SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Sec. 240.14a-11(c) or Sec. 240.14a-12 |

The New Ireland Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: | |

| | | | |

| | | | |

| | | | |

| | 2) | Aggregate number of securities to which transaction applies: | |

| | | | |

| | | | |

| | | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | | | |

| | | | |

| | 4) | Proposed maximum aggregate value of transaction: | |

| | | | |

| | | | |

| | | | |

| | 5) | Total fee paid: | |

| | | | |

| | | | |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: | |

| | | | |

| | | | |

| | 2) | Form, Schedule or Registration Statement No.: | |

| | | | |

| | | | |

| | 3) | Filing Party: | |

| | | | |

| | | | |

| | 4) | Date Filed: | |

| | | | |

| | | | |

April 28, 2017

Dear Stockholder,

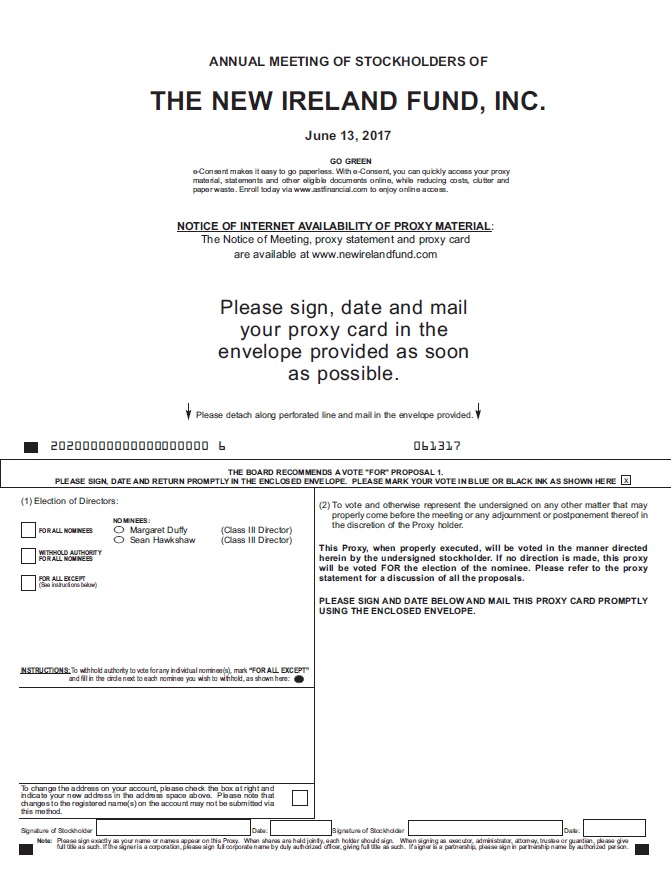

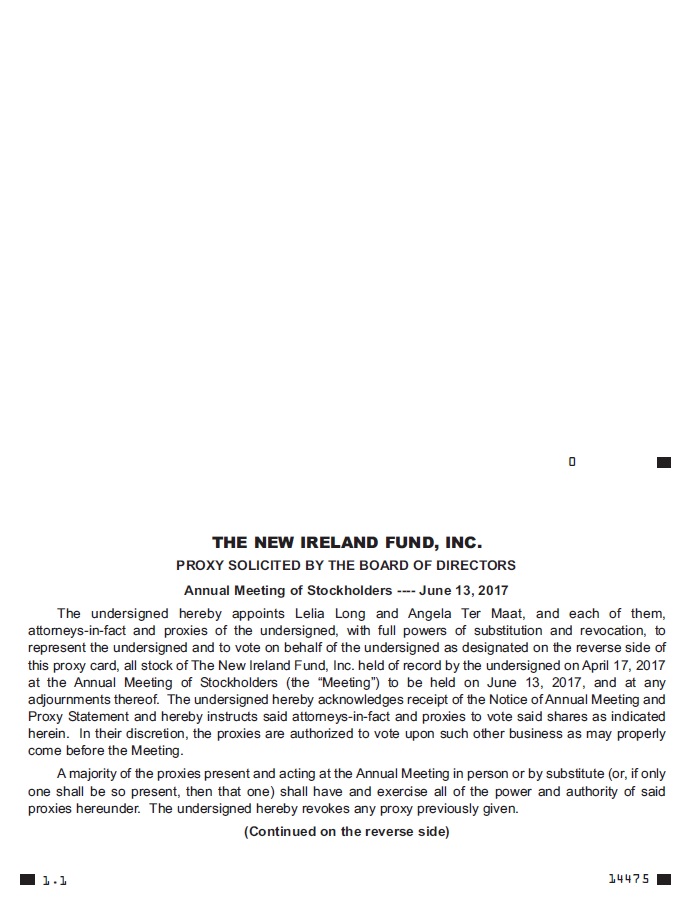

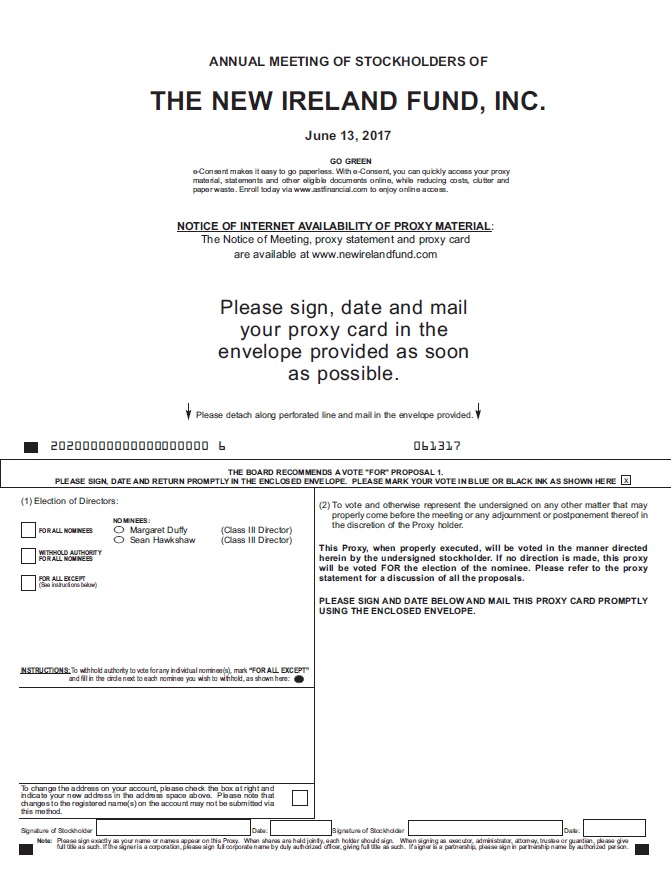

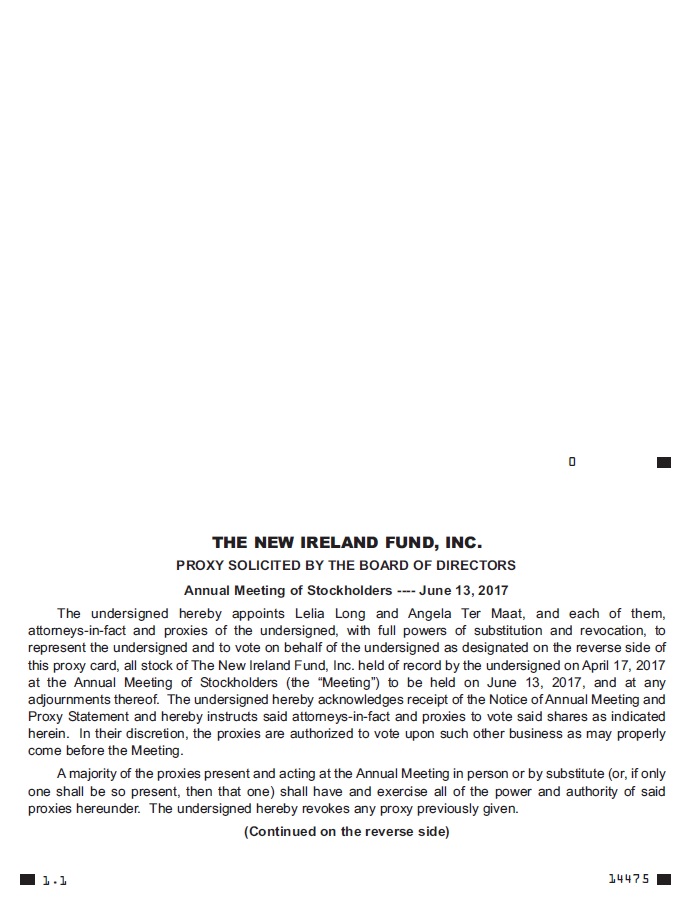

Enclosed you will find a Notice and Proxy Statement for the Annual Meeting of Stockholders (the “Meeting”) of The New Ireland Fund, Inc. (the “Fund”) to be held on Tuesday, June 13, 2017 at 9:00 a.m. New York time, at the Harvard Club, 27 West 44th Street, New York, NY 10036. At the Meeting, stockholders will vote on the election of two Directors and such other matters as may properly come before the Meeting.

On behalf of the Board of Directors, I cordially invite all stockholders to attend the Meeting. Whether or not you plan to attend the Meeting in person, please take the time to cast your vote by mailing in your proxy card. As explained in the attached Proxy Statement, you may withdraw your proxy at any time before it is actually voted at the Meeting.

We look forward to your continued support.

Sincerely,

Chairperson

________________________________

The New Ireland Fund, Inc.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

1-800-GO-TO-IRL (1-800-468-6475)

THE NEW IRELAND FUND, INC.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

_________________________

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 13, 2017

_________________________

To the Stockholders of The New Ireland Fund, Inc.:

Notice is hereby given that the Annual Meeting of Stockholders (the "Meeting") of The New Ireland Fund, Inc. (the "Fund"), a Maryland corporation, will be held on Tuesday, June 13, 2017 at 9:00 a.m., New York time, at the Harvard Club, 27 West 44th Street, New York, NY 10036, for the following purposes:

1. To elect two (2) Directors of the Fund (Proposal 1).

2. To consider and act upon any other business as may properly come before the Meeting or any adjournment thereof.

These items are discussed in greater detail in the attached Proxy Statement.

Only stockholders of record at the close of business on Monday, April 17, 2017 are entitled to notice of, and to vote at, the Meeting or at any adjournments thereof.

If you sign, date, and return the proxy card but give no voting instructions, your shares will be voted “FOR” the proposal above.

By order of the Board of Directors

Angela Ter Maat

Secretary

Dated: April 28, 2017

Important Notice Regarding the Availability of Proxy Materials for the Meeting. The Notice of Annual Meeting of Stockholders, Proxy Statement and the Fund’s most recent annual report are posted on the Fund’s website atwww.newirelandfund.com.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, WE ASK THAT YOU PLEASE COMPLETE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. IN ORDER TO AVOID THE ADDITIONAL EXPENSE TO THE FUND OF FURTHER SOLICITATION, WE ASK FOR YOUR COOPERATION IN MAILING IN YOUR PROXY CARD PROMPTLY. INSTRUCTIONS FOR THE PROPER EXECUTION OF PROXIES ARE SET FORTH BELOW.

INSTRUCTIONS FOR SIGNING PROXY CARDS

The following general rules for signing proxy cards may be of assistance to you and avoid the time and expense to the Fund involved in validating your vote if you fail to sign your proxy card properly.

1. Individual Accounts: Sign your name exactly as it appears in the registration on the proxy card.

2. Joint Accounts: Joint owners should each sign, exactly as your names are shown in the registration.

3. All Other Accounts: The capacity of the individuals signing the proxy card should be indicated unless it is reflected in the form of registration. For example:

| Registration | | Valid Signature |

| | | |

| Corporate Accounts | | |

| | | |

| (1) ABC Corp. | | ABC Corp. |

| (2) ABC Corp. | | John Doe, Treasurer |

| (3) ABC Corp. | | |

| c/o John Doe, Treasurer | | John Doe |

| (4) ABC Corp. Profit Sharing Plan | | John Doe, Trustee |

| | | |

| Trust Accounts | | |

| | | |

| (1) ABC Trust | | Jane B. Doe, Trustee |

| (2) Jane B. Doe, Trustee | | |

| u/t/d 12/28/78 | | Jane B. Doe |

| | | |

| Custodian or Estate Accounts | | |

| | | |

| (1) John B. Smith, Cust. | | |

| f/b/o John B. Smith, Jr. UGMA | | John B. Smith |

| (2) Estate of John B. Smith | | .John B. Smith, Jr., Executor |

THE NEW IRELAND FUND, INC.

c/o KBI Global Investors (North America) Limited

One Boston Place

201 Washington Street, 36th Floor

Boston, Massachusetts 02108

ANNUAL MEETING OF STOCKHOLDERS

June 13, 2017

PROXY STATEMENT

This Proxy Statement is furnished by the Board of Directors of The New Ireland Fund, Inc. (the "Fund") in connection with its solicitation of proxies for use at the Annual Meeting of Stockholders (the "Meeting") of the Fund to be held on Tuesday, June 13, 2017 at 9:00 a.m. New York time, at the Harvard Club, 27 West 44th Street, New York, NY 10036 and at any adjournments thereof. The purpose of the Meeting and the matters to be acted upon are set forth in the accompanying Notice of Annual Meeting of Stockholders.

If the accompanying proxy is executed properly and returned by June 13, 2017 in time to be voted at the Meeting, shares represented by it will be voted at the Meeting in accordance with the instructions on the proxy. If, however, no instructions are specified, shares will be voted for the election of Directors. If your shares are held though a broker, your shares can be voted on the election of Directors in your broker’s discretion. For purposes of the election of Directors, abstentions and broker non-votes, if any, will be treated as shares present, but will not be counted as votes cast. A proxy may be revoked at any time prior to the time it is voted by executing a superseding proxy by mail following the process described on the proxy card, by submitting a written notice to the Secretary of the Fund or by attendance at the Meeting and executing a superseding proxy.

A quorum of the Fund’s stockholders is required to properly conduct the business of the Meeting. Under the By-Laws of the Fund, a quorum is constituted by the presence in person or by proxy of stockholders entitled to cast a majority of the votes entitled to be cast at the Meeting. In the event a quorum is not present at the Meeting, the Chairperson of the Meeting will have the power to adjourn the Meeting, without notice other than an announcement at the Meeting, until the requisite amount of stock entitled to vote at such Meeting is present. Once a quorum is established, the stockholders present, either in person or by proxy, at the Meeting may continue to transact business until adjournment, notwithstanding the withdrawal from the Meeting of enough stockholders to leave fewer than would be required to establish a quorum. In the event a quorum is present at the Meeting, but sufficient votes to approve any of the proposed items are not received, the persons named as proxies may propose one or more adjournments of such Meeting to permit further solicitation of proxies. A stockholder vote may be taken on one or more of the proposals in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate. Any such adjournment will require the affirmative vote of a majority of those shares present at the Meeting in person or by proxy and the persons named as proxies will vote those proxies which they are entitled to vote FOR or AGAINST any such proposal in their discretion. Absent the establishment of a subsequent record date and the giving of notice to the holders of record thereon, the adjourned Meeting will take place not more than 120 days after the original record date. At such adjourned Meeting, any business may be transacted which might have been transacted at the original Meeting.

The close of business on April 17, 2017 has been fixed as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Meeting. As of the Record Date, the Fund had 5,337,618 shares of common stock outstanding and entitled to vote. At the Meeting, each share will be entitled to one vote, and fractional shares, if any, shall have proportionate voting rights. It is expected that the Notice of Annual Meeting, Proxy Statement, and form of proxy will be mailed to stockholders on or about May 1, 2017.

Proxy solicitations will be made primarily by mail, but solicitations may also be made by telephone or personal contact conducted by officers or employees of the Fund. All costs of solicitation, including (a) printing and mailing of this Proxy Statement and accompanying material, (b) the reimbursement of brokerage firms and others for their expenses in forwarding solicitation material to the beneficial owners of the Fund’s shares and (c) supplementary solicitations to submit proxies, will be borne by the Fund.

The Annual Report of the Fund, including audited financial statements for the fiscal year ended October 31, 2016, is available upon request, without charge, by writing to The New Ireland Fund, Inc., C/O KBI Global Investors (North America) Limited, One Boston Place, 201 Washington Street, 36th Floor, Boston, Massachusetts 02108, by accessing the Fund’s website at www.newirelandfund.com, by calling toll-free 1-800-468-6475, or by emailing investor.query@newirelandfund.com.

The date of this Proxy Statement is April 28, 2017.

ELECTION OF DIRECTORS

(Proposal No. 1)

At the Meeting, two Directors will be elected. Pursuant to the Fund's By-laws, the terms of office of the Directors are staggered. The Board of Directors is divided into three classes, designated: Class I, Class II, and Class III. Class I currently consists of Peter J. Hooper, Class II currently consists of David Dempsey and Michael Pignataro, and Class III currently consists of Margaret Duffy and Sean Hawkshaw. The two Directors in Class III are being considered for election at the Meeting. If elected, each of Ms. Duffy and Mr. Hawkshaw will hold office for a term of three years and until his or her successor is elected and qualified. It is the intention of the persons named in the accompanying proxy to vote, on behalf of the stockholders, for the election of Margaret Duffy and Sean Hawkshaw.

The nominees have consented to being named in this Proxy Statement and to serve as Directors if elected. The Board of Directors has no reason to believe that the nominees will become unavailable for election as Directors, but if that should occur before the Meeting, proxies will be voted for such other persons as the Board of Directors may recommend.

The Directors and officers of the Fund are listed below, together with their respective positions, and a brief statement of their principal occupations during the past five years and, in the case of Directors, their positions with certain organizations and publicly-held companies. For the purposes of the table below and this Proxy Statement, except as otherwise defined, the term “Independent Director” means those Directors who are not “interested persons” (as defined in the Investment Company Act of 1940 (the “1940 Act”)), of the Fund, and the term “Interested Director” means those Directors who are “interested persons” of the Fund.

| Name Address, and Age | | Position(s)

Held with

the Fund | | Term of

Office and

Length of

Time

Served* | | Principal Occupation(s) and Other

Directorships During Past Five Years | | Number of

Portfolios

in Fund

Complex

Overseen

by Director |

| | | | | | |

| INDEPENDENT DIRECTORS: | | | | | | | | |

| | | | | | | | | |

Margaret Duffy, 73 One Boston Place 201 Washington Street, 36th Floor Boston, Massachusetts 02108 | | Director and Chairperson of the Board of Directors | | Director Since 2006 Chairperson of the Board of Directors Since 2015 | | Retired Partner, Arthur Andersen LLP, Director, Lavelle Fund for the Blind (2014 to present). | | 1 |

David Dempsey, 67 One Boston Place 201 Washington Street, 36th Floor Boston, Massachusetts 02108 | | Director | | Since 2007 | | Managing Director, Bentley Associates L.P., - Investment Bank (1992 to present); Director, Hong Kong Association of New York (2014 to present). | | 1 |

Peter J. Hooper, 77 One Boston Place 201 Washington Street, 36th Floor Boston, Massachusetts 02108 | | Director | | Since 1990 | | President, Hooper Associates-Consultants (1994 to present); Director, The Ireland United States Council for Commerce and Industry (1984 to present). | | 1 |

Michael A. Pignataro, 57 One Boston Place 201 Washington Street, 36th Floor Boston, Massachusetts 02108 | | Director | | Since 2015 | | Director, Credit Suisse Asset Management (2001 to 2013); Chief Financial Officer, Credit Suisse US Registered Funds (1996 to 2012); Trustee, INDEXIQ Trust, INDEXIQ ETF Trust and INDEXIQ Active ETF Trust (April 2015 to present). | | 1 |

___________________________

*Each Director shall serve until the expiration of his or her current term and until his or her successor is elected and qualified.

| Name Address, and Age | | Position(s)

Held with

the Fund | | Term of

Office and

Length of

Time

Served* | | Principal Occupation(s) and Other

Directorships During Past Five Years | | Number of

Portfolios

in Fund

Complex

Overseen

by Director |

| | | | | | | | | |

| INTERESTED DIRECTOR: | | | | | | | | |

| | | | | | | | | |

Sean Hawkshaw, 52 KBI Global Investors (North America) Ltd One Boston Place 201 Washington Street, 36th Floor Boston, Massachusetts, 02108 | | President and Director** | | President Since 2011 Director from July 2011 to June 2012 and Since March 2013 | | Chief Executive Officer & Director, KBI Global Investors (North America) Ltd (2002 to Present); Director, KBI Global Investors Limited (1994 to Present); Director, KBI Fund Managers Limited (2002 to 2013); Director, KBI Institutional Funds PLC (2004 to 2013); Director, KBI/Lothbury Qualifying Investor Fund, PLC (2006 to present); Director, Irish Auditing and Accounting Supervisory Authority (2006 to 2015); Director, KBC Asset Management (U.K.) Ltd (2002 to 2010); Director, Fusion Alternative Investments PLC (2008 to 2014); Director, Irish Association of Investment Managers (2003 to Present). | | 1 |

| | | | | | | | | |

| OFFICERS***: | | | | | | | | |

| | | | | | | | | |

| Sean Hawkshaw | | President | | Since 2011 | | See description above | | |

Lelia Long, 5441 c/o KBI Global Investors

(North America) Limited One Boston Place 201 Washington Street, 36th Floor Boston, Massachusetts 02108 | | Treasurer | | Since 2002 | | Investment Management and Compliance Consultant (2009 to present). | | |

Salvatore Faia, 54 c/o KBI Global Investors

(North America) Limited One Boston Place 201 Washington Street, 36th Floor Boston, Massachusetts 02108 | | Chief Compliance Officer | | Since 2005 | | President, Vigilant Compliance LLC, (2004 to present); Director, EIP Growth and Income Fund (2005 to present). | | |

Angela Ter Maat, 36 c/o U.S. Bancorp Fund Services, LLC 615 E Michigan Street Milwaukee, WI 53202 | | Secretary | | Since 2016 | | Vice President, U.S. Bancorp Fund Services, LLC (2003 to present). | | |

_____________________________

*Each Director shall serve until the expiration of his or her current term and until his or her successor is elected and qualified.

** Mr. Hawkshaw is deemed to be an “interested” director because of his affiliation with KBI Global Investors (North America) Ltd, the investment adviser to the Fund.

*** Each officer of the Fund will hold office until a successor has been elected by the Board of Directors.

Equity Securities Beneficially Owned by the Directors

| Name of Director | | Dollar Range of Equity Securities Held in the Fund*+ | | Aggregate Dollar Range of Equity Securities in All Registered

Investment Companies Overseen by Director in Family of Investment Companies*+ |

| Independent Directors | | | | |

| David Dempsey | | C | | C |

| Margaret Duffy | | E | | E |

| Peter J. Hooper | | D | | D |

| Michael Pignataro | | C | | C |

| | | | | |

| Interested Director | | | | |

| Sean Hawkshaw | | A | | A |

_______________________

* Key to Dollar Ranges

+ As of April 17, 2017, the Family of Investment Companies consisted of only the Fund.

As of April 17, 2017, none of the Independent Directors, nor any of his or her immediate family members owned beneficially or of record securities in the Fund’s investment adviser, KBI Global Investors (North America) Ltd,(“KBIGI” or the “Investment Adviser”) or any person directly or indirectly controlling, controlled by, or under common control with KBIGI.

Compensation

The following table sets forth certain information regarding the compensation of the Fund’s Directors and officers. The Fund currently pays each of its Directors, who is not a managing director, officer, or employee of the Investment Adviser or any affiliate thereof an annual fee of $26,000 plus $2,000 for each meeting of the Board of Directors attended in person and $1,000 for each meeting of the Board of Directors attended via telephone. The Directors also receive a fee of $2,000 for each meeting of any Committee of the Board of Directors attended in person or via telephone, as well as for any stockholder meeting attended in person not held on the same day as a meeting of the Board of Directors. In addition, each Independent Director may be compensated for incremental work, over and above attending a meeting, as a member of an ad hoc committee. The Fund pays the Chairperson of the Board of Directors an additional retainer of $25,000 annually, pays the Chairman of the Audit and Valuation Committee an additional retainer of $6,000 annually and pays the Chairman of the Governance and Nominating Committee an additional retainer of $4,000. In addition, each Director is reimbursed for travel and certain out-of-pocket expenses. Officers of the Fund who are employed by U.S. Bancorp Fund Services, LLC. (“USBFS”), the Fund’s administrator, receive reimbursement from the Fund for travel to and from Board of Director meetings. No Director received compensation from the Fund in excess of $120,000 for the fiscal year ended October 31, 2016.

Compensation Schedule for the

Fiscal Year Ended October 31, 2016

| Name of Person and Position | | Aggregate Compensation

From the Fund | | | Pension or

Retirement Benefits

Accrued as Part

of Fund Expenses | | | Estimated

Annual Benefits

upon Retirement | | Total Compensation

From the Fund Paid to Directors | |

| | | | | | | | | | | | |

Independent Directors | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Margaret Duffy

Chairperson of the Board of Directors | | $ | 70,335 | | | $ | 0 | | | N/A | | $ | 70,335 | |

| | | | | | | | | | | | | | | |

David Dempsey

Director | | $ | 51,579 | | | $ | 0 | | | N/A | | $ | 51,579 | |

| Name of Person and Position | | Aggregate Compensation

From the Fund | | | Pension or

Retirement Benefits

Accrued as Part

of Fund Expenses | | | Estimated

Annual Benefits

upon Retirement | | Total Compensation

From the Fund Paid to Directors | |

| | | | | | | | | | | | | | | |

Peter J. Hooper

Director | | $ | 42,916 | | | $ | 0 | | | N/A | | $ | 42,916 | |

| | | | | | | | | | | | | | | |

Michael Pignataro

Director | | $ | 51,665 | | | $ | 0 | | | N/A | | $ | 51,665 | |

| | | | | | | | | | | | | | | |

| Interested Director | | | | | | | | | | | | | | |

| | | | | | | | | | |

Sean Hawkshaw

Director and President | | $ | 0 | | | $ | 0 | | | N/A | | $ | 0 | |

There were four regular meetings and six special meetings of the Board of Directors held during the fiscal year ended October 31, 2016. Each Director attended at least 75% of the aggregate total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board of Directors on which the Director served. Aggregate fees paid to the Board of Directors for the fiscal year ended October 31, 2016 were $216,495.

Additional Information about the Fund’s Board of Directors

Board Responsibilities

The Board of Directors has the overall responsibility for monitoring the operations of the Fund. The Board of Directors has approved contracts under which certain companies provide essential management services to the Fund. The Board of Directors is responsible for supervising the services provided by those companies.

Like most registered investment companies, the day-to-day business of the Fund, including the management of risk, is performed by third-party service providers, such as the Investment Adviser, USBFS and the Fund’s transfer agent. The Directors are responsible for overseeing the Fund’s service providers and, thus, have oversight responsibility with respect to risk management performed by those service providers. Risk management seeks to identify and address risks – that is, events or circumstances that could have material adverse effects on the business, operations, shareholder services, investment performance or reputation of the Fund. The Fund and its service providers employ a variety of processes, procedures and controls to identify those possible events or circumstances, to lessen the probability of their occurrence, and/or to mitigate the effects of such events or circumstances if they do occur. Each service provider is responsible for one or more discrete aspects of the Fund’s business, and, consequently, for managing the risks associated with that business. The Board of Directors has emphasized to the Fund’s service providers the importance of maintaining vigorous risk management.

As part of its oversight, the Board of Directors, acting at its scheduled meetings, or the Chairperson, acting between Board of Directors meetings, regularly interacts with and receives reports from service providers. Additionally, the Investment Adviser provides the Board of Directors with an overview of, among other things, its investment philosophy, brokerage practices and compliance infrastructure. The Board of Directors continues its oversight function as various personnel, including the Fund’s Chief Compliance Officer and personnel of other service providers, such as the Fund’s independent registered public accounting firm, make periodic reports to the Audit and Valuation Committee of the Board of Directors or to the entire Board of Directors with respect to various aspects of risk management. The Board of Directors and the Audit and Valuation Committee oversee efforts by management and service providers to manage risks to which the Fund may be exposed.

The Fund’s Chief Compliance Officer reports regularly to the Board of Directors to review and discuss compliance issues. At least annually, the Fund’s Chief Compliance Officer provides the Board of Directors with a written report reviewing the adequacy and effectiveness of the Fund’s policies and procedures and those of its service providers. The report addresses the operation of the policies and procedures of the Fund and each service provider since the date of the last report; any material changes to the policies and procedures since the date of the last report; any recommendations for material changes to the policies and procedures; and any material compliance matters since the date of the last report.

The Board of Directors receives reports from the Fund’s service providers regarding operational risks and risks related to the valuation and liquidity of portfolio securities. The Investment Adviser’s Pricing Committee reports to the Board of Directors concerning any investments for which market quotations are not readily available. Annually, the independent registered public accounting firm reviews with the Audit and Valuation Committee its audit of the Fund’s financial statements, focusing on major areas of risk encountered by the Fund and noting any significant deficiencies or material weaknesses in the Fund’s internal controls. Additionally, in connection with its oversight function, the Board of Directors oversees Fund management’s implementation of disclosure controls and procedures, which are designed to ensure that information required to be disclosed by the Fund in its periodic reports with the Securities and Exchange Commission (“SEC”) are recorded, processed, summarized, and reported within the required time periods. The Board of Directors also oversees the Fund’s internal controls over financial reporting, which comprise policies and procedures designed to provide reasonable assurance regarding the reliability of the Fund’s financial reporting and the preparation of the Fund’s financial statements.

From their review of these reports and their discussions with each service provider, the Chief Compliance Officer and the independent registered public accounting firm, the Board of Directors and the Audit and Valuation Committee learn about the material risks of the Fund, thereby facilitating a dialogue about how management and service providers identify and mitigate those risks.

The Board of Directors recognizes that not all risks that may affect the Fund can be identified and/or quantified, that it may not be practical or cost-effective to eliminate or mitigate certain risks, that it may be necessary to bear certain risks (such as investment-related risks) to achieve the Fund’s goals, and that the processes, procedures and controls employed to address certain risks may be limited in their effectiveness. Moreover, reports received by the Directors as to risk management matters are typically summaries of the relevant information. Most of the Fund’s investment management and business affairs are carried out by or through the Investment Adviser and other service providers each of which has an independent interest in risk management but whose policies and the methods by which one or more risk management functions are carried out may differ from the Fund’s and each other’s in the setting of priorities, the resources available or the effectiveness of relevant controls. As a result of the foregoing and other factors, the Board of Director’s ability to monitor and manage risk, as a practical matter, is subject to limitations.

Members and Structure of the Board of Directors

There are currently five members of the Board of Directors, four of whom are Independent Directors. Margaret Duffy serves as Chairperson of the Board of Directors. The Fund has determined its leadership structure is appropriate given the specific characteristics and circumstances of the Fund. The Fund made this determination in consideration of, among other things, the fact that the Board of Directors consists of five members, four of which are Independent Directors, including the Chairperson, the fact that the Chairman of the Audit and Valuation Committee is an Independent Director and the amount of assets under management in the Fund. The Board of Directors also believes that its leadership structure facilitates the orderly and efficient flow of information to the Independent Directors from Fund management.

Individual Director Qualifications

The Board of Directors has concluded that the Directors of the Fund should serve on the Board of Directors because of their ability to review and understand information about the Fund provided to them by management, identify and request other information they may deem relevant to the performance of their duties, question management and other service providers regarding material factors bearing on the management and administration of the Fund, and exercise their business judgment in a manner that serves the best interests of the Fund’s stockholders. In addition, the Board of Directors has concluded that each of the Directors should serve as a Director based on his or her own experience, qualifications, attributes and skills as described below.

Independent Directors

The Board of Directors has concluded that Ms. Duffy should serve as a Director because of her experience in financial consulting, her experience and background in the public accounting profession, including serving as an audit partner on multinational companies for an international accounting firm and her experience serving as a director of other companies, and as a Director of the Fund since 2006.

The Board of Directors has concluded that Mr. Dempsey should serve as a Director because of the financial and management experience he gained serving as a managing director of an international investment banking firm since 1991, his knowledge of the financial services and banking industries, and his experience serving as a Director of the Fund since 2007.

The Board of Directors has concluded that Mr. Hooper should serve as a Director because of the business and management experience he has gained as President of the consulting firm he founded in 1994, his knowledge of and experience in the financial services industry, and his experience serving as a Director of the Fund since 1990.

The Board of Directors has concluded that Mr. Pignataro should serve as a Director because of the financial and management experience he gained as a director at an asset management company from 2001 to 2013, his experience as the chief financial officer of a mutual fund complex from 1996 to 2012, his knowledge of the mutual fund operations and the mutual fund industry and his experience serving as a Director of the Fund since 2015.

Interested Director

The Board of Directors concluded that Mr. Hawkshaw should serve as a Director because of his experience as Chief Executive Officer of KBI Global Investors Limited and his many years of experience in the asset management business. He has served as a Director of the Fund since March 5, 2013. Prior thereto, Mr. Hawkshaw served as a Director of the Fund from July 21, 2011 to June 5, 2012.

In its periodic assessment of the effectiveness of the Board of Directors, the Board of Directors considers the complementary individual skills and experience of the individual Directors primarily in the broader context of the Board of Director’s overall composition so that the Board of Directors, as a body, possesses the appropriate (and appropriately diverse) skills and experience to oversee the operation of the Fund. Moreover, references to the qualifications, attributes and skills of individual Directors are pursuant to requirements of the SEC, do not constitute that the Board of Directors, or any Director, possesses any special expertise or experience, and shall not be deemed to impose any greater responsibility, or liability, on any such person or on the Board of Directors by reason thereof.

Committees of the Board of Directors

Audit and Valuation Committee/Audit and Valuation Committee Report

The role of the Audit and Valuation Committee is to assist the Board of Directors in its oversight of the Fund's financial reporting process and to oversee the activities of the Investment Adviser’s Pricing Committee and perform the responsibilities assigned to the Audit and Valuation Committee in the Fund’s valuation policies and procedures. The Audit and Valuation Committee operates pursuant to a Charter that was most recently approved by the Board of Directors on February 14, 2014. A copy of the Audit and Valuation Committee Charter (the “Charter”) is attached hereto as Exhibit A. As set forth in the Charter, management of the Fund is responsible for the preparation, presentation and integrity of the Fund's financial statements, and for the procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent registered public accounting firm for the Fund is responsible for auditing the Fund's financial statements and expressing an opinion as to their conformity with accounting principles generally accepted in the United States of America.

The Audit and Valuation Committee consists of Messrs. Pignataro, Dempsey and Hooper, all of whom are “independent” Directors of the Fund, as defined in the listing standards of the New York Stock Exchange. The Board of Directors has determined that Mr. Pignataro is qualified to serve as the Fund’s Audit committee financial expert. The Audit and Valuation Committee is responsible for the engagement of the independent registered public accounting firm and reviewing with the independent registered public accounting firm the plan and results of the audit engagement and matters having a material effect on the Fund's financial operations. The Audit and Valuation Committee met two times during the fiscal year ended October 31, 2016.

In performing its oversight function, the Audit and Valuation Committee has reviewed and discussed the audited financial statements with management and the independent registered public accounting firm. The Audit and Valuation Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 114,The Auditor’s Communication with Those Charged with Governance,AU Section 380, as modified or supplemented. The Audit and Valuation Committee has also received the written disclosures from the independent registered public accounting firm required by Public Company Accounting Oversight Board (“PCAOB”) Ethics and Independence Rule 3526,Communications with Audit Committees Concerning Independence, as may be modified or supplemented, and has discussed with the independent registered public accounting firm its independence.

The members of the Audit and Valuation Committee are not professionally engaged in the practice of auditing or accounting and are not experts in the fields of accounting or auditing, including in respect of auditor independence. Members of the Audit and Valuation Committee rely, without independent verification, on the information provided to them and on the representations made by management and the independent registered public accounting firm. Accordingly, the Audit and Valuation Committee's oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit and Valuation Committee’s considerations and discussions referred to above do not assure that the audit of the Fund's financial statements has been carried out in accordance with generally accepted auditing standards, that the financial statements are presented in accordance with accounting principles generally accepted in the United States of America or that the Fund's auditors are in fact "independent".

Based upon the reports and discussion described in this report, and subject to the limitations on the role and responsibilities of the Audit and Valuation Committee referred to above and in the Charter, the Audit and Valuation Committee recommended that the audited financial statements be included in the Fund's Annual Report for the year ended October 31, 2016.

Submitted by the Audit and Valuation Committee of the Fund's Board of Directors

Michael Pignataro

David Dempsey

Peter J. Hooper

Governance and Nominating Committee

The Fund’s Governance and Nominating Committee is currently composed of Ms. Duffy and Messrs. Pignataro and Dempsey. All of the members of the Governance and Nominating Committee are independent, as independence is defined in the listing standards of the New York Stock Exchange applicable to closed-end funds. The primary purposes and responsibilities of the Governance and Nominating Committee are (i) reviewing governance standards of the Board of Directors in light of best practices (with the understanding that the Board of Directors will seek to conform its practices to what it perceives to be best practices); (ii) screening and nominating candidates for election to the Board of Directors in the event that a position is vacated or created; (iii) setting any necessary standards or qualifications for service on the Board of Directors; (iv) reviewing any policy matters affecting the operation of the Board of Directors or Board of Directors committees and making recommendations to the Board of Directors as deemed appropriate by the Governance and Nominating Committee; and (v) establishing and reviewing Director compensation.

The Governance and Nominating Committee met two times during the Fund's fiscal year ended October 31, 2016 and most recently on March 14, 2017 to consider the nomination of Margaret Duffy and Sean Hawkshaw.

If a vacancy on the Board of Directors were to exist, the Governance and Nominating Committee would consider recommendations for Independent Director candidates properly submitted by Fund stockholders. Stockholders should submit such recommendations for nomination in a signed writing addressed to the Secretary of the Fund. Any stockholder seeking to nominate a Director candidate (a “Proposed Nominee”) must provide timely notice of the nomination and include in the notice certain information regarding the Proposed Nominee, including, among other things: (i) information relating to the Proposed Nominee that would be required to be disclosed in connection with the solicitation of proxies for the election of the Proposed Nominee as a director in an election contest (even if an election contest is not involved), and (ii) whether the stockholder believes that the Proposed Nominee is, or is not, an “interested person” of the Fund, as defined in the 1940 Act.

The Board of Directors has adopted a written charter for the Governance and Nominating Committee which was approved on November 7, 2013 and is available at the Fund’s website, www.newirelandfund.com. The Governance and Nominating Committee Charter describes the factors considered by the Governance and Nominating Committee in selecting nominees. These factors may include judgment, skill, diversity, experience with investment companies and other organizations of comparable purpose, complexity, size and subject to similar legal restrictions and oversight, the interplay of the candidate's experience with the experience of other Board of Directors members, and the extent to which the candidate would be a desirable addition to the Board of Directors and any committees thereof. The Governance and Nominating Committee will treat all equally qualified candidates in the same manner. The Governance and Nominating Committee may modify its policies and procedures for director nominees and recommendations in response to changes in the Fund’s circumstances, and as applicable legal or listing standards change.

Independent Registered Public Accounting Firm

At a meeting held on December 13, 2016, the Audit and Valuation Committee, which consists entirely of Independent Directors selected Tait, Weller & Baker LLP (“Tait Weller”), 1818 Market Street, Suite 2400, Philadelphia, Pennsylvania to serve as the independent registered public accounting firm for the Fund for the fiscal year ending October 31, 2017. The selection of Tait Weller was subsequently ratified and approved by the entire Board of Directors. Tait Weller was also the independent registered public accounting firm for the Fund for the fiscal year ended October 31, 2016. Tait Weller has advised the Fund that, to the best of its knowledge and belief, as of the Record Date, no Tait Weller professional had any direct or material indirect ownership interest in the Fund inconsistent with independent professional standards pertaining to accountants. It is expected that representatives of Tait Weller will not be present at the Meeting, but will be available by telephone and have the opportunity to make a statement, if the representatives so desire, and to answer any questions that may arise. In reliance on Rule 32a-4 under the 1940 Act, the Fund is not seeking stockholder ratification of the selection of Tait Weller as independent registered public accounting firm.

Set forth in the table below are fees billed to the Fund by Tait Weller for professional services rendered to the Fund for the fiscal years ended October 31, 2015 and October 31, 2016. There were no other fees billed to the Fund.

| Fiscal Year Ended | | Audit Fees | | | Audit-Related Fees | | | Tax Fees* | | | All Other Fees | |

| | | | | | | | | | | | | |

| 10/31/15 | | $ | 38,500 | | | | - | | | $ | 4,500 | | | | - | |

| | | | | | | | | | | | | | | | | |

| 10/31/16 | | $ | 38,500 | | | | - | | | $ | 4,500 | | | $ | 500 | |

*Fees billed to the Fund in connection with tax consulting services, including the review of the Fund's income tax returns.

The Fund’s Audit and Valuation Committee Charter requires that the Audit and Valuation Committee pre-approve all audit and non-audit services to be provided to the Fund by the Fund’s independent registered public accounting firm. All of the audit and tax services described above for which Tait Weller billed the Fund fees for the fiscal years ended October 31, 2015 and October 31, 2016 were pre-approved by the Audit and Valuation Committee.

Tait Weller did not bill any non-audit fees for services rendered to the Investment Adviser, or any entity controlling, controlled by, or under the common control with the Investment Adviser that provides ongoing services to the Fund, for the fiscal years ended October 31, 2015 and October 31, 2016.

Stockholder Communications

Stockholders who wish to send communications to the Board of Directors should address them to the Board of Directors of the Fund, c/o KBI Global Investors (North America) Ltd., One Boston Place, 201 Washington Street, 36th Floor, Boston, MA 02108 or to investor.query@newirelandfund.com. All such communications will be directed to the Board of Director’s attention.

The Fund does not have a formal policy regarding attendance of Directors at the Annual Meeting of Stockholders; however, all of the Directors of the Fund attended the June 14, 2016 Annual Meeting of Stockholders.

Required Vote

In the election of a Director of the Fund, a plurality of the votes cast by the Fund stockholders represented at a meeting at which a quorum is present is required to elect a Director candidate. A “plurality” means that the nominees who receive the largest number of votes cast “FOR” are elected as Directors. For this purpose, abstentions, broker non-votes and votes that are withheld will have no effect on the outcome of the election.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT

YOU VOTE "FOR" EACH OF THE NOMINEES FOR DIRECTOR.

ADDITIONAL INFORMATION

Investment Adviser

As described above, KBI Global Investors (North America) Ltd, One Boston Place, 201 Washington St., 36th Floor, Boston, MA 02108, and headquartered at 2 Harbourmaster Place, 3rd floor, IFSC, Dublin 1, Ireland currently serves as the Fund's investment adviser.

Administrator

USBFS acts as the Fund’s administrator pursuant to an Administration Agreement between the Administrator and the Fund. The principal business address of USBFS is 615 E. Michigan Street Milwaukee, Wisconsin, 53202.

Voting Results

Stockholders of the Fund will be informed of the voting results of the Meeting in the Fund’s Annual Report for the year ending October 31, 2017.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL/RECORD OWNERS

To the knowledge of the Fund, as of the Record Date, (i) the Directors and officers of the Fund as a “group” (as defined in Section 13(d) of the Securities Exchange Act of 1934, as amended (the “1934 Act”) owned less than 1% of the outstanding securities of the Fund, and (ii) other than the stockholders listed below, no person owned of record or owned beneficially more than 5% of the Fund’s outstanding shares. This information is based on the Fund’s review of filings made pursuant to Section 13 of the 1934 Act.

| Stockholder Name and Address | | Number of Shares Beneficially

Owned | | | Percent of Shares | |

| | | | | | | |

Karpus Management, Inc., d/b/a Karpus Investment Management

183 Sully’s Trail

Pittsford, New York 14534 | | | 935,537 | | | | 17.53 | % |

| | | | | | | | | |

1607 Capital Partners, LLC

4991 Lake Brook Drive, Suite 125

Glen Allen, VA 23060 | | | 464,741 | | | | 8.71 | % |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the 1934 Act, and Section 30(h) of the 1940 Act, and the rules thereunder, require that the Fund’s Directors and officers, certain persons affiliated with the Investment Adviser, and persons who own more than 10% of a registered class of the Fund’s securities, file reports of ownership and changes of ownership with the SEC and, in some cases, the New York Stock Exchange. Directors, officers, and greater than 10% stockholders are required by SEC regulations to furnish the Fund with copies of all Section 16(a) forms they file.

Based solely upon the Fund's review of the copies of such forms it received and written representations from certain of such persons, the Fund believes that during the Fund’s fiscal year ended October 31, 2016 these persons complied with all such applicable filing requirements.

OTHER MATTERS

No business other than as set forth herein is expected to come before the Meeting, but should any other matter requiring a vote of stockholders arise, including any question as to an adjournment of the Meeting, the persons named in the enclosed proxy will vote thereon according to their best judgment in the interests of the Fund.

STOCKHOLDER PROPOSALS

A stockholder's proposal intended to be presented at the Fund's Annual Meeting of Stockholders to be held in 2018 must be received by the Fund within the period beginning December 1, 2017 and ending January 2, 2018 in order to be included in the Fund's proxy statement and proxy relating to that meeting and must satisfy the requirements of federal securities laws. In addition, stockholders seeking to nominate an individual for election to the Board of Directors, or seeking to propose other business (that is a proper matter for action by the stockholders) to be considered by the stockholders at an annual meeting of stockholders, must provide timely notice of the proposal in a signed writing addressed to the Secretary of the Fund.

Angela Ter Maat

Secretary

Dated: April 28, 2017

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. STOCKHOLDERS WHO DO NOT EXPECT TO BE PRESENT AT THE MEETING WHO WISH TO HAVE THEIR SHARES VOTED ARE REQUESTED TO COMPLETE, SIGN, DATE AND PROMPTLY RETURN THE ENCLOSED PROXY CARD IN THE ENCLOSED SELF-ADDRESSED ENVELOPE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

Exhibit A

THE NEW IRELAND FUND, INC.

AUDIT AND VALUATION COMMITTEE CHARTER

Amended and Restated as of February 14, 2014

I.COMPOSITION OF THE AUDIT AND VALUATION COMMITTEE

The Audit and Valuation Committee (the “Committee”) of the Board of The New Ireland Fund, Inc. (the “Fund”) shall be composed of at least three Directors:

| (a) | Each of whom shall not be an “interested person” of the Fund, as defined in the Investment Company Act of 1940, as amended, (the “Investment Company Act”) or an “affiliated person” of the Fund, as described in the Securities Exchange Act of 1934, as amended (the “1934 Act”). |

| (b) | Each of whom shall not accept any consulting, advisory, or other compensatory fee from the Fund (other than fees for serving on the Board of Directors or any committee thereof) or have any other relationship to the Fund that may interfere with the exercise of such person’s independence from the Fund and Fund management. |

| (c) | Each of whom shall otherwise satisfy the applicable independence requirements for any stock exchange or market quotation system on which Fund shares are listed or quoted. |

| (d) | Each of whom shall be financially literate, as such qualification is interpreted by the Board of Directors in its business judgment, or shall become financially literate within a reasonable period of time after his or her appointment to the Committee. |

| (e) | At least one of whom shall have accounting or related financial management expertise as the Board of Directors interprets such qualification in its business judgment. |

The Committee shall determine whether at least one member of the Committee is an “audit committee financial expert” as defined in Item 407 of Securities and Exchange Commission (“SEC”) Regulation S-K, and shall consider whether any member thereon serves on the audit committee of any other public companies.

No Director may serve as a member of the Committee if such Director serves on the audit committee of more than two other public companies unless the Board of Directors determines such simultaneous service would not impair the ability of such Director to effectively serve on the Committee and, if required by law, discloses this determination in the Fund’s annual proxy statement. Members shall be appointed by the Board, and shall serve at the pleasure of the Board and for such term or terms as the Board may determine. The Board shall designate one member of the Committee as its Chairperson. In the event of a tie vote on any issue, the Chairperson’s vote shall decide the issue, subject to any requirements for a majority or other vote under applicable law.

II.PURPOSES OF THE AUDIT and valution COMMITTEE

The purposes of the Committee are:

| (a) | to oversee the accounting and financial reporting processes of the Fund and its internal control over financial reporting and, as the Committee deems appropriate, to inquire into the internal control over financial reporting of certain third-party service providers; |

| (b) | to oversee, or, as appropriate, assist Board oversight of the quality and integrity of the Fund’s financial statements and the independent audit thereof; |

| (c) | to oversee, or, as appropriate, assist Board oversight of the Fund’s compliance with legal and regulatory requirements that relate to the Fund’s accounting and financial reporting, internal control over financial reporting and independent audits; |

| (d) | to approve prior to appointment the engagement of the Fund’s independent accountants and, in connection therewith, to review and evaluate their qualifications, independence and performance; |

| (e) | to act as a liaison between the Fund’s independent accountants and the Board; |

| (f) | to prepare a Committee report to be included in proxy statements relating to the election of directors; |

| (g) | to assist Board oversight of the Fund’s compliance function as it relates to financial statements; and |

| (h) | to oversee the activities of the pricing committee of the Fund’s investment adviser (the “Adviser”) and perform the responsibilities that may be assigned to the Committee in the Fund’s valuation policies and procedures. |

III.MEETINGS OF THE COMMITTEE

The Committee shall meet with the Fund’s independent auditors (outside the presence of the Fund’s management) at least twice a year and at such other times as the circumstances dictate (including telephonic meetings). Special meetings may be called by the Chair or a majority of the members of the Committee upon reasonable notice to the other members of the Committee. The Committee shall meet at least once annually with the Administrator and the Chief Compliance Officer of the Fund (“CCO”).

Although the Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Committee to plan or conduct audits nor to determine that the Fund’s financial statements are complete or accurate or have been prepared in accordance with generally accepted accounting principles. That is the responsibility of management and the independent auditors. It is also not the duty of the Committee to assure compliance with laws, regulations or any Code of Ethics approved or adopted by the Board of Directors.

Nothing in this Charter shall be construed to reduce the responsibilities or liabilities of the Fund’s service providers, including the independent auditors.

IV.RESPONSIBILITIES AND DUTIES OF THE COMMITTEE

To fulfill its responsibilities and duties, the Committee shall:

| A. | Charter.Review this Charter annually and recommend any proposed changes to the Board. |

| 1. | Selection and Oversight. Be directly responsible for the appointment, compensation, retention and oversight of the work of the independent auditors (including resolution of any disagreements between management and the independent auditors regarding financial reporting) in relation to the preparation or issuance of an audit report or performing other audit, review or attest services for the Fund. Any such engagement shall be pursuant to a written engagement letter approved by the Committee. Annually evaluate the lead partner of the independent auditor. Discuss process and timing for rotation of lead partner, concurring partner and any other partners assigned. The independent auditors shall report directly to the Committee. |

| 2. | Quality Controls. On an annual basis, obtain and review a report by the independent auditors describing the independent auditors’ internal quality- control procedures and any material issues raised by the independent auditors’ most recent internal quality-control review, peer review, or any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the Firm and the Firm’s response thereto. Obtain and review the most recent written findings of the PCAOB in connection with its inspection of the Fund’s independent auditors and their response thereto. |

| 3. | Pre-approval of audit and non-audit services to the Fund.Pre-approve or adopt appropriate procedures to pre-approve all audit and permissible non- audit services fees to be provided by the independent auditors to the Fund. |

| 4. | Pre-approval of non- audit Services to the Adviser and its Affiliates. Pre- approve or adopt appropriate procedures to pre-approve non-audit services and fees related directly to the operations and financial reporting of the Fund, to be provided by the Fund’s independent auditors to the Adviser and its affiliates. |

| 5. | Auditor Independence. On an annual basis, request, receive in writing and consider specific representations from the Fund’s independent auditors with respect to the independence of such auditors, audit partner rotation, and conflicts of interest described in Section 10A(l) of the 1934 Act, and to consider whether the provision of any non-audit services to the Fund and or its Adviser and its affiliates by the Fund’s independent accountants, which were not pre-approved by the Committee, is compatible with maintaining the independence of those accountants. |

| 6. | Audit Scope.Meet with the independent auditors and management to review the arrangements for and scope of the proposed audit for the current year: |

| · | Discuss with auditors their planned audit procedures in response to their risk assessment and understanding of financial and accounting controls of the Fund. |

| · | Discuss and consider their required communication with audit committees in accordance with professional auditing standards and SEC rules and regulations. |

| · | Approve the auditors’ engagement letter. |

| · | Approve the auditors’ estimated audit and non-audit fees. |

| 7. | Audit Results. At the conclusion of an audit, and before the filing of the annual audited financial statements with the SEC, meet with the independent auditors and management to: |

| · | Discuss and consider written reports from the Fund’s independent auditors regarding (1) all critical accounting policies and practices to be used; (2) all alternative treatments of financial information within generally accepted accounting principles that have been discussed with Fund management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditors; and (3) other material written communications between the independent auditors and Fund management, such as any management letter or schedule of unadjusted differences and all other matters the independent auditors believe are required to be communicated to audit committees under professional auditing standards. |

| · | Discuss and consider any comments or recommendations of the independent auditors or management regarding their assessment of significant risks or exposures and the steps taken by management to minimize such risks to the Fund. |

| · | Discuss and consider any deviations from the proposed scope of the audit previously presented to the Committee. |

| · | Discuss with legal counsel, management and the Fund’s CCO any legal or compliance issues. |

| · | Discuss with management and the independent auditors their respective procedures used to assess the appropriateness of securities prices provided by external pricing services. |

| · | Discuss the form of opinion the independent auditors propose to render to the Board of Directors and shareholders. |

| · | Discuss with management and the independent auditors the Fund’s compliance with Subchapter M of the Internal Revenue Code of 1986, as amended. |

| · | Approve all final audit and non-audit fees to the Fund. |

| · | Review a schedule of any non-audit services and fees to the Adviser and its affiliates which were not pre-approved in accordance with this Charter and consider the impact of any such services and fees on the independence of the auditors. |

| 8. | Management Letter. Review any management letter issued by the independent auditors and management’s response to any such letter. |

| C. | Risk Assessment and Internal Controls |

| 1. | Review annually with management and the independent auditors their separate risk assessments and evaluations of the adequacy and effectiveness of the Fund’s system of internal controls over the processing of financial transactions and the preparation of the financial statements. |

| 2. | Review with management and the independent auditors: |

| a. | any significant audit findings related to the Fund’s systems for accounting, reporting and internal controls; and |

| b. | any recommendations for the improvement of internal control procedures or particular areas where new of more detailed controls or procedures are desirable. |

| 3. | Review with the Fund’s principal executive officer and chief financial officer, in connection with the required certifications on Form N-CSR, any material weaknesses or significant deficiencies in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the Fund’s ability to process, summarize and report financial information and as to the existence of any fraud, whether or not material, that involves management or other employees or service providers who have a significant role in the Fund’s internal control over financial reporting. |

| 1. | Financial Statements. Review with management and the independent auditors the Fund’s audited annual financial statements and semi-annual unaudited financial statements, including any discussion or analysis of the Fund’s financial condition and results of operations and recommend to the Board, if appropriate, that the annual audited financial statements be included in the Fund’s annual report to shareholders required by the Investment Company Act. |

| 2. | Press Releases. Discuss press releases issued by the Fund to the extent they are related to financial information of the Fund. |

| 3. | Committee Report. Prepare a Committee report as required to be included in the annual proxy statement. |

| 1. | Discuss with the Adviser and the Fund’s auditors, as appropriate, the methodologies used to value portfolio holdings and, for fair valued securities, any testing of the reasonableness of the prices obtained. |

| 2. | Consider the appropriateness of the methods used by the Adviser’s pricing committee to value portfolio holdings and the valuations those methodologies produce. |

| 3. | Discuss with the Adviser the role of the Fund’s portfolio manager in the Adviser’s pricing process and any controls in place to prevent inappropriate influence of the manager in setting the prices of Fund holdings. |

| 4. | Approve and review periodically any third party pricing service used to value portfolio holdings. |

| 5. | Review the fair value pricing determinations of the pricing committee of the Fund and ratify or revise such determinations, in accordance with the Fund’s valuation policies and procedures. |

| 6. | Review any changes to fair valuations or changes in pricing methodology in a special meeting, if called to do so by the Adviser’s pricing committee. |

| 1. | Report to the Board. Report regularly its significant activities to the Board and make such recommendations with respect to any matters herein as the Committee may deem necessary or appropriate. |

| 2. | Whistleblower Procedures. Establish procedures for the receipt, retention and treatment of complaints received by the Fund or the Adviser regarding accounting, internal accounting controls or audit matters, and for the confidential, anonymous submission by any employee of the Fund, the Adviser or its affiliates of concerns regarding questionable accounting or auditing matters. |

| 3. | Pre-approval of services and fees of independent auditors. Establish written policy with respect to this matter. Update policy annually. |

| 4. | Hiring Policies. If the Fund proposes to employ any current or former employee of the independent auditors, set clear policies for hiring any such person. |

| 5. | Selection of principal accounting officer and administrative service provider. Provide advice to the Board on selecting the principal accounting officer and administrative service provider. |

| 6. | Performance Evaluation.The Committee shall prepare and review with the Board an annual performance evaluation of the Committee, which evaluation shall compare the performance of the Committee with the requirements of this Charter. The performance evaluation by the Committee shall be conducted in such manner as the Committee deems appropriate. The report to the Board may take the form of an oral report by the Chairperson of the Committee or any other member of the Committee designated by the Committee to make the report. |

V.AUTHORITY

| A. | Information. Have direct access to management and personnel responsible for the Fund’s accounting and financial reporting and for the Fund’s internal controls, as well as to the independent auditors and the Fund’s other service providers. |

| B. | Investigation. Have the authority to investigate any matter brought to its attention within the scope of its duties and, in its discretion, to engage independent legal counsel and other advisers, as it determines necessary to carry out its duties. The Committee may request any officer or employee of the Adviser, the Administrator, the Fund’s independent auditors, or outside counsel to attend any meeting of the Committee or to meet with any member of, or consultants to, the Committee. |

| C. | Funding. Be provided with appropriate funding by the Fund, as determined by the Committee, for the payment of (a) compensation to any independent auditors engaged for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Fund, (b) compensation to any counsel or advisers employed by the Committee, and (c) ordinary administrative expenses of the Committee that are necessary or appropriate in carrying out its duties. |

| D. | Code of Ethics. Have the authority to review any violations under the Fund’s Codes of Ethics brought to its attention by the Chief Legal Counsel, Chief Compliance Officer or Designated Supervisory Person and review any waivers sought by a covered officer under either code. |

| E. | Delegation.The Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the Committee. The Committee may, in its discretion, delegate to one or more of its members the authority to pre-approve any audit or non-audit services to be performed by the independent auditors, provided that any such approvals are presented to the Committee at its next scheduled meeting. |

Adopted: April 24, 2007

Approved: March 4, 2008

Approved: March 3, 2009

Approved: June 8, 2010

Approved: June 7, 2011

Approved and Amended: September 10, 2013

Approved and Amended: February 14, 2014