UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05962

| Name of Registrant: | Vanguard Variable Insurance Funds |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code:(610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2019—December 31, 2019

Item 1:Reports to Shareholders

| | |

| | |

| | |

| | |

| Annual Report|December 31, 2019 | |

| | |

| | |

| Vanguard Variable Insurance Fund |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Balanced Portfolio Capital Growth Portfolio Conservative Allocation Portfolio Diversified Value Portfolio Equity Income Portfolio Equity Index Portfolio Global Bond Index Portfolio with underlying Total Bond Market Index Portfolio Growth Portfolio High Yield Bond Portfolio International Portfolio | Mid-Cap Index Portfolio Moderate Allocation Portfolio Money Market Portfolio Real Estate Index Portfolio Short-Term Investment-Grade Portfolio Small Company Growth Portfolio Total Bond Market Index Portfolio Total International Stock Market Index Portfolio Total Stock Market Index Portfolio

with underlying Equity Index Portfolio |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. |

| | |

Important information about access to shareholder reports

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com.

You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.

| Contents | |

| | |

| CEO’s Perspective | 1 |

| Balanced Portfolio | 2 |

| Capital Growth Portfolio | 31 |

| Conservative Allocation Portfolio | 45 |

| Diversified Value Portfolio | 57 |

| Equity Income Portfolio | 73 |

| Equity Index Portfolio | 89 |

Global Bond Index Portfolio

(with underlying Total Bond Market Index Portfolio) | 104 |

| Growth Portfolio | 183 |

| High Yield Bond Portfolio | 198 |

| International Portfolio | 219 |

| Mid-Cap Index Portfolio | 236 |

| Moderate Allocation Portfolio | 251 |

| Money Market Portfolio | 263 |

| Real Estate Index Portfolio | 275 |

| Short-Term Investment-Grade Portfolio | 290 |

| Small Company Growth Portfolio | 334 |

| Total Bond Market Index Portfolio | 350 |

| Total International Stock Market Index Portfolio | 418 |

Total Stock Market Index Portfolio

(with underlying Equity Index Portfolio) | 430 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

A Note From Our Chairman

Tim Buckley

Chairman and Chief Executive Officer

Dear Planholder,

Recent volatility in financial markets—affecting stocks, bonds, and commodities—has been a good reminder of the wise old adage, “Never keep all your eggs in one basket.” Maintaining balance and diversification in your investment portfolio can help to both limit risk and set you up for long-term success.

It’s understandable why some investors might become complacent after a long market run-up like the one that lifted stock prices, especially U.S. stock prices, in the years following the global financial crisis. But failing to rebalance regularly can leave a portfolio with a much different mix of assets than intended and, often, more risk than intended.

Balance across and diversification within asset classes are powerful tools for managing risk and achieving your investment goals. A portfolio’s allocation will determine a large portion of its long-term return and also the majority of its volatility risk. A well-diversified portfolio is less vulnerable to significant swings in the performance of any one segment of the asset classes in which it invests.

Balance and diversification will never eliminate the risk of loss, nor will they guarantee positive returns in a declining market. But they may reduce the chance that you’ll suffer disproportionate losses in one particular high-flying asset class or sector when it comes back to earth. And exposure to all key market components should give you at least some participation in the sectors that are performing best at any given time.

Vanguard is committed to helping you achieve balance and diversification in your portfolios to help meet your investment goals. We thank you for your continued loyalty.

Sincerely,

Mortimer J. Buckley

Chairman and Chief Executive Officer

January 23, 2020

Balanced Portfolio

Your Portfolio’s Performance at a Glance

• The Balanced Portfolio of Vanguard Variable Insurance Fund returned 22.48% for the 12 months ended December 31, 2019, trailing the 24.40% return of its composite benchmark. Please note that the portfolio returns in Vanguard Variable Insurance Fund are different from those in Vanguard Variable Annuity (and other plans that invest in the fund), which take into account insurance-related expenses.

• Stocks and bonds recorded their best results in years. Stocks benefited from three reductions of the Federal Reserve’s target for short-term interest rates during the year. And safer assets including bonds attracted investors as U.S.-China trade tensions fueled global economic growth concerns.

• Growth stocks outperformed their value counterparts, while large- and mid-capitalization stocks surpassed small-caps.

• The portfolio’s returns were positive in all 11 equity sectors. The advisor’s holdings in industrials and consumer discretionary contributed most to relative performance. Information technology and communication services were the biggest net detractors.

• The fixed income portfolio benefited from strong selection in investment-grade corporate bonds and modestly from duration and yield curve positioning.

• Over the decade ended December 31, 2019, the portfolio’s average annual return trailed that of its benchmark.

| Market Barometer | |

| | Average Annual Total Returns |

| | Periods Ended December 31, 2019 |

| | One Year | Three Years | Five Years |

| Stocks |

| Russell 1000 Index (Large-caps) | 31.43% | 15.05% | 11.48% |

| Russell 2000 Index (Small-caps) | 25.53 | 8.59 | 8.23 |

| Russell 3000 Index (Broad U.S. market) | 31.02 | 14.57 | 11.24 |

| FTSE All-World ex US Index (International) | 21.81 | 9.96 | 5.83 |

| |

| Bonds |

Bloomberg Barclays U.S. Aggregate Bond Index

(Broad taxable market) | 8.72% | 4.03% | 3.05% |

Bloomberg Barclays Municipal Bond Index

(Broad tax-exempt market) | 7.54 | 4.72 | 3.53 |

| FTSE Three-Month U.S. Treasury Bill Index | 2.25 | 1.65 | 1.04 |

| |

| CPI |

| Consumer Price Index | 2.29% | 2.10% | 1.82% |

Balanced Portfolio

Advisor’s Report

The Balanced Portfolio returned 22.48% for the 12 months ended December 31, 2019, below the 24.40% return of its blended benchmark (a mix of 65% large-capitalization stocks and 35% high-quality corporate bonds). The stock portion of the portfolio underperformed its benchmark, the Standard & Poor’s 500 Index, while the bond portion outperformed its benchmark, the Bloomberg Barclays U.S. Credit A or Better Bond Index.

The investment environment

Stock markets in the United States and abroad posted positive results for the year. The S&P 500 Index returned 31.49%, the MSCI World Index 28.40%, and the MSCI EAFE Index 22.01%.

The market rallied sharply at the start of 2019 because of supportive rhetoric from the Federal Reserve, the perception of easing tensions between the U.S. and China, and solid corporate earnings. As the year progressed, corporate earnings remained resilient but not robust, and geopolitical tensions again spiked. Ultimately, the combination of stabilizing economic data, accommodative central banks, and continued optimism toward an eventual U.S.-China trade deal proved favorable for equities.

The Fed pursued what could be termed a pro-market policy path, cutting interest rates 75 basis points over the year. (A basis point is one-hundredth of a percentage point.) Although geopolitical tensions ebbed and flowed, President Trump seemed to give the market sufficient hope that a trade deal with China could ultimately be consummated.

Corporate earnings for the 12 months were decent, if not spectacular. Earnings growth for the S&P 500 slowed significantly, but stocks and earnings over the past three years have largely moved in lockstep.

In the United States, large-capitalization growth stocks significantly outperformed large-cap value stocks, as measured by the Russell 1000 Growth Index (36.39%) and the Russell 1000 Value Index (26.54%).

This served as a slight headwind to the portfolio, which historically has had a value tilt.

The broad fixed income market generated largely positive returns, driven by a decline in sovereign yields in most markets, particularly in the first three quarters of the year. Corporate bond spreads tightened because of optimism that monetary accommodation could offset the drag on global growth from restrictive trade policies. Inflation showed no meaningful acceleration even as wage growth edged higher.

The Bloomberg Barclays U.S. Aggregate Bond Index returned 8.72%. The higher-quality credit market performed even better, as the Bloomberg Barclays U.S. Credit A or Better Bond Index returned 11.53%. The yield on the 10-year U.S. Treasury note declined 76 basis points, ending 2019 at 1.92%.

Our successes

In the stock portion of the portfolio, although security selection was a slight detractor to overall performance, selection was best in industrials, consumer discretionary, energy, and financials. Our holdings in Bank of America, JPMorgan Chase, American Tower, and Hilton Worldwide were strong contributors.

Relative performance was also boosted by not holding some securities. These included Berkshire Hathaway, Amazon. com, Johnson & Johnson, and Boeing.

In the fixed income market, spread sectors rallied at the beginning of 2019, reversing the widening that occurred at the end of 2018. Security selection in investment-grade corporates, particularly consumer noncyclicals and the communications subsector of industrials, drove the portfolio’s relative outperformance. Selection in financials and utilities also helped. In noncorporate credit, underweights to supranationals and local agency bonds as well as selection in local agency and taxable municipals contributed.

Duration/yield curve positioning modestly lifted overall performance. But short duration/yield curve flattening strategies, particularly in the early part of the year, detracted, partially offsetting the positive impact of a longer duration positioning later. Duration is a measure of the sensitivity of fixed income securities to changes in yields.

Our shortfalls

In the stock portion of the portfolio, sector allocation detracted most from relative performance. Our underweighted position in information technology was a significant headwind, as was our overweight to energy.

Security selection in communication services, information technology, and materials also hurt. Notable detractors included Verizon Communications, Simon Property Group, Pfizer, and Exelon. Stocks we did not hold or held underweighted positions in that reduced relative performance included Apple, Facebook, and Mastercard.

In fixed income, the portfolio’s under-weighted positioning in credit spread duration versus the all-credit benchmark lagged most as spreads tightened during the year. An underweight to financials (banking) and an overweight to utilities (electric) also hurt. An out-of-benchmark allocation to agency mortgage-backed securities--pass-throughs and collateralized mortgage obligations–detracted further.

Portfolio positioning

Our intermediate-term outlook for equity markets is balanced. On the encouraging side, economic growth is modestly positive in most regions, central banks have largely adopted an accommodative posture to setting monetary policy, and President Trump has sustained a pro-market orientation with respect to trade negotiations and fiscal policy. On the cautious side, we are ten years into an economic cycle and growth remains subdued, geopolitical relations delicate, and equity valuations near all-time highs.

Balanced Portfolio

In the stock portion of the portfolio, we are enthusiastic about the prospects for many individual businesses, such as JPMorgan Chase and Bank of America. These two, in particular, are extending their competitive advantage through investments in technology. Additionally, large pharmaceutical companies including Pfizer, Novartis, and AstraZeneca are reinvigorating their growth pipelines.

Global consumer staples such as Nestle and Diageo are using sharpened strategies to deliver growth. Consumer companies including Hilton Worldwide, Home Depot, Lowe’s, and TJX are reinvesting their scale advantages to enhance consumer value. Technology firms such as Microsoft and Alphabet are providing compelling innovation in attractive end-markets and driving scale benefits from their customers, employees, and shareholders.

Over the course of the year, we initiated new positions in American Express, Raytheon, and Boston Properties. We believe these companies are superb fits for our philosophy and process and we are optimistic about their future. We eliminated holdings in United Parcel Service, Citigroup, and Halliburton as we believe that challenging industry dynamics will make it difficult for these businesses to compound value at an attractive rate.

The portfolio is overweighted in financials because we believe large U.S. banks present a particularly compelling combination of quality and value. It is underweighted in information technology because we are concerned about the sustainability of very high growth rates and lofty equity valuations.

We remain committed to our investment philosophy and process of constructing a portfolio of resilient businesses at reasonable valuations run by strong management teams likely to make value-enhancing decisions. Our goal is to deliver a superior rate of economic growth (earnings plus dividends) over the long term and protect on the downside during difficult markets and economies.

In fixed income, we believe credit valuations are modestly rich because of risks involving geopolitics, trade tensions, and elections. However, global central banks should continue to support asset valuations. We expect global inflation to remain benign, making it unlikely that we will see a sustained move higher in global rates in 2020. We have positioned the fixed income portion of the portfolio with a slight duration overweight relative to the benchmark.

We are increasingly cautious about the business cycle and believe that credit fundamentals have deteriorated in part because of slowing earnings growth. Credit remains the portfolio’s main investment focus, and we continue to look for opportunities in the sector. We are positioned with an underweight to corporate credit relative to the all-credit benchmark and a bias toward more defensive sectors such as utilities and communication services.

We believe that taxable municipals remain fairly valued and a high-quality diversifier relative to our corporate bond risk. We retain a core overweighted position to the sector but have modestly reduced it recently, particularly for not-for-profit hospitals, because of secular headwinds and tight valuations.

The portfolio maintains an out-of-benchmark allocation to Treasury bills. We have increased our out-of-benchmark mortgage allocation and favor low- to mid-coupon agency pass-throughs and collateralized mortgage obligations for their favorable prepayment profile.

We own a modest out-of-benchmark allocation to prime, non-agency mortgage-backed securities. We also hold out-of-benchmark allocations to the securitized sectors, such as asset-backed securities, collateralized loan obligations, and commercial mortgage-backed securities, that offer attractive value and diversification relative to corporates. We are focused on acquiring high-quality issuance and senior portions of the capital structure.

Consistent with our practices, we always endeavor to hold adequate liquidity in the fixed income portion of the portfolio, most notably by owning government bonds and agency mortgage-backed securities. This liquidity should provide some downside protection for shareholders if the economic cycle or the equity portfolio takes an unfavorable turn.

We remain disciplined in the application of our investment process, allowing us to create a balanced portfolio that we believe should perform well in a variety of environments. We focus on long-term, low-turnover investing—features that have served the portfolio’s shareholders well over time.

Portfolio Managers:

Edward P. Bousa, CFA,

Senior Managing Director and

Equity Portfolio Manager

Daniel J. Pozen

Senior Managing Director and

Equity Portfolio Manager

Michael E. Stack, CFA,

Senior Managing Director and

Fixed Income Portfolio Manager

Loren L. Moran, CFA,

Senior Managing Director and

Fixed Income Portfolio Manager

Wellington Management Company LLP

January 14, 2020

Balanced Portfolio

About Your Portfolio’s Expenses

As a shareholder of the portfolio, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a portfolio’s gross income, directly reduce the investment return of the portfolio.

A portfolio’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your portfolio and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The table below illustrates your portfolio’s costs in two ways:

• Based on actual portfolio return. This section helps you to estimate the actual expenses that you paid over the period. The “Ending Account Value” shown is derived from the portfolio’s actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your portfolio under the heading “Expenses Paid During Period.”

• Based on hypothetical 5% yearly return. This section is intended to help you compare your portfolio’s costs with those of other mutual funds. It assumes that the portfolio had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the portfolio’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your portfolio’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Note that the expenses shown in the table are meant to highlight and help you compareongoingcosts only and do not reflect transaction costs incurred by the portfolio for buying and selling securities. The portfolio’s expense ratio does not reflect additional fees and expenses associated with the annuity or life insurance program through which you invest.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the portfolio’s expenses in the Financial Statements section. For additional information on operating expenses and other shareholder costs, please refer to the prospectus.

| Six Months Ended December 31, 2019 | | | |

| | Beginning | Ending | Expenses |

| | Account Value | Account Value | Paid During |

| Balanced Portfolio | 6/30/2019 | 12/31/2019 | Period |

| Based on Actual Portfolio Return | $1,000.00 | $1,085.76 | $1.10 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,024.15 | 1.07 |

The calculations are based on expenses incurred in the most recent six-month period. The portfolio’s annualized six-month expense ratio for that period is 0.21%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (184/365).

Balanced Portfolio

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the portfolio. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on portfolio distributions or on the sale of portfolio shares. Nor do the returns reflect fees and expenses associated with the annuity or life insurance program through which a shareholder invests. If these fees and expenses were included, the portfolio’s returns would be lower.

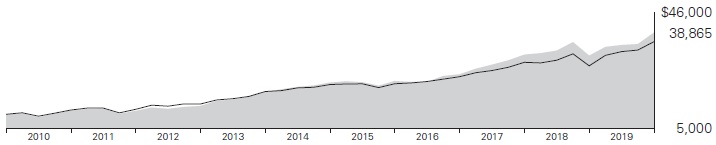

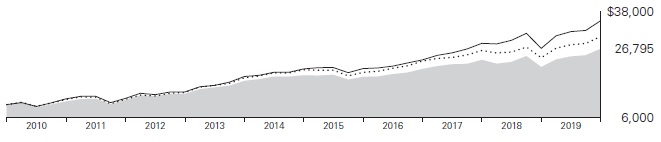

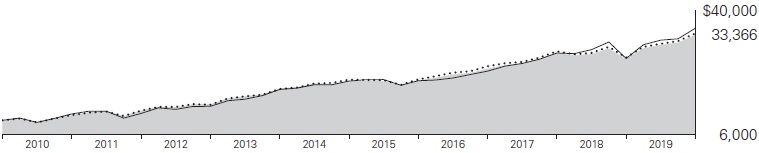

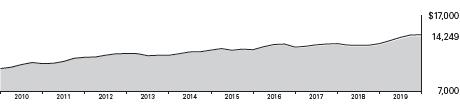

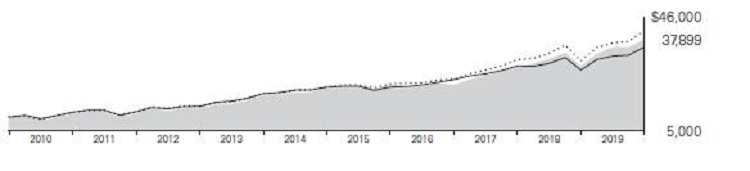

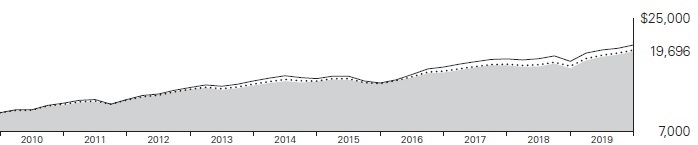

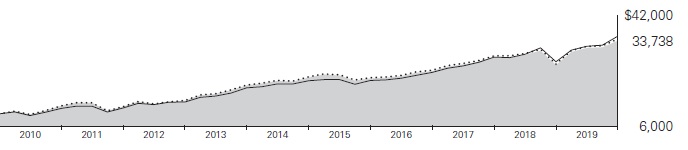

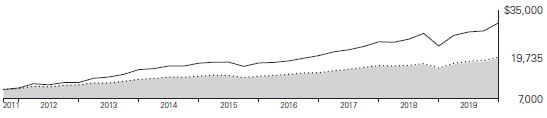

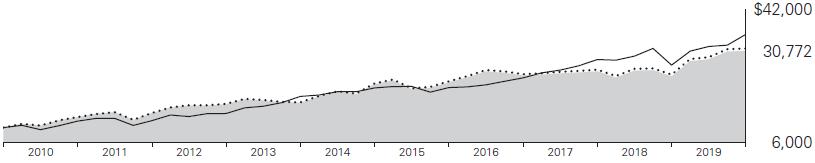

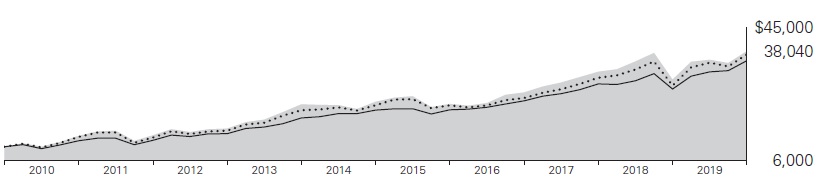

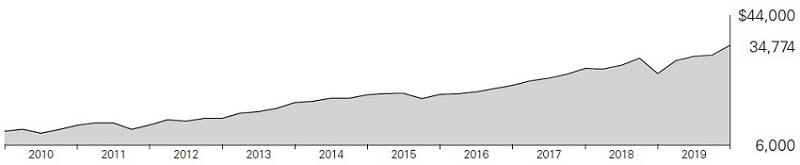

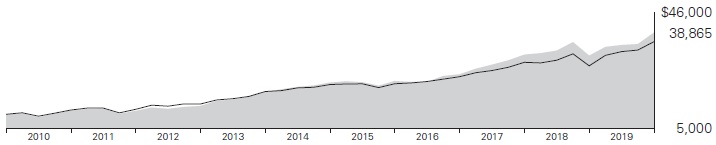

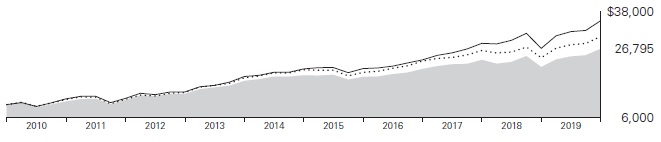

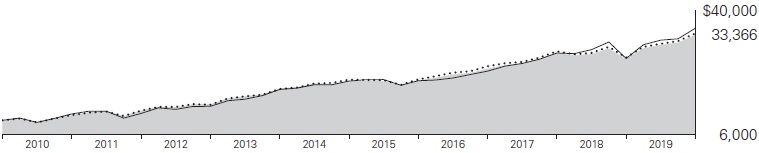

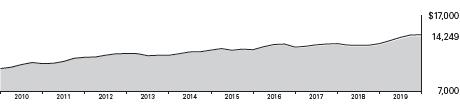

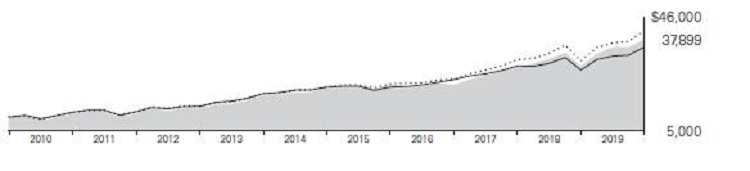

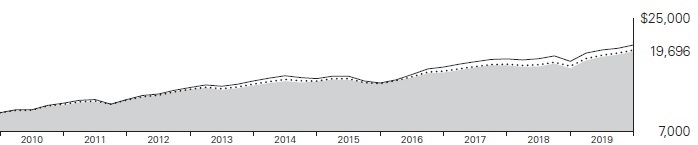

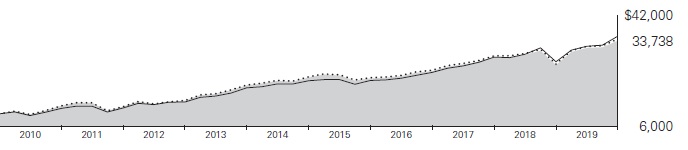

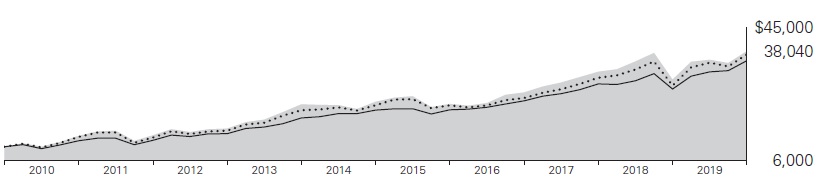

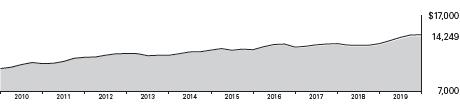

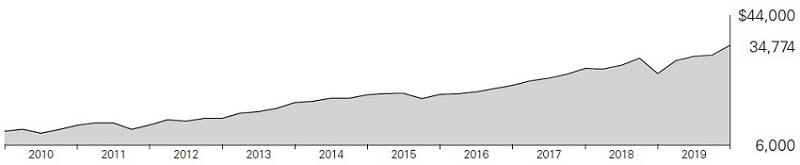

Cumulative Performance: December 31, 2009–December 31, 2019 Initial

Investment of $10,000

| | | Average Annual Total Returns | Final Value |

| | | Periods Ended December 31, 2019 | of a $10,000 |

| | | One Year | Five Years | Ten Years | Investment |

| Balanced Portfolio | 22.48% | 8.56% | 9.91% | $25,733 |

| S&P 500 Index | 31.49 | 11.70 | 13.56 | 35,666 |

| Composite Stock/Bond Index | 24.40 | 9.09 | 10.62 | 27,428 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 30.90 | 11.18 | 13.43 | 35,251 |

Composite Stock/Bond Index: Weighted 65% S&P 500 Index and 35% Bloomberg Barclays U.S. Credit A or Better Bond Index.

See Financial Highlights for dividend and capital gains information.

Balanced Portfolio

Sector Diversification

As of December 31, 2019

| Equity Exposure | |

| | |

| Communication Services | 10.0% |

| Consumer Discretionary | 5.3 |

| Consumer Staples | 7.4 |

| Energy | 6.7 |

| Financials | 22.7 |

| Health Care | 16.2 |

| Industrials | 9.5 |

| Information Technology | 13.9 |

| Materials | 1.2 |

| Real Estate | 2.6 |

| Utilities | 4.5 |

The table reflects the portfolio’s equity exposure, based on its investments in stocks and stock index futures. Any holdings in short-term reserves are excluded. Sector categories are based on the Global Industry Classification Standard (“GICS”), except for the “Other” category (if applicable), which includes securities that have not been provided a GICS classification as of the effective reporting period.

| Fixed Income Exposure | |

| | |

| Asset-Backed | 4.8% |

| Finance | 24.7 |

| Foreign | 4.1 |

| Government Mortgage-Backed | 8.2 |

| Industrial | 30.9 |

| Treasury | 13.8 |

| Utilities | 8.4 |

| Other | 5.1 |

The table reflects the portfolio’s market exposure. Any holdings in short-term reserves are excluded. The agency and mortgage-backed securities sectors may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government.

The Global Industry Classification Standard (“GICS”) was developed by and is the exclusive property and a service mark of MSCI Inc. (“MSCI”) and Standard and Poor’s, a division of McGraw-Hill Companies, Inc. (“S&P”), and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Balanced Portfolio

Financial Statements

Statement of Net Assets

As of December 31, 2019

The portfolio files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The portfolio’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | | | Market | |

| | | | | Value• | |

| | | Shares | | ($000 | ) |

| Common Stocks (65.4%) | |

| Communication Services (6.6%) | | | |

| | Verizon Communications Inc. | 1,303,788 | | 80,053 | |

| * | Alphabet Inc. Class A | 53,232 | | 71,298 | |

| | Comcast Corp. Class A | 1,137,493 | | 51,153 | |

| | AT&T Inc. | 294,452 | | 11,507 | |

| | | | | 214,011 | |

| Consumer Discretionary (3.4%) | | | |

| | Home Depot Inc. | 122,973 | | 26,855 | |

| | Lowe’s Cos. Inc. | 193,594 | | 23,185 | |

| | TJX Cos. Inc. | 330,934 | | 20,207 | |

| | Hilton Worldwide Holdings Inc. | 181,998 | | 20,185 | |

| | McDonald’s Corp. | 85,336 | | 16,863 | |

| | Ross Stores Inc. | 45,465 | | 5,293 | |

| | | | 112,588 | |

| Consumer Staples (4.8%) | | | | |

| | Nestle SA | 295,228 | | 31,963 | |

| | PepsiCo Inc. | 188,116 | | 25,710 | |

| | Coca-Cola Co. | 448,365 | | 24,817 | |

| | Sysco Corp. | 272,758 | | 23,332 | |

| | Walmart Inc. | 186,283 | | 22,138 | |

| | Diageo plc | 460,154 | | 19,389 | |

| | Unilever NV | 175,236 | | 10,057 | |

| | | | 157,406 | |

| Energy (4.4%) | | | | |

| | Chevron Corp. | 418,565 | | 50,441 | |

| | TOTAL SA | 498,338 | | 27,653 | |

| | ConocoPhillips | 312,942 | | 20,351 | |

| | Suncor Energy Inc. | 588,518 | | 19,289 | |

| | Exxon Mobil Corp. | 159,283 | | 11,115 | |

| | BP plc | 1,435,658 | | 9,031 | |

| | Hess Corp. | 75,089 | | 5,017 | |

| | | | 142,897 | |

| Financials (14.9%) | | | | |

| | JPMorgan Chase & Co. | 608,572 | | 84,835 | |

| | Bank of America Corp. | 2,346,016 | | 82,627 | |

| | Chubb Ltd. | 265,934 | | 41,395 | |

| | Prudential Financial Inc. | 399,275 | | 37,428 | |

| | American Express Co. | 204,233 | | 25,425 | |

| | PNC Financial Services Group Inc. | 137,040 | | 21,876 | |

| | Northern Trust Corp. | 201,607 | | 21,419 | |

| | American International Group Inc. | 415,596 | | 21,332 | |

| | Intercontinental Exchange Inc. | 218,861 | | 20,256 | |

| | Progressive Corp. | 272,331 | | 19,714 | |

| | BlackRock Inc. | 38,607 | | 19,408 | |

| | Mitsubishi UFJ Financial Group Inc. | 2,891,510 | | 15,632 | |

| | Bank of Nova Scotia | 261,909 | | 14,795 | |

| | Hartford Financial Services Group Inc. | 186,106 | | 11,310 | |

| | Marsh & McLennan Cos.Inc. | 95,276 | | 10,615 | |

| | Charles Schwab Corp. | 204,970 | | 9,748 | |

| | Tokio Marine Holdings Inc. | 135,665 | | 7,596 | |

| | ING Groep NV | 517,786 | | 6,225 | |

| | BNP Paribas SA | 91,845 | | 5,459 | |

| | UBS Group AG | 350,957 | | 4,415 | |

| | Prudential plc | 186,082 | | 3,565 | |

| | | | | 485,075 | |

| Health Care (10.6%) | | | | |

| | Pfizer Inc. | 1,213,471 | | 47,544 | |

| | AstraZeneca plc ADR | 834,171 | | 41,592 | |

| | UnitedHealth Group Inc. | 119,218 | | 35,048 | |

| | Medtronic plc | 307,627 | | 34,900 | |

| | Merck & Co. Inc. | 338,198 | | 30,759 | |

| | Novartis AG | 308,797 | | 29,240 | |

| | Eli Lilly & Co. | 221,262 | | 29,081 | |

| | CVS Health Corp. | 334,459 | | 24,847 | |

| | Bristol-Myers Squibb Co. | 350,653 | | 22,508 | |

| | Koninklijke Philips NV | 352,247 | | 17,219 | |

| | Abbott Laboratories | 186,541 | | 16,203 | |

| | HCA Healthcare Inc. | 92,481 | | 13,670 | |

| | Becton Dickinson and Co. | 16,051 | | 4,365 | |

| | | | | 346,976 | |

| Industrials (6.2%) | | | | |

| | United Technologies Corp. | 200,832 | | 30,077 | |

| | Union Pacific Corp. | 163,546 | | 29,567 | |

| | Deere & Co. | 162,251 | | 28,112 | |

| | Lockheed Martin Corp. | 62,927 | | 24,502 | |

| | Vinci SA | 150,742 | | 16,789 | |

| | Schneider Electric SE | 162,824 | | 16,729 | |

| | General Dynamics Corp. | 91,047 | | 16,056 | |

| | Raytheon Co. | 72,108 | | 15,845 | |

| | Johnson Controls International plc | 321,084 | | 13,071 | |

| | CSX Corp. | 103,239 | | 7,470 | |

| | Eaton Corp. plc | 47,031 | | 4,455 | |

| | | | | 202,673 | |

| Information Technology (9.1%) | | | |

| | Microsoft Corp. | 732,676 | | 115,543 | |

| | Apple Inc. | 162,022 | | 47,578 | |

| | Intel Corp. | 669,571 | | 40,074 | |

| | Cisco Systems Inc. | 628,530 | | 30,144 | |

| | Texas Instruments Inc. | 142,936 | | 18,337 | |

| | Accenture plc Class A | 68,489 | | 14,422 | |

| | Samsung Electronics Co.Ltd. GDR | 9,633 | | 11,528 | |

| | HP Inc. | 368,146 | | 7,565 | |

| | Taiwan Semiconductor Manufacturing Co. Ltd.ADR | 114,254 | | 6,638 | |

| | International Business Machines Corp. | 37,796 | | 5,066 | |

| | | | | 296,895 | |

| Materials (0.8%) | | | | |

| | International Paper Co. | 388,896 | | 17,909 | |

| | PPG Industries Inc. | 56,890 | | 7,594 | |

| | | | | 25,503 | |

| Real Estate (1.7%) | | | | |

| | American Tower Corp. | 100,026 | | 22,988 | |

| | Simon Property Group Inc. | 125,970 | | 18,765 | |

| | Boston Properties Inc. | 94,960 | | 13,091 | |

| | | | | 54,844 | |

| Utilities (2.9%) | | | | |

| | Dominion Energy Inc. | 383,799 | | 31,786 | |

| | NextEra Energy Inc. | 111,577 | | 27,020 | |

| | Exelon Corp. | 526,359 | | 23,997 | |

| * | Iberdrola SA | 1,241,308 | | 12,792 | |

| | | | | 95,595 | |

Total Common Stocks

(Cost $1,514,146) | | | 2,134,463 | |

Balanced Portfolio

| | | | Face | | Market | |

| | | Maturity | Amount | | Value• | |

| | Coupon | Date | ($000 | ) | ($000 | ) |

| U.S. Government and Agency Obligations (7.3%) | |

| U.S. Government Securities (4.6%) | | | | | | |

| | United States Treasury Note/Bond | 1.500% | 8/31/21 | 4,500 | | 4,492 | |

| | United States Treasury Note/Bond | 2.875% | 11/15/21 | 4,100 | | 4,196 | |

| | United States Treasury Note/Bond | 2.500% | 3/31/23 | 18,815 | | 19,327 | |

| | United States Treasury Note/Bond | 2.625% | 6/30/23 | 6,650 | | 6,871 | |

| 1 | United States Treasury Note/Bond | 2.875% | 10/31/23 | 5,600 | | 5,849 | |

| | United States Treasury Note/Bond | 2.625% | 12/31/23 | 6,400 | | 6,635 | |

| | United States Treasury Note/Bond | 1.750% | 6/30/24 | 12,675 | | 12,707 | |

| | United States Treasury Note/Bond | 1.500% | 10/31/24 | 4,100 | | 4,064 | |

| | United States Treasury Note/Bond | 3.125% | 11/15/28 | 570 | | 627 | |

| | United States Treasury Note/Bond | 2.625% | 2/15/29 | 5,695 | | 6,035 | |

| | United States Treasury Note/Bond | 2.375% | 5/15/29 | 18,515 | | 19,244 | |

| | United States Treasury Note/Bond | 1.625% | 8/15/29 | 11,730 | | 11,426 | |

| | United States Treasury Note/Bond | 1.750% | 11/15/29 | 4,300 | | 4,235 | |

| | United States Treasury Note/Bond | 2.875% | 5/15/43 | 6,088 | | 6,635 | |

| | United States Treasury Note/Bond | 3.375% | 5/15/44 | 2,935 | | 3,475 | |

| | United States Treasury Note/Bond | 3.125% | 8/15/44 | 1,740 | | 1,980 | |

| | United States Treasury Note/Bond | 2.500% | 2/15/45 | 2,060 | | 2,103 | |

| | United States Treasury Note/Bond | 2.250% | 8/15/46 | 3,068 | | 2,982 | |

| | United States Treasury Note/Bond | 2.750% | 8/15/47 | 2,390 | | 2,563 | |

| | United States Treasury Note/Bond | 3.000% | 8/15/48 | 545 | | 614 | |

| | United States Treasury Note/Bond | 2.875% | 5/15/49 | 8,100 | | 8,932 | |

| | United States Treasury Note/Bond | 2.250% | 8/15/49 | 8,780 | | 8,521 | |

| | United States Treasury Strip Principal | 0.000% | 5/15/47 | 4,910 | | 2,527 | |

| | United States Treasury Strip Principal | 0.000% | 8/15/47 | 6,835 | | 3,491 | |

| | | | | | | 149,531 | |

| Conventional Mortgage-Backed Securities (2.1%) | | | | | |

| 2,3 | Fannie Mae Pool | 2.500% | 4/1/37–12/1/49 | 4,762 | | 4,731 | |

| 2,3 | Fannie Mae Pool | 2.780% | 6/1/26 | 1,025 | | 1,061 | |

| 2,3 | Fannie Mae Pool | 3.000% | 11/1/49 | 7,038 | | 7,141 | |

| 2,3 | Fannie Mae Pool | 3.070% | 2/1/25 | 500 | | 522 | |

| 2,3 | Fannie Mae Pool | 3.500% | 12/1/47–1/1/58 | 17,781 | | 18,369 | |

| 2,3 | Fannie Mae Pool | 4.000% | 8/1/48–12/1/49 | 3,605 | | 3,765 | |

| 2,3 | Freddie Mac Gold Pool | 4.000% | 9/1/41–12/1/48 | 1,475 | | 1,537 | |

| 2 | Ginnie Mae I Pool | 7.000% | 11/15/31–11/15/33 | 68 | | 76 | |

| 2 | Ginnie Mae I Pool | 8.000% | 9/15/30 | 45 | | 53 | |

| 2,3,4 | UMBS Pool | 2.500% | 11/1/49–1/1/50 | 18,884 | | 18,735 | |

| 2,3,4 | UMBS Pool | 3.000% | 7/1/49–1/1/50 | 8,862 | | 8,993 | |

| 2,3 | UMBS Pool | 4.000% | 12/1/49 | 4,753 | | 4,977 | |

| 2,3,4 | UMBS TBA | 3.500% | 1/1/50 | 400 | | 411 | |

| | | | | | | 70,371 | |

| Nonconventional Mortgage-Backed Securities (0.6%) | | | | |

| 2,3 | Fannie Mae REMICS | 1.500% | 8/25/41–6/25/42 | 766 | | 744 | |

| 2,3 | Fannie Mae REMICS | 1.700% | 6/25/43 | 157 | | 155 | |

| 2,3 | Fannie Mae REMICS | 2.000% | 6/25/44 | 180 | | 179 | |

| 2,3 | Fannie Mae REMICS | 3.000% | 3/25/53–9/25/57 | 3,079 | | 3,140 | |

| 2,3 | Fannie Mae REMICS | 3.500% | 4/25/31–6/25/59 | 10,422 | | 10,870 | |

| 2,3 | Fannie Mae REMICS | 4.000% | 9/25/29–7/25/53 | 628 | | 654 | |

| 2,3 | Freddie Mac REMICS | 3.000% | 12/15/39 | 222 | | 226 | |

| 2,3 | Freddie Mac REMICS | 3.500% | 3/15/31 | 116 | | 121 | |

| 2,3 | Freddie Mac REMICS | 4.000% | 12/15/30–4/15/31 | 2,186 | | 2,320 | |

| 2 | Government National Mortgage Assn. | 1.700% | 10/20/45 | 326 | | 322 | |

| 2 | Government National Mortgage Assn. | 1.800% | 5/20/41 | 359 | | 355 | |

| | | | | | | 19,086 | |

Total U.S. Government and Agency Obligations

(Cost $233,314) | | | | | 238,988 | |

| Asset-Backed/Commercial Mortgage-Backed Securities (1.6%) | | | | | |

| 2,5 | Aaset 2019-1 Trust | 3.844% | 5/15/39 | 426 | | 429 | |

| 2,5 | American Express Credit Account Master Trust | 2.950% | 3/15/23 | 1,720 | | 1,739 | |

| 5 | American Tower Trust I | 3.070% | 3/15/23 | 1,100 | | 1,114 | |

| 2 | AmeriCredit Automobile Receivables Trust 2016-3 | 2.240% | 4/8/22 | 360 | | 360 | |

| 2,5 | Angel Oak Mortgage Trust 2019-5 | 2.593% | 10/25/49 | 428 | | 427 | |

| 2,5 | Angel Oak Mortgage Trust 2019-6 | 2.620% | 11/25/59 | 1,085 | | 1,083 | |

| 2,5 | Angel Oak Mortgage Trust I LLC 2019-2 | 3.628% | 3/25/49 | 258 | | 261 | |

| 2,5 | Angel Oak Mortgage Trust LLC | 2.993% | 7/26/49 | 891 | | 893 | |

| 2,5,6 | Ares XXIX CLO Ltd., 3M USD LIBOR + 1.190% | 3.192% | 4/17/26 | 328 | | 329 | |

| 2,5,6 | Atlas Senior Loan Fund X Ltd., 3M USD LIBOR + 1.090% | 3.091% | 1/15/31 | 250 | | 248 | |

| 2,5,6 | Avery Point IV CLO Ltd., 3M USD LIBOR + 1.100% | 3.040% | 4/25/26 | 569 | | 570 | |

| 5 | Bank of Montreal | 2.500% | 1/11/22 | 1,700 | | 1,723 | |

| 2 | BMW Vehicle Lease Trust 2018-1A | 3.260% | 7/20/21 | 295 | | 297 | |

| 2,5 | Canadian Pacer Auto Receivable Trust A Series 2018 | 3.000% | 6/21/21 | 87 | | 87 | |

| 2,5 | Canadian Pacer Auto Receivable Trust A Series 2018 | 3.270% | 12/19/22 | 140 | | 141 | |

| 2 | CarMax Auto Owner Trust 2018-4 | 3.110% | 2/15/22 | 542 | | 544 | |

| 2 | CarMax Auto Owner Trust 2018-4 | 3.360% | 9/15/23 | 975 | | 993 | |

| 2,5 | Castlelake Aircraft Securitization Trust 2019-1 | 3.967% | 4/15/39 | 842 | | 853 | |

| 2,5,6 | Cent CLO, 3M USD LIBOR + 1.150% | 3.090% | 10/25/28 | 550 | | 551 | |

| 2,5 | Chesapeake Funding II LLC | 3.390% | 1/15/31 | 759 | | 768 | |

| 2,5 | Chesapeake Funding II LLC 2017-2A | 1.990% | 5/15/29 | 94 | | 93 | |

| 2,5 | Chesapeake Funding II LLC 2018-1 | 3.040% | 4/15/30 | 784 | | 792 | |

| 2,5 | Cloud Pass-Through Trust 2019-1 | 3.554% | 12/5/22 | 939 | | 950 | |

| 2,5 | COLT 2018-3 Mortgage Loan Trust | 3.692% | 10/26/48 | 249 | | 250 | |

| 2,5 | COLT 2019-2 Mortgage Loan Trust | 3.337% | 5/25/49 | 430 | | 434 | |

| 2 | COMM 2012-CCRE2 Mortgage Trust | 3.147% | 8/15/45 | 480 | | 490 | |

| 2,5 | Daimler Trucks Retail Trust 2019-1 | 2.770% | 4/15/21 | 549 | | 550 | |

| 2,5 | DB Master Finance LLC | 3.787% | 5/20/49 | 453 | | 462 | |

| 2,5 | DB Master Finance LLC | 4.021% | 5/20/49 | 403 | | 413 | |

| 2,5 | Deephave Residential Mortgage Trust 2019-2 | 3.558% | 4/25/59 | 399 | | 405 | |

| 5 | DNB Boligkreditt AS | 2.500% | 3/28/22 | 1,315 | | 1,332 | |

| 2,5 | Enterprise Fleet Financing LLC | 3.100% | 10/20/23 | 270 | | 274 | |

| 2,5 | Enterprise Fleet Financing LLC | 2.290% | 2/20/25 | 960 | | 963 | |

| 2,5 | Enterprise Fleet Financing LLC Series 2017-1 | 2.130% | 7/20/22 | 19 | | 19 | |

| 2,5 | Enterprise Fleet Financing LLC Series 2018-1 | 2.870% | 10/20/23 | 532 | | 534 | |

| 2,5 | Enterprise Fleet Financing LLC Series 2018-3 | 3.380% | 5/20/24 | 467 | | 472 | |

| 2,5 | Enterprise Fleet Financing LLC Series 2019-1 | 2.980% | 10/20/24 | 745 | | 752 | |

| 2,5 | Enterprise Fleet Financing LLC Series 2019-3 | 2.060% | 5/20/25 | 645 | | 646 | |

| 2,5 | Exeter Automobile Receivables Trust 2018-3 | 2.900% | 1/18/22 | 8 | | 8 | |

| 2,5 | Exeter Automobile Receivables Trust 2019-3 | 2.590% | 9/15/22 | 312 | | 313 | |

| 2,5 | Exeter Automobile Receivables Trust 2019-4 | 2.180% | 1/17/23 | 513 | | 513 | |

Balanced Portfolio

| | | | Face | | Market | |

| | | Maturity | Amount | | Value• | |

| | Coupon | Date | ($000 | ) | ($000 | ) |

| 2,3,6 | Fannie Mae Connecticut Avenue Securities, 1M USD LIBOR + 5.900% | 7.692% | 10/25/28 | 273 | | 293 | |

| 2 | Ford Credit Floorplan Master Owner Trust A | 2.440% | 9/15/26 | 370 | | 371 | |

| 2,3 | Freddie Mac Multifamily Structured Pass Through Certificates | 2.610% | 1/25/26 | 525 | | 531 | |

| 2,3 | Freddie Mac Multifamily Structured Pass Through Certificates | 2.282% | 7/25/26 | 885 | | 885 | |

| 2,5 | Golden Credit Card Trust | 1.980% | 4/15/22 | 545 | | 545 | |

| 2,5 | Golden Credit Card Trust 2018-1A | 2.620% | 1/15/23 | 485 | | 488 | |

| 5 | GTP Acquisition Partners I LLC | 2.350% | 6/15/20 | 580 | | 580 | |

| 2,5 | Hertz Fleet Lease Funding LP 2019-1 | 2.700% | 1/10/33 | 1,095 | | 1,103 | |

| 2,5 | Horizon Aircraft Finance Ltd. | 3.721% | 7/15/39 | 324 | | 324 | |

| 2,5 | Horizon Aircraft Finance Ltd. | 3.425% | 11/15/39 | 323 | | 321 | |

| 2,5 | MACH 1 Cayman 2019-1 Ltd. | 3.474% | 10/15/39 | 385 | | 383 | |

| 2,5,6 | Madison Park Funding XII Ltd., 3M USD LIBOR + 1.260% | 3.226% | 7/20/26 | 399 | | 399 | |

| 2,5,6 | Madison Park Funding XIII Ltd., 3M USD LIBOR + 0.950% | 2.916% | 4/19/30 | 930 | | 925 | |

| 2,5 | MAPS Ltd. | 4.458% | 3/15/44 | 233 | | 240 | |

| 2,5,6 | Master Credit Card Trust II Series 2018-1A, 1M USD LIBOR + 0.490% | 2.275% | 7/21/24 | 1,000 | | 998 | |

| 2 | Nissan Auto Lease Trust 2018-B | 3.250% | 9/15/21 | 460 | | 464 | |

| 2,5 | OneMain Direct Auto Receivables Trust | 3.430% | 12/16/24 | 1,100 | | 1,114 | |

| 2,5 | OneMain Direct Auto Receivables Trust 2017-2 | 2.310% | 12/14/21 | 44 | | 44 | |

| 2,5 | OneMain Financial Issuance Trust 2017-1 | 2.370% | 9/14/32 | 220 | | 220 | |

| 2,5 | OneMain Financial Issuance Trust 2019-1 | 3.480% | 2/14/31 | 1,000 | | 1,010 | |

| 2 | Santander Drive Auto Receivables Trust 2018-5 | 3.190% | 3/15/22 | 170 | | 170 | |

| 2,5 | Santander Retail Auto Lease Trust 2019-A | 2.720% | 1/20/22 | 528 | | 530 | |

| 2,5 | Santander Retail Auto Lease Trust 2019-B | 2.300% | 1/20/23 | 345 | | 347 | |

| 2 | Seasoned Credit Risk Transfer Trust Series 2018-4 | 3.500% | 3/25/58 | 741 | | 759 | |

| 2 | Seasoned Credit Risk Transfer Trust Series 2019-1 | 3.500% | 7/25/58 | 1,072 | | 1,102 | |

| 2 | Seasoned Credit Risk Transfer Trust Series 2019-3 | 3.500% | 10/25/58 | 1,681 | | 1,730 | |

| 2,5 | Securitized Term Auto Receivables Trust 2018-2 | 3.060% | 2/25/21 | 120 | | 120 | |

| 2,5 | Securitized Term Auto Receivables Trust 2018-2 | 3.325% | 8/25/22 | 550 | | 557 | |

| 2,5,6 | Seneca Park CLO Ltd. 2014-1, 3M USD LIBOR + 1.120% | 3.122% | 7/17/26 | 223 | | 223 | |

| 2,5 | SFAVE Commercial Mortgage Securities Trust 2015-5AVE | 4.144% | 1/5/43 | 700 | | 726 | |

| 2,5 | SoFi Consumer Loan Program 2018-2 Trust | 2.930% | 4/26/27 | 14 | | 14 | |

| 2,5 | SoFi Consumer Loan Program 2018-4 Trust | 3.540% | 11/26/27 | 421 | | 424 | |

| 2,5 | SoFi Consumer Loan Program 2019-1 Trust | 3.240% | 2/25/28 | 538 | | 541 | |

| 2,5 | Springleaf Funding Trust 2015-B | 3.480% | 5/15/28 | 590 | | 594 | |

| §,2,5 | Start III Ltd. | 3.536% | 11/15/44 | 399 | | 399 | |

| 2,5 | START Ireland | 4.089% | 3/15/44 | 549 | | 556 | |

| 2,5,6 | Symphony CLO XIV Ltd., 3M USD LIBOR + 0.950% | 2.951% | 7/14/26 | 1,125 | | 1,124 | |

| 2,5,6 | Thacher Park CLO Ltd., 3M USD LIBOR + 1.160% | 3.126% | 10/20/26 | 271 | | 271 | |

| 5 | Toronto-Dominion Bank | 2.500% | 1/18/22 | 2,100 | | 2,126 | |

| 2,5 | Towd Point Mortgage Trust 2016-3 | 2.250% | 4/25/56 | 40 | | 40 | |

| 2,5 | Trillium Credit Card Trust II 2019-2A | 3.038% | 1/26/24 | 1,250 | | 1,264 | |

| 2 | Utility Debt Securitization Authority Series 2013T | 3.435% | 12/15/25 | 210 | | 216 | |

| 2,5 | Vantage Data Centers LLC 2018-1A | 4.072% | 2/16/43 | 481 | | 501 | |

| 2,5 | Vantage Data Centers LLC 2019-1A | 3.188% | 7/15/44 | 269 | | 271 | |

| 2 | Verizon Owner Trust 2018-A | 3.230% | 4/20/23 | 585 | | 594 | |

| 2,5 | Verus Securitization Trust 2019-2 | 3.211% | 5/25/59 | 438 | | 442 | |

| 2,5,6 | Voya CLO 2014-1 Ltd., 3M USD LIBOR + 0.990% | 2.993% | 4/18/31 | 515 | | 510 | |

| 2,5 | Westlake Automobile Receivables Trust | 2.150% | 2/15/23 | 415 | | 415 | |

Total Asset-Backed/Commercial Mortgage-Backed Securities

(Cost $51,612) | | | | 51,879 | |

| Corporate Bonds (21.2%) | | | | | | |

| Finance (8.2%) | | | | | | |

| | Banking (6.8%) | | | | | | |

| 5 | ABN AMRO Bank NV | 2.450% | 6/4/20 | 623 | | 624 | |

| | American Express Credit Corp. | 2.700% | 3/3/22 | 1,505 | | 1,529 | |

| | Banco Santander SA | 3.125% | 2/23/23 | 800 | | 816 | |

| | Banco Santander SA | 3.848% | 4/12/23 | 400 | | 416 | |

| | Bank of America Corp. | 3.300% | 1/11/23 | 120 | | 124 | |

| 2 | Bank of America Corp. | 2.816% | 7/21/23 | 1,645 | | 1,668 | |

| | Bank of America Corp. | 3.004% | 12/20/23 | 3,408 | | 3,482 | |

| | Bank of America Corp. | 4.000% | 1/22/25 | 875 | | 930 | |

| 2 | Bank of America Corp. | 3.559% | 4/23/27 | 2,450 | | 2,583 | |

| 2 | Bank of America Corp. | 3.593% | 7/21/28 | 1,025 | | 1,088 | |

| 2 | Bank of America Corp. | 3.419% | 12/20/28 | 512 | | 536 | |

| 2 | Bank of America Corp. | 4.271% | 7/23/29 | 4,780 | | 5,294 | |

| 2 | Bank of America Corp. | 3.974% | 2/7/30 | 1,895 | | 2,063 | |

| 2 | Bank of America Corp. | 3.194% | 7/23/30 | 1,055 | | 1,091 | |

| | Bank of America Corp. | 5.875% | 2/7/42 | 260 | | 369 | |

| | Bank of America Corp. | 5.000% | 1/21/44 | 1,000 | | 1,306 | |

| 2 | Bank of America Corp. | 4.330% | 3/15/50 | 2,235 | | 2,680 | |

| | Bank of Montreal | 3.100% | 4/13/21 | 1,290 | | 1,309 | |

| | Bank of New York Mellon Corp. | 2.150% | 2/24/20 | 1,580 | | 1,580 | |

| | Bank of New York Mellon Corp. | 2.200% | 8/16/23 | 460 | | 465 | |

| | Bank of New York Mellon Corp. | 3.000% | 2/24/25 | 720 | | 748 | |

| 6 | Bank of New York Mellon Corp., 3M USD LIBOR + 1.050% | 2.986% | 10/30/23 | 1,145 | | 1,165 | |

| | Bank of Nova Scotia | 2.800% | 7/21/21 | 750 | | 760 | |

| | Bank of Nova Scotia | 2.700% | 8/3/26 | 1,825 | | 1,854 | |

| 5 | Banque Federative du Credit Mutuel SA | 2.750% | 10/15/20 | 1,200 | | 1,208 | |

| | Barclays Bank plc | 5.140% | 10/14/20 | 160 | | 163 | |

| 2 | Barclays plc | 3.932% | 5/7/25 | 1,565 | | 1,644 | |

| 6 | Barclays plc, 3M USD LIBOR + 1.380% | 3.284% | 5/16/24 | 1,005 | | 1,015 | |

| 5 | BNP Paribas SA | 2.950% | 5/23/22 | 200 | | 204 | |

| | BNP Paribas SA | 3.250% | 3/3/23 | 190 | | 197 | |

| 5 | BNP Paribas SA | 3.800% | 1/10/24 | 1,170 | | 1,227 | |

| 5 | BNP Paribas SA | 3.375% | 1/9/25 | 1,775 | | 1,837 | |

| 2,5 | BNP Paribas SA | 2.819% | 11/19/25 | 1,335 | | 1,345 | |

| 5 | BNP Paribas SA | 3.500% | 11/16/27 | 2,050 | | 2,136 | |

| 5 | BPCE SA | 5.700% | 10/22/23 | 270 | | 298 | |

| | BPCE SA | 4.000% | 4/15/24 | 775 | | 829 | |

| 5 | BPCE SA | 5.150% | 7/21/24 | 1,260 | | 1,381 | |

| 5 | BPCE SA | 3.500% | 10/23/27 | 1,780 | | 1,840 | |

| 5 | BPCE SA | 2.700% | 10/1/29 | 1,450 | | 1,437 | |

| 6 | Canadian Imperial Bank of Commerce, 3M USD LIBOR + 0.720% | 2.614% | 6/16/22 | 1,565 | | 1,579 | |

| | Capital One Financial Corp. | 2.500% | 5/12/20 | 500 | | 501 | |

| | Capital One Financial Corp. | 4.750% | 7/15/21 | 400 | | 416 | |

| | Capital One Financial Corp. | 3.750% | 4/24/24 | 1,305 | | 1,369 | |

| | Capital One Financial Corp. | 3.200% | 2/5/25 | 760 | | 783 | |

| | Citibank NA | 3.050% | 5/1/20 | 1,850 | | 1,855 | |

| | Citigroup Inc. | 2.400% | 2/18/20 | 800 | | 800 | |

| | Citigroup Inc. | 4.500% | 1/14/22 | 1,975 | | 2,069 | |

| 2 | Citigroup Inc. | 3.520% | 10/27/28 | 1,975 | | 2,074 | |

| | Citigroup Inc. | 6.625% | 6/15/32 | 2,000 | | 2,679 | |

| 2 | Citigroup Inc. | 3.878% | 1/24/39 | 1,025 | | 1,121 | |

| | Citigroup Inc. | 8.125% | 7/15/39 | 101 | | 169 | |

| | Comerica Bank | 2.500% | 7/23/24 | 790 | | 799 | |

| | Commonwealth Bank of Australia | 2.300% | 3/12/20 | 655 | | 655 | |

| 5 | Credit Agricole SA | 3.750% | 4/24/23 | 1,160 | | 1,210 | |

| 5 | Credit Agricole SA | 3.250% | 10/4/24 | 2,390 | | 2,472 | |

| | Credit Suisse AG | 3.000% | 10/29/21 | 735 | | 749 | |

| | Credit Suisse AG | 3.625% | 9/9/24 | 250 | | 265 | |

Balanced Portfolio

| | | | Face | | Market | |

| | | Maturity | Amount | | Value• | |

| | Coupon | Date | ($000 | ) | ($000 | ) |

| 5 | Credit Suisse Group AG | 3.574% | 1/9/23 | 550 | | 564 | |

| 2,5 | Credit Suisse Group AG | 4.207% | 6/12/24 | 340 | | 359 | |

| 2,5 | Credit Suisse Group AG | 2.593% | 9/11/25 | 520 | | 521 | |

| 2,5 | Credit Suisse Group AG | 3.869% | 1/12/29 | 305 | | 324 | |

| 5,6 | Credit Suisse Group AG, 3M USD LIBOR + 1.240% | 3.127% | 6/12/24 | 690 | | 699 | |

| | Credit Suisse Group Funding Guernsey Ltd. | 3.800% | 9/15/22 | 1,335 | | 1,388 | |

| | Credit Suisse Group Funding Guernsey Ltd. | 3.750% | 3/26/25 | 3,470 | | 3,667 | |

| 5 | Danske Bank A/S | 2.000% | 9/8/21 | 1,120 | | 1,113 | |

| 5 | Danske Bank A/S | 5.000% | 1/12/22 | 610 | | 640 | |

| 5 | Danske Bank A/S | 3.875% | 9/12/23 | 1,220 | | 1,264 | |

| 5 | Danske Bank A/S | 5.375% | 1/12/24 | 795 | | 872 | |

| | Deutsche Bank AG | 4.250% | 10/14/21 | 815 | | 838 | |

| | Fifth Third Bank | 2.875% | 10/1/21 | 425 | | 431 | |

| | Fifth Third Bank | 3.850% | 3/15/26 | 830 | | 882 | |

| | Goldman Sachs Group Inc. | 5.375% | 3/15/20 | 405 | | 408 | |

| | Goldman Sachs Group Inc. | 2.600% | 4/23/20 | 170 | | 170 | |

| | Goldman Sachs Group Inc. | 5.250% | 7/27/21 | 865 | | 907 | |

| | Goldman Sachs Group Inc. | 5.750% | 1/24/22 | 360 | | 385 | |

| 2 | Goldman Sachs Group Inc. | 2.876% | 10/31/22 | 1,795 | | 1,817 | |

| | Goldman Sachs Group Inc. | 3.625% | 1/22/23 | 1,980 | | 2,056 | |

| 2 | Goldman Sachs Group Inc. | 3.272% | 9/29/25 | 1,205 | | 1,244 | |

| | Goldman Sachs Group Inc. | 3.500% | 11/16/26 | 2,000 | | 2,086 | |

| | Goldman Sachs Group Inc. | 3.850% | 1/26/27 | 740 | | 787 | |

| 2 | Goldman Sachs Group Inc. | 3.691% | 6/5/28 | 810 | | 859 | |

| 2 | Goldman Sachs Group Inc. | 3.814% | 4/23/29 | 3,065 | | 3,279 | |

| 2 | Goldman Sachs Group Inc. | 4.223% | 5/1/29 | 2,630 | | 2,889 | |

| | Goldman Sachs Group Inc. | 6.750% | 10/1/37 | 835 | | 1,157 | |

| 5 | HSBC Bank plc | 4.750% | 1/19/21 | 1,700 | | 1,743 | |

| | HSBC Holdings plc | 3.400% | 3/8/21 | 1,535 | | 1,558 | |

| | HSBC Holdings plc | 4.000% | 3/30/22 | 2,395 | | 2,492 | |

| | HSBC Holdings plc | 3.600% | 5/25/23 | 1,600 | | 1,664 | |

| 2 | HSBC Holdings plc | 4.041% | 3/13/28 | 890 | | 950 | |

| 2 | HSBC Holdings plc | 4.583% | 6/19/29 | 1,675 | | 1,869 | |

| | HSBC Holdings plc | 6.500% | 5/2/36 | 1,000 | | 1,360 | |

| | HSBC Holdings plc | 6.100% | 1/14/42 | 375 | | 532 | |

| | HSBC Holdings plc | 5.250% | 3/14/44 | 440 | | 557 | |

| 6 | HSBC Holdings plc, 3M USD LIBOR + 1.000% | 2.904% | 5/18/24 | 730 | | 735 | |

| | HSBC USA Inc. | 2.350% | 3/5/20 | 2,775 | | 2,775 | |

| | HSBC USA Inc. | 3.500% | 6/23/24 | 620 | | 656 | |

| | Huntington Bancshares Inc. | 3.150% | 3/14/21 | 800 | | 808 | |

| | Huntington National Bank | 2.400% | 4/1/20 | 1,160 | | 1,160 | |

| | ING Groep NV | 3.150% | 3/29/22 | 365 | | 373 | |

| | ING Groep NV | 3.950% | 3/29/27 | 2,695 | | 2,898 | |

| | JPMorgan Chase & Co. | 4.350% | 8/15/21 | 1,862 | | 1,931 | |

| | JPMorgan Chase & Co. | 4.500% | 1/24/22 | 495 | | 519 | |

| | JPMorgan Chase & Co. | 3.250% | 9/23/22 | 970 | | 1,002 | |

| | JPMorgan Chase & Co. | 3.375% | 5/1/23 | 875 | | 908 | |

| | JPMorgan Chase & Co. | 3.875% | 2/1/24 | 800 | | 856 | |

| | JPMorgan Chase & Co. | 3.900% | 7/15/25 | 2,270 | | 2,449 | |

| | JPMorgan Chase & Co. | 4.125% | 12/15/26 | 765 | | 837 | |

| | JPMorgan Chase & Co. | 4.250% | 10/1/27 | 2,295 | | 2,537 | |

| 2 | JPMorgan Chase & Co. | 4.452% | 12/5/29 | 2,100 | | 2,389 | |

| | JPMorgan Chase & Co. | 5.400% | 1/6/42 | 750 | | 1,014 | |

| 2 | JPMorgan Chase & Co. | 3.964% | 11/15/48 | 6,150 | | 6,896 | |

| 5 | Macquarie Bank Ltd. | 2.400% | 1/21/20 | 330 | | 330 | |

| 2,5 | Macquarie Group Ltd. | 4.150% | 3/27/24 | 1,375 | | 1,441 | |

| | Manufacturers & Traders Trust Co. | 2.100% | 2/6/20 | 495 | | 495 | |

| | Manufacturers & Traders Trust Co. | 2.900% | 2/6/25 | 685 | | 704 | |

| | Mitsubishi UFJ Financial Group Inc. | 2.623% | 7/18/22 | 1,940 | | 1,965 | |

| | Morgan Stanley | 5.750% | 1/25/21 | 1,740 | | 1,804 | |

| | Morgan Stanley | 2.500% | 4/21/21 | 1,175 | | 1,180 | |

| | Morgan Stanley | 2.625% | 11/17/21 | 800 | | 809 | |

| | Morgan Stanley | 2.750% | 5/19/22 | 1,710 | | 1,740 | |

| | Morgan Stanley | 3.700% | 10/23/24 | 750 | | 794 | |

| 2 | Morgan Stanley | 2.720% | 7/22/25 | 1,750 | | 1,766 | |

| | Morgan Stanley | 3.125% | 7/27/26 | 1,345 | | 1,384 | |

| | Morgan Stanley | 6.250% | 8/9/26 | 3,000 | | 3,642 | |

| | Morgan Stanley | 3.625% | 1/20/27 | 1,250 | | 1,327 | |

| 2 | Morgan Stanley | 3.772% | 1/24/29 | 3,910 | | 4,200 | |

| | Morgan Stanley | 4.300% | 1/27/45 | 850 | | 998 | |

| 2,5 | Nationwide Building Society | 3.622% | 4/26/23 | 680 | | 699 | |

| 5 | NBK SPC Ltd. | 2.750% | 5/30/22 | 1,530 | | 1,540 | |

| | PNC Bank NA | 3.300% | 10/30/24 | 460 | | 478 | |

| | PNC Bank NA | 2.950% | 2/23/25 | 1,105 | | 1,130 | |

| | PNC Bank NA | 4.200% | 11/1/25 | 255 | | 277 | |

| | PNC Bank NA | 3.100% | 10/25/27 | 1,165 | | 1,215 | |

| | PNC Bank NA | 3.250% | 1/22/28 | 1,675 | | 1,759 | |

| | PNC Financial Services Group Inc. | 3.900% | 4/29/24 | 580 | | 610 | |

| | Royal Bank of Canada | 2.750% | 2/1/22 | 1,195 | | 1,215 | |

| | Santander Holdings USA Inc. | 2.650% | 4/17/20 | 580 | | 581 | |

| | Santander Holdings USA Inc. | 3.700% | 3/28/22 | 915 | | 940 | |

| | Santander Holdings USA Inc. | 3.400% | 1/18/23 | 605 | | 620 | |

| 5 | Skandinaviska Enskilda Banken AB | 2.450% | 5/27/20 | 1,600 | | 1,603 | |

| 5 | Societe Generale SA | 3.250% | 1/12/22 | 1,015 | | 1,036 | |

| 2,5 | Standard Chartered plc | 2.744% | 9/10/22 | 2,030 | | 2,039 | |

| 2 | State Street Corp. | 2.653% | 5/15/23 | 840 | | 853 | |

| | Svenska Handelsbanken AB | 1.875% | 9/7/21 | 1,050 | | 1,048 | |

| | Synchrony Bank | 3.650% | 5/24/21 | 1,290 | | 1,315 | |

| | Toronto-Dominion Bank | 2.500% | 12/14/20 | 985 | | 990 | |

| | Truist Bank | 2.625% | 1/15/22 | 1,250 | | 1,265 | |

| | Truist Bank | 3.300% | 5/15/26 | 340 | | 353 | |

| | Truist Financial Corp. | 3.200% | 9/3/21 | 665 | | 678 | |

| | Truist Financial Corp. | 2.750% | 4/1/22 | 1,700 | | 1,730 | |

| | Truist Financial Corp. | 3.700% | 6/5/25 | 1,385 | | 1,492 | |

| 5 | UBS AG | 2.200% | 6/8/20 | 750 | | 751 | |

| 2,5 | UBS Group AG | 3.126% | 8/13/30 | 555 | | 565 | |

| 5 | UBS Group Funding Jersey Ltd. | 2.950% | 9/24/20 | 1,160 | | 1,168 | |

| 5 | UBS Group Funding Jersey Ltd. | 2.650% | 2/1/22 | 1,250 | | 1,263 | |

| | US Bancorp | 2.625% | 1/24/22 | 1,305 | | 1,324 | |

| | US Bancorp | 3.700% | 1/30/24 | 1,560 | | 1,658 | |

| | Wachovia Corp. | 7.500% | 4/15/35 | 1,000 | | 1,400 | |

| | Wells Fargo & Co. | 3.000% | 1/22/21 | 505 | | 511 | |

| | Wells Fargo & Co. | 3.500% | 3/8/22 | 640 | | 660 | |

| | Wells Fargo & Co. | 3.069% | 1/24/23 | 195 | | 198 | |

| | Wells Fargo & Co. | 3.450% | 2/13/23 | 735 | | 760 | |

| | Wells Fargo & Co. | 4.480% | 1/16/24 | 1,199 | | 1,291 | |

| | Wells Fargo & Co. | 3.750% | 1/24/24 | 1,560 | | 1,643 | |

| | Wells Fargo & Co. | 3.000% | 2/19/25 | 890 | | 918 | |

| | Wells Fargo & Co. | 3.550% | 9/29/25 | 860 | | 909 | |

| | Wells Fargo & Co. | 3.000% | 4/22/26 | 1,045 | | 1,075 | |

| | Wells Fargo & Co. | 4.100% | 6/3/26 | 340 | | 365 | |

| | Wells Fargo & Co. | 3.000% | 10/23/26 | 170 | | 174 | |

| 2 | Wells Fargo & Co. | 3.196% | 6/17/27 | 1,705 | | 1,765 | |

| 2 | Wells Fargo & Co. | 2.879% | 10/30/30 | 435 | | 438 | |

| | Wells Fargo & Co. | 5.606% | 1/15/44 | 2,276 | | 3,010 | |

| | Wells Fargo & Co. | 4.900% | 11/17/45 | 515 | | 629 | |

| | Wells Fargo & Co. | 4.750% | 12/7/46 | 2,070 | | 2,465 | |

| | Westpac Banking Corp. | 2.300% | 5/26/20 | 630 | | 631 | |

| | | | | | | | |

| | Brokerage (0.0%) | | | | | | |

| | Ameriprise Financial Inc. | 5.300% | 3/15/20 | 305 | | 307 | |

| | Charles Schwab Corp. | 3.200% | 3/2/27 | 545 | | 572 | |

| | | | | | | | |

| | Insurance (1.2%) | | | | | | |

| | Aetna Inc. | 2.800% | 6/15/23 | 680 | | 691 | |

| 5 | AIA Group Ltd. | 3.600% | 4/9/29 | 1,475 | | 1,552 | |

| | American International Group Inc. | 4.250% | 3/15/29 | 1,040 | | 1,155 | |

| | American International Group Inc. | 4.500% | 7/16/44 | 200 | | 229 | |

| | American International Group Inc. | 4.750% | 4/1/48 | 135 | | 161 | |

| | Anthem Inc. | 3.300% | 1/15/23 | 1,100 | | 1,138 | |

| | Anthem Inc. | 3.650% | 12/1/27 | 750 | | 791 | |

| | Anthem Inc. | 4.101% | 3/1/28 | 1,140 | | 1,235 | |

| | Anthem Inc. | 4.650% | 8/15/44 | 426 | | 473 | |

| | Anthem Inc. | 4.375% | 12/1/47 | 625 | | 685 | |

| | Berkshire Hathaway Inc. | 2.750% | 3/15/23 | 1,050 | | 1,078 | |

| | Berkshire Hathaway Inc. | 3.125% | 3/15/26 | 715 | | 754 | |

| | Chubb INA Holdings Inc. | 2.300% | 11/3/20 | 170 | | 171 | |

| | Chubb INA Holdings Inc. | 3.350% | 5/15/24 | 555 | | 583 | |

Balanced Portfolio

| | | | Face | | Market | |

| | | Maturity | Amount | | Value• | |

| | Coupon | Date | ($000 | ) | ($000 | ) |

| | Chubb INA Holdings Inc. | 4.350% | 11/3/45 | 800 | | 961 | |

| 5 | Five Corners Funding Trust | 4.419% | 11/15/23 | 210 | | 228 | |

| 5 | Liberty Mutual Group Inc. | 4.250% | 6/15/23 | 80 | | 85 | |

| 5 | Liberty Mutual Group Inc. | 4.569% | 2/1/29 | 280 | | 313 | |

| | Loews Corp. | 2.625% | 5/15/23 | 440 | | 448 | |

| | Marsh & McLennan Cos. Inc. | 4.375% | 3/15/29 | 675 | | 769 | |

| | Marsh & McLennan Cos. Inc. | 4.900% | 3/15/49 | 265 | | 335 | |

| 2,5 | Massachusetts Mutual Life Insurance Co. | 7.625% | 11/15/23 | 2,000 | | 2,283 | |

| | MetLife Inc. | 3.600% | 4/10/24 | 580 | | 618 | |

| | MetLife Inc. | 4.125% | 8/13/42 | 145 | | 164 | |

| | MetLife Inc. | 4.875% | 11/13/43 | 530 | | 656 | |

| 5 | Metropolitan Life Global Funding I | 3.450% | 10/9/21 | 810 | | 832 | |

| 5 | Metropolitan Life Global Funding I | 2.650% | 4/8/22 | 340 | | 345 | |

| 5 | Metropolitan Life Global Funding I | 3.450% | 12/18/26 | 640 | | 683 | |

| 5 | Metropolitan Life Global Funding I | 3.000% | 9/19/27 | 1,165 | | 1,199 | |

| 5 | Nationwide Financial Services Inc. | 3.900% | 11/30/49 | 1,430 | | 1,481 | |

| 5 | New York Life Global Funding | 2.900% | 1/17/24 | 810 | | 836 | |

| 5 | New York Life Insurance Co. | 5.875% | 5/15/33 | 2,100 | | 2,766 | |

| 5 | New York Life Insurance Co. | 4.450% | 5/15/69 | 435 | | 499 | |

| 5 | Northwestern Mutual Life Insurance Co. | 3.850% | 9/30/47 | 656 | | 688 | |

| 5 | Northwestern Mutual Life Insurance Co. | 3.625% | 9/30/59 | 270 | | 268 | |

| 5 | Principal Financial Global Funding LLC | 2.500% | 9/16/29 | 1,000 | | 986 | |

| 5 | Teachers Insurance & Annuity Assn. of America | 4.900% | 9/15/44 | 875 | | 1,079 | |

| 5 | Teachers Insurance & Annuity Assn. of America | 4.270% | 5/15/47 | 1,145 | | 1,302 | |

| | UnitedHealth Group Inc. | 3.875% | 10/15/20 | 601 | | 608 | |

| | UnitedHealth Group Inc. | 2.875% | 3/15/22 | 27 | | 28 | |

| | UnitedHealth Group Inc. | 2.875% | 3/15/23 | 1,175 | | 1,202 | |

| | UnitedHealth Group Inc. | 3.100% | 3/15/26 | 430 | | 448 | |

| | UnitedHealth Group Inc. | 3.850% | 6/15/28 | 1,190 | | 1,303 | |

| | UnitedHealth Group Inc. | 4.625% | 7/15/35 | 240 | | 290 | |

| | UnitedHealth Group Inc. | 4.250% | 3/15/43 | 1,600 | | 1,819 | |

| | UnitedHealth Group Inc. | 4.750% | 7/15/45 | 760 | | 928 | |

| | UnitedHealth Group Inc. | 4.200% | 1/15/47 | 215 | | 246 | |

| | UnitedHealth Group Inc. | 4.250% | 6/15/48 | 880 | | 1,021 | |

| | | | | | | | |

| | Real Estate Investment Trusts (0.2%) | | | | | | |

| | AvalonBay Communities Inc. | 3.625% | 10/1/20 | 520 | | 524 | |

| | Boston Properties LP | 3.125% | 9/1/23 | 355 | | 366 | |

| | Boston Properties LP | 3.800% | 2/1/24 | 45 | | 47 | |

| | Healthpeak Properties Inc. | 3.000% | 1/15/30 | 930 | | 929 | |

| | Realty Income Corp. | 4.650% | 8/1/23 | 640 | | 692 | |

| | Simon Property Group LP | 3.750% | 2/1/24 | 90 | | 95 | |

| | Simon Property Group LP | 3.375% | 10/1/24 | 275 | | 289 | |

| | Simon Property Group LP | 2.450% | 9/13/29 | 1,160 | | 1,138 | |

| 5 | WEA Finance LLC | 4.125% | 9/20/28 | 590 | | 637 | |

| 5 | WEA Finance LLC | 4.625% | 9/20/48 | 755 | | 866 | |

| | | | | | | 268,371 | |

| Industrial (10.2%) | | | | | | |

| | Basic Industry (0.0%) | | | | | | |

| | International Paper Co. | 4.350% | 8/15/48 | 1,255 | | 1,333 | |

| | | | | | | | |

| | Capital Goods (0.7%) | | | | | | |

| 5 | BAE Systems Holdings Inc. | 2.850% | 12/15/20 | 160 | | 161 | |

| 5 | BAE Systems Holdings Inc. | 3.850% | 12/15/25 | 1,085 | | 1,148 | |

| | Boeing Co. | 2.700% | 2/1/27 | 495 | | 499 | |

| | Boeing Co. | 5.875% | 2/15/40 | 175 | | 231 | |

| | Boeing Co. | 3.375% | 6/15/46 | 614 | | 594 | |

| | Boeing Co. | 3.850% | 11/1/48 | 198 | | 208 | |

| | Boeing Co. | 3.750% | 2/1/50 | 90 | | 95 | |

| | Boeing Co. | 3.825% | 3/1/59 | 67 | | 70 | |

| | Boeing Co. | 3.950% | 8/1/59 | 408 | | 436 | |

| | Caterpillar Financial Services Corp. | 2.625% | 3/1/23 | 1,360 | | 1,387 | |

| | Caterpillar Inc. | 3.900% | 5/27/21 | 590 | | 606 | |

| | Caterpillar Inc. | 2.600% | 6/26/22 | 705 | | 715 | |

| | Caterpillar Inc. | 3.400% | 5/15/24 | 810 | | 856 | |

| | General Dynamics Corp. | 2.875% | 5/11/20 | 1,505 | | 1,511 | |

| | General Dynamics Corp. | 3.875% | 7/15/21 | 355 | | 365 | |

| | General Electric Co. | 2.700% | 10/9/22 | 210 | | 213 | |

| | General Electric Co. | 3.100% | 1/9/23 | 360 | | 367 | |

| | Honeywell International Inc. | 4.250% | 3/1/21 | 1,002 | | 1,032 | |

| | Illinois Tool Works Inc. | 3.500% | 3/1/24 | 1,295 | | 1,371 | |

| | John Deere Capital Corp. | 3.450% | 3/13/25 | 1,200 | | 1,274 | |

| | Lockheed Martin Corp. | 2.900% | 3/1/25 | 610 | | 634 | |

| | Lockheed Martin Corp. | 4.500% | 5/15/36 | 211 | | 250 | |

| | Lockheed Martin Corp. | 4.700% | 5/15/46 | 376 | | 475 | |

| | Lockheed Martin Corp. | 4.090% | 9/15/52 | 144 | | 168 | |

| | Parker-Hannifin Corp. | 3.250% | 6/14/29 | 270 | | 280 | |

| | Parker-Hannifin Corp. | 4.450% | 11/21/44 | 450 | | 500 | |

| 5 | Siemens Financieringsmaatschappij NV | 2.900% | 5/27/22 | 1,050 | | 1,070 | |

| 5 | Siemens Financieringsmaatschappij NV | 3.125% | 3/16/24 | 1,680 | | 1,740 | |

| 5 | Siemens Financieringsmaatschappij NV | 4.400% | 5/27/45 | 800 | | 955 | |

| | Stanley Black & Decker Inc. | 4.850% | 11/15/48 | 685 | | 846 | |

| | United Technologies Corp. | 3.100% | 6/1/22 | 535 | | 549 | |

| | United Technologies Corp. | 4.125% | 11/16/28 | 1,125 | | 1,265 | |

| | United Technologies Corp. | 6.050% | 6/1/36 | 675 | | 909 | |

| | United Technologies Corp. | 4.450% | 11/16/38 | 275 | | 323 | |

| | United Technologies Corp. | 4.500% | 6/1/42 | 787 | | 942 | |

| | United Technologies Corp. | 3.750% | 11/1/46 | 163 | | 178 | |

| | | | | | | | |

| | Communication (1.6%) | | | | | | |

| | America Movil SAB de CV | 3.125% | 7/16/22 | 1,880 | | 1,918 | |

| | America Movil SAB de CV | 3.625% | 4/22/29 | 780 | | 827 | |

| | America Movil SAB de CV | 6.125% | 3/30/40 | 390 | | 523 | |

| | American Tower Corp. | 3.450% | 9/15/21 | 1,125 | | 1,152 | |

| | American Tower Corp. | 5.000% | 2/15/24 | 80 | | 88 | |

| | American Tower Corp. | 4.400% | 2/15/26 | 450 | | 492 | |

| | American Tower Corp. | 3.800% | 8/15/29 | 1,111 | | 1,187 | |

| | AT&T Inc. | 2.450% | 6/30/20 | 225 | | 226 | |

| | AT&T Inc. | 4.600% | 2/15/21 | 100 | | 102 | |

| | AT&T Inc. | 3.600% | 7/15/25 | 625 | | 660 | |

| 5 | British Telecommunications plc | 3.250% | 11/8/29 | 905 | | 904 | |

| | Charter Communications Operating LLC / Charter Communications Operating Capital | 4.800% | 3/1/50 | 955 | | 1,000 | |

| | Comcast Corp. | 3.600% | 3/1/24 | 2,900 | | 3,071 | |

| | Comcast Corp. | 3.375% | 2/15/25 | 70 | | 74 | |

| | Comcast Corp. | 2.350% | 1/15/27 | 540 | | 538 | |

| | Comcast Corp. | 4.250% | 1/15/33 | 1,032 | | 1,183 | |

| | Comcast Corp. | 4.200% | 8/15/34 | 730 | | 833 | |

| | Comcast Corp. | 5.650% | 6/15/35 | 110 | | 144 | |

| | Comcast Corp. | 4.400% | 8/15/35 | 877 | | 1,026 | |

| | Comcast Corp. | 6.500% | 11/15/35 | 115 | | 162 | |

| | Comcast Corp. | 6.400% | 5/15/38 | 27 | | 38 | |

| | Comcast Corp. | 4.600% | 10/15/38 | 1,335 | | 1,584 | |

| | Comcast Corp. | 4.650% | 7/15/42 | 1,290 | | 1,533 | |

| | Comcast Corp. | 4.500% | 1/15/43 | 500 | | 583 | |

| | Comcast Corp. | 4.750% | 3/1/44 | 876 | | 1,063 | |

| | Comcast Corp. | 4.600% | 8/15/45 | 1,198 | | 1,429 | |

| | Comcast Corp. | 3.969% | 11/1/47 | 252 | | 275 | |

| | Comcast Corp. | 4.000% | 3/1/48 | 345 | | 379 | |

| | Comcast Corp. | 4.700% | 10/15/48 | 1,670 | | 2,056 | |

| | Comcast Corp. | 3.999% | 11/1/49 | 602 | | 665 | |

| | Comcast Corp. | 4.049% | 11/1/52 | 187 | | 211 | |

| | Comcast Corp. | 4.950% | 10/15/58 | 1,020 | | 1,326 | |

| 5 | Cox Communications Inc. | 3.250% | 12/15/22 | 795 | | 817 | |

| 5 | Cox Communications Inc. | 2.950% | 6/30/23 | 145 | | 147 | |

| 5 | Cox Communications Inc. | 3.150% | 8/15/24 | 181 | | 186 | |

| 5 | Cox Communications Inc. | 4.800% | 2/1/35 | 1,540 | | 1,700 | |

| 5 | Cox Communications Inc. | 6.450% | 12/1/36 | 45 | | 57 | |

| 5 | Cox Communications Inc. | 4.600% | 8/15/47 | 125 | | 138 | |

| | Crown Castle International Corp. | 3.650% | 9/1/27 | 285 | | 300 | |

| | Crown Castle International Corp. | 3.800% | 2/15/28 | 235 | | 250 | |

| 5 | Deutsche Telekom International Finance BV | 3.600% | 1/19/27 | 300 | | 315 | |

| 5 | Deutsche Telekom International Finance BV | 4.375% | 6/21/28 | 671 | | 743 | |

| | NBCUniversal Media LLC | 2.875% | 1/15/23 | 240 | | 246 | |

Balanced Portfolio

| | | | Face | | Market | |

| | | Maturity | Amount | | Value• | |

| | Coupon | Date | ($000 | ) | ($000 | ) |

| | NBCUniversal Media LLC | 4.450% | 1/15/43 | 309 | | 358 | |

| | Orange SA | 4.125% | 9/14/21 | 1,740 | | 1,804 | |

| | Orange SA | 9.000% | 3/1/31 | 530 | | 820 | |

| 5 | SK Telecom Co. Ltd. | 3.750% | 4/16/23 | 385 | | 399 | |

| 5 | Sky Ltd. | 3.750% | 9/16/24 | 1,435 | | 1,535 | |

| 2,5 | Sprint Spectrum Co LLC / Sprint Spectrum Co II LLC / Sprint Spectrum Co III LLC | 4.738% | 3/20/25 | 1,300 | | 1,377 | |

| | Telefonica Emisiones SAU | 5.213% | 3/8/47 | 800 | | 950 | |

| | Telefonica Emisiones SAU | 5.520% | 3/1/49 | 755 | | 944 | |

| | Time Warner Entertainment Co. LP | 8.375% | 3/15/23 | 95 | | 112 | |

| | Verizon Communications Inc. | 4.812% | 3/15/39 | 2,406 | | 2,909 | |

| | Verizon Communications Inc. | 4.750% | 11/1/41 | 290 | | 351 | |

| | Verizon Communications Inc. | 4.862% | 8/21/46 | 1,151 | | 1,425 | |

| | Verizon Communications Inc. | 5.012% | 4/15/49 | 647 | | 827 | |

| | Verizon Communications Inc. | 4.672% | 3/15/55 | 274 | | 336 | |

| | Viacom Inc. | 5.850% | 9/1/43 | 600 | | 752 | |

| | ViacomCBS Inc. | 4.300% | 2/15/21 | 675 | | 687 | |

| | ViacomCBS Inc. | 3.700% | 6/1/28 | 440 | | 459 | |

| | Vodafone Group plc | 5.000% | 5/30/38 | 50 | | 58 | |

| | Vodafone Group plc | 5.250% | 5/30/48 | 1,260 | | 1,522 | |

| | Walt Disney Co. | 3.000% | 9/15/22 | 245 | | 252 | |

| | Walt Disney Co. | 2.000% | 9/1/29 | 2,600 | | 2,520 | |

| | Walt Disney Co. | 2.750% | 9/1/49 | 560 | | 526 | |

| | | | | | | | |

| | Consumer Cyclical (1.1%) | | | | | | |

| | Alibaba Group Holding Ltd. | 3.600% | 11/28/24 | 1,065 | | 1,119 | |

| | Alibaba Group Holding Ltd. | 3.400% | 12/6/27 | 3,470 | | 3,616 | |

| 5 | Alimentation Couche-Tard Inc. | 3.550% | 7/26/27 | 2,450 | | 2,511 | |

| | Amazon.com Inc. | 2.500% | 11/29/22 | 885 | | 902 | |

| | Amazon.com Inc. | 2.800% | 8/22/24 | 715 | | 740 | |

| | Amazon.com Inc. | 4.800% | 12/5/34 | 995 | | 1,253 | |

| | Amazon.com Inc. | 4.950% | 12/5/44 | 580 | | 759 | |

| | Amazon.com Inc. | 4.250% | 8/22/57 | 1,335 | | 1,622 | |

| | AutoZone Inc. | 3.700% | 4/15/22 | 1,371 | | 1,414 | |

| 5 | BMW US Capital LLC | 2.000% | 4/11/21 | 585 | | 585 | |

| 5 | BMW US Capital LLC | 2.250% | 9/15/23 | 2,500 | | 2,498 | |

| 5 | Daimler Finance North America LLC | 2.200% | 5/5/20 | 470 | | 470 | |

| 5 | Daimler Finance North America LLC | 2.450% | 5/18/20 | 155 | | 155 | |

| 5 | Daimler Finance North America LLC | 2.300% | 2/12/21 | 945 | | 947 | |

| 5 | Daimler Finance North America LLC | 3.250% | 8/1/24 | 160 | | 165 | |

| | Ford Motor Credit Co. LLC | 3.157% | 8/4/20 | 710 | | 713 | |

| | Ford Motor Credit Co. LLC | 3.815% | 11/2/27 | 1,075 | | 1,038 | |

| | General Motors Financial Co. Inc. | 3.550% | 4/9/21 | 455 | | 462 | |

| | General Motors Financial Co. Inc. | 3.950% | 4/13/24 | 1,570 | | 1,641 | |

| | Home Depot Inc. | 2.700% | 4/1/23 | 720 | | 737 | |

| | Home Depot Inc. | 3.900% | 12/6/28 | 290 | | 324 | |

| | Home Depot Inc. | 4.400% | 3/15/45 | 780 | | 928 | |

| | Home Depot Inc. | 4.500% | 12/6/48 | 345 | | 425 | |

| 5 | Hyundai Capital America | 2.550% | 4/3/20 | 790 | | 791 | |

| 5,6 | Hyundai Capital America, 3M USD LIBOR + 0.940% | 2.967% | 7/8/21 | 1,400 | | 1,403 | |

| | Lowe’s Cos. Inc. | 3.100% | 5/3/27 | 1,300 | | 1,342 | |

| | Lowe’s Cos. Inc. | 6.500% | 3/15/29 | 334 | | 424 | |

| | Lowe’s Cos. Inc. | 4.550% | 4/5/49 | 1,140 | | 1,330 | |

| | McDonald’s Corp. | 2.625% | 1/15/22 | 195 | | 198 | |

| | McDonald’s Corp. | 3.250% | 6/10/24 | 140 | | 147 | |

| | McDonald’s Corp. | 4.875% | 12/9/45 | 1,160 | | 1,399 | |

| | McDonald’s Corp. | 3.625% | 9/1/49 | 275 | | 279 | |

| | Starbucks Corp. | 4.500% | 11/15/48 | 1,000 | | 1,148 | |

| | Walmart Inc. | 2.550% | 4/11/23 | 1,250 | | 1,275 | |

| | Walmart Inc. | 3.550% | 6/26/25 | 1,605 | | 1,717 | |

| | Walmart Inc. | 3.625% | 12/15/47 | 380 | | 421 | |

| | | | | | | | |

| | Consumer Noncyclical (3.3%) | | | | | | |

| 5 | AbbVie Inc. | 4.050% | 11/21/39 | 590 | | 617 | |

| 5 | AbbVie Inc. | 4.250% | 11/21/49 | 970 | | 1,021 | |

| 5 | Alcon Finance Corp. | 2.750% | 9/23/26 | 200 | | 203 | |

| 5 | Alcon Finance Corp. | 3.800% | 9/23/49 | 400 | | 418 | |

| | Allergan Funding SCS | 3.450% | 3/15/22 | 450 | | 460 | |

| | Allergan Funding SCS | 3.800% | 3/15/25 | 575 | | 602 | |

| | Allergan Funding SCS | 4.850% | 6/15/44 | 450 | | 500 | |

| | Altria Group Inc. | 4.750% | 5/5/21 | 590 | | 610 | |

| | Altria Group Inc. | 2.850% | 8/9/22 | 455 | | 463 | |

| | Altria Group Inc. | 5.800% | 2/14/39 | 770 | | 900 | |

| | Altria Group Inc. | 4.500% | 5/2/43 | 245 | | 249 | |

| | Altria Group Inc. | 3.875% | 9/16/46 | 625 | | 580 | |

| | Amgen Inc. | 5.150% | 11/15/41 | 620 | | 750 | |

| | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide Inc. | 4.900% | 2/1/46 | 1,940 | | 2,297 | |

| | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide Inc. | 4.700% | 2/1/36 | 1,290 | | 1,488 | |

| | Anheuser-Busch InBev Finance Inc. | 3.300% | 2/1/23 | 1,798 | | 1,860 | |

| | Anheuser-Busch InBev Worldwide Inc. | 2.500% | 7/15/22 | 1,007 | | 1,024 | |

| | Anheuser-Busch InBev Worldwide Inc. | 3.750% | 7/15/42 | 520 | | 526 | |

| | Anheuser-Busch InBev Worldwide Inc. | 4.600% | 4/15/48 | 395 | | 449 | |

| | Archer-Daniels-Midland Co. | 4.500% | 3/15/49 | 970 | | 1,183 | |

| | Ascension Health | 2.532% | 11/15/29 | 655 | | 647 | |

| | Ascension Health | 3.945% | 11/15/46 | 280 | | 310 | |

| 2 | Ascension Health | 4.847% | 11/15/53 | 55 | | 69 | |

| | AstraZeneca plc | 2.375% | 11/16/20 | 1,180 | | 1,184 | |

| | AstraZeneca plc | 4.000% | 1/17/29 | 2,345 | | 2,600 | |

| | AstraZeneca plc | 6.450% | 9/15/37 | 615 | | 861 | |

| | BAT Capital Corp. | 3.557% | 8/15/27 | 1,875 | | 1,909 | |

| 5 | BAT International Finance plc | 3.500% | 6/15/22 | 235 | | 242 | |

| 5 | BAT International Finance plc | 3.250% | 6/7/22 | 1,480 | | 1,512 | |

| 5 | Bayer US Finance II LLC | 4.250% | 12/15/25 | 2,325 | | 2,503 | |

| 5 | Bayer US Finance LLC | 3.000% | 10/8/21 | 1,980 | | 2,005 | |

| 5 | Bayer US Finance LLC | 3.375% | 10/8/24 | 815 | | 839 | |

| | Boston Scientific Corp. | 4.000% | 3/1/29 | 195 | | 215 | |

| 5 | Bristol-Myers Squibb Co. | 3.550% | 8/15/22 | 662 | | 684 | |

| 5 | Bristol-Myers Squibb Co. | 2.750% | 2/15/23 | 138 | | 140 | |

| 5 | Bristol-Myers Squibb Co. | 3.250% | 2/20/23 | 239 | | 246 | |

| 5 | Bristol-Myers Squibb Co. | 4.000% | 8/15/23 | 45 | | 48 | |

| 5 | Bristol-Myers Squibb Co. | 3.400% | 7/26/29 | 885 | | 945 | |

| 5 | Bristol-Myers Squibb Co. | 4.125% | 6/15/39 | 505 | | 582 | |

| 5 | Bristol-Myers Squibb Co. | 4.550% | 2/20/48 | 217 | | 266 | |

| 5 | Bristol-Myers Squibb Co. | 4.250% | 10/26/49 | 1,100 | | 1,296 | |

| 5 | Cargill Inc. | 4.307% | 5/14/21 | 2,092 | | 2,158 | |

| 5 | Cargill Inc. | 6.875% | 5/1/28 | 645 | | 813 | |

| 5 | Cargill Inc. | 4.760% | 11/23/45 | 635 | | 790 | |

| 5 | Cigna Corp. | 3.250% | 4/15/25 | 880 | | 905 | |

| | Cigna Corp. | 4.375% | 10/15/28 | 515 | | 570 | |

| | Cigna Corp. | 4.800% | 8/15/38 | 730 | | 840 | |

| | Cigna Corp. | 4.900% | 12/15/48 | 497 | | 589 | |

| | Coca-Cola European Partners plc | 3.500% | 9/15/20 | 500 | | 505 | |

| | Coca-Cola Femsa SAB de CV | 3.875% | 11/26/23 | 850 | | 898 | |

| | Colgate-Palmolive Co. | 7.600% | 5/19/25 | 480 | | 604 | |

| | CommonSpirit Health | 2.950% | 11/1/22 | 535 | | 544 | |

| | CommonSpirit Health | 4.200% | 8/1/23 | 535 | | 562 | |

| | CommonSpirit Health | 2.760% | 10/1/24 | 860 | | 865 | |

| | CommonSpirit Health | 3.347% | 10/1/29 | 1,245 | | 1,252 | |

| 2 | CommonSpirit Health | 4.350% | 11/1/42 | 536 | | 551 | |

| | CommonSpirit Health | 4.187% | 10/1/49 | 1,275 | | 1,271 | |

| | Conagra Brands Inc. | 4.600% | 11/1/25 | 220 | | 242 | |

| | Conagra Brands Inc. | 5.300% | 11/1/38 | 655 | | 777 | |

| | Constellation Brands Inc. | 2.700% | 5/9/22 | 65 | | 66 | |

| | CVS Health Corp. | 2.750% | 12/1/22 | 965 | | 980 | |

| | CVS Health Corp. | 4.875% | 7/20/35 | 315 | | 359 | |

| | CVS Health Corp. | 5.125% | 7/20/45 | 855 | | 1,007 | |

| 5 | Danone SA | 2.947% | 11/2/26 | 735 | | 744 | |

| | Diageo Capital plc | 2.625% | 4/29/23 | 1,230 | | 1,250 | |

| | Diageo Capital plc | 2.375% | 10/24/29 | 580 | | 571 | |

| | Diageo Investment Corp. | 2.875% | 5/11/22 | 525 | | 535 | |

| | Dignity Health | 3.812% | 11/1/24 | 560 | | 587 | |

| 5 | EMD Finance LLC | 2.950% | 3/19/22 | 605 | | 614 | |

| | Estee Lauder Cos. Inc. | 2.375% | 12/1/29 | 370 | | 370 | |

| 5 | Forest Laboratories Inc. | 4.875% | 2/15/21 | 268 | | 274 | |

| | Gilead Sciences Inc. | 2.550% | 9/1/20 | 615 | | 618 | |

| | Gilead Sciences Inc. | 3.700% | 4/1/24 | 1,010 | | 1,072 | |

| | Gilead Sciences Inc. | 3.500% | 2/1/25 | 560 | | 594 | |

| | Gilead Sciences Inc. | 4.500% | 2/1/45 | 825 | | 952 | |

Balanced Portfolio

| | | | Face | | Market | |

| | | Maturity | Amount | | Value• | |

| | Coupon | Date | ($000 | ) | ($000 | ) |

| | Gilead Sciences Inc. | 4.750% | 3/1/46 | 195 | | 233 | |

| | GlaxoSmithKline Capital Inc. | 2.800% | 3/18/23 | 385 | | 394 | |

| | GlaxoSmithKline Capital Inc. | 5.375% | 4/15/34 | 2,000 | | 2,550 | |