SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by Registrant [x]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [x] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

The New Ireland Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: | |

| | | | |

| | | | |

| | | | |

| | 2) | Aggregate number of securities to which transaction applies: | |

| | | | |

| | | | |

| | | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | | | |

| | | | |

| | 4) | Proposed maximum aggregate value of transaction: | |

| | | | |

| | | | |

| | | | |

| | 5) | Total fee paid: | |

| | | | |

| | | | |

| [ ] | Fee paid previously with preliminary materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: | |

| | | | |

| | | | |

| | 2) | Form, Schedule or Registration Statement No.: | |

| | | | |

| | | | |

| | 3) | Filing Party: | |

| | | | |

| | | | |

| | 4) | Date Filed: | |

| | | | |

| | | | |

April 26, 2021

Dear Stockholder,

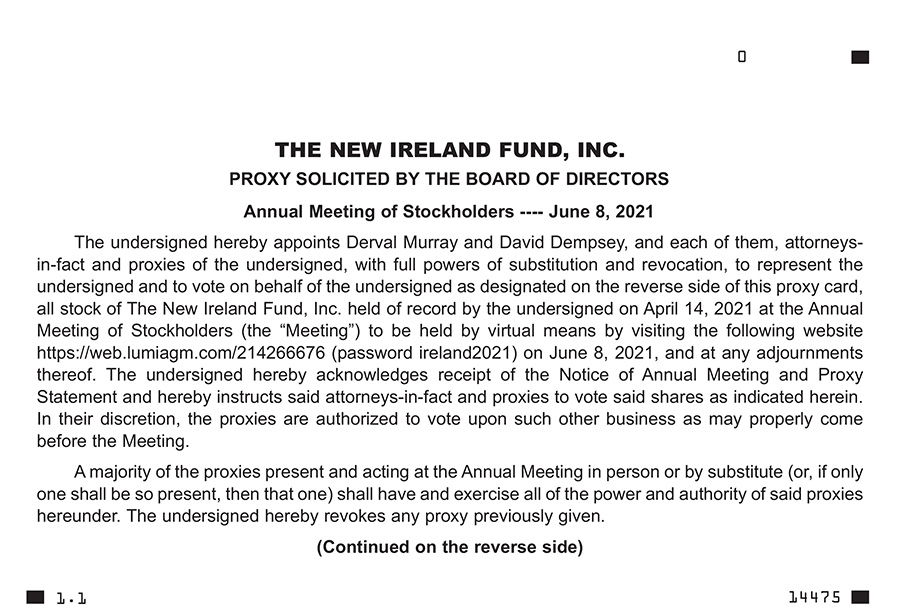

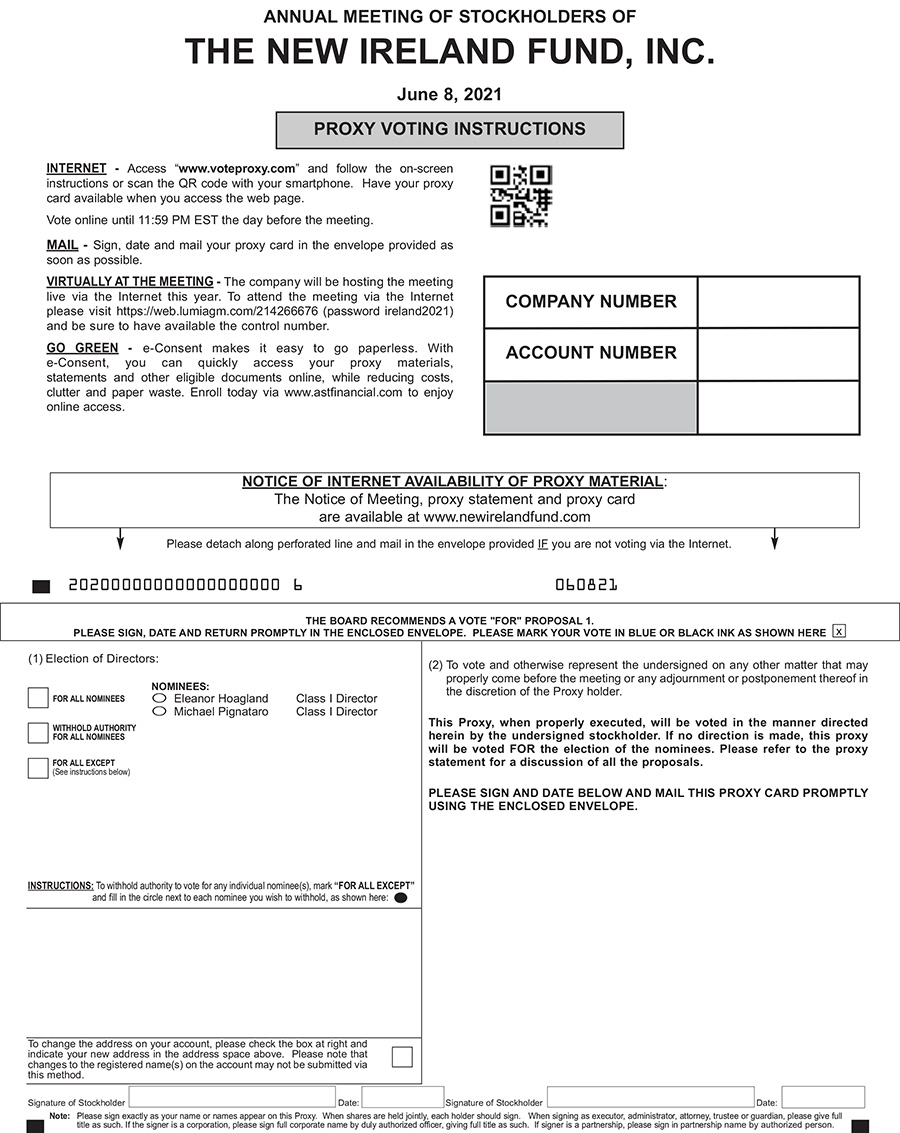

Enclosed you will find a Notice and a Proxy Statement for the Annual Meeting of Stockholders (the “Meeting”) of The New Ireland Fund, Inc. (the “Fund”) to be held on Tuesday, June 8, 2021 at 9:00 a.m. Eastern time. Due to the continued public health impact of the coronavirus, or COVID-19, outbreak and to support the health and well-being of our stockholders, service providers, personnel and other stakeholders, the Meeting will be held solely by virtual means over the Internet. At the Meeting, stockholders will vote on the election of two Directors and such other matters as may properly come before the Meeting.

On behalf of the Board of Directors, I cordially invite all stockholders to attend the Meeting. Whether or not you plan to attend the Meeting by virtual means, please take the time to cast your vote by mailing in your proxy card. If you prefer, you can authorize your proxy through the Internet, as described in the proxy statement and on the enclosed proxy card. As explained in the attached Proxy Statement, you may withdraw your proxy at any time before it is actually voted at the Meeting.

We look forward to your continued support.

| | Sincerely, |

| | |

| |  |

| | |

| | Chairperson |

| | David Dempsey |

The New Ireland Fund, Inc.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

1-800-GO-TO-IRL (1-800-468-6475)

THE NEW IRELAND FUND, INC.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the Stockholders of The New Ireland Fund, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders (the “Meeting”) of The New Ireland Fund, Inc. (the “Fund”), a Maryland corporation, will be held on Tuesday, June 8, 2021 at 9:00 a.m., Eastern time. , for the following purposes:

| 1. | To elect two (2) Directors of the Fund (Proposal 1). |

| 2. | To consider and act upon any other business as may properly come before the Meeting or any adjournment thereof. |

These items are discussed in greater detail in the attached Proxy Statement.

Only stockholders of record at the close of business on Wednesday, April 14, 2021 are entitled to notice of, and to vote at, the Meeting or at any adjournments thereof. Due to the continued public health impact of the coronavirus, of COVID-19, and to support the health and well-being of our stockholders, service providers, personnel and other stakeholders, the Meeting will be held solely by virtual means over the Internet. Stockholders of record on the record date may attend, participate in and vote at the Meeting by visiting the following website: https://web.lumiagm.com/214266676 (password ireland2021)

If you have any questions concerning your proxy card call AST at (877) 295-6932 and verify that you are a stockholder on the record date. If you are a record owner of shares, please have your 11-digit control number on your proxy card available when you call or include it in your email.

If you hold your shares in the name of a brokerage firm, bank, nominee or other institution (“street name”) as of the record date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via email to AST at proxy@astfinancial.com and you should label the email “Legal Proxy” in the subject line. If you hold your shares in street name as of the record date and wish to attend, but not vote at, the Meeting, you must verify to AST that you owned the shares as of the record date through an account statement or some other similar means.

Requests for registration must be received by AST no later than 3.00pm Eastern Time, on Monday June 7, 2021. You will then receive a confirmation email of your registration, with a control number for voting purposes from AST (if you hold your shares in street name and obtained a legal proxy).

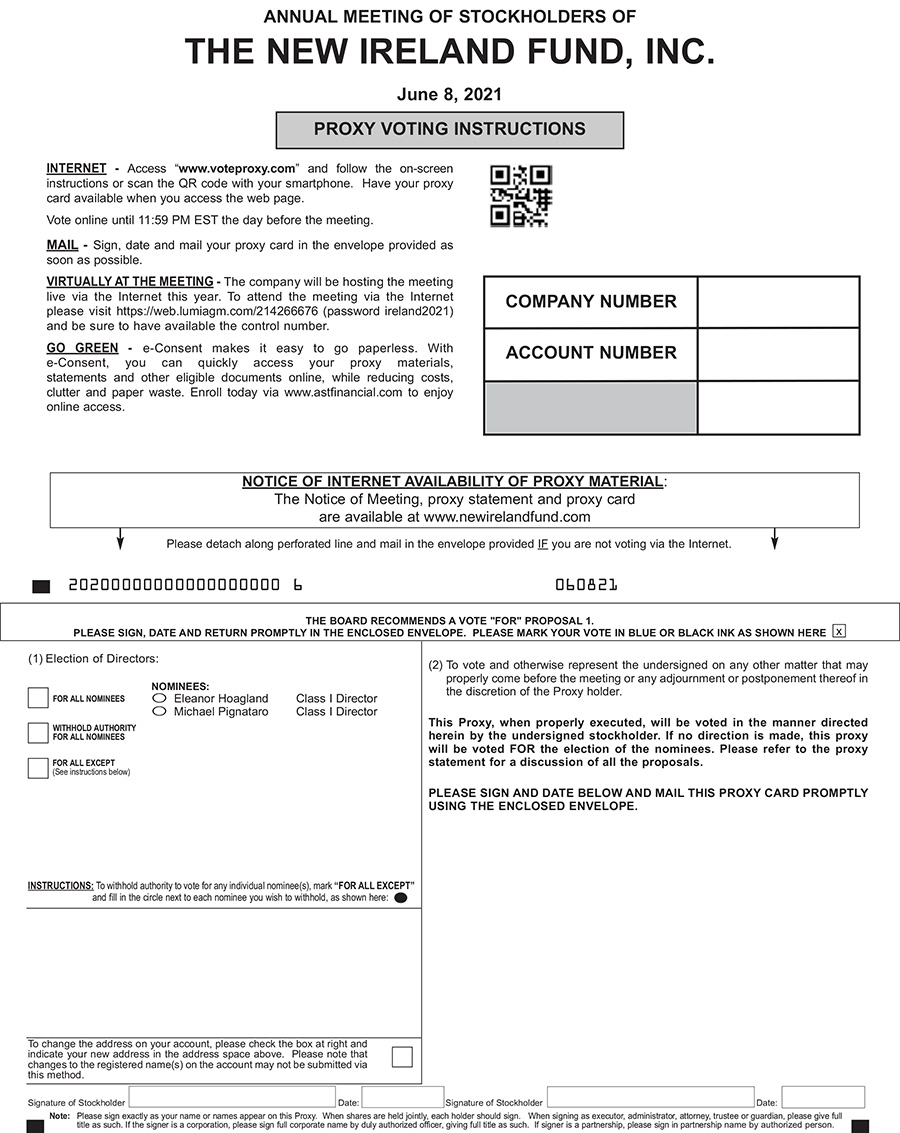

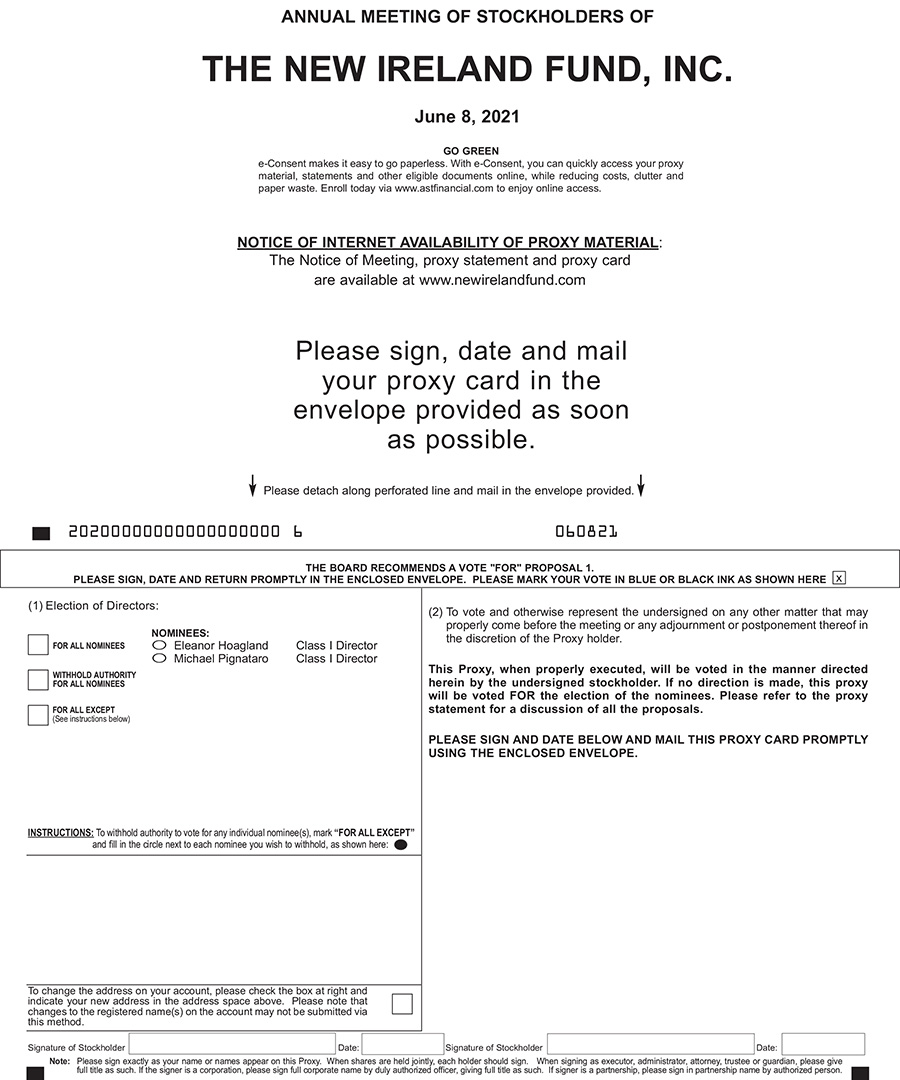

You have the right to receive notice of and to vote at the meeting if you were a stockholder of record at the close of business on April 14, 2021. Please complete, sign, date and return your proxy card to us in the enclosed, postage-prepaid envelope at your earliest convenience, even if you plan to attend the Meeting. If you prefer, you can authorize your proxy through the Internet as described in the proxy statement and on the enclosed proxy card.

If you sign, date, and return the proxy card but give no voting instructions, your shares will be voted “FOR” the proposal above.

| | By order of the Board of Directors |

| | |

| |  |

| | |

| | Derval Murray |

| | Secretary |

Dated: April 26, 2021

Important Notice Regarding the Availability of Proxy Materials for the Meeting. The Notice of Annual Meeting of Stockholders, Proxy Statement and the Fund’s most recent annual report are posted on the Fund’s website at www.newirelandfund.com.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, WE ASK THAT YOU PLEASE COMPLETE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. IN ORDER TO AVOID THE ADDITIONAL EXPENSE TO THE FUND OF FURTHER SOLICITATION, WE ASK FOR YOUR COOPERATION IN MAILING IN YOUR PROXY CARD PROMPTLY. INSTRUCTIONS FOR THE PROPER EXECUTION OF PROXIES ARE SET FORTH BELOW.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense to the Fund involved in validating your vote if you fail to sign your proxy card properly.

| 1. | Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card. |

| 2. | Joint Accounts: Joint owners should each sign, exactly as your names are shown in the registration. |

| 3. | All Other Accounts: The capacity of the individuals signing the proxy card should be indicated unless it is reflected in the form of registration. For example: |

| Registration | Valid Signature |

| Corporate Accounts | |

| (1) ABC Corp. | ABC Corp. |

| (2) ABC Corp | John Doe, Treasurer |

(3) ABC Corp. c/o John Doe, Treasurer | John Doe |

| (4) ABC Corp. Profit Sharing Plan | John Doe, Trustee |

| | |

| Trust Accounts | |

| (1) ABC Trust | Jane B. Doe, Trustee |

(2) Jane B. Doe, Trustee u/t/d 12/28/78 | Jane B. Doe |

| | |

| Custodian or Estate Accounts | |

(1) John B. Smith, Cust. f/b/o John B. Smith, Jr. UGMA | John B. Smith |

| (2) Estate of John B. Smith | John B. Smith, Jr., Executor |

THE NEW IRELAND FUND, INC.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

ANNUAL MEETING OF STOCKHOLDERS

June 8, 2021

PROXY STATEMENT

This Proxy Statement is furnished by the Board of Directors of The New Ireland Fund, Inc. (the “Fund”) in connection with its solicitation of proxies for use at the Annual Meeting of Stockholders (the “Meeting”) of the Fund to be held on Tuesday, June 8, 2021 at 9:00 a.m. Eastern time, and at any adjournments thereof. Due to the continued public health impact of the coronavirus, of COVID-19, and to support the health and well-being of our stockholders, service providers, personnel and other stakeholders, the Meeting will be held solely by virtual means over the Internet. Stockholders of record on the record date may attend, participate in and vote at the Meeting by visiting the following website: https://web.lumiagm.com/214266676 (password ireland2021)

If you have any questions concerning your proxy card call AST at (877) 295-6932 and verify that you were a stockholder on the record date. If you are a record owner of shares, please have your 11-digit control number on your proxy card available when you call or include it in your email.

If you hold your shares in the name of a brokerage firm, bank, nominee or other institution (“street name”) as of the record date, you must provide a legal proxy from that institution in order to vote your shares at the Meeting. You may forward an email from your intermediary or attach an image of your legal proxy and transmit it via email to AST at proxy@astfinancial.com and you should label the email “Legal Proxy” in the subject line. If you hold your shares in street name as of the record date and wish to attend, but not vote at, the Meeting, you must verify to AST that you owned the shares as of the record date through an account statement or some other similar means.

You may vote via the Internet. To vote via the Internet, go to www.voteproxy.com to complete an electronic proxy card (have your proxy card in hand when you visit the website). You will be asked to provide the company number and control number from your proxy card. Internet voting is available 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on (06/7/2021).

The purpose of the Meeting and the matters to be acted upon are set forth in the accompanying Notice of Annual Meeting of Stockholders.

If the accompanying proxy is executed properly and returned by June 8, 2021 in time to be voted at the Meeting, shares represented by it will be voted at the Meeting in accordance with the instructions on the proxy. If, however, no instructions are specified, shares will be voted for the election of Directors. If your shares are held through a broker, your shares can be voted on the election of Directors in your broker’s discretion. For purposes of the election of Directors, abstentions and broker non-votes, if any, will be treated as shares present, but will not be counted as votes cast. A proxy may be revoked at any time prior to the time it is voted by executing a superseding proxy by mail following the process described on the proxy card, by submitting a written notice to the Secretary of the Fund or by attendance at the Meeting and executing a superseding proxy.

A quorum of the Fund’s stockholders is required to properly conduct the business of the Meeting. Under the By-Laws of the Fund, a quorum is constituted by the presence in person or by proxy of stockholders entitled to cast a majority of the votes entitled to be cast at the Meeting. In the event a quorum is not present at the Meeting, the Chairperson of the Meeting will have the power to adjourn the Meeting, without notice other than an announcement at the Meeting, until the requisite amount of stock entitled to vote at such Meeting is present. Once a quorum is established, the stockholders present, either in person or by proxy, at the Meeting may continue to transact business until adjournment, notwithstanding the withdrawal from the Meeting of enough stockholders to leave fewer than would be required to establish a quorum. In the event a quorum is present at the Meeting, but sufficient votes to approve any of the proposed items are not received, the persons named as proxies may propose one or more adjournments of such Meeting to permit further solicitation of proxies. A stockholder vote may be taken on one or more of the proposals in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting in person or by proxy and the persons named as proxies will vote those proxies which they are entitled to vote FOR or AGAINST any such proposal in their discretion. Absent the establishment of a subsequent record date and the giving of notice to the holders of record thereon, the adjourned Meeting will take place not more than 120 days after the original record date. At such adjourned Meeting, any business may be transacted which might have been transacted at the original Meeting.

The close of business on April 14, 2021 has been fixed as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Meeting. As of the Record Date, the Fund had 4,853,202 shares of common stock outstanding and entitled to vote. At the Meeting, each share will be entitled to one vote, and fractional shares, if any, shall have proportionate voting rights. It is expected that the Notice of Annual Meeting, Proxy Statement, and form of proxy will be mailed to stockholders on or about April 26, 2021.

Proxy solicitations will be made primarily by mail, but solicitations may also be made by telephone, or personal contact conducted by officers or employees of the Fund. All costs of solicitation, including (a) printing and mailing of this Proxy Statement and accompanying material, (b) the reimbursement of brokerage firms and others for their expenses in forwarding solicitation material to the beneficial owners of the Fund’s shares and (c) supplementary solicitations to submit proxies, will be borne by the Fund.

The Annual Report of the Fund, including audited financial statements for the fiscal year ended October 31, 2020, is available upon request, without charge, by writing to The New Ireland Fund, Inc., C/O KBI Global Investors (North America) Limited, One Boston Place, 201 Washington Street, 36th Floor, Boston, Massachusetts 02108, by accessing the Fund’s website at www.newirelandfund.com, by calling toll-free 1-800-468-6475, or by emailing investor.query@newirelandfund.com.

The date of this Proxy Statement is April 26, 2021.

PROPOSAL 1: ELECTION OF DIRECTORS

At the Meeting, two Directors will be elected. Pursuant to the Fund’s By-laws, the terms of office of the Directors are staggered. The Board of Directors is divided into three classes, designated: Class I, Class II, and Class III. Class I currently consists of Michael Pignataro and Eleanor Hoagland, Class II currently consists of David Dempsey, and Class III currently consists of Sean Hawkshaw. Michael Pignataro and Eleanor Hoagland are being considered for election as Class I Directors at the Meeting. If elected, Mr. Pignataro and Ms. Hoagland will hold office for a term of three years and until his or her successor is elected and qualified. It is the intention of the persons named in the accompanying proxy to vote, on behalf of the stockholders, for the election of Mr. Pignataro and Ms. Hoagland.

The nominees have consented to being named in this Proxy Statement and to serve as Directors if elected. The Board of Directors has no reason to believe that the nominees will become unavailable for election as Directors, but if that should occur before the Meeting, proxies will be voted for such other persons as the Board of Directors may recommend.

The Directors and officers of the Fund are listed below, together with their respective positions, and a brief statement of their principal occupations during the past five years and, in the case of Directors, their positions with certain organizations and publicly-held companies. For the purposes of the table below and this Proxy Statement, except as otherwise defined, the term “Independent Director” means those Directors who are not “interested persons” (as defined in the Investment Company Act of 1940 (the “1940 Act”)), of the Fund, and the term “Interested Director” means those Directors who are “interested persons” of the Fund.

| Name Address, and Age | Position(s) Held with the Fund | Term of Office and Length of Time Served1 | Principal Occupation(s) and Other Directorships During Past Five Years | Number of Portfolios in Fund Complex Overseen by Director |

| INDEPENDENT directors: |

David Dempsey, 71 c/o KBI Global Investors (North America) Ltd

One Boston Place

201 Washington Street,

36th Floor

Boston, Massachusetts 02108 | Director & Chairperson of the Board of Directors | Director since 2007; Chairperson since 2019 | Managing Director, Bentley Associates L.P. – Investment Bank (1992 to present); Director, Hong Kong Association of New York (2014 to 2018); Director, Society of Aviation and Flight Educators (2017 to 2020). | 1 |

Eleanor Hoagland, 69 c/o KBI Global Investors (North America) Ltd

One Boston Place

201 Washington Street,

36th Floor

Boston, Massachusetts 02108 | Director | Since 2018 | Chief Compliance Officer and Senior Managing Director, Magni Global Asset Management, LLC (2012 to 2021); Principal, VCS Advisory, LLC (2011 to present); Independent Trustee, Alpine Funds (2012 to 2018). | 1 |

Michael A. Pignataro, 61 c/o KBI Global Investors (North America) Ltd

One Boston Place

201 Washington Street,

36th Floor

Boston, Massachusetts 02108 | Director | Since 2015 | Trustee, INDEXIQ Trust, INDEXIQ ETF Trust and INDEXIQ Active ETF Trust (April 2015 to present). | 1 |

| | | | | |

| INTERESTED DIRECTOR: |

Sean Hawkshaw, 56

KBI Global Investors (North America) Ltd

One Boston Place

201 Washington Street,

36th Floor

Boston, Massachusetts, 02108 | President and Director | President since 2011 Director from July 2011 to June 2012 & since March 2013 | Chief Executive Officer & Director, KBI Global Investors (North America) Ltd (2002 to Present); Director, KBI Global Investors Limited (1994 to Present); Director, KBI/Lothbury Qualifying Investor Fund, PLC (2006 to present); Director, Irish Auditing and Accounting Supervisory Authority (2006 to 2015); Director, Irish Association of Investment Managers (2003 to Present). | 1 |

| 1 | Each Director shall serve until the expiration of his or her current term and until his or her successor is elected and qualified. Mr. Hawkshaw is deemed to be an “interested” director because of his affiliation with KBI Global Investors (North America) Ltd, the investment adviser to the Fund. |

| Name Address, and Age | Position(s) Held with the Fund | Term of Office and Length of Time Served | Principal Occupation(s) and Other Directorships During Past Five Years | Number of Portfolios in Fund Complex Overseen by Director |

| OFFICERS2: | | | | |

| Sean Hawkshaw | President | Since 2011 | See description above | |

Derval Murray, 49

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street,

36th Floor

Boston, Massachusetts 02108 | Treasurer & Secretary | Since 2020 | Executive Director & Head of Compliance & Risk, KBI Global Investors Ltd (2008 to present); Director, KBI Fund Managers Ltd (2004 to present) Director, KBI Funds ICAV, (2004 to present) | |

Suzanne Hammer, 60

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street,

36th Floor

Boston, Massachusetts 02108 | Chief Compliance Officer | Since 2021 | Director, Vigilant Compliance LLC, (2021 to present); | |

| 2 | Each officer of the Fund will hold office until a successor has been elected by the Board of Directors. |

Equity Securities Beneficially Owned by the Directors

Set forth in the table below is the dollar range of equity securities in the Fund and the aggregate dollar range of equity securities in the Family of Investment Companies beneficially owned by each Director or nominee. The following key relates to the dollar ranges in the chart:

Key to Dollar Ranges

A. None

B. $1-$10,000

C. $10,001-$50,000

D. $50,001-$100,000

E. Over $100,000

| Name of Director | Dollar Range of Equity Securities Held in the Fund*+ | Aggregate Dollar Range of Equity Securities in All Registered Investment Companies Overseen by Director in Family of Investment Companies*+ |

| Independent Directors | | |

| David Dempsey | C | C |

| Eleanor Hoagland | C | C |

| Michael Pignataro | C | C |

| | | |

| Interested Director | | |

| Sean Hawkshaw | A | A |

| * | This information has been furnished by each Director as of April 15, 2021. “Beneficial ownership” is determined in accordance with Rule 16a-1(a)(2) promulgated under the Securities Exchange Act of 1934, as amended (the “1934 Act”). |

| + | As of April 15, 2021, the Family of Investment Companies consisted of only the Fund. |

As of April 15, 2021, none of the Independent Directors, nor any of his or her immediate family members owned beneficially or of record securities in the Fund’s investment adviser, KBI Global Investors (North America) Ltd (the “Investment Adviser”), or any person directly or indirectly controlling, controlled by, or under common control with the Investment Adviser.

Compensation

The following table sets forth certain information regarding the compensation of the Fund’s Directors and officers. The Fund currently pays each of its Directors, who is not a managing director, officer, or employee of the Investment Adviser or any affiliate thereof an annual fee of $27,500 plus $2,000 for each meeting of the Board of Directors attended in person or via telephone if the meeting is held telephonically due to circumstances outside the control of the Directors (e.g., a pandemic) and $1,000 for each meeting of the Board of Directors attended via telephone. The Directors also receive a fee of $2,000 for each meeting of any Committee of the Board of Directors attended in person or via telephone, as well as for any stockholder meeting attended in person not held on the same day as a meeting of the Board of Directors. In addition, each Independent Director may be compensated for incremental work, over and above attending a meeting, as a member of an ad hoc committee. The Fund pays the Chairperson of the Board of Directors an additional retainer of $26,500 annually, pays the Chairperson of the Audit and Valuation Committee an additional retainer of $6,500 annually and pays the Chairperson of the Governance and Nominating Committee an additional retainer of $4,000. In addition, each Director is reimbursed for travel and certain out-of-pocket expenses. Officers of the Fund who are employed by the Investment Adviser, receive reimbursement from the Fund for travel to and from Board of Director meetings. No Director received compensation from the Fund in excess of $120,000 for the fiscal year ended October 31, 2020.

Compensation Schedule for the

Fiscal Year Ended October 31, 2020

| Name of Person and Position | | Aggregate Compensation From the Fund | | Pension or Retirement Benefits Accrued as Part of Fund Expenses | | Estimated Annual Benefits upon Retirement | | Total Compensation From the Fund Paid to Directors |

| Independent Directors | | | | | | | | |

David Dempsey

Chairperson of the Board of Directors | | $72,000 | | $0 | | N/A | | $72,000 |

Eleanor Hoagland

Director | | $49,500 | | $0 | | N/A | | $49,500 |

Michael Pignataro

Director | | $52,000 | | $0 | | N/A | | $52,000 |

| | | | | | | | | |

| Interested Director | | | | | | | | |

Sean Hawkshaw

Director and President | | $0 | | $0 | | N/A | | $0 |

There were four regular meetings of the Board of Directors held during the fiscal year ended October 31, 2020. Each Director attended at least 75% of the aggregate total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which the Director served. Aggregate fees paid to the Board of Directors for the fiscal year ended October 31, 2020 were $173,500

Additional Information about the Fund’s Board of Directors

Board Responsibilities

The Board of Directors has the overall responsibility for monitoring the operations of the Fund. The Board of Directors has approved contracts under which certain companies provide essential management services to the Fund. The Board of Directors is responsible for supervising the services provided by those companies.

Like most registered investment companies, the day-to-day business of the Fund, including the management of risk, is performed by third-party service providers, such as the Investment Adviser, Fund Services and the Fund’s transfer agent. The Directors are responsible for overseeing the Fund’s service providers and, thus, have oversight responsibility with respect to risk management performed by those service providers. Risk management seeks to identify and address risks – that is, events or circumstances that could have material adverse effects on the business, operations, shareholder services, investment performance or reputation of the Fund. The Fund and its service providers employ a variety of processes, procedures and controls to identify those possible events or circumstances, to lessen the probability of their occurrence, and/or to mitigate the effects of such events or circumstances if they do occur. Each service provider is responsible for one or more discrete aspects of the Fund’s business, and, consequently, for managing the risks associated with that business. The Board of Directors has emphasized to the Fund’s service providers the importance of maintaining vigorous risk management.

As part of its oversight, the Board of Directors, acting at its scheduled meetings, or the Chairperson, acting between Board of Directors meetings, regularly interacts with and receives reports from service providers. Additionally, the Investment Adviser provides the Board of Directors with an overview of, among other things, its investment philosophy, brokerage practices and compliance infrastructure. The Board of Directors continues its oversight function as various personnel, including the Fund’s Chief Compliance Officer and personnel of other service providers, such as the Fund’s independent registered public accounting firm, make periodic reports to the Audit and Valuation Committee of the Board of Directors or to the entire Board of Directors with respect to various aspects of risk management. The Board of Directors and the Audit and Valuation Committee oversee efforts by management and service providers to manage risks to which the Fund may be exposed.

The Fund’s Chief Compliance Officer reports regularly to the Board of Directors to review and discuss compliance issues. At least annually, the Fund’s Chief Compliance Officer provides the Board of Directors with a written report reviewing the adequacy and effectiveness of the Fund’s policies and procedures and those of its service providers. The report addresses the operation of the policies and procedures of the Fund and each service provider since the date of the last report; any material changes to the policies and procedures since the date of the last report; any recommendations for material changes to the policies and procedures; and any material compliance matters since the date of the last report.

The Board of Directors receives reports from the Fund’s service providers regarding operational risks and risks related to the valuation and liquidity of portfolio securities. The Investment Adviser’s Pricing Committee reports to the Board of Directors concerning any investments for which market quotations are not readily available. Annually, the independent registered public accounting firm reviews with the Audit and Valuation Committee its audit of the Fund’s financial statements, focusing on major areas of risk encountered by the Fund and noting any significant deficiencies or material weaknesses in the Fund’s internal controls. Additionally, in connection with its oversight function, the Board of Directors oversees Fund management’s implementation of disclosure controls and procedures, which are designed to ensure that information required to be disclosed by the Fund in its periodic reports with the Securities and Exchange Commission (“SEC”) are recorded, processed, summarized, and reported within the required time periods. The Board of Directors also oversees the Fund’s internal controls over financial reporting, which comprise policies and procedures designed to provide reasonable assurance regarding the reliability of the Fund’s financial reporting and the preparation of the Fund’s financial statements.

From their review of these reports and their discussions with each service provider, the Chief Compliance Officer and the independent registered public accounting firm, the Board of Directors and the Audit and Valuation Committee learn about the material risks of the Fund, thereby facilitating a dialogue about how management and service providers identify and mitigate those risks.

The Board of Directors recognizes that not all risks that may affect the Fund can be identified and/or quantified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve the Fund’s goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Directors as to risk management matters are typically summaries of the relevant information. Most of the Fund’s investment management and business affairs are carried out by or through the Investment Adviser and other service providers each of which has an independent interest in risk management but whose policies and the methods by which one or more risk management functions are carried out may differ from the Fund’s and each other’s in the setting of priorities, the resources available or the effectiveness of relevant controls. As a result of the foregoing and other factors, the Board of Director’s ability to monitor and manage risk, as a practical matter, is subject to limitations.

Members and Structure of the Board of Directors

There are currently four members of the Board of Directors, three of whom are Independent Directors. David Dempsey serves as Chairperson of the Board of Directors. The Fund has determined its leadership structure is appropriate given the specific characteristics and circumstances of the Fund. The Fund made this determination in consideration of, among other things, the fact that the Board of Directors consists of four members, three of which are Independent Directors, including the Chairperson, the fact that the Chairman of the Audit and Valuation Committee is an Independent Director and the amount of assets under management in the Fund. The Board of Directors also believes that its leadership structure facilitates the orderly and efficient flow of information to the Independent Directors from Fund management.

Individual Director Qualifications

The Board of Directors has concluded that the Directors of the Fund should serve on the Board of Directors because of their ability to review and understand information about the Fund provided to them by management, identify and request other information they may deem relevant to the performance of their duties, question management and other service providers regarding material factors bearing on the management and administration of the Fund, and exercise their business judgment in a manner that serves the best interests of the Fund’s stockholders. In addition, the Board of Directors has concluded that each of the Directors should serve as a Director based on his or her own experience, qualifications, attributes and skills as described below.

Independent Directors

The Board of Directors has concluded that Mr. Dempsey should serve as a Director because of the financial and management experience he gained serving as a managing director of an international investment banking firm since 1991, his knowledge of the financial services and banking industries, and his experience serving as a Director of the Fund since 2007.

The Board of Directors has concluded that Ms. Hoagland should serve as a Director because of the management experience she has gained as Chief Compliance Officer and Senior Managing Director of Magni Global Asset Management, LLC, her many years of experience in the asset management business, and her experience serving as an Independent Trustee of a mutual fund complex from 2012 to 2018. Ms. Hoagland has served as a Director of the Fund since December 2018.

The Board of Directors has concluded that Mr. Pignataro should serve as a Director because of the financial and management experience he gained as a director at an asset management company from 2001 to 2013, his experience as the chief financial officer of a mutual fund complex from 1996 to 2012, his knowledge of the mutual fund operations and the mutual fund industry and his experience serving as a Director of the Fund since 2015.

Interested Director

The Board of Directors concluded that Mr. Hawkshaw should serve as a Director because of his experience as Chief Executive Officer of KBI Global Investors (North America) Ltd and his many years of experience in the asset management business. He has served as a Director of the Fund since March 5, 2013. Prior thereto, Mr. Hawkshaw served as a Director of the Fund from July 21, 2011 to June 5, 2012.

In its periodic assessment of the effectiveness of the Board of Directors, the Board of Directors considers the complementary individual skills and experience of the individual Directors primarily in the broader context of the Board of Director’s overall composition so that the Board of Directors, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the operation of the Fund. Moreover, references to the qualifications, attributes and skills of individual Directors are pursuant to requirements of the SEC, do not constitute that the Board of Directors, or any Director, possesses any special expertise or experience, and shall not be deemed to impose any greater responsibility, or liability, on any such person or on the Board of Directors by reason thereof.

Committees of the Board of Directors

Audit and Valuation Committee/Audit and Valuation Committee Report

The role of the Audit and Valuation Committee is to assist the Board of Directors in its oversight of the Fund’s financial reporting process and to oversee the activities of the Investment Adviser’s Pricing Committee and perform the responsibilities assigned to the Audit and Valuation Committee in the Fund’s valuation policies and procedures. The Audit and Valuation Committee operates pursuant to a Charter that was most recently approved by the Board of Directors on December 8, 2020, and is available at the Fund’s website, www.newirelandfund.com. As set forth in the Charter, management of the Fund is responsible for the preparation, presentation and integrity of the Fund’s financial statements, and for the procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm for the Fund is responsible for auditing the Fund’s financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America.

The Audit and Valuation Committee consists of Messrs. Pignataro, Dempsey and Ms. Hoagland, all of whom are “independent” Directors of the Fund, as defined in the listing standards of the New York Stock Exchange. The Board of Directors has determined that each of Mr. Pignataro and Ms. Hoagland is qualified to serve on the Fund’s Audit and Valuation Committee as a financial expert. The Audit and Valuation Committee is responsible for the engagement of the independent registered public accounting firm and reviewing with the independent registered public accounting firm the plan and results of the audit engagement and matters having a material effect on the Fund’s financial operations. The Audit and Valuation Committee met twice during the fiscal year ended October 31, 2020.

In performing its oversight function, the Audit and Valuation Committee has reviewed and discussed the audited financial statements with management and the independent registered public accounting firm. The Audit and Valuation Committee has discussed with the independent registered public accounting firm the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”). The Audit and Valuation Committee has also received the written disclosures from the independent registered public accounting firm required by PCAOB Ethics and Independence Rule 3526, Communications with Audit Committees Concerning Independence, as may be modified or supplemented, and has discussed with the independent registered public accounting firm its independence.

The members of the Audit and Valuation Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Members of the Audit and Valuation Committee rely, without independent verification, on the information provided to them and on the representations made by management and the independent registered public accounting firm. Accordingly, the Audit and Valuation Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles, or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit and Valuation Committee’s considerations and discussions referred to above do not assure that the audit of the Fund’s financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with accounting principles generally accepted in the United States of America or that the Fund’s auditors are in fact “independent”.

Based upon the reports and discussion described in this report, and subject to the limitations on the role and responsibilities of the Audit and Valuation Committee referred to above, and in the Charter, the Audit and Valuation Committee recommended that the audited financial statements be included in the Fund’s Annual Report for the year ended October 31, 2020.

Submitted by the Audit and Valuation Committee of the Fund’s Board of Directors

Michael Pignataro

David Dempsey

Eleanor Hoagland

Governance and Nominating Committee

The Fund’s Governance and Nominating Committee is currently composed of Ms. Hoagland and Messrs. Pignataro and Dempsey. All of the members of the Governance and Nominating Committee are independent, as independence is defined in the listing standards of the New York Stock Exchange applicable to closed-end funds. The primary purposes and responsibilities of the Governance and Nominating Committee are (i) identifying, considering and recommending to the Board of Directors for nomination and re-nomination director candidates for election or appointment by the Board of Directors; (ii) monitoring and evaluating industry and legal developments affecting corporate governance and recommending from time to time appropriate policies and procedures for adoption by the Board of Directors; (iii) establishing any minimum standards or qualifications to serve as members of the Board of Directors; (iv) considering matters that affect the operations of the Board of Directors and/or its committees and, in connection therewith and as necessary, recommending any modifications to the Board of Directors; and (v) reviewing and making recommendations to the Board of Directors regarding compensation of Board of Directors and committee members.

The Governance and Nominating Committee met three times during the Fund’s fiscal year ended October 31, 2020 and most recently on February 18, 2021 to consider the nominations of Mr. Pignataro and Ms Hoagland.

If a vacancy on the Board of Directors were to exist, the Governance and Nominating Committee would consider recommendations for Independent Director candidates properly submitted by Fund stockholders. Stockholders should submit such recommendations for nomination in a signed writing addressed to the Secretary of the Fund. Any stockholder seeking to nominate a Director candidate (a “Proposed Nominee”) must provide timely notice of the nomination and include in the notice certain information regarding the Proposed Nominee, including, among other things: (i) information relating to the Proposed Nominee that would be required to be disclosed in connection with the solicitation of proxies for the election of the Proposed Nominee as a director in an election contest (even if an election contest is not involved), and (ii) whether the stockholder believes that the Proposed Nominee is, or is not, an “interested person” of the Fund, as defined in the 1940 Act.

The Board of Directors has adopted a written charter for the Governance and Nominating Committee which was approved on November 7, 2013 and most recently reviewed on March 10, 2020 and is available at the Fund’s website, www.newirelandfund.com. The Governance and Nominating Committee Charter describes the factors considered by the Governance and Nominating Committee in selecting nominees. These factors may include judgment, skill, diversity, experience with investment companies and other organizations of comparable purpose, complexity, size and subject to similar legal restrictions and oversight, the interplay of the candidate’s experience with the experience of other Board of Directors members, and the extent to which the candidate would be a desirable addition to the Board of Directors and any committees thereof. The Governance and Nominating Committee will treat all equally qualified candidates in the same manner. The Governance and Nominating Committee may modify its policies and procedures for director nominees and recommendations in response to changes in the Fund’s circumstances, and as applicable legal or listing standards change.

Independent Registered Public Accounting Firm

At a meeting held on December 8, 2020, the Audit and Valuation Committee, which consists entirely of Independent Directors, selected Tait, Weller & Baker LLP (“Tait Weller”), 50 South 16th Street, Suite 2900, Philadelphia, Pennsylvania to serve as the independent registered public accounting firm for the Fund for the fiscal year ending October 31, 2021. The selection of Tait Weller was subsequently ratified and approved by the entire Board of Directors. Tait Weller was also the independent registered public accounting firm for the Fund for the fiscal year ended October 31, 2020. Tait Weller has advised the Fund that, to the best of its knowledge and belief, as of the Record Date, no Tait Weller professional had any direct or material indirect ownership interest in the Fund inconsistent with independent professional standards pertaining to accountants. It is expected that representatives of Tait Weller will be present at the Meeting, and have the opportunity to make a statement, if the representatives so desire, and to answer any questions that may arise. In reliance on Rule 32a-4 under the 1940 Act, the Fund is not seeking stockholder ratification of the selection of Tait Weller as independent registered public accounting firm.

Set forth in the table below are fees billed to the Fund by Tait Weller for professional services rendered to the Fund for the fiscal years ended October 31, 2019 and October 31, 2020. There were no other fees billed to the Fund.

| Fiscal Year Ended | Audit Fees | Audit-Related Fees | Tax Fees* | All Other Fees |

| 10/31/19 | $38,500 | $— | $4,500 | $— |

| 10/31/20 | $38,500 | $— | $4,500 | $— |

| * | Fees billed to the Fund in connection with tax consulting services, including the review of the Fund’s income tax returns. |

The Fund’s Audit and Valuation Committee Charter requires that the Audit and Valuation Committee pre-approve all audit and non-audit services to be provided to the Fund by the Fund’s independent registered public accounting firm. All of the audit and tax services described above for which Tait Weller billed the Fund fees for the fiscal years ended October 31, 2019 and October 31, 2020 were pre-approved by the Audit and Valuation Committee.

Tait Weller did not bill any non-audit fees for services rendered to the Investment Adviser, or any entity controlling, controlled by, or under the common control with the Investment Adviser that provides ongoing services to the Fund, for the fiscal years ended October 31, 2019 and October 31, 2020.

Stockholder Communications

Stockholders who wish to send communications to the Board of Directors should address them to the Board of Directors of the Fund, c/o KBI Global Investors (North America) Ltd, One Boston Place, 201 Washington Street, 36th Floor, Boston, MA 02108 or to investor.query@newirelandfund.com. All such communications will be directed to the Board of Director’s attention.

The Fund does not have a formal policy regarding attendance of Directors at the Annual Meeting of Stockholders; however, all of the Directors of the Fund attended the June 9, 2020 Annual Meeting of Stockholders.

Required Vote

In the election of a Director of the Fund, a plurality of the votes cast by the Fund stockholders represented at a meeting at which a quorum is present is required to elect a Director candidate. A “plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as Directors. For this purpose, abstentions, broker non-votes and votes that are withheld will have no effect on the outcome of the election.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS

THAT YOU VOTE “FOR” THE NOMINEES FOR DIRECTOR

ADDITIONAL INFORMATION

Investment Adviser

As described above, KBI Global Investors (North America) Ltd, One Boston Place, 201 Washington St., 36th Floor, Boston, MA 02108, and headquartered at 2 Harbormaster Place, 3rd floor, IFSC, Dublin 1, Ireland currently serves as the Fund’s investment adviser.

Administrator

U.S. Bancorp Fund Services, LLC, d/b/a U.S. Bank Global Fund Services ('Fund Services') acts as the Fund’s administrator pursuant to an Administration Agreement between the Administrator and the Fund. The principal business address of Fund Services is 615 E. Michigan Street Milwaukee, Wisconsin, 53202.

Voting Results

Stockholders of the Fund will be informed of the voting results of the Meeting in the Fund’s Annual Report for the year ending October 31, 2021.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL/RECORD OWNERS

To the knowledge of the Fund, as of the Record Date, (i) the Directors and officers of the Fund as a “group” (as defined in Section 13(d) of the 1934 Act owned less than 1% of the outstanding securities of the Fund, and (ii) other than the stockholders listed below, no person owned of record or owned beneficially more than 5% of the Fund’s outstanding shares. This information is based on the Fund’s review of filings made pursuant to Section 13 of the 1934 Act.

| Stockholder Name and Address | Number of Shares Beneficially Owned | Percent of Shares |

1607 Capital Partners LLC 13 S. 13th Street, Suite 400 Richmond VA 23219 | 848, 085 | 17.24% |

Bulldog Investors, LLP Park 80 West – Plaza Two250 Pehle Ave., Suite 708,

Saddle Brook NJ 07663 | 494,056 | 10.04% |

CSS LLC/IL 175 West Jackson Blvd, Suite 440 Chicago IL 60604 | 283, 208 | 5.69% |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act, and Section 30(h) of the 1940 Act, and the rules thereunder, require that the Fund’s Directors and officers, certain persons affiliated with the Investment Adviser, and persons who own more than 10% of a registered class of the Fund’s securities, file reports of ownership and changes of ownership with the SEC and, in some cases, the New York Stock Exchange. Directors, officers, and greater than 10% stockholders are required by SEC regulations to furnish the Fund with copies of all Section 16(a) forms they file.

Based solely upon the Fund’s review of the copies of such forms it received and written representations from certain of such persons, the Fund believes that during the Fund’s fiscal year ended October 31, 2020 these persons complied with all such applicable filing requirements.

OTHER MATTERS

No business other than as set forth herein is expected to come before the Meeting, but should any other matter requiring a vote of stockholders arise, including any question as to an adjournment of a Meeting, the persons named in the enclosed proxy will vote thereon according to their best judgment in the interests of the Fund.

STOCKHOLDER PROPOSALS

A stockholder’s proposal intended to be presented at the Fund’s Annual Meeting of Stockholders to be held in 2022 must be received by the Fund by December 27, 2021 in order to be included in the Fund’s proxy statement and proxy relating to that meeting and must satisfy the requirements of federal securities laws. In addition, stockholders seeking to nominate an individual for election to the Board of Directors, or seeking to propose other business (that is a proper matter for action by the stockholders) to be considered by the stockholders at an annual meeting of stockholders, must provide timely notice of the proposal in a signed writing addressed to the Secretary of the Fund.

| |  |

| | |

| | Derval Murray |

| | Secretary |

Dated: April 26, 2021

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. STOCKHOLDERS WHO DO NOT EXPECT TO BE PRESENT AT THE MEETING WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES