Exhibit 10.3

LEASE AGREEMENT

between

PCCP HC Kierland, LLC,

a Delaware limited liability company,

as “Landlord”

and

The Ryland Group, Inc.,

a Maryland corporation,

as “Tenant”

Ryan Kierland Corporate Center

Scottsdale, Arizona

TABLE OF CONTENTS

SECTION | | PAGE | |

| | | |

1. | | PREMISES | 4 |

2. | | TERM; POSSESSION | 4 |

3. | | RENT; SECURITY DEPOSIT | 7 |

4. | | RENTAL TAXES | 12 |

5. | | USE AND COMPLIANCE WITH LAWS | 12 |

6. | | TENANT IMPROVEMENTS AND ALTERATIONS | 16 |

7. | | MAINTENANCE AND REPAIRS | 17 |

8. | | TENANT’S PERSONAL PROPERTY TAXES | 18 |

9. | | UTILITIES AND SERVICES | 18 |

10. | | EXCULPATION AND INDEMNIFICATION | 20 |

11. | | INSURANCE | 21 |

12. | | DAMAGE OR DESTRUCTION | 24 |

13. | | CONDEMNATION | 25 |

14. | | ASSIGNMENT AND SUBLETTING | 27 |

15. | | DEFAULT AND REMEDIES | 29 |

16. | | LATE CHARGE AND INTEREST | 32 |

17. | | WAIVER | 32 |

18. | | ENTRY, INSPECTION AND CLOSURE | 33 |

19. | | SURRENDER AND HOLDING OVER | 34 |

20. | | ENCUMBRANCES | 35 |

21. | | ESTOPPEL CERTIFICATES | 35 |

22. | | NOTICES | 36 |

23. | | ATTORNEYS’ FEES | 36 |

24. | | QUIET POSSESSION | 36 |

25. | | SECURITY MEASURES | 37 |

26. | | FORCE MAJEURE | 37 |

27. | | RULES AND REGULATIONS | 37 |

28. | | LANDLORD’S LIABILITY | 37 |

29. | | CONSENTS AND APPROVALS | 38 |

30. | | WAIVER OF RIGHT TO JURY TRIAL | 38 |

31. | | BROKERS | 38 |

32. | | INTENTIONALLY DELETED | 39 |

33. | | PARKING | 39 |

34. | | ENTIRE AGREEMENT | 39 |

35. | | MISCELLANEOUS | 40 |

36. | | AUTHORITY | 40 |

-i-

37. | | SIGNAGE | 40 |

38. | | RIGHT OF FIRST OFFER | 40 |

39. | | LEASE CONTINGENCY | 41 |

39. | | LEASE CONTINGENCY | 41 |

-ii-

BASIC LEASE INFORMATION |

| | |

Lease Date: | | For identification purposes only, the date of this Lease is February 28, 2006. |

| | |

Landlord: | | PCCP HC Kierland, LLC, a Delaware limited liability company |

| | |

Tenant: | | The Ryland Group, Inc., a Maryland corporation |

| | |

Project: | | Ryan Kierland Corporate Center |

| | |

Building Address: | | 14635 North Kierland Boulevard, Scottsdale, Arizona 85254 |

| | |

Rentable Area of

Building: | | 106,548 rentable square feet |

| | |

Premises: | | Floor: Second |

| | Suite Number: 200 |

| | Rentable Area: 56,608 rentable square feet |

| | Usable Area: 53,225 usable square feet |

| | |

Initial Term: | | Seventy-six (76) full calendar months (plus any partial month at the beginning of the Term) |

| | |

Renewal Terms: | | Two (2) additional periods of sixty (60) months each (for a total if all Renewal Terms are exercised of one hundred twenty (120) months) |

| | |

Commencement Date: | | The date that is one hundred twenty (120) days following Landlord’s delivery of the Premises to Tenant in accordance with Section 2.1 below |

| | |

Expiration Date: | | The last day of the seventy-sixth (76th)full calendar month in the Term |

Base Rent: | | Monthly Installments of

Base Rent | | Annual Base Rent per rentable

square foot of the Premises | |

Months 01 through 04 | | $0.00 | | $0.00 | |

Months 05 through 16 | | $125,009.33 | | $26.50 | |

Months 17 through 28 | | $127,368.00 | | $27.00 | |

Months 29 through 40 | | $129,726.67 | | $27.50 | |

Months 41 through 52 | | $132,085.33 | | $28.00 | |

Months 53 through 64 | | $134,444.00 | | $28.50 | |

Months 65 through 76 | | $136,802.67 | | $29.00 | |

1

Security Deposit: | | $0.00 |

| | |

Tenant’s Share: | | Approximately 53.13% |

| | |

Operating Costs

Expense Stop: | | An amount equal to the Operating Costs incurred by Landlord during calendar year 2006. |

| | |

Improvement

Allowance: | | $35.00 multiplied by the Usable Area of the Premises (or $1,862,875.00 based on a Premises consisting of 53,225 usable square feet), subject to reduction based upon the costs incurred by Landlord in connection with the Data Room Floor Construction as more particularly described under Section 25 of Exhibit C to this Lease. |

| | |

Covered Reserved

Parking Spaces: | | Fifty-three (53) covered/reserved parking stalls |

| | |

Landlord’s Address

for Payment of Rent: | | PCCP HC Kierland, LLC

c/o Transwestern Commercial Services

10040 North 25th Avenue, Suite 125

Phoenix, Arizona 85021

Attn: Joanne Damman |

| | |

Business Hours: | | Between 7:00 a.m. and 6:00 p.m., Monday through Friday, and between 8:00 a.m. and noon on Saturday |

| | |

Landlord’s Address

For Notices: | | PCCP HC Kierland, LLC

c/o Transwestern Commercial Services

10040 North 25th Avenue, Suite 125

Phoenix, Arizona 85021

Attn: Joanne Damman |

| | |

with a copy to: | | PCCP HC Kierland, LLC

c/o Hibernia Capital Advisors, LLC

2398 East Camelback Road, Suite 245

Phoenix, Arizona 85016

Attn: Richard A. O’Brien |

| | |

with a copy to: | | Mr. R. Michael Valenzuela

Valenzuela Law Group, PLC

2398 East Camelback Road, Suite 760

Phoenix, Arizona 85016 |

2

Tenant’s Address

For Notices: | | The Ryland Group, Inc. 6300 Canoga Avenue, 14th Floor

Woodlands, California 91367

Attn: Eric Menyuk |

| | |

Landlord’s Broker: | | Lee & Associates (Tom Boyle) |

| | |

Tenant’s Broker: | | Travers Realty Company (Jim Travers) and Core Realty Advisors (Mike Cavanaugh) |

| | |

Property Manager: | | Transwestern Commercial Services |

Exhibits: | | |

Exhibit A: | | Legal Description of the Land |

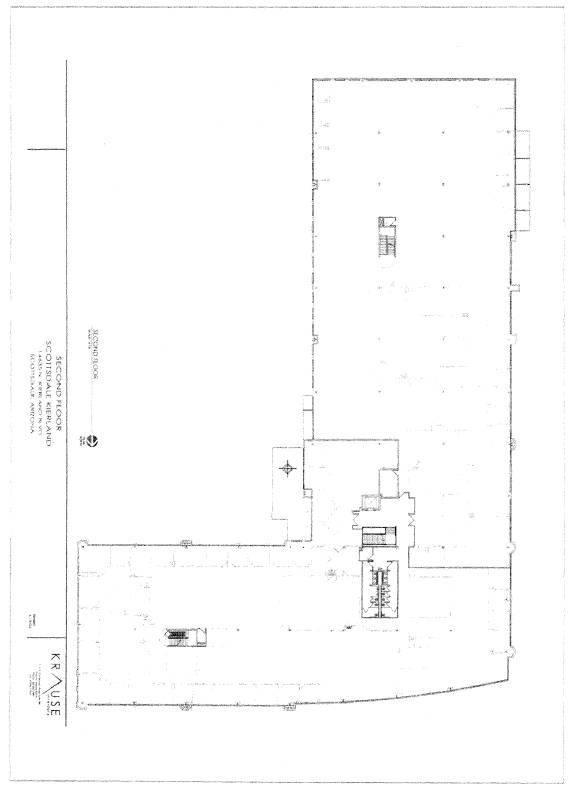

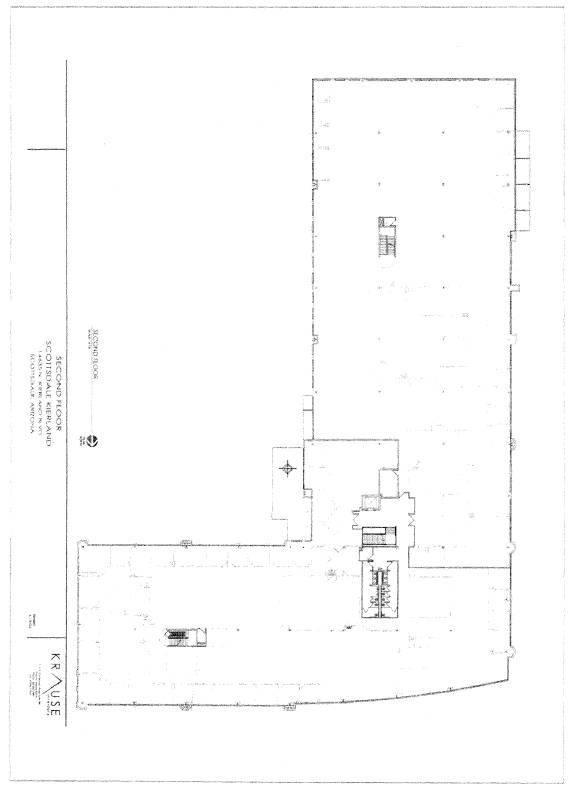

Exhibit B: | | The Premises |

Exhibit C: | | Construction Rider |

Exhibit D: | | Building Rules |

Exhibit E: | | Subordination, Non-Disturbance and Attornment Agreement |

Exhibit F: | | Operating Costs Exclusions |

Exhibit G: | | Exterior Building Signage Locations |

Exhibit G-1: | | Landlord Approved Signage |

The Basic Lease Information set forth above is part of the Lease. In the event of any conflict between any provision in the Basic Lease Information and the Lease, the Lease shall control.

3

THIS LEASE is made as of the Lease Date set forth in the Basic Lease Information, by and between the Landlord identified in the Basic Lease Information (“Landlord”), and the Tenant identified in the Basic Lease Information (“Tenant”). Landlord and Tenant hereby agree as follows:

1. PREMISES. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, upon the terms and subject to the conditions of this Lease, the space identified in the Basic Lease Information as the Premises (the “Premises”), in the Building located at the address specified in the Basic Lease Information (the “Building”). The land upon which the Building is located is described on Exhibit A (the “Land”). The approximate configuration and location of the Premises is shown on Exhibit B. Landlord and Tenant agree that, for all purposes of this Lease, the Rentable Area of the Premises, the Usable Area of the Premises and the Rentable Area of the Building shall be as specified in the Basic Lease Information. For purposes of Landlord’s determination of the Rentable Area and Usable Area, the load factor (the Floor R/U Ratio) is six and four-tenths percent (6.4%). The Building, the Land, and all improvements thereon (collectively, the “Property”) are part of the Project identified in the Basic Lease Information (the “Project”).

2. TERM; POSSESSION.

2.1 Term. The term of this Lease (the “Term”) shall commence on the Commencement Date as described below and, unless sooner terminated, shall expire on the Expiration Date set forth in the Basic Lease Information (the “Expiration Date”). Subject to the timely satisfaction of the contingencies set forth in Sections 39 and 40 below, Landlord will deliver the Premises to Tenant on or before April 1, 2006 so that Tenant may cause the Tenant Improvements to be constructed therein as soon as is reasonably practicable thereafter. Tenant acknowledges and agrees that, subject to Landlord’s representations and warranties concerning the Base Building as described in the Construction Rider attached as Exhibit C (the “Construction Rider”), the Premises are being leased to Tenant in an “AS IS” condition, without representation, warranty or covenant of or from Landlord and without any obligation of Landlord to construct any tenant improvements of any kind or character whatsoever. Tenant further acknowledges that, except as expressly set forth to the contrary in this Lease, Landlord has made no representations or warranties, express or implied, concerning the tenant improvements presently existing at, or the condition of, the Premises, and Tenant further acknowledges that it has had adequate opportunity to inspect and approve, and has adequately inspected and approved, the tenant improvements presently existing at, and the condition of, the Premises. The “Commencement Date” shall be the date that is one hundred twenty (120) days following Landlord’s delivery of the Premises to Tenant as specified above in this Section notwithstanding the actual date of Substantial Completion of the Tenant Improvements. Tenant shall not do anything that could delay Substantial Completion of the Tenant Improvements and, in the event the Tenant Improvements are not Substantially Completed on or before the Commencement Date, then in that event Tenant shall complete the Tenant Improvements at the earliest practicable date thereafter. When the Commencement Date has been established, Landlord and Tenant shall confirm the Commencement Date and the Expiration Date in writing.

4

2.2 Tenant’s Property. Tenant agrees that Landlord shall not be liable in any way for any injury, loss or damage which may occur to any of Tenant’s property placed upon or installed in the Premises prior to the Commencement Date, the same being at Tenant’s sole risk, and Tenant shall be liable for all injury, loss or damage to persons or property arising as a result of such entry into the Premises by Tenant or its Representatives (as hereinafter defined).

2.3 Occupancy of Premises. Tenant shall have the right to occupy the Premises throughout the Term, seven (7) days a week, twenty-four (24) hours a day, subject to all of the terms of this Lease, including, without limitation, casualty, condemnation, Force Majeure or other events beyond the control of Landlord. From and after the Commencement Date, during any period that Tenant is not occupying and operating the Premises, Tenant will keep those portions of the Premises visible from Common Areas (as hereinafter defined) from appearing abandoned, including, without limitation, keeping such areas lighted during Business Hours, free of stored materials, clean and otherwise maintained such that it is not apparent that business is not being conducted therein.

2.4 Renewal Options. In the absence of an Event of Default by Tenant when it exercises a Renewal Option or when a Renewal Term begins, Tenant has the option (each, a “Renewal Option”) to renew this Lease for the number of successive terms set forth in the Basic Lease Information (each, a “Renewal Term”) (for a total if all Renewal Options are exercised of ten (10) years) by giving notice of exercise of a Renewal Option to Landlord at least nine (9) months before the end of the then-current Term. If Tenant fails to deliver timely written notice of exercise of a Renewal Option to Landlord, all remaining Renewal Options shall lapse and Tenant will have no further privilege to extend the Term. Time is of the essence of this provision. The terms of the Renewal Terms are as follows:

(a) Each Renewal Term shall be on the same terms and conditions of this Lease (unless clearly inapplicable), except that Base Rent during each Renewal Term shall be based upon the fair market rental rate for comparable space in buildings of similar size, type, quality, age and location prevailing at the start of each Renewal Term (“Market Rental Rate”). Within thirty (30) days after Landlord receives Tenant’s notice of exercise of a Renewal Option, Landlord will reasonably calculate the Market Rental Rate and will notify Tenant of same. Determination of the effective Market Rental Rate will give appropriate consideration to rental rates for renewals, rental escalations, common area charges, operating costs, and other terms that would affect the economics in a similar lease renewal at a competing building in the area.

(b) If Tenant disputes Landlord’s determination of the Market Rental Rate for a Renewal Term, Tenant will deliver notice of such dispute, together with Tenant’s proposed Market Rental Rate, to Landlord within five days of Tenant’s receipt of Landlord’s determination. The parties will then attempt in good faith to agree upon the Market Rental Rate. If they fail to agree within fifteen (15) days, they will within seven days thereafter mutually appoint an appraiser to select the

5

Market Rental Rate in the manner set forth below. The appraiser must have at least five years of full-time commercial appraisal experience with projects comparable to the Project and be a member of the American Institute of Real Estate Appraisers or a similar appraisal association. The appraiser shall not have any material financial or business interest in common with either of the parties. If Landlord and Tenant are unable to agree upon an appraiser within such seven days, the parties will within five days thereafter each appoint an appraiser meeting the criteria set forth above, which appraisers will, within seven days of their appointment, mutually select a third appraiser meeting the criteria set forth above to select the Market Rental Rate in the manner set forth below. Within seven days of the appointment (either by agreement or selection) of the deciding appraiser, Landlord and Tenant will submit to that appraiser their respective determinations of the Market Rental Rate and any related information. Within twenty (20) days thereafter, the appraiser will review each party’s submittal (and such other information as the appraiser deems necessary) and will select one party’s submittal as representing the most reasonable approximation of the Market Rental Rate for the Premises. The rate so selected will be used for the applicable Renewal Term as the Base Rent rate. Subject to the previous sentence, if the appraiser timely receives one party’s submittal, but not both, the appraiser must designate the submitted rent rate as the Market Rental Rate for the applicable Renewal Term. Landlord and Tenant will each pay, directly to the appraiser selecting the Market Rental Rate, one-half of all fees, costs and expenses of such appraiser. Landlord and Tenant will each separately pay all costs, fees and expenses of their respective additional appraiser (if any) appointed to determine the deciding appraiser.

(c) In addition to paying Base Rent determined pursuant to this Section 2.4, Tenant will continue to pay Additional Rent and all other sums required under this Lease during all Renewal Terms.

(d) If this Lease or Tenant’s right to possession of the Premises shall expire or terminate for any reason whatsoever before Tenant exercises all Renewal Options, then immediately upon such expiration or termination, all Renewal Options shall simultaneously terminate and become null and void. In addition, Tenant may not exercise a Renewal Option if it is subletting or has assigned all or any portion of the Premises other than to a Tenant Affiliate (as defined below) at the time Tenant seeks to exercise such Renewal Option. The Renewal Options are personal to Tenant and its Tenant Affiliates, and under no circumstances shall a subtenant or an assignee other than a Tenant Affiliate have the right to exercise any Renewal Option. Until such time as Tenant properly exercises a Renewal Option, all references to the “Term” of this Lease will mean the Initial Term only. If Tenant properly exercises its right to renew this Lease for a Renewal Term, then all references to the “Term” of this Lease will include such Renewal Term.

6

3. RENT; SECURITY DEPOSIT.

3.1 Base Rent. Tenant shall pay to Landlord annual rent (“Base Rent”) in the amount set forth in the Basic Lease Information, without prior notice or demand, in monthly installments equal to one-twelfth (1/12) of the Base Rent, on or before the first day of each and every calendar month during the Term, except that Base Rent for the first full calendar month in which Base Rent is payable shall be paid upon Tenant’s execution of this Lease and Base Rent for any partial month at the beginning of the Term shall be paid on the Commencement Date. Base Rent for any partial month at the beginning or end of the Term shall be prorated based on the actual number of days in the month.

3.2 Additional Rent: Operating Costs and Taxes.

(a) Definitions.

1) “Operating Costs” means all Taxes (as defined below) and other costs of managing, operating, maintaining and repairing the Property in good condition and repair, including, without limitation, all costs, expenditures, fees and charges set forth below. Operating Costs include:

(A) operation, maintenance and repair of the Property (including maintenance, repair and replacement of glass, the roof covering or membrane, the parking lot and driveways (including re-painting, re-striping, seal-coating, cleaning, sweeping, resurfacing, patching and repairing parking areas and other paved surfaces), sidewalks, exterior light fixtures, common signage, other common areas and elements, regular painting of the exterior of the Building and lawn care and landscaping). The terms “repair” or “repairs” shall include reasonable replacements or renewals when necessary.

(B) utilities and services (including, without limitation, electricity, water, sewer, gas (if used at the Project), telecommunications facilities and equipment, recycling programs and trash removal), and associated supplies and materials.

(C) wages, benefits and other compensation (including employment taxes and fringe benefits) for persons who perform duties in connection with the operation, management, maintenance and repair of the Property up to, and including, level of Building Manager (or equivalent), such compensation to be appropriately allocated for persons who also perform duties unrelated to the Property.

(D) property (including coverage for earthquake and flood if carried by Landlord), liability, rental income and other insurance relating to the Property, and expenditures for deductible amounts paid under such insurance.

7

(E) licenses, permits and inspections.

(F) complying with the requirements of any law, statute, ordinance or governmental rule or regulation or any orders pursuant thereto (collectively “Laws”), but only to the extent such Laws are enacted and enforceable from and after the date of this Lease.

(G) amortization of capital improvements required to comply with Laws, or which are intended to reduce Operating Costs or improve the utility, efficiency or capacity of any of the Building Systems, with interest on the unamortized balance at the rate paid by Landlord on funds borrowed to finance such capital improvements (or, if Landlord finances such improvements out of Landlord’s funds without borrowing, the rate that Landlord would have paid to borrow such funds, as reasonably determined by Landlord), over such useful life as Landlord shall reasonably determine, but in no event greater than ten percent (10%) per annum.

(H) an office in the Project for the management of the Property, including expenses of furnishing and equipping such office and the rental value of any space occupied for such purposes.

(I) commercially reasonable property management fees not to exceed three percent (3%) of Landlord’s gross rental revenue received for that fiscal year for the Property.

(J) fees and costs for accounting, legal and other professional services incurred in connection with the operation of the Property and the calculation of Operating Costs.

(K) a reasonable allowance for depreciation on machinery and equipment used to maintain the Property and on other personal property owned by Landlord in the Property (including window coverings and carpeting in common areas).

(L) fees and costs incurred in contesting the validity or applicability of any Laws that may affect the Property to the extent that contesting the Law results in a savings to Tenant. “Savings” under this section would mean, by example, if any Operating Expense is reduced (or if a proposed increase is avoided or reduced) because a Law was contested, Landlord may include in its computation of Operating Expenses the costs of any fees and costs incurred in connection with such contest up to the amount of any Operating Expense reduction obtained in connection with the contest or any Operating Expense increase avoided or reduced in connection with the contest, as the case may be.

8

(M) the Building’s or Property’s share of any shared or common area maintenance fees and expenses, property association fees, dues and assessments, and all payments under any recorded documents (excluding mortgages and deeds of trust) affecting the Property (including costs and expenses of operating, managing, owning and maintaining the common areas of the Project and any fitness center or conference center in the Project).

(N) janitorial services, window washing, cleaning, rubbish removal and other services provided to the Property.

(o) security and access control equipment and services.

(P) subject to the remaining provisions of this Section 3.2(a)(l), any other cost, expenditure, fee or charge, whether or not hereinbefore described, which in accordance with generally accepted property management practices would be considered an expense of managing, operating, maintaining and repairing the Property.

Operating Costs shall not include:

(i) capital improvements (except as otherwise provided above).

(ii) costs of special services rendered to individual tenants (including Tenant) for which a special charge is made.

(iii) interest and principal payments on loans or indebtedness secured by the Building.

(iv) costs of interior improvements for Tenant or other tenants of the Building.

(v) costs of services or other benefits of a type which are not available to Tenant but which are available to other tenants or occupants, and costs for which Landlord is reimbursed by other tenants of the Building other than through payment of tenants’ shares of Operating Costs.

(vi) leasing commissions, attorneys’ fees and other expenses incurred in connection with leasing space in the Building or enforcing such leases.

9

(vii) depreciation or amortization, other than as specifically enumerated in the definition of Operating Costs above.

(viii) costs, fines or penalties incurred due to Landlord’s violation of any Law.

(ix) commercially unreasonable contributions to employee pension plans.

(x) Any other exclusions from Operating Costs specifically described on Exhibit F attached hereto and incorporated herein.

2) “Taxes” means all real property taxes and general, special or district assessments or other governmental impositions, of whatever kind, nature or origin, imposed on or by reason of the ownership or use of the Property; any state, county or municipal governmental property lease excise tax or the equivalent thereof; service payments in lieu of taxes and taxes and assessments of every kind and nature whatsoever levied or assessed in addition to, in lieu of or in substitution for existing or additional real or personal property taxes on the Property or the personal property described above; and the reasonable cost of contesting by appropriate proceedings the amount or validity of any taxes, assessments or charges described above. Taxes shall include all Taxes either payable in, or attributable to, each calendar year or portion thereof during the Term.

3) “Tenant’s Share” means the Rentable Area of the Premises divided by the Rentable Area of the Building. If the Rentable Area of the Premises is increased by Tenant’s leasing of additional space hereafter, Tenant’s Share shall be increased accordingly.

(b) Additional Rent.

1) Tenant shall pay Landlord as “Additional Rent” for each calendar year during the Term Tenant’s Share of the amount by which Operating Costs for such year exceed the Operating Costs Expense Stop, which amount shall be prorated for the last year of the Term if such year is less than a full calendar year. Both Landlord and Tenant acknowledge that basing the Operating Costs Expense Stop on expenses for 2006, the intent is to base such Expense Stop on the actual Operating Expenses that Tenant would have incurred had the Building been fully occupied the entire year. Therefore, Tenant will not incur any costs associated with Tenant’s Share of Operating Costs until January 2007. In addition, in determining the Operating Costs Expense Stop, the actual Operating Costs incurred in 2006 that vary with occupancy shall be adjusted to an amount reasonably determined by Landlord to be the Operating Costs that would have been incurred and paid had such occupancy been at least ninety-five percent (95%) during all of 2006.

10

2) Prior to the beginning of the Term and each calendar year thereafter, Landlord shall notify Tenant of Landlord’s estimate of Operating Costs and Tenant’s Additional Rent for the remaining and following calendar year, as applicable. Commencing on the first day of the Term and continuing on the first day of every month thereafter, Tenant shall pay to Landlord one-twelfth (1/12th) of the estimated Additional Rent. If Landlord thereafter estimates that Operating Costs for any year will vary from Landlord’s prior estimate, Landlord may, by notice to Tenant, revise the estimate for such year (and Additional Rent shall thereafter be payable based on the revised estimate).

3) As soon as reasonably practicable after the end of each calendar year during the Term, Landlord shall furnish Tenant a reconciliation statement with respect to such year, showing Operating Costs and Additional Rent for the year, and the total payments made by Tenant with respect thereto. Unless Tenant raises any objections to Landlord’s statement within thirty (30) days after receipt of the same, such statement shall presumptively be deemed correct and Tenant shall have no right thereafter to dispute such statement or any item therein or the computation of Additional Rent based thereon, subject only to Tenant’s right of audit. If Tenant does object to such statement, then Landlord shall provide Tenant with reasonable verification of the figures shown on the statement and the parties shall negotiate in good faith to resolve any disputes. Any objection of Tenant to Landlord’s statement and resolution of any dispute shall not postpone the time for payment of any amounts due Tenant or Landlord based on Landlord’s statement, nor shall any failure of Landlord to deliver Landlord’s statement in a timely manner relieve Tenant of Tenant’s obligation to pay any amounts due Landlord based on Landlord’s statement.

4) If Tenant’s Additional Rent as finally determined for any calendar year exceeds the total payments made by Tenant on account thereof, Tenant shall pay Landlord the deficiency within fifteen (15) business days of Tenant’s receipt of Landlord’s statement. If the total payments made by Tenant on account thereof exceed Tenant’s Additional Rent as finally determined for such year, Tenant’s excess payment shall be credited toward the rent next due from Tenant under this Lease. For any partial calendar year at the beginning or end of the Term, Additional Rent shall be prorated on the basis of a 365-day year by computing Tenant’s Share of Operating Costs for the entire year and then prorating such amount for the number of days during such year included in the Term. Notwithstanding the termination of this Lease, Landlord shall pay to Tenant or Tenant shall pay to Landlord, as the case may be, within fifteen (15) business days after Tenant’s receipt of Landlord’s final statement for the calendar year in which this Lease terminates, the difference between Tenant’s Additional Rent for that year, as finally determined by Landlord, and the total amount previously paid by Tenant on account thereof.

5) Tenant shall have the right at any time during Landlord’s normal business hours and upon reasonable prior notice to Landlord, which shall not be

11

given later than the first anniversary of Tenant’s receipt of Landlord’s reconciliation statement for the preceding year, to audit Landlord’s books and records with respect to such reconciliation statement, at Tenant’s sole expense. Should the audit disclose an overcharge to Tenant or an underpayment to Landlord, the party owing an amount to the other party shall reimburse the other party within fifteen (15) business days after the results of the audit are known to Landlord and Tenant. Additionally, if the audit report shows that Tenant was overcharged by five percent (5%) or more, Landlord shall reimburse Tenant for its reasonable out of pocket costs of conducting the audit, not to exceed $3,000.00 per audit.

3.3 Payment of Rent. All amounts payable or reimbursable by Tenant under this Lease, including late charges and interest, shall constitute “Rent” and shall be payable and recoverable as Rent in the manner provided in this Lease. All sums payable to Landlord on demand under the terms of this Lease shall be payable within ten (10) days after notice from Landlord of the amounts due. Except as specifically provided for in this Lease to the contrary, all Rent shall be paid without offset, recoupment or deduction in lawful money of the United States of America to Landlord at Landlord’s Address for Payment of Rent as set forth in the Basic Lease Information, or to such other person or at such other place as Landlord may from time to time designate.

3.4 Intentionally Deleted.

4. RENTAL TAXES. Tenant shall pay to Landlord with each installment of Rent the amount of any gross receipts, transaction privilege, sales, excise or similar tax, exclusive of any income tax, payable by Landlord on account of this Lease or Tenant’s payment of such items to, or on behalf of, Landlord.

5. USE AND COMPLIANCE WITH LAWS.

5.1 Use. The Premises shall be used and occupied solely for general business office purposes for Tenant’s mortgage and information technology departments and for no other use or purpose. Tenant shall comply with all present and future Laws relating to Tenant’s use or occupancy of the Premises (and make any repairs, alterations or improvements as required to comply with all such Laws), and shall observe the Building Rules (as defined in Section 27 - Rules and Regulations). Tenant shall not do, bring, keep or sell anything in or about the Premises that is prohibited by, or that will cause a cancellation of or an increase in the existing premium for, any insurance policy covering the Property or any part thereof. Tenant shall not permit the Premises to be occupied or used in any manner that will constitute waste or a nuisance, or disturb the quiet enjoyment of or otherwise annoy other tenants in the Building. Except as may be provided in the Construction Rider, Tenant shall not, without the prior consent of Landlord, (i) bring into the Building or the Premises anything that may cause substantial noise, odor or vibration, overload the floors in the Premises or the Building or any of the heating, ventilating and air-conditioning (“HVAC”), mechanical, elevator, plumbing, electrical, fire protection, life safety, security or other systems in the Building (“Building Systems”), or jeopardize the structural integrity of the Building or any part thereof; (ii) connect to the utility systems of the Building any apparatus, machinery or

12

other equipment other than typical office equipment; or (iii) connect to any electrical circuit in the Premises any equipment or other load with aggregate electrical power requirements in excess of 80% of the rated capacity of the circuit.

5.2 Hazardous Materials.

(a) Definitions.

1) “Hazardous Materials” shall mean any substance: (A) that now or in the future is regulated or governed by, requires investigation or remediation under, or is defined as a hazardous waste, hazardous substance, pollutant or contaminant under, any governmental statute, code, ordinance, regulation, rule or order, and any amendment thereto, including the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. §9601 et seq., and the Resource Conservation and Recovery Act, 42 U.S.C. §6901 et seq., or (B) that is toxic, explosive, corrosive, flammable, radioactive, carcinogenic, dangerous or otherwise hazardous, including gasoline, diesel fuel, petroleum hydrocarbons, polychlorinated biphenyls (PCBs), asbestos, radon and urea formaldehyde foam insulation.

2) “Environmental Requirements” shall mean all present and future Laws, orders, permits, licenses, approvals, authorizations and other requirements of any kind applicable to Hazardous Materials.

3) “Handled by Tenant” and “Handling by Tenant” shall mean and refer to any installation, handling, generation, storage, use, disposal, discharge, release, abatement, removal, transportation, or any other activity of any type by Tenant or its agents, employees, contractors, licensees, assignees, sublessees, transferees or representatives (collectively, “Representatives”) or its guests, customers, invitees, or visitors (collectively, “Visitors”), at or about the Premises in connection with or involving Hazardous Materials.

4) “Environmental Losses” shall mean all costs and expenses of any kind, damages (including foreseeable and unforeseeable consequential damages), fines and penalties incurred in connection with any violation of or compliance with Environmental Requirements, and all losses of any kind attributable to the diminution of value, loss of use or adverse effects on marketability or use of any portion of the Premises or the Property.

(b) Tenant’s Covenants. No Hazardous Materials shall be Handled by Tenant at or about the Premises or Property without Landlord’s prior written consent, which consent may be granted, denied, or conditioned upon compliance with Landlord’s requirements, all in Landlord’s absolute discretion. Notwithstanding the foregoing, normal quantities and use of those Hazardous Materials customarily used in the conduct of general office activities, such as copier

13

fluids and cleaning supplies (“Permitted Hazardous Materials”), may be used and stored at the Premises without Landlord’s prior written consent, provided that Tenant’s activities at or about the Premises and Property and the Handling by Tenant of all Hazardous Materials shall comply at all times with all Environmental Requirements. At the expiration or termination of the Lease, Tenant shall promptly remove from the Premises and Property all Hazardous Materials Handled by Tenant at the Premises or the Property. Tenant shall keep Landlord fully and promptly informed of all Handling by Tenant of Hazardous Materials other than Permitted Hazardous Materials. Tenant shall be responsible and liable for the compliance with all of the provisions of this Section by all of Tenant’s Representatives and Visitors, and all of Tenant’s obligations under this Section (including its indemnification obligations under paragraph (e) below) shall survive the expiration or termination of this Lease.

(c) Compliance. Tenant shall at Tenant’s expense promptly take all actions required by any governmental agency or entity in connection with or as a result of the Handling by Tenant of Hazardous Materials at or about the Premises or the Property, including inspection and testing, performing all cleanup, removal and remediation work required with respect to those Hazardous Materials, complying with all closure requirements and post-closure monitoring, and filing all required reports or plans. All of the foregoing work and all Handling by Tenant of all Hazardous Materials shall be performed in a good, safe and workmanlike manner by consultants qualified and licensed to undertake such work and in a manner that will not interfere with any other tenant’s quiet enjoyment of the Property or Landlord’s use, operation, leasing and sale of the Property. Tenant shall deliver to Landlord prior to delivery to any governmental agency, or promptly after receipt from any such agency, copies of all permits, manifests, closure or remedial action plans, notices, and all other documents relating to the Handling by Tenant of Hazardous Materials at or about the Premises or the Property. If any lien attaches to the Premises or the Property in connection with or as a result of the Handling by Tenant of Hazardous Materials, and if Tenant does not cause the same to be released, by payment, bonding or otherwise, within ten (10) days after the attachment thereof, Landlord shall have the right but not the obligation to cause the same to be released and any sums expended by Landlord (plus Landlord’s administrative costs) in connection therewith shall be payable by Tenant on demand.

(d) Landlord’s Rights. Landlord shall have the right, but not the obligation, to enter the Premises at any reasonable time (i) to confirm Tenant’s compliance with the provisions of this Section 5.2, and (ii) to perform Tenant’s obligations under this Section if Tenant has failed to do so after reasonable notice to Tenant. Landlord shall also have the right to engage qualified Hazardous Materials consultants to inspect the Premises and review the Handling by Tenant of Hazardous Materials, including review of all permits, reports, plans, and other documents regarding same. Tenant shall pay to Landlord on demand the costs of Landlord’s consultants’ fees and all costs incurred by Landlord in performing Tenant’s obligations under this

14

Section. Landlord shall use reasonable efforts to minimize any interference with Tenant’s business caused by Landlord’s entry into the Premises, but Landlord shall not be responsible for any interference caused thereby.

(e) Tenant’s Indemnification. Tenant agrees to indemnify, defend, protect and hold harmless Landlord and its partners or members and its or their partners, members, directors, officers, shareholders, employees and agents from all Environmental Losses and all other claims, actions, losses, damages, liabilities, costs and expenses of every kind, including reasonable attorneys’, experts’ and consultants’ fees and costs, incurred at any time and arising from or in connection with the Handling by Tenant of Hazardous Materials at or about the Property or Tenant’s failure to comply in full with all Environmental Requirements with respect to the Premises.

(f) Landlord’s Representations. Landlord represents to Tenant that the Base Building does not contain any Hazardous Materials other than insubstantial amounts, if any, in quantities not having any materially adverse effect on Tenant’s health and safety, and that Landlord has not released any Hazardous Materials onto the Property in violation of Environmental Requirements. Landlord is making no further representations to Tenant with respect to Hazardous Materials.

5.3 Americans With Disabilities Act. The parties agree that the liabilities and obligations of Landlord and Tenant under that certain federal statute commonly known as the Americans With Disabilities Act, as well as the regulations and accessibility guidelines promulgated thereunder, as each of the foregoing is supplemented or amended from time to time (collectively, the “ADA”), shall be apportioned as follows:

(a) Except as otherwise provided in (c) below, if the structural elements of the Premises or any other portion of the Base Building (as defined in the Construction Rider) are not in compliance with the public accommodations provisions of the ADA on the Commencement Date, including lavatory facilities, such nonconformity shall be promptly made to comply by Landlord.

(b) Except as otherwise provided in (c) below, from and after the commencement date of the Lease, Tenant covenants and agrees to conduct its operations within the Premises in compliance with the ADA. If any of the Premises fails to comply with the ADA, such nonconformity shall be promptly made to comply by Tenant. In the event that Tenant elects to undertake any alterations to, for or within the Premises, including initial build-out work, Tenant agrees to cause such alterations to be performed and constructed in compliance with the ADA.

(c) Notwithstanding the foregoing, Tenant shall cause all parts of the Premises, the Building or the Project designed by Tenant or its own architects, space planners and designers (“Tenant Design”) to comply with the ADA, and Landlord

15

shall have no responsibility therefor or liability for any noncompliance resulting from Tenant Design.

6. TENANT IMPROVEMENTS AND ALTERATIONS.

6.1 Landlord and Tenant shall perform their respective obligations with respect to design and construction of any improvements to be constructed and installed in the Premises as provided in the Construction Rider attached hereto as Exhibit C. Except for (i) any improvements to be constructed by Tenant as provided in the Construction Rider and (ii) non-structural alterations not affecting the Building Systems and costing less than $50,000.00 in the aggregate (for which no Landlord consent shall be required), Tenant shall not make any alterations, improvements or changes to the Premises, including installation of any security system or telephone or data communication wiring (“Alterations”), without Landlord’s prior written consent, not to be unreasonably withheld, conditioned or delayed; provided, however, that it shall in all events be reasonable for Landlord to withhold such consent if the proposed Alterations affect the structure of the Building and/or any of the Building Systems. Any such Alterations shall be completed by Tenant at Tenant’s sole cost and expense: (i) with due diligence, in a good and workmanlike manner, using new materials; (ii) in compliance with plans and specifications approved by Landlord; (iii) in compliance with the construction rules and regulations promulgated by Landlord from time to time; (iv) in accordance with all applicable Laws (including all work, whether structural or non-structural, inside or outside the Premises, required to comply fully with all applicable Laws and necessitated by Tenant’s work); and (v) subject to all conditions which Landlord may in Landlord’s reasonable discretion impose. Such conditions may include requirements for Tenant to: (i) provide payment or performance bonds or additional insurance (from Tenant or Tenant’s contractors, subcontractors or design professionals); (ii) use contractors or subcontractors designated by Landlord (provided that such contractors or sub-contractors priced competitively with others chosen by Tenant); and (iii) remove all or part of the Alterations prior to or upon expiration or termination of the Term, as designated by Landlord prior to the commencement of such Alterations. If any work outside the Premises, or any work on or adjustment to any of the Building Systems, is required in connection with or as a result of Tenant’s work, such work shall be performed at Tenant’s expense by contractors designated by Landlord (provided that such contractors or sub-contractors are priced competitively with market rates). Landlord’s right to review and approve (or withhold approval of) Tenant’s plans, drawings, specifications, contractor(s) and other aspects of construction work proposed by Tenant is intended solely to protect Landlord, the Property and Landlord’s interests. No approval or consent by Landlord shall be deemed or construed to be a representation or warranty by Landlord as to the adequacy, sufficiency, fitness or suitability of the proposed Alterations or compliance thereof with applicable Laws or other requirements. Except as otherwise provided in Landlord’s consent, all Alterations shall upon installation become part of the realty and be the property of Landlord.

6.2 Before making any Alterations, Tenant shall submit to Landlord for Landlord’s prior approval reasonably detailed final plans and specifications prepared by a licensed architect or engineer, a copy of the construction contract, including the name of the contractor and all subcontractors proposed by Tenant to make the Alterations, and a copy of the contractor’s license. Tenant shall reimburse Landlord upon demand for any reasonable expenses incurred by

16

Landlord in connection with any Alterations made by Tenant, including reasonable fees charged by Landlord’s contractors or consultants to review plans and specifications prepared by Tenant and to update the existing as-built plans and specifications of the Building to reflect the Alterations. Tenant shall obtain all applicable permits, authorizations and governmental approvals and deliver copies of the same to Landlord before commencement of any Alterations.

6.3 Tenant shall keep the Premises and the Property free and clear of all mechanics’, materialmen’s, contractors’ or other liens arising out of any work performed, materials furnished or obligations incurred by Tenant. If any such lien attaches to the Premises or the Property, and Tenant does not cause the same to be released by payment, bonding or otherwise within ten (10) days after notice of the attachment thereof, Landlord shall have the right but not the obligation to cause the same to be released, and any sums expended by Landlord (plus Landlord’s administrative costs) in connection therewith shall be payable by Tenant on demand with interest thereon from the date of expenditure by Landlord at the Interest Rate (as defined in Section 16.2 -Interest). Tenant shall give Landlord at least ten (10) business days’ notice prior to the commencement of any Alterations and cooperate with Landlord in posting and maintaining notices of non-responsibility in connection therewith.

6.4 Subject to the provisions of Section 5 - Use and Compliance with Laws and the foregoing provisions of this Section, Tenant may install and maintain furnishings, equipment, movable partitions, business equipment and other trade fixtures (“Trade Fixtures”) in the Premises, provided that the Trade Fixtures do not become an integral part of the Premises or the Building, without first obtaining approval from Landlord. Tenant shall promptly repair any damage to the Premises or the Building caused by any installation or removal of such Trade Fixtures.

7. MAINTENANCE AND REPAIRS.

7.1 By taking possession of the Premises, Tenant agrees that the Premises are then in a good and tenantable condition. During the Term, Tenant at Tenant’s expense but under the direction of Landlord, shall repair and maintain the Premises, including the interior walls, floor coverings, ceiling (ceiling tiles and grid), Tenant Improvements, Alterations, fire extinguishers, outlets and fixtures, and any appliances (including dishwashers, hot water heaters and garbage disposers) in the Premises, in a first class condition, and keep the Premises in a clean, safe and orderly condition.

7.2 Landlord shall maintain or cause to be maintained in reasonably good order, condition and repair, the structural portions of the roof, foundations, floor slab and exterior walls of the Building, the Building Systems, and the public and common areas of the Property; provided, however, that Tenant shall pay the cost of repairs for any damage occasioned by Tenant’s use of the Premises or the Property or any act or omission of Tenant or Tenant’s Representatives or Visitors, to the extent (if any) not covered by Landlord’s property insurance. Landlord shall be under no obligation to inspect the Premises. Tenant shall promptly report in writing to Landlord any defective condition known to Tenant which Landlord is required to repair.

17

7.3 Landlord hereby reserves the right, at any time and from time to time, without liability to Tenant, and without constituting an eviction, constructive or otherwise, or entitling Tenant to any abatement of rent or to terminate this Lease or otherwise releasing Tenant from any of Tenant’s obligations except as may be specifically provided for under this Lease:

(a) To make alterations, additions, repairs, improvements to or in, or to decrease the size of area of, all or any part of the Building, the fixtures and equipment therein, and the Building Systems, so long as such alterations, additions, repairs and improvements do not alter the size of the Premises or materially interfere with Tenant’s use and enjoyment of the Premises, excepting only temporary inconvenience or interference reasonably necessary and unavoidable as a result of the necessity of such alterations, additions, repairs or improvements;

(b) To change the Building’s name, provided that the name shall not be the name of a competitor of Tenant or a Tenant Affiliate;

(c) To install and maintain any and all signs on the exterior and interior of the Building, subject to the provisions of this Lease;

(d) To reduce, increase, enclose or otherwise change at any time and from time to time the size, number, location, lay-out and nature of the common areas and other tenancies and premises in the Property, and to create additional rentable areas through use or enclosure of common areas; and

If any governmental authority promulgates or revises any Law or imposes mandatory or voluntary controls or guidelines on Landlord or the Property relating to the use or conservation of energy or utilities or the reduction of automobile or other emissions or reduction or management of traffic or parking on the Property (collectively “Controls”), to comply with such Controls, whether mandatory or voluntary, or make any alterations to the Property related thereto.

8. TENANT’S PERSONAL PROPERTY TAXES. Tenant shall pay prior to delinquency all taxes levied by any governmental authority on Tenant’s personal property including, but not limited to, unsecured personal property taxes.

9. UTILITIES AND SERVICES.

9.1 Description of Services. Landlord shall furnish to the Premises: reasonable amounts of heat, ventilation and air-conditioning during the Business Hours specified in the Basic Lease Information (“Business Hours”) on weekdays and Saturday except public holidays (“Business Days”); reasonable amounts of electricity; janitorial services five days a week (except public holidays); and hot and cold water from standard outlets for lavatory, restroom and drinking purposes. Landlord shall also provide the Building with normal fluorescent lamp replacement, window washing, elevator service, and common area toilet room supplies. Any additional utilities or services that Landlord may agree to provide (including lamp or tube replacement for other than Building Standard lighting fixtures) shall be at Tenant’s sole expense. Landlord will provide the

18

following utility connections: 1600 AMPS at 277/480, 3 phase, 4 wire, 50,000 A.I.C. NEMA 1, which will be provided to the second (2nd) floor of the Building via the Project’s SES and distributed to such second (2nd) floor at Distribution Panel #2, which is located on such second (2nd) floor. Notwithstanding the foregoing, all step-down transformers shall be provided by Tenant, at Tenant’s sole cost and expense, in order to distribute the available power per the Tenant Improvements as defined in the Construction Rider.

9.2 Payment for Additional Utilities and Services.

(a) Upon request by Tenant in accordance with the procedures established by Landlord from time to time for furnishing HVAC service at times other than Business Hours on Business Days, Landlord shall furnish such service to Tenant and Tenant shall pay for such services on an hourly basis at the then prevailing rate established for the Building by Landlord (which rate is $8.00 per hour per zone as of the date of this Lease), which usage by Tenant shall be reasonably estimated by Landlord.

(b) If the temperature otherwise maintained in any portion of the Premises by the HVAC systems of the Building is affected as a result of (i) any lights, machines or equipment used by Tenant in the Premises, or (ii) the occupancy of the Premises by more than one person per 150 square feet of rentable area, then Landlord shall have the right to install any machinery or equipment reasonably necessary to restore the temperature, including modifications to the standard air-conditioning equipment. The cost of any such equipment and modifications, including the cost of installation and any additional cost of operation and maintenance of the same, shall be paid by Tenant to Landlord upon demand.

(c) If Tenant’s usage of electricity, water or any other utility service exceeds the use of such utility Landlord determines to be typical, normal and customary for the Building, Landlord may determine the amount of such excess use by any reasonable means (including the installation at Landlord’s request but at Tenant’s expense of a separate meter or other measuring device) and charge Tenant for the cost of such excess usage. In addition, Landlord may impose a reasonable charge for the use of any additional or unusual janitorial services required by Tenant because of any unusual Tenant Improvements or Alterations, the carelessness of Tenant or the nature of Tenant’s business (including hours of operation).

9.3 Interruption of Services. Subject to Section 9.4 below, in the event of an interruption in or failure or inability to provide any services or utilities to the Premises or Building for any reason (a “Service Failure”), such Service Failure shall not, regardless of its duration, impose upon Landlord any liability whatsoever, constitute an eviction of Tenant, constructive or otherwise, entitle Tenant to an abatement of rent or to terminate this Lease or otherwise release Tenant from any of Tenant’s obligations under this Lease. Tenant waives the protection of any statute or rule of law that gives or purports to give Tenant any right to terminate this Lease or surrender possession of the Premises upon a Service Failure.

19

9.4 Abatement. Notwithstanding the foregoing, if there is a Service Failure which is (a) specific to the Building and/or Property (as opposed to an interruption or curtailment in essential services which extends beyond the Building or Property), (b) causes the Premises to be untenantable, (c) is caused solely by Landlord, and (d) lasts for more than five (5) consecutive Business Days after Landlord has notice of such Service Failure or otherwise prevents Tenant from reasonably being able to access the Premises for more than five (5) consecutive Business Days after notice to Landlord, then Tenant will be entitled to an abatement of Basic Rent as provided in this Section 9.4. If Tenant properly delivers such an abatement notice to Landlord, and the untenantability caused by the interruption is not remedied within such five (5) Business Day period, then, subject to the following sentence, Tenant shall thereafter be entitled to an abatement of Basic Rent and Additional Rent (in proportion to the portion of the Premises rendered untenantable by Service Failure) until such service is restored. Notwithstanding the foregoing, if Basic Rent and Additional Rent are abated pursuant to the preceding sentence for a period of ninety (90) consecutive days, then, unless otherwise mutually agreed to in writing between Landlord and Tenant, Tenant shall elect, in writing delivered to Landlord within ten (10) Business Days following the expiration of such 90-day period, to either terminate this Lease as of the date of such notice or commence paying full Basic Rent and Additional Rent from and after the date of such notice as otherwise provided under this Lease. In the event Tenant fails to provide such written notice within the aforementioned 10-Business Day period, then in that event Tenant will be deemed to have elected not to terminate this Lease and, unless otherwise mutually agreed to in writing between Landlord and Tenant, will immediately return to paying full Basic Rent and Additional Rent as otherwise provided under this Lease.

10. EXCULPATION AND INDEMNIFICATION.

10.1 Landlord’s Indemnification of Tenant. Landlord shall indemnify, protect, defend and hold Tenant harmless from and against any claims, actions, liabilities, damages, costs or expenses, including reasonable attorneys’ fees and costs incurred in defending against the same (“Claims”), asserted by any third party against Tenant which arise out of (i) any bodily injury, death or property damage occurring to such third parties at the Project (other than within the Premises) to the extent caused by the willful misconduct or negligent acts of Landlord or its authorized representatives and are not caused in whole or in part by Tenant and (ii) Landlord’s uncured breach of any representation, warranty or obligation under this Lease.

10.2 Tenant’s Indemnification of Landlord. Tenant shall indemnify, protect, defend and hold Landlord and Landlord’s authorized representatives harmless from and against Claims arising from (a) the acts or omissions of Tenant or Tenant’s Representatives or Visitors in or about the Property, or (b) any construction or other work undertaken by Tenant on the Premises (including any design defects), or (c) any breach or default or occurrence of Tenant Delay under this Lease by Tenant, or (d) any loss, injury or damage, howsoever and by whomsoever caused, to any person or property, occurring in or about the Premises during the Term, excepting only Claims described in this clause (d) to the extent they are caused by the willful misconduct or negligent acts of Landlord or its authorized representatives.

20

10.3 Damage to Tenant and Tenant’s Property. Landlord shall not be liable to Tenant for any loss, injury or other damage to Tenant or to Tenant’s property in or about the Premises or the Property from any cause (including defects in the Property or in any equipment in the Property; fire, explosion or other casualty; bursting, rupture, leakage or overflow of any plumbing or other pipes or lines, sprinklers, tanks, drains, drinking fountains or washstands in, above, or about the Premises or the Property; or acts of other tenants in the Property) unless caused by the gross negligence or willful misconduct of Landlord or its employees or agents. Notwithstanding any other provision of this Lease to the contrary, in no event shall Landlord be liable to Tenant for any punitive or consequential damages or damages for loss of business by Tenant.

10.4 Survival. The obligations of the parties under this Section 10 shall survive the expiration or termination of this Lease.

11. INSURANCE.

11.1 Tenant’s Insurance.

(a) Liability Insurance. Tenant shall maintain in full force throughout the Term commercial general liability insurance providing coverage on an occurrence form basis with limits of not less than Two Million Dollars ($2,000,000.00) each occurrence for bodily injury and property damage combined, Two Million Dollars ($2,000,000.00) annual general aggregate, and Two Million Dollars ($2,000,000.00) products and completed operations annual aggregate. Tenant’s liability insurance policy or policies shall: (i) include premises and operations liability coverage, products and completed operations liability coverage, broad form property damage coverage, including completed operations, blanket contractual liability coverage, including, to the maximum extent possible, coverage for the indemnification obligations of Tenant under this Lease, and personal and advertising injury coverage; (ii) provide that the insurance company has the duty to defend all insureds under the policy; (iii) provide that defense costs are paid in addition to and do not deplete any of the policy limits; and (iv) cover liabilities arising out of or incurred in connection with Tenant’s use or occupancy of the Premises or the Property. Each policy of liability insurance required by this Section shall: (i) contain a cross liability endorsement or separation of insureds clause; (ii) provide that any waiver of subrogation rights or release prior to a loss does not void coverage; (iii) provide that it is primary to and not contributing with, any policy of insurance carried by Landlord covering the same loss; (iv) provide that any failure to comply with the reporting provisions shall not affect coverage provided to Landlord or its partners, property managers or Mortgagees (as defined below); and (v) name Landlord and its partners, the Property Manager identified in the Basic Lease Information (the “Property Manager”), and such other parties in interest as Landlord may from time to time designate to Tenant in writing, as additional insureds. Such additional insureds shall be provided at least the same extent of coverage as is provided to Tenant under such policies. All endorsements effecting such additional insured

21

status shall be at least as broad as additional insured endorsement form number CG 20 11 11 85 promulgated by the Insurance Services Office.

(b) Property Insurance. Tenant shall at all times maintain in effect with respect to any Alterations and Tenant’s Trade Fixtures and personal property, commercial property insurance providing coverage, on an “all risk” or “special form” basis, in an amount equal to at least 90% of the full replacement cost of the covered property. Tenant may carry such insurance under a blanket policy, provided that such policy provides coverage equivalent to a separate policy. During the Term, the proceeds from any such policies of insurance shall be used for the repair or replacement of the Alterations, Trade Fixtures and personal property so insured. Landlord shall be provided coverage under such insurance to the extent of its insurable interest and, if requested by Landlord, both Landlord and Tenant shall sign all documents reasonably necessary or proper in connection with the settlement of any claim or loss under such insurance. Landlord will have no obligation to carry insurance on any Alterations or on Tenant’s Trade Fixtures or personal property.

(c) Requirements For All Policies. Each policy of insurance required under this Section 11.1 shall: (i) be in a form, and written by an insurer, reasonably acceptable to Landlord, (ii) be maintained at Tenant’s sole cost and expense, and (iii) require at least thirty (30) days’ written notice to Landlord prior to any cancellation, nonrenewal or modification of insurance coverage. Insurance companies issuing such policies shall have rating classifications of “A” or better and financial size category ratings of “VII” or better according to the latest edition of the A.M. Best Key Rating Guide. All insurance companies issuing such policies shall be admitted carriers licensed to do business in the state where the Property is located. To the extent Tenant does not self-insure as permitted under subsection (f) below, any deductible amount under such insurance shall not exceed $5,000. Tenant shall provide to Landlord, upon request, evidence that the insurance required to be carried by Tenant pursuant to this Section, including any endorsement effecting the additional insured status, is in full force and effect and that premiums therefor have been paid.

(d) Updating Coverage. Tenant shall increase the amounts of insurance as required by any Mortgagee and, not more frequently than once every three (3) years, as recommended by Landlord’s insurance broker, if, in the opinion of either of them, the amount of insurance then required under this Lease is not adequate. Any limits set forth in this Lease on the amount or type of coverage required by Tenant’s insurance shall not limit the liability of Tenant under this Lease.

(e) Certificates of Insurance. Prior to occupancy of the Premises by Tenant, and not less than thirty (30) days prior to expiration of any policy thereafter, Tenant shall furnish to Landlord a certificate of insurance reflecting that the insurance required by this Section is in force, accompanied by an endorsement showing the required additional insureds satisfactory to Landlord in substance and

22

form. Notwithstanding the requirements of this paragraph, Tenant shall at Landlord’s request provide to Landlord a certified copy of each insurance policy required to be in force at any time pursuant to the requirements of this Lease or its Exhibits.

(f) Self-Insurance. Subject to the provisions of this subsection (f), Tenant may self-insure under a commercially reasonable self-insurance program with respect to the insurance coverages set forth in subsection (b) above. Tenant must demonstrate to Landlord’s satisfaction at the beginning of each calendar year of such self insurance that Tenant maintains a tangible net financial worth of at least $100,000,000. Tenant will, to the fullest extent allowable under the applicable laws, indemnify, protect, defend (with counsel reasonably acceptable to Landlord) and hold harmless Landlord from and against any and all claims that would have been covered by the insurance replaced by the self-insurance. Such self-insurance will not affect any waivers, releases or limitations of liability of Landlord set forth in this Lease. If Tenant elects to self-insure, Tenant will deliver written notice to Landlord (a) detailing the coverages being self insured; (b) setting forth the amount, limits, and scope of the self insurance for each such coverage (which will not be less than those required herein); (c) demonstrating such tangible net worth; and (d) describing Tenant’s self-insurance program (including, without limitations, its funding, claim defense policies, coverage provisions, and other relevant matters). Upon Landlord’s request, Tenant will provide a certificate reasonably satisfactory to any mortgagee or assignee of Landlord setting forth the self-insured coverages and naming (as applicable) such party as an additional insured and/or loss payee, as its interests may appear.

11.2 Landlord’s Insurance. During the Term, to the extent such coverages are available at a commercially reasonable cost, Landlord shall maintain in effect insurance on the Building with responsible insurers, on an “all risk” or “special form” basis, insuring the Building and the Tenant Improvements in an amount equal to at least 90% of the replacement cost thereof, excluding land, foundations, footings and underground installations. Landlord may, but shall not be obligated to, carry insurance against additional perils and/or in greater amounts.

11.3 Mutual Waiver of Right of Recovery and Waiver of Subrogation. Landlord and Tenant each hereby waive any right of recovery against each other and the partners, managers, members, shareholders, officers, directors and authorized representatives of each other for any loss or damage that is covered by any policy of property insurance maintained by either party (or required by this Lease to be maintained) with respect to the Premises or the Property or any operation therein, regardless of cause, including negligence (active or passive) of the party benefiting from the waiver. If any such policy of insurance relating to this Lease or to the Premises or the Property does not permit the foregoing waiver, or if the coverage under any such policy would be invalidated as a result of such waiver, the party maintaining such policy shall obtain from the insurer under such policy a waiver of all right of recovery by way of subrogation against either party in connection with any claim, loss or damage covered by such policy.

23

12. DAMAGE OR DESTRUCTION.

12.1 Landlord’s Duty to Repair.

(a) If all or a substantial part of the Premises are rendered untenantable or inaccessible by damage to all or any part of the Property from fire or other casualty then, unless either party is entitled to and elects to terminate this Lease pursuant to Sections 12.2 - Landlord’s Right to Terminate and 12.3 - Tenant’s Right to Terminate, Landlord shall, at its expense, use reasonable efforts to repair and restore the Premises and/or the Property, as the case may be, to substantially their former condition to the extent permitted by then applicable Laws; provided, however, that in no event shall Landlord have any obligation for repair or restoration beyond the extent of insurance proceeds received by Landlord for such repair or restoration, or for any of Tenant’s personal property, Trade Fixtures or Alterations.

(b) If Landlord is required or elects to repair damage to the Premises and/or the Property, this Lease shall continue in effect, but Tenant’s Base Rent and Additional Rent shall be abated with regard to any portion of the Premises that Tenant is prevented from using by reason of such damage or its repair from the date of the casualty until substantial completion of Landlord’s repair of the affected portion of the Premises as required under this Lease. In no event shall Landlord be liable to Tenant by reason of any injury to or interference with Tenant’s business or property arising from fire or other casualty or by reason of any repairs to any part of the Property necessitated by such casualty.

12.2 Landlord’s Right to Terminate. Landlord may elect to terminate this Lease following damage by fire or other casualty under the following circumstances:

(a) If, in the reasonable judgment of Landlord, the Premises and the Property cannot be substantially repaired and restored under applicable Laws within one hundred eighty (180) days from the date of the casualty;

(b) If, in the reasonable judgment of Landlord, adequate proceeds are not, for any reason, made available to Landlord from Landlord’s insurance policies (and/or from Landlord’s funds made available for such purpose, at Landlord’s sole option) to make the required repairs;

(c) If the Building is damaged or destroyed to the extent that, in the reasonable judgment of Landlord, the cost to repair and restore the Building would exceed twenty-five percent (25%) of the full replacement cost of the Building, whether or not the Premises are at all damaged or destroyed; or

(d) If the fire or other casualty occurs during the last year of the Term.

24

If any of the circumstances described in subparagraphs (a), (b), (c) or (d) of this Section 12.2 occur or arise, Landlord shall give Tenant notice within thirty (30) days after the date of the casualty, specifying whether Landlord elects to terminate this Lease as provided above and, if not, Landlord’s estimate of the time required to complete Landlord’s repair obligations under this Lease.

12.3 Tenant’s Right to Terminate. If all or a substantial part of the Premises are rendered untenantable or inaccessible by damage to all or any part of the Property from fire or other casualty, and Landlord does not elect to terminate as provided above, then Tenant may elect to terminate this Lease if (a) Landlord’s estimate of the time required to complete Landlord’s repair obligations under this Lease is greater than one hundred eighty (180) days, or (b) Tenant receives a certified, written statement from a contractor stating that repairs cannot be executed in one hundred eighty (180) days, in which event Tenant may elect to terminate this Lease by giving Landlord notice of such election to terminate within thirty (30) days after Landlord’s notice to Tenant pursuant to Section 12.2 - Landlord’s Right to Terminate or within thirty (30) days of receiving the contractor’s statement under this Section 12.3 – Tenant’s Right to Terminate.

12.4 Waiver of Statutory Rights. Tenant waives any statutory right to terminate this Lease or abate Rent because of any damage or destruction to the Premises due to fire or other casualty.

13. CONDEMNATION.

13.1 Definitions.

(a) “Award” shall mean all compensation, sums, or anything of value awarded, paid or received on a total or partial Condemnation.

(b) “Condemnation” shall mean (i) a permanent taking (or a temporary taking for a period extending beyond the end of the Term) pursuant to the exercise of the power of condemnation or eminent domain by any public or quasi-public authority, private corporation or individual having such power (“Condemnor”), whether by legal proceedings or otherwise, or (ii) a voluntary sale or transfer by Landlord to any such authority, either under threat of condemnation or while legal proceedings for condemnation are pending.

(c) “Date of Condemnation” shall mean the earlier of the date that title to the property taken is vested in the Condemnor or the date the Condemnor has the right to possession of the property being condemned.

13.2 Effect on Lease.

(a) If the Premises are totally taken by Condemnation, this Lease shall terminate as of the Date of Condemnation. If a portion but not all of the Premises is taken by Condemnation, this Lease shall remain in effect; provided, however, that if the portion of the Premises remaining after the Condemnation will be unsuitable for

25

Tenant’s continued use, then, upon notice to Landlord within thirty (30) days after Landlord notifies Tenant of the Condemnation, Tenant may terminate this Lease effective as of the Date of Condemnation.

(b) If twenty-five percent (25%) or more of the Project or of the parcel(s) of land on which the Building is situated or of the floor area in the Building is taken by Condemnation, or if as a result of any Condemnation the Building is no longer reasonably suitable for use as an office building, whether or not any portion of the Premises is taken, Landlord may elect to terminate this Lease, effective as of the Date of Condemnation, by notice to Tenant within thirty (30) days after the Date of Condemnation.

(c) If all or a portion of the Premises is temporarily taken by a Condemnor for a period not extending beyond the end of the Term, this Lease shall remain in full force and effect.

13.3 Restoration. If this Lease is not terminated as provided in Section 13.2 - Effect on Lease, Landlord, at its expense, shall diligently proceed to repair and restore the Premises to substantially its former condition (to the extent permitted by then applicable Laws) and/or repair and restore the Building to an architecturally complete office building; provided, however, that Landlord’s obligations to so repair and restore shall be limited to the amount of any Award received by Landlord and not required to be paid to any Mortgagee. In no event shall Landlord have any obligation to repair or replace any improvements in the Premises beyond the amount of any Award received by Landlord for such repair or to repair or replace any of Tenant’s personal property, Trade Fixtures, or Alterations.

13.4 Abatement and Reduction of Rent. If any portion of the Premises is taken in a Condemnation or is rendered permanently untenantable by repairs necessitated by the Condemnation, and this Lease is not terminated, the Base Rent and Additional Rent payable under this Lease shall be proportionally reduced as of the Date of Condemnation based upon the percentage of rentable square feet in the Premises so taken or rendered permanently untenantable. In addition, if this Lease remains in effect following a Condemnation and Landlord proceeds to repair and restore the Premises, the Base Rent and Additional Rent payable under this Lease shall be abated during the period of such repair or restoration to the extent such repairs prevent Tenant’s use of the Premises.

13.5 Awards. Any Award made shall be paid to Landlord, and Tenant hereby assigns to Landlord, and waives all interest in or claim to, any such Award, including any claim for the value of the unexpired Term; provided, however, that Tenant shall be entitled to receive, or to prosecute a separate claim for, an Award for a temporary taking of the Premises or a portion thereof by a Condemnor where this Lease is not terminated (to the extent such Award relates to the unexpired Term), or an Award or portion thereof separately designated for relocation expenses or the interruption of or damage to Tenant’s business or as compensation for Tenant’s personal property, Trade Fixtures or Alterations.

26

14. ASSIGNMENT AND SUBLETTING.

14.1 Landlord’s Consent Required. Tenant shall not assign this Lease or any interest therein, or sublet or license or permit the use or occupancy of the Premises or any part thereof by or for the benefit of anyone other than Tenant or a Tenant Affiliate, or in any other manner transfer all or any part of Tenant’s interest under this Lease (each and all a “Transfer”), without the prior written consent of Landlord, which consent (subject to the other provisions of this Section 14) shall not be unreasonably conditioned, withheld or delayed. The term “Tenant Affiliate” shall mean an entity controlling, controlled by, or under common control with Tenant, or a successor to Tenant by reason of merger or consolidation. If Tenant is a business entity, any direct or indirect transfer of twenty five percent (25%) or more of the ownership interest of the entity (whether in a single transaction or in the aggregate through more than one transaction) shall be deemed a Transfer. Notwithstanding any provision in this Lease to the contrary, Tenant shall not mortgage, pledge, hypothecate or otherwise encumber this Lease or all or any part of Tenant’s interest under this Lease.

14.2 Reasonable Consent.

(a) Prior to any proposed Transfer, Tenant shall submit in writing to Landlord (i) the name and legal composition of the proposed assignee, subtenant, user or other transferee (each a “Proposed Transferee”); (ii) the nature of the business proposed to be carried on in the Premises; (iii) such reasonable financial and other information concerning the Proposed Transferee as Landlord may request; and (iv) a copy of the proposed assignment, sublease or other agreement governing the proposed Transfer. Within fifteen (15) Business Days after Landlord receives all such information, it shall notify Tenant whether it approves or disapproves such Transfer or if it elects to proceed under Section 14.6 - Landlord’s Right to Space.