UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ | |

Filed by a Party other than the Registrant ☐ |

| Check the appropriate box: | |

☒ Preliminary Proxy Statement | ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ Definitive Proxy Statement |

☐ Definitive Additional Materials |

☐ Soliciting Material Pursuant to § 240.14a-12 |

The New Ireland Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | (1) Title of each class of securities to which transaction applies: |

| | | |

| | (2) Aggregate number of securities to which transaction applies: |

| | | |

| | (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) Proposed maximum aggregate value of transaction: |

| | | |

| | (5) Total fee paid: |

| | | |

| ☐ | Fee paid previously with preliminary materials. |

| | |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) Amount Previously Paid: |

| | | |

| | (2) Form, Schedule or Registration Statement No.: |

| | | |

| | (3) Filing Party: |

| | | |

| | (4) Date Filed: |

| | | |

IMPORTANT STOCKHOLDER INFORMATION

[ ], 2022

Dear Stockholder,

Enclosed you will find a Notice and a Proxy Statement for a Special Meeting of Stockholders (the “Meeting”) of The New Ireland Fund, Inc. (the “Fund”) to be held on Thursday, January 5, 2023 at [9:00 a.m.] Eastern time. The Meeting will be held solely by virtual means over the Internet. At the Meeting, stockholders will be asked to consider and vote upon a proposal to approve the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation attached to the Proxy Statement.

Dissolution of the Fund is not an outcome any of us hoped for. However, in light of the Fund’s current level of assets and expenses and the tendency of the Fund’s shares to trade at prices that are below net asset values, or at a discount, during recent years, after considering various alternatives with respect to the Fund, the Board of Directors of the Fund (the “Board”) has determined that it is advisable and in the best interest of the Fund and its stockholders to liquidate the Fund. The Board recommends that you vote “FOR” the proposed liquidation and dissolution of the Fund. It is important that you vote your shares so that we will have the ability to liquidate and dissolve the Fund in an orderly manner and without undue costs to stockholders.

If stockholders approve the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation, and certain conditions are met, the liquidation is expected to occur shortly after the Meeting, likely sometime in February 2023, or, if adjourned, shortly after the date of the reconvened Meeting at which stockholders approve the liquidation of the Fund. Pursuant to the liquidation, each stockholder will receive payment of one or more liquidating distributions equal to the stockholder’s proportionate interest in the net assets of the Fund.

You have received the enclosed proxy statement because you were a stockholder of record of the Fund on November [ ], 2022 (the “Record Date”).

Your vote is important. Participation in the Meeting will be limited to stockholders of the Fund as of the close of business on the Record Date. You are entitled to receive notice of, and to vote at, the Meeting and any adjournment thereof, even if you no longer hold shares of the Fund. Your vote is important no matter how many shares you own. It is important that your vote be received no later than the time of the Meeting.

Voting is quick and easy. Everything you need is enclosed. You may vote by completing and returning your proxy card in the enclosed postage-paid return envelope, [by calling the toll-free telephone number listed on the enclosed proxy card,] or by visiting the Internet website listed on the enclosed proxy card. You may also vote at the Meeting, though we request that you vote using one of the above methods even if you plan to attend the Meeting. You may receive more than one set of proxy materials if you hold shares in more than one account. Please be sure to vote each proxy card you receive.

If you have any questions concerning your proxy card call the Fund at 1-800-468-6475 and verify that you are a stockholder on the Record Date. If you are a record owner of shares, please have your [11-digit control number] on your proxy card available when you call or include it in your email. If you sign, date, and return the proxy card but give no voting instructions, your shares will be voted “FOR” the proposal above.

We look forward to your continued support.

Sincerely,

Derval Murray

Secretary

The New Ireland Fund, Inc.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

1-800-GO-TO-IRL (1-800-468-6475)

THE NEW IRELAND FUND, INC.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To the Stockholders of The New Ireland Fund, Inc.:

NOTICE IS HEREBY GIVEN that the Special Meeting of Stockholders (the “Meeting”) of The New Ireland Fund, Inc. (the “Fund”), a Maryland corporation, will be held on Thursday, January 5, 2023 at [ ] Eastern time., for the following purposes:

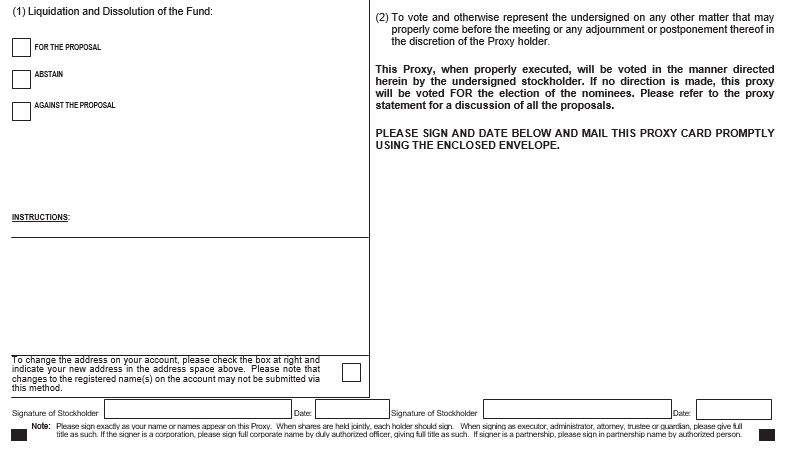

| 1. | To consider and vote on a proposal to liquidate and dissolve the Fund pursuant to a Plan of Liquidation (Proposal 1). |

| 2. | To consider and act upon any other business as may properly come before the Meeting or any adjournment thereof. |

These items are discussed in greater detail in the attached Proxy Statement.

Only stockholders of record at the close of business on November [ ], 2022 (the “Record Date”) are entitled to notice of, and to vote at, the Meeting or at any adjournments thereof. The Meeting will be held solely by virtual means over the Internet. Stockholders of record on the record date may attend, participate in and vote at the Meeting by visiting the following website: [https://web.lumiagm.com/214266676 (password [ ])].

If you have any questions concerning your proxy card call the Fund at 1-800-468-6475 and verify that you are a stockholder on the record date. If you are a record owner of shares, please have your [11-digit control number] on your proxy card available when you call.

You have the right to receive notice of and to vote at the meeting if you were a stockholder of record at the close of business on November [__], 2022. Please complete, sign, date and return your proxy card to us in the enclosed, postage-prepaid envelope at your earliest convenience, even if you plan to attend the Meeting. If you prefer, you can authorize your proxy through the Internet as described in the proxy statement and on the enclosed proxy card.

If you sign, date, and return the proxy card but give no voting instructions, your shares will be voted “FOR” the Proposal 1 above.

| | By order of the Board of Directors, |

| | |

| | Derval Murray Secretary |

Dated: [ ], 2022

Important Notice Regarding the Availability of Proxy Materials for the Meeting. The Notice of Special Meeting of Stockholders, Proxy Statement and the Fund’s most recent annual report and semi-annual report are posted on the Fund’s website at www.newirelandfund.com.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, WE ASK THAT YOU PLEASE COMPLETE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE OR VOTE [BY TELEPHONE OR] THROUGH THE INTERNET PURSUANT TO INSTRUCTIONS ON THE ENCLOSED PROXY CARD. IN ORDER TO AVOID THE ADDITIONAL EXPENSE TO THE FUND OF FURTHER SOLICITATION, WE ASK FOR YOUR COOPERATION IN MAILING IN YOUR PROXY CARD PROMPTLY. INSTRUCTIONS FOR THE PROPER EXECUTION OF PROXIES ARE SET FORTH BELOW.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense to the Fund involved in validating your vote if you fail to sign your proxy card properly.

| 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Joint owners should each sign, exactly as your names are shown in the registration. |

| 3. | All Other Accounts: The capacity of the individuals signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| |

| Corporate Accounts | |

| (1) ABC Corp. | ABC Corp. |

| (2) ABC Corp | John Doe, Treasurer |

(3) ABC Corp.

c/o John Doe, Treasurer | John Doe |

| (4) ABC Corp. Profit Sharing Plan | John Doe, Trustee |

| | |

| Trust Accounts | |

| (1) ABC Trust | Jane B. Doe, Trustee |

(2) Jane B. Doe, Trustee

u/t/d 12/28/78 | Jane B. Doe |

| | |

| Custodian or Estate Accounts | |

(1) John B. Smith, Cust.

f/b/o John B. Smith, Jr. UGMA | John B. Smith |

| (2) Estate of John B. Smith | John B. Smith, Jr., Executor |

| | |

THE NEW IRELAND FUND, INC.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

SPECIAL MEETING OF STOCKHOLDERS

January 5, 2023

PROXY STATEMENT

This Proxy Statement is furnished by the Board of Directors (the “Board”) of The New Ireland Fund, Inc. (the “Fund”) in connection with its solicitation of proxies for use at the Special Meeting of Stockholders (the “Meeting”) of the Fund to be held on Thursday, January 5, 2023 at [ ] p.m. Eastern time, and at any adjournments thereof. The Meeting will be held solely by virtual means over the Internet. Stockholders of record on the record date may attend, participate in and vote at the Meeting by visiting the following website: [https://web.lumiagm.com/214266676 (password [ ])].

If you have any questions concerning your proxy card call the Fund at 1-800-468-6475 and verify that you were a stockholder on the record date. If you are a record owner of shares, please have your [11-digit control number] on your proxy card available when you call or include it in your email.

You may vote via the Internet. To vote via the Internet, go to www.voteproxy.com to complete an electronic proxy card (have your proxy card in hand when you visit the website). You will be asked to provide the company number and control number from your proxy card. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on ([_____]).

The purpose of the Meeting and the matters to be acted upon are set forth in the accompanying Notice of Special Meeting of Stockholders.

Even if you plan to attend the Meeting, please sign, date and return the enclosed proxy card. If you vote [by telephone or] via the Internet, you will be asked to enter a unique code that has been assigned to you, which is printed on your proxy card. This code is designed to confirm your identity, provide access to the voting website and confirm that your voting instructions are properly recorded.

All properly executed proxies received prior to the Meeting will be voted at the Meeting and at any and all adjournments, postponements or delays thereof. On any matter coming before the meeting as to which a stockholder has specified a choice on that stockholder’s proxy, the shares will be voted accordingly. Subject to the discussion below regarding abstentions and broker non-votes, if a proxy card is properly executed and returned and no choice is specified with respect to Proposal 1, the shares will be voted “FOR” Proposal 1. Stockholders who execute proxies or provide voting instructions [by telephone or] via the Internet may revoke them with respect to the proposal at any time before a vote is taken on the proposal by submitting a written notice to the Secretary of the Fund, by delivering a duly executed proxy bearing a later date or by participation in the Meeting and executing a superseding proxy.

A proxy on shares held by brokers or nominees which (a) is properly executed and returned accompanied by instructions to withhold authority to vote, or (b) as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter, represents a broker “non-vote”. Proxies that reflect abstentions or broker non-votes will be counted as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum.

A quorum of the Fund’s stockholders is required to properly conduct the business of the Meeting. Under the By-Laws of the Fund, a quorum is constituted by the presence in person or by proxy of stockholders entitled to cast a majority of the votes entitled to be cast at the Meeting. In the event a quorum is not present at the Meeting, the Chairperson of the Meeting will have the power to adjourn the Meeting, without notice other than an announcement at the Meeting, to permit the further solicitation of proxies. Once a quorum is established, the stockholders present, either in person or by proxy, at the Meeting may continue to transact business until adjournment, notwithstanding the withdrawal from the Meeting of enough stockholders to leave fewer than would be required to establish a quorum. Absent the establishment of a subsequent record date and the giving of notice to the holders of record thereon, the adjourned Meeting will take place not more than 120 days after the original record date. At such adjourned Meeting, any business may be transacted which might have been transacted at the original Meeting.

The close of business on November [ ], 2022 has been fixed as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Meeting. As of the Record Date, the Fund had [ ] shares of common stock outstanding and entitled to vote. At the Meeting, each share will be entitled to one vote, and fractional shares, if any, shall have proportionate voting rights. It is expected that the Notice of Special Meeting, Proxy Statement, and form of proxy will be mailed to stockholders on or about November [ ], 2022.

Proxy solicitations will be made primarily by mail, but solicitations may also be made by telephone, or personal contact conducted by officers or employees of the Fund. All costs of solicitation, including (a) printing and mailing of this Proxy Statement and accompanying material, (b) the reimbursement of brokerage firms and others for their expenses in forwarding solicitation material to the beneficial owners of the Fund’s shares and (c) supplementary solicitations to submit proxies, will be borne by the Fund.

The Fund has opted into and is subject to the provisions of the Maryland Control Share Acquisition Act (the “MCSAA”). Generally, the MCSAA provides that a holder of “control shares” (as defined in the MCSAA) of a Maryland corporation (e.g., the Fund) acquired in a “control share acquisition” (as defined in the MCSAA) will not be entitled to vote its control shares unless the other stockholders of the corporation reinstate those voting rights at a meeting of stockholders by a vote of two-thirds of the votes entitled to be cast on the matter, excluding the “acquiring person” (i.e., the holder or group of holders acting in concert that acquires, or proposes to acquire, “control shares”) and any other holders of “interested shares” (as defined in the MCSAA).

Generally, “control shares” are shares that, when aggregated with shares already owned by an acquiring person, would entitle the acquiring person to exercise 10% or more, 33 1/3% or more, or a majority of the total voting power of shares entitled to vote in the election of directors. The MCSAA does not apply (a) to shares acquired in a merger, consolidation or share exchange if the corporation is a party to the transaction, (b) to shares acquired under the satisfaction of a pledge or other security interest created in good faith and not for the purpose of circumventing the MCSAA, or (c) to acquisitions of shares approved or exempted by a provision contained in the charter or bylaws of the corporation and adopted at any time before the acquisition of the shares. Stockholders (together with any “associated persons” (as defined in the MCSAA)) that own less than ten percent of the shares entitled to vote in the election of directors are not affected by the restrictions on voting rights under the MCSAA.

Accordingly, any holder of the Fund’s outstanding shares that is deemed to hold “control shares” under the MCSAA will not be entitled to vote its control shares at the Meeting.

On February 18, 2022, the U.S. District Court for the Southern District of New York granted judgment in favor of a plaintiff’s claim for rescission of a control share provision in the bylaws of certain Nuveen-sponsored closed-end funds and the plaintiff’s declaratory judgment claim, and declared that the funds’ control share bylaw provision violates Section 18(i) of the Investment Company Act of 1940 (the “1940 Act”). The Nuveen-sponsored closed-end funds have appealed the district court’s decision to the United States Court of Appeals for the Second Circuit. Although the district court’s decision relates to closed-end funds that adopted a control share provision in their bylaws, as opposed to a closed-end fund opting into a control share statute (as the Fund opted into the MCSAA), it is possible that a court could decide that a fund opting into the MCSAA violates Section 18(i) of the 1940 Act. Such a judicial decision could potentially affect the outcome of the vote on Proposal 1 to the extent any “control shares” of the Fund are voted at the Meeting, because the voting rights of holders of such control shares would not have been limited by the MCSAA.

The Annual Report of the Fund, including audited financial statements for the fiscal year ended October 31, 2021, and the Semi-Annual Report of the Fund, including unaudited financial statements for the six-month period ended April 30, 2022, are available upon request, without charge, by writing to The New Ireland Fund, Inc., C/O KBI Global Investors (North America) Limited, One Boston Place, 201 Washington Street, 36th Floor, Boston, Massachusetts 02108, by accessing the Fund’s website at www.newirelandfund.com, by calling toll-free 1-800-468-6475, or by emailing investor.query@newirelandfund.com.

The date of this Proxy Statement is [ ], 2022.

Please vote now. Your vote is important. To avoid the wasteful and unnecessary expense of further solicitation and no matter how large or small your holdings may be, we urge you to vote your shares by signing and dating the enclosed proxy card and returning it promptly in the postage-paid envelope provided, or record your voting instructions [by telephone or] via the Internet. If you submit a properly executed proxy card but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” the proposed liquidation and dissolution of the Fund described in this proxy statement. If your shares of the Fund are held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the Meeting. |

PROPOSAL 1: LIQUIDATION AND DISSOLUTION OF THE FUND PURSUANT TO THE PLAN OF LIQUIDATION

Introduction

At a meeting held on October 26, 2022, the Board of the Fund unanimously approved the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation adopted by the Board of Directors of the Fund (the “Plan of Liquidation”), a form of which is attached hereto as Appendix A, and directed that the matter be submitted to the Fund's stockholders for their consideration and approval. The Fund's charter and Maryland law requires that the liquidation and dissolution of the Fund be approved by the affirmative vote of a majority of the total number of votes entitled to be cast thereon. If stockholders approve the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation, KBI Global Investors (North America) Ltd, the Fund’s investment adviser (the “Investment Adviser”), will direct the orderly liquidation of the Fund's assets as soon as reasonably practicable, the discharging of, making reasonable provision for the payment of, or maintaining reserves against all liabilities of the Fund, and the distribution of the net proceeds to stockholders in one or more liquidating distributions. Fund management expects that stockholders will receive such distributions in cash. Such amount will be reduced by the expenses of the Fund in connection with the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation. As soon as reasonably practicable following the payment of the final liquidating distribution, the Fund will dissolve. In addition, as soon as practicable after the liquidation and distribution of the Fund's assets, the Fund will take such actions as may be necessary in order to deregister the Fund under the 1940 Act, and will file, if required, a final Form N-CEN with the Securities and Exchange Commission (“SEC”). If stockholders do not approve the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation, the Board will consider what further action, if any, to take, including resubmitting a proposal to liquidate and dissolve the Fund to stockholders.

The Board unanimously recommends that you vote “FOR” Proposal 1 to liquidate and dissolve the Fund pursuant to the Plan of Liquidation.

Background

Shares of closed-end funds often trade in the marketplace at a discount to their net asset value (“NAV”) per share. This has historically been true in the case of the Fund, which has traded at a persistent discount to its NAV for the past several years despite tender offers, a managed distribution policy and the Fund's share repurchase program. As of September 30, 2022, prior to the Board's approval of the Plan of Liquidation, the NAV per share of the Fund's Shares was $[ ] and the market price of its Shares was $[ ], representing a discount of approximately [ ]%. During the 12-month and 18-month periods ended September 30, 2022, the average discount to NAV of the Fund's shares was approximately [ ]% and [ ]%, respectively. Furthermore, the Fund's asset size is relatively small compared to other closed-end funds and has consistently declined over time due to distributions as a result of strong long-term performance and activities to help manage the persistent discount including tender offers, a managed distribution policy and open market share repurchases. The Fund's assets declined from approximately $[ ] million (as of September 30, 2021) to $[ ] million (as of September 30, 2022).

Board Considerations

The Board of the Fund regularly reviews with Fund management possible actions that could address the Fund's persistent discount and enhance stockholder value. Considering the current assets and expenses of the Fund and the persistent discount at which the Fund's shares have traded, the Board of the Fund unanimously approved the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation after considering various other alternatives. Specifically, the Board considered the possibility of increasing the assets of the Fund through one or more offerings of common stock, converting the Fund to an open-end fund, merging the Fund into another investment company, or changing the Fund's investment strategy. The Board has determined that none of these options were feasible or likely to enhance stockholder value. The Board further considered that the actual amounts to be distributed to stockholders of the Fund upon liquidation are subject to uncertainties and not possible to predict at this time. The amount available for distribution to stockholders will be based, in part, on such factors as the value of the Fund's assets at the time of liquidation and then-current market conditions and the amount of the Fund's actual costs, expenses and liabilities to be paid in the future.

The Board determined that the Fund’s ability to increase its assets through one or more offerings of additional common stock, including through the issuance of rights to existing stockholders, was limited under the 1940 Act as a result of the Fund’s inability to issue shares at or above net asset value due to the trading discount of the shares. In addition, the Board determined that converting to an open-end fund was likely to further reduce the size of the Fund, as there would likely be significant redemption requests in connection with such a conversion, resulting in a higher expense ratio, and conversion would involve additional trading and tax costs. The Board also concluded that a merger of the Fund or a change in investment strategy were not viable strategic alternatives.

The Board also considered the possibility of continuing to pursue the Fund's share repurchase program, which was put in place for purposes of enhancing stockholder value and reducing the discount at which the Fund's shares trade from their NAV. Since the inception of the share repurchase program on [ ], the Fund has repurchased [ ] of its shares at an average discount of [ ]% from NAV. The Board also concluded that a large scale tender offer to repurchase the Fund's shares or continuing to pursue the Fund's share repurchase program was likely to further reduce the size of the Fund and could result in an increased total expense ratio for the Fund, and was therefore not in the best interests of the Fund's stockholders in the long term.

After considering the feasibility of the continued operation of the Fund and alternatives to liquidation, and based upon the foregoing considerations and other relevant factors, at a special meeting held on October 26, 2022, the Board determined that, under the circumstances, liquidation of the Fund is in the best interests of the Fund and its stockholders. Following review and discussions with the Investment Adviser and Fund counsel, the Fund's directors, including the Independent Directors, then unanimously approved the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation and directed that the Plan of Liquidation be submitted for consideration by the Fund's stockholders.

If liquidation and dissolution of the Fund pursuant to the Plan of Liquidation is approved by stockholders, the Investment Adviser, under the oversight of the Board and the officers of the Fund, will proceed to wind up the Fund's affairs as soon as reasonably practicable thereafter in a timeframe that allows for an orderly liquidation of portfolio holdings under then-current market conditions. If stockholders do not approve the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation, the Board will consider what further action, if any, to take, including resubmitting a proposal to liquidate and dissolve the Fund to stockholders.

Description of the Plan of Liquidation and Liquidation of the Fund

The Plan of Liquidation is attached hereto as Appendix A, and this summary of the Plan of Liquidation is qualified in its entirety by the reference to Appendix A.

Effective Date of the Plan of Liquidation and Cessation of the Fund's Activities as an Investment Company. The Plan of Liquidation shall be and become effective only upon the adoption and approval of the Plan of Liquidation by the affirmative vote of a majority of the total number of votes entitled to be cast thereon. The date of such adoption and approval of the Plan of Liquidation by stockholders is hereinafter called the “Effective Date.” After the Effective Date, the Fund shall not engage in any business activities except for the purpose of winding up its business and affairs, preserving the value of its assets and distributing its assets to its stockholders in accordance with the provisions of this Plan of Liquidation after the payment to (or reservation of assets for payment to) all creditors of the Fund; provided that the Fund shall, prior to the making of the final liquidating distribution, continue to, as determined to be appropriate by the Board, make payment of dividends and other distributions to stockholders, as applicable. After the distribution of assets to stockholders, the Fund will be dissolved in accordance with the Plan of Liquidation and Maryland law.

Closing of Books and Restriction on Transfer of Shares. The proportionate interests of stockholders in the assets of the Fund shall be fixed on the basis of their respective holdings at the close of business on the Effective Date, or on such later date as may be determined by the Board (the “Valuation Date”). On the Valuation Date, the books of the Fund shall be closed and, unless the books of the Fund are reopened because the Plan of Liquidation cannot be carried into effect under the laws of the State of Maryland or otherwise, the stockholders' respective interests in the Fund's assets shall not be transferable by the negotiation of share certificates and the Fund's shares will cease to be traded on the New York Stock Exchange.

Liquidation Distributions. Following stockholder approval of the liquidation of the Fund, the Fund will, as soon as reasonable and practicable after the Effective Date, complete the sale of the portfolio securities it holds in order to convert its assets to cash. As soon as reasonably practicable after the Effective Date, the Fund will send to each stockholder of record a liquidating distribution equal to the stockholder’s proportionate interest in the remaining assets of the Fund and information concerning the sources of the liquidating distribution. Except as may be otherwise agreed to between the Fund and the Investment Adviser, all expenses incurred by or allocable to the Fund in carrying out the Plan of Liquidation and dissolving the Fund shall be borne by the Fund. If approved, the Fund’s payment of liquidating distributions to stockholders is expected to occur shortly after the Meeting, likely sometime in February 2023, or, if adjourned, shortly after the date of the reconvened Meeting at which stockholders approve the liquidation of the Fund. Such expenses are estimated to be approximately $[ ] in the aggregate.

Amendment or Abandonment of the Plan of Liquidation. The Plan of Liquidation provides that the Board may authorize such variations from, or amendments to, the provisions of the Plan of Liquidation as may be necessary or appropriate to effect the dissolution and complete liquidation and termination of the existence of the Fund in accordance with the purposes intended to be accomplished by the Plan of Liquidation. Further, the Plan of Liquidation allows the Board to determine at any point prior to filing Articles of Dissolution with the State Department of Assessments and Taxation of Maryland that liquidation and dissolution of the Fund is no longer advisable and in the best interests of the Fund and the Fund’s stockholders, and may therefore abandon the Plan of Liquidation.

Deregistration under the 1940 Act. As soon as practicable after the Effective Date and the completion of the implementation of the Plan of Liquidation, steps will be taken to deregister the Fund as an investment company under the 1940 Act.

Other Actions. The officers of the Fund will take such other actions as may be deemed necessary or advisable to carry out the provisions and purposes of the Plan of Liquidation.

General Income Tax Consequences

The following is a summary of certain federal income tax considerations generally relevant to the Fund and its stockholders. No attempt is made to present a detailed explanation of the tax treatment of the Fund or its stockholders, and the discussion here is not intended as a substitute for careful tax planning. Stockholders are urged to consult their tax advisors with specific reference to their own tax situations.

This general discussion of certain federal income tax consequences is based on the Internal Revenue Code of 1986, as amended (the “Code”), and the regulations issued thereunder as in effect on the date of this Proxy Statement. New legislation, as well as administrative changes or court decisions, may significantly change the conclusions expressed herein, possibly with retroactive effect.

If its stockholders approve the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation, the Fund will sell its assets and distribute the proceeds and any income to stockholders. The Fund anticipates that it will retain its qualification for treatment as a regulated investment company during the liquidation period and will make required distributions so that it will not be taxed on the Fund's net gain, if any, realized from the sale of its assets. The Fund may, if eligible, treat all or a portion of the amounts required to be distributed as having been paid out as part of the liquidation distribution.

The Fund expects to treat all or a portion of its investment company taxable income, if any, and its net capital gains, if any, required to be distributed for the taxable years ending at or prior to the dissolution date, as an income dividend or capital gain distribution, as applicable, on account of the Fund's final taxable year as having been paid out as liquidation distributions made to the Fund's stockholders in complete liquidation of the Fund. As described in the next paragraph, any such liquidation distributions (in lieu of an income dividend or capital gain distribution) will be treated for U.S. federal income tax purposes as having been received by Fund stockholders as consideration for a sale or exchange of their Fund stock. However, to the extent necessary, the Fund may declare, before the date of dissolution, a dividend or dividends which, together with all such previous dividends, will have the effect of distributing to the Fund's stockholders all or a portion of such income and gains for the taxable years ending at or prior to the dissolution date (computed without regard to any deduction for dividends paid), if any, realized in the taxable years ending at or prior to the dissolution date (after reduction for any capital loss carryforward) and any additional amounts necessary to avoid any income or excise tax for such periods. The tax consequences to stockholders from any such dividends will be the same as is normally the case with respect to the payment of dividends by the Fund.

A stockholder who receives liquidating distributions will be treated as having received the distribution in exchange for the stockholder's stock in the Fund and will recognize gain or loss based on the difference between the amount received and the stockholder's basis in the Fund stock. If a stockholder holds stock as capital assets, the gain or loss will be characterized as a capital gain or loss. If the stock has been held for more than one year, any such gain will be treated as long-term capital gain, taxable to individual stockholders at a maximum U.S. federal tax rate of 15% or 20%, and any such loss will be treated as long-term capital loss. Capital gain or loss on stock held for one year or less will be treated as short-term capital gain or loss, except that any loss realized with respect to stock in the Fund held for six months or less will be treated as long-term capital loss to the extent of any capital gain dividends that were received on the stock.

Liquidating distributions to a stockholder may be subject to backup withholding. Generally, stockholders subject to backup withholding will be those for whom no taxpayer identification number is on file with the applicable withholding agent, those who, to such withholding agent's knowledge, have furnished an incorrect number, and those who underreport their tax liability. Certain stockholders specified in the Code may be exempt from backup withholding. The backup withholding tax is not an additional tax and may be credited against a taxpayer's U.S. federal income tax liability.

Required Vote

Approval of the liquidation and dissolution of the Fund pursuant to the Plan of Liquidation is to be determined by the affirmative vote of a majority of the total number of votes entitled to be cast thereon.

Impact of the Plan of Liquidation on the Fund’s Status under the 1940 Act

After the Effective Date, the Fund will cease doing business as an investment company (including ceasing to invest assets in accordance with the Fund’s investment objective) and, as soon as practicable, will apply for deregistration under the 1940 Act. It is expected that the SEC will issue an order approving the deregistration of the Fund if the Fund is no longer doing business as an investment company. Accordingly, the Plan of Liquidation provides for the eventual cessation of the Fund’s activities as an investment company and its deregistration under the 1940 Act. Until the Fund’s deregistration as an investment company becomes effective, the Fund, as a registered investment company, will continue to be subject to and will comply with the 1940 Act.

Impact of the Plan of Liquidation on the Fund’s Status under Maryland Law

As soon as practicable after the Effective Date, pursuant to Maryland law, Articles of Dissolution stating that the dissolution has been authorized will in due course be executed, acknowledged and filed with the State Department of Assessments and Taxation of Maryland, and will become effective in accordance with such law. Upon the effective date of such Articles of Dissolution, the Fund will be legally dissolved, but thereafter the Fund will continue to exist for the purpose of winding up its business and affairs, but not for the purpose of continuing the business for which the Fund was organized.

Appraisal Rights

Stockholders will not be entitled to appraisal rights under Maryland law in connection with the Plan of Liquidation.

THE FUND’S BOARD, INCLUDING THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” PROPOSAL 1 TO LIQUIDATE AND DISSOLVE THE FUND PURSUANT TO THE PLAN OF LIQUIDATION. |

Stockholder Communications

Stockholders who wish to send communications to the Board should address them to the Board of Directors of the Fund, c/o KBI Global Investors (North America) Ltd, One Boston Place, 201 Washington Street, 36th Floor, Boston, MA 02108 or to investor.query@newirelandfund.com. All such communications will be directed to the Board of Director’s attention.

The Fund does not have a formal policy regarding participation of Directors in the Special Meeting of Stockholders; however, all of the Directors of the Fund attended the June 14, 2022 Annual Meeting of Stockholders.

Expenses of Proxy Solicitation

Your vote is being solicited by the Directors. The cost of soliciting proxies is borne by the Fund. The Fund reimburses brokerage firms and others for their reasonable expenses in forwarding proxy material to the beneficial owners and soliciting them to execute proxies.

The Fund expects that the solicitation will be primarily by mail, but also may include advertisement, telephone, telecopy, facsimile transmission, electronic, oral, or other means of communication, or by personal contacts. If the Fund does not receive your proxy by a certain time you may receive a telephone call from an officer or employee of the Fund asking you to vote.

Although no precise estimate can be made at the present time, it is currently estimated that the aggregate amount to be spent in connection with the solicitation of proxies by the Fund (excluding the salaries and fees of officers and employees) will be between [$_____ and $____]. Estimates include fees for attorneys, accountants, public relations or financial advisers, proxy solicitors, advertising, printing, transportation, litigation, and other costs incidental to the solicitation, but exclude costs represented by salaries and wages of regular employees and officers.

ADDITIONAL INFORMATION

Investment Adviser

As described above, KBI Global Investors (North America) Ltd, One Boston Place, 201 Washington St., 36th Floor, Boston, MA 02108, and headquartered at 2 Harbormaster Place, 3rd floor, IFSC, Dublin 1, Ireland currently serves as the Fund’s investment adviser.

Administrator

US Bancorp Fund Services LLC acts as the Fund’s administrator pursuant to an Administration Agreement between the Administrator and the Fund. The principal business address of US Bancorp Fund Services LLC is 615 E. Michigan Street Milwaukee, Wisconsin, 53202.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL/RECORD OWNERS

To the knowledge of the Fund, as of the Record Date, (i) the Directors and officers of the Fund as a “group” (as defined in Section 13(d) of the Securities Exchange Act of 1934, as amended (the “1934 Act”) owned less than 1% of the outstanding securities of the Fund, and (ii) other than the stockholders listed below, no person owned of record or owned beneficially more than 5% of the Fund’s outstanding shares. This information is based on the Fund’s review of filings made pursuant to Section 13 of the 1934 Act.

Stockholder Name and Address | Number of Shares Beneficially Owned | |

1607 Capital Partners LLC 13 S. 13th Street, Suite 400 Richmond VA 23219 | 471,916 | 13.0% |

| | | |

Saba Capital Management, L.P. 405 Lexington Avenue, 58th Floor New York, NY 10174 | 482,592 | 13.31% |

| | | |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act, and Section 30(h) of the 1940 Act, and the rules thereunder, require that the Fund’s Directors and officers, certain persons affiliated with the Investment Adviser, and persons who own more than 10% of a registered class of the Fund’s securities, file reports of ownership and changes of ownership with the SEC and, in some cases, the New York Stock Exchange. Directors, officers, and greater than 10% stockholders are required by SEC regulations to furnish the Fund with copies of all Section 16(a) forms they file.

Based solely upon the Fund’s review of the copies of such forms it received and written representations from certain of such persons, the Fund believes that during the Fund’s fiscal year ended October 31, 2021 these persons complied with all such applicable filing requirements.

OTHER MATTERS

No business other than as set forth herein is expected to come before the Meeting, but should any other matter requiring a vote of stockholders arise, including any question as to an adjournment of a Meeting, the persons named in the enclosed proxy will vote thereon according to their best judgment in the interests of the Fund.

Dated: [ ], 2022

| IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. STOCKHOLDERS WHO DO NOT EXPECT TO BE PRESENT AT THE MEETING WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE OR VOTE BY TELEPHONE OR THROUGH THE INTERNET PURSUANT TO INSTRUCTIONS ON THE ENCLOSED PROXY CARD. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. |

| |

THE NEW IRELAND FUND, INC.

PLAN OF LIQUIDATION

The following Plan of Liquidation (the “Plan”) of The New Ireland Fund, Inc. (the “Fund”), a corporation organized and existing under the laws of the State of Maryland, which operates as a closed-end, non-diversified management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), is intended to accomplish the complete liquidation and dissolution of the Fund in conformity with the provisions of the charter of the Fund (the “Charter”) and under the Maryland General Corporation Law (the “MGCL”).

WHEREAS, the Fund’s Board of Directors (the “Board”) has deemed it advisable and in the best interests of the Fund and its stockholders for the Fund to liquidate and dissolve, and the Board, on October 26, 2022, considered the matter and directed that such liquidation and dissolution pursuant to this Plan be submitted to stockholders of the Fund for approval.

NOW, THEREFORE, the liquidation and dissolution of the Fund shall be carried out in the manner hereinafter set forth:

1. Effective Date of the Plan. The Plan shall be and become effective only upon the adoption and approval of the Plan by the affirmative vote of a majority of the total number of votes entitled to be cast thereon. The date of such adoption and approval of the Plan by stockholders is hereinafter called the “Effective Date.”

2. Cessation of Business. After the Effective Date, the Fund shall not engage in any business activities except for the purpose of winding up its business and affairs, preserving the value of its assets and distributing its assets to its stockholders in accordance with the provisions of this Plan after the payment to (or reservation of assets for payment to) all creditors of the Fund; provided that the Fund shall, prior to the making of the final liquidating distribution, continue to, as determined to be appropriate by the Board, make payment of dividends and other distributions to stockholders, as applicable.

3. Restriction of Transfer of Shares. The proportionate interests of stockholders in the assets of the Fund shall be fixed on the basis of their respective holdings at the close of business on the Effective Date, or on such later date as may be determined by the Board (the “Valuation Date”). On the Valuation Date, the books of the Fund shall be closed and, unless the books of the Fund are reopened because the Plan cannot be carried into effect under the laws of the State of Maryland or otherwise, the stockholders’ respective interests in the Fund’s assets shall not be transferable by the negotiation of share certificates and the Fund’s shares will cease to be traded on the New York Stock Exchange (the “NYSE”).

4. Liquidation of Assets. After the Effective Date, the Fund shall cause the liquidation of its assets to cash form as soon as practicable consistent with the terms of the Plan.

5. Payment of Debts. As soon as practicable after the Effective Date, the Fund shall determine and pay (or reserve sufficient amounts to pay) the amount of all known or reasonably ascertainable liabilities of the Fund incurred or expected to be incurred prior to the date of the liquidating distribution provided in Section 6 below.

6. Liquidating Distributions. In accordance with Section 331 of the Internal Revenue Code of 1986, as amended (the “Code”), the Fund’s assets are expected to be distributed by one or more cash payments in complete cancellation of all the outstanding shares of common stock, par value $0.001 per share (the “Common Stock”), of the Fund. As soon as practicable after the Effective Date, the Fund will mail or wire, as applicable, the following to each stockholder of record: (i) one or more liquidating distributions equal to the stockholder’s proportionate interest in the remaining assets of the Fund (after the payments and creation of the reserves contemplated by Section 5 above) as of the Valuation Date, and (ii) information concerning the sources of the liquidating distribution. Upon the mailing or transfer of the final liquidating distribution, all outstanding shares of Common Stock will be deemed cancelled. Stockholders in possession of certificated shares of Common Stock will not be required to surrender their certificates to complete the liquidating distribution.

7. Expenses of Liquidation and Dissolution. Except as may be otherwise agreed to between the Fund and its investment adviser, KBI Global Investors (North America) Ltd., all expenses incurred by or allocable to the Fund in carrying out this Plan shall be borne by the Fund.

8. Power of the Board of Directors. The Board and, subject to the general direction of the Board, the officers of the Fund, shall have authority to do or authorize any and all acts and things provided for in this Plan and any and all such further acts and things as they may consider necessary or desirable to carry out the purposes of this Plan, including without limitation, the execution and filing of all certificates, documents, information returns, tax returns, forms, and other papers which may be necessary or appropriate to implement this Plan or which may be required by the provisions of the 1940 Act, the Securities Act of 1933, the Code and the MGCL.

9. Amendment or Abandonment of the Plan. The Board shall have the authority to authorize such variations from and amendments to the provisions of this Plan (other than the terms of the liquidating distributions) at any time without stockholder approval as may be necessary or appropriate to effect the complete liquidation, dissolution and termination of existence of the Fund, and the distribution of assets of the Fund to its stockholders, in accordance with the purposes intended to be accomplished by this Plan. In addition, the Board may abandon this Plan prior to the filing of the Articles of Dissolution as provided in Section 11 below if it determines that abandonment would be advisable and in the best interests of the Fund and its stockholders.

10. Deregistration Under the 1940 Act. As soon as practicable after the liquidation and distribution of the Fund’s assets, the Fund shall prepare and file a Form N-8F with the Securities and Exchange Commission and take such other actions as may be necessary in order to deregister the Fund under the 1940 Act. The Fund shall also file, if required, a final Form N-CEN with the Securities and Exchange Commission.

11. Dissolution under the MGCL. As soon as practicable after the Effective Date, the Fund shall be dissolved in accordance with the laws of the State of Maryland and the Charter, including filing Articles of Dissolution with and for acceptance by the State Department of Assessments and Taxation of Maryland.

12. No Appraisal Rights. Under Maryland law, stockholders will not be entitled to appraisal rights in connection with the liquidation and dissolution of the Fund pursuant to this Plan.

13. Governing Law. This Plan shall be governed and construed in accordance with the laws of the State of Maryland.

14. Further Actions. The Fund’s officers shall be authorized to make such filings and provide such notices with the U.S. Internal Revenue Service, the State of Maryland, the NYSE, and any other governmental, regulatory or other entity as such officers deem necessary or appropriate to effectuate the intents and purposes of this Plan.