- HAYN Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Haynes International (HAYN) DEF 14ADefinitive proxy

Filed: 22 Jan 21, 4:19pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Haynes International, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

January 22, 2021

As fiscal year 2021 begins, we look back on a very unusual year. Fiscal 2020 was characterized not only by the challenging business and personal impacts of COVID-19, but also by the positive team-wide efforts to address the many challenges our company has faced, and continues to face, during this unprecedented time. I'm so very proud of how our employees worked to protect each other's health and safety and how our team set and accomplished goals related to significant cash generation and improvement of our long term cost structure and future profitability. Our team is continuing to strategically position our company to emerge from this downturn with a competitive advantage through the supply of our high-value differentiated products and services.

We are an industry leader in developing nickel- and cobalt-based high performance alloys, identifying applications for our existing and new alloys and providing support to our customers to help them meet their specialized and demanding requirements. While volumes in our first two quarters of fiscal 2020 were negatively impacted by the halt in production of the Boeing 737MAX, the final two quarters also bore the full impact of the pandemic. Our customers across all markets significantly pulled back on orders to conserve cash, and excess inventory existed across all relevant supply chains. Haynes experienced a 22.4% drop in our year on year revenues and a 34.8% reduction in our backlog. This revenue drop led to both a net loss for fiscal 2020 and a temporary halt of the significant momentum we had previously established with gross margin percentage improvement. We quickly addressed the COVID-19 issues directly, first instituting all appropriate safety protocols, then pivoting to a focus on cash generation and reducing our cost structure wherever possible, including salary decreases and an approximately 16% reduction in our overall workforce.

I firmly believe that the future for Haynes is bright. We are a strong company. In our nearly 109-year history, this company, in various ownership forms, has overcome several significant issues, including the Great Depression, the aftermath of the terrorist attacks of September 11, 2001 in the aerospace industry and the COVID-19 pandemic. Until last March, when the pandemic started to have a major effect on the economy, our aerospace growth was steady and strong. With the potential vaccines and the Boeing 737MAX approvals, we are expecting the pre-pandemic fundamentals to once again drive aerospace growth in the future.

While fiscal 2020 was a difficult year, our team executed very well. Examples of the progress made across our entire workforce are as follows:

Finally, my sincere thanks to our shareholders and everyone at Haynes. Our employees have set goals, established metrics, exhibited accountability for results and driven a performance-based mentality into our company. We look forward to our markets improving, and, in conjunction with our safety, cash, price, cost and growth initiatives, showing our shareholders what our business is capable of achieving.

We wish everyone a healthy and safe 2021.

Sincerely,

Michael L. Shor

President and Chief Executive Officer

January 22, 2021

Dear Stockholders of Haynes International, Inc.:

You are cordially invited to attend the Annual Meeting of Stockholders of Haynes International, Inc. ("Haynes") to be held Tuesday, February 23, 2021 at 10:00 a.m. (EST). This year's annual meeting will be a completely "virtual" meeting of stockholders. You can attend the meeting online and vote shares electronically during the annual meeting by visiting www.virtualshareholdermeeting.com/HAYN2021 at the time of the meeting. Prior to the date of the annual meeting, you will be able to vote at www.proxyvote.com or by telephone as described in the accompanying Notice of Annual Meeting. The proposals to be voted upon are described in the accompanying Notice of Annual Meeting and Proxy Statement. You may also submit questions before the annual meeting. Questions will be subject to standard screening criteria such as relevancy, tone and elimination of redundancy.

We hope you are able to attend the annual meeting virtually. Whether or not you attend, it is important that your stock be represented and voted at the meeting. I urge you to please complete, date and return the proxy card in the enclosed envelope, visit www.proxyvote.com to vote your shares electronically or vote by telephone as described in the attached Notice of Annual Meeting. The vote of each stockholder is very important. You may revoke your proxy at any time before it is voted at the annual meeting by giving written notice to the Corporate Secretary of Haynes, by submitting a properly executed paper proxy bearing a later date or by attending the virtual annual meeting and voting online during the meeting. Stockholders may also revoke their proxies prior to the date of the meeting by entering a new vote over the Internet or by telephone.

On behalf of the Board of Directors and management of Haynes, I thank you for your continued support.

Sincerely,

Haynes International, Inc.

Michael L. Shor

President and Chief Executive Officer

HAYNES INTERNATIONAL, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FEBRUARY 23, 2021

Stockholders of Haynes International, Inc.:

The Annual Meeting of Stockholders of Haynes International, Inc. ("Haynes") will be held on Tuesday, February 23, 2021 at 10:00 a.m. (EST) for the following purposes:

Only stockholders of record at the close of business on January 8, 2021 are entitled to notice of, and to vote at, the annual meeting.

YOUR VOTE IS IMPORTANT. EVEN IF YOU EXPECT TO ATTEND THE VIRTUAL ANNUAL MEETING, PLEASE DATE, SIGN AND PROMPTLY MAIL THE ENCLOSED PROXY CARD. A RETURN ENVELOPE IS PROVIDED FOR THIS PURPOSE. YOU MAY ALSO VOTE YOUR PROXY PRIOR TO THE MEETING DATE BY VISITING WWW.PROXYVOTE.COM OR BY TELEPHONE AS DESCRIBED BELOW.

You can attend the meeting online and vote shares electronically during the annual meeting by visiting www.virtualshareholdermeeting.com/HAYN2021 at the time of the meeting. Online check-in will begin at 9:45 EST, and you should allow approximately 15 minutes for the online check-in procedure. Please have the control number on your proxy card available for check-in. Prior to the date of the annual meeting, you will be able to vote at www.proxyvote.com, and the proxy materials will be available at that site. You may also vote prior to the date of the meeting by telephone by calling 1-800-690-6903. Please consult your proxy card for additional information regarding these alternative methods. You may also submit questions before the annual meeting. Questions will be subject to standard screening criteria such as relevancy, tone and elimination of redundancy.

We hope you are able to attend the annual meeting virtually. Whether or not you attend, it is important that your stock be represented and voted at the meeting. I urge you to please complete, date and return the proxy card in the enclosed envelope, visit www.proxyvote.com prior to the annual meeting date to vote your shares electronically or vote by telephone prior to the meeting date using the information provided above. The vote of each stockholder is very important. You may revoke your written proxy at any time before it is voted at the annual meeting by giving written notice to the Corporate Secretary of Haynes, by submitting a properly executed paper proxy bearing a later date or by attending the virtual annual meeting and voting online during the meeting. Stockholders may also revoke their proxies by entering a new vote over the Internet or by telephone prior to the date of the annual meeting.

By Order of the Board of Directors,

Janice W. Gunst

Corporate Secretary

January 22, 2021

Kokomo, Indiana

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on February 23, 2021: This Notice of Annual Meeting and Proxy Statement and the Company's Fiscal 2020 Annual Report are available in the "Investor Relations" section of the Company's website at www.haynesintl.com

HAYNES INTERNATIONAL, INC. PROXY STATEMENT

TABLE OF CONTENTS

| | Page | |||

|---|---|---|---|---|

GENERAL INFORMATION | 1 | |||

PROPOSALS FOR 2022 ANNUAL MEETING | 2 | |||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS | 3 | |||

SECURITY OWNERSHIP OF MANAGEMENT | 4 | |||

PROPOSALS TO BE VOTED UPON | 5 | |||

ELECTION OF DIRECTORS | 5 | |||

Nominees | 5 | |||

Business Experience of Nominated Directors | 6 | |||

CORPORATE GOVERNANCE | 7 | |||

Board Committee Structure | 7 | |||

Meetings of the Board of Directors and Committees | 9 | |||

Meetings of Non-Management Directors | 10 | |||

Independence of the Board of Directors and Committee Members | 10 | |||

Family Relationships | 10 | |||

Conflict of Interest and Related Party Transactions | 10 | |||

Governance Committee and Director Nominations | 11 | |||

Code of Ethics | 12 | |||

Board of Directors' Role in Risk Oversight | 12 | |||

Communications with Board of Directors | 13 | |||

Changes in 2020 Director Compensation Program | 13 | |||

Compensation Committee Interlocks and Insider Participation | 16 | |||

EXECUTIVE COMPENSATION | 16 | |||

Compensation Committee Report | 16 | |||

Compensation Discussion and Analysis | 16 | |||

Compensation Tables and Narrative Disclosure | 29 | |||

CEO Pay Ratio | 42 | |||

Environmental, Social and Governance Matters | 43 | |||

Human Capital Resources | 45 | |||

AUDIT COMMITTEE REPORT | 48 | |||

RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 48 | |||

ADVISORY VOTE ON EXECUTIVE COMPENSATION | 49 | |||

OTHER MATTERS | 50 | |||

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD FEBRUARY 23, 2021

This proxy statement is furnished in connection with the solicitation by the Board of Directors of Haynes International, Inc. ("Haynes" or the "Company") of proxies to be voted at the Annual Meeting of Stockholders to be held at 10:00 a.m. (EST) on Tuesday, February 23, 2021, and at any adjournment thereof. The meeting will be held completely virtual. This proxy statement and the accompanying form of proxy were first mailed to stockholders of the Company on or about January 22, 2021.

You may revoke your written proxy at any time before it is voted at the annual meeting by giving written notice to the Corporate Secretary of Haynes, by submitting a properly executed paper proxy bearing a later date or by attending the virtual annual meeting and voting online during the meeting. Stockholders may also revoke their proxies by entering a new vote over the Internet or by telephone prior to the date of the annual meeting.

All proxies returned prior to the annual meeting, and not revoked, will be voted in accordance with the instructions contained therein. Any executed proxy not specifying to the contrary will be voted as follows:

The vote with respect to approval of the compensation of the Company's Named Executive Officers is advisory in nature and will not be binding on the Company or the Board of Directors.

As of the close of business on January 8, 2021, the record date for the annual meeting, there were outstanding and entitled to vote 12,682,147 shares of common stock of Haynes. Each outstanding share of common stock is entitled to one vote on each matter properly brought before the annual meeting and can be voted only if the record owner of that share, determined as of the record date, is present in person or represented by a properly completed proxy or a vote by any of the other authorized voting methods described herein at the annual meeting. For beneficial owners who are not record holders, the brokers, banks or nominees holding shares for beneficial owners must vote those shares as instructed. If the broker, bank or nominee has not received instructions from the beneficial owner, the broker, bank

1

or nominee generally has discretionary voting power only with respect to matters that are considered routine matters. If you are not the record holder of your shares and want to attend the virtual meeting and vote in person, you must obtain a legal proxy from your broker, bank or nominee and present it to the inspector of election with your ballot when you vote at the meeting. Haynes has no other voting securities outstanding. Stockholders do not have cumulative voting rights. All stockholders of record as of January 8, 2021 are entitled to notice of and to vote at the annual meeting.

A quorum will be present if holders of a majority of the outstanding shares of common stock are present, in person or by proxy, or other authorized voting method, at the annual meeting. Shares registered in the names of brokers or other "street name" nominees for which proxies are voted on some, but not all, matters will be considered to be present at the annual meeting for quorum purposes, but will be voted only as to those matters as to which a vote is indicated, and will not be voted as to the matters with respect to which no vote is indicated (commonly referred to as "broker non-votes"). If a quorum is present, the nominees for director will be elected by a majority of the votes cast. Abstentions and broker non-votes are treated as votes not cast and will have no effect on the election of directors. The affirmative vote of the majority of the shares present and entitled to vote on the matter is required for adoption of the proposal to ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm and approval of the compensation of the Company's Named Executive Officers. Accordingly, abstentions applicable to shares represented at the meeting will have the same effect as votes against these proposals. Broker non-votes will have no effect on the outcome of the advisory proposal with respect to the compensation of the Company's Named Executive Officers because this is a non-routine matter for which brokers, banks or other nominees may not vote absent instructions, but will have the same effect as votes against the proposal to ratify the appointment of Deloitte & Touche LLP because this proposal is a routine matter for which brokers, banks or other nominees have discretionary voting power. With respect to any other proposals which may properly come before the annual meeting, proposals will be approved upon the affirmative vote of a majority of the shares of common stock present in person or represented by proxy or other authorized voting method and entitled to vote on such matters at the annual meeting.

A copy of the Haynes International, Inc. Fiscal Year 2020 Annual Report on Form 10-K, including audited financial statements and a description of operations for the fiscal year ended September 30, 2020, accompanies this proxy statement. The financial statements contained in the Form 10-K are not incorporated by reference in this proxy statement, but they do contain important information regarding Haynes.

This solicitation of proxies is being made by Haynes, and all expenses in connection with this solicitation of proxies will be borne by Haynes. Haynes expects to solicit proxies primarily by mail, but directors, officers and other employees of Haynes may also solicit proxies electronically, in person or by telephone.

PROPOSALS FOR 2022 ANNUAL MEETING

Stockholders desiring to submit proposals to be included in the Proxy Statement for the 2022 Annual Meeting pursuant to Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), will be required to submit them to the Company in writing on or before September 24, 2021, provided that if the date of the 2022 Annual Meeting is more than 30 days from the anniversary of the 2021 Annual Meeting, then the deadline would be a reasonable time before Haynes begins to print and send its proxy materials. Any such stockholder proposal must also be proper in form and substance, as determined in accordance with the Exchange Act and the rules and regulations promulgated thereunder.

Stockholder proposals other than those to be included in the proxy statement for the 2022 Annual Meeting of Stockholders, pursuant to Rule 14a-8 must be submitted in writing to the Corporate

2

Secretary of Haynes and received on or before November 25, 2021 and not earlier than October 26, 2021, provided however, that in the event that the 2022 Annual Meeting of Stockholders is called for a date that is not within twenty-five (25) days before or after the anniversary date of the 2021 Annual Meeting of Stockholders, notice by the stockholder in order to be timely must be submitted and received not later than the close of business on the tenth (10th) day following the day on which notice of the date of the 2022 Annual Meeting of Stockholders was mailed or public disclosure of the date of the 2022 Annual Meeting is made, whichever first occurs. In addition, any such stockholder proposal must be in proper written form. To be in proper written form, a stockholder proposal (i) other than with respect to director nominations must set forth as to each matter the stockholder proposes to bring before the 2022 Annual Meeting of Stockholders (a) a brief description of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting, (b) the name and record address of the stockholder, (c) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the stockholder, (d) a description of all arrangements or understandings between the stockholder and any other person or persons (including their names) in connection with the proposal of such business by the stockholder and any material interest of the stockholder in such business and (e) a representation that the stockholder intends to appear in person or by proxy at the annual meeting to bring such business before the meeting and (ii) with respect to director nominations must set forth the information described under the heading "Governance Committee and Director Nominations" herein.

The mailing address of the principal executive offices of Haynes is 1020 West Park Avenue, P.O. Box 9013, Kokomo, Indiana 46904-9013.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Listed below are the only individuals and entities known by the Company to beneficially own more than 5% of the outstanding common stock of the Company as of January 8, 2021 (assuming that their holdings have not changed from such other date as may be shown below):

Name | Number | Percent(1) | |||||

|---|---|---|---|---|---|---|---|

BlackRock, Inc.(2) | 1,976,813 | 15.8 | % | ||||

T. Rowe Price Associates, Inc.(3) | 1,472,507 | 11.7 | % | ||||

The Vanguard Group(4) | 1,300,879 | 10.39 | % | ||||

Dimensional Fund Advisors LP(5) | 1,046,991 | 8.37 | % | ||||

Royce & Associates, LLC(6) | 784,301 | 6.27 | % | ||||

Edenbrook Capital(7) | 658,975 | 5.25 | % | ||||

3

Represents sole voting power over 13,543 shares, shared voting power over 1,182 shares, sole dispositive power over 1,289,225 shares and shared dispositive power over 11,654 shares.

SECURITY OWNERSHIP OF MANAGEMENT

The following table shows the ownership of shares of the Company's common stock as of January 8, 2021 (except as described in any associated footnote), by each director, the Chief Executive Officer, the Chief Financial Officer and the other three most highly compensated officers during fiscal year 2020 (the "Named Executive Officers") and the directors and all executive officers as a group. Except as noted below, the directors and executive officers have sole voting and investment power over these shares of common stock. The business address of each person indicated is c/o Haynes International, Inc., 1020 West Park Avenue, P.O. Box 9013, Kokomo, Indiana 46904-9013.

Name | Number | Percent(1) | | ||||||

|---|---|---|---|---|---|---|---|---|---|

Michael L. Shor(2) | 131,721 | 1.01 | |||||||

Robert H. Getz(3) | 30,206 | * | |||||||

Donald C. Campion(4) | 27,262 | * | |||||||

Dawne S. Hickton(5) | 15,007 | * | |||||||

Larry O. Spencer(6) | 7,221 | * | |||||||

Daniel W. Maudlin(7) | 71,320 | * | |||||||

David L. Strobel(8) | 31,183 | * | |||||||

Venkat R. Ishwar(9) | 63,531 | * | |||||||

Marlin C. Losch III(10) | 70,492 | * | |||||||

All directors and executive officers as a group (14 persons)(11) | 661,317 | 4.82% | |||||||

4

1 through 5. ELECTION OF DIRECTORS

The Amended and Restated By-Laws of the Company provide that the number of directors constituting the whole board shall be fixed from time to time by resolutions of the Board of Directors, but shall not be less than three nor more than nine directors. By resolution, the Board of Directors has fixed the number of directors at five. The terms of all incumbent directors will expire at the annual meeting. Directors elected at the annual meeting will serve for a term ending at the 2022 annual meeting of stockholders and until their respective successors are elected and qualified.

Upon the unanimous recommendation of the Corporate Governance and Nominating Committee (the "Governance Committee"), the Board of Directors has nominated five directors who served in fiscal 2020 for election at the annual meeting. The Board of Directors believes that all of its nominees will be available for re-election at the annual meeting and will serve if re-elected. The directors nominated for election (the "Nominated Directors") are:

Name | Age on 12/31/20 | Current Position | Served as Director Since | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Robert H. Getz | 58 | Chairman of the Board; Director | 2006 | ||||||

| Donald C. Campion | 72 | Director | 2004 | ||||||

| Dawne S. Hickton | 63 | Director | 2017 | ||||||

| Michael L. Shor | 61 | President and Chief Executive Officer; Director | 2012 | ||||||

| Larry O. Spencer | 67 | Director | 2020 | ||||||

5

The Board of Directors recommends that stockholders vote FOR the election of all of the Nominated Directors. Unless authority to vote for any Nominated Director is withheld, the accompanying proxy or alternative method of voting will be voted FOR the election of all the Nominated Directors. However, the persons designated as proxies reserve the right to cast votes for another person designated by the Board of Directors in the event that any Nominated Director becomes unable to, or for any reason will not, serve. If a quorum is present, those nominees receiving a majority of the votes cast will be elected to the Board of Directors.

Business Experience of Nominated Directors

Robert H. Getz has been a director since March 31, 2006. Mr. Getz serves as Chairman of the Board and as a member of the Compensation and Corporate Governance and Nominating Committees. Mr. Getz is Managing Partner and Founder of Pecksland Capital Partners, a private investment firm. Prior to 2016, Mr. Getz served as a Managing Director and Partner of Cornerstone Equity Investors, LLC, a private equity investment firm which he co-founded in 1996. Prior to the formation of Cornerstone, Mr. Getz served as a Managing Director and Partner of Prudential Equity Investors and Prudential Venture Capital. Mr. Getz has invested in and served on the boards of numerous public and private technology, manufacturing and metals and mining companies. Mr. Getz currently serves on the Board of Directors of Techtronic Industries (HKG:0669), a leading developer and manufacturer of power tools and equipment. He also serves on the board of Ero Copper (TSX:ERO), a copper mining and exploration company. Mr. Getz formerly served as a Director of Jaguar Mining until 2019. He also served as a Director of NewMarket Gold Inc. until 2016 and as Chairman of Crocodile Gold Corp until its merger with NewMarket in 2015. The board believes that Mr. Getz's experience as an investor and extensive record as a director of other public and private companies, as well as his wide variety of operating experience, enable him to lead the board with his valuable perspective on a variety of strategic issues.

Donald C. Campion has been a director since August 31, 2004. Mr. Campion also serves as the Chairman of the Audit Committee and as a member of the Compensation Committee of the Board. Mr. Campion has also served on several company boards, both public and private. He currently serves on the board of MasterCraft Boat Holdings, Inc. (NASDAQ: MCFT), a public company, where he is Chairman of the Audit Committee and is a member of the Compensation Committee. Mr. Campion previously served as Chief Financial Officer of several companies, including VeriFone, Inc., Special Devices, Inc., Cambridge, Inc., Oxford Automotive, Inc. and Delco Electronics Corporation. The Board believes Mr. Campion's substantial tax and accounting experience built through his career in finance at several significant corporations, his work in engineering and lean manufacturing and his experience serving as a director of other companies make him well qualified to serve as a director. Mr. Campion's tax and accounting acumen also qualify him as the Company's Audit Committee financial expert.

Dawne S. Hickton has been a director since July 1, 2017. Ms. Hickton also serves as Chairperson of the Compensation Committee and a member of the Audit and Corporate Governance and Nominating Committees of the Board. Ms. Hickton is an Executive Vice President and Chief Operating Officer of Jacobs, Critical Missions Solutions line of business (NYSE:J). Serving now in an advisory role, Ms. Hickton is a Founding Partner of Cumberland Highstreet Partners, Inc., an executive strategic consulting firm for manufacturing businesses. Ms. Hickton previously served as Vice Chairman, President and Chief Executive Officer of RTI International Metals, Inc. from 2007 until its sale to Alcoa Corporation in 2015. She was Chair of the board of the Federal Reserve Bank of Cleveland from 2018 to 2020, and was a Director of Triumph Aerospace Group (NYSE:TGI) from 2015 to 2019 and a Director of FNB Corporation (NYSE:FNB) from 2006 to 2013. In addition, she serves on the University of Pittsburgh board of trustees and the board of the Smithsonian National Air & Space Museum. The Board believes that Ms. Hickton's leadership experience in specialty metals, her extensive experience on public boards, as well as her knowledge of Haynes' key markets are benefits to Haynes.

6

Michael L. Shor served as the Company's interim President and Chief Executive Officer from May 29, 2018 through August 31, 2018 and was elected as the Company's President and Chief Executive Officer effective September 1, 2018. Mr. Shor has been a director since August 1, 2012, and served as Chairman of the Board from February 2017 through August 2018. Mr. Shor retired as Executive Vice President—Advanced Metals Operations & Premium Alloys Operations of Carpenter Technology Corporation on July 1, 2011 after a thirty-year career with Carpenter Technology. At Carpenter, Mr. Shor held managerial positions in technology, marketing and operations before assuming full responsibility for the performance of Carpenter's operating divisions. From November 2016 through February 2018, Mr. Shor was a member of the board of AG&E Holdings Inc. (OTC-QB: AGNU), a leading parts distributor and service provider to the casino and gaming industry. The Board believes Mr. Shor's extensive management experience, and specific specialty materials experience, provides valuable insight to lead the Company in its strategic direction, operational excellence and growth initiatives.

Larry O. Spencer, General, USAF (Ret.) has served as a director since January 1, 2020 and serves as Chairman of the Corporate Governance and Nominating Committee and a member of the Audit Committee. Mr. Spencer currently serves as President of the Armed Forces Benefit Association and 5Star Life Insurance Company. Mr. Spencer served until March 1, 2019 as President of the United States Air Force Association, a position he held since his retirement as a four-star general in 2015 after serving 44 years with the United States Air Force. Mr. Spencer held positions of increasing responsibility with the Air Force, which included Vice Chief of Staff, the second highest-ranking military member in the Air Force. Mr. Spencer served as Vice Commander of the Oklahoma City Logistics Center where he led repair and overhaul operations for a myriad of Air Force aircraft and engines. Mr. Spencer was also the first Air Force officer to serve as the Assistant Chief of Staff in the White House Military Office, and he served as Chief Financial Officer and Director of Mission Support at a major command. Mr. Spencer has also been a board director of the Whirlpool Corporation since August 2016 and of Triumph Group, Inc. since February 2018. The Board believes it benefits from Mr. Spencer's experiences as a leader of large, complex organizations and global business operations and logistics and his knowledge of aerospace and insights into defense and government affairs.

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of the nominated directors.

The Board of Directors has three standing committees: (i) an Audit Committee; (ii) a Compensation Committee; and (iii) a Corporate Governance and Nominating Committee.

The Audit Committee is currently composed of three members, Messrs. Campion (who chairs the Committee), Spencer and Ms. Hickton, all of whom are independent under the definitions and interpretations of NASDAQ. Under the Audit Committee Charter, adopted by the Board of Directors and available in the investor relations section of the Company's website at www.haynesintl.com, the Audit Committee is primarily responsible for, among other matters:

7

The Compensation Committee is currently composed of three members, Ms. Hickton (who chairs the Committee), and Messrs. Campion and Getz, all of whom are independent under the definitions and interpretations of NASDAQ. Under the Compensation Committee Charter, adopted by the Board of Directors and available in the investor relations section of the Company's website at www.haynesintl.com, the Compensation Committee is primarily responsible for, among other matters:

8

The Corporate Governance and Nominating Committee is currently composed of three members, Mr. Spencer (who chairs the Committee), Mr. Getz and Ms. Hickton, all of whom are independent under the definitions and interpretations of NASDAQ. Under the Governance Committee Charter, adopted by the Board of Directors and available in the investor relations section of the Company's website at www.haynesintl.com, the Governance Committee is responsible for overseeing the performance and composition of the Board of Directors to ensure effective governance. The Governance Committee identifies and recommends the nomination of qualified directors to the Board of Directors as well as develops and recommends governance principles for the Company. The Governance Committee is primarily responsible for, among other things:

Meetings of the Board of Directors and Committees

The Board of Directors held eleven meetings during the fiscal year ended September 30, 2020. During fiscal 2020, no member of the Board of Directors attended fewer than 75% of the aggregate of meetings of the Board of Directors and meetings of any committee of the Board of Directors of which he or she was a member during his or her tenure as a director. Meetings include those held in person, by telephone or by any available electronic means. Scheduled meetings are supplemented by frequent informal exchanges of information and, on occasion, actions taken by unanimous written consent without meetings. All of the members of the Board of Directors are encouraged and expected to attend Haynes' annual meetings of stockholders. All of the members of the Board of Directors attended

9

Haynes' 2020 annual meeting in person. The following chart shows the number of meetings in fiscal 2020 of each of the standing committees of the Board of Directors at which a quorum was present:

Committee | | Meetings in Fiscal 2020 | | |||

|---|---|---|---|---|---|---|

Audit Committee | | | 9 | | | |

Compensation Committee | | | 7 | | | |

Corporate Governance and Nominating Committee | | | 5 | | | |

Meetings of Non-Management Directors

Consistent with NASDAQ governance requirements, the non-management members of the Board of Directors meet in an executive session at least twice per year, and usually in connection with every regularly-scheduled in-person, telephonic or electronic board meeting, to: (a) review the performance of the management team; (b) discuss their views on management's strategic planning and its implementation; and (c) address any other matters affecting the Company that may concern individual directors. The executive sessions are designed to ensure that the Board of Directors is not only structurally independent, but also is given ample opportunity to exercise independent thought and action. In fiscal 2020, the non-management directors met in executive session six times. When meeting in executive session, the presiding person was the Chairman.

Independence of the Board of Directors and Committee Members

Except for Mr. Shor, all of the members of the Board of Directors, including each member of the Audit Committee, the Compensation Committee and the Governance Committee, meet the criteria for independence set forth in the rules and regulations of the Securities and Exchange Commission, including Rules 10A-3(b)(1) and 10C-1(b)(1) of the Exchange Act and the definitions and interpretations of NASDAQ. The Board of Directors has determined that Mr. Campion, the Chairman of the Audit Committee, is an "audit committee financial expert" (as defined by Item 407(d)(5)(ii) of Regulation S-K) and is "independent" (under the definitions and interpretations of NASDAQ).

The roles of Chairman and Chief Executive Officer are split into two positions. The Board of Directors believes that separating these roles aligns the Company with best practices for corporate governance of public companies and accountability to stockholders. The Board also believes that the separation of roles provides a leadership model that clearly distinguishes the roles of the Board and management. The separation of the Chairman and Chief Executive Officer positions allows the Company's Chief Executive Officer to direct his or her energy toward operational and strategic issues while the non-executive Chairman focuses on governance, leadership and providing counsel and advice to the Chief Executive Officer. The Company believes that separating the Chairman and Chief Executive Officer positions enhances the independence of the Board, provides independent business counsel for the Company's Chief Executive Officer and facilitates improved communications between Company management and Board members.

There are no family relationships among the directors and executive officers of the Company.

Conflict of Interest and Related Party Transactions

It is the Company's policy to require that all conflict of interest transactions between the Company and any of its directors, officers or 5% or greater beneficial owners (each, an "insider") and all transactions where any insider has a direct or indirect financial interest, including related party transactions required to be reported under Item 404(a) of Regulation S-K, must be reviewed and approved or ratified by the Audit Committee of the Board of Directors. Management discloses the

10

existence of any such transaction to the Audit Committee. In addition, the material terms of any such transaction, including the nature and extent of the insider's interest therein, must be disclosed to the Audit Committee. The Audit Committee will then review the terms of the proposed transaction to determine whether the terms of the proposed transaction are fair to the Company and are no less favorable to the Company than those that would be available from an independent third party. Following the Audit Committee's review and discussion, the proposed transaction will be approved or ratified only if it receives the affirmative votes of a majority of the members of the Audit Committee who have no direct or indirect financial interest in the proposed transaction, even though the disinterested directors may represent less than a quorum. Interested directors may be counted in determining the presence of a quorum at a meeting of the Audit Committee which authorizes the contract or transaction. Haynes did not enter into any transactions in fiscal 2020 with any insider.

Governance Committee and Director Nominations

Nominees for the Board of Directors are currently recommended for nomination to the Board of Directors by the Governance Committee. The Governance Committee bases its recommendation for nomination on criteria that it believes will provide a broad perspective and depth of experience in the Board of Directors. In general, when considering independent directors, the Governance Committee will consider the candidate's experience in areas central to the Company, such as operational experience in a manufacturing environment, aerospace or specialty metals industry experience, general business management experience, finance and legal acumen and experience and demonstrated leadership capabilities as well as considering the candidate's personal qualities and accomplishments and their ability to devote sufficient time and effort to their duties as directors. Important areas of experience and expertise include manufacturing, international operations, finance and the capital markets, accounting and experience as a director or executive of other companies, or similar experience in a governmental or non-profit setting. The Governance Committee does not have a formal diversity policy but considers diversity as one criteria evaluated as a part of the total package of attributes and qualifications a particular candidate possesses. The Governance Committee construes the notion of diversity broadly, considering differences in viewpoint, professional experience, education, skills and other individual qualities, including gender identity and similar matters, in addition to race, gender, age, ethnicity and cultural background as elements that contribute to a diverse Board. As of September 30, 2020, diverse persons constituted 50% of the independent members of the Board of Directors, and the same directors are nominees for 2021.

The Governance Committee has adopted Corporate Governance Guidelines which establish, among other matters, a mandatory retirement age for Board members of 72, subject to exceptions that may be granted by the Board. An exception was granted for Mr. Campion. In recent years, two directors have retired pursuant to the Board's retirement age policy, which the Board believes demonstrates the Board's adherence to proper board refreshment. In keeping with its commitment to enhancing diversity of viewpoints and background on the Board, the two most recent directors appointed to the Board, each of whom brings substantial experience in the form of executive leadership in the specialty metals industry and the U.S. Air Force, respectively, further the Board's goals of enhancing diversity of viewpoints and experience. The Company benefits from their valuable perspectives on the competitive landscape confronting the Company, emerging trends in the defense and aerospace industry as well as their general leadership skills.

Although the Governance Committee has no formal policy regarding the consideration of director candidates recommended by stockholders, the Committee will consider candidates recommended by stockholders, provided the names of such persons, accompanied by relevant biographical information, are properly submitted in writing to the Secretary of the Company in accordance with the procedure described below for stockholder nominations. Candidates recommended by stockholders are evaluated in the same manner using the same criteria as candidates recommended by the Board or Governance

11

Committee or individual directors or officers. In any case, the Governance Committee encourages the proposal of diverse candidates.

Stockholders may nominate directors by providing timely notice thereof in proper written form to the Secretary of Haynes. To be timely, a stockholder's notice to the Secretary must be delivered to or mailed and received at Haynes' principal executive offices (a) in the case of an annual meeting, not less than ninety days nor more than one hundred twenty days prior to the anniversary date of the immediately preceding annual meeting; provided, however, that in the event that the annual meeting is called for a date that is not within twenty-five days before or after such anniversary date, notice by the stockholder in order to be timely must be so received not later than the close of business on the tenth day following the day on which notice of the date of the annual meeting is mailed or public disclosure of the date of the annual meeting is made, whichever first occurs; and (b) in the case of a special meeting of stockholders called for the purpose of electing directors, not later than the close of business on the tenth day following the day on which notice of the date of the special meeting is mailed or public disclosure of the date of the special meeting is made, whichever first occurs.

To be in proper written form, a stockholder's notice to the Secretary must set forth (a) as to each person whom the stockholder proposes to nominate for election as a director (i) the name, age, business address and residence address of the person, (ii) the principal occupation or employment of the person, (iii) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by the person and (iv) any other information relating to the person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder; and (b) as to the stockholder giving the notice (i) the name and record address of such stockholder, (ii) the class or series and number of shares of capital stock of the Company which are owned beneficially or of record by such stockholder, (iii) a description of all arrangements or understandings between such stockholder and each proposed nominee and any other person or persons (including their names) pursuant to which the nomination(s) are to be made by such stockholder, (iv) a representation that such stockholder intends to appear in person or by proxy at the meeting to nominate the persons named in its notice and (v) any other information relating to such stockholder that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act and the rules and regulations promulgated thereunder. Such notice must be accompanied by a written consent of each proposed nominee to being named as a nominee and to serving as a director if elected.

The Company has adopted a Code of Business Conduct and Ethics that applies to its Chief Executive Officer, Chief Financial Officer and Chief Accounting Officer, as well as to its directors and other officers and employees. This Code is posted on the Company's website at www.haynesintl.com/investor-relations/our-company/code-of-business-conduct-and-ethics. The Audit Committee of the Board regularly reviews the Code of Business Conduct and Ethics and is informed of any whistleblower complaints provided thereunder. In addition, the Chief Executive Officer discusses the importance of ethical conduct and compliance with the Code in each quarterly employee meeting or update.

Board of Directors' Role in Risk Oversight

As a part of its oversight function, the Board of Directors monitors how management operates the Company. The full Board is engaged in the Company's Enterprise Risk Management program, including through regular reporting and discussion, and by working with management to identify and prioritize enterprise risks—the specific financial, operational, business and strategic risks that the

12

Company faces, whether internal or external. These functions are distributed among the full Board, the committees of the Board and management, as appropriate. Certain strategic and business risks, such as those relating to the Company's products, markets and capital investments (including environmental and social risks), are overseen by the entire Board of Directors. The Audit Committee oversees management of market and operational risks that could have a financial impact, such as those relating to internal controls or liquidity. The Corporate Governance and Nominating Committee manages the risks associated with governance issues, such as the independence of the Board of Directors, and the Compensation Committee manages risks relating to the Company's compensation plans and policies.

In addition to the formal compliance program, the Board of Directors encourages management to promote a corporate culture that understands risk management and incorporates it into the overall corporate strategy and day-to-day business operations of the Company. The Company's risk management structure also includes a standing enterprise risk management committee comprised of members of the executive team and led by the CEO, collectively undertaking an ongoing effort to assess and analyze the most likely areas of future risk for the Company and to address them in its long-term planning process. This committee, or individual members thereof, periodically reports to the Board, and individual members of the committee may also do so on an informal basis.

Communications with Board of Directors

Stockholders may communicate with the full Board of Directors by sending a letter to Haynes International, Inc. Board of Directors, c/o Corporate Secretary, 1020 West Park Avenue, P.O. Box 9013, Kokomo, Indiana 46904-9013. The Company's Corporate Secretary will review the correspondence and forward it to the chairman of the appropriate committee or to any individual director or directors to whom the communication is directed, unless the communication is unduly hostile, threatening, illegal, does not reasonably relate to the Company or its business or is similarly inappropriate. In addition, interested parties may contact the non-management directors as a group by sending a written communication to the Corporate Secretary as directed above. Such communication should be clearly addressed to the non-management directors.

Changes in 2020 Director Compensation Program

Directors who are also Company employees do not receive compensation for their services as directors. Following is a description of the Company's compensation program for non-management directors in fiscal 2020. In consultation with its independent compensation consultant, Total Rewards Strategies, the Compensation Committee reviews the compensation paid to non-management directors and recommends changes to the Board of Directors, as appropriate.

In consultation with Total Rewards Strategies, for fiscal 2020, the Compensation Committee initially established a target equity grant amount of $105,000 for the Chairman of the Board and $85,000 for each remaining non-employee Director. On November 19, 2019, the Chairman of the Board was granted 2,838 shares of restricted stock and each remaining non-employee director was granted 2,297 shares of restricted stock, pursuant to the Haynes International, Inc. 2016 Incentive Compensation Plan. In December 2019, after reviewing the Company's director compensation program and consulting with its compensation consultant, the Committee recommended and the Board approved an increase in the equity grant amount by $10,000 in order to increase the equity portion of the total amount of compensation paid to the Company's directors in line with its comparator group. Pursuant to the Haynes International, Inc. 2016 Incentive Compensation Plan, on February 5, 2020, each non-employee director was granted 272 of restricted stock, except for Mr. Spencer who received 2,583 shares of restricted stock, the difference being reflective of the timing of Mr. Spencer's election to the Board of Directors during a blackout period in which his initial grant upon election could not be made. In granting the awards, the Compensation Committee considered information provided by Total

13

Rewards Strategies on methods of encouraging long-term stock ownership by directors, as well as information regarding how comparator group companies utilized restricted or deferred stock.

In December 2019, after reviewing the Company's director compensation program and consulting with its compensation consultant, the Board approved a reduction in the annual committee retainer fees, effective January 1, 2020, to $10,000 each for the Audit Committee members, $7,500 each for the Compensation Committee members and $5,000 each for the Corporate Governance and Nominating Committee members

Effective in April 2020, the Board of Directors temporarily reduced all of its cash fees (including committee service-related fees) by 10% in response to the economic impacts of COVID-19. Such reductions will remain in place until otherwise determined.

Director Compensation Table

The following table provides information regarding the compensation paid to the Company's non-employee members of the Board of Directors in fiscal 2020, giving effect to the changes discussed above.

Name | | Fees Earned or Paid in Cash ($) | | Restricted Stock Awards ($)(1) | | Dividends on Stock Awards ($) | | Total ($) | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

R. H. Getz, Chairman | | | $ | 108,688 | | | $ | 112,508 | | | $ | 7,209 | | | $ | 228,404 | |

D. C. Campion, Director | | | $ | 93,375 | | | $ | 92,491 | | | $ | 6,733 | | | $ | 192,599 | |

J. C. Corey, Director(2) | | | $ | 35,417 | | | $ | 84,989 | | | $ | 3,904 | | | $ | 124,310 | |

D. S. Hickton, Director | | | $ | 88,250 | | | $ | 92,491 | | | $ | 7,305 | | | $ | 188,046 | |

L. O. Spencer, Director | | | $ | 57,063 | | | $ | 71,239 | | | $ | 1,705 | | | $ | 130,006 | |

W. P. Wall, Director(3) | | | $ | 74,500 | | | $ | 92,491 | | | $ | 6,613 | | | $ | 173,604 | |

Annual Cash Retainer

In fiscal 2020, non-management members of the Board of Directors received a reduced $57,000 annual retainer related to their Board of Directors duties and responsibilities, which reflects the COVID-related reduction discussed above. The retainer was paid in four installments of $15,000, $15,000, $13,500 and $13,500. Additionally, there was a $42,750 annual retainer for serving as Chairman of the Board, similarly reduced, paid in four quarterly installments of $11,250, $11,250, $10,125 and $10,125.

Committee Fees

As noted above, committee service fees were further reduced in April 2020 by the COVID-related reductions in April 2020. In fiscal 2020, directors received an additional annual retainer of $9,500 for each standing committee on which they served, paid in four quarterly installments of $2,500, $2,500, $2,250 and $2,250. In addition, there was a $16,625 annual retainer for serving as the chairman of the Audit Committee, a $11,875 annual retainer for serving as the chairman of the Compensation Committee and a $9,500 annual retainer for serving as the chairman of the Corporate Governance and Nominating Committee of the Board of Directors. Each of the amounts noted above reflects the COVID-related reductions effective in April 2020.

14

Equity Compensation

Members of the Board of Directors are granted shares of time-based restricted stock annually. Such amounts were adjusted in fiscal 2020 as set forth under "Director Compensation Program". The shares of restricted stock will vest in full on the earlier of (i) the first anniversary of the grant date, or (ii) the failure of the director to be re-elected at an annual meeting of the stockholders of the Company as a result of the director being excluded from the nominations for any reason other than "cause" as defined in the 2016 Incentive Compensation Plan. Upon their respective retirements, 2,569 restricted shares owned by Mr. Wall vested and 2,297 restricted shares owned by Mr. Corey vested.

The Company has a deferred compensation plan for directors and executives that permits directors to defer up to 100% of their cash retainers and up to 100% of their annual equity grant. Several non-employee directors elected to defer the receipt of shares upon vesting to a later date. Any deferral election also results in deferral of the receipt of dividends throughout the deferral period on deferred restricted stock.

Director Stock Retention Guidelines

The Board of Directors approved stock ownership guidelines for non-employee members of the Board of Directors effective January 1, 2014. The guidelines provide that directors own common stock equal to 400% of their annual cash retainer within five (5) years of their date of election to the Board. For purposes of this calculation, shares owned by an individual include shares or other equity interests owned directly or indirectly, including those subject to risk of forfeiture (but not forfeited) under the Company's 2009 Restricted Stock Plan, the 2016 Incentive Compensation Plan, or the 2020 Incentive Compensation Plan, as applicable, and shares subject to a deferral election. The guidelines also provide that directors retain a certain amount of stock (based upon the value of shares owned) after meeting the ownership goal. As of January 8, 2021, given that the guidelines allow for a five (5) year accumulation period, all of the directors to whom the ownership guideline applied met the guideline.

The share ownership amount for each non-employee director as of January 8, 2021 is summarized below and is based on the closing price of the Company's stock as of January 8, 2021.

Name | | Number of Non-vested Shares | | All Other Shares | | Total Share Ownership | | Ownership Value as of 1/8/2021 | | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

R. H. Getz | | | 5,521 | | | | 24,685 | | | | 30,206 | | | | $ | 747,599 | | | |||

D. C. Campion | | | 4,638 | | | | 22,624 | | | | 27,262 | | | | $ | 674,735 | | | |||

D. S. Hickton | | | 4,638 | | | | 10,369 | | | | 15,007 | | | | $ | 371,423 | | | |||

L. O. Spencer | | | 4,638 | | | | 2,583 | | | | 7,221 | | | | $ | 178,720 | | | |||

Total Compensation

In accordance with the 2020 Incentive Compensation Plan the annual maximum equity award for each director is $250,000, and the maximum annual total compensation (cash and equity) limit is $350,000 for each director.

Expenses

The Company reimburses directors for their reasonable out-of-pocket expenses incurred in attending meetings of the Board of Directors or any committee thereof and other expenses incurred by directors in connection with their service to the Company.

15

Indemnification Agreements

Pursuant to individual written agreements, the Company indemnifies all of its directors against loss or expense arising from such individuals' service to the Company and its subsidiaries and affiliates and advances attorneys' fees and other costs of defense to such individuals in respect of claims that may be eligible for indemnification under certain circumstances.

Compensation Committee Interlocks and Insider Participation

The members of the Compensation Committee as of September 30, 2020 were Ms. Hickton, Mr. Campion and Mr. Getz. None of the members of the Compensation Committee are now serving or previously have served as employees or officers of the Company or any subsidiary, and none of the Company's executive officers serve as directors of, or in any compensation related capacity for, companies with which members of the Compensation Committee are affiliated.

The Compensation Committee of the Board of Directors has reviewed and discussed the following Compensation Discussion and Analysis with management and, based on such review and discussion, has recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this proxy statement and in the Company's Annual Report on Form 10-K for the fiscal year ended September 30, 2020.

SUBMITTED BY THE COMPENSATION COMMITTEE

Dawne S. Hickton, Chair

Donald C. Campion

Robert H. Getz

Compensation Discussion and Analysis

2020 Business Summary

In fiscal 2020, the Company results, which were heavily impacted by both the COVID-19 pandemic and the issues relating to the grounding of the Boeing 737 MAX, were as follows.

Overview

This Compensation Discussion and Analysis describes the key principles and approaches used to determine the compensation in fiscal 2020 for Michael L. Shor, the Company's principal executive officer; Daniel W. Maudlin, the Company's principal financial officer; and David L. Strobel, Venkat R. Ishwar and Marlin C. Losch III, the Company's other three most highly compensated executive officers in fiscal 2020, as well as other senior executives. Detailed information regarding the compensation of these named executive officers, who are referred to as "Named Executive Officers" or "NEOs",

16

appears in the tables following this Compensation Discussion and Analysis. This Compensation Discussion and Analysis should be read in conjunction with those tables.

This Compensation Discussion and Analysis consists of the following parts:

Responsibility for Executive Compensation Decisions

Role of Executive Officers in Compensation Decisions

Executive Compensation Philosophy and Principles

Committee Procedures

Setting Named Executive Officer Compensation in Fiscal 2020

Responsibility for Executive Compensation Decisions

The Compensation Committee of the Board of Directors, whose membership is limited to independent directors, acts pursuant to a Board-approved charter. The Compensation Committee is responsible for approving the compensation programs for all executive officers, including the Named Executive Officers, and making decisions regarding specific compensation to be paid or awarded to them. The Compensation Committee has responsibility for establishing and monitoring adherence to the Company's compensation philosophies and objectives. The Compensation Committee aims to ensure that the total compensation paid to the Company's executives, including the NEOs, is fair, reasonable and competitive. Although the Compensation Committee approves all elements of an executive officer's compensation, it approves equity grants and certain other incentive compensation subject to approval by the full Board of Directors.

Role of Executive Officers in Compensation Decisions

No Named Executive Officer participates directly in the determination of his or her compensation. For Named Executive Officers other than himself, the Company's Chief Executive Officer provides the Compensation Committee with performance evaluations and presents individual compensation recommendations to the Compensation Committee, as well as compensation program design recommendations. The Chief Executive Officer's performance is evaluated by the Board of Directors. Mr. Shor's salary was established by the Executive Employment Agreement between Mr. Shor and the Company entered into on September 1, 2018 (as reduced by the 10% temporary salary reduction put in place in April 2020 for the Named Executive Officers and other executive officers of the Company discussed below). The Chief Executive Officer and the Chief Financial Officer work closely with the Compensation Committee on the development of the financial targets and overall compensation awardable to the Named Executive Officers under the Company's Management Incentive Plan ("MIP") as those amounts are determined by reference to the Company's annual operating budget. The Compensation Committee retains the full authority to modify, accept or reject all compensation recommendations provided by management.

Executive Compensation Philosophy and Objectives

The Company's compensation program is designed to attract, motivate, reward and retain key executives who drive the Company's success and enable it to consistently achieve corporate performance goals in the competitive high-performance alloy business and increase stockholder value. The Company seeks to achieve these objectives through a compensation package that:

17

stockholder returns through long-term corporate performance, including through the attainment of performance targets applicable to performance share grants.

In addition to aligning management's interests with the interests of the stockholders, a key objective of the Company's compensation plan is mitigating the risk in the compensation package by ensuring that a significant portion of compensation is based on the long-term performance of the Company. This reduces the risk that executives will place too much focus on short-term achievements to the detriment of the long-term sustainability of the Company. The Compensation Committee also values and seeks diversity in the executive team, including the Named Executive Officers. As of September 30, 2020, the ten-person executive team included three diverse members.

As part of its oversight responsibilities, the Compensation Committee, along with a cross-functional team with representatives from Human Resources, Legal and Finance, annually evaluates the risks arising from the Company's compensation policies and practices, with the assistance of its independent compensation consultant. The Committee considered, among other factors, the design of the incentive compensation programs, which are closely linked to corporate performance, the mix of short-term and long-term compensation, the maximum payout levels for short- term and long-term incentives, the distribution of compensation between equity and cash and other factors that mitigate risk. The Committee concluded that the Company's compensation policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company.

At the Company's 2019 annual meeting of stockholders, the stockholders voted on a non-binding advisory proposal to approve the compensation of the Named Executive Officers. Approximately 96.59% of the shares voted on the proposal were voted in favor of the proposal. In light of the approval by a substantial majority of stockholders of the compensation programs described in the Company's 2019 proxy statement, the Compensation Committee did not implement material changes to the executive compensation programs as a result of the stockholders' advisory vote.

18

2020 Compensation Plan Highlights

The design of the Company's executive compensation program for 2020 was generally consistent with the design of the 2019 program. The following table highlights the features of the program:

• Pay-for-performance philosophy • Pay positioning philosophy relative to comparator group and mix of base salary and annual and long-term incentive compensation • Annual incentive compensation metrics • Change-in-control agreements with best practice features (double-trigger severance, less than three times base salary and target bonus, no tax gross-up, no enhanced retirement benefits) • Compensation risk assessment | • Performance share awards to enhance the balance of the long-term incentive program, together with stock options and restricted stock • Relative total shareholder return (TSR) as performance share metric to ensure alignment with shareholders • Clawback policy consistent with SEC proposed regulations mandated by Dodd Frank • Share ownership and retention requirement for management and directors • Limited perquisites |

Committee Procedures

The Compensation Committee retains the services of Total Rewards Strategies, an independent compensation consulting firm, to analyze the compensation and financial data of a comparator group of companies. Total Rewards Strategies also provides the Compensation Committee with alternatives to consider when making compensation decisions and provides opinions on compensation recommendations the Compensation Committee receives from management. Total Rewards Strategies provided analyses and opinions regarding executive compensation trends and practices to the Compensation Committee during fiscal 2019 and fiscal 2020. Total Rewards Strategies did not provide any services to the Company other than compensation consulting to the Compensation Committee in fiscal 2019 or fiscal 2020. Total Rewards Strategies' work for the Company in fiscal 2020 did not raise any conflicts of interest.

Comparator Group

| Ampco-Pittsburgh | Insteel Industries | Olympic Steel | |||

CECO Environmental | L.B. Foster | Shiloh Industries | |||

CIRCOR International | Lindsay Corp. | Skyline Champion | |||

Columbus-McKinnon | LSB Industries | Stoneridge | |||

Core Molding Technologies | Materion | Synalloy Corp. | |||

CTS | Myers Industries | Timken Steel | |||

Ducommun | NN | Titan International | |||

Global Brass and Copper | Northwest Pipe | Universal Stainless & Alloy Products |

19

Market Rates

Among other analyses, Total Rewards Strategies provides the 50th percentile, or median, of the comparator group for base salary, cash bonus, long-term incentives and total overall compensation, or the Median Market Rate. The Compensation Committee uses the Median Market Rate as a primary reference point when determining compensation targets for each element of pay. As noted, by changing the composition of its comparator group, the Committee believes it adjusted the Median Market Rate to a level more consistent with the Company's revenue base, market capitalization and performance. When individual and targeted company financial performance is achieved, the objective of the executive compensation program is to provide overall compensation near the Median Market Rate of pay practices of the comparator group of companies. Actual target pay for an individual may be more or less than the Median Market Rate based on the Compensation Committee's evaluation of the individual's performance, experience and potential.

Consistent with the Compensation Committee's philosophy of pay for performance, incentive payments can exceed target levels only if overall Company financial targets are exceeded and will fall below target levels if overall financial goals are not achieved. The Compensation Committee requires appropriate targets to achieve incentive payments in order to promote alignment of interests with the Company's stockholders. In recent years, the Company's financial performance and stock price performance fell below the Compensation Committee's targets, which resulted in the Company's executives foregoing significant incentive payments and equity compensation. The Compensation Committee believes this best ensures that the Company's executives are properly aligned with stockholders. The effectiveness of this approach is demonstrated by the fact that (i) in three of the last five fiscal years, no incentive payments were earned by management due to the Company's underperformance versus the financial targets established by the Compensation Committee, (ii) in two years less than the target was paid out due to underperformance versus target, (iii) approximately 24,550 shares of restricted stock were forfeited as unearned for failure to achieve required performance targets, (iv) 14,993 performance share awards expired without resulting in the earning of shares and (v) 115,500 options expired worthless. The Committee believes its philosophy, and the implementation of that philosophy, is in the best interests of the Company's stockholders, and has resulted in a significant transformation in the focus and effort of its management team under the leadership of Michael Shor, its Chief Executive Officer who began service in May 2018.

Setting Named Executive Officer Compensation in Fiscal 2020

Michael L. Shor was appointed President and Chief Executive Officer of the Company on September 1, 2018, after serving as interim President and Chief Executive Officer since May 29, 2018. The disclosures regarding Mr. Shor's fiscal 2020 compensation within this section should be read with that background and in conjunction with the disclosures provided under the "CEO Compensation" section and the notes to the "Summary Compensation Table" provided herein.

Components of Compensation

The chief components of each Named Executive Officer's compensation in fiscal 2020 were:

20

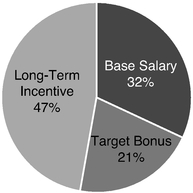

Each element of compensation is designed to achieve a specific purpose and to contribute to a total package that is competitive, appropriately performance-based and valued by the Company's executives. The Compensation Committee reviews information provided by Total Rewards Strategies and the Company's historical pay practices to determine the appropriate level and mix of compensation. In allocating compensation among elements, the Company believes the compensation of the Company's most senior executives, including the Named Executive Officers, who have the greatest ability to influence Company performance, should be predominately performance-based. As a result of this strategy, 68% of the Named Executive Officers' total target compensation, including the Chief Executive Officer's compensation, was allocated to performance-based pay in fiscal 2020.

Fiscal 2020 Target Compensation

Base Salary

The Company provides executives with a base salary that is intended to attract and retain the quality of executives needed to lead the Company's complex businesses. Base salaries for executives are generally targeted at the Median Market Rate of the comparator group, although individual performance, experience, internal equity, compensation history and contributions of the executive are also considered. The Committee reviews base salaries for Named Executive Officers annually and may make adjustments based on individual performance, experience, market competitiveness, internal equity and the scope of responsibilities.

The base salaries of the Named Executive Officers were generally increased at the beginning of fiscal 2020, prior to the implementation of a 10% temporary salary reduction put in place in April 2020 for the Named Executive Officers and other executive officers of the Company in response to the adverse financial impacts of the COVID-19 pandemic. These reductions were reversed effective as of January 1, 2021 for all of the Named Executive Officers other than the Chief Executive Officer, whose salary will remain at the reduced amount until determined otherwise. Other than the reversal of previous reductions, no Named Executive Officer (or other executive officer of the Company) received any salary increase at the beginning of fiscal 2021. More widely across the Company, furloughs and layoffs occurred in fiscal 2020, resulting in the reduction of the Company's workforce by approximately 16%. In addition, most employees were required to take a week of unpaid furlough in the fourth quarter of fiscal 2020 and were required to choose between a 7.7% reduction in pay or a week of unpaid furlough in the first quarter of fiscal 2021. The furlough requirement did not apply to the Named Executive Officers, or any other executive officers of the Company, due to the previous 10% reduction of their base salaries in April 2020.

21

The following table provides annualized base salary information for the Named Executive Officers effective July 1, 2019 and base salary as of July 1, 2020 as a percentage of the Median Market Rate for 2020:

Named Executive Officer | Base Salary as of July 1, 2019 | Base Salary Prior to April 1, 2020 | Base Salary as of July 1, 2020 | Base Salary as a Percentage of Median Market Rate for 2020 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Michael L. Shor | $ | 580,000 | $ | 637,500 | $ | 573,750 | 77 | % | |||||

Daniel W. Maudlin | $ | 305,000 | $ | 312,000 | $ | 280,800 | 76 | % | |||||

David L. Strobel | $ | 280,000 | $ | 295,000 | $ | 265,500 | 86 | % | |||||

Venkat R. Ishwar | $ | 286,000 | $ | 293,000 | $ | 263,700 | 92 | % | |||||

Marlin C. Losch III | $ | 275,000 | $ | 285,000 | $ | 256,500 | 87 | % | |||||

Management Incentive Plan—Annual Cash Incentive

The purpose of the MIP is to provide an annual cash bonus based on the achievement of specific operational and financial performance targets, tying compensation to the creation of value for stockholders. Target cash bonus awards are determined for each executive position by competitive analysis of the comparator group. In general, the median annual cash bonus opportunity of the comparator group is used to establish target bonus opportunities, but consideration is given to the individual executive's responsibilities and contributions to business results and internal equity. The MIP allows the Board of Directors discretion to administer the plan, including not paying out any compensation thereunder, accounting for unforeseen one-time transactions or adjusting the performance measures based on external economic factors. No such adjustments were made for fiscal 2020, and no MIP payments were earned. MIP payments are made on a sliding scale in accordance with established performance targets and are earned as of the end of the applicable fiscal year. MIP payments are sometimes referred to herein as a "bonus".

For fiscal 2020, the target performance level was established by reference to the Company's consolidated annual operating budget. The annual operating budget is developed by management and presented by the CEO and the CFO to the Board of Directors for its review and approval. The bonus target was intended to represent corporate performance which the Board of Directors believed was more likely than not to be achieved based upon management's presentation of the annual operating budget. For fiscal 2020, the Compensation Committee established a target by reference to the Company's net income (loss) as the sole financial goal for MIP payouts. The Board of Directors did not make any changes to the 2020 net income targets or thresholds in response to the economic effects of COVID-19.

The Board of Directors establishes income and performance goals in order the align the interests of management with those of the Company's stockholders. Based upon fiscal 2019's net income and 2020's net loss, MIP payments in excess of the minimum threshold but less than target were made for fiscal year 2019, and no payment was made for fiscal 2020.

22

The table below lists the 2020 MIP incentive awards that could have been earned at the minimum, target and maximum levels by each Named Executive Officer as a percentage of his base salary:

| | MIP Incentive as % of Base Salary | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Named Executive Officer | Minimum | Target | Maximum | |||||||

Michael L. Shor | 40.0 | % | 80.0 | % | 120.0 | % | ||||

Daniel W. Maudlin | 32.5 | % | 65.0 | % | 97.5 | % | ||||

David L. Strobel | 30.0 | % | 60.0 | % | 90.0 | % | ||||

Venkat R. Ishwar | 25.0 | % | 50.0 | % | 75.0 | % | ||||

Marlin C. Losch III | 25.0 | % | 50.0 | % | 75.0 | % | ||||

The following table sets forth the targets for net income (loss), as well as actual net income (loss) for fiscal 2020:

| ($ in thousands) | Net Income | |||

|---|---|---|---|---|

Threshold | $ | 10,500 | ||

Target | $ | 21,000 | ||

Maximum | $ | 28,000 | ||

Fiscal 2020 Actual Net Loss | $ | (6,478 | ) | |