QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

CARROLLTON BANCORP |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CARROLLTON BANCORP

344 North Charles Street, Suite 300

Baltimore, Maryland 21201

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 20, 2004

TO THE SHAREHOLDERS OF CARROLLTON BANCORP:

The Annual Meeting of Shareholders of Carrollton Bancorp, a Maryland corporation (the "Company"), will be held at 344 North Charles Street, Baltimore, Maryland on April 20, 2004 at 10:00 a.m., prevailing local time, for the following purposes:

- 1.

- To elect four directors for a three-year term ending in 2007, and until their respective successors are duly elected and qualify.

- 2.

- To ratify the appointment of Rowles & Company, LLP as independent public accountants to audit the financial statements of the Company for 2004.

- 3.

- To vote on the amendment to the 1998 Long Term Incentive Plan to increase the number of shares available for issuance.

- 4.

- To act upon any other matter which may properly come before the meeting or any adjournment thereof.

The close of business on March 1, 2004, has been fixed by the Board of Directors as the date for determining shareholders of record entitled to receive notice of and to vote at the Annual Meeting.

Your attention is directed to the enclosed Proxy Statement and annual report of the Company for the fiscal year ended December 31, 2003.

Please sign, date and mail the accompanying proxy in the enclosed, self-addressed, stamped envelope, whether or not you expect to attend the meeting in person. You may withdraw your proxy at the meeting should you be present and desire to vote your shares in person. Your cooperation is respectfully requested.

| | By Order of the Board of Directors |

|

|

|

D. Doreen Smith

Secretary |

Baltimore, Maryland

March 19, 2004

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AND VOTED. ACCORDINGLY, PLEASE DATE, SIGN AND RETURN THE ENCLOSED PROXY PROMPTLY.

3

(This Page Intentionally Left Blank)

4

CARROLLTON BANCORP

344 North Charles Street, Suite 300

Baltimore, Maryland 21201

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

APRIL 20, 2004

SOLICITATION AND REVOCATION OF PROXIES

This Proxy Statement (the "Proxy Statement") is being furnished to the shareholders of Carrollton Bancorp (the "Company") in connection with the solicitation of proxies by the Board of Directors of the Company for use at the Annual Meeting of Shareholders, and any adjournments thereof, to be held at 344 North Charles Street, Baltimore, Maryland at 10:00 a.m. prevailing local time, on Tuesday, April 20, 2004. Our principal executive offices are located at 344 North Charles Street, Baltimore, Maryland 21201. This Proxy Statement is being sent to the shareholders of the Company on or about March 19, 2004.

The Board of Directors has selected David P. Hessler, Ben F. Mason, and Howard S. Klein and each of them, to act as proxies with full power of substitution. A proxy may be revoked at any time prior to its exercise by giving written notice of revocation to the Company, by executing and delivering a substitute proxy to the Company, or by attending the Annual Meeting and voting in person. If no instructions are specified in the proxy, it is the intention of the persons named therein to voteFOR the election of the nominees named herein as directors of the Company,FOR the ratification of Rowles and Company, LLP as independent public accountants to audit the financial statements of the Company for 2004, andFOR the amendment to the 1998 Long Term Incentive Plan to increase the number of shares available for issuance.

Shareholders of the Company are requested to complete, date and sign the accompanying form of proxy and return it promptly to the Company in the enclosed envelope. If a proxy is properly executed and returned in time for voting, it will be voted as indicated thereon.

The Company does not know of any matter to be presented at the Annual Meeting except as described herein. If any other matters are properly brought before the Annual Meeting, the persons named in the enclosed proxy intend to vote the proxy according to their best judgment.

The Company will bear the costs of the solicitation of proxies, including the reimbursement of banks, brokers and other fiduciaries for expenses in forwarding proxy solicitation materials to beneficial owners. Such expenses are estimated not to exceed $5,000. Solicitations may be made by mail, telegraph or personally by directors, officers or employees of the Company, none of whom will receive additional compensation for performing such services.

5

VOTING SECURITIES

On March 1, 2004, the Company had outstanding 2,828,078 shares of Common Stock, $1.00 par value per share. Each share of Common Stock entitles the holder thereof to one vote on each matter to be voted upon at the Annual Meeting. Neither the Company's Charter nor its Bylaws provides for cumulative voting rights.

The close of business on March 1, 2004 has been fixed by the Board of Directors as the record date for determining the shareholders of the Company entitled to receive notice of and to vote at the Annual Meeting.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Board of Directors is divided into three classes. Each year the directors in one class are elected to serve for a term of three years, and until their respective successors are duly elected and qualify. The Shareholders will vote at this Annual Meeting for the election of four directors for the three-year term expiring at the Annual Meeting of Shareholders in 2007.

The proxies solicited hereby, unless directed to the contrary, will be voted FOR the election as directors of all four nominees listed in the following tables. In order to be elected, a plurality of the shares voted at a meeting at which a quorum is present is necessary for the election of a director. Each nominee has consented to serve as a director, if elected.

Your Company's Board of Directors unanimously recommends a vote FOR the election of each of the nominees named below as directors of the Company.

In the event that any of the nominees should be unable to serve, the persons named in the proxy will vote for such substitute nominee or nominees as they, in their sole discretion, shall determine. The Board of Directors has no reason to believe that any nominee named herein will be unable to serve.

The following material contains information concerning the nominees for election and those directors whose terms continue beyond the date of the Annual Meeting.

NOMINEES FOR DIRECTOR FOR TERM

EXPIRING IN 2007

Robert J. Aumiller – Mr. Aumiller, age 55, currently is serving as a director of Carrollton Bank ("the Bank"), the principal subsidiary of the Company, and the Company beginning with his appointment in 2001. He has been the Executive Vice President and General Counsel of MacKenzie Commercial Real Estate Services, LLC involved in brokerage and real estate development of various commercial real estate projects, since 1983. (2)

Ben F. Mason – Mr. Mason, age 66, currently is serving as a director of the Bank and the Company beginning with his appointment in 2001. He has been the Executive Director of the Baltimore City Chamber of Commerce, a member business association that promotes business development within Baltimore City, since 1993. (2) (4)

Charles E. Moore, Jr. – Mr. Moore, age 54, currently is serving as a director of the Bank and the Company beginning with his appointment in 2001. He has been the Co-Founder, Director, President and CFO of TelAtlantic, a consolidation of rural telephone companies across the United States, since 1999. (1) (2) (3) (4)

John Paul Rogers – Mr. Rogers, age 68, has served as director of the Bank since 1970 and of the Company since its inception in 1990. Mr. Rogers has been Chairman of the Bank since February 1994. He was a partner of the law firm of Rogers, Moore and Rogers, counsel of the Bank, from 1970 until 1992. Mr. Rogers was senior title officer of The Security Title Guarantee Corporation of Baltimore from May 1991 until December 1992, having served as President from March 1989 until May 1991, and as Executive Vice President from March 1970 until March 1989. He is the brother of William C. Rogers, Jr., a director of the Bank and the Company.

DIRECTORS CONTINUING IN OFFICE

DIRECTORS WHOSE TERMS EXPIRE IN 2005

Steven K. Breeden – Mr. Breeden, age 45, has served as a director of the Bank, since June 1994, and of the Company since October 1995. Mr. Breeden is currently a managing member of Security Development LLC and related real estate and development companies, a position he has held since 1980. (2) (3) (4)

Harold I. Hackerman – Mr. Hackerman, age 52, has served as a director of the Bank since February 2002 and of the Company since February 2002. Since 1984, Mr. Hackerman has been Vice President of Ellin & Tucker, a certified public accounting firm, and has provided audit, accounting and consulting services since 1973. (1) (2) (4) (5)

Howard S. Klein – Mr. Klein, age 45, has served as a director of the Bank since March 1999 and of the Company since April 1999. Mr. Klein has been Vice President and General Counsel for Klein's Super Markets, a family-operated chain of six full serve supermarkets and related development and operating companies since 1987. (1) (4)

6

DIRECTORS WHOSE TERMS EXPIRE IN 2006

Albert R. Counselman – Mr. Counselman, age 55, has served as a director of the Bank since April 1985, and of the Company since its inception in 1990. Mr. Counselman was elected Chairman of the Board of the Company in January 2002. He has been President of Riggs, Counselman, Michaels & Downes, Inc., an insurance brokerage firm, since September 1987, and served in various executive positions with that firm from 1972 to September 1987.

John P. Hauswald – Mr. Hauswald, age 81, has served as a director of the Bank since 1964 and of the Company since its inception in 1990. He was, until his retirement in October 1989, President of The Hauswald Bakery. (4)

David P. Hessler – Mr. Hessler, age 47, has served as a director of the Bank since March 1999, and the Company since May 1999. He has been President and CEO of Eastern Sales & Engineering, an electrical contracting and service maintenance firm, since 1987 and was Vice President from 1986 to 1987. Mr. Hessler has been Vice President of Advanced Petroleum Equipment, a distributorship, since its inception in 1998. (1)(3)(4)

William C. Rogers, Jr. – Mr. Rogers, age 77, has served as a director of the Bank since 1955 and of the Company since its inception in 1990. He has been a partner in the law firm of Rogers, Moore and Rogers, counsel to the Bank, since 1950. He has been Chairman of the Board of The Security Title Guarantee Corporation of Baltimore since 1989 and a director since 1952, and was President from 1970 until March 1989. Mr. Rogers is President of Maryland Mortgage Company where he has been a director since 1953. He is also President of Moreland Memorial Park Cemetery, Inc. where he has been a director since 1959. He is the brother of John Paul Rogers, a director of the Bank and the Company.

- (1)

- Member of the Audit Committee

- (2)

- Member of the Compensation Committee

- (3)

- Member of the Nominating Committee

- (4)

- Independent Director

- (5)

- Financial expert for Audit Committee

The Board of Directors of the Company met 4 times and the Board of Directors of the Bank met 12 times during the year ended December 31, 2003. The Board of Directors of the Bank meets regularly 12 times each year. No director attended fewer than 75% of the total number of meetings of both Boards and committees to which they were assigned during the year ended December 31, 2003.

As of the date of this Proxy Statement, the Board of Directors has standing audit, nominating and compensation committees.

The Audit Committee held 13 meetings during 2003. Its current members are Messrs. Hackerman, Hessler, Klein and Moore. Only non-employee directors are eligible to serve on the Audit Committee. The duties of the Audit Committee include reviewing the quarterly and annual financial statements and regulatory filings of the Company and Bank and the scope of the independent annual audit and internal audits. It also reviews the independent accountant's letter to management concerning the effectiveness of the Company's internal financial and accounting controls and management's response to that letter. In addition, the Committee reviews and recommends to the Board the firm to be engaged as the Company's independent accountants. The Committee also approves all insider loans. The Committee may also examine and consider other matters relating to the financial affairs of the Company as it determines appropriate.

The Compensation Committee met four times during 2003. Its current members are Messrs. Aumiller, Breeden, Hackerman, Mason and Moore. The purpose of the Compensation Committee is to review and approve major compensation and benefit policies of the Company and the Bank. In addition, the committee recommends to the Board the compensation to be paid to all officers, Senior Vice President and above, of the Bank.

Directors who are not employees of the Bank receive a monthly fee of $900 for Board meetings, and between $75 and $150 per committee meeting attended. The Chairman of the Board of the Bank receives a monthly fee of $1,100. Directors do not receive additional fees for their service as directors of the Company.

OTHER EXECUTIVE OFFICERS AND

DIRECTORS OF THE BANK

Certain information regarding significant employees of the Bank other than those previously mentioned is set forth below.

Robert A. Altieri – Mr. Altieri, age 42, has been President and Chief Executive Officer of both the Bank and Company since his appointment in February 2001. Mr. Altieri previously was the Senior Vice President—Lending of the Bank since June 1994, and Vice President—Commercial Lending since September 1991.

Edward R. Bootey – Mr. Bootey, age 57, has been Senior Vice President—Automation & Technology since October, 1995, and was Senior Vice President—Operations of the Bank from June 1994 to

7

October 1995. Mr. Bootey previously served as Vice President—Operations from January 1991. He served as Assistant Vice President—Operations from December 1987 until January 1991.

John A. Giovanazi – Mr. Giovanazi, age 46, has been Senior Vice President and Chief Lending Officer since his appointment in February 2001. Mr. Giovanazi previously was Vice President of Commercial Lending since August 1996. Prior to joining Carrollton Bank, he was a Vice President, Commercial Lending, with Citizens Bank of Maryland, from 1992 to 1996.

Robert F. Hickey – Mr. Hickey, age 42, has been Senior Vice President—Branch Administration since December 2003. Prior to joining Carrollton Bank, Mr. Hickey was an Account Executive for Chase Manhattan Mortgage from 2000 to 2003. He served as President of Carrollton Mortgage Services, Inc. from 1997 to 2000.

Gary M. Jewell – Mr. Jewell, age 57, has been Senior Vice President—Electronic Banking since July 1998. He was previously Senior Vice President and Retail Delivery Group Manager from March 1996 to July 1998. Prior to joining the Bank, Mr. Jewell was Director of Product Management and Point of Sale Services for the MOST EFT network in Reston, Virginia from March 1995 to March 1996 and prior to that Director/Manager of Merchant Services for the Farmers and Mechanics National Bank from 1993 to March 1995.

Randall M. Robey – Mr. Robey, age 46, has been Executive Vice President and Chief Financial Officer of both the Bank and Company, since November 2000. Previously he had been the Senior Vice President and Chief Financial Officer and Treasurer since October 1999. Prior to joining the Bank, Mr. Robey was Vice President of Financial Services of Mercantile Bank & Trust in Baltimore, Maryland from June 1998 to October 1999, and prior to that Senior Vice President and Chief Financial Officer of Annapolis Bank & Trust from March of 1989 to June 1998.

CODE OF ETHICS

A Code of Ethics is in existence for the Chief Executive Officer, Chief Financial Officer and Bank Controller positions. There have been no exceptions to the Code of Ethics; any exceptions are required to be reported to the Audit Committee.

SECTION 16 (A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires the Company's directors and executive officers, and persons who own more than 10% of a registered class of the Company's equity securities ("10% Holders"), to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the Company. Directors, executive officers and 10% Holders are required by regulations under the Exchange Act to furnish the Company with copies of all of the Section 16(a) reports which they file. Based solely upon a review of copies of Forms 3 and 4 furnished to the Company during its fiscal year 2003 and copies of Form 5 furnished to the Company with respect to its fiscal year 2003, and any written representations made by the reporting persons to the Company, the Company believes that its directors, executive officers and 10% Holders complied with the filing requirements under Section 16(a) of the Exchange Act, except that Mr. Aumiller did not file a Form 4 on a timely basis to report the purchase of 105 shares of stock.

STOCK PERFORMANCE TABLE

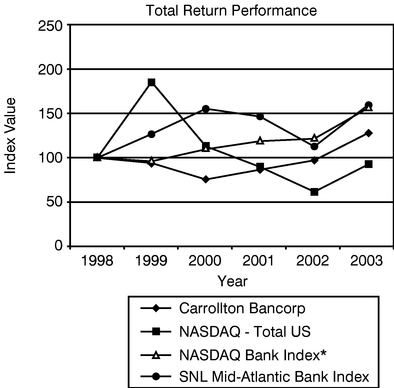

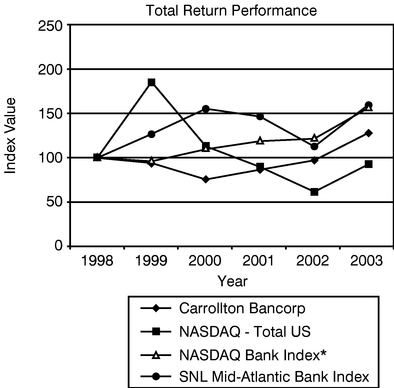

The Company is required by the SEC to provide a five-year comparison of the cumulative total Shareholder return on our Common Stock compared with that of a broad equity market index, and either a published industry index or a constructed peer group index of the Company.

The following chart compares the cumulative Shareholder return on the Company's Common Stock from December 31, 1998 to December 31, 2003 with the cumulative total of the NASDAQ Composite (U.S.), the NASDAQ Bank and SNL Mid-Atlantic Indices. The comparison assumes $100 was invested on December 31, 1998 in the Company's Common Stock and in each of the foregoing indices. It also assumes reinvestment of any dividends.

The Company does not make, nor does it endorse, any predictions as to future stock performance.

8

CARROLLTON BANCORP STOCK PERFORMANCE

| | Period Ending

|

|---|

Index

|

|---|

| | 12/31/98

| | 12/31/99

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

|

|---|

|

| Carrollton Bancorp | | 100.00 | | 94.10 | | 75.66 | | 86.61 | | 97.29 | | 128.33 |

| NASDAQ — Total US | | 100.00 | | 185.95 | | 113.19 | | 89.65 | | 61.67 | | 92.90 |

| NASDAQ Bank Index* | | 100.00 | | 96.15 | | 109.84 | | 118.92 | | 121.74 | | 156.62 |

| SNL Mid-Atlantic Bank Index | | 100.00 | | 127.05 | | 155.70 | | 146.73 | | 112.85 | | 160.45 |

*Source: CRSP, Center for Research in Security Prices, Graduate School of Business, The University of Chicago 2004. Used with permission. All rights reserved. crsp.com. |

9

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of March 1, 2004, certain information concerning shares of the Common Stock of the Company beneficially owned by (i) the executive officers of the Company and Bank; (ii) all directors and nominees for directors of the Company and the Bank; (iii) all directors and executive officers of the Company and the Bank as a group; and (iv) other significant shareholders.

Beneficial Owner(1)(21)

|

|

Amount and Nature

of Beneficial Ownership

|

|

Percent of Class

|

|

|---|

| |

|---|

| EXECUTIVE OFFICERS: | | | | | |

| Chief Executive Officer: Robert A. Altieri | | 26,773 | (2) | * | |

| Chief Financial Officer: Randall M. Robey | | 10,850 | (3) | * | |

| Senior Vice President—Bank: Edward R. Bootey | | 21,325 | (4) | * | |

| Senior Vice President—Bank: John A. Giovanazi | | 4,515 | (5) | * | |

| Senior Vice President—Bank: Robert F. Hickey | | 390 | | * | |

| Senior Vice President—Bank: Gary M. Jewell | | 16,800 | (6) | * | |

| DIRECTORS: | | | | | |

| Robert J. Aumiller | | 3,150 | (7) | * | |

| Steven K. Breeden | | 12,516 | (8) | * | |

| Albert R. Counselman | | 39,807 | (9) | 1.41 | % |

| Harold I. Hackerman | | 2,625 | (10) | * | |

| John P. Hauswald | | 16,072 | (11) | * | |

| David P. Hessler | | 3,990 | (12) | * | |

| Howard S. Klein | | 9,567 | (13) | * | |

| Ben F. Mason | | 69,619 | (14) | 2.46 | % |

| Charles E. Moore, Jr. | | 4,668 | (15) | * | |

| John Paul Rogers | | 206,992 | (16) | 7.32 | % |

| William C. Rogers, Jr. | | 274,226 | (17)(18)(19) | 9.70 | % |

| All Directors and Executive Officers of the Company as a Group (17 persons) | | 579,706 | (21) | 20.50 | % |

| OTHER SIGNIFICANT SHAREHOLDER: | | | | | |

| Patricia A. Rogers | | 192,062 | (20) | 6.79 | % |

- *

- Less than 1%

- (1)

- Unless otherwise indicated, the named person has sole voting and investment power with respect to all shares.

- (2)

- Includes 1,050 shares owned jointly by Mr. Altieri and his wife, 173 shares Mr. Altieri holds as trustee for minor children under the Maryland Uniform Gifts to Minors Act, and 25,550 fully vested options to purchase shares at an exercise price of between $10.94 and $17.79 per share.

- (3)

- Includes 100 shares owned jointly by Mr. Robey and his wife and 10,750 fully vested options to purchase shares at an exercise price of between $10.94 and $15.48 per share.

- (4)

- Includes 2,425 shares owned jointly by Mr. Bootey and his wife and 18,900 fully vested options to purchase shares at an exercise price of between $10.94 and $17.79 per share.

- (5)

- Includes 4,515 fully vested options to purchase shares at an exercise price of between $10.94 and $15.42 per share.

- (6)

- Includes 14,700 fully vested options to purchase shares at an exercise price of between $10.94 and $17.79 per share.

- (7)

- Includes 2,205 shares owned jointly by Mr. Aumiller and his wife and 840 fully vested options to purchase shares at an exercise price of between $9.71 and $14.50 per share.

- (8)

- Includes 3,777 shares owned jointly by Mr. Breeden and his wife and 3,780 fully vested options to purchase shares at an exercise price of between $9.71 and $18.10 per share.

- (9)

- Includes 3,780 fully vested options to purchase shares at an exercise price of between $9.71 and $18.10 per share, but excludes 7,982 shares owned by Mr. Counselman's wife.

- (10)

- Includes 1,470 shares owned jointly by Mr. Hackerman and his wife, and 1,050 fully vested options to purchase shares at an exercise price of between $12.11 and $14.50 per share.

- (11)

- Includes 210 shares owned jointly by Mr. Hauswald and his wife and 3,570 fully vested options to purchase shares at an exercise price of between $9.71 and $18.10 per share.

- (12)

- Includes 1,470 shares owned jointly by Mr. Hessler and his wife and 2,520 fully vested options to purchase shares at an exercise price of between $9.71 and $15.42 per share.

- (13)

- Includes 1,680 shares owned by Colgate Investments, LLP, of which Mr. Klein is partner and 2,079 shares Mr. Klein holds as trustee for minor children under the Maryland Uniform Gifts to Minors Act. Also includes 2,520 fully vested options to purchase shares at an exercise price of between $9.71 and $15.36 per share.

- (14)

- Includes 1,890 fully vested options to purchase shares at an exercise price of between $9.71 and $14.50 per share. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore of which Mr. Mason is a Director.

10

- (15)

- Includes 840 fully vested options to purchase shares at an exercise price of between $9.71 and $14.50 per share, but excludes 17,320 shares owned by Mr. Moore's wife.

- (16)

- Includes 3,780 fully vested options to purchase shares at an exercise price of between $9.71 and $18.10 per share. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore and 9,981 shares owned by Maryland Mortgage Company of which Mr. Rogers is a principal shareholder.

- (17)

- Includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore of which William C. Rogers, Jr. is Chairman, as well as a Director. Includes 3,360 fully vested options to purchase shares at an exercise price of between $9.71 and $18.10 per share.

- (18)

- Includes 6,818 shares owned by the Moreland Memorial Park Cemetery Bronze Perpetual Care Trust Agreement, Inc., 6,168 shares owned by Moreland Memorial Park Perpetual Care, 34,034 shares owned by Moreland Memorial Park Perpetual Care Trust, 3,597 shares owned by Moreland Memorial Park, Inc. Bronze Marker Perpetual Care Trust Fund, 6,168 shares owned by Moreland Memorial Park Cemetery, Inc. Perpetual Care Trust Agreement, and 9,981 shares owned by Maryland Mortgage Company of which William C. Rogers, Jr., is President as well as a Director.

- (19)

- Includes 137,001 shares owned jointly by Mr. Rogers and his wife. Excludes 12,251 shares owned by Mr. Roger's wife.

- (20)

- Includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore and 9,981 shares owned by Maryland Mortgage Company of which Mrs. Rogers is a principal shareholder.

- (21)

- All directors, executive officers and other significant shareholders may be contacted at the Company's corporate offices by addressing correspondence to the appropriate person, care of Carrollton Bancorp, 344 North Charles Street, Suite 300, Baltimore, Maryland 21201.

PRINCIPAL HOLDERS OF VOTING SECURITIES

The following table sets forth information with respect to the ownership of shares of Common Stock of the Company by the only persons believed by management to be the beneficial owners of more than five percent of the Company's outstanding Common Stock. The information is based on the most recent Schedule 13-G filed by such persons with the Securities and Exchange Commission.

Name and Address

of Beneficial Owner

| | Amount and Nature

of Beneficial

Ownership

| | Percentage of

Common Stock

Outstanding

| |

|---|

| |

|---|

John Paul Rogers

46 C Queen Anne Way

Chester, MD 21619 | | 206,992 | (a) | 7.3 | % |

William C. Rogers, Jr.

6 South Calvert Street

Baltimore, MD 21201 |

|

274,226 |

(b) |

9.7 |

% |

Patricia A. Rogers

P.O. Box 246

Gibson Island, MD 21056 |

|

192,062 |

(c) |

6.8 |

% |

- (a)

- A Schedule 13-G filed on February 12, 2004, states that John Paul Rogers has sole voting and dispositive power over 126,132 shares. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore, and 9,981 shares owned by Maryland Mortgage Company of which Mr. Rogers is a principal shareholder.

- (b)

- A Schedule 13-G dated February 12, 2004 states that William C. Rogers, Jr. has sole voting and dispositive power over 4,704 shares, and shared voting and dispositive power over 274,226 shares. Also includes 67,099 shares owned by the Security Title Guarantee Corporation of Baltimore of which Mr. Rogers is chairman, as well as a director; 9,981 shares owned by Maryland Mortgage Company of which Mr. Rogers is president as well as a director; and 56,785 shares owned by Moreland Memorial Park Cemetery, Inc. of which Mr. Rogers is a trustee.

- (c)

- A Schedule 13-G dated February 12, 2004 states that Patricia A. Rogers has sole voting and dispositive power over 114,982 shares. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore, and 9,981 shares owned by Maryland Mortgage Company of which Mrs. Rogers is a principal shareholder.

REPORT OF THE COMPENSATION COMMITTEE

OVERALL POLICY

The Board of Directors of the Company establishes the overall goals and objectives of, and the policies to be followed in pursuing these goals and objectives, including the selection of necessary key management personnel, and the evaluating of the performance of those personnel. The major responsibility for assisting in satisfying the compensatory aspect of the overall supervisory duty of the Board rests with the Compensation Committee. The membership of the Compensation Committees (collectively the "Committee") of the Company and the Bank is identical, composed of independent nonemployee Directors of both institutions who do not participate in any executive compensation plan.

In order to achieve the overall goals and objectives of the Company, and recognizing the interest of the shareholders in that achievement, the Committee has developed and maintains an executive compensation plan based on a philosophy that links executive compensation to individual and corporate performance, and return to shareholders. This philosophy is intended to enable the Company to attract and retain highly motivated executive personnel of outstanding ability and initiative, and to create an identity of interests between executives and the Company's shareholders. The Company's executive compensation plan consists of basic cash compensation, the opportunity for annual incentive compensation based on corporate performance, and continuing stock based compensation.

The Committee administers the provisions of the Company's incentive cash compensation plan and its stock based plans. In addition, the Committee is authorized to make recommendations to the Boards of the Company and the Bank with respect to basic salaries, supplemental pension, deferred compensation, employment and similar agreements affecting their executive officers, and performs such

11

other functions as may be delegated to it by the Boards.

The Committee takes various factors into consideration when establishing and reviewing executive compensation. There follows an explanation of general principles governing basic cash compensation, annual incentive compensation based on corporate earnings performance, stock based compensation, and the factors considered in establishing basic cash compensation for 2003.

BASIC CASH COMPENSATION

The Committee, in determining basic cash compensation of the executive officers of the Company, considers corporate profitability, financial condition, capital adequacy, return on assets and other factors. The Committee also considers the performance and compensation levels of other banking institutions as more fully set forth under the caption "2003 Compensation". The Committee does not consider these factors by any formula and does not assign specific weight to any given factor. Instead, the Committee applies its collective business judgment to reach a consensus on compensation fair to the Company, its shareholders and its executive officers.

STOCK BASED COMPENSATION

The 1998 Long-Term Incentive Plan, previously approved by the shareholders, was designed to create a common interest between key employees, non-employee board members and shareholders on a long-term basis, encouraging participants to maintain and increase their proprietary interests as shareholders in the Company with the opportunity to benefit from the long-term performance of the Company.

From 1998 through 2003, the Committee granted, under the 1998 Long-Term Incentive Plan, options for a total of 272,115 shares of Common Stock to directors and key employees of the Company and the Bank. The exercise price of the stock options equals the market price of the Common Stock on the date of grant and the options have a ten year life. Options are not performance-based and become exercisable in equal annual installments over three years.

2003 COMPENSATION

The Committee, in determining the 2003 basic cash compensation of the executive officers of the Company, considered the factors described in this Report.

Robert A. Altieri serves as President and Chief Executive Officer of the Company and President and Chief Executive Officer of the Bank and, as such, had the ultimate management responsibility for the strategic direction, performance, operating results and financial condition of the Company and its subsidiaries, and the carrying out of corporate policies and procedures. Randall M. Robey is Executive Vice President and Chief Financial Officer of the Company and the Bank; Edward R. Bootey is Senior Vice President—Operations of the Bank; Robert F. Hickey is Senior Vice President—Branch Administration of the Bank; John A. Giovanazi is Senior Vice President—Lending of the Bank; Gary M. Jewell is Senior Vice President—Electronic Banking of the Bank.

The Committee was aware of 2003 earnings of the Company. The Committee further reviewed profitability and capital strength ratios (return on assets, net interest margin, efficiency ratio, equity to assets and return on equity) and loan loss performance ratios (period-end non-performing assets to loans and foreclosed real estate, net charge-offs to average loans and period-end allowance for loan losses to non-performing loans) as compared to comparable information for peer banking companies with assets from $250 to $500 million, considered by an independent analyst as the Company's peer group. The Committee compared similar ratios showing profitability, capital adequacy, reserve strength, and asset quality with those of the peer institutions as prepared by that financial analyst. The Committee was aware of the strategic plan of improving profitability and the factors that influence management's ability to accomplish strategic goals under the plan in the current economic environment in its assessment of management's performance.

The Committee compared the proposed compensation of Mr. Altieri with independent studies published in 2002 reflecting compensation information for 2001 of the peer group commercial banking institutions participating in the study and with the compensation of executive officers of banking institutions, based on proxy information covering institutions comparable to the Company in terms of criteria including the nature and quality of operations, or geographic proximity. This group included financial institutions having high returns on assets, capital significantly in excess of that required by current federal regulations, and located within a 100 mile radius of Baltimore so as to include companies operating in a comparable economic climate. No target was established in the comparison with this group of institutions.

The Committee concluded that the Company's profitability is below comparisons while capital strength ratios continued to be strong, and that loan loss ratios were favorable, both standing alone and in comparison to the banking companies constituting the peer group. Based on the Committees review and its evaluation of the qualifications, experience and responsibilities of Mr. Altieri and the other members of executive management, and of the importance of the continued services for transitional and other purposes, the Committee approved the compensation and other arrangements with Mr. Altieri, Mr. Robey, Mr. Bootey, Mr. Giovanazi and Mr. Jewell as described in the Summary Compensation Table in this Proxy Statement.

12

Section 162(m) of the Internal Revenue Code provides for non-deductibility, in certain cases, of compensation paid to certain executives in excess of $1 million per year. The Company does not have a policy limiting compensation to amounts deductible under Section 162(m). The annual incentive plan and the Omnibus Stock Plans have been approved by the shareholders and are designed to be qualified performance-based plans so that Section 162(m) limits would not apply to plan benefits. Section 162(m) limits would apply to salary, bonuses in excess of bonuses under the annual incentive compensation plan and certain amounts included under "Other Annual Compensation" and "All Other Compensation" in the Summary Compensation Table.

| | The Compensation Committee |

| | | Ben F. Mason, Chair

Robert J. Aumiller

Steven K. Breeden

Harold I. Hackerman

Charles E. Moore, Jr. |

| Note: | | Albert R. Counselman served as a member of the Compensation Committee until November 2003. Steven K. Breeden and Robert J. Aumiller were appointed to the Compensation Committee in January 2004. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

In 2003, the Company and the Bank had banking and other relationships, in the ordinary course of business, with a number of its Directors and companies associated with them. The Company purchased insurance from Riggs, Counselman, Michaels & Downes, Inc. of which Mr. Counselman is President. The insurance coverage purchased was made on substantially the same terms, as those prevailing at the time, for comparable transactions with others. Management believes the terms of the insurance coverage obtained through Riggs, Counselman, Michaels & Downes, Inc. were at least as favorable to the Company as could have been obtained elsewhere.

Outstanding loans exist to Mr. Breeden, Mr. Moore and their related companies which were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with others not considered outsiders, and did not involve more than the normal risk of collectibility or present other unfavorable features.

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid or allocated for services rendered to the Company in all capacities during the years ended December 31, 2003, 2002, and 2001 to the chief executive officer of the Company, as well as other members of Executive Management whose compensation exceeded $100,000 in 2003.

SUMMARY COMPENSATION TABLE

Name and

Principal Position

| | Year

| | Salary

| | Long-Term

Incentive Plan

Stock Options

Grants (Shares)

| | Bonus

|

|---|

|

|---|

Robert A. Altieri

President and Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 180,600

184,515

172,943 | | 0

8,400

10,500 | | $

$

$ | 0

0

0 |

Randall M. Robey

Executive Vice President and Chief Financial Officer |

|

2003

2002

2001 |

|

$

$

$ |

125,648

127,109

119,682 |

|

0

5,250

7,350 |

|

$

$

$ |

0

0

0 |

Gary M. Jewell

Senior Vice President |

|

2003

2002

2001 |

|

$

$

$ |

99,757

97,576

90,392 |

|

0

3,150

3,150 |

|

$

$

$ |

20,566

14,524

9,135 |

John A. Giovanazi

Senior Vice President |

|

2003

2002

2001 |

|

$

$

$ |

109,865

106,933

88,418 |

|

0

3,150

3,150 |

|

$

$

$ |

0

0

0 |

Edward R. Bootey

Senior Vice President |

|

2003

2002

2001 |

|

$

$

$ |

100,286

96,908

83,384 |

|

0

3,150

3,150 |

|

$

$

$ |

0

0

0 |

The Company had no employment agreements, termination of employment, or change-in-control agreements or understandings with any of its directors, executive officers or any other party whatsoever.

LONG-TERM INCENTIVE PLAN

The 1998 Long-Term Incentive Plan, (the "Plan") which was approved at the 1998 Annual Meeting of Shareholders, authorizes the granting of awards in the form of options, stock appreciation rights, restricted stock, performance awards, phantom shares, bonus shares or cash awards. Any executive or other employee of the Company, its subsidiaries, affiliated entities and non-employee Directors of the Company shall be eligible to receive awards under the Plan. Non-employee Directors of subsidiaries or affiliated entities of the Company will not be eligible to participate in the Plan.

The Plan provides for 210,000 shares of the Company's Common Stock to be issued as awards under the Plan, either directly or upon exercise of an option. The Plan provides for appropriate adjustments in the number of shares subject to the Plan in the event of a stock dividend, stock split, reverse stock split or other similar changes in the Company's common stock or in the event of a merger, consolidation or certain other types of recapitalizations affecting the Company.

13

OPTION GRANTS IN 2003

The following table contains information concerning the grant of stock options under the Long-Term Incentive Plan to the Chief Executive Officer and other members of Executive Management whose compensation exceeded $100,000.

| |

| |

| |

| |

| | Potential Realizable Value

at Assumed Annual Rates of

Stock Appreciation for

Option Term

|

|---|

| |

| | % of Total

Options Granted to

Employees

in year

| |

| |

|

|---|

| | Options Granted

(Number of Shares)

| | Exercise or Base

Price

| | Expiration Date

|

|---|

Name

| | 5%

| | 10%

|

|---|

|

|---|

| Robert A. Altieri | | 0 | | 0 | % | $ | 0.00 | | — | | $ | 0 | | $ | 0 |

| Randall M. Robey | | 0 | | 0 | % | $ | 0.00 | | — | | $ | 0 | | $ | 0 |

| Edward R. Bootey | | 0 | | 0 | % | $ | 0.00 | | — | | $ | 0 | | $ | 0 |

| John A. Giovanazi | | 0 | | 0 | % | $ | 0.00 | | — | | $ | 0 | | $ | 0 |

| Gary M. Jewell | | 0 | | 0 | % | $ | 0.00 | | — | | $ | 0 | | $ | 0 |

A total of 9,930 incentive stock options were granted in 2003 under the 1998 Long-Term Incentive Plan to directors and employees. Of that total, 6,930 incentive stock options were granted to directors at an exercise price of $14.50. The options granted to directors vest over a three-year period and expire, if not exercised, in 2013. There were no grants in 2003 for restricted stock, stock appreciation rights, performance grants, phantom shares, bonus shares or cash awards.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During the past year the Company has had banking transactions in the ordinary course of its business with: (i) its directors and nominees for directors; (ii) its executive officers; (iii) its 5% or greater shareholders; (iv) members of the immediate family of its directors, nominees for directors or executive officers and 5% shareholders; and (v) the associates of such persons on substantially the same terms, including interest rates, collateral, and repayment terms on loans, as those prevailing at the same time for comparable transactions with others. The extensions of credit by the Company to these persons have not had and do not currently involve more than the normal risk of collectibility or present other unfavorable features. At December 31, 2003, the balance of loans outstanding to directors, executive officers, owners of 5% or more of the outstanding Common Stock, and their associates, including loans guaranteed by such persons, aggregated $3,209,200 which represented approximately 9.4% of the Company's equity capital accounts.

William C. Rogers, Jr., a director of both the Company and the Bank, is a partner of the law firm of Rogers, Moore and Rogers, which performs legal services for the Company, the Bank, and Bank subsidiaries (Carrollton Financial Services, Inc., Carrollton Mortgage Services, Inc., and Carrollton Community Development Corporation). Management believes that the terms of these transactions, which totaled $259,502 in 2003, were at least as favorable to the Company as could have been obtained elsewhere.

Albert R. Counselman, a director of both the Company and the Bank, is President and Chief Executive Officer of Riggs, Counselman, Michaels & Downes, Inc., an insurance brokerage firm through which the Company, the Bank, and Bank subsidiaries place various insurance policies. The Company and the Bank paid total premiums for insurance policies placed by Riggs, Counselman, Michaels & Downes, Inc in 2003 of $244,721. Related commissions on these policies amounted to $32,528 in 2003. Management believes that the terms of these transactions were at least as favorable to the Company as could have been obtained elsewhere.

Robert J. Aumiller, a director of both the Company and the Bank is Executive Vice President of MacKenzie Real Estate Services, a brokerage and real estate development firm, through which the Company and the Bank paid for commercial real estate services of $100,949 in 2003 for appraisal and property management services provided by MacKenzie Commercial Real Estate Services. Management believes these terms were as favorable as could have been obtained elsewhere.

David P. Hessler, a director of both the Company and the Bank, is the President and Chief Executive Officer of Eastern Sales and Services, a firm which performs electrical services for the Company, the Bank, and Bank subsidiaries. Management believes that the terms of these transactions, which totaled

14

$3,341 in 2003, were at least as favorable as could have been obtained elsewhere.

VOTING PROCEDURES

Generally, each proposal submitted to the Company shareholders for a vote is deemed approved if a majority of the shareholders present, in person or by proxy, at a meeting at which a quorum is present, votes in favor of the proposal. The presence of a majority, in person or by proxy, of shareholders entitled to cast votes at the meeting constitutes a quorum. A shareholder is entitled to one vote for each share owned.

Shareholder votes are tabulated by the Company's Registrar and Transfer Agent. Proxies received by the Company, if such proxy is properly executed and delivered, will be voted in accordance with the voting specifications made on such proxy. Proxies received by the Company on which no voting specification has been made by the shareholder will be voted "for" all items discussed in the Proxy Statement, in the manner stated on the proxy card. Shareholders who execute and deliver proxies retain the right to revoke them by notice delivered to the Company Secretary at any time before such proxies are voted.

The vote of a plurality of all of the votes cast at a meeting at which a quorum is present is necessary for the election of a director. For purposes of the election of directors, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will count toward the presence of a quorum.

SUBMISSION OF MATTERS TO A VOTE OF SHAREHOLDERS

There have been no matters submitted to a vote of the Company's shareholders since its 2003 Annual Shareholders' Meeting held on April 22, 2003.

SHAREHOLDER PROPOSALS FOR THE 2005 ANNUAL MEETING

Proposals of shareholders to be presented at the 2005 Annual Meeting of the Company must be received at the Company's principal executive offices prior to November 19, 2004 in order to be included in the proxy statement for such meeting. In order to curtail controversy as to compliance with this requirement, shareholders are urged to submit proposals to the Secretary of the Company by Certified Mail—Return Receipt Requested.

If a shareholder intends to submit a proposal at the 2005 Annual Meeting of the Company that is not eligible for inclusion in the proxy statement and proxy, the shareholder must do so no later than February 4, 2005.

PROPOSAL 2: RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS

The Company's Board of Directors has selected the firm of Rowles & Company, LLP, certified public accounts, as independent auditors for the Company for the fiscal year 2004 and seeks ratification of such selection by the shareholders of the Company. Rowles & Company, LLP has served as independent auditors for the Company since 1955. No qualified opinions have been issued during such engagement. A representative of Rowles & Company, LLP will be present at the 2004 Annual Shareholders' Meeting.

A majority of votes cast at the meeting is required at this meeting for approval of this proposal. Abstentions and broker non-votes will have no effect on the vote for this proposal.

Your Company's Board of Directors unanimously recommends a vote "FOR" the ratification of the appointment of Rowles & Company, LLP as independent public accountants for fiscal year 2004.

AUDIT COMMITTEE REPORT

The Audit Committee has adopted a written charter which is included in this document. The members of the Audit Committee are independent as such term is defined in Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards. The Audit Committee has (1) reviewed and discussed the Company's audited financial statements with Company management and representatives of Rowles & Company, LLP, the Company's independent auditors; (2) discussed with Rowles & Company, LLP all matters required to be discussed by SAS No. 61, as modified or supplemented; and (3) has received the written disclosures and the letter from Rowles & Company, LLP required by Independence Standards Board Standard No. 1, as modified or supplemented and has discussed with Rowles & Company, LLP the independence of Rowles & Company, LLP. Based on its review and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements for the year ended December 31, 2003 be included in the Company's Annual Report on Form 10-K for the last fiscal year.

Audit Committee: |

|

By: |

|

Harold I. Hackerman

David P. Hessler

Howard S. Klein

Charles E. Moore, Jr. |

Note: |

|

Albert R. Counselman served as a member of the Audit Committee until November 2003. |

15

PROPOSAL 3: AMENDMENT OF THE 1998 LONG TERM INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES AVAILABLE FOR ISSSUANCE.

The shareholders are being asked to approve an amendment to the Company's 1998 Long-Term Incentive Plan in order to increase the number of shares of common stock reserved for issuance under the plan, and the number of shares of common stock for which options may be granted by 90,000, to an aggregate of 300,000.

The purpose of the Incentive Plan is to advance the interests of the Company by enabling it to attract and retain outstanding key management employees and non-employee directors, and to provide an incentive to and encourage stock ownership in the Company by those employees and directors responsible for the policies and operations of the Company. By encouraging such stock ownership, the Company seeks to attract, retain and motivate the best available personnel for positions of substantial responsibility and to provide additional incentive to key employees and directors of the Company and its subsidiaries to promote the success of the business as measured by the value of its shares, and to increase the commonality of interests among key employees, directors and other shareholders. The principal features of the Incentive Plan are described above under the caption "Report Of The Compensation Committee-Stock Based Compensation." Except as proposed to be amended hereby, the provisions of the Incentive Plan, as currently in effect, will continue in full force and effect. The exercise price of the stock options equals the market price of the Common Stock on the date of grant and the options have a ten year life. Options are not performance-based and become exercisable in equal annual installments over three years.

REASONS FOR THE AMENDMENT

Since adoption of the Incentive Plan, awards for an aggregate of 272,115 shares have been granted to directors, officers and employees of the Company and the Bank or reserved for future issuance in accordance with the terms of outstanding awards. As of March 2, 2004 only 29,130 shares remain available for issuance under the Incentive Plan. The Board of Directors feels that this number of shares is inadequate to permit the Company to appropriately compensate employees, officers and directors in coming years. If the amendment to the Incentive Plan is approved, an aggregate of 119,130 shares will be available for issuance upon the exercise of future options grants.

The Board of Directors believes that the availability of a stock based compensation program is necessary in order to attract and retain high caliber directors, officers and employees in key positions. The Board of Directors also believes that such a plan is necessary to align the interests of such persons with the interests of the Company's shareholders, which will increase their incentive to improve the Company's performance. As such, the Board of Directors believes that the authorization of additional shares for issuance under the Incentive Plan is necessary in order to permit the Company's continued growth and profitability.

If the amendment to the Incentive Plan is approved, the total number of shares subject to issuance under outstanding and future awards pursuant to the Incentive Plan will be 300,000 or 10.61% of the outstanding common stock, and 9.41% of the common stock assuming the exercise of all options.

NEW PLAN BENEFITS

Approximately 136 employees and 11 Directors are currently eligible to participate in the Incentive Plan. The number of shares that may be granted to executive officers and non-executive officers is undeterminable at this time, as such grants are subject to the discretion of the Committee.

FEDERAL INCOME TAX CONSEQUENCES

The following discussion is a general summary of the material federal income tax consequences to participants in the Plan. The discussion is based on the Internal Revenue Code, regulations thereunder, rulings and decisions now in effect, all of which are subject to change. The summary does not discuss all aspects of federal income taxation that may be relevant to a particular participant in light of such participant's personal investment circumstances. Also, state and local income taxes are not discussed and may vary from locality to locality.

Non-Qualified Stock Options. Currently, an optionee who is granted a non-qualified stock option will not realize taxable income at the time the option is granted. In general, an optionee will be subject to tax for the year of exercise on an amount of ordinary income equal to the excess of the fair market value of the shares over the option price. The Company will be entitled to an income tax deduction equal to the amount of ordinary income recognized by the optionee with respect to the exercised non-qualified stock option. The deduction will, in general, be allowed for the taxable year in which such ordinary income is recognized by the optionee.

Incentive Options. No taxable income is recognized by the optionee at the time of the option grant, and no taxable income is generally recognized at the time the option is exercised. The optionee will, however, recognize taxable income in the year in which the purchased shares are sold or

16

otherwise made the subject of a taxable disposition. For Federal income tax purposes, dispositions are divided into two categories: (i) qualifying and (ii) disqualifying. A qualifying disposition occurs if the sale or other disposition is made after the optionee has held the shares for more than two years after the option grant date and more than one year is not met, then a disqualifying disposition will result.

If the optionee makes a disqualifying disposition of the purchased shares, then the Company will be entitled to an income tax deduction, for the taxable year in which such disposition occurs, equal to the excess of (i) fair market value of such share on the option exercise date over (ii) the exercise price paid for the shares. In no other instance will the Company be allowed a deduction with respect to the optionee's disposition of the purchase shares.

Stock Appreciation Rights. An optionee who is granted a stock appreciation right will recognize ordinary income in the year of exercise equal to the amount of the appreciated distribution. The Company will be entitled to an income tax deduction equal to such distribution for the taxable year in which the ordinary income is recognized by the optionee.

Restricted Stock. Recipients of Shares of restricted Stock that are not "transferable" and are subject to "substantial risk of forfeiture" at the time of grant will not be subject to federal income taxes until lapse or release of the restrictions on the shares, unless the recipient files a specific election under the Code to be taxed at the time of the grant. The recipients income and the Company's tax deduction will be equal to the fair market value of the shares on the date of lapse or release of such restrictions (or on the date of grant if such election is made) less any purchase price.

Performance Awards. Upon receipt of the shares or cash underlying a performance award, the recipient will be taxed at ordinary income tax rates on the amount of cash received and/or the current fair market value of stock received. The Company will be entitled to an income tax deduction equal to the distribution for the taxable year in which the ordinary income is recognized by the recipient.

Bonus Shares and Cash Awards. A recipient of bonus shares and/or cash awards will be taxed at ordinary income tax rates on the amount of cash received and/or the current fair market value of stock received after the exercise date. If either of these two holding periods Company will be entitled to an income tax deduction equal to the distribution for the taxable year in which the ordinary income is recognized by the recipient.

A majority of affirmative votes cast at the meeting on the proposal to amend the Incentive Plan is required for the approval of the amendment to the Incentive Plan. Abstention and broker non-votes will have no effect on the vote for approval on the amendment to the Incentive Plan.

Your Company's Board of Directors unanimously recommends a vote "FOR" the approval of the amendment to the Incentive Plan.

Plan Category

| | (a)

Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | (b)

Weighted-

average exercise price of outstanding options, warrants and rights

| | (c)

Number of

securities

remaining

available for

future issuance

under equity

compensation plans (excluding securities reflected in column (a))

|

|---|

|

|---|

| 1998 Long Term Incentive Plan approved by security holders | | 174,785 | | $13.88 | | 29,130 |

THE AUDIT COMMITTEE CHARTER

PURPOSE

The Audit Committee is appointed by the Board of Directors (the "Board") to assist the Board in monitoring (1) the integrity of the financial statements of Carrollton Bancorp, Inc. (the "Company"), (2) the independent auditor's qualifications and independence, and (3) the performance of the Company's internal audit function and independent auditors, and (4) the compliance by the Company with legal and regulatory requirements.

The primary responsibility of the Audit Committee is to oversee the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company on behalf of the Board and report the results of its activities to the Board. Management is responsible for preparing the Company's financial statements and related disclosures and the Company's independent auditors are responsible for auditing those financial statements. It is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles ("GAAP"). It shall be the duty of the Audit Committee to assist the Board in the oversight of the Company's legal and regulatory requirements.

17

COMMITTEE MEMBERSHIP

The Audit Committee shall consist of no fewer than three and no more than five members, each of whom shall be a non-employee director of the Company. Each member of the Audit Committee shall meet the independence and experience requirements of the listing standards of NASDAQ, Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act") and the rules and regulations of the Securities and Exchange Commission ("SEC"), and all other applicable legal requirements, including the requirement that at least one member of the Audit Committee be an "audit committee financial expert" within the meaning of rules promulgated by the SEC under the Sarbanes-Oxley Act of 2002. Each member of the Audit Committee must be able to read and understand fundamental financial statements, including a balance sheet, income statement and cash flow statement. A majority of the members of the Committee shall constitute a quorum.

Audit Committee members shall be appointed and may be replaced by the Board.

The Audit Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or consultants to, the Committee without the consent of management or the Board. The Audit Committee shall meet with management, the internal auditors and the independent auditor in separate executive sessions at least quarterly. The Audit Committee shall make regular reports to the Board. The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Policy Committee and to the Board for approval. The Audit Committee shall annually review the Audit Committee's own performance and present such review to the Board.

STATEMENT OF POLICY

The Audit Committee shall provide assistance to the Board in fulfilling its responsibility to the shareholders, potential shareholders, the investment community and others relating to the Company's corporate accounting and financial reporting processes, the systems of internal accounting and financial controls, the internal audit function, and the annual independent audit of the Company's financial statements.

In carrying out its responsibilities, the Audit Committee believes its policies and procedures should remain flexible, in order to best react to changing circumstances and conditions.

The Committee, and each member of the Committee in his or her capacity as such, shall be entitled to rely, in good faith, on information, opinions, reports or statements, or other information prepared or presented to them by (i) officers and other employees of the Company or Carrollton Bank, whom such member believes to be reliable and competent in the matters presented, (ii) counsel, public accountants or other persons as to matters which the member believes to be within the professional competence of such person.

COMMITTEE AUTHORITY AND RESPONSIBILITIES

- •

- Responsibilities Relating to Retention of Public Accounting Firms – The Committee shall have the sole authority and be directly responsible for the appointment, compensation, oversight of the work, evaluation and termination of any accounting firm employed by the Company (including resolving disagreements between management and the auditor regarding financial reporting) for the purpose of preparing or issuing an audit report and related work. The accounting firm shall report directly to the Committee.

- •

- Pre-approval of Services – All auditing services (which may entail providing comfort letters in connection with securities underwritings) and all non-audit services, provided to the Company by the Company's auditors, subject to exception set forth below, shall be pre-approved by the Committee pursuant to such processes as are determined to be advisable. Pre-approval shall include blanket pre-approval of non-prohibited services for limited dollar amounts which the Committee, in its business judgment, does not believe possess the potential for abuse or conflict.

- •

- Exception – The pre-approval requirement set forth above, shall not be applicable with respect to the provision of non-audit services, if:

- i.

- the aggregate amount of all such non-audit services provided to the Company constitutes not more than 5 percent of the total amount of revenues paid by the Company to its auditor during the fiscal year in which the non-audit services are provided;

- ii.

- such services were not recognized by the Company at the time of the engagement to be non-audit services; and

- iii.

- such services are promptly brought to the attention of the Committee and approved prior to the completion of the audit by the

18

FINANCIAL STATEMENT AND DISCLOSURE MATTERS

The Audit Committee, to the extent it deems necessary or appropriate, shall:

- •

- Review and discuss with management and the independent auditor the annual audited financial statements, including disclosures made in management's discussion and analysis of financial condition and results of operation, and recommend to the Board whether the audited financial statements should be included in the Company's Form 10-K.

- •

- Review and discuss with management and the independent auditor the Company's quarterly financial statements, including the disclosures made in management's discussion and analysis of financial condition and results of operations prior to the filing of the Company's Form 10-Q, including the results of the independent auditors' reviews of the quarterly financial statements.

- •

- Discuss with management and the independent auditor significant financial reporting issues and judgments made in connection with the preparation of the Company's financial statements, including (i) any significant changes in the Company's selection or application of accounting principles, (ii) any major issues as to the adequacy of the Company's internal controls, (iii) the development, selection and disclosure of critical accounting estimates, (iv) analyses of the effect of alternative assumptions, estimates or GAAP methods on the Company's financial statements, (v) analyses and disclosure of financial trends, and (vi) presentation of the financial statements and notes thereto.

- •

- Review and discuss reports from the independent auditors on (i) all critical accounting policies and practices to be used; (ii) all alternative treatments of financial information within GAAP that have been discussed with management officials of the Company, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditors; and (iii) other material written communications between the independent auditors and management of the Company, such as any management letter or schedule of unadjusted differences.

- •

- Discuss with management the Company's earnings press releases, including the use of "pro forma," "adjusted" or other non-GAAP information, as well as financial information and earnings guidance provided to analysts and rating agencies.

- •

- Discuss with management and the independent auditor the effect of accounting initiatives as well as off-balance sheet structures on the Company's financial statements.

- •

- Discuss with management, the internal auditors and the legal/compliance department the effect of regulatory initiatives on the Company's financial statements.

- •

- Discuss with management the Company's major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company's risk assessment and risk management policies.

- •

- Discuss with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit including:

- i.

- The adoption of, or changes to, the Company's significant auditing and accounting principles and practices.

- ii.

- The management letter provided by the independent auditor and the Company's response to that letter.

19

- iii.

- Any difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or access to requested information, or personnel and any significant disagreements with management.

- •

- Review disclosures made to the Audit Committee by the Company's chief executive officer and chief financial officer during the certification process for the Form 10-K and Form 10-Q about any significant deficiencies in the design or operation of internal controls or material weaknesses therein and any fraud involving management or other employees who have a significant role in the Company's internal controls.

- •

- Review and sign the call report prior to its filing.

OVERSIGHT OF THE COMPANY'S RELATIONSHIP WITH THE INDEPENDENT AUDITOR

- •

- Review the experience and qualifications of the senior members of the independent auditor team.

- •

- Obtain and review a written report from the independent auditor at least annually regarding (i) the independent auditor's internal quality-control procedures, (ii) any material issues raised by the most recent quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years concerning one or more independent audits carried out by the firm (iii) any steps taken to deal with any such issues, and (iv) all relationships, both direct and indirect, between the independent auditor and the Company. Evaluate the qualifications, performance and independence of the independent auditor, including considering whether the auditor's quality controls are adequate and the provision of non-audit services is compatible with maintaining the auditor's independence, and taking into account the opinions of management and the internal auditor. The Audit Committee shall present its conclusions to the Board and, if so determined by the Audit Committee, recommend that the Board take additional action to satisfy itself of the qualifications, performance and independence of the auditor.

- •

- Ensure the rotation of the lead (or coordinating) audit partner having primary responsibility for the audit and the audit partner responsible for reviewing the audit as required by law. Consider whether, in order to assure continuing auditor independence, it is appropriate to adopt a policy of rotating the lead audit partner or even the independent auditing firm itself on a regular basis.

- •

- Recommend to the Board policies for the Company's hiring of employees or former employees of the independent auditor who were engaged on the Company's account.

- •

- Discuss with the independent auditor issues on which the independent auditor communicated with its national office regarding auditing or accounting issues.

- •

- Meet with the independent auditor prior to the audit to discuss the planning and staffing of the audit.

OVERSIGHT OF THE COMPANY'S INTERNAL AUDIT FUNCTION

- •

- Review the appointment and replacement of the senior internal auditing executive.

- •

- Review the significant reports to management prepared by the internal auditing department and management's responses.

- •

- Discuss with the independent auditor and management the internal audit department responsibilities, budget and staffing and any recommended changes in the planned scope of the internal audit.

COMPLIANCE OVERSIGHT

- •

- Obtain from the independent auditor such assurance as it deems adequate that such auditor has fulfilled its responsibilities under Section 10A(b) of the Exchange Act.

- •

- Obtain reports from management, the Company's senior internal auditing executive and the regulatory compliance and legal/compliance department relating to the Company's conformity with applicable legal and regulatory requirements. Review reports and disclosures of insider and affiliated party transactions.

- •

- Review with management, the Company's internal auditors and the Company's legal/compliance department compliance with laws and regulations. Advise the Board with respect to the Company's compliance with applicable laws and regulations.

- •

- Review with the appropriate officers and/or the Company's legal counsel, pending material litigation and compliance matters.

20

- •

- The Committee will address and take action, as it deems necessary or appropriate, with respect to any issues regarding the provisions of the Company's Code of Ethics to the extent the issue relates to accounting and disclosure and regulations of the SEC, the NASDAQ or other bank regulatory authority, and to the extent such misrepresentation or omission relates to financial statements or related financial information.

- •

- The Committee will address and take any action, as it deems necessary or appropriate, with respect to any issues relating to inquiries or investigations regarding the quality of financial reports filed by the Company with the SEC or otherwise distributed to the public.

MISCELLANEOUS POWERS AND RESPONSIBILITIES

- •

- The Committee shall have the power to investigate any matter brought to its attention within the scope of its duties, with the power to retain outside counsel for this purpose if, in its judgment, that is appropriate.

- •

- The Committee shall have the responsibility to submit the minutes of all meetings of the Audit Committee to the Board of Directors.

- •

- The Committee shall have the responsibility of reviewing and assessing the adequacy of this Charter at least annually.

- •

- The Audit Committee shall have the responsibility to prepare the report required to be included in the Company's annual proxy statement by the rules of the Securities and Exchange Commission.

- •

- The Committee shall have the power to access the Company's counsel without the approval of management, as it determines necessary to carry out its duties.

- •

- The Audit Committee shall also have the authority without the consent of management or the Board, to the extent it deems necessary or appropriate, to retain special independent legal, accounting or other consultants to advise the Committee in connection with fulfilling its obligations hereunder. The Company shall provide for appropriate funding, as determined by the Audit Committee, for payment of compensation to the independent auditor for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company and to any advisors employed by the Audit Committee.

- •

- The Committee shall have the responsibility of discussing with management and the independent auditor any significant or material correspondence with regulators or governmental agencies, including all examination reports received from the various supervisory authorities, and any employee complaints or published reports that raise material issues regarding the Company's financial statements or accounting policies and review management's replies to such correspondence, complaints, or reports.

- •

- The Committee shall have the responsibility to discuss with the Company's General Counsel legal matters that may have a material impact on the financial statements or the Company's compliance policies.

- •

- The Committee shall make provision to examine all dealings between the Company or Bank and members of the Committee and to examine or have examined all dealings between the Company or Bank and any company by whom a Committee member may be employed.

- •