine bio and healthcare products exclusively in the PRC. Through our Seattle office, we are able to work directly with wholesale and retail buyers. The programs established with retail distributors are rather different than with wholesalers. Retailers require product introduction and marketing support and pay differently than wholesalers. The latter generally take delivery of product ex-plant and pay through a letter of credit, while the former take delivery in the United States and pay on negotiated terms.

The Seattle office is charged with maintaining existing accounts and introducing our toxin free tilapia products to a new target market of retail and food service industry purchasers. We plan to introduce our family of products branded “Lillian’s Healthy Gourmet” throughout North America in 2009. We are currently selling our toxin free tilapia products to the European market through distributors and retailers. We are actively seeking to expand our distributor network in Europe for our TILOVEYA® brand.

Currently, all of our marine bio and healthcare products are sold in the PRC. Through our subsidiary Jiahua Marine, we currently sell a range of healthcare products under the brand name “Jiahua” in the PRC.

Our China sales are principally marketed through our offices in Wenchang to customers that include domestic supermarkets, airlines, hotels and local distributors. Direct sales of healthcare products target tourists in various popular destinations in China, such as Sanya, Beihai and the Three Gorges project. Seminars are organized for these tourists that usually result in the purchase of our products. These products are also sold in various chain stores, over the internet, and through mail order sales throughout China.

Properties

We own two processing plants located in Wenchang, Hainan Province, the PRC, and the related manufacturing equipment, office equipment and motor vehicles. We use one plant to process the seafood products we produce, and the other plant to process our marine bio and healthcare products. We have also purchased the piece of land for the construction of our new large organic feed mill.

In addition, we currently lease corporate premises for our new United States headquarters located in Seattle, Washington, consisting of approximately 4,170 square feet from Doncaster Investments NV, Inc. The term of the related lease is sixty months, which term commenced on December 1, 2005. Our monthly payment under the lease is $3,500 per month.

Our properties are in good condition and are sufficient to meet our needs at this time. We do not plan to obtain additional space in the foreseeable future for the above cited plants but we intend to build additional processing facilities from the proceeds of this offering.

13

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of common stock as of October 23, 2009 by:

| | • | | each person known to us to own beneficially more than 5 percent, in the aggregate, of the outstanding shares of our common stock |

| | • | | each of our chief executive officer and our other two most highly compensated executive officers; and |

| | • | | all executive officers and directors as a group |

The number of shares beneficially owned and the percent of shares outstanding are based on 14,657,163 shares outstanding as of October 23, 2009. Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Except as otherwise noted below, the address of each of the shareholders in the table is c/o HQ Sustainable Maritime Industries, Inc., 1511 Third Avenue, Suite 788, Seattle, Washington.

| | | | | | | | |

Beneficial Owner | | Shares of Common

Stock Number (1) | | Beneficially Owned

Percent (1) | | Shares of Series A

Preferred Stock (2) | | Beneficially Owned

Percent (2) |

Norbert Sporns | | 796,761 | | 5.4 percent | | 24,000 | | 24.0 percent |

Lillian Wang Li | | 828,918 | | 5.7 percent | | 25,000 | | 25.0 percent |

Harry Wang Hua | | 1,639,993 | | 11.2 percent | | 51,000 | | 51.0 percent |

Andrew Intrader(3) | | 4,155 | | Less than 1 percent | | | | |

Fred Bild | | 3,892 | | Less than 1 percent | | | | |

Daniel Too | | 10,502 | | Less than 1 percent | | | | |

Joseph I. Emas | | 17,155 | | Less than 1 percent | | | | |

Jean-Pierre Dallaire | | 10,000 | | Less than 1 percent | | | | |

All such directors and executive officers as a group (8 persons) | | 3,311,376 | | 22.6 percent | | 100,000 | | 100.0 percent |

| | | | |

Five Percent Shareholders (Other than Directors and named executive officers | | | | | | | | |

River Road Asset Management, LLC (4) | | 784,103 | | 5.4 percent | | | | |

Hound Partners, LLC, Hound Performance, LLC and Jonathan Auerbach (5) | | 785,915 | | 5.4 percent | | | | |

The Tail Wind Fund Ltd. (6) | | 1,017,980 | | 6.9 percent | | | | |

| (1) | Beneficially owns the shares indicated, which are owned of record by Red Coral Group Limited and Sino-Sult Canada (S.S.C.) Limited. Each of Mr. Sporns, Ms. Wang and Mr. Wang own respectively 24 percent, 25 percent and 51 percent of the issued capital of Red Coral Group Limited and Sino-Sult Canada (S.S.C.) Limited and share voting and investment power over the shares held by Red Coral Group Limited and Sino-Sult Canada (S.S.C.) Limited. The number of shares includes the common stock shares based upon the Series A preferred stock held by the beneficial owners convertible at a rate of 2 common stock shares for 1 preferred stock share at the option of the beneficial holder, which has been adjusted to reflect a 1 for 20 reverse stock split effectuated on January 31, 2007 to 0.1 shares of common stock for 1 preferred stock share. |

14

| (2) | Beneficially owns the shares indicated, which are owned of record by Sino-Sult Canada (S.S.C.) Limited. Each of Mr. Sporns, Ms. Wang and Mr. Wang own respectively 24 percent, 25 percent and 51 percent of the issued capital of Sino-Sult Canada (S.S.C.) Limited and share voting and investment power over the shares held by Sino-Sult Canada (S.S.C.) Limited. Each share of Series A Preferred Stock has the right to the voting power equal to that of 1,000 shares of the Company’s Common Stock. The voting power of the Series A Preferred Shares remains the same and is not adjusted for any reverse split, namely each Series A Preferred Shares continues to have the voting power of 1,000 shares of Common Stock. |

| (3) | The address of this stockholder is c/o Renova U.S. Management LLC, 153 E. 53rd Street, 58th Floor, New York, New York 10022. |

| (4) | Based on a Schedule 13G/A filed by River Road Asset Management, LLC with the SEC on February 17, 2009. The address of the indicated holder is 462 S. 4th Street, Suite 1600, Louisville, KY 40202. |

| (5) | Based on a Schedule 13G/A jointly filed by Hound Partners, LLC, Hound Performance, LLC and Jonathan Auerbach with the SEC on February 13, 2009. The address of the indicated holders is 101 Park Avenue, 48th Floor, New York, New York 10178. |

| (6) | Tail Wind Advisory & Management Ltd., a UK corporation authorized and regulated by the Financial Services Authority of Great Britain (“TWAM”), is the investment manager for The Tail Wind Fund Ltd., and David Crook is the CEO and controlling stockholder of TWAM. Each of TWAM and David Crook expressly disclaims any equitable or beneficial ownership of the shares being registered hereunder and held by The Tail Wind Fund Ltd. |

15

DESCRIPTION OF CAPITAL STOCK

General

The following description summarizes the material terms and provisions of our capital stock. The following summary description of our common stock and preferred stock is based on the provisions of our certificate of incorporation and bylaws, which are incorporated by reference, and the applicable provisions of Delaware Corporation Law. This information is only a summary and is qualified in its entirety by reference to our certificate of incorporation and bylaws and the applicable provisions of Delaware Corporation Law.

Our authorized capital stock consists of 200,000,000 shares of common stock, par value $0.001 per share, and 10,000,000 shares of preferred stock, par value $0.001 per share, of which 100,000 are designated as Series A preferred stock.

Common Stock

Authorized. We currently have authority to issue up to 200,000,000 shares of common stock, par value $0.001 per share.

Voting. Each holder of common stock is entitled to one vote for each share owned on all matters voted upon by stockholders. In addition, our Series A preferred stock is entitled to vote on all matters to be voted on by holders of our common stock. The Series A preferred stock is entitled to 1,000 votes per share. A majority vote is required for all actions to be taken by stockholders, except that a plurality is required for the election of directors. The common stock has no preemptive rights, no cumulative voting rights and no redemption, sinking fund or conversion provisions.

Dividends. Holders of common stock are entitled to receive dividends, if and when declared by our board of directors, out of funds legally available for such purpose, subject to the dividend and liquidation rights of any preferred stock that may then be outstanding, including but not limited to, the Series A preferred stock.

We have never declared or paid any cash dividends on our common stock. We currently intend to retain future earnings, if any, to finance the expansion of our business. In addition, as stipulated by the relevant laws and regulations for enterprises operating in the PRC, Hainan Quebec Ocean Fishing Co. Ltd. and Jiahua Marine are required to make annual appropriations to two reserve funds, consisting of the statutory surplus and public welfare funds, which amounts are not available for the payment of dividends. As a result, we do not anticipate paying cash dividends on our common stock in the foreseeable future and we may not have sufficient funds to legally pay dividends.

Liquidation and Dissolution. In the event we liquidate, dissolve or wind-up our operations, the holders of the common stock are entitled to share equally and ratably in our assets, if any, remaining after the payment of all our debts and liabilities and the liquidation preference of any shares of preferred stock that may then be outstanding.

Fully Paid and Nonassessable. All shares of our outstanding common stock are fully paid and nonassessable and any additional shares of common stock that we issue will be fully paid and nonassessable.

Listing. Our common stock is listed on the NYSE Amex Equities, formerly known as the American Stock Exchange (AMEX) under the symbol “HQS.”

Transfer Agent and Registrar. The transfer agent and registrar for our common stock is American Stock Transfer & Trust Company, 59 Maiden Lane, Plaza Level, New York, NY 10038.

16

Preferred Stock

Under the terms of our certificate of incorporation, our board of directors has the authority, without further action by the stockholders and subject to the limits imposed by Delaware Corporation Law, to issue up to 10,000,000 shares of preferred stock, par value $0.001 per share, in one or more series and to designate the rights, preferences, privileges and restrictions of each such series. The issuance of preferred stock could have the effect of restricting dividends on the common stock, diluting the voting power for the common stock, impairing the liquidation rights of the common stock or delaying or preventing a change in control without further action by the stockholders.

Series A Preferred Stock

Authorized. Of the 10,000,000 shares of preferred stock we are authorized to issue, 100,000 shares have been designated as Series A preferred stock.

Voting. Each holder of shares of our Series A preferred stock is entitled to 1,000 votes per share on all matters to be voted on by holders of our common stock;provided, however, that the vote or consent of the holders of at least a majority of the shares of Series A preferred stock then outstanding is required for us to (1) authorize, create or issue, or increase the authorized number of shares of, any class or series of capital stock ranking prior to or on a parity with the Series A preferred stock either as to dividends or liquidation; (2) authorize, create or issue any class or series of our stock other than the common stock; (3) authorize any reclassification of the Series A preferred stock; (4) authorize, create or issue any securities convertible into or exercisable for capital stock prohibited by clauses (1) through (3) above; (5) amend our certificate of incorporation; or (6) enter into any disposal, merger or reorganization involving 20% of our total capitalization.

Conversion Rights. The holders of our Series A preferred stock have an optional right to convert each share of Series A preferred stock into two shares of our common stock, which has been adjusted to 0.1 shares of common stock for 1 preferred stock share to reflect a one for 20 reverse stock split effectuated on January 31, 2007.

Dividends. Subject to the rights of the holders of any class or series of capital stock ranking senior to or on parity with the Series A preferred stock, the holders of our Series A preferred stock have the right to receive cumulative dividends when and as declared by the board of directors.

Liquidation. The holders of our Series A preferred stock have the right to receive a liquidation preference of $1.00 per share of Series A preferred stock, plus an amount equal to all dividends accrued and unpaid, in preference to the holders of our common stock or any other class or series of capital stock ranking junior to the Series A preferred stock. This liquidation preference will be adjusted to reflect any stock dividend, stock distribution or stock split with respect to the Series A preferred stock.

Reacquired Shares. Any shares of Series A preferred stock acquired by us will be retired and not reissued.

AUDIT AND CERTAIN OTHER FEES PAID TO ACCOUNTANTS

Our auditors Schwartz, Levitsky, Feldman., LLP, billed us aggregate fees in the amount of approximately $240,000 for year ended December 31, 2008 while Rotenberg billed us $155,000 for the financial year ended December 31, 2007. These amounts were billed for professional services our auditors provided for the audit of our annual financial statements and SOX 404 internal controls over financial reporting, review of our securities offerings and other services typically provided by an accountant in connection with statutory and regulatory filings or engagements for those financial years.

Schwartz Levitsky Feldman billed us aggregate fees in the amount of $60,000 for year ended December 31, 2008 while Rotenberg billed us $105,000 for the financial year ended December 31, 2007, and for assurance and related services that were reasonably related to the performance of the reviews of our financial statements.

17

Schwartz Levitsky Feldman and Rotenberg billed us aggregate fees in the amount of $0 for the financial years ended December 31, 2008 and December 31, 2007, for tax compliance, tax advice, and tax planning.

Schwartz Levitsky Feldman and Rotenberg billed us aggregate fees in the amount of $0 for the financial years ended December 31, 2008 and December 31, 2007, and for all other fees.

All audit-related services, tax services and other non-audit services were pre-approved by the Audit Committee, which concluded that the provision of such services by Schwartz Levitsky Feldman was compatible with the maintenance of that firm’s independence in the conduct of its auditing functions. The Audit Committee’s Outside Auditor Independence Policy provides for pre-approval of audit, audit-related and tax services specifically described by the committee on an annual basis and, in addition, individual engagements anticipated to exceed pre-established thresholds must be separately approved. The policy authorizes the committee to delegate to one or more of its members pre-approval authority with respect to permitted services.

Audit Committee Pre-Approval Policies and Procedures

On an ongoing basis, our management of defines and communicates specific projects and categories of service for which the advance approval of the Audit Committee is requested. The Audit Committee reviews these requests and advises management if the Committee approves the engagement of Schwartz Levitsky Feldman. On a periodic basis, our management reports to the Audit Committee regarding the actual spending for such projects and services compared to the approved amounts. The projects and categories of service are as follows:

Audit — These fees include the cost of professional services to audit our financial statements and internal control over financial reporting. The cost of the annual audit includes costs associated with the quarterly review of financial statements performed in connection with the audit and scope modifications initiated during the course of the audit work.

Audit-Related Services — The Committee separately pre-approves budgets for services related to accounting consultations, due diligence and audit services related to mergers and acquisitions, internal control reviews and attest services related to financial reporting that are not required by statute or legislation.

Tax — The Committee separately pre-approves a budget for services related to tax compliance, tax planning and tax advice. The specific types of tax services approved include (a) the review of tax returns; (b) assistance with tax examinations and elections; (c) the provision of customs consultancy services; and (d) advice regarding tax codes including interpretations, procedures and private letter rulings thereof, or their equivalent in applicable jurisdictions, in the areas of income tax, value added tax, sales and use tax, and excise taxes.

Other Services — Other services were discussed with and approved by the Audit Committee.

18

BOARD OF DIRECTORS

Directors are elected at the Company’s Annual Meeting of Stockholders and serve for one year until the next annual Stockholders’ meeting or until their successors are elected and qualified. Officers are elected by the Board of Directors and their terms of office are at the discretion of the Board.

Board of Directors and Officers

The current Board of Directors consists of Norbert Sporns, Lillian Wang, Harry Wang Hua, Fred Bild, Daniel Too, Joseph I. Emas and Andrew Intrater. The nominated Board of Directors consists of Norbert Sporns, Lillian Wang, Harry Wang Hua, Fred Bild, Daniel Too, Joseph I. Emas and Andrew Intrater. Their biographies are in Proposal One herein. Norbert Sporns is our Chief Executive Officer. Jean-Pierre Dallaire is our Chief Financial Officer.

Compensation of Directors

Our bylaws provide that, unless otherwise restricted by our certificate of incorporation, our board of directors has the authority to fix the compensation of directors. The directors may be paid their expenses, if any, related to attendance at each meeting of the board of directors and may be paid a fixed sum for attendance at each meeting of the board of directors or a stated salary as our director. Our bylaws further provide that no such payment will preclude any director from serving our company in any other capacity and receiving compensation therefor. Further, members of special or standing committees may be given compensation for attending committee meetings.

Legal Proceedings

We are currently not involved in any litigation that we believe could have a materially adverse effect on our financial condition or results of operations. There is no action, suit, proceeding, inquiry or investigation before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the executive officers of our company or any of our subsidiaries, threatened against or affecting our company, our common stock, any of our subsidiaries or of our company’s or our company’s subsidiaries’ officers or directors in their capacities as such, in which an adverse decision could have a material adverse effect.

19

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Executive Compensation Philosophy

Our compensation program is designed to attract, retain and motivate highly qualified executives and drive sustainable growth. We compensate our executives named in the “Summary Compensation Table,” which we refer to as “named executive officers” or “NEOs,” through a combination of base salary, incentive, and cash bonuses. Cash bonuses are designed to reward current performance and are based on the Company’s performance, the executive’s performance and the executive’s adherence to our core values.

Our Compensation Committee

The responsibilities of the Compensation Committee are to:

| | • | | oversee development and administration of the Company’s executive compensation plans; set the compensation of the Chief Executive Officer and other executive officers; review and consider the performance of the Chief Executive Officer and other officers; |

| | • | | oversee the evaluation of the Chief Executive Officer and other members of management; and review and approve employment, severance, change-in-control, termination and retirement arrangements for all officers. |

The Compensation Committee has not delegated its authority for officer compensation, but has delegated all of its authority under the Company’s equity plan to the Chief Executive Officer to grant equity awards to employees below the officer level.

Officer compensation decisions are made by the Compensation Committee after discussing recommendations with the Chief Executive Officer. He may attend Compensation Committee meetings to discuss the financial performance of the Company and the performance of individual executives.

The members of the Compensation Committee are Fred Bild and Daniel Too. The Board has determined that all of the members of the Compensation Committee are independent under the Company’s Corporate Governance Guidelines and the AMEX Corporate Governance Rules. No member of the Compensation Committee was or is an officer or employee of the Company or any of its subsidiaries.

Overview of Our Executive Compensation

Our compensation objectives are to:

| | • | | attract first-class executive talent |

| | • | | reward past performance |

| | • | | motivate future performance |

| | • | | foster the identification and development of leadership potential in key talent |

20

The compensation framework for our named executive officers consists of the following three key elements:

| | • | | Annual cash bonuses; and |

| | • | | Long-term incentives (including the grant of stock options) |

In addition to these key elements of compensation, our compensation framework includes limited fringe benefits, perquisites, severance and other benefits.

Our executive compensation program is designed to develop and motivate the collective and individual abilities of our management team. In establishing the type and size of executive compensation awards, the Compensation Committee considers the factors listed below under “Performance Criteria.”

Base Salaries

Our named executive officers receive a majority of their overall cash compensation as base salary. Generally, base salaries have not been based upon specific measures of corporate performance, but are determined upon the recommendations of the Chief Executive Officer, based upon his determination of each employee’s individual performance, position and responsibilities, and contributions to both our financial performance and ethical culture, and approved by the Compensation Committee. We kept the original terms of the employment agreements including the amount of salaries for the named executive officers over the years.

Annual Bonuses

Pursuant to employment agreements, the named executive officers are entitled to an annual cash bonus in an amount no less than $100,000 for Mr. Harry Wang, $100,000 for Ms. Lillian Wang, $50,000 for Mr. Norbert Sporns and $25,000 Mr. Jean-Pierre Dallaire. The Compensation Committee determines whether to pay any annual cash bonus to the named executive officers in excess of these thresholds and the amount of such excess. The Compensation Committee makes this determination at the end of each fiscal year, based on the factors described below under “Performance Criteria.”

For each of the last four fiscal years, the Compensation Committee increased the cash bonus for each of the named executive officers by 10%. Although the Compensation Committee does not directly link the amounts of annual cash bonuses to the Company’s financial performance when determining the amount of these bonuses, the Compensation Committee considered the fact that the Company’s income from operations increased substantially over 10% in each of the past four years. The amount of the cash bonus for each named executive officer for each of the last three years is set forth below under “Summary Compensation Table.”

Long-Term Incentives

The Compensation Committee believes that the grant of non-cash, long-term compensation, primarily in the form of long-term incentive awards, to our named executive officers is appropriate to attract, motivate and retain such individuals, and enhance stockholder value through the use of non-cash, equity incentive compensation opportunities. The Compensation Committee believes that our best interests will be advanced by enabling our named executive officers, who are responsible for our management, growth and success, to receive compensation in the form of long-term incentive awards. Since long-term awards will increase in value in conjunction with an increase in the value of our common stock, the awards are designed to provide our named executive officers with an incentive to remain with us.

21

Perquisites

Our compensation framework includes limited fringe benefits, perquisites and other benefits. Based on the employment agreements entered into between the Company and the named executives, the named executives are eligible to participate in incentive, savings, retirement (401(k)), and welfare benefit plans, including without limitation, health medical, dental, vision, life (including accidental death and dismemberment) and disability insurance plans. Since our main operation is in China and the named executive officers maintain personal residences in China and other places than Seattle, our headquarters office, the company also supports the rent for the named executive officers during their stay in Seattle.

The Company periodically reviews the perquisites that named executive officers receive. These perquisites are relatively few in number, and the Compensation Committee believes that its policies regarding perquisites are conservative compared to other companies.

The total costs to the Company for providing perquisites and personal benefits to the named executive officers during fiscal 2008 are shown in the “Summary Compensation Table.”

Our Executive Compensation Principles

The following core principles reflect the compensation philosophy of the Company with respect to the named executive officers, as established and refined from time to time by the Compensation Committee:

| 1. | Compensation should reinforce the Company’s business objectives and values. |

| 2. | Compensation should be performance-related. |

| 3. | There should be flexibility in allocating the various compensation elements. |

| 4. | Incentive compensation should balance short-term and long-term performance. |

| 5. | Named executive officers should have financial risk and reward tied to their business decisions. |

These principles are intended to motivate the named executive officers to improve the Company’s financial performance; to be personally accountable for the performance of the business units, divisions, or functions for which they are responsible; and to collectively make decisions about the Company’s business that will deliver stockholder value. Below is a description of how these principles are implemented.

1. Compensation should reinforce the Company’s business objectives and values.