QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

CARROLLTON BANCORP |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

CARROLLTON BANCORP

344 North Charles Street, Suite 300

Baltimore, Maryland 21201

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 18, 2006

TO THE SHAREHOLDERS OF CARROLLTON BANCORP:

The Annual Meeting of Shareholders of Carrollton Bancorp, a Maryland corporation (the "Company"), will be held at 344 North Charles Street, Baltimore, Maryland on [April 18, 2006 at 10:00 a.m.], prevailing local time, for the purpose of considering and acting upon:

- 1.

- The election of four directors for a three-year term ending in 2009, or until their respective successors are duly elected and qualified.

- 2.

- The ratification of the appointment of Rowles & Company, LLP as the Independent Registered Public Accounting Firm to serve for the fiscal year ending December 31, 2006.

- 3.

- Any other matters that may properly come before the meeting or any adjournment thereof.

The close of business on March 1, 2006, has been fixed by the Board of Directors as the record date for determining shareholders entitled to receive notice of and to vote at the Annual Meeting.

Your attention is directed to the enclosed Proxy Statement and annual report of the Company for the fiscal year ended December 31, 2005.

PLEASE SIGN, DATE AND MAIL THE ACCOMPANYING PROXY IN THE ENCLOSED, SELF-ADDRESSED, STAMPED ENVELOPE, AS DIRECTED ON THE PROXY CARD IN ORDER THAT YOUR STOCK MAY BE VOTED. YOU MAY WITHDRAW YOUR PROXY AT THE MEETING SHOULD YOU BE PRESENT AND DESIRE TO VOTE YOUR SHARES IN PERSON. YOUR COOPERATION IS RESPECTFULLY REQUESTED.

| | By Order of the Board of Directors |

|

Allyson Cwiek

Secretary |

Baltimore, Maryland

March 17, 2006

3

(This Page Intentionally Left Blank)

4

CARROLLTON BANCORP

344 North Charles Street, Suite 300

Baltimore, Maryland 21201

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

APRIL 18, 2006

SOLICITATION AND REVOCATION OF PROXIES

This Proxy Statement (the "Proxy Statement") is furnished on or about March 17, 2006 to the shareholders of Carrollton Bancorp (the "Company") in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting of Shareholders, and any adjournments thereof. Our principal executive offices are located at 344 North Charles Street, Baltimore, Maryland 21201.

The Board of Directors has selected Robert J. Aumiller, Steven K. Breeden, and Harold I. Hackerman and each of them, to act as proxies with full power of substitution. A proxy may be revoked at any time prior to its exercise by giving written notice of revocation to the Company, by executing and delivering a substitute proxy to the Company, or by attending the Annual Meeting and voting in person. If no instructions are specified in the proxy, it is the intention of the persons named therein to voteFOR the election of the nominees named herein as directors of the Company, andFOR the ratification of Rowles and Company, LLP as the Independent Registered Public Accounting Firm to audit the financial statements of the Company for 2006.

Shareholders of the Company are requested to complete, date and sign the accompanying form of proxy and return it promptly to the Company in the enclosed envelope. If a proxy is properly executed and returned in time for voting, it will be voted as indicated thereon.

The Company does not know of any matter to be presented at the Annual Meeting except as described herein. If any other matters are properly brought before the Annual Meeting, the persons named in the enclosed proxy intend to vote the proxy according to their best judgment.

The Company will bear the costs of the solicitation of proxies, including the reimbursement of banks, brokers and other fiduciaries for expenses in forwarding proxy solicitation materials to beneficial owners. Such expenses are estimated not to exceed $5,000. Solicitations may be made by mail, telegraph or personally by directors, officers or employees of the Company, none of whom will receive additional compensation for performing such services.

VOTING PROCEDURES

Generally, each proposal submitted to the Company shareholders for a vote is deemed approved if a majority of the votes cast by the shareholders present, in person or by proxy, at a meeting at which a quorum is present, are in favor of the proposal. The presence of a majority, in person or by proxy, of shareholders entitled to cast votes at the meeting constitutes a quorum. A shareholder is entitled to one vote for each share owned.

Shareholder votes are tabulated by the Company's Registrar and Transfer Agent. Proxies received by the Company, if such proxy is properly executed and delivered, will be voted in accordance with the voting specifications made on such proxy. Proxies received by the Company on which no voting specification has been made by the shareholder will be voted "for" all items discussed in the Proxy Statement, in the manner stated on the proxy card. Shareholders who execute and deliver proxies retain the right to revoke them by notice delivered to the Company Secretary at any time before such proxies are voted.

The vote of a plurality of all of the votes cast at a meeting at which a quorum is present is necessary for the election of a director. For purposes of the election of directors, abstentions and broker non-votes will not be counted as votes cast and will have no effect on the result of the vote, although they will count toward the presence of a quorum. For purposes of the Annual Meeting, however, there should not be any broker "non-votes" because a broker who holds shares for a beneficial owner and does not receive voting instructions from the beneficial owner has discretionary authority to vote on each of the proposals to be considered at the Annual Meeting.

SUBMISSION OF MATTERS TO A VOTE OF SHAREHOLDERS

There have been no matters submitted to a vote of the Company's shareholders since its 2005 Annual Shareholders' Meeting held on April 19, 2005.

5

VOTING SECURITIES

On March 1, 2006, the Company had outstanding 2,813,268 shares of Common Stock, $1.00 par value per share. Each share of Common Stock entitles the holder thereof to one vote on each matter to be voted upon at the Annual Meeting. Neither the Company's Charter nor its Bylaws provides for cumulative voting rights.

The close of business on March 1, 2006 has been fixed by the Board of Directors as the record date for determining the shareholders entitled to receive notice of and to vote at the Annual Meeting.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Board of Directors is divided into three classes. Each year the directors in one class are elected to serve for a term of three years, or until their respective successors are duly elected and qualified. The Shareholders will vote at this Annual Meeting for the election of four directors for the three-year term expiring at the Annual Meeting of Shareholders in 2009.

The proxies solicited hereby, unless directed to the contrary, will be voted FOR the election as directors of all four nominees listed in the following tables. In order to be elected, a plurality of the shares voted at a meeting at which a quorum is present is necessary for the election of a director. Each nominee has consented to serve as a director, if elected.

Your Company's Board of Directors unanimously recommends a vote FOR the election of each of the nominees named below as directors of the Company.

In the event that any of the nominees should be unable to serve on the Board of Directors, the persons named in the proxy will vote for such substitute nominee or nominees as they, in their sole discretion, shall determine. The Board of Directors has no reason to believe that any nominee named here will be unable to serve. Alternatively, the Board of Directors may elect to reduce the size of the Board of Directors.

The following material shows, as of December 31, 2005, the names and ages of all nominees, the principal occupation and business experience of each nominee during the last five years and the year in which each nominee was first elected to the Board of Directors. The material also contains information on those directors whose terms continue beyond the date of the Annual Meeting.

NOMINEES FOR DIRECTORS WHOSE TERMS EXPIRE IN 2006

Albert R. Counselman – Mr. Counselman, age 57, has served as a director of Carrollton Bank ("the Bank"), the principal subsidiary of the Company, since April 1985 and of the Company since its inception in 1990. Mr. Counselman was elected Chairman of the Board of the Company in January 2002. He has been President and Chief Executive Officer of Riggs, Counselman, Michaels & Downes, Inc., an insurance brokerage firm, since September 1987, and served in various executive positions with that firm from 1972 to September 1987.

John P. Hauswald – Mr. Hauswald, age 83, has served as a director of the Bank since 1964 and of the Company since its inception in 1990. He was, until his retirement in October 1989, President of The Hauswald Bakery. (4)

David P. Hessler – Mr. Hessler, age 49, has served as a director of the Bank since March 1999, and the Company since May 1999. He has been President and CEO of Eastern Sales & Engineering, an electrical contracting and service maintenance firm, since 1987 and was Vice President from 1986 to 1987. Mr. Hessler has been Vice President of Advanced Petroleum Equipment, a distributorship, since its inception in 1998. (1)(3)(4)

William C. Rogers, Jr. – Mr. Rogers, age 79, has served as a director of the Bank since 1955 and of the Company since its inception in 1990. He has been a partner in the law firm of Rogers, Moore and Rogers, counsel to the Bank, since 1950. He has been Chairman of the Board of The Security Title Guarantee Corporation of Baltimore since 1989 and a director since 1952, and was President from 1970 until March 1989. Mr. Rogers is President of Maryland Mortgage Company where he has been a director since 1953. He is also President of Moreland Memorial Park Cemetery, Inc. where he has been a director since 1959. He is the brother of John Paul Rogers, a director of the Bank and the Company.

- (1)

- Member of the Audit Committee

- (2)

- Member of the Compensation Committee

- (3)

- Member of the Nominating/Corporate Governance Committee

- (4)

- Independent Director

- (5)

- Financial expert for Audit Committee

6

DIRECTORS CONTINUING IN OFFICE

DIRECTORS WHOSE TERMS EXPIRE IN 2007

Robert J. Aumiller – Mr. Aumiller, age 57, currently is serving as a director of the Bank and the Company beginning with his appointment in 2001. He has been the Executive Vice President and General Counsel of MacKenzie Commercial Real Estate Services, LLC involved in brokerage and real estate development of various commercial real estate projects, since 1983. (2)

Ben F. Mason – Mr. Mason, age 68, currently is serving as a director of the Bank and the Company beginning with his appointment in 2001. He is the Special Assistant to the President of Sojourner-Douglass College since January 2006 and formerly Executive Vice President of the Plexus Corporation, a network engineering corporation, as of August 2004. Prior to August 2004, Mr Mason served as the Executive Director of the Baltimore City Chamber of Commerce, a member business association that promotes business development within Baltimore City. (2)(4)

Charles E. Moore, Jr. – Mr. Moore, age 56, currently is serving as a director of the Bank and the Company beginning with his appointment in 2001. He has been the Co-Founder, Director, President and CFO of TelAtlantic, a consolidation of rural telephone companies across the United States, since 1999. (1)(2)(3)(4)

John Paul Rogers – Mr. Rogers, age 70, has served as director of the Bank since 1970 and of the Company since its inception in 1990. Mr. Rogers has been Chairman of the Board of the Bank since February 1994. He was a partner of the law firm of Rogers, Moore and Rogers, counsel of the Bank, from 1970 until 1992. Mr. Rogers was senior title officer of The Security Title Guarantee Corporation of Baltimore from May 1991 until December 1992, having served as President from March 1989 until May 1991, and as Executive Vice President from March 1970 until March 1989. He is the brother of William C. Rogers, Jr., a director of the Bank and the Company.

DIRECTOR WHOSE TERMS EXPIRE IN 2008

Steven K. Breeden – Mr. Breeden, age 47, has served as a director of the Bank, since June 1994, and of the Company since October 1995. Mr. Breeden is currently a managing member of Security Development LLC and related real estate and development companies, a position he has held since 1980. (2) (3) (4)

Harold I. Hackerman – Mr. Hackerman, age 54, has served as a director of the Bank and the Company since February 2002. Since 1984, Mr. Hackerman has been Vice President of Ellin & Tucker, a certified public accounting firm, and has provided audit, accounting and consulting services since 1973. (1) (2) (4) (5)

Howard S. Klein – Mr. Klein, age 47, has served as a director of the Bank since March 1999 and of the Company since April 1999. Mr. Klein has been Vice President and General Counsel for Klein's Super Markets, a family-operated chain of seven full service supermarkets and related development and operating companies since

1987. (1) (4)

FAMILY RELATIONSHIPS

Mr. John Paul Rogers and Mr. William C. Rogers are brothers. Mr. Howard S. Klein is married to Messrs. Rogers' niece.

COMMITTEES OF THE BOARD OF DIRECTORS

The Board of Directors has an Audit Committee, Nominating/Corporate Governance Committee, Compensation Committee, Executive Committee, Loan Committee, Strategic Plan Committee, Facilities Committee, and an Asset/Liability Committee. The Audit Committee, The Compensation Committee, and The Nominating/Corporate Governance Committee are discussed below.

The Audit Committee held thirteen meetings during 2005. Its current members are Messrs. Hackerman, Hessler, Klein, and Moore. Only non-employee independent directors are eligible to serve on the Audit Committee. The Audit Committee is established pursuant to Section 3(a) (58) (A) of the Exchange Act and is responsible for reviewing the quarterly and annual financial statements and regulatory filings of the Company and Bank and the scope of the independent annual audit and internal audits. It also reviews the independent accountant's letter to management concerning the effectiveness of the Company's internal financial and accounting controls and management's response to that letter. In addition, the Committee reviews and recommends to the Board the firm to be engaged as the Company's Independent Registered Public Accounting Firm. The Committee also approves all insider loans. The Committee may also examine and consider other matters relating to the financial affairs of the Company as it determines appropriate.

The Compensation Committee met five times during 2005. Its current members are Messrs. Aumiller, Breeden, Hackerman, Mason and Moore. The purpose of the Compensation Committee is to review and approve major compensation and benefit policies of the Company and the Bank. In addition, the committee recommends to the Board the compensation to be paid to all officers, Senior Vice President and above, of the Bank.

7

The Nominating/Corporate Governance Committee held no meetings during 2005. Its members are Messrs. Breeden, Hessler and Moore. The purposes of the Nominating/Corporate Governance Committee are (a) to assist the Board by identifying individuals qualified to become Board members and to recommend to the Board nominees for the next annual meeting of shareholders, (b) to recommend to the Board the corporate governance principles applicable to us, (c) to lead the Board in its annual review of its performance, and (d) to recommend to the Board members and chairpersons of each committee.

DIRECTOR COMPENSATION

Directors who are not employees of the Bank received a monthly fee of $1,000 for Board meetings, and between $200 and $250 per committee meeting attended. The Chairman of the Board of the Bank received a monthly fee of $1,250. Directors do not receive additional fees for their service as directors of the Company. On November 17, 2005, the Board of Directors approved an additional $300 for Board members and $400 for the Chairman of the Board for attendance at the regular Board meetings to be effective January 1, 2006. In addition, the Board of Directors approved $400 for the Audit Committee members, $450 for the Audit Committee Chairman, $300 for the Loan Committee members and $350 for the Loan Committee Chairman for each committee meeting attended. After review of a report by a consultant on director fees, the Compensation Committee recommended and the Board of Directors approved on February 23, 2006 increasing the Bank Chairman's fee $200, the Company Chairman's fee $100, and the Audit Committee Chairman's fee $150 per meeting. All other committee fees remained the same.

ATTENDANCE AT BOARD MEETINGS

The Board of Directors of the Company met nine times and the Board of Directors of the Bank met fifteen times during the year ended December 31, 2005. The Board of Directors of the Bank meets regularly twelve times each year. No director attended fewer than 75% of the total number of meetings of both Boards and committees to which they were assigned during the year ended December 31, 2005.

SHAREHOLDER COMMUNICATIONS WITH THE BOARD

Shareholders may send communications to the Board by mailing the same addressed to: Board of Directors, Carrollton Bancorp, Suite 300, 344 North Charles Street, Baltimore, Maryland 21201.

DIRECTOR NOMINATION PROCESS

The Nominating/Corporate Governance Committee operates pursuant to a charter adopted by the Board, a copy of which is attached to this proxy statement and can also be found on the Company's website atwww.carrolltonbank.com.

In recommending director nominees, the Nominating/Corporate Governance Committee will consider candidates recommended by the Company's stockholders. Notice of Nominees to the Board recommended by shareholders must be timely delivered in writing to the Secretary of the Company prior to the meeting. To be timely, the notice must be delivered within the time permitted for nomination of directors in Article I, Section VII of the Bylaws of the Company. The notice must include:

- •

- information regarding the shareholder making the nomination, including name, address, and the number of shares of our stock beneficially owned by the shareholder; and

- •

- the name and address of the person(s) being nominated and such other information regarding each nominee that would be required in a proxy statement filed pursuant to the proxy rules adopted by the Securities and Exchange Commission if the person had been nominated for election by or at the direction of the Board of Directors;

The Nominating/Corporate Governance Committee will evaluate nominees recommended by shareholders against the same criteria that it uses to evaluate other nominees. Whether recommended by a stockholder or chosen independently by the Nominating/Corporate Governance Committee, a candidate will be recommended for nomination based on his or her talents in relation to the talents of the existing Board members and the needs of the Board. It is the goal of the Nominating/Corporate Governance Committee in recommending director nominees to foster relationships among directors that are complimentary and that will make the Board most effective. A candidate, whether recommended by a Company stockholder or otherwise, will not be considered for nomination unless he or she (i) is of good character, (ii) is a citizen of the United States, (iii) owns shares of Company common stock the aggregate value of which is not less than $500, as determined in accordance with the Financial Institutions Article of the Annotated Code of Maryland, and (iv) satisfies all other requirements imposed under applicable law. Additionally, the Nominating/Corporate Governance Committee believes that it is important for candidates recommended for nomination to have the ability to attract business to the Company, live or work within the communities in which the Company operates, and possess the skills and expertise necessary to provide leadership to the Company. Certain Board positions, such as Audit Committee membership, may require other special skills or expertise. To identify potential nominees for the Board, the Nominating/Corporate Governance Committee first evaluates the current members of the Board willing to continue in service. Current members of the Board are considered for re-nomination, balancing the value of their continued service with that of obtaining new perspectives and in view of

8

our developing needs. If necessary, the Nominating/Corporate Governance Committee then solicits ideas for possible candidates from a number of sources, which can include other Board members, senior management, individuals personally known to members of the Board and research. The Nominating/Corporate Governance Committee may also retain a third party to assist it in identifying potential nominees; however, the committee has not done so in the past.

The Nominating/Corporate Governance Committee is responsible for assembling and maintaining a list of qualified candidates to fill vacancies on the Board. The Nominating/Corporate Governance Committee periodically reviews this list and researches the talent, skills, expertise, and general background of these candidates.

AUDIT COMMITTEE REPORT

The Audit Committee has adopted a written charter which was included as part of the definitive proxy statement delivered to stockholders with respect to the 2004 Annual Meeting. The members of the Audit Committee are "independent" as such term is defined in Rule 4200(a)(15) of the National Association of Securities Dealers' listing standards and applicable SEC rules. The Audit Committee has (1) reviewed and discussed the Company's audited financial statements with management and representatives of Rowles & Company, LLP, the Company's Independent Registered Public Accounting Firm; (2) discussed with Rowles & Company, LLP all matters required to be discussed by Statement on Auditing Standards No. 61, as amended by Statement on Auditing Standards No. 90 (Communication with Audit Committees); and (3) reviewed the written disclosures required by Independence Standards Board Standard No. 1, which were received from the Company's Independent Registered Public Accounting Firm, and has discussed the Independent Registered Public Accounting Firm's independence with them. The Audit Committee has reviewed the fees of the Independent Registered Accounting Firm for non-audit services and believes that such fees are compatible with the independence of the Independent Registered Accounting Firm.

Based on these reviews and discussions, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended December 31, 2005.

Audit Committee:

| | | By: | Charles E. Moore, Jr., Chair |

| | | | Harold I. Hackerman |

| | | | David P. Hessler |

| | | | Howard S. Klein |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has ratified and affirmed the Audit Committee's appointment of the accounting firm of Rowles & Company, LLP, to serve as Independent Registered Public Accounting Firm for the Company for 2006 subject to ratification by the shareholders of the Company. Rowles & Company, LLP has served as independent auditors for the Company since 1955. No qualified opinions have been issued during such engagement. A representative of Rowles & Company, LLP will be present at the 2006 Annual Shareholders' Meeting.

A majority of votes cast at the meeting is required at this meeting for approval of this proposal. Abstentions and broker non-votes will have no effect on the vote for this proposal.

The Board of Directors unanimously recommends a vote "FOR" ratification.

AUDIT FEES AND SERVICES

| | 2005

| | 2004

|

|---|

|

|---|

| Audit Fees | | $ | 75,880 | | $ | 72,762 |

| Audit – Related Fees | | | 9,995 | | | 12,662 |

| Tax Fees | | | 9,998 | | | 9,292 |

| All Other Fees | | | — | | | — |

| | |

| |

|

| | Total | | $ | 95,873 | | $ | 94,716 |

| | |

| |

|

Audit services of Rowles & Company, LLP for 2005 consisted of professional services rendered for the audit of the Company's annual consolidated financial statements included in the Company's Form 10-K and the review of the consolidated financial statements included in the Company's Quarterly Reports on Forms 10-Q. "Audit- Related Fees" incurred in 2005 include charges related to the Company's defined benefit plan audit and the Company's 401(K) plan audit. "Tax Fees" in 2005 represent income tax return preparation and advice.

9

Audit services of Rowles & Company, LLP for 2004 consisted of professional services rendered for the audit of the Company's annual consolidated financial statements included in the Company's Form 10-K and the review of the consolidated financial statements included in the Company's Quarterly Reports on Forms 10-Q. "Audit- Related Fees" incurred in 2004 include charges related to Federal Home Loan Bank Mortgage Collateral Verification audit and the Company's defined benefit plan audit and the Company's 401(K) plan audit. "Tax Fees" in 2004 represent income tax return preparation and advice.

The Audit Committee's policy is to pre-approve all audit and permitted non-audit services other thande minimis non-audit services as defined in Section 10A(i)(1) of the Exchange Act, which will be approved prior to the completion of the independent auditor's report. The Audit Committee has reviewed summaries of the services provided and the related fees and has determined that the provision of non-audit services is compatible with maintaining the independence of Rowles & Company, LLP

FINANCIAL INFORMATION SYSTEMS DESIGN AND IMPLEMENTATION FEES

During the year ended December 31, 2005, Rowles & Company, LLP did not render to the Company any professional services with regard to financial information systems design and implementation described in paragraph (c)(4)(ii) of Rule 2-01 of Regulation S-X.

EXECUTIVE OFFICERS

Certain information regarding significant employees of the Bank other than those previously mentioned is set forth below.

Robert A. Altieri – Mr. Altieri, age 44, has been President and Chief Executive Officer of both the Bank and Company since his appointment in February 2001. Mr. Altieri previously was the Senior Vice President – Lending of the Bank since June 1994, and Vice President – Commercial Lending since September 1991.

Edward R. Bootey – Mr. Bootey, age 59, has been Senior Vice President – Automation & Technology since October, 1995, and was Senior Vice President – Operations of the Bank from June 1994 to October 1995. Mr. Bootey previously served as Vice President – Operations from January 1991. He served as Assistant Vice President – Operations from December 1987 until January 1991.

John A. Giovanazi – Mr. Giovanazi, age 48, has been Senior Vice President and Chief Lending Officer since his appointment in February 2001. Mr. Giovanazi previously was Vice President of Commercial Lending since August 1996. Prior to joining Carrollton Bank, he was a Vice President, Commercial Lending, with Citizens Bank of Maryland, from 1992 to 1996.

Robert F. Hickey – Mr. Hickey, age 44, has been Senior Vice President – Branch Administration since December 2003. Prior to joining Carrollton Bank, Mr. Hickey was an Account Executive for Chase Manhattan Mortgage from 2000 to 2003. He served as President of Carrollton Mortgage Services, Inc. from 1997 to 2000.

Gary M. Jewell – Mr. Jewell, age 59, has been Senior Vice President – Electronic Banking since July 1998. He was previously Senior Vice President and Retail Delivery Group Manager from March 1996 to July 1998. Prior to joining the Bank, Mr. Jewell was Director of Product Management and Point of Sale Services for the MOST EFT network in Reston, Virginia from March 1995 to March 1996 and prior to that Director/Manager of Merchant Services for the Farmers and Mechanics National Bank from 1993 to March 1995.

James M. Uveges – Mr. Uveges, age 55, replaced Barbara M. Broczkowski as Senior Vice President and Chief Financial Officer of the Bank on June 6, 2005. See Form 8K filed on May 24, 2005. He was previously an Interim Executive Consultant from May 2004 to June 2005. Prior to that, Mr. Uveges held the position of Senior Vice President and Chief Financial Officer at Spectera, Inc. from March 1999 to April 2004, Susquehanna Bank from January 1998 to February 1999 and American National Bancorp from 1990 to 1997.

10

EXECUTIVE COMPENSATION

The following table sets forth the compensation paid or allocated for services rendered to the Company in all capacities during the years ended December 31, 2005, 2004, and 2003 to the chief executive officer of the Company, as well the next four most highly compensated members of Executive Management whose compensation also exceeded $100,000 in 2005.

SUMMARY COMPENSATION TABLE

| | Annual Compensation

| |

| | Long Term Compensation

| |

|---|

| |

| |

| |

| |

| | Awards

| | Payouts

| |

|---|

Name and principal position

| | Year

| | Salary

| | Bonus

| | Restricted Stock

Awards

| | Securities

Underlying

Options/SARs

| | LTIP

payouts

| | All Other

Compensation

| |

|---|

| |

|---|

Robert A. Altieri

President and Chief

Executive Officer | | 2005

2004

2003 | | $

| 200,648

191,879

180,600 | | $

| 0

0

0 | | $

| 0

0

0 | | 10,000

0

0 | | $

| 0

0

0 | | $

| 12,218

4,873

3,653 | (1)

(1)

(1) |

Gary M. Jewell

Senior Vice President

|

|

2005

2004

2003 |

|

|

109,782

104,931

99,757 |

|

|

28,072

26,736

20,566 |

|

|

0

0

0 |

|

5,000

5,000

0 |

|

|

0

0

0 |

|

|

7,747

3,295

2,633 |

(2)

(2)

(2) |

John A. Giovanazi

Senior Vice President |

|

2005

2004

2003 |

|

|

121,221

115,825

109,865 |

|

|

0

5,500

0 |

|

|

0

0

0 |

|

5,000

5,000

0 |

|

|

0

0

0 |

|

|

7,542

2,975

2,359 |

(3)

(3)

(3) |

Robert F. Hickey

Senior Vice President |

|

2005

2004

2003 |

|

|

116,217

113,089

8,461 |

|

|

0

0

0 |

|

|

0

0 |

|

5,000

5,000

3,000 |

|

|

0

0 |

|

|

3,666

180

0 |

(4)

(4)

|

Edward R. Bootey

Senior Vice President |

|

2005

2004

2003 |

|

|

109,343

104,941

100,286 |

|

|

0

0

0 |

|

|

0

0

0 |

|

5,000

3,000

0 |

|

|

0

0

0 |

|

|

4,916

3,098

2,682 |

(5)

(5)

(5) |

Randall M. Robey

Former Executive Vice

President and Chief

Financial Officer |

|

2005

2004

2003 |

|

|

NA

125,486

127,109 |

|

|

NA

0

0 |

|

|

NA

0

0 |

|

NA

5,000

0 |

|

|

NA

0

0 |

|

|

NA

1,092

1,299 |

(6)

(6) |

- (1)

- For 2005, amount includes $12,038 as a safe harbor and matching contribution to the Bank's 401(K) plan and $180 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2004, amount includes $4,693 as a matching contribution to the Bank's 401(K) plan and $180 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2003, amount includes $3,473 as a matching contribution to the Bank's 401(K) plan and $180 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000.

- (2)

- For 2005, amount includes $6,973 as a safe harbor and matching contribution to the Bank's 401(K) plan and $774 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2004, amount includes $2,521 as a matching contribution to the Bank's 401(K) plan and $774 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2003, amount includes $1,859 as a matching contribution to the Bank's 401(K) plan and $774 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000.

- (3)

- For 2005, amount includes $7,272 as a safe harbor and matching contribution to the Bank's 401(K) plan and $270 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2004, amount includes $2,705 as a matching contribution to the Bank's 401(K) plan and $270 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2003, amount includes $2,089 as a matching contribution to the Bank's 401(K) plan and $270 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000.

11

- (4)

- For 2005, amount includes $3,486 as a safe harbor contribution to the Bank's 401(K) plan and $180 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2004, amount includes $180 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000.

- (5)

- For 2005, amount includes $4,142 as a safe harbor and matching contribution to the Bank's 401(K) plan and $774 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2004, amount includes $2,324 as a matching contribution to the Bank's 401(K) plan and $774 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2003, amount includes $1,908 as a matching contribution to the Bank's 401(K) plan and $774 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000.

- (6)

- Mr. Robey left the Company's employment effective August 31, 2004. In connection with his separation from the Company, Mr. Robey received severance of $62,500 payable in thirteen equal bi-weekly installments. For 2004, amount includes $822 as a matching contribution to the Bank's 401(K) plan and $270 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000. For 2003, amount includes $2,029 as a matching contribution to the Bank's 401(K) plan and $270 attributed to the portion of the premium paid by the Bank for a group term life insurance policy for coverage in excess of $50,000.

RETIREMENT PLANS

The Company had a defined benefit pension plan covering substantially all of the employees. Benefits are based on years of service and the employee's highest average rate of earnings for the three consecutive years during the last five full years before retirement. Assets of the plan are held in a trust fund managed by an insurance company. Effective December 31, 2004, the Company froze the Plan. Participant benefits stopped accruing as of the date of the freeze.

The following table shows the estimated annual retirement benefits payable under the Carrollton Bank Retirement Income Plan to persons in specified average compensation and credited service classifications, assuming retirement at age 65.

Final three-year

Average Compensation

| | Years of Service

|

|---|

| | 10

| | 15

| | 20

|

|---|

|

|---|

| $125,000 | | $ | 21,500 | | $ | 32,250 | | $ | 43,000 |

| $150,000 | | | 26,250 | | | 39,375 | | | 52,500 |

| $175,000 | | | 31,000 | | | 46,500 | | | 62,000 |

| $200,000 | | | 35,750 | | | 53,625 | | | 71,500 |

Compensation covered by the Retirement Income Plan was W-2 earnings up to the current compensation limit in effect for the plan year. Benefits are payable on a ten-year certain and life annuity basis.

As of December 31, 2005, for purposes of computing benefits under the Retirement Plan, age and years of credited service of the Company's Named Executives are as follows:

Name

| | Age

| | Years of

Service

|

|---|

|

|---|

| Robert A. Altieri | | 44 | | 15 |

| Gary M. Jewell | | 59 | | 9 |

| John A. Giovanazi | | 48 | | 9 |

| Robert F. Hickey | | 44 | | 2 |

| Edward R. Bootey | | 59 | | 31 |

The Company has a contributory thrift plan qualifying under Section 401(K) of the Internal Revenue Code. Employees with one year of service are eligible for participation in the Plan. In conjunction with the curtailment of the pension plan, the Company expanded the thrift plan to make it a Safe Harbor Plan. Once an employee has been at the Company for one year, the Company then contributes 3% of the employee's salary quarterly to the Plan for the employee's benefit. The Company also matches 50% of the employee's 401(K) contribution up to 6% of the employee's compensation. The Company's contributions to this Plan, included in employee benefit expenses were $292,080, $92,485 and $70,678 for 2005, 2004, and 2003, respectively.

12

LONG-TERM INCENTIVE PLAN

The 1998 Long-Term Incentive Plan, as amended, (the "Plan") which was approved at the 1998 Annual Meeting of Shareholders and amended as of December 2, 2004, authorizes the granting of awards in the form of options, stock appreciation rights, restricted stock, performance awards, phantom shares, bonus shares or cash awards. Any executive or other employee of the Company, its subsidiaries, affiliated entities and non-employee Directors of the Company shall be eligible to receive awards under the Plan. Non-employee Directors of subsidiaries or affiliated entities of the Company will not be eligible to participate in the Plan.

The Plan provides for 300,000 shares of the Company's Common Stock to be issued as awards under the Plan, either directly or upon exercise of an option. The Plan provides for appropriate adjustments in the number of shares subject to the Plan in the event of a stock dividend, stock split, reverse stock split or other similar changes in the Company's common stock or in the event of a merger, consolidation or certain other types of recapitalizations affecting the Company

OPTION GRANTS IN 2005

The following table contains information concerning the grant of stock options under the Long-Term Incentive Plan to the Chief Executive Officer and other members of Executive Management whose compensation exceeded $100,000.

| |

| |

| |

| |

| | Potential Realizable

Value at

Assumed Annual

Rates of Stock

Appreciation for

Option Term

|

|---|

| | Options Granted

(Number of

Shares)

| | % of Total

Options Granted to

Employees

in year

| | Exercise or

Base

Price

| |

|

|---|

Name

| | Expiration Date

| | 5%

| | 10%

|

|---|

|

|---|

| Robert A. Altieri | | 10,000 | | 21% | | $ | 14.50 | | 12/15/2015 | | $ | 260,949 | | $ | 415,518 |

| Edward R. Bootey | | 5,000 | | 11% | | | 14.50 | | 12/15/2015 | | | 130,474 | | | 207,759 |

| John A. Giovanazi | | 5,000 | | 11% | | | 14.50 | | 12/15/2015 | | | 130,474 | | | 207,759 |

| Robert F. Hickey | | 5,000 | | 11% | | | 14.50 | | 12/15/2015 | | | 130,474 | | | 207,759 |

| Gary M. Jewell | | 5,000 | | 11% | | | 14.50 | | 12/15/2015 | | | 130,474 | | | 207,759 |

A total of 53,930 incentive stock options were granted in 2005 under the 1998 Long-Term Incentive Plan, as amended, to directors and employees. Of that total, 6,930 stock options were granted to directors at an exercise price of $14.45. The options granted to directors vest over a three-year period and expire, if not exercised, in 2015. On December 15, 2005, The Board of Directors authorized 42,000 options to officers and the immediate vesting of such options and all outstanding options to officers where the exercise price of the option exceeded the fair market value of the Company's stock. This resulted in 47,000 of the 53,930 options granted in 2005 becoming vested that would otherwise have vested in future years. There were no grants in 2005 for restricted stock, stock appreciation rights, performance grants, phantom shares, and bonus shares or cash awards.

AGGREGATED OPTIONS EXERCISES IN THE LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

The following table provides information concerning options for Common Stock exercised by the Company's Named Executives in 2005 and the value of options held by each at December 31, 2005

| |

| |

| | Number of Shares

Underlying Unexercised

Options at Fiscal Year-End

| | Value of Unexercised

In-the-Money Options at

Fiscal Year-End (1)

|

|---|

| | Shares

Acquired on

Exercise

| |

|

|---|

| | Value

Realized

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

|

|---|

| Robert A. Altieri | | — | | — | | 44,650 | | 0 | | $ | 72,072 | | $ | 0 |

| Gary M. Jewell | | — | | — | | 27,850 | | 0 | | $ | 18,985 | | $ | 0 |

| John A. Giovanazi | | — | | — | | 17,665 | | 0 | | $ | 23,441 | | $ | 0 |

| Robert F. Hickey | | — | | — | | 13,000 | | 0 | | $ | 2,500 | | $ | 0 |

| Edward R. Bootey | | — | | — | | 30,050 | | 0 | | $ | 27,505 | | $ | 0 |

- (1)

- Value represents the difference between the option price and the market value of the common stock on December 31, 2005, rounded to the nearest dollar.

CODE OF ETHICS

A Code of Ethics is in existence for all employees with a specific one for the Chief Executive Officer, Chief Financial Officer, and a Controller. There have been no exceptions to the Code of Ethics; any exceptions are required to be reported to the Audit Committee.

13

STOCK PERFORMANCE TABLE

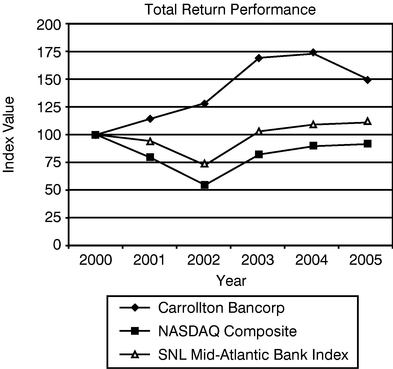

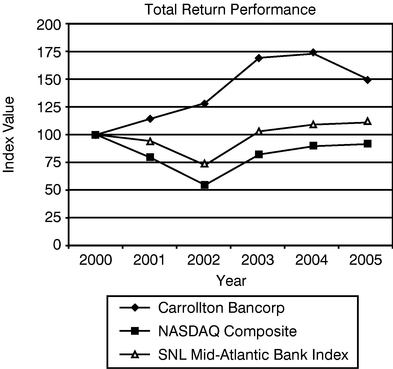

The Company is required by the SEC to provide a five-year comparison of the cumulative total Shareholder return on our Common Stock compared with that of a broad equity market index, and either a published industry index or a constructed peer group index of the Company.

The following chart compares the cumulative Shareholder return on the Company's Common Stock from December 31, 2000 to December 31, 2005 with the cumulative total of the NASDAQ Composite (U.S.), the NASDAQ Bank and SNL Mid-Atlantic Indices. The comparison assumes $100 was invested on December 31, 2000 in the Company's Common Stock and in each of the foregoing indices. It also assumes reinvestment of any dividends.

The Company does not make, nor does it endorse, any predictions as to future stock performance.

| | Period Ending

|

|---|

Index

|

|---|

| | 12/31/00

| | 12/31/01

| | 12/31/02

| | 12/31/03

| | 12/31/04

| | 12/31/05

|

|---|

|

| Carrollton Bancorp | | 100.00 | | 114.48 | | 128.59 | | 169.62 | | 173.29 | | 150.17 |

| NASDAQ Composite | | 100.00 | | 79.18 | | 54.44 | | 82.09 | | 89.59 | | 91.54 |

| SNL Mid-Atlantic Bank Index | | 100.00 | | 94.24 | | 72.48 | | 103.05 | | 109.15 | | 111.08 |

14

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of December 31, 2005, certain information concerning shares of the Common Stock of the Company beneficially owned by (i) the executive officers of the Company and Bank; (ii) all directors and nominees for directors of the Company and the Bank; (iii) all directors and executive officers of the Company and the Bank as a group; and (iv) other significant shareholders.

Beneficial Owner(1)(21)

| | Amount and Nature

of Beneficial Ownership

| | Percent of Class

| |

|---|

| |

|---|

| EXECUTIVE OFFICERS: | | | | | |

| Chief Executive Officer: Robert A. Altieri | | 45,877 | (2) | 1.63 | % |

| Senior Vice President—Bank: Edward R. Bootey | | 32,475 | (3) | 1.16 | % |

| Senior Vice President—Bank: John A. Giovanazi | | 17,665 | (4) | * | |

| Senior Vice President—Bank: Robert F. Hickey | | 16,390 | (5) | * | |

| Senior Vice President—Bank: Gary M. Jewell | | 27,850 | (6) | * | |

| Senior Vice President—Bank: James M. Uveges | | 5,000 | (7) | * | |

DIRECTORS: |

|

|

|

|

|

| Robert J. Aumiller | | 3,780 | (8) | * | |

| Steven K. Breeden | | 14,280 | (9) | * | |

| Albert R. Counselman | | 38,156 | (10) | 1.36 | % |

| Harold I. Hackerman | | 3,665 | (11) | * | |

| John P. Hauswald | | 16,702 | (12) | * | |

| David P. Hessler | | 4,620 | (13) | * | |

| Howard S. Klein | | 10,197 | (14) | * | |

| Ben F. Mason | | 70,349 | (15) | 2.50 | % |

| Charles E. Moore, Jr. | | 5,298 | (16) | * | |

| John Paul Rogers | | 206,992 | (17) | 7.36 | % |

| William C. Rogers, Jr. | | 278,174 | (18)(19)(20) | 9.90 | % |

All Directors and Executive Officers of the Company as a Group

(17 persons) | | 653,291 | (22) | 23.25 | % |

OTHER SIGNIFICANT SHAREHOLDER: |

|

|

|

|

|

| Patricia A. Rogers | | 184,062 | (21) | 6.55 | % |

- *

- Less than 1%

- (1)

- Unless otherwise indicated, the named person has sole voting and investment power with respect to all shares.

- (2)

- Includes 1,054 shares owned jointly by Mr. Altieri and his wife, 173 shares Mr. Altieri holds as trustee for minor children under the Maryland Uniform Gifts to Minors Act, and 44,650 fully vested options to purchase shares at an exercise price of between $10.94 and $17.79 per share.

- (3)

- Includes 2,425 shares owned jointly by Mr. Bootey and his wife and 30,050 fully vested options to purchase shares at an exercise price of between $10.94 and $17.79 per share.

- (4)

- Includes 17,665 fully vested options to purchase shares at an exercise price of between $10.94 and $16.02 per share.

- (5)

- Includes 13,000 fully vested options to purchase shares at an exercise price of between $14.50 and $17.75 per share.

- (6)

- Includes 27,850 fully vested options to purchase shares at an exercise price of between $10.94 and $17.79 per share.

- (7)

- Includes 5,000 fully vested options to purchase shares at an exercise price of $14.85 per share.

- (8)

- Includes 3,465 shares owned jointly by Mr. Aumiller and his wife and 210 fully vested options to purchase shares at an exercise price of between $14.45 and $16.22 per share.

- (9)

- Includes 4,577 shares owned jointly by Mr. Breeden and his wife and 4,410 fully vested options to purchase shares at an exercise price of between $9.71 and $18.10 per share.

- (10)

- Includes 1,890 fully vested options to purchase shares at an exercise price of between $12.11 and $18.10 per share, but excludes 13,058 shares owned by Mr. Counselman's wife.

15

- (11)

- Includes 1,670 shares owned jointly by Mr. Hackerman and his wife, and 1,890 fully vested options to purchase shares at an exercise price of between $12.11 and $16.22 per share.

- (12)

- Includes 210 shares owned jointly by Mr. Hauswald and his wife and 4,200 fully vested options to purchase shares at an exercise price of between $9.71 and $18.10 per share.

- (13)

- Includes 1,470 shares owned jointly by Mr. Hessler and his wife and 3,150 fully vested options to purchase shares at an exercise price of between $9.71 and $16.22 per share.

- (14)

- Includes 1,680 shares owned by Colgate Investments, LLP, of which Mr. Klein is partner and 2,079 shares Mr. Klein holds as trustee for minor children under the Maryland Uniform Gifts to Minors Act. Also includes 3,150 fully vested options to purchase shares at an exercise price of between $9.71 and $16.22 per share.

- (15)

- Includes 2,520 fully vested options to purchase shares at an exercise price of between $9.71 and $16.22 per share. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore of which Mr. Mason is a Director.

- (16)

- Includes 630 fully vested options to purchase shares at an exercise price of between $12.11 and $16.22 per share. Excludes 17,320 shares owned by Mr. Moore's wife and 4,689 shares of which Mrs. Moore has voting control as a personal representative of an estate.

- (17)

- Includes 3,780 fully vested options to purchase shares at an exercise price of between $12.11 and $18.10 per share. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore and 9,981 shares owned by Maryland Mortgage Company of which Mr. Rogers is a principal shareholder.

- (18)

- Includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore of which William C. Rogers, Jr. is Chairman, as well as a Director. Also includes 2,520 fully vested options to purchase shares at an exercise price of between $14.45 and $18.10 per share.

- (19)

- Includes 6,818 shares owned by the Moreland Memorial Park Cemetery Bronze Perpetual Care Trust Agreement, Inc., 6,168 shares owned by Moreland Memorial Park Perpetual Care, 34,034 shares owned by Moreland Memorial Park Perpetual Care Trust, 3,597 shares owned by Moreland Memorial Park, Inc. Bronze Marker Perpetual Care Trust Fund, 6,168 shares owned by Moreland Memorial Park Cemetery, Inc. Perpetual Care Trust Agreement, and 9,981 shares owned by Maryland Mortgage Company of which William C. Rogers, Jr., is President as well as a Director.

- (20)

- Includes 135,126 shares owned jointly by Mr. Rogers and his wife and 4,689 shares of which Mr. Rogers has voting control as a personal representative of an estate. Excludes 12,322 shares owned by Mr. Roger's wife.

- (21)

- Includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore and 9,981 shares owned by Maryland Mortgage Company of which Mrs. Rogers is a principal shareholder.

- (22)

- All directors, executive officers and other significant shareholders may be contacted at the Company's corporate offices by addressing correspondence to the appropriate person, care of Carrollton Bancorp, 344 North Charles Street, Suite 300, Baltimore, Maryland 21201.

16

PRINCIPAL HOLDERS OF VOTING SECURITIES

The following table sets forth information with respect to the ownership of shares of Common Stock of the Company by the only persons believed by management to be the beneficial owners of more than five percent of the Company's outstanding Common Stock. The information is based on the most recent Schedule 13-G filed by such persons with the Securities and Exchange Commission.

Name and Address of Beneficial Owner

| | Amount and Nature

of Beneficial

Ownership

| | Percentage of

Common Stock

Outstanding

|

|---|

|

|---|

John Paul Rogers

46 C Queen Anne Way

Chester, MD 21619 | | 206,992(a) | | 7.36% |

William C. Rogers, Jr.

6 South Calvert Street

Baltimore, MD 21201 |

|

278,174(b) |

|

9.90% |

Patricia A. Rogers

P.O. Box 246

Gibson Island, MD 21056 |

|

184,062(c) |

|

6.55% |

- (a)

- A Schedule 13-G filed on February 10, 2006, states that John Paul Rogers has sole voting and dispositive power over 129,912 shares and shared voting and dispositive power over 77,080 shares. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore, and 9,981 shares owned by Maryland Mortgage Company of which Mr. Rogers is a principal shareholder.

- (b)

- A Schedule 13-G dated February 14, 2006 states that William C. Rogers, Jr. has sole voting and dispositive power over 4,494 shares, and shared voting and dispositive power over 268,991 shares. This includes 67,099 shares owned by the Security Title Guarantee Corporation of Baltimore of which Mr. Rogers is chairman, as well as a director; 9,981 shares owned by Maryland Mortgage Company of which Mr. Rogers is president as well as a director; and 56,785 shares owned by Moreland Memorial Park Cemetery, Inc. of which Mr. Rogers is a trustee. Also includes 4,689 shares of which Mr. Rogers has voting control as a personal representative of an estate.

- (c)

- A Schedule 13-G dated February 10, 2006 states that Patricia A. Rogers has sole voting and dispositive power over 106,982 shares. Also includes 67,099 shares owned by The Security Title Guarantee Corporation of Baltimore, and 9,981 shares owned by Maryland Mortgage Company of which Mrs. Rogers is a principal shareholder.

REPORT OF THE COMPENSATION COMMITTEE

OVERALL POLICY

The Board of Directors of the Company establishes the overall goals and objectives of, and the policies to be followed in pursuing these goals and objectives, including the selection of necessary key management personnel, and the evaluating of the performance of those personnel. The major responsibility for assisting in satisfying the compensatory aspect of the overall supervisory duty of the Board rests with the Compensation Committee. The membership of the Compensation Committees (collectively the "Committee") of the Company and the Bank is identical, composed of independent nonemployee Directors of both institutions who do not participate in any executive compensation plan.

In order to achieve the overall goals and objectives of the Company, and recognizing the interest of the shareholders in that achievement, the Committee has developed and maintains an executive compensation plan based on a philosophy that links executive compensation to individual and corporate performance, and return to shareholders. This philosophy is intended to enable the Company to attract and retain highly motivated executive personnel of outstanding ability and initiative, and to create an identity of interests between executives and the Company's shareholders. The Company's executive compensation plan consists of basic cash compensation, the opportunity for annual incentive compensation based on corporate performance, and continuing stock based compensation.

The Committee administers the provisions of the Company's incentive cash compensation plan and its stock based plans. In addition, the Committee is authorized to make recommendations to the Boards of the Company and the Bank with respect to basic salaries, supplemental pension, deferred compensation, employment and similar agreements affecting their executive officers, and performs such other functions as may be delegated to it by the Boards.

17

The Committee takes various factors into consideration when establishing and reviewing executive compensation. There follows an explanation of general principles governing basic cash compensation, annual incentive compensation based on corporate earnings performance, stock based compensation, and the factors considered in establishing basic cash compensation for 2005.

BASIC CASH COMPENSATION

The Committee, in determining basic cash compensation of the executive officers of the Company, considers corporate profitability, financial condition, capital adequacy, return on assets and other factors. The Committee also considers the performance and compensation levels of other banking institutions as more fully set forth under the caption "2005 Compensation". The Committee does not consider these factors by any formula and does not assign specific weight to any given factor. Instead, the Committee applies its collective business judgment to reach a consensus on compensation fair to the Company, its shareholders and its executive officers.

STOCK BASED COMPENSATION

The 1998 Long-Term Incentive Plan, as amended, was designed to create a common interest between key employees, non-employee board members and shareholders on a long-term basis, encouraging participants to maintain and increase their proprietary interests as shareholders in the Company with the opportunity to benefit from the long-term performance of the Company.

From 1998 through 2005, the Committee granted, under the 1998 Long-Term Incentive Plan, options for a total of 274,760 shares of Common Stock to directors and key employees of the Company and the Bank. The exercise price of the stock options equals the market price of the Common Stock on the date of grant and the options have a ten year life. Options are not performance-based and become exercisable in equal annual installments over three years.

On December 15, 2005, the Board of Directors authorized 42,000 options to officers and the immediate vesting of these options and all outstanding options to officers where the exercise price of the option exceeded the fair market value of the Company's stock. This resulted in 75,500 options becoming vested in 2005 that would have otherwise vested in future years.

2005 COMPENSATION

The Committee, in determining the 2005 basic cash compensation of the executive officers of the Company, considered the factors described in this Report.

Robert A. Altieri serves as President and Chief Executive Officer of the Company and President and Chief Executive Officer of the Bank and, as such, had the ultimate management responsibility for the strategic direction, performance, operating results and financial condition of the Company and its subsidiaries, and the carrying out of corporate policies and procedures. Edward R. Bootey is Senior Vice President—Operations of the Bank; James M. Uveges is Senior Vice President and Chief Financial Officer of the Bank; Robert F. Hickey is Senior Vice President—Branch Administration of the Bank; John A. Giovanazi is Senior Vice President—Lending of the Bank; and Gary M. Jewell is Senior Vice President—Electronic Banking of the Bank.

The Committee was aware of 2005 earnings of the Company. The Committee further reviewed profitability and capital strength ratios (return on assets, net interest margin, efficiency ratio, equity to assets and return on equity) and loan loss performance ratios (period-end non-performing assets to loans and foreclosed real estate, net charge-offs to average loans and period-end allowance for loan losses to non-performing loans) as compared to comparable information for peer banking companies with assets from $250 to $500 million, considered by an independent analyst as the Company's peer group. The Committee compared similar ratios showing profitability, capital adequacy, reserve strength, and asset quality with those of the peer institutions as prepared by that financial analyst. The Committee was aware of the strategic plan of improving profitability and the factors that influence management's ability to accomplish strategic goals under the plan in the current economic environment in its assessment of management's performance.

The Committee compared the proposed compensation of Mr. Altieri with independent studies published reflecting compensation information of the peer group commercial banking institutions participating in the study and with the compensation of executive officers of banking institutions, based on proxy information covering institutions comparable to the Company in terms of criteria including the nature and quality of operations, or geographic proximity. This group included financial institutions having high returns on assets, capital significantly in excess of that required by current federal regulations, and located within a 100 mile radius of Baltimore so as to include companies operating in a comparable economic climate. No target was established in the comparison with this group of institutions.

18

The Committee concluded that the Company's profitability is below comparisons, but improved significantly over prior years while capital strength ratios continued to be strong, and that loan loss ratios were favorable, both standing alone and in comparison to the banking companies constituting the peer group. Based on the Committees review and its evaluation of the qualifications, experience and responsibilities of Mr. Altieri and the other members of executive management, and of the importance of the continued services for transitional and other purposes, the Committee approved the compensation and other arrangements with Mr. Altieri, Mr. Bootey, and Mr. Hickey, Mr. Giovanazi, and Mr. Jewell as described in the Summary Compensation Table in this Proxy Statement.

Section 162(m) of the Internal Revenue Code provides for non-deductibility, in certain cases, of compensation paid to certain executives in excess of $1 million per year. The Company does not have a policy limiting compensation to amounts deductible under Section 162(m). The annual incentive plan and the Omnibus Stock Plans have been approved by the shareholders and are designed to be qualified performance-based plans so that Section 162(m) limits would not apply to plan benefits. Section 162(m) limits would apply to salary, bonuses in excess of bonuses under the annual incentive compensation plan and certain amounts included under "Other Annual Compensation" and "All Other Compensation" in the Summary Compensation Table.

| | The Compensation Committee |

| | | Ben F. Mason, Chair

Robert J. Aumiller

Steven K. Breeden

Harold I. Hackerman

Charles E. Moore, Jr. |

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

In 2005, the Company and the Bank had banking and other relationships, in the ordinary course of business, with a number of its Directors and companies associated with them. The Company purchased insurance through its broker, Riggs, Counselman, Michaels & Downes, Inc., of which Mr. Counselman is President and Chief Executive Officer. The insurance coverage purchased was made on substantially the same terms, as those prevailing at the time, for comparable transactions with others. Management believes the terms of the insurance coverage obtained through Riggs, Counselman, Michaels & Downes, Inc. were at least as favorable to the Company as could have been obtained elsewhere.

Outstanding loans exist to Steven K. Breeden, David P. Hessler, William C. Rogers, Jr. and their related companies which were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with others not considered outsiders, and did not involve more than the normal risk of collectibility or present other unfavorable features.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

During the past year the Company has had banking transactions in the ordinary course of its business with: (i) its directors and nominees for directors; (ii) its executive officers; (iii) its 5% or greater shareholders; (iv) members of the immediate family of its directors, nominees for directors or executive officers and 5% shareholders; and (v) the associates of such persons on substantially the same terms, including interest rates, collateral, and repayment terms on loans, as those prevailing at the same time for comparable transactions with others. The extensions of credit by the Company to these persons have not had and do not currently involve more than the normal risk of collectibility or present other unfavorable features. At December 31, 2005, the balance of loans outstanding to directors, executive officers, owners of 5% or more of the outstanding Common Stock, and their associates, including loans guaranteed by such persons, aggregated $1,820,717 which represented approximately 5.32% of the Company's equity capital accounts.

William C. Rogers, Jr., a director of both the Company and the Bank, is a partner of the law firm of Rogers, Moore and Rogers, which performs legal services for the Company, the Bank, and Bank subsidiaries (Carrollton Financial Services, Inc., Carrollton Mortgage Services, Inc., and Carrollton Community Development Corporation). Management believes that the terms of these transactions, which totaled $220,000 in 2005, were at least as favorable to the Company as could have been obtained elsewhere.

Albert R. Counselman, a director of both the Company and the Bank, is President and Chief Executive Officer of Riggs, Counselman, Michaels & Downes, Inc., an insurance brokerage firm through which the Company, the Bank, and Bank subsidiaries place various insurance policies. The Company and the Bank paid total premiums for insurance policies placed by Riggs, Counselman, Michaels & Downes, Inc in 2005 of $215,000. Management believes that the terms of these transactions were at least as favorable to the Company as could have been obtained elsewhere.

Robert J. Aumiller, a director of both the Company and the Bank is Executive Vice President of MacKenzie Real Estate Services, a brokerage and real estate development firm, through which the Company and the Bank paid for appraisal, construction, brokerage and management services of $169,000 in 2005 for appraisal and property management services provided by MacKenzie Commercial Real Estate Services. Management believes these terms were as favorable as could have been obtained elsewhere.

19

SHAREHOLDER PROPOSALS FOR THE 2006 ANNUAL MEETING

Proposals of shareholders to be presented at the 2007 Annual Meeting of the Company must be received at the Company's principal executive offices prior to December 17, 2006 in order to be included in the proxy statement for such meeting. In order to curtail controversy as to compliance with this requirement, shareholders are urged to submit proposals to the Secretary of the Company by Certified Mail—Return Receipt Requested.

If a shareholder intends to submit a proposal at the 2006 Annual Meeting of the Company that is not eligible for inclusion in the proxy statement and proxy, the shareholder must do so no later than February 3, 2006.

NOMINATING/CORPORATE GOVERNANCE COMMITTEE CHARTER

PURPOSE

The Nominating/Corporate Governance Committee (the "Committee") is appointed by the Board of Directors (the "Board") of Carrollton Bancorp (the "Company") (1) to assist the Board, on an annual basis, by identifying individuals qualified to become Board members, and to recommend to the Board, the director nominees for the next annual meeting of shareholders; (2) to assist the Board in the event of any vacancy on the Board by identifying individuals qualified to become Board members, and to recommend to the Board qualified individuals to fill any such vacancy; (3) develop and recommend to the Board a set of corporate governance guidelines applicable to the Company; and (4) take a leadership role in shaping the corporate governance of the Company.

COMMITTEE MEMBERSHIP

The Committee shall consist of no fewer than three members, each of whom shall be a non-employee director of the Company. Each member of the Committee shall meet the independence definition standards of NASDAQ and all other applicable legal requirements. The Committee will also consider the absence or presence of material relationships with the Company that might impact independence. The Committee shall report to the Board. Members shall be appointed and removed by the Board. A majority of the members of the Committee shall constitute a quorum.

COMMITTEE AUTHORITY AND RESPONSIBILITIES

- 1.

- The Committee shall have the responsibility to develop and recommend criteria for the selection of new directors to the Board, including, but not limited to, diversity, age, skills, experience, time availability (including the number of other boards he or she sits on) in the context of the needs of the Board and the Company and such other criteria as the Committee shall determine to be relevant at the time. The Committee shall have the power to apply such criteria in connection with the identification of individuals to be board members, as well as to apply the standards for independence imposed by the Company's listing agreement with NASDAQ and all applicable federal laws in connection with such identification process.

- 2.

- When vacancies occur or otherwise at the direction of the Board, the Committee shall actively seek individuals whom the Committee determines meet such criteria and standards for recommendation to the Board.

- 3.

- The Committee shall have the sole authority to retain and terminate any search firm to be used to identify director candidates and shall have sole authority to approve the search firm's fees and other retention terms, at the Company's expense.

- 4.

- The Committee shall recommend to the Board, on an annual basis, nominees for elections of directors for the next annual meeting of shareholders.

- 5.

- The Committee may form and delegate authority to subcommittees or members when appropriate.

- 6.

- The Committee shall review the function of the Board and management and shall make recommendations to the Board from time to time as to changes that the Committee believes to be desirable to the size of the Board or to the manner in which the board directs the management of the business and affairs of the Company.

- 7.

- The Committee shall approve and recommend to the Board a set of corporate governance guidelines applicable to the Company prepared by management or counsel to the Company and, at least once a year, shall review and reevaluate the adequacy of those corporate governance guidelines and recommend any proposed changes to the Board for approval.

- 8.

- The Committee shall approve and recommend to the Board a code of ethics and business principles (the "Code of Ethics") applicable to the Company prepared by management or counsel to the Company and, at least once a year shall review and reevaluate the adequacy of the Code of Ethics and recommend any proposed changes to the Board for approval.

- 9.

- The Committee shall make regular reports to the Board, including copies of the minutes of its meetings.

- 10.

- The Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed changes to the Board for approval. The Committee shall annually review its own performance and present such review to the Board.

20

- 11.

- The Committee, and each member of the Committee in his or her capacities as such, shall be entitled to rely, in good faith, on information, opinions, reports or statements, or other information prepared or presented to them by (i) officers and other employees of the Company or Carrollton Bank, whom such member believes to be reliable and competent in the matters presented, (ii) counsel, public accountants or other persons as to matters which the member believes to be within the professional competence of such person.

- 12.

- Review conflicts of interest or potential conflicts of interest of Directors, senior executives and consider waivers or other action related thereto. Any waiver granted must be reported to the shareholders.

- 13.

- Review breaches of the Company's Code of Ethics for Directors and executive officers and consider waivers or other action related thereto. Any waiver granted must be reported to the shareholders.

- 14.

- Make provision to assure that the independent Directors meet at regularly scheduled executive sessions without management or non-independent Directors being present.

- 15.

- Make provisions for the annual continuing education of the Company directors.

- 16.

- If requested by the Compensation Committee, to participate in the oversight of the annual evaluation process for the Board and management.

- 17.

- The Committee shall perform such other duties and responsibilities and shall have such other authority as may be assigned or delegated to it from time to time by the Board.

| | The Nominating Committee |

| | | David P. Hessler

Steven K. Breeden

Charles E. Moore, Jr. |

The Nominating Committee Charter can be found on the Carrollton Bank website at www.carrolltonbank.com.

THE AUDIT COMMITTEE CHARTER

PURPOSE

The Audit Committee (the "Committee) is appointed by the Board of Directors (the "Board") to assist the Board in monitoring (1) the integrity of the financial statements of Carrollton Bancorp (the "Company"), (2) the independent auditor's qualifications and independence, and (3) the performance of the Company's internal audit function and independent auditors, and (4) the compliance by the Company with legal and regulatory requirements.

Management of the Company is responsible for the preparation, presentation and integrity of the financial statements of the Company. The Company's independent external auditor is responsible for rendering an opinion on the Company's financial statements based on their audit. The Bank shall provide to the Federal Deposit Insurance Corporation and any other appropriate federal and state banking agency, a copy of each audit report and any qualification to such report, any management letter, and any other report within fifteen days of receipt of such report, qualification, or letter from the Bank's independent external auditor. The Company's independent external auditor is responsible for planning and carrying out, in accordance with generally accepted auditing standards, an audit of the Company's financial statement.

The primary responsibility of the Committee is to oversee the accounting and financial reporting processes of the Company and the audits of the financial statements of the Company on behalf of the Board and report the results of its activities to the Board. Management is responsible for preparing the Company's financial statements and related disclosures and the Company's independent auditors are responsible for auditing those financial statements. It is not the duty of the Committee to plan or conduct audits or to determine that the Company's financial statements are complete and accurate and in accordance with generally accepted accounting principles ("GAAP"). It shall be the duty of the Committee to assist the Board in the oversight of the Company's legal and regulatory requirements.

COMMITTEE MEMBERSHIP