UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

| | |

| Investment Company Act file number: | 811-05972 |

Name of Registrant: | Vanguard International Equity Index Funds |

Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000 |

Date of fiscal year end: October 31 | |

Date of reporting period: November 1, 2016 – October 31, 2017 |

Item 1: Reports to Shareholders | |

Annual Report | October 31, 2017

Vanguard International Stock Index Funds

Vanguard European Stock Index Fund

Vanguard Pacific Stock Index Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Performance at a Glance. | 1 |

| Chairman’s Perspective. | 4 |

| European Stock Index Fund. | 7 |

| Pacific Stock Index Fund. | 32 |

| Your Fund’s After-Tax Returns. | 57 |

| About Your Fund’s Expenses. | 58 |

| Glossary. | 60 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises

or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this

report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Nautical images have been part of Vanguard’s rich heritage since its start in 1975. For an

incoming ship, a lighthouse offers a beacon and safe path to shore. You can similarly depend on Vanguard to put

you first––and light the way––as you strive to meet your financial goals. Our client focus and low costs,

stemming from our unique ownership structure, assure that your interests are paramount.

Your Fund’s Performance at a Glance

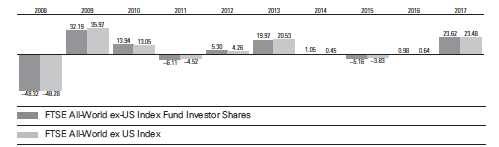

• Global stocks rallied over the 12 months ended October 31, 2017, amid steady economic growth, accommodative monetary policies, and benign inflation.

• For the fiscal year, Vanguard European Stock Index Fund returned 27.77% and Vanguard Pacific Stock Index Fund returned 21.71%. (All returns are for Investor Shares.) Both funds’ returns tracked those of their benchmark indexes. The European fund modestly bested the average return of its peer group, while the Pacific fund slightly trailed its peer average.

• Nearly all European markets returned 22% or more. The rising value of the euro and British pound against the U.S. dollar boosted returns for U.S. investors. Among sectors, financials and industrials had the biggest impact on results.

• In the Pacific region, South Korean stocks soared about 37%, Japan’s market rose nearly 20%, and Australian stocks returned nearly 18%. Companies in the financial and consumer goods arenas contributed most.

| |

| Total Returns: Fiscal Year Ended October 31, 2017 | |

| | Total |

| | Returns |

| Vanguard European Stock Index Fund | |

| Investor Shares | 27.77% |

| FTSE Europe ETF Shares | |

| Market Price | 28.17 |

| Net Asset Value | 27.98 |

| Admiral™ Shares | 27.99 |

| Institutional Shares | 28.00 |

| Institutional Plus Shares | 28.03 |

| FTSE Developed Europe All Cap Index | 27.96 |

| European Region Funds Average | 26.23 |

| European Region Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

1

| |

| | Total |

| | Returns |

| Vanguard Pacific Stock Index Fund | |

| Investor Shares | 21.71% |

| FTSE Pacific ETF Shares | |

| Market Price | 21.63 |

| Net Asset Value | 21.89 |

| Admiral Shares | 21.90 |

| Institutional Shares | 21.91 |

| FTSE Developed Asia Pacific All Cap Index | 21.11 |

| Japan/Pacific Region Funds Average | 22.38 |

Japan/Pacific Region Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements. Institutional Shares

and Institutional Plus Shares are available to certain institutional investors who meet specific administrative, service, and account-size

criteria. The Vanguard ETF® Shares shown are traded on the NYSE Arca exchange and are available only through brokers. The table

provides ETF returns based on both the NYSE Arca market price and the net asset value for a share. U.S. Pat. Nos. 6,879,964; 7,337,138;

7,720,749; 7,925,573; 8,090,646; and 8,417,623.

For the ETF Shares, the market price is determined by the midpoint of the bid-offer spread as of the closing time of the New York Stock

Exchange (generally 4 p.m., Eastern time). The net asset value is also determined as of the NYSE closing time. For more information about

how the ETF Shares' market prices have compared with their net asset value, visit vanguard.com, select your ETF, and then select the

Price and Performance tab. The ETF premium/discount analysis there shows the percentages of days on which the ETF Shares' market

price was above or below the NAV.

| |

| Total Returns: Ten Years Ended October 31, 2017 | |

| | Average |

| | Annual Return |

| European Stock Index Fund Investor Shares | 0.86% |

| Spliced European Stock Index | 0.88 |

| European Region Funds Average | 1.08 |

| For a benchmark description, see the Glossary. | |

| European Region Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

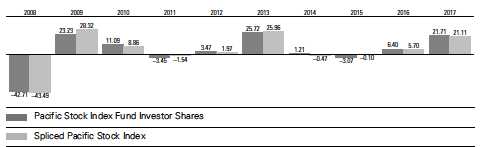

| Pacific Stock Index Fund Investor Shares | 2.27% |

| Spliced Pacific Stock Index | 2.42 |

| Japan/Pacific Region Funds Average | 1.82 |

| For a benchmark description, see the Glossary. |

| Japan/Pacific Region Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

The figures shown represent past performance, which is not a guarantee of future results. (Current

performance may be lower or higher than the performance data cited. For performance data current to the

most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment

returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more

or less than their original cost.

2

| | | | | | |

| Expense Ratios | | | | | | |

| Your Fund Compared With Its Peer Group | | | | | |

| | Investor | ETF | Admiral | Institutional | Institutional | Peer Group |

| | Shares | Shares | Shares | Shares | Plus Shares | Average |

| European Stock Index | | | | | | |

| Fund | 0.26% | 0.10% | 0.10% | 0.08% | 0.07% | 1.48% |

| Pacific Stock Index Fund | 0.26 | 0.10 | 0.10 | 0.08 | — | 1.05 |

The fund expense ratios shown are from the prospectus dated February 24, 2017, and represent estimated costs for the current fiscal year.

For the fiscal year ended October 31, 2017, the funds’ expense ratios were: for the European Stock Index Fund, 0.26% for Investor Shares,

0.10% for FTSE Europe ETF Shares, 0.10% for Admiral Shares, 0.08% for Institutional Shares, and 0.07% for Institutional Plus Shares; and

for the Pacific Stock Index Fund, 0.26% for Investor Shares, 0.10% for FTSE Pacific ETF Shares, 0.10% for Admiral Shares, and 0.08% for

Institutional Shares. The peer-group expense ratio is derived from data provided by Lipper, a Thomson Reuters Company, and captures

information through year-end 2016.

Peer groups: For the European Stock Index Fund, European Region Funds; and for the Pacific Stock Index Fund, Japan/Pacific Region

Funds.

3

Chairman’s Perspective

Bill McNabb

Chairman and Chief Executive Officer

Dear Shareholder,

When I find outstanding products or services, I’m likely to be loyal to them. And my loyalty usually gets rewarded as I experience consistently high quality––whether it’s from a favorite restaurant or a favorite author. What’s past, in most cases, is prologue.

As tempting as it is to apply this rationale to investing—for example, if technology stocks have done well this year, they’re bound to do well the next—it’s not all that helpful and can actually be counterproductive. You’ve heard it many times: Past performance cannot be used to predict future returns.

Taking a new approach

The caution about past performance is so familiar that investors are apt to treat it as mere background noise. That’s why past-performance bias merited a fresh look from Vanguard’s Investment Strategy Group, which tackled the issue last year in a research paper. (I encourage you to read the full paper, Reframing Investor Choices: Right Mindset, Wrong Market, at vanguard.com/research.)

Our strategists were hardly the first to delve into the topic, but they approached it in a new way. They started with the premise that it’s perfectly understandable for investors to lean heavily on past performance, because that works well in many areas of life. After all, as the paper describes, in lots of other industries and realms, performance from one time period

4

to another is extremely consistent. The researchers looked at everything from cars to fine restaurants to heart surgeons, and in all these examples, past performance was a good predictor of later outcomes.

It’s different with investing

In a nutshell, our brains typically are rewarded and our satisfaction is boosted when we use past performance as a guide for navigating decisions, big and small. But when applied to investing, this method breaks down.

Why? Among other reasons, top-performing asset classes one year tend not to repeat as leaders the next. Strong past performance leads to higher valuations, making an investment, all else being equal, less attractive in the future. The data are quite overwhelming in this regard.

By allowing past performance to inform their decisions, individual and institutional investors inadvertently end up as momentum investors, putting them on a treadmill of buying high and selling low.

A path to better decision-making

Of course, many investors are already aware of the pitfalls of projecting past performance into the future. The real question is, what can we all do about it? What does it take to go from having a general awareness to actually changing our behavior?

| | | |

| Market Barometer | | | |

| | Average Annual Total Returns |

| | Periods Ended October 31, 2017 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 23.67% | 10.58% | 15.18% |

| Russell 2000 Index (Small-caps) | 27.85 | 10.12 | 14.49 |

| Russell 3000 Index (Broad U.S. market) | 23.98 | 10.53 | 15.12 |

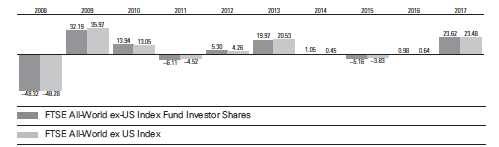

| FTSE All-World ex US Index (International) | 23.48 | 6.12 | 7.67 |

| |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index | | | |

| (Broad taxable market) | 0.90% | 2.40% | 2.04% |

| Bloomberg Barclays Municipal Bond Index | | | |

| (Broad tax-exempt market) | 2.19 | 3.04 | 3.00 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.71 | 0.31 | 0.20 |

| |

| CPI | | | |

| Consumer Price Index | 2.04% | 1.28% | 1.29% |

5

Acknowledging that such change isn’t easy, our strategists offered a few ideas for reframing how investors approach their decisions. These recommendations were targeted at advisors working with clients, but they apply equally to individuals and institutions:

• Educate yourself. The more investors understand why a method that works so well in other areas of life—relying on past performance to drive decisions—doesn’t carry over to investing, the better off they’ll be.

• Be disciplined. The bias toward past performance is ingrained in everybody, professionals included, and shifting away from it can be difficult. But the long-term benefits make the effort worthwhile.

• Focus on what you can control. It’s always most constructive for investors to concentrate on what’s actually within their control, such as setting goals, following long-term portfolio construction principles, selecting low-cost investments, and rebalancing periodically.

Here’s to keeping the past in the rearview mirror. And, as always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

November 14, 2017

6

European Stock Index Fund

Fund Profile

As of October 31, 2017

| | | | | |

| Share-Class Characteristics | | | | | |

| | Investor | FTSE Europe | Admiral | Institutional | Institutional |

| | Shares | ETF Shares | Shares | Shares | Plus Shares |

| Ticker Symbol | VEURX | VGK | VEUSX | VESIX | VEUPX |

| Expense Ratio1 | 0.26% | 0.10% | 0.10% | 0.08% | 0.07% |

| | | |

| Portfolio Characteristics | | |

| | | FTSE | FTSE |

| | | Developed | Global |

| | | Europe All | All Cap ex |

| | | Cap | US |

| | Fund | Index | Index |

| Number of Stocks | 1,282 | 1,258 | 5,902 |

| Median Market Cap | $42.1B | $42.2B | $26.5B |

| Price/Earnings Ratio | 17.9x | 17.9x | 16.1x |

| Price/Book Ratio | 1.9x | 1.9x | 1.7x |

| Return on Equity | 12.0% | 12.0% | 12.0% |

| Earnings Growth Rate | 1.8% | 1.8% | 7.2% |

| Dividend Yield | 3.0% | 3.0% | 2.7% |

| Turnover Rate | 4% | — | — |

| Short-Term Reserves | -0.3% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | FTSE | FTSE |

| | | Developed | Global |

| | | Europe All | All Cap ex |

| | | Cap | US |

| | Fund | Index | Index |

| Basic Materials | 7.8% | 7.8% | 7.9% |

| Consumer Goods | 18.2 | 18.2 | 16.2 |

| Consumer Services | 6.7 | 6.7 | 8.1 |

| Financials | 22.6 | 22.7 | 25.6 |

| Health Care | 11.1 | 11.0 | 7.1 |

| Industrials | 15.5 | 15.5 | 15.4 |

| Oil & Gas | 6.7 | 6.7 | 6.2 |

| Technology | 4.2 | 4.2 | 6.5 |

| Telecommunications | 3.5 | 3.5 | 3.8 |

| Utilities | 3.7 | 3.7 | 3.2 |

Sector categories are based on the Industry Classification

Benchmark (“ICB”), except for the “Other” category (if applicable),

which includes securities that have not been provided an ICB

classification as of the effective reporting period.

| | |

| Volatility Measures | | |

| | Spliced | |

| | European | FTSE Global |

| | Stock | All Cap ex US |

| | Index | Index |

| R-Squared | 0.99 | 0.87 |

| Beta | 0.95 | 0.97 |

| These measures show the degree and timing of the fund’s |

| fluctuations compared with the indexes over 36 months. |

| | |

| Ten Largest Holdings (% of total net assets) |

| Royal Dutch Shell plc | Integrated Oil & Gas | 2.5% |

| Nestle SA | Food Products | 2.5 |

| HSBC Holdings plc | Banks | 1.9 |

| Novartis AG | Pharmaceuticals | 1.8 |

| Roche Holding AG | Pharmaceuticals | 1.5 |

| British American | | |

| Tobacco plc | Tobacco | 1.5 |

| Unilever | Personal Products | 1.4 |

| BP plc | Integrated Oil & Gas | 1.2 |

| TOTAL SA | Integrated Oil & Gas | 1.2 |

| Siemens AG | Diversified Industrials | 1.0 |

| Top Ten | | 16.5% |

| The holdings listed exclude any temporary cash investments and equity index products. |

1 The expense ratios shown are from the prospectus dated February 24, 2017, and represent estimated costs for the current fiscal year. For the

fiscal year ended October 31, 2017, the expense ratios were 0.26% for Investor Shares, 0.10% for FTSE Europe ETF Shares, 0.10% for Admiral

Shares, 0.08% for Institutional Shares, and 0.07% for Institutional Plus Shares.

7

European Stock Index Fund

| | | |

| Market Diversification (% of equity exposure) |

| | | FTSE | FTSE |

| | | Developed | Global |

| | | Europe All | All Cap ex |

| | | Cap | US |

| | Fund | Index | Index |

| Europe | | | |

| United Kingdom | 28.5% | 28.6% | 12.4% |

| France | 15.1 | 15.1 | 6.6 |

| Germany | 15.0 | 14.9 | 6.5 |

| Switzerland | 12.3 | 12.2 | 5.3 |

| Netherlands | 5.4 | 5.4 | 2.3 |

| Spain | 5.1 | 5.2 | 2.2 |

| Sweden | 5.1 | 5.1 | 2.2 |

| Italy | 4.3 | 4.3 | 1.9 |

| Denmark | 2.9 | 2.9 | 1.3 |

| Belgium | 2.0 | 2.0 | 0.9 |

| Finland | 1.7 | 1.7 | 0.7 |

| Norway | 1.3 | 1.3 | 0.6 |

| Other | 1.3 | 1.3 | 0.7 |

| Subtotal | 100.0% | 100.0% | 43.6% |

| Pacific | 0.0% | 0.0% | 29.6% |

| Emerging Markets | 0.0% | 0.0% | 19.8% |

| North America | 0.0% | 0.0% | 6.6% |

| Middle East | 0.0% | 0.0% | 0.4% |

8

European Stock Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

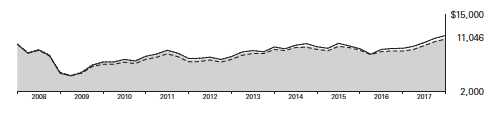

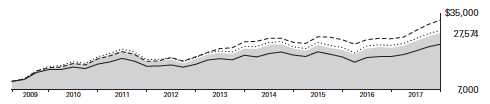

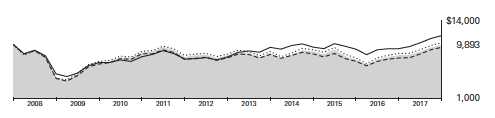

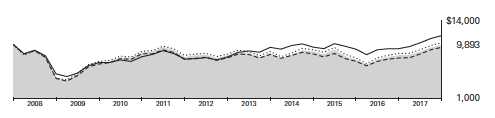

Cumulative Performance: October 31, 2007, Through October 31, 2017

Initial Investment of $10,000

| | | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended October 31, 2017 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | European Stock Index Fund Investor | | | | |

| | Shares | 27.77% | 8.42% | 0.86% | $10,896 |

| • • • • • • • • | Spliced European Stock Index | 27.96 | 8.62 | 0.88 | 10,918 |

| |

| |

| – – – – | European Region Funds Average | 26.23 | 8.90 | 1.08 | 11,130 |

| | FTSE Global All Cap ex US Index | 23.52 | 7.79 | 1.40 | 11,490 |

| For a benchmark description, see the Glossary. |

| European Region Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| FTSE Europe ETF Shares Net Asset Value | 27.98% | 8.59% | 1.01% | $11,052 |

| Spliced European Stock Index | 27.96 | 8.62 | 0.88 | 10,918 |

| FTSE Global All Cap ex US Index | 23.52 | 7.79 | 1.40 | 11,490 |

See Financial Highlights for dividend and capital gains information.

9

European Stock Index Fund

| | | | |

| | Average Annual Total Returns | |

| | Periods Ended October 31, 2017 | |

| | | | | Final Value |

| | One | Five | Ten | of a $10,000 |

| | Year | Years | Years | Investment |

| European Stock Index Fund Admiral Shares | 27.99% | 8.58% | 1.00% | $11,043 |

| Spliced European Stock Index | 27.96 | 8.62 | 0.88 | 10,918 |

| FTSE Global All Cap ex US Index | 23.52 | 7.79 | 1.40 | 11,490 |

| | | | |

| | | | | Final Value |

| | One | Five | Ten | of a $5,000,000 |

| | Year | Years | Years | Investment |

| European Stock Index Fund Institutional | | | | |

| Shares | 28.00% | 8.61% | 1.03% | $5,540,558 |

| |

| Spliced European Stock Index | 27.96 | 8.62 | 0.88 | 5,458,888 |

| |

| FTSE Global All Cap ex US Index | 23.52 | 7.79 | 1.40 | 5,744,800 |

| | | |

| | | Since | Final Value |

| | One | Inception | of a $100,000,000 |

| | Year | (12/5/2014) | Investment |

| European Stock Index Fund Institutional Plus | | | |

| Shares | 28.03% | 5.45% | $116,662,818 |

| Spliced European Stock Index | 27.96 | 5.38 | 116,436,543 |

| FTSE Global All Cap ex US Index | 23.52 | 6.60 | 120,401,306 |

| "Since Inception" performance is calculated from the Institutional Plus Shares’ inception date for both the fund and its comparative standards. |

| | | |

| Cumulative Returns of ETF Shares: October 31, 2007, Through October 31, 2017 | |

| | One | Five | Ten |

| | Year | Years | Years |

| FTSE Europe ETF Shares Market Price | 28.17% | 50.90% | 10.25% |

| FTSE Europe ETF Shares Net Asset Value | 27.98 | 51.02 | 10.52 |

| Spliced European Stock Index | 27.96 | 51.19 | 9.18 |

10

European Stock Index Fund

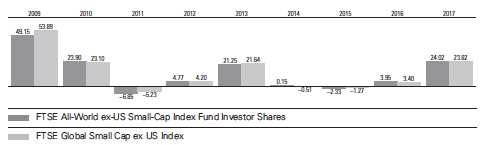

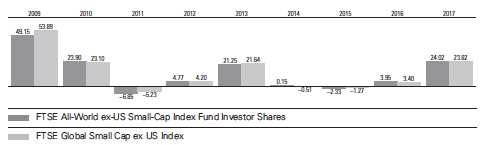

Fiscal-Year Total Returns (%): October 31, 2007, Through October 31, 2017

For a benchmark description, see the Glossary.

Average Annual Total Returns: Periods Ended September 30, 2017

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Investor Shares | 6/18/1990 | 22.91% | 8.67% | 1.30% |

| FTSE Europe ETF Shares | 3/4/2005 | | | |

| Market Price | | 23.19 | 8.87 | 1.43 |

| Net Asset Value | | 23.14 | 8.85 | 1.44 |

| Admiral Shares | 8/13/2001 | 23.14 | 8.84 | 1.43 |

| Institutional Shares | 5/15/2000 | 23.16 | 8.86 | 1.47 |

| Institutional Plus Shares | 12/5/2014 | 23.18 | — | 5.451 |

| 1 Return since inception. |

11

European Stock Index Fund

Financial Statements

Statement of Net Assets—Investments Summary

As of October 31, 2017

This Statement summarizes the fund’s holdings by asset type. Details are reported for each of the fund’s 50 largest individual holdings and for investments that, in total for any issuer, represent more than 1% of the fund’s net assets. The total value of smaller holdings is reported as a single amount within each category.

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the complete listing of the fund’s holdings is available electronically on vanguard.com and on the Securities and Exchange Commission’s website (sec.gov), or you can have it mailed to you without charge by calling 800-662-7447. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | |

| | | Market | Percentage |

| | | Value• | of Net |

| | Shares | ($000) | Assets |

| Common Stocks | | | |

| Austria † | | 140,223 | 0.6% |

| |

| Belgium | | | |

| Anheuser-Busch InBev SA/NV | 1,731,354 | 212,303 | 0.9% |

| Belgium—Other † | | 267,832 | 1.1% |

| | | 480,135 | 2.0% |

| Denmark | | | |

| Novo Nordisk A/S Class B | 4,009,848 | 199,646 | 0.8% |

| 1 Denmark—Other † | | 494,818 | 2.0% |

| | | 694,464 | 2.8% |

| |

| Finland † | | 411,281 | 1.7% |

| |

| France | | | |

| TOTAL SA | 5,033,245 | 280,547 | 1.2% |

| Sanofi | 2,489,382 | 235,714 | 1.0% |

| BNP Paribas SA | 2,461,481 | 192,120 | 0.8% |

| LVMH Moet Hennessy Louis Vuitton SE | 567,196 | 169,176 | 0.7% |

| AXA SA | 4,312,538 | 130,190 | 0.5% |

| Airbus SE | 1,244,448 | 127,701 | 0.5% |

| Danone SA | 1,333,614 | 108,999 | 0.5% |

| Schneider Electric SE | 1,205,013 | 105,875 | 0.4% |

| ^ Vinci SA | 1,057,609 | 103,623 | 0.4% |

| Euler Hermes Group | 35,536 | 4,123 | 0.0% |

| 1 France—Other † | | 2,168,865 | 9.0% |

| | | 3,626,933 | 15.0% |

| Germany | | | |

| Siemens AG | 1,733,696 | 249,018 | 1.0% |

| Bayer AG | 1,887,159 | 245,482 | 1.0% |

12

| | | |

| European Stock Index Fund | | | |

| |

| |

| |

| | | Market | Percentage |

| | | Value• | of Net |

| | Shares | ($000) | Assets |

| Allianz SE | 1,017,871 | 237,634 | 1.0% |

| SAP SE | 2,072,303 | 236,789 | 1.0% |

| BASF SE | 2,087,152 | 228,240 | 0.9% |

| Daimler AG | 2,196,284 | 183,361 | 0.8% |

| Deutsche Telekom AG | 7,362,321 | 133,314 | 0.6% |

| adidas AG | 450,359 | 100,244 | 0.4% |

| 1 Germany—Other † | | 1,973,081 | 8.1% |

| | | 3,587,163 | 14.8% |

| |

| 2Ireland † | | 102,560 | 0.4% |

| |

| Italy | | | |

| Enel SPA | 17,731,580 | 109,967 | 0.5% |

| 1 Italy—Other † | | 932,017 | 3.8% |

| | | 1,041,984 | 4.3% |

| Netherlands | | | |

| Unilever NV | 3,489,346 | 202,698 | 0.8% |

| ING Groep NV | 8,863,265 | 163,790 | 0.7% |

| ASML Holding NV | 716,656 | 129,307 | 0.5% |

| 1 Netherlands—Other † | | 789,255 | 3.3% |

| | | 1,285,050 | 5.3% |

| |

| 1Norway † | | 307,088 | 1.3% |

| |

| Portugal † | | 76,574 | 0.3% |

| |

| Spain | | | |

| Banco Santander SA | 36,007,342 | 244,108 | 1.0% |

| Banco Bilbao Vizcaya Argentaria SA | 15,191,223 | 132,841 | 0.6% |

| Telefonica SA | 10,012,347 | 104,985 | 0.4% |

| Iberdrola SA | 12,699,882 | 102,629 | 0.4% |

| Siemens Gamesa Renewable Energy SA | 517,285 | 7,501 | 0.0% |

| * Banco Santander Rights Temporary Line | 253,572 | 1,720 | 0.0% |

| 1 Spain—Other † | | 641,000 | 2.7% |

| | | 1,234,784 | 5.1% |

| |

| 1Sweden † | | 1,213,475 | 5.0% |

| |

| Switzerland | | | |

| Nestle SA | 7,069,923 | 594,853 | 2.5% |

| Novartis AG | 5,363,006 | 442,337 | 1.8% |

| Roche Holding AG | 1,601,781 | 370,221 | 1.5% |

| UBS Group AG | 7,912,764 | 134,621 | 0.6% |

| ABB Ltd. | 4,393,310 | 114,731 | 0.5% |

| Cie Financiere Richemont SA | 1,159,347 | 106,876 | 0.5% |

| Zurich Insurance Group AG | 342,107 | 104,399 | 0.4% |

| Roche Holding AG (Bearer) | 40,966 | 9,520 | 0.0% |

| 1 Switzerland—Other † | | 1,070,992 | 4.4% |

| | | 2,948,550 | 12.2% |

| |

| United Kingdom | | | |

| HSBC Holdings plc | 45,744,964 | 446,709 | 1.9% |

| British American Tobacco plc | 5,052,272 | 326,429 | 1.4% |

13

| | | | |

| European Stock Index Fund | | | | |

| |

| |

| |

| | | | Market | Percentage |

| | | | Value• | of Net |

| | | Shares | ($000) | Assets |

| BP plc | | 43,930,643 | 297,969 | 1.2% |

| Royal Dutch Shell plc Class A | | 8,756,455 | 275,654 | 1.2% |

| Royal Dutch Shell plc Class B | | 8,546,723 | 275,184 | 1.1% |

| GlaxoSmithKline plc | | 11,018,091 | 197,747 | 0.8% |

| AstraZeneca plc | | 2,887,736 | 195,389 | 0.8% |

| Diageo plc | | 5,634,071 | 192,399 | 0.8% |

| Vodafone Group plc | | 60,750,078 | 173,767 | 0.7% |

| Unilever plc | | 2,688,686 | 152,380 | 0.6% |

| Lloyds Banking Group plc | | 162,673,933 | 147,454 | 0.6% |

| Prudential plc | | 5,894,760 | 144,690 | 0.6% |

| Rio Tinto plc | | 2,710,485 | 128,100 | 0.5% |

| Glencore plc | | 26,549,560 | 128,055 | 0.5% |

| Reckitt Benckiser Group plc | | 1,419,174 | 126,970 | 0.5% |

| Shire plc | | 2,029,726 | 99,976 | 0.4% |

| Royal Dutch Shell plc Class A (Amsterdam Shares) | | 1,458,521 | 45,926 | 0.2% |

| British American Tobacco plc ADR | | 161,443 | 10,397 | 0.1% |

| 1, 2 United Kingdom—Other † | | | 3,482,545 | 14.4% |

| | | | 6,847,740 | 28.3% |

| Total Common Stocks (Cost $25,749,890) | | | 23,998,004 | 99.1%3 |

| |

| | Coupon | | | |

| Temporary Cash Investments | | | | |

| Money Market Fund | | | | |

| 4,5 Vanguard Market Liquidity Fund | 1.246% | 4,819,471 | 481,995 | 2.0% |

| |

| 6U.S. Government and Agency Obligations† | | | 25,945 | 0.1% |

| Total Temporary Cash Investments (Cost $508,004) | | | 507,940 | 2.1%3 |

| Total Investments (Cost $26,257,894) | | | 24,505,944 | 101.2% |

| |

| | | | Amount | |

| | | | ($000) | |

| Other Assets and Liabilities | | | | |

| Other Assets | | | | |

| Investment in Vanguard | | | 1,481 | |

| Receivables for Investment Securities Sold | | | 4 | |

| Receivables for Accrued Income | | | 87,299 | |

| Receivables for Capital Shares Issued | | | 5,686 | |

| Variation Margin Receivable—Futures Contracts | | | 1,030 | |

| Unrealized Appreciation—Forward Currency Contracts | | | 1,799 | |

| Other Assets7 | | | 14,252 | |

| Total Other Assets | | | 111,551 | 0.5% |

| Liabilities | | | | |

| Payables for Investment Securities Purchased | | | (288) | |

| Collateral for Securities on Loan | | | (382,738) | |

| Payables for Capital Shares Redeemed | | | (3,678) | |

| Payables to Vanguard | | | (13,932) | |

| Unrealized Depreciation—Forward Currency Contracts | | | (4,884) | |

| Other Liabilities | | | (94) | |

| Total Liabilities | | | (405,614) | (1.7%) |

| Net Assets | | | 24,211,881 | 100.0% |

14

| |

| European Stock Index Fund | |

| |

| |

| |

| At October 31, 2017, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 26,480,194 |

| Undistributed Net Investment Income | 28,810 |

| Accumulated Net Realized Losses | (547,157) |

| Unrealized Appreciation (Depreciation) | |

| Investment Securities | (1,751,950) |

| Futures Contracts | 7,092 |

| Forward Currency Contracts | (3,085) |

| Foreign Currencies | (2,023) |

| Net Assets | 24,211,881 |

| |

| |

| Investor Shares—Net Assets | |

| Applicable to 22,279,546 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 700,545 |

| Net Asset Value Per Share—Investor Shares | $31.44 |

| |

| |

| ETF Shares—Net Assets | |

| Applicable to 305,410,051 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 17,879,584 |

| Net Asset Value Per Share—ETF Shares | $58.54 |

| |

| |

| Admiral Shares—Net Assets | |

| Applicable to 64,915,959 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 4,753,681 |

| Net Asset Value Per Share—Admiral Shares | $73.23 |

15

| |

| European Stock Index Fund | |

| |

| |

| |

| | Amount |

| | ($000) |

| Institutional Shares—Net Assets | |

| Applicable to 24,197,457 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 755,649 |

| Net Asset Value Per Share—Institutional Shares | $31.23 |

| |

| Institutional Plus Shares—Net Assets | |

| Applicable to 877,727 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 122,422 |

| Net Asset Value Per Share—Institutional Plus Shares | $139.48 |

• See Note A in Notes to Financial Statements.

^ Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $362,832,000.

* Non-income-producing security.

† Represents the aggregate value, by category, of securities that are not among the 50 largest holdings and, in total for any issuer,

represent 1% or less of net assets.

1 Certain of the fund’s securities are exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may

be sold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2017, the aggregate

value of these securities was $388,105,000, representing 1.6% of net assets.

2 Security value determined using significant unobservable inputs.

3 The fund invests a portion of its cash reserves in equity markets through the use of index futures contracts. After giving effect

to futures investments, the fund’s effective common stock and temporary cash investment positions represent 99.9% and 1.3%,

respectively, of net assets.

4 Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown

is the 7-day yield.

5 Includes $382,738,000 of collateral received for securities on loan.

6 Securities with a value of $12,427,000 have been segregated as initial margin for open futures contracts.

7 Cash of $6,190,000 has been segregated as collateral for open forward currency contracts.

ADR—American Depositary Receipt.

16

| | | | | | |

| European Stock Index Fund | | | | | | |

| |

| |

| Derivative Financial Instruments Outstanding as of Period End | | | |

| |

| Futures Contracts | | | | | | |

| | | | | | ($000) |

| | | | | | | Value and |

| | | | Number of | | Unrealized |

| | | | Long (Short) | Notional | Appreciation |

| | | Expiration | Contracts | Amount | (Depreciation) |

| Long Futures Contracts | | | | | | |

| Dow Jones EURO STOXX 50 Index | December 2017 | | 3,061 | 131,155 | 6,232 |

| FTSE 100 Index | December 2017 | | 618 | 61,284 | 860 |

| | | | | | | 7,092 |

| |

| Unrealized appreciation (depreciation) on open futures contracts is required to be treated as realized |

| gain (loss) for tax purposes. | | | | | | |

| |

| Forward Currency Contracts | | | | | | |

| | | | | | | Unrealized |

| | Contract | | | | | Appreciation |

| | Settlement | Contract Amount (000) | (Depreciation) |

| Counterparty | Date | | Receive | | Deliver | ($000) |

| Barclays Bank plc | 12/20/17 | EUR | 145,409 | USD | 174,699 | (4,815) |

| Toronto-Dominion Bank | 12/20/17 | GBP | 60,092 | USD | 80,011 | (69) |

| BNP Paribas | 12/20/17 | USD | 46,439 | EUR | 38,524 | 1,431 |

| BNP Paribas | 12/20/17 | USD | 19,369 | GBP | 14,283 | 368 |

| | | | | | | (3,085) |

| EUR—Euro. |

| GBP—British pound. |

| USD—U.S. dollar. |

Unrealized appreciation (depreciation) on open forward currency contracts is treated as realized gain (loss) for tax purposes.

At October 31, 2017, a counterparty had deposited in a segregated account securities with a value of $2,302,000 in connection with open forward currency contracts.

See accompanying Notes, which are an integral part of the Financial Statements.

17

European Stock Index Fund

Statement of Operations

| |

| | Year Ended |

| | October 31, 2017 |

| | ($000) |

| Investment Income | |

| Income | |

| Dividends1 | 572,844 |

| Interest 2 | 848 |

| Securities Lending—Net | 13,683 |

| Total Income | 587,375 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 2,661 |

| Management and Administrative—Investor Shares | 1,343 |

| Management and Administrative—ETF Shares | 8,145 |

| Management and Administrative—Admiral Shares | 2,527 |

| Management and Administrative—Institutional Shares | 322 |

| Management and Administrative—Institutional Plus Shares | 46 |

| Marketing and Distribution—Investor Shares | 115 |

| Marketing and Distribution—ETF Shares | 729 |

| Marketing and Distribution—Admiral Shares | 259 |

| Marketing and Distribution—Institutional Shares | 15 |

| Marketing and Distribution—Institutional Plus Shares | 2 |

| Custodian Fees | 2,397 |

| Auditing Fees | 49 |

| Shareholders’ Reports and Proxy—Investor Shares | 98 |

| Shareholders’ Reports and Proxy—ETF Shares | 1,063 |

| Shareholders’ Reports and Proxy—Admiral Shares | 187 |

| Shareholders’ Reports and Proxy—Institutional Shares | 6 |

| Shareholders’ Reports and Proxy—Institutional Plus Shares | — |

| Trustees’ Fees and Expenses | 15 |

| Total Expenses | 19,979 |

| Net Investment Income | 567,396 |

| Realized Net Gain (Loss) | |

| Investment Securities Sold 2 | (28,493) |

| Futures Contracts | 19,699 |

| Foreign Currencies and Forward Currency Contracts | 9,072 |

| Realized Net Gain (Loss) | 278 |

| Change in Unrealized Appreciation (Depreciation) | |

| Investment Securities 2 | 3,957,765 |

| Futures Contracts | 7,159 |

| Foreign Currencies and Forward Currency Contracts | 3,523 |

| Change in Unrealized Appreciation (Depreciation) | 3,968,447 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 4,536,121 |

| 1 Dividends are net of foreign withholding taxes of $38,308,000. |

| 2 Interest income, realized net gain (loss), and change in unrealized appreciation (depreciation) from an affiliated company of the fund |

| were $679,000, $45,000, and ($64,000), respectively. |

| See accompanying Notes, which are an integral part of the Financial Statements. |

18

European Stock Index Fund

Statement of Changes in Net Assets

| | |

| | Year Ended October 31, |

| | 2017 | 2016 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 567,396 | 648,072 |

| Realized Net Gain (Loss) | 278 | (249,917) |

| Change in Unrealized Appreciation (Depreciation) | 3,968,447 | (1,807,591) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 4,536,121 | (1,409,436) |

| Distributions | | |

| Net Investment Income | | |

| Investor Shares | (17,979) | (21,135) |

| ETF Shares | (409,188) | (453,005) |

| Admiral Shares | (116,545) | (129,984) |

| Institutional Shares | (18,620) | (24,805) |

| Institutional Plus Shares | (3,247) | (3,926) |

| Realized Capital Gain | | |

| Investor Shares | — | — |

| ETF Shares | — | — |

| Admiral Shares | — | — |

| Institutional Shares | — | — |

| Institutional Plus Shares | — | — |

| Total Distributions | (565,579) | (632,855) |

| Capital Share Transactions | | |

| Investor Shares | (52,062) | (53,855) |

| ETF Shares | 4,559,972 | (3,566,616) |

| Admiral Shares | 270,199 | (133,939) |

| Institutional Shares | 40,847 | (213,685) |

| Institutional Plus Shares | (710) | (121,144) |

| Net Increase (Decrease) from Capital Share Transactions | 4,818,246 | (4,089,239) |

| Total Increase (Decrease) | 8,788,788 | (6,131,530) |

| Net Assets | | |

| Beginning of Period | 15,423,093 | 21,554,623 |

| End of Period1 | 24,211,881 | 15,423,093 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $28,810,000 and $19,219,000. |

See accompanying Notes, which are an integral part of the Financial Statements.

19

European Stock Index Fund

Financial Highlights

| | | | | |

| Investor Shares | | | | | |

| |

| For a Share Outstanding | Year Ended October 31, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $25.27 | $27.98 | $29.05 | $30.42 | $24.69 |

| Investment Operations | | | | | |

| Net Investment Income | . 8271 | .881 | .866 | 1.2352 | .830 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 6.109 | (2.738) | (1.058) | (1.380) | 5.800 |

| Total from Investment Operations | 6.936 | (1.857) | (.192) | (.145) | 6.630 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (.766) | (. 853) | (. 878) | (1.225) | (. 900) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (.766) | (. 853) | (. 878) | (1.225) | (. 900) |

| Net Asset Value, End of Period | $31.44 | $25.27 | $27.98 | $29.05 | $30.42 |

| |

| Total Return3 | 27.77% | -6.63% | -0.77% | -0.73% | 27.47% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $701 | $608 | $730 | $782 | $868 |

| Ratio of Total Expenses to Average Net Assets | 0.26% | 0.26% | 0.26% | 0.26% | 0.26% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.81% | 3.35% | 3.05% | 4.12%2 | 3.02% |

| Portfolio Turnover Rate 4 | 4% | 6% | 13% | 7% | 10% |

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.299 and 0.97%,

respectively, resulting from income received from Vodafone Group plc in the form of cash and shares in Verizon Communications Inc.

in February 2014.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information

about any applicable account service fees.

4 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital

shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

20

European Stock Index Fund

Financial Highlights

| | | | | |

| FTSE Europe ETF Shares | | | | | |

| |

| For a Share Outstanding | Year Ended October 31, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $47.05 | $52.09 | $54.08 | $56.64 | $46.01 |

| Investment Operations | | | | | |

| Net Investment Income | 1.5671 | 1.717 | 1.691 | 2.3842 | 1.626 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 11.434 | (5.094) | (1.970) | (2.577) | 10.787 |

| Total from Investment Operations | 13.001 | (3.377) | (.279) | (.193) | 12.413 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.511) | (1.663) | (1.711) | (2.367) | (1.783) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (1.511) | (1.663) | (1.711) | (2.367) | (1.783) |

| Net Asset Value, End of Period | $58.54 | $47.05 | $52.09 | $54.08 | $56.64 |

| |

| Total Return | 27.98% | -6.43% | -0.62% | -0.60% | 27.67% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $17,880 | $10,533 | $15,578 | $11,676 | $12,061 |

| Ratio of Total Expenses to Average Net Assets | 0.10% | 0.10% | 0.12% | 0.12% | 0.12% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.97% | 3.51% | 3.19% | 4.26%2 | 3.16% |

| Portfolio Turnover Rate 3 | 4% | 6% | 13% | 7% | 10% |

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.556 and 0.97%,

respectively, resulting from income received from Vodafone Group plc in the form of cash and shares in Verizon Communications Inc.

in February 2014.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital

shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

21

European Stock Index Fund

Financial Highlights

| | | | | |

| Admiral Shares | | | | | |

| |

| For a Share Outstanding | Year Ended October 31, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $58.85 | $65.16 | $67.64 | $70.85 | $57.54 |

| Investment Operations | | | | | |

| Net Investment Income | 2.0161 | 2.151 | 2.113 | 2.983 2 | 2.026 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 14.251 | (6.379) | (2.454) | (3.233) | 13.503 |

| Total from Investment Operations | 16.267 | (4.228) | (.341) | (.250) | 15.529 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (1.887) | (2.082) | (2.139) | (2.960) | (2.219) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (1.887) | (2.082) | (2.139) | (2.960) | (2.219) |

| Net Asset Value, End of Period | $73.23 | $58.85 | $65.16 | $67.64 | $70.85 |

| |

| Total Return3 | 27.99% | -6.48% | -0.61% | -0.61% | 27.64% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $4,754 | $3,609 | $4,137 | $3,949 | $3,340 |

| Ratio of Total Expenses to Average Net Assets | 0.10% | 0.10% | 0.12% | 0.12% | 0.12% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.97% | 3.51% | 3.19% | 4.26%2 | 3.16% |

| Portfolio Turnover Rate 4 | 4% | 6% | 13% | 7% | 10% |

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.695 and 0.97%,

respectively, resulting from income received from Vodafone Group plc in the form of cash and shares in Verizon Communications Inc.

in February 2014.

3 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information

about any applicable account service fees.

4 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital

shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

22

European Stock Index Fund

Financial Highlights

| | | | | |

| Institutional Shares | | | | | |

| |

| For a Share Outstanding | Year Ended October 31, |

| Throughout Each Period | 2017 | 2016 | 2015 | 2014 | 2013 |

| Net Asset Value, Beginning of Period | $25.10 | $27.79 | $28.85 | $30.21 | $24.54 |

| Investment Operations | | | | | |

| Net Investment Income | . 8731 | .921 | .910 | 1.2822 | .871 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 6.068 | (2.719) | (1.048) | (1.371) | 5.755 |

| Total from Investment Operations | 6.941 | (1.798) | (.138) | (.089) | 6.626 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (. 811) | (. 892) | (. 922) | (1.271) | (. 956) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (. 811) | (. 892) | (. 922) | (1.271) | (. 956) |

| Net Asset Value, End of Period | $31.23 | $25.10 | $27.79 | $28.85 | $30.21 |

| |

| Total Return | 28.00% | -6.46% | -0.58% | -0.55% | 27.66% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $756 | $574 | $867 | $1,006 | $901 |

| Ratio of Total Expenses to Average Net Assets | 0.08% | 0.08% | 0.09% | 0.09% | 0.09% |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 2.99% | 3.53% | 3.22% | 4.29%2 | 3.19% |

| Portfolio Turnover Rate 3 | 4% | 6% | 13% | 7% | 10% |

1 Calculated based on average shares outstanding.

2 Net investment income per share and the ratio of net investment income to average net assets include $.297 and 0.97%,

respectively, resulting from income received from Vodafone Group plc in the form of cash and shares in Verizon Communications Inc.

in February 2014.

3 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital

shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

European Stock Index Fund

Financial Highlights

| | | | | |

| Institutional Plus Shares | | | | | |

| | Year | Year | Dec. 5, | Nov. 1, | May 17, |

| | Ended | Ended | 2014 3 to | 2013 to | 20131 to |

| | Oct. 31, | Oct. 31, | Oct. 31, | Mar. 17, | Oct. 31, |

| For a Share Outstanding Throughout Each Period | 2017 | 2016 | 2015 | 20142 | 2013 |

| Net Asset Value, Beginning of Period | $112.09 | $124.09 | $131.51 | $126.52 | $116.90 |

| Investment Operations | | | | | |

| Net Investment Income | 3.910 4 | 4.121 | 3.878 | 2.2535 | 2.257 |

| Net Realized and Unrealized Gain (Loss) | | | | | |

| on Investments | 27.110 | (12.133) | (7.151) | 2.866 | 9.966 |

| Total from Investment Operations | 31.020 | (8.012) | (3.273) | 5.119 | 12.223 |

| Distributions | | | | | |

| Dividends from Net Investment Income | (3.630) | (3.988) | (4.147) | (.539) | (2.603) |

| Distributions from Realized Capital Gains | — | — | — | — | — |

| Total Distributions | (3.630) | (3.988) | (4.147) | (.539) | (2.603) |

| Net Asset Value, End of Period | $139.48 | $112.09 | $124.09 | $131.102 | $126.52 |

| |

| Total Return | 28.03% | -6.45% | -2.59% | 4.06% | 10.81% |

| |

| Ratios/Supplemental Data | | | | | |

| Net Assets, End of Period (Millions) | $122 | $99 | $242 | — | $110 |

| Ratio of Total Expenses to Average Net Assets | 0.07% | 0.07% | 0.08%6 | 0.08%6 | 0.08%6 |

| Ratio of Net Investment Income to | | | | | |

| Average Net Assets | 3.00% | 3.54% | 3.11%6 | 4.80%5,6 | 3.20%6 |

| Portfolio Turnover Rate7 | 4% | 6% | 13% | 7% | 10% |

1 Inception.

2 Net asset value as of March 17, 2014, on which date all shares were redeemed.

3 Recommencement of operations.

4 Calculated based on average shares outstanding.

5 Net investment income per share and the ratio of net investment income to average net assets include $1.242 and 0.97%,

respectively, resulting from income received from Vodafone Group plc in the form of cash and shares in Verizon Communications Inc.

in February 2014.

6 Annualized.

7 Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital

shares, including ETF Creation Units.

See accompanying Notes, which are an integral part of the Financial Statements.

24

European Stock Index Fund

Notes to Financial Statements

Vanguard European Stock Index Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally associated with investing in securities of U.S. corporations. The fund offers five classes of shares: Investor Shares, ETF Shares, Admiral Shares, Institutional Shares, and Institutional Plus Shares. Investor Shares are available to any investor who meets the fund’s minimum purchase requirements. ETF Shares, known as Vanguard FTSE Europe ETF Shares, are listed for trading on NYSE Arca; they can be purchased and sold through a broker. Admiral Shares, Institutional Shares, and Institutional Plus Shares are designed for investors who meet certain administrative, service, and account-size criteria. Institutional Plus Shares were first issued May 17, 2013, and on March 17, 2014, all outstanding shares were redeemed. Institutional Plus Shares recommenced operations on December 5, 2014.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued at their fair values calculated according to procedures adopted by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to identify significant market-or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same securities. Investments in Vanguard Market Liquidity Fund are valued at that fund’s net asset value. Temporary cash investments are valued using the latest bid prices or using valuations based on a matrix system (which considers such factors as security prices, yields, maturities, and ratings), both as furnished by independent pricing services.

2. Foreign Currency: Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures and Forward Currency Contracts: The fund uses index futures contracts to a limited extent, with the objectives of maintaining full exposure to the stock market, enhancing returns, maintaining liquidity, and minimizing transaction costs. The fund may purchase futures contracts to immediately invest incoming cash in the market, or sell futures in response to cash outflows, thereby simulating a fully invested position in the underlying index while maintaining a cash balance for liquidity. The fund may seek to enhance returns by using futures contracts instead of the

25

European Stock Index Fund

underlying securities when futures are believed to be priced more attractively than the underlying securities. The primary risks associated with the use of futures contracts are imperfect correlation between changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and has entered into clearing agreements with its clearing brokers. The clearinghouse imposes initial margin requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract.

The fund also enters into forward currency contracts to provide the appropriate currency exposure related to any open futures contracts. The fund’s risks in using these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the ability of the counterparties to fulfill their obligations under the contracts. The fund mitigates its counterparty risk by entering into forward currency contracts only with a diverse group of prequalified counterparties, monitoring their financial strength, entering into master netting arrangements with its counterparties, and requiring its counterparties to transfer collateral as security for their performance. In the absence of a default, the collateral pledged or received by the fund cannot be repledged, resold, or rehypothecated. The master netting arrangements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate the forward currency contracts, determine the net amount owed by either party in accordance with its master netting arrangements, and sell or retain any collateral held up to the net amount owed to the fund under the master netting arrangements. The forward currency contracts contain provisions whereby a counterparty may terminate open contracts if the fund’s net assets decline below a certain level, triggering a payment by the fund if the fund is in a net liability position at the time of the termination. The payment amount would be reduced by any collateral the fund has pledged. Any assets pledged as collateral for open contracts are noted in the Statement of Net Assets. The value of collateral received or pledged is compared daily to the value of the forward currency contracts exposure with each counterparty, and any difference, if in excess of a specified minimum transfer amount, is adjusted and settled within two business days.

Futures contracts are valued at their quoted daily settlement prices. Forward currency contracts are valued at their quoted daily prices obtained from an independent third party, adjusted for currency risk based on the expiration date of each contract. The notional amounts of the contracts are not recorded in the Statement of Net Assets. Fluctuations in the value of the contracts are recorded in the Statement of Net Assets as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized gains (losses) on futures or forward currency contracts.

During the year ended October 31, 2017, the fund’s average investments in long and short futures contracts represented less than 1% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the period. The fund’s average investment in forward currency contracts represented 2% of net assets, based on the average of the notional amounts at each quarter-end during the period.

26

European Stock Index Fund

4. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its taxable income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (October 31, 2014–2017), and has concluded that no provision for federal income tax is required in the fund’s financial statements.

5. Distributions: Distributions to shareholders are recorded on the ex-dividend date.

6. Securities Lending: To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When this occurs, the collateral is adjusted and settled on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Net Assets for the return of the collateral, during the period the securities are on loan. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

7. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at October 31, 2017, or at any time during the period then ended.

8. Other: Dividend income is recorded on the ex-dividend date. Interest income includes income distributions received from Vanguard Market Liquidity Fund and is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

27

European Stock Index Fund

Withholding taxes on foreign dividends and capital gains have been provided for in accordance with the fund’s understanding of the applicable countries’ tax rules and rates. The fund has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union countries. These filings are subject to various administrative and judicial proceedings within these countries. Such tax reclaims received during the year, if any, are included in dividend income. No other amounts for additional tax reclaims are reflected in the financial statements due to the uncertainty as to the ultimate resolution of proceedings, the likelihood of receipt of these reclaims, and the potential timing of payment.

Each class of shares has equal rights as to assets and earnings, except that each class separately bears certain class-specific expenses related to maintenance of shareholder accounts (included in Management and Administrative expenses), shareholder reporting, and the proxy. Marketing and distribution expenses are allocated to each class of shares based on a method approved by the board of trustees. Income, other non-class-specific expenses, and gains and losses on investments are allocated to each class of shares based on its relative net assets.

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At October 31, 2017, the fund had contributed to Vanguard capital in the amount of $1,481,000, representing 0.01% of the fund’s net assets and 0.59% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments valued with significant unobservable inputs are

noted on the Statement of Net Assets.

28

European Stock Index Fund

The following table summarizes the market value of the fund’s investments as of October 31, 2017, based on the inputs used to value them.

| | | |

| | Level 1 | Level 2 | Level 3 |

| Investments | ($000) | ($000) | ($000) |

| Common Stocks | 21,035 | 23,976,969 | — |

| Temporary Cash Investments | 481,995 | 25,945 | — |

| Futures Contracts—Assets1 | 1,030 | — | — |

| Forward Currency Contracts—Assets | — | 1,799 | — |

| Forward Currency Contracts—Liabilities | — | (4,884) | — |

| Total | 504,060 | 23,999,829 | — |

| 1 Represents variation margin on the last day of the reporting period. |

D. At October 31, 2017, the fair values of derivatives were reflected in the Statement of Net Assets as follows:

| | | |

| | | Foreign | |

| | Equity | Exchange | |

| | Contracts | Contracts | Total |

| Statement of Net Assets Caption | ($000) | ($000) | ($000) |

| Variation Margin Receivable—Futures Contracts | 1,030 | | 1,030 |

| Unrealized Appreciation—Forward Currency Contracts | — | 1,799 | 1,799 |

| Unrealized Depreciation—Forward Currency Contracts | — | (4,884) | (4,884) |

Realized net gain (loss) and the change in unrealized appreciation (depreciation) on derivatives for the year ended October 31, 2017, were:

| | | |

| | | Foreign | |

| | Equity | Exchange | |

| | Contracts | Contracts | Total |

| Realized Net Gain (Loss) on Derivatives | ($000) | ($000) | ($000) |

| Futures Contracts | 19,699 | — | 19,699 |

| Forward Currency Contracts | — | 4,038 | 4,038 |

| Realized Net Gain (Loss) on Derivatives | 19,699 | 4,038 | 23,737 |

| |

| Change in Unrealized Appreciation (Depreciation) on Derivatives | | | |

| Futures Contracts | 7,159 | — | 7,159 |

| Forward Currency Contracts | — | 1,692 | 1,692 |

| Change in Unrealized Appreciation (Depreciation) on Derivatives | 7,159 | 1,692 | 8,851 |

E. Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain, or

29

European Stock Index Fund

loss are recognized in different periods for financial statement and tax purposes. These differences will reverse at some time in the future. Differences in classification may also result from the treatment of short-term gains as ordinary income for tax purposes.

During the year ended October 31, 2017, the fund realized $21,450,000 of net capital losses resulting from in-kind redemptions—in which shareholders exchanged fund shares for securities held by the fund rather than for cash. Because such losses are not taxable to the fund, and are not distributed to shareholders, they have been reclassified from accumulated net realized losses to paid-in capital.

For tax purposes, at October 31, 2017, the fund had $77,478,000 of ordinary income available for distribution. At October 31, 2017, the fund had available capital losses totaling $542,064,000 to offset future net capital gains. Of this amount, $449,638,000 is subject to expiration dates; $282,885,000 may be used to offset future net capital gains through October 31, 2018, and $166,753,000 through October 31, 2019. Capital losses of $92,426,000 realized beginning in fiscal 2012 may be carried forward indefinitely under the Regulated Investment Company Modernization Act of 2010, but must be used before any expiring loss carryforwards. Capital loss carryforwards of $1,500,333,000 expired on October 31, 2017; accordingly, such losses have been reclassified from accumulated net realized losses to paid-in capital.

At October 31, 2017, the cost of investment securities for tax purposes was $26,295,021,000. Net unrealized depreciation of investment securities for tax purposes was $1,789,077,000, consisting of unrealized gains of $2,433,459,000 on securities that had risen in value since their purchase and $4,222,536,000 in unrealized losses on securities that had fallen in value since their purchase.

F. During the year ended October 31, 2017, the fund purchased $6,059,104,000 of investment securities and sold $1,380,249,000 of investment securities, other than temporary cash investments. Purchases and sales include $4,660,198,000 and $579,652,000, respectively, in connection with in-kind purchases and redemptions of the fund’s capital shares.

30

European Stock Index Fund

G. Capital share transactions for each class of shares were:

| | | | |

| | Year Ended October 31, |

| | 2017 | 2016 |

| | Amount | Shares | Amount | Shares |

| | ($000) | (000) | ($000) | (000) |

| Investor Shares | | | | |

| Issued | 159,694 | 5,562 | 100,437 | 3,906 |

| Issued in Lieu of Cash Distributions | 14,995 | 523 | 17,789 | 697 |

| Redeemed | (226,751) | (7,858) | (172,081) | (6,639) |

| Net Increase (Decrease)—Investor Shares | (52,062) | (1,773) | (53,855) | (2,036) |

| ETF Shares | | | | |

| Issued | 5,081,845 | 92,347 | 340,229 | 7,004 |

| Issued in Lieu of Cash Distributions | — | — | — | — |

| Redeemed | (521,873) | (10,800) | (3,906,845) | (82,200) |

| Net Increase (Decrease)—ETF Shares | 4,559,972 | 81,547 | (3,566,616) | (75,196) |

| Admiral Shares | | | | |

| Issued | 901,375 | 13,382 | 454,762 | 7,584 |

| Issued in Lieu of Cash Distributions | 97,636 | 1,462 | 108,578 | 1,827 |

| Redeemed | (728,812) | (11,258) | (697,279) | (11,579) |

| Net Increase (Decrease)—Admiral Shares | 270,199 | 3,586 | (133,939) | (2,168) |

| Institutional Shares | | | | |

| Issued | 256,341 | 8,907 | 129,495 | 5,017 |

| Issued in Lieu of Cash Distributions | 12,203 | 429 | 19,570 | 772 |

| Redeemed | (227,697) | (8,002) | (362,750) | (14,133) |

| Net Increase (Decrease)—Institutional Shares | 40,847 | 1,334 | (213,685) | (8,344) |

| Institutional Plus Shares | | | | |

| Issued | 15,118 | 114 | 35,730 | 311 |

| Issued in Lieu of Cash Distributions | 3,247 | 26 | 3,926 | 34 |

| Redeemed | (19,075) | (144) | (160,800) | (1,413) |

| Net Increase (Decrease)—Institutional Plus Shares | (710) | (4) | (121,144) | (1,068) |

H. Management has determined that no material events or transactions occurred subsequent to October 31, 2017, that would require recognition or disclosure in these financial statements.

31

Pacific Stock Index Fund

Fund Profile

As of October 31, 2017

| | | | |

| Share-Class Characteristics | | | | |

| | Investor | FTSE Pacific ETF | Admiral | Institutional |

| | Shares | Shares | Shares | Shares |

| Ticker Symbol | VPACX | VPL | VPADX | VPKIX |

| Expense Ratio1 | 0.26% | 0.10% | 0.10% | 0.08% |

| | | |

| Portfolio Characteristics | | |

| | | FTSE | FTSE |

| | | Developed | Global |

| | | APAC All | All Cap ex |

| | | Cap | US |

| | Fund | Index | Index |

| Number of Stocks | 2,288 | 2,256 | 5,902 |

| Median Market Cap | $18.5B | $18.5B | $26.5B |

| Price/Earnings Ratio | 14.7x | 14.7x | 16.1x |

| Price/Book Ratio | 1.4x | 1.4x | 1.7x |

| Return on Equity | 10.1% | 10.1% | 12.0% |

| Earnings Growth Rate | 12.5% | 12.5% | 7.2% |

| Dividend Yield | 2.3% | 2.3% | 2.7% |

| Turnover Rate | 3% | — | — |

| Short-Term Reserves | -0.3% | — | — |

| | | |

| Sector Diversification (% of equity exposure) |

| | | FTSE | FTSE |

| | | Developed | Global |

| | | APAC All | All Cap ex |

| | | Cap | US |

| | Fund | Index | Index |

| Basic Materials | 7.6% | 7.7% | 7.9% |

| Consumer Goods | 21.2 | 21.1 | 16.2 |

| Consumer Services | 9.7 | 9.7 | 8.1 |

| Financials | 24.3 | 24.3 | 25.6 |

| Health Care | 5.8 | 5.8 | 7.1 |

| Industrials | 18.9 | 18.9 | 15.4 |

| Oil & Gas | 1.7 | 1.7 | 6.2 |

| Technology | 5.0 | 5.0 | 6.5 |

| Telecommunications | 3.4 | 3.4 | 3.8 |

| Utilities | 2.4 | 2.4 | 3.2 |

Sector categories are based on the Industry Classification

Benchmark (“ICB”), except for the “Other” category (if applicable),

which includes securities that have not been provided an ICB

classification as of the effective reporting period.

| | |

| Volatility Measures | | |

| | Spliced | |

| | Pacific | FTSE Global |

| | Stock | All Cap ex US |

| | Index | Index |

| R-Squared | 0.93 | 0.83 |

| Beta | 0.91 | 0.89 |

| These measures show the degree and timing of the fund’s |

| fluctuations compared with the indexes over 36 months. |

| | |

| Ten Largest Holdings (% of total net assets) |

| Samsung Electronics | Consumer | |

| Co. Ltd. | Electronics | 3.7% |

| Toyota Motor Corp. | Automobiles | 2.2 |

| Commonwealth Bank of | | |

| Australia | Banks | 1.4 |

| AIA Group Ltd. | Life Insurance | 1.2 |

| Mitsubishi UFJ Financial | | |

| Group Inc. | Banks | 1.2 |

| Westpac Banking Corp. | Banks | 1.2 |

| SoftBank Group Corp. | Mobile | |

| | Telecommunications | 1.0 |

| Australia & New Zealand | | |

| Banking Group Ltd. | Banks | 1.0 |

| National Australia Bank | | |

| Ltd. | Banks | 0.9 |

| BHP Billiton Ltd. | General Mining | 0.9 |

| Top Ten | | 14.7% |

| The holdings listed exclude any temporary cash investments and equity index products. |

1 The expense ratios shown are from the prospectus dated February 24, 2017, and represent estimated costs for the current fiscal year. For the

fiscal year ended October 31, 2017, the expense ratios were 0.26% for Investor Shares, 0.10% for FTSE Pacific ETF Shares, 0.10% for Admiral

Shares, and 0.08% for Institutional Shares.

32

Pacific Stock Index Fund

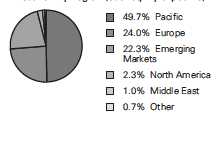

| | | |

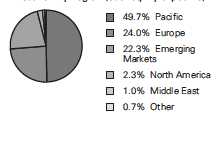

| Market Diversification (% of equity exposure) |

| | | FTSE | FTSE |

| | | Developed | Global |

| | | APAC All | All Cap ex |

| | | Cap | US |

| | Fund | Index | Index |

| Europe | 0.0% | 0.0% | 43.6% |

| Pacific | | | |

| Japan | 58.9% | 58.8% | 17.4% |

| Australia | 16.1 | 16.2 | 4.8 |

| South Korea | 12.7 | 12.7 | 3.8 |

| Hong Kong | 8.5 | 8.5 | 2.5 |

| Singapore | 3.1 | 3.1 | 0.9 |

| Other | 0.7 | 0.7 | 0.2 |

| Subtotal | 100.0% | 100.0% | 29.6% |

| Emerging Markets | 0.0% | 0.0% | 19.8% |

| North America | 0.0% | 0.0% | 6.6% |

| Middle East | 0.0% | 0.0% | 0.4% |

33

Pacific Stock Index Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

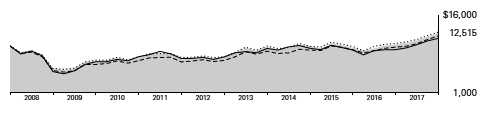

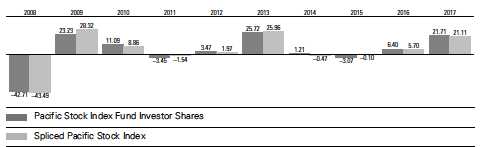

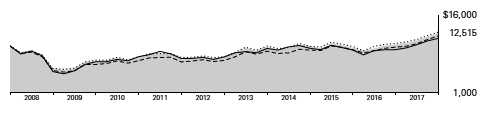

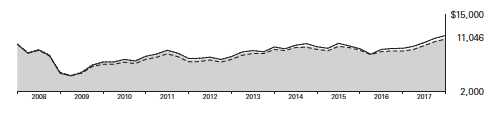

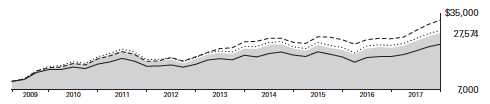

Cumulative Performance: October 31, 2007, Through October 31, 2017

Initial Investment of $10,000

| | | | | |

| | | Average Annual Total Returns | |

| | | Periods Ended October 31, 2017 | |

| | | | | | Final Value |

| | | One | Five | Ten | of a $10,000 |

| | | Year | Years | Years | Investment |

| | Pacific Stock Index Fund Investor | | | | |

| | Shares | 21.71% | 9.82% | 2.27% | $12,515 |

| • • • • • • • • | Spliced Pacific Stock Index | 21.11 | 9.90 | 2.42 | 12,707 |

| |

| |