UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | | |

| Investment Company Act file number: | | 811- 06024 |

| | |

| Exact name of registrant as specified in charter: | | Aberdeen Indonesia Fund, Inc. |

| | |

| Address of principal executive offices: | | 1735 Market Street, 32nd Floor Philadelphia, PA 19103 |

| | |

| Name and address of agent for service: | | Ms. Andrea Melia Aberdeen Asset Management Inc. 1735 Market Street, 32nd Floor Philadelphia, PA 19103 |

| | |

| Registrant’s telephone number, including area code: | | 866-839-5205 |

| | |

| Date of fiscal year end: | | December 31 |

| | |

| Date of reporting period: | | June 30, 2010 |

Item 1. Reports to Stockholders.

10

Aberdeen Indonesia

Fund, Inc.

Semi-Annual Report

June 30, 2010

Invests primarily in Indonesian securities.

Letter to Shareholders (unaudited)

August 13, 2010

Dear Shareholder,

We present this Semi-Annual Report which covers the activities of Aberdeen Indonesia Fund, Inc. (the "Fund") for the six-month period ended June 30, 2010. The Fund's primary objective is to seek long-term capital appreciation by investing in Indonesian companies, with current income as a secondary objective of the Fund.

For the period ended June 30, 2010, the total return to shareholders based on the net asset value ("NAV") of the Fund was 20.3% versus a return of 15.3% for the Fund's benchmark, the MSCI Indonesia Index. Based on market price, the Fund's return was 14.7% during the period, assuming reinvestment of dividends and distributions.

Share Price Performance

The Fund's market price per share increased 14.7% over the six months, from $9.50 on December 31, 2009 to $10.90 on June 30, 2010. The Fund's market price on June 30, 2010 represented a discount of 10.9% to the NAV per market of $12.23 on that date, compared with a discount of 6.6% to the NAV per share of $10.17 on December 31, 2009. As of August 13, 2010, the market price was $12.03, representing a discount of 17.9% to the NAV per share of $13.06.

Change in Legal Entity Name

On March 29, 2010, the Board of Directors of the Fund approved a name change for the Fund in order to align the Fund more closely with the investment adviser and to differentiate the Fund in a competitive market with many known brands. The Fund's investment objectives and NYSE Amex ticker symbol, IF, remains unchanged.

Market Review

Indonesian equities outperformed their Asian counterparts in the six months under review, with the MSCI Indonesia Index posting a gain whereas most of the rest of the region fell. However, the market's advance masked the underlying volatility. At first, market sentiment was lifted by rosy quarterly corporate profits, underpinned by resilient economic expansion that had resulted in ratings upgrades. While a surprise discount rate hike by the US Federal Reserve in February pared gains, the market, unlike its peers, did not then succumb to fears over monetary tightening in China, nor to the proposed banking reforms in the US. The benchmark rose to new highs in April, but fell in May on the back of growing fears that the ongoing Eurozone debt crisis may stall the global economic recovery. Subsequently, equities across Asia rebounded in June as China's move to increase the flexibility of its exchange rate provided some respite.

The economy maintained its growth momentum throughout the period. First-quarter gross domestic product data were aided by healthy domestic consumption and improved exports, building on the larger-than-expected fourth-quarter growth rates. Trade minister Mari Pangestu expressed confidence that export growth could accelerate to as much as 8%, despite risks to demand from the Eurozone, which accounts for 12% of total shipments. Meanwhile, Moody's raised the country's sovereign debt rating.

Our holdings' first-quarter results were largely positive. Unilever Indonesia, Astra International, Holcim Indonesia, United Tractor, along with telecom and utility holdings, such as Telekomunikasi, Indosat and PGAS, posted good results. Financial holdings also did well, with Bank OCBC NISP and Bank Permata's net profits driven by net interest income and lower provisions. Meanwhile, nickel miner INCO benefited from higher delivery volume and better nickel prices. In contrast, Merck Indonesia's operating profits were flat as improving revenue was eroded by higher input costs.

Among other portfolio-related news, Unilever Indonesia's acquisition of Sara Lee Body Care Indonesia will allow it to expand locally; it will also build more factories over the next few years to bolster its market position, both at home and abroad. Astra acquired the rest of finance company Astra Sedaya Finance from GE to make it a wholly owned unit. OCBC enlarged its stake in Bank OCBC NISP to 81.9% after it bought out International Finance Corp. Earlier in the year, Telkom had issued rupiah-denominated bonds to finance capital spending. Separately, it bought a controlling stake in AdMedika for US$13 million, a leading healthcare administration provider, and is set to acquire three more companies in the IT or media sectors.

Outlook

We believe Indonesia's economy is poised for further growth. Although there are potential external headwinds, the country appears well insulated, with two-thirds of its economy driven by domestic consumption. Here, the indicators are bullish: incomes have risen substantially, while consumer confidence has continued to improve. At the same time, it is among the least leveraged of key emerging markets, such as Brazil, Russia, India and China. Meanwhile, investments – as indicated by a record level of loans for capital expenditure – should underpin the country's upbeat long-term prospects. We believe this augurs well for the stock market, which is already undergoing a revaluation, while there is room for current valuations to expand further.

Dividend Reinvestment and Cash Purchase Plan

We invite you to participate in the Fund's Dividend Reinvestment and Cash Purchase Plan (the "Plan"), which allows you to automatically reinvest your distributions in shares of the Fund's common stock at favorable commission rates. Distributions made under the Plan are taxable to the same extent as are cash distributions. The Plan also

Aberdeen Indonesia Fund, Inc.

1

Letter to Shareholders (unaudited) (concluded)

enables you to make additional cash investments in shares of at least $100 per transaction. To request a brochure containing more information on the Plan, together with an enrollment form, please contact Computershare Trust Company, N.A. ("Computershare"), the Plan Agent, toll free at 1-800-647-0584 (international 1-781-575-3100).

In addition, as part of a broad effort to enhance available services to shareholders, we are please to announce the availability of a new Dividend Reinvestment and Direct Stock Purchase Plan (the "New Plan") that will be sponsored and administered by Computershare. Effective September 24, 2010, the existing Plan will terminate and participants in the Plan will automatically be enrolled in the New Plan. Shareholders will receive a separate mailing containing additional information about the enhanced features of the New Plan, including the related terms and conditions.

Investor Relations Information

For information about the Fund, daily updates of share price, NAV and details of recent distributions, please contact Aberdeen by:

• Calling toll free at 1-866-839-5205 in the United States,

• Emailing InvestorRelations@aberdeen-asset.com, or

• Visiting the website at www.aberdeenif.com.

For additional information on the Aberdeen Closed-End Funds, Aberdeen invites you to visit our recently redesigned website and Closed-End Investor Center at: www.aberdeen-asset.us/cef.

From the site you will be able to review performance, download literature and sign up for email services. The site houses most topical information about the funds, including fact sheets from Morningstar that are updated daily and monthly manager reports.

Yours sincerely,

Christian Pittard

President

Aberdeen Indonesia Fund, Inc.

2

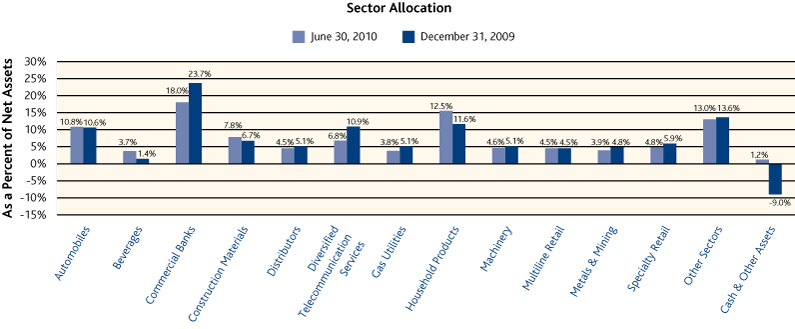

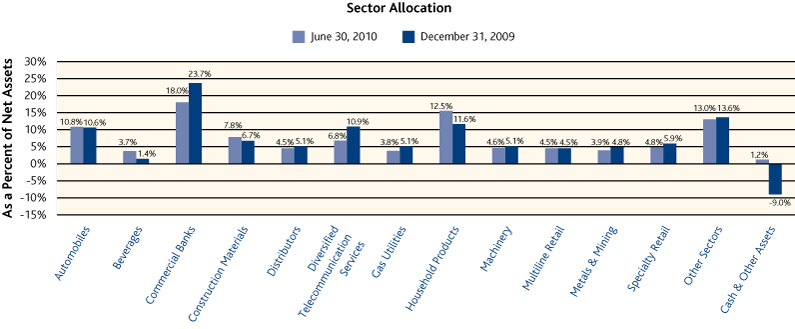

Portfolio Summary

June 30, 2010 (unaudited)

Top 10 Holdings, by Issuer

June 30, 2010 (unaudited)

| | Holding | | Sector | | Percent of Net Assets | |

| | 1. | | | PT Unilever Indonesia Tbk | | Household Products | | | 12.5 | % | |

| | 2. | | | PT Astra International Tbk | | Automobiles | | | 10.8 | % | |

| | 3. | | | PT Holcim Indonesia Tbk | | Construction Materials | | | 7.8 | % | |

| | 4. | | | PT Bank OCBC NISP Tbk | | Commercial Banks | | | 7.2 | % | |

| | 5. | | | PT Telekomunikasi Indonesia Tbk | | Diversified Telecommunication Services | | | 6.8 | % | |

| | 6. | | | PT ACE Hardware Indonesia Tbk | | Specialty Retail | | | 4.7 | % | |

| | 7. | | | PT Bank Permata Tbk | | Commercial Banks | | | 4.7 | % | |

| | 8. | | | PT United Tractors Tbk | | Machinery | | | 4.6 | % | |

| | 9. | | | Jardine Cycle & Carriage Ltd. | | Distributors | | | 4.5 | % | |

| | 10. | | | PT Ramayana Lestari Sentosa Tbk | | Multiline Retail | | | 4.5 | % | |

Average Annual Returns

June 30, 2010 (unaudited)

| | | 1 Year | | 3 Years | | 5 Years | | 10 Years | |

| Net Asset Value (NAV) | | | 65.19 | % | | | 9.12 | % | | | 18.64 | % | | | 19.10 | % | |

| Market Price | | | 58.14 | % | | | 5.85 | % | | | 16.30 | % | | | 14.15 | % | |

Aberdeen Asset Management Asia Limited may waive fees and/or reimburse expenses but has made no determination to do so. Without such waivers and/or reimbursed expenses, performance would be lower. Waivers and/or reimbursements are subject to change and may be discontinued at any time. Returns represent past performance. Total investment return at net asset value is based on changes in the net asset value of Fund shares and assumes reinvestment of dividends and distributions, if any. Total investment return at market price is based on changes in the market price at which the Fund's shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund's dividend reinvestment program. Because the Fund's shares trade in the stock market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on market price and NAV. Past performance is no guarantee of future results. The current performance of the Fund may be lower or higher than the figures shown. The Fund's yield, return, market price and NAV will fluctuate. Performance information current to the most recent month-end is available by calling 866-839-5205.

The annualized gross and net expense ratios are 1.52%.

Aberdeen Indonesia Fund, Inc.

3

Portfolio of Investments

June 30, 2010 (unaudited)

No. of

Shares | | Description | | Value | |

| EQUITY OR EQUITY-LINKED SECURITIES—98.8% | | | |

| INDONESIA—92.7% | | | |

| AUTOMOBILES—10.8% | | | |

| | 2,062,461 | | | PT Astra International Tbk(a) | | $ | 10,896,987 | | |

| BEVERAGES—3.7% | | | |

| | 215,000 | | | PT Multi Bintang Indonesia Tbk | | | 3,771,098 | | |

| COMMERCIAL BANKS—12.0% | | | |

| | 72,918,960 | | | PT Bank OCBC NISP Tbk(b) | | | 7,320,050 | | |

| | 36,503,000 | | | PT Bank Permata Tbk(a)(b) | | | 4,771,955 | | |

| | | | 12,092,005 | | |

| CONSTRUCTION MATERIALS—7.8% | | | |

| | 33,319,000 | | | PT Holcim Indonesia Tbk(a)(b) | | | 7,902,802 | | |

| CONTAINERS & PACKAGING—0.7% | | | |

| | 5,145,000 | | | PT Dynaplast Tbk | | | 686,757 | | |

| DISTRIBUTORS—4.5% | | | |

| | 215,000 | | | Jardine Cycle & Carriage Ltd.(a) | | | 4,585,800 | | |

| DIVERSIFIED TELECOMMUNICATION SERVICES—6.8% | | | |

| | 8,091,560 | | | PT Telekomunikasi Indonesia Tbk(a) | | | 6,858,517 | | |

| FOOD PRODUCTS—3.5% | | | |

| | 700,000 | | | MP Evans Group PLC(a) | | | 3,555,807 | | |

| GAS UTILITIES—3.8% | | | |

| | 9,000,000 | | | PT Perusahaan Gas Negara(a) | | | 3,815,284 | | |

| HOUSEHOLD PRODUCTS—12.5% | | | |

| | 6,792,000 | | | PT Unilever Indonesia Tbk(a) | | | 12,664,974 | | |

| MACHINERY—4.6% | | | |

| | 2,287,700 | | | PT United Tractors Tbk(a) | | | 4,688,973 | | |

| METALS & MINING—3.9% | | | |

| | 9,720,000 | | | PT International Nickel Indonesia Tbk(a) | | | 3,968,148 | | |

| MULTILINE RETAIL—4.5% | | | |

| | 43,318,000 | | | PT Ramayana Lestari Sentosa Tbk(a) | | | 4,553,007 | | |

| OIL, GAS & CONSUMABLE FUELS—1.4% | | | |

| | 350,000 | | | PT Indo Tambangraya Megah(a) | | | 1,423,138 | | |

| PERSONAL PRODUCTS—3.1% | | | |

| | 4,186,000 | | | PT Mandom Indonesia Tbk(a) | | | 3,116,377 | | |

| PHARMACEUTICALS—0.3% | | | |

| | 42,000 | | | PT Merck Tbk | | | 328,958 | | |

| SPECIALTY RETAIL—4.7% | | | |

| | 24,186,500 | | | PT ACE Hardware Indonesia Tbk(a) | | | 4,807,740 | | |

| TEXTILES, APPAREL & LUXURY GOODS—1.3% | | | |

| | 259,500 | | | PT Sepatu Bata Tbk | | | 1,288,196 | | |

| WIRELESS TELECOMMUNICATION SERVICES—2.8% | | | |

| | 5,150,000 | | | PT Indosat Tbk(a) | | | 2,792,169 | | |

| | | | | Total Indonesia (cost $48,131,877) | | | 93,796,737 | | |

Aberdeen Indonesia Fund, Inc.

4

Portfolio of Investments (concluded)

June 30, 2010 (unaudited)

No. of

Shares | | Description | | Value | |

| EQUITY OR EQUITY-LINKED SECURITIES (continued) | | | |

| SINGAPORE—6.1% | | | |

| COMMERCIAL BANKS—6.1% | | | |

| | 478,663 | | | Overseas-Chinese Banking Corp. Ltd.(a) | | $ | 3,021,106 | | |

| | 225,140 | | | United Overseas Bank Ltd.(a) | | | 3,139,297 | | |

| | | | | Total Singapore (cost $4,715,583) | | | 6,160,403 | | |

| | | | | Total Equity or Equity-Linked Securities (cost $52,847,460) | | | 99,957,140 | | |

| SHORT-TERM INVESTMENT—1.0% | |

Principal

Amount

(000's) | | | | | |

| UNITED KINGDOM—1.0% | |

| $ | 1,046 | | | Citibank London, overnight deposit, 0.03%, 07/01/10 (cost $1,046,000) | | | 1,046,000 | | |

| | | | | Total Investments—99.8% (cost $53,893,460) | | | 101,003,140 | | |

| | | | | Cash and other assets in excess of liabilities—0.2% | | | 166,074 | | |

| | | | | Net Assets—100.0% | | $ | 101,169,214 | | |

(a) Security was fair valued as of June 30, 2010. Security is valued at fair value as determined in good faith by, or under the direction of, the Board of Directors, under procedures established by the Board of Directors. (See Note 1).

(b) Non-income producing security.

See Notes to Financial Statements.

Aberdeen Indonesia Fund, Inc.

5

Statement of Assets and Liabilities

As of June 30, 2010 (unaudited)

| Assets | |

| Investments, at value (cost $53,893,460) | | $ | 101,003,140 | | |

| Cash | | | 896 | | |

| Dividends receivable | | | 641,668 | | |

| Receivable for investments sold | | | 188,246 | | |

| Prepaid expenses | | | 26,364 | | |

| Total assets | | | 101,860,314 | | |

| Liabilities | |

| Payable for investments purchased | | | 306,124 | | |

| Investment advisory fees payable (Note 2) | | | 238,598 | | |

| Administration fees payable (Note 2) | | | 13,233 | | |

| Accrued expenses and other liabilities | | | 133,145 | | |

| Total liabilities | | | 691,100 | | |

| Net Assets | | $ | 101,169,214 | | |

| Net Assets consist of | |

| Capital stock, $0.001 par value (Note 3) | | $ | 8,272 | | |

| Paid-in capital | | | 48,216,861 | | |

| Undistributed net investment income | | | 564,216 | | |

| Accumulated net realized gain on investments and foreign currency transactions | | | 5,267,965 | | |

| Net unrealized appreciation on investments and foreign currency translation | | | 47,111,900 | | |

| Net Assets applicable to shares outstanding | | $ | 101,169,214 | | |

| Net asset value per share, based on 8,271,922 shares issued and outstanding | | $ | 12.23 | | |

See Notes to Financial Statements.

Aberdeen Indonesia Fund, Inc.

6

Statement of Operations

For the Six Months Ended June 30, 2010 (unaudited)

| Investment Income | |

| Income: | |

| Dividends and other income | | $ | 1,323,323 | | |

| Less: Foreign taxes withheld | | | (159,354 | ) | |

| Total investment income | | | 1,163,969 | | |

| Expenses: | |

| Investment advisory fees (Note 2) | | | 450,609 | | |

| Custodian's fees and expenses | | | 68,833 | | |

| Directors' fees and expenses | | | 48,088 | | |

| Legal fees and expenses | | | 33,422 | | |

| Administration fees (Note 2) | | | 26,490 | | |

| Reports to shareholders and proxy solicitation | | | 19,012 | | |

| Independent auditor's fees and expenses | | | 17,673 | | |

| Insurance expense | | | 10,187 | | |

| Transfer agent's fees and expenses | | | 9,677 | | |

| Investor relations fees and expenses | | | 9,438 | | |

| Miscellaneous | | | 7,932 | | |

| Total expenses | | | 701,361 | | |

| Net investment income | | | 462,608 | | |

Net Realized and Unrealized Gain/(Loss) on Investments and

Foreign Currency Transactions | |

| Net realized gain/(loss) on: | |

| Investment transactions | | | 4,884,138 | | |

| Foreign currency transactions | | | 49,858 | | |

| Net change in unrealized appreciation on investments and foreign currency translation | | | 11,637,547 | | |

| Net realized and unrealized gain on investments and foreign currency transactions | | | 16,571,543 | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 17,034,151 | | |

See Notes to Financial Statements.

Aberdeen Indonesia Fund, Inc.

7

Statement of Changes in Net Assets

| | | For the

Six Months Ended

June 30, 2010

(unaudited) | | For the

Year Ended

December 31, 2009 | |

| Increase/(Decrease) in Net Assets | |

| Operations: | |

| Net investment income | | $ | 462,608 | | | $ | 455,286 | | |

| Net realized gain on investments and foreign currency transactions | | | 4,933,996 | | | | 15,026,067 | | |

| Net increase from payments by affiliates on disposal of investments in violation of restrictions | | | – | | | | 131,786 | | |

| Net change in unrealized appreciation on investments and foreign currency translation | | | 11,637,547 | | | | 31,418,854 | | |

| Net increase in net assets resulting from operations | | | 17,034,151 | | | | 47,031,993 | | |

| Dividends and distributions to shareholders from: | |

| Net investment income | | | – | | | | (240,713 | ) | |

| Net realized gain on investments | | | – | | | | (9,673,186 | ) | |

| Total dividends and distributions to shareholders | | | – | | | | (9,913,899 | ) | |

| Capital share transactions: | |

| Issuance of 0 and 1,551 shares through the directors compensation plan (Note 2) | | | – | | | | 14,735 | | |

| Total capital share transactions | | | – | | | | 14,735 | | |

| Total increase in net assets resulting from operations | | | 17,034,151 | | | | 37,132,829 | | |

| Net Assets | |

| Beginning of period | | | 84,135,063 | | | | 47,002,234 | | |

| End of period* | | $ | 101,169,214 | | | $ | 84,135,063 | | |

* Includes undistributed net investment income of $564,216 and $101,608, respectively.

See Notes to Financial Statements.

Aberdeen Indonesia Fund, Inc.

8

Financial Highlights

| | | For the

Six Months

Ended

June 30, 2010 | | For the Fiscal Years Ended December 31, | |

| | | (unaudited) | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 | |

| PER SHARE OPERATING PERFORMANCE | |

| Net asset value, beginning of period | | $ | 10.17 | | | $ | 5.68 | | | $ | 12.89 | | | $ | 9.66 | | | $ | 6.00 | | | $ | 5.08 | | |

| Net investment income | | | 0.06 | (a) | | | 0.06 | (a) | | | 0.09 | (a) | | | 0.03 | (a) | | | 0.05 | | | | 0.02 | | |

Net realized and unrealized gain/(loss) on investments

and foreign currency related transactions | | | 2.00 | | | | 5.63 | (b) | | | (7.23 | ) | | | 3.22 | | | | 3.66 | | | | 0.90 | | |

Net increase/(decrease) in net assets resulting from

operations | | | 2.06 | | | | 5.69 | | | | (7.14 | ) | | | 3.25 | | | | 3.71 | | | | 0.92 | | |

| Dividends and distributions to shareholders: | |

| Net investment income | | | – | | | | (0.03 | ) | | | (0.07 | ) | | | (0.02 | ) | | | (0.05 | ) | | | 0.00 | (c) | |

Net realized gain on investments and foreign currency

related transactions | | | – | | | | (1.17 | ) | | | – | | | | – | | | | – | | | | – | | |

| Total dividends and distributions to shareholders | | | – | | | | (1.20 | ) | | | (0.07 | ) | | | (0.02 | ) | | | (0.05 | ) | | | 0.00 | (c) | |

| Net asset value, end of period | | $ | 12.23 | | | $ | 10.17 | | | $ | 5.68 | | | $ | 12.89 | | | $ | 9.66 | | | $ | 6.00 | | |

| Market value, end of period | | $ | 10.90 | | | $ | 9.50 | | | $ | 5.10 | | | $ | 12.01 | | | $ | 11.70 | | | $ | 5.76 | | |

| Total Investment Return(d) | | | 14.74 | % | | | 107.82 | % | | | (56.94 | %) | | | 2.89 | % | | | 104.14 | % | | | 13.69 | % | |

| Ratio/Supplementary Data | |

| Net assets, end of period (000 omitted) | | $ | 101,169 | | | $ | 84,135 | | | $ | 47,002 | | | $ | 106,577 | | | $ | 79,844 | | | $ | 49,576 | | |

| Ratio of expenses to average net assets | | | 1.52 | %(e) | | | 1.57 | % | | | 1.62 | % | | | 1.55 | % | | | 1.65 | % | | | 1.81 | % | |

| Ratio of net investment income to average net assets | | | 1.00 | %(e) | | | 0.67 | % | | | 0.95 | % | | | 0.29 | % | | | 0.67 | % | | | 0.42 | % | |

| Portfolio turnover rate | | | 6.48 | % | | | 88.34 | % | | | 33.05 | % | | | 20.25 | % | | | 23.93 | % | | | 67.87 | % | |

(a) Based on average shares outstanding.

(b) The investment adviser fully reimbursed the Fund for a loss on a transaction not meeting the Fund's investment guidelines, which otherwise would have reduced the amount by $0.02.

(c) Amount is less than a $0.01.

(d) Total investment return at market value is based on the changes in market price of a share during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund's dividend reinvestment program.

(e) Annualized.

See Notes to Financial Statements.

Aberdeen Indonesia Fund, Inc.

9

Notes to Financial Statements

June 30, 2010 (unaudited)

Aberdeen Indonesia Fund, Inc. (the "Fund"), formerly The Indonesia Fund, Inc., was incorporated in Maryland on January 8, 1990 and commenced investment operations on March 9, 1990. The Fund is registered under the Investment Company Act of 1940, as amended, as a closed-end, non-diversified management investment company.

The Fund seeks long-term capital appreciation as a primary objective and income as a secondary objective, by investing primarily in Indonesian securities.

On March 29, 2010, the Board of Directors of the Fund (the "Board") approved a name change for the Fund in order to align the Fund more closely with the investment adviser and to differentiate the Fund in a competitive market with many known brands. The Fund's investment objectives and NYSE Amex ticker symbol, IF, remain unchanged.

1. Significant Accounting Policies

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. The financial statements of the Fund are prepared in accordance with accounting principles generally accepted in the United States of America which requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from those estimates.

(a) Security Valuation:

Securities for which market quotations are readily available are valued at current market value as of "Valuation Time." Valuation Time is as of the close of regular trading on the New York Stock Exchange (usually 4:00 p.m. Eastern Standard Time). Equity securities are valued at the last quoted sale price or, if there is no sale price, the last quoted bid price provided by an independent pricing service approved by the Board. Securities traded on NASDAQ are valued at the NASDAQ official closing price. Prices are taken from the primary market or exchange in which each security trades. Investment companies are valued at net asset value as reported by such company.

Most securities listed on a foreign exchange are valued either at fair value (see description below) or at the last sale price at the close of the exchange on which the security is principally traded. Foreign securities, currencies, and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars at the exchange rate of said currencies against the U.S. dollar, as of Valuation Time, as provided by an independent pricing service approved by the Board.

Debt and other fixed-income securities (other than short-term obligations) are valued at the last quoted bid price and/or by using a combination of daily quotes and matrix evaluations provided by an independent pricing service, the use of which has been approved by the Board. In the event such quotes are not available from such pricing agents, then the security may be priced based on bid quotations from broker-dealers. Short-term debt securities such as commercial paper and U.S. Treasury Bills having a remaining maturity of 60 days or less at the time of purchase, are valued at amortized cost, which approximates market value.

Securities for which market quotations are not readily available, or for which an independent pricing service does not provide a value or provides a value that does not represent fair value in the judgment of the Fund's investment adviser or designee, are valued at fair value under procedures approved by the Board. In addition, fair value determinations are required for securities whose value is affected by a "significant" event that materially affects the value of a domestic or foreign security which occurs subsequent to the time of the close of the principal market on which such domestic or foreign security trades and before the Valuation Time (i.e., a "subsequent event"). Typically, this will involve events occurring after the close of a foreign market on which a security trades and before the next Valuation Time.

The Fund values foreign securities at fair value in the circumstances described below. Generally, trading in foreign securities markets is completed each day at various times prior to the Valuation Time. The fair value of each such security generally is calculated by applying a valuation factor provided by the independent pricing service to the last sales price for that security. If the pricing service is unable to provide a fair value for a security, the security will continue to be valued at the last sale price at the close of the exchange on which it is principally traded, subject to adjustment by the Fund's Pricing Committee. When the fair value prices are utilized, the values assigned to the foreign investments may not be the quoted or published prices of the investments on their primary markets.

In accordance with ASC 820, Fair Value Measurements and Disclosures ("ASC 820"), fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. ASC 820 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, for example, the risk inherent in a particular valuation technique used to measure fair value including such a pricing model and/or the risk inherent in the inputs to the valuation technique. Inputs may be observable or unobservable.

Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based

Aberdeen Indonesia Fund, Inc.

10

Notes to Financial Statements (continued)

June 30, 2010 (unaudited)

on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity's own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

Level 1 – quoted prices in active markets for identical investments.

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

Level 3 – significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments, information provided by the General Partner or investee companies such as publicly traded prices, financial statements, capital statements, recent transactions, and general market conditions.)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of June 30, 2010 in valuing the Fund's investments carried at value:

| Investments, at value | | Level 1* | | Level 2* | | Level 3* | | Balance as of

06/30/2010 | |

| Automobiles | | $ | – | | | $ | 10,896,987 | | | $ | – | | | $ | 10,896,987 | | |

| Beverages | | | 3,771,098 | | | | – | | | | – | | | | 3,771,098 | | |

| Commercial Banks | | | 7,320,050 | | | | 10,932,358 | | | | – | | | | 18,252,408 | | |

| Construction Materials | | | – | | | | 7,902,802 | | | | – | | | | 7,902,802 | | |

| Containers & Packaging | | | 686,757 | | | | – | | | | – | | | | 686,757 | | |

| Distributors | | | – | | | | 4,585,800 | | | | – | | | | 4,585,800 | | |

| Diversified Telecommunication Services | | | – | | | | 6,858,517 | | | | – | | | | 6,858,517 | | |

| Food Products | | | – | | | | 3,555,807 | | | | – | | | | 3,555,807 | | |

| Gas Utilities | | | – | | | | 3,815,284 | | | | – | | | | 3,815,284 | | |

| Household Products | | | – | | | | 12,664,974 | | | | – | | | | 12,664,974 | | |

| Machinery | | | – | | | | 4,688,973 | | | | – | | | | 4,688,973 | | |

| Metals & Mining | | | – | | | | 3,968,148 | | | | – | | | | 3,968,148 | | |

| Multiline Retail | | | – | | | | 4,553,007 | | | | – | | | | 4,553,007 | | |

| Oil, Gas & Consumable Fuels | | | – | | | | 1,423,138 | | | | – | | | | 1,423,138 | | |

| Personal Products | | | – | | | | 3,116,377 | | | | – | | | | 3,116,377 | | |

| Pharmaceuticals | | | 328,958 | | | | – | | | | – | | | | 328,958 | | |

| Specialty Retail | | | – | | | | 4,807,740 | | | | – | | | | 4,807,740 | | |

| Textiles, Apparel & Luxury Goods | | | 1,288,196 | | | | – | | | | – | | | | 1,288,196 | | |

| Wireless Telecommunication Services | | | – | | | | 2,792,169 | | | | – | | | | 2,792,169 | | |

| Short-Term Investments | | | – | | | | 1,046,000 | | | | – | | | | 1,046,000 | | |

| Total | | $ | 13,395,059 | | | $ | 87,608,081 | | | $ | – | | | $ | 101,003,140 | | |

* At June 30, 2010, there were no significant transfers in or out of Level 1, Level 2 and Level 3 fair value measurements.

For the six months ended June 30, 2010, there have been no significant changes to the fair valuation methodologies.

(b) Short-Term Investment:

The Fund sweeps available cash into a short-term time deposit available through Brown Brothers Harriman & Co., ("BBH & Co.") the Fund's custodian. The short-term time deposit is a variable rate account classified as a short-term investment.

(c) Investment Transactions and Investment Income:

Investment transactions are accounted for on a trade date basis. The cost of investments sold is determined by use of the specific identification method for both financial reporting and U.S. income tax purposes. Interest income is accrued as earned; dividend income is recorded on the ex-dividend date.

Aberdeen Indonesia Fund, Inc.

11

Notes to Financial Statements (continued)

June 30, 2010 (unaudited)

(d) Taxes:

The Fund intends to continue to qualify as a "regulated investment company" by complying with the provisions available to certain investment companies, as defined in Subchapter M of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve the Fund from all, or substantially all, federal income taxes. Therefore, no federal income tax provision is required.

Income received by the Fund from sources within Indonesia and other foreign countries may be subject to withholding and other taxes imposed by such countries.

The Fund is subject to the provisions of ASC 740 Income Taxes ("ASC 740"). Management of the Fund has concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Since tax authorities can examine previously filed tax returns, the Fund's U.S. federal tax returns for the prior four fiscal years are subject to review by the Internal Revenue Service.

(e) Foreign Currency Translations:

The books and records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars on the following basis:

(I) market value of investment securities, assets and liabilities at the valuation date rate of exchange; and

(II) purchases and sales of investment securities, income and expenses at the relevant rates of exchange prevailing on the respective dates of such transactions.

The Fund does not isolate that portion of gains and losses on investments in equity securities which is due to changes in the foreign exchange rates from that which is due to changes in market prices of equity securities. Accordingly, realized and unrealized foreign currency gains and losses with respect to such securities are included in the reported net realized and unrealized gains and losses on investment transactions balances.

The Fund reports certain foreign currency related transactions and foreign taxes withheld on security transactions as components of realized gains for financial reporting purposes, whereas such foreign currency related transactions are treated as ordinary income for U.S. income tax purposes.

Net unrealized currency gains or losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation/depreciation in value of investments, and translation of other assets and liabilities denominated in foreign currencies.

Net realized foreign exchange gains or losses represent foreign exchange gains and losses from transactions in foreign currencies and forward foreign currency contracts, exchange gains or losses realized between the trade date and settlement date on security transactions, and the difference between the amounts of interest and dividends recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received.

(f) Distributions of Income and Gains:

The Fund distributes at least annually to shareholders substantially all of its net investment income and net realized short-term capital gains, if any. The Fund determines annually whether to distribute any net realized long-term capital gains in excess of net realized short-term capital losses, including capital loss carryovers, if any. An additional distribution may be made to the extent necessary to avoid the payment of a 4% U.S. federal excise tax. Dividends and distributions to shareholders are recorded by the Fund on the ex-dividend date.

Income distributions and capital and currency gains distributions are determined in accordance with income tax regulations which may differ from accounting principles generally accepted in the United States of America. These differences are primarily due to differing treatments for foreign currencies.

(g) Recent Accounting Pronouncements:

In January 2010, the Financial Accounting Standards Board issued Accounting Standards Update ("ASU") No. 2010-06 "Improving Disclosures about Fair Value Measurements." This adds new requirements for disclosures into and out of Levels I, II and III fair-value measurements and information on purchases, sales, issuances and settlements on a gross basis in the reconciliation of Level III fair-valued measurements. It also clarifies existing fair value disclosures about the level of disaggregation, inputs and valuation techniques. Except for the detailed Level III reconciliation disclosures, the guidance in the ASU is effective for annual and interim reporting periods in fiscal years beginning after December 15, 2009.

2. Agreements

Aberdeen Asset Management Asia Limited ("AAMAL") serves as the Fund's investment adviser with respect to all investments. The adviser is a direct wholly-owned subsidiary of Aberdeen Asset Management PLC. AAMAL receives as compensation after the end of each calendar quarter, a fee for the previous quarter computed monthly at an annual rate of 1.00% of the first $50 million of the Fund's average weekly net assets, 0.95% of the next $50 million and 0.90% of amounts above $100 million. For the six months ended June 30, 2010, AAMAL earned $450,609 for advisory services.

BBH & Co. is the U.S. Administrator for the Fund and certain other funds advised by AAMAL or its affiliates (collectively the "Funds"). The

Aberdeen Indonesia Fund, Inc.

12

Notes to Financial Statements (continued)

June 30, 2010 (unaudited)

Funds pay BBH monthly, at an annual rate of .06% of the Funds aggregate assets up to $500 million and .0525% for the next $500 million and .0425% in excess of $1 billion. Each Fund pays its pro rata portion of the fee based on its level of assets. For the six months ended June 30, 2010, BBH & Co. earned $26,490 from the Fund for administrative and fund accounting services

Fifty percent (50%) of the annual retainer of the Independent Directors is invested in Fund shares and, at the option of each Independent Director, 100% of the annual retainer can be invested in shares of the Fund. During the fiscal year ended December 31, 2009, 1,551 shares were issued and an additional 1,554 shares were purchased pursuant to the Directors compensation plan. During the six months ended June 30, 2010, no shares were issued or purchased pursuant to the Directors compensation plan. Directors as a group own less than 1% of the Fund's outstanding shares.

Effective March 1, 2010, the Board approved an Investor Relations Services Agreement. Under the terms of the Investor Relations Services Agreement, Aberdeen Asset Management Inc. ("AAMI") provides investor relations services to the Fund and certain other Funds. The Fund incurred fees of approximately $9,438 as of June 30, 2010. Investor relations fees and expenses in the Statement of Operations include certain out-of-pocket expenses.

3. Capital Stock

The authorized capital stock of the Fund is 100,000,000 shares of common stock, $0.001 par value. As of June 30, 2010 the Fund held 8,271,922 shares outstanding.

4. Investment in Securities

For the six months ended June 30, 2010, purchases and sales of securities, other than short-term investments, were $6,008,175 and $13,698,149, respectively.

5. Credit Facility

On November 13, 2009, the Fund entered into a credit facility along with certain other Funds. The Funds agreed to a $10 million committed revolving credit facility with BBH & Co. for temporary or emergency purposes. Under the terms of the credit facility, the Funds pay an aggregate commitment fee on the average unused amount of the credit facility. In addition, the Funds pay interest on borrowings at the Overnight LIBOR rate plus a spread. For the six months ended June 30, 2010, the Fund had no borrowings under the Credit Facility.

6. Tax Cost of Investments

At June 30, 2010, the identified cost for federal income tax purposes, as well as the gross unrealized appreciation from investments for those securities having an excess of value over cost, gross unrealized depreciation from investments for those securities having an excess of cost over value and the net unrealized appreciation from investments were $53,893,460, $47,874,313, $(764,633) and $47,109,680, respectively.

7. Contingencies

In the normal course of business, the Fund may provide general indemnifications pursuant to certain contracts and organizational documents. The Fund's maximum exposure under these arrangements is dependent on future claims that may be made against the Fund and, therefore, cannot be estimated; however, based on experience, the risk of loss from such claims is considered remote.

8. Portfolio Investment Risks

(a) Risks Associated with Foreign Securities and Currencies:

Investments in securities of foreign issuers, including Indonesia, carry certain risks not ordinarily associated with investments in securities of U.S. issuers. Such risks include, among others, currency risks, information risk and political risk. Currency risk results from securities dominated in currencies other than U.S. dollars that are subject to changes in value due to fluctuations in exchange rates. Information risk arises with respect to foreign securities when key information about foreign issuers may be inaccurate or unavailable. Political risk includes future political and economic developments, and the possible imposition of exchange controls or other foreign governmental laws and restrictions. In addition, with respect to certain countries, there is the possibility of expropriation of assets, confiscatory taxation, political or social instability or diplomatic developments, which could adversely affect investments in those countries. Other risks of investing in foreign securities include liquidity and valuation risks.

(b) Risks Associated with Indonesian Markets:

The limited liquidity of the Indonesian and other foreign securities markets may also affect the Fund's ability to acquire or dispose of securities at a price and time that it wishes to do so. Accordingly, in periods of rising market prices, the Fund may be unable to participate in such price increases fully to the extent that it is unable to acquire desired portfolio positions quickly; conversely the Fund's inability to dispose fully and promptly of positions in declining markets will cause its net asset value to decline as the value of unsold positions is marked to lower prices.

The Indonesian securities market is an emerging market characterized by a small number of company listings, high price volatility and a relatively illiquid secondary trading environment. These factors, coupled with restrictions on investment by foreigners and other factors, limit the supply of securities available for investment by the Fund. This will

Aberdeen Indonesia Fund, Inc.

13

Notes to Financial Statements (concluded)

June 30, 2010 (unaudited)

affect the rate at which the Fund is able to invest in Indonesian and other foreign securities, the purchase and sale prices for such securities and the timing of purchases and sales.

9. Subsequent Events

Management has evaluated the need for disclosures and/or adjustments resulting from subsequent events. Based on this evaluation, no adjustments were required to the Financial Statements as of June 30, 2010.

Aberdeen Indonesia Fund, Inc.

14

Results of Annual Meeting of Shareholders (unaudited)

The Annual Meeting of Shareholders was held on April 8, 2010 at 1735 Market Street, Philadelphia, Pennsylvania. The description of the proposal and number of shares voted at the meeting are as follows:

(1) To re-elect certain directors to the Board of the Fund:

| Name of Director | | Votes For | | Votes

Withheld | |

| James J. Cattano | | | 4,618,050 | | | | 1,115,924 | | |

Directors whose term of office continued beyond this meeting are as follows: Enrique R. Arzac, Lawrence J. Fox, and Steven N. Rappaport.

Proxy Voting and Portfolio Holdings Information (unaudited)

Information regarding how the Fund voted proxies related to its portfolio securities during the 12-month period ended June 30, of each year, as well as the policies and procedures that the Fund uses to determine how to vote proxies relating to its portfolio securities are available:

• By calling 1-866-839-5205;

• On the website of the Securities and Exchange Commission, www.sec.gov.

The Fund files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Fund's Forms N-Q are available on the SEC's website at www.sec.gov and may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the SEC's Public Reference Room may be obtained by calling 1-800-SEC-0330.

The Fund makes the information on Form N-Q available to shareholders on the Fund's website or upon request and without charge by calling Investor Relations toll-free at 1-866-839-5205.

Aberdeen Indonesia Fund, Inc.

15

Dividend Reinvestment and Cash Purchase Plan (unaudited)

The Fund offers a Dividend Reinvestment and Cash Purchase Plan (the "Plan") to its common stockholders. The Plan offers common stockholders a prompt and simple way to reinvest net investment income dividends and capital gains and other periodic distributions in shares of the Fund's common stock. Computershare Trust Company, N.A. ("Computershare") acts as Plan Agent for stockholders in administering the Plan.

You should be aware that all net investment income dividends and capital gain distributions are taxable to you as ordinary income and capital gain, respectively, whether received in cash or reinvested in additional shares of the Fund's common stock.

You may terminate your participation in the Plan at any time by requesting a certificate or a sale of your shares held in the Plan. Your withdrawal will be effective immediately if your notice is received by Computershare prior to any dividend or distribution record date; otherwise, such termination will be effective only with respect to any subsequent dividend or distribution. Your dividend participation option will remain the same unless you withdraw all of your whole and fractional Plan shares, in which case your participation in the Plan will be terminated and you will receive subsequent dividends and capital gains distributions in cash instead of shares.

If you want further information about the Plan, including a brochure describing the Plan in greater detail, please contact Computershare as follows:

| By Internet: | | www.computershare.com | |

|

| By phone: | | (800) 647-0584 (U.S. and Canada)

(781) 575-3100 (Outside U.S. and Canada)

Customer service associates are available from 9:00 a.m. to 5:00 p.m. Eastern time, Monday through Friday | |

|

| By mail: | | Aberdeen Indonesia Fund, Inc.

c/o Computershare

P.O. Box 43078

Providence, Rhode Island 02940-3078 | |

|

All notices, correspondence, questions or other communications sent by mail should be sent by registered or certified mail, return receipt requested.

In addition, as part of a broad effort to enhance available services to shareholders, we are please to announce the availability of a new Dividend Reinvestment and Direct Stock Purchase Plan (the "New Plan") that will be sponsored and administered by Computershare. Effective September 24, 2010, the existing Plan will terminate and participants in the Plan will automatically be enrolled in the New Plan. Shareholders will receive a separate mailing containing additional information about the enhanced features of the New Plan, including the related terms and conditions.

Aberdeen Indonesia Fund, Inc.

16

Corporate Information

Directors

Enrique R. Arzac, Chairman

James J. Cattano

Lawrence J. Fox

Steven N. Rappaport

Officers

Christian Pittard, President

Vincent McDevitt, Chief Compliance Officer

Andrea Melia, Treasurer and Chief Financial Officer

Megan Kennedy, Vice President and Secretary

William Baltrus, Vice President

Alan Goodson, Vice President

Joanne Irvine, Vice President

Devan Kaloo, Vice President

Jennifer Nichols, Vice President

Lucia Sitar, Vice President

Tim Sullivan, Vice President

Hugh Young, Vice President

Investment Adviser

Aberdeen Asset Management Asia Limited

21 Church Street

#01-01 Capital Square Two

Singapore 049480

Administrator & Custodian

Brown Brothers Harriman & Co.

40 Water Street

Boston, MA 02109

Shareholder Servicing Agent

Computershare Trust Company, N.A.

P.O. Box 43078

Providence, RI 02940

Independent Registered Public Accounting Firm

PricewaterhouseCoopers LLP

125 High Street

Boston, MA 02110

Legal Counsel

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New York, NY 10019

Investor Relations

Aberdeen Asset Management Inc.

1735 Market Street, 32nd Floor

Philadelphia, PA 19103

1-866-839-5205

InvestorRelations@aberdeen-asset.com

Aberdeen Asset Management Asia Limited

The accompanying Financial Statements as of June 30, 2010, were not audited and accordingly, no opinion is expressed thereon.

Notice is hereby given in accordance with Section 23(c) of the Investment Company Act of 1940 that the Fund may purchase, from time to time, shares of its common stock in the open market.

Shares of Aberdeen Indonesia Fund, Inc. are traded on the NYSE Amex Exchange under the symbol "IF". Information about the Fund's net asset value and market price is available at www.aberdeenif.com.

This report, including the financial information herein, is transmitted to the shareholders of Aberdeen Indonesia Fund, Inc. for their general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person. Past performance is no guarantee of future returns.

Item 2. Code of Ethics.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 3. Audit Committee Financial Expert.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 4. Principal Accountant Fees and Services.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 5. Audit Committee of Listed Registrants.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 6. Schedule of Investments.

(a) Included as part of the Report to Shareholders filed under Item 1 of this Form N-CSR.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

This item is inapplicable to semi-annual report on Form N-CSR.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

(a) This item is inapplicable to semi-annual report on Form N-CSR.

(b) During the period ended June 30, 2010, there were no changes to any of the Portfolio Managers identified in the Registrant’s Annual Report on Form N-CSR filed on March 8, 2010.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

None.

Item 10. Submission of Matters to a Vote of Security Holders.

There were no material changes to the procedures by which shareholders may recommend nominees to the Registrant’s Board of Directors since the Registrant last provided disclosure in response to the requirements of Item 407(c)(2)(iv) of Regulation S-K (as required by Item 22(b)(15) of Schedule 14A).

Item 11. Controls and Procedures.

(a) It is the conclusion of the Registrant’s principal executive officer and principal financial officer that the effectiveness of the Registrant’s current disclosure controls and procedures (such disclosure controls and procedures having been evaluated within 90 days of the filing) provide reasonable assurance that the information required to be disclosed by the Registrant has been recorded, processed, summarized and reported within the time period specified by the Commission’s rules and forms and that the information required to be disclosed by the Registrant has been accumulated and communicated to the Registrant’s principal executive officer and principal financial officer in order to allow timely decisions regarding required disclosure.

(b) There were no changes in the Registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

| (a)(1) | | Not applicable. |

| | | |

| (a)(2) | | The certifications of the registrant as required by Rule 30a-2(a) under the Act are exhibits to this report. |

| | | |

| (a)(3) | | Not applicable. |

| | | |

| (b) | | The certifications of the registrant as required by Rule 30a-2(b) under the Act are an exhibit to this report. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

By: /s/ Christian Pittard

Christian Pittard,

President of

Aberdeen Indonesia Fund, Inc.

Date: August 30, 2010

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

Aberdeen Indonesia Fund, Inc.

By: /s/ Christian Pittard

Christian Pittard,

President of

Aberdeen Indonesia Fund, Inc.

Date: August 30, 2010

By: /s/ Andrea Melia

Andrea Melia,

Treasurer of

Aberdeen Indonesia Fund, Inc.

Date: August 30, 2010