- HAYN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Haynes International (HAYN) DEF 14ADefinitive proxy

Filed: 25 Jan 19, 4:13pm

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Haynes International, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

January 25, 2019

Dear Stockholders of Haynes International, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders of Haynes International, Inc. ("Haynes") to be held Wednesday, February 27, 2019 at 10:00 a.m. (EST) at the Hyatt Regency Indianapolis, One South Capitol Avenue, Indianapolis, Indiana 46204.

The business to be discussed and voted upon by the stockholders at the annual meeting is described in the accompanying Notice of Annual Meeting and Proxy Statement.

We hope you are able to attend the annual meeting personally, and we look forward to meeting with you. Whether or not you attend, it is important that your stock be represented and voted at the meeting. I urge you to please complete, date and return the proxy card in the enclosed envelope. The vote of each stockholder is very important. You may revoke your proxy at any time before it is voted at the annual meeting by giving written notice to the Secretary of Haynes, by filing a properly executed proxy bearing a later date or by attending the annual meeting and voting in person.

On behalf of the Board of Directors and management of Haynes, I thank you for your continued support.

Sincerely,

Haynes International, Inc.

Michael L. Shor

President and Chief Executive Officer

HAYNES INTERNATIONAL, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FEBRUARY 27, 2019

Stockholders of Haynes International, Inc.:

The Annual Meeting of Stockholders of Haynes International, Inc. ("Haynes") will be held at the Hyatt Regency Indianapolis, One South Capitol Avenue, Indianapolis, Indiana 46204 on Wednesday, February 27, 2019 at 10:00 a.m. (EST) for the following purposes:

Only stockholders of record at the close of business on January 11, 2019 are entitled to notice of, and to vote at, the annual meeting.

YOUR VOTE IS IMPORTANT. EVEN IF YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED PROXY. A RETURN ENVELOPE IS PROVIDED FOR THIS PURPOSE.

By Order of the Board of Directors,

Janice W. Gunst

Corporate Secretary

January 25, 2019

Kokomo, Indiana

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on February 27, 2019: This Notice of Annual Meeting and Proxy Statement and the Company's Fiscal 2018 Annual Report are available in the "Investor Relations" section of the Company's website atwww.haynesintl.com

HAYNES INTERNATIONAL, INC. PROXY STATEMENT

TABLE OF CONTENTS

| | Page | |||

|---|---|---|---|---|

GENERAL INFORMATION | 1 | |||

PROPOSALS FOR 2020 ANNUAL MEETING | 2 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | 3 | |||

SECURITY OWNERSHIP OF MANAGEMENT | 4 | |||

PROPOSALS TO BE VOTED UPON | 5 | |||

ELECTION OF DIRECTORS | 5 | |||

Nominees | 5 | |||

Business Experience of Nominated Directors | 6 | |||

CORPORATE GOVERNANCE | 8 | |||

Board Committee Structure | 8 | |||

Meetings of the Board of Directors and Committees | 10 | |||

Meetings of Non-Management Directors | 11 | |||

Independence of the Board of Directors and Committee Members | 11 | |||

Family Relationships | 12 | |||

Conflict of Interest and Related Party Transactions | 12 | |||

Governance Committee and Director Nominations | 12 | |||

Code of Ethics | 13 | |||

Board of Directors' Role in Risk Oversight | 13 | |||

Communications with Board of Directors | 14 | |||

Director Compensation Program | 14 | |||

Compensation Committee Interlocks and Insider Participation | 16 | |||

EXECUTIVE COMPENSATION | 16 | |||

Compensation Committee Report | 16 | |||

Compensation Discussion and Analysis | 17 | |||

Compensation Tables and Narrative Disclosure | 30 | |||

CEO Pay Ratio | 45 | |||

AUDIT COMMITTEE REPORT | 46 | |||

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 46 | |||

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 47 | |||

ADVISORY VOTE ON EXECUTIVE COMPENSATION | 48 | |||

OTHER MATTERS | 49 | |||

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FEBRUARY 27, 2019

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Haynes International, Inc. ("Haynes" or the "Company") of proxies to be voted at the Annual Meeting of Stockholders to be held at 10:00 a.m. (EST) on Wednesday, February 27, 2019, and at any adjournment thereof. The meeting will be held at the Hyatt Regency Indianapolis, One South Capitol Avenue, Indianapolis, Indiana 46204. This proxy statement and the accompanying form of proxy were first mailed to stockholders of the Company on or about January 25, 2019.

A stockholder signing and returning the enclosed proxy may revoke it at any time before it is exercised by delivering written notice to the Corporate Secretary of Haynes, by filing a properly executed proxy bearing a later date or by attending the annual meeting and voting in person. The signing of a proxy does not preclude a stockholder from attending the annual meeting in person. All proxies returned prior to the annual meeting, and not revoked, will be voted in accordance with the instructions contained therein. Any executed proxy not specifying to the contrary will be voted as follows:

The vote with respect to approval of the compensation of the Company's Named Executive Officers is advisory in nature and will not be binding on the Company or the Board of Directors. Stockholders may also choose to abstain from voting on such matter.

As of the close of business on January 11, 2019, the record date for the annual meeting, there were outstanding and entitled to vote 12,517,492 shares of common stock of Haynes. Each outstanding share of common stock is entitled to one vote on each matter properly brought before the annual meeting and can be voted only if the record owner of that share, determined as of the record date, is present in person or represented by a properly completed proxy at the annual meeting. For beneficial owners, the brokers, banks or nominees holding shares for beneficial owners must vote those shares as

1

instructed. If the broker, bank or nominee has not received instructions from the beneficial owner, the broker, bank or nominee generally has discretionary voting power only with respect to matters that are considered routine matters. If you are not the record holder of your shares and want to attend the meeting and vote in person, you must obtain a legal proxy from your broker, bank or nominee and present it to the inspector of election with your ballot when you vote at the meeting. Haynes has no other voting securities outstanding. Stockholders do not have cumulative voting rights. All stockholders of record as of January 11, 2019 are entitled to notice of and to vote at the annual meeting.

A quorum will be present if holders of a majority of the outstanding shares of common stock are present, in person or by proxy, at the annual meeting. Shares registered in the names of brokers or other "street name" nominees for which proxies are voted on some, but not all, matters will be considered to be present at the annual meeting for quorum purposes, but will be voted only as to those matters as to which a vote is indicated, and will not be voted as to the matters with respect to which no vote is indicated (commonly referred to as "broker non-votes"). If a quorum is present, the nominees for director will be elected by a majority of the votes cast. Abstentions and broker non-votes are treated as votes not cast and will have no effect on the election of directors. The affirmative vote of the majority of the shares present and entitled to vote on the matter is required for adoption of the proposal to ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm and approval of the compensation of the Company's Named Executive Officers. Accordingly, abstentions applicable to shares represented at the meeting will have the same effect as votes against these proposals. Broker non-votes will have no effect on the outcome of the advisory proposal with respect to the compensation of the Company's Named Executive Officers because this is a non-routine matter for which brokers, banks or other nominees may not vote absent instructions, but will have the same effect as votes against the proposal to ratify the appointment of Deloitte & Touche LLP because this proposal is a routine matter for which brokers, banks or other nominees have discretionary voting power. With respect to any other proposals which may properly come before the annual meeting, proposals will be approved upon the affirmative vote of a majority of the shares of common stock present in person or represented by proxy and entitled to vote on such matters at the annual meeting.

A copy of the Haynes International, Inc. Fiscal Year 2018 Annual Report on Form 10-K, including audited financial statements and a description of operations for the fiscal year ended September 30, 2018, accompanies this proxy statement. The financial statements contained in the Form 10-K are not incorporated by reference in this proxy statement, but they do contain important information regarding Haynes.

This solicitation of proxies is being made by Haynes, and all expenses in connection with this solicitation of proxies will be borne by Haynes. Haynes expects to solicit proxies primarily by mail, but directors, officers and other employees of Haynes may also solicit proxies electronically, in person or by telephone.

PROPOSALS FOR 2020 ANNUAL MEETING

Stockholders desiring to submit proposals to be included in the Proxy Statement for the 2020 Annual Meeting pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), will be required to submit them to the Company in writing on or before September 27, 2019, provided that if the date of the 2020 Annual Meeting is more than 30 days from the anniversary of the 2019 Annual Meeting, then the deadline would be a reasonable time before Haynes begins to print and send its proxy materials. Any such stockholder proposal must also be proper in form and substance, as determined in accordance with the Exchange Act and the rules and regulations promulgated thereunder.

2

Stockholder proposals other than those to be included in the proxy statement for the 2020 Annual Meeting of Stockholders, pursuant to Rule 14a-8 must be submitted in writing to the Corporate Secretary of Haynes and received on or before November 29, 2019 and not earlier than October 30, 2019, provided however, that in the event that the 2020 Annual Meeting of Stockholders is called for a date that is not within twenty-five (25) days before or after the anniversary date of the 2019 Annual Meeting of Stockholders, notice by the stockholder in order to be timely must be submitted and received not later than the close of business on the tenth (10th) day following the day on which notice of the date of the 2020 Annual Meeting of Stockholders was mailed or public disclosure of the date of the 2020 Annual Meeting is made, whichever first occurs. In addition, any such stockholder proposal must be in proper written form. To be in proper written form, a stockholder proposal (i) other than with respect to director nominations must set forth as to each matter the stockholder proposes to bring before the 2020 Annual Meeting of Stockholders (a) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (b) the name and record address of the stockholder, (c) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the stockholder, (d) a description of all arrangements or understandings between the stockholder and any other person or persons (including their names) in connection with the proposal of such business by the stockholder and any material interest of the stockholder in such business and (e) a representation that the stockholder intends to appear in person or by proxy at the annual meeting to bring such business before the meeting and (ii) with respect to director nominations must set forth the information described under the heading "Governance Committee and Director Nominations" herein.

The mailing address of the principal executive offices of Haynes is 1020 West Park Avenue, P.O. Box 9013, Kokomo, Indiana 46904-9013.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Listed below are the only individuals and entities known by the Company to beneficially own more than 5% of the outstanding common stock of the Company as of January 11, 2019 (assuming that their holdings have not changed from such other date as may be shown below):

Name | Number | Percent(1) | |||||

|---|---|---|---|---|---|---|---|

BlackRock, Inc.(2) | 1,615,733 | 12.9 | % | ||||

T. Rowe Price Associates, Inc.(3) | 1,536,613 | 12.2 | % | ||||

The Vanguard Group(4) | 1,262,299 | 10.1 | % | ||||

Royce & Associates, LLC(5) | 1,137,816 | 9.1 | % | ||||

Dimensional Fund Advisors LP(6) | 1,056,339 | 8.4 | % | ||||

3

Represents sole voting power over 11,651 shares, shared voting power over 1,182 shares, sole dispositive power over 1,250,166 shares and shared dispositive power over 12,133 shares.

SECURITY OWNERSHIP OF MANAGEMENT

The following table shows the ownership of shares of the Company's common stock as of January 11, 2019 (except as described in any associated footnote), by each director, each person who held the office of Chief Executive Officer in fiscal 2018, the Chief Financial Officer and the other three most highly compensated officers during fiscal year 2018 (the "Named Executive Officers") and the directors and all executive officers as a group. Except as noted below, the directors and executive officers have sole voting and investment power over these shares of common stock. The business address of each person indicated is c/o Haynes International, Inc., 1020 West Park Avenue, P.O. Box 9013, Kokomo, Indiana 46904-9013.

Name | Number | Percent(1) | |||

|---|---|---|---|---|---|

Michael L. Shor(2) | 25,605 | * | |||

Mark Comerford(3) | 17,480 | * | |||

John C. Corey(4) | 22,449 | * | |||

Donald C. Campion(4) | 14,905 | * | |||

Robert H. Getz(4) | 15,425 | * | |||

Dawne S. Hickton(5) | 2,000 | * | |||

William P. Wall(4) | 13,906 | * | |||

Marlin C. Losch III(6) | 48,891 | * | |||

Daniel W. Maudlin(7) | 39,404 | * | |||

Scott R. Pinkham(8) | 49,342 | * | |||

Venkat R. Ishwar(9) | 42,562 | * | |||

All directors and executive officers as a group (16 persons)(10) | 407,656 | 3.20% | |||

4

to Mr. Comerford's former employment with the Company. The Company has no additional information regarding Mr. Comerford's holdings or transaction activity.

1 through 7. ELECTION OF DIRECTORS

The Amended and Restated By-Laws of the Company provide that the number of directors constituting the whole board shall be fixed from time to time by resolutions of the Board of Directors, but shall not be less than three nor more than nine directors. By resolution, the Board of Directors has fixed the number of directors at six. The terms of all incumbent directors will expire at the annual meeting. Directors elected at the annual meeting will serve for a term ending at the 2020 annual meeting of stockholders and until their respective successors are elected and qualified.

Upon the unanimous recommendation of the Corporate Governance and Nominating Committee, the Board of Directors has nominated six directors who served in fiscal 2018 for re-election at the annual meeting. The Board of Directors believes that all of its nominees will be available for

5

re-election at the annual meeting and will serve if re-elected. The directors nominated for re-election (the "Nominated Directors") are:

Name | Age on 12/31/18 | Current Position | Served as Director Since | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Robert H. Getz | 56 | Chairman of the Board; Director | 2006 | ||||||

| Donald C. Campion | 70 | Director | 2004 | ||||||

| John C. Corey | 71 | Director | 2004 | ||||||

| Dawne S. Hickton | 61 | Director | 2017 | ||||||

| Michael L. Shor | 59 | President and Chief Executive Officer; Director | 2012 | ||||||

| William P. Wall | 56 | Director | 2004 | ||||||

The Board of Directors recommends that stockholders vote FOR the election of all of the Nominated Directors. Unless authority to vote for any Nominated Director is withheld, the accompanying proxy will be voted FOR the election of all the Nominated Directors. However, the persons designated as proxies reserve the right to cast votes for another person designated by the Board of Directors in the event that any Nominated Director becomes unable to, or for any reason will not, serve. If a quorum is present, those nominees receiving a majority of the votes cast will be elected to the Board of Directors.

Business Experience of Nominated Directors

Robert H. Getz has been a director since March 31, 2006. Mr. Getz serves as Chairman of the Board and as a member of the Corporate Governance and Nominating Committee. Mr. Getz is Managing Partner and Founder of Pecksland Capital Partners, a private investment firm. Prior to 2016, Mr. Getz served as a Managing Director and Partner of Cornerstone Equity Investors, LLC, a private equity investment firm which he co-founded in 1996. Prior to the formation of Cornerstone, Mr. Getz served as a Managing Director and Partner of Prudential Equity Investors and Prudential Venture Capital. Mr. Getz has invested in and served on the board of several metals and mining companies and currently serves on the Board of Directors of Ero Copper (TSX:ERO.TO), where he serves as Chairman of the Compensation Committee and a member of the Governance Committee. Mr. Getz also serves on the board of Jaguar Mining (TSX: JAG.TO). Mr. Getz formerly served as a Director of NewMarket Gold Inc. and as Chairman of the Board of Crocodile Gold Corp prior to its acquisition by NewMarket Gold in 2015. The board believes that Mr. Getz's experience as an investor and extensive record as a director of other public and private companies, as well as his wide variety of operating experience, enables him to lead the board with his valuable perspective on a variety of strategic issues.

Donald C. Campion has been a director since August 31, 2004. Mr. Campion also serves as the Chairman of the Audit Committee and as a member of the Compensation Committee of the Board. Mr. Campion has also served on several company boards, both public and private. He currently serves on the board of MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT), a public company, where he is Chairman of the Audit Committee and is a member of the Compensation Committee. From 2013 through 2014, Mr. Campion was a member of the board of directors of Cash Store Financial, Inc., a publicly traded company with shares listed on the Toronto Stock Exchange and the New York Stock Exchange. Mr. Campion previously served as Chief Financial Officer of several companies, including VeriFone, Inc., Special Devices, Inc., Cambridge, Inc., Oxford Automotive, Inc. and Delco Electronics Corporation. The Board believes Mr. Campion's substantial tax and accounting experience built through his career in finance at several significant corporations, his work in engineering and lean manufacturing and his experience serving as a director of other companies make him well qualified to serve as a director. Mr. Campion's tax and accounting acumen also qualify him as the Company's Audit Committee financial expert.

6

John C. Corey has been a director since August 31, 2004. Mr. Corey also serves as a member of the Audit Committee and Compensation Committee of the Board. From January 2006 until his retirement in March 2015, Mr. Corey served as President, Chief Executive Officer and a director of Stoneridge, Inc., a global manufacturer of electrical and electronic components, modules and systems for the automotive, medium- and heavy-duty truck, agricultural and off-highway vehicle markets. From October 2000 through December 2005, Mr. Corey served as the President, Chief Executive Officer and a director of Safety Components International, Inc., a global manufacturer of automotive airbags. From January 2014 until December 31, 2015, Mr. Corey served on the board and was Chairman of the Motor Equipment Manufacturers Association, which represents the interests of suppliers to the motor vehicle industry. Mr. Corey has also served on several company boards, both public and private. The Board believes Mr. Corey's extensive experience as a President and Chief Executive Officer, garnered in service of a New York Stock Exchange listed corporation, as well as substantial operations, international and business development experience, make him well qualified to serve as a director.

Dawne S. Hickton has been a director since July 1, 2017. Ms. Hickton also serves as Chairperson of the Corporate Governance and Nominating Committee and a member of the Audit Committee of the Board. Ms. Hickton is the President and Founding Partner of Cumberland Highstreet Partners, Inc., an executive strategic consulting firm for manufacturing businesses. She is also a member of the boards of directors of Jacobs Engineering Group (NYSE: JEC) and Triumph Group, Inc. (NYSE: TGI). Ms. Hickton previously served as Vice Chairman, President and Chief Executive Officer of RTI International Metals, Inc. from 2007 until its sale to Alcoa Corporation in 2015. She is also a member of the board of the Federal Reserve Bank of Cleveland, the University of Pittsburgh board of trustees, the board of the International Titanium Association, where she founded Women in Titanium, and the board of the Smithsonian National Air & Space Museum. The Board believes that Ms. Hickton's leadership experience in specialty metals as well as her knowledge of Haynes' key markets are a benefit to Haynes.

Michael L. Shor served as the Company's interim President and Chief Executive Officer from May 29, 2018 through August 31, 2018 and was elected as the Company's President and Chief Executive Officer effective September 1, 2018. Mr. Shor has been a director since August 1, 2012, and served as Chairman of the Board from February 2017 through August 2018. Mr. Shor retired as Executive Vice President—Advanced Metals Operations & Premium Alloys Operations of Carpenter Technology Corporation on July 1, 2011 after a thirty-year career with Carpenter Technology. At Carpenter, Mr. Shor held managerial positions in technology, marketing and operations before assuming full responsibility for the performance of Carpenter's operating divisions. From November 2016 through February 2017, Mr. Shor was a member of the board of AG&E Holdings Inc. (OTC-QB: AGNU), a leading parts distributor and service provider to the casino and gaming industry. The Board believes Mr. Shor's extensive management experience, and specific specialty materials experience, provides valuable insight to lead the Company in its strategic direction, operational excellence and growth initiatives.

William P. Wall has been a director since August 31, 2004. Mr. Wall also serves as the Chairman of Compensation Committee and as a member of the Audit and Corporate Governance and Nominating Committees of the Board. Mr. Wall is a managing member of OQ Partners, LLC, a private investment firm headquartered in Lexington, MA. Mr. Wall is a member of the Board of Directors of STAAR Surgical, Inc. (NASDAQ: STAA), where he serves as Chairman of the Nominating and Governance Committee and a member of the Compensation Committee and Audit Committee. Mr. Wall was also a member of the Board of Directors of Altisource Residential Corporation (NYSE: RESI), where he served as Chairman of the Audit Committee, Chairman of the Nominating and Governance Committee and a member of the Compensation Committee until March 2018. From February 2006 until June 2015, Mr. Wall served as general counsel of Abrams Capital Management, LLC, a value-oriented investment firm headquartered in Boston. Prior to joining Abrams Capital, Mr. Wall was a partner at a

7

hedge fund for two years and was employed with Fidelity Investments for seven years, concluding as a Managing Director in its private investment group. The Board believes, in addition to his experience as an attorney, Mr. Wall provides financing and investment analysis experience as a result of his career in the investment management industry. Mr. Wall's leadership, investment and corporate governance experience enable him to advise the Company on its strategic direction, allocation of capital and management development.

The Board of Directors unanimously recommends that stockholders voteFOR the election of each of the nominated directors.

The Board of Directors had four standing committees in fiscal 2018: (i) an Audit Committee; (ii) a Compensation Committee; (iii) a Corporate Governance and Nominating Committee; and (iv) a Risk Committee. The Risk Committee was dissolved in December 2018 and its functions spread among the full Board, other Board committees and management, as appropriate. In reviewing its overall governance and committee structure and costs, the Board determined that the cost of the Risk Committee was not a necessary expense given the ability of the full Board, other committees of the Board and management to handle the committee's responsibilities.

The Audit Committee is currently composed of four members, Messrs. Campion (who chairs the Committee), Corey and Wall and Ms. Hickton, all of whom are independent under the definitions and interpretations of NASDAQ. Under the Audit Committee Charter, adopted by the Board of Directors and available in the investor relations section of the Company's website atwww.haynesintl.com, the Audit Committee is primarily responsible for, among other matters:

8

The Compensation Committee is currently composed of three members, Messrs. Wall (who chairs the Committee), Campion and Corey, all of whom are independent under the definitions and interpretations of NASDAQ. Under the Compensation Committee Charter, adopted by the Board of Directors and available in the investor relations section of the Company's website atwww.haynesintl.com, the Compensation Committee is primarily responsible for, among other matters:

The Corporate Governance and Nominating Committee is currently composed of three members, Ms. Hickton (who chairs the Committee) and Messrs. Getz and Wall, all of whom are independent under the definitions and interpretations of NASDAQ. Under the Governance Committee Charter, adopted by the Board of Directors and available in the investor relations section of the Company's website atwww.haynesintl.com, the Governance Committee is responsible for overseeing the performance and composition of the Board of Directors to ensure effective governance. The Governance Committee identifies and recommends the nomination of qualified directors to the Board of Directors as well as develops and recommends governance principles for the Company. The Governance Committee is primarily responsible for, among other things:

9

The Risk Committee was dissolved in December 2018 and its functions spread among the full Board, other Board committees and management, as appropriate. During fiscal 2018, the Risk Committee was composed of three members, Messrs. Corey (who chaired the Committee) and Campion and Ms. Hickton, all of whom are independent under the definitions and interpretations of NASDAQ. Under the Risk Committee charter, adopted by the Board of Directors and available in the investor relations section of the Company's website atwww.haynesintl.com, the Risk Committee was primarily responsible for, among other matters:

Meetings of the Board of Directors and Committees

The Board of Directors held fourteen meetings during the fiscal year ended September 30, 2018. During fiscal 2018, no member of the Board of Directors attended fewer than 75% of the aggregate of meetings of the Board of Directors and meetings of any committee of the Board of Directors of which he or she was a member. Scheduled meetings are supplemented by frequent informal exchanges of information and, on occasion, actions taken by unanimous written consent without meetings. All of the members of the Board of Directors are encouraged, but not required, to attend Haynes' annual meetings of stockholders. All of the members of the Board of Directors attended Haynes' 2018 annual

10

meeting in person. The following chart shows the number of meetings in fiscal 2018 of each of the standing committees of the Board of Directors at which a quorum was present:

Committee | Meetings in Fiscal 2018 | |||

|---|---|---|---|---|

Audit Committee | 8 | |||

Compensation Committee | 14 | |||

Corporate Governance and Nominating Committee | 6 | |||

Risk Committee | 4 | |||

Meetings of Non-Management Directors

Consistent with NASDAQ governance requirements, the non-management members of the Board of Directors meet in an executive session at least twice per year, and usually in connection with every regularly-scheduled in-person board meeting, to: (a) review the performance of the management team; (b) discuss their views on management's strategic planning and its implementation; and (c) address any other matters affecting the Company that may concern individual directors. The executive sessions are designed to ensure that the Board of Directors is not only structurally independent, but also is given ample opportunity to exercise independent thought and action. In fiscal 2018, the non-management directors met in executive session five times. When meeting in executive session, the presiding person was the Chairman. However, in the period from May 29, 2018 through September 1, 2018, during which time Mr. Shor served as the Chairman of the Board and the interim Chief Executive Officer, the presiding person was Mr. Wall, who was appointed as the lead independent director for that time period.

Independence of the Board of Directors and Committee Members

Except for Mr. Shor, all of the members of the Board of Directors, including each member of the Audit Committee, the Compensation Committee, the Governance Committee and the Risk Committee, meet the criteria for independence set forth in the rules and regulations of the Securities and Exchange Commission, including Rules 10A-3(b)(1) and 10C-1(b)(1) of the Exchange Act and the definitions and interpretations of NASDAQ. The Board of Directors has determined that Mr. Campion, the Chairman of the Audit Committee, is an "audit committee financial expert" (as defined by Item 407(d)(5)(ii) of Regulation S-K) and is "independent" (under the definitions and interpretations of NASDAQ).

The roles of Chairman and Chief Executive Officer are customarily split into two positions. However, between May 29, 2018 and September 1, 2018, Mr. Shor served as both Chairman of the Board and interim Chief Executive Officer of the Company. During that time, Mr. Wall served as the lead independent director of the Board. Mr. Shor resigned as Chairman when he became the Company's permanent Chief Executive Officer on September 1, 2018, and Mr. Getz was appointed as the Chairman of the Board at that time. The Board of Directors believes that separating these roles aligns the Company with best practices for corporate governance of public companies and accountability to stockholders. The Board also believes that the separation of roles provides a leadership model that clearly distinguishes the roles of the Board and management. The separation of the Chairman and Chief Executive Officer positions allows the Company's Chief Executive Officer to direct his or her energy toward operational and strategic issues while the non-executive Chairman focuses on governance and stockholders. The Company believes that separating the Chairman and Chief Executive Officer positions enhances the independence of the Board, provides independent business counsel for the Company's Chief Executive Officer and facilitates improved communications between Company management and Board members.

11

There are no family relationships among the directors and executive officers of the Company.

Conflict of Interest and Related Party Transactions

It is the Company's policy to require that all conflict of interest transactions between the Company and any of its directors, officers or 10% beneficial owners (each, an "insider") and all transactions where any insider has a direct or indirect financial interest, including related party transactions required to be reported under Item 404(a) of Regulation S-K, must be reviewed and approved or ratified by the Board of Directors. The material terms of any such transaction, including the nature and extent of the insider's interest therein, must be disclosed to the Audit Committee. The Audit Committee will then review the terms of the proposed transaction to determine whether the terms of the proposed transaction are fair to the Company and are no less favorable to the Company than those that would be available from an independent third party. Following the Audit Committee's review and discussion, the proposed transaction will be approved or ratified only if it receives the affirmative votes of a majority of the members of the Audit Committee who have no direct or indirect financial interest in the proposed transaction, even though the disinterested directors may represent less than a quorum. Interested directors may be counted in determining the presence of a quorum at a meeting of the Audit Committee which authorizes the contract or transaction. Haynes did not enter into any transactions in fiscal 2018 with any insider.

Governance Committee and Director Nominations

Nominees for the Board of Directors are currently recommended for nomination to the Board of Directors by the Governance Committee. The Governance Committee bases its recommendation for nomination on criteria that it believes will provide a broad perspective and depth of experience in the Board of Directors. In general, when considering independent directors, the Governance Committee will consider the candidate's experience in areas central to the Company, such as business, finance and legal and regulatory compliance, as well as considering the candidate's personal qualities and accomplishments and their ability to devote sufficient time and effort to their duties as directors. Important areas of experience and expertise include manufacturing, international operations, finance and the capital markets, accounting and experience as a director of other companies. The Governance Committee does not have a formal diversity policy but considers diversity as one criteria evaluated as a part of the total package of attributes and qualifications a particular candidate possesses. The Governance Committee construes the notion of diversity broadly, considering differences in viewpoint, professional experience, education, skills and other individual qualities, in addition to race, gender, age, ethnicity and cultural background as elements that contribute to a diverse Board. The Governance Committee has adopted Corporate Governance Guidelines which establish, among other matters, a mandatory retirement age for Board members of 72, subject to exceptions that may be granted by the Board.

Although the Governance Committee has no formal policy regarding the consideration of director candidates recommended by stockholders, the Committee will consider candidates recommended by stockholders, provided the names of such persons, accompanied by relevant biographical information, are properly submitted in writing to the Secretary of the Company in accordance with the procedure described below for stockholder nominations. Candidates recommended by stockholders are evaluated in the same manner using the same criteria as candidates not so recommended.

Stockholders may nominate directors by providing timely notice thereof in proper written form to the Secretary of Haynes. To be timely, a stockholder's notice to the Secretary must be delivered to or mailed and received at Haynes' principal executive offices (a) in the case of an annual meeting, not less than ninety days nor more than one hundred twenty days prior to the anniversary date of the

12

immediately preceding annual meeting; provided, however, that in the event that the annual meeting is called for a date that is not within twenty-five days before or after such anniversary date, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth day following the day on which notice of the date of the annual meeting is mailed or public disclosure of the date of the annual meeting is made, whichever first occurs; and (b) in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which notice of the date of the special meeting is mailed or public disclosure of the date of the special meeting is made, whichever first occurs.

To be in proper written form, a stockholder's notice to the Secretary must set forth (a) as to each person whom the stockholder proposes to nominate for election as a director (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the person and (iv) any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and (b) as to the stockholder giving the notice (i) the name and record address of such stockholder, (ii) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such stockholder, (iii) a description of all arrangements or understandings between such stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder, (iv) a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice and (v) any other information relating to such stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. Such notice must be accompanied by a written consent of each proposed nominee to being named as a nominee and to serving as a director if elected.

The Company has adopted a Code of Business Conduct and Ethics that applies to its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, as well as to its directors and other officers and employees. This Code is posted on the Company's website atwww.haynesintl.com/CodeofBusinessConductandEthics.pdf.

Board of Directors' Role in Risk Oversight

As a part of its oversight function, the Board of Directors monitors how management operates the Company. In fiscal 2018, the Risk Committee acted as the primary tool to keep risk as an important part of the Board's and the various committees' deliberations throughout the year by working with management to identify and prioritize enterprise risks—the specific financial, operational, business and strategic risks that the Company faces, whether internal or external. With the dissolution of the Risk Committee in December 2018, those functions were distributed among the full Board, other committees of the Board and management, as appropriate. Certain strategic and business risks, such as those relating to the Company's products, markets and capital investments, are overseen by the entire Board of Directors. The Audit Committee oversees management of market and operational risks that could have a financial impact, such as those relating to internal controls or liquidity. The Corporate Governance and Nominating Committee manages the risks associated with governance issues, such as the independence of the Board of Directors, and the Compensation Committee manages risks relating to the Company's compensation plans and policies.

13

In addition to the formal compliance program, the Board of Directors encourages management to promote a corporate culture that understands risk management and incorporates it into the overall corporate strategy and day-to-day business operations of the Company. The Company's risk management structure also includes a standing enterprise risk management committee comprised of members of the executive team and a Chief Risk Officer, collectively undertaking an ongoing effort to assess and analyze the most likely areas of future risk for the Company and to address them in its long-term planning process.

Communications with Board of Directors

Stockholders may communicate with the full Board of Directors by sending a letter to Haynes International, Inc. Board of Directors, c/o Corporate Secretary, 1020 West Park Avenue, P.O. Box 9013, Kokomo, Indiana 46904-9013. The Company's Corporate Secretary will review the correspondence and forward it to the chairman of the appropriate committee or to any individual director or directors to whom the communication is directed, unless the communication is unduly hostile, threatening, illegal, does not reasonably relate to the Company or its business or is similarly inappropriate. In addition, interested parties may contact the non-management directors as a group by sending a written communication to the Corporate Secretary as directed above. Such communication should be clearly addressed to the non-management directors.

Directors who are also Company employees do not receive compensation for their services as directors. Following is a description of the Company's compensation program for non-management directors in fiscal 2018. In consultation with its independent compensation consultant, Total Rewards Strategies, the Compensation Committee reviews the compensation paid to non-management directors and recommends changes to the Board of Directors, as appropriate.

Director Compensation Table

The following table provides information regarding the compensation paid to the Company's non-employee members of the Board of Directors in fiscal 2018.

Name | Fees Earned or Paid in Cash ($) | Restricted Stock Awards ($)(1) | Dividends on Stock Awards ($) | Total ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

R. H. Getz, Chairman | $ | 156,250 | $ | 84,164 | $ | 2,332 | $ | 242,746 | |||||

D. C. Campion, Director | $ | 122,500 | $ | 84,164 | $ | 2,332 | $ | 208,996 | |||||

J. C. Corey, Director | $ | 102,500 | $ | 84,164 | $ | 2,332 | $ | 188,996 | |||||

D. S. Hickton, Director | $ | 125,000 | $ | 104,808 | $ | 2,904 | $ | 232,712 | |||||

W. P. Wall, Director | $ | 150,000 | $ | 84,164 | $ | 2,332 | $ | 236,496 | |||||

The compensation earned by Mr. Shor as a non-employee director during fiscal 2018 is disclosed in the Summary Compensation table.

14

Director Compensation Analysis

Total Rewards Strategies, the Compensation Committee's independent compensation consulting firm, reviewed the Board of Directors' total compensation in fiscal 2018, including Board of Directors and Committee annual retainers and restricted stock grants. Specifically, Total Rewards Strategies provided a report to the Compensation Committee evaluating the Haynes fiscal 2017 director compensation and the comparator group companies' (as identified under "Committee Procedures") director compensation and making recommendations with respect to Haynes' fiscal 2018 director compensation. Based upon its review of this information, the Compensation Committee, in consultation with Total Rewards Strategies, decided to maintain the existing director compensation structure for 2018.

Annual Retainer

Non-management members of the Board of Directors receive a $60,000 annual retainer related to their Board of Directors duties and responsibilities, which is paid in four equal installments of $15,000 each. Additionally, there is a $40,000 annual retainer for serving as Chairman of the Board, also paid in four equal installments. The Company reimburses directors for their out-of-pocket expenses incurred in attending meetings of the Board of Directors or any committee thereof and other expenses incurred by directors in connection with their service to the Company.

Committee Fees

Directors receive an additional annual retainer of $15,000 for each standing committee on which they serve, paid in four equal installments. In addition, there is a $17,500 annual retainer for serving as the chairman of the Audit Committee, a $12,500 annual retainer for serving as the chairman of the Compensation Committee or the Risk Committee and a $10,000 annual retainer for serving as the chairman of any other committee of the Board of Directors. In fiscal 2017, the Board of Directors formed a Strategic Committee for the purposes of reviewing and analyzing potential acquisitions and capital allocation. Committee members received retainers ranging from $35,000 for committee members to $50,000 for the committee chair in fiscal 2018.

Equity Compensation

On November 20, 2017, each director was granted 2,650 shares of restricted stock, except for Ms. Hickton who was granted 3,300 shares, pursuant to the Haynes International, Inc. 2016 Incentive Compensation Plan. The additional number of shares granted to Ms. Hickton was attributable to her service as a director from the time of her appointment in July 2017 through September 30, 2017. In granting the awards, the Compensation Committee considered information provided by Total Rewards Strategies on methods of encouraging long-term stock ownership by directors, as well as information regarding how comparator group companies utilized restricted or deferred stock. The shares of restricted stock will vest in full on the earlier of (i) the first anniversary of the grant date, or (ii) the failure of the director to be re-elected at an annual meeting of the stockholders of the Company as a result of the director being excluded from the nominations for any reason other than "cause" as defined in the 2016 Incentive Compensation Plan.

The Company adopted a deferred compensation plan for directors and executives in 2017 that permits directors to defer up to 100% of their cash retainers and up to 100% of their annual equity grant. Each non-employee director elected to defer the receipt of shares upon vesting to a later date. That election also resulted in deferral of the receipt of dividends throughout fiscal 2018 on restricted stock held on the record date of each dividend paid during the year.

15

Director Stock Retention Guidelines

The Board of Directors approved stock ownership guidelines for non-employee members of the Board of Directors effective January 1, 2014. The guidelines provide that directors own common stock equal to 400% of their annual retainer within five (5) years of their date of election to the Board. For purposes of this calculation, shares owned by an individual include shares or other equity interests owned directly or indirectly, including those subject to risk of forfeiture (but not forfeited) under the Company's 2009 Restricted Stock Plan or under the 2016 Incentive Compensation Plan, as applicable, and shares subject to a deferral election. The guidelines also provide that directors retain a certain amount of stock (based upon the value of shares owned) after meeting the ownership goal. As of September 30, 2018 all of the directors met the ownership goal other than Ms. Hickton who joined the

Board in 2017 and has not reached the five (5) year anniversary applicable to the goal. It is expected that Ms. Hickton will timely meet the ownership goal.

The share ownership amount for each director as of September 30, 2018 is summarized below.

Name | Number of Shares Owned | Number of Deferred Shares | Number of Non Vested Shares | Total Share Ownership | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

R. H. Getz | 15,425 | 2,650 | — | 18,075 | |||||||||

D. C. Campion | 14,905 | 2,650 | — | 17,555 | |||||||||

J. C. Corey | 22,449 | 2,650 | — | 25,099 | |||||||||

D. S. Hickton | 2,000 | 3,300 | — | 5,300 | |||||||||

W. P. Wall | 13,906 | 2,650 | — | 16,556 | |||||||||

Indemnification Agreements

Pursuant to individual written agreements, the Company indemnifies all of its directors against loss or expense arising from such individuals' service to the Company and its subsidiaries and affiliates and advances attorneys' fees and other costs of defense to such individuals in respect of claims that may be eligible for indemnification under certain circumstances.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee as of September 30, 2018 were Messrs. Wall, Campion and Corey. None of the members of the Compensation Committee are now serving or previously have served as employees or officers of the Company or any subsidiary, and none of the Company's executive officers serve as directors of, or in any compensation related capacity for, companies with which members of the Compensation Committee are affiliated.

The Compensation Committee of the Board of Directors has reviewed and discussed the following Compensation Discussion and Analysis with management and, based on such review and discussion, has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2018.

SUBMITTED BY THE COMPENSATION COMMITTEE

William P. Wall, Chair

Donald C. Campion

John C. Corey

16

Compensation Discussion and Analysis

2018 Business Summary

In fiscal 2018, the Company:

Overview

This Compensation Discussion and Analysis describes the key principles and approaches used to determine the compensation in fiscal 2018 for Mark M. Comerford and Michael L. Shor, the Company's principal executive officers in fiscal 2018; Daniel W. Maudlin, the Company's principal financial officer; and Scott R. Pinkham, Venkat R. Ishwar and Marlin C. Losch III, the Company's other three most highly compensated executive officers in fiscal 2018. Detailed information regarding the compensation of these executive officers, who are referred to as "Named Executive Officers" or "NEOs", appears in the tables following this Compensation Discussion and Analysis. This Compensation Discussion and Analysis should be read in conjunction with those tables.

This Compensation Discussion and Analysis consists of the following parts:

Responsibility for Executive Compensation Decisions

Role of Executive Officers in Compensation Decisions

Executive Compensation Philosophy and Principles

Committee Procedures

Setting Named Executive Officer Compensation in Fiscal 2018

Responsibility for Executive Compensation Decisions

The Compensation Committee of the Board of Directors, whose membership is limited to independent directors, acts pursuant to a Board-approved charter. The Compensation Committee is responsible for approving the compensation programs for all executive officers, including the Named Executive Officers, and making decisions regarding specific compensation to be paid or awarded to them. The Compensation Committee has responsibility for establishing and monitoring adherence to the Company's compensation philosophies and objectives. The Compensation Committee aims to ensure that the total compensation paid to the Company's executives, including the NEOs, is fair, reasonable and competitive. Although the Compensation Committee approves all elements of an executive officer's compensation, it approves equity grants and certain other incentive compensation subject to approval by the full Board of Directors.

Role of Executive Officers in Compensation Decisions

No Named Executive Officer participates directly in the determination of his or her compensation. For Named Executive Officers other than himself, the Company's Chief Executive Officer provides the Compensation Committee with performance evaluations and presents individual compensation recommendations to the Compensation Committee, as well as compensation program design

17

recommendations. The Chief Executive Officer's performance is evaluated by the Board of Directors. Mr. Comerford's fiscal 2018 base salary was established by the employment agreement he renewed in fiscal 2017, as modified by subsequent Compensation Committee actions. Mr. Shor's salary was established by the Interim Executive Employment Agreement between Mr. Shor and the Company for the period of May 29, 2018 through August 31, 2018 and by the Executive Employment Agreement between Mr. Shor and the Company on and after September 1, 2018. The Chief Executive Officer and the Chief Financial Officer work closely with the Compensation Committee on the development of the financial targets and overall compensation awardable to the Named Executive Officers under the Company's Management Incentive Plan ("MIP") as those amounts are based on the annual operating budget. The Compensation Committee retains the full authority to modify, accept or reject all compensation recommendations provided by management.

Executive Compensation Philosophy and Objectives

The Company's compensation program is designed to attract, motivate, reward and retain key executives who drive the Company's success and enable it to consistently achieve corporate performance goals in the competitive high-performance alloy business and increase stockholder value. The Company seeks to achieve these objectives through a compensation package that:

In addition to aligning management's interests with the interests of the stockholders, a key objective of the Company's compensation plan is mitigating the risk in the compensation package by ensuring that a significant portion of compensation is based on the long-term performance of the Company. This reduces the risk that executives will place too much focus on short-term achievements to the detriment of the long-term sustainability of the Company.

As part of its oversight responsibilities, the Compensation Committee, along with a cross-functional team with representatives from Human Resources, Legal and Finance, annually evaluates the risks arising from the Company's compensation policies and practices, with the assistance of its independent compensation consultant. The Committee considered, among other factors, the design of the incentive compensation programs, which are closely linked to corporate performance, the mix of short-term and long-term compensation, the maximum payout levels for short- term and long-term incentives, the distribution of compensation between equity and cash and other factors that mitigate risk. The Committee concluded that the Company's compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company.

18

At the Company's 2018 annual meeting of stockholders, the stockholders voted on a non-binding advisory proposal to approve the compensation of the Named Executive Officers. Approximately 97.34% of the shares voted on the proposal were voted in favor of the proposal. In light of the approval by a substantial majority of stockholders of the compensation programs described in the Company's 2018 proxy statement, the Compensation Committee did not implement material changes to the executive compensation programs as a result of the stockholders' advisory vote.

2018 Compensation Plan Highlights

The design of the Company's executive compensation program for 2018 was generally consistent with the design of the 2017 program. The Company made several enhancements in 2017 to further drive the pay-for-performance philosophy, combined with ongoing use of many best practices, to align executive compensation and shareholder value creation. These enhancements were continued in fiscal 2018. The following table highlights the features of the program:

• Pay-for-performance philosophy • Pay positioning philosophy relative to comparator group and mix of base salary and annual and long-term incentive compensation • Annual incentive compensation metrics • Change-in-control agreements with best practice features (double-trigger severance, less than three times base salary and target bonus, no tax gross-up, no enhanced retirement benefits) • Compensation risk assessment | • Performance share awards to enhance the balance of the long-term incentive program, together with stock options and restricted stock • Relative total shareholder return (TSR) as performance share metric to ensure alignment with shareholders • Clawback policy consistent with SEC proposed regulations mandated by Dodd-Frank • Share ownership requirement for management and directors • Limited perquisites |

Committee Procedures

The Compensation Committee retains the services of Total Rewards Strategies, an independent compensation consulting firm, to analyze the compensation and financial data of a comparator group of companies. Total Rewards Strategies also provides the Compensation Committee with alternatives to consider when making compensation decisions and provides opinions on compensation recommendations the Compensation Committee receives from management. Total Rewards Strategies provided analyses and opinions regarding executive compensation trends and practices to the Compensation Committee during fiscal 2017 and fiscal 2018. Total Rewards Strategies did not provide any services to the Company other than compensation consulting to the Compensation Committee in fiscal 2017 or fiscal 2018. Total Rewards Strategies' work for the Company in fiscal 2018 did not raise any conflicts of interest.

Comparator Group

19

| Aegion | II-VI | Patrick Industries | |||

AZZ | Insteel Industries | Quaker Chemical | |||

Calgon Carbon | KEMET | Quanex Building Products | |||

Carpenter Technology | L.B. Foster | Rogers | |||

CIRCOR | LMI Aerospace | Shiloh Industries | |||

Compass Minerals | Materion Corporation | Skyline | |||

CTS | Myers Industries | Stoneridge | |||

Ducommun | NN | Supreme Industries | |||

EnPro Industries | Northwest Pipe | Titan International | |||

Franklin Electric | Olympic Steel | Universal Stainless & Alloy |

Market Rates

Among other analyses, Total Rewards Strategies provides the 50th percentile, or median, of the comparator group for base salary, cash bonus, long-term incentives and total overall compensation, or the Median Market Rate. The Compensation Committee uses the Median Market Rate as a primary reference point when determining compensation targets for each element of pay. When individual and targeted company financial performance is achieved, the objective of the executive compensation program is to provide overall compensation near the Median Market Rate of pay practices of the comparator group of companies. Actual target pay for an individual may be more or less than the Median Market Rate based on the Compensation Committee's evaluation of the individual's performance, experience and potential.

Consistent with the Compensation Committee's philosophy of pay for performance, incentive payments can exceed target levels only if overall Company financial targets are exceeded and will fall below target levels if overall financial goals are not achieved.

Setting Named Executive Officer Compensation in Fiscal 2018

Effective May 29, 2018, upon the announced departure of Mr. Comerford, Michael L. Shor was appointed interim President and Chief Executive Officer of the Company and on September 1, 2018 he was appointed permanent President and Chief Executive Officer of the Company. The disclosures regarding Mr. Shor's fiscal 2018 compensation within this section should be read with that background and in conjunction with the disclosures provided under the "CEO Compensation" section and the notes to the "Summary Compensation Table" provided herein.

Components of Compensation

The chief components of each Named Executive Officer's compensation in fiscal 2018 were:

20

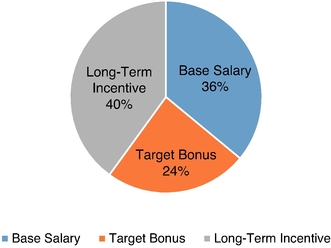

Each element of compensation is designed to achieve a specific purpose and to contribute to a total package that is competitive, appropriately performance-based and valued by the Company's executives. The Compensation Committee reviews information provided by Total Rewards Strategies and the Company's historical pay practices to determine the appropriate level and mix of compensation. In allocating compensation among elements, the Company believes the compensation of the Company's most senior executives, including the Named Executive Officers, who have the greatest ability to influence Company performance, should be predominately performance-based. As a result of this strategy, 64% of the Named Executive Officers' total target compensation, including the Chief Executive Officer's compensation, was allocated to performance-based pay in fiscal 2018.

Fiscal 2018 Target Compensation

Base Salary

The Company provides executives with a base salary that is intended to attract and retain the quality of executives needed to lead the Company's complex businesses. Base salaries for executives are generally targeted at the Median Market Rate of the comparator group, although individual performance, experience, internal equity, compensation history and contributions of the executive are also considered. The Committee reviews base salaries for Named Executive Officers annually and may make adjustments based on individual performance, experience, market competitiveness, internal equity and the scope of responsibilities.

21

The base salaries of the Named Executive Officers were generally increased in fiscal 2018. The following table provides annualized base salary information for the Named Executive Officers effective July 1, 2017 and base salary as of July 1, 2018 as a percentage of the median market rate for 2018:

Named Executive Officer | Base Salary as of July 1, 2017 | Base Salary as of July 1, 2018 | Base Salary as a Percentage of Median Market Rate for 2018 | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Michael L. Shor(1) | N/A | $ | 400,000 | 60 | % | |||||

Mark M. Comerford(2) | $ | 619,000 | $ | 619,000 | 92 | % | ||||

Daniel W. Maudlin | $ | 275,000 | $ | 280,500 | 79 | % | ||||

Scott R. Pinkham | $ | 271,500 | $ | 277,000 | 98 | % | ||||

Venkat R. Ishwar | $ | 273,500 | $ | 279,000 | 99 | % | ||||

Marlin C. Losch III | $ | 262,750 | $ | 268,100 | 101 | % | ||||

Management Incentive Plan—Annual Cash Incentive

The purpose of the MIP is to provide an annual cash bonus based on the achievement of specific operational and financial performance targets, tying compensation to the creation of value for stockholders. Target cash bonus awards are determined for each executive position by competitive analysis of the comparator group. In general, the median annual cash bonus opportunity of the comparator group is used to establish target bonus opportunities, but consideration is given to the individual executive's responsibilities and contributions to business results and internal equity. The MIP allows the Board of Directors discretion to administer the plan, including not paying out any compensation thereunder, accounting for unforeseen one-time transactions or adjusting the performance measures based on external economic factors. MIP payments are made on a sliding scale in accordance with established performance targets and are earned as of the end of the applicable fiscal year. MIP payments are sometimes referred to herein as a "bonus".

For fiscal 2018, the target performance level was established by the Company's consolidated annual operating budget. The annual operating budget is developed by management and presented by the CEO and the CFO to the Board of Directors for its review and approval. The target was intended to represent corporate performance which the Board of Directors believed was more likely than not to be achieved based upon management's presentation of the annual operating budget. For fiscal 2018, the Compensation Committee established income (loss) before income taxes, excluding the impacts of special charges, as the sole financial goal for MIP payouts.

The Board of Directors establishes income and performance goals in order the align the interests of management with those of the Company's stockholders. For fiscal years 2016 and 2017, no MIP payments were made based upon the Company's financial performance in those years. Based upon fiscal 2018's income (loss) before income taxes, MIP payments in excess of the minimum threshold but less than target were made for fiscal 2018.

22

The table below lists the 2018 MIP incentive awards that could have been earned at the minimum, target and maximum levels by each Named Executive Officer as a percentage of his base salary:

| | MIP Incentive as % of Base Salary | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Named Executive Officer | Minimum | Target | Maximum | |||||||

Michael L. Shor(1) | 40 | % | 80 | % | 120 | % | ||||

Mark M. Comerford | 40 | % | 80 | % | 120 | % | ||||

Daniel W. Maudlin | 30 | % | 60 | % | 90 | % | ||||

Scott R. Pinkham | 30 | % | 60 | % | 90 | % | ||||

Venkat R. Ishwar | 25 | % | 50 | % | 75 | % | ||||

Marlin C. Losch III | 25 | % | 50 | % | 75 | % | ||||

The following table sets forth the targets for net income (loss) before income taxes, as well as actual net income (loss) before income taxes adjusted for special charges for fiscal 2018:

| ($ in thousands) | Net Income before income taxes | |||

|---|---|---|---|---|

Threshold | $ | (1,639 | ) | |

Target | $ | 1,803 | ||

Maximum | $ | 8,195 | ||

Fiscal 2018 Actual Net Loss Before Income Taxes (Adjusted for Special Charges of $2,786) | $ | (1,268 | ) | |

Long-Term Incentives

Stockholders approved the 2016 Incentive Compensation Plan on March 1, 2016. Grants were made under that plan in fiscal 2018. The plan provides the Company with a means to grant compensation awards designed to attract and retain key management, including the Named Executive Officers. The Compensation Committee administers the plan and believes awards available under the plan provide an appropriate incentive to produce superior returns to stockholders over the long term by offering participants an opportunity to benefit from stock appreciation through stock ownership.

Competitive benchmarking to the comparator group, the executive's responsibilities and the individual's contributions to the Company's business results determine the level of long-term compensation. In general, the median value of long-term compensation in the comparator group is used to determine the approximate value of long-term incentives. Fair value methodologies, which are consistent with the Company's expensing of equity awards under Financial Accounting Standards Board ASC Topic 718 Compensation—Stock Compensation, were used in fiscal 2018 to determine the value of stock options.

The Company currently does not have any formal plan requiring it to grant equity compensation on specified dates. With respect to newly hired or promoted executives, the Company's practice is typically to consider stock equity grants at the first meeting of the Compensation Committee and Board of Directors following such executive's hire date. The recommendations of the Compensation Committee are subsequently submitted to the Board of Directors for approval. The Compensation Committee intends to ensure that the Company avoids equity grants in connection with the release, or the withholding, of material non-public information, and that the grant value of all equity awards is

23

equal to the fair market value on the date of grant, which is determined using the closing price on the trading day prior to the grant date. The Compensation Committee considers whether or not to grant additional equity awards to the management team on an annual basis.

The amount of equity compensation is determined by the Committee as part of the total mix of compensation, including base salary, long-term incentive compensation and short-term incentive compensation. The Committee uses information provided by its compensation consultant regarding the composition and median value of equity compensation for equivalent executive officers in the comparator group as a reference point in its analysis of appropriate equity compensation for the CEO and the other Named Executive Officers. The Committee then applies its judgment and experience to balance the following factors in determining equity compensation for the CEO and the other Named Executive Officers:

The Committee believes that a combination of performance shares, time-based restricted stock and stock options aligns the executive's interests with those of the stockholders and provides an appropriate balance between long-term stock price appreciation and executive retention. In fiscal 2018, the equity grants to the NEOs consisted of twenty-five percent (25%) stock options, thirty-five percent (35%) performance shares and forty percent (40%) time-based restricted stock.

Clawback Policy

The Board of Directors has adopted a clawback policy that is consistent with the currently proposed SEC regulations mandated by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010. If needed to comply with the final regulations when issued, the Board of Directors will make changes to that policy.

Anti-Pledging Policy

Pledging is the practice in which a director or executive secures a loan by using equity compensation obtained from the Company as collateral to secure the loan ("Pledging"). Any director, executive officer or other employee of the Company is prohibited from Pledging.

Stock Ownership and Retention Guidelines

On September 23, 2013, the Board of Directors approved stock ownership guidelines applicable to executive officers and members of the Board of Directors, and those guidelines were subsequently updated. The guidelines became effective on January 1, 2014 and established the goal that, within five (5) years from the effective date or date of hiring, promotion or election, executive officers and directors each own an amount of the Company's common stock determined based upon a multiple of base salary, in the case of executive officers, or annual retainer, in the case of board members. The multiples are as follows: in the case of the Chief Executive Officer, 300% of base salary; in the case of all other named executive officers, 200% of base salary; in the case of other executive officers, 100% of base salary; and in the case of non-employee members of the Board of Directors, 400% of annual

24

retainer. The calculation of shares owned by an individual includes shares or other equity interests owned directly or indirectly, including those subject to risk of forfeiture (but not forfeited) under the Company's 2009 Restricted Stock Plan or under the 2016 Incentive Compensation Plan, as applicable, including performance shares at target amount, whether or not then earned, shares subject to a deferral election and shares subject to exercisable stock options with exercise prices lower than then current market value. The guidelines also require that executive officers and directors retain a certain amount of stock (based upon value of shares owned) after meeting the ownership goal.

Stock Options

All options granted to the Company's NEOs (other than for the option grant made to Mr. Shor in fiscal 2018) vest in three equal annual installments on the first, second and third anniversaries of the grant date. The Company currently grants stock option awards under the 2016 Incentive Compensation Plan.

The Compensation Committee granted stock options to the management team, including the Named Executive Officers who were officers at that time, in November 2017. The Compensation Committee believes that the stock options, in conjunction with the other elements of compensation described herein, align management's interests with those of the stockholders and will provide no return whatsoever if stockholders do not also realize gains. In determining the number of shares underlying the options to be granted to the Named Executive Officers (other than to Mr. Shor), the Compensation Committee established the value of such shares underlying the options at $9.74 for the November 2017 grant using a fair value methodology. The Compensation Committee then set a total pool of options for grant to all executive officers of approximately $0.6 million.

Restricted Stock and Performance Shares

Grants of restricted stock and performance shares vest in accordance with the terms and conditions established by the Compensation Committee. In fiscal 2018, the Compensation Committee set restrictions on the vesting of the performance share grants based on the achievement of specific performance goals, while vesting of the restricted stock grants is time-based.

Restricted stock and performance share grants are subject to forfeiture if employment or service terminates prior to the end of the vesting period or, in the case of performance shares, if performance goals are not met. The Company assesses, on an ongoing basis, the probability of whether performance criteria will be achieved. The Company will recognize compensation expense over the performance period if it is deemed probable that the goal will be achieved. The fair value of the Company's restricted stock is determined based upon the closing price of the Company's common stock on the trading day before the grant date. The plan provides for the adjustment of the number of shares covered by an outstanding grant and the maximum number of shares for which restricted stock may be granted in the event of a stock split, extraordinary dividend or distribution or similar recapitalization event. Outstanding shares of restricted stock are entitled to receive dividends on shares of common stock.

Vesting or Forfeiture of 2016 Fiscal Year Grants

On November 24, 2015, executives, including the Named Executive Officers, were granted restricted stock. Two types of restricted shares were granted: those with performance-based vesting and those with time-based vesting. For the grant of performance-based restricted shares, the Compensation Committee established a three-year net income performance goal for the period of October 1, 2015 through September 30, 2018, which determined whether those restricted shares vested or were forfeited. The performance-based shares would have vested in equal installments on the first, second, and third anniversaries of the grant date provided that (a) the recipient was still an employee of the

25

Company on such date, and (b) the Company had met annual net income performance goals set by the Company's Compensation Committee, provided that, if the Company had exceeded the total net income performance goal for the three year period, restricted shares that did not vest due to the Company's failure to meet the annual net income performance goals may have vested at the end of such three year period. Participants must be employees at the end of the performance period to receive a payout, except in the event of death, disability or change in control.