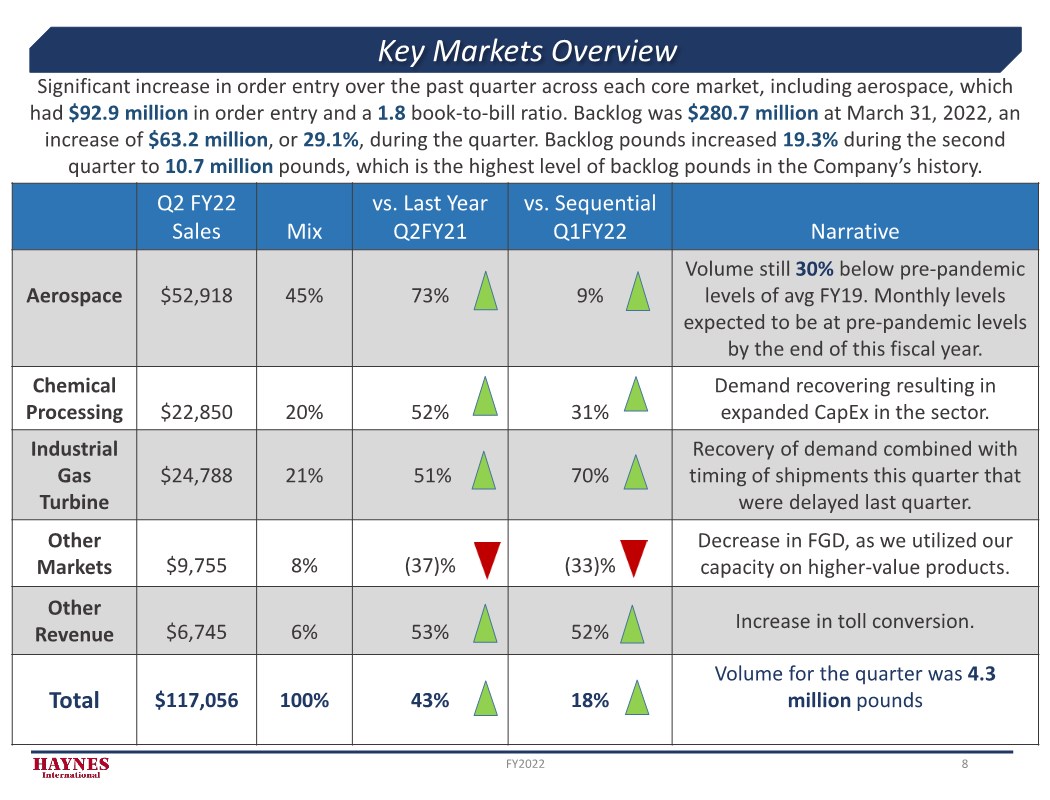

| “Our business continues to gain momentum. Sequentially, our second quarter performance included a 17.7% revenue increase, a 210 basis point improvement in gross margin to 20%, and an 82% increase in net income to $8.5M, all with just 4.3 million pounds shipped.” Michael L. Shor, President and CEO of Haynes International From our conference call We have invested in manpower and inventory increases, which, when combined with our on-going, relentless pursuit of customer service, innovation, quality, pricing for value, and cost improvements, positions us very well for the future. The recovery we are seeing in our three core markets, led by aerospace, continues to accelerate and drive backlog growth, increasing 99%, year over year. We continue to expect our monthly aerospace shipping volumes to reach our fiscal year 2019 company record run-rate levels by the end of our fiscal year. Higher production rates driven by the backlog growth, along with significant increases in raw material costs, led to cash investments in inventory. Liquidity remains strong at $90.7 million, including $78.5 million available from the credit facility and $12.2 million in cash as of March 31, 2022. FY21 to FY25 projections estimate revenue growth at a 15% CAGR, with aerospace at 25% (highest growth this year from FY21-22). Gross margins remaining over 20% with incremental growth. Operating cash flow positive in FY23. U.S. Pension is at zero-net liability in two years. FY2022 3 |