New contract opportunities – next 24 months

Greenfield – North Carolina & Oklahoma

Competitor contracts – Maryland, West Virginia, Germany, Greece,

Hamburg, Lower Saxony, Malaysia and Shanghai

Continue to drive same store sales growth with new content

Monopoly-themed game – 1st branded game in U.S. lottery history

More than 50 new games under development and 40 at Atronic

Gaming Expansion

California – joining Mega-Millions in June

Florida – considering multi-state game

Rhode Island – 500 new VLTs in Q1, additional 1700 proposed; 50% to

GTECH

Other potential opportunities – Kentucky and Texas

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

FY’06 Outlook. . .

7

Elected not to participate in new procurement process

Complex solutions not adequately evaluated in commodity auction process

Revenue withholding restricts ability to generate value for shareholders

Committed to supporting Caixa’s migration to new business model

Extension negotiations ongoing

Civil case update

30% withholding to be discontinued

Funds in escrow in excess of BRR40M to be returned

(as of April 8, approximately BRR38M/$14M)

Decision can be appealed

Improved clarity 4 – 6 weeks

Maintaining current outlook

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Brazil Update. . .

8

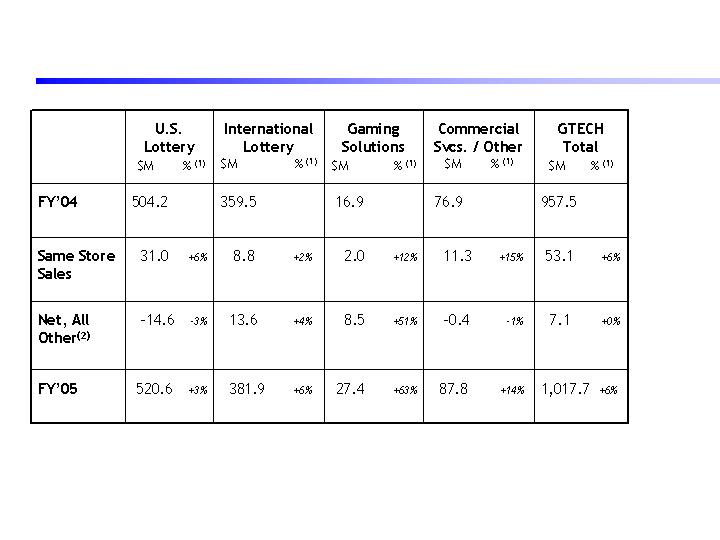

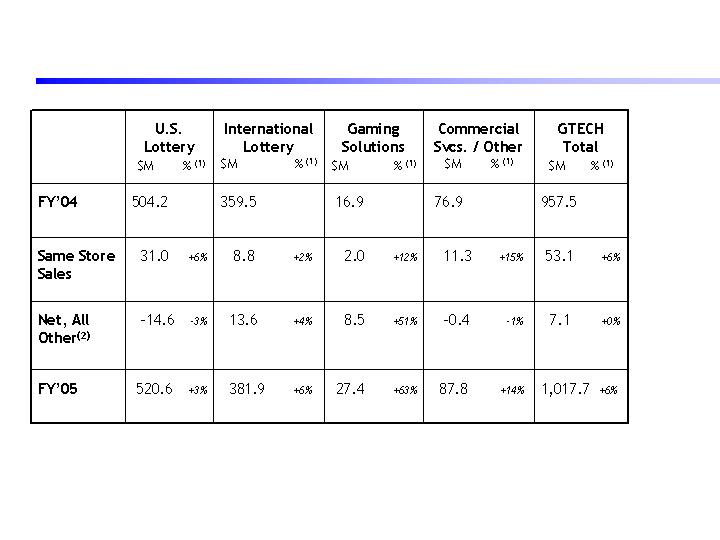

(1)All percentage points are rounded to the nearest percent

(2)Reflects impact of 53 rd week in FY’04, contract wins/losses, jackpot activity, contractual rate

changes, foreign exchange changes, the impact of acquisitions, and revenue withheld in Brazil.

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Service Revenue Analysis. . .

Q4 FY’05 vs. FY’04

9

Total Revenue +21%

Service Revenues In line with Q4 FY’04

Same Store Sales +5%

Operating Expense Ratio 13% 300+ BP Improvement

Diluted Earnings Per Share Ahead of Expectations

Free Cash Flow $37M

Stock Repurchases 0.9M Shares, $20M

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Key Financial Highlights. . .

Q4 FY’05 vs. FY’04

10

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

(1)

For a calculation, explanation, and reconciliation to GAAP measure, see Supplemental Financial Data in the Investor

Presentation section of our Website www.gtech.com

Cash Flow. . .

Q4 FY’05

Cash from

Operations

Maintenance

Capital (1)

Investing for

Growth (1)

Recurring Free

Cash Flow

Free Cash Flow

$96.7M

$33.5M

$63.2M

$26.0M

$10M Dividends

$20M Share Repurchases

$30M Total

$37.2M

Cash Returned

to Shareholders

11

(1)All percentage points are rounded to the nearest percent

(2)Reflects impact of 53 rd week in FY’04, contract wins/losses, jackpot activity, contractual rate

changes, foreign exchange changes, the impact of acquisitions, and revenue withheld in Brazil.

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Service Revenue Analysis. . .

FY’05 vs. FY’04

12

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Total Revenue. . .

FY’05

$88M

$77M

$81M

$18M

$540M

$513M

$548M

$443M

FY’05

FY’04

13

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

(1) For a calculation, explanation, and reconciliation to GAAP measure, see Supplemental Financial Data in the Investor

Presentation section of our Website www.gtech.com

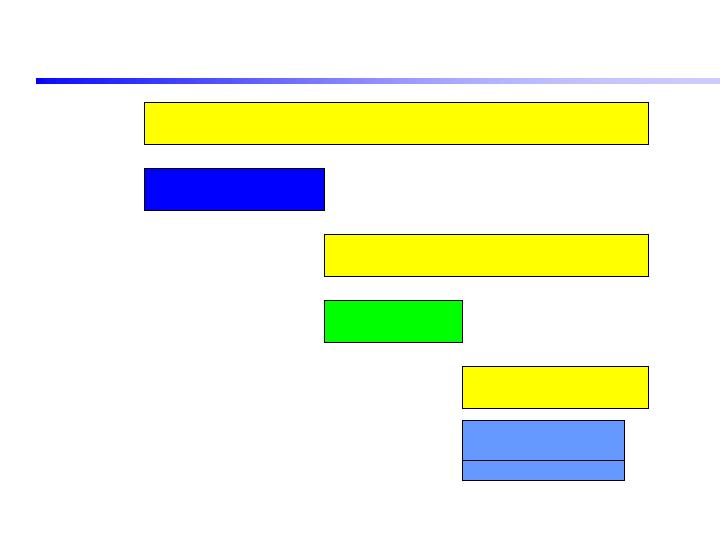

Cash Flow. . .

FY’05

Cash from

Operations

Maintenance

Capital (1)

Investing for

Growth (1)

Recurring Free

Cash Flow

$375M

$135M

$240M

Cash Returned

to Shareholders

$201M Spielo, LILHCo, and Billbird

$114M Other Growth Capital

$315M Total Growth Capital

$40MDividends

$121MShare Repurchases

$161MTotal

14

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

For a calculation and an explanation of ROCE, see Supplemental Financial Data in the Investor Presentation

section of our Website www.gtech.com

Return on Capital Employed. . .

FY’05 vs. FY’04

$M

ROCE 19.9% 15.9%

15

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

FY’06(1)

FY’06 Guidance. . .

As of April 14, 2005

16

Service Revenue Growth

8% - 10%

Same store sales growth 5% - 6%

Net effect of contract wins and contractual rate changes

Impact of recent acquisitions

Contract extension through May 2006

Forecast full year of revenues with ramp down beginning in third

quarter FY’06

30% withholding continues

Average exchange rate for FY’06 - 2.9BRR to 1USD

Revenues from Brazil

FY’06 ~$80M - $85M

FY’05 $93M

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Brazil Assumptions. . .

17

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

FY’06(1)

(1) Assumes full year of revenue from Brazil with 30% hold back

(2) Based on a diluted share estimate of 132M shares

FY’06 Guidance Continued. . .

As of April 14, 2005

18

Service Revenue Growth

8% - 10%

Product Sales

$180M - $210M

Service Margins

~40%

Product Margins

38% - 40%

Full-Year Effective Tax Rate

35%

Earnings per Share(2); Excluding impact of SFAS 123R

$1.53 - $1.58

Earnings per Share(2); Including impact of SFAS 123R

$1.50 - $1.55

Net Cash Invested

$240M - $250M

Free Cash Flow

$160M - $180M

EBITDA

$520M - $530M

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Revenue $15M - - $20M $25M - $35M

Earnings per Share (1) $0.06 - - $0.08 $0.07 - $0.12

Reflects or includes impact of

Collection of 100% of Caixa revenues

Release of $14M from escrow ($11M relating to FY’05; $3M to FY’06)

Accelerated de-installation schedule

Potential incremental (Non-Brazil) investments of $8M - $10M

1st Quarter

(1) Based on diluted share estimate of 131M shares for Q1; 132M shares for FY’06

Net Potential Upside. . .

Full Year

19

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Cash Flow. . .

FY’06 Preliminary Guidance

Cash from

Operations

Capital

Expenditures

Free Cash Flow

Cash returned to shareholders

$40M in dividends

Ongoing share repurchase program

$240M - $250M

$410M - $420M

$160M - $180M

20

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Q1 FY’06

(1) Based on Diluted Share Estimate of 131M Shares

Q1 FY’06 Guidance. . .

As of April 14, 2005

21

Service Revenue Growth

5% - 7%

Product Sales

$30M - $35M

Service Margins

38% - 40%

Product Margins

38% - 40%

Effective Tax Rate

36%

Earnings per Share (1)

$0.33 - $0.36

Fiscal Year 2005 – Fourth Quarter Earnings Conference Call

Closing. . .

22