UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-05984

The New Ireland Fund, Inc.

(Exact name of registrant as specified in charter)

BNY Mellon Investment Servicing (US) Inc.

One Boston Place, 34th Floor

Boston, MA 02108

(Address of principal executive offices) (Zip code)

BNY Mellon Investment Servicing (US) Inc.

One Boston Place, 34th Floor

Boston, MA 02108

(Name and address of agent for service)

Registrant’s telephone number, including area code: 508 871 8500

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

Annual Report

October 31, 2013

Cover Photograph - Ashford Castle, Co. Mayo

Provided Courtesy of Tourism Ireland

Letter to Shareholders

Dear Shareholder,

We are pleased to present this Annual Report covering the activities of The New Ireland Fund, Inc. (the “Fund”) for the fiscal year ended October 31, 2013.

Introduction

While Europe has still not fully recovered from its economic problems, Ireland has made significant progress towards economic recovery. The Irish Government recently exited the support program being provided by the IMF and the European Union. While a stringent budget is being introduced for the coming year, significant advances have been made across the Irish economy from increased employment, a strong growth in exports and improvement in the property and banking sectors.

All of this has significantly improved the level of confidence in Ireland. This has been reflected in the amount of inward investment from many companies, particularly from the U.S., which during the past 12 months have been setting up or expanding their operations in Ireland. This investment in Ireland will continue to help the Irish employment figures, particularly in the services sector, and it should also further benefit exports.

As shown below, the performance of the Fund, for the fiscal year ended October 31, 2013, has been excellent with the Fund’s Net Asset Value (“NAV”) increasing by 48.49%, in U.S. Dollar terms*, as compared to the increase of 46.06% of the Irish Stock Market Index (“ISEQ”). Over the most recent fiscal quarter, the increase in NAV was 9.29% as compared to an increase of 10.43% of the ISEQ.

In December, the Fund’s Board of Directors declared an annual distribution of $0.07 per share, which is wholly attributable to income. The distribution will be paid by way of a cash dividend under date of December 30, 2013 to all shareholders of record on December 20, 2013.

The Board reviews its Discount Management Program on a regular basis and, as discussed below, the Fund continued to implement its Share Repurchase Program during the fiscal year.

Performance

For the fiscal year just ended, the Fund’s net asset value (“NAV”) rose 48.49% to $14.24, compared to the 46.06% return of the Irish Stock Market Index (“ISEQ”). The Fund’s performance was driven by its exposure to quality Irish companies, which are benefiting from the improving economic environment in Ireland, while at the same time, exploiting growth opportunities in its primary export markets.

When compared to the broad Euro Stoxx 50 index, the ISEQ index underperformed by close to 3% for the past quarter, but outperformed by almost 12% over the 12 months ended October 31, 2013. When compared to

| * | All returns are quoted in U.S. Dollars unless otherwise stated |

1

the S&P 500 index, the ISEQ outperformed by almost 6% over the past quarter and outperformed by 18.9% over the 12 months ended October 31, 2013. The US dollar strengthened by just 0.7% versus the Euro over the last three months, but weakened by almost 7% versus the Euro over the 12 months of the Funds fiscal year, which also helped the performance of the Fund.

In the third quarter of the year, the world equity markets rose 6.4% in local currency terms, as defined by the MSCI World Index, resulting in the Fund’s assets growing strongly after a pause in the second quarter. These gains were achieved, as increasingly the global economy seemed to be making progress towards a more normal pace of growth. Economic data released in the U.S. showed reasonably strong growth while a widely feared ‘hard landing’ in China failed to materialize and the eurozone economy officially emerged from recession. The decision in September by the Federal Reserve to continue without any change to its liquidity creation policies (i.e. the decision not to “taper” its pace of quantitative easing) was welcomed by the markets and emphasised how strongly policymakers around the world continue to pursue “pro-growth” policies. Ireland, as a relatively small and open economy, is a major beneficiary of any such improvement in sentiment and in the activity of her main export-markets. The Irish stock market continued to perform strongly, driven by positive macro developments as well as continued earnings growth and positive corporate developments by Irish company management teams.

The more positive market was reflected in some very strong stock movements over the last fiscal quarter for a number of the Fund’s portfolios holdings. Names such as Bank of Ireland, TVC Holdings, Origin Enterprises and Aryzta AG were very strong performers. By contrast, stocks such as Kenmare Resources, Aer Lingus, Ryanair and Paddy Power were poorer performers over the quarter.

During fiscal 2013, we continued to implement the Share Repurchase Program and, over the 12 months, the Fund repurchased and retired 122,026 shares at a cost of $1.15 million. These repurchases represented a reduction of 2.37% of the shares outstanding at October 31, 2012 and they positively impacted the Fund’s NAV by 3 Cents per share.

Irish Economic Review

Economic growth statistics released during the period (Q2 2013) were once again mixed - with GDP rising by 0.4% and GNP falling by the same amount. The main difference between the two measures is that GNP excludes the impact of profit repatriation from multi-national corporations operating in Ireland. Further complications arise when analyzing the components of growth, with large aircraft purchases specifically distorting total imports and investment - these aircraft are thought to be purchased by the large European airline headquartered in Ireland (Ryanair) but in truth have little to do with the Irish economy and indeed may never physically be in the country. The true picture of activity in the economy is thus difficult to discern in a statistical sense, but the economy is likely growing, but at a slow pace. It was notable that consumer spending rose by 0.7%.

2

For 2013 as a whole, the Central Bank of Ireland is forecasting stronger GDP growth of 0.7%, while the private sector consensus is for a lower rate of 0.1%. For 2014, the Central Bank is forecasting 2.1% while the private sector consensus forecast is for 1.6%. KBI, the Fund’s investment Adviser is optimistic and expects at least 2.0% GDP growth in 2014. For 2013, capital investment is forecast to be strong, while consumer spending is forecast to remain weak and exports quite sluggish, due to the recession in the eurozone economy. However, for next year, in contrast, exports are expected to grow strongly, and the consumer sector is expected to return to growth for the first time since 2010.

Retail sales were weak for the last several years, but in more recent months, early and tentative signs of a recovery are beginning to emerge. The year-on-year change has remained positive for the latest three months for which data is available.

Consumer confidence remains volatile, and indeed it is usually difficult to see much correlation between reported consumer confidence and changes in retail sales. However, a fairly strong upward trend can be seen over the last few months, which is presumably a result of progress in reducing the country’s debt burden through extensions in the maturity of ECB and IMF loans, as well as a less-tougher than expected Budget.

Business confidence, as measured by the Purchasing Manager Index (“PMI”) for the manufacturing sector, dipped below the “neutral” level of 50 from March to May - possibly as a result of the recession in the eurozone economy - but then recovered very well, and has been well above the “breakeven”, or neutral level, ever since.

There continues to be a steady, but mild, trend downwards in unemployment, as measured by the “live register”. The number of unemployed on this measure has fallen from a peak of 449,000 in August of 2011 to 410,000 in October of this year. The unemployment rate has also declined and still stands at a high level of 12.5%, down from a peak of 14.9%. Separate employment statistics show increases in the last four quarters for which statistics are available.

The headline rate of inflation has been very low in recent months. A year ago the rate stood at 1.2%, but in October 2013 (the last available data point) the rate had fallen to just 0.1%. The Harmonized inflation rate (the common measure of inflation used by all EU countries, which among other things excludes the impact of mortgage interest rates) was even lower at -0.1%. The Central Bank of Ireland is forecasting 0.7% for headline inflation for calendar year 2013, while the private sector consensus is slightly higher, at 0.8%. The domestic economy is generating no upwards price pressure, with inflation generally arising only from imported goods and services.

Demand for credit from businesses and households continue to remain depressed. The annual rate of change in loans to households was -4.2% in September. Lending for house purchases was 2.4% lower on an annual basis in June, whereas lending to the non-financial corporate sector declined by 4.5% over the same period. These numbers generally represent a very modest

3

improvement in the sense that the rate of declines has moderated - very slightly - in recent months.

The government deficit was just under €15billion or 11.1% of GDP in 2012, while the “General Government Balance”, a standardized EU measure of the deficit, was 7.6% of GDP, well ahead of the 8.6% target agreed with the EU/IMF/ECB (“Troika”) lenders, and down significantly from the 9.3% outturn for 2011. The 7.5% target for 2013 should be achieved without a great deal of difficulty. The debt/GDP ratio is expected to peak this year, at about 124%, before falling back during 2014 to about 121%.

The 2014 Budget was announced earlier than usual, in October, and contained austerity measures amounting to about €2.5billion, lower than the €3billion plus target previously agreed with the Troika. This was on the basis that the agreement on the promissory note restructuring earlier this year created substantial savings. The Budget itself contained relatively less controversial measures than in previous years, which has been helpful to consumer and business confidence.

Equity Market Review

World stock markets posted a mixed performance during the quarter:

| | | | | | | | | | | | | | | | | | | | |

Market | | Quarter Ended

October 31, 2013 | | Year Ended

October 31, 2013 |

| | Local | | USD$ | | Local | | USD$ |

Irish Equities (ISEQ) | | | | 7.9% | | | | | 10.4% | | | | | 39.2% | | | | | 46.1% | |

| | | | |

US Equities (S&P 500) | | | | 4.8% | | | | | 4.8% | | | | | 27.2% | | | | | 27.2% | |

US Equities (NASDAQ) | | | | 8.4% | | | | | 8.4% | | | | | 33.5% | | | | | 33.5% | |

UK Equities (FTSE 100) | | | | 2.7% | | | | | 8.8% | | | | | 20.7% | | | | | 20.4% | |

Japanese Equities (Topix) | | | | 6.3% | | | | | 6.5% | | | | | 64.0% | | | | | 33.6% | |

| | | | |

Dow Jones Eurostoxx 50 | | | | 11.2% | | | | | 13.8% | | | | | 27.3% | | | | | 33.6% | |

German Equities (DAX) | | | | 9.2% | | | | | 11.8% | | | | | 24.4% | | | | | 30.5% | |

| | | | |

French Equities (CAC 40) | | | | 7.9% | | | | | 10.4% | | | | | 29.7% | | | | | 36.1% | |

Dutch Equities (AEX) | | | | 6.5% | | | | | 9.0% | | | | | 22.1% | | | | | 28.1% | |

Note-Indices are total gross return

Some notable highlights relating to the Fund’s top performers for the year are detailed below:

Bank of Ireland has been a star performer in the portfolio with its stock price rising by over 200% during the financial year. The stock price continues to recover in line with the broad based “rehabilitation” of the bank from the depths of the financial crisis. The bank has heavily restructured and re-capitalized its balance sheet. It has attracted a new base of equity shareholders who are buying the stock as a company highly operationally leveraged to a recovery in many aspects of the domestic Irish economy. The management team

4

delivered credible and tangible evidence of its turnaround plans during 2013 which has maintained the stock price appreciation.

Smurfit Kappa Group PLC, as a leading producer of paper-based packaging in the world, is both cyclically and financially geared into the upturn in the global economy. This was reflected in very strong financial results delivered by the company during the year. They also announced a series of price increases, which were very well received by the market. In addition, the management team successfully restructured the maturity and cost of the debt on their balance sheet during the year, which was also a strong positive.

Grafton Group PLC, a builder’s merchanting and DIY group, is a well-run company, strongly positioned to benefit from a pickup from both the Irish and UK economies. The company implemented aggressive cost cutting during the downturn which, when combined with an upturn in volumes, has led it to deliver strong operating earnings recovery during 2013. A new very credible management team with a focus on increasing revenue growth, margin growth and increasing capital return has also helped the stock price performance.

CPL Resources PLC, as a recruitment agency, is well positioned to benefit from a recovery in the Irish employment market. The company has strong management and is also financially strong. In its FY 2013 results, the company delivered strong operating growth and its outlook statement also led to investors’ confidence for continued recovery in earnings potential for the company.

Total Produce PLC is the only non-cyclical stock in the top 5 performers of the year. The company’s management continued to deliver steady earnings and dividend growth during the year. In addition, they continue to utilize the balance sheet for bolt-on acquisitions. The stock was also cheaply valued and therefore benefitted from a re-rating of its valuation throughout 2013.

In relation to the Fund’s investment policy, under normal circumstances, the Fund invests at least 80% of its total assets in Irish securities, with at least 65% invested in equity securities of Irish companies. The Fund defines Irish companies as issuers organized under the laws of Ireland. Accordingly, the Fund’s assets invested in equity securities of Irish companies may include investments in companies that are organized in Ireland, but have limited business activities in Ireland. The Board of Directors recently approved an amendment to the Fund’s investment policies to permit the remaining 20% of the Fund’s assets to be invested in other types of securities, including equity and debt securities of issuers from throughout the world regardless of whether such issuers are or may be affected by developments in the Irish economy or Ireland’s international economic relations.

To the extent the Fund invests in companies that are organized in Ireland, but have limited business activities in Ireland, or in non-Irish companies that have no economic ties to Ireland, its performance may diverge, perhaps materially, from the performance of the Irish economy and securities markets, and the Fund may be exposed to the risks of countries in which these companies are located or have their principal business activities.

5

Market Outlook

The Irish economic rebound remains on track albeit in a slow fashion from quarter to quarter. Nonetheless, it is a sustained economic recovery with positive annual GDP growth achieved since 2009. The drivers of growth continue to see a rebalancing from being mainly made up of exports towards including an element of domestic demand growth. Other indicators also continue to improve with a gradual increase in employment, a strong house price recovery, in Dublin in particular, and improved consumer sentiment. With the prospect of a continued recovery in the global economy and the expectation that European economies will soon emerge from recession, Ireland, as a small open economy, is well placed to continue to benefit from this.

While Ireland has made significant progress since the depths of the 2008 crisis, as a result of the gradual acceleration of global economic growth, its recovery can best be described as sub-trend. However, its continued optimism is centred on an expectation that the country will see a further strengthening over the next 12 months. Global profit growth is also expected to continue to improve from the levels achieved in 2013. As the baton passes from central banks to company profit growth, it is expected that equity returns will increasingly be more in line with expected profit growth. The outlook for Ireland remains strongly linked to these global expectations.

In light of the progress that Ireland has made and the continued expectation of further global growth, the Irish market continues to be attractive for the active stock picker. The Fund remains invested in names with strong franchises, management teams and balance sheets.

Sincerely

| | |

| |

|

Peter J. Hooper | | Sean Hawkshaw |

Chairman | | President |

December 20, 2013 | | December 20, 2013 |

6

Investment Summary (unaudited)

Total Return (%)

| | | | | | | | | | | | | | | | | | | | |

| | | Market Value (a) | | Net Asset Value (a) |

| | | Cumulative | | Average

Annual | | Cumulative | | Average

Annual |

One Year | | | | 40.27 | | | | | 40.27 | | | | | 48.49 | | | | | 48.49 | |

Three Year | | | | 92.68 | | | | | 24.44 | | | | | 87.07 | | | | | 23.22 | |

Five Year | | | | 121.24 | | | | | 17.21 | | | | | 122.94 | | | | | 17.39 | |

Ten Year | | | | 114.29 | | | | | 7.92 | | | | | 108.62 | | | | | 7.63 | |

Per Share Information and Returns

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2004 | | 2005 | | 2006 | | 2007 | | 2008 | | 2009 | | 2010 | | 2011 | | 2012 | | 2013 |

Net Asset

Value ($) | | | | 20.74 | | | | | 24.36 | | | | | 32.55 | | | | | 30.95 | | | | | 10.18 | | | | | 8.20 | | | | | 7.70 | | | | | 8.45 | | | | | 9.59 | | | | | 14.24 | |

Income

Dividends ($) | | | | (0.09 | ) | | | | (0.03 | ) | | | | (0.16 | ) | | | | (0.24 | ) | | | | (0.36 | ) | | | | (0.33 | ) | | | | — | | | | | (0.06 | ) | | | | (0.02 | ) | | | | — | |

Capital Gains | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other

Distributions ($) | | | | — | | | | | — | | | | | (1.77 | ) | | | | (2.40 | ) | | | | (4.86 | ) | | | | (2.76 | ) | | | | — | | | | | — | | | | | — | | | | | — | |

Total Net

Asset Value

Return (%) (a) | | | | 28.14 | | | | | 17.51 | | | | | 45.97 | | | | | 2.88 | | | | | -58.62 | | | | | 26.91 | | | | | -6.10 | | | | | 10.69 | | | | | 13.82 | | | | | 48.49 | |

Notes

| (a) | Total Market Value returns reflect changes in share market prices and assume reinvestment of dividends and capital gain distributions, if any, at the price obtained under the Dividend Reinvestment and Cash Purchase Plan (the “Plan”). Total Net Asset Value returns reflect changes in share net asset value and assume reinvestment of dividends and capital gain distributions, if any, at the price obtained under the Plan. For more information with regard to the Plan, see page 22. |

Past results are not necessarily indicative of future performance of the Fund.

7

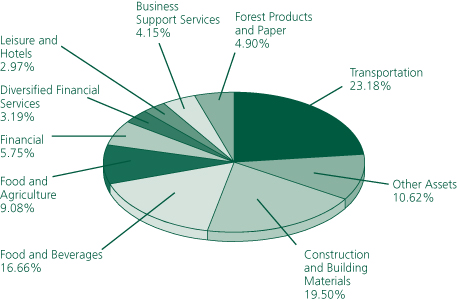

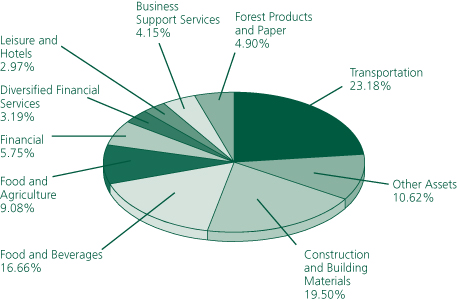

Portfolio by Market Sector as of October 31, 2013

(Percentage of Net Assets)

Top 10 Holdings by Issuer as of October 31, 2013

| | | | | | |

Holding | | Sector | | % of Net Assets | |

Ryanair Holdings PLC | | Transportation | | | 17.23% | |

Kerry Group PLC, Series A | | Food and Beverages | | | 10.50% | |

CRH PLC | | Construction and Building Materials | | | 10.49% | |

Aryzta AG | | Food and Agriculture | | | 9.08% | |

Bank of Ireland (The) | | Financial | | | 5.75% | |

Smurfit Kappa Group PLC | | Forest Products and Paper | | | 4.90% | |

Kingspan Group PLC | | Construction and Building Materials | | | 4.53% | |

Grafton Group PLC-UTS | | Construction and Building Materials | | | 4.48% | |

CPL Resources PLC | | Business Support Services | | | 4.15% | |

Irish Continental Group PLC | | Transportation | | | 4.12% | |

8

The New Ireland Fund, Inc.

Portfolio Holdings

| | | | | | | | |

| | |

| October 31, 2013 | | Shares | | | Value (U.S.)

(Note A) | |

COMMON STOCKS (99.04%) | | | | | | | | |

COMMON STOCKS OF IRISH COMPANIES (98.04%) | | | | | | | | |

| | |

Agricultural Operations (1.69%) | | | | | | | | |

Origin Enterprises PLC* | | | 124,171 | | | $ | 1,208,690 | |

| | | | | | | | |

| | |

Business Services (1.00%) | | | | | | | | |

DCC PLC | | | 15,931 | | | | 716,400 | |

| | | | | | | | |

| | |

Business Support Services (4.15%) | | | | | | | | |

CPL Resources PLC | | | 362,057 | | | | 2,977,927 | |

| | | | | | | | |

| | |

Construction and Building Materials (19.50%) | | | | | | | | |

CRH PLC | | | 308,948 | | | | 7,518,309 | |

Grafton Group PLC-UTS | | | 336,202 | | | | 3,213,858 | |

Kingspan Group PLC | | | 193,702 | | | | 3,244,342 | |

| | | | | | | | |

| | | | | | | 13,976,509 | |

| | | | | | | | |

| | |

Diversified Financial Services (3.19%) | | | | | | | | |

FBD Holdings PLC | | | 94,778 | | | | 2,048,738 | |

TVC Holdings PLC | | | 285,973 | | | | 236,769 | |

| | | | | | | | |

| | | | | | | 2,285,507 | |

| | | | | | | | |

| | |

Energy (2.85%) | | | | | | | | |

Dragon Oil PLC | | | 219,805 | | | | 2,043,974 | |

| | | | | | | | |

| | |

Financial (5.75%) | | | | | | | | |

Bank of Ireland (The)* | | | 11,229,060 | | | | 4,121,819 | |

| | | | | | | | |

| | |

Food and Agriculture (9.08%) | | | | | | | | |

Aryzta AG | | | 87,110 | | | | 6,509,811 | |

| | | | | | | | |

| | |

Food and Beverages (16.66%) | | | | | | | | |

C&C Group PLC | | | 156,993 | | | | 921,391 | |

Glanbia PLC | | | 162,282 | | | | 2,276,836 | |

Kerry Group PLC, Series A | | | 117,406 | | | | 7,528,213 | |

Total Produce PLC | | | 1,091,757 | | | | 1,217,087 | |

| | | | | | | | |

| | | | | | | 11,943,527 | |

| | | | | | | | |

| | |

Forest Products and Paper (4.90%) | | | | | | | | |

Smurfit Kappa Group PLC | | | 144,285 | | | | 3,511,203 | |

| | | | | | | | |

See Notes to Financial Statements.

9

The New Ireland Fund, Inc.

Portfolio Holdings (continued)

| | | | | | | | |

| | |

| October 31, 2013 | | Shares | | | Value (U.S.)

(Note A) | |

COMMON STOCKS (continued) | | | | | | | | |

| | |

Health Care Services (2.58%) | | | | | | | | |

Elan Corp. PLC-Sponsored ADR* | | | 110,956 | | | $ | 1,848,527 | |

| | | | | | | | |

| | |

Leisure and Hotels (2.97%) | | | | | | | | |

Paddy Power PLC | | | 26,058 | | | | 2,125,564 | |

| | | | | | | | |

| | |

Mining (0.54%) | | | | | | | | |

Kenmare Resources PLC* | | | 1,212,752 | | | | 390,753 | |

| | | | | | | | |

| | |

Transportation (23.18%) | | | | | | | | |

Aer Lingus Group PLC | | | 686,793 | | | | 1,307,181 | |

Irish Continental Group PLC | | | 84,247 | | | | 2,956,707 | |

Ryanair Holdings PLC | | | 911,868 | | | | 7,562,120 | |

Ryanair Holdings PLC-Sponsored ADR | | | 95,422 | | | | 4,791,139 | |

| | | | | | | | |

| | | | | | | 16,617,147 | |

| | | | | | | | |

TOTAL COMMON STOCKS OF IRISH COMPANIES

(Cost $44,622,186) | | | | | | | 70,277,358 | |

| | | | | | | | |

COMMON STOCKS OF UNITED KINGDOM COMPANIES (1.00%) | | | | | |

| | |

Utility Company (1.00%) | | | | | | | | |

Severn Trent PLC | | | 23,966 | | | | 715,018 | |

| | | | | | | | |

TOTAL COMMON STOCKS OF UNITED KINGDOM COMPANIES

(Cost $593,937) | | | | | | | 715,018 | |

| | | | | | | | |

| | | | | | | | |

TOTAL COMMON STOCKS BEFORE FOREIGN CURRENCY ON DEPOSIT

(Cost $45,216,123) | | | | | | $ | 70,992,376 | |

| | | | | | | | |

| | |

| | | Face

Value | | | | |

FOREIGN CURRENCY ON DEPOSIT (0.96%) | | | | | | | | |

Euro | | € | 506,070 | | | | 688,006 | |

| | | | | | | | |

TOTAL FOREIGN CURRENCY ON DEPOSIT

(Cost $690,298)** | | | | | | | 688,006 | |

| | | | | | | | |

TOTAL INVESTMENTS (100.00%)

(Cost $45,906,421) | | | | | | | 71,680,382 | |

OTHER ASSETS AND LIABILITIES (0.00%) | | | | | | | 3,239 | |

| | | | | | | | |

NET ASSETS (100.00%) | | | | | | $ | 71,683,621 | |

| | | | | | | | |

See Notes to Financial Statements.

10

The New Ireland Fund, Inc.

Portfolio Holdings (continued)

| | | | |

| * | | | | Non-income producing security. |

| ** | | | | Foreign currency held on deposit at JPMorgan Chase & Co. |

| ADR | | – | | American Depositary Receipt traded in U.S. dollars. |

| UTS | | – | | Units. |

The Inputs of methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. Transfers in and out of levels are recognized at market value at the end of the period. The summary of inputs used to value the Fund’s net assets as of October 31, 2013 is as follows (See Note A – Security Valuation and Fair Value measurements in the Notes to Financial Statements):

| | | | | | | | | | | | | | | | |

| | | Total

Value at

10/31/13 | | | Level 1

Quoted

Price | | | Level 2

Significant

Observable

Input | | | Level 3

Significant

Unobservable

Input | |

| | | | | | | | | | | | | | | | |

Investments in Securities*† | | $ | 70,992,376 | | | $ | 70,992,376 | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | |

| * | See Portfolio Holdings detail for country breakout. |

| † | Total Investments exclude Foreign Currency on Deposit and Other Assets. |

At the end of the period ended October 31, 2013, an investment with a total aggregate value of $236,769 was transferred from Level 2 to Level 1 because the security traded on the last day of the quarter.

See Notes to Financial Statements.

11

The New Ireland Fund, Inc.

Statement of Assets and Liabilities

October 31, 2013

| | | | | | | | |

ASSETS: | | | | | | | | |

Investments at value (Cost $45,216,123)

See accompanying schedule | | | U.S. | | | $ | 70,992,376 | |

Cash | | | | | | | 105,791 | |

Foreign currency (Cost $690,298) | | | | | | | 688,006 | |

Dividends receivable | | | | | | | 45,922 | |

Prepaid expenses | | | | | | | 30,080 | |

| | | | | | | | |

Total Assets | | | | | | | 71,862,175 | |

| | | | | | | | |

| | |

LIABILITIES: | | | | | | | | |

Printing fees payable | | | | | | | 14,203 | |

Accrued legal fees payable | | | | | | | 44,195 | |

Investment advisory fee payable (Note B) | | | | | | | 38,043 | |

Accrued audit fees payable | | | | | | | 42,000 | |

Custodian fees payable (Note B) | | | | | | | 13,605 | |

Administration fee payable (Note B) | | | | | | | 10,667 | |

Directors’ fees and expenses | | | | | | | 13,612 | |

Accrued expenses and other payables | | | | | | | 2,229 | |

| | | | | | | | |

Total Liabilities | | | | | | | 178,554 | |

| | | | | | | | |

NET ASSETS | | | U.S. | | | $ | 71,683,621 | |

| | | | | | | | |

| | |

AT OCTOBER 31, 2013 NET ASSETS CONSISTED OF: | | | | | | | | |

Common Stock, U.S. $.01 Par Value -

Authorized 20,000,000 Shares

Issued and Outstanding 5,034,322 Shares | | | U.S. | | | $ | 50,343 | |

Additional Paid-in Capital | | | | | | | 51,902,803 | |

Undistributed Net Investment Income | | | | | | | 350,215 | |

Accumulated Net Realized Loss | | | | | | | (6,394,319 | ) |

Net Unrealized Appreciation of Securities,

Foreign Currency and Net Other Assets | | | | | | | 25,774,579 | |

| | | | | | | | |

TOTAL NET ASSETS | | | U.S. | | | $ | 71,683,621 | |

| | | | | | | | |

| | |

NET ASSET VALUE PER SHARE

(Applicable to 5,034,322 outstanding shares)

(authorized 20,000,000 shares) | | | | | | | | |

(U.S. $71,683,621 ÷ 5,034,322) | | | U.S. | | | $ | 14.24 | |

| | | | | | | | |

See Notes to Financial Statements.

12

The New Ireland Fund, Inc.

Statement of Operations

| | | | | | | | | | | | |

| | | | | | | | | For the Year Ended

October 31, 2013 | |

| | | |

INVESTMENT INCOME | | | | | | | | | | | | |

Dividends | | | | | | | U.S. | | | $ | 1,807,195 | |

| | | | | | | | | | | | |

| | | |

TOTAL INVESTMENT INCOME | | | | | | | | | | | 1,807,195 | |

| | | | | | | | | | | | |

| | | |

EXPENSES | | | | | | | | | | | | |

Investment advisory fee (Note B) | | $ | 386,681 | | | | | | | | | |

Directors’ fees | | | 192,753 | | | | | | | | | |

Legal fees | | | 183,122 | | | | | | | | | |

Administration fee (Note B) | | | 128,077 | | | | | | | | | |

Printing fees | | | 34,303 | | | | | | | | | |

Compliance fees | | | 67,641 | | | | | | | | | |

Insurance premiums | | | 51,298 | | | | | | | | | |

Audit fees | | | 42,700 | | | | | | | | | |

Custodian fees (Note B) | | | 24,646 | | | | | | | | | |

Other | | | 122,651 | | | | | | | | | |

| | | | | | | | | | | | |

| | | |

TOTAL EXPENSES | | | | | | | | | | | 1,233,872 | |

| | | | | | | | | | | | |

| | | |

NET INVESTMENT INCOME | | | | | | | U.S. | | | $ | 573,323 | |

| | | | | | | | | | | | |

| | |

REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY | | | | | | | | | |

Realized gain on: | | | | | | | | | | | | |

Securities transactions | | | 6,698,925 | | | | | | | | | |

Foreign currency transactions | | | 104,710 | | | | | | | | | |

| | | | | | | | | | | | |

Net realized gain on investments and foreign currency during the year | | | | | | | | | | | 6,803,635 | |

| | | | | | | | | | | | |

Net change in unrealized appreciation/(depreciation) of: | | | | | | | | | | | | |

Securities | | | 15,992,686 | | | | | | | | | |

Foreign currency and net other assets | | | (2,233 | ) | | | | | | | | |

| | | | | | | | | | | | |

Net unrealized appreciation of investments and foreign currency during the year | | | | | | | | | | | 15,990,453 | |

| | | | | | | | | | | | |

| | |

NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY | | | | | | | | 22,794,088 | |

| | | | | | | | | | | | |

| | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | | U.S. | | | $ | 23,367,411 | |

| | | | | | | | | | | | |

See Notes to Financial Statements.

13

The New Ireland Fund, Inc.

Statement of Changes in Net Assets

| | | | | | | | | | | | | | | | |

| | | Year Ended

October 31, 2013 | | | Year Ended

October 31, 2012 | |

| | | | |

Net investment income/(loss) | | | U.S. | | | $ | 573,323 | | | | U.S. | | | $ | (198,048 | ) |

Net realized gain on investments and foreign currency transactions | | | | | | | 6,803,635 | | | | | | | | 2,827,384 | |

Net unrealized appreciation of investments, foreign currency holdings and net other assets | | | | | | | 15,990,453 | | | | | | | | 2,816,333 | |

| | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | | | | | 23,367,411 | | | | | | | | 5,445,669 | |

| | | | | | | | | | | | | | | | |

| | | |

DISTRIBUTIONS TO SHAREHOLDERS FROM: | | | | | | | | | | | | | |

Net investment income | | | | | | | — | | | | | | | | (127,802 | ) |

| | | | | | | | | | | | | | | | |

Total distributions | | | | | | | — | | | | | | | | (127,802 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

Value of 122,026 and 316,714 shares repurchased, respectively (Note F) | | | | | | | (1,151,983 | ) | | | | | | | (2,444,590 | ) |

Value of 0 and 924,000 shares, respectively, in connection with a Tender Offer (Note F) | | | | | | | — | | | | | | | | (7,475,160 | ) |

Value of 0 and 631 shares issued, respectively, to shareholders in connection with a stock distribution (Note E) | | | | | | | — | | | | | | | | 4,379 | |

| | | | | | | | | | | | | | | | |

| | | | |

NET DECREASE IN NET ASSETS RESULTING FROM CAPITAL SHARE TRANSACTIONS | | | | | | | (1,151,983 | ) | | | | | | | (9,915,371 | ) |

| | | | | | | | | | | | | | | | |

Total Increase/(decrease) in net assets | | | | | | | 22,215,428 | | | | | | | | (4,597,504 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

NET ASSETS | | | | | | | | | | | | | | | | |

Beginning of year | | | | | | | 49,468,193 | | | | | | | | 54,065,697 | |

| | | | | | | | | | | | | | | | |

End of year (Including accumulated/undistributed net investment income/(loss) of $350,215 and $(327,818), respectively) | | | U.S. | | | $ | 71,683,621 | | | | U.S. | | | $ | 49,468,193 | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

14

The New Ireland Fund, Inc.

Financial Highlights (For a Fund share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended October 31, | |

| | | 2013 | | | 2012 | | | 2011 | | | 2010 | | | 2009 | |

| | | | | | |

Operating Performance: | | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value, Beginning of Year | | | U.S. | | | | $9.59 | | | | $8.45 | | | | $7.70 | | | | $8.20 | | | | $10.18 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income/(Loss) | | | | | | | 0.11 | | | | (0.04 | ) | | | 0.01 | | | | 0.05 | | | | (0.06 | ) |

Net Realized and Unrealized Gain/(Loss) on Investments | | | | | | | 4.51 | | | | 1.11 | | | | 0.76 | | | | (0.61 | ) | | | 1.23 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Investment Operations | | | | | | | 4.62 | | | | 1.07 | | | | 0.77 | | | | (0.56 | ) | | | 1.17 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Distributions to Shareholders from: | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | | | | | — | | | | (0.02 | ) | | | (0.06 | ) | | | — | | | | (0.33 | ) |

Net Realized Gains | | | | | | | — | | | | — | | | | — | | | | — | | | | (2.76 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from Distributions | | | | | | | — | | | | (0.02 | ) | | | (0.06 | ) | | | — | | | | (3.09 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Anti-Dilutive/(Dilutive) Impact of Capital Share Transactions | | | | | | | 0.03 | (a) | | | 0.09 | (b) | | | 0.04 | (c) | | | 0.06 | (d) | | | (0.06 | ) (e) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Net Asset Value,

End of Year | | | U.S. | | | | $14.24 | | | | $9.59 | | | | $8.45 | | | | $7.70 | | | | $8.20 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Share Price, End of Year | | | U.S. | | | | $12.40 | | | | $8.84 | | | | $7.61 | | | | $6.51 | | | | $7.09 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total NAV Investment Return (f) | | | | | | | 48.49% | | | | 13.82% | | | | 10.69% | | | | (6.10)% | | | | 26.91% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Market Investment Return (g) | | | | | | | 40.27% | | | | 16.50% | | | | 17.91% | | | | (8.18)% | | | | 25.06% | |

| | | | | | | | | | | | | | | | | | | | | | | | |

|

RATIOS TO AVERAGE NET ASSETS/SUPPLEMENTAL DATA: | |

Net Assets,

End of Period (000’s) | | | U.S. | | | | $71,684 | | | | $49,468 | | | | $54,066 | | | | $51,428 | | | | $57,786 | |

Ratio of Net Investment Income/(Loss) to Average Net Assets | | | | | | | 0.95% | | | | (0.39 | )% | | | 0.15% | | | | 0.69% | | | | (0.87 | )% |

Ratio of Operating Expenses to Average Net Assets | | | | | | | 2.05% | | | | 2.66% | | | | 2.22% | | | | 2.02% | | | | 2.65% | |

Portfolio Turnover Rate | | | | | | | 35% | | | | 21% | | | | 23% | | | | 11% | | | | 16% | |

| (a) | | Amount represents $0.03 per share impact for shares repurchased by the Fund under the Share Repurchase Program. |

| (b) | | Amount represents $0.09 per share repurchased by the Fund. $0.09 per share impact represents $0.06 for shares repurchased under the Share Repurchase Program and $0.03 per share impact related to the Tender Offer, which was completed in June, 2012. |

| (c) | | Amount represents $0.04 per share impact for shares repurchased by the Fund under the Share Repurchase Program. |

| (d) | | Amount represents $0.06 per share impact for shares repurchased by the Fund under the Share Repurchase Program. |

| (e) | | Amount represents $0.08 per share impact for shares repurchased by the Fund under the Share Repurchase Program and $0.14 per share impact for the new shares issued as Capital Gain Stock Distribution. |

| (f) | | Based on share net asset value and reinvestment of distribution at the price obtained under the Dividend Reinvestment and Cash Purchase Plan. |

| (g) | | Based on share market price and reinvestment of distributions at the price obtained under the Dividend Reinvestment and Cash Purchase Plan. |

See Notes to Financial Statements.

15

The New Ireland Fund, Inc.

Notes to Financial Statements

The New Ireland Fund, Inc. (the “Fund”) was incorporated under the laws of the State of Maryland on December 14, 1989 and is registered as a non-diversified, closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is long-term capital appreciation through investment primarily in equity securities of Irish Companies. The Fund is designed for U.S. and other investors who wish to participate in the Irish securities markets. In order to take advantage of significant changes that have occurred in the Irish economy and to advance the Fund’s investment objective, the investment strategy now has a bias towards Ireland’s growth companies.

Under normal circumstances, the Fund invests at least 80% of its total assets in Irish equity and fixed income securities. At least 65% of the Fund’s total assets will be invested in equity securities of Irish companies. Irish companies are defined as issuers organized under the laws of Ireland. Accordingly, the Fund’s assets invested in equity securities of Irish Companies may include investments in Companies that are organized in Ireland, but have limited business activities in Ireland. The Board of Directors recently approved an amendment to the Fund’s investment policies to permit the remaining 20% of the Fund’s assets to be invested in other types of securities, including equity and debt securities of issuers from throughout the world regardless of whether such issuers are or may be affected by developments in the Irish economy or Ireland’s international economic relations. The Fund may invest up to 25% of its assets in equity securities that are not listed on any securities exchange.

To the extent the Fund invests in companies that are organized in Ireland, but have limited business activities in Ireland, or in non-Irish companies that have no economic ties to Ireland, its performance may diverge, perhaps materially, from the performance of the Irish economy and securities markets, and the Fund may be exposed to the risks of countries in which these companies are located or have their principal business activities.

A. Significant Accounting Policies:

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Security Valuation: Securities listed on a stock exchange for which market quotations are readily available are valued at the closing prices on the date of valuation, or if no such closing prices are available, at the last bid price quoted on such day. If there are no such quotations available for the date of valuation, the last available closing price will be used. The value of securities and other assets for which no market quotations are readily available, or whose values have been materially affected by events occurring before the Funds’ pricing time but after the close of the securities’ primary markets, are valued by methods deemed by the Board of Directors to represent fair value. Short-term securities that mature in 60 days or less are valued at amortized cost.

Fair Value Measurements: As described above, the Fund utilizes various methods to measure the fair value of most of its investments on a recurring basis. U.S. Generally Accepted Accounting Principles (“GAAP”) establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 – unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 – observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs

16

The New Ireland Fund, Inc.

Notes to Financial Statements (continued)

may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level 3 – unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety. A summary of the levels of the Fund’s investments as of October 31, 2013 is included with the Fund’s Portfolio of Holdings.

At the end of each calendar quarter, management evaluates the Level 2 and Level 3 assets and liabilities, if any, for changes in liquidity, including but not limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from third party services, and the existence of contemporaneous, observable trades in the market. Additionally, management evaluates the Level 1 and Level 2 assets and liabilities on a quarterly basis for changes in listings or delistings on national exchanges.

Dividends and Distributions to Stockholders: Distributions are determined on a tax basis and may differ from net investment income and realized capital gains for financial reporting purposes. Differences may be permanent or temporary. Permanent differences are reclassified among capital accounts in the financial statements to reflect their tax character. Temporary differences arise when certain items of income, expense, gain or loss are recognized in different periods for financial statement and tax purposes; these differences will reverse at some point in the future. Differences in classification may also result from the treatment of short-term gain as ordinary income for tax purposes.

For tax purposes at October 31, 2013 and October 31, 2012, the Fund distributed $0 and $127,802, respectively, of ordinary income. The Fund did not have any net long-term capital gains for distribution for years ended October 31, 2013 and October 31, 2012.

Permanent differences between book and tax basis reporting for the year ended October 31, 2013 have been identified and appropriately reclassified to reflect an increase in accumulated net investment income of $104,710 and a decrease in accumulated net realized loss of $104,710. These adjustments were related to Section 988 gain (loss) reclasses. Net assets were not affected by this reclassification.

U.S. Federal Income Taxes: It is the Fund’s intention to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended, and distribute all of its taxable income within the prescribed time. It is also the intention of the Fund to make distributions in sufficient amounts to avoid Fund excise tax. Accordingly, no provision for U.S. Federal income taxes is required.

17

The New Ireland Fund, Inc.

Notes to Financial Statements (continued)

Management has analyzed the Fund’s tax positions taken on Federal income tax returns for all open tax years (October 31, 2013, 2012, and 2011), and has concluded that no provision for federal income tax is required in the Fund’s financial statements. The Fund’s federal and state income and federal excise tax returns for tax years for which the applicable statutes of limitations have not expired are subject to examination by the Internal Revenue Service and state departments of revenue.

Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the spot rate of such currencies against U.S. dollars by obtaining from Interactive Data Corp. (“IDC”) each day the current 4:00pm London time spot rate and future rate (the future rates are quoted in 30-day increments) on foreign currency contracts. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amount actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gains and losses on security transactions.

Securities Transactions and Investment Income: Securities transactions are recorded based on their trade date. Realized gains and losses from securities sold are recorded on the identified cost basis. Dividend income is recorded on the ex-dividend date except that certain dividends from foreign securities are recorded as soon as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates. Non-cash dividends, if any, are recorded at the fair market value of the securities received. Interest income is recorded on the accrual basis.

Use of Estimates: The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

B. Management Services:

Effective July 21, 2011, the Fund entered into an investment advisory agreement (the “Investment Advisory Agreement”) with Kleinwort Benson Investors International Ltd. (“KBII”). Under the Investment Advisory Agreement, the Fund pays a monthly fee at an annualized rate equal to 0.65% of the value of the average daily net assets of the Fund up to the first $50 million, 0.60% if the value of the average daily net assets of the Fund over $50 million and up to and including $100 million and 0.50% of the value of the average daily net assets of the Fund on amounts in excess of $100 million. In addition, KBII provides investor services to existing and potential shareholders.

The Fund has entered into an administration agreement (the “Administration Agreement”) with BNY Mellon Investment Servicing (US) Inc. (“BNY Mellon”). The Fund pays BNY Mellon an annual fee payable monthly. During the year ended October 31, 2013, the Fund incurred expenses of U.S. $128,077 in administration fees to BNY Mellon.

18

The New Ireland Fund, Inc.

Notes to Financial Statements (continued)

JPMorgan Chase & Co. served as the custodian of the Fund’s assets. During the year ended October 31, 2013, the Fund incurred expenses for JPMorgan Chase & Co. of U.S. $24,646.

C. Purchases and Sales of Securities:

The cost of purchases and proceeds from sales of securities for the year ended October 31, 2013 excluding U.S. government and short-term investments, aggregated U.S. $20,826,797 and U.S. $21,755,816, respectively.

D. Components of Distributable Earnings:

At October 31, 2013, the components of distributable earnings on a tax basis were as follows:

| | | | | | | | | | | | | | | | | | |

Capital Loss Carryforward | | | Qualified

Late Year

Losses Deferred | | | Undistributed Ordinary Income | | | Undistributed Long-Term

Gains | | | Net Unrealized Appreciation | |

| $ | (4,924,318 | ) | | $ | — | | | $ | 350,215 | | | $ | — | | | $ | 24,304,578 | |

As of October 31, 2013, the Fund had pre-enactment capital loss carryforwards of $4,924,318 which will expire on October 31, 2018. During the year ended October 31, 2013 $5,988,506 of capital loss carryforward was utilized.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 was enacted to modernize several of the federal income and excise tax provisions related to regulated investment companies. Under pre-enactment law, capital losses could be carried forward for eight years, and carried forward as short-term capital losses, irrespective of the character of the original loss. New net capital losses (those earned in taxable years beginning after December 22, 2010) may be carried forward indefinitely and must retain the character of the original loss. Such new net capital losses generally must be used by a regulated investment company before it uses any net capital losses incurred in taxable years beginning on or before December 22, 2010. This increases the likelihood that net capital losses incurred in taxable years beginning on or before December 22, 2010 will expire unused.

The aggregate cost of investments and the composition of unrealized appreciation and depreciation on investments and appreciation on assets and liabilities in foreign currencies on a tax basis as of October 31, 2013 were as follows:

| | | | | | | | | | | | | | | | | | | | |

Total Cost of Investments | | Gross Unrealized Appreciation on Investments | | | Gross Unrealized Depreciation on Investments | | | Net Unrealized Appreciation on Investments | | | Gross Unrealized Depreciation on Foreign Currency | | | Net Unrealized Appreciation | |

$46,686,124 | | $ | 27,032,029 | | | $ | (2,725,777 | ) | | $ | 24,306,252 | | | $ | (1,674 | ) | | $ | 24,304,578 | |

E. Common Stock:

For the year ended October 31, 2013, the Fund issued no shares in connection with stock distribution. For the year ended October 31, 2012, the Fund issued 631 shares in connection with stock distribution in the amount of $4,379.

19

The New Ireland Fund, Inc.

Notes to Financial Statements (continued)

F. Share Repurchase Program:

In accordance with Section 23(c) of the 1940 Act, the Fund hereby gives notice that it may from time to time repurchase shares of the Fund in the open market at the option of the Board of Directors and upon such terms as the Directors shall determine.

For the year ended October 31, 2013, the Fund repurchased 122,026 (2.37% of the shares outstanding at October 31, 2012) of its shares for a total cost of $1,151,983, at an average discount of 11.62% of net asset value.

For the year ended October 31, 2012, the Fund repurchased 316,714 (4.95% of the shares outstanding at October 31, 2011) of its shares for a total cost of $2,444,590, at an average discount of 12.52% of net asset value. In addition the Fund had a tender offer of 924,000 (14.4% of the shares outstanding at October 31, 2011) of its shares for a total cost of $7,475,160, at an average discount of 2.06% of net asset value.

G. Market Concentration:

Because the Fund concentrates its investments in securities issued by corporations in Ireland, its portfolio may be subject to special risks and considerations typically not associated with investing in a broader range of domestic securities. In addition, the Fund is more susceptible to factors adversely affecting the Irish economy than a comparable fund not concentrated in these issuers to the same extent.

H. Risk Factors:

Investing in the Fund may involve certain risks including, but not limited to, those described below.

The prices of securities held by the Fund may decline in response to certain events, including those directly involving the companies whose securities are owned by the Fund; conditions affecting the general economy; overall market changes; local, regional or global political, social or economic instability; and currency, interest rate and commodity price fluctuations. The growth-oriented, equity-type securities generally purchased by the Fund may involve large price swings and potential for loss.

Investments in securities issued by entities based outside the United States may also be affected by currency controls; different accounting, auditing, financial reporting, and legal standards and practices in some countries; expropriation; changes in tax policy; greater market volatility; differing securities market structures; higher transaction costs; and various administrative difficulties, such as delays in clearing and settling portfolio transactions or in receiving payment of dividends. These risks may be heightened in connection with investments in developing countries.

I. Subsequent Event:

Management has evaluated the impact of all subsequent events on the Fund through the date the financial statements were issued, and has determined that there was the following subsequent event: The Fund changed its custodian from JPMorgan Chase & Co. to U.S. Bank, N.A., effective on November 12, 2013.

20

The New Ireland Fund, Inc.

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of

The New Ireland Fund, Inc.

We have audited the accompanying statements of assets and liabilities of The New Ireland Fund, Inc. (the “Fund”), including the portfolio holdings, as of October 31, 2013, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2013, by correspondence with the custodian. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of The New Ireland Fund, Inc. as of October 31, 2013, and the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

TAIT, WELLER & BAKER LLP

Philadelphia, Pennsylvania

December 19, 2013

21

Additional Information (unaudited)

Dividend Reinvestment and Cash Purchase Plan

The Fund will distribute to shareholders, at least annually, substantially all of its net income from dividends and interest payments and expects to distribute substantially all its net realized capital gains annually. Pursuant to the Dividend Reinvestment and Cash Purchase Plan (the “Plan”) approved by the Fund’s Board of Directors (the “Directors”), each shareholder will be deemed to have elected, unless American Stock Transfer & Trust Company (the “Plan Agent”) is instructed otherwise by the shareholder in writing, to have all distributions automatically reinvested by the Plan Agent in Fund shares pursuant to the Plan. Distributions with respect to Fund shares registered in the name of a broker-dealer or other nominee (i.e., in “street name”) will be reinvested by the broker or nominee in additional Fund shares under the Plan, unless the service is not provided by the broker or nominee or the shareholder elects to receive distributions in cash. Investors who own Fund shares registered in street names may not be able to transfer those shares to another broker-dealer and continue to participate in the Plan. These shareholders should consult their broker-dealer for details. Shareholders who do not participate in the Plan will receive all distributions in cash paid by check in U.S. dollars mailed directly to the shareholder by the Plan Agent, as paying agent. Shareholders who do not wish to have distributions automatically reinvested should notify the Fund, in care of the Plan Agent for The New Ireland Fund, Inc.

The Plan Agent will serve as agent for the shareholders in administering the Plan. If the Directors of the Fund declare an income dividend or a capital gains distribution payable either in the Fund’s common stock or in cash, as shareholders may have elected, non-participants in the Plan will receive cash and participants in the Plan will receive common stock to be issued by the Fund. If the market price per share on the valuation date equals or exceeds net asset value per share on that date, the Fund will issue new shares to participants at net asset value or, if the net asset value is less than 95% of the market price on the valuation date, then at 95% of the market price. The valuation date will be the dividend or distribution payment date or, if that date is not a trading day on the New York Stock Exchange, Inc. (“New York Stock Exchange”), the next preceding trading day. If the net asset value exceeds the market price of Fund shares at such time, participants in the Plan will be deemed to have elected to receive shares of stock from the Fund, valued at market price on the valuation date. If the Fund should declare a dividend or capital gains distribution payable only in cash, the Plan Agent as agent for the participants, will buy Fund shares in the open market, on the New York Stock Exchange or elsewhere, with the cash in respect of such dividend or distribution, for the participants’ account on, or shortly after, the payment date.

Participants in the Plan have the option of making additional cash payments to the Plan Agent, annually, in any amount from U.S. $100 to U.S. $3,000, for investment in the Fund’s common stock. The Plan Agent will use all funds received from participants (as well as any dividends and capital gain distributions received in cash) to purchase Fund shares in the open market on or about January 15 of each year. Any voluntary cash payments received more than thirty days prior to such date will be returned by the Plan Agent, and interest will not be paid on any uninvested cash payments. To avoid unnecessary cash accumulations and to allow ample time for receipt and processing by the Plan Agent, it is suggested that the participants send in voluntary cash payments to be received by the Plan Agent approximately ten days before January 15. A participant

22

Additional Information (unaudited) (continued)

may withdraw a voluntary cash payment by written notice, if the notice is received by the Plan Agent not less than forty-eight hours before such payment is to be invested.

The Plan Agent maintains all shareholder accounts in the Plan and furnishes written confirmations of all transactions in the account, including information needed by shareholders for personal and U.S. Federal tax records. Shares in the account of each Plan participant will be held by the Plan Agent in non-certificated form in the name of the participant, and each shareholder’s proxy will include those shares purchased pursuant to the Plan.

In the case of shareholders such as banks, brokers or nominees who hold shares for beneficial owners, the Plan Agent will administer the Plan on the basis of the number of shares certified from time to time by the shareholder as representing the total amount registered in the shareholder’s name and held for the account of beneficial owners who are participating in the Plan.

There is no charge to participants for reinvesting dividends or capital gains distributions. The Plan Agent’s fee for the handling of the reinvestment of dividends and distributions will be paid by the Fund. However, each participant’s account will be charged a pro rata share of brokerage commissions incurred with respect to the Plan Agent’s open market purchases in connection with the reinvestment of dividends or capital gains distributions. A participant will also pay brokerage commissions incurred in purchases in connection with the reinvestment of dividends or capital gains distributions. A participant will also pay brokerage commissions incurred in purchases from voluntary cash payments made by the participant. Brokerage charges for purchasing small amounts of stock of individual accounts through the Plan are expected to be less than the usual brokerage charges for such transactions, because the Plan Agent will be purchasing stock for all participants in blocks and prorating the lower commission thus attainable.

The automatic reinvestment of dividends and distributions will not relieve participants of any U.S. Federal income tax which may be payable on such dividends or distributions.

Experience under the Plan may indicate that changes are desirable. Accordingly, the Fund reserves the right to amend or terminate the Plan as applied to any voluntary cash payment made and any dividend or distribution paid subsequent to notice of the change sent to all shareholders at least ninety days before the record date for such dividend or distribution. The Plan also may be amended or terminated by the Plan Agent with at least ninety days written notice to all shareholders. All correspondence concerning the Plan should be directed to the Plan Agent for The New Ireland Fund, Inc. in care of American Stock Transfer & Trust Company, 59 Maiden Lane, New York, New York, 10038, telephone number (718) 921-8283.

Meeting of Shareholders

On June 4, 2013, the Fund held its Annual Meeting of Shareholders. David Dempsey was elected as a Director by the following votes: 3,650,434 For; 337,434 Abstaining. Peter Hooper, Sean Hawkshaw and Margaret Duffy continue to serve in their capacities as Directors of the Fund.

23

Additional Information (unaudited) (continued)

Fund’s Privacy Policy

The New Ireland Fund, Inc. appreciates the privacy concerns and expectations of its registered shareholders and safeguarding their nonpublic personal information (“Information”) is of great importance to the Fund.

The Fund collects Information pertaining to its registered shareholders, including matters such as name, address, tax I.D. number, Social Security number and instructions regarding the Fund’s Dividend Reinvestment Plan. The Information is collected from the following sources:

| | • | | Directly from the registered shareholder through data provided on applications or other forms and through account inquiries by mail, telephone or e-mail. |

| | • | | From the registered shareholder’s broker as the shares are initially transferred into registered form. |

Except as permitted by law, the Fund does not disclose any Information about its current or former registered shareholders to anyone. The disclosures made by the Fund are primarily to the Fund’s service providers as needed to maintain account records and perform other services for the Fund’s shareholders. The Fund maintains physical, electronic, and procedural safeguards to protect the shareholders’ Information in the Fund’s possession.

The Fund’s privacy policy applies only to its individual registered shareholders. If you own shares of the Fund through a third party broker, bank or other financial institution, that institution’s privacy policies will apply to you and the Fund’s privacy policy will not.

Portfolio Information

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The Fund’s Form N-Q is available (1) by calling 1-800-468-6475; (2) on the Fund’s website located at http://www.newirelandfund.com; (3) on the SEC’s website at http://www.sec.gov; or (4) for review and copying at the SEC’s Public Reference Room (“PRR”) in Washington, DC. Information regarding the operation of the PRR may be obtained by calling 1-800-SEC-0330.

Proxy Voting Information

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities held by the Fund is available, without charge and upon request, by calling 1-800-468-6475. This information is also available from the EDGAR database or the SEC’s website at http://www.sec.gov. Information regarding how the Fund voted proxies relating to portfolio securities during the most recent twelve-month period ended June 30 is available, without charge and upon request, by calling 1-800-468-6475, and at http://www.sec.gov.

Certifications

The Fund’s president has certified to the New York Stock Exchange (“NYSE”) that, as of June 21, 2013, he was not aware of any violation by the Fund of applicable NYSE corporate governance listing standards. The Fund’s reports to the SEC on Forms N-CSR and N-CSRS contain certifications by the Fund’s principal executive officer and principal

24

Additional Information (unaudited) (continued)

financial officer that relate to the Fund’s disclosure in such reports and that are required by rule 30a2(a) under the Investment Company Act.

Tax Information

For the fiscal year ended October 31, 2013, the Fund had no designated long-term capital gains.

Advisory Agreement

(In this disclosure, the term “Fund” refers to The New Ireland Fund, Inc., the term “Adviser” refers to Kleinwort Benson Investors International Ltd. and the term “Administrator” refers to BNY Mellon).

The Directors, including a majority of the Directors who are considered to be “interested persons” of the Fund under the 1940 Act (the “Independent Directors”), unanimously approved the continuance of the Investment Advisory Agreement (the “Advisory Agreement”) between the Fund and the Adviser for an additional annual period at an in-person meeting held on June 4, 2013.

In considering whether to approve the renewal of the Advisory Agreement, the Directors reviewed a variety of information provided by the Adviser and the Administrator, including comparative performance, fee and expense information and other information regarding the nature, extent and quality of services provided by the Adviser. The materials provided to the Directors generally include, among other items: (i) information on the investment performance of the Fund and the performance of peer groups of funds and the Fund’s performance benchmarks; (ii) information on the Fund’s advisory fees and other expenses, including information comparing the Fund’s expenses to those of a peer group of funds and information about any applicable expense limitations and fee “breakpoints”; (iii) information about the profitability of the Advisory Agreement to the Adviser; (iv) a report prepared by the Adviser in response to a request submitted by the Independent Directors’ independent legal counsel on behalf of such Directors; and (v) a memorandum from the Independent Directors’ independent legal counsel on the responsibilities of the Board in considering for approval the investment advisory arrangement under the 1940 Act and Maryland law. The Directors, including the Independent Directors, also considered other matters such as: (i) the Adviser’s financial results and financial condition; (ii) the Fund’s investment objective and strategies; (iii) the Adviser’s investment personnel and operations; (iv) the procedures employed to determine the value of the Fund’s assets; (v) the allocation of the Fund’s brokerage, if any, including, if applicable, allocations to brokers affiliated with the Adviser and the use, if any, of “soft” commission dollars to pay Fund expenses and to pay for research and other similar services; (vi) the resources devoted to, and the record of compliance with, the Fund’s investment policies and restrictions, policies on personal securities transactions and other compliance policies; and (vii) possible conflicts of interest. Throughout the process, the Board was afforded the opportunity to ask questions of and request additional materials from the Adviser.

In addition to the materials requested by the Directors in connection with their annual consideration of the continuation of the Advisory Agreement, the Directors received materials in advance of each regular quarterly meeting of the Board that provided information relating to the services provided by the Adviser.

25

Additional Information (unaudited) (continued)

The Independent Directors were advised by separate independent legal counsel throughout the process. The Independent Directors also discussed the proposed continuances in a private session with counsel at which no representatives of the Adviser were present. In reaching their determinations relating to continuance of the Advisory Agreement in respect of the Fund, the Directors considered all factors they believed relevant, including the following:

| | 1) | | the total compensation to be received, directly or indirectly, by the Adviser; |

| | 2) | | the expenses incurred by the Advisor in performing services under the Agreement; |

| | 3) | | the Fund’s expense ratio; |

| | 4) | | the possible reduction in advisory fees to reflect economies of scale; |

| | 5) | | competitive prices for comparable services; |

| | 6) | | competitive expense ratios; |

| | 7) | | past performance and reliability of the Adviser; and |

| | 8) | | the terms of other advisory contracts to which the Adviser is a party. |

The Directors did not identify any single factor as determinative. Individual Directors may have evaluated information presented differently from one another, giving different weights to different factors.

Matters considered by the Directors, including the Independent Directors, in connection with their approval of the Advisory Agreement included in the factors listed below.

Nature, extent and quality of services provided by the Adviser

The Directors considered the nature, extent and quality of services provided by the Adviser under the Advisory Agreement and noted that the scope of services continue to expand as a result of regulatory and other market developments. The Directors noted that, for example, the Adviser is responsible for maintaining and monitoring its own compliance program and coordinates certain activities with the Fund’s Chief Compliance Officer, and these compliance programs are routinely refined and enhanced in light of new regulatory requirements and current market conditions. The Directors considered the Adviser’s investment experience, the quality of the investment research capabilities of the Adviser and the other resources dedicated to performing services for the Fund. The quality of other services, including the Adviser’s assistance in the coordination of the activities of some of the Fund’s other service providers, also were considered. The Directors concluded that, overall, they were satisfied with the nature, extent and quality of services provided (and expected to be provided) to the Fund under the Advisory Agreement.

Costs of services provided and profitability to the Adviser

At the request of the Directors, the Adviser provided information concerning the profitability to the Adviser of the Advisory Agreement. The Directors reviewed with the Adviser assumptions and methods of allocation used by the Adviser in preparing this Fund-specific profitability data. The Directors recognized that it is difficult to make comparisons of profitability from investment advisory contracts. This is because comparative information is not generally publicly available and is affected by numerous factors, including the structure of the particular adviser, the type of clients it advises, its business mix, and numerous assumptions regarding allocations and the adviser’s capital structure and cost of capital. In considering profitability information, the Directors

26

Additional Information (unaudited) (continued)

considered the effect of fall-out benefits on the Adviser’s expenses. The Directors recognized that the Adviser should, in the abstract, be entitled to earn a reasonable level of profits for the services it provides, to the Fund. Based on their review, they concluded they were satisfied that the Adviser’s level of profitability, from its relationship with the Fund, was not excessive.

Fall-Out benefits

The Directors also considered so-called “fall-out benefits” to the Adviser and its affiliates, such as reputational and other benefits from the Adviser’s association with the Fund. The Directors considered any possible conflicts of interest associated with these fall-out and other benefits.

The Adviser advised the Directors that no portfolio transactions were expected to be allocated pursuant to arrangements whereby the Adviser receives brokerage and research services from brokers that execute the Fund’s purchases and sales of securities. As a result, none of the Adviser’s research or other expenses was anticipated to be offset by the use of the Fund’s commissions.

Investment results