SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| x | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

| The New Ireland Fund, Inc. |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| | | |

| | | |

| 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

June [__], 2016

Dear Stockholder,

Enclosed you will find a Notice and a Proxy Statement for a Special Meeting of Stockholders (the “Meeting”) ofThe New Ireland Fund, Inc. (the “Fund”) to be held on Wednesday, July 20, 2016 at 9:30 a.m., New York time, at the Harvard Club, 27 West 44th Street, New York, NY 10036. At the Meeting, stockholders will vote on the approval of an Investment Advisory Agreement between the Fund and Kleinwort Benson Investors International Ltd. and such other matters as may properly come before the Meeting.

On behalf of the Board of Directors, I cordially invite all stockholders to attend the Meeting. Whether or not you plan to attend the Meeting in person, please take the time to cast your vote by telephone, via the Internet or by mailing in your proxy cards. As explained in the attached Proxy Statement, you may withdraw your proxy at any time before it is actually voted at the Meeting.

We look forward to your continued support.

| | Sincerely, |

| |  |

| | Chairperson |

| | ________________________________ | |

| | The New Ireland Fund, Inc. | |

| | c/o BNY Mellon Investment Servicing | |

| | BNY Mellon Center | |

| | One Boston Place | |

| | 201 Washington Street, 34th Floor | |

| | Boston, Massachusetts 02109 | |

| | 1-800-GO-TO-IRL (1-800-468-6475) | |

THE NEW IRELAND FUND, INC.

c/o BNY Mellon Investment Servicing (US) Inc.

BNY Mellon Center

One Boston Place

201 Washington Street, 34th Floor

Boston, Massachusetts 02109

_________________________

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

July 20, 2016

_________________________

To the Stockholders of The New Ireland Fund, Inc.:

Notice is hereby given that a Special Meeting of Stockholders (the "Meeting") of The New Ireland Fund, Inc. (the "Fund"), a Maryland corporation, will be held on Wednesday, July 20, 2016 at 9:30 a.m., New York time, at the Harvard Club, 27 West 44th Street, New York, NY 10036, for the following purposes:

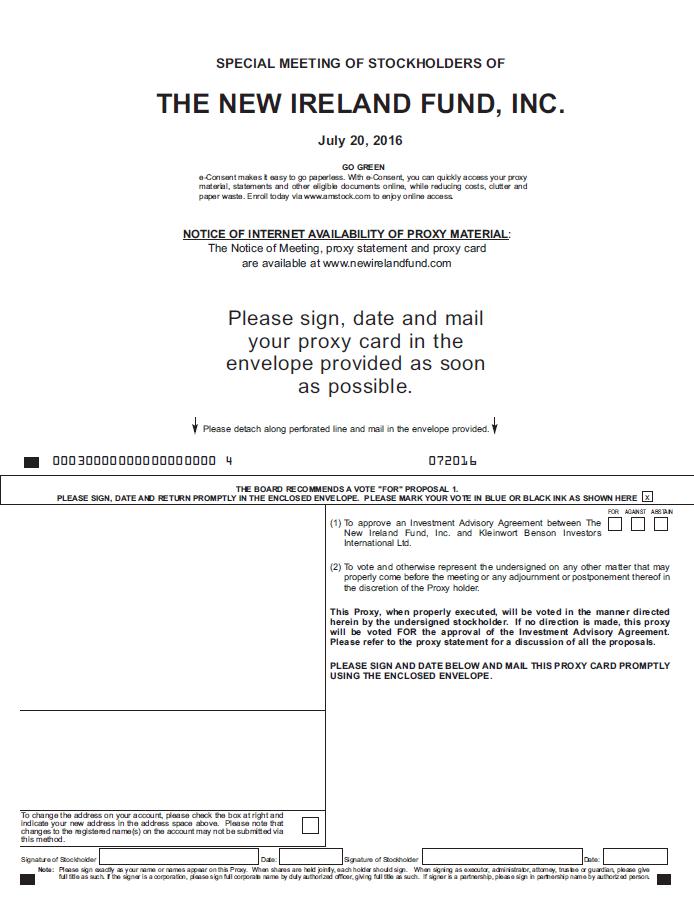

1. To approve an Investment Advisory Agreement between the Fund and Kleinwort Benson Investors International Ltd. (Proposal 1).

2. To consider and act upon any other business as may properly come before the Meeting or any adjournment thereof.

These items are discussed in greater detail in the attached Proxy Statement.

Only stockholders of record at the close of business on Friday, June 24, 2016 are entitled to notice of, and to vote at, the Meeting or at any adjournments thereof.

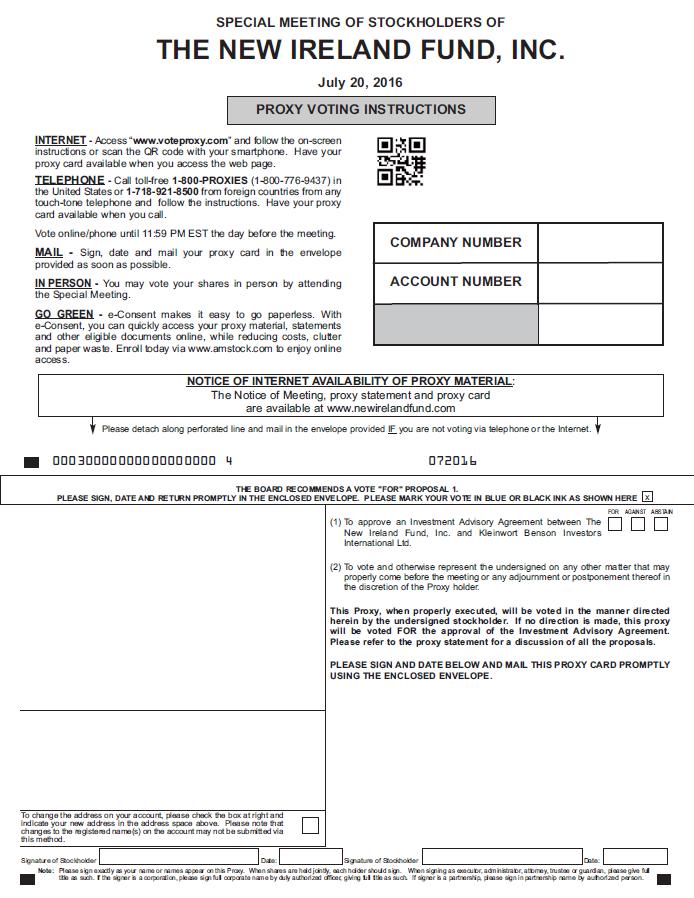

Whether or not you plan to attend the Meeting in person, please vote your shares. As a convenience to our stockholders, you may now vote in any one of four ways:

| · | Through the Internet – log on at the Internet address provided on the proxy card |

| · | By telephone – call the toll-free number listed on the proxy card |

| · | By mail – using the enclosed proxy card and postage paid envelope |

| · | In Person – at the Meeting |

We encourage you to vote by telephone or through the Internet; have your proxy card in hand, and call the number or go to the website and follow the instructions given there. Use of telephone or Internet voting will reduce the time and cost associated with this proxy solicitation. Whichever method you choose, please read the enclosed Proxy Statement carefully before you vote.

If you sign, date, and return the proxy card but give no voting instructions, your shares will be voted “FOR” the proposal above.

| | By order of the Board of Directors |

| | |

| | |

| | Vincenzo A. Scarduzio, Esq. |

| | Secretary |

Dated: June [__], 2016

Important Notice Regarding the Availability of Proxy Materials for the Meeting. The Notice of Special Meeting of Stockholders, Proxy Statement and the Fund’s most recent annual report are posted on the Fund’s website atwww.newirelandfund.com.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, WE ASK THAT YOU PLEASE VOTE THROUGH THE INTERNET OR BY TELEPHONE, OR COMPLETE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. IN ORDER TO AVOID THE ADDITIONAL EXPENSE TO THE FUND OF FURTHER SOLICITATION, WE ASK FOR YOUR COOPERATION IN VOTING PROMPTLY. INSTRUCTIONS FOR THE PROPER EXECUTION OF PROXIES ARE SET FORTH ON THE NEXT PAGE.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense to the Fund involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Joint owners should each sign, exactly as your names are shown in the registration.

3. All Other Accounts: The capacity of the individuals signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| Registration | | Valid Signature |

| | | |

| Corporate Accounts | | |

| | | |

| (1) ABC Corp. | | ABC Corp. |

| (2) ABC Corp. | | John Doe, Treasurer |

| (3) ABC Corp. | | |

| c/o John Doe, Treasurer | | John Doe |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| | | |

| Trust Accounts | | |

| | | |

| (1) ABC Trust | | Jane B. Doe, Trustee |

| (2) Jane B. Doe, Trustee | | |

| u/t/d 12/28/78 | | Jane B. Doe |

| | | |

| Custodian or Estate Accounts | | |

| | | |

| (1) John B. Smith, Cust. | | |

| f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

| (2) Estate of John B. Smith | | John B. Smith, Jr., Executor |

THE NEW IRELAND FUND, INC.

c/o BNY Mellon Investment Servicing (US) Inc.

BNY Mellon Center

One Boston Place

201 Washington Street, 34th Floor

Boston, Massachusetts 02109

SPECIAL MEETING OF STOCKHOLDERS

July 20, 2016

PROXY STATEMENT

This Proxy Statement is furnished by the Board of Directors of The New Ireland Fund, Inc. (the “Fund”) in connection with its solicitation of proxies for use at the Special Meeting of Stockholders (the “Meeting”) of the Fund to be held on Wednesday, July 20, 2016 at 9:30 a.m., New York time, at the Harvard Club, 27 West 44th Street, New York, NY 10036 and at any adjournments thereof. The purpose of the Meeting and the matters to be acted upon are set forth in the accompanying Notice of Special Meeting of Stockholders.

If the accompanying proxy is executed properly and returned by July 20, 2016 in time to be voted at the Meeting, shares represented by it will be voted at the Meeting in accordance with the instructions on the proxy. A proxy may be revoked at any time prior to the time it is voted by executing a superseding proxy by telephone, the Internet or mail following the process described on the proxy card, by submitting a written notice to the Secretary of the Fund or by attendance at the Meeting and executing a superseding proxy. Subject to the discussion below regarding abstentions and broker non-votes, all properly executed proxies received at or before the time of the Meeting will be voted as specified in the proxy or, if no specification is made, will be voted FOR the approval of the proposed investment advisory agreement, as described in this Proxy Statement.

A proxy on shares held by brokers or nominees which (a) is properly executed and returned accompanied by instructions to withhold authority to vote, or (b) as to which (i) instructions have not been received from the beneficial owners or the persons entitled to vote and (ii) the broker or nominee does not have discretionary voting power on a particular matter, represents a broker “non-vote”. Proxies that reflect abstentions or broker non-votes will be counted as shares that are present and entitled to vote on the matter for purposes of determining the presence of a quorum.

A quorum of the Fund’s stockholders is required to properly conduct the business of the Meeting. Under the By-Laws of the Fund, a quorum is constituted by the presence in person or by proxy of stockholders entitled to cast a majority of the votes entitled to be cast at the Meeting. In the event a quorum is not present at the Meeting, the Chairperson of the Meeting will have the power to adjourn the Meeting, without notice other than an announcement at the Meeting, until the requisite amount of stock entitled to vote at the Meeting is present. Once a quorum is established, the stockholders present, either in person or by proxy, at the Meeting may continue to transact business until adjournment, notwithstanding the withdrawal from the Meeting of enough stockholders to leave fewer than would be required to establish a quorum. In the event a quorum is present at the Meeting, but sufficient votes to approve any of the proposed items are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting in person or by proxy and the persons named as proxies will vote those proxies which they are entitled to vote FOR or AGAINST any such proposal in their discretion. Absent the establishment of a subsequent record date and the giving of notice to the holders of record thereon, the adjourned Meeting will take place not more than 120 days after the original record date. At such adjourned Meeting, any business may be transacted which might have been transacted at the original Meeting.

The close of business on June 24, 2016 has been fixed as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Meeting. As of the Record Date, the Fund had [5,337,618] shares of common stock outstanding and entitled to vote. At the Meeting, each share will be entitled to one vote, and fractional shares, if any, shall have proportionate voting rights. It is expected that the Notice of Special Meeting, Proxy Statement, and forms of proxy will be mailed to stockholders on or about July [__], 2016.

Proxy solicitations will be made primarily by mail, but solicitations may also be made by telephone, Internet or personal contact conducted by representatives of the Fund. AST Fund Solutions, LLC (“AST”) has been engaged to assist in the solicitation of proxies. The anticipated cost of such solicitation services is approximately [$64,000]. All costs of solicitation, including (a) printing and mailing of this Proxy Statement and accompanying material, (b) the reimbursement of brokerage firms and others for their expenses in forwarding solicitation material to the beneficial owners of the Fund’s shares and (c) supplementary solicitations to submit proxies, will be borne by Kleinwort Benson Investors International Ltd., the Fund’s investment adviser.

The Annual Report of the Fund, including audited financial statements for the fiscal year ended October 31, 2015, is available upon request, without charge, by writing to The New Ireland Fund, Inc., C/O BNY Mellon Investment Servicing (US) Inc., One Boston Place, 201 Washington Street, 34th Floor, Boston, Massachusetts 02109, by accessing the Fund’s website atwww.newirelandfund.com, by calling toll-free 1-800-468-6475, or by emailing investor.query@newirelandfund.com.

The date of this Proxy Statement is June [__], 2016.

PROPOSAL 1: APPROVAL OF INVESTMENT ADVISORY AGREEMENT

WITH KLEINWORT BENSON INVESTORS INTERNATIONAL LTD.

Kleinwort Benson Investors International Ltd. (“KBI” or the “Investment Adviser”) was appointed as investment adviser to the Fund pursuant to an investment advisory agreement between KBI and the Fund dated July 21, 2011 (the “Previous Advisory Agreement”).

KBI is a majority-owned subsidiary of Kleinwort Benson Investors Dublin Ltd. On January 14, 2016, KBI notified the Fund that Oddo & Cie SCA (“Oddo”) had raised its equity interest in BHF Kleinwort Benson Group SA, the ultimate indirect parent of Kleinwort Benson Investors Dublin Ltd., and intended to acquire 100% of the equity interest in BHF Kleinwort Benson Group SA, which could cause an “assignment” of the Previous Advisory Agreement under the Investment Company Act of 1940 (the “1940 Act”) resulting in its automatic termination. At a special meeting the Board of Directors of the Fund (the “Board of Directors,” the “Board” or the “Directors”) held on January 22, 2016, the Directors, including a majority of the Directors who are not “interested persons” (as defined in the 1940 Act) of the Fund (the “Independent Directors”), approved an interim investment advisory agreement between KBI and the Fund (the “Interim Advisory Agreement”) pursuant to Rule 15a-4 under the 1940 Act.

Pursuant to a tender offer and follow-on transaction, Oddo acquired 100% of the equity interest in BHF Kleinwort Benson Group SA, including a “controlling block” of BHF Kleinwort Benson Group SA’s voting securities on February 25, 2016. The acquisition of the controlling block caused an “assignment” of the Previous Advisory Agreement resulting in its automatic termination. Accordingly, the Interim Advisory Agreement took effect, with an effective date of February 25, 2016. The Interim Advisory Agreement has a term of the earlier of 150 days or the effective date of a new investment advisory agreement between KBI and the Fund.

On March 8, 2016, the Board of Directors approved and recommended for stockholder approval a new investment advisory agreement between KBI and the Fund (the “First New Advisory Agreement”). The First New Advisory Agreement will become effective upon approval by stockholders. A Special Meeting of Stockholders of the Fund originally scheduled for June 14, 2016 was called for the purpose of stockholders voting on the approval of the First New Advisory Agreement.

On May 18, 2016, Amundi Asset Management (the “Buyer”) and BHF Group UK Ltd (“BHF”), the parent of Kleinwort Benson Investors Dublin Ltd., which is currently owned by Oddo, entered into a share purchase agreement pursuant to which BHF agreed to sell, and the Buyer agreed to purchase, 87.5% of the equity interest of Kleinwort Benson Investors Dublin Ltd., the majority owner of KBI (the “Transaction”). The Buyer is a global asset manager with a presence in 30 countries across five continents. The Buyer is wholly owned by Amundi, a publicly traded company listed on the French stock exchange, that is majority owned by Credit Agricole. As of March 31, 2016, the Buyer had assets under management in excess of $1 trillion. The address of the Buyer is 90 Boulevard Pasteur, Paris, France 75015. BHF and a group of key employees of Kleinwort Benson Investors Dublin Ltd. and Kleinwort Benson Investors International Ltd. entered into a separate share purchase agreement pursuant to which BHF agreed to sell, and the key employees agreed to purchase, the remaining 12.5% of the equity interest of Kleinwort Benson Investors Dublin Ltd. Both transactions, which are subject to regulatory approval, are currently expected to close in the third quarter of calendar year 2016.

The Transaction is not expected to materially impact the business conducted by KBI. It is expected that, after the Transaction, KBI will maintain an independent organizational and operating structure, and there is currently no intention to integrate KBI’s operations into the Buyer’s existing businesses. The Buyer currently plans to retain the existing management team and operating structure both for KBI and in support of the Fund. It is expected that KBI’s management team that is currently responsible for overseeing and managing the day-to-day activities of the Fund will be retained. As noted above, the Buyer does not currently expect to materially change KBI’s business, operational structure or personnel; however, over time, KBI expects to be able to benefit from access to the Buyer’s global resources.

The closing of the Transaction would cause an “assignment” of the Interim Advisory Agreement, or the First New Advisory Agreement if stockholders have approved such agreement by the closing date, under the 1940 Act resulting in in its automatic termination. As a result of the termination and the need to consider a new investment advisory agreement between KBI and the Fund, at an in-person meeting on June 14, 2016, the Board of Directors approved and recommended for stockholder approval a new investment advisory agreement between KBI and the Fund (the “Second New Advisory Agreement”). The Second New Advisory Agreement will become effective upon approval by stockholders.

As discussed below, the Second New Advisory Agreement is substantially similar to the First New Advisory Agreement, the Previous Advisory Agreement and the Interim Advisory Agreement (collectively, the “Prior Agreements” and together with the Second New Advisory Agreement, the “Agreements”), except for the effective date and term of each agreement, and certain other immaterial exceptions. The fees for services payable under the Second New Advisory Agreement are the same as those that are or were payable under the Prior Agreements.

Section 15(f) of the 1940 Act

The Board of Directors has been advised that the parties to the Transaction intend to rely on Section 15(f) of the 1940 Act, which provides a non-exclusive safe harbor whereby an owner (such as BHF) of an investment adviser (such as KBI) to an investment company (such as the Fund) may receive payment or benefit in connection with the sale of an interest in the investment adviser if two conditions are satisfied. The first condition is that during the three-year period following the closing, at least 75% of the investment company’s board must not be “interested persons” (as defined in the 1940 Act) of the investment adviser or its predecessor. The Board of Directors currently meets this test and is expected to do so after the Transaction is completed. Second, no “unfair burden” can be imposed on the investment company as a result of the sale of the interest in the investment adviser. An “unfair burden” includes: any arrangement during the two-year period after the sale of the interest in the investment adviser where the investment adviser (or predecessor or successor adviser), or any of its “interested persons” (as defined in the 1940 Act), receive or is entitled to receive any compensation, directly or indirectly, (i) from any person in connection with the purchase or sale of securities or other property to, from or on behalf of the investment company (other than bona fide ordinary compensation as principal underwriter for the investment company), or (ii) from the investment company or its shareholders (other than fees for bona fide investment advisory or other services). The Buyer has represented that, following the closing of the Transaction, it will use its reasonable best efforts to meet the requirements of Section 15(f) of the 1940 Act. In that regard, from and after the closing date and to the extent within its control, the Buyer has agreed to conduct its businesses (and to cause each of its affiliates to conduct its business) so as to assure that the two aforementioned conditions are satisfied.

Comparison of the Second New Advisory Agreement and the Prior Agreements

At the Meeting, you will be asked to approve the Second New Advisory Agreement. A comparison of the proposed Second New Advisory Agreement and the Prior Agreements is included below. A form of the Second New Advisory Agreement is attached hereto asAppendix A. The First New Advisory Agreement was approved by the Board of Directors, including a majority of the Independent Directors, at an in-person meeting on March 8, 2016. The Previous Advisory Agreement was last approved by the Board of Directors, including a majority of Independent Directors, at an in-person meeting on March 10, 2015, and was initially and last approved by stockholders on July 21, 2011.

The terms of the Second New Advisory Agreement are substantially similar to those of the Prior Agreements. The fees payable to KBI by the Fund under the Second New Advisory Agreement are identical to those payable under the Prior Agreements. If approved by stockholders, the Second New Advisory Agreement will expire two years from its effective date, unless specifically reapproved in the manner required by the 1940 Act and the rules thereunder. The following discussion provides a comparison of certain material terms of the Prior Agreements to the material terms of the Second New Advisory Agreement.

Investment Advisory Services. The investment advisory services to be provided by KBI to the Fund under the Second New Advisory Agreement will be the same as those services provided by KBI to the Fund under the Prior Agreements. The Agreements each provide that KBI undertakes and agrees (i) to make investment decisions for the Fund, to prepare and make available to the Fund research and statistical data in connection therewith, and to supervise the acquisition and disposition of securities by the Fund, including the selection of brokers or dealers to carry out the transactions, all in accordance with the Fund’s investment objective and policies and in accordance with guidelines and directions from the Fund’s Board of Directors; (ii) to assist the Fund as it may reasonably request in the conduct of the Fund’s business subject to the direction and control of the Fund’s Board of Directors; and (iii) to maintain and furnish or cause to be maintained and furnished for the Fund all records, reports and other information required under the 1940 Act to the extent that such records, reports and other information are not maintained or furnished by the administrators, custodians or other agents of the Fund. The investment advisory services will be provided by the same KBI personnel under the Second New Advisory Agreement as under the Prior Agreements. KBI does not anticipate that the ownership by the Buyer will have any adverse effect on the performance of its obligations under the Second New Advisory Agreement.

Fees. The fees payable to KBI under the Second New Advisory Agreement are identical to the fees payable to KBI under the Prior Agreements. Specifically, under the Agreements, the Fund has agreed to pay KBI a fee, payable monthly, at an annualized rate equal to 0.65% of the value of the average daily net assets of the Fund up to the first $50 million, 0.60% of the value of the average daily net assets of the Fund over $50 million and up to and including $100 million, and 0.50% of the value of the average daily net assets of the Fund in excess of $100 million. The Fund paid a fee of $493,605 to KBI for the Fund’s most recent fiscal year for services performed under the Previous Advisory Agreement.

Payment of Expenses. Under each of the Agreements, KBI undertakes and agrees (i) to furnish at its expense for the use of the Fund such office space and facilities as the Fund may reasonably require for its needs in Dublin, Ireland, and to furnish at its expense clerical services in the United States or Ireland related to research, statistical and investment work; and (ii) to pay the reasonable salaries and expenses of such of the Fund’s officers and employees and any fees and expenses of such of the Fund’s directors as are directors, officers or employees of KBI or any of its affiliates. Under each of the Agreements, the Investment Adviser shall bear all expenses arising out of its duties but shall not be responsible for any other expenses of the Fund other than those specifically allocated to the Investment Adviser as described in the Agreement. The expenses to be borne by the Fund under the Second New Advisory Agreement are the same as in the Prior Agreements.

Continuance. The Previous Advisory Agreement was renewed for a one-year period at the March 10, 2015 in-person meeting of the Board of Directors and, if not terminated, could have been continued in effect thereafter if such continuance was specifically approved at least annually in the manner required by the 1940 Act and the rules thereunder. The Interim Advisory Agreement has a term of 150 days, which term may not be renewed. If the stockholders approve the First New Advisory Agreement, the First New Advisory Agreement will expire two years from its effective date, unless its continuance is approved in the manner required by the 1940 Act and the rules thereunder. If the stockholders approve the Second New Advisory Agreement, the Second New Advisory Agreement will expire two years from its effective date, unless its continuance is approved in the manner required by the 1940 Act and the rules thereunder. The Previous Advisory Agreement, the First New Advisory Agreement and the Second New Advisory Agreement contain the same provisions regarding continuance of the agreement, with the exception of the date of effectiveness.

Termination. Each of the Agreements provides for termination without penalty, by the Fund’s Board of Directors, by vote of holders of a majority of the outstanding voting securities of the Fund or by the Investment Adviser upon 60 days’ written notice delivered or sent to the other party. As with the Prior Agreements, the Second New Advisory Agreement also will terminate automatically in the event of assignment.

Board Considerations in Approving the Second New Advisory Agreement

The Second New Advisory Agreement was approved by the Board of Directors, including a majority of the Independent Directors, at an in-person meeting on June 14, 2016 (the “June Board Meeting”) after consideration of all factors determined to be relevant to their deliberations, including those discussed below. The Board of Directors authorized the submission of the Second New Advisory Agreement for consideration by the Fund’s stockholders in this Proxy Statement.

In approving the Second New Advisory Agreement, the Board of Directors followed substantially the same process and considered substantially the same factors as it considered in approving the approval of the First New Advisory Agreement, which was completed at the Board meeting on March 8, 2016 (the “March Approval”), in addition to new information regarding the Transaction.

Prior to approving the Second New Advisory Agreement, the Independent Directors had requested and had been provided with detailed materials relating to KBI, the Buyer and the Transaction in advance of the June Board Meeting. In addition, the Board was provided with any material updates to the materials provided in connection with the March Approval, related to, among other items: (i) information on the investment performance of the Fund and the performance of a peer group of funds and the Fund’s performance benchmark; (ii) information on the Fund’s advisory fees and other expenses, including information comparing the Fund’s expenses to those of a peer group of funds and information about any applicable expense limitations and fee “breakpoints”; (iii) information about the profitability of the Previous Advisory Agreement to the Investment Adviser; (iv) a report prepared by the Investment Adviser in response to a request submitted by the Independent Directors’ independent legal counsel on behalf of such Directors; and (v) other information relevant to the approval of the Second New Advisory Agreement. Throughout the process, the Board of Directors was afforded the opportunity to ask questions of and request additional materials from the Investment Adviser.

In addition to the materials requested by the Directors in connection with their consideration of the Second New Advisory Agreement, the Directors received materials in advance of each regular quarterly meeting of the Board of Directors that provided information relating to the services provided by the Investment Adviser.

The Independent Directors were advised by separate independent legal counsel throughout the process. The Independent Directors also discussed the proposed approval in a private session with counsel at which no representatives of the Investment Adviser were present. In addition, at the June Board Meeting, representatives of KBI met with the Board to discuss the Transaction and the Buyer’s general plans and intentions with respect to KBI and the Fund. In addition, the Directors were provided with a copy of the proposed form of the Second New Advisory Agreement, along with a representation from KBI that the terms and conditions of the Second New Advisory Agreement are substantially identical to each of the First New Advisory Agreement and the Previous Advisory Agreement. The material factors and conclusions that formed the basis for the Board’s approval and its recommendation that shareholders vote “FOR” the approval of the Second New Advisory Agreement are discussed below.

The Directors did not identify any single factor as determinative. Individual Directors may have evaluated information presented differently from one another, giving different weights to different factors.

Matters considered by the Directors, including the Independent Directors, in connection with their approval of the Second New Advisory Agreement are included in the factors listed below.

Nature, Extent, and Quality of the Services Provided by the Investment Adviser. The Board considered the representations made by KBI that: (i) neither the Buyer nor KBI expect the Transaction to materially impact the business conducted by KBI; (ii) KBI will maintain an independent organizational and operating structure; (iii) it is expected that KBI’s management team that is currently responsible for overseeing and managing the day-to-day activities of the Fund will be

retained; (iv) the terms of the agreement between KBI and the Fund will not be materially changed; and (v) there are no anticipated material changes or reductions in the nature, quality or extent of the services currently provided by KBI to the Fund.

The Directors considered the nature, extent and quality of services provided by the Investment Adviser under the Previous Advisory Agreement and to be provided under the Second New Advisory Agreement and noted that the scope of services continues to expand as a result of regulatory and other market developments. The Directors noted that, for example, the Investment Adviser is responsible for maintaining and monitoring its own compliance program and coordinates certain activities with the Fund’s Chief Compliance Officer, and these compliance programs are routinely refined and enhanced in light of new regulatory requirements and current market conditions. The Directors considered the Investment Adviser’s investment experience, the quality of the investment research capabilities of the Investment Adviser and the other resources dedicated to performing services for the Fund. The quality of other services, including the Investment Adviser’s assistance in the coordination of the activities of some of the Fund’s other service providers, also were considered. The Directors concluded that, overall, they were satisfied with the nature, extent and quality of services provided (and expected to be provided) to the Fund under the Previous Advisory Agreement and Second New Advisory Agreement.

Costs of Services Provided and Profitability to the Investment Adviser. The Board considered information concerning the profitability to the Investment Adviser of the Previous Advisory Agreement provided in connection with the March Approval. The Board reviewed information relating to the financial stability of the Buyer. The Board also considered that KBI has been operated as an independent entity and it is expected that KBI will continue to be operated as an independent entity after the Transaction is completed. The Board further considered that KBI expects that its profitability will not materially change as a result of the Transaction. In addition, the Board was informed that the Buyer’s current intention is to finance the Transaction with internal funds and it is not expected that either the Buyer or KBI will be incurring any debt in connection with the Transaction.

The Directors recognized that the Investment Adviser should, in the abstract, be entitled to earn a reasonable level of profits for the services it provides, to the Fund. Based on their review, they concluded they were satisfied that the Investment Adviser’s level of profitability, from its relationship with the Fund, was not excessive.

Fall-Out Benefits.The Directors also considered so-called “fall-out benefits” to the Investment Adviser and its affiliates, such as reputational and other benefits from the Investment Adviser’s association with the Fund. The Directors considered any possible conflicts of interest associated with these fall-out and other benefits. The Investment Adviser advised the Directors that no portfolio transactions were expected to be allocated pursuant to arrangements whereby the Investment Adviser receives brokerage and research services from brokers that execute the Fund’s purchases and sales of securities. As a result, none of the Investment Adviser’s research or other expenses was anticipated to be offset by the use of the Fund’s commissions.

Investment Results.The Board considered the overall investment performance of the Fund that had been presented in connection with the March Approval in addition to performance results for the Fund presented at the June Board Meeting. Additionally, the Board considered that KBI’s ability to implement the Fund’s investment strategies is expected to be unchanged by the Transaction.

The Directors concluded that KBI’s performance record in managing the Fund demonstrates that its continued management of the Fund will benefit the Fund and its shareholders following the Transaction.

Advisory Fee.The Board considered a detailed analysis of the Fund’s fees and expenses in connection with the March Approval. The Board also considered the Buyer’s representation that it does not anticipate causing KBI to seek any increases in advisory fees as a result of the Transaction.

Based on these factors, among others, the Directors concluded that the level of the fees charged by KBI to the Fund is expected to be unchanged following the Transaction and continues to be reasonable in relation to the services provided by KBI.

Conclusion.Based on their evaluation of all factors that they deemed to be material, including those factors described above, and assisted by the advice of independent counsel, the Directors, including the Independent Directors, concluded that the investment advisory arrangements between the Fund and the Investment Adviser were fair and reasonable and that the approval of the New Advisory Agreement would be in the best interest of the Fund and its shareholders. Accordingly, the Board, including the Independent Directors voting separately, approved the New Advisory Agreement.

Additional Information About the Investment Adviser

Kleinwort Benson Investors International Ltd. is a limited liability company organized under the laws of the Republic of Ireland. The registered office of the KBI is 2 Harbourmaster Place, 3rd Floor, IFSC, Dublin 1, Ireland. KBI is a majority-owned subsidiary of Kleinwort Benson Investors Dublin Ltd., which is indirectly and wholly owned by BHF, which in turn is wholly owned by Oddo. BHF is owned by BHF Kleinwort Benson Group SA, the parent company of an asset management group managing approximately $65.2 billion in assets as of June 30, 2015 for a range of private and corporate clients. The registered offices of BHF are located at 14 St. George St., London, England W1S 1FE. The registered offices of Oddo are 12, Boulevard de la Madeleine, 75440 Paris Cedex 09, France.

KBI is registered as an investment adviser under the Investment Advisers Act of 1940. Founded in 1980, KBI is an institutional asset manager, and together with its direct parent Kleinwort Benson Investors Dublin Ltd, manages approximately $9.1 billion in assets as of March 31, 2016 for clients based in the US, Canada, Asia and Europe. The Investment Adviser currently manages specialist equity strategies which are offered to institutional investors on both a segregated and commingled basis and registered investment companies. In providing these services, the Investment Adviser directs and manages the investment and reinvestment of assets in client accounts. The Investment Adviser also provides non-discretionary investment advisory services in the form of investment model provision.

Noel O’Halloran, Chief Investment Officer of KBI, will continue to serve as the portfolio manager of the Fund and have responsibility for the day-to-day management of the Fund’s portfolio. Mr. O’Halloran joined KBI in 1992, was promoted to Head of Equities in 1996 and was appointed Chief Investment Officer in 2002. As Chief Investment Officer, he has overall responsibility for investment process and performance of the firm's assets across the various asset classes and specialist equity portfolios. He has specifically managed equity portfolios across Irish, European, Asian and U.S. equity markets. Mr. O’Halloran holds a degree in Civil Engineering from University College Cork. He also holds a Certified Diploma in Accounting and Finance and is an Associate of the Institute of Investment Management and Research. He is also an associate member of the Chartered Financial Analyst Institute. Mr. O'Halloran has managed the Fund since July 21, 2011.

The following persons serve as the principal executive officers of the Investment Adviser at the address for the Investment Adviser listed above:

| Name | | Positions Held With

the Investment Adviser | | Principal Occupation |

| | | | | |

| Sean Hawkshaw* | | Chief Executive Officer and Director | | Chief Executive Officer and Director of Kleinwort Benson Investors International Ltd. and Kleinwort Benson Investors Dublin Ltd. |

| | | | | |

| Noel O’Halloran | | Chief Investment Officer | | Chief Investment Officer and Director of Kleinwort Benson Investors Dublin Ltd. |

| | | | | |

| Gerard Solan | | Chief Operational Officer and Chief Financial Officer | | Chief Operational Officer, Chief Financial Officer and Director of Kleinwort Benson Investors Dublin Ltd. |

| | | | | |

| Derval Murray | | Chief Compliance Officer and Company Secretary | | Chief Compliance Officer and Director of Kleinwort Benson Investors Dublin Ltd. |

| | | | | |

| Geoff Blake | | Head of Business Development and Director | | Head of Business Development and Director of Kleinwort Benson Investors International Ltd. |

* Mr. Hawkshaw also serves as a Director of the Fund, as noted above.

KBI does not serve as investment adviser to any registered investment companies that have similar investment objectives and strategies to the Fund.

Required Vote

Approval of the Second New Advisory Agreement requires the affirmative vote of a majority of the outstanding voting securities of the Fund as defined in the 1940 Act. A “majority of the outstanding voting securities” for this purpose means the lesser of (1) 67% or more of the Fund’s shares of common stock, present at a meeting of shareholders, if the holders of more than 50% of such shares are present or represented by proxy at the meeting, or (2) more than 50% of the outstanding shares. For this purpose, abstentions and broker non-votes will have the effect of a vote “against” the proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

YOU VOTE “FOR” THE APPROVAL OF THE SECOND NEW ADVISORY AGREEMENT.

ADDITIONAL INFORMATION

Investment Adviser

As described above, Kleinwort Benson Investors International Ltd, One Boston Place, 201 Washington St., Boston, MA 02109, and headquartered at 2 Harbourmaster Place, 3rd floor, IFSC, Dublin 1, Ireland currently serves as the Fund’s investment adviser.

Administrator

BNY Mellon Investment Servicing (US)Inc. acts as the Fund’s administrator pursuant to an Administration Agreement between the Administrator and the Fund. The principal business address of BNY Mellon is One Boston Place, 201 Washington Street, 34th Floor, Boston, Massachusetts 02108.

Voting Results

Stockholders of the Fund will be informed of the voting results of the Meetings in the Fund’s Annual Report for the year ending October 31, 2016.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL/RECORD OWNERS

To the knowledge of the Fund, as of the Record Date, (i) the Directors and officers of the Fund as a “group” (as defined in Section 13(d) of the Securities Exchange Act of 1934, as amended (the “1934 Act”) owned less than 1% of the outstanding securities of the Fund, and (ii) other than the stockholders listed below, no person owned of record or owned beneficially more than 5% of the Fund’s outstanding shares. This information is based on the Fund’s review of filings made pursuant to Section 13 of the 1934 Act.

| Stockholder Name and Address | | Number of Shares Beneficially

Owned | | | Percent of Shares | |

| | | | | | | |

Karpus Management, Inc., d/b/a Karpus Investment

Management

183 Sully’s Trail

Pittsford, New York 14534 | | | [804,852 | ] | | | [15.98 | ]% |

| | | | | | | | | |

1607 Capital Partners, LLC

4991 Lake Brook Drive, Suite 125

Glen Allen, VA 23060 | | | [441,004 | ] | | | [8.80 | ]% |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act, and Section 30(h) of the 1940 Act, and the rules thereunder, require that the Fund’s Directors and officers, certain persons affiliated with the Investment Adviser, and persons who own more than 10% of a registered class of the Fund’s securities, file reports of ownership and changes of ownership with the Securities and Exchange Commission (“SEC”) and, in some cases, the New York Stock Exchange. Directors, officers, and greater than 10% stockholders are required by SEC regulations to furnish the Fund with copies of all Section 16(a) forms they file.

Based solely upon the Fund's review of the copies of such forms it received and written representations from certain of such persons, the Fund believes that during the Fund’s fiscal year ended October 31, 2015 these persons complied with all such applicable filing requirements.

OTHER MATTERS

No business other than as set forth herein is expected to come before the Meeting, but should any other matter requiring a vote of stockholders arise, including any question as to an adjournment of the Meeting, the persons named in the enclosed proxy will vote thereon according to their best judgment in the interests of the Fund.

STOCKHOLDER PROPOSALS

A stockholder's proposal intended to be presented at the Fund's Annual Meeting of Stockholders to be held in 2017 must be received by the Fund within the period beginning December 2, 2016 and ending January 1, 2017 in order to be included in the Fund's proxy statement and proxy relating to that meeting and must satisfy the requirements of federal securities laws. In addition, stockholders seeking to nominate an individual for election to the Board of Directors, or seeking to propose other

business (that is a proper matter for action by the stockholders) to be considered by the stockholders at an annual meeting of stockholders, must provide timely notice of the proposal in a signed writing addressed to the Secretary of the Fund.

| | Vincenzo A. Scarduzio, Esq. |

| | Secretary |

Dated: June [__], 2016

| IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. STOCKHOLDERS WHO DO NOT EXPECT TO BE PRESENT AT THE MEETING WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO VOTE THROUGH THE INTERNET OR BY TELEPHONE, OR COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES. |

Appendix A

INVESTMENT ADVISORY AGREEMENT

Agreement, dated and effective as of ______ __, 2016, between THE NEW IRELAND FUND, INC., a Maryland corporation (herein referred to as the “Fund”) and KLEINWORT BENSON INVESTORS INTERNATIONAL LIMITED, a limited liability company organized under the laws of the Republic of Ireland (herein referred to as the “Investment Adviser”).

WITNESSETH: That in consideration of the mutual covenants herein contained, it-is agreed by the parties as follows:

1. The Investment Adviser hereby undertakes and agrees, upon the terms and conditions herein set forth, (i) to make investment decisions for the Fund, to prepare and make available to the Fund research and statistical data in connection therewith, and to supervise the acquisition and disposition of securities by the Fund, including the selection of brokers or dealers to carry out the transactions, all in accordance with the Fund’s investment objective and policies and in accordance with guidelines and directions from the Fund’s Board of Directors; (ii) to assist the Fund as it may reasonably request in the conduct of the Fund’s business subject to the direction and control of the Fund’s Board of Directors; (iii) to maintain and furnish or cause to be maintained and furnished for the Fund all records, reports and other information required under the Investment Company Act of 1940, as amended (the “1940 Act”), to the extent that such records, reports and other information are not maintained or furnished by the administrators, custodians or other agents of the Fund; (iv) to furnish at the Investment Adviser’s expense for the use of the Fund such office space and facilities as the Fund may reasonably require for its needs in Dublin, Ireland, and to furnish at the Investment Adviser’s expense clerical services in the United States or Ireland related to research, statistical and investment work; and (v) to pay the reasonable salaries and expenses of such of the Fund’s officers and employees (including, where applicable, the Fund’s share of payroll taxes) and any fees and expenses of such of the Fund’s directors as are directors, officers or employees of the Investment Adviser or any of its affiliates,provided, however, that the Fund, and not the Investment Adviser or any of its affiliates, shall bear travel expenses or an appropriate fraction thereof of directors and officers of the Fund who are directors, officers or employees of the Investment Adviser or any of its affiliates to the extent that such expenses relate to attendance at meetings of the Board of Directors of the Fund or any committees thereof. The Investment Adviser shall bear all expenses arising out of its duties hereunder but shall not be responsible for any expenses of the Fund other than those specifically allocated to the Investment Adviser in this paragraph 1. In particular, but without limiting the generality of the foregoing, the Investment Adviser shall not be responsible, except to the extent of the compensation of such of the Fund’s employees as are directors, officers or employees of the Investment Adviser whose services may be involved, for the following expenses of the Fund: organization expenses (but not the overhead or employee costs of the Investment Adviser); legal fees and expenses of counsel (United States and Irish) to the Fund and, if counsel is retained by the directors who are not “interested persons” of the Fund, of such counsel; auditing and accounting expenses; taxes and governmental fees; New York Stock Exchange listing fees; dues and expenses incurred in connection with membership in investment company organizations; fees and expenses of the Fund’s custodians, transfer agents and registrars; fees and expenses with respect to administration except as may be provided otherwise pursuant to administration agreements; expenses for portfolio pricing services by a pricing agent, if any; expenses of preparing share certificates and other expenses in connection with the issuance, offering and underwriting of shares issued by the Fund; expenses relating to investor and public relations; fees and expenses involved in registering and maintaining registration of the Fund and of its shares with the Securities and Exchange Commission, and qualifying its shares under state securities laws, including the preparation and printing of the Fund’s registration statements and prospectuses for such purposes; freight, insurance and other charges in connection with the shipment of the Fund’s portfolio securities; brokerage commissions, stamp duties or other costs of acquiring, disposing or maintaining any portfolio holding of the Fund; expenses of preparation and distribution of reports, notices and dividends to shareholders; expenses of the dividend reinvestment and share purchase plan; costs of stationery; any litigation expenses; and costs of shareholders’ and other meetings.

2. In connection with the rendering of the services required under paragraph 1, the Fund may contract with or consult with such banks, other securities firms or other parties in Ireland or elsewhere as it may deem appropriate to obtain, advice regarding economic factors and trends, advice as to currency exchange matters and clerical and accounting services and other assistance.

3. The Fund agrees to pay in U.S. dollars to the Investment Adviser, as full compensation for the services to be rendered and expenses to be borne by the Investment Adviser hereunder, a fee, payable monthly, at an annualized rate equal to 0.65% of the value of the average daily net assets of the Fund up to the first $50 million, 0.60% of the value of the average daily net assets of the Fund over $50 million and up to and including $100 million, and 0.50% of the value of the average daily net assets of the Fund in excess of $100 million. For purposes of computing the monthly fee, the daily net assets of the Fund for a month shall be determined as of the close of business in New York each day with respect to which such last business day falls within that month, and the aggregate value of all such daily net assets shall be divided by the number of such days in such month. The value of the net assets of the Fund shall be determined pursuant to the applicable provisions of the 1940 Act and the directions of the Fund’s Board of Directors. Such fee shall be computed beginning on the effective date of this Agreement (the “Effective Date”) until the termination, for whatever reason, of this Agreement. The fee for the period from the end of the last month ending prior to termination of this Agreement to the date of termination and the fee for the period from the Effective Date through the end of the month in which the Effective Date occurs shall be pro rated according to the proportion which such period

bears to the full monthly period. Except as provided below, each payment of a monthly fee to the Investment Adviser shall be made within ten days of the first day of each month following the day as of which such payment is computed. Upon the termination of this Agreement before the end of any month, such fee shall be payable on the date of termination of this Agreement.

4. The Investment Adviser represents and warrants that it is duly registered and authorized as an investment adviser under the U.S. Investment Advisers Act of 1940, as amended, and agrees to maintain effective all requisite registrations, authorizations and licenses, as the case may be, until the termination of this Agreement.

5. Nothing herein shall be construed as prohibiting the Investment Adviser from providing investment management and advisory services to, or entering into investment management and advisory agreements with, other clients, including other registered investment companies and clients which may invest in securities of Irish issuers, or from utilizing (in providing such services) information furnished to the Investment Adviser as contemplated by section 2 of this Agreement; nor, except as explicitly provided herein, shall anything herein be construed as constituting the Investment Adviser an agent of the Fund.

6. The Investment Adviser may rely on information reasonably believed by it to be accurate and reliable. Neither the Investment Adviser nor its officers, directors, employees, agents or controlling persons as defined in the 1940 Act shall be subject to any liability for any act or omission, error of judgment or mistake of law, or for any loss suffered by the Fund, in the course of, connected with or arising out of any services to be rendered hereunder, except by reason of willful misfeasance, bad faith or gross negligence on the part of the Investment Adviser in the performance of its duties or by reason of reckless disregard on the part of the Investment Adviser of its obligations and duties under this Agreement. Any person, even though also employed by the Investment Adviser, who may be or become an employee of the Fund shall be deemed, when acting within the scope of his employment by the Fund, to be acting in such employment solely for the Fund and not as an employee or agent of the Investment Adviser.

7. This Agreement shall remain in effect for a period of two years from the date on which it is approved by the holders of a majority of the outstanding voting securities of the Fund, and shall continue in effect thereafter, but only so long as such continuance is specifically approved at least annually by the affirmative vote of (i) a majority of the members of the Fund’s Board of Directors who are neither parties to this Agreement nor interested persons of the Fund or of the Investment Adviser or of any entity regularly furnishing investment advisory services with respect to the Fund pursuant to an agreement with the Investment Adviser, cast in person at a meeting called for the purpose of voting on such approval, and (ii) a majority of the Fund’s Board of Directors or the holders of a majority of the outstanding voting securities of the Fund.

Notwithstanding the above, this Agreement (a) may nevertheless be terminated at any time without penalty, by the Fund’s Board of Directors, by vote of holders of a majority of the outstanding voting securities of the Fund or by the Investment Adviser upon 60 days’ written notice delivered or sent to the other party, and (b) shall automatically be terminated in the event of its assignment,provided, however, that a transaction which does not, in accordance with the 1940 Act, result in a change of actual control or management of the Investment Adviser’s business shall not be deemed to be an assignment for the purposes of this Agreement. Any such noticeshall be deemed given when received by the addressee.

8. This Agreement may not be transferred, assigned, sold or in any manner hypothecated, or pledged by either party hereto other than pursuant to Section 7. It may be amended by mutual agreement, but only after authorization of such amendment by the affirmative vote of (i) the holders of a majority of the outstanding voting securities of the Fund, and (ii) a majority of the members of the Fund’s Board of Directors who are not interested persons of the Fund or of the Investment Adviser or of an entity regularly furnishing investment advisory services with respect to the Fund pursuant to any agreement with the Investment Adviser, cast in person at a meeting called for the purpose of voting on such approval.

9. This Agreement shall be construed in accordance with the laws of the State of New York,provided, however, that nothing herein shall be construed as being inconsistent with the 1940 Act. As used herein, the terms “interested person”, “assignment”, and “vote of a majority of the outstanding voting securities” shall have the meanings set forth in the 1940 Act.

10. Any notice hereunder shall be in writing and shall be delivered in person or by facsimile (followed by mailing such notice, air mail postage prepaid, on the day on which such facsimile is sent to the address set forth below) to the following address or facsimile numbers:

If to Kleinwort Benson Investors International Ltd., to the attention of Geoff Blake, Kleinwort Benson Investors International Limited, 3rd Floor, 2 Harbourmaster Place, IFSC, Dublin 1, Ireland.

If to the Fund, to the attention of Treasurer, The New Ireland Fund, Inc., c/o BNY Mellon Center, One Boston Place, 201 Washington Street, 34th Floor, Boston, MA 02109,or to such other address as to which the recipient shall have informed the other parties in writing.

Unless specifically provided elsewhere, notice given as provided above shall be deemed to have been given, if by personal delivery, on the day of such delivery, and, if by facsimile and mail, on the date on which such facsimile and confirmatory letter are sent.

11. Each party hereto irrevocably agrees, that any suit, action or proceeding against the Investment Adviser or the Fund arising out of or relating to this Agreement shall be subject exclusively to the jurisdiction of the United States District Court for the Southern District of New York and the Supreme Court of the State of New York, New York County, and each party hereto irrevocably submits to the jurisdiction of each such court in connection with any such suit, action or proceeding. Each party hereto waives any objection to the laying of venue of any such suit, action or proceeding in either such court and waives any claim that such suit, action or proceeding has been brought in an inconvenient forum. Each party hereto irrevocably consents to service of process in connection with such suit, action or proceeding by mailing a copy thereof registered or certified, mail, postage prepaid, to their respective addresses as set forth in this Agreement.

IN WITNESS WHEREOF, the parties have executed this Agreement by their officers thereunto duly authorized as of the day and year first written above.

| | THE NEW IRELAND FUND, INC. |

| | |

| | By: | |

| | | Name: |

| | | Title: |

| | | |

| | KLEINWORT BENSON INVESTORS INTERNATIONAL LTD. |

| | |

| | By: | |

| | | Name: |

| | | Title: |

| | By: | |

| | | Name: |

| | | Title: |