GTECH Holdings Corporation

W. Bruce Turner

President & Chief Executive Officer

Jaymin B. Patel

Sr. Vice President & Chief Financial Officer

Fiscal Year 2006

Second Quarter Earnings Conference Call

September 23, 2005

8:30 AM

Safe Harbor Act. . .

Comments made during this presentation may contain forward-

looking statements, including, without limitation, statements relating

to the future operations and financial performance of the Company

and the Company’s future strategies. Such forward-looking

statements reflect management’s assessment based on information

currently available, but are not guarantees and are subject to risks and

uncertainties, which would cause the results to differ materially from

those contemplated in the forward-looking statements. These risks

and uncertainties include, but are not limited to, those set forth here

and in the Company’s filings with the SEC.

Fiscal Year 2006 – Second Quarter Earnings Conference Call

2

Agenda. . .

W. Bruce Turner, Chief Executive Officer

Welcome

Q2 Performance Review

Strategy Update

Jaymin B. Patel, Chief Financial Officer

Review of Q2 Financial Results

Guidance for Fiscal Year 2006 and Guidance for Q3

Fiscal Year 2006 – Second Quarter Earnings Conference Call

3

Second Quarter Business Review. . .

Financial Performance

Service revenue growth

Florida

Virginia

LILHCo

Same store sales growth

Significant free cash flow

Fiscal Year 2006 – Second Quarter Earnings Conference Call

4

Q2 FY’06 Strategic Progress. . .

Key wins / Extensions

Content

+15 new games developed in Q2, +30 games YTD

California – MegaMillions

Washington State – Instant Online Bingo

Fiscal Year 2006 – Second Quarter Earnings Conference Call

ONCE

New Zealand

Germany – WestLotto

Washington State

Ohio – Online & ITVM

Swiss Loro

5

New Games

Wisconsin – Cash game

Trinidad & Tobago – Extra

Licensed content

BattleshipTM – Minnesota

Universal Studios’ KING KONG motion picture – Instant ticket markets

New products

WinWaveTM

Dynamic floor management system

19 new games for Class III and Native American markets

Q2 FY’06 Strategic Progress. . .

Fiscal Year 2006 – Second Quarter Earnings Conference Call

* BATTLESHIP is a trademark of Hasbro and is used with permission. © 2005 Hasbro. All Rights Reserved.

**Universal Studios’ KING KONG movie © Universal Studios. Licensed by Universal Studios

Licensing LLLP. All Rights Reserved.

6

New contract opportunities

Arizona

Maryland

New Jersey

Greece

Further expansion opportunities

North Carolina

Pennsylvania

Massachusetts

New Jersey

Rhode Island

Q2 FY’06 Strategic Progress. . .

Fiscal Year 2006 – Second Quarter Earnings Conference Call

Awards pending

7

(1)All percentage points are rounded to the nearest percent

(2)Reflects impact of contract wins/losses, jackpot activity, contractual rate changes, foreign exchange changes, the

impact of acquisitions, and the net change of revenue withholdings and new contract terms in Brazil.

Fiscal Year 2006 – Second Quarter Earnings Conference Call

28.7 +42%

6.2 +31%

2.3 +11%

20.2

Commercial

Svcs. / Other

$M % (1)

248.1

7.6

91.2

129.1

FY’05

9.0 +3%

0.1 +2%

(4.1) -4%

6.8 +5%

Net, All

Other(2)

266.3 +7%

8.1 +7%

90.3 -1%

139.2 +8%

FY’06

9.2 +4%

0.4 +5%

3.2 +3%

3.3 +3%

Same

Store

Sales

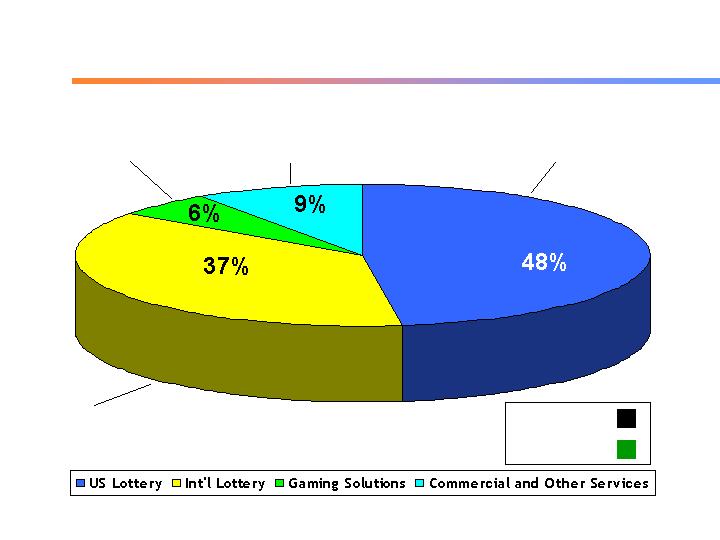

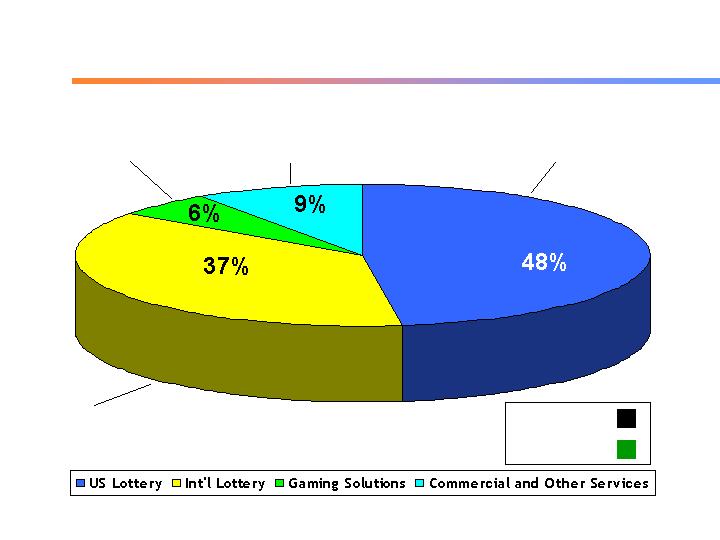

GTECH

Total

$M % (1)

Gaming

Solutions

$M % (1)

International

Lottery

$M % (1)

U.S.

Lottery

$M % (1)

Service Revenue Analysis. . .

Q2 FY’06 vs. Q2 FY’05

8

Service Revenue +$18M

Product Sales $44M

Gross Profit Margins 40%

Service Margins 39%

Product Margins 43%

Operating Expenses $41M

Operating Expense Ratio 13%

Net Income $49M

Diluted Earnings Per Share $0.38

Cash from Operations $94M

Key Financial Highlights. . .

Q2 FY’06

Fiscal Year 2006 – Second Quarter Earnings Conference Call

9

Fiscal Year 2006 – Second Quarter Earnings Conference Call

(1)

For a calculation, explanation, and reconciliation to the GAAP measure, see Supplemental Financial

Data in the Investor Presentation section of our Website www.gtech.com

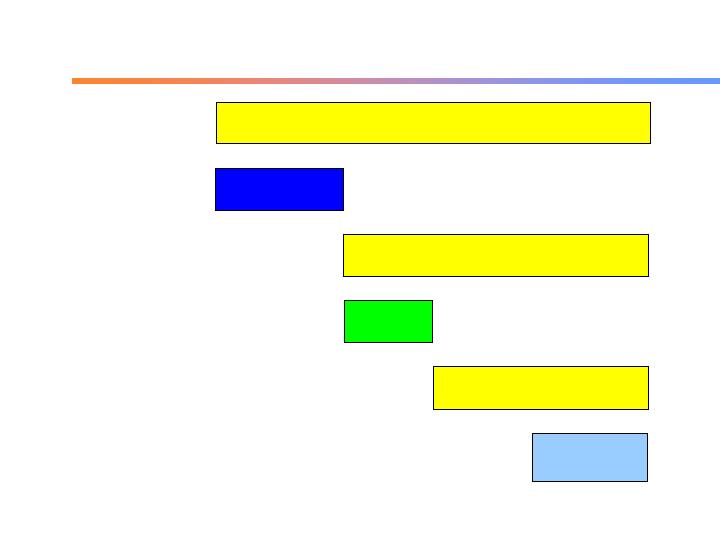

Cash Flow. . .

Q2 FY’06

Cash from

Operations

Maintenance

Capital (1)

Investing for

Growth (1)

Recurring Free

Cash Flow

Free Cash Flow

$94M

$19M

$75M

$4M

$71M

Cash Returned

to Shareholders

$10M Dividends

10

(1)All percentage points are rounded to the nearest percent

(2)Reflects impact of contract wins/losses, jackpot activity, contractual rate changes, foreign exchange changes, the

impact of acquisitions, and the net change of revenue withholdings and new contract terms in Brazil.

Fiscal Year 2006 – Second Quarter Earnings Conference Call

60.6 +46%

14.5 +35%

4.7 +11%

41.4

Commercial

Svcs. / Other

$M % (1)

501.4

13.1

189.6

257.3

FY’05

32.8 +6%

2.1 +16%

2.2 +1%

14.0 +6%

Net, All

Other(2)

557.7 +11%

16.1 +23%

198.7 +5%

282.3 +10%

FY’06

23.5 +5%

0.9 +7%

6.9 +4%

11.0 +4%

Same

Store

Sales

GTECH

Total

$M % (1)

Gaming

Solutions

$M % (1)

International

Lottery

$M % (1)

U.S.

Lottery

$M % (1)

Service Revenue Analysis. . .

FY’06 YTD vs. FY’05

11

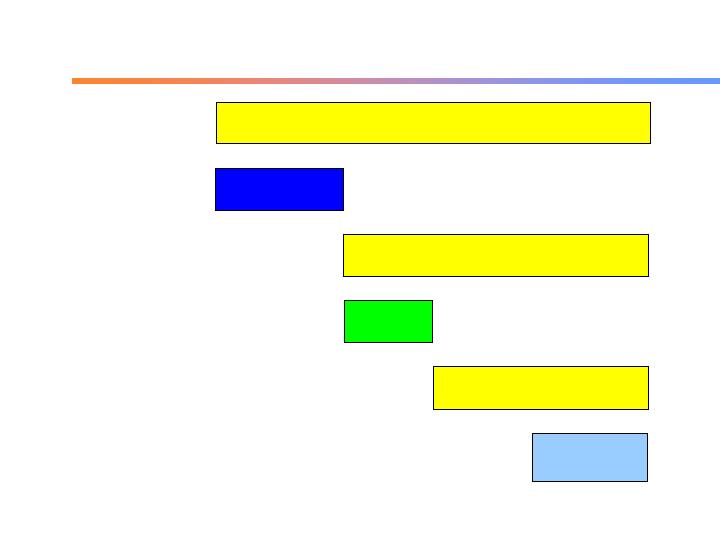

Total Revenue. . .

FY’06 YTD

$60M

$41M

$36M

$31M

$304M

$269M

$236M

$263M

FY’06 YTD

FY’05 YTD

Fiscal Year 2006 – Second Quarter Earnings Conference Call

12

Fiscal Year 2006 – Second Quarter Earnings Conference Call

(1)

For a calculation, explanation, and reconciliation to the GAAP measure, see Supplemental Financial

Data in the Investor Presentation section of our Website www.gtech.com

Cash Flow. . .

FY’06 YTD

Cash from

Operations

Maintenance

Capital (1)

Investing for

Growth (1)

Recurring Free

Cash Flow

Free Cash Flow

$215M

$52M

$163M

$13M

$20M Dividends

$32M Share Repurchases

$52M Total

$150M

Cash Returned

to Shareholders

13

Return on Capital Employed. . .

FY’06 YTD vs. FY’05

Average Capital Employed +$300M

+26% year over year

ROCE 15.5%

ROCE (Excluding cash balances) 19.0%

Fiscal Year 2006 – Second Quarter Earnings Conference Call

For a calculation and an explanation of ROCE, see Supplemental Financial Data in the Investor Presentation

section of our Website www.gtech.com

14

Service Revenue Growth 10% - 12%

Product Sales $190M - $210M

Service Margins 40% - 42%

Product Margins 38% - 40%

Full-Year Effective Tax Rate 34% - 35%

Earnings per Share(1); Excluding impact of SFAS 123R $1.64 - $1.70

Net Cash Invested $190M - $200M

Free Cash Flow $210M - $230M

EBITDA ; $530M - $540M

FY’06

(1) Based on a diluted share estimate of 130.7M shares

FY’06 Guidance. . .

As of September 23, 2005

Fiscal Year 2006 – Second Quarter Earnings Conference Call

15

$410M - $420M

Cash from

Operations

Capital

Expenditures

$190M - $200M

$210M - $230M

Free Cash Flow

Cash Flow. . .

FY’06 Guidance

Fiscal Year 2006 – Second Quarter Earnings Conference Call

16

Service Revenue Growth 9% - 10%

Product Sales $30M - $40M

Service Margins ~ 40%

Product Margins 38% - 40%

Tax Rate 29% - 30%

Earnings per Share (1) $0.34 - $0.37

Q3 FY’06

(1) Based on Diluted Share Estimate of 130.8M Shares

Q3 FY’06 Guidance. . .

As of September 23, 2005

Fiscal Year 2006 – Second Quarter Earnings Conference Call

17

Q&A. . .

Fiscal Year 2006 – Second Quarter Earnings Conference Call

18

Summary. . .

Business growth continues

Development of new content

Long-term strategy remains on track

Creating value for shareholders

Confident in our ability to meet objectives for FY’06

and beyond

Fiscal Year 2006 – Second Quarter Earnings Conference Call

19