Exhibit (c)(1)

Estimation of the Fair Market Value of

South Hertfordshire UK Fund Ltd’s interest in

the ordinary shares of

ntl (South Hertfordshire) Limited

As of 30 September 2010

![]()

24th November 2010

Mr. Shuja Khan

Strategy Director

Virgin Media Limited

Media House, Bartley Woods Business Park

Hook, Hampshire, RG27 9UP

Estimation of the Fair Market Value of South Hertfordshire UK Fund Ltd’s interest in the ordinary shares of ntl (South Hertfordshire) Limited as of 30 September 2010

Dear Mr. Khan:

This report presents our estimation of the Fair Market Value (as defined below) of South Hertfordshire UK Fund Ltd’s (the “Partnership”) interest in the ordinary shares of ntl (South Hertfordshire) Limited (the “Company”) on a non-marketable, controlling basis as of 30 September 2010 (the “Valuation Date”). We understand that the Partnership owns 299,390 Class A shares of the Company (the “Partnership Asset” or the “Subject Interest”) representing a 66.7% ownership interest. The results of our analysis may be used by ntl Fawnspring Limited (the “General Partner”), South Hertfordshire UK Fund Ltd, and Virgin Media Limited (“Virgin Media”), (collectively the “Group”) in connection with the possible acquisition of the Subject Interest by Virgin Media (or one of its subsidiaries or affiliates). Our repor t and valuation analysis are intended for use by the Group solely for this purpose. In addition, our report and analysis shall not be provided to any third party, other than the Group’s general counsel, independent auditors, and the appropriate regulatory authorities, without our prior written consent. If a sale process of the Subject Interest is authorized, our report will be filed with the SEC and will be summarized within a proxy statement available to unit holders upon request.

DEFINITION OF VALUE

The basic valuation premise we have applied in our analysis is Fair Market Value. Fair Market Value is defined as the price at which an asset would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell, and both having reasonable knowledge of relevant facts. Our valuation assumes that ntl (South Hertfordshire) Limited will continue as a going concern.

SOURCES OF INFORMATION

In the course of our valuation analysis, we relied upon historical financial and other information obtained from the Company’s independent auditors and from various public and industry sources. Our conclusion is dependent on such information being complete and accurate in all material respects. However, as is customary in the business valuation profession, the scope of our work does not enable us to accept responsibility for the accuracy and completeness of such provided information.

BTG Mesirow Financial Consulting LLC is a Delaware limited liability company. Alternative Investment Services are provided on a consultative basis. BTG Mesirow Financial Consulting SM is a service mark of BTG Mesirow Financial Consulting LLC. The Mesirow Financial ® name and logo are registered service marks of Mesirow Financial Holdings, Inc. 2010, Mesirow Financial Holdings, Inc. Begbies Traynor Group plc is a company registered in England and Wales No: 5120043. Registered Office: 340 Deansgate, Manchester, M3 4LY.

The principal sources of information used in performing our valuation include:

· Audited historical financial statements for ntl (South Hertfordshire) Limited for fiscal years ended 31 December 2007 through 31 December 2009;

· Various documents (Form 10-Ks, Form 10-Qs, etc.) filed with the Securities and Exchange Commission (“SEC”) for South Hertfordshire United Kingdom Fund, Ltd. and Virgin Media Inc.;

· Interviews and discussions with Virgin Media management (“Management”);

· Project Apple Tree presentation prepared by Management in October 2010 based on data available as of the Valuation Date;

· Jones United Kingdom Fund, Ltd. Limited Partnership Agreement (“Partnership Agreement”);

· Memorandum and Articles of Association of ntl (South Hertfordshire) Limited;

· Project Apple Tree Request for Proposal: Valuation of Partnership Assets;

· Various analyst reports for publicly-traded companies with operations in the telephony, broadband and cable television industries;

· The Virgin Media web-site (www.virginmedia.com, www.investors.virginmedia.com);

· Ibbotson Associates’ SBBI Valuation Edition 2010 Yearbook;

· FactSet Mergerstat, LLC Mergerstat Review 2010;

· Capital IQ’s database of publicly-traded companies;

· Bloomberg’s on-line database covering financial markets, commodities, and news;

· The Deal.com database covering M&A, bankruptcy, private equity, venture capital, law & tax, and corporate restructuring activity;

· The Corpfinworldwide.com database, covering M&A, bankruptcy, private equity, venture capital, law & tax, and corporate restructuring activity; and

· Other data pertinent to our analysis.

PROCEDURES

In general, our procedures included, but were not limited to, the following:

· Analysis of conditions in, and the economic outlook for, the telephony, broadband, and cable television industries in the United Kingdom;

· Analysis of general market data including economic, governmental, and environmental forces;

· Discussions concerning the history, current state, and expected future operations of the Company with Management;

· Discussions with Management to obtain an explanation and clarification of data provided;

· Analysis of the Company’s historical operating and financial results;

· Preparation by us of financial and operating projections including sales, operating margins (e.g., earnings before interest and taxes), working capital investments, and capital expenditures based on the Company’s historical operating results, industry results and expectations, and Management discussions. Such projections formed the basis for the Discounted Cash Flow Method;

· Gathering and analysis of financial data for publicly-traded companies engaged in the same or similar lines of business to develop the appropriate discount rate as part of the Discounted Cash Flow Method and various valuation multiples as part of the Market Comparable Method;

· Gathering and analysis of financial data for companies engaged in the same or similar lines of business involved in transactions;

· Estimation of the appropriate control premium to apply to various valuation multiples as part of the Market Comparable Method;

· Estimation of the appropriate marketability discount to apply to a controlling interest in order to arrive at the Fair Market Value of the Subject Interest on a non-marketable, controlling basis; and

· Analysis of other facts and data considered pertinent to this valuation to arrive at our conclusion.

HISTORY AND NATURE OF THE BUSINESS

The Company offers broadband, cable television and fixed line telephony services to approximately 34,500 customers as of 30 June 2010, and passes approximately 96,000 homes and 7,000 businesses. The Company is not a standalone business, although it owns the local cable infrastructure. The Company’s network, however, is fully integrated with Virgin Media. Moreover, the Company’s customers procure the Company’s services through Virgin Media and under the Virgin Media name. Additionally, the Company is dependent on Virgin Media for its technology infrastructure, telecommunications backbone, cable television content, marketing and billing services, customer and technical support, financing, and back office services. As of the Valuation date, the Company’s indebtedness to Virgin Media totaled £19.2 million.

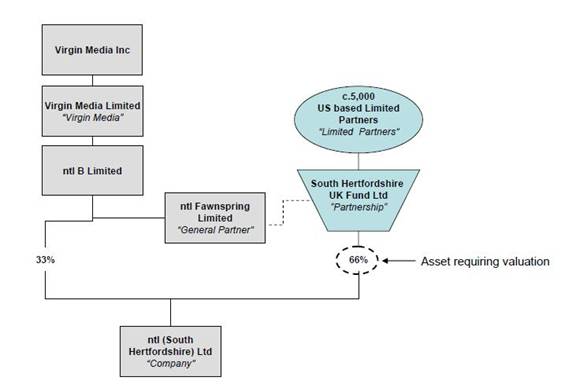

The Company is 33.3% owned by ntl B Limited, a wholly owned subsidiary of Virgin Media Inc., and 66.7% owned by the Partnership. The General Partner is a wholly owned subsidiary of Virgin Media Inc. The Company has no employees of its own and is dependent on Virgin Media to finance and manage its operations. Please refer to Appendix A for the structure of the relevant entities.

Management believes that its advanced, deep fibre access network is what enables it to offer faster and higher quality broadband services than its digital subscriber line, or DSL, competitors. As a result, Virgin Media provides its customers with a leading, broadband service and one of the most advanced TV on-demand services available in the U.K. market. Being fully integrated into Virgin Media, the Company is also able to offer these market leading technologies and services.

VALUATION APPROACHES

We have considered the following valuation approaches when estimating the Fair Market Value of the Subject Interest: the Income Approach, the Market Approach, and the Underlying Asset Approach. We

valued the Subject Interest by applying these techniques under the premise of the Company’s value to a prudent investor contemplating retention and use of the assets in an ongoing business.

INCOME APPROACH

The Income Approach indicates the Fair Market Value of a business based on the present value of the cash flows that the business can be expected to generate in the future. The Income Approach is typically applied using the Discounted Cash Flow Method.

Discounted Cash Flow Method

The Discounted Cash Flow Method comprises four steps: 1) estimate future cash flows for a certain discrete projection period; 2) discount these cash flows to present value at a rate of return that considers the relative risk of achieving the cash flows and the time value of money; 3) estimate the residual value of cash flows subsequent to the discrete projection period; and 4) combine the present value of the residual cash flows with the discrete projection period cash flows to indicate the Fair Market Value of a marketable, controlling interest in the business. Any interest-bearing debt is then subtracted to arrive at the Fair Market Value of the equity of the business. A discount for lack of marketability is then applied to estimate the Fair Market Value of equity on a non-marketable, controlling basis.

MARKET APPROACH

The Market Approach indicates the Fair Market Value of the equity of a business based on a comparison of the Company to comparable firms in similar lines of business that are publicly-traded or are a part of a public transaction. The conditions and prospects of companies in similar lines of business depend on common factors such as overall demand for their products and services. An analysis of the market multiples of companies engaged in similar businesses yields insight into investor perceptions and, therefore, the value of the subject company. The Market Approach can be applied through the Market Comparable Method or the Market Transaction Method.

Market Comparable Method

The Market Comparable Method indicates the Fair Market Value of the equity of a business based on a comparison of the subject business to comparable publicly-traded companies in its industry. The valuation process is essentially that of comparison and correlation between the subject business and the comparable companies. Once the comparable companies are identified, market multiples of the publicly-traded companies are then calculated. These market multiples are then applied to the Company’s operating results for the prior twelve months as of the Valuation Date to indicate the value on a marketable, minority basis. Any interest-bearing debt is then subtracted to indicate the value of the equity on a marketable, minority basis. A control premium is then applied to arrive at the Fair Market Value of Equity on a marketable, controlling basis. A discount for lack of marketab ility is then applied to arrive at the Fair Market Value of equity on a non-marketable, controlling basis.

Market Transaction Method

The Market Transaction Method indicates the Fair Market Value based on exchange prices in actual transactions. The process essentially involves comparison and correlation of the subject company with similar companies involved in the transactions. This variation of the Market Approach results in an indicated Fair

Market Value of a marketable, controlling interest in the business. Any interest-bearing debt is then subtracted to arrive at the Fair Market Value of equity on a marketable, controlling basis. A discount for lack of marketability is then applied to estimate the Fair Market Value of equity on a non-marketable, controlling basis.

UNDERLYING ASSET APPROACH

The Underlying Asset Approach indicates the Fair Market Value of a business by adjusting the asset and liability balances on the subject company’s balance sheet to their Fair Market Value equivalents. The Underlying Asset Approach is based on the summation of the individual piecemeal values of the underlying assets.

APPROACHES UTILIZED

In our valuation of the Company, we relied on the results of the Income Approach (Discounted Cash Flow Method) and Market Approach (Market Comparable Method). Due to limited comparability of market transactions with the Company, the Market Approach (Market Transaction Method) was used to assess the reasonableness of the results of the Income Approach and Market Approach (Market Comparable Method). We did not perform the Underlying Asset Approach as this approach is generally inappropriate for valuing a business, such as ntl (South Hertfordshire) Limited, that is operating as a going concern.

INCOME APPROACH: Discounted Cash Flow Method

ESTIMATION OF DISCOUNT RATE

When applying the Income Approach, the cash flows expected to be generated by a business are discounted to their present value equivalent using a rate of return that reflects the relative risk of the investment, as well as the time value of money. This return, known as the weighted average cost of capital (“WACC”), is an overall rate based on the rates of return for invested capital. The WACC is calculated by weighting the required returns on debt and common equity capital in proportion to their estimated percentages in an expected capital structure.

The following is a general discussion of the method used in our derivation of the WACC.

The general formula for calculating the WACC is:

WACC | = | [ Kd * (d%) ] + [ Ke * (e%) ] |

where: |

|

|

|

|

|

WACC | = | Weighted average cost of capital on invested capital; |

Kd | = | After-tax rate of return on debt capital; |

d% | = | Debt capital as a percentage of total invested capital; |

Ke | = | Rate of return on common equity capital; and |

e% | = | Common equity capital as a percentage of the total invested capital. |

RATES OF RETURN ON DEBT

The rate of return on debt capital is the rate a likely investor would require on interest-bearing debt of the subject company assuming a typical industry capital structure. Since the interest on debt capital is deductible for income tax purposes, we used the after-tax interest rate in our calculation.

The after-tax rate of return on debt capital is calculated using the formula:

Kd | = | K * (1 - t) |

where: |

|

|

|

|

|

Kd | = | After-tax rate of return on debt capital; |

K | = | Pre-tax rate of return on debt capital; and |

t | = | Effective tax rate. |

The pre-tax rate of return on debt for this valuation is assumed to be equal to the yield on a Baa rated corporate bond as of the Valuation Date plus the spread between a U.K. 20-Year Gilt Treasury note and a U.S. 20-Year Treasury note. We then applied an effective tax rate of 28% to calculate an after-tax cost of debt of 4.3% as of the Valuation Date.

REQUIRED RETURN ON EQUITY

The rate of return on equity capital was estimated using the Modified Capital Asset Pricing Model (“MCAPM”). The MCAPM estimates the rate of return on common equity as the current risk-free rate of return on government issued treasury bonds, plus a market risk premium expected over the risk-free rate of return, multiplied by the “beta” for the stock. Beta is a risk measure that reflects the sensitivity of a company’s stock price to the movements of the stock market as a whole.

The MCAPM rate of return on equity capital is calculated using the formula:

Ke | = | Rf + (B * (Rm - Rf)) + Ssp + A |

where: |

|

|

|

|

|

Ke | = | Rate of return on equity capital; |

Rf | = | Risk-free rate of return; |

B | = | Beta or systematic risk for this type of equity investment; |

Rm - Rf | = | Market risk premium: The expected return on a broad portfolio of stocks in the market (Rm) less the risk free rate (Rf); |

Ssp | = | Small stock premium; and |

A | = | Company specific risk (Alpha). |

Practical application of the MCAPM relies upon the ability to identify publicly-traded companies that have similar risk characteristics as the subject company in order to derive meaningful measures of the subject company beta.

The measures used in our estimation of the required rate of return on equity capital for the Company were as follows:

| U.K. Risk-free rate of return: |

| 3.76 | % |

|

|

| Beta: |

| 0.88 |

|

|

|

| Market Risk Premium: |

| 6.70 | % |

|

|

| Small Stock Premium: |

| 6.28 | % |

|

|

| Alpha: |

| N/A |

|

|

|

Risk Free Rate of Return: For the risk-free rate of return, we utilized the yield on U.K. 20-Year Gilt Treasury notes.

Beta: Beta is a statistical measure of the volatility of the return of a specific stock relative to the movement of returns of a general group. Generally, beta is considered to be indicative of the market’s perception of the relative risk of the specific stock. Betas reported in public sources are “leveraged”, which incorporates the added risk to a stockholder due to the debt financing of the company. To derive a beta for our industry WACC based on the guideline companies, the reported levered betas must first be unlevered and then relevered at assumed industry debt levels.

The guideline companies were selected from publicly-traded domestic and international companies with telephony, broadband and cable television operations. Predicted betas, calculated by Barra, were unlevered for each company and then a median was calculated for the group. This median beta was then relevered at the assumed industry debt level resulting in a beta of 0.88.

Market Risk Premium: Market risk premiums are based on common stock total returns less risk-free government bond income returns. Financial theory suggests that investors in common stocks require a premium over the return on Treasury securities as a reward for incurring additional investment risk. The Market Risk Premium (“MRP”) is defined as the excess return that investors expect to receive from investing in common stocks less bond income returns for Treasury securities. Based on our research and empirical evidence, the MRP is estimated to be 6.7% as of the Valuation Date.

Small Stock Premium: The MCAPM rate of return is adjusted by a premium, which reflects the extra risk of an investment in a small company. This premium is derived from historical differences in returns between small companies and large companies using data published by Ibbotson Associates. Based on this study, a small stock premium of 6.28% was deemed appropriate for the Company.

Alpha: Alpha is the measure of the unsystematic or company specific risk. We determined that an alpha adjustment was not warranted as of the Valuation Date.

Return on Equity Capital Conclusion: Accordingly, based on this analysis, the required rate of return on equity for the Company is estimated to be 15.9% as of the Valuation Date.

ESTIMATION OF CAPITAL STRUCTURE

Our estimate of the typical capital structure was based on observing typical proportions of debt and common equity of publicly-traded companies in similar lines of business as the Company. The observed long-term debt-to-total capital ratio was 40.0% and, accordingly, the observed equity-to-total capital ratio was 60.0%.

WACC CONCLUSION

Based on this analysis, the WACC for the Company was estimated to be as follows:

| Cost of Debt: | 4.3% * 40.0% | = | 1.7 | % |

|

| Cost of Equity: | 15.9% * 60.0% | = | 9.6 | % |

|

| Weighted Average Cost of Capital | 11.3 | % |

| ||

Therefore, the WACC for the Company was estimated to be 11.5% (Rounded) as of the Valuation Date. See Exhibit 4 for the detailed WACC calculations.

PRESENT VALUE OF FUTURE CASH FLOWS

We estimated the Fair Market Value of the Company using the Discounted Cash Flow Method, a form of the Income Approach. Management projections were not provided to us. As a result, the projections used in the Discounted Cash Flow Method were based on our analysis of the future prospects of the Company, taking into account both industry and company specific factors, discussions with Management, as well as a consideration of historical performance and margins. The financial projections utilized in the Discounted Cash Flow Method can be summarized as follows:

Sales: Based on the limited geographic territory of the Company, the relative maturity of the business, and the competitive environment for the provision of telephony, broadband and cable television in the U.K., a limited increase in sales was forecast over the discrete period. Sales are determined by average revenue per user (“ARPU”) multiplied by number of customers. Growth rates were assumed for each of these variables. Projected sales growth is driven by forecasted increases in ARPU and forecasted increases in number of customers. We forecasted sales to grow from £18.1 million in 2009 to £19.8 million in 2014, growing subsequently at a rate of 1.5% per annum in the residual period. Exhibit 2, Page 4 presents the detailed calculations behind the revenue assumptions.

Cost of Sales: Cost of sales are forecasted to be 18% of sales for the year ending December 2010. Based on the Company’s historical performance and its cost structures in place, it is forecast that cost of sales will increase to 20% of sales in 2011 and remain constant at this level through the rest of the discrete period and in the residual period.

Operating Expenses: Operating expenses as a percentage of sales are forecast to increase slightly during the discrete period. Given the maturity of the business, it is forecast that operating expenses will increase to 42% of sales by 2011, and remain constant at this level through the rest of the discrete period and in the residual period.

Depreciation & Amortization: Based on an analysis of industry levels and discussions with Management, depreciation and amortization are forecast to be 14% of sales in 2011, and remain at that level throughout the rest of the discrete and residual period.

EBIT: Based on the above projections, the Company’s EBIT margin is forecast to be 25.9% in 2010, decreasing to 24.0% of sales in 2011, and to remain constant at this level through the rest of the discrete and residual periods. Historically, the Company’s EBIT margin was 15.9%, 19.2% and 23.2% in 2007, 2008 and 2009, respectively.

Cash Flows: To determine the annual after-tax cash flows generated by the Company, the following adjustments were made to EBIT:

· Income taxes were deducted based on an assumed tax rate of 28.0%, 27.3%, 26.3%, 25.3% and 24.3% for six months ending 31 December 2010, and twelve months ending 2011, 2012, 2013 and 2014, respectively. The tax rate is held constant in the residual period at 24.0%. Additionally, the presence of net operating loss (“NOL”) and capital allowance balances required an additional analysis for calculating cash taxes, which will be discussed in further detail in the adjustments to the indicated value of total invested capital section.

· Depreciation and amortization expense, as detailed previously, was added back as this expense does not require a cash outflow.

· Future capital expenditures were then subtracted. Recurring annual capital expenditures were estimated to be approximately 14% of sales, which takes into account maintaining and enhancing the Company’s network.

· Finally, working capital requirements were considered. Based on a review of historical levels of working capital, industry averages, and discussions with Management, the Company is expected to have a working capital balance of zero (i.e., current assets equal current liabilities).

CALCULATION OF RESIDUAL VALUE

The present value of the residual represents the amount an investor would pay today for the rights to the cash flows of the business for years subsequent to the discrete projection period. In calculating the residual value, a normalized available cash flow was estimated. Depreciation and amortization, capital expenditures, and working capital requirements were normalized to match long-term expectations of sales. Normalized available cash flows were then capitalized using a rate calculated by subtracting the residual growth rate from the overall WACC estimated previously. The present value factor from 2014 was then applied to estimate the present value of the residual cash flows. The present value of the residual and the sum of the present value of available cash flows for the discrete projection period were then summed to arrive at the indicated value of total invested capital on a marketable, controlling basis before adjustments.

TAX ASSET ADJUSTMENT

We estimated the fair value of the Company’s NOL and capital allowance balances. The value of the tax asset is the present value of the tax savings resulting from the actual NOL and capital allowance balances in excess of a normalized amount. The calculation relating to the Income Approach is presented in the following steps:

Step 1) Estimate Taxes Based on Actual NOL and Capital Allowance Balances: Calculate projected cash taxes to be paid by the Company based on the actual NOL balance of £699 thousand and capital allowance balance of £51.435 million as of 31 December 2009 using tax rates outlined above.

Step 2) Estimate Normalized Taxes: Calculate the projected cash taxes that would be paid based on our estimated “normalized” NOL balance of zero and capital allowance balance of £6.1 million as of 31 December 2009.

Step 3) Discrete Projection Period (30 September 2010 through 31 December 2014): Incorporate the estimated taxes from Step 1 into the discrete period in the Discounted Cash Flow Method. As a result, the cash flows for the discrete period reflect the benefit of the capital allowances directly through reduced taxes.

Step 4) Unadjusted Residual Value: In order to apply the Gordon Growth Method into perpetuity, we must estimate taxes for the residual period assuming no excess capital allowance balance exists (See Exhibit 2, Page 2). However, in order to appropriately reflect the value of the tax asset as of the Valuation Date, we need to independently estimate the value of the excess capital allowance balance in the residual period (2015 and beyond).

Step 5) Fair Value of Tax Asset (2015 and Beyond): The value of the excess capital allowance balance beyond the discrete period is the present value of the tax savings generated by the tax asset. This is calculated as the present value of the difference between the taxes in Step 2 (normalized balance) and Step 1 (actual balance) from 2015 and beyond. This amount is estimated to be £1.96 million. Exhibit 2, Page 5 presents the detailed calculations.

INCOME APPROACH CONCLUSION BEFORE MARKETABILITY DISCOUNT, SUBJECT INTEREST AND CURRENCY ADJUSTMENTS

Based on our application of the Income Approach, we have estimated the Fair Market Value of 100% of the equity of the Company on a marketable, controlling basis to be £22.7 million as of 30 September 2010. See Exhibit 2, Page 1 for the detailed calculations leading to our conclusion.

MARKET APPROACH — Market Comparable Method

The first step in performing the Market Comparable Method is to identify publicly-traded companies that are similar to the Company (similar lines of business, basis of competition, target markets, etc.). Below is a brief description of the companies selected for the Market Comparable Method:

Virgin Media Inc., through its subsidiaries, provides of entertainment and communications services in the United Kingdom. The company operates through three segments: Consumer, Business, and Content. The Consumer segment offers cable broadband Internet, television, and fixed line telephone services under the Virgin Media brand to residential customers; mobile telephony services through Virgin Mobile, a mobile virtual network operator; and broadband and telephone services to residential customers through third-party telecommunications networks. The Business segment provides a portfolio of voice, data, and Internet solutions to commercial customers, including analog telephony and managed data networks and applications, as well as supplies communications services to emergency services providers. Virgin Media owns a 50% interest in the companie s that comprise the UKTV Group, a series of joint ventures with BBC Worldwide. The company was founded in 1993 and is based in New York, New York.

TalkTalk Telecom Group PLC provides fixed line voice and broadband telecommunications services to residential and business customers primarily in the United Kingdom. The company offers voice telephony, including line rental, calls, and added value services, such as voicemail; broadband Internet access services, including email and storage; and dial-up Internet access services to residential customers under the TalkTalk and AOL brand names. It also provides telephone lines and calls, mobile handsets and services, business-grade broadband Internet access, inbound contact centre automated solutions, telephone systems, wide area data network design and supply services, mobile reselling services, and wholesale Ethernet services to business customers under the Opal brand name. The company sells its products and services directly, as well as throu gh retail channels, field marketing agencies, outbound telesales, and telemarketing. As of 31 March 2009, it served approximately 4.1 million broadband customers and approximately 1.1 million voice-only and narrowband customers. TalkTalk Telecom Group PLC was founded in 2002 and is headquartered in London, the United Kingdom.

Telefonica, S.A. provides fixed and mobile telephony services primarily in Spain, rest of Europe, and Latin America. Its fixed telecommunication services include public switched telephone network lines; integrated services digital network access; public telephone; local, domestic, and international long distance and fixed-to-mobile communications; corporate communications; video telephony; supplementary and business-oriented value-added services; network services; leasing and sale of terminal equipment; and telephony information services. The company’s Internet and broadband multimedia services comprise Internet service provider service; portal and network services; retail and wholesale broadband access; narrowband switched access to Intern et; and television services, such as IPTV, cable television, and satellite television. It also provides various mobile and related services and products that include mobile voice services, value added services, mobile data and Internet services, wholesale services, corporate services, roaming, fixed wireless, and trunking and paging services. The company was founded in 1924 and is headquartered in Madrid, Spain.

France Telecom provides fixed telephony and mobile telecommunications, data transmission, Internet, and multimedia services to consumers, businesses, and other telecommunications operators in France, the United Kingdom, Spain, Poland, and the rest of the world. It operates in three segments: Personal Communication Services (PCS), Home Communication Services (HCS), and Enterprise Communication Services (ECS). The PCS segment provides mobile telecommunications services. The HCS segment offers the fixed-line telecommunications services, including fixed-line telephony, Internet services, and services to operators, as well as engages in the distribution activities and support functions. The ECS segment provides business communication solutions and services, as well as data transmission services, including low and high-speed Internet, d ata transmission, and leased lines services. France Telecom also has a 50-50 joint venture agreement with Deutsche Telekom AG. The company was founded in 1990 and is headquartered in Paris, France.

British Sky Broadcasting Group PLC and its subsidiaries provide pay television broadcast services in the United Kingdom and Ireland. It primarily broadcasts sports events, movies, entertainment, and news programs. As of 30 June 2009, the company owned, operated, distributed, and retailed 29 Sky Channels, including multiplex versions of the Sky Channels, and retailed 159 Sky Distributed Channels to direct-to-home (DTH) viewers. Additionally, the company provides broadband and telephony services comprising Sky Broadband, a broadband Internet access service; and Sky Talk, a telephony service available to DTH subscribers. Furthermore, the company broadcasts versions of three of its channels, Sky News, Sky Sports News, and Sky Three; provides analogue and digital cable services; and owns and operates various Web sites, including sky.com, sk ysports.com, and sky.com/news. British Sky Broadcasting Group was founded in 1988 and is headquartered in Isleworth, the United Kingdom.

BT Group PLC operates as a communications services company. It offers fixed lines, broadband, mobile, and television (TV) products and services, as well as networked IT services. It operates in four segments: BT Global Services, BT Retail, BT Wholesale, and Openreach. The BT Global Services segment provides networked IT services to multinational corporations, domestic businesses, government departments, and other communications providers worldwide. The BT Retail segment provides audio, video and internet collaboration services; directory enquiries, operator and emergency services, and phone book; software and IT services for retailers; street, managed, prison, card, and private payphones; and alarm monitoring and tracking facilities. The BT Wholesale segment offers broadband, voice, and data connectivity services, interconnect to bespoke an d managed network outsourcing, and value-added solutions to the communications providers in the United Kingdom. The Openreach segment connects communications providers’ customers to their local telephone exchange, giving them access to the U.K. network. BT Group plc was founded in 1981 and is based in London, the United Kingdom.

Comcast Corporation, together with its subsidiaries, provides consumer entertainment, information, and communication products and services to the residential and commercial customers in the United States. The company operates in two segments, Cable and Programming. The Cable segment manages and operates cable systems, including video, high-speed Internet, and phone services, as well as regional sports and news networks. Its video services include analog, digital, on demand, and high-definition television and/or digital video recorders. The Programming segment operates national programming networks consisting of E!, The Golf Channel, VERSUS, G4, and Style. As of 31 December 2009, Comcast Corporation served approximately 23.6 million video cu stomers, 15.9 million high-speed Internet customers, and 7.6 million phone customers, as well as approximately 50.6 million homes in 39 states and the District of Columbia. The company was founded in 1969 and is based in Philadelphia, Pennsylvania.

CALCULATION OF MARKET MULTIPLES

The Market Comparable Method consists of the calculation of valuation multiples based on publicly-traded comparable companies that are then applied to the Company’s operating results. For the basis of our analysis, we relied on two commonly used multiples: Market Value of Invested Capital (“MVIC”) to Revenue and MVIC to EBITDA.

The first step in calculating the valuation multiples is estimating the MVIC for each of the selected comparable companies as of the Valuation Date. The general formula for calculating MVIC is:

MVIC = MVE + Current Debt + LT Debt

where:

MVE | = | Shares outstanding times the share price as of the Valuation Date; |

Current Debt | = | Short-term borrowings, current portion of long-term debt, and current portion of long-term lease obligations; |

LT Debt | = | Preferred stock, long-term debt, minority interests, and long-term lease obligations. |

Once the MVIC for each of the comparable companies is determined, the operating results (Revenue and EBITDA) for the latest twelve months ending 30 June 2010 of each comparable company is then applied to arrive at the implied valuation multiples.

ESTIMATION OF VALUE

Once the selected multiples are determined, the Company’s operating results for the latest twelve months ending 30 June 2010 are applied to each of the valuation multiples resulting in an indicated value of invested capital on a marketable, minority basis. For the latest twelve months (“LTM”) 30 June 2010, the Company had revenues of £17.9 million and EBITDA of £7.5 million.

Interest-bearing debt is then deducted to arrive at the Fair Market Value of equity before adjustments on a marketable, minority basis. A control premium is defined as the additional consideration that an investor would pay over a marketable, minority equity value (due to certain rights control provides that minority shares do not enjoy) in order to own a controlling interest in the common stock of the Company. Since the Fair Market Value of equity using the Market Comparable Method results in value on a marketable, minority basis, a control premium is applied to represent the value of equity on a controlling basis.

Based on our analysis of the specific facts and circumstances and consideration of premiums paid for controlling interests in similar companies as obtained from Mergerstat Review, we have estimated the control premium for equity to be 20%.

The fair value of the tax asset is then be added to arrive at the indicated value of equity on a marketable, controlling basis.

TAX ASSET ADJUSTMENT

We estimated the fair value of the Company’s NOL and capital allowance balances. The value of the tax asset is the present value of the tax savings resulting from the actual NOL and capital allowance balances in excess of a normalized amount. The calculation relating to the Market Approach is presented in the following steps:

Step 1) Estimate Taxes Based on Actual NOL and Capital Allowance Balances: Calculate projected cash taxes to be paid by the Company based on the actual NOL balance of £699 thousand and capital allowance balance of £51.435 million as of 31 December 2009 using tax rates outlined above.

Step 2) Estimate Normalized Taxes: Calculate the projected cash taxes that would be paid based on our estimated “normalized” NOL balance of zero and capital allowance balance of £6.128 million as of 31 December 2009.

Step 3) Fair Value of Tax Asset (Discrete and Residual Periods): The value of the excess capital allowance balance is the present value of the tax savings generated by the tax asset. For the Market Approach, this is calculated as the present value of the difference between the taxes in Step 2 (normalized balance) and Step 1 (actual balance) for all periods. This amount is estimated to be £6.64 million. Exhibit 2, Pages 5 presents the detailed calculations.

MARKET COMPARABLE METHOD CONCLUSION BEFORE MARKETABILITY DISCOUNT, SUBJECT INTEREST AND CURRENCY ADJUSTMENTS

Based on our application of the Market Comparable Method as described above, the Fair Market Value of the Equity of the Company on a marketable, controlling basis is estimated to be £26.7 million as of 30 September 2010. Exhibit 3 presents the detailed calculations leading to our conclusion.

INDICATED EQUITY VALUE OF THE COMPANY BEFORE MARKETABILITY DISCOUNT, SUBJECT INTEREST AND CURRENCY ADJUSTMENTS

We considered the results and merits of the two approaches in estimating the Fair Market Value of equity of £23.7 million (before marketability discount, Subject Interest and currency adjustments) on a marketable, controlling basis. We primarily relied upon the Income Approach due to the Company’s unique operating arrangements and the limited comparability of the “peer” companies. We then applied a marketability discount and certain adjustments to arrive at the Fair Market Value of the Subject Interest on a non-marketable, controlling basis.

DISCOUNT FOR LACK OF MARKETABILITY

The Class A shares of the Company representing the Subject Interest are illiquid, or non-marketable, in that they are not traded on any exchange and are not readily transferable. There is also a lack of marketability consideration related to the following section of the Partnership Agreement:

“In some instances, such as the ownership of shares of a United Kingdom corporation which owns a cable television/telephony property, the shares are the cable television/telephony property because they represent an indirect interest in the underlying assets.”

Marketability discounts refer to the percentage difference between the value of a privately held security/asset and a similar publicly traded security/asset. The discount for limited marketability of the Class A shares (as discussed above) is mitigated by the fact that the Subject Interest represents a 66.7% ownership of the Company (controlling interest). Based on a consideration of these facts and circumstances, we have estimated the marketability discount for the controlling Subject Interest in the Company to be 10%.

SUBJECT INTEREST AND CURRENCY ADJUSTMENTS

In order to arrive at the Fair Market Value of the Subject Interest in U.S. dollars, adjustments to reflect the ownership percentage of the Subject Interest (66.7%) and a currency conversion from GBP to U.S. dollars (at 1.5716 as of the Valuation Date) were necessary.

CONCLUSION

Based on our analysis as described in this report, we estimated the Fair Market Value of the Subject Interest on a non-marketable, controlling basis as of 30 September 2010 to be £14.2 million as follows:

Currency in Thousands

Methodology |

| Reference |

| Indicated Fair Value of Equity |

| |

|

|

|

|

|

| |

Income Approach |

|

|

|

|

| |

|

|

|

|

|

| |

Discounted Cash Flow Method |

| Exhibit 2 |

| £ | 22,700 |

|

|

|

|

|

|

| |

Market Approach |

|

|

|

|

| |

|

|

|

|

|

| |

Guideline Company Method |

| Exhibit 3 |

| £ | 26,700 |

|

|

|

|

|

|

| |

Indicated Equity Value of 100% Interest in ntl (South Hertfordshire) Limited (1) (Marketable, Controlling) |

|

|

| £ | 23,700 |

|

|

|

|

|

|

| |

Less: Marketability Discount at 10% |

|

|

| (2,370 | ) | |

|

|

|

|

|

| |

Concluded Equity Value (Non-Marketable, Controlling) |

|

|

| £ | 21,330 |

|

|

|

|

|

|

| |

Subject Interest |

|

|

| 66.7 | % | |

|

|

|

|

|

| |

ntl (South Hertfordshire) Limited Subject Interest at 66.7% in Sterling |

|

|

| £ | 14,227 |

|

|

|

|

|

|

| |

ntl (South Hertfordshire) Limited Subject Interest at 66.7% in Sterling (Rounded) |

|

|

| £ | 14,200 |

|

|

|

|

|

|

| |

Exchange Rate at GBP/USD (2) |

|

|

| 1.5716 |

| |

|

|

|

|

|

| |

ntl (South Hertfordshire) Limited Subject Interest at 66.7% in US Dollars |

|

|

| $ | 22,317 |

|

Notes

(1) Indicated value based on the relative merits of the Discounted Cash Flow Method and Guideline Company Method (See page 14).

(2) Exchange rate is the spot rate on 30 September 2010 (Source: Bloomberg LP).

LIMITING CONDITIONS

The employees of BTG Mesirow Financial Consulting LLC who worked on this engagement have no known or contemplated financial interest in Virgin Media. Further, our compensation for this engagement is neither based nor contingent on the value we determined.

This document has been prepared solely for the Group for the purposes stated herein and should not be relied upon for any other purpose. Unless required by law, it shall not be provided to any third party, other than the Group’s general counsel, independent auditors, and the appropriate regulatory authorities, without our prior written consent. In no event, regardless of whether consent has been provided, shall we assume any responsibility to any third party to which the report is disclosed or otherwise made available. Our work was performed in accordance with the Letter of Engagement dated 8 October 2010.

Yours very truly,

BTG Mesirow Financial Consulting LLC

By: Paul C. du Vair

ntl (South Hertfordshire) Limited | Exhibit 1 |

Equity Valuation of ntl (South Hertfordshire) Limited |

|

As of 30 September 2010 |

|

Currency in Thousands |

|

Summary |

|

Methodology |

| Reference |

| Indicated Fair Value of Equity |

| |

|

|

|

|

|

| |

Income Approach |

|

|

|

|

| |

|

| Exhibit 2 |

| £ | 22,700 |

|

Discounted Cash Flow Method |

|

|

|

|

| |

|

|

|

|

|

| |

Market Approach |

|

|

|

|

| |

|

|

|

|

|

| |

Guideline Company Method |

| Exhibit 3 |

| £ | 26,700 |

|

|

|

|

|

|

| |

Indicated Equity Value of 100% Interest in ntl (South Hertfordshire) Limited (1) (Marketable, Controlling) |

|

|

| £ | 23,700 |

|

|

|

|

|

|

| |

Less: Marketability Discount at 10% |

|

|

| (2,370 | ) | |

|

|

|

|

|

| |

Concluded Equity Value (Non-Marketable, Controlling) |

|

|

| £ | 21,330 |

|

|

|

|

|

|

| |

Subject Interest |

|

|

| 66.7 | % | |

|

|

|

|

|

| |

ntl (South Hertfordshire) Limited Subject Interest at 66.7% in Sterling |

|

|

| £ | 14,227 |

|

|

|

|

|

|

| |

ntl (South Hertfordshire) Limited Subject Interest at 66.7% in Sterling (Rounded) |

|

|

| £ | 14,200 |

|

|

|

|

|

|

| |

Exchange Rate at GBP/USD (2) |

|

|

| 1.5716 |

| |

|

|

|

|

|

| |

ntl (South Hertfordshire) Limited Subject Interest at 66.7% in US Dollars |

|

|

| $ | 22,317 |

|

Notes

(1) Indicated value based on the results of the Discounted Cash Flow Method and Guideline Company Method.

(2) Exchange rate is the spot rate on 30 September 2010 (Source: Bloomberg LP).

![]()

ntl (South Hertfordshire) Limited | Exhibit 2 |

Equity Valuation of ntl (South Hertfordshire) Limited |

|

As of 30 September 2010 |

|

Income Approach: Discounted Cash Flow Method |

|

GBP in Thousands |

|

Summary |

|

Sum of Present Value of Available Cash Flow |

|

|

| £ | 15,603 |

|

Plus: Present Value of Residual Available Cash Flow |

|

|

| 24,321 |

| |

Indicated Value of Total Invested Capital (Marketable, Controlling Basis) |

|

|

| £ | 39,924 |

|

|

|

|

|

|

| |

Plus: Working Capital Requirement Excess / (Deficit) |

|

|

| — |

| |

Plus: Non-Operating Assets / (Liabilities) |

|

|

| — |

| |

Plus: Fair Value of Tax Assets (2015 and beyond) |

|

|

| 1,964 |

| |

Less: Interest-Bearing Obligations as of Valuation Date |

|

|

| (19,158 | ) | |

Indicated Value of 100% Equity (Marketable, Controlling Basis) |

|

|

| £ | 22,730 |

|

|

|

|

|

|

| |

|

| Rounded |

| £ | 22,700 |

|

ntl (South Hertfordshire) Limited |

| Exhibit 2 |

Equity Valuation of ntl (South Hertfordshire) Limited |

|

|

As of 30 September 2010 |

|

|

Income Approach: Discounted Cash Flow Method |

|

|

GBP in Thousands |

|

|

Discounted Cash Flow Model |

|

|

|

|

|

|

|

|

|

|

|

| Historical |

| Projected |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

| Six Months |

| Six Months |

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

| Historical Year Ended |

| Ended |

| Ending |

| Projected Year Ending |

| Normalized |

| |||||||||||||||||||||||

|

| 12/31/2006 |

| 12/31/2007 |

| 12/31/2008 |

| 12/31/2009 |

| 6/30/2010 |

| 12/31/2010 |

| 12/31/2011 |

| 12/31/2012 |

| 12/31/2013 |

| 12/31/2014 |

| Residual Year |

| |||||||||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Revenue |

| £ | 21,052 |

| £ | 19,657 |

| £ | 18,309 |

| £ | 18,092 |

| £ | 9,093 |

| £ | 9,379 |

| £ | 18,992 |

| £ | 19,230 |

| £ | 19,471 |

| £ | 19,764 |

| £ | 20,060 |

|

Revenue Growth |

|

|

| -6.6 | % | -6.9 | % | -1.2 | % | n/a |

| n/a |

| 2.8 | % | 1.3 | % | 1.3 | % | 1.5 | % | 1.5 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Cost of Sales |

| £ | (5,434 | ) | £ | (4,892 | ) | £ | (4,499 | ) | £ | (3,918 | ) | £ | (1,636 | ) | £ | (1,687 | ) | £ | (3,798 | ) | £ | (3,846 | ) | £ | (3,894 | ) | £ | (3,953 | ) | £ | (4,012 | ) |

Gross Margin |

| £ | 15,618 |

| £ | 14,765 |

| £ | 13,810 |

| £ | 14,174 |

| £ | 7,457 |

| £ | 7,692 |

| £ | 15,194 |

| £ | 15,384 |

| £ | 15,577 |

| £ | 15,811 |

| £ | 16,048 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Allocated Overhead (inc. other charges) |

| £ | (9,255 | ) | £ | (7,201 | ) | £ | (6,218 | ) | £ | (6,379 | ) | £ | (3,254 | ) | £ | (3,517 | ) | £ | (7,027 | ) | £ | (7,115 | ) | £ | (7,204 | ) | £ | (7,313 | ) | £ | (7,422 | ) |

Management Fees |

| (1,053 | ) | (983 | ) | (915 | ) | (905 | ) | (455 | ) | (469 | ) | (950 | ) | (962 | ) | (974 | ) | (988 | ) | (1,003 | ) | |||||||||||

Total Operating Expenses |

| £ | (10,308 | ) | £ | (8,184 | ) | £ | (7,133 | ) | £ | (7,284 | ) | £ | (3,709 | ) | £ | (3,986 | ) | £ | (7,977 | ) | £ | (8,077 | ) | £ | (8,178 | ) | £ | (8,301 | ) | £ | (8,425 | ) |

EBITDA |

| £ | 5,310 |

| £ | 6,581 |

| £ | 6,677 |

| £ | 6,890 |

| £ | 3,749 |

| £ | 3,706 |

| £ | 7,217 |

| £ | 7,307 |

| £ | 7,399 |

| £ | 7,510 |

| £ | 7,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Depreciation/Amortization |

| (3,762 | ) | (3,465 | ) | (3,162 | ) | (2,697 | ) | (1,313 | ) | (1,354 | ) | (2,659 | ) | (2,692 | ) | (2,726 | ) | (2,767 | ) | (2,808 | ) | |||||||||||

Adjusted Operating Income/EBIT |

| £ | 1,547 |

| £ | 3,116 |

| £ | 3,514 |

| £ | 4,194 |

| £ | 2,436 |

| £ | 2,351 |

| £ | 4,558 |

| £ | 4,615 |

| £ | 4,673 |

| £ | 4,743 |

| £ | 4,814 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Cash Flow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

EBIT |

|

|

|

|

|

|

|

|

|

|

| £ | 2,351 |

| £ | 4,558 |

| £ | 4,615 |

| £ | 4,673 |

| £ | 4,743 |

| £ | 4,814 |

| |||||

Less: Income Taxes (cash taxes) |

|

|

|

|

|

|

|

|

|

|

| 0 |

| 0 |

| 0 |

| (43 | ) | (263 | ) | (1,155 | ) | |||||||||||

Plus: Depreciation and Amortization |

|

|

|

|

|

|

|

|

|

|

| 1,354 |

| 2,659 |

| 2,692 |

| 2,726 |

| 2,767 |

| 2,808 |

| |||||||||||

Less: Capital Expenditures |

|

|

|

|

|

|

|

|

|

|

| (1,313 | ) | (2,659 | ) | (2,692 | ) | (2,726 | ) | (2,767 | ) | (2,808 | ) | |||||||||||

Less: Working Capital Investment (Increase)/Decrease |

|

|

|

|

|

|

|

|

|

|

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| |||||||||||

Available Cash Flow |

|

|

|

|

|

|

|

|

|

|

| £ | 2,393 |

| £ | 4,558 |

| £ | 4,615 |

| £ | 4,630 |

| £ | 4,480 |

| £ | 3,659 |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Present Value Factor @ 11.5% |

|

|

|

|

|

|

|

|

|

|

| 0.9864 |

| 0.9214 |

| 0.8264 |

| 0.7411 |

| 0.6647 |

|

|

| |||||||||||

Partial Period Adjustment |

|

|

|

|

|

|

|

|

|

|

| 0.5000 |

| 1.0000 |

| 1.0000 |

| 1.0000 |

| 1.0000 |

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Present Value of Available Cash Flow |

|

|

|

|

|

|

|

|

|

|

| £ | 1,180 |

| £ | 4,200 |

| £ | 3,814 |

| £ | 3,431 |

| £ | 2,978 |

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Sum of Present Value of Available Cash Flow |

|

|

| £ | 15,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residual Calculation |

|

|

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residual Cash Flow |

| £ | 3,659 |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Divided By: Cap Rate (r-g) (1) |

| 10.0 | % | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equal: Residual Value |

| £ | 36,590 |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Times: PV Factor |

| 0.6647 |

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PV of Residual Value |

| £ | 24,321 |

| ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

Margin Analysis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

EBITDA |

| £ | 5,310 |

| £ | 6,581 |

| £ | 6,677 |

| £ | 6,890 |

| £ | 3,749 |

| £ | 3,706 |

| £ | 7,217 |

| £ | 7,307 |

| £ | 7,399 |

| £ | 7,510 |

| £ | 7,623 |

|

EBITDA as a % of Revenue |

| 25.2 | % | 33.5 | % | 36.5 | % | 38.1 | % | 41.2 | % | 39.5 | % | 38.0 | % | 38.0 | % | 38.0 | % | 38.0 | % | 38.0 | % | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

EBIT |

| £ | 1,547 |

| £ | 3,116 |

| £ | 3,514 |

| £ | 4,194 |

| £ | 2,436 |

| £ | 2,351 |

| £ | 4,558 |

| £ | 4,615 |

| £ | 4,673 |

| £ | 4,743 |

| £ | 4,814 |

|

EBIT as a % of Revenue |

| 7.4 | % | 15.9 | % | 19.2 | % | 23.2 | % | 26.8 | % | 25.1 | % | 24.0 | % | 24.0 | % | 24.0 | % | 24.0 | % | 24.0 | % | |||||||||||

Note:

(1) Cap Rate calculated as Weighted Average Cost of Capital (r) minus long term growth rate (g) (i.e. 11.5% - 1.5% = 10%).

ntl (South Hertfordshire) Limited | Exhibit 2 |

Equity Valuation of ntl (South Hertfordshire) Limited |

|

As of 30 September 2010 |

|

Income Approach: Discounted Cash Flow Method |

|

GBP in Thousands |

|

Discounted Cash Flow Projections |

|

|

| Projected Six |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

| Months Ending |

| Projected Year Ending |

| Normalized |

| ||||||||||||

|

| 12/31/2010 |

| 12/31/2011 |

| 12/31/2012 |

| 12/31/2013 |

| 12/31/2014 |

| Residual Year |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Revenue |

| £ | 9,379 |

| £ | 18,992 |

| £ | 19,230 |

| £ | 19,471 |

| £ | 19,764 |

| £ | 20,060 |

|

Revenue Growth |

|

|

| 2.8 | % | 1.3 | % | 1.3 | % | 1.5 | % | 1.5 | % | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cost of Sales |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Cost of Sales |

| -18.0 | % | -20.0 | % | -20.0 | % | -20.0 | % | -20.0 | % | -20.0 | % | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Allocated Overhead (inc. other charges) |

| -37.5 | % | -37.0 | % | -37.0 | % | -37.0 | % | -37.0 | % | -37.0 | % | ||||||

Management Fees |

| -5.0 | % | -5.0 | % | -5.0 | % | -5.0 | % | -5.0 | % | -5.0 | % | ||||||

Total Operating Expenses |

| -42.5 | % | -42.0 | % | -42.0 | % | -42.0 | % | -42.0 | % | -42.0 | % | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Depreciation/Amortization |

| -14.4 | % | -14.0 | % | -14.0 | % | -14.0 | % | -14.0 | % | -14.0 | % | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

EBITDA as a % of Revenue |

| 39.5 | % | 38.0 | % | 38.0 | % | 38.0 | % | 38.0 | % | 38.0 | % | ||||||

EBIT as a % of Revenue |

| 25.1 | % | 24.0 | % | 24.0 | % | 24.0 | % | 24.0 | % | 24.0 | % | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Marginal Total Cash Income Tax Rate |

| 28.0 | % | 27.3 | % | 26.3 | % | 25.3 | % | 24.3 | % | 24.0 | % | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Capital Expenditures |

| (1,313 | ) | (2,659 | ) | (2,692 | ) | (2,726 | ) | (2,767 | ) | (2,808 | ) | ||||||

Capital Expenditures as a % of Sales |

| -14.0 | % | -14.0 | % | -14.0 | % | -14.0 | % | -14.0 | % | -14.0 | % | ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Working Capital as a % of Sales |

| 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | 0.0 | % | ||||||

Working Capital Balance |

| — |

| — |

| — |

| — |

| — |

| — |

| ||||||

Change in Working Capital |

| — |

| — |

| — |

| — |

| — |

| — |

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Working Capital Balance as of Valuation Date (1) |

| £ | — |

|

|

|

|

|

|

|

|

|

|

| |||||

Assumed Required Working Capital Balance |

| — |

|

|

|

|

|

|

|

|

|

|

| ||||||

Working Capital Excess (Deficit) |

| £ | — |

|

|

|

|

|

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Discount Rate |

| 11.5 | % |

|

|

|

|

|

|

|

|

|

| ||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Present Value Factor |

| 0.9864 |

| 0.9214 |

| 0.8264 |

| 0.7411 |

| 0.6647 |

| 0.5961 |

| ||||||

Midpoint Convention |

| 0.1260 |

| 0.7521 |

| 1.7521 |

| 2.7521 |

| 3.7521 |

| 4.7521 |

| ||||||

Cash Flow Period |

| 0.2521 |

| 1.0000 |

| 1.0000 |

| 1.0000 |

| 1.0000 |

| 1.0000 |

| ||||||

Partial Period Adjustment |

| 0.5000 |

|

|

|

|

|

|

|

|

|

|

| ||||||

|

| At 11.5% WACC |

| ||||

|

| Without |

| With |

| ||

|

| Tax |

| Tax |

| ||

Implied EBITDA Multiple (Marketable, Controlling) |

| Assets |

| Assets |

| ||

Total Invested Capital |

| £ | 35,244 |

| £ | 41,888 |

|

Latest Twelve Months |

| 4.7x |

| 5.6x |

| ||

Notes:

(1) Working Capital Balance per discussions with management is zero.

ntl (South Hertfordshire) Limited | Exhibit 2 |

Equity Valuation of ntl (South Hertfordshire) Limited |

|

As of 30 September 2010 |

|

Income Approach: Discounted Cash Flow Method |

|

GBP in Thousands |

|

Revenue Assumptions |

|

|

|

|

| Projected |

|

|

|

|

|

|

|

|

|

|

| |||||||

|

|

|

| Six Months |

|

|

|

|

|

|

|

|

|

|

| |||||||

|

| Actual |

| Ending |

| Projected Year Ending |

| Normalized |

| |||||||||||||

|

| 6/30/2010 |

| 12/31/2010 |

| 12/31/2011 |

| 12/31/2012 |

| 12/31/2013 |

| 12/31/2014 |

| Residual Year |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

ARPU |

| £ | 44.82 | (1) | £ | 45.27 |

| £ | 45.72 |

| £ | 46.18 |

| £ | 46.64 |

| £ | 47.22 |

| £ | 47.81 |

|

ARPU Growth |

| N/A |

| 1.00 | % | 1.00 | % | 1.00 | % | 1.00 | % | 1.25 | % | 1.25 | % | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Customers |

| 34,530 | (1) | 34,530 |

| 34,616 |

| 34,703 |

| 34,790 |

| 34,877 |

| 34,964 |

| |||||||

Customer Growth |

| N/A |

| 0.00 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | 0.25 | % | |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Revenue |

|

|

| £ | 9,379 |

| £ | 18,992 |

| £ | 19,230 |

| £ | 19,471 |

| £ | 19,764 |

| £ | 20,060 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Revenue Growth |

|

|

|

|

| 2.8 | % | 1.3 | % | 1.3 | % | 1.5 | % | 1.5 | % | |||||||

Note:

(1) ARPU and Customers from Management Presentation October 2010.

ntl (South Hertfordshire) Limited | Exhibit 2 |

Equity Valuation of ntl (South Hertfordshire) Limited |

|

As of 30 September 2010 |

|

NOLs and Capital Allowances |

|

GBP in Thousands |

|

Normalized Opening Balance |

|

Assumptions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

WACC |

| 11.5 | % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Normalized NOL Balance |

| £ | — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized Capital Allowances |

| £ | 6,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Historical |

| Projected |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

|

| Six Months |

| Six Months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

|

| Ended |

| Ending |

| Projected Year Ending |

| |||||||||||||||||||||||||||||||||||||||

|

| 6/30/2010 |

| 12/31/2010 |

| 12/31/2011 |

| 12/31/2012 |

| 12/31/2013 |

| 12/31/2014 |

| 12/31/2015 |

| 12/31/2016 |

| 12/31/2017 |

| 12/31/2018 |

| 12/31/2019 |

| 12/31/2020 |

| 12/31/2021 |

| 12/31/2022 |

| 12/31/2023 |

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Adjusted Operating Income/EBIT (1) |

| £ | 2,436 |

| £ | 2,351 |

| £ | 4,558 |

| £ | 4,615 |

| £ | 4,673 |

| £ | 4,743 |

| £ | 4,814 |

| £ | 4,887 |

| £ | 4,960 |

| £ | 5,034 |

| £ | 5,110 |

| £ | 5,187 |

| £ | 5,264 |

| £ | 5,343 |

| £ | 5,423 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Depreciation |

| 1,313 |

| 1,354 |

| 2,659 |

| 2,692 |

| 2,726 |

| 2,767 |

| 2,808 |

| 2,851 |

| 2,893 |

| 2,937 |

| 2,981 |

| 3,025 |

| 3,071 |

| 3,117 |

| 3,164 |

| |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Taxable Income |

| £ | 3,749 |

| £ | 3,706 |

| £ | 7,217 |

| £ | 7,307 |

| £ | 7,399 |

| £ | 7,510 |

| £ | 7,623 |

| £ | 7,737 |

| £ | 7,853 |

| £ | 7,971 |

| £ | 8,091 |

| £ | 8,212 |

| £ | 8,335 |

| £ | 8,460 |

| £ | 8,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Opening NOL (2) |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

|

NOLs Accrued During Period |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| |||||||||||||||

NOLs Available |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| |||||||||||||||

NOLs utilized |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| 0 |

| |||||||||||||||

Closing NOL |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

| £ | — |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Taxable Income after NOL Utilisation |

| £ | 3,749 |

| £ | 3,706 |

| £ | 7,217 |

| £ | 7,307 |

| £ | 7,399 |

| £ | 7,510 |

| £ | 7,623 |

| £ | 7,737 |

| £ | 7,853 |

| £ | 7,971 |

| £ | 8,091 |

| £ | 8,212 |

| £ | 8,335 |

| £ | 8,460 |

| £ | 8,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||

Opening Capital Allowances Pool (2) |

| £ | 6,128 |

| £ | 5,392 |

| £ | 5,364 |

| £ | 6,419 |

| £ | 7,425 |

| £ | 8,324 |

| £ | 9,095 |

| £ | 9,760 |

| £ | 10,341 |

| £ | 10,852 |

| £ | 11,307 |

| £ | 11,716 |

| £ | 12,088 |

| £ | 12,430 |

| £ | 12,749 |

|

Capital Allowance Capex Additions During Period |

| 613 |

| 1,313 |

| 2,659 |

| 2,692 |

| 2,726 |

| 2,767 |

| 2,808 |

| 2,851 |

| 2,893 |

| 2,937 |

| 2,981 |

| 3,025 |

| 3,071 |

| 3,117 |

| 3,164 |

| |||||||||||||||

Revised Capital Allowances Pool |

| 6,740 |

| 6,705 |

| 8,023 |

| 9,111 |

| 10,151 |

| 11,091 |

| 11,903 |

| 12,611 |

| 13,234 |

| 13,789 |

| 14,288 |

| 14,741 |

| 15,159 |

| 15,547 |

| 15,912 |

| |||||||||||||||

Capital Allowances Available for Use |

| 1,348 |

| 1,341 |

| 1,605 |

| 1,685 |

| 1,827 |

| 1,996 |

| 2,143 |

| 2,270 |

| 2,382 |

| 2,482 |

| 2,572 |

| 2,653 |

| 2,729 |

| 2,798 |

| 2,864 |

| |||||||||||||||

Capital Allowances utilized |

| 1,348 |