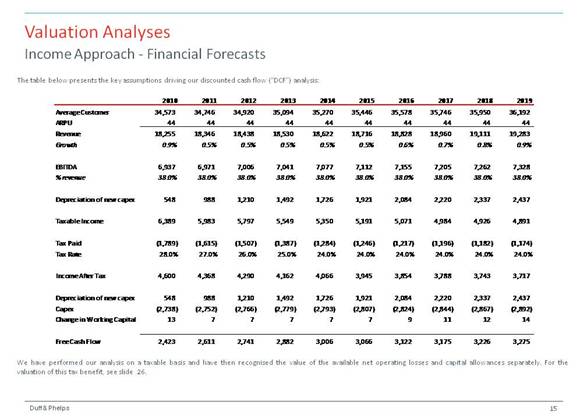

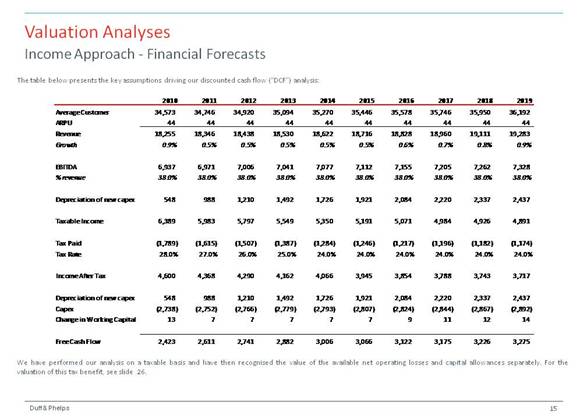

| Duff & Phelps The table below presents the key assumptions driving our discounted cash flow (“DCF”) analysis: Valuation Analyses Income Approach - Financial Forecasts We have performed our analysis on a taxable basis and have then recognised the value of the available net operating losses and capital allowances separately. For the valuation of this tax benefit, see slide 26. 15 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 Average Customer 34,573 34,746 34,920 35,094 35,270 35,446 35,578 35,746 35,950 36,192 ARPU 44 44 44 44 44 44 44 44 44 44 Revenue 18,255 18,346 18,438 18,530 18,622 18,716 18,828 18,960 19,111 19,283 Growth 0.9% 0.5% 0.5% 0.5% 0.5% 0.5% 0.6% 0.7% 0.8% 0.9% EBITDA 6,937 6,971 7,006 7,041 7,077 7,112 7,155 7,205 7,262 7,328 % revenue 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% Depreciation of new capex 548 988 1, 210 1,492 1,726 1,921 2,084 2,220 2,337 2,437 Taxable Income 6,389 5,983 5,797 5,549 5,350 5,191 5,071 4,984 4,926 4,891 Tax Paid (1,789) (1,615) (1,507) (1,387) (1,284) (1,246) (1,217) (1,196) (1,182) (1,174) Tax Rate 28.0% 27.0% 26.0% 25.0% 24.0% 24.0% 24.0% 24.0% 24.0% 24.0% Income After Tax 4,600 4,368 4,290 4,162 4,066 3,945 3,854 3,788 3,743 3,717 Depreciation of new capex 548 988 1,210 1,492 1,726 1,921 2,084 2,220 2,337 2,437 Capex (2,738) (2,752) (2,766) (2,779) (2,793) (2,807) (2,824) (2,844) (2,867) (2,892) Change in Working Capital 13 7 7 7 7 7 9 11 12 14 Free Cash Flow 2,423 2,611 2,741 2,882 3,006 3,066 3,122 3,175 3,226 3,275 |