UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-05962

| Name of Registrant: | Vanguard Variable Insurance Funds |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | Anne E. Robinson, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: December 31

Date of reporting period: January 1, 2020-December 31, 2020

Item 1: Reports to Shareholders

Annual Report | December 31, 2020

Vanguard Variable Insurance Funds

Contents

Your Portfolio’s Performance at a Glance

| 1 |

Advisor’s Report

| 2 |

About Your Portfolio’s Expenses

| 4 |

Performance Summary

| 5 |

Financial Statements

| 7 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your portfolio are spelled out in the prospectus.

Your Portfolio’s Performance at a Glance

| • | The Balanced Portfolio of Vanguard Variable Insurance Funds returned 10.68% for the 12 months ended December 31, 2020, trailing the 15.80% return of its composite benchmark. Please note that the portfolio’s returns are different from those in Vanguard Variable Annuity (and other plans that invest in the portfolio), which take into account insurance-related expenses. |

| • | The emergence of COVID-19 in early 2020 turned into a global health crisis, and aggressive attempts to contain it resulted in a sharp downturn in economic activity. Unemployment spiked, and sectors where social distancing isn’t possible were hit hard. Stocks initially plummeted as infections surged, but they finished the year significantly higher, thanks in part to rapid and robust monetary and fiscal action by policymakers and the rollout of COVID-19 vaccines as the year drew to a close. Many central banks slashed short-term interest rates and expanded or extended asset-purchase programs. |

| • | Returns were positive in eight of the stock sectors the portfolio invests in. Poor selection in consumer discretionary and an underweighting of information technology were the biggest detractors relative to the benchmark. |

| • | Over the decade ended December 31, the portfolio’s average annual return trailed that of its benchmark by about 1 percentage point. |

Market Barometer

Average Annual Total Returns

Periods Ended December 31, 2020 |

| | One Year | Three Years | Five Years |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 20.96% | 14.82% | 15.60% |

| Russell 2000 Index (Small-caps) | 19.96 | 10.25 | 13.26 |

| Russell 3000 Index (Broad U.S. market) | 20.89 | 14.49 | 15.43 |

| FTSE All-World ex US Index (International) | 11.22 | 5.18 | 9.16 |

| Bonds | | | |

| Bloomberg Barclays U.S. Aggregate Bond Index (Broad taxable market) | 7.51% | 5.34% | 4.44% |

Bloomberg Barclays Municipal Bond Index

(Broad tax-exempt market) | 5.21 | 4.64 | 3.91 |

| FTSE Three-Month U.S. Treasury Bill Index | 0.58 | 1.56 | 1.16 |

| CPI | | | |

| Consumer Price Index | 1.36% | 1.85% | 1.95% |

The Balanced Portfolio of Vanguard Variable Insurance Funds returned 10.68% for the 12 months ended December 31, 2020, trailing the 15.80% return of its blended benchmark (a mix of 65% large-capitalization stocks and 35% high-quality corporate bonds). The stock portion of the portfolio underperformed its benchmark, the Standard & Poor’s 500 Index, while the bond portion outperformed its benchmark, the Bloomberg Barclays U.S. Credit A or Better Bond Index.

The investment environment

Stock markets in the United States and abroad posted positive results for the year. The S&P 500 Index returned 18.40%, the MSCI World Index 16.50%, and the MSCI EAFE Index 7.82%.

Throughout the year, the primary factors influencing the environment for equities were effects of the COVID-19 pandemic, declining interest rates, and the U.S. presidential election.

COVID-19 spread globally in March, bringing affected countries’ economies to a near-standstill. The impact extended to businesses across almost all sectors, even those considered more stable or defensive. Stock prices fell sharply at the outset for businesses directly affected by the shutdown and those with higher leverage. As the pandemic extended into the summer, high-growth stocks drove up the market from the lows of March, with many of these businesses benefiting from consumers’ shift to digital.

In addition, interest rates generally declined during 2020. The Federal Reserve continued its supportive policy, cutting rates to near zero in March to help bolster the market. The low rates magnified exceptional fundamentals for many high-growth stocks. This resulted in strong performance from many high-growth technology companies, particularly in the mega-capitalization spectrum of the market.

The fourth quarter of 2020 was marked by two significant events: the presidential

election and the development of COVID-19 vaccines. The market reacted positively to both events and performed strongly throughout the quarter. The high-growth dominance that marked much of 2020 began to subside as positive vaccine news led to optimism for a cyclical recovery.

In the U.S., large-cap growth stocks, as measured by the Russell 1000 Growth Index (+38.49%), significantly outperformed large-cap value stocks, as measured by the Russell 1000 Value Index (+2.80%). This trend hindered the portfolio, which incorporates valuation as a component of the investment process.

The broad fixed income markets largely generated positive total returns over the year, spurred by a significant decline in U.S. Treasury yields and the compression of credit spreads after they had widened earlier in 2020. Markets were primarily influenced by the pandemic-driven growth slowdown and then by the unprecedented speed and magnitude of stimulus measures enacted by the Fed and the U.S. government.

For the year, the Bloomberg Barclays U.S. Aggregate Bond Index returned 7.51% and the higher-quality credit market performed even better, as the Bloomberg Barclays U.S. Credit A or Better Bond Index returned 9.42%. The yield of the 10-year Treasury note fell, beginning 2020 at 1.92% and ending at 0.91%.

Our shortfalls

In the stock portfolio, sector allocation and security selection detracted from relative returns. Specifically, the portfolio’s average overweight position in the financial sector significantly hurt, contributing to underperformance for the year. The portfolio’s average overweight position in energy also detracted, as did its underweight allocation to information technology.

Selection was weakest in consumer discretionary, health care, and real estate. The biggest detractors included Bank of America, BP, Prudential Financial, and

JPMorgan Chase. A lack of exposure to or underweight positions in Amazon, NVIDIA, and PayPal also hurt relative returns.

On the fixed income side, moderate out-of-benchmark allocations to consumer asset-backed securities and commercial mortgage-backed securities (MBS) were slight relative detractors, as was an underweight allocation to local agency bonds. Our duration/yield curve positioning also modestly hurt. The primary detractor was positioning in the long end of the yield curve in the second quarter as the curve steepened.

Our successes

Our stock selection in financials, energy, and utilities partly offset negative returns. Taiwan Semiconductor, BlackRock, Charles Schwab, and Deere & Co. were strong individual contributors to results, as was a lack of exposure to Wells Fargo and Boeing. An underweight allocation to Exxon Mobil also helped overall performance.

In the fixed income portfolio, spread sectors struggled at the start of 2020 before reversing course and rallying to end up tightening for the year. Selection among investment-grade corporates—particularly consumer noncyclicals, technology, communications, and transportation within the industrial sector—mainly drove outperformance of the benchmark. Selection in financials and utilities also helped. In noncorporate credit, an underweighting of local authority bonds and supranationals contributed, as did selection in sovereigns. An out-of-benchmark allocation to agency MBS pass-throughs also boosted relative returns.

Portfolio positioning

We remain balanced on the intermediate-term outlook for equity markets. On the encouraging side, the uncertainty surrounding the election is largely behind us. And with all the vaccine progress, we can begin to conceive of a post-COVID economy. However, we appreciate the logistical challenges of

vaccine production and distribution and recognize the economic uncertainty that still lies ahead.

At the portfolio level, we are excited about the prospects for many individual businesses. Large-cap financials Charles Schwab and JPMorgan Chase show strong underlying growth despite the difficult rate environment. Across sectors, businesses such as McDonald’s, HCA, Facebook, Danaher, Blackstone, and Home Depot have all navigated the difficult conditions far better than expected. Pharmaceutical giant Pfizer has been one of the leaders in developing a COVID-19 vaccine. IT companies such as Google and Microsoft continue to achieve success across a range of businesses, products, and shareholders.

Over the year, we initiated new positions in Facebook, Procter & Gamble, and medical supply company Becton Dickinson. We believe that Facebook has shown excellent business resilience and has benefited from the accelerating shift to digital. It is investing to extend its competitive advantage, and we believe it still has a long runway for growth. Procter & Gamble has an excellent management team with solid market-share dynamics across key products that have continued to execute well. Nine of its 10 product categories have grown organically despite the difficult economic environment. Becton Dickinson makes a wide range of everyday products that are essential to the delivery of health care. It has a stable demand profile, with a dominant market-share position across most categories.

Although the portfolio remains overweight in financials, we significantly reduced our positioning in the sector during the year: We eliminated several holdings because we were less confident they could create value at an attractive rate over time. The portfolio remains underweight in IT,

though we added to the sector over the year by buying competitively advantaged, growing businesses with strong management teams.

We remain committed to our investment philosophy and process of constructing a portfolio of resilient businesses at reasonable valuations run by management teams that are likely to make value-enhancing decisions over the long term. Our goal is to deliver a superior rate of economic growth (earnings plus dividends) over the long term and provide downside protection in difficult economic and market environments.

On the fixed income side, we believe that credit valuations are modestly high in the face of near-term uncertainty. We expect the Fed to hold short rates low while long rates could rise over time as economic activity rebounds after the vaccine rollout. We have positioned the portfolio’s fixed income portion with a slight duration underweight relative to the benchmark.

While fundamentals are likely to remain strained for the medium term, credit markets continue to be our main investment focus and are well-supported by global central bank policy. We are underweight in corporate credit relative to the all-credit benchmark, with a bias toward defensive sectors with lower earnings volatility while also seeking opportunities to move up in credit quality. On an industry basis, the portfolio is overweight in less-cyclical sectors such as communications and utilities while remaining cautious about more cyclical ones such as energy. We remain overweight in taxable municipals given their diversification benefit and resilient underlying credit quality coupled with relatively attractive valuations.

The fixed income portfolio maintains an out-of-benchmark allocation to U.S. governments and an out-of-benchmark

agency MBS allocation. We believe that agency MBS, beyond providing strong liquidity, are well-supported by Fed buying despite concerns about prepayment speeds. The portfolio holds MBS pass-throughs, focusing on low-coupon To-Be-Announced (TBA) securities to maintain carry and liquidity, as well as collateralized mortgage obligations and a modest allocation to delegated underwriting and servicing for their stable cash flows.

Consistent with our practices, we hold adequate liquidity in the portfolio’s fixed income portion, notably government bonds and agency MBS as our “all-weather” liquidity buffer. This buffer should provide downside protection for shareholders if the economic cycle or the equity portfolios, or both, take an unfavorable turn.

We remain disciplined in applying our investment process, which allows us to create a balanced portfolio that we believe should perform well in various environments. We remain focused on long-term, low-turnover investing— features that we believe will serve the portfolio’s shareholders well over time.

Portfolio Managers:

Daniel J. Pozen

Senior Managing Director and

Equity Portfolio Manager

Michael E. Stack, CFA,

Senior Managing Director and

Fixed Income Portfolio Manager

Loren L. Moran, CFA,

Senior Managing Director and

Fixed Income Portfolio Manager

Wellington Management Company llp

January 21, 2021

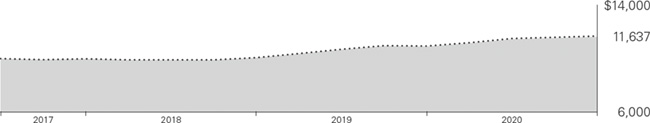

About Your Portfolio’s Expenses

As a shareholder of the portfolio, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a portfolio's gross income, directly reduce the investment return of the portfolio.

A portfolio's expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your portfolio and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table illustrates your portfolio's costs in two ways:

| • | Based on actual portfolio return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the portfolio's actual return, and the third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the portfolio. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period. |

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your portfolio under the heading ”Expenses Paid During Period.“

| • | Based on hypothetical 5% yearly return. This section is intended to help you compare your portfolio's costs with those of other mutual funds. It assumes that the portfolio had a yearly return of 5% before expenses, but that the expense ratio is unchanged. In this case—because the return used is not the portfolio's actual return—the results do not apply to your investment. The example is useful in making comparisons because the Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your portfolio's costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds. |

Note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the portfolio for buying and selling securities. The portfolio’s expense ratio does not reflect additional fees and expenses associated with the annuity or life insurance program through which you invest.

The calculations assume no shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information about the portfolio's expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your portfolio's current prospectus.

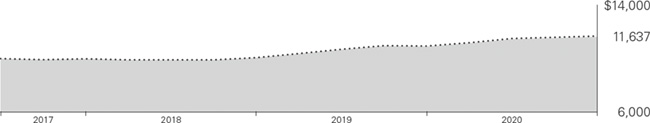

| Six Months Ended December 31, 2020 | | | |

| Balanced Portfolio | Beginning

Account Value

6/30/2020 | Ending

Account Value

12/31/2020 | Expenses

Paid During

Period |

| Based on Actual Portfolio Return | $1,000.00 | $1,144.90 | $1.08 |

| Based on Hypothetical 5% Yearly Return | 1,000.00 | 1,024.13 | 1.02 |

The calculations are based on expenses incurred in the most recent six-month period. The portfolio’s annualized six-month expense ratio for that period is 0.20%. The dollar amounts shown as “Expenses Paid” are equal to the annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month period (184/366).

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the portfolio. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on portfolio distributions or on the sale of portfolio shares. Nor do the returns reflect fees and expenses associated with the annuity or life insurance program through which a shareholder invests. If these fees and expenses were included, the portfolio's returns would be lower.

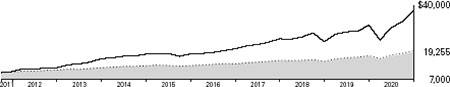

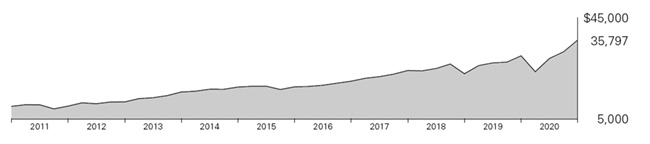

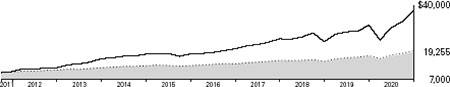

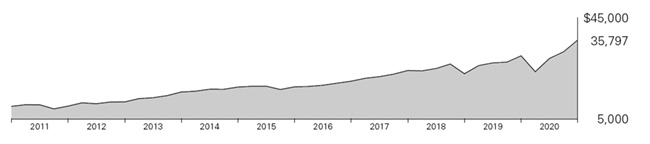

Cumulative Performance: December 31, 2010, Through December 31, 2020

Initial Investment of $10,000

| | | | Average Annual Total Returns

Periods Ended December 31, 2020 |

| | | One

Year | Five

Years | Ten

Years | Final Value

of a $10,000

Investment |

| Balanced Portfolio | 10.68% | 10.77% | 9.88% | $25,655 |

| Composite Stock/Bond Index | 15.80 | 12.03 | 10.89 | 28,114 |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 20.79 | 15.36 | 13.74 | 36,240 |

Composite Stock/Bond Index: Weighted 65% S&P 500 Index and 35% Bloomberg Barclays U.S. Credit A or Better Bond Index

See Financial Highlights for dividend and capital gains information.

| Asset-Backed/Commercial Mortgage-Backed Securities | 0.8% |

| Common Stocks | 67.3 |

| Corporate Bonds | 23.4 |

| Sovereign Bonds | 0.6 |

| Taxable Municipal Bonds | 1.9 |

| U.S. Government and Agency Obligations | 6.0 |

The table reflects the portfolio’s investments, except for short-term investments and derivatives. The agency and mortgage-backed securities may include issues from government-sponsored enterprises; such issues are generally not backed by the full faith and credit of the U.S. government.

The portfolio files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The portfolio’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | Shares | Market

Value•

($000) |

| Common Stocks (65.2%) |

| Communication Services (8.2%) |

| * | Alphabet Inc. Class A | 82,844 | 145,196 |

| * | Facebook Inc. Class A | 293,753 | 80,242 |

| | Comcast Corp. Class A | 901,613 | 47,244 |

| | | | 272,682 |

| Consumer Discretionary (6.5%) |

| | McDonald's Corp. | 344,722 | 73,970 |

| | TJX Cos. Inc. | 781,754 | 53,386 |

| | Home Depot Inc. | 172,884 | 45,922 |

| * | Alibaba Group Holding Ltd. ADR | 125,691 | 29,252 |

| | Dollar General Corp. | 53,243 | 11,197 |

| * | Airbnb Inc. Class A | 15,900 | 2,334 |

| | | | 216,061 |

| Consumer Staples (5.6%) |

| | Procter & Gamble Co. | 397,188 | 55,265 |

| | Coca-Cola Co. | 822,511 | 45,106 |

| | Nestle SA (Registered) | 331,748 | 39,216 |

| | Sysco Corp. | 518,110 | 38,475 |

| | Diageo plc | 230,934 | 9,138 |

| | | | 187,200 |

| Energy (1.3%) |

| | TOTAL SE | 1,028,578 | 44,396 |

| Financials (10.1%) |

| | JPMorgan Chase & Co. | 542,891 | 68,985 |

| | Charles Schwab Corp. | 1,194,620 | 63,363 |

| | BlackRock Inc. | 59,513 | 42,941 |

| | Bank of America Corp. | 1,356,968 | 41,130 |

| | Progressive Corp. | 394,706 | 39,028 |

| | | Shares | Market

Value•

($000) |

| | Blackstone Group Inc. Class A | 434,705 | 28,173 |

| | American Express Co. | 232,840 | 28,153 |

| | Prudential plc | 749,489 | 13,782 |

| | Morgan Stanley | 174,647 | 11,968 |

| | | | 337,523 |

| Health Care (10.0%) |

| | Pfizer Inc. | 1,242,779 | 45,747 |

| | UnitedHealth Group Inc. | 124,051 | 43,502 |

| | Becton Dickinson and Co. | 173,224 | 43,344 |

| | Novartis AG (Registered) | 396,702 | 37,353 |

| | Abbott Laboratories | 295,052 | 32,305 |

| | HCA Healthcare Inc. | 168,139 | 27,652 |

| | Anthem Inc. | 82,350 | 26,442 |

| | AstraZeneca plc ADR | 515,479 | 25,769 |

| | Humana Inc. | 54,132 | 22,209 |

| | Danaher Corp. | 76,236 | 16,935 |

| | Baxter International Inc. | 170,118 | 13,650 |

| | | | 334,908 |

| Industrials (6.3%) |

| | Union Pacific Corp. | 135,311 | 28,174 |

| | Deere & Co. | 101,067 | 27,192 |

| | Raytheon Technologies Corp. | 353,916 | 25,309 |

| | Trane Technologies plc | 165,731 | 24,057 |

| | Northrop Grumman Corp. | 73,519 | 22,403 |

| | Schneider Electric SE | 133,501 | 19,295 |

| | Fortive Corp. | 263,647 | 18,671 |

| | Lockheed Martin Corp. | 49,665 | 17,630 |

| | United Parcel Service Inc. Class B | 86,866 | 14,628 |

| | | Shares | Market

Value•

($000) |

| | Vinci SA | 125,325 | 12,484 |

| | | | 209,843 |

| Information Technology (14.6%) |

| | Microsoft Corp. | 689,992 | 153,468 |

| | Apple Inc. | 821,664 | 109,027 |

| 1 | Taiwan Semiconductor Manufacturing Co. Ltd. ADR | 486,054 | 52,999 |

| | Texas Instruments Inc. | 278,340 | 45,684 |

| | Global Payments Inc. | 190,047 | 40,940 |

| | Accenture plc Class A | 68,303 | 17,841 |

| | Lam Research Corp. | 34,130 | 16,119 |

| | KLA Corp. | 56,045 | 14,511 |

| | Cisco Systems Inc. | 291,360 | 13,038 |

| | Fidelity National Information Services Inc. | 84,617 | 11,970 |

| * | salesforce.com Inc. | 44,173 | 9,830 |

| * | Vontier Corp. | 76,448 | 2,553 |

| | | | 487,980 |

| Real Estate (0.6%) |

| | American Tower Corp. | 94,735 | 21,264 |

| Utilities (2.0%) |

| | Exelon Corp. | 822,937 | 34,744 |

| | Duke Energy Corp. | 364,316 | 33,357 |

| | | | 68,101 |

| Total Common Stocks (Cost $1,533,656) | 2,179,958 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| U.S. Government and Agency Obligations (5.9%) |

| U.S. Government Securities (5.0%) |

| | U.S. Treasury Note/Bond | 0.125% | 10/31/22 | 20,050 | 20,050 |

| | U.S. Treasury Note/Bond | 0.125% | 11/30/22 | 2,800 | 2,800 |

| | U.S. Treasury Note/Bond | 2.500% | 3/31/23 | 7,915 | 8,333 |

| | U.S. Treasury Note/Bond | 0.125% | 5/15/23 | 3,005 | 3,004 |

| | U.S. Treasury Note/Bond | 2.625% | 6/30/23 | 6,650 | 7,059 |

| | U.S. Treasury Note/Bond | 2.875% | 10/31/23 | 5,600 | 6,029 |

| | U.S. Treasury Note/Bond | 2.625% | 12/31/23 | 6,400 | 6,868 |

| | U.S. Treasury Note/Bond | 1.750% | 6/30/24 | 12,675 | 13,352 |

| | U.S. Treasury Note/Bond | 1.500% | 10/31/24 | 4,100 | 4,297 |

| | U.S. Treasury Note/Bond | 1.125% | 2/28/25 | 6,395 | 6,620 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | U.S. Treasury Note/Bond | 0.250% | 5/31/25 | 13,400 | 13,373 |

| | U.S. Treasury Note/Bond | 0.250% | 7/31/25 | 5,655 | 5,637 |

| | U.S. Treasury Note/Bond | 0.250% | 8/31/25 | 4,800 | 4,783 |

| | U.S. Treasury Note/Bond | 0.250% | 10/31/25 | 19,000 | 18,917 |

| | U.S. Treasury Note/Bond | 0.625% | 5/15/30 | 5,870 | 5,737 |

| | U.S. Treasury Note/Bond | 0.875% | 11/15/30 | 8,290 | 8,258 |

| 2 | U.S. Treasury Note/Bond | 1.125% | 8/15/40 | 6,050 | 5,725 |

| | U.S. Treasury Note/Bond | 3.125% | 8/15/44 | 1,740 | 2,293 |

| | U.S. Treasury Note/Bond | 2.250% | 8/15/46 | 88 | 100 |

| | U.S. Treasury Note/Bond | 2.250% | 8/15/49 | 10 | 11 |

| | U.S. Treasury Note/Bond | 2.000% | 2/15/50 | 2,116 | 2,297 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | U.S. Treasury Note/Bond | 1.250% | 5/15/50 | 1,394 | 1,264 |

| | U.S. Treasury Note/Bond | 1.375% | 8/15/50 | 6,475 | 6,058 |

| | U.S. Treasury Note/Bond | 1.625% | 11/15/50 | 15,060 | 14,985 |

| | | | | | | 167,850 |

| Conventional Mortgage-Backed Securities (0.4%) |

| 3,4 | Fannie Mae Pool | 2.780% | 6/1/26 | 1,025 | 1,124 |

| 3,4 | Fannie Mae Pool | 3.070% | 2/1/25 | 500 | 543 |

| 3,4 | Freddie Mac Gold Pool | 4.000% | 9/1/41 | 3 | 3 |

| 3 | Ginnie Mae I Pool | 7.000% | 11/15/31 - 11/15/33 | 51 | 59 |

| 3 | Ginnie Mae I Pool | 8.000% | 9/15/30 | 39 | 47 |

| 3,4,5 | UMBS Pool | 1.500% | 1/16/36 | 2,200 | 2,264 |

| 3,4,5 | UMBS Pool | 2.000% | 1/16/36 | 6,800 | 7,112 |

| 3,4 | UMBS Pool | 2.500% | 4/1/37 - 4/1/38 | 1,360 | 1,433 |

| | | | | | | 12,585 |

| Nonconventional Mortgage-Backed Securities (0.5%) |

| 3,4 | Fannie Mae REMICS | 1.500% | 8/25/41 - 6/25/42 | 547 | 554 |

| 3,4 | Fannie Mae REMICS | 1.700% | 6/25/43 | 110 | 112 |

| 3 | Fannie Mae REMICS | 2.000% | 6/25/44 | 113 | 115 |

| 3,4 | Fannie Mae REMICS | 3.000% | 2/25/49 - 9/25/57 | 2,535 | 2,677 |

| 3,4 | Fannie Mae REMICS | 3.500% | 4/25/31 - 6/25/59 | 8,239 | 8,852 |

| 3,4 | Fannie Mae REMICS | 4.000% | 5/25/31 - 7/25/53 | 430 | 458 |

| 3,4 | Freddie Mac REMICS | 3.000% | 12/15/39 | 103 | 104 |

| 3,4 | Freddie Mac REMICS | 3.500% | 3/15/31 | 88 | 95 |

| 3,4 | Freddie Mac REMICS | 4.000% | 12/15/30 - 4/15/31 | 1,793 | 1,965 |

| 3 | Ginnie Mae | 1.700% | 10/20/45 | 193 | 195 |

| 3 | Ginnie Mae | 1.800% | 5/20/41 | 184 | 184 |

| | | | | | | 15,311 |

| Total U.S. Government and Agency Obligations (Cost $192,234) | 195,746 |

| Asset-Backed/Commercial Mortgage-Backed Securities (0.8%) |

| 3,6 | Aaset Trust Class A Series 2019-1 | 3.844% | 5/15/39 | 395 | 373 |

| 3,6 | American Tower Trust #1 Class 2A Series 13 | 3.070% | 3/15/48 | 1,100 | 1,120 |

| 3 | AmeriCredit Automobile Receivables Trust Class C Series 2016-3 | 2.240% | 4/8/22 | 18 | 18 |

| 3,6,7 | Angel Oak Mortgage Trust Class A1 Series 2019-5 | 2.593% | 10/25/49 | 314 | 318 |

| 3,6,7 | Angel Oak Mortgage Trust Class A1 Series 2019-6 | 2.620% | 11/25/59 | 733 | 742 |

| 3,6,7 | Angel Oak Mortgage Trust I LLC Class A1 Series 2019-2 | 3.628% | 3/25/49 | 151 | 154 |

| 3,6,7 | Angel Oak Mortgage Trust I LLC Class A1 Series 2019-4 | 2.993% | 7/26/49 | 520 | 524 |

| 3,6,7 | Atlas Senior Loan Fund X Ltd Class A Series 2018-10A, 3M USD LIBOR + 1.090% | 1.327% | 1/15/31 | 246 | 243 |

| 3,6,7 | Avery Point IV CLO Ltd. Class AR Series 2014-1A, 3M USD LIBOR + 1.100% | 1.315% | 4/25/26 | 123 | 123 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 3,6 | Canadian Pacer Auto Receivables Trust Class A3 Series 2018-2A | 3.270% | 12/19/22 | 86 | 87 |

| 3,6 | Castlelake Aircraft Structured Trust Class A Series 2019-1A | 3.967% | 4/15/39 | 734 | 698 |

| 3,6 | Chesapeake Funding II LLC Class A1 Series 2017-A1 | 1.990% | 5/15/29 | 9 | 9 |

| 3,6 | Chesapeake Funding II LLC Class A1 Series 2018-1A | 3.040% | 4/15/30 | 415 | 420 |

| 3,6 | Chesapeake Funding II LLC Class A1 Series 2018-3A | 3.390% | 1/15/31 | 495 | 507 |

| 3,6,7 | Cloud Pass-Through Trust Class CLOU Series 2019-1A | 3.554% | 12/5/22 | 364 | 370 |

| 3,6,7 | COLT Mortgage Loan Trust Class A1 Series 2019-2 | 3.337% | 5/25/49 | 221 | 222 |

| 3,6,7 | COLT Mortgage Loan Trust Class A1 Series 2020-1 | 2.488% | 2/25/50 | 416 | 421 |

| 3,6,7 | Columbia Cent CLO 27 Ltd. Class A1 Series 2018-27A, 3M USD LIBOR + 1.150% | 1.365% | 10/25/28 | 550 | 548 |

| 3 | COMM Mortgage Trust Class A4 Series 2012-CR2 | 3.147% | 8/15/45 | 480 | 493 |

| 3,6 | DB Master Finance LLC Class A2I Series 2019-1A | 3.787% | 5/20/49 | 449 | 460 |

| 3,6 | DB Master Finance LLC Class A2II Series 2019-1A | 4.021% | 5/20/49 | 400 | 421 |

| 3,6,7 | Deephave Residential Mortgage Trust Class A1 Series 2019-2A | 3.558% | 4/25/59 | 206 | 208 |

| 3,6 | Enterprise Fleet Financing LLC Class A2 Series 2018-1 | 2.870% | 10/20/23 | 84 | 85 |

| 3,6 | Enterprise Fleet Financing LLC Class A2 Series 2018-3 | 3.380% | 5/20/24 | 214 | 216 |

| 3,6 | Enterprise Fleet Financing LLC Class A2 Series 2019-1 | 2.980% | 10/20/24 | 395 | 400 |

| 3,6 | Enterprise Fleet Financing LLC Class A2 Series 2019-2 | 2.290% | 2/20/25 | 697 | 709 |

| 3,6 | Enterprise Fleet Financing LLC Class A2 Series 2019-3 | 2.060% | 5/20/25 | 530 | 538 |

| 3,6 | Enterprise Fleet Financing LLC Class A3 Series 2018-A3 | 3.100% | 10/20/23 | 270 | 274 |

| 3,6 | Exeter Automobile Receivables Trust Class A Series 2019-4A | 2.180% | 1/17/23 | 69 | 69 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 3,4,7 | Fannie Mae Connecticut Avenue Securities Class 2M2 Series 2016-C03, 1M USD LIBOR + 5.900% | 6.048% | 10/25/28 | 165 | 174 |

| 3,4 | Freddie Mac Multifamily Structured Pass Through Certificates Class A2 Series K736 | 2.282% | 7/25/26 | 885 | 954 |

| 3,4 | Freddie Mac Multifamily Structured Pass Through Certificates Class A2 Series KJ25 | 2.610% | 1/25/26 | 525 | 566 |

| 3,4 | Freddie Mac Multifamily Structured Pass Through Certificates Class A3 Series K-1512 | 3.059% | 4/25/34 | 300 | 346 |

| 3,4 | Freddie Mac Multifamily Structured Pass Through Certificates Class A3 Series K-1513 | 2.797% | 8/25/34 | 300 | 340 |

| 3,6 | Hertz Fleet Lease Funding LP Class A2 Series 2019-1 | 2.700% | 1/10/33 | 599 | 607 |

| 3,6 | Horizon Aircraft Finance II Ltd. Class A Series 2019-1 | 3.721% | 7/15/39 | 314 | 303 |

| 3,6 | Horizon Aircraft Finance III Ltd. Class A Series 2019-1 | 3.425% | 11/15/39 | 314 | 303 |

| 3,6 | MACH 1 Cayman Ltd. Class A Series 2019-1 | 3.474% | 10/15/39 | 343 | 331 |

| 3,6,7 | Madison Park Funding XII Ltd. Class AR Series 2014-12A, 3M USD LIBOR + 1.260% | 1.478% | 7/20/26 | 77 | 77 |

| 3,6,7 | Madison Park Funding XIII Ltd. Class AR2 Series 2014-13A, 3M USD LIBOR + 0.950% | 1.168% | 4/19/30 | 930 | 929 |

| 3,6 | MAPS Ltd. Class A Series 2019-1A | 4.458% | 3/15/44 | 215 | 204 |

| 3,6,7 | Master Credit Card Trust II Class A Series 2018-1A, 1M USD LIBOR + 0.490% | 0.642% | 7/21/24 | 1,000 | 996 |

| 3,6 | OneMain Direct Auto Receivables Trust Class A Series Series 2018-1A | 3.430% | 12/16/24 | 655 | 662 |

| 3,6 | OneMain Financial Issuance Trust Class A Series 2019-1A | 3.480% | 2/14/31 | 1,000 | 1,003 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 3,6 | OneMain Financial Issuance Trust Class A1 Series 2017-1A | 2.370% | 9/14/32 | 51 | 51 |

| 3,6 | Santander Retail Auto Lease Trust Class A2 Series 2019-A | 2.720% | 1/20/22 | 124 | 124 |

| 3,6 | Santander Retail Auto Lease Trust Class A3 Series 2019-B | 2.300% | 1/20/23 | 345 | 351 |

| 3 | Seasoned Credit Risk Transfer Trust Class MA Series 2018-4 | 3.500% | 3/25/58 | 611 | 653 |

| 3 | Seasoned Credit Risk Transfer Trust Class MA Series 2019-1 | 3.500% | 7/25/58 | 883 | 941 |

| 3 | Seasoned Credit Risk Transfer Trust Class MA Series 2019-3 | 3.500% | 10/25/58 | 1,375 | 1,483 |

| 3,6 | Securitized Term Auto Receivables Trust Class A3 Series 2018-2A | 3.325% | 8/25/22 | 247 | 248 |

| 3,6,7 | Seneca Park CLO Ltd. Class AR Series 2014-1A, 3M USD LIBOR + 1.120% | 1.338% | 7/17/26 | 10 | 10 |

| 3,6,7 | SFAVE Commercial Mortgage Securities Trust Class A2B Series 2015-5AVE | 4.144% | 1/5/43 | 700 | 657 |

| 3,6 | SoFi Consumer Loan Program Trust Class A Series 2018-4 | 3.540% | 11/26/27 | 60 | 60 |

| 3,6 | SoFi Consumer Loan Program Trust Class A Series 2019-1 | 3.240% | 2/25/28 | 144 | 145 |

| 3,6 | SoFi Consumer Loan Program Trust Class A Series 2020-1 | 2.020% | 1/25/29 | 353 | 356 |

| 3,6 | Springleaf Funding Trust Class A Series 2015-BA | 3.480% | 5/15/28 | 240 | 241 |

| 3,6 | Start III LTD Class A Series 2019-2 | 3.536% | 11/15/44 | 29 | 28 |

| 3,6 | START Ireland Class A Series 2019-1 | 4.089% | 3/15/44 | 365 | 342 |

| 3,6,7 | Symphony CLO XIV Ltd Class AR Series 2014-14A, 3M USD LIBOR + 0.950% | 1.179% | 7/14/26 | 832 | 828 |

| 3,6,7 | Thacher Park CLO Ltd Class AR Series 2014-1A, 3M USD LIBOR + 1.160% | 1.378% | 10/20/26 | 84 | 84 |

| 3,6,7 | Towd Point Mortgage Trust Class A1 Series 2016-3 | 2.250% | 4/25/56 | 21 | 21 |

| 3,6 | Vantage Data Centers Issuer LLC Class A2 Series 2019-1A | 3.188% | 7/15/44 | 266 | 279 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 3,6 | Vantage Data Centers LLC Class A2 Series 2020-1A | 1.645% | 9/15/45 | 855 | 852 |

| 3,6,7 | Verus Securitization Trust Class A1 Series 2019-2 Series 2019-2 | 3.211% | 5/25/59 | 256 | 258 |

| 3,6,7 | Voya CLO Ltd. Class AAR2 Series 2014-1A, 3M USD LIBOR + 0.990% | 1.208% | 4/18/31 | 511 | 508 |

| 3,6 | Westlake Automobile Receivables Trust Class A2 Series 2019-3A | 2.150% | 2/15/23 | 222 | 223 |

| Total Asset-Backed/Commercial Mortgage-Backed Securities (Cost $27,144) | 27,308 |

| Corporate Bonds (22.6%) |

| Communications (1.9%) |

| | America Movil SAB de CV | 3.125% | 7/16/22 | 1,880 | 1,955 |

| | America Movil SAB de CV | 3.625% | 4/22/29 | 780 | 883 |

| | America Movil SAB de CV | 6.125% | 3/30/40 | 390 | 576 |

| | AT&T Inc. | 2.750% | 6/1/31 | 1,305 | 1,391 |

| | AT&T Inc. | 3.650% | 6/1/51 | 162 | 169 |

| | AT&T Inc. | 3.850% | 6/1/60 | 598 | 627 |

| 6 | British Telecommunications plc | 3.250% | 11/8/29 | 905 | 995 |

| | Charter Communications Operating LLC / Charter Communications Operating Capital | 5.375% | 5/1/47 | 110 | 137 |

| | Charter Communications Operating LLC / Charter Communications Operating Capital | 5.125% | 7/1/49 | 94 | 114 |

| | Charter Communications Operating LLC / Charter Communications Operating Capital | 4.800% | 3/1/50 | 127 | 151 |

| | Charter Communications Operating LLC / Charter Communications Operating Capital | 3.700% | 4/1/51 | 530 | 550 |

| | Comcast Corp. | 3.600% | 3/1/24 | 2,900 | 3,182 |

| | Comcast Corp. | 3.375% | 2/15/25 | 70 | 77 |

| | Comcast Corp. | 4.250% | 1/15/33 | 1,032 | 1,289 |

| | Comcast Corp. | 4.200% | 8/15/34 | 730 | 915 |

| | Comcast Corp. | 5.650% | 6/15/35 | 110 | 156 |

| | Comcast Corp. | 4.400% | 8/15/35 | 877 | 1,111 |

| | Comcast Corp. | 6.500% | 11/15/35 | 115 | 177 |

| | Comcast Corp. | 6.400% | 5/15/38 | 27 | 42 |

| | Comcast Corp. | 4.600% | 10/15/38 | 1,335 | 1,750 |

| | Comcast Corp. | 4.650% | 7/15/42 | 1,290 | 1,741 |

| | Comcast Corp. | 4.500% | 1/15/43 | 500 | 658 |

| | Comcast Corp. | 4.750% | 3/1/44 | 876 | 1,200 |

| | Comcast Corp. | 4.600% | 8/15/45 | 1,198 | 1,600 |

| | Comcast Corp. | 3.969% | 11/1/47 | 252 | 314 |

| | Comcast Corp. | 4.000% | 3/1/48 | 345 | 431 |

| | Comcast Corp. | 4.700% | 10/15/48 | 1,175 | 1,633 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Comcast Corp. | 3.999% | 11/1/49 | 602 | 757 |

| | Comcast Corp. | 4.049% | 11/1/52 | 1,187 | 1,516 |

| | Comcast Corp. | 4.950% | 10/15/58 | 20 | 30 |

| | Comcast Corp. | 2.650% | 8/15/62 | 615 | 615 |

| 6 | Cox Communications Inc. | 3.250% | 12/15/22 | 795 | 836 |

| 6 | Cox Communications Inc. | 2.950% | 6/30/23 | 145 | 153 |

| 6 | Cox Communications Inc. | 3.150% | 8/15/24 | 181 | 196 |

| 6 | Cox Communications Inc. | 4.800% | 2/1/35 | 1,540 | 1,939 |

| 6 | Cox Communications Inc. | 6.450% | 12/1/36 | 45 | 63 |

| 6 | Cox Communications Inc. | 4.600% | 8/15/47 | 125 | 161 |

| 6 | Deutsche Telekom International Finance BV | 3.600% | 1/19/27 | 300 | 336 |

| 6 | Deutsche Telekom International Finance BV | 4.375% | 6/21/28 | 671 | 796 |

| | NBCUniversal Media LLC | 4.450% | 1/15/43 | 309 | 403 |

| | Orange SA | 4.125% | 9/14/21 | 1,740 | 1,783 |

| | Orange SA | 9.000% | 3/1/31 | 530 | 867 |

| 6 | SK Telecom Co. Ltd. | 3.750% | 4/16/23 | 385 | 411 |

| 6 | Sky Ltd. | 3.750% | 9/16/24 | 1,435 | 1,599 |

| 3,6 | Sprint Spectrum Co LLC / Sprint Spectrum Co II LLC / Sprint Spectrum Co III LLC | 4.738% | 9/20/29 | 1,300 | 1,412 |

| | Telefonica Emisiones SA | 5.213% | 3/8/47 | 800 | 1,027 |

| | Telefonica Emisiones SA | 5.520% | 3/1/49 | 1,055 | 1,422 |

| 6 | Tencent Holdings Ltd. | 3.575% | 4/11/26 | 200 | 222 |

| 6 | Tencent Holdings Ltd. | 3.595% | 1/19/28 | 2,495 | 2,752 |

| 6 | Tencent Holdings Ltd. | 3.975% | 4/11/29 | 925 | 1,054 |

| | Time Warner Entertainment Co. LP | 8.375% | 3/15/23 | 95 | 111 |

| 6 | T-Mobile USA Inc. | 2.050% | 2/15/28 | 900 | 936 |

| 6 | T-Mobile USA Inc. | 3.875% | 4/15/30 | 710 | 822 |

| 6 | T-Mobile USA Inc. | 3.300% | 2/15/51 | 580 | 597 |

| | Verizon Communications Inc. | 4.329% | 9/21/28 | 675 | 811 |

| | Verizon Communications Inc. | 4.812% | 3/15/39 | 2,406 | 3,118 |

| | Verizon Communications Inc. | 4.750% | 11/1/41 | 290 | 382 |

| | Verizon Communications Inc. | 4.862% | 8/21/46 | 1,151 | 1,545 |

| | Verizon Communications Inc. | 5.012% | 4/15/49 | 69 | 96 |

| | Verizon Communications Inc. | 4.672% | 3/15/55 | 274 | 365 |

| 6 | Verizon Communications Inc. | 2.987% | 10/30/56 | 731 | 734 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | ViacomCBS Inc. | 3.700% | 6/1/28 | 440 | 502 |

| | Vodafone Group plc | 5.000% | 5/30/38 | 50 | 65 |

| | Vodafone Group plc | 5.250% | 5/30/48 | 1,260 | 1,747 |

| | Walt Disney Co. | 3.000% | 9/15/22 | 245 | 256 |

| | Walt Disney Co. | 2.000% | 9/1/29 | 2,600 | 2,713 |

| | Walt Disney Co. | 2.650% | 1/13/31 | 170 | 186 |

| | Walt Disney Co. | 3.500% | 5/13/40 | 1,490 | 1,748 |

| | Walt Disney Co. | 2.750% | 9/1/49 | 560 | 592 |

| | Walt Disney Co. | 3.600% | 1/13/51 | 805 | 977 |

| | Walt Disney Co. | 3.800% | 5/13/60 | 485 | 609 |

| | | | | | | 63,086 |

| Consumer Discretionary (1.1%) |

| | Alibaba Group Holding Ltd. | 3.600% | 11/28/24 | 1,065 | 1,171 |

| | Alibaba Group Holding Ltd. | 3.400% | 12/6/27 | 3,470 | 3,876 |

| | Amazon.com Inc. | 2.800% | 8/22/24 | 345 | 373 |

| | Amazon.com Inc. | 4.800% | 12/5/34 | 995 | 1,361 |

| | Amazon.com Inc. | 4.950% | 12/5/44 | 580 | 847 |

| | Amazon.com Inc. | 4.250% | 8/22/57 | 1,335 | 1,884 |

| | AutoZone Inc. | 3.700% | 4/15/22 | 1,371 | 1,420 |

| 6 | BMW U.S. Capital LLC | 2.000% | 4/11/21 | 585 | 587 |

| 6 | BMW U.S. Capital LLC | 2.250% | 9/15/23 | 2,500 | 2,607 |

| 6 | Daimler Finance North America LLC | 2.300% | 2/12/21 | 945 | 947 |

| 6 | Daimler Finance North America LLC | 3.250% | 8/1/24 | 160 | 173 |

| 3 | Duke University | 2.832% | 10/1/55 | 775 | 841 |

| | Emory University | 2.143% | 9/1/30 | 770 | 809 |

| 6 | ERAC USA Finance LLC | 4.500% | 8/16/21 | 325 | 333 |

| 6 | ERAC USA Finance LLC | 3.300% | 10/15/22 | 40 | 42 |

| 6 | ERAC USA Finance LLC | 7.000% | 10/15/37 | 1,150 | 1,767 |

| 6 | ERAC USA Finance LLC | 5.625% | 3/15/42 | 340 | 473 |

| | General Motors Financial Co. Inc. | 3.550% | 4/9/21 | 455 | 458 |

| | General Motors Financial Co. Inc. | 3.950% | 4/13/24 | 1,570 | 1,705 |

| | Georgetown University | 4.315% | 4/1/49 | 150 | 191 |

| | Georgetown University | 2.943% | 4/1/50 | 295 | 295 |

| | Home Depot Inc. | 3.900% | 12/6/28 | 290 | 347 |

| | Home Depot Inc. | 3.300% | 4/15/40 | 825 | 971 |

| | Home Depot Inc. | 4.400% | 3/15/45 | 780 | 1,039 |

| | Home Depot Inc. | 4.500% | 12/6/48 | 345 | 484 |

| 6,7 | Hyundai Capital America, 3M USD LIBOR + 0.940% | 1.170% | 7/8/21 | 1,400 | 1,402 |

| 3 | Johns Hopkins University | 4.083% | 7/1/53 | 200 | 265 |

| 3 | Johns Hopkins University | 2.813% | 1/1/60 | 180 | 190 |

| | Lowe's Cos. Inc. | 3.100% | 5/3/27 | 1,300 | 1,457 |

| | Lowe's Cos. Inc. | 6.500% | 3/15/29 | 334 | 452 |

| | McDonald's Corp. | 2.625% | 1/15/22 | 195 | 200 |

| | McDonald's Corp. | 3.250% | 6/10/24 | 140 | 153 |

| | McDonald's Corp. | 4.875% | 12/9/45 | 1,160 | 1,565 |

| | McDonald's Corp. | 3.625% | 9/1/49 | 470 | 548 |

| 6 | Meituan | 3.050% | 10/28/30 | 230 | 240 |

| 3 | Northeastern University | 2.894% | 10/1/50 | 225 | 237 |

| | President and Fellows of Harvard College | 2.517% | 10/15/50 | 515 | 548 |

| | Starbucks Corp. | 4.500% | 11/15/48 | 1,471 | 1,894 |

| 3 | University of Chicago | 2.761% | 4/1/45 | 165 | 169 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | VF Corp. | 2.800% | 4/23/27 | 595 | 650 |

| | VF Corp. | 2.950% | 4/23/30 | 1,320 | 1,452 |

| | Yale University | 2.402% | 4/15/50 | 480 | 494 |

| | | | | | | 36,917 |

| Consumer Staples (1.3%) |

| 6 | Alimentation Couche-Tard Inc. | 3.550% | 7/26/27 | 2,450 | 2,756 |

| | Altria Group Inc. | 2.850% | 8/9/22 | 455 | 473 |

| | Altria Group Inc. | 5.800% | 2/14/39 | 770 | 1,012 |

| | Altria Group Inc. | 4.500% | 5/2/43 | 245 | 281 |

| | Altria Group Inc. | 3.875% | 9/16/46 | 625 | 658 |

| | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide Inc. | 4.700% | 2/1/36 | 1,290 | 1,633 |

| | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide Inc. | 4.900% | 2/1/46 | 1,940 | 2,516 |

| | Anheuser-Busch InBev Worldwide Inc. | 3.750% | 7/15/42 | 520 | 585 |

| | Anheuser-Busch InBev Worldwide Inc. | 4.600% | 4/15/48 | 395 | 500 |

| | Archer-Daniels-Midland Co. | 4.500% | 3/15/49 | 970 | 1,383 |

| | BAT Capital Corp. | 3.557% | 8/15/27 | 1,875 | 2,088 |

| 6 | Cargill Inc. | 4.307% | 5/14/21 | 2,092 | 2,122 |

| 6 | Cargill Inc. | 6.875% | 5/1/28 | 645 | 843 |

| 6 | Cargill Inc. | 2.125% | 4/23/30 | 225 | 237 |

| 6 | Cargill Inc. | 4.760% | 11/23/45 | 635 | 856 |

| 6 | CK Hutchison International 20 Ltd. | 3.375% | 5/8/50 | 560 | 639 |

| | Colgate Palmolive Co. | 7.600% | 5/19/25 | 480 | 614 |

| | Conagra Brands Inc. | 4.600% | 11/1/25 | 220 | 259 |

| | Conagra Brands Inc. | 1.375% | 11/1/27 | 345 | 347 |

| | Conagra Brands Inc. | 5.300% | 11/1/38 | 300 | 399 |

| | Constellation Brands Inc. | 2.700% | 5/9/22 | 65 | 67 |

| | Constellation Brands Inc. | 3.750% | 5/1/50 | 105 | 123 |

| 6 | Danone SA | 2.947% | 11/2/26 | 735 | 807 |

| | Diageo Capital plc | 2.625% | 4/29/23 | 1,230 | 1,288 |

| | Diageo Capital plc | 2.375% | 10/24/29 | 580 | 623 |

| | Diageo Capital plc | 2.000% | 4/29/30 | 265 | 275 |

| | Diageo Investment Corp. | 2.875% | 5/11/22 | 525 | 543 |

| | Estee Lauder Cos. Inc. | 2.375% | 12/1/29 | 370 | 400 |

| 6 | Imperial Brands Finance plc | 3.750% | 7/21/22 | 1,680 | 1,752 |

| | Kroger Co. | 3.850% | 8/1/23 | 270 | 291 |

| | Kroger Co. | 4.000% | 2/1/24 | 540 | 592 |

| | McCormick & Co. Inc. | 2.500% | 4/15/30 | 135 | 145 |

| | Molson Coors Beverage Co. | 3.500% | 5/1/22 | 690 | 718 |

| | Molson Coors Beverage Co. | 3.000% | 7/15/26 | 1,800 | 1,974 |

| | PepsiCo Inc. | 2.375% | 10/6/26 | 1,945 | 2,115 |

| | PepsiCo Inc. | 4.000% | 3/5/42 | 845 | 1,086 |

| | PepsiCo Inc. | 3.450% | 10/6/46 | 1,215 | 1,458 |

| | Philip Morris International Inc. | 2.500% | 8/22/22 | 575 | 596 |

| | Philip Morris International Inc. | 2.625% | 3/6/23 | 1,150 | 1,209 |

| | Philip Morris International Inc. | 3.600% | 11/15/23 | 620 | 676 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Philip Morris International Inc. | 3.375% | 8/11/25 | 424 | 472 |

| | Philip Morris International Inc. | 4.875% | 11/15/43 | 145 | 192 |

| 3 | Procter & Gamble Co. | 9.360% | 1/1/21 | 122 | 122 |

| 6 | Sigma Alimentos SA de CV | 4.125% | 5/2/26 | 510 | 562 |

| | Unilever Capital Corp. | 4.250% | 2/10/21 | 2,805 | 2,815 |

| | Walmart Inc. | 3.550% | 6/26/25 | 1,605 | 1,816 |

| | Walmart Inc. | 3.625% | 12/15/47 | 380 | 481 |

| | | | | | | 43,399 |

| Energy (1.2%) |

| 6 | BG Energy Capital plc | 4.000% | 10/15/21 | 555 | 570 |

| | BP Capital Markets America Inc. | 3.245% | 5/6/22 | 650 | 675 |

| | BP Capital Markets America Inc. | 1.749% | 8/10/30 | 345 | 346 |

| | BP Capital Markets plc | 3.062% | 3/17/22 | 1,100 | 1,136 |

| | BP Capital Markets plc | 2.500% | 11/6/22 | 500 | 519 |

| | BP Capital Markets plc | 3.994% | 9/26/23 | 420 | 460 |

| | BP Capital Markets plc | 3.814% | 2/10/24 | 1,700 | 1,866 |

| | BP Capital Markets plc | 3.506% | 3/17/25 | 1,280 | 1,427 |

| | Chevron Corp. | 3.191% | 6/24/23 | 525 | 557 |

| | Cimarex Energy Co. | 4.375% | 6/1/24 | 927 | 1,007 |

| | ConocoPhillips Co. | 4.950% | 3/15/26 | 115 | 138 |

| | Energy Transfer Operating LP | 5.250% | 4/15/29 | 1,375 | 1,597 |

| | Energy Transfer Operating LP | 5.300% | 4/15/47 | 155 | 171 |

| | Enterprise Products Operating LLC | 4.250% | 2/15/48 | 730 | 851 |

| | Enterprise Products Operating LLC | 3.700% | 1/31/51 | 170 | 186 |

| | Equinor ASA | 2.750% | 11/10/21 | 850 | 868 |

| | Equinor ASA | 2.450% | 1/17/23 | 382 | 399 |

| | Equinor ASA | 2.650% | 1/15/24 | 360 | 382 |

| | Equinor ASA | 3.700% | 3/1/24 | 640 | 702 |

| | Equinor ASA | 3.250% | 11/10/24 | 655 | 721 |

| | Equinor ASA | 2.875% | 4/6/25 | 140 | 152 |

| | Equinor ASA | 3.125% | 4/6/30 | 2,350 | 2,656 |

| | Equinor ASA | 2.375% | 5/22/30 | 335 | 355 |

| | Exxon Mobil Corp. | 2.726% | 3/1/23 | 320 | 335 |

| | Exxon Mobil Corp. | 3.043% | 3/1/26 | 225 | 249 |

| | Exxon Mobil Corp. | 2.275% | 8/16/26 | 1,070 | 1,152 |

| | Exxon Mobil Corp. | 2.440% | 8/16/29 | 735 | 786 |

| | Exxon Mobil Corp. | 2.610% | 10/15/30 | 1,055 | 1,151 |

| | Exxon Mobil Corp. | 4.114% | 3/1/46 | 320 | 394 |

| | Phillips 66 Partners LP | 3.750% | 3/1/28 | 1,525 | 1,646 |

| 6 | Saudi Arabian Oil Co. | 3.500% | 4/16/29 | 630 | 700 |

| 6 | Schlumberger Holdings Corp. | 3.900% | 5/17/28 | 807 | 909 |

| 6 | Schlumberger Investment SA | 2.400% | 8/1/22 | 630 | 646 |

| | Schlumberger Investment SA | 3.650% | 12/1/23 | 1,120 | 1,214 |

| | Shell International Finance BV | 4.125% | 5/11/35 | 1,130 | 1,404 |

| | Shell International Finance BV | 5.500% | 3/25/40 | 345 | 496 |

| | Shell International Finance BV | 4.375% | 5/11/45 | 2,500 | 3,289 |

| 6 | Sinopec Group Overseas Development 2015 Ltd. | 3.250% | 4/28/25 | 1,615 | 1,732 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 6 | Sinopec Group Overseas Development 2017 Ltd. | 3.000% | 4/12/22 | 850 | 871 |

| | Suncor Energy Inc. | 5.950% | 12/1/34 | 500 | 653 |

| | Sunoco Logistics Partners Operations LP | 5.350% | 5/15/45 | 90 | 100 |

| | Sunoco Logistics Partners Operations LP | 5.400% | 10/1/47 | 20 | 22 |

| | Total Capital International SA | 2.700% | 1/25/23 | 885 | 928 |

| | Total Capital International SA | 3.750% | 4/10/24 | 1,400 | 1,553 |

| | TransCanada PipeLines Ltd. | 4.875% | 1/15/26 | 1,255 | 1,487 |

| | TransCanada PipeLines Ltd. | 4.100% | 4/15/30 | 415 | 486 |

| | | | | | | 39,944 |

| Financials (7.8%) |

| 6 | AIA Group Ltd. | 3.600% | 4/9/29 | 1,475 | 1,670 |

| 6 | AIA Group Ltd. | 3.375% | 4/7/30 | 370 | 415 |

| | American Express Credit Corp. | 2.700% | 3/3/22 | 1,505 | 1,544 |

| | American International Group Inc. | 4.250% | 3/15/29 | 1,040 | 1,247 |

| | American International Group Inc. | 4.500% | 7/16/44 | 200 | 256 |

| | American International Group Inc. | 4.750% | 4/1/48 | 135 | 181 |

| 6 | Australia & New Zealand Banking Group Ltd. | 2.570% | 11/25/35 | 685 | 695 |

| | Banco Santander SA | 3.125% | 2/23/23 | 800 | 842 |

| | Banco Santander SA | 3.848% | 4/12/23 | 400 | 429 |

| | Banco Santander SA | 2.749% | 12/3/30 | 400 | 412 |

| | Bank of America Corp. | 3.300% | 1/11/23 | 120 | 127 |

| | Bank of America Corp. | 2.816% | 7/21/23 | 1,645 | 1,709 |

| | Bank of America Corp. | 4.000% | 1/22/25 | 875 | 979 |

| | Bank of America Corp. | 3.559% | 4/23/27 | 2,450 | 2,759 |

| | Bank of America Corp. | 3.593% | 7/21/28 | 1,025 | 1,158 |

| | Bank of America Corp. | 3.419% | 12/20/28 | 512 | 578 |

| | Bank of America Corp. | 4.271% | 7/23/29 | 4,780 | 5,686 |

| | Bank of America Corp. | 3.974% | 2/7/30 | 1,895 | 2,223 |

| | Bank of America Corp. | 3.194% | 7/23/30 | 1,055 | 1,177 |

| | Bank of America Corp. | 2.496% | 2/13/31 | 1,495 | 1,586 |

| | Bank of America Corp. | 5.875% | 2/7/42 | 260 | 395 |

| | Bank of America Corp. | 5.000% | 1/21/44 | 1,000 | 1,393 |

| | Bank of America Corp. | 4.330% | 3/15/50 | 2,235 | 2,924 |

| | Bank of Montreal | 3.100% | 4/13/21 | 1,290 | 1,300 |

| 6 | Bank of Montreal | 2.500% | 1/11/22 | 1,700 | 1,737 |

| | Bank of New York Mellon Corp. | 2.200% | 8/16/23 | 460 | 482 |

| | Bank of New York Mellon Corp. | 3.000% | 2/24/25 | 720 | 790 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 7 | Bank of New York Mellon Corp., 3M USD LIBOR + 1.050% | 1.264% | 10/30/23 | 1,145 | 1,157 |

| | Bank of Nova Scotia | 2.800% | 7/21/21 | 750 | 760 |

| | Bank of Nova Scotia | 2.700% | 8/3/26 | 1,825 | 2,003 |

| | Barclays plc | 3.932% | 5/7/25 | 1,565 | 1,712 |

| 7 | Barclays plc, 3M USD LIBOR + 1.380% | 1.601% | 5/16/24 | 1,005 | 1,016 |

| | Berkshire Hathaway Inc. | 3.125% | 3/15/26 | 715 | 799 |

| 6 | BNP Paribas SA | 2.950% | 5/23/22 | 200 | 207 |

| | BNP Paribas SA | 3.250% | 3/3/23 | 190 | 202 |

| 6 | BNP Paribas SA | 3.800% | 1/10/24 | 1,170 | 1,276 |

| 6 | BNP Paribas SA | 3.375% | 1/9/25 | 1,775 | 1,935 |

| 6 | BNP Paribas SA | 2.819% | 11/19/25 | 1,335 | 1,422 |

| 6 | BNP Paribas SA | 3.500% | 11/16/27 | 2,050 | 2,301 |

| 6 | BPCE SA | 5.700% | 10/22/23 | 270 | 305 |

| | BPCE SA | 4.000% | 4/15/24 | 775 | 858 |

| 6 | BPCE SA | 5.150% | 7/21/24 | 1,260 | 1,423 |

| 6 | BPCE SA | 3.500% | 10/23/27 | 1,780 | 1,992 |

| 6 | BPCE SA | 2.700% | 10/1/29 | 1,450 | 1,562 |

| 7 | Canadian Imperial Bank of Commerce, 3M USD LIBOR + 0.720% | 0.939% | 6/16/22 | 1,565 | 1,577 |

| | Capital One Financial Corp. | 4.750% | 7/15/21 | 400 | 409 |

| | Capital One Financial Corp. | 3.750% | 4/24/24 | 1,305 | 1,423 |

| | Capital One Financial Corp. | 3.200% | 2/5/25 | 760 | 828 |

| | Charles Schwab Corp. | 3.200% | 3/2/27 | 545 | 607 |

| | Chubb INA Holdings Inc. | 3.350% | 5/15/24 | 555 | 606 |

| | Chubb INA Holdings Inc. | 4.350% | 11/3/45 | 800 | 1,081 |

| | Citigroup Inc. | 4.500% | 1/14/22 | 1,975 | 2,059 |

| | Citigroup Inc. | 3.520% | 10/27/28 | 1,975 | 2,226 |

| | Citigroup Inc. | 6.625% | 6/15/32 | 2,000 | 2,833 |

| | Citigroup Inc. | 3.878% | 1/24/39 | 1,025 | 1,220 |

| | Comerica Bank | 2.500% | 7/23/24 | 790 | 841 |

| 6 | Credit Agricole SA | 3.750% | 4/24/23 | 1,160 | 1,245 |

| 6 | Credit Agricole SA | 3.250% | 10/4/24 | 2,390 | 2,603 |

| | Credit Suisse AG | 3.000% | 10/29/21 | 735 | 751 |

| | Credit Suisse AG | 3.625% | 9/9/24 | 250 | 277 |

| 6 | Credit Suisse Group AG | 3.574% | 1/9/23 | 550 | 568 |

| 6 | Credit Suisse Group AG | 4.207% | 6/12/24 | 340 | 367 |

| | Credit Suisse Group AG | 3.750% | 3/26/25 | 3,470 | 3,850 |

| 6 | Credit Suisse Group AG | 2.593% | 9/11/25 | 520 | 547 |

| 6 | Credit Suisse Group AG | 3.869% | 1/12/29 | 305 | 344 |

| 6,7 | Credit Suisse Group AG, 3M USD LIBOR + 1.240% | 1.460% | 6/12/24 | 690 | 700 |

| | Credit Suisse Group Funding Guernsey Ltd. | 3.800% | 9/15/22 | 1,335 | 1,407 |

| 6 | Danske Bank A/S | 2.000% | 9/8/21 | 1,120 | 1,133 |

| 6 | Danske Bank A/S | 5.000% | 1/12/22 | 610 | 636 |

| 6 | Danske Bank A/S | 3.875% | 9/12/23 | 1,220 | ��� 1,313 |

| 6 | Danske Bank A/S | 5.375% | 1/12/24 | 795 | 893 |

| 6 | Danske Bank A/S | 1.621% | 9/11/26 | 855 | 855 |

| | Deutsche Bank AG | 4.250% | 10/14/21 | 815 | 835 |

| 6 | DNB Boligkreditt AS | 2.500% | 3/28/22 | 1,315 | 1,349 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 6 | Equitable Financial Life Global Funding | 1.400% | 7/7/25 | 370 | 378 |

| 6 | Equitable Financial Life Global Funding | 1.400% | 8/27/27 | 535 | 536 |

| | Fifth Third Bancorp | 2.550% | 5/5/27 | 425 | 462 |

| | Fifth Third Bank NA | 3.850% | 3/15/26 | 830 | 939 |

| 6 | Five Corners Funding Trust | 4.419% | 11/15/23 | 210 | 233 |

| | Goldman Sachs Group Inc. | 5.250% | 7/27/21 | 865 | 889 |

| | Goldman Sachs Group Inc. | 5.750% | 1/24/22 | 360 | 380 |

| | Goldman Sachs Group Inc. | 2.876% | 10/31/22 | 1,795 | 1,829 |

| | Goldman Sachs Group Inc. | 3.625% | 1/22/23 | 1,980 | 2,110 |

| | Goldman Sachs Group Inc. | 3.272% | 9/29/25 | 1,205 | 1,316 |

| | Goldman Sachs Group Inc. | 3.500% | 11/16/26 | 2,000 | 2,243 |

| | Goldman Sachs Group Inc. | 3.850% | 1/26/27 | 740 | 844 |

| | Goldman Sachs Group Inc. | 3.691% | 6/5/28 | 810 | 933 |

| | Goldman Sachs Group Inc. | 3.814% | 4/23/29 | 3,065 | 3,532 |

| | Goldman Sachs Group Inc. | 4.223% | 5/1/29 | 2,630 | 3,108 |

| | Goldman Sachs Group Inc. | 6.750% | 10/1/37 | 835 | 1,265 |

| 6 | HSBC Bank plc | 4.750% | 1/19/21 | 1,700 | 1,703 |

| | HSBC Holdings plc | 3.600% | 5/25/23 | 1,600 | 1,720 |

| | HSBC Holdings plc | 1.589% | 5/24/27 | 805 | 816 |

| | HSBC Holdings plc | 4.041% | 3/13/28 | 890 | 1,010 |

| | HSBC Holdings plc | 4.583% | 6/19/29 | 1,675 | 1,981 |

| | HSBC Holdings plc | 2.357% | 8/18/31 | 900 | 924 |

| | HSBC Holdings plc | 6.500% | 5/2/36 | 1,000 | 1,446 |

| | HSBC Holdings plc | 6.100% | 1/14/42 | 375 | 564 |

| | HSBC Holdings plc | 5.250% | 3/14/44 | 440 | 612 |

| 7 | HSBC Holdings plc, 3M USD LIBOR + 1.000% | 1.220% | 5/18/24 | 730 | 734 |

| | HSBC USA Inc. | 3.500% | 6/23/24 | 620 | 678 |

| | Huntington Bancshares Inc. | 3.150% | 3/14/21 | 499 | 501 |

| | ING Groep NV | 3.150% | 3/29/22 | 365 | 377 |

| | ING Groep NV | 3.950% | 3/29/27 | 2,695 | 3,116 |

| | Intercontinental Exchange Inc. | 2.650% | 9/15/40 | 170 | 174 |

| | Intercontinental Exchange Inc. | 3.000% | 6/15/50 | 465 | 492 |

| | Intercontinental Exchange Inc. | 3.000% | 9/15/60 | 850 | 887 |

| 6 | JAB Holdings BV | 2.200% | 11/23/30 | 290 | 291 |

| | JPMorgan Chase & Co. | 3.375% | 5/1/23 | 875 | 934 |

| | JPMorgan Chase & Co. | 3.875% | 2/1/24 | 800 | 879 |

| | JPMorgan Chase & Co. | 3.900% | 7/15/25 | 2,270 | 2,561 |

| | JPMorgan Chase & Co. | 4.125% | 12/15/26 | 765 | 887 |

| | JPMorgan Chase & Co. | 4.250% | 10/1/27 | 2,295 | 2,706 |

| | JPMorgan Chase & Co. | 4.452% | 12/5/29 | 2,100 | 2,557 |

| | JPMorgan Chase & Co. | 3.702% | 5/6/30 | 2,525 | 2,911 |

| | JPMorgan Chase & Co. | 3.109% | 4/22/41 | 835 | 932 |

| | JPMorgan Chase & Co. | 5.400% | 1/6/42 | 750 | 1,108 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | JPMorgan Chase & Co. | 3.964% | 11/15/48 | 6,150 | 7,724 |

| | JPMorgan Chase & Co. | 3.109% | 4/22/51 | 845 | 935 |

| 6 | Liberty Mutual Group Inc. | 4.250% | 6/15/23 | 80 | 87 |

| 6 | Liberty Mutual Group Inc. | 4.569% | 2/1/29 | 280 | 341 |

| | Loews Corp. | 2.625% | 5/15/23 | 440 | 460 |

| 6 | Macquarie Group Ltd. | 4.150% | 3/27/24 | 1,375 | 1,474 |

| | Manufacturers & Traders Trust Co. | 2.900% | 2/6/25 | 685 | 743 |

| | Marsh & McLennan Cos. Inc. | 4.375% | 3/15/29 | 675 | 821 |

| | Marsh & McLennan Cos. Inc. | 4.900% | 3/15/49 | 305 | 440 |

| 3,6 | Massachusetts Mutual Life Insurance Co. | 7.625% | 11/15/23 | 2,000 | 2,258 |

| | MetLife Inc. | 3.600% | 4/10/24 | 580 | 639 |

| | MetLife Inc. | 4.125% | 8/13/42 | 145 | 184 |

| | MetLife Inc. | 4.875% | 11/13/43 | 530 | 749 |

| 6 | Metropolitan Life Global Funding I | 3.450% | 10/9/21 | 810 | 829 |

| 6 | Metropolitan Life Global Funding I | 2.650% | 4/8/22 | 340 | 350 |

| 6 | Metropolitan Life Global Funding I | 3.450% | 12/18/26 | 640 | 730 |

| 6 | Metropolitan Life Global Funding I | 3.000% | 9/19/27 | 1,165 | 1,294 |

| | Mitsubishi UFJ Financial Group Inc. | 2.623% | 7/18/22 | 1,940 | 2,006 |

| | Morgan Stanley | 5.750% | 1/25/21 | 1,740 | 1,744 |

| | Morgan Stanley | 2.500% | 4/21/21 | 1,175 | 1,182 |

| | Morgan Stanley | 2.625% | 11/17/21 | 800 | 816 |

| | Morgan Stanley | 2.750% | 5/19/22 | 1,710 | 1,766 |

| | Morgan Stanley | 3.700% | 10/23/24 | 750 | 835 |

| | Morgan Stanley | 2.720% | 7/22/25 | 1,750 | 1,872 |

| | Morgan Stanley | 3.125% | 7/27/26 | 1,345 | 1,498 |

| | Morgan Stanley | 6.250% | 8/9/26 | 3,000 | 3,817 |

| | Morgan Stanley | 3.625% | 1/20/27 | 1,250 | 1,432 |

| | Morgan Stanley | 3.772% | 1/24/29 | 3,910 | 4,517 |

| | Morgan Stanley | 2.699% | 1/22/31 | 1,105 | 1,202 |

| | Morgan Stanley | 4.300% | 1/27/45 | 850 | 1,131 |

| 6 | National Australia Bank Ltd. | 2.332% | 8/21/30 | 1,745 | 1,759 |

| 6 | Nationwide Building Society | 3.622% | 4/26/23 | 680 | 706 |

| 6 | Nationwide Financial Services Inc. | 3.900% | 11/30/49 | 1,430 | 1,587 |

| 6 | Nationwide Mutual Insurance Co. | 4.350% | 4/30/50 | 1,320 | 1,548 |

| 6 | NBK SPC Ltd. | 2.750% | 5/30/22 | 1,530 | 1,571 |

| 6 | New York Life Global Funding | 2.900% | 1/17/24 | 810 | 868 |

| 6 | New York Life Insurance Co. | 5.875% | 5/15/33 | 2,100 | 2,876 |

| 6 | New York Life Insurance Co. | 3.750% | 5/15/50 | 345 | 409 |

| 6 | New York Life Insurance Co. | 4.450% | 5/15/69 | 435 | 581 |

| 6 | Northwestern Mutual Life Insurance Co. | 3.850% | 9/30/47 | 656 | 779 |

| 6 | Northwestern Mutual Life Insurance Co. | 3.625% | 9/30/59 | 270 | 308 |

| | PNC Bank NA | 3.300% | 10/30/24 | 460 | 506 |

| | PNC Bank NA | 2.950% | 2/23/25 | 1,105 | 1,209 |

| | PNC Bank NA | 4.200% | 11/1/25 | 255 | 292 |

| | PNC Bank NA | 3.100% | 10/25/27 | 1,165 | 1,303 |

| | PNC Bank NA | 3.250% | 1/22/28 | 1,675 | 1,905 |

| | PNC Financial Services Group Inc. | 3.900% | 4/29/24 | 580 | 641 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | PNC Financial Services Group Inc. | 2.550% | 1/22/30 | 1,625 | 1,776 |

| 6 | Principal Life Global Funding II | 2.500% | 9/16/29 | 1,000 | 1,081 |

| | Prudential plc | 3.125% | 4/14/30 | 645 | 731 |

| 8 | Royal Bank of Canada | 0.000% | 1/7/21 | 833 | 654 |

| | Royal Bank of Canada | 2.750% | 2/1/22 | 1,195 | 1,226 |

| | Santander Holdings USA Inc. | 3.700% | 3/28/22 | 915 | 945 |

| | Santander Holdings USA Inc. | 3.400% | 1/18/23 | 605 | 634 |

| 6 | Societe Generale SA | 3.250% | 1/12/22 | 1,015 | 1,043 |

| 6 | Standard Chartered plc | 2.744% | 9/10/22 | 2,030 | 2,052 |

| | State Street Corp. | 2.653% | 5/15/23 | 840 | 862 |

| | Svenska Handelsbanken AB | 1.875% | 9/7/21 | 1,050 | 1,062 |

| | Synchrony Bank | 3.650% | 5/24/21 | 1,290 | 1,302 |

| 6 | Teachers Insurance & Annuity Association of America | 4.900% | 9/15/44 | 875 | 1,172 |

| 6 | Teachers Insurance & Annuity Association of America | 4.270% | 5/15/47 | 1,145 | 1,428 |

| 6 | Temasek Financial I Ltd. | 2.375% | 1/23/23 | 1,130 | 1,177 |

| 6 | Temasek Financial I Ltd. | 3.625% | 8/1/28 | 1,025 | 1,199 |

| 6 | Temasek Financial I Ltd. | 2.250% | 4/6/51 | 1,150 | 1,158 |

| 6 | Temasek Financial I Ltd. | 2.500% | 10/6/70 | 670 | 678 |

| 6 | Toronto-Dominion Bank | 2.500% | 1/18/23 | 2,100 | 2,146 |

| | Truist Bank | 2.625% | 1/15/22 | 460 | 470 |

| | Truist Bank | 3.300% | 5/15/26 | 340 | 380 |

| | Truist Financial Corp. | 3.200% | 9/3/21 | 665 | 677 |

| | Truist Financial Corp. | 2.750% | 4/1/22 | 1,700 | 1,746 |

| | Truist Financial Corp. | 3.700% | 6/5/25 | 1,385 | 1,560 |

| | Truist Financial Corp. | 1.950% | 6/5/30 | 795 | 826 |

| | U.S. Bancorp | 3.700% | 1/30/24 | 1,560 | 1,701 |

| 6 | UBS Group AG | 2.650% | 2/1/22 | 1,250 | 1,281 |

| 6 | UBS Group AG | 3.126% | 8/13/30 | 555 | 621 |

| | Wachovia Corp. | 7.500% | 4/15/35 | 1,000 | 1,471 |

| | Wells Fargo & Co. | 3.500% | 3/8/22 | 640 | 664 |

| | Wells Fargo & Co. | 3.069% | 1/24/23 | 195 | 200 |

| | Wells Fargo & Co. | 3.450% | 2/13/23 | 735 | 778 |

| | Wells Fargo & Co. | 4.480% | 1/16/24 | 1,199 | 1,328 |

| | Wells Fargo & Co. | 3.750% | 1/24/24 | 1,560 | 1,700 |

| | Wells Fargo & Co. | 3.000% | 2/19/25 | 890 | 965 |

| | Wells Fargo & Co. | 3.550% | 9/29/25 | 860 | 963 |

| | Wells Fargo & Co. | 3.000% | 4/22/26 | 1,045 | 1,150 |

| | Wells Fargo & Co. | 4.100% | 6/3/26 | 340 | 389 |

| | Wells Fargo & Co. | 3.000% | 10/23/26 | 170 | 188 |

| | Wells Fargo & Co. | 3.196% | 6/17/27 | 1,705 | 1,885 |

| | Wells Fargo & Co. | 2.879% | 10/30/30 | 435 | 472 |

| | Wells Fargo & Co. | 2.572% | 2/11/31 | 2,235 | 2,358 |

| | Wells Fargo & Co. | 5.606% | 1/15/44 | 2,276 | 3,213 |

| | Wells Fargo & Co. | 4.900% | 11/17/45 | 515 | 685 |

| | Wells Fargo & Co. | 4.750% | 12/7/46 | 2,070 | 2,708 |

| | | | | | | 260,934 |

| Health Care (2.7%) |

| | AbbVie Inc. | 3.450% | 3/15/22 | 450 | 464 |

| | AbbVie Inc. | 3.800% | 3/15/25 | 575 | 641 |

| | AbbVie Inc. | 4.050% | 11/21/39 | 590 | 705 |

| | AbbVie Inc. | 4.850% | 6/15/44 | 450 | 584 |

| | AbbVie Inc. | 4.450% | 5/14/46 | 1,010 | 1,282 |

| | Advocate Health & Hospitals Corp. | 2.211% | 6/15/30 | 360 | 372 |

| | Advocate Health & Hospitals Corp. | 3.008% | 6/15/50 | 540 | 582 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Aetna Inc. | 2.800% | 6/15/23 | 680 | 716 |

| 6 | Alcon Finance Corp. | 2.750% | 9/23/26 | 200 | 218 |

| 6 | Alcon Finance Corp. | 2.600% | 5/27/30 | 200 | 213 |

| 6 | Alcon Finance Corp. | 3.800% | 9/23/49 | 800 | 938 |

| | Amgen Inc. | 2.300% | 2/25/31 | 1,575 | 1,672 |

| | Amgen Inc. | 3.150% | 2/21/40 | 1,075 | 1,170 |

| | Amgen Inc. | 5.150% | 11/15/41 | 311 | 427 |

| 6 | Amgen Inc. | 2.770% | 9/1/53 | 430 | 434 |

| | Anthem Inc. | 3.300% | 1/15/23 | 1,100 | 1,165 |

| | Anthem Inc. | 3.650% | 12/1/27 | 750 | 864 |

| | Anthem Inc. | 4.101% | 3/1/28 | 1,140 | 1,348 |

| | Anthem Inc. | 4.650% | 8/15/44 | 92 | 121 |

| | Ascension Health | 2.532% | 11/15/29 | 1,405 | 1,531 |

| 3 | Ascension Health | 4.847% | 11/15/53 | 50 | 74 |

| | AstraZeneca plc | 4.000% | 1/17/29 | 2,345 | 2,793 |

| | AstraZeneca plc | 6.450% | 9/15/37 | 615 | 942 |

| 6 | Bayer US Finance II LLC | 4.250% | 12/15/25 | 1,100 | 1,257 |

| 6 | Bayer US Finance LLC | 3.000% | 10/8/21 | 1,980 | 2,018 |

| 6 | Bayer US Finance LLC | 3.375% | 10/8/24 | 815 | 888 |

| 3 | Bon Secours Mercy Health Inc. | 3.464% | 6/1/30 | 590 | 667 |

| | Bon Secours Mercy Health Inc. | 2.095% | 6/1/31 | 330 | 338 |

| | Boston Scientific Corp. | 4.000% | 3/1/29 | 195 | 229 |

| | Bristol-Myers Squibb Co. | 2.750% | 2/15/23 | 138 | 145 |

| | Bristol-Myers Squibb Co. | 3.250% | 2/20/23 | 239 | 253 |

| | Bristol-Myers Squibb Co. | 4.000% | 8/15/23 | 45 | 49 |

| | Bristol-Myers Squibb Co. | 3.400% | 7/26/29 | 885 | 1,021 |

| | Bristol-Myers Squibb Co. | 4.125% | 6/15/39 | 505 | 639 |

| | Bristol-Myers Squibb Co. | 4.550% | 2/20/48 | 217 | 299 |

| | Bristol-Myers Squibb Co. | 4.250% | 10/26/49 | 1,473 | 1,973 |

| | Children's Hospital Corp. | 2.585% | 2/1/50 | 160 | 160 |

| | Cigna Corp. | 3.250% | 4/15/25 | 880 | 963 |

| | Cigna Corp. | 4.375% | 10/15/28 | 515 | 620 |

| | CommonSpirit Health | 2.950% | 11/1/22 | 535 | 560 |

| | CommonSpirit Health | 4.200% | 8/1/23 | 535 | 578 |

| | CommonSpirit Health | 2.760% | 10/1/24 | 860 | 924 |

| | CommonSpirit Health | 3.347% | 10/1/29 | 1,245 | 1,368 |

| | CommonSpirit Health | 2.782% | 10/1/30 | 465 | 492 |

| 3 | CommonSpirit Health | 4.350% | 11/1/42 | 536 | 625 |

| | CommonSpirit Health | 4.187% | 10/1/49 | 1,275 | 1,480 |

| | Cottage Health Obligated Group | 3.304% | 11/1/49 | 470 | 524 |

| | CVS Health Corp. | 2.750% | 12/1/22 | 965 | 1,002 |

| | CVS Health Corp. | 4.300% | 3/25/28 | 110 | 131 |

| | CVS Health Corp. | 4.875% | 7/20/35 | 315 | 409 |

| | CVS Health Corp. | 4.125% | 4/1/40 | 430 | 511 |

| | CVS Health Corp. | 5.125% | 7/20/45 | 855 | 1,146 |

| | Dignity Health | 3.812% | 11/1/24 | 560 | 609 |

| | Eli Lilly and Co. | 4.150% | 3/15/59 | 80 | 109 |

| 6 | EMD Finance LLC | 2.950% | 3/19/22 | 605 | 620 |

| | Gilead Sciences Inc. | 3.700% | 4/1/24 | 1,010 | 1,103 |

| | Gilead Sciences Inc. | 3.500% | 2/1/25 | 560 | 619 |

| | Gilead Sciences Inc. | 4.500% | 2/1/45 | 940 | 1,196 |

| | Gilead Sciences Inc. | 4.750% | 3/1/46 | 600 | 795 |

| | Gilead Sciences Inc. | 2.800% | 10/1/50 | 1,235 | 1,229 |

| | GlaxoSmithKline Capital Inc. | 2.800% | 3/18/23 | 385 | 406 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | GlaxoSmithKline Capital Inc. | 5.375% | 4/15/34 | 2,000 | 2,860 |

| | Kaiser Foundation Hospitals | 3.150% | 5/1/27 | 380 | 428 |

| | Kaiser Foundation Hospitals | 4.875% | 4/1/42 | 365 | 499 |

| | Medtronic Inc. | 3.500% | 3/15/25 | 396 | 444 |

| | Memorial Sloan-Kettering Cancer Center | 2.955% | 1/1/50 | 590 | 625 |

| | Memorial Sloan-Kettering Cancer Center | 4.125% | 7/1/52 | 310 | 402 |

| | Memorial Sloan-Kettering Cancer Center | 4.200% | 7/1/55 | 280 | 372 |

| | Merck & Co. Inc. | 2.750% | 2/10/25 | 1,210 | 1,314 |

| | Merck & Co. Inc. | 3.400% | 3/7/29 | 1,470 | 1,709 |

| | Merck & Co. Inc. | 4.150% | 5/18/43 | 760 | 992 |

| | Merck & Co. Inc. | 4.000% | 3/7/49 | 1,915 | 2,525 |

| | Mercy Health | 4.302% | 7/1/28 | 570 | 657 |

| | Novartis Capital Corp. | 3.400% | 5/6/24 | 415 | 455 |

| | Novartis Capital Corp. | 4.400% | 5/6/44 | 640 | 880 |

| | Partners Healthcare System Inc. | 3.192% | 7/1/49 | 935 | 1,026 |

| | Partners Healthcare System Inc. | 3.342% | 7/1/60 | 955 | 1,087 |

| | Pfizer Inc. | 3.000% | 12/15/26 | 725 | 817 |

| | Pfizer Inc. | 3.450% | 3/15/29 | 2,165 | 2,524 |

| | Pfizer Inc. | 4.100% | 9/15/38 | 1,505 | 1,917 |

| | Pfizer Inc. | 2.550% | 5/28/40 | 275 | 292 |

| | Pfizer Inc. | 2.700% | 5/28/50 | 305 | 326 |

| | Providence St. Joseph Health Obligated Group | 2.746% | 10/1/26 | 390 | 424 |

| | Providence St. Joseph Health Obligated Group | 2.532% | 10/1/29 | 985 | 1,056 |

| 3 | Providence St. Joseph Health Obligated Group | 3.930% | 10/1/48 | 325 | 389 |

| 6 | Roche Holdings Inc. | 2.375% | 1/28/27 | 1,650 | 1,791 |

| 6 | Royalty Pharma plc | 3.300% | 9/2/40 | 425 | 446 |

| 6 | Royalty Pharma plc | 3.550% | 9/2/50 | 1,405 | 1,495 |

| | Rush Obligated Group | 3.922% | 11/15/29 | 330 | 391 |

| | SSM Health Care Corp. | 3.823% | 6/1/27 | 940 | 1,063 |

| | Sutter Health | 2.294% | 8/15/30 | 560 | 583 |

| 9 | Toledo Hospital | 5.750% | 11/15/38 | 560 | 667 |

| | UnitedHealth Group Inc. | 2.875% | 3/15/22 | 27 | 28 |

| | UnitedHealth Group Inc. | 2.875% | 3/15/23 | 1,175 | 1,241 |

| | UnitedHealth Group Inc. | 3.100% | 3/15/26 | 430 | 482 |

| | UnitedHealth Group Inc. | 3.850% | 6/15/28 | 1,190 | 1,411 |

| | UnitedHealth Group Inc. | 2.000% | 5/15/30 | 275 | 291 |

| | UnitedHealth Group Inc. | 4.625% | 7/15/35 | 240 | 323 |

| | UnitedHealth Group Inc. | 2.750% | 5/15/40 | 310 | 334 |

| | UnitedHealth Group Inc. | 4.250% | 3/15/43 | 1,600 | 2,100 |

| | UnitedHealth Group Inc. | 4.750% | 7/15/45 | 592 | 830 |

| | UnitedHealth Group Inc. | 4.200% | 1/15/47 | 215 | 283 |

| | UnitedHealth Group Inc. | 4.250% | 6/15/48 | 880 | 1,173 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | UnitedHealth Group Inc. | 4.450% | 12/15/48 | 140 | 193 |

| | UnitedHealth Group Inc. | 3.700% | 8/15/49 | 675 | 841 |

| | UnitedHealth Group Inc. | 2.900% | 5/15/50 | 1,253 | 1,377 |

| | UnitedHealth Group Inc. | 3.875% | 8/15/59 | 115 | 148 |

| 6 | Viatris Inc. | 3.850% | 6/22/40 | 530 | 596 |

| 6 | Viatris Inc. | 4.000% | 6/22/50 | 710 | 812 |

| | | | | | | 90,130 |

| Industrials (1.0%) |

| 6 | BAE Systems Holdings Inc. | 3.850% | 12/15/25 | 1,085 | 1,226 |

| 6 | BAE Systems plc | 3.400% | 4/15/30 | 215 | 243 |

| | Boeing Co. | 2.700% | 2/1/27 | 495 | 515 |

| | Burlington Northern Santa Fe LLC | 3.000% | 3/15/23 | 565 | 593 |

| | Burlington Northern Santa Fe LLC | 3.850% | 9/1/23 | 1,630 | 1,766 |

| | Burlington Northern Santa Fe LLC | 4.550% | 9/1/44 | 250 | 337 |

| | Burlington Northern Santa Fe LLC | 4.150% | 4/1/45 | 415 | 542 |

| | Burlington Northern Santa Fe LLC | 4.050% | 6/15/48 | 60 | 79 |

| | Burlington Northern Santa Fe LLC | 3.050% | 2/15/51 | 405 | 460 |

| | Canadian National Railway Co. | 2.450% | 5/1/50 | 205 | 212 |

| | Carrier Global Corp. | 2.722% | 2/15/30 | 448 | 478 |

| | Caterpillar Inc. | 3.900% | 5/27/21 | 590 | 599 |

| | Caterpillar Inc. | 2.600% | 6/26/22 | 705 | 725 |

| | Caterpillar Inc. | 3.400% | 5/15/24 | 810 | 884 |

| 3 | Continental Airlines Class A Series 2007-1 Pass Through Trust | 5.983% | 10/19/23 | 488 | 489 |

| | CSX Corp. | 4.300% | 3/1/48 | 445 | 573 |

| | CSX Corp. | 3.350% | 9/15/49 | 235 | 267 |

| 3 | Federal Express Corp. 1998 Pass Through Trust | 6.720% | 7/15/23 | 216 | 220 |

| | FedEx Corp. | 2.700% | 4/15/23 | 255 | 267 |

| | FedEx Corp. | 4.100% | 2/1/45 | 130 | 154 |

| | FedEx Corp. | 4.550% | 4/1/46 | 178 | 225 |

| | FedEx Corp. | 4.050% | 2/15/48 | 48 | 57 |

| | Illinois Tool Works Inc. | 3.500% | 3/1/24 | 1,295 | 1,406 |

| | John Deere Capital Corp. | 3.450% | 3/13/25 | 1,200 | 1,344 |

| | Kansas City Southern | 4.950% | 8/15/45 | 480 | 613 |

| | Lockheed Martin Corp. | 2.900% | 3/1/25 | 610 | 664 |

| | Lockheed Martin Corp. | 1.850% | 6/15/30 | 60 | 63 |

| | Lockheed Martin Corp. | 4.500% | 5/15/36 | 211 | 277 |

| | Lockheed Martin Corp. | 4.700% | 5/15/46 | 376 | 529 |

| | Lockheed Martin Corp. | 2.800% | 6/15/50 | 265 | 286 |

| | Lockheed Martin Corp. | 4.090% | 9/15/52 | 144 | 190 |

| | Otis Worldwide Corp. | 2.565% | 2/15/30 | 225 | 241 |

| | Otis Worldwide Corp. | 3.112% | 2/15/40 | 510 | 556 |

| | Otis Worldwide Corp. | 3.362% | 2/15/50 | 890 | 1,018 |

| | Parker-Hannifin Corp. | 3.250% | 6/14/29 | 270 | 305 |

| | Parker-Hannifin Corp. | 4.450% | 11/21/44 | 450 | 575 |

| 6 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 3.450% | 7/1/24 | 465 | 506 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 6 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 2.700% | 11/1/24 | 385 | 411 |

| 6 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 3.950% | 3/10/25 | 1,435 | 1,606 |

| 6 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 4.450% | 1/29/26 | 925 | 1,070 |

| | Raytheon Technologies Corp. | 4.125% | 11/16/28 | 1,125 | 1,338 |

| | Raytheon Technologies Corp. | 6.050% | 6/1/36 | 675 | 978 |

| | Raytheon Technologies Corp. | 4.450% | 11/16/38 | 275 | 346 |

| | Raytheon Technologies Corp. | 4.500% | 6/1/42 | 407 | 532 |

| 6 | Siemens Financieringsmaatschappij NV | 2.900% | 5/27/22 | 1,050 | 1,087 |

| 6 | Siemens Financieringsmaatschappij NV | 3.125% | 3/16/24 | 1,680 | 1,813 |

| 6 | Siemens Financieringsmaatschappij NV | 4.400% | 5/27/45 | 800 | 1,073 |

| 3 | Southwest Airlines Co. Series 2007-1 Pass Through Trust | 6.150% | 2/1/24 | 157 | 161 |

| | Stanley Black & Decker Inc. | 4.850% | 11/15/48 | 685 | 954 |

| | Union Pacific Corp. | 3.700% | 3/1/29 | 505 | 586 |

| | Union Pacific Corp. | 3.250% | 2/5/50 | 200 | 226 |

| | Union Pacific Corp. | 3.799% | 10/1/51 | 666 | 811 |

| | Union Pacific Corp. | 3.839% | 3/20/60 | 285 | 351 |

| 6 | Union Pacific Corp. | 2.973% | 9/16/62 | 625 | 652 |

| | Union Pacific Corp. | 3.750% | 2/5/70 | 335 | 406 |

| 3 | United Airlines Class B Series 2018-1 Pass Through Trust | 4.600% | 9/1/27 | 177 | 172 |

| | | | | | | 34,057 |

| Materials (0.0%) |

| | International Paper Co. | 4.350% | 8/15/48 | 1,255 | 1,641 |

| Real Estate (0.4%) |

| | American Tower Corp. | 5.000% | 2/15/24 | 80 | 90 |

| | American Tower Corp. | 4.400% | 2/15/26 | 450 | 520 |

| | American Tower Corp. | 3.800% | 8/15/29 | 981 | 1,137 |

| | Boston Properties LP | 3.125% | 9/1/23 | 355 | 376 |

| | Boston Properties LP | 3.800% | 2/1/24 | 45 | 49 |

| | Crown Castle International Corp. | 3.650% | 9/1/27 | 285 | 321 |

| | Crown Castle International Corp. | 3.800% | 2/15/28 | 235 | 269 |

| | Equinix Inc. | 3.000% | 7/15/50 | 1,020 | 1,034 |

| | Healthpeak Properties Inc. | 3.000% | 1/15/30 | 930 | 1,019 |

| | Realty Income Corp. | 3.250% | 1/15/31 | 380 | 431 |

| 6 | SBA Tower Trust | 3.168% | 4/9/47 | 1,330 | 1,342 |

| 6 | SBA Tower Trust | 3.448% | 3/15/48 | 705 | 743 |

| 6 | SBA Tower Trust | 2.836% | 1/15/50 | 725 | 769 |

| 6 | SBA Tower Trust | 1.884% | 7/15/50 | 265 | 271 |

| 6 | Scentre Group Trust 1 / Scentre Group Trust 2 | 4.375% | 5/28/30 | 695 | 809 |

| | Simon Property Group LP | 3.750% | 2/1/24 | 90 | 97 |

| | Simon Property Group LP | 3.375% | 10/1/24 | 275 | 299 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Simon Property Group LP | 2.450% | 9/13/29 | 1,160 | 1,217 |

| | VEREIT Operating Partnership LP | 3.400% | 1/15/28 | 210 | 232 |

| | VEREIT Operating Partnership LP | 2.200% | 6/15/28 | 735 | 752 |

| | VEREIT Operating Partnership LP | 2.850% | 12/15/32 | 405 | 423 |

| | | | | | | 12,200 |

| Technology (2.0%) |

| | Apple Inc. | 3.000% | 2/9/24 | 620 | 667 |

| | Apple Inc. | 3.450% | 5/6/24 | 1,000 | 1,101 |

| | Apple Inc. | 2.850% | 5/11/24 | 1,225 | 1,321 |

| | Apple Inc. | 2.750% | 1/13/25 | 590 | 639 |

| | Apple Inc. | 3.250% | 2/23/26 | 1,020 | 1,145 |

| | Apple Inc. | 2.450% | 8/4/26 | 1,170 | 1,275 |

| | Apple Inc. | 3.350% | 2/9/27 | 1,545 | 1,758 |

| | Apple Inc. | 3.200% | 5/11/27 | 1,065 | 1,205 |

| | Apple Inc. | 2.900% | 9/12/27 | 2,250 | 2,517 |

| | Apple Inc. | 3.850% | 5/4/43 | 430 | 546 |

| | Apple Inc. | 4.450% | 5/6/44 | 120 | 164 |

| | Apple Inc. | 3.850% | 8/4/46 | 985 | 1,267 |

| | Apple Inc. | 2.650% | 5/11/50 | 640 | 677 |

| | Apple Inc. | 2.550% | 8/20/60 | 1,425 | 1,459 |

| | Broadcom Corp. / Broadcom Cayman Finance Ltd. | 3.875% | 1/15/27 | 305 | 343 |

| | Broadcom Inc. | 4.250% | 4/15/26 | 170 | 193 |

| | Broadcom Inc. | 4.110% | 9/15/28 | 1,452 | 1,653 |

| | Broadcom Inc. | 4.150% | 11/15/30 | 130 | 150 |

| | Cisco Systems Inc. | 2.500% | 9/20/26 | 431 | 472 |